IST,

IST,

Anecdote 1 - The Humble Pie

Towards the nineteenth century, the pie was the smallest minted coin in India. It constituted 1/3 rd of a pice and was officially termed 1/12th of an Anna. 3 pies made a pice; 4 pice made an anna and 16 annas made a rupee. One rupee, thus consisted of 192 pies. (No wonder arithmetic daunted the faint-hearted then!!)

In the wake of the second world war, India witnessed an inflationary situation as well as a scarcity of metals that had to be imported. It was in this context of rising prices that the minting of the copper pie was discontinued after 1942.

Ten years later,there was a proposal by the Mint Master that the pie be reintroduced as a part of the coinage of Republic India. The proposal, however, was very gently squashed by the then Finance Secretary, Shri K.G. Ambegaokar on cost-benefit considerations. Ambegaokar, later also served as Governor of the Bank for about one month in 1957. C.D. Deshmukh, the former Governor of the Bank was then the Finance Minister. He as "Minister" wrote the last word ending the saga of the humble pie

Anecdote 2: The Dividend Warrant

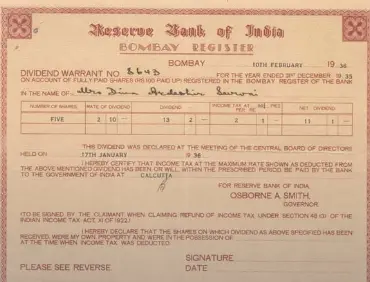

The Reserve Bank of India was set up as a share holders' bank. The share flotation in March 1935 was the largest of its kind ever attempted in the country. Despite this, the issue was heavily oversubscribed. The image above is a picture of one of the first dividend warrants issued in 1936 to the shareholders.

It is interesting to observe the rate of dividend as well as the rate of Income Tax is expressed in absolute terms, i.e., in rupees, annas and pies. The rate of dividend is indicated as 2 rupees and 10 annas. The rate of income tax is indicated on the certificate as 30 1/3 pies per rupee.

Q1. Can we calculate the rate of dividend in percentage terms?

Q2. Also calculate the rate of income tax in percentage terms.

Read More

Anecdote 3: Of Art, Central Banks, and Philistines

On achieving independence, the government planned a number of public buildings to house the institutions of independent India. In this context, Pandit Jawaharlal Nehru, the Prime Minister, suggested that public buildings, many of which were large imposing structures, could be utilised to ‘encourage Indian artists to function in some way’ and sculptors, painters, designers, etc. could be asked to cooperate. Nehru opined that the art work ‘…should cost very little in comparison with the total cost of the buildings. But it will encourage Indian artists and would be greatly welcomed, I think, by the public’. The Finance Secretary, Shri K.G. Ambegaokar, sent a copy of the note to B. Rama Rau, the then Governor. This was the time when the Reserve Bank was in the process of constructing/contemplating new buildings at New Delhi, Madras and Nagpur.

Read More

Anecdote 4: Of Cranks, Central Banks and Public Policy

From the Files

The Reserve Bank, as the central bank of the country, often receives letters from the common man on matters of public policy and interest. Some of these letters are focused and lend themselves to policy decisions. Many, however, while imbued with reformist zeal, are emotional outbursts merely lamenting the state of affairs and do not lend themselves to any action. The authors of these, however, are persistent in their 'pro bono publico' endeavours. Such letters are addressed to the central bank, often to the Governor, as the central bank is in some ways involved in charting the economic policies of the country.

The traditional systems in the Bank demand that all letters received need to be 'inwarded', examined and 'marked off'. A specific decision even on persistent 'crank' letters needs to be taken. A note recorded on one such letter in the Department of External Investments and Operations (DEIO) is reproduced below.

Read MoreAnecdote 5: Of Aspirants, Pensioners and Continuity

Jobs at the Reserve Bank of India were highly coveted. Just before the Bank opened it doors for business in April 1935, its Calcutta Office advertised fifty odd temporary job vacancies. The response was overwhelming. There were reportedly over ten thousand applications. The journal Indian Finance of March 1935 wrote this rather dramatic report:

“It was not a rain, but a downpour of applicants. They came from all corners of Calcutta - from most mofussil stations of Bengal. The building was chokeful of crowding graduates. The overflow in the streets was so heavy that the traffic was held up; and there was a traffic jam. The men who got into the building could not get out; the crowd in the street, who were all the time pressing towards the entrance of the building, were panting and perspiring; and some fainted in the crush, I understand. The officials who were to make the selection, were nonplussed. Never did any advertisement in Calcutta papers have such pulling power. In sheer desperation, the police were rung up; and their assistance requisitioned to clear up the building and the streets…”

Unfortunately for job aspirants, new recruitments were few. Much of the staff for the Bank’s establishment was transferred to it from the Imperial Bank and Government of India. The Government staff were the erstwhile employees of the Office of the Controller of the Currency from whom the Bank took over the function of Currency Management and issuance of Public Debt.

Read More