The Annual Report on the Working of the Reserve Bank of India

Part Two : The Working and Operations of

The Reserve Bank of India

III MONETARY AND CREDIT POLICY

OPERATIONS

III.1 The key issues that had to be addressed by monetary management during 2005-06 were the risks arising from rising domestic demand, high and volatile international crude oil prices and upturn in the global interest rate cycle. Monetary management also faced some challenges in maintaining stable liquidity conditions, which particularly arose in the last quarter of 2005-06, partly due to transient factors such as the redemption of India Millennium Deposits (IMDs) and partly cyclical factors associated with the upturn in credit demand. Nonetheless, calibrated and pre-emptive monetary measures during the year helped to keep inflation and inflationary expectations well-contained while supporting investment demand in the economy. The Reserve Bank continued with its policy of active demand management of liquidity through the flexible use of policy instruments at its disposal designed to ensure stability in financial markets. With inflation contained and inflationary expectations seen to be consistent with the policy stance, real growth picked up in an environment of price and financial stability, raising expectations of a structural shift in the medium-term growth path of the economy. Monetary policy was particularly effective in ensuring that the cost-push impulses from oil prices did not feed through into aggregate demand conditions. Monetary management during 2005-06 was, thus, conducted broadly in conformity with the stance of the policy set out in the policy statements during the year.

III.2 During 2005-06, the Reserve Bank initiated the system of reviewing the Annual Policy Statement on a quarterly basis as against the prevailing system of a half-yearly review. With a view to fur ther strengthening the consultative process in monetary policy formulation, the Reserve Bank, in July 2005, set up a Technical Advisory Committee on Monetary Policy (TACMP) with external experts in the areas of monetary economics, central banking, financial markets and public finance. The Committee meets at least once in a quarter and reviews macroeconomic and monetary developments, and advises the Reserve Bank on the stance of monetary policy. The Committee has met five times since its inception and has contributed to enriching the inputs and processes of policy setting.

III.3 This Chapter presents monetary and credit policy operations of the Reserve Bank during 2005-06. Various monetary measures by the Reserve Bank along with liquidity management operations are covered in this Chapter. Policy initiatives to improve the credit delivery mechanism are also included in this Chapter.

MONETARY POLICY OPERATIONS III.4 The Annual Policy Statement for 2005-06 (April 2005) indicated that the stance of monetary policy would depend on several factors, including macroeconomic prospects, global developments and the balance of risks. Assuming a normal monsoon, and with expectations that industry and services sectors would maintain their growth momentum while absorbing the impact of oil prices, real GDP growth during 2005-06 was placed around 7.0 per cent for the purpose of monetary policy formulation. The inflation rate in 2005-06, on a point-to-point basis, was projected in a range of 5.0-5.5 per cent subject to the growing uncertainties on the oil front both in regard to global prices and their domestic absorption. The Statement stressed that the system has to recognise interest rate cycles and strengthen risk management processes to cope with eventualities so that financial stability could be maintained and interest rate movements could be transited in a non-disruptive manner. The Statement also stressed that it would be instructive to observe global trends as the Indian economy is progressively getting linked to the world economy. It was noted that while there was an overhang of domestic liquidity, partly mirroring abundant global liquidity, the trends in global interest rates, inflationary expectations and investment demand would also have some relevance in the evolution of the domestic interest rates. It would, therefore, be desirable to contain inflationary pressures to stabilise domestic financing conditions both for the Governments and the private sector. Against this backdrop, barring the emergence of any adverse and unexpected developments in various sectors of the economy and keeping in view the inflationary situation, the overall stance of monetary policy for the year 2005-06 was stated as follows:

• Provision of appropriate liquidity to meet credit growth and support investment and export demand in the economy while placing equal emphasis on price stability.

• Consistent with the above, to pursue an interest rate environment that is conducive to macroeconomic and price stability, and maintaining the momentum of growth.

• To consider measures in a calibrated manner in response to evolving circumstances with a view to stabilising inflationary expectations.

III.5 At the time of presentation of the Annual Policy Statement, the Reserve Bank faced two major challenges: (i) reining in inflationary expectations in the face of several uncertainties so as to ensure stability in the financial markets and maintaining financing conditions at levels appropriate to lend support to the ongoing growth momentum; and (ii) liquidity management in the context of budgeted Government borrowings and indications of strong credit growth. The Reserve Bank, therefore, sought to moderate inflationary expectations by demonstrable commitment to price stability by increasing the LAF reverse repo rate by 25 basis points to 5.0 per cent while retaining the repo rate at 6.0 per cent, thereby narrowing the LAF rate corridor from 125 basis points to 100 basis points with effect from April 29, 2005.

III.6 In its First Quarter Review of the Annual Statement on Monetary Policy (July 2005), the Reserve Bank indicated that while the outlook for global growth and inflation was broadly unchanged from the presentation in the Annual Policy Statement in April 2005, the risks had increased since then. On balance, the Review noted that, during the first quarter, the underlying inflationary pressures appeared to have been contained and inflationary expectations maintained, as anticipated. While global factors were getting to be increasingly significant for India, the domestic factors were still the dominant factors and the latter pointed to favouring stability to maintain growth momentum. Accordingly, the Reserve Bank indicated that the overall stance of monetary policy for the remaining part of 2005-06 would continue to be as set out in the Annual Policy Statement of April 2005, but it would respond, promptly and effectively, to the evolving situation depending on the unfolding of the risks.

III.7 While leaving the repo rate and the reverse repo rate unchanged during the July 2005 Review, the Reserve Bank, however, enhanced risk weights on exposures to certain sectors around the same time in view of rapid credit growth to these sectors. Accordingly, the Reserve Bank raised risk weights on exposures of banks to commercial real estate as well as for credit risk on capital market exposures from 100 per cent to 125 per cent in July 2005 (Box III.1).

III.8 In its Mid-term Review of the Annual Policy Statement (October 2005), while noting that, on balance, macroeconomic and financial conditions have evolved as anticipated, the Reserve Bank pointed to the emergence of several factors posing risks to the outlook on growth and inflation. These included: need to ensure credit quality in light of the high expansion of non-food credit; continued infrastructure bottlenecks; substantial increase in asset prices, especially housing prices; high and volatile global crude oil prices, with an overwhelming part of the increase being increasingly regarded as permanent; emergence of increased current account deficits even if manageable; and upturn in the international interest rates cycle. Taking into account real sector developments of the first half, the Review revised upwards real GDP growth projections for 2005-06 to a range of 7.0-7.5 per cent from around 7.0 per cent as projected earlier. As regards outlook for inflation, taking into account oil prices having reached record highs, the Review noted that it may be difficult to contain the inflation in the range of 5.0-5.5 per cent projected earlier without an appropriate policy response. The Review reiterated that it is necessary, both for policy makers and market participants, to recognise interest rate cycles and strengthen risk management processes to cope with eventualities so that financial stability could be maintained and interest rate movements could be transited in a non-disruptive manner.

III.9 Against the backdrop of these developments, the Mid-term Review reaffirmed the stance of monetary policy set out in the Annual Policy Statement while rebalancing the priorities assigned to policy objectives in the context of the assessment of the economy and, particularly, the outlook on inflation. In response to the risks that had emerged, greater emphasis was placed on price stability. The fixed reverse repo rate under the LAF was increased by 25 basis points to 5.25 per cent to stabilize inflationary expectations while retaining the spread between reverse repo and repo rates at 100 basis points. The overall stance of monetary policy for the remaining part of the year was stated as:

• Consistent with emphasis on price stability, provision of appropriate liquidity to meet genuine credit needs and support export and investment demand in the economy. • Ensuring an interest rate environment that is conducive to macroeconomic and price stability, and maintaining the growth momentum.

• To consider measures in a calibrated and prompt manner, in response to evolving circumstances with a view to stabilising inflationary expectations. Box III.1

Bank Credit and Financial Stability Bank credit plays a critical role in economic growth, particularly in case of bank-based financial systems like India. At the same time, sustained episodes of high credit growth have often been found to be followed by banking and financial crisis. Credit booms, especially in the current environment of relatively less regulated global order, therefore, need careful watch by policy authorities. With many central banks moving away from quantitative targets to use of interest rates as the key instrument of monetary policy, neglect of credit and monetary aggregates can be risky. Periods of credit boom are often associated with easing of lending standards, which sow possible seeds of future financial instability. It is widely believed that the Asian financial crisis of the late 1990s was, inter alia, caused by the existence of an inefficient banking system that failed to perform the role of effective financial intermediation, as money and credit expanded without adequate risk management. Credit in many pre-crisis Asian economies was directed to speculative and ultimately unprofitable investments, such as real estate ventures or loss-making projects. Empirical evidence suggests that credit booms – defined as a situation where credit/GDP ratio is four percentage points above its trend – turn out to be the best predictor of future financial imbalances and dominate other possible predictors such as money, asset prices and output gaps. Over a 3-5 year horizon, credit booms predict 80 per cent of banking crises, much higher than the predictive power of 47 per cent in case of asset price misalignments. Asset price misalignments taken in conjunction with sharp movements in credit aggregates turn out to be the best predictors of future instability. With more and more EMEs progressively moving away from micromanagement of credit towards permitting interest rates a greater role in credit allocation, the potential threat of speculative movement of bank credit is stronger than ever before unless an efficient prudential and regulatory framework is put in place for the banking and financial system. Thus, it is necessary on the part of central banks today to pay particular attention to developments and movements in the credit market. Financial instability that might result from credit booms can, in fact, threaten the objective of price stability. Therefore, adequate stress by central banks on the quantum and quality of credit would be helpful in maintaining monetary and financial stability. Accordingly, the use of monetary and credit data can be a basis for resisting financial excesses.

In this context, following the multiple indicator approach adopted by the Reserve Bank, monetary policy in India has consistently emphasised the need to be watchful about indications of rising aggregate demand embedded in consumer and business confidence, asset prices, corporate performance, the sizeable growth of reserve money and money supply, the rising trade and current account deficits and, in particular, the quality of credit growth. This risk sensitive approach has served the Reserve Bank well in reining in aggregate demand pressures and second round effects of oil price increases to an extent while ensuring that constant vigil is maintained on threats to financial stability. Since growth in credit during the recent period was relatively higher in a few sectors such as retail credit and real estate, monetary policy faced a dilemma in terms of instruments. An increase in policy rate across the board could adversely affect even the productive sectors of the economy such as industry and agriculture. While policy rates have indeed been raised, they have been mainly aimed at reining in inflation expectations in view of continuing pressures from high and volatile crude oil prices. Therefore, while ensuring that credit demand for the productive sectors of the economy is met, the Reserve Bank has resorted to prudential measures in order to engineer a ‘calibrated’ deceleration in the overall growth of credit to the commercial sector. Accordingly, the Reserve Bank raised risk weights on loans to these sectors during July 2005 and April 2006. It also more than doubled provisioning requirements on standard loans for the specific sectors from 0.4 per cent to 1.0 per cent in April 2006. Thus, the basic objective has been to ensure that the growth process is facilitated while ensuring price and financial stability in the economy.

Reference

1. Bank for International Settlements (2005), 75th Annual Report.

2. Borio. C. and P. Lowe (2004), “Securing Sustainable Price Stability: Should Credit Come Back from the Wilderness?”, Working Paper No.157, Bank for International Settlements.

3. Mohan, Rakesh (2006), “Financial Sector Reforms and Monetary Policy: The Indian Experience”, Reserve Bank of India Bulletin, July.

4. White, W. (2006), “Is Price Stability Enough?”, Working Paper No.205, Bank for International Settlements.

5. Reser ve Bank of India (2006), Annual Policy Statement for 2006-07. III.10 In its Third Quarter Review of the Annual Statement on Monetary Policy (January 2006), the Reserve Bank observed that macroeconomic and financial developments were in support of the monetary policy stance. Real GDP growth in 2005-06, for the purpose of monetary management, was further revised upwards in the range of 7.5-8.0 per cent based on the assessment of a pick up in agricultural output and in the momentum in industrial and services sectors. Inflation was placed in the range of 5.0-5.5 per cent as projected earlier. While recognising that the current configuration of macroeconomic and financial factors favoured growth with stability in India, the need to extend these gains by continuing the greater emphasis on price stability was stressed. The risks to inflation from both domestic and global developments were perceived to remain high, persisting well into 2006-07, in view of the remaining pass-through of international crude prices into domestic prices. Emphasising the need to shore up the gains of recent high growth, the monetary policy stance was articulated in favour of a greater emphasis on price stability through measured but timely and even pre-emptive policy action to anchor inflation expectations. Accordingly, the fixed reverse repo rate and the repo rate under the LAF were increased by 25 basis points each to 5.50 per cent and 6.50 per cent, respectively. The overall stance of monetary policy was stated as:

• To maintain the emphasis on price stability with a view to anchoring inflationary expectations.

• To continue to support export and investment demand in the economy for maintaining the growth momentum by ensuring a conducive interest rate environment for macroeconomic, price and financial stability.

• To provide appropriate liquidity to meet genuine credit needs of the economy with due emphasis on quality.

• To consider responses as appropriate to evolving circumstances.

III.11 The fixed reverse repo rate, the price at which the Reserve Bank absorbs liquidity under the LAF was, thus, increased by 75 basis points during 2005-06 – 25 basis points each on three occasions (April 2005, July 2005 and January 2006) – to 5.50 per cent by end-March 2006 (Table 3.1). The repo rate, the price at which the Reserve Bank injects liquidity under the LAF, was hiked twice – 25 basis points each during October 2005 and January 2006 – to 6.5 per cent by end-March 2006. The spread between the repo rate and the reverse repo rate has, thus, been progressively reduced to 100 basis points by end-April 2005 from 200 basis points at end-March 2003.

Table 3.1: Movement in Key Policy Rates |

(Per cent) |

Effective since |

Reverse |

Repo Rate |

Effective since |

Bank Rate |

Effective since |

Cash Reserve |

|

Repo Rate |

|

|

|

|

Ratio (CRR) |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

|

|

|

|

|

|

|

March 5, 2002 |

6.00 |

8.50 |

February 17, 2001 |

7.50 |

December 29, 2001 |

5.50 |

March 28, 2002 |

6.00 |

8.00 |

March 2, 2001 |

7.00 |

June 1, 2002 |

5.00 |

June 27, 2002 |

5.75 |

8.00 |

October 23, 2001 |

6.50 |

November 16, 2002 |

4.75 |

October 30, 2002 |

5.50 |

8.00 |

October 30, 2002 |

6.25 |

June 14, 2003 |

4.50 |

November 12, 2002 |

5.50 |

7.50 |

April 30, 2003 |

6.00 |

September 18, 2004 |

4.75 |

March 3, 2003 |

5.00 |

7.50 |

|

|

October 2, 2004 |

5.00 |

March 7, 2003 |

5.00 |

7.10 |

|

|

|

|

March 19, 2003 |

5.00 |

7.00 |

|

|

|

|

August 25, 2003 |

4.50 |

7.00 |

|

|

|

|

March 31, 2004 |

4.50 |

6.00 |

|

|

|

|

October 27, 2004 |

4.75 |

6.00 |

|

|

|

|

April 29, 2005 |

5.00 |

6.00 |

|

|

|

|

October 26, 2005 |

5.25 |

6.25 |

|

|

|

|

January 24, 2006 |

5.50 |

6.50 |

|

|

|

|

June 9, 2006 |

5.75 |

6.75 |

|

|

|

|

July 25, 2006 |

6.00 |

7.00 |

|

|

|

|

|

|

|

|

|

|

|

Note : With effect from October 29, 2004, nomenclature of repo and reverse repo has been interchanged as per international usage. Prior to that date, repo indicated absorption of liquidity while reverse repo meant injection of liquidity. The nomenclature in this Report is based on the new use of terms even for the period prior to October 29, 2004. |

Bank Rate

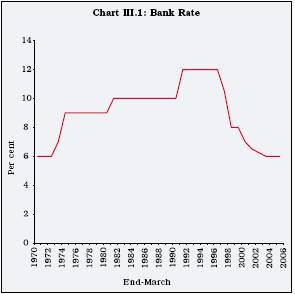

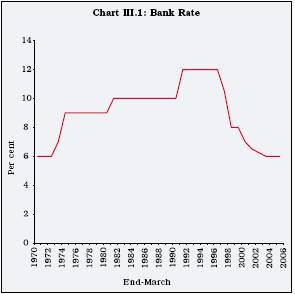

III.12 The Bank Rate signals the medium-term stance of monetary policy. Keeping in view the assessment of the economy including the outlook for inflation, the Bank Rate was retained at the existing level of 6.0 per cent, unchanged since April 2003 (Chart III.1). Cash Reserve Ratio

III.13 The cash reserve ratio (CRR), which was increased by 50 basis points during September-October 2004, was left unchanged at 5.0 per cent of the net demand and time liabilities (NDTL) during 2005-06. All scheduled commercial banks (excluding RRBs) complied with CRR requirements during 2005-06. In line with the stipulation, banks generally maintained minimum daily level of 70 per cent of fortnightly CRR requirement on all the days.

