PART TWO : THE WORKING AND OPERATIONS OF THE RESERVE BANK OF INDIA III MONETARY AND CREDIT POLICY OPERATIONS Monetary management during 2008-09 had to contend with the challenges of high inflation in the first half and the high speed and magnitude of the external shock and its spill-over effects through the real, financial and confidence channels in the second half. Policy initiatives by the Reserve Bank were aimed at providing ample rupee liquidity, ensuring comfortable foreign exchange liquidity and maintaining a market environment conducive for the continued flow of credit at viable rates to productive sectors of the economy. The large government borrowings resulting from the fiscal stimulus, and net capital outflows in the second half of the year warranted simultaneous offsetting operations by the Reserve Bank in different markets, particularly the money market, the government securities market and the foreign exchange market. The flexible use of multiple instruments enabled the Reserve Bank to steer the liquidity and interest rate conditions amidst uncertain global macroeconomic environment. III.1 The stance of monetary policy shifted in phases in response to multiple challenges that emerged during the course of the year in the form of significant changes in both outcome and outlook relating to inflation, growth and stability of financial markets. Both the Government and the Reserve Bank responded to the challenges decisively, swiftly and in close coordination and consultation. The policy stance shifted from monetary tightening in response to the elevated inflationary pressures in the first half of 2008-09 to monetary easing in the second half as significant moderation in inflationary pressures created the scope for enhancing the magnitude and speed of response to the weakening growth impulses as well as to occasional disorderly pressures in financial markets. The changing stance of policy must be seen in the context of the previous period of gradual withdrawal of monetary accommodation from September 2004 till August 2008 during which the repo/reverse repo rates had been increased by 300/150 basis points, the cash reserve ratio (CRR) for scheduled banks had been raised by 450 basis points, and risk weights and general provisioning requirements for standard advances were raised in the case of specific sectors. In response to the knock-on effects of the global economic crisis on the Indian economy, since October 11, 2008 the Reserve Bank has reduced the CRR by a cumulative 400 basis points to 5.0 per cent of NDTL, the repo rate by 425 basis points to 4.75 per cent and the reverse repo rate by 275 basis points to 3.25 per cent. III.2 The magnitude and the pace of the response have to be seen particularly in the context of the fact that despite significant moderation, India’s growth remained one of the highest in the world, at 6.7 per cent for the full year, and the minimum quarterly growth during the year was 5.8 per cent. Thus, the policy stance clearly reflected the forward looking undertone, particularly the expectations of more prolonged adverse external conditions in the face of no visible risks to inflation. Moreover, the gradual withdrawal of monetary accommodation that had started from September 2004 was a signal of the Reserve Bank’s assessment of possible overheating, even though subsequent monetary tightening was in response to building of inflationary pressures up to mid 2008-09. The need for monetary policy cycle remaining ahead of the business cycle, which emerged as a lesson from the current global crisis, was already evident in the Reserve Bank’s actual conduct of policy even before the crisis. Similarly, the current post-crisis suggestion for use of pro-cyclical provisioning norms and counter-cyclical regulations as a bulwark against financial instability had already been implemented in India prior to the crisis.

Organisational Framework for Monetary Policy

Technical Advisory Committee

III.3 The Reserve Bank had constituted a Technical Advisory Committee (TAC) on Monetary Policy in July 2005 with four external experts in the areas of monetary economics, central banking, financial markets and public finance with a view to strengthening the consultative process in the conduct of monetary policy. The TAC reviews macroeconomic and monetary developments and advises the Reserve Bank on the stance of monetary policy and monetary measures. The Committee was reconstituted in April 2007 and the membership of the Committee was expanded by including two additional members of the Central Board of the Reserve Bank and one more external expert. The tenure of the reconstituted Committee was extended up to June 30, 2009. The Reserve Bank has now reconstituted the TAC on Monetary Policy with effect from July 1, 2009 with a view to obtaining continued benefit of advice from external experts. The tenure of the Committee is for two years, i.e., up to June 30, 2011. The Committee is headed by Governor, with the Deputy Governor in charge of monetary policy as the vice-chairman. The other Deputy Governors of the Bank are also members of the Committee. The TAC normally meets once in a quarter. However, the meeting of the TAC could be held at any other time also, if necessary. The role of the TAC is advisory in nature.The responsibility, accountability and time path of the decision making remain entirely with the Reserve Bank. In addition to the quarterly pre-policy meeting where the TAC members contributed to enriching the inputs and processes of policy setting, there were two special meetings held on June 23, 2008 and December 17, 2008 in the context of the evolving global economic crisis and to advise the Reserve Bank on the stance of monetary policy.

Pre-policy Consultation Meetings

III.4 It has been the endeavour of the Reserve Bank to make the policy making process more consultative. As part of this outreach and the Reserve Bank’s growing emphasis on strengthening the consultative process of monetary policy formulation, the Reserve Bank has constituted a process of consulting different entities/ experts before each policy Statement/Review. Accordingly, with effect from October 2005, the Reserve Bank has introduced pre-policy consultation meetings with the Indian Banks’ Association (IBA), market participants (Fixed Income Money Market and Derivatives Association of India, Foreign Exchange Dealers’ Association of India, and Primary Dealers Association of India), leaders of trade and industry and other institutions (urban co-operative banks, non-banking financial companies, rural co-operatives and regional rural banks). This consultative process has contributed to enriching the policy formulation process and enhanced the effectiveness of monetary policy measures.

III.5 The specific aspects of monetary policy operations of the Reserve Bank during 2008-09 and 2009-10 so far and the context against which policy decisions were formulated and implemented have been outlined in this chapter.

MONETARY POLICY OPERATIONS: 2008-09

III.6 The conduct of monetary policy during 2008-09 witnessed two distinctly different phases. The first phase up to mid-September 2008 was characterised by monetary tightening, reflecting the need to contain high inflation and adverse inflation expectations. The policy stance during the second phase starting from mid-September 2008 was guided by the ramifications of the global financial crisis for economic growth and financial markets in India.

Annual Policy Statement for 2008-09

III.7 The Annual Policy Statement (APS) for 2008-09 (April 29, 2008) had noted that there were significant shifts in both global and domestic developments in relation to initial assessments presented for 2007-08. In the backdrop of the deteriorating outlook for the global economy, the APS highlighted that the dangers of global recession had increased at the time of announcement of the Third Quarter Review of January 2008. It also added that since January 2008, the upside pressures from international food and energy prices appeared to have imparted a degree of persistent upward pressure to inflation globally. On the domestic front, the outlook remained positive up to January 2008, with some indications of moderation in industrial production, services sector activity, business confidence and non-food credit thereafter.

III.8 The initial forecast predicted a near-normal rainfall in the 2008 South-West monsoon season, suggesting sustenance of the trend growth in agriculture. The Statement noted that the expected decline in world GDP growth in 2008 in relation to the preceding year could temper the prospects of growth in the industrial and services sectors at the margin, although the underlying momentum of expansion in these sectors was likely to be maintained. In view of this overall macroeconomic scenario, the APS placed real GDP growth during 2008-09 in the range of 8.0 to 8.5 per cent for policy purposes, assuming that (a) global financial and commodity markets and real economy would be broadly aligned with the central scenario as assessed at that stage; and (b) domestically, normal monsoon conditions may prevail. In view of the lagged and cumulative effects of monetary policy on aggregate demand and assuming that supply management would be conducive, capital flows had to be managed actively and in the absence of new adversities emanating in the domestic or global economy, the Policy Statement indicated that the monetary policy endeavour would be to bring down inflation from the prevailing high level of above 7.0 per cent to around 5.5 per cent in 2008-09, with a preference for bringing it close to 5.0 per cent as soon as possible, recognising the evolving complexities in globally-transmitted inflation. The Statement also added that going forward, the Reserve Bank would continue to condition policy and perceptions for inflation in the range of 4.0-4.5 per cent so that an inflation rate of around 3.0 per cent became a medium-term objective consistent with India’s broader integration into the global economy and with the goal of maintaining self-accelerating growth over the medium-term.

