Gallery Child Page - CAB - Reserve Bank of India

IST,

IST,

Workshop on Insolvency and Bankruptcy Code for Directors and CEOs of Tier III & IV UCBs: December 13, 2024 (in-campus)

Workshop on Financing of Farmer Producer Organizations (FPOs) (April 18-19, 2024)

Workshop on Empowering Women through Financial Inclusion (Online Mode) (January 06 & 07, 2025)

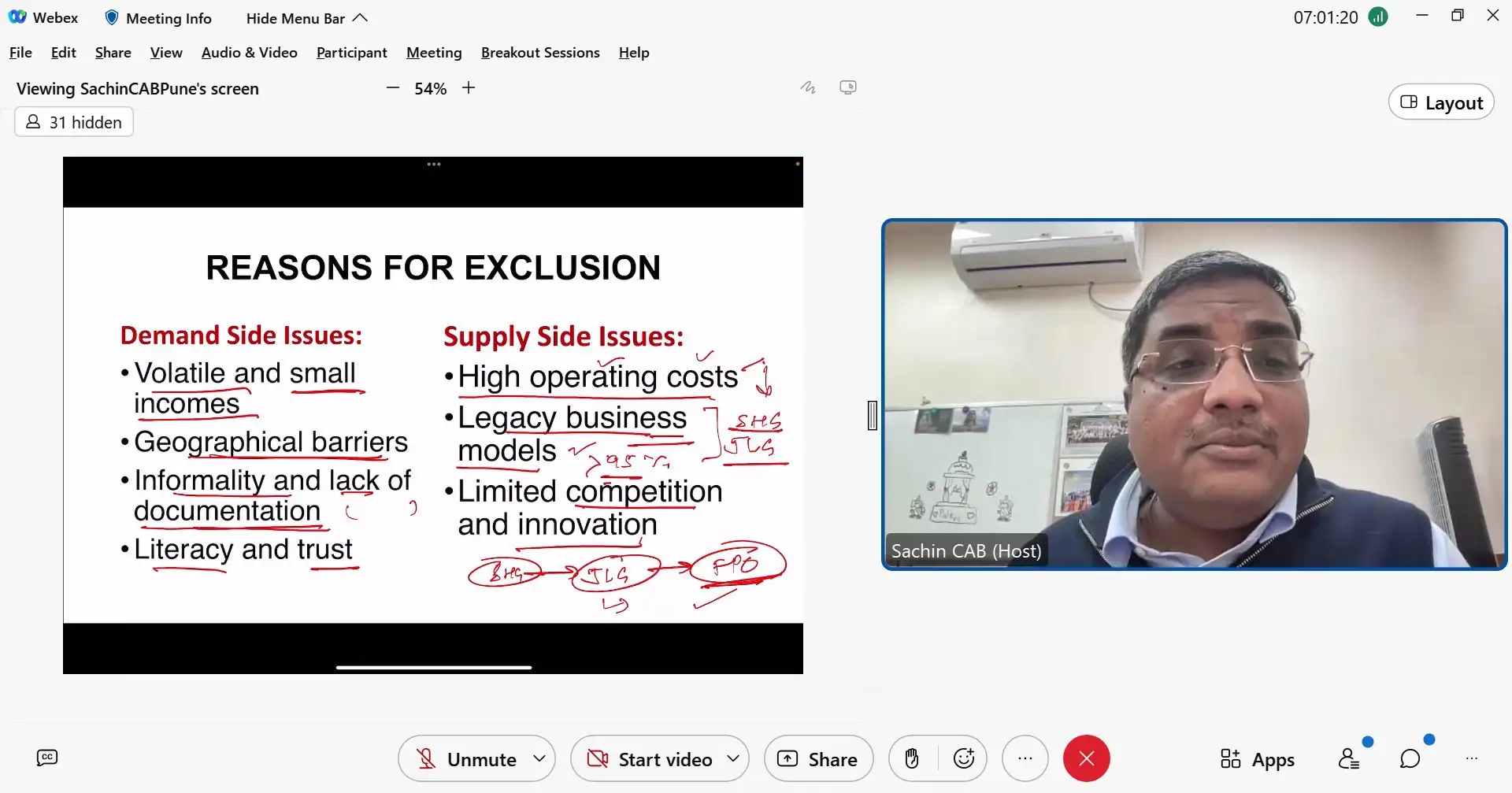

Workshop on Compliance Awareness for IDBI: June 27 & 28, 2024 (online mode)

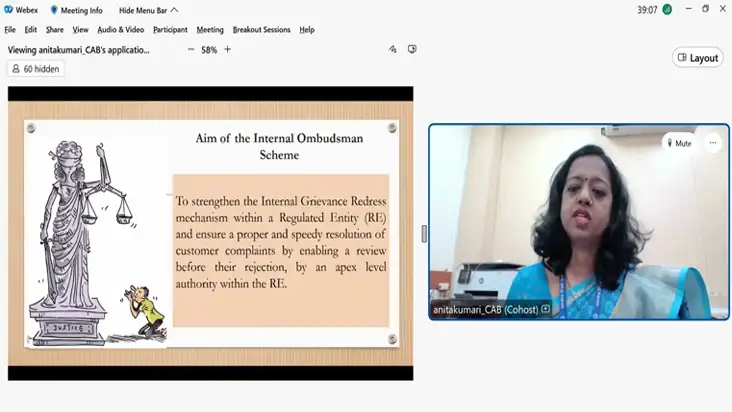

Webinar on Financial Consumer Protection – Policy Approaches and Initiatives of Reserve Bank of India (May 24, 2024)

Webinar on 'Role of Language in Building Work Culture' (Online): November 12 & 13, 2025

Webinar on 'Impact of Information Technology on Human Behaviour' (Online): April 18, 19 & 23, 2024

Webinar on 'How to Fail Successfully: The Art of Handling Failure' (Online): September 20, 2024

Webinar on 'Future of Human Interaction with Artificial Intelligence' (Online): May 22, 2024

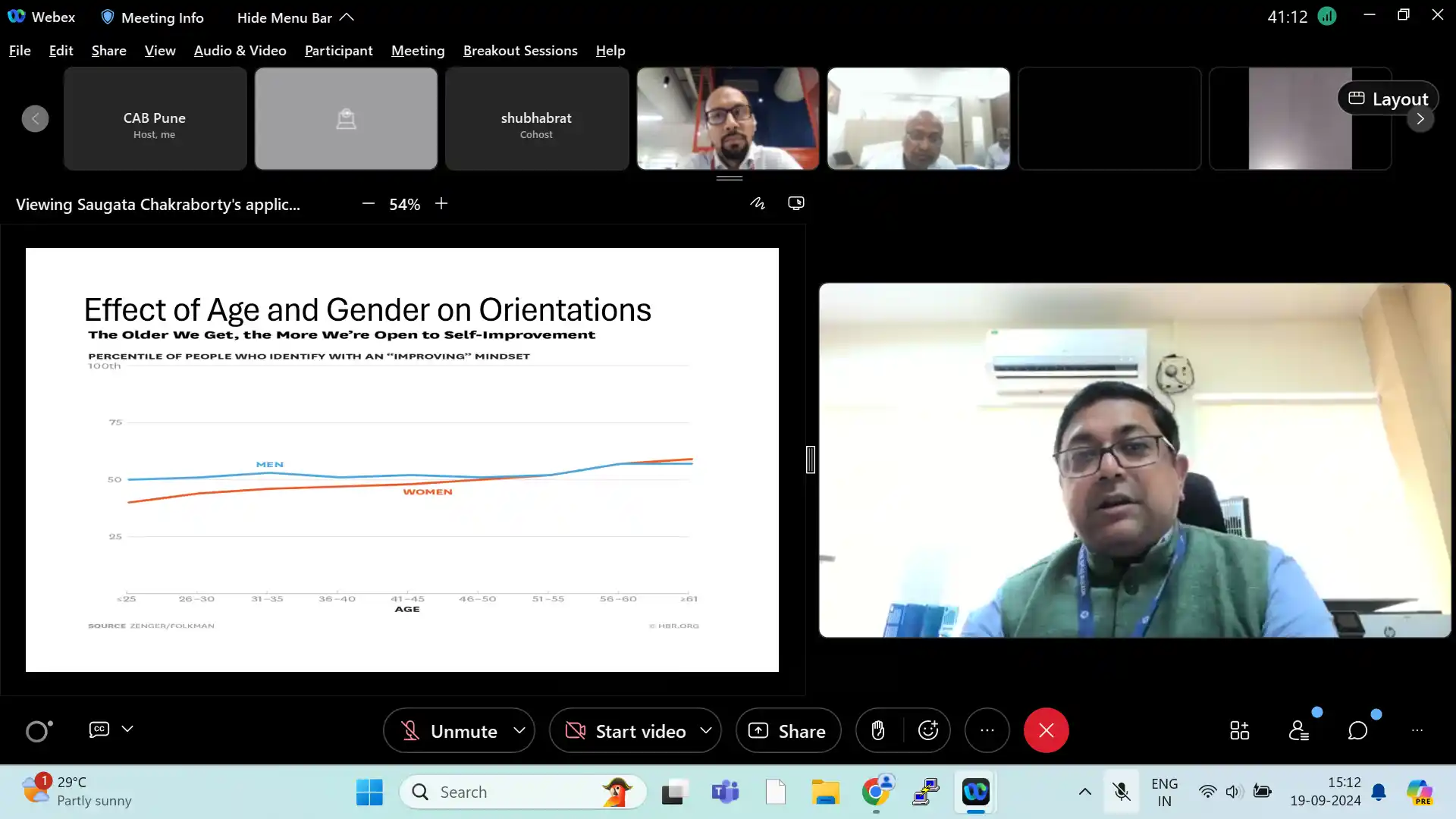

Webinar on 'Be a Better You: Self Improvement through Self Awareness' (Online): September 19, 2024

Webcast: Discussion on Operational Risk Capital Charge & Guidance Note on Operational Risk Management and Operational Resilience: April 08, 2025

Training Programme for Assessors (In Campus): January 05-09, 2026

Training of Trainers Programme on Consumer Protection (May 15 to 17, 2024)

Training of Trainers Programme on Consumer Protection (January 13 to 15, 2025)

Training of Trainers on NAMCABS Workshop- September 25 to 27, 2023

Training of Trainers (ToT) programme to Officers of RBI on Financial Literacy Contents for the Centre for Financial Literacy (CFL) – November 03 to 04, 2025

Training of Trainers (ToT) programme to Officers of RBI on Financial Literacy Contents for the Centre for Financial Literacy (CFL) - August 18 to 19, 2025

