IST,

IST,

Evolution of FinTech and Central Banks: A Text Mining-Based Survey

|

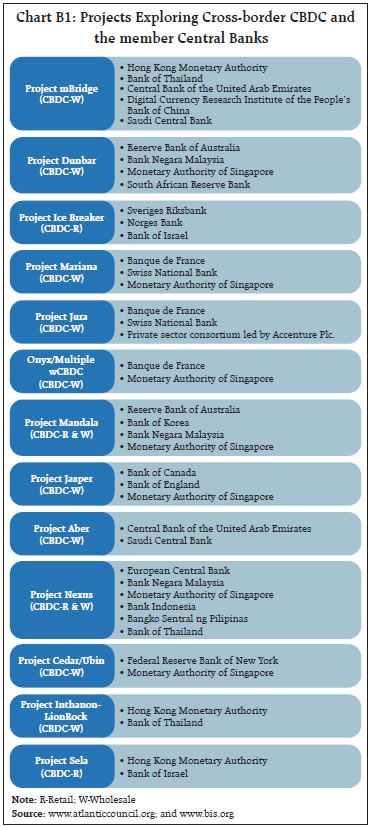

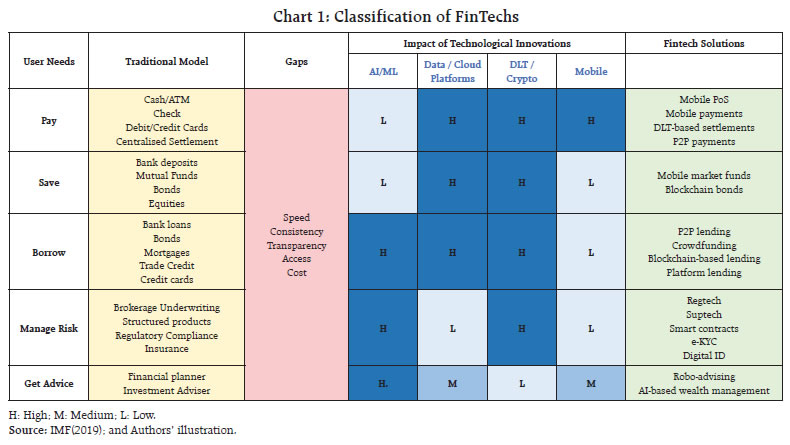

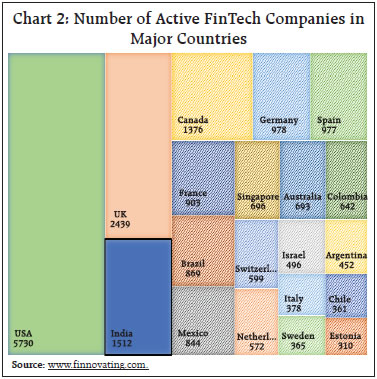

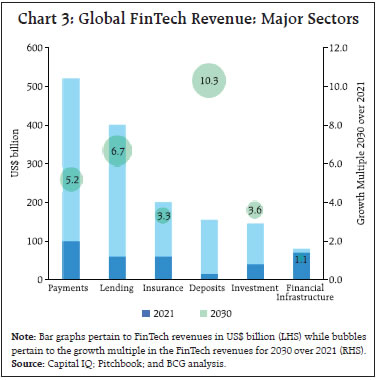

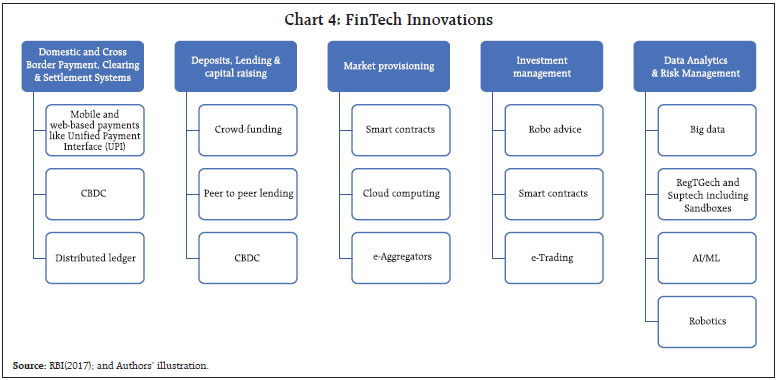

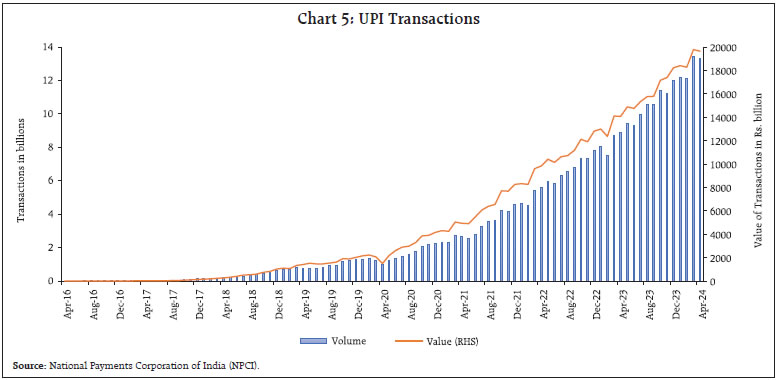

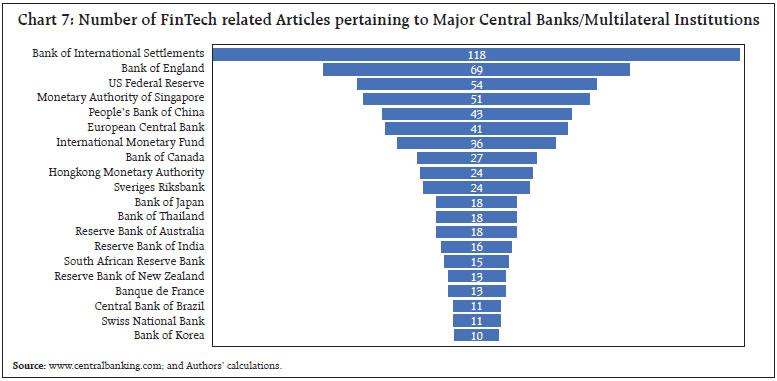

by Manu Sharma, Dirghau Keshao Raut, Shobhit Goel and Madhuresh Kumar^ Amidst rapid innovations in the delivery of financial services, this article surveys the policy focus of central banks towards FinTech developments using natural language processing-based text mining analysis of central banks’ news articles, speeches and interviews. The analysis suggests that ‘payment systems’ are a priority, both in terms of innovations and regulation by the central banks among different areas of FinTech. Temporal analysis indicates that ‘central bank digital currency’ (CBDC) and its usage is emerging as the central area of policy discussions and initiatives, with the focus shifting towards modalities of CBDC implementation from the earlier concerns related to applicable technology and financial implications. Introduction FinTech developments are reshaping access, affordability and delivery of financial services. FinTech-enabled digital payment platforms, peer-to-peer payment apps and blockchain-based technologies facilitate faster information processing and credential checks and offer more convenience to money transfers and transactions (Laven and Bruggink, 2016). These efficiency benefits have the potential to bring financial services to the underserved and unbanked populations. FinTech solutions, particularly mobile banking and digital wallets often complement traditional banking services, thus promoting financial inclusion. The FinTech revolution can be enabled by both public and private payment platforms, for instance, the United Payment Interface (UPI) - launched by the National Payment Corporation of India. On the other hand, FinTech companies are also playing a crucial role in financing small and medium-sized enterprises (SMEs) in countries such as China, the United States, the United Kingdom, Korea and Kenya. The underlying technology driving a vast majority of FinTech innovations including cloud services, AI models and block-chain technology solutions are provided by only a few providers for all financial institutions, and they are currently not subject to supervision by bank regulators leading to concerns about quality control, data security, and a possible conflict of interest (Allen et al., 2021). Accordingly, the central banks are monitoring evolution of FinTech-driven solutions to preserve consumer confidence and the stability of overall financial system. Moreover, in view of their implications for central banking functions such as issuance of currency, regulation/supervision of the banking system and monetary policymaking, central banks are actively involved in tracking developments of FinTech arena. As recently pointed out by the RBI Governor, “Technological innovation has unprecedented potential to make finance more inclusive, competitive and robust. It is crucial that technological advancements in the world of FinTech evolve in a responsible manner and are truly beneficial to the people at large”1. Many central banks are exploring FinTech innovations such as (i) cross-border uses of CBDC in collaboration with BIS Innovation Hub (BISIH) (ii) linking fast payment systems with other jurisdictions for cross-border financial integration (iii) operationalising regulatory sandboxes to facilitate FinTechs to test their services before full scale deployment. As the digital economy and financial advancements transcend regulatory boundaries and national frontiers, policymakers require established frameworks that facilitate their cooperation and knowledge-sharing. Against this backdrop, this study attempts to analyse