III.9 The Statement also noted that money supply remained above indicative projections persistently through 2005-07 on the back of sizeable accretions to the Reserve Bank’s foreign exchange assets and a cyclical acceleration in credit and deposit growth. In view of the resulting monetary overhang, the Statement mentioned that there was a need to moderate monetary expansion in the range of 16.5-17.0 per cent in 2008-09 in consonance with the outlook on growth and inflation so as to ensure macroeconomic and financial stability. Consistent with the projections of money supply, the growth in aggregate deposits for 2008-09 was placed at around 17.0 per cent or around Rs.5,50,000 crore. Based on the overall assessment of the sources of funding and the overall credit requirements of various productive sectors of the economy, the growth of non-food credit, including investments in bonds/debentures/ shares of public sector undertakings and private corporate sector and commercial paper (CP), was placed at around 20.0 per cent for 2008-09 consistent with the monetary projections. III.10 Given the unprecedented complexities involved and the heightened uncertainties, a number of factors influenced the stance of monetary policy for 2008-09. First, there was the immediate challenge of escalated and volatile food and energy prices, which possibly contained some structural components apart from cyclical components. Second, while demand pressures persisted, there was some improvement in the domestic supply response. Third, previous initiatives in regard to supply-management by the Government of India and monetary measures by the Reserve Bank were in the process of impacting the economy. Fourth, policy responses emphasised managing expectations in an environment of the evolving global and domestic uncertainties. Fifth, monetary policy had demonstrated a resolve to act decisively on a continuing basis to curb any signs of adverse developments with regard to inflation expectations.

III.11 In view of the macroeconomic conditions and then prevailing inflationary condition, the Reserve Bank continued with its pre-emptive and calibrated approach to contain inflation expectations, and raised CRR by 25 basis points to 8.25 per cent with effect from the fortnight beginning May 24, 2008. This followed the hike in the CRR by 25 basis points each effective from the fortnights beginning April 26 and May 10, 2008 respectively. The Reserve Bank announced on June 11, 2008 an increase in the repo rate under the Liquidity Adjustment Facility (LAF) by 25 basis points to 8.00 per cent from 7.75 per cent with immediate effect.

III.12 Inflation, based on variations in the wholesale price index (WPI) on a year-on-year basis, increased to 11.05 per cent as on June 7, 2008 from 7.75 per cent at end-March 2008 and 4.28 per cent a year ago. At that juncture, the overriding priority for monetary policy was to eschew any further intensification of inflationary pressures and to firmly anchor inflation expectations and to urgently address aggregate demand pressures which appeared to be strongly in evidence. Accordingly, the Reserve Bank increased the repo rate under the LAF from 8.00 per cent to 8.50 per cent effective from June 25, 2008. The CRR was also raised by 50 basis points to 8.75 per cent in two stages, 25 basis points each, effective from the fortnights beginning July 5 and July 19, 2008 respectively (Table 3.1).

First Quarter Review 2008-09

III.13 The First Quarter Review of the Annual Statement on Monetary Policy for 2008-09 (July 29, 2008) noted that after the announcement of the Annual Policy Statement in April 2008, global as well as domestic developments on both supply and demand sides pointed to accentuation of inflationary pressures, especially in terms of inflation expectations. In an environment of surging global inflation, and with domestic inflation also rising to a 13-year high, the Reserve Bank noted with concern that inflation had emerged as the biggest risk to the global outlook, having risen to very high levels across the world, not generally seen for a couple of decades.

III.14 The First Quarter Review stated that inflation was expected to moderate from the then high levels in the months to come and a noticeable decline in inflation was expected towards the last quarter of 2008-09. Accordingly, it emphasised that while the policy actions would aim to bring down the prevailing intolerable level of inflation to a tolerable level of below 5.0 per cent as soon as possible and around 3.0 per cent over the medium-term, at that juncture a realistic policy endeavour would be to bring down inflation from the then prevailing level of about 11.0-12.0 per cent to a level close to 7.0 per cent by end-March 2009. It stated that taking into account aggregate demand management and supply prospects, the projection of real GDP growth of the Indian economy in 2008-09, in the range of 8.0 to 8.5 per cent as set out in the Annual Policy Statement of April 2008, might prove to be optimistic and hence, for policy purposes, a projection of around 8.0 per cent appeared to be a more realistic scenario, barring domestic or external shocks.

Table 3.1: Movement in Key Policy Rates and Reserve Requirements |

(Per cent) |

Effective since |

Bank Rate |

Reverse Repo Rate |

Repo Rate |

Cash Reserve Ratio |

Statutory Liquidity Ratio |

1 |

2 |

3 |

4 |

5 |

6 |

March 31, 2004 |

6.00 |

4.50 |

6.00 |

4.50 |

25 |

September 18, 2004 |

6.00 |

4.50 |

6.00 |

4.75 (+0.25) |

25 |

October 2, 2004 |

6.00 |

4.50 |

6.00 |

5.00 (+0.25) |

25 |

October 27, 2004 |

6.00 |

4.75 (+0.25) |

6.00 |

5.00 |

25 |

April 29, 2005 |

6.00 |

5.00 (+0.25) |

6.00 |

5.00 |

25 |

October 26, 2005 |

6.00 |

5.25 (+0.25) |

6.25 (+0.25) |

5.00 |

25 |

January 24, 2006 |

6.00 |

5.50 (+0.25) |

6.50 (+0.25) |

5.00 |

25 |

June 9, 2006 |

6.00 |

5.75 (+0.25) |

6.75 (+0.25) |

5.00 |

25 |

July 25, 2006 |

6.00 |

6.00 (+0.25) |

7.00 (+0.25) |

5.00 |

25 |

October 31, 2006 |

6.00 |

6.00 |

7.25 (+0.25) |

5.00 |

25 |

December 23, 2006 |

6.00 |

6.00 |

7.25 |

5.25 (+0.25) |

25 |

January 6, 2007 |

6.00 |

6.00 |

7.25 |

5.50 (+0.25) |

25 |

January 31, 2007 |

6.00 |

6.00 |

7.50 (+0.25) |

5.50 |

25 |

February 17, 2007 |

6.00 |

6.00 |

7.50 |

5.75 (+0.25) |

25 |

March 3, 2007 |

6.00 |

6.00 |

7.50 |

6.00 (+0.25) |

25 |

March 30, 2007 |

6.00 |

6.00 |

7.75 (+0.25) |

6.00 |

25 |

April 14, 2007 |

6.00 |

6.00 |

7.75 |

6.25 (+0.25) |

25 |

April 28, 2007 |

6.00 |

6.00 |

7.75 |

6.50 (+0.25) |

25 |

August 4, 2007 |

6.00 |

6.00 |

7.75 |

7.00 (+0.50) |

25 |

November 10, 2007 |

6.00 |

6.00 |

7.75 |

7.50 (+0.50) |

25 |

April 26, 2008 |

6.00 |

6.00 |

7.75 |

7.75 (+0.25) |

25 |

May 10, 2008 |

6.00 |

6.00 |

7.75 |

8.00 (+0.25) |

25 |

May 24, 2008 |

6.00 |

6.00 |

7.75 |

8.25 (+0.25) |

25 |

June 11, 2008 |

6.00 |

6.00 |

8.00 (+0.25) |

8.25 |

25 |

June 25, 2008 |

6.00 |

6.00 |

8.50 (+0.50) |

8.25 |

25 |

July 5, 2008 |

6.00 |

6.00 |

8.50 |

8.50 (+0.25) |

25 |

July 19, 2008 |

6.00 |

6.00 |

8.50 |

8.75 (+0.25) |

25 |

July 30, 2008 |

6.00 |

6.00 |

9.00 (+0.50) |

8.75 |

25 |

August 30, 2008 |

6.00 |

6.00 |

9.00 |

9.00 (+0.25) |

25 |

October 11, 2008 |

6.00 |

6.00 |

9.00 |

6.50 (-2.50) |

25 |

October 20, 2008 |

6.00 |

6.00 |

8.00 (-1.00) |

6.50 |

25 |

October 25, 2008 |

6.00 |

6.00 |

8.00 |

6.00 (-0.50) |

25 |

November 03, 2008 |

6.00 |

6.00 |

7.50 (-0.50) |

6.00 |

25 |

November 08, 2008 |

6.00 |

6.00 |

7.50 |

5.50 (-0.50) |

24 (-1.00) |

December 08, 2008 |

6.00 |

5.00 (-1.00) |

6.50 (-1.00) |

5.50 |

24 |

January 05,2009 |

6.00 |

4.00 (-1.00) |

5.50 (-1.00) |

5.50 |

24 |

January 17,2009 |

6.00 |

4.00 |

5.50 |

5.00 (-0.50) |

24 |

March 05,2009 |

6.00 |

3.50 (-0.50) |

5.00 (-0.50) |

5.00 |

24 |

April 21,2009 |

6.00 |

3.25 (-0.25) |

4.75 (-0.25) |

5.00 |

24 |

Note: 1. With effect from October 29, 2004, the nomenclature of repo and reverse repo was changed keeping with international usage. Now, reverse repo indicates absorption of liquidity and repo signifies injection of liquidity. Prior to October 29, 2004, repo indicated absorption of liquidity while reverse repo meant injection of liquidity. The nomenclature in this Report is based on the new usage of terms even for the period prior to October 29, 2004.

