IST,

IST,

Minutes of the Monetary Policy Committee Meeting, April 7 to 9, 2025

|

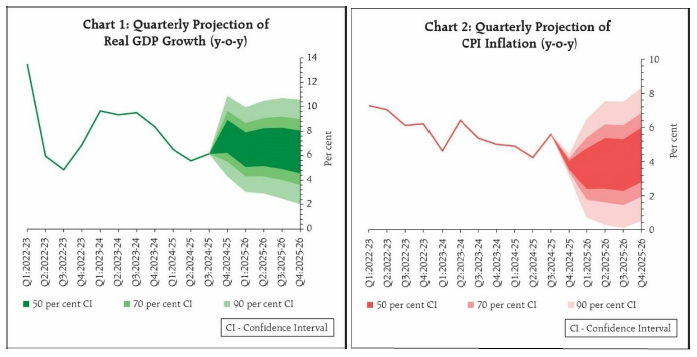

[Under Section 45ZL of the Reserve Bank of India Act, 1934] The fifty fourth meeting of the Monetary Policy Committee (MPC), constituted under Section 45ZB of the Reserve Bank of India Act, 1934, was held during April 7 to 9, 2025. 2. The meeting was chaired by Shri Sanjay Malhotra, Governor and was attended by all the members – Dr. Nagesh Kumar, Director and Chief Executive, Institute for Studies in Industrial Development, New Delhi; Shri Saugata Bhattacharya, Economist, Mumbai; Professor Ram Singh, Director, Delhi School of Economics, Delhi; Dr. Rajiv Ranjan, Executive Director (the officer of the Reserve Bank nominated by the Central Board under Section 45ZB(2)(c) of the Reserve Bank of India Act, 1934), and Shri M Rajeshwar Rao, Deputy Governor in charge of monetary policy. 3. According to Section 45ZL of the Reserve Bank of India Act, 1934, the Reserve Bank shall publish, on the fourteenth day after every meeting of the Monetary Policy Committee, the minutes of the proceedings of the meeting which shall include the following, namely: a) the resolution adopted at the meeting of the Monetary Policy Committee; b) the vote of each member of the Monetary Policy Committee, ascribed to such member, on the resolution adopted in the said meeting; and c) the statement of each member of the Monetary Policy Committee under sub-section (11) of section 45ZI on the resolution adopted in the said meeting. 4. The MPC reviewed the surveys conducted by the Reserve Bank to gauge consumer confidence, households’ inflation expectations, corporate sector performance, credit conditions, the outlook for the industrial, services and infrastructure sectors, and the projections of professional forecasters. The MPC also reviewed in detail the staff’s macroeconomic projections, and alternative scenarios around various risks to the outlook. Drawing on the above and after extensive discussions on the stance of monetary policy, the MPC adopted the resolution that is set out below. Resolution 5. The Monetary Policy Committee (MPC) held its 54th meeting from April 7 to 9, 2025 under the chairmanship of Shri Sanjay Malhotra, Governor, Reserve Bank of India. The MPC members Dr. Nagesh Kumar, Shri Saugata Bhattacharya, Prof. Ram Singh, Dr. Rajiv Ranjan, and Shri M. Rajeshwar Rao attended the meeting. 6. After assessing the current and evolving macroeconomic situation, the MPC unanimously voted to reduce the policy repo rate by 25 basis points to 6.00 per cent with immediate effect. Consequently, the standing deposit facility (SDF) rate under the liquidity adjustment facility (LAF) shall stand adjusted to 5.75 per cent and the marginal standing facility (MSF) rate and the Bank Rate to 6.25 per cent. This decision is in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth. Growth and Inflation Outlook 7. The global economic outlook is fast changing. The recent trade tariff related measures have exacerbated uncertainties clouding the economic outlook across regions, posing new headwinds for global growth and inflation. Financial markets have responded through sharp fall in dollar index and equity sell-offs with significant softening in bond yields and crude oil prices. 