the areas of policy focus of major central banks/ multilateral institutions in the domain of FinTech utilising sources of information such as central bank news, press releases, interviews, speeches. It also classifies the FinTech related concerns of central banks into broad policy clusters and identifies the shift in focus areas of central banks over time to gauge the perspectives/policy priorities of central banks. To achieve the objective, the study employs word frequency plot analysis and networking analysis through Natural Language Processing (NLP) based text mining approach. The rest of this paper is divided into six sections. Section II briefly covers the literature review on FinTech. Section III highlights the Global FinTech developments and Section IV summarises the FinTech developments in the Indian case. Section V highlights the data and the methodology. Sections VI and VII analyse the results and provide key takeaways and concluding observations. With information technology (IT) developments such as the emergence of the World Wide Web and internet accessibility through mobile phones, financial services are witnessing “electronic” versions coming into existence as products, such as e-banking, e-KYC. FinTech provides an innovative solution bridging financial services and information technology to make the system more efficient and inclusive. The term “FinTech” originates from combining finance and technology, embodying and synergising the essence of employing innovative solutions (using cutting-edge technologies of the likes of internet, artificial intelligence and cloud computing, to name a few) to enhance the quality and ease of accessing banking and financial services (such as lending, payments, money transfers, and other banking activities). The Financial Stability Board (FSB) defines FinTech as “technology-enabled innovation in financial services in terms of new business models, applications, processes, or products with an associated material effect on the provision of financial services” (FSB, 2019). A common theme that emerges from the definitions of Fintech is the usage of technological innovations like Artificial Intelligence (AI) / Machine Learning (ML), Cloud Platforms, Distributed Ledger Technology (DLT) or mobile internet to address the high cost, low speed, lack of transparency, access and security in traditional financial services used for making payments, savings, credit, or even financial management and advisory (Chart 1). FinTech has led to the development of innovative banking and financial products to address the gap in traditional banking models. FinTech lenders are found to have been able to penetrate areas underserved by traditional banks and areas with fewer bank branches per capita, /thereby promoting financial inclusion although in an unregulated environment (Jagtiani & Lemieux 2018). Using web crawling and text analysis techniques, Cheng & Qu (2020) find that FinTech reduces credit risk in Chinese commercial banks. Deng et al. (2021) find that FinTech has a restraining effect on the overall risk of banks; thus, it may contain bank’s risk-taking ability and improve the overall stability of operations. The adoption of FinTech is found to improve competitiveness and performance of the banking industry in the UAE (Dwivedi et al. 2021); and also capital adequacy, asset quality, management efficiency, earnings power, and liquidity (Xu, 2022). The literature has also assessed the impact of FinTech on the traditional banking sector (Tang et al., 2023). Regulatory arbitrage to roll-out high profit products hurting profitability of traditional banks and putting consumers at risk are observed (Murinde et al., 2022; Tang et al., 2023). Further, there is concern regarding unfair and discriminatory uses of data leading to loss of privacy combined with possible manipulation of consumer behaviour. Compromised data security can lead to fraud and scams (Barefoot, 2020). Big FinTechs (BFT) could undermine developing and emerging countries by crowding out their domestic players, creating monopolies over time, avoiding taxes by shifting profits, taking advantage of regulatory arbitrage to undermine consumer protection laws (Foster et al., 2021). RBI (2024) finds the role of FinTechs in promoting digitalisation which plays a crucial role in financial inclusion. FinTechs can also influence consumer decisions and have far-reaching implications for monetary policy and financial stability (RBI, 2024).  III. Global FinTech Developments FinTech has transformed the delivery of financial services by making them faster, cheaper, efficient and more accessible2. The global FinTech industry generated revenues of around US$ 285 billion in 2021 across the major sectors, which is projected to reach US$ 1.5 trillion by 2030. This growth will be driven primarily by Emerging Asia Pacific (e.g. China, India, and Indonesia), as it has the largest FinTechs, underbanked populations, a high number of small and medium-sized enterprises, and a rising tech-savvy youth and middle class3. In terms of number of active FinTech entities, the Unites States of America (USA), the United Kingdom (UK) and India are leading the lot (Chart 2). The growth in Fintech-led credit remains in a nascent stage in Continental Europe, the Middle East and Latin America (Claessens et al., 2018; FSB, 2019). FinTech has expanded financial access in emerging markets and developing economies, reduced the cost of cross-border remittances and benefited women by enabling direct access to government payments and wages without any intermittent leakages through digital accounts (Feyen et al., 2023). FinTech/BigTech credit also witnessed sharp jump driven by advanced countries, which is expected to reach US$4.9 trillion by 2030 (AMR, 2021). The latest data from the World Bank’s Global Financial Inclusion (Global Findex) Database4 reveals that worldwide financial account ownership increased from 51 percent to 76 percent between 2011 and 2021. Furthermore, the percentage of adults engaged in digital payment transactions rose from 35 percent in 2014 to 57 percent in 2021. Rapid growth of mobile money, bank applications and financial services offered by BigTechs, as well as the emergence of crypto-assets and CBDCs, has led to introduction of new infrastructures, products and business models that are fundamentally reshaping the structure of financial markets. The developments around cross border usage of CBDCs are particularly on a rise (Box I).  These developments have fuelled up the expectations of a multi-fold increase in the global FinTech revenues across various FinTech sectors by 2030 (Chart 3).  On the regulation aspect, Regulatory Sandboxes have attracted interest across countries. These sandboxes serve to facilitate FinTech initiatives that align with the regulatory intent but may not fully adhere to the precise wording of the regulations (Feyen et al., 2023). Drawing from the findings of Working Group on FinTech and Digital Banking by RBI (2018), FinTech innovations can be classified into five broad categories on the basis of their application (Chart 4). As per the Payment Council of India and FinTech Convergence Council Annual Report 2021-225, India is the third largest FinTech ecosystem in the world with the industry’s market size expected at nearly US$ 150 billion by December, 2025. The application of FinTech to payment system has already woven a success story for India with Unified Payment Interface (UPI), crossing 13 billion monthly transactions as on April, 2024 (Chart 5). The user friendliness and ease of transaction has been increasingly making UPI a popular medium for retail/ low value transactions which is reflected in a decrease in the average value of UPI based transactions (rupee value of transactions per unit volume) from ₹1,657 as on January, 2020 to ₹1509 as on January 20246.

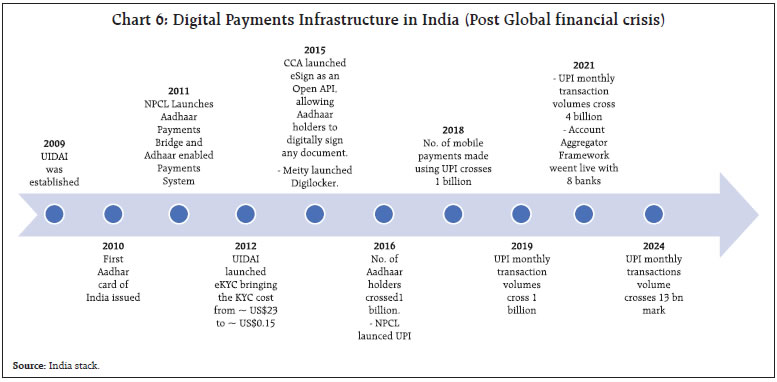

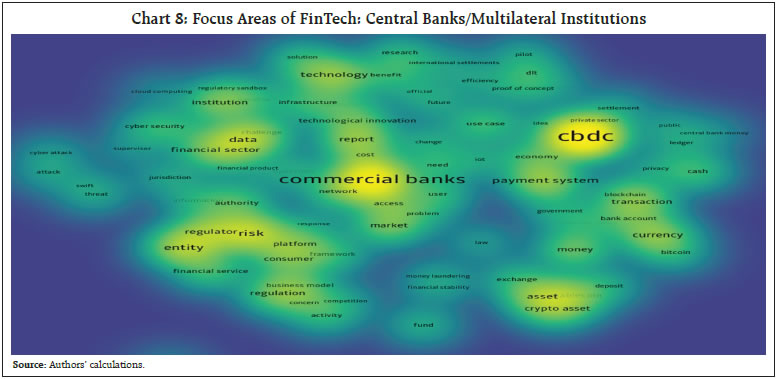

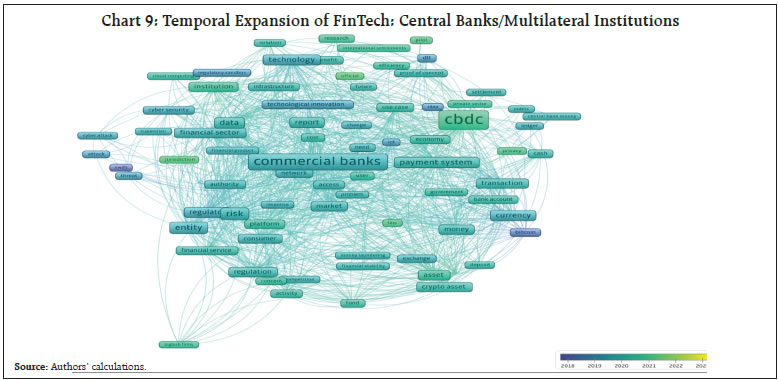

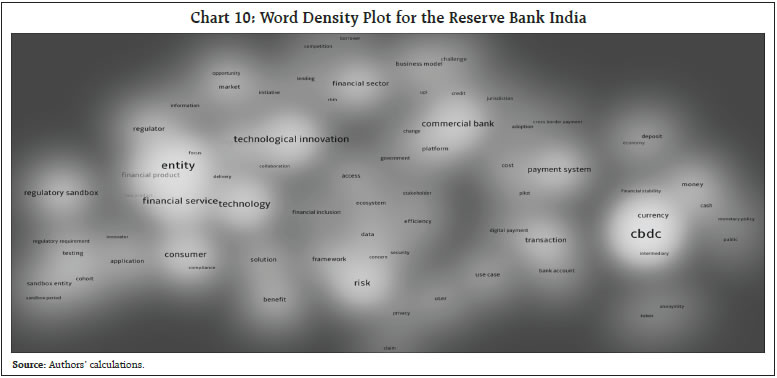

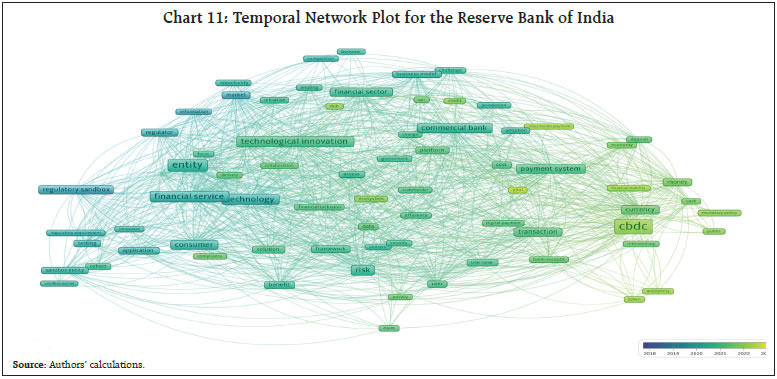

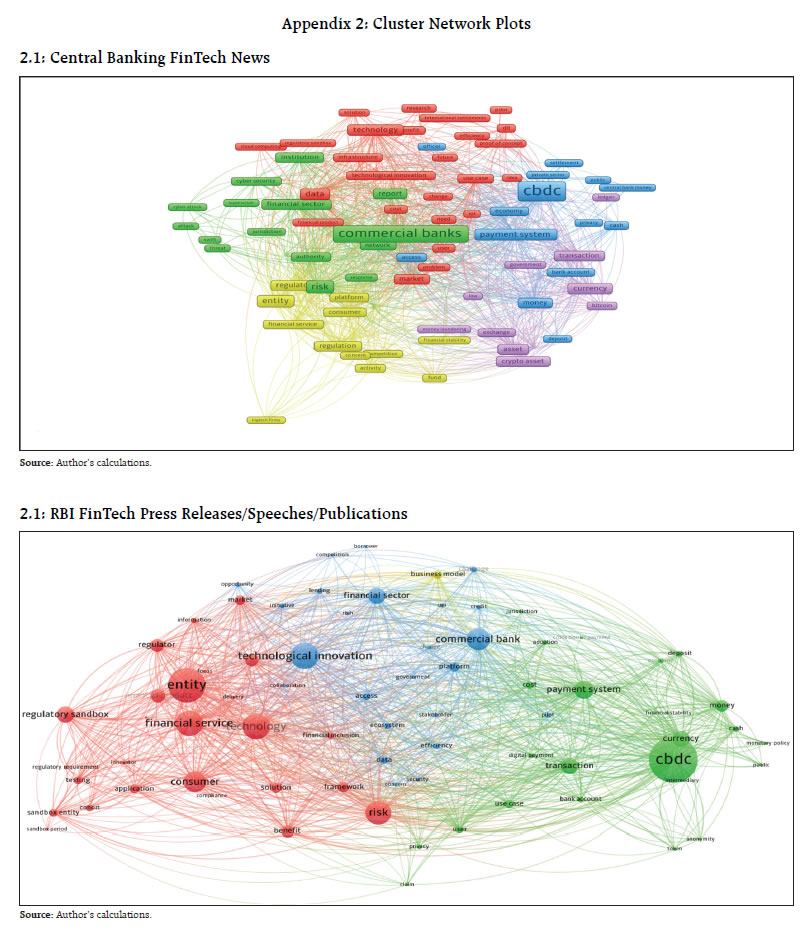

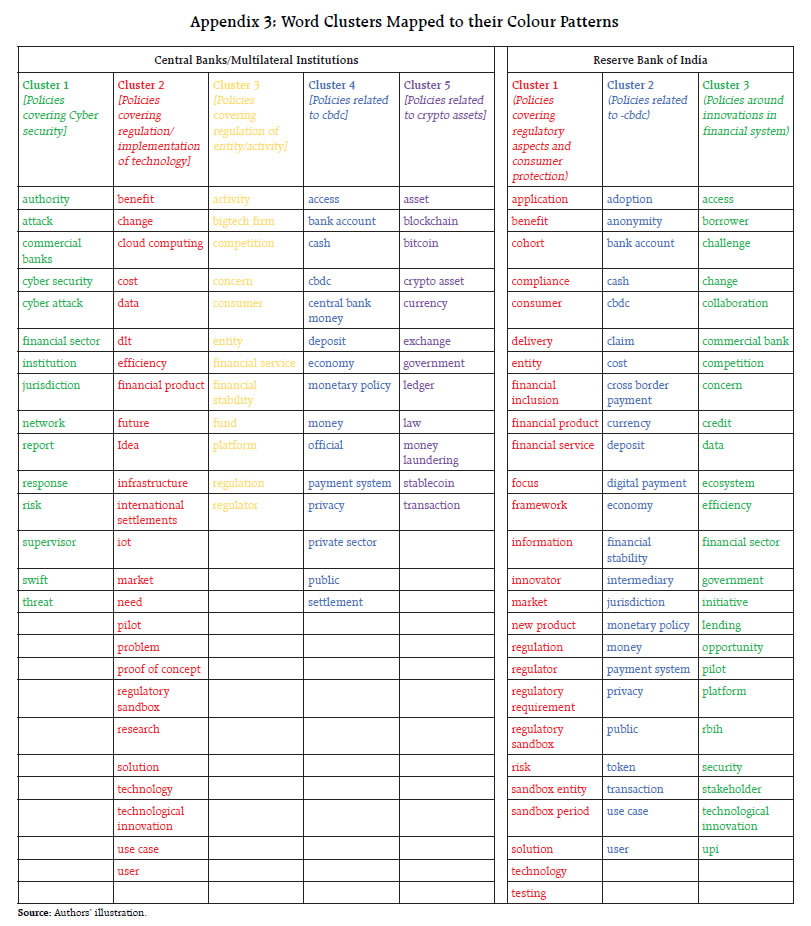

The journey of digital payment infrastructure had its roots in the novel Unique Identity Authority of India (UIDAI) project, which is the world’s largest national identity project (Ramnath and Assisi, 2018). The unique 12-digit Aadhar number had been powering digital banking and payments in India (Chart 6). The Aadhaar-based payment systems including Aadhaar Enabled Payment System (AEPS), Aadhaar Payment Bridge (APB) and Aadhaar Payment App have not only been encouraging cashless transactions but also tend to remove the need for merchants in order to access the Point-of-Sale (POS) terminal/hardware for digital payments.   To give a further boost to the FinTech sector by fostering innovation, while remaining vigilant and addressing the risks associated with the FinTech ecosystem under the adequacy framework, the Reserve Bank established a dedicated FinTech department with effect from January 4, 20227. Regulatory sandboxes have been conducted since 2019 in ‘retail payments’, ‘Cross Border Payments’, ‘MSME Lending’, and ‘Prevention and Mitigation of Financial Frauds’. This broader aim is to achieve actionable goals like promoting constructive innovations and incubation in the FinTech sector, amidst the implications for the financial industry and markets within the jurisdiction of the Reserve Bank. In 2020, the RBI set up Reserve Bank Innovation Hub (RBIH) to promote innovation across the financial sector by leveraging on technology and creating an environment which would facilitate and foster innovation. In some of the more recent developments, the Reserve Bank launched pilots of CBDC in 2022 with the commercial banks offering interoperability with UPI. The Reserve Bank is also actively engaging itself in exploring the use of CBDCs for cross border payments. Under India’s G20 Presidency, the Reserve Bank and the BIS Innovation Hub (BISIH) jointly launched the fourth edition of the G20 TechSprint, a global technology competition to promote innovative solutions aimed at improving cross-border payments. The study applies NLP based text mining approach to analyse the text data related to FinTech to explore the policy developments in this field. Text mining, a component of data mining, uses NLP techniques8 to extract useful information and insights from large amount of unstructured text data. The process of text mining involves structuring the input text, deriving patterns within the structured data, and finally evaluating and interpreting the output. In recent years, text mining has found significant applications in economic and financial sector research, with one specific application being the effective analysis of the regulatory communications in form of publications, research papers and news related to central banks (Bholat et al., 2015). Apel & Grimaldi (2012) measure the sentiment and tone of the minutes of the Swedish central bank, thereby converting qualitative text into quantitative measure and find that this measure is useful in predicting future policy rate decisions. Hendry & Madeley (2012) use Latent Semantic Analysis on Bank of Canada MPRs to investigate what type of information affects returns and volatility in short-term as well as long-term interest rate market. The recent literature has focussed on using specific dictionaries to better capture the subtlety of central bank communications (Lee et al., 2019), along with usage of these techniques to analyse central banks of emerging and developing economies (Omotosho, 2020; Tumala & Omotosho, 2020). This study utilises the methodology proposed by Van Eck and Waltman (2010 and 2014) employing Apache OpenNLP library9 to carry out text extraction, pre-processing and analysis. Two separate text analytics exercises have been attempted on text data samples obtained from (i) the FinTech section of Central Banking10 News Portal’s website www.centralbanking.com, and (ii) the official website of the Reserve Bank of India (www.rbi.org.in). The FinTech section of Central Banking News Portal includes all the news pieces, articles, speeches, publications and press releases on topics associated with FinTech and the allied domains which are disseminated publicly by nearly 100 central banks and multilateral organisations (Appendix 1). Thus, it provides the information on global FinTech developments at the central bank level under one roof. The obtained text data covers the period from November 2013 to August 2023. The FinTech section of the