2. Figures in parentheses indicate changes in policy rates/ratios. |

III.15 The First Quarter Review emphasised the necessity of moderating monetary expansion and revised the projection for indicative money supply growth in the range of around 17.0 per cent in 2008-09 in consonance with the outlook on growth and inflation so as to ensure macroeconomic and financial stability in the period ahead. III.16 The First Quarter Review noted that in view of the criticality of anchoring inflation expectations, a continuous heightened vigil over ensuing monetary and macroeconomic developments was to be maintained to enable swift responses with appropriate measures as necessary, consistent with the monetary policy stance. Furthermore, in view of the then macroeconomic and overall monetary conditions, the First Quarter Review announced an increase in fixed repo rate under the LAF by 50 basis points from 8.5 per cent to 9.0 per cent with effect from July 30, 2008 and an increase of CRR by 25 basis points to 9.0 per cent with effect from August 30, 2008.

III.17 As the global liquidity crisis deepened in September 2008, capital inflows dried up and the demand for credit from the domestic banking system increased, thereby aggravating the liquidity pressures. In the wake of the emerging stress on India’s financial markets as a result of the contagion from the global financial crisis, the immediate challenge for the Reserve Bank was to infuse confidence by augmenting both domestic and foreign exchange liquidity. Accordingly, the Reserve Bank announced the first phase of measures on September 16, 2008, including increase in the interest rate ceilings on FCNR (B) deposits of all maturities and on deposits under the NR(E)RA for one to three years maturity by 50 basis points and other measures to augment liquidity (for details see Chapter II.5, Box II.27).

III.18 Liquidity conditions tightened even further after October 7, 2008 as contagion from the US financial crisis spread to Europe and Asia. Globally, money markets froze and the stock markets turned highly volatile. Even coordinated policy actions by monetary authorities in America, Europe, Asia and Australia failed to inspire the confidence of financial markets. In view of the persisting uncertainty in the global financial situation and its impact on India, and continuing demand for domestic market liquidity, the Reserve Bank took further measures in October 2008 including a cumulative reduction of 250 basis points in the CRR effective from the fortnight beginning October 11, further increase in the interest rate ceilings on FCNR (B) deposits of all maturities and on deposits under the NR(E)RA for one to three years maturity by 50 basis points each and other measures to enhance availability of liquidity in the financial system (for details see Chapter II.5, Box II.27). On October 20, 2008 in order to alleviate the pressures on domestic credit markets brought on by the indirect impact of the global liquidity constraint and, in particular, to maintain financial stability, the Reserve Bank decided to reduce the repo rate under the LAF by 100 basis points to 8.0 per cent with immediate effect.

Mid-Term Review 2008-09

III.19 The Mid-Term Review of the Annual Policy Statement 2008-09 (October 24, 2008) was set in the context of several complex and compelling policy challenges as the global financial crisis witnessed unprecedented dimensions. Governments, central banks and financial regulators around the world responded to the crisis with aggressive, radical and unconventional measures to restore calm and confidence to the markets and bring them back to normalcy and stability.

III.20 The Mid-Term Review highlighted that India’s financial sector continued to remain stable and healthy. All indicators of financial strength and soundness such as capital adequacy, ratios of non-performing assets (NPA) and return on assets (RoA) for commercial banks were robust. The Review also noted that the global developments, however, had some indirect, knock-on effects on domestic financial markets.

III.21 The Mid-Term Review noted that the measures taken since mid-September 2008 substantially assuaged liquidity stress in domestic financial markets arising from the contagion of adverse external developments. The total liquidity support through reductions in the CRR, the temporary accommodation under the SLR and the first instalment of the agricultural debt waiver and debt relief scheme was of the order of Rs.1,85,000 crore. The Review further noted that the cut in the repo rate effected on October 20, 2008 was expected to ease the conditions in the money and credit markets, restore their orderly functioning and sustain financial stability.

III.22 The First Quarter Review of July 2008 had placed the projection of real GDP growth in 2008-09 at around 8.0 per cent for policy purposes. The Mid-Term Review noted that since then there had been significant global and domestic developments, which rendered the outlook uncertain, suggesting increased downside risks associated with this projection. Taking these developments and prospects into account, the Mid-Term Review revised the projection of overall real GDP growth for 2008-09 to the range of 7.5-8.0 per cent.

III.23 The Mid-Term Review assessed that inflation would remain a concern and emphasised that the Reserve Bank would keep a strong vigil on inflation. Keeping in view the supply management measures taken by the Central Government and the lagged demand response to the monetary policy measures taken by the Reserve Bank over the last one year, the Review maintained the earlier projection of inflation of 7.0 per cent by end-March 2009 for policy purposes.

III.24 The Mid-Term Review noted that India’s balance of payments till then reflected strength and resilience in a highly unsettled international environment. Assessing the various factors affecting balance of payments, the Review expected somewhat higher current account deficit in 2008-09 than in the preceding year, but it also expected enough capital inflows to meet the external financing requirement in 2008-09.

III.25 The Review expressed the Reserve Bank’s concerns about the depth of global financial crisis and its endeavour to remain proactive, and take measures to manage the unfolding developments by easing pressures stemming from the global crisis. Against the backdrop of the ensuing global and domestic developments and in the light of measures taken by the Reserve Bank over September-October 2008, the Bank Rate, the repo rate and the reverse repo rate and the cash reserve ratio (CRR) were kept unchanged. III.26 Early signs of a global recession became evident by late October 2008 as global financial conditions continued to remain uncertain and unsettled. Globally, commodity prices, including crude oil prices, began to abate which reduced domestic inflationary pressures. It was also important to ensure that credit requirements for productive purposes were adequately met so as to support the growth momentum of the economy. Accordingly, the Reserve Bank announced a series of measures on November 1, 2008 including reduction in the repo rate under the LAF by 50 basis points to 7.5 per cent with effect from November 3, 2008, reduction in the CRR by 100 basis points to 5.5 per cent of NDTL and the relaxation of the SLR, on a temporary basis earlier, was made permanent and reduced to 24 per cent of NDTL effective from November 8, 2008. By mid-November 2008, there were indications that the global slowdown was deepening with a larger than expected impact on the domestic economy, particularly for the medium and small industry sector and export-oriented units. In the context of these developments, for augmenting rupee and forex liquidity, and strengthening and improving credit delivery mechanisms, the Reserve Bank announced measures on November 15, 2008 including increase in interest rate ceilings on FCNR(B) and NR(E)RA deposits by 75 basis points each to Libor/ swap rates plus 100 basis points and Libor/swap rates plus 175 basis points, respectively. On a further review of the then prevailing liquidity conditions, the Reserve Bank again announced measures for liquidity management and improving credit flows on November 28, 2008. III.27 The global outlook deteriorated further during December 2008 indicating that the recession would be deeper and the recovery longer than anticipated earlier. With indications of slowing down of the domestic economic activity while inflationary pressures abated significantly, the Reserve Bank initiated a series of measures on December 6 and 11, 2008 which included reduction in the repo rate under the LAF by 100 basis points to 6.5 per cent, reduction in the reverse repo rate by 100 basis points from 6.0 per cent to 5.0 per cent, effective from December 8, 2008 and measures relating to refinance facilities (for details see Chapter II.5, Box II.27). These measures were aimed at improving the credit flow to productive sectors to sustain the growth momentum.

III.28 While domestic financial markets continued to function in an orderly manner, India’s growth trajectory was impacted by the global recession. The Reserve Bank’s monetary policy stance recognised the concerns over rising credit risk together with the slowing of economic activity which appeared to affect credit growth. Accordingly, in order to stimulate growth, the Reserve Bank took the following measures on January 2, 2009: (i) the repo rate under the LAF was reduced by 100 basis points to 5.5 per cent with effect from January 5, 2009; (ii) the reverse repo rate under the LAF was reduced by 100 basis points to 4.0 per cent with effect from January 5, 2009; and (iii) the CRR was reduced from 5.5 per cent to 5.0 per cent of NDTL effective from the fortnight beginning January 17, 2009.

Third Quarter Review 2008-09

III.29 The Third Quarter Review of Monetary Policy 2008-09 (January 27, 2009) was set in the context of a deepening global crisis with persistent uncertainty in the global financial system. There was a rapid and marked deterioration in the global economic outlook after the release of the Reserve Bank’s Mid-term Review in October 2008. The continued bad news from large international financial institutions on a regular basis renewed concerns about the time when the global financial sector would attain a semblance of stability. There was an emerging consensus that there might be no recovery till late 2009; indeed, some outlook suggested that the recovery might be delayed beyond 2009.

III.30 The Third Quarter Review, prepared in the backdrop of rising effects of contagion from the global crisis, observed that the Indian economy experienced a cyclical moderation in growth accompanied by high inflation in the first half of 2008-09 and there was a distinct evidence of further slowdown as a consequence of the global downturn. The knock-on effects of the global crisis, and falling commodity prices affected the Indian economy in several ways. Access to international credit continued to be constrained; capital market valuations remained low; industrial production growth slackened; export growth turned negative, and overall business sentiment deteriorated. On the positive side, the Review noted that the headline inflation decelerated, though consumer price inflation did not show any moderation. Also, the domestic financial markets continued to function in an orderly manner and in sharp contrast to their international counterparts, the financial system in India remained resilient and stable. The Review further observed that although bank credit growth was higher in 2008-09 (up to mid- January 2009) than in the previous year, the flow of overall financial resources to the commercial sector during April 2008-January 2009 declined marginally as compared with the previous year. This was on account of decline in other sources of funding such as resource mobilisation from the capital market and external commercial borrowings (ECBs).

III.31 The Third Quarter Review noted that the downside risks to growth had amplified since MidTerm Review of October 2008 because of slowdown in industrial activity and weakening of external demand, as reflected in decline in exports. Services sector activities were likely to further decelerate in the second half of 2008-09. Keeping in view the slowdown in industry and services and with the assumption of normal agricultural production, the Third Quarter Review revised the projection of overall real GDP growth for 2008-09 downwards to 7.0 per cent with a downward bias. The Review emphasised that the fundamental strengths continued to be in place and once the global economy started to recover, India’s turnaround would be sharper and swifter, backed by India’s strong fundamentals and the untapped growth potential. III.32 Since the time of presentation of the MidTerm Review in October 2008, pressures on commodity prices had abated markedly around the world, reflecting slump in global demand. In the domestic market, WPI inflation was already below 7.0 per cent, which was projected earlier for end-March 2009. Based on the then available information, the Review assessed the inflation rate to moderate further in the last quarter of 2008-09. The Review recognised that the headline WPI inflation might fall well below 3.0 per cent in the short-run partly because of the statistical reason of high base, and the global trends caused by sharp corrections from exceptionally high oil and commodity prices prevailing in early 2008.

III.33 The Review recognised that with the decline in upside risks to inflation, monetary policy was responding to slackening economic growth in the context of significant global stress. Accordingly, in the Third Quarter Review, for policy purposes, the projection of money supply (M3) growth for 2008-09 was raised to 19.0 per cent from 16.5-17.0 per cent projected earlier. III.34 Based on the assessment of the global scenario and the domestic economy, particularly the outlook for growth and inflation, the Reserve Bank in the Third Quarter Review maintained its monetary policy stance of provision of comfortable liquidity to meet the required credit growth consistent with the overall projection of economic growth. Furthermore, the Reserve Bank announced that monetary policy actions would be aimed at ensuring a monetary and interest rate environment consistent with price stability, well-anchored inflation expectations and orderly conditions in financial markets. In light of the measures already taken by the Reserve Bank over November 2008-January 2009, the Review kept the Bank Rate, the repo rate and the reverse repo rate under the LAF and the CRR unchanged. On a review of the then prevailing liquidity conditions, the Reserve Bank announced the extension of the special term repo facility under the LAF and special refinance facility for banks up to September 30, 2009.

III.35 In view of the continuing uncertain credit conditions globally and domestically, the Reserve Bank, on February 5, 2009 extended the forex swap facility and restructuring of advances by banks and raised ceiling rate on export credit in foreign currency.

III.36 Subsequent to the release of the Third Quarter Review in January 2009, there was evidence of further slowing down of economic activity as manifested by the decline in exports and IIP and moderation in GDP growth (across all the sectors). The total flow of resources to the commercial sector from banks and non-banks during April-February 2008-09 was also lower than in the corresponding period of the last year. Against the backdrop of the then prevailing macroeconomic conditions, the Reserve Bank on March 4, 2009 decided to reduce both repo and reverse repo rate under the LAF by 50 basis points to 5.0 per cent and 3.5 per cent, respectively, effective from March 5, 2009.

MONETARY POLICY OPERATIONS: 2009-10

Annual Policy Statement 2009-10

III.37 The Annual Policy Statement (APS) 2009- 10 (April 21, 2009) was presented in the midst of exceptionally challenging circumstances in the global economy. It noted that the global economic crisis had called into question several fundamental assumptions and beliefs governing economic resilience and financial stability. What started off as turmoil in the financial sector of the advanced economies had snowballed into the deepest and most widespread financial and economic crisis of the last 60 years. The Statement noted that although the governments and central banks around the world responded to the crisis through both conventional and unconventional fiscal and monetary measures, the global financial situation remained uncertain and the global economy continued to cause anxiety for several reasons. There was no clear estimate of the quantum of tainted assets, and doubts persisted on whether the initiatives underway were sufficient to restore the stability of the financial system. There was a continued debate on the adequacy of the fiscal stimulus packages across countries, and their effectiveness in arresting the downturn, reversing job losses and reviving consumer confidence.

III.38 The Statement mentioned that both the Government and the Reserve Bank responded to the challenge of minimising the impact of the crisis on India in co-ordination and consultation. The policy responses in India beginning September 2008 were designed largely to mitigate the adverse impact of the global financial crisis on the Indian economy. The conduct of monetary policy had to contend with the high speed and magnitude of the external shock and its spill-over effects through the real, financial and confidence channels. The evolving stance of policy had been increasingly conditioned by the need to preserve financial stability while arresting the moderation in the growth momentum. The Policy Statement also mentioned that taking a cue from the Reserve Bank’s monetary easing; most banks started to reduce their deposit and lending rates.

III.39 It was viewed that the fiscal and monetary stimulus measures initiated during 2008-09 coupled with lower commodity prices could cushion the downturn in the growth momentum during 2009-10 by stabilising domestic economic activity to some extent. While based on the available information it was found that domestic financing conditions had improved, external financing conditions were expected to remain tight. Private investment demand was, therefore, expected to remain subdued. On balance, with the assumption of normal monsoon, the Statement, for policy purpose, projected real GDP growth for 2009-10 at around 6.0 per cent.

III.40 On account of a slump in global demand, pressures on global commodity prices abated markedly around the world by the end of the fiscal year 2008-09. The sharp decline in prices of crude oil, metals, foodgrains, cotton and cement had influenced inflation expectations in most parts of the world. This was also reflected in the domestic WPI inflation reaching close to zero. Keeping in view the global trend in commodity prices and domestic demand-supply balance, the Statement projected WPI inflation at around 4.0 per cent by end-March 2010. The Statement emphasised that monetary policy in India would continue to condition and contain perceptions of inflation in the range of 4.0-4.5 per cent so that an inflation rate of around 3.0 per cent becomes the medium-term objective.

III.41 Monetary and credit aggregates had exhibited deceleration from their peak levels in October 2008. The liquidity overhang emanating from the earlier surge in capital inflows had substantially moderated in 2008-09. The Reserve Bank was committed to provide ample liquidity for all productive activities on a continuous basis. As the upside risks to inflation declined, monetary policy started responding to slackening economic growth in the context of significant global stress. Accordingly, for policy purposes, the Statement projected money supply (M3) growth at 17.0 per cent for 2009-10.

III.42 The Annual Policy Statement recognised that while continuing to support adequate liquidity in the economy, the Reserve Bank would have to ensure that as economic growth gathers momentum, the excess liquidity is rolled back in an orderly manner. Based on the overall assessment of the macroeconomic situation, the Policy Statement emphasised the need to ensure a policy regime that would enable credit expansion at viable rates while preserving credit quality so as to support the return of the economy to a high growth path. It indicated that the Reserve Bank would continuously monitor the global and domestic conditions and respond swiftly and effectively through policy adjustments as warranted so as to minimise the impact of adverse developments and reinforce the impact of positive developments. The stance further emphasised to maintain a monetary and interest rate regime supportive of price stability and financial stability taking into account the emerging lessons of the global financial crisis. Against the backdrop of global and domestic developments, the Reserve Bank reduced the repo rate under the LAF by 25 basis points from 5.0 per cent to 4.75 per cent with effect from April 21, 2009. The reverse repo rate under the LAF was also reduced by 25 basis points from 3.5 per cent to 3.25 per cent with effect from April 21, 2009.

First Quarter Review 2009-10

III.43 The First Quarter Review of Monetary Policy 2009-10 (July 28, 2009) noted that the global economy was showing incipient signs of stabilisation, albeit not recovery. The pace of decline in economic activity in several major advanced economies had slowed, frozen credit markets had thawed and equity markets had begun to recover. Recent months also witnessed industrial activity reviving in a number of emerging market economies. Notwithstanding some positive signs, the path and the time horizon for global recovery remained uncertain in the light of subdued consumption demand, increased unemployment levels and in anticipation of further contraction in global trade and private capital flows. While business and consumer confidence were yet to show definitive signs of revival and the financial sector appeared to be stabilising in response to concerted actions taken by governments and central banks across the world, economic recession in the real sector persisted.

III.44 The Indian economy experienced a significant slowdown in 2008-09 in comparison with the robust growth performance in the preceding five years, largely due to the knock-on effect of the global financial crisis. India’s exports contracted for eight straight months which, in turn, impacted the industrial sector and the services sector. The financial sector, however, remained relatively unaffected despite the severe stress created by the global deleveraging process, which triggered capital outflows in the second half of 2008-09. Quick and aggressive policy responses both by the Government and the Reserve Bank mitigated the impact of the global financial crisis. The large domestic demand bolstered by the government consumption, provision of forex and rupee liquidity coupled with sharp cuts in policy rates, a sound banking sector and well-functioning financial markets helped to cushion the economy from the worst impact of the crisis.

III.45 The First Quarter Review noted the progressive signs of recovery in India: (i) increase in food stocks; (ii) positive industrial production growth; (iii) improved corporate performance; (iv) optimism in business confidence surveys; (v) upturn in leading indicators; (vi) easing of lending rates; (vii) pick-up in credit off-take after May 2009; (viii) rebound in stock prices; (ix) activity in the primary capital market; and (x) improved external financing conditions. On the other hand, the negative signs included: (i) delayed and deficient monsoon; (ii) food price inflation; (iii) rebound in global commodity prices; (iv) continuing weak external demand; and (v) high fiscal deficit.

III.46 It was noted that due to various policy initiatives by the Reserve Bank, the liquidity situation remained comfortable since mid-November 2008 as evidenced by the LAF window where the Reserve Bank was absorbing more than Rs.1,20,000 crore on a daily average basis. The liquidity expansion was consistent with the Reserve Bank’s stance of ensuring a policy regime that would enable credit expansion at viable rates while preserving credit quality. With ample liquidity, the competitive pressure on banks to reduce lending rates increased and the transmission of policy rate changes to bank lending rates improved since the last Annual Policy Statement in April 2009. It further noted that as the short-term deposits contracted earlier at high rates mature and get repriced, it opens up room for banks to further reduce their lending rates.

III.47 The First Quarter Review revised the indicative policy projection for GDP growth in 2009-10 to 6.0 per cent with an upward bias which marked a slight improvement over the growth expectation of around 6.0 per cent indicated in the Annual Policy Statement. It was recognised that an uptrend in the growth momentum was unlikely before the middle of 2009-10. On inflation prospects, WPI inflation for end-March 2010 was projected higher at around 5.0 per cent from 4.0 per cent given in the Annual Policy Statement of April 2009. It was noted that the WPI inflation turned negative in June 2009 due to the statistical base effect as anticipated, and not because of any contraction in demand. However, the sharp decline in WPI inflation had not been commensurately matched by a similar decline in inflation expectations. Also, inflation of WPI primary articles, particularly food articles, remained significantly positive and consumer price indices (CPIs) also were elevated, indeed also hardened in recent months. The Review further noted that global commodity prices had rebounded ahead of global recovery and the uncertain monsoon outlook could further accentuate food price inflation. On balance, the risks to the revised projections of real GDP growth and inflation for 2009-10 were on the upside. The comfortable levels of food grains stocks should help mitigate the risks in the event of price pressures from the supply side. It was emphasised that the Reserve Bank will also closely monitor the level of liquidity so as to contain inflationary expectations if supply side price pressures were to rise. Further, in order to ensure that the increased Government market borrowing programme does not crowd out credit flow to the private sector, the projection of money supply (M3) growth for 2009-10 was raised to 18.0 per cent from 17.0 per cent indicated in the Annual Policy Statement. Consistent with this, aggregate deposits and adjusted non-food credit of commercial banks were projected to grow by 19.0 per cent and 20.0 per cent, respectively.

III.48 On the basis of the overall assessment, the stance of monetary policy for the remaining period of 2009-10 was stated to be as: (i) managing liquidity actively so that the credit demand of the Government is met while ensuring the flow of credit to the private sector at viable rates (ii) keeping a vigil on the trends and signals of inflation, and be prepared to respond quickly and effectively through policy adjustments; (iii) maintaining a monetary and interest rate regime consistent with price stability and financial stability supportive of returning the economy to the high growth path. III.49 Consistent with the assessment of macroeconomic and monetary conditions, the repo rate, the reverse repo rate and the CRR were kept unchanged. The Reserve Bank reiterated that it would maintain an accommodative monetary stance until there are definite and robust signs of recovery. This accommodative monetary stance is, however, not the steady state. On the way forward, the Reserve Bank would have to reverse the expansionary measures to anchor inflation expectations and subdue inflationary pressures while preserving the growth momentum. The exit strategy will be modulated in accordance with the evolving macroeconomic developments.

III.50 The stance of monetary policy changed swiftly during 2008-09 in response to the changing domestic and international environment. In the first half of 2008-09, the Reserve Bank continued with the tight monetary stance to contain inflationary expectations in view of the elevated inflationary pressures emanating from the substantial increase in commodity prices. All the policy rates and the CRR were accordingly increased on a continuous basis up to August 2008. However, the Reserve Bank reversed the stance of monetary policy swiftly after mid-September 2008 and moved towards monetary easing anticipating the impact of the international financial turmoil on the Indian economy, in the backdrop of declining inflation. Accordingly, the Reserve Bank reduced the CRR, cut policy rates and injected liquidity in the system to support the growth momentum of the economy and make credit available for productive purposes. During the course of last one year, thus, the stance of monetary policy had to change significantly to meet the various challenges in relation to the objectives of the monetary policy (Box III.1).

Cash Reserve Ratio

III.51 Between April-August 2008, the CRR for scheduled banks was raised by 150 basis points in six stages of 25 basis points each to 9.0 per cent of the banks’ net demand and time liabilities (NDTL) (Chart III.1). Subsequently, the CRR was reduced by 400 basis points to 5.0 per cent in four stages between October 11, 2008 and April 21, 2009. Box III.1

Changing Stance of Monetary Policy in India 2008-09

Annual Policy Statement (April 2008)

- To ensure a monetary and interest rate environment that accords high priority to price stability well-anchored inflation expectations and orderly conditions in financial markets while being conducive to continuation of the growth momentum.

- To respond swiftly on a continuing basis to the evolving constellation of adverse international developments and to the domestic situation impinging on inflation expectations, financial stability and growth momentum, with both conventional and unconventional measures, as appropriate.

- To emphasise credit quality as well as credit delivery, in particular, for employment-intensive sectors, while pursuing financial inclusion.

First Quarter Review (July 2008)

- To ensure a monetary and interest rate environment that accords high priority to price stability, well-anchored inflation expectations and orderly conditions in financial markets while being conducive to continuation of the growth momentum.

- To respond swiftly on a continuing basis to the evolving constellation of adverse international developments and to the domestic situation impinging on inflation expectations, financial stability and growth momentum, with both conventional and unconventional measures, as appropriate.

- To emphasise credit quality as well as credit delivery, in particular, for employment-intensive sectors, while pursuing financial inclusion.

Mid-Term Review (October 2008)

- Ensure a monetary and interest rate environment that optimally balances the objectives of financial stability, price stability and well-anchored inflation expectations, and growth;

- Continue with the policy of active demand management of liquidity through appropriate use of all instruments including the CRR, open market operations (OMO), the MSS and the LAF to maintain orderly conditions in financial markets;

- In the context of the uncertain and unsettled global situation and its indirect impact on the domestic economy in general and the financial markets in particular, closely and continuously monitor the situation and respond swiftly and effectively to developments, employing both conventional and unconventional measures;

- Emphasise credit quality and credit delivery, in particular, for employment-intensive sectors, while pursuing financial inclusion.

Third Quarter Review (January 2009)

- Provision of comfortable liquidity to meet the required credit growth consistent with the overall projection of economic growth.

- Respond swiftly and effectively with all possible measures as warranted by the evolving global and domestic situation impinging on growth and financial stability.

- Ensure a monetary and interest rate environment consistent with price stability, well-anchored inflation expectations and orderly conditions in financial markets.

2009-10

Annual Policy Statement (April 2009)

- Ensure a policy regime that will enable credit expansion at viable rates while preserving credit quality so as to support the return of the economy to a high growth path.

- Continuously monitor the global and domestic conditions and respond swiftly and effectively through policy adjustments as warranted so as to minimise the impact of adverse developments and reinforce the impact of positive developments.

- Maintain a monetary and interest rate regime supportive of price stability and financial stability taking into account the emerging lessons of the global financial crisis.

First Quarter Review (July 2009)

- Manage liquidity actively so that the credit demand of the Government is met while ensuring the flow of credit to the private sector at viable rates.

- Keep a vigil on the trends and signals of inflation, and be prepared to respond quickly and effectively through policy adjustments.

- Maintain a monetary and interest rate regime consistent with price stability and financial stability supportive of returning the economy to the high growth path.

Since September 2008, along with the usual emphasis on containment of inflation and inflation expectations, supporting growth momentum and financial stability, the balance of focus in the policy stance has changed in response to the evolving conditions with greater policy accent on adequate and swift response, using conventional and unconventional measures, to maintain orderly market conditions, and provision of adequate liquidity to support credit growth and aggregate demand without diluting the emphasis on credit quality.

|

Statutory Liquidity Ratio

III.52 The statutory liquidity ratio (SLR) was reduced by 100 basis points to 24.0 per cent of banks’ NDTL effective from November 8, 2008. Commercial banks’ actual holdings of SLR securities as at end-March 2009 stood at 28.1 per cent of their NDTL as compared with 27.8 per cent at end-March 2008.

LIQUIDITY MANAGEMENT

III.53 Central banks around the world faced complex challenges in the conduct of their liquidity management operations, as the pressure on funding liquidity became unprecedented in the face of significant erosion in market liquidity. Sharp corrections in asset prices affected market liquidity, which had the potential to create insolvency problem for several leading global financial institutions. Moreover, as the liquidity needs of non-banks, ranging from investment banks, insurance companies, housing finance companies, hedge funds to even money market mutual funds increased exponentially, it came to the notice of the central banks that liquidity injected by the central banks to the commercial banks may not reach the non-banks in the face of heightened risk aversion and uncertainties about the soundness of even the most reputed global financial institutions. The global financial crisis not only tested the limits of conventional liquidity management operations of central banks, but also necessitated extensive resort to a range of unconventional measures as it became increasingly evident that to avoid a systemic financial crisis, not only the liquidity needs of “too big to fail” banks have to be met, but even the liquidity needs of “too interconnected to fail” financial institutions (such as Bear Stearns & AIG) must also be met.

III.54 Despite no direct exposure of the Indian banks and financial institutions to the failing international institutions or troubled assets, liquidity management operations of the Reserve Bank assumed greater urgency in the face of the knock-on effects of the global financial crisis, which manifested not only as reversals in capital inflows but also adverse market expectations causing sharp correction in asset prices, and pressures on the exchange rate. The Reserve Bank had to swiftly respond to the rapidly evolving macroeconomic conditions. In the initial few months of 2008-09, inflation expectations driven by surge in global commodity prices dictated a contractionary stance; during the following few months, the autonomous pressures on liquidity arising from capital outflows, and drying up of sources of overseas funding necessitated discretionary expansion; in the last few months, the surge in Government’s market borrowings to deal with the slow-down of the economy elicited further accommodating response from the Reserve Bank (Table 3.2). Thus, by synchronising the liquidity management operations with those of exchange rate management and non-disruptive internal debt management operations, the Reserve Bank ensured that appropriate liquidity was maintained in the system so that all legitimate requirements of credit were met, particularly for productive purposes, consistent with the objective of price and financial stability. The management of liquidity was through appropriate use of CRR stipulations and open market operations (OMO), including MSS and LAF and a slew of special facilities (Table 3.3).

Table 3.2: Reserve Bank’s Liquidity Management Operations |

(Rupees crore) |

Item |

2007-08 |

2008-09 |

2008-09 |

Q1 |

Q2 |

Q3 |

Q4 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

A. |

Drivers of Liquidity (1+2+3+4+5) |

2,03,010 |

-1,67,708 |

6,061 |

-18,851 |

-1,01,278 |

-53,640 |

|

1. |

RBI’s net purchases from Authorised Dealers |

3,12,054 |

-1,78,592 |

-8,555 |

-40,249 |

-1,12,168 |

-17,620 |

|

2. |

Currency with the Public |

-85,587 |

-97,921 |

-30,063 |

12,360 |

-40,070 |

-40,147 |

|

3. |

Surplus cash balances of the Centre with the Reserve Bank |

-26,594 |

60,367 |

40,073 |

-3,845 |

36,554 |

-12,415 |

|

4. |

WMA and OD |

0 |

0 |

0 |

0 |

0 |

0 |

|

5. |

Others (residual) |

3,137 |

48,438 |

4,606 |

12,884 |

14,406 |

16,542 |

B. |

Management of Liquidity (6+7+8+9) |

-1,17,743 |

2,35,209 |

-37,659 |

7,217 |

1,33,325 |

1,32,326 |

|

6. |

Liquidity impact of LAF Repos |

21,165 |

-51,835 |

-18,260 |

24,390 |

-71,110 |

13,145 |

|

7. |

Liquidity impact of OMO (Net) * |

13,510 |

1,04,480 |

14,642 |

11,949 |

10,681 |

67,208 |

|

8. |

Liquidity impact of MSS |

-1,05,418 |

80,314 |

-6,041 |

628 |

53,754 |

31,973 |

|

9. |

First round liquidity impact due to CRR change |

-47,000 |

1,02,250 |

-28,000 |

-29,750 |

1,40,000 |

20,000 |

C. |

Bank Reserves (A+B) # |

85,267 |

67,501 |

-31,598 |

-11,634 |

32,047 |

78,686 |

(+) : Indicates injection of liquidity into the banking system.

(-) : Indicates absorption of liquidity from the banking system.

# : Includes vault cash with banks and adjusted for first round liquidity impact due to CRR change.

* : Includes oil bonds but excludes purchases of government securities on behalf of State Governments.

Note : Data pertain to March 31 and last Friday for all other months. |

Table 3.3: Monthly Primary Liquidity Flows and Open Market Operations |

(Rupees crore) |

Month |

RBI’s Net Foreign Currency Assets # |

Net Repos under the LAF |

Net Open Market Operations |

Market Stabilisation Scheme |

2007-08 |

2008-09 |

2009-10 |

2007-08 |

2008-09 |

2009-10 |

2007-08 |

2008-09 |

2009-10 |

2007-08 |

2008-09 |

2009-10 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

9 |

10 |

11 |

12 |

13 |

14 |

Apr |

11,935 |

15,059 |

-1,971 |

-19,189 |

-83,115 |

-1,06,945 |

-313 |

-111 |

18,591 |

-12,951 |

-4,052 |

17,861 |

May |

8,138 |

9,447 |

-7,519 |

-5,306 |

3,155 |

-26,410 |

-680 |

-54 |

16,959 |

-11,395 |

-2,918 |

30,326 |

Jun |

27,655 |

-8,971 |

3,245 |

-7,687 |

34,610 |

555 |

-252 |

8,860 |

6,451 |

4,702 |

929 |

17,000 |

Jul |

25,219 |

-33,674 |

23,592 |

-3 |

29,325 |

-5,405 |

-664 |

9,488 |

5,243 |

-2,410 |

2,993 |

1,827 |

Aug |

38,817 |

15,580 |

|

-13,855 |

-26,725 |

|

-498 |

1,883 |

|

-21,407 |

-2,218 |

|

Sep |

54,039 |

-13,547 |

|

22,925 |

48,880 |

|

-398 |

-836 |

|

-25,039 |

-146 |

|

Oct |

52,372 |

-42,465 |

|

-24,205 |

-67,285 |

|

-531 |

-1 |

|

-42,804 |

8,617 |

|

Nov |

29,994 |

-47,375 |

|

9,425 |

6,785 |

|

-146 |

-7 |

|

-1,103 |

22,821 |

|

Dec |

18,521 |

-2,262 |

|

31,080 |

-1,670 |

|

4,597 |

7,677 |

|

12,716 |

22,316 |

|

Jan |

45,251 |

10,557 |

|

-34,305 |

-48,915 |

|

680 |

6,621 |

|

1,607 |

11,286 |

|

Feb |

38,428 |

6,022 |

|

3,850 |

-5,215 |

|

2,321 |

5,801 |

|

-14,031 |

6,773 |

|

Mar |

20,181 |

-8,679 |

|

58,435 |

58,335 |

|

1,809 |

55,227 |

|

6,697 |

13,914 |

|

Total |

3,70,550 |

-1,00,308 |

17,347 |

21,165 |

-51,835 |

-1,38,205 |

5,925 |

94,548 |

47,244 |

-1,05,418 |

80,315 |

67,014 |

# : Adjusted for revaluation.

+ : Indicates injection of liquidity into the banking system.

- : Indicates absorption of liquidity from the banking system.

Note : 1. Data based on March 31 for March and last reporting Friday for all other months.

2. From April 2006 onwards, the Reserve Bank has stopped participating in the primary market for Government securities in line with the stipulations of the Fiscal Responsibility and Budget Management (FRBM) Act. 2003. |

First Half of the Fiscal Year 2008-09

III.55 The initial impact of the sub-prime crisis on the Indian economy was rather muted. During most part of the first half of fiscal 2008-09, liquidity management operations were essentially geared towards mopping up of excess domestic liquidity, mainly through CRR hikes (in April, May, July and August cumulatively by 150 basis points to 9.0 per cent) with a view to containing inflationary pressures. Signalling the contractionary stance, the Bank also raised the repo rate cumulatively by 125 basis points (in June and July 2008) to 9.0 per cent effective July 30, 2008. Meanwhile, by end May, 2008, capital flows had been adversely affected as a consequence of the worsening global financial conditions leading to foreign exchange market operations by the Reserve Bank to contain excessive volatility in the exchange rate, which in turn contributed to some absorption of domestic liquidity. Concomitantly, with the reversal in the nature of foreign exchange market operations, auction of dated securities under the MSS was suspended. Reflecting the impact of these developments, the LAF turned from absorption mode to injection mode after the first week of June 2008.

Second Half of the Fiscal Year 2008-09

III.56 Though the direct impact of the sub-prime crisis on Indian banks/financial sector was almost negligible because of limited exposure to the troubled assets, prudential policies put in place by the Reserve Bank and relatively lower presence of foreign banks in the Indian banking sector, there was a sudden change in the external environment following the Lehman Brothers’ failure in mid-September, 2008.

III.57 With a view to maintaining orderly conditions in the foreign exchange market which had turned volatile, the Reserve Bank scaled up its intervention operations, particularly in October, 2008. The other important measures taken by the Reserve Bank to contain foreign exchange volatility included a rupee-dollar swap facility for Indian banks to give them comfort in managing their short- term foreign funding requirements. The Reserve Bank also continued with the Special Market Operations (SMO) which were instituted in June 2008 for meeting the foreign exchange requirements of public sector oil marketing companies, taking into account the then prevailing extraordinary situation in the money and foreign exchange markets. Finally, measures to ease foreign exchange liquidity also included those aimed at encouraging capital inflows, such as an upward adjustment of the interest rate ceiling on the foreign currency deposits by non-resident Indians, substantially relaxing the external commercial borrowings (ECB) regime for corporates, and allowing non-banking financial companies and housing finance companies access to foreign borrowing.

III.58 The cumulative effect of Reserve Bank’s operations in the foreign exchange market as well as transient local factors such as build up in government balances following quarterly advance tax payments, however, adversely impacted the domestic liquidity conditions. Consequently, with receding inflationary pressures and rising possibility of global crisis affecting India’s growth prospects the Reserve Bank switched to an expansionary regime in mid-October, 2008 in contrast to its contractionary regime earlier.

III.59 As a fallout of the global financial crisis, foreign funding dwindled and the domestic capital market slumped, which, in turn, put pressures on some segments of the Indian financial system, such as mutual funds and NBFCs. Facing large redemption pressures, the mutual funds started conserving their liquidity which, in turn, affected other sections of the market, particularly NBFCs, that had been dependent on mutual funds for their funding needs. To address such liquidity shortages, the Reserve Bank introduced a term repo facility for an amount up to Rs.60,000 crore under which banks could avail central bank funds to address the liquidity stress faced by mutual funds, NBFC and housing finance companies (HFCs) with associated SLR exemption of up to 1.5 per cent of NDTL. This facility has been extended up to March 31, 2010. A SPV was also set up to address the temporary liquidity constraints of systemically important non-deposit taking NBFCs. Thus, the Reserve Bank addressed the financial stress faced by non-banks indirectly through the banking channel and a SPV and without compromising either on the eligible counterparties or on the asset quality of its balance sheet, which was in contrast to the approach adopted by the Central Banks of some of the advanced countries (See Box III.2).

III.60 In addition, a special refinance facility was introduced by the Reserve Bank, under which all scheduled commercial banks (SCBs) (excluding Regional Rural Banks) were provided refinance, against the collateral of promissory notes, equivalent to up to 1.0 per cent of their NDTL as on October 24, 2008 at the LAF repo rate up to a maximum period of 90 days. Banks were also encouraged to use this facility for the purpose of extending finance to micro and small enterprises.

III.61 The other measures that aimed at keeping the domestic money and credit markets functioning normally, since solvency was not an issue in India at all, included (a) reduction in statutory liquidity ratio (SLR) by one percentage point, (b) extension of the period of entitlement of pre-shipment and post-shipment rupee export credit, (c) increase in the eligible limit of the ECR facility and (d) amounts to be allotted from SCBs for contribution to the SIDBI and the NHB.

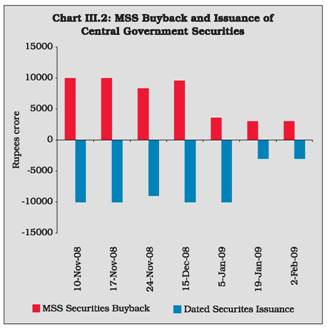

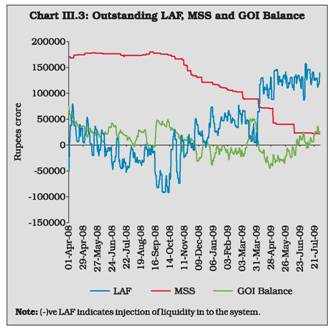

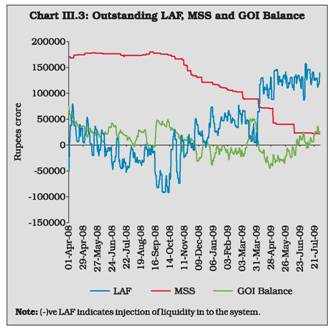

III.62 Following the reversal in capital flows and significant increase in the liquidity needs of the economy, the Reserve Bank also started unwinding of the outstanding MSS balances. After September, 2008, the issue of Treasury Bills under the MSS was suspended, resulting in a steady release of liquidity. With effect from November 2008, the Reserve Bank also started buy back of dated securities issued earlier under the MSS to augment liquidity. The buyback was conducted through auctions and largely dovetailed with normal market borrowing programme of the Central Government (Chart III.2). Outstanding balances under the MSS had declined by around Rs.50,000 crore (comprising buyback of Rs.37,964 crore and redemptions of Rs.54,737 crore offsetting issuances of Rs 43,500 crore ) to Rs.1,21,353 crore at end December 2008 (Table 3.4 and Chart III.3).

|

Table 3.4: Indicators of Liquidity |

(Rupees crore) |

Outstanding as on last Friday |

LAF |

MSS |

Centre’s Surplus with the RBI@ |

Total

(2 to 4) |

1 |

2 |

3 |

4 |

5 |

2008 |

|

|

|

|

January |

985 |

1,66,739 |

70,657 |

2,38,381 |

February |

8,085 |

1,75,089 |

68,538 |

2,51,712 |

March* |

-50,350 |

1,68,392 |

76,586 |

1,94,628 |

April |

32,765 |

1,72,444 |

36,549 |

2,41,758 |

May |

-9,600 |

1,75,362 |

17,102 |

1,82,864 |

June |

-32,090 |

1,74,433 |

36,513 |

1,78,856 |

July |

-43,260 |

1,71,327 |

15,043 |

1,43,110 |

August |

-7,600 |

1,73,658 |

17,393 |

1,83,451 |

September |

-56,480 |

1,73,804 |

40,358 |

1,57,682 |

October |

-73,590 |

1,65,187 |

14,383 |

1,05,980 |

November |

-9,880 |

1,32,531 |

7,981 |

1,30,632 |

December |

14,630 |

1,20,050 |

3,804 |

1,38,484 |

2009 |

|

|

|

|

January |

54,605 |

1,08,764 |

-9,166 |

1,54,203 |

February |

59,820 |

1,01,991 |

-9,603 |

1,52,208 |

March* |

1,485 |

88,077 |

16,219 |

1,05,781 |

April |

1,08,430 |

70,216 |

-40,412 |

1,38,234 |

May |

1,10,685 |

39,890 |

-6,114 |

1,44,461 |

June |

1,31,505 |

22,890 |

12,837 |

1,67,232 |

July |

1,39,690 |

21,063 |

26,440 |

1,87,193 |

@ : Excludes minimum cash balances with the Reserve Bank in case of surplus.

* : Data pertain to March 31.

Note: 1. Negative sign in column 2 indicates injection of liquidity through

LAF.

2. Negative sign in column 4 indicates injection of liquidity through

WMA/overdraft. |

Box III.2

Central Banks’ Unconventional Policy Measures - International Experience on

Liquidity Support to Non-banking Financial Entities Some Central Banks provided liquidity support to non-bank financial institutions (NBFIs) as part of their ‘unconventional’ policy response to deal with the intense liquidity scare that was experienced during the global financial crisis. Despite adequate access to central bank liquidity at falling costs for the banking system, the non-banking financial entities had to contend with a severe liquidity crisis, as the monetary policy transmission turned increasingly ineffective in allocating the liquidity injected into the banking system among non-banks. Moreover, the uncertain environment and the associated concerns about counterparties, falling asset (collateral) values, and rising risk premium also contributed to the liquidity problems for the non-banks. The central banks, in response, had to introduce a range of non-conventional policy measures to provide the non-banks direct access to liquidity.

There are important strategic issues relating to use of unconventional monetary policy measures, as highlighted by Smaghi (2009), which include: (a) why and when should central banks resort to unconventional measures?, (b) what are the main characteristics of unconventional measures?, (c) how are unconventional measures implemented, if and when they are needed, and (d) how and when do central banks need to unwind the extra monetary stimulus? On the first issue, central banks use unconventional measures because either they exhaust the conventional option when the policy rates drop to zero, or, even when the policy rates are above zero, the monetary policy transmission may get significantly impaired during an intense financial crisis. As regards the second issue, while the conventional measures may primarily target to anchor the market rates around the policy rates, the unconventional measures could focus on “directly targeting liquidity shortages and credit spreads in certain market segments”. One possible implication of unconventional measures, though, is the impact on the soundness of the balance sheets of central banks. On the third question of implementation of unconventional measures, there could be “direct quantitative easing”, or “direct credit easing” or “indirect/endogenous easing”.

In the case of direct quantitative easing, the central bank could expand the balance sheet by buying all sorts of assets from the commercial banks (as opposed to only gilts and highly rated papers). Banks then get enough liquidity to expand new loans. If the banks, however, decide to hoard liquidity rather than lend, then this option may not work. The next option then could be “direct credit easing”, under which, instead of providing liquidity through banks, the central bank could extend liquidity support to all non-banks directly, particularly to certain wholesale markets “through the purchase of commercial papers, corporate bonds and asset-backed securities”. When banks face crisis and tighten credit norms contrary to the expectations of the monetary policy stance, direct easing could become more effective, and a better policy alternative for the central banks.

Central Banks such as the Federal Reserve, the Bank of England and the Bank of Japan adopted a range of direct credit easing measures to address liquidity shortages and spreads in certain wholesale market segments via the purchase of commercial paper, corporate bonds and asset-backed securities. Notable examples of direct credit easing include: (i) the outright purchases of Commercial Paper and Asset-backed Commercial Paper as well as corporate bonds by the Bank of Japan to facilitate corporate financing; (ii) the Bank of England’s Asset Purchase Facility; and (iii) the Fed’s Commercial Paper Funding Facility (CPFF); Term Asset-Backed Securities Loan Facility (TALF); and purchases by the Fed, in cooperation with the US Treasury Department, of mortgage securities backed by government-sponsored enterprises (GSEs). Even though it is difficult to distill the impact of all these measures, it has been observed that the spreads of eligible commercial paper in the US have declined after the introduction of the CPFF; the spread between mortgage rates and Treasuries have also declined.

Unlike direct easing, indirect (endogenous) easing options have been resorted to by the ECB. In the case of direct easing, the central bank acquires assets, in exchange for central bank money, which leads to the central bank holding the assets until maturity or resale, and taking thereby the associated risks on its balance sheet. In the indirect (endogenous) approach, however, “the size of the balance sheet expands by lending to banks at longer maturities, against collateral which includes assets whose markets are temporarily impaired. The increase in the monetary base is determined endogenously by the banking system, based on banks’ preference for liquidity and thus on the state of stress of the banking system” Smaghi (2009). This option could widen the pool of collaterals that may be accepted by the central bank for the refinancing operations. The primary reason as to why the ECB’s approach was different from that of the Fed is the importance of the banking channel in providing credit in the euro-area as against a more market-based financial system in other advanced countries.

In India, on the conventional side, the Reserve Bank reduced the policy interest rates aggressively and rapidly, lowered the quantum of bank reserves impounded by the central bank and expanded/ liberalised the refinance facilities for export credit. The important among the many unconventional measures taken by the Reserve Bank of India were introduction of a rupee-dollar swap facility for Indian banks to give them comfort in managing their short-term foreign funding requirements, an exclusive refinance window as also a special purpose vehicle for supporting non-banking financial companies, and expanding the lendable resources available to apex finance institutions for refinancing credit extended to small industries, housing and exports. Unlike other central banks, however, the Reserve Bank deliberately avoided exposing its balance sheet to risks arising from counterparties and collaterals in the process of implementing the unconventional measures.

Reference

- Berananke, B. S. and Reinhart V. R. (2004), “Conducting Monetary Policy at Very Low Short-Term Interest Rates”, American Economic Review, 94(2), pp.85-90.

- Smaghi, Lorenzo Bini (2009), “Conventional and Unconventional Monetary Policy”, Keynote lecture at the International Centre for Monetary and Banking Studies, Geneva, April 28, 2009.

|

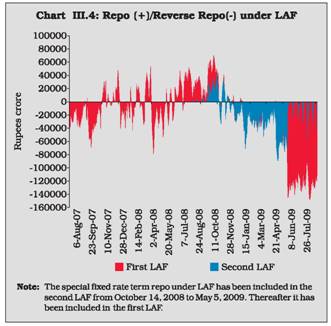

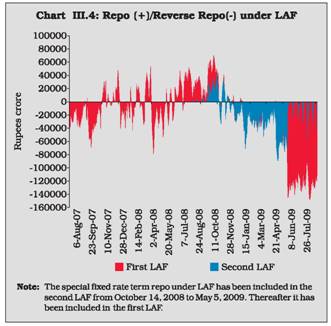

III.63 Reflecting the impact of these measures, the average daily net outstanding liquidity injection under LAF which had increased to around Rs.43,000-46,000 crore during September and October 2008, declined sharply thereafter and has turned into net absorption since early December 2008 (Chart III.4).