8. The National Statistics Office (NSO) has estimated real Gross Domestic Product (GDP) growth at 6.5 per cent for 2024-25, on top of 9.2 per cent in 2023-24. Going forward, sustained demand from rural areas, an anticipated revival in urban consumption, expected recovery of fixed capital formation supported by increased government capital expenditure, higher capacity utilisation, and healthy balance sheets of corporates and banks are expected to support growth. Merchandise exports would be weighed down by the evolving global economic landscape which appears to be uncertain at the current juncture, while services exports are expected to sustain the resilience. On the supply side, while agricultural prospects appear bright, industrial activity continues to recover, and services sector is expected to be resilient. Headwinds from global trade disruptions continue to pose downward risks. Taking all these factors into consideration, real GDP growth for 2025-26 is now projected at 6.5 per cent, with Q1 at 6.5 per cent; Q2 at 6.7 per cent; Q3 at 6.6 per cent; and Q4 at 6.3 per cent (Chart 1). The risks are evenly balanced. 9. CPI headline inflation declined by a cumulative 1.6 percentage points during January-February 2025, from 5.2 per cent in December 2024 to a low of 3.6 per cent in February 2025. On the back of a strong seasonal correction in vegetable prices this year, food inflation dropped to a 21-month low of 3.8 per cent in February. Fuel group continued to remain in deflation. Core inflation, after remaining steady in December 2024-January 2025, inched up to 4.1 per cent in February 2025, driven primarily by a sharp pick-up in gold prices. 10. The outlook for food inflation has turned decisively positive. There has been a substantial and broad-based seasonal correction in vegetable prices. The uncertainties on rabi crops have abated considerably and the second advance estimates point to a record wheat production and higher production of key pulses over last year. Along with robust kharif arrivals, this is expected to set the stage for a durable softening in food inflation. Sharp decline in inflation expectations for three months and one year ahead period would help anchor inflation expectations going ahead. Furthermore, the fall in crude oil prices augurs well for the inflation outlook. Concerns on lingering global market uncertainties and recurrence of adverse weather-related supply disruptions pose upside risks to the inflation trajectory. Taking all these factors into consideration, and assuming a normal monsoon, CPI inflation for the financial year 2025-26 is projected at 4.0 per cent, with Q1 at 3.6 per cent; Q2 at 3.9 per cent; Q3 at 3.8 per cent; and Q4 at 4.4 per cent (Chart 2). The risks are evenly balanced. Rationale for Monetary Policy Decisions 11. The MPC noted that inflation is currently below the target, supported by a sharp fall in food inflation. Moreover, there is a decisive improvement in the inflation outlook. As per projections, there is now a greater confidence of a durable alignment of headline inflation with the target of 4 per cent over a 12-month horizon. On the other hand, impeded by a challenging global environment, growth is still on a recovery path after an underwhelming performance in the first half of 2024-25. While the risks are evenly balanced around the baseline projections of growth, uncertainties remain high in the wake of the recent spurt in global volatility. In such challenging global economic conditions, the benign inflation and moderate growth outlook demands that the MPC continues to support growth. Accordingly, the MPC unanimously voted to reduce the policy repo rate by 25 basis points to 6.00 per cent. Moreover, it also decided to change the stance from neutral to accommodative. However, it noted that the rapidly evolving situation requires continuous monitoring and assessment of the economic outlook. 12. The minutes of the MPC’s meeting will be published on April 23, 2025. 13. The next meeting of the MPC is scheduled from June 4 to 6, 2025.