Reserve Bank’s website includes the publicly disseminated information on FinTech by the Reserve Bank. The obtained text data covers the period from February 2018 to August 2023. Text extraction and pre-processing includes sentence detection, tokenisation, part-of-speech tagging, lemmatisation and noun phrase identification. The noun phrases so obtained are fed into NLP based text analytics algorithms to generate the following: Frequency based Word Plot: The size of each word/its background colour density indicates its frequency or importance in the text. Larger size of words indicates their more frequent appearance in the central bank disseminations (source text) and hence hold greater policy significance. These plots consolidate the variations of words, such as singular and plural forms, into a single word for simplicity. A thesaurus of such words as well as acronyms can be defined by the user for their replacement. Cluster Network Plot: A Network Plot is a visual representation of the co-occurrence where the networking lines between the words reflect their relatedness. This relatedness is established by analysing how often the terms co-appear in documents. Groups of words that frequently appear together in the parent text are shown as part of one cluster with similar colouring pattern. Also, the words within one cluster are highly networked i.e., treated together in the parent text as related terms or topics which not only provides the meaning and significance of individual words, but also the overall context in which these are used.  Trend based Temporal Network Plot: The trend in the usage of a word over a period can be visualised using Temporal Network Plot. This tool superimposes a time dimension over the Cluster Network Plot by placing a colour gradient that is changing with a timeline of the occurrence. Certain words which are re-occurring or highly repetitive, owing to the nature of the text, such as FinTech or financial technology, central bank, policy, world, report, interview, example, instructions etc, have been excluded. Moreover, names of countries, central banks, months etc, which are less relevant in the context, have also been excluded in all three plots. VI. Results of Text Mining based Survey VI.1 FinTech Focus of Central Banks across the World As noted earlier, the Central Banking news portal provides articles, speeches and interviews from across nearly 100 central banks and multilateral organisations. Among the central banks, The Bank of England, the US Federal Reserve and the Monetary Authority of Singapore appear at the top with the Reserve Bank of India in the top 15 (Chart 7). While creating the density plot, only those words occurring more than 100 times in the total text data have been included. The choice of this threshold is to emphasise the most discussed FinTech issue. Accordingly, around 90 such words are identified. The word plot is dominated by words like ‘CBDC’, ‘commercial banks’, ‘risk’, ‘entity’, ‘data’, ‘payment system’ and ‘technology’, consistent with the broader policy priorities of the central banks (Chart 8). The emergence of CBDC as the most important area being focused by the central banks is on expected lines as 130 countries, representing 98 per cent of global GDP, are exploring CBDC and 64 countries are in an advanced phase of exploration (development, pilot, or launch)11.  The networking analysis highlights that there are 5 broad clusters, with the following themes: ‘cyber security’, ‘regulation/implementation of technology’, ‘regulation of entity/activity’, ‘policies related to CBDC’ and ‘regulation of crypto assets’ (Appendix 2.1 & 3): Cluster 1: This cluster covers policies addressing the cyber security aspect of commercial banks and financial sector and the supervisory vigilance of the central bank towards threats emanating from cyber-attacks. It also highlights the perception of risks and the response mechanism together with other legal aspects faced in the jurisdiction. Cluster 2: This cluster identifies regulatory aspects of central bank releases inclined towards technological domain. It includes policy discussions around the use case of pilot projects based on cloud computing, DLT, IoT etc. in obtaining/processing data for implementing regulatory sandboxes and other central bank functionalities, primarily international settlements. The discussion also covers the need for research on such ideas for the future and the technological infrastructure, the related efficiency, benefits as well as the problems in implementing such solutions including the cost aspects. Cluster 3: This cluster largely focuses on the regulation of the financial services - especially the BigTech firms and the concerns emanating from their