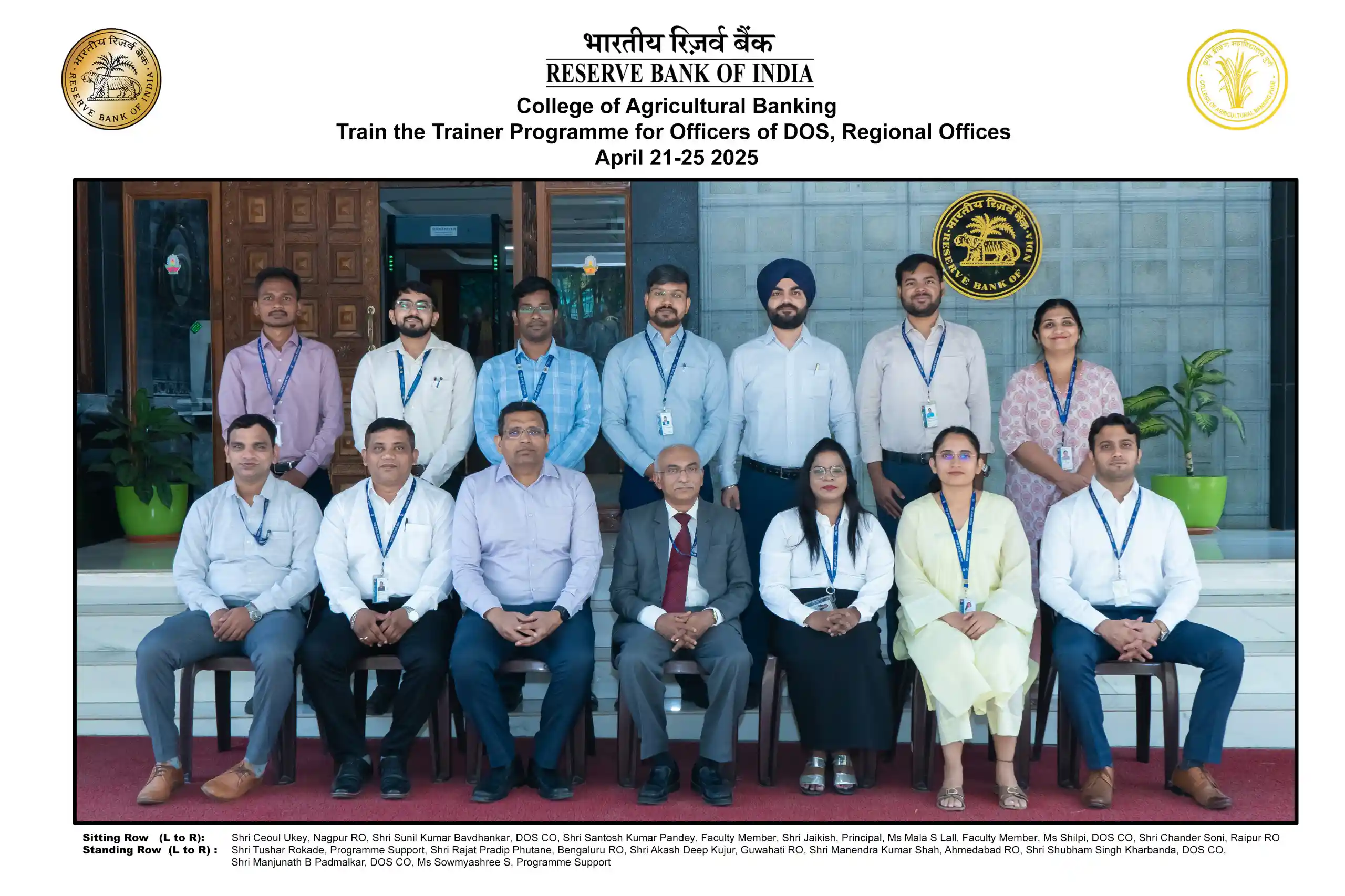

Train the Trainer Programme for Officers of DOS, ROs/CO: April 21-25, 2025

Train the Trainer Programme for Officers of DOS, Regional Offices, May 14-17, 2024 ( in-campus)

Seminar on Policy Issues for Senior General Managers of Reserve Bank of India, November 17-21, 2025

Seminar on IBC for NBFCs in Middle Layer and Upper Layer: September 22-23, 2025 (on campus)

Seminar on Corporate Governance and Compliance Management for Chief Compliance Officers of NBFCs (ML & UL): December 05-06, 2024 (in-campus)

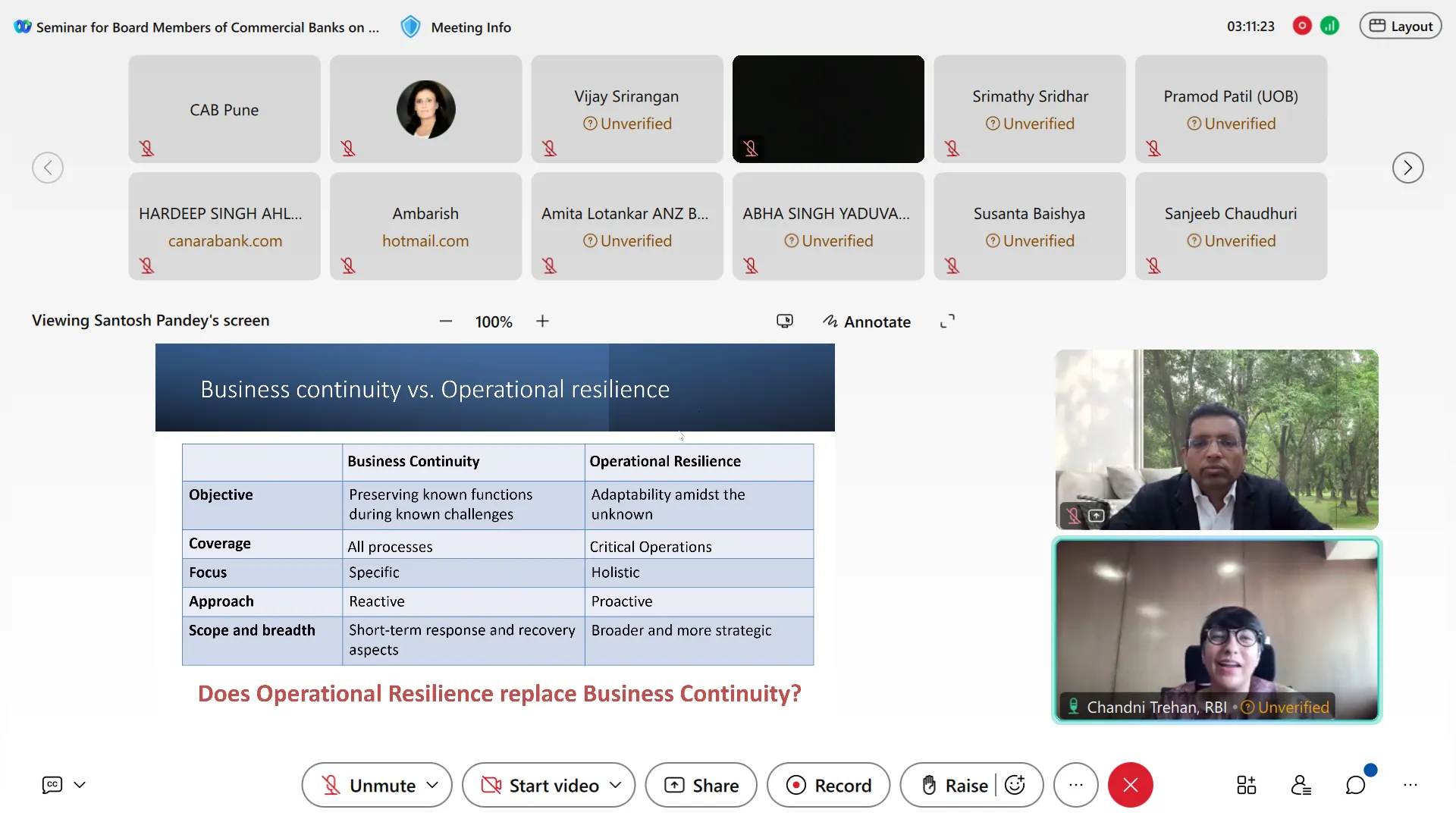

Seminar for Board Members of Commercial Banks on Operational Risk Management: March 12-13, 2025 (online mode)

RBI’s Financial Literacy Week (February 24-28, 2025)

Programme on Strengthening Grievance Redressal for officers of Urban Cooperative Banks (July 14–16, 2025)

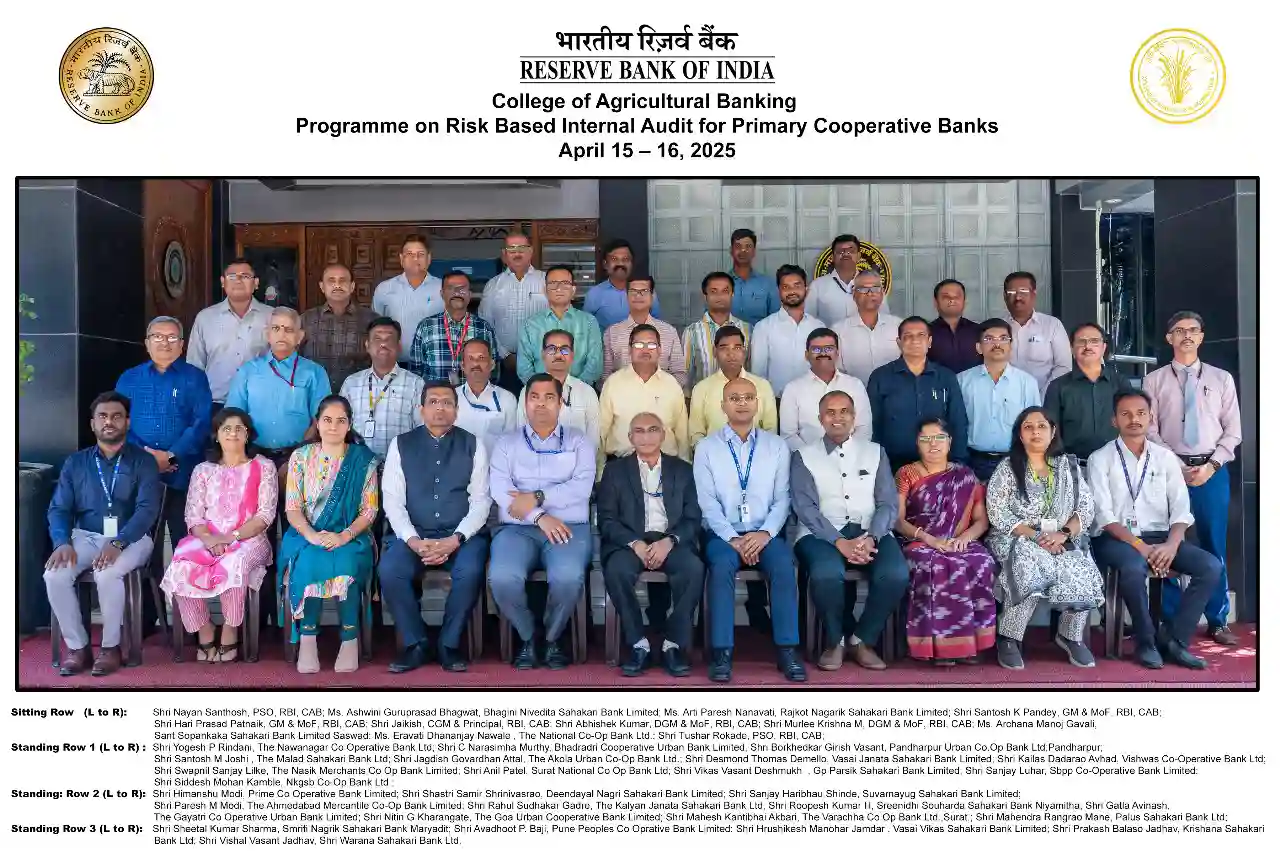

Programme on Risk-Based Internal Audit for Officers of Primary Co-operative Banks: April 15-16, 2025 (In-Campus)