Statement by Dr. Nagesh Kumar 14. The April MPC meeting is taking place against the backdrop of highly disruptive global events of the previous week. In a huge blow to the multilateral trading system, and its bedrock Most-Favoured Nations (MFN) treatment that the members of the WTO accord to each other, President Donald Trump of the United States announced high reciprocal tariffs on imports from most countries of the world on 2 April 2025, the so-called Liberation Day. China, among other countries, retaliated, provoking a further punitive dose of tariffs on it, leading to a full-scale trade war between the US and China, bringing the rate of tariffs applied to imports from China to a staggering 145%. Expectedly, these announcements led to a meltdown in the financial markets around the world. 15. Different countries are mulling actions to address the effects of these tariffs. For India, the Trump Tariffs represent a mixed blessing. The 26% tariff applied to Indian exports is somewhat lower than that imposed on the Asian peers, especially China and Vietnam. They may help to extend India’s export share in the US. They may also hasten the restructuring of supply chains away from China, some of which may find India to be a good base. However, India may face competitiveness pressures in other markets like the EU/UK, besides its domestic market, where Chinese companies would dump their products, pushed out of the US. With huge excess capacities and deep pockets, the dumping of cheap goods in different markets has become a real threat already. Several countries in Southeast Asia, like Thailand, have already seen thousands of factories closing down under the dumping of cheap stuff from China and have begun to take steps to contain the damage. India needs to take action to protect the domestic industry from the dumping of Chinese goods, especially in labour-intensive consumer goods like garments, imitation jewellery, non-leather footwear, toys, and furniture where it is already rampant. In addition, the ongoing FTA negotiations with the EU and UK need to be concluded quickly to preserve market access for Indian products in these markets. 16. Furthermore, there is a serious risk of the world economy getting into a prolonged recession because of the trade wars and protectionism, which would also affect India’s growth prospects adversely. The WTO has already warned about the negative outlook for world trade. The global GDP growth projections for the current year are likely to be revised downwards in the aftermath of the reciprocal tariff and the trade war. 17. The economic growth and inflation outlook in India since the February MPC Meeting presents a mixed picture. The sales growth in manufacturing and IT companies improved in 2024-25:Q3 and the improvement was likely to continue in Q4. Capacity utilisation in the manufacturing sector has also improved. Despite these healthy improvements, however, investment intentions of private corporations were estimated to have moderated in 2024-25:Q4. Gross FDI inflows and ECBs for private capex were expected to moderate. The net FDI inflows continue to remain trivial due to hefty repatriations. The credit growth has also shown some signs of moderation in recent months, as the RBI surveys suggest. The growth outlook for 2025-26 has been downgraded by 20 basis points from earlier projections. The global uncertainty arising from the ongoing trade war is also likely to adversely affect FDI inflows and private capex. 18. In such times of such uncertainties, there is a greater need for stimulating private consumption and investments through fiscal and monetary policy to sustain the growth momentum. Fortunately, there is policy space for necessary actions. The Union Budget has augmented fiscal space by limiting the fiscal deficit to just 4.4% in 2025-26 while sustaining the momentum of public investment. The monetary policy space is provided by a downward movement in headline inflation. The CPI Headline was 3.6% in February 2025, down 70 basis points from January 2025, due to a sharp correction in vegetable prices that have seen a nearly 39% correction since November 2024. The inflationary expectations remain anchored. Furthermore, the declining crude oil and other commodity prices with the subdued global demand, and normal monsoon predictions for 2025-26 suggest that CPI headline will remain within the target range of 4%. This provides headroom for adopting a more accommodative monetary policy. 19. The RBI has already started normalising the monetary policy since February 2025 with a 25 basis point cut in the repo rate. The time has now come for changing the stance to an ‘accommodative’ from ‘neutral.’ Given the need to support growth through private consumption and investment, we should continue with further repo rate cut. One could be more ambitious and target a 50 basis point cut, which in my view may be more effective than two cuts of 25 basis points each. However, given the global uncertainty, we can go about it cautiously in a phased manner. We need to remain watchful regarding the evolving global scenario and its impact on India’s growth outlook. 20. Hence, I vote for a 25 basis point cut in the repo rate and go with the change in stance from neutral to accommodative. Statement by Shri Saugata Bhattacharya 21. Due to the elevated uncertainty regarding global trade, the continuing spillovers into financial markets volatility and the prospects, continuing well into the medium term, of adverse economic shocks on growth, economic forecasts at this point are only indicative in nature, conveying merely a sense of the direction of travel. 22. The dominant balance of probability is that inflation in India is likely to remain moderate over FY26. Factoring in a likely pre-emptive need to support growth given the evolving disruptions, I vote to cut the policy repo rate by 25 basis points to 6.0%. 23. High Frequency Indicators – both those presented in the RBI’s March Bulletin and the Monetary Policy Report – suggest that economic activity in Q4 FY25 had remained resilient. Even a predicted growth slowdown (RBI FY26 forecast of 6.5% and the Economic Survey 2024-25 6.3-6.8%, relative to the 9.2% in FY24) is respectable considering the pervasive uncertainty in the global economy. My sense, however, is that – if the trade tariff actions are not significantly diluted – global trade and hence growth will slow down materially, likely spilling over into India via external channels, further decelerating India’s growth. 24. India’s FY26 external balance might also become a matter of concern. Trends in India’s (goods and services) trade will need close monitoring, and the trade balance will depend inter alia on the responses of domestic households to their consumption – savings decisions if growth does indeed slow. Capital inflows and remittances might also be adversely affected. 25. As stated above, I remain more sanguine about moderate inflation. Skymet has just forecast a normal monsoon in 2025. Although prices of vegetable oils remain high, the March ’25 FAO Food Price Index has largely remained stable over the past 5 months. The CRB Commodity Index had eased sharply in early April, to October ’24 levels. Industrial metals prices were mostly lower or stable. Most importantly, crude oil prices have reduced on concerns about slowing growth and oil demand. The IEA March 2025 Report[1] states that “global oil supply may exceed demand by around 600 kb/d” in 2025. Softer crude prices (even after factoring in higher excise duties and LPG price hikes) will help to further moderate CPI inflation. In addition, concerns on “dumping” of foreign goods in India, if they were to materialise, while adverse for domestic output, will also help lower input and intermediate goods costs. 26. RBI forecasts an average 4% CPI inflation in FY26. Despite the possibility of adverse tariff related supply chain dislocations pushing up input costs in the short term, these are likely to be transitory; growth and demand slowdown in developed and other markets are likely to result in lower prices over the course of the year. In addition, domestic household inflation expectations remain well anchored. 27. This forecasted moderate inflation path opens up more space for “good news” policy easing. Moreover, the present resilience of economic activity does not as yet necessitate additional “bad news” actions associated with prospects of a significant growth slowdown. RBI’s liquidity infusion will also hasten transmission to the relevant interest rates. 28. I did have prior reservations on changing the policy stance to accommodative. I have associated a neutral stance with the flexibility for policy to respond appropriately to the changing balance of risks. The elevated uncertainty at present regarding the evolving economic outlook, which is likely to continue into the near future, warrants that policy decisions be taken considering incoming data on a “meeting-by-meeting” basis. However, it was clarified that the change in stance signals only that “a rate hike is off the table”; an accommodative stance remains consistent with a pause, should macro-financial conditions necessitate. Hence, I concur with the change of stance to accommodative while noting that, in my view, this does not provide guidance of a pre-determined policy easing path. 29. These decisions, I believe, are the appropriate policy responses at this point given the evolving balance in the domestic growth – inflation dynamics. Statement by Prof Ram Singh 30. My assessment of the situation and the appropriate monetary policy (MP) response align with the MPC statement for the April 2025 meeting. So, to avoid repeating the contents of the MPC statement and in the interest of brevity, I will keep my statement brief, mentioning only a few key considerations regarding policy rate and stance. 31. The global economic outlook has been changing fast for the last couple of months. Recent trade tariff-related measures have exacerbated uncertainties clouding the economic outlook across regions, posing new headwinds for global growth and inflation. Amidst this turbulence, the USD has weakened noticeably, equity markets are correcting, and crude oil prices have fallen to their lowest in recent times. This calls for the MPC to remain cautious while focusing on domestic priorities regarding inflation and growth. Inflation 32. On the inflation front, the decline in food inflation has been significant, driving down the CPI inflation. The headline inflation moderated during January-February 2025 following a sharp correction in food inflation. CPI headline inflation declined from 5.2 per cent in December 2024 to a low of 3.6 per cent in February 2025, with food inflation dropping to a 21-month low of 3.8 per cent. CPI excluding food and fuel inflation inched up to 4.1 per cent in February 2025, mainly on account of increases in gold prices. 33. Looking ahead, inflation levels and volatility are expected to remain within the RBI's comfort band. The outlook for food inflation has turned decisively positive. The uncertainties regarding rabi crops have abated considerably. Furthermore, the fall in crude oil prices and the forecast for stable commodity prices augur well for the inflation outlook. However, concerns about lingering global market uncertainties and the recurrence of adverse weather-related supply disruptions pose upside risks to the inflation trajectory. 34. Overall, we are looking at a durable softening of food inflation. Assuming a normal monsoon, CPI inflation for the financial year 2025-26 is projected at 4.0 per cent, with Q1 at 3.6 per cent, Q2 at 3.9 per cent, Q3 at 3.8 per cent, and Q4 at 4.4 per cent. The risks are evenly balanced. GDP Growth 35. Real GDP is estimated to grow 6.5 per cent in 2024-25. Gross value added (GVA) at basic prices (y-o-y) is expected to grow by 6.4 per cent. In 2024-25, agriculture and allied activities witnessed an improvement to register a growth of 4.6 per cent, and services grew by 7.5 per cent, even as industrial growth was low at 4.3 per cent. In 2025-26, prospects of the agriculture sector remain bright on the back of healthy reservoir levels and robust crop production. Manufacturing activity and business expectations show revival, with PMI manufacturing at 64.4. Services sector activity continues to be resilient. 36. On the demand side, rural demand is likely to remain healthy, riding on the good prospects of the agriculture sector's growth. Investment activity is expected to improve further due to improvements in capacity utilisation, demand revival, and healthy balance sheets of banks and corporations. 37. Taking all these factors into consideration, real GDP growth for 2025-26 is expected to be a tad lower than the earlier estimate - 6.5 per cent for FY 2025-26, with Q1 at 6.5 per cent, Q2 at 6.7 per cent, Q3 at 6.6 per cent, and Q4 at 6.3 per cent. 38. India’s foreign exchange reserves are substantial, providing a comfortable import cover of about 11 months. INR is also holding up well. The external sector remains resilient; however, uncertainties remain high in the wake of the recent spike in global uncertainties, which are likely to dampen merchandise exports while services exports are expected to remain resilient. Headwinds from global trade disruptions pose a downward risk to the growth rate. 39. Overall, the inflation outlook has improved decisively, and confidence in a durable alignment of headline inflation with the target of 4 per cent over a 12-month horizon has improved. On the other hand, growth is still on a recovery path after an underwhelming performance in the first half of 2024-25. Under these economic conditions, with growth below potential and a benign inflation outlook, the MPC should support growth by cutting the repo rate. 40. In addition, there is a strong case for changing the stance to accommodative as a signal of policy guidance for the near term. For an effective and fast transmission of interest rate cuts and consistent with a changed stance, the RBI's liquidity management tool need to be geared accordingly to operationalise these changes. In particular, monitoring the liquidity conditions to take timely measures to ensure adequate liquidity will be salient to the transmission of the rate cuts. 41. Considering the above-described case for a supportive MP while remaining cautious about the upside risks on the inflation front and unquantifiable global uncertainties, I vote to reduce the policy repo rate under the liquidity adjustment facility (LAF) by 25 basis points to 6.00 per cent. 42. Further, I support the change in the monetary policy stance from ‘neutral’ to ‘accommodative’. Statement by Dr. Rajiv Ranjan 43. Since the February Monetary Policy Committee (MPC) meeting, global uncertainty has increased further. Yet, amidst this heightened uncertainty, some clarity is emerging on the global front. All pervasive tariff is now a reality with adverse implications for global trade and growth. On the domestic front, inflation has entered a decisive softening phase with risks to growth outweighing those of inflation. Let me elaborate on these points. 44. The current global environment is highly challenging with a new restricted and fragmented global trade order taking shape amidst announcements of reciprocal and retaliatory tariffs. The broader implications of these tariffs and the individual policy responses of different countries could result in prolonged instability, upended and inefficient global supply chains, a slowdown in international trade and lower investment confidence, ultimately jeopardising the prospects of global economic recovery. Global growth, that was already below its historical average of 3.7 per cent,[2] is going to undergo downward revisions. Faced with this uncertainty and complete assessment of the impact of these tariffs taking time, monetary policy actions by central banks remain guarded with many countries taking a pause in their latest meeting in March/April 2025, while a few reduced rates with caution.[3] 45. With global rules of the game changing, India is bound to get affected through several channels. Even as India remains essentially domestic demand driven, the drag to growth may come from global front, through lower external sector contribution and high investment uncertainty. Accordingly, we have pared our GDP growth projections for 2025-26 to 6.5 per cent now, which matches the growth seen in 2024-25. As indicated in the Monetary Policy Report, April 2025, real GDP growth for 2026-27 is projected only a tad higher at 6.7 per cent. 46. On inflation, there seems to be greater conviction of inflation remaining aligned with the 4 per cent target during the current financial year. Even during 2026-27, our model projects CPI headline inflation averaging 4.3 per cent. Sharp decline in inflation expectations of households for both three months and one year ahead and of businesses for one year ahead suggest anchoring of inflation expectations going ahead. While the impact of tariffs on our domestic inflation is uncertain, the fall in energy prices augurs well for the inflation outlook. All in all, considerable progress achieved on the disinflation front has offered latitude to monetary policy to be growth supportive. This state contingent policy preference is the true spirit of flexible inflation targeting. 47. On balance, while growth is still reasonable, it is lower than our aspirations and needs policy impetus amidst a challenging global environment. As emphasised in my last minutes, India’s forte is its higher growth potential supported by strong macroeconomic fundamentals, and accordingly, we need to continue to accord higher weight to growth in our policy setting amidst benign inflation outlook with reasonable degree of definiteness. Thus, given the evolving growth inflation dynamics – lower growth and lower inflation projections – I vote for another rate cut of 25 bps. 48. Also, keeping in mind the evolving growth-inflation outlook, the change of stance to accommodative is best at this juncture. The current uncertain global environment has enhanced monetary policy and interest rate uncertainty globally, creating frictions between markets and central banks on the one hand and across different segments of the market, on the other,[4] which is detrimental to monetary policy transmission. In this context, a change in stance to accommodative helps provide a clear signal for future rate action, thereby facilitating monetary transmission.[5] This stance indicates that the direction of policy rates going forward would be either a status quo or further easing, considering the benign outlook for inflation for most of the year on the one hand and the formidable headwinds facing domestic growth from heightened global uncertainties on the other. This will also be consistent with the large liquidity infusion that we have been doing in the recent past to aid policy transmission in this easing cycle. As the saying goes, never let a crisis go to waste; we should use the current tumultuous geo-economic episode as an opportunity to reform our domestic economy by undertaking productivity enhancing and Ease of Doing Business (EoDB) measures. Statement by Shri M. Rajeshwar Rao 49. Uncertainty is the key word dominating the discourse in financial world at this juncture. The escalating trade tensions led by recent reciprocal tariff impositions impart greater uncertainty to the global as well as domestic growth outlook. Its effects are still unfolding and there is uncertainty on its eventual outcomes. Global composite PMI has already begun signaling a slowdown in growth momentum. The global growth estimates for both 2025 and 2026, which have been revised down in the OECD March 2025 report, are expected to undergo further downward revisions by the IMF and the World Bank in their upcoming releases. 50. The benign inflation outlook with headline CPI inflation for February 2025 falling sharply to 3.6 per cent - registered a decline for the fourth consecutive month. In terms of CPI food sub-groups, the deflationary pressures are broad based. Core CPI inflation edged up contributed partially by personal care and effects which include rise in price of gold. Food price momentum (m-o-m) based on high frequency data from the Department of Consumer Affairs (DCA) shows that food prices have fallen in April so far (April 1-7). Further correction in global crude and commodity prices due to slowing global demand provide further comfort on inflation outlook. The significant softening of headline inflation and greater confidence of a benign outlook, especially on food prices, signals a likely durable alignment of inflation with the target rate over 2025-26. 51. On the growth front, even though the Indian economy has recovered from a weak Q2:2024-25, the annual GDP growth for 2024-25 is lower at 6.5 per cent compared to a strong growth of 9.2 percent as per the Second Advance Estimates (SAE) released by NSO. Strong rural demand on brightened prospects for agriculture along with improving urban demand, and a resilient services sector bode well for the growth outlook, however, global headwinds pose downside risk to growth. Uncertainties remain high going ahead. Accordingly, growth projection for 2025-26 has been revised downward by 20 basis points to 6.5 per cent. Our model-based projection (MPR, April 2025) suggest that growth will recover to 6.7 per cent during 2026-27, which will still be below 7.0 per cent. 52. Growth in aggregate deposits (y-o-y) of all scheduled commercial banks (SCBs) and bank credit remain in double digits. The liquidity conditions have also improved in the recent months in response to a slew of measure taken by the RBI which we believe will ensure orderly market conditions and thereby, facilitate monetary transmission. 53. India’s external sector situation looks sustainable supported by a comfortable current account deficit (CAD) of 1.1 per cent of GDP in Q3:2024-25. Among capital flows, external commercial borrowing (ECB) and non-resident deposit flows remained robust during 2024-25 so far. Though remittances from abroad face risks from lower global growth especially from the US, they remain robust. FPI inflows will depend largely on the evolving global situation, although the domestic macroeconomic conditions provide the crucial support. In the context of emerging situation, foreign exchange reserves US$ 665.4 billion at the week ended March 28, 2025, provides the much-needed buffer to tackle unforeseen global headwinds. 54. The current environment mired as it is with unprecedented global uncertainties, calls for constant watchfulness and monitoring, as well as promptness in policy actions to deal with any emerging risk to the growth-inflation balance. While the exact impact of US tariffs on India is not certain, with US being India’s largest export destination, it could weigh on trade, financial markets, and domestic economic activity through both direct and indirect channels. 55. Assessing the overall situation, we find that while inflation outlook remains benign, GDP growth could face a downward pressure. The recent waves of global uncertainty demand decisive policy support to growth. Continuing with the easing cycle in February policy, I vote in favour of a 25 bps rate cut. I also support a change in stance from neutral to accommodative. Statement by Shri Sanjay Malhotra 56. The global economic landscape remains in a state of flux amidst heightened trade and policy uncertainties, with attendant implications for economies across the world, posing complex challenges and trade-offs in policy making. The channels through which these global shocks could impact economies, particularly emerging market economies, include spillovers from global growth slowdown, elevated financial markets volatility and dented consumer and investor confidence. The Indian economy remains relatively less exposed and better placed to withstand such spillovers with its growth driven largely by domestic demand. Nevertheless, we are not immune to the aftershocks and ripple effects associated with global disturbances. There may also be some positive spin-off to the Indian economy from the likely softening of crude oil and commodity prices and relative tariff advantage. 57. The high frequency indicators for the latest period indicate that domestic demand continues to be resilient, with urban consumption improving with an uptick in discretionary spending and rural consumption remaining robust on the back of favourable agricultural prospects. Investment activity shall get a boost from a pick-up in government capex and a congenial environment for private corporate investment. Thus, I believe that robust domestic demand will cushion the impact of external headwinds as in the past. At this juncture, the growth projection for 2025-26 at 6.5 per cent, a downward revision of 20 basis points from the February 2025 policy, is appropriate. Although even at 6.5 per cent growth, India would continue to be the fastest growing major economy, this is lower than what we aspire for. 58. Turing to inflation, headline inflation reading at 3.6 per cent in February 2025 (averaging at 4.0 per cent during January-February 2025) aided further disinflation with food inflation turning out to be very benign. There is now greater clarity on the food inflation outlook as the uncertainties related to rabi crops production have abated. The second advance estimates suggest record wheat production and higher production of key pulses. Core inflation (excluding fuel and food), although inching up to 4.1 per cent in February 2025 from 3.6 per cent in January, continues to be around the 4 per cent mark, suggesting that underlying inflationary impulses in the economy are benign and well anchored. CPI inflation excluding food, fuel, gold and silver was still at a muted 3.2 per cent in February 2025. Fuel group continues to be in deflation. Moreover, the decline in crude oil prices should impart a softening bias to the inflation outlook. Coming to the imposition of tariffs, in my view, the implications for inflation are two sided. On the upside, uncertainties may lead to possible currency pressures resulting in imported inflation. On the downside, slowdown in global growth will further soften commodity and crude oil prices, which would ease the pressure on inflation. Overall, favourable factors for the inflation outlook outweigh those with possible adverse impact and should drive further disinflation in the headline CPI. It is expected that inflation will be well aligned to the target during the current financial year. 59. When consumer price inflation is decisively around its target rate of 4.0 per cent and growth is still moderate and recovering, monetary policy needs to nurture domestic demand impulses to further increase the growth momentum. This is specially so amidst an uncertain global environment, which has amplified downside risks to growth. Accordingly, I vote for a reduction in the repo rate by 25 basis points. This will bolster private consumption and support a revival in private corporate investment activity. Going forward too, considering the evolving growth-inflation trajectories, monetary policy needs to be accommodative. (Puneet Pancholy) Press Release: 2025-2026/164 [2] The IMF, in its January 2025 update of the World Economic Outlook (WEO), projected the global economy to grow by 3.3 per cent in 2025, as against the average growth of 3.7 per cent recorded during 2000-2019. [3] US, UK, Japan, Australia, Czech Republic, Israel, Norway and Sweden among advanced economies (AEs) and Russia, China, South Africa, Chile, Colombia, Hungary, Indonesia, Malaysia, Peru, Poland and Romania among emerging market economies (EMEs) maintained the status quo on their monetary policy rates. On the other hand, Euro area, Canada, Iceland, Switzerland, Mexico and Turkey cut their benchmark rates while Brazil hiked its policy rate. |

||||||||||||||||

পৃষ্ঠাটো শেহতীয়া আপডেট কৰা তাৰিখ: