Performance of Non-Government Non-Banking Financial and Investment Companies, 2013-14 - RBI - Reserve Bank of India

Performance of Non-Government Non-Banking Financial and Investment Companies, 2013-14

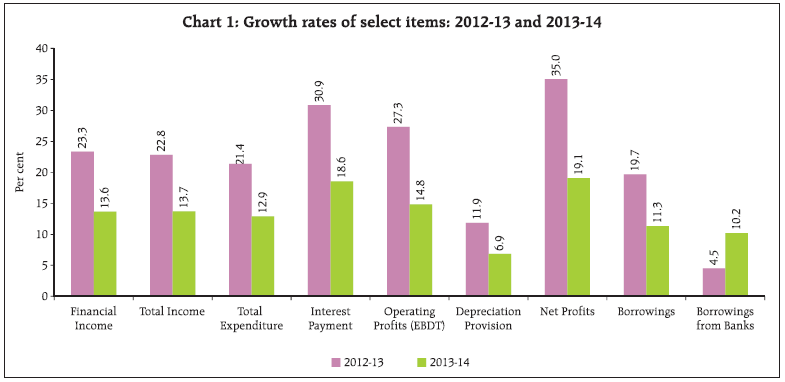

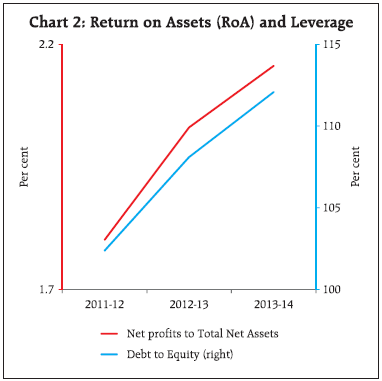

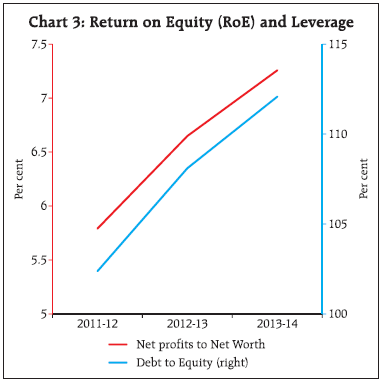

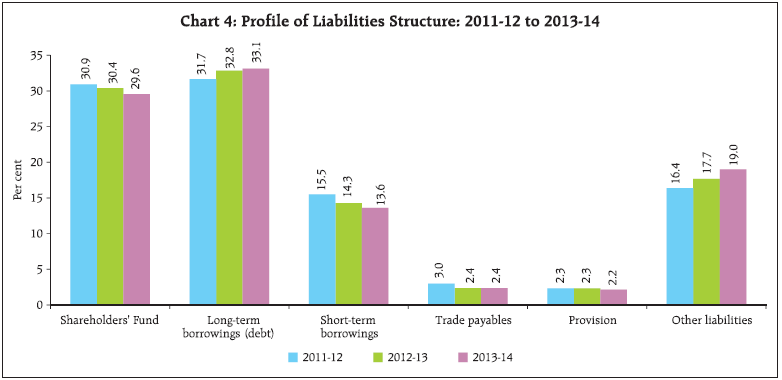

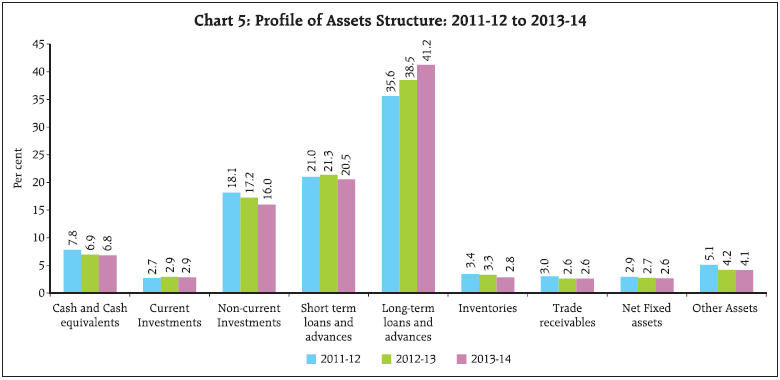

An analysis of financial performance of select 18,225 non-government non-banking financial and investment companies (NGNBF&I) for the year 2013-14, based on their audited annual accounts showed that the performance of NGNBF&I companies had declined during 2013-14 as compared to the previous year. The growth in financial income declined during 2013-14 as compared to the previous year mainly due to modest growth in interest income. The growth in operating profit (EBDT) and net profit declined significantly in 2013-14. However, the operating profit margin, return on assets and return on shareholders’ equity increased marginally in 2013-14 as compared to the previous year. The share of long-term borrowings in total liabilities of select NGNBF&I companies increased during 2013-14, whereas share of short-term borrowings declined marginally during the year vis-à-vis the previous year. The share of shareholders’ funds continued to fall gradually over the three years period. On the assets side, the share of long-term loans and advances in total assets improved during 2013-14. While the share of non-current investment in total assets declined, that of current investment improved marginally in 2013-14. The NGNBF&I companies continued to rely mainly on external sources for their business expansion, however their share in total sources of funds decreased marginally in 2013-14. The funds raised through debt finance (including short-term borrowings) decreased marginally in 2013-14. The select NGNBF&I companies predominantly used their funds for expanding their long-term loans portfolios. This article presents an analysis of the performance of non-government non-banking financial and investment companies (excluding insurance and banking companies) for the financial year 2013-14 based on the audited annual accounts data of 18,225 companies, Of which 17,636 companies’ data are based on Ministry of Corporate Affairs (MCA)1, Government of India (GoI), systems (Extensible Business Reporting Language (XBRL) and Form 23AC/ACA (Non-XBRL) platform) and remaining 589 companies’ data are as collated by Department of Statistics and Information Management, Reserve Bank of India (not included in the select NGNBF&I of MCA), which closed their accounts during the period April 2013 to March 2014. The performance of these companies during the three years period i.e., from 2011-12 to 2013-14 has been assessed in this article2. The detailed data for select 18,225 companies for the study year 2013-14 along with explanatory notes have also been made available in the website of the Reserve Bank of India. As per provisional estimate of population paid-up capital (PUC) supplied by MCA, the select 18,225 NGNBF&I companies accounted for 91.3 per cent of total PUC of all NGNBF&I as on March 31, 2014. Based on National Industrial Classification (NIC) 2004 code, the NGNBF&I companies were classified3 into five major activity groups, viz., (1) Share Trading and Investment Holding, (2) Loan Finance, (3) Asset Finance, (4) Diversified and (5) Miscellaneous (including Chit Fund and Mutual Fund companies). In terms of number of companies, the composition of select 18,225 NGNBF&I companies showed that ‘Share Trading and Investment Holding’ has the largest share followed by ‘Miscellaneous’ and ‘Asset Finance’ companies. However, ‘Loan Finance’ companies dominated the sample in terms of financial parameters viz., paid-up capital, financial income and total net assets during 2013-14 (Table 1). 1. Growth in Income as well as Profits declined 1.1 The growth in total income of the select NGNBF&I companies declined to 13.7 per cent in 2013-14 from 22.8 per cent recorded in 2012-13. The total expenditure also grew at lower rate of 12.9 per cent in 2013-14 as compared to 21.4 per cent observed in 2012-13 (Chart 1). 1.2 The financial income of the select NGNBF&I companies grew at 13.6 per cent in 2013-14 as against 23.3 per cent witnessed in 2012-13. This modest growth in financial income was mainly due to moderate growth in interest income during the year. The growth in interest income declined to 15.3 per cent in 2013-14 from 27.1 per cent in the previous year. However, dividend income growth accelerated significantly to 14.3 per cent in 2013-14 from 3.9 per cent in 2012-13 (Statement 1). Growth in interest expenses also decelerated sharply to 18.6 per cent vis-à-vis 30.9 per cent recorded in the previous year, which resulted in moderate growth in total expenditure (Chart 1). 1.3 The operating profits (EBDT) of the select NGNBF&I companies grew at a lower rate of 14.8 per cent in 2013- 14 as compared to 27.3 per cent observed in 2012-13. Growth in net profits also declined significantly to 19.1 per cent in 2013-14 from 35.0 per cent in 2012-13 (Chart 1). Dividend payment grew at much lower rates of 13.2 per cent during 2013-14 as compared 61.1 per cent in the previous year, leading to higher growth in the retained profit of select financial and investment companies during 2013-14 (Statement 1). 1.4 Growth in total borrowings declined to 11.3 per cent in 2013-14 from 19.7 per cent in 2012-13. However, the growth in borrowings from banks had increased significantly to 10.2 per cent in 2013-14 from and 4.5 per cent registered in the previous year. It was also observed that the growth in investment had declined to 4.9 per cent in 2013-14 from 15.8 per cent witnessed in the previous year (Chart 1, Statement 1). 1.5 Among the activity groups, except for ‘Share Trading and Investment Holding’, lower growth in interest income was observed in all the activity group viz., ‘Loan Finance’, ‘Asset Finance’, ‘Diversified’ and ‘Miscellaneous’ group of companies. Lower growth in operating profits and net profits were observed in all the activity groups in 2013-14 except for ‘Loan Finance’ companies, which witnessed marginal increase in net profit during 2013-14 as compared to the previous year (Statement 1). 2. Profitability Ratios: Profitability ratios increased marginally, while leverage ratio increased gradually 2.1 Return on assets (RoA) (measured as a ratio of net profits to total net assets) and return on equity (RoE) (measured as a ratio of net profit to net worth) of select NGNBF&I companies increased gradually to 2.2 per cent and 7.3 per cent, respectively, in 2013-14 from 1.8 per cent and 5.8 per cent in 2011-12 (Chart 2 and Chart 3). All the activity groups except ‘Share Trading and Investment Holding’ and ‘Miscellaneous’ companies witnessed an increase in RoA and RoE during 2013-14 as compared to the previous year (Statement 2). 2.2 The operating profit margin, measured as a ratio of operating profits to financial income of select NGNBF&I companies increased marginally to 26.4 per cent in 2013-14 from 26.1 per cent in the previous year. The activity group viz., ‘Share Trading and Investment Holding’, ‘Loan Finance’ and ‘Asset Finance’ witnessed an increase in operating profit margin during 2013-14 as compared to the previous year (Statement 2). 2.3 The dividend payout ratio (measured as a ratio of dividends paid to net profits) of the select NGNBF&I companies declined to 48.1 per cent in 2013-14 from 50.6 per cent recorded in the previous year. Among the activity groups, the dividend payout ratio for ‘Loan Finance’ and ‘Asset Finance’ declined in 2013-14, whereas ‘Share Trading and Investment Holding’ and ‘Miscellaneous’ group of companies witnessed a marginal increase in dividend payout ratio during 2013-14 as compared to the previous year (Statement 2). 2.4 The leverage ratio (measured as a ratio of debt to equity) of the select NGNBF&I companies witnessed a gradual increase from 102.4 per cent in 2011-12 to 112.1 per cent in 2013-14. Gradual increase in leverage ratio was observed among all the activity groups except for ‘Loan Finance’. The leverage ratio of ‘Loan Finance’ and ‘Asset Finance’ companies was at a very high level compared to other activity groups during the three years period, however, the leverage ratio for ‘Loan Finance’ witnessed declining trend over the three years period (Statement 2). 2.5 The ratio of total borrowings to total net assets of select NGNBF&I companies declined marginally to 46.8 per cent in 2013-14 from 47.1 per cent in 2012-13. Further, the ratio of bank borrowings to total borrowings of select NGNBF&I companies also declined marginally to 33.1 per cent in 2013-14 from 33.4 per cent in 2012-13. The marginal decline in the ratio of bank borrowings to total borrowings during 2013-14 were seen for ‘Asset Finance’ and ‘Miscellaneous’ companies, whereas ‘Share Trading and Investment Holding’, ‘Loan Finance’ and ‘Diversified’ companies witnessed an increase in the ratio during 2013-14 as compared to the previous year (Statement 2). 3. Income and Expenditure: Share of Interest Income in Total Income and share of Interest Expenses in Total Expenditure increased marginally 3.1 The fund based income continued to play a dominant role in generating income for NGNBF&I companies as compared to the fee-based income. The share of interest income, which is the main component of fund-based income for NGNBF&I companies, in total income increased marginally from 66.3 to 67.2 per cent during 2013-14. Increase in share of interest income in total income during the year was observed for ‘Share Trading and Investment Holding’ and ‘Miscellaneous’ companies, whereas ‘Loan Finance’, ‘Asset Finance’ companies witnessed marginal and ‘Diversified’ companies recorded substantial decline in 2013-14 as compared to the previous year (Statement 3). 3.2 On the expenditure side, the share of interest expenses in total expenditure of select NGNBF&I companies continued to increase gradually from 49.1 per cent in 2011-12 to 55.6 per cent in 2013-14. Further, the shares of bad debt expenses and provisions (inclusive of both depreciation provision and other provisions) in total expenditure declined marginally during the year. The increase in the share of interest expenses in total expenditure during 2013-14 as compared to the previous year was observed among all the activity groups (Statement 3). 4. Capital Structure: Share of Shareholders’ Funds declined gradually 4.1 The share of shareholders’ funds in total liabilities witnessed a gradual decline from 30.9 per cent in 2011-12 to 29.6 per cent in 2013-14 (Chart 4). The decline in the share of shareholders’ funds in total liabilities during 2013-14 was witnessed among all the activity groups except for ‘Miscellaneous’ group of companies (Statement 4). 4.2 The capital structure of select NGNBF&I companies showed that the share of long-term borrowings in total liabilities increased gradually to 33.1 per cent in 2013-14 from 31.7 per cent in 2011-12. Further, the share of long-term loans from banks also increased marginally to 10.6 per cent in 2013-14 from 10.4 per cent in the previous year (Statement 4). However, the share of short-term borrowings in total liabilities declined gradually to 13.6 per cent in 2013-14 from 15.5 per cent in 2011-12 (Chart 4). 4.3 A marginal increase in the shares of long-term borrowings in total liabilities was observed among all activity groups except for ‘Loan Finance’ companies. For ‘Loan Finance’ companies, the share of both short-term and long-term borrowings in total liabilities declined marginally during 2013-14 as compared to the previous year (Statement 4). 5. Assets Pattern: Share of Long-term Loans and Advances in Total Assets increase gradually 5.1 The increase in the share of long-term loans and advances in total assets was seen in all activity groups, whereas the share of non-current investments in total assets declined in all the activity groups during 2013-14 except for ‘Diversified’ companies (Statement 5). 5.2 However, the select NGNBF&I companies witnessed marginal decline in the share of short-term loans and advances in total assets during 2013-14 as compared to the previous year. Loans and advances of select NGNBF&I companies, both short-term and long-term together constituted more than 50.0 per cent of the total assets. 5.3 The assets pattern of select NGNBF&I companies showed that the share of non-current investments in total assets declined in 2013-14 as compared to the previous year with long-term loans and advances substituting for it (Chart 5). The share of non-current investments in total assets declined gradually from 18.1 per cent in 2011-12 to 16.0 per cent in 2013-14, while the share of long-term loans and advances increased to 41.2 per cent in 2013-14 as against 38.5 per cent witnessed in the previous year. 6. Sources of Funds: Share of External Sources of Funds decreased 6.1 With larger role of long-term borrowings in total liabilities structure of select NGNBF&I companies, the external sources continued to play a major role in expanding the business. However, the share of external sources of funds in total sources of funds declined marginally to 72.7 per cent in 2013-14 as against 74.7 per cent recorded in 2012-13. 6.2 The fund raised through debt finance had declined marginally during the year. The share of funds mobilized from long-term borrowings in total sources of funds declined marginally to 34.9 per cent in 2013-14 from 35.3 per cent in 2012-13. However, the share of fund raised through term loans from banks in total sources of funds increased to 12.3 per cent in 2013-14 from 6.0 per cent in the previous year. The decline in the share of external sources of funds in total sources of funds was observed among all the activity groups except for ‘Asset Finance’ and ‘Diversified’ companies (Statement 6). 6.3 The share of internal sources of funds in total sources of funds increased to 27.3 per cent in 2013-14 from 25.3 per cent in the previous year, which was largely contributed by lower share of dividend payout in net profit during 2013-14. The increase in the share of internal sources of funds in total sources of funds was observed in all the activity groups except for ‘Asset Finance’ and ‘Diversified’ companies (Statement 6). 7. Uses of Funds: Long-term loans financing pick-up in business activity 7.1 The share of long-term loans and advances extended by select NGNBF&I companies in total uses of funds increased significantly to 62.9 per cent in 2013-14 from 48.0 per cent recorded in 2012-13, whereas the share of short-term loans and advances in total uses of funds declined marginally to 13.7 per cent in 2013-14 from 21.0 per cent in the previous year (Statement 7). 7.2 Further, it was also observed that the share of both current and non-current investments in total uses of funds declined to 2.2 per cent and 5.8 per cent in 2013-14 from 3.7 per cent and 11.4 per cent in 2012-13, respectively. 7.3 Increase in the share of long-term loans and advances in total uses of funds during 2013-14 was observed among all the activity groups except for ‘Loan finance’ companies. Further, decline in the share of short-term loans and advances was observed for ‘Loan Finance’, ‘Asset Finance’ and ‘Miscellaneous’ companies (Statement 7). 8. Performance of Chit Fund and Mutual Fund Companies: Operating Profit margin, RoA and RoE declined gradually over the past three years 8.1 In contrast to the general declining trend observed at aggregate level for the select NGNBF&I companies in their financial performance, the financial income for select 1,416 Chit Fund and Mutual Fund companies grew at higher rate of 15.8 per cent during 2013-14 as against 12.2 per cent registered in previous year. However, their total income grew at lower rate of 9.6 per cent in 2013-14 as compared to 14.1 per cent in 2012-13 (Table 2). 8.2 The total expenditure of select chit and mutual fund companies grew at higher rate of 19.6 per cent in 2013-14 as compared to 14.8 per cent in 2012-13. The operating profits grew at much lower rate in 2013-14 as compared to previous year mainly due to relatively higher growth rate in total expenditure to the total income. The growth in net profits of select chit and mutual fund companies had contracted during 2013-14. 8.3 Following the trend at aggregate level, the leverage ratio (debt to equity ratio) of select chit and mutual fund companies increased gradually over the last three years. However, operating profit margin, RoA and RoE of select chit and mutual fund companies declined gradually over the last three years. 8.4 The share of borrowings to total net assets increased gradually to 27.4 per cent in 2013-14 from 17.9 per cent in 2011-12, whereas the share of borrowings from banks in total borrowings of select chit and mutual fund companies declined gradually from 37.8 per cent in 2011-12 to 13.0 per cent in 2013-14. 9. Concluding Observations 9.1 It was observed from the aggregate results of the select 18,225 NGNBF&I companies that the income and expenditure grew at moderate rate during the year 2013-14 as compared to the previous year. Further, the operating profit (EBDT) and net profits also grew at lower rates as compared to the previous year. However, the operating profit margin as well as profitability ratios like return on assets and return on shareholders’ equity improved marginally in 2013-14 as compared to the previous year. 9.2 The shares of long-term borrowings in total liabilities of select NGNBF&I companies increased in 2013-14, whereas the share of short-term borrowings in total liabilities declined marginally during the year as compared to the previous year. Further, there was a marginal decline in the share of shareholders’ funds in total liabilities. On the assets side, share of long-term loans and advances in total assets increased, whereas the share of short-term loans and advances declined in 2013-14. The share of non-current investments in total assets declined marginally in 2013-14. 9.3 The select NGNBF&I companies continued to rely mainly on external sources for business expansion, however their share had decreased marginally in 2013-14. The share of funds raised through debt finance declined marginally during 2013-14 as compared to the previous year. While the share of long-term loans and advances in total assets increased significantly in 2013-14, indicating that the select NGNBF&I companies used their funds predominantly in expanding their long term loans portfolios. * Prepared in the Company Finances Division of the Department of Statistics and Information Management, Reserve Bank of India, Mumbai. The previous article was published in October 2014 issue of the Reserve Bank of India Bulletin, which covered 1,005 non-government non-banking financial and investment companies during 2012-13. 1 The CFD has been receiving corporate data from MCA, which collects corporate sector statistics, i.e., annual balance sheet and profit and loss accounts data, through two mutually exclusive systems viz., Extensible Business Reporting language (XBRL) and Form 23AC/ACA (Non-XBRL) platform. Under XBRL based system, corporate with PUC ₹ 5 crore and above or having turnover ₹ 100 crore and above or listed companies submit their complete annual accounts, whereas through ‘Form 23AC/ACA’ system, data on select variables from annual accounts of remaining companies are submitted. 2 Growth rates and ratios of select financial items for some activity groups in the present article may not match with the previous articles published in RBI Bulletin due to differences in the composition and method of classification of activity groups as well as categorization of income from various activities. Reference may please be made to the explanatory notes released with data in the RBI website. 3 In the previous articles, a company was classified in one of the three principal activity group viz., ‘Share Trading and Investment Holding’, ‘Loan Finance’ and ‘Asset Finance’, if at least half of its annual income during the study year was derived from that principal activity consistent with the income yielding assets. In case no single principal activity was predominant, the company was classified under ‘Diversified’ group. Companies not engaged in any of the above three activities, but conducting financial activities were classified under ‘Miscellaneous’ group. |