Programme on Risk-Based Internal Audit for NBFCs, November 06-07, 2025

Programme on Risk Management for Tier II, III, IV UCBs: August 11-13, 2025 (on campus)

Programme on Risk Management for Tier II, III & IV UCBs: August 12-14, 2024 (in-campus)

Programme on Risk Management for Scheduled Commercial Banks, November 26-28, 2025

Programme on Risk Management for SCBs, May 20-22, 2024 (in-campus)

Programme on Risk Management for NBFCs (ML & UL): January 27-29, 2025 (in-campus)

Programme on Risk Based Internal Audit for Primary Cooperative Banks, April 18-19, 2024 (in-campus)

Programme on Risk Based Internal Audit (RBIA): October 18-20, 2023: Online

Programme on Risk Based Internal Audit (RBIA) for NBFCs: November 18-19, 2024 (online mode)

Programme on Project Approach to Agricultural Finance (October 14 to 18, 2024)

Programme on Priority Sector Lending for Urban Cooperative Banks (Online Mode) (May 26 - 28, 2025)

Programme on Payment and Settlement Systems for Senior & Middle-Level Functionaries of UCBs (Levels I and II) - July 14-16, 2025 (In-campus)

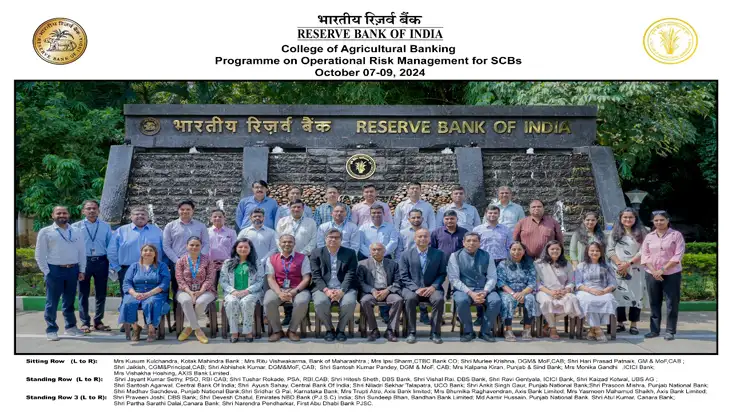

Programme on Operational Risk Management for SCBs: October 7 - 9, 2024 (in-campus)

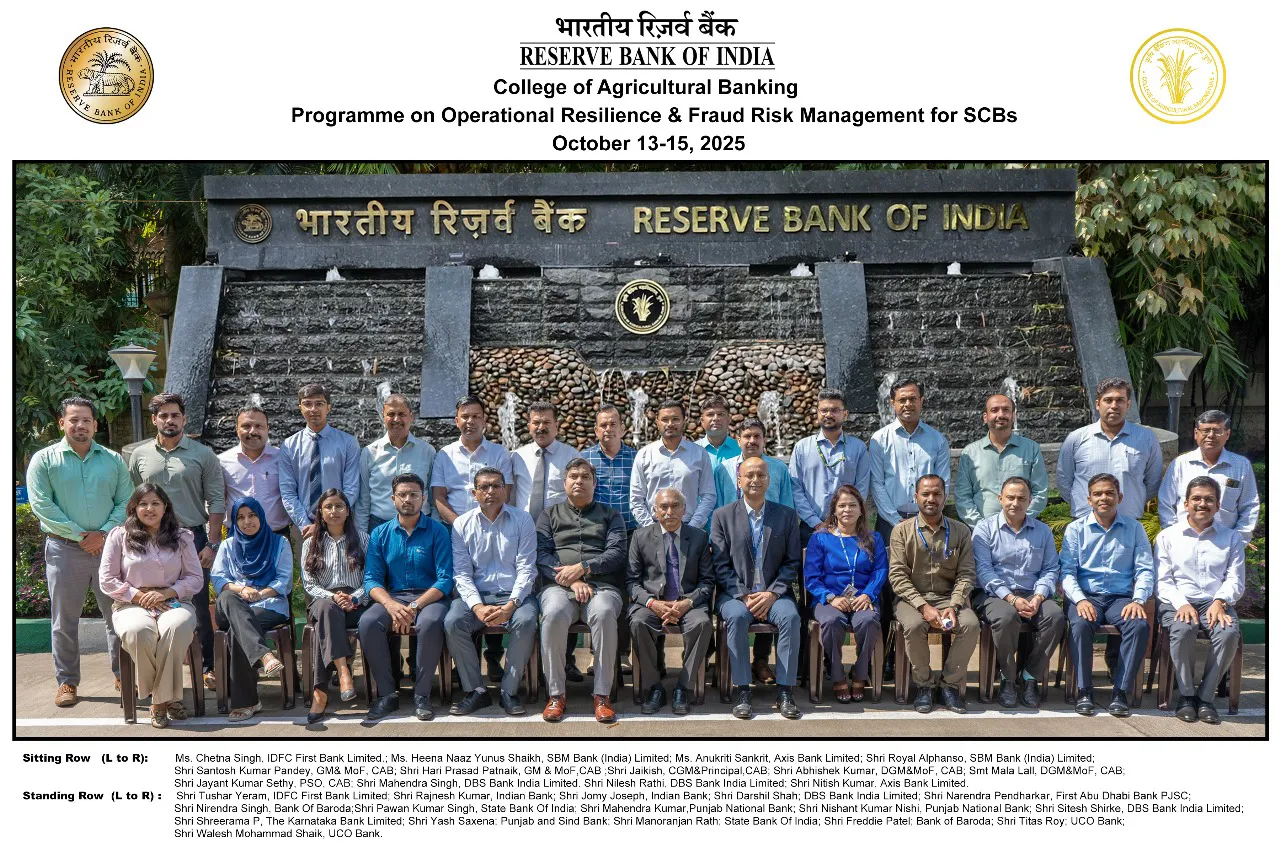

Programme on Operational Resilience & Fraud Risk Management for Scheduled Commercial Banks- October 13-15, 2025

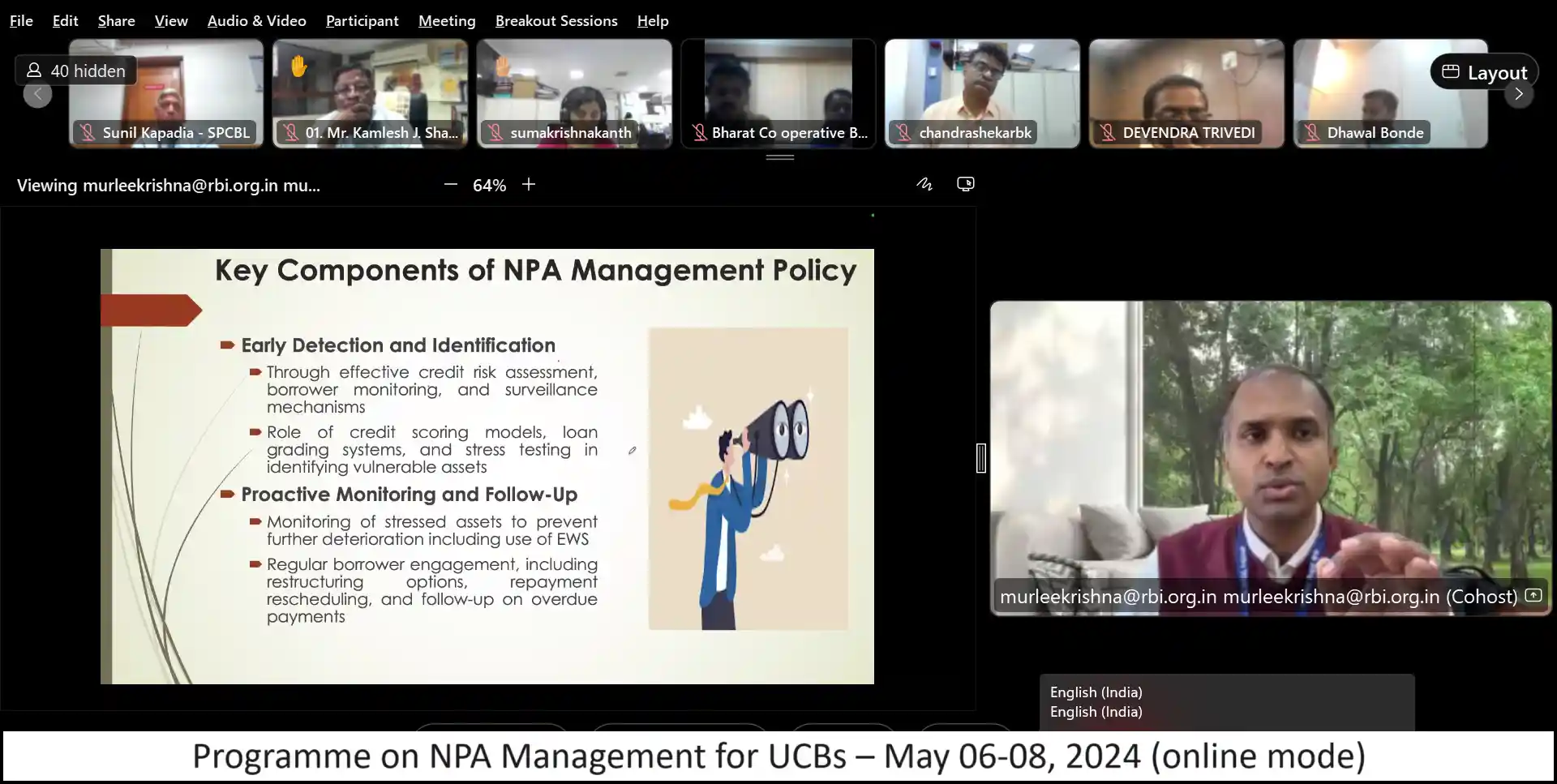

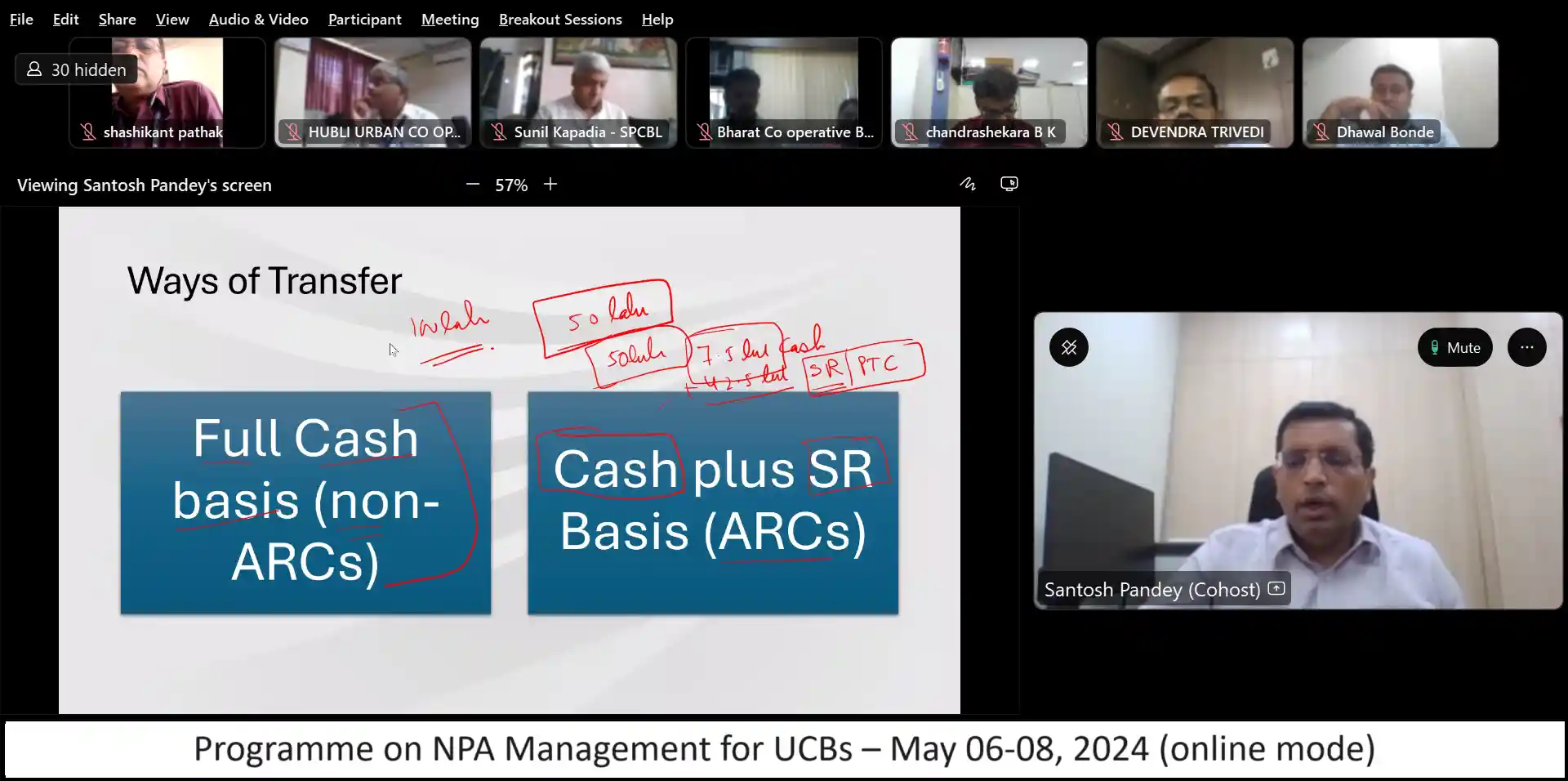

Programme on NPA Management for UCBs – May 06-08, 2024 (Online)

Programme on NPA Management for SCBs: October 29-31, 2025 (on-campus)

Programme on Market Risk Measurement and Management, December 15-17, 2025

Programme on Liquidity Risk and Investment Management for NBFCs (UL & ML): February 03-05, 2025 (in-campus)

Programme on Lead Bank Scheme for Lead District Officers, Lead District Managers and District Development Managers (May 05 to 09, 2025)

Programme on Lead Bank Scheme for Lead District Officers (May 27-31, 2024)

Programme on Lead Bank Scheme for LDOs of RBI-July 21 to 25, 2025

Programme on Lead Bank Scheme for LDMs, DDMs and LDOs - January 12 to 16, 2026

Programme on KYC/AML Compliance for Principal Officers of UCBs– April 29-30, 2024 (online mode)

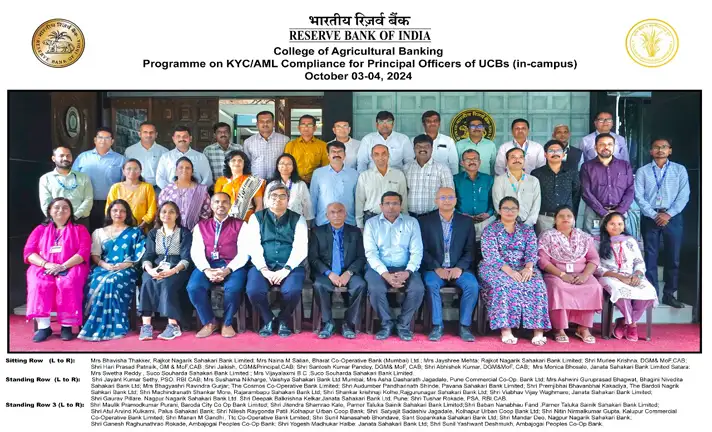

Programme on KYC/AML Compliance for Principal Officers of UCBs: October 03-04, 2024 (in-campus)

Programme on KYC/AML Compliance for Principal Officers of UCBs: April 28-29, 2025 (Online)

Programme on IT Vendor Risk Management for IT Officers of all Banks-November 04-06, 2024

Programme on IT Vendor Risk Management for IT Officers of all Banks-May 20-22, 2024

Programme on IT Vendor Risk Management for IT Officers of all Banks - June 18-20, 2025

Programme on Investment Management for RRBs: September 20-22, 2023 (On-Campus)

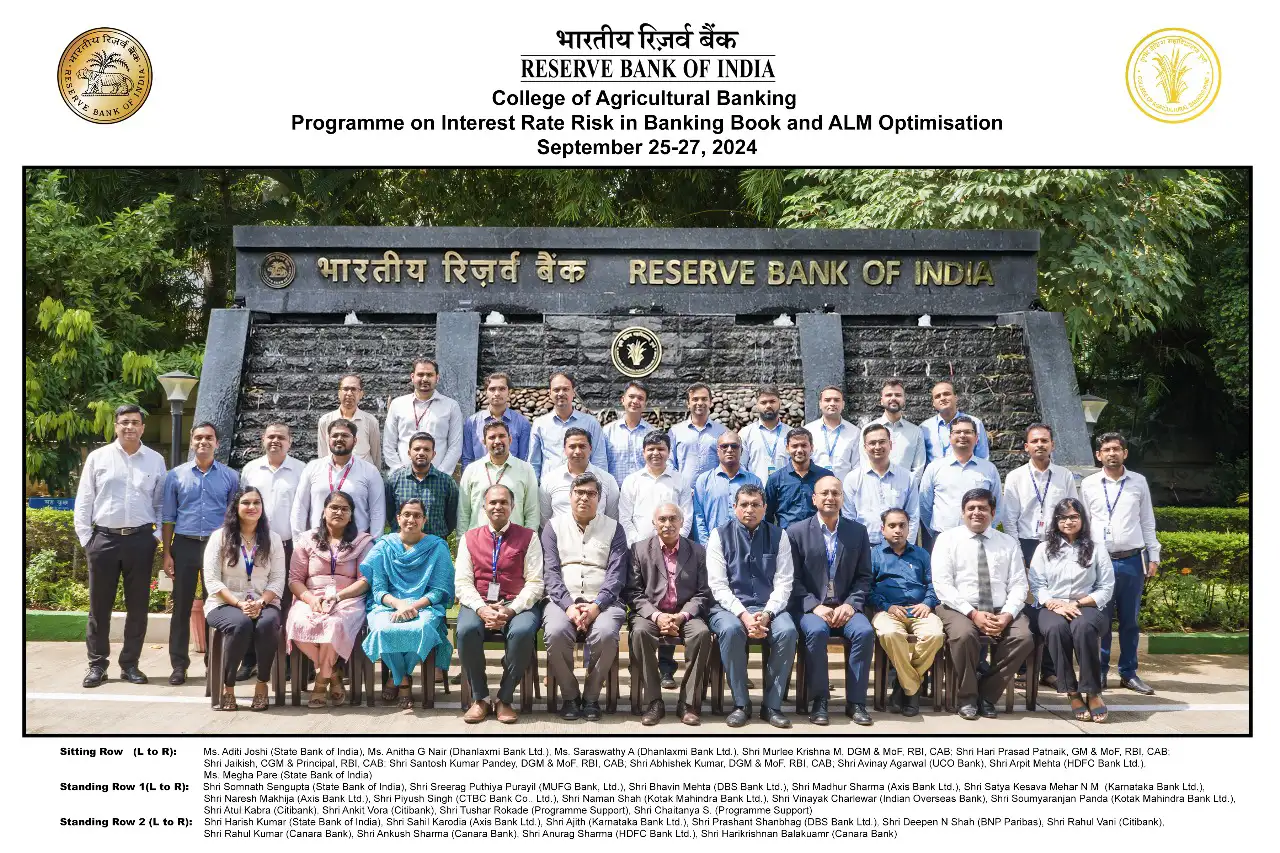

Programme on Interest Rate Risk in Banking Book and ALM Optimisation: September 25-27, 2024 (in-campus)

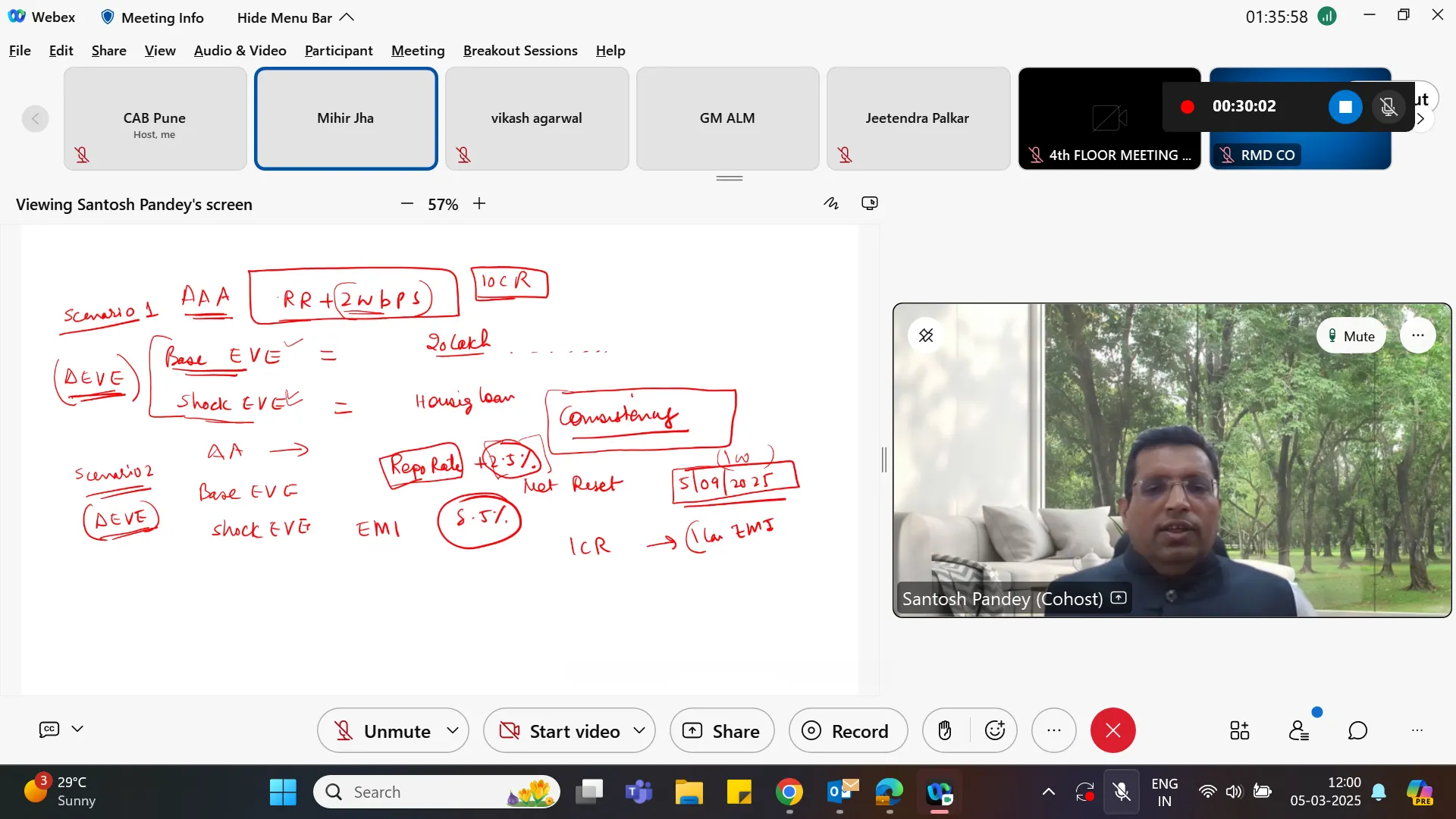

Programme on Interest Rate Risk in Banking Book and ALM Optimisation: March 03-05, 2025 (online mode)

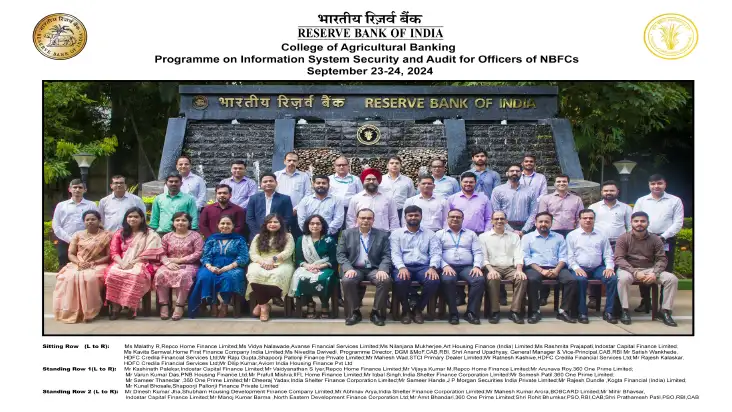

Programme on Information System Security and Audit for Officers of NBFCs – September 23-24, 2024 (In-Campus)

Programme on Information System Security and Audit for Officers of NBFCs – September 23-24, 2024 (In-Campus)

Programme on Information System Security and Audit for Officers of NBFCs – January 15-17, 2025 (In-Campus)

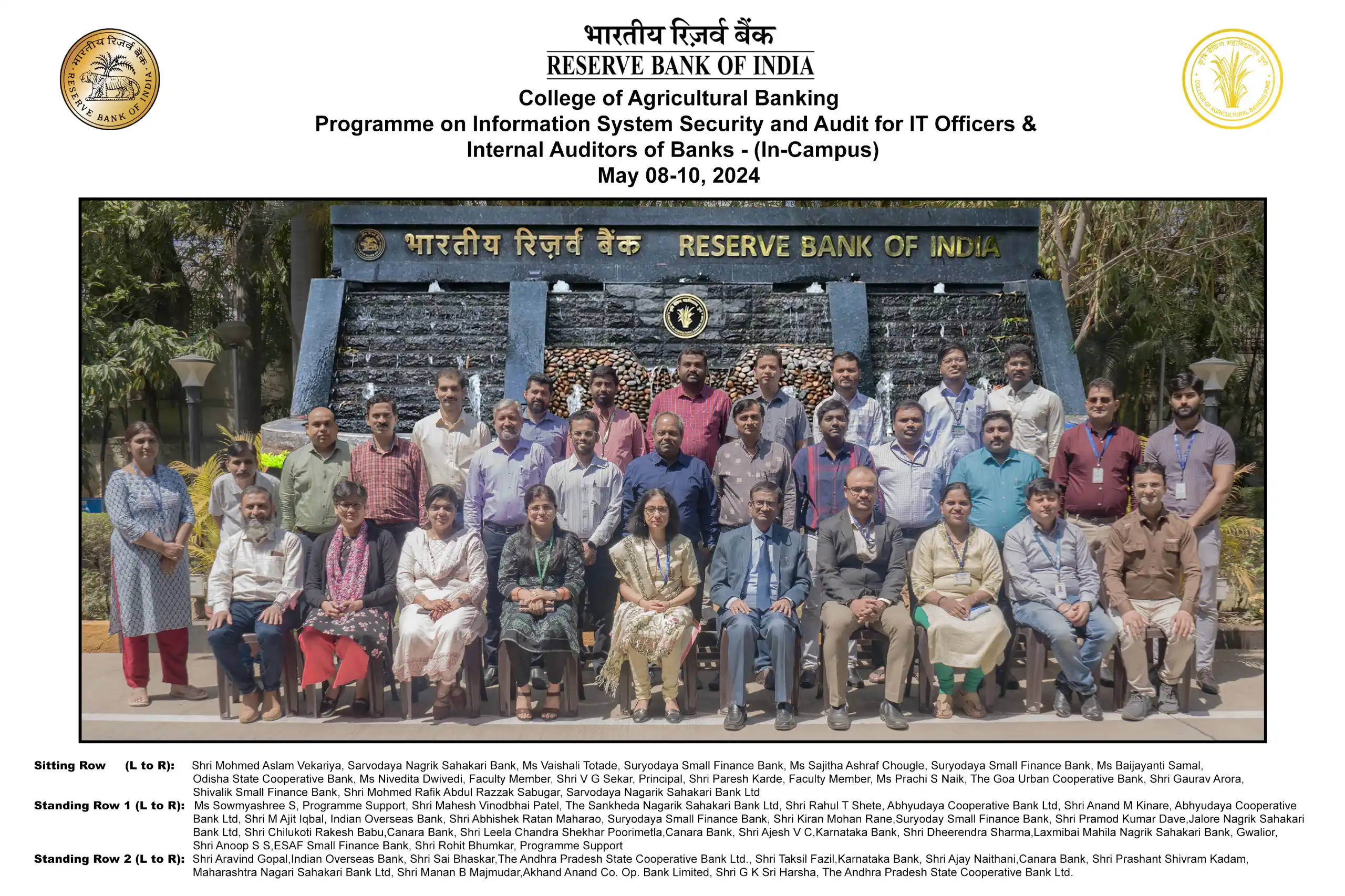

Programme on Information System Security and Audit for IT Officers & Internal Auditors of Banks - May 08-10, 2024 (In-Campus)

Programme on Ind AS 109 for NBFCs: October 14-15, 2024 (in-campus)

Programme on Ind AS 109 for NBFCs, December 22-24, 2025

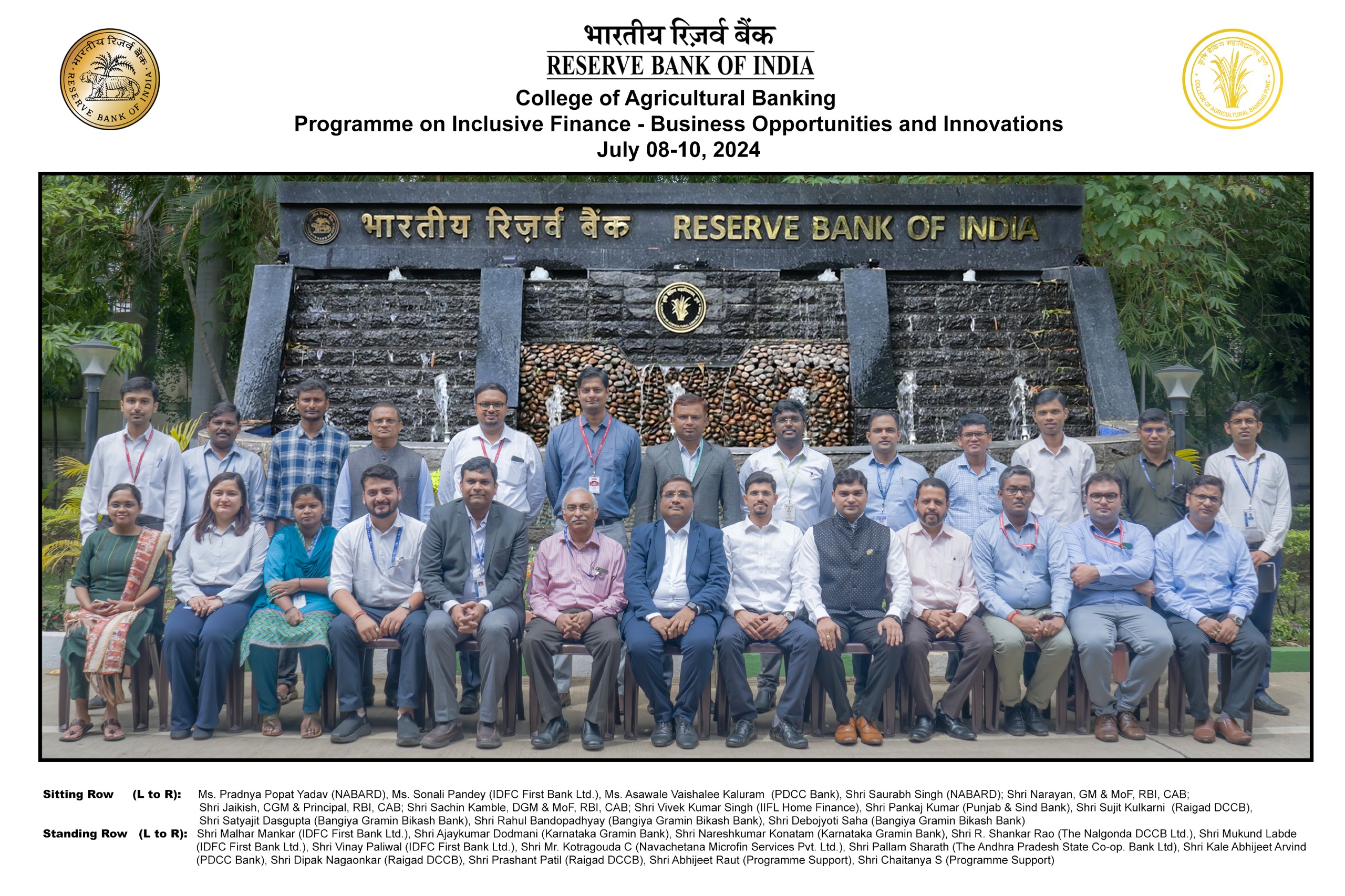

Programme on Inclusive Finance-Business Opportunities and Innovations (July 08 to 10, 2024)

Programme on ICAAP and Stress Testing for SCBs, January 05-07, 2026

Programme on Governance, Measurement, and Management of Interest Rate Risk in Banking Book for Statutory Auditors of Banks, October 30 2023: (On-Campus)

Programme on Fraud Detection in Computerized Operations for IT Officers of all Urban Cooperative Banks - August 28-30, 2024

Programme on Fostering Leadership and Effective Team Building for Women Executives (In Campus): July 22-24, 2024

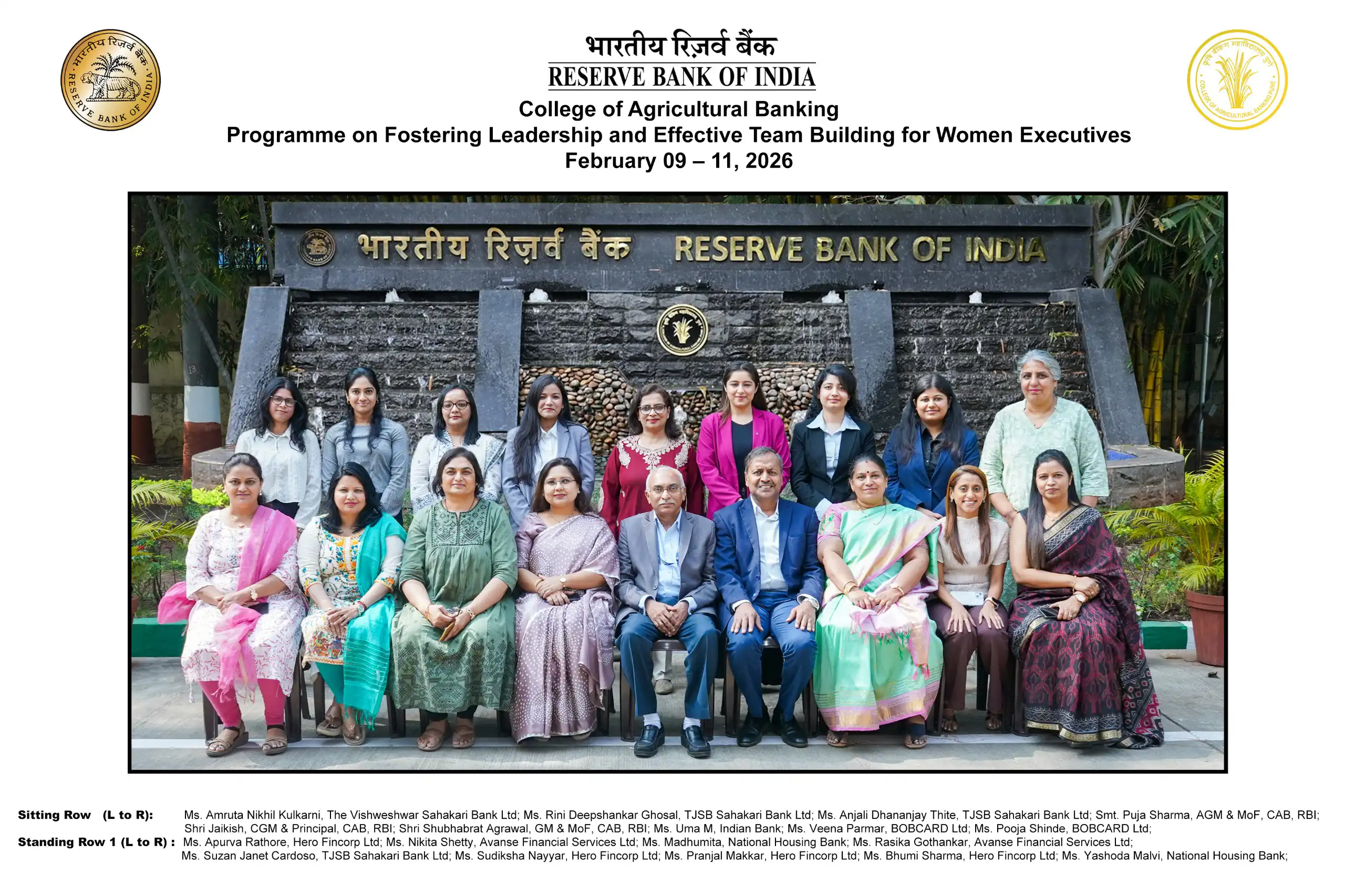

Programme on Fostering Leadership and Effective Team Building for Women Executives (In Campus): February 09-11, 2026

Programme on Fostering Leadership and Effective Team Building for Women Executives (In Campus): December 09-11, 2024

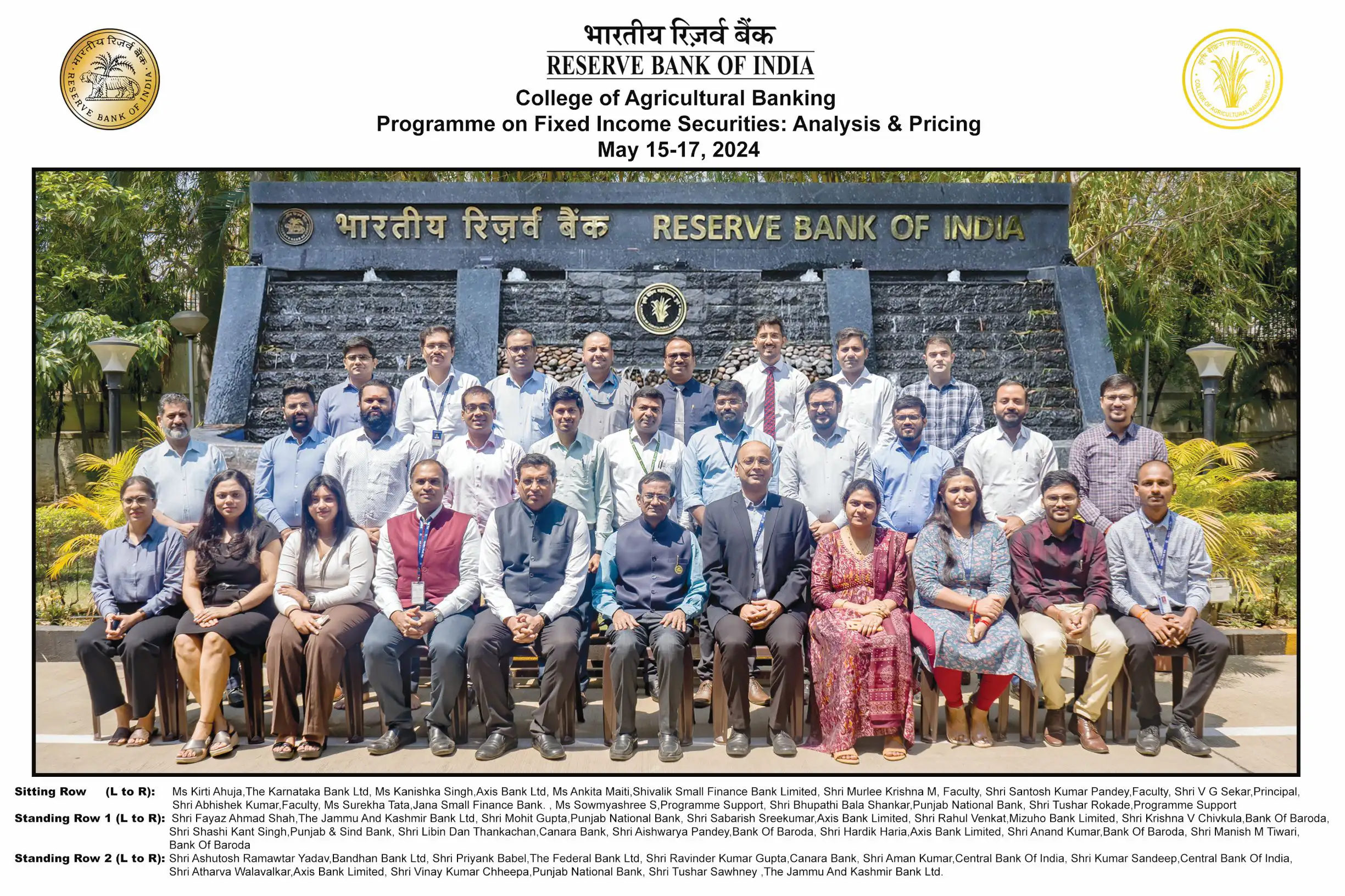

Programme on Fixed Income Securities: Analysis and Pricing, May 15-17, 2024 (in-campus)

Programme on Fintech for Officers of Banks - June 19-21, 2024

Programme on Financing of MSMEs for UCBs - October 06 to10, 2025

Programme on Financing of MSMEs for The Mehsana Urban Cooperative Bank (November 06 to 10, 2023)

Programme on Financing MSMEs (Online Mode) (February 11 to 14, 2025)

Programme on Financing MSMEs (June 23 to 27, 2025)

Programme on Financing Hi-tech Agriculture and Allied Sectors (Online Mode) (May 20 to 22, 2024)

Programme on Financial Statistics for Probationary Officers of Indian Statistical Service (May 19 to 23, 2025)

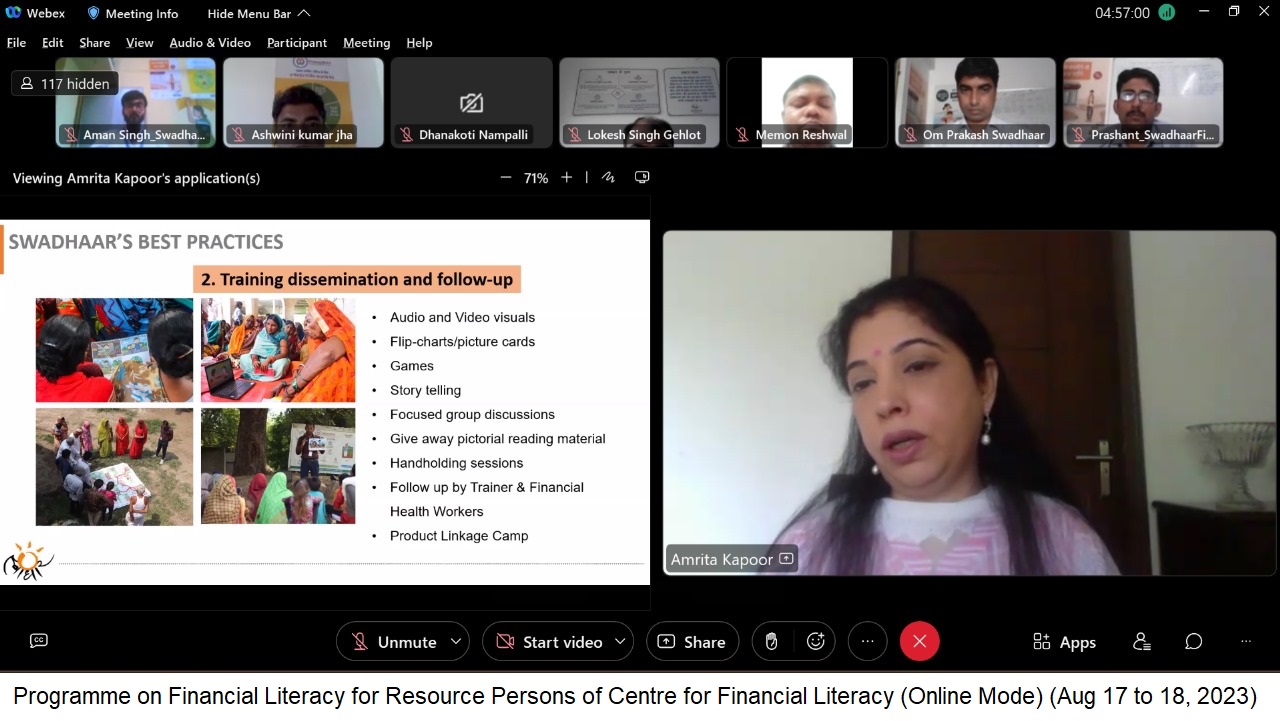

Programme on Financial Literacy for Resource Persons of Centre for Financial Literacy (Online Mode) (August 17 to 18, 2023)

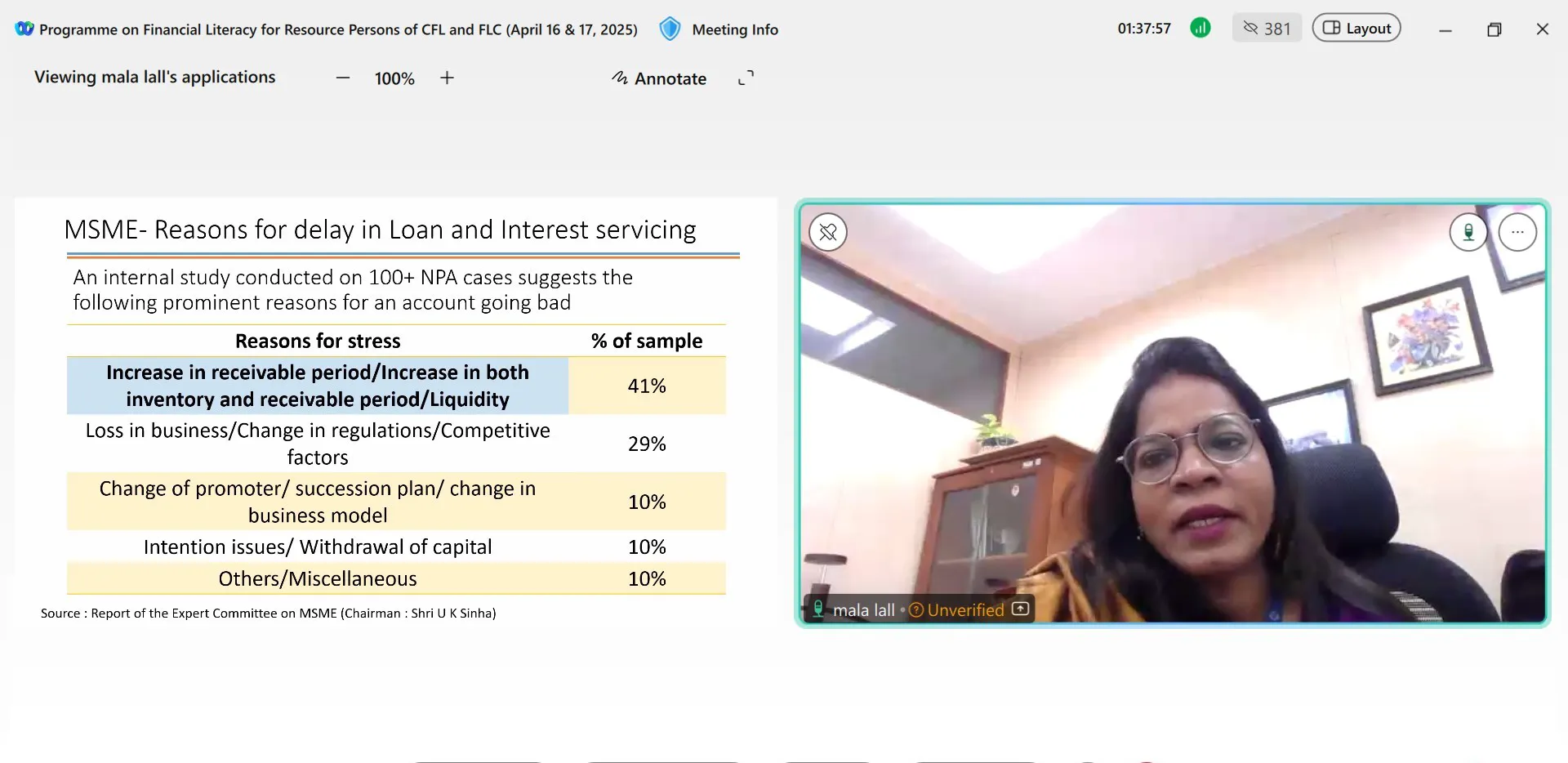

Programme on Financial Literacy for Resource Persons of Centre for Financial Literacy (CFL) and FL Counselors (FLCs) (Online Mode) (April 16 & 17, 2025)

Programme on Financial Literacy for Resource Persons of Centre for Financial Literacy (CFL) (Online Mode) (October 03 & 04, 2024)

Programme on Financial Literacy for Resource Persons of Centre for Financial Literacy (CFL) (Online Mode) (June 03-04, 2024)

Programme on Financial Inclusion, Financial Literacy and MSMEs (September 02-06, 2024)

Programme on Financial Inclusion, Financial Literacy and MSMEs (July 31 to August 4, 2023)

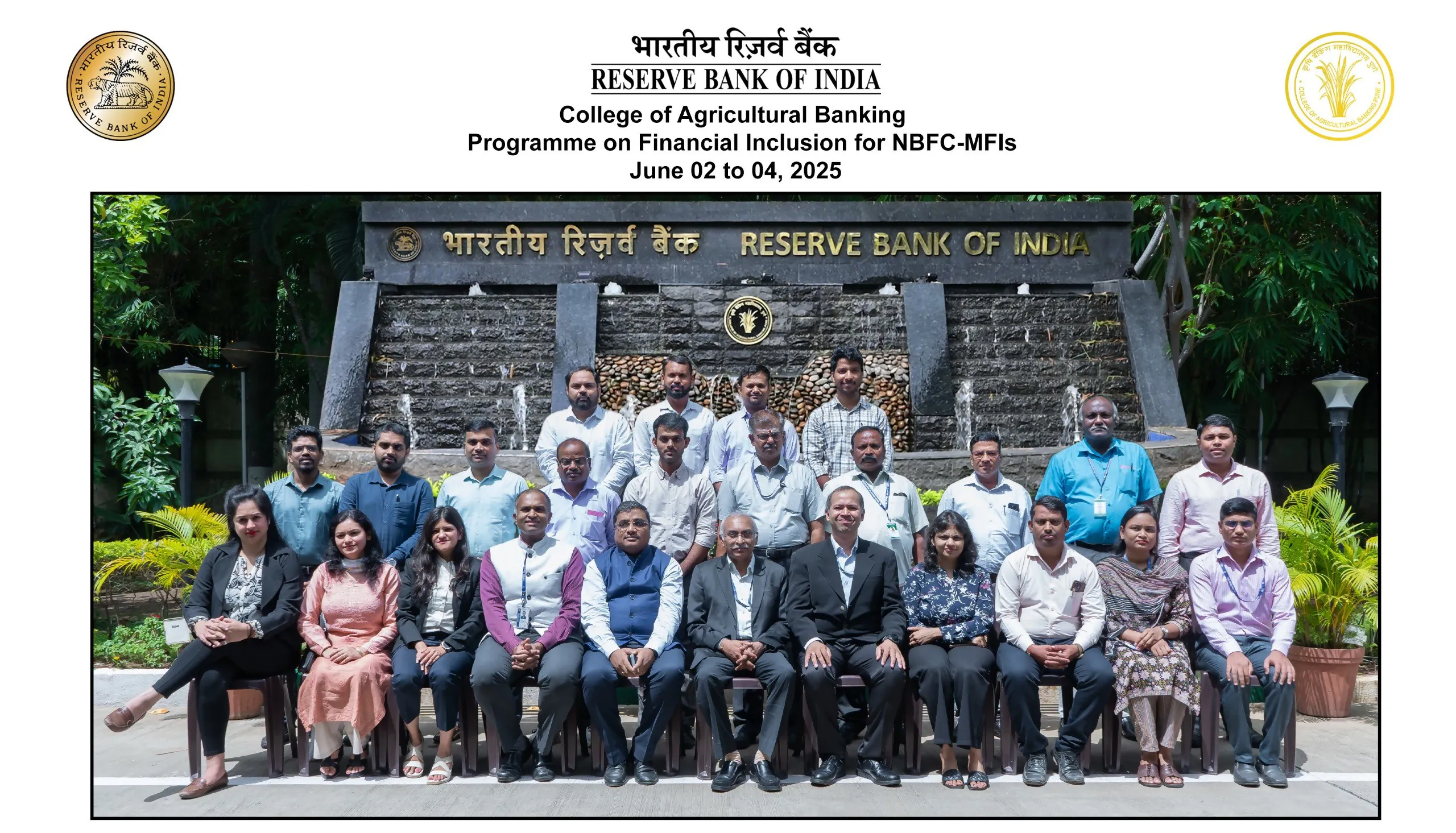

Programme on Financial Inclusion for NBFC-MFIs (June 02 to 04, 2025)

Programme on Financial Inclusion for NBFC -MFIs (August 12 to 13, 2024)

Programme on Emerging Technologies for Financial Inclusion - June 05-07, 2024

Programme on Digitalization and Financial Inclusion (in collaboration with CICTAB) (October 09-13, 2023)

Programme on Digital Banking for the Officers of Urban Co-operative Banks in collaboration with NAFCUB-November 11-13, 2024

Programme on Developing Interpersonal & Communication Skills for RBI Officers (In campus): May 05-08, 2025

Programme on Developing Interpersonal & Communication Skills (In Campus): October 13-16, 2025

Programme on Developing Interpersonal & Communication Skills (In Campus): January 13-16, 2025

Programme on Cyber Security for Officers of NBFCs – December 04-06, 2024 (In-Campus)

Programme on Cyber Security for Officers of NBFCs – August 12-14, 2024 (In-Campus)

Programme on Credit Management for officers of Urban Cooperative Banks (In Collaboration with NAFCUB): August 05-09, 2024: (in-campus)

Programme on Credit Management for officers of Urban Co-operative Banks (In Collaboration with NAFCUB): September 01-04, 2025 (on-campus)

Programme on Credit Management for officers of UCBs- October 09-13, 2023 (Online)

Programme on Credit Analysis and Management: June 24-26, 2024 (in-campus)

Programme on Corporate Governance, Credit, Investment Management & Cyber Security for the Directors of UCBs: August 19-23, 2024 (in-campus)

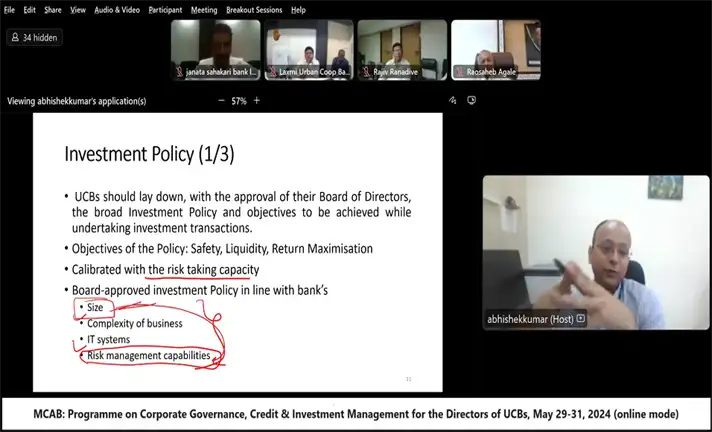

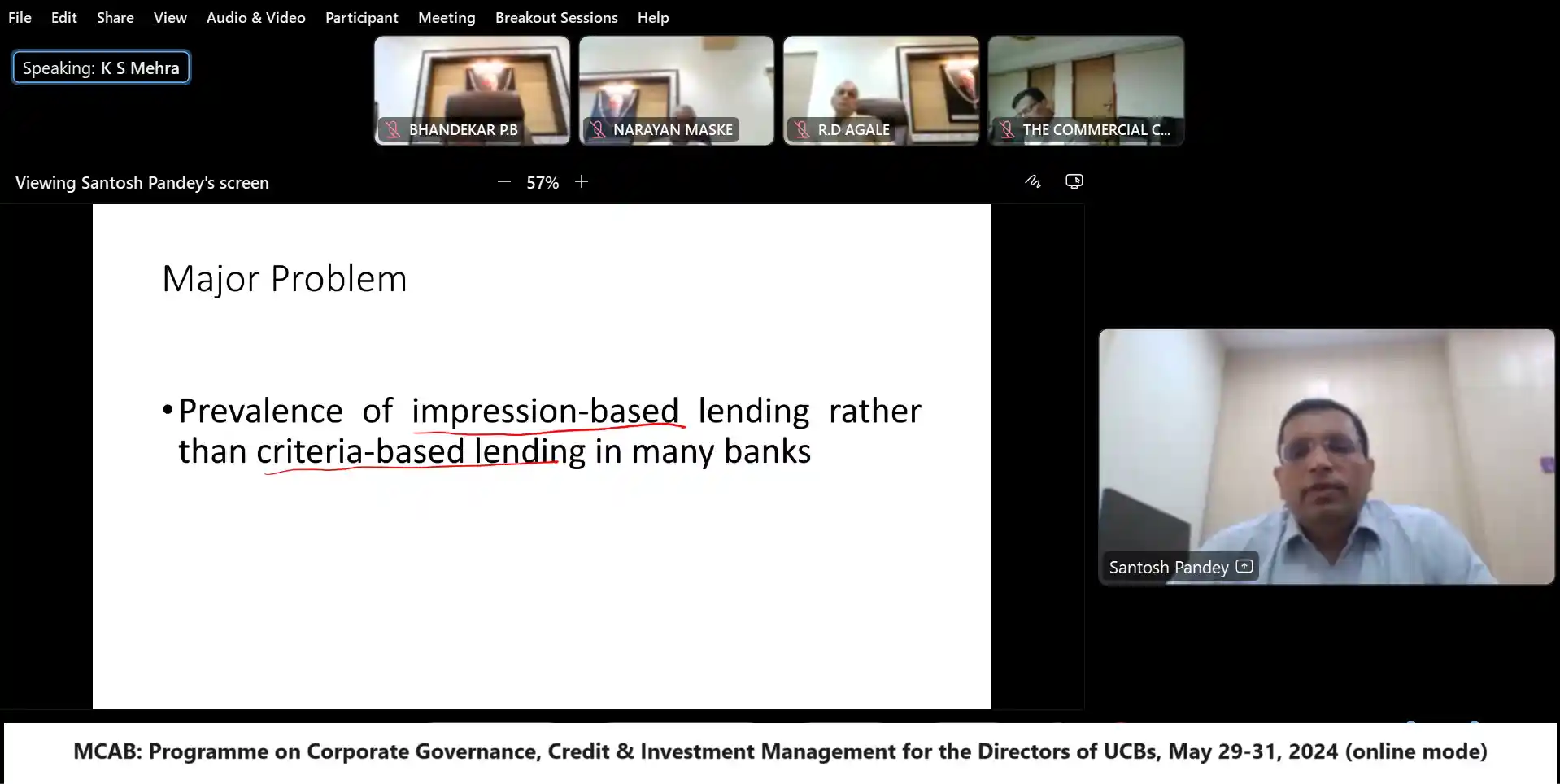

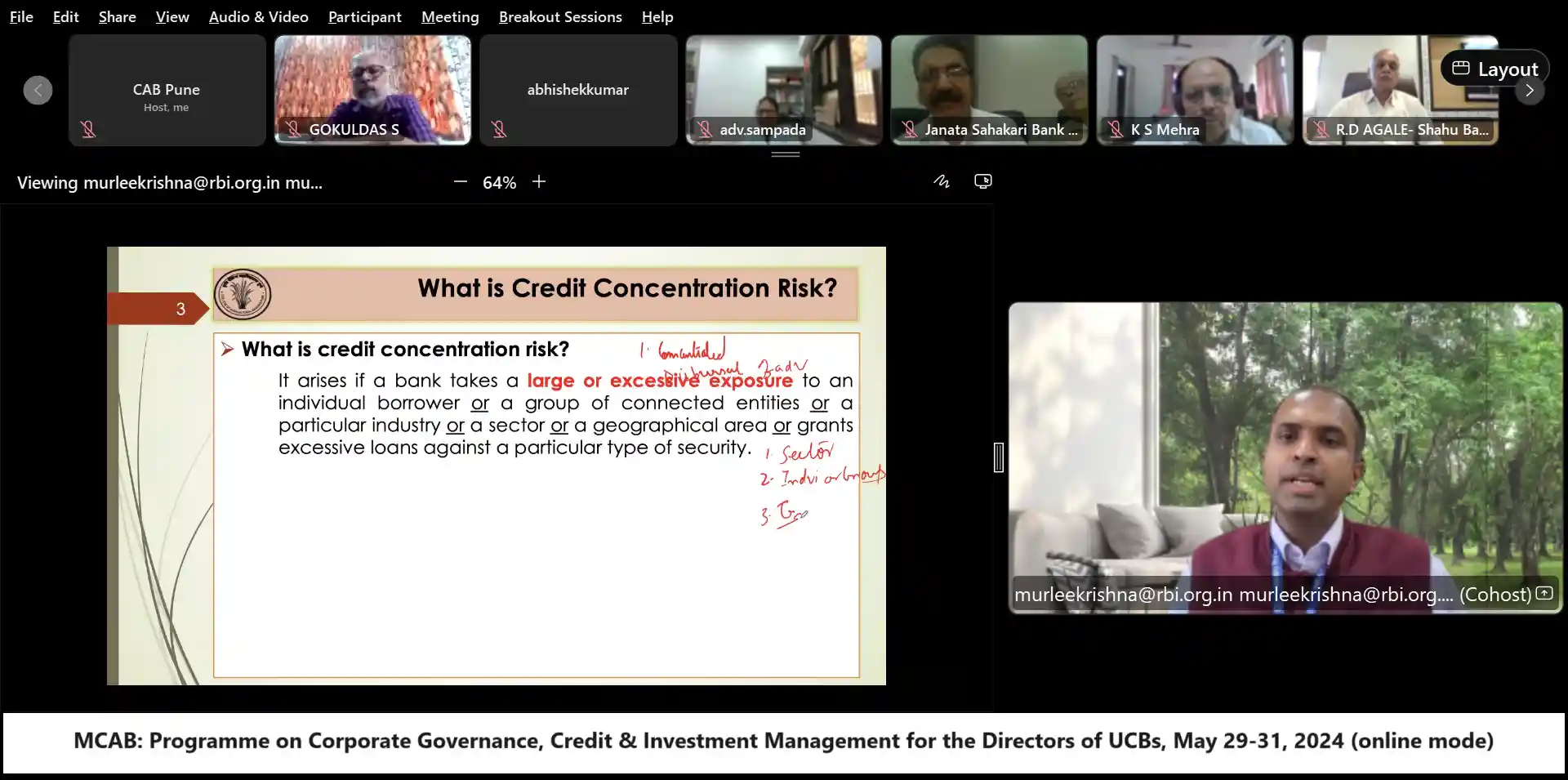

Programme on Corporate Governance, Credit and Investment Management for Directors of UCBs-May 29-31, 2024 (online mode)