III.14 Consequent upon amendment to sub-Section 42(1) of the Reserve Bank of India Act, 1934 in June 2006, the Reserve Bank, having regard to the needs of securing the monetary stability in the country, can prescribe CRR for scheduled banks without any floor rate or ceiling rate. Before the enactment of this amendment, in terms of Section 42(1) of the Act, the Reserve Bank could prescribe CRR for scheduled banks between 3 per cent and 20 per cent of their NDTL. The amendments will provide the Reserve Bank with greater flexibility in the conduct of monetary policy. In the light of the enactment of the Reserve Bank of India (Amendment) Bill, 2006 the Reserve Bank has decided to continue with the status quo on the existing provisions of CRR maintenance, including the CRR rate and extant exemptions. Accordingly, scheduled banks shall continue to maintain CRR of 5.0 per cent of their NDTL.

III.15 The Reserve Bank, prior to the amendment of the Act, had been paying interest on scheduled banks’ CRR balances above the statutory minimum of 3.0 per cent and up to the prescribed level of 5.0 per cent – known as eligible cash balances – at an interest rate determined by the Reserve Bank, which has been set at 3.5 per cent with effect from September 18, 2004. No interest was payable on any amount upto the statutory minimum CRR balances of 3.0 per cent or any amount actually maintained in excess of the balance required to be maintained. Consequent upon the amendment of sub-Section 42 (1A) of the Act, the statutory minimum CRR of 3.0 per cent no longer exists. Furthermore, with the removal of the sub-Section 42 (1B) of the Act, the Reserve Bank can not pay interest on any portion of CRR balances of banks. Accordingly, no interest is payable on CRR balances with effect from the fortnight beginning June 24, 2006.

III.16 The CRR for non-scheduled banks and non-scheduled cooperative banks continues to be governed by the provisions of Section 18 and Section 56, respectively, of the Banking Regulation Act, 1949 which remain unchanged. Accordingly, non-scheduled banks, including non-scheduled cooperative banks, shall continue to maintain CRR equivalent to 3.0 per cent of their NDTL as on the last Friday of the second preceding fortnight. Statutory Liquidity Ratio

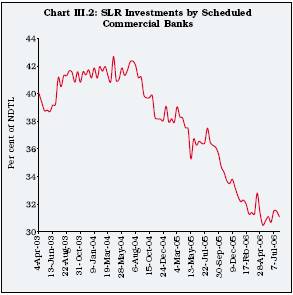

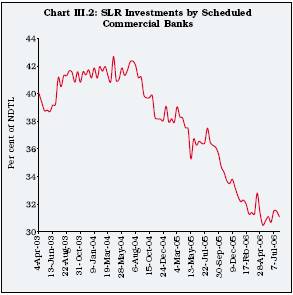

III.17 Statutory liquidity ratio (SLR) for scheduled commercial banks, at present, is at the statutory minimum of 25 per cent of their NDTL. Any further reduction in SLR would require amendment to the Banking Regulation Act. The legislative process of amendment of the Act in this regard has been initiated in order to provide greater flexibility to the Reserve Bank to specify SLR without any floor subject to the ceiling of 40 per cent. As discussed in Chapter I, reflecting strong demand for credit from the commercial sector, banks liquidated their holdings of Government securities during 2005-06. As a result, scheduled commercial banks’ holding of SLR securities fell from around 38 per cent of NDTL at end-March 2005 to 31.3 per cent at end-March 2006, but still above the statutory requirements (Chart III.2). The excess holdings of SLR securities at end-March 2006 at about Rs.1,45,297 crore exceeded the budgeted combined net market borrowings programme of the Central and State Governments for 2006-07.

Liquidity Management III.18 Monetary management faced some challenges in maintaining stable liquidity conditions particularly in the last quarter of 2005-06. The recourse of market participants to primary liquidity support from the Reserve Bank during the last quarter of 2005-06 suggested an overlap between frictional and structural liquidity. First, some market participants had not prepared for the liquidity implications of the movements in the interest rate cycle as also the one-off impact of IMDs redemption and, as a consequence, found themselves facing a shortage of liquidity as well as securities eligible for accessing the Reserve Bank’s liquidity facilities or even the collateralised money markets. Second, the banking system as a whole was significantly overdrawn in order to sustain the credit disbursements and the persistent mismatches between the sources and uses of funds forced them to seek recourse to borrowing and rolling over on an overnight basis, thereby putting pressure on interest rates and liquidity conditions.

III.19 Against this backdrop, the Reserve Bank continued to manage liquidity using a combination of instruments consisting of repo and reverse repo operations under the LAF, open market operations (OMOs), operations under the MSS and interest rate signals through the reverse repo/repo rates (Box III.2 and Table 3.2). Course of Liquidity Management

III.20 The market operations of the Reserve Bank responded to the change in liquidity conditions during 2005-06. The year 2005-06 was characterised by strong and sustained credit demand, a relatively lower order of accretion of the foreign exchange reserves to the Reserve Bank and redemption of IMDs along with a build-up of the Centre’s surplus with the Reserve Bank in the second half of the year. Against this backdrop, the Reserve Bank’s liquidity management operations led to injection of liquidity through LAF operations and unwinding of the balances under the MSS in contrast to liquidity absorption through issuances under the MSS during the preceding year. Liquidity management operations during 2005-06 could be analysed in terms of five phases (Table 3.3). In the first phase, between end-March 2005 and up to July 22, 2005, absorption through continued issuances under the MSS was accompanied by reduction in absorption through reverse repos under LAF. In the face of widening of the trade deficit, outflows by the FIIs during April-May 2005 and strong currency demand, banks unwound their investments in Government securities in order to finance the buoyant credit demand. Reduction in the Centre’s surplus with the Reserve Bank also kept liquidity conditions comfortable. Liquidity in the system increased during the second phase (July 23 - August 12, 2005), mainly due to the spurt in foreign exchange inflows (following the revaluation of the Chinese currency) and a further reduction in the Centre’s surplus investment balances with the Reserve Bank. Excess liquidity in the system was absorbed by the Reserve Bank through LAF reverse repos which rose from Rs.10,485 crore as on July 22 to a peak of Rs.50,610 crore as on August 3, 2005.

III.21 During the third phase (August 13 – October 28, 2005), the Reserve Bank’s purchase of foreign exchange assets moderated while Government’s cash balances with the Reserve Bank started to build up. In view of the resultant tightness in liquidity, there was decline in bids received under LAF reverse repos. On the whole, liquidity conditions were broadly stable and comfortable with call money rates generally staying within the reverse repo and the repo rate corridor. Till the third phase, the Reserve Bank injected liquidity through LAF repos only on four occasions; on a net basis, the Reserve Bank absorbed liquidity even on those four days. Box III.2

Liquidity Management by the Reserve Bank Following the initiation of reforms in India in the early 1990s, the monetary policy framework also witnessed a significant transformation. While the conduct of monetary policy continues to be guided by the twin objectives of maintaining price stability and to provide appropriate liquidity to meet genuine credit needs of the economy, maintenance of financial stability has also emerged as a key consideration in the conduct of monetary policy. Concomitantly, with the growing market-orientation of the economy, there has been a shift from direct instruments of monetary management to an increasing reliance on indirect instruments. In the context of this shift towards indirect instruments and in line with international trends, the Reserve Bank has put in place a liquidity management framework. Liquidity management is carried out through open market operations (OMO) in the form of outright purchases/sales of Government securities and reverse repo/repo operations, supplemented by the Market Stabilisation Scheme (MSS).

The Liquidity Adjustment Facility (LAF), introduced in June 2000, enables the Reserve Bank to manage day-to-day liquidity or short-term mismatches under varied financial market conditions in order to ensure stable conditions in the overnight money market. The LAF operates through reverse repo and repo auctions, thereby setting a corridor for the short-term interest rate consistent with the policy objectives. The introduction of LAF had several advantages. First, it helped the transition from direct instruments of monetary control to indirect instruments. Second, it enabled the Reserve Bank to modulate the supply of funds on a daily basis to meet day-to-day liquidity mismatches. Third, it enabled the Reserve Bank to affect demand for funds through policy rate changes. Finally, it helped stabilise short-term money market rates. Open market operations (OMOs) through outright sale and purchase of securities are also an important array of tools of the Reserve Bank’s monetary management. Apart from being directed at influencing enduring liquidity, OMOs can also be undertaken as ‘switch’ operations through purchase of gilts of a particular maturity against the sale of another to provide liquidity. In view of the large stock of Government securities in its portfolio, the OMOs were used effectively by the Reserve Bank from the second half of the 1990s to 2003-04 to manage the impact of capital flows. However, in the context of sustained large capital flows, large-scale OMOs led to a decline in the Reserve Bank’s holdings of Government securities. The finite stock of Government securities held by the Reserve Bank as well as the legal restrictions on the Reserve Bank on issuing its own paper were seen as placing constraints on future sterilisation operations. Accordingly, an innovative scheme in the form of MSS was introduced in April 2004 wherein Government of India dated securities/Treasury Bills are being issued to absorb enduring surplus liquidity. These dated securities/ Treasury Bills are the same as those issued for normal market borrowings and this avoids segmentation of the market. With the introduction of MSS, the pressure of sterilisation on LAF has declined considerably and the LAF operations have been able to fine-tune liquidity on a day-to-day basis more effectively. The MSS has provided the flexibility to the Reserve Bank to not only absorb liquidity but also to inject liquidity in case of need. The efficacy of various liquidity management tools was reflected clearly in the Reserve Bank’s market operations during 2005-06. Liquidity surpluses declined during October-November 2005 due to sustained demand for bank credit and currency demand during the festival season. Ahead of the redemption of the IMDs in December 2005, the Reserve Bank, making a forward looking assessment, began to unwind sterilised liquidity in a calibrated manner from September 2005. As part of this unwinding, fresh issuances under the MSS were suspended between November 2005 and April 2006. Redemptions of securities/ Treasury Bills issued earlier along with active management of liquidity through repo/reverse repo operations under LAF during January-March 2006 provided liquidity to the market. Some private placement during March 2006 and purchases of foreign exchange from the market also injected liquidity. The various tools of liquidity management, thus, provided the flexibility to Reserve Bank to maintain liquidity conditions and conduct monetary policy in accordance with the stated objectives.

References

1. Reserve Bank of India (2005), Report of the Internal Technical Group on Central Government Securities Market.

2. Mohan, Rakesh (2006), “Coping With Liquidity Management in India: A Practitioner’s View”, Reserve Bank of India Bulletin, April.

3. Reddy, Y.V. (2005), “Globalisation of Monetary Policy and Indian Experience”, Reserve Bank of India Bulletin, July.

Table 3.2: Liquidity Management |

(Rupees crore) |

Outstanding as on |

LAF |

MSS |

Centre’s |

Total |

last Friday of |

|

|

Surplus with |

(2 to 4) |

|

|

|

the RBI @ |

|

1 |

2 |

3 |

4 |

5 |

2005 |

|

|

|

|

January |

14,760 |

54,499 |

17,274 |

86,533 |

February |

26,575 |

60,835 |

15,357 |

1,02,767 |

March* |

19,330 |

64,211 |

26,102 |

1,09,643 |

April |

27,650 |

67,087 |

6,449 |

1,01,186 |

May |

33,120 |

69,016 |

7,974 |

1,10,110 |

June |

9,670 |

71,681 |

21,745 |

1,03,096 |

July |

18,895 |

68,765 |

16,093 |

1,03,753 |

August |

25,435 |

76,936 |

23,562 |

1,25,933 |

September |

24,505 |

67,328 |

34,073 |

1,25,906 |

October |

20,840 |

69,752 |

21,498 |

1,12,090 |

November |

3,685 |

64,332 |

33,302 |

1,01,319 |

December |

-27,755 |

46,112 |

45,855 |

64,212 |

2006 |

January |

-20,555 |

37,280 |

39,080 |

55,805 |

February |

-12,715 |

31,958 |

37,013 |

56,256 |

March |

7,250 |

29,062 |

48,828 |

85,140 |

April |

47,805 |

24,276 |

5,611 |

77,692 |

May |

57,245 |

27,817 |

0 |

85,062 |

June |

42,565 |

33,295 |

8,621 |

84,481 |

July |

44,155 |

38,995 |

8,770 |

91,920 |

@ : Excludes minimum cash balances with the Reserve Bank.

* : Data pertain to March 31, 2005.

Note:

Negative sign in column

2 indicates injection of liquidity

through LAF repo. |

III.22 In the fourth phase (October 29 – December 30, 2005), some tightness in the liquidity position started emanating from a host of factors such as festival season currency demand, scheduled auctions, advance tax outflows and redemption of IMDs amidst continuing strong demand for commercial credit. To ensure smooth redemption of IMDs, the Reserve Bank sold foreign exchange of US $ 7.1 billion out of its foreign exchange reserves to the State Bank of India during December 27-29, 2005 against equivalent rupees (Rs.31,959 crore). In response to the emergence of tight liquidity conditions, balances under LAF transited from absorption to injection mode, characterised by a swing of Rs.48,595 crore. The Reserve Bank provided liquidity on a net basis to the market through repo operations during November 10-18, 2005 (daily average net injection of Rs.1,565 crore). Furthermore, in view of the tightness in liquidity conditions, auctions of Treasury Bills (TBs) under the MSS were discontinued effective November 16, 2005. This also led to a substantial injection of liquidity (Rs.23,640 crore) during this phase from the redemption of maturing issuances under MSS. III.23 In the fifth phase (end-December 2005 to end-March 2006), liquidity conditions generally remained tight following the IMDs redemption and a further build-up of Centre’s cash balances amidst sustained growth in demand for bank credit. On a review of the prevalent macroeconomic, monetary and liquidity

Table 3.3: Reserve Bank’s Liquidity Management Operations: 2005-06 |

(Rupees crore) |

Item |

April 1 - |

July 23 - |

August 13 - |

October 29 - |

December |

2005-06 |

|

July 22, |

August 12, |

October 28, |

December |

31, 2005 |

|

|

2005 |

2005 |

2005 |

30, 2005 |

March 31, 2006 |

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

A. |

Drivers of Liquidity (1 to 4) |

-6,587 |

27,406 |

-14,621 |

-60,555 |

22,638 |

-31,719 |

|

1. |

RBI’s Foreign Currency Assets |

|

|

|

|

|

|

|

|

(adjusted for revaluation) |

6,412 |

19,348 |

5,193 |

- 21,696 |

59,577 |

68,834 |

|

2. |

Currency with the Public |

-15,125 |

-1,914 |

-7,434 |

-12,734 |

-20,073 |

-57,280 |

|

3. |

Surplus Cash Balances of the Centre with the |

|

|

|

|

|

|

|

|

Reserve Bank |

6,053 |

5,972 |

-7,421 |

-24,357 |

-2,973 |

-22,726 |

|

4. |

Others (residual) |

-3,927 |

4,000 |

-4,959 |

-1,768 |

- 13,893 |

-20,547 |

|

|

|

|

|

|

|

|

|

B. |

Management of Liquidity (5 to 8) |

1,329 |

-24,567 |

16,187 |

72,235 |

-7,215 |

57,969 |

|

5. |

Liquidity impact of LAF Repos |

8,845 |

-26,565 |

16,210 |

48,595 |

-35,005 |

12,080 |

|

6. |

Liquidity impact of OMO* (net) |

0 |

0 |

0 |

0 |

10,740 |

10,740 |

|

7. |

Liquidity impact of MSS |

-7,516 |

1,998 |

-23 |

23,640 |

17,050 |

35,149 |

|

8. |

First round liquidity impact due to CRR change |

0 |

0 |

0 |

0 |

0 |

0 |

C. |

Bank Reserves # (A+B) |

-5,258 |

2,839 |

1,566 |

11,680 |

15,423 |

26,250 |

+ : Indicates injection of liquidity into the banking system.

– : Indicates absorption of liquidity from the banking system.

# : Includes vault cash with banks and adjusted for first round liquidity impact due to CRR change.

* : Adjusted for Consolidated Sinking Funds (CSF) and including private placement. |

Table 3.4: Primary Liquidity Flows and Open Market Operations |

(Rupees crore) |

Month |

RBI’s Net Foreign |

Net Repos under |

RBI’s |

Net Open Market |

Market Stabilisation |

|

Currency Assets # |

the LAF |

Initial Subscription |

Operations |

Scheme |

|

2004-05 |

2005-06 |

2006-07 |

2004-05 |

2005-06 |

2006-07 |

2004-05 |

2005-06 |

2006-07 |

2004-05 |

2005-06 |

2006-07 |

2004-05 |

2005-06 |

2006-07 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

12 |

13 |

14 |

15 |

16 |

April |

32,608 |

1,432 |

20,832 |

-38,430 |

-8,320 |

-40,555 |

0 |

0 |

0 |

-253 |

-263 |

-112 |

-22,851 |

-2,876 |

4,786 |

May |

202 |

1,970 |

4,781 |

230 |

-5,470 |

-9,440 |

0 |

0 |

0 |

-116 |

-325 |

-1,303 |

-7,850 |

-1,929 |

-3,541 |

June |

350 |

1,632 |

2,494 |

11,480 |

23,450 |

26,935 |

0 |

0 |

0 |

-60 |

-954 |

-121 |

-7,111 |

-2,665 |

-5,307 |

July |

946 |

1,378 |

2,556 |

3,290 |

-815 |

-15,760 |

0 |

0 |

0 |

-218 |

-526 |

-967 |

-8,394 |

-47 |

-4,603 |

August |

-5,360 |

20,069 |

|

24,350 |

-15,450 |

|

217 |

0 |

|

-78 |

-66 |

|

-3,235 |

1,765 |

|

September |

1,001 |

2,218 |

|

6,565 |

1,430 |

|

630 |

0 |

|

-131 |

-348 |

|

-2,815 |

2,635 |

|

October |

1,635 |

2,254 |

|

19,705 |

3,665 |

|

0 |

0 |

|

-189 |

-124 |

|

-2,831 |

-2,424 |

|

November |

15,039 |

2,811 |

|

1,630 |

17,155 |

|

0 |

0 |

|

-342 |

-79 |

|

3,215 |

5,420 |

|

December |

13,184 |

6,933 |

|

6,265 |

-2,185 |

|

0 |

0 |

|

-339 |

-59 |

|

-737 |

16,717 |

|

January |

1,537 |

-29,512 |

|

-15,795 |

19,640 |

|

0 |

0 |

|

-703 |

-660 |

|

-945 |

7,911 |

|

February |

14,392 |

12,292 |

|

-10,610 |

-4,850 |

|

0 |

0 |

|

-37 |

-401 |

|

-5,800 |

6,772 |

|

March |

39,510 |

45,357 |

|

6,635 |

-16,170 |

|

350 |

10,000 |

|

-431 |

-107 |

|

-4,857 |

3,869 |

|

Total |

1,15,044 |

68,835 |

30,663 |

15,315 |

12,080 |

-38,820 |

1,197 |

10,000 |

0 |

-2,897 |

-3,912 |

-2,503 |

-64,211 |

35,148 |

-8,665 |

# : Adjusted for revaluation.

+ : Indicates injection of liquidity into the banking system.

- : Indicates absorption of liquidity from the banking system.

Note : Data are based on March 31 for March and last reporting Friday for all other months. |

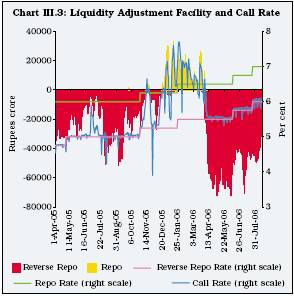

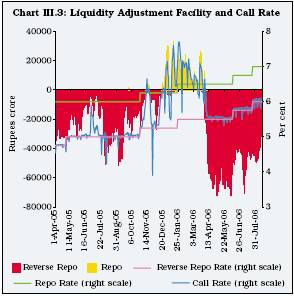

conditions, including the redemptions of IMDs, the Reserve Bank decided on December 30, 2005 to suspend the issue of Treasury Bills and dated securities under the MSS. Consequently, Rs.17,050 crore was further injected between end-December 2005 and end-March 2006 through unwinding of balances held under the MSS. The Reserve Bank also injected liquidity through repo operations (on a net basis) averaging Rs.15,386 crore during January 2006, Rs.13,532 crore during February 2006 and Rs.6,319 crore during March 2006 (Chart III.3). Although call money rates edged above the repo rate

during January-February 2006, the rates in the collateralised segment of the money market – market repos and Collateralised Borrowing and Lending Obligations (CBLO), which account for nearly 80 per cent of the market turnover – remained below the repo rate (see Chapter I).

III.24 During March 2006, the private placement of dated Government securities (Rs.10,000 crore) with the Reserve Bank and the Reserve Bank’s forex operations led to some easing of liquidity conditions (Table 3.4). As a result, repo volumes under LAF declined in the first half of March 2006 and there was absorption of liquidity on a few occasions. Call money rates also started easing. In the third week of March 2006, some tightness in market liquidity was again observed due to advance tax outflows and build-up of Centre’s surplus with the Reserve Bank. Liquidity conditions, however, improved during the last week of March 2006 and the LAF window witnessed net absorption of liquidity of Rs.7,250 crore as at end-March 2006. Call rates edged below the repo rate.

III.25 During 2006-07 (up to August 18, 2006), liquidity conditions have remained comfortable. This can largely be attributed to a reduction in the Centre’s surplus with the Reserve Bank as well as purchases of foreign exchange by the Reserve Bank. Concomitantly, the liquidity absorbed through LAF reverse repos has increased from Rs.7,250 crore at end-March 2006 to Rs.29,990 crore as on August 18, 2006. On a review of liquidity conditions, issuances under the MSS were reintroduced effective May 3, 2006.

Call rate eased to 6.10 per cent as on August 18, 2006 from 6.64 per cent at end-March 2006, notwithstanding the two hikes of 25 basis points each in the policy rates by the Reserve Bank.

Liquidity Adjustment Facility

III.26 The LAF remained the Reserve Bank’s primary instrument for managing day-to-day liquidity and transmitting interest rate signals to the market. During 2005-06, the Reserve Bank injected liquidity through repo operations on 76 days while it absorbed liquidity through reverse repo operations on as many as 244 days (Table 3.5).

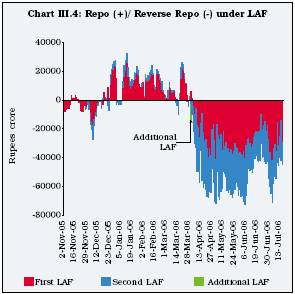

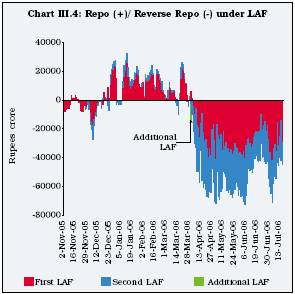

III.27 In order to fine-tune the management of liquidity and in response to suggestions from the market participants, the Reserve Bank also introduced a Second Liquidity Adjustment Facility (SLAF) with effect from November 28, 2005 (Chart III.4). While operations under the second LAF were relatively lower with respect to the first LAF during the phase of liquidity injection between November 2005 and March 2006, there has been a substantial recourse to second LAF from April 2006 onwards. The daily

Table 3.5: Reverse Repo/Repo Bids under LAF |

Year/ Month |

Reverse Repo |

Repo |

|

No. of days |

No. of days |

No. of days |

No. of days |

No. of days |

No. of days |

No. of days |

No. of days |

|

bids were |

all bids |

of full |

of partial |

bids |

all

bids |

of full |

of partial |

|

received |

were |

acceptance |

acceptance |

were |

were |

acceptance |

acceptance |

|

|

rejected |

of bids |

of bids |

received |

rejected |

of bids |

of bids |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

2004-05 |

242 |

0 |

242 |

0 |

23 |

0 |

23 |

0 |

2005-06 |

244 |

0 |

244 |

0 |

78 |

0 |

76 |

0 |

April |

18 |

0 |

18 |

0 |

0 |

0 |

0 |

0 |

May |

21 |

0 |

21 |

0 |

0 |

0 |

0 |

0 |

June |

22 |

0 |

22 |

0 |

2 |

0 |

2 |

0 |

July |

18 |

0 |

18 |

0 |

0 |

0 |

0 |

0 |

August |

22 |

0 |

22 |

0 |

0 |

0 |

0 |

0 |

September |

21 |

0 |

21 |

0 |

2 |

0 |

2 |

0 |

October |

20 |

0 |

20 |

0 |

0 |

0 |

0 |

0 |

November |

20 |

0 |

20 |

0 |

7 |

0 |

7 |

0 |

December |

22 |

0 |

22 |

0 |

11 |

0 |

11 |

0 |

January |

20 |

0 |

20 |

0 |

18 |

0 |

17@ |

0 |

February |

19 |

0 |

19 |

0 |

19 |

0 |

19 |

0 |

March |

21 |

0 |

21 |

0 |

19 |

0 |

18@ |

0 |

2006-07 |

|

|

|

|

|

|

|

|

April |

17 |

0 |

17 |

0 |

3 |

0 |

2@ |

0 |

May |

22 |

0 |

22 |

0 |

0 |

0 |

0 |

0 |

June |

22 |

0 |

22 |

0 |

0 |

0 |

0 |

0 |

July |

21 |

0 |

21 |

0 |

0 |

0 |

0 |

0 |

@ : Number of days of full acceptance of bids is less than number of days bids were received on account of non-acceptance of one bid each on technical grounds on January 24, 2006, March 23, 2006 and April 4, 2006.

Note :

1. With effect from October 29, 2004, nomenclature of repo and reverse repo has been interchanged

as per international usage.

Prior to that date, repo indicated absorption of liquidity while reverse repo meant injection of liquidity. The nomenclature in this Report is based on the new use of terms even for the period prior to October 29, 2004.

2. With effect from November 2005, data include operations under second LAF (SLAF). |

Table 3.6: Reserve Bank’s Holdings of Central Government Dated Securities |

(Rupees crore) |

Year |

Devolvement |

Private |

OMO |

Conversion |

Total Addition |

Open |

Net Addition |

Outstanding |

Memo: |

|

on Reserve |

Placement |

Purchases |

of Special |

to Stock of |

Market |

to Stock |

Holding by |

Net Repo |

|

Bank |

taken by |

by Reserve |

Securities |

Reserve |

Sales by |

(6-7) |

Reserve |

(+)/Reverse |

|

|

Reserve |

Bank |

into Dated |

Bank’s |

Reserve |

|

Bank |

Repos (-) |

|

|

Bank |

|

Securities |

Investments |

Bank |

|

(end |

Out- |

|

|

|

|

|

(2+3+4+5) |

|

|

period)* |

standing # |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

1996-97 |

3,698 |

– |

623 |

– |

4,321 |

11,206 |

-6,885 |

6,666 |

-2,300 |

1997-98 |

7,028 |

6,000 |

467 |

20,000 |

33,495 |

8,081 |

25,414 |

31,977 |

-4,202 |

1998-99 |

8,205 |

30,000 |

– |

– |

38,205 |

26,348 |

11,857 |

42,212 |

-400 |

1999-00 |

– |

27,000 |

1,244 |

– |

28,244 |

36,614 |

-8,370 |

35,190 |

– |

2000-01 |

13,151 |

18,000 |

4,471 |

– |

35,622 |

23,795 |

11,827 |

41,732 |

-1,355 |

2001-02 |

679 |

28,213 |

5,084 |

– |

33,976 |

35,419 |

-1,443 |

40,927 |

-4,355 |

2002-03 |

5,175 |

31,000 |

– |

40,000 |

76,175 |

53,780 |

22,395 |

55,438 |

-2,415 |

2003-04 |

– |

21,500 |

– |

61,818 |

83,318 |

41,849 |

41,469 |

77,397 |

-34,645 |

2004-05 |

847 |

350 |

– |

– |

1,197 |

2,899 |

-1,702 |

80,770 |

-19,330 |

2005-06 |

– |

10,000 |

740 |

– |

10,740 |

4,653 |

6,087 |

83,205 |

-7,250 |

* : Inclusive of securities sold under the LAF.

# : Data pertain to end-March |

average absorption under the second LAF during April-July 2006 was nearly the same as that in the first LAF. At the request of the market participants, the Reserve Bank conducted an additional LAF on March 31, 2006 between 9.00 p.m. to 9.30 p.m. to facilitate funds management by banks on account of the year-end closing on March 31, 2006 falling on a reporting Friday.

Open Market Operations

III.28 In view of the finite stock of Government securities with the Reserve Bank, the use of open market operations (OMOs) as an instrument of liquidity management has been limited since 2004-05. However, in view of the recent developments, including the FRBM provisions which prohibit the Reserve Bank from participating in the primary market for Central Government securities, OMOs are set to increase in importance as an operating instrument. The activation of OMOs will further enable the LAF to be even more focused on the role for which it has been designed. In view of these developments, the increase in the Reserve Bank’s holdings of dated securities during 2005-06 will provide greater flexibility to the Reserve Bank in conducting OMOs (Table 3.6).

Interest Rate Policy

III.29 Progressive deregulation of interest rates in those segments that have remained regulated for reasons relevant at different times has been engaging the attention of Reserve Bank and wide consultations have been held with various stakeholders. In this context, the Reserve Bank requested the Indian Banks’ Association (IBA) to undertake a comprehensive review of the interest rate on savings bank deposits and lending rates on small loans up to Rs.2 lakh.

III.30 The interest rate on savings bank deposits is regulated by the Reserve Bank and is currently prescribed at 3.5 per cent per annum. Based on a review of current monetary and interest rate conditions, including a careful consideration of the suggestions received from the IBA, the Annual Policy Statement for 2006-07 maintained the status quo while recognising that the deregulation of this interest rate would be essential for product innovation and price discovery in the long run.

Interest Rates on Non-Resident Deposits

III.31 The ceilings on interest rates on non-resident deposits are linked to the LIBOR/swap rates and are reviewed from time to time depending on monetary and macroeconomic developments. On a review, the ceiling interest rate on foreign currency non-resident (banks) [FCNR(B)] deposits was raised by 25 basis points from “LIBOR/swap rates for the respective currency/maturities minus 25 basis points” to “LIBOR/ swap rates for the respective currency/maturities” with effect from close of business in India on March 28, 2006. The ceiling interest rate on non-resident (external) rupee deposits for one to three year maturity was increased by 50 basis points in two stages – from “50 basis points above LIBOR/swap rates for US dollar of corresponding maturity” to “75 basis points above LIBOR/swap rates” effective close of business in India on November 17, 2005 and further to “100 basis points above LIBOR/swap rates” effective close of business in India on April 18, 2006.

Rupee Export Credit Rate

III.32 The validity of the reduction in the interest rate ceiling to 250 basis points below benchmark prime lending rate (BPLR) on pre-shipment rupee export credit up to 180 days and post-shipment rupee export credit up to 90 days announced on September 24, 2001 has been extended up to October 31, 2006.

Foreign Currency Export Credit Rate

III.33 On the basis of the recommendations of the Working Group to Review Export Credit, the Annual Policy Statement for 2006-07 increased the ceiling interest rate on export credit in foreign currency by 25 basis points to LIBOR plus 100 basis points with effect from April 18, 2006.

MONETARY POLICY STANCE FOR 2006-07

III.34 Under the assumption of a normal monsoon, positive industrial outlook and sustained momentum in services sector growth, the Annual Policy Statement for 2006-07 (April 2006), for policy purposes, placed real GDP growth in the range of 7.5-8.0 per cent during 2006-07 barring domestic or external shocks. Taking into account the real, monetary and global factors having a bearing on domestic prices, the statement noted that containing inflationary expectations would continue to pose a challenge to monetary management. The policy endeavour would be to contain the year-on-year inflation rate for 2006-07 in the range of 5.0-5.5 per cent. For the purpose of monetary policy formulation, the expansion in was projected at around 15.0 per cent for 2006- M3 07. While this indicative projection is consistent with the projected GDP growth and inflation, the Statement pointed to overhang of above-trend growth in money supply in the preceding year. In normal circumstances, the policy preference would be for maintaining a lower order of money supply growth in 2006-07. The growth in aggregate deposits was projected at around Rs.3,30,000 crore in 2006-07. Non-food bank credit including investments in bonds/debentures/shares of public sector undertakings and private corporate sector and commercial paper (CP) was expected to increase by around 20 per cent, implying a calibrated deceleration from a growth of above 30 per cent ruling at end-March 2006.

III.35 Against the backdrop of developments during 2005-06, the stance of monetary policy during 2006-07, as the Annual Policy Statement for 2006-07 noted, would depend on macroeconomic developments including the global scenario. Domestic macroeconomic and financial conditions support prospects of sustained growth momentum with stability in India. It is important to recognise, however, that there are risks to both growth and stability from domestic as well as global factors and, the balance of risks is currently tilted towards the global factors. The adverse consequences of further escalation of international crude prices and/or of disruptive unwinding of global imbalances are likely to be pervasive across economies, including India. Moreover, in a situation of generalised tightening of monetary policy, India cannot afford to stay out of step. Barring the emergence of any adverse and unexpected developments in various sectors of the economy and keeping in view the prevailing assessment of the economy including the outlook for inflation, the Annual Policy Statement for 2006-07 indicated that the overall stance of monetary policy would be:

• To ensure a monetar y and interest rate environment that enables continuation of the growth momentum consistent with price stability while being in readiness to act in a timely and prompt manner on any signs of evolving circumstances impinging on inflation expectations.

• To focus on credit quality and financial market conditions to support export and investment demand in the economy for maintaining macroeconomic, in particular, financial stability.

• To respond swiftly to evolving global developments.

III.36 While leaving the repo rate and the reverse repo rate unchanged, the Reserve Bank took certain prudential measures in April 2006 (see Box III.1). In the context of continued strong credit growth and in order to maintain asset quality, the Reserve Bank raised risk weight on exposures to commercial real estate and banks’ total exposure to venture capital funds further to 150 per cent. The general provisioning requirement on standard advances in specific sectors, i.e., personal loans, loans and advances qualifying as capital market exposures, residential housing loans beyond Rs.20 lakh and commercial real estate loans was also raised from the existing level of 0.40 per cent to 1.0 per cent.

III.37 On review of macroeconomic and overall monetary conditions, the Reserve Bank increased the reverse repo rate and the repo rate by 25 basis points each to 5.75 per cent and 6.75 per cent, respectively, with effect from June 9, 2006.

Quarterly Review of Monetary Policy

III.38 In its First Quar ter Review of Annual Statement on Monetary Policy in July 2006, the Reserve Bank observed that the domestic economy is exhibiting strong fundamentals and displaying considerable resilience. At the same time, the Review pointed out that disturbing signs of demand pressures, especially continuing high credit growth, could exert upward pressure on prices when associated with supply shocks such as from oil. These pressures have the potential for impacting stability and inflationary expectations. Although domestic developments continue to dominate the Indian economy, global factors tend to gain more attention now than before. The global outlook for growth is positive but downside risks in regard to inflation and re-pricing of risks in financial markets need to be recognised. Both domestic and global factors are delicately balanced in terms of growth vis-à-vis price stability with a tilt towards the possibility of identified downside risks materialising in the near-term being more likely than before. While reaffirming its forecast for GDP growth of 7.5-8.0 per cent as set out in the April 2006 Statement, the Reserve Bank observed that containing the year-on-year inflation rate for 2006-07 in the range of 5.0-5.5 per cent warrants appropriate priority in policy responses. On balance, the Reserve Bank indicated that a modest pre-emptive action in monetary policy was appropriate. Accordingly, the Reserve Bank increased the reverse repo rate and the repo rate further by 25 basis points each to 6.00 per cent and 7.00 per cent, respectively, with effect from July 25, 2006.

III.39 Barring the emergence of any adverse and unexpected developments in various sectors of the economy and keeping in view the current assessment of the economy including the outlook for inflation, the Reserve Bank indicated that the overall stance of monetary policy in the period ahead will be:

• To ensure a monetary and interest rate environment that enables continuation of the growth momentum while emphasising price stability with a view to anchoring inflation expectations.

• To reinforce the focus on credit quality and financial market conditions to support export and investment demand in the economy for maintaining macroeconomic and, in particular, financial stability.

• To consider measures as appropriate to the evolving global and domestic circumstances impinging on inflation expectations and the growth momentum.

III.40 The Mid-term Review and the Third Quarter Review of the Annual Policy Statement will be undertaken on October 31, 2006 and January 30, 2007, respectively.

CREDIT DELIVERY

III.41 It has been the endeavour of the Reserve Bank to improve credit delivery mechanisms for small borrowers, particularly the agriculture and Small Scale Industries (SSI) sector by creating a conducive environment for banks to provide adequate and timely finance at reasonable rates without procedural hassles.

Priority Sector Lending

III.42 In order to improve the credit delivery to priority sector, the Reserve Bank took various measures during 2005-06. These included:

• For stepping up credit to small and medium enterprises (SMEs), banks to treat units with investment in plant and machinery in excess of SSI limit and up to Rs.10 crore as Medium Enterprises (ME). However, only SSI financing to be included in priority sector.

• Banks to fix self-targets for financing to SME sector to achieve higher disbursement over the immediately preceding year and initiate steps to rationalise the cost of loans to SME sector by adopting a transparent rating system with cost of credit being linked to the credit rating of enterprise.

• Banks to consider the Credit Appraisal and Rating Tool (CART) as well as Risk Assessment Model (RAM) and the comprehensive rating model for risk assessment of proposals for SMEs developed by SIDBI as appropriate and reduce their transaction costs.

• Banks to make concerted efforts to provide credit cover on an average to at least 5 new small/medium enterprises per year at each of their semi-urban/urban branches.

• In respect of loans to SME sector, boards of banks to formulate more comprehensive and liberal policies, based on the guidelines issued on lending to SSI sector.

• Banks to adopt cluster based approach as a thrust area and increasingly adopt the same for SME financing.

• Public sector banks to implement a one-time settlement scheme for recovery of NPAs below Rs.10 crore for SME accounts.

• Banks to ensure specialised SME branches in identified clusters/centres with preponderance of MEs to enable the SME entrepreneurs to have easy access to bank credit. The existing specialised SSI branches to be redesignated as SME branches.

• In order to offer small borrowers an opportunity to settle their NPA accounts with banks and to become eligible for fresh finance, banks to provide a simplified mechanism for one-time settlement of loans where the principal amount is equal to or less than Rs.25,000 and which have become doubtful and loss assets as on September 30, 2005. In case of loans granted under Government sponsored schemes, banks to frame separate guidelines following a state-specific approach to be evolved by the State Level Bankers’ Committee (SLBC).

• Banks to introduce a General Credit Card (GCC) scheme for issuing GCC to their constituents in rural and semi-urban areas, based on the assessment of income and cash flow of the household, without any insistence on security and the purpose or end-use of the credit. Banks to utilise the services of local post offices, schools, pr imary health centres, local government functionaries, farmers’ associations/ clubs, well-established community-based agencies and civil society organisations for sourcing of borrowers for issuing GCC. Fifty per cent of credit outstanding under GCC to be classified as indirect finance to agriculture.

• Loans to power distribution corporations/ companies emerging out of bifurcation/ restructuring of State Electricity Boards (SEBs) for reimbursing the expenditure already incurred by them for providing low tension connection from step-down point to individual farmers for energising their wells to be classified as indirect finance to agriculture.

• Fresh investments made on or after July 1, 2005 in venture capital not eligible for classification under priority sector lending. The investments already made up to June 30, 2005 not eligible for classification under priority sector lending with effect from April 1, 2006.

III.43 Public sector banks, private sector banks and foreign banks, as groups, achieved the overall target for priority sector lending as on the last reporting Friday of March 2006 (Table 3.7). However, two public sector banks and 11 private sector banks could not achieve the overall priority sector lending target of 40 per cent.

III.44 An internal Working Group was set up by the Reserve Bank to examine the need for continuance of priority sector lending prescriptions, review the existing policy on priority sector lending including the segments constituting the priority sector, targets and sub-targets and to recommend changes, if any, required in this regard. The draft Technical Paper submitted by the Group was placed in the public domain for inviting views/comments from the public. Based on the feedback received, modifications would again be placed in public domain for views.

Credit to Agricultural Sector

III.45 The Reserve Bank had advised public sector banks in 1994-95 to prepare Special Agricultural Credit Plans (SACPs) on an annual basis. During the fiscal year 2005-06, the disbursements to agriculture under this Plan, at Rs.94,278 crore, exceeded the target of Rs.85,024 crore (Table 3.8). The SACP mechanism has been made applicable to private sector banks from the year 2005-06. Disbursements to agriculture by private sector banks were Rs.30,386 crore (provisional) as against the target of Rs.24,222 crore for the year.

III.46 With a view to doubling credit flow to agriculture within a period of three years and to provide some debt relief to farmers within the limits of financial prudence, the Union Finance Minister had announced several measures on June 18, 2004. While the Reserve Bank and the IBA issued necessary operational guidelines to commercial banks, NABARD issued similar guidelines to regional rural banks (RRBs), state cooperative banks (StCBs) and district central cooperative banks (DCCBs). As against a target of Rs.1,05,000 crore to agriculture sector for the year 2004-05, banks (including cooperative banks and RRBs) disbursed Rs.1,15,243 crore, a growth of 32 per cent over the actual disbursement of Rs.86,981 crore during 2003-04. For the year 2005-06, banks were advised to increase the flow of credit to agriculture to Rs.1,42,000 crore. As against this target, the disbursement by all banks during the year 2005-06 was Rs.1,57,480 crore, a growth of 37 per cent over the disbursement during the previous year.

III.47 The Union Finance Minister, in his budget speech for the year 2006-07, asked the banks to increase the level of agricultural credit to Rs.1,75,000 crore during the year 2006-07 and also add another five million farmers to their portfolio. In view of tenant farmers not being adequately served, banks have been asked to open a separate window for Self-Help Groups (SHGs) or joint liability groups of tenant

Table 3.7: Priority Sector Advances |

(Amount in Rupees crore) |

As on Last |

Public Sector |

Private Sector |

Foreign |

Reporting Friday |

Banks |

Banks |

Banks |

1 |

2 |

3 |

4 |

March-2000 |

1,27,478 |

18,368 |

9,934 |

|

(40.3) |

(38.0) |

(35.2) |

March-2001 |

1,49,116 |

21,567 |

11,572 |

|

(43.7) |

(36.7) |

(33.5) |

March-2002 |

1,71,484 |

24,184 |

9,936 |

|

(43.5) |

(38.4) |

(34.6) |

March-2003 |

1,99,786 |

36,648 |

14,555 |

|

(41.2) |

(44.1) |

(33.1) |

March-2004 |

2,44,456 |

48,920 |

17,960 |

|

(43.6) |

(47.3) |

(34.1) |

March-2005 |

3,07,046 |

69,886 |

23,843 |

|

(42.8) |

(43.6) |

(35.3) |

March-2006* |

4,10,379 |

1,06,566 |

30,449 |

|

(40.3) |

(42.8) |

(34.6) |

* Data are provisional.

Notes:

1. Figures in parentheses are percentages to net bank credit in the respective groups.

2. The target for aggregate advances to the priority sector is 40 per cent of net bank credit for domestic banks and 32 per cent of net bank credit for foreign banks. |

Table 3.8: Disbursements by Public Sector Banks |

under Special Agricultural Credit Plans |

(Amount in Rupees crore) |

Year |

Target |

Disburse- |

Achieve- |

Annual |

|

|

ments |

ment of |

Growth in |

|

|

|

Target |

Disburse- |

|

|

|

(Per cent) |

ments |

|

|

|

|

(Per cent) |

1 |

2 |

3 |

4 |

5 |

2000-01 |

25,893 |

24,654 |

95.2 |

12.5 |

2001-02 |

30,883 |

29,332 |

95.0 |

19.0 |

2002-03 |

36,838 |

33,921 |

92.1 |

15.6 |

2003-04 |

42,576 |

42,211 |

99.1 |

24.4 |

2004-05 |

55,616 |

65,218 |

117.3 |

54.5 |

2005-06 |

85,024 |

94,278 |

110.9 |

44.6 |

Table 3.9: Outstanding Agricultural Advances |

(Amount in Rupees crore) |

As at |

Public Sector |

Private Sector |

end- March |

Banks |

Banks |

|

Amount

Outstanding |

% of Net

Bank Credit |

Amount

Outstanding |

% of Net

Bank Credit |

1 |

2 |

3 |

4 |

5 |

2000 |

45,296 |

14.3 |

4,023 |

8.3 |

2001 |

53,571 |

15.7 |

5,634 |

9.6 |

2002 |

58,142 |

14.8 |

6,581 |

8.5 |

2003 |

70,501 |

14.5 |

9,924 |

10.9 |

2004 |

84,435 |

15.1 |

14,730 |

14.2 |

2005 |

1,09,917 |

15.3 |

21,636 |

12.3 |

2006* |

1,54,900 |

15.2 |

36,185 |

13.5 |

* : Data are provisional.

Note:

For the domestic banks, the target for advances to agriculture is 18 per cent of net bank credit. |

farmers and ensure that a certain proportion of the total credit is extended to them.

III.48 Outstanding agricultural advances of public as well as private sector banks increased by 40.9 per cent and 67.2 per cent, respectively, during 2005-06. While the share of agricultural advances in bank credit for public sector banks decreased marginally during the year, that of private sector banks increased (Table 3.9).

III.49 The recovery of direct agricultural advances of public sector banks continued to show improvement during the year ended June 2005 (Table 3.10).

Guidelines for Relief to Farmers

III.50 The Union Budget 2006-07 envisaged grant of interest relief of two percentage points in the interest rate on the principal amount up to Rs. one lakh on crop loans availed by the farmers for Kharif and Rabi 2005-06. The amount of the relief was

Table 3.10: Public Sector Banks – Recovery of |

Direct Agricultural Advances |

(Rupees crore) |

Year |

Demand |

Recovery |

Overdues |

Recovery to |

ended |

|

|

|

Demand |

June |

|

|

|

(per cent) |

1 |

2 |

3 |

4 |

5 |

2001 |

22,429 |

15,540 |

6,889 |

69.3 |

2002 |

24,561 |

17,758 |

6,803 |

72.3 |

2003 |

28,940 |

21,011 |

7,930 |

72.6 |

2004 |

33,544 |

25,002 |

8,542 |

74.5 |

2005 |

35,192 |

29,612 |

5,580 |

84.1 |

required to be credited to the borrower’s account before March 31, 2006. Commercial banks were advised that all crop loans for Kharif and Rabi disbursed to farmers during the financial year 2005-06 would be eligible for the interest relief. In cases, where each crop loan exceeds Rs. one lakh, the interest relief would be applicable on the principal amount up to Rs. one lakh only. Banks were also advised that interest relief may be calculated at two percentage points on the amount of the crop loan disbursed from the date of disbursement/drawal up to the date of payment or up to the date beyond which the outstanding loan becomes overdue (i.e., March 31, 2006 for Kharif and June 30, 2006 for Rabi, respectively), whichever was earlier.

III.51 Furthermore, to provide farmers loans at a reasonable rate, the Government has decided to ensure that the farmers receive short-term credit at 7 per cent on loans up to Rs.3,00,000 on the principal amount with effect from Kharif 2006-07. The public sector banks and regional rural banks have been advised that Government will provide interest rate subvention of 2 per cent per annum to them in respect of short-term production credit up to Rs.3,00,000 provided to farmers. This amount of subvention will be calculated on the amount of crop loan disbursed from the date of disbursement/drawal up to the date of payment or up to the date beyond which the outstanding loan becomes overdue i.e. March 31, 2007 for Kharif and June 30, 2007 for Rabi, respectively, whichever is earlier.

III.52 Following the announcement in the Annual Policy Statement for 2006-07, a Working Group has been constituted under the chairmanship of Prof. S.S. Johl to suggest measures for assisting distressed farmers, including provision of financial counselling services and introduction of a specific Credit Guarantee Scheme under the DICGC Act for such farmers. The Group is expected to submit its report by September 30, 2006.

Micro Finance

III.53 Among the different models for purvey of micro finance, the Self Help Group (SHG)-bank linkage programme has emerged as the major micro finance programme in the country, which is being implemented by commercial banks, RRBs and cooperative banks. During the year 2005-06, 6.2 lakh new SHGs were provided with bank loans amounting to Rs.2330 crore and 3.45 lakh existing SHGs were extended further financial assistance. The total bank loan disbursed during the year 2005-06 amounted to Rs.4499 crore. As at March 31, 2006, the cumulative number of SHGs linked to banks stood at 2.2 million with total bank credit to these SHGs at Rs.11,398 crore. The Union Budget for the year 2006-07 envisages the banking industry to credit link another 3,85,000 SHGs in the year 2006-07.

III.54 In the context of the recent developments in the micro finance sector in certain districts of the country, the Reserve Bank, responding to requests from the various stakeholders, provided a forum to promote better understanding of the issues involved and enhance transparency in the operations of the MFIs. All Regional Directors of the Reserve Bank were advised that whenever issues relating to the sector are brought to their notice, they may offer to constitute a coordination forum comprising representatives of SLBC convenor bank, NABARD, SIDBI, State Government officials and representatives of MFIs (including NBFCs) and NGOs/SHGs to facilitate discussion and enable resolution of issues affecting the operations of the micro finance sector.

III.55 In order to examine the issues relating to (i) allowing banks to adopt agency model by using infrastructure of civil society organisations, (ii) appointment of ‘banking correspondents’ to function as intermediaries between the lending banks and the beneficiaries and (iii) identification of steps to promote MFIs, an in-house Group was set up in the Reserve Bank under the Chairmanship of Shri H. R. Khan, Principal, College of Agricultural Banking, Pune. Based on the recommendations of the Group and with the objective of ensuring greater financial inclusion and increasing the outreach of the banking sector, banks have been permitted to use the services of specified intermediaries as also post offices as business facilitator and correspondents.

Technical Group for Review of Legislation on Money Lending