activities on consumer, competition and financial stability related matters. The focus seems to be on the entities or firms rather than the technology itself. Cluster 4: This cluster centres around the implementation of CBDC, its role vis-a-vis cash and deposits, and its overall impact on monetary policy and economy. Cluster 5: This cluster spans across the central banks’ stance on transactions related to crypto assets including digital currencies such as Bitcoin, stablecoins and their exchanges based on blockchain/distributed ledger and the related concerns such as money laundering. It highlights the stance of the government and limit of the law. These policy priorities are not static and have evolved over time, adjusting to the needs and challenges. The Temporal Network Plot for the last 5 years showcases that the policy priorities in 2018 and 2019 centred around bitcoin, SWIFT, IoT, DLT, regulatory sandbox, technology, technological innovations, currency, ledger etc, which reflect the conceptual building blocks of the FinTech innovations as well as the regulatory regime. This shifted to more mature/implementation stage themes over time (such as CBDC, cloud computing, research, cost etc.). The policy debate seems to be shifting towards topics such as bigtech firms, jurisdiction, law, pilots and privacy which mirror the contemporary FinTech concerns of the central bankers’ world over (Chart 9).  VI.2 FinTech Focus of the Reserve Bank of India The density plot shows dominance of words such as CBDC, entity, technological innovation, financial service, technology, risk, commercial bank, consumer etc. CBDC appears to be the most frequently used word in the FinTech related information dissemination of the RBI, as observed in case of other central banks (Chart 10). While creating the density plot, only those words occurring for more than 20 times in the total text data have been included. Accordingly, around 75 such important words are identified.  The networking analysis identifies 3 clusters. Upon examining the words clustered together, they seem to represent three broad themes - ‘regulatory aspects and consumer protection’, ‘CBDC’ and ‘financial innovations’ (Appendix 2.2 & 3): Cluster 1: The cluster spans across regulatory aspects of FinTech covering entity, technology, risk, sandbox mechanism, cohort, framework, compliance, testing, solution, financial product and service. Interestingly, the cluster also encompasses the Reserve Bank’s focus on consumer, financial service, delivery and financial inclusion, thus, seemingly broadening the regulatory ambit to consumer protection. Cluster 2: This cluster highlights the policy debate around CBDC in conjunction with cash and deposits, highlighting its role in payment system and transactions and cross border payments. The impact of CBDC on currency, cash, deposits, financial stability, money, monetary policy and overall economy also emerged as an area of interest. The features of CBDC like token-based, privacy and anonymity of transactions are also discussed. Cluster 3: This cluster reflects the FinTech discussions around the existing technological innovations in the financial sector, including the commercial banks and their initiatives/priorities revolving around credit, lending, UPI and data. It highlights the policy concerns, challenges, competition and opportunities for the stakeholders, including borrowers, regarding collaboration, efficiency, access and security to enhance the ecosystem. The Reserve Bank Innovation Hub (RBIH) also appears in the cluster, justifying its role as a platform for financial sector innovations. According to the Temporal Network Plot for the last 5 years, the policy priorities in 2018 and 2019 were centred around regulatory sandboxes, identifying technologies in financial services, setting regulatory requirements for entities, testing and market information systems. In the ensuing years, the approach graduated to specific policies centred around risk assessment, lending, user cases, security and data platforms. The recent policy debate seems to be shifting towards topics such as CBDC, its role in monetary policy and its status vis-à-vis deposits and currency. Currently, the CBDC related discussions have focussed more on aspects such as its role in cross border payments, financial stability and the features of its pilot launch such as anonymity of transactions (Chart 11).  There is a broad consensus within the global central banking institutions and the Reserve Bank, as reflected in the alignment of policy priorities in areas of FinTech, although their stance towards the regulation of FinTechs is still evolving. Central banks are increasingly focusing on their payment systems, with CBDC emerging as the most widely discussed FinTech application globally and in India. Results obtained from text mining of central banking news/articles shows that the policy discussions on CBDC have evolved beyond initial concerns about technology and its effects on cash, bank deposits, and monetary policy. They now focus on more detailed, practical, and operational aspects, including legal implications, interoperability across jurisdictions, cross-border payments, privacy and pilot projects. The text mining analysis of FinTech news/policy documents of the Reserve Bank shows that due emphasis is given to consumer protection, service delivery and financial inclusion, stressing upon the need to maintain a healthy balance among all the stakeholders and enshrining an essential feature of the financial services – that of a public good. The central banks have put on regulatory discussions towards the specific technologies (including IoT, DLT and Cloud computing) apart from the entities applying these technologies. On the other hand, the Reserve Bank’s regulatory focus appears to be encompassing the regulated entity/activity and the technology with a focus to bring the regulator and the market/innovators together. The Reserve Bank of India’s recent push to encourage FinTechs to establish a Self-Regulating Organisation (SRO), to evolve the industry best practices norms in sync with the laws of the land and the set standards, may go a long way in delineating regulatory perimeter for the FinTech in India. References Allen, F., Gu, X., & Jagtiani, J. (2021). A Survey of Fintech Research and Policy Discussion. Review of Corporate Finance, 1(3–4), 259–339. https://doi.org/10.1561/114.00000007 Allied Market Research. (2021). FinTech Lending Market to Reach $4,957.16 Billion, Globally, by 2030 at 27.4% CAGR. PRNewswire news release, November 15. Retrieved from https://www.alliedmarketresearch.com/fintech-lending-market Apel, M., & Grimaldi, M. B. (2014). How informative are central bank minutes?. Review of Economics, 65(1), 53-76. Auer, R., Haene, P. & Holden, H. (2021). Multi-CBDC arrangements and the future of cross-border payments. BIS Paper No 115, Monetary and Economic Department, Bank for International Settlements, March. Barefoot, J. A. (2020). Digital Technology Risks for Finance : Dangers Embedded in Fintech and Regtech. In M-RCBG Associate Working Paper Series (Issue 151). https://www.hks.harvard.edu/centers/mrcbg/publications/awp/awp151 Bholat, D. M., Hansen, S., Santos, P. M., & Schonhardt-Bailey, C. (2015). Text Mining for Central Banks. SSRN Electronic Journal, 33. https://doi.org/10.2139/ssrn.2624811 BIS (2019). Big tech in finance: opportunities and risks. Annual Economic Report. Bank for International Settlements, June. Bank for International Settlements. (2023). Lessons learnt from CBDCs. Report to the G20 Finance Ministers and Central Bank Governors. Bank for International Settlements Innovation Hub, July. Chen, S., Goel, T., Qiu, H., & Shim, I. (2022). CBDCs in emerging market economies. BIS Papers. Cheng, M., & Qu, Y. (2020). Does bank FinTech reduce credit risk? Evidence from China. Pacific Basin Finance Journal, 63(12), 1013-98. https://doi.org/10.1016/j.pacfin.2020.101398 Deng, L., Lv, Y., Liu, Y., & Zhao, Y. (2021). Impact of fintech on bank risk-taking: Evidence from China. Risks, 9(5). https://doi.org/10.3390/risks9050099 Dwivedi, P., Alabdooli, J. I., & Dwivedi, R. (2021). Role of FinTech Adoption for Competitiveness and Performance of the Bank: A Study of Banking Industry in UAE. International Journal of Global Business and Competitiveness, 16(2), 130–138. https://doi.org/10.1007/s42943-021-00033-9 Feyen, E., Natarajan, H., & Saal, M. (2023). Fintech and the Future of Finance: Market and Policy Implications. World Bank Group. Foster, K., Blakstad, S., Gazi, S., & Bos, M. (2021). BigFintechs and Their Impacts on Macroeconomic Policies. In UNDP Technical Paper. https://doi.org/10.2139/ssrn.3871371 Frost, J., Gambacorta, L., Huang, Y., Shin, H. S., & Zbinden, P. (2019). BigTech and the changing structure of financial intermediation. Economic Policy, 34(100), 761-799. FSB (2019). FinTech and Market Structure in Financial Services: Market Developments and Potential Financial Stability Implications, Financial Stability Board, February. Hendry, S., & Madeley, A. (2012). Text Mining and the Information Content of Bank of Canada Communications. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.172282 IMF (2019). FinTech: The Experience So Far. IMF Policy Paper. International Monetary Fund. June. Jagtiani, J., & Lemieux, C. (2018). Do fintech lenders penetrate areas that are underserved by traditional banks? Journal of Economics and Business, 100(April), 43–54. https://doi.org/10.1016/j.jeconbus.2018.03.001 Laven, M., & Bruggink, D. (2016). How FinTech is transforming the way money moves around the world: An interview with Mike Laven. Journal of Payments Strategy & Systems, 10(1), 6-12. Lee, Y. J., Kim, S., & Park, K. Y. (2019). Deciphering monetary policy board minutes with text mining: The case of South Korea. Korean Economic Review, 35(2), 471–511. Murinde, V., Rizopoulos, E., & Zachariadis, M. (2022). The impact of the FinTech revolution on the future of banking: Opportunities and risks. International Review of Financial Analysis, 81(June 2021), 102103. https://doi.org/10.1016/j.irfa.2022.102103 Omotosho, B. S. (2020). Central Bank Communication in Ghana: Insights from a Text Mining Analysis. SSRN Electronic Journal, 2005, 1–15. https://doi.org/10.2139/ssrn.3526451 Prasad, E. (2023). Managing risks from crypto assets and decentralized finance: an emerging market and developing economy perspective. Background Note for G-20 Discussions on Regulation of Crypto Assets, June. Ramnath, N. S., & Assisi, C. (2018). The Aadhaar effect: Why the world’s largest identity project matters. Oxford University Press. RBI (2024). The Report on Currency and Finance. Reserve Bank of India, July. RBI (2017). The Report of the Working Group on FinTech and Digital Banking. Reserve Bank of India, November. Tang, M., Hu, Y., Corbet, S., Hou, Y. (Greg), & Oxley, L. (2023). Fintech, bank diversification and liquidity: Evidence from China. Research in International Business and Finance, 67(PA), 1020-82. https://doi.org/10.1016/j.ribaf.2023.102082 Tumala, M. M., & Omotosho, B. S. (2020). A Text Mining Analysis of Central Bank Monetary Policy Communication in Nigeria. Central Bank of Nigeria Journal of Applied Statistics, 10(2). Van Eck, N. & Waltman, L. (2010). Software survey: VOSviewer, a computer program for bibliometric mapping. Scientometrics, 84(2), 523-538. Van Eck, N. & Waltman, L. (2014). Visualizing bibliometric networks, In Measuring scholarly impact: Methods and practice (pp. 285-320). Cham: Springer International Publishing. Xu, F. (2022). FinTech and Bank Performance in Europe: A Text-mining Analysis. Master Thesis, University of Barcelona. Appendices    ^ The authors are from Department of Economic and Policy Research, Reserve Bank of India. The views expressed are those of the authors and not of the Reserve Bank of India. 1 Keynote address by Shri Shaktikanta Das, Governor, RBI (dated September 6, 2023) on FinTech and the Changing Financial Landscape at the Global Fintech Festival, Mumbai. Available at: https://rbi.org.in/web/rbi/-/speeches-interview/fintech-and-the-changing-financial-landscape-keynote-address-by-shri-shaktikanta-das-governor-rbi-september-6-2023-at-the-global-fintech-festival-mumbai-1383 2 Keynote address by Shri Shaktikanta Das, Governor, RBI (dated September 6, 2023) on FinTech and the Changing Financial Landscape at the Global Fintech Festival, Mumbai. Available at: https://rbi.org.in/web/rbi/-/speeches-interview/fintech-and-the-changing-financial-landscape-keynote-address-by-shri-shaktikanta-das-governor-rbi-september-6-2023-at-the-global-fintech-festival-mumbai-1383 3 https://www.bcg.com/press/3may2023-fintech-1-5-trillion-industry-by-2030 4 The Global Findex serves as a pioneer publicly available database gauging individuals’ utilisation of financial services overtime across various economies. It is based on over 150,000 interviews conducted across more than 140 economies. This database facilitates a comprehensive exploration of how individuals engage in saving, borrowing, conducting payments, and handling financial risks. 5 Available at: https://www.fintechcouncil.in/pdf/PCI_FCC_Annual_Report_2021_22.pdf 6 According to the Payment Systems data available on Database on Indian Economy (DBIE). 7 FinTech Department was created after subsuming the FinTech division of Department of Payment and Settlement Systems. 8 NLP involves various techniques at the intersection of computer science and linguistics to empower computers to comprehend natural language akin to humans by receiving real-world inputs, analyse them and interpret them in a manner comprehensible to computers. 9 Apache OpenNLP library is a machine learning toolkit for processing of natural language text. For more information on Apache OpenNLP library, reader may refer to Apache OpenNLP Developer Documentation available at https://opennlp.apache.org/docs/2.0.0/manual/opennlp.html#opennlp 10 The FinTech portal of Central Banking (https://www.centralbanking.com) covers Fintech and the related news from a network of nearly 100 central bank around the globe which includes speeches, publications, public releases and interviews of executives. |

পৃষ্ঠাটো শেহতীয়া আপডেট কৰা তাৰিখ: