| CONTENTS |

| S.No. |

Particulars |

| 1. |

Select abbreviations |

| 2. |

Foreword |

| 3. |

Executive Summary |

| 4. |

Chapter 1 – The Ombudsman Schemes of RBI: Activities during April 1, 2021 to March 31, 2022 |

| |

Receipt of complaints |

| |

ORBIO-wise receipt and allocation of complaints |

| |

Geographic dispersion of complaints across the states |

| |

Modes of receipt of complaints |

| |

Category-wise receipt of complaints |

| |

Population group-wise distribution of complaints |

| |

Complainant type-wise receipt of complaints |

| |

Entity type-wise receipt of complaints |

| |

Disposal of complaints |

| |

Mode of disposal of maintainable complaints |

| |

Reasons for closure of complaints under non-maintainable clauses |

| |

Receipt of Appeals |

| |

Cost of handling a complaint |

| |

Turn Around Time (TAT) for disposal of complaints |

| |

Bank group-wise complaint conversion rate |

| 5. |

Chapter 2 - The Banking Ombudsman Scheme (BOS), 2006: Activities during April 1, 2021 to November 11, 2021 |

| |

Receipt of complaints |

| |

Mode of receipt of complaints |

| |

Zone-wise distribution of complaints |

| |

Complainant group-wise classification of complaints |

| |

Entity type-wise classification of complaints |

| |

Category-wise receipt of complaints |

| |

Mode of disposal of complaints |

| |

Grounds for rejection of maintainable complaints |

| |

Appeals against the decisions of the Banking Ombudsmen (BOs) |

| 6. |

Chapter 3 - The Ombudsman Scheme for Non-Banking Financial Companies (OSNBFC), 2018: Activities during April 1, 2021 to November 11, 2021 |

| |

Receipt of complaints |

| |

Mode of receipt of complaints |

| |

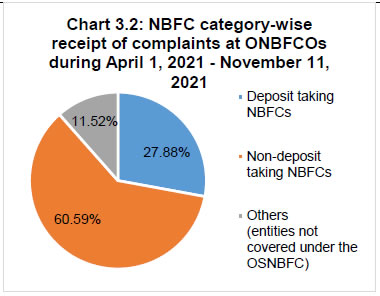

NBFC category-wise complaints received |

| |

Complainant group-wise classification |

| |

Nature of complaints handled |

| |

Disposal of complaints |

| |

Mode of disposal of maintainable complaints |

| |

Grounds for rejection of maintainable complaints |

| |

Appeals against the decisions of the NBFC Ombudsmen (NBFCOs) |

| 7. |

Chapter 4 – The Ombudsman Scheme for Digital Transactions (OSDT), 2019: Activities during April 1, 2021 to November 11, 2021 |

| |

Receipt of complaints |

| |

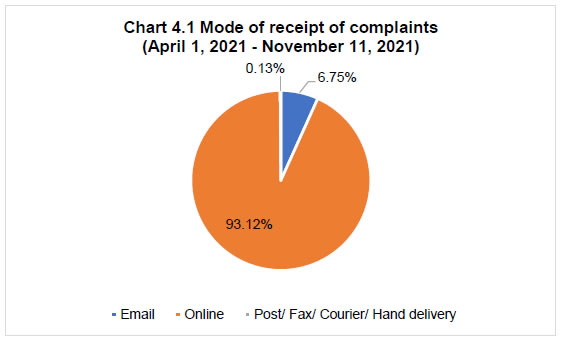

Mode of receipt of complaints |

| |

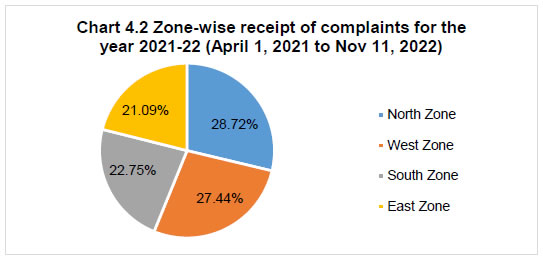

Zone-wise distribution of complaints |

| |

Complainant group-wise classification |

| |

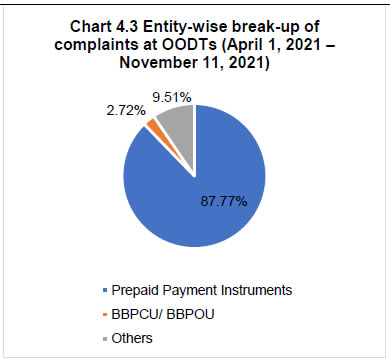

Entity type-wise classification |

| |

Nature of complaints handled |

| |

Disposal of complaints |

| |

Mode of disposal of maintainable complaints |

| |

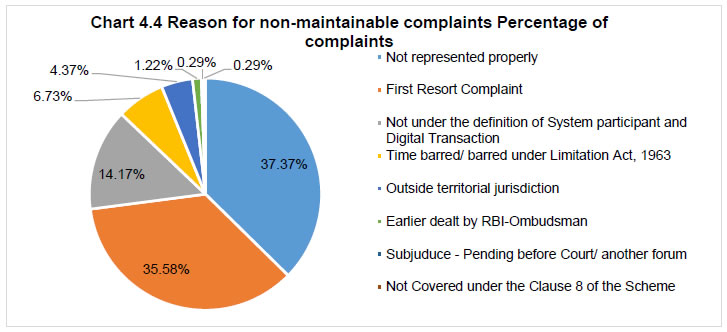

Grounds for rejection of maintainable complaints |

| |

Age-wise classification of pending complaints |

| |

Appeals against the decisions of Ombudsmen for Digital Transactions (ODTs) |

| 8. |

Chapter 5 – The Reserve Bank – Integrated Ombudsman Scheme, 2021: Activities during November 12, 2021 to March 31, 2022 |

| |

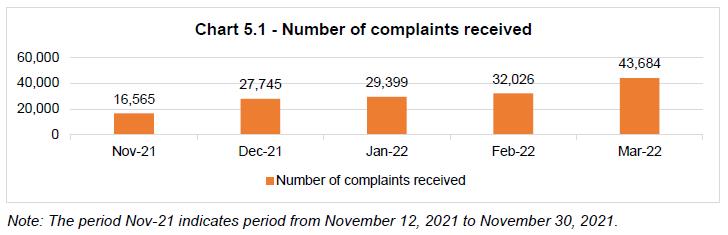

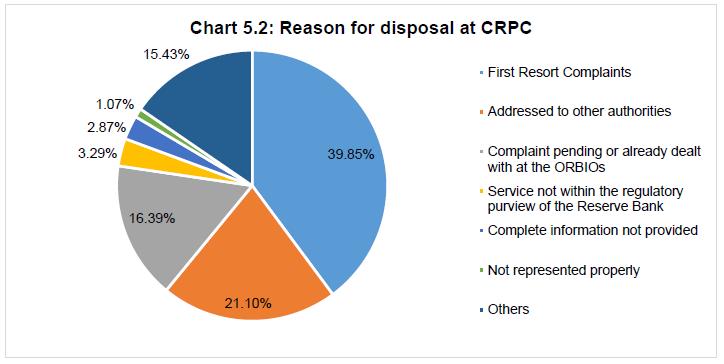

Receipt and handling of complaints at the Centralised Receipt and Processing Center (CRPC) |

| |

Receipt and handling of complaints at the Offices of the RBI Ombudsman (ORBIOs) |

| |

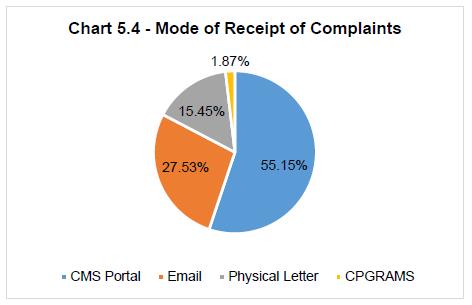

Mode of receipt of complaints |

| |

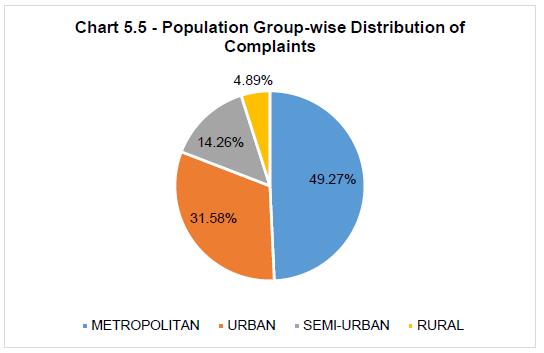

Population group-wise distribution of complaints |

| |

Zone-wise distribution of complaints |

| |

Complainant group-wise classification of complaints |

| |

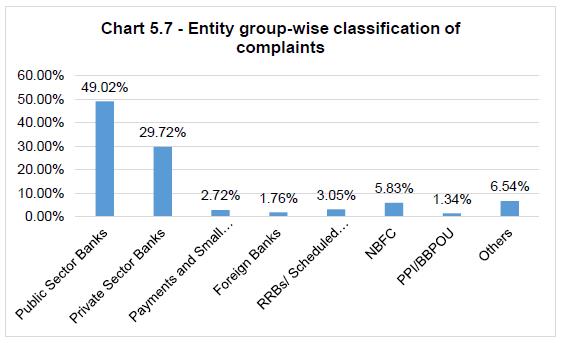

Entity group-wise classification of complaints |

| |

Nature of complaints handled |

| |

Disposal of complaints |

| |

Mode of disposal of maintainable complaints |

| |

Grounds for rejection of maintainable complaints |

| |

Turn Around Time (TAT) of complaints |

| |

Awards Issued |

| |

Appeals against the decisions of the ORBIOs |

| 9. |

Chapter 6 - Other developments |

| |

Regulations: Important regulatory measures taken by the Reserve Bank |

| |

Root Cause Analysis (RCA) of major areas of complaints |

| |

Status of implementation of the action plan set out in ‘Utkarsh 2022’ for the year, April 1, 2021 to March 31, 2022 |

| |

Formulate policy/scheme for handling complaints not covered under the Ombudsman Scheme |

| |

Efforts for inclusion of safe banking practices in educational curriculum |

| |

Extension of the IO Scheme to NBFCs |

| |

Awareness generation activities of Consumer Education and Protection Department (CEPD) and Ombudsmen Offices |

| |

Nationwide Customer Satisfaction Survey for RB-IOS, CRPC and the Contact Center |

| |

Framework for Strengthening the Grievance Redress of banks |

| |

Winding down of Banking Codes and Standards Board of India (BCSBI) |

| |

Way forward |

| 10. |

Chapter 7 – Complaints Centralised Public Grievance Redress and Monitoring System (CPGRAMS) and applications under Right to Information (RTI) Act, 2005 |

| |

CPGRAMS |

| |

RTI Act, 2005 |

| 11. |

Appendices |

| TABLES |

| Table No. |

Table Title |

| Table 1.1 |

Total receipt of complains under the Ombudsman Schemes during past three years |

| Table 1.2 |

Office-wise receipt of complaints under Ombudsman Schemes for past three years |

| Table 1.3 |

Entity type-wise top five categories of complaints received at ORBIOs |

| Table 1.4 |

Complainant type-wise receipt of complaints under the Ombudsman Schemes |

| Table 1.5 |

Entity type-wise receipt of complaints at the ORBIOs |

| Table 1.6 |

Disposal and pendency position at the ORBIOs during the past three years |

| Table 1.7 |

Mode of disposal of maintainable complaints under the Ombudsman Schemes |

| Table 1.8 |

Receipt and disposal of Appeals under the Ombudsman Schemes for past three years |

| Table 2.1 |

Number of complaints received by OBOs |

| Table 2.2 |

Position of customer complaints handled by OBOs |

| Table 2.3 |

Entity type-wise receipt of complaints during April 1, 2021 – November 11, 2021 |

| Table 2.4 |

Category-wise receipt of complaints under the BOS |

| Table 2.5 |

Mode of disposal of maintainable complaints under BOS |

| Table 2.6 |

Grounds/reasons for rejection of maintainable complaints under the BOS |

| Table 2.7 |

Receipt and disposal of Appeals under the BOS |

| Table 3.1 |

Position of customer complaints handled by ONBFCOs |

| Table 3.2 |

NBFC Category-wise receipt of complaints during April 1, 2021 to November 11, 2021 |

| Table 3.3 |

Category-wise distribution of complaints |

| Table 3.4 |

Mode of disposal of maintainable complaints by ONBFCOs |

| Table 3.5 |

Grounds/reasons for rejection of maintainable complaints |

| Table 3.6 |

Position of Appeals – ONBFCOs |

| Table 4.1 |

Number of complaints received by OODTs |

| Table 4.2 |

Position of customer complaints handled by OODTs |

| Table 4.3 |

Entity type-wise break-up of complaints received at OODTs during April 1, 2021 to November 11, 2021 |

| Table 4.4 |

Category-wise distribution of complaints |

| Table 4.5 |

Mode of disposal of maintainable complaints |

| Table 4.6 |

Grounds/reasons for rejection of maintainable complaints |

| Table 5.1 |

Category-wise distribution of complaints received at ORBIOs |

| Table 5.2 |

Disposal of complaints at ORBIOs |

| Table 5.3 |

Mode of disposal of maintainable complaints under RB-IOS, 2021 |

| Table 5.4 |

Grounds/reasons for rejection of maintainable complaints under RB-IOS, 2021 |

| Table 5.5 |

Position of Appeals under RB-IOS as on March 31, 2022 |

| Table 6.1 |

Root Cause Analysis (RCA) 2021-22 – Major concerns, root causes identified and remedial measures |

| CHARTS |

| Chart No. |

Chart Title |

| Chart 1.1 |

Distribution of complaints among the ORBIOs |

| Chart 1.2 |

Geographic dispersion – Complaints received per 1 lakh accounts held |

| Chart 1.3 |

Mode of receipt of complaints |

| Chart 1.4 |

Population group-wise receipt of complaints |

| Chart 1.5 |

Number of complaints received from Senior Citizens at ORBIOs |

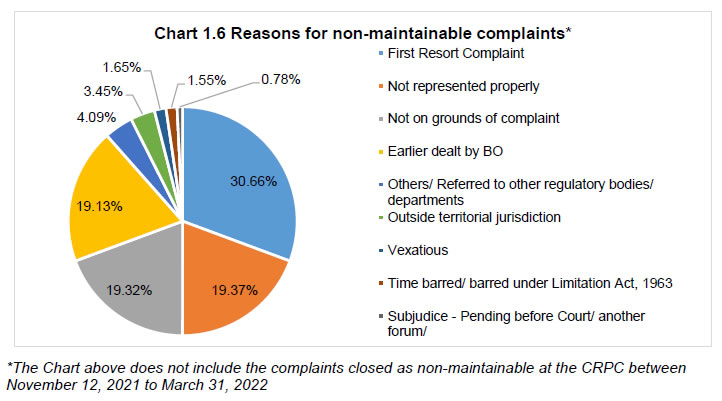

| Chart 1.6 |

Reasons for non-maintainable complaints |

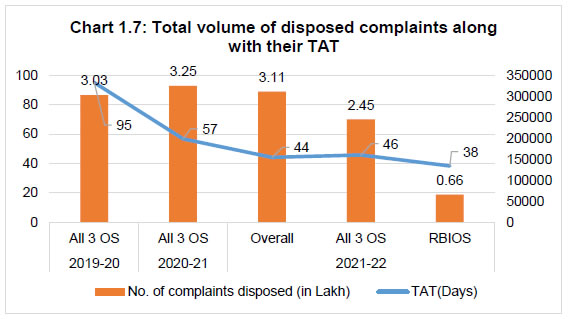

| Chart 1.7 |

Total volume of disposed complaints along with their TAT |

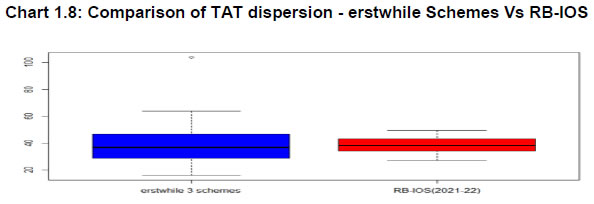

| Chart 1.8 |

Comparison of TAT dispersion – erstwhile Schemes vs RB-IOS |

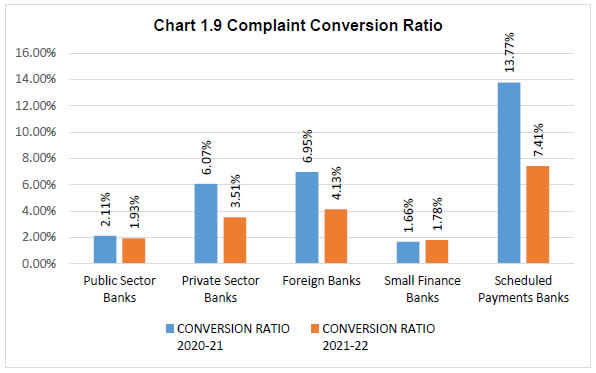

| Chart 1.9 |

Bank group-wise complaint conversion ratio |

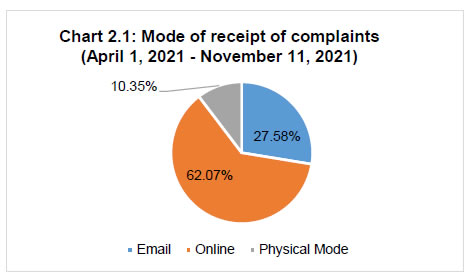

| Chart 2.1 |

Mode of receipt of complaints (April 1, 2021 – November 11, 2021) |

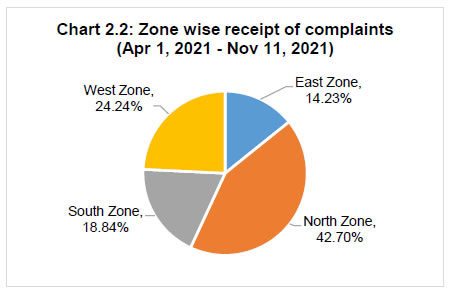

| Chart 2.2 |

Zone-wise receipt of complaints (April 1, 2021 – November 11, 2021) |

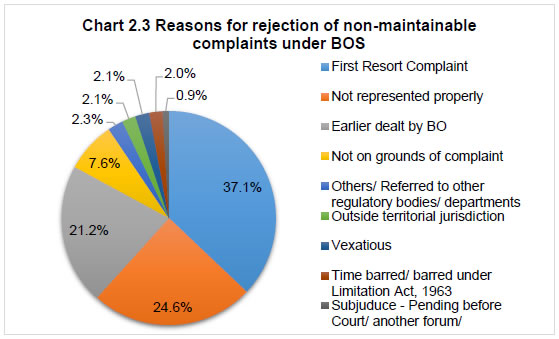

| Chart 2.3 |

Reasons for rejection of non-maintainable complaints under BOS |

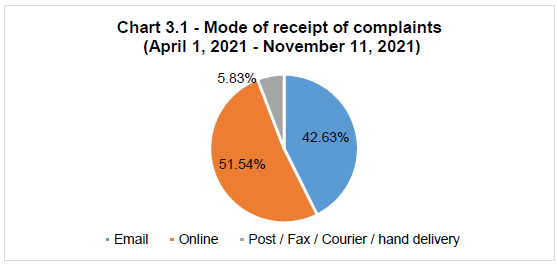

| Chart 3.1 |

Mode of receipt of complaints (April 1, 2021 – November 11, 2021) |

| Chart 3.2 |

NBFC category-wise receipt of complaints at ONBFCOs (April 1, 2021 – November 11, 2021) |

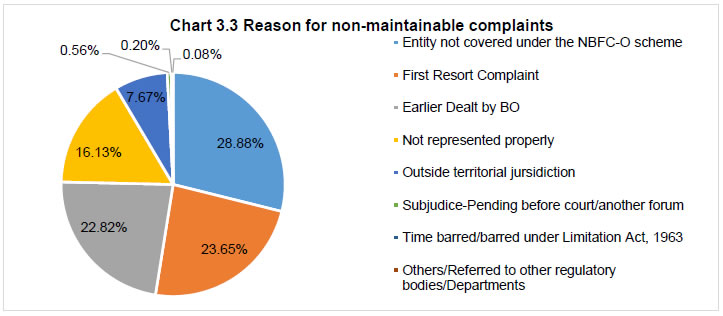

| Chart 3.3 |

Reasons for non-maintainable complaints |

| Chart 4.1 |

Mode of receipt of complaints (April 1, 2021 – November 11, 2021) |

| Chart 4.2 |

Zone-wise receipt of complaints (April 1, 2021 – November 11, 2021) |

| Chart 4.3 |

Entity-wise break-up of complaints at OODTs (April 1, 2021 – November 11, 2021) |

| Chart 4.4 |

Reason for non-maintainable complains: Percentage of complaints |

| Chart 5.1 |

Number of complaints received |

| Chart 5.2 |

Reason for disposal at CRPC |

| Chart 5.3 |

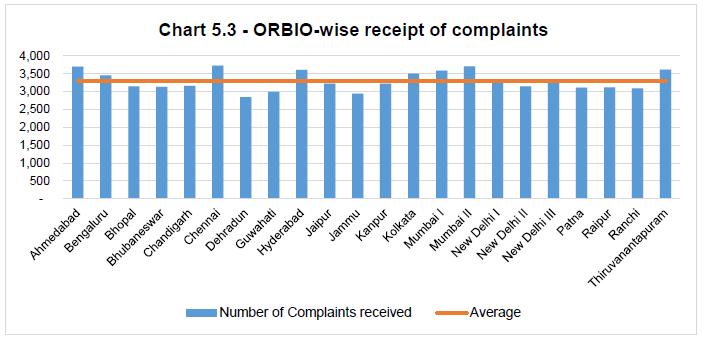

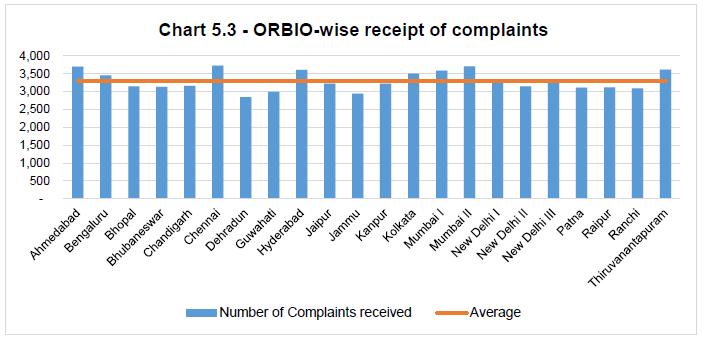

ORBIO-wise receipt of complaints |

| Chart 5.4 |

Mode of receipt of complaints |

| Chart 5.5 |

Population group-wise distribution of complaints |

| Chart 5.6 |

Zone-wise distribution of complaints |

| Chart 5.7 |

Entity group-wise classification of complaints |

| Chart 6.1 |

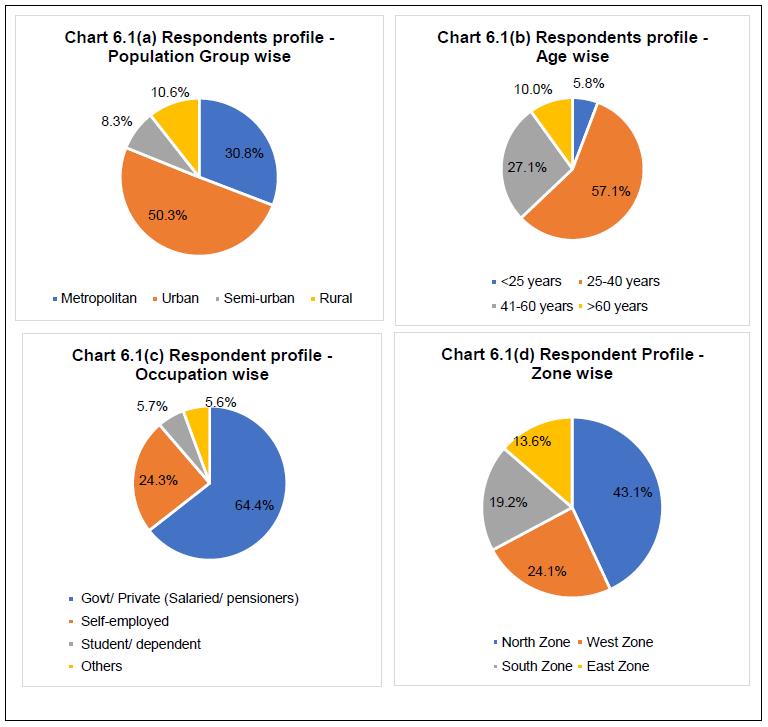

Respondent profile of the Nationwide Customer Satisfaction Survey for RB-IOS, CRPC and the Contact Center |

| APPENDICES |

| Appendix No. |

Appendix Title |

| Appendix 1.1 |

Category-wise receipt of complaints under the Ombudsman Schemes for the past three years |

| Appendix 1.2 |

ORBIO-wise position of Appeals received during April 1, 2021 to March 31, 2022 |

| Appendix 1.3 |

Office-wise Cost of handling complaints at ORBIOs |

| Appendix 1.4 |

Complainant group-wise classification of complaints |

| Appendix 1.5 |

Mode of disposal of Maintainable Complaints against Scheduled Commercial Banks |

| Appendix 2.1 |

Mode of receipt of complaints under the BOS (April 1, 2021 – November 11, 2021) |

| Appendix 2.2 |

Zone-wise receipt of complaints under the BOS (April 1, 2021 – November 11, 2021) |

| Appendix 2.3 |

Office-wise receipt and disposal of complaints received at OBOs during April 1, 2021 – November 11, 2021. |

| Appendix 3.1 |

Mode of receipt of complaints during April 1, 2021 – November 11, 2021 |

| Appendix 3.2 |

ONBFCO-wise position of complaints during April 1, 2021 – November 11, 2021 |

| Appendix 3.3 |

ONBFCO-wise position of maintainable complaints disposed during April 1, 2021 – November 11, 2021 |

| Appendix 4.1 |

Mode of receipt of complaints |

| Appendix 4.2 |

Zone-wise receipt of complaints |

| Appendix 4.3 |

Office-wise receipt and disposal of complaints received at OODTs during the year |

| Appendix 4.4 |

OODT-wise distribution of maintainable complaints |

| Appendix 5.1 |

Mode of receipt of complaints during November 12, 2021 to March 31, 2022 |

| Appendix 5.2 |

Zone-wise distribution of complaints received during November 12, 2021 to March 31, 2022 |

| Appendix 5.3 |

Entity group-wise classification of complaints received during November 12, 2021 to March 31, 2022 |

| Appendix 6.1 |

Important notifications relating to Customer Service issued by RBI in 2021-22 (Apr-Mar) |

| Appendix 6.2 |

Number of awareness programmes conducted during April 1, 2021 to March 31, 2022 |

| Appendix 7.1 |

Position of complaints received by ORBIOs through CPGRAMS |

| Appendix 7.2 |

Applications received by ORBIOs under RTI Act, 2005 |

SELECT ABBREVIATIONS

| AA |

Appellate Authority |

| ADR |

Alternate Dispute Resolution |

| AEPS |

Aadhar Enabled Payment System |

| AFA |

Additional Factor of Authentication |

| AGR |

Alternate Grievance Redress |

| AI |

Artificial Intelligence |

| APBS |

Aadhaar Payment Bridge System |

| ARC |

Asset Reconstruction Company |

| ATM |

Automated Teller Machine |

| BBPCU |

Bharat Bill Payment Central Unit |

| BBPOU |

Bharat Bill Payment Operating Unit |

| BBPS |

Bharat Bill Payment System |

| BC |

Business Correspondent |

| BCSBI |

Banking Codes and Standards Board of India |

| BO |

Banking Ombudsman |

| BOS |

Banking Ombudsman Scheme |

| BSBDA |

Basic Savings Bank Deposit Account |

| CC |

Contact Center |

| CDD |

Customer Due Diligence |

| CEPC |

Consumer Education and Protection Cell |

| CEPD |

Consumer Education and Protection Department |

| CIBIL |

Credit Information Bureau of India Limited |

| CIC |

Credit Information Company |

| CKYCR |

Central KYC Records Registry |

| CMS |

Complaint Management System |

| CNP |

Card Not Present |

| CPGRAMS |

Centralised Public Grievance Redress and Monitoring System |

| CRPC |

Centralised Receipt and Processing Center |

| CTS |

Cheque Truncation System |

| DC |

Debit Card |

| DG |

Deputy Governor |

| DLA |

Digital Lending Application |

| DO |

Dealing Official |

| DRBIO |

Deputy RBI Ombudsman |

| DSA |

Direct Selling Agent |

| ECS |

Electronic Clearing Service |

| EMI |

Equated Monthly Instalment |

| FB |

Foreign Bank |

| FIDD |

Financial Inclusion and Development Department |

| FPC |

Fair Practices Code |

| FRC |

First Resort Complaint |

| FSWM |

Financially Sound and Well Managed |

| GoI |

Government of India |

| HFC |

Housing Finance Company |

| IGR |

Internal Grievance Redress |

| IMPS |

Immediate Payment System |

| IO |

Internal Ombudsman |

| IRDAI |

Insurance Regulatory and Development Authority of India |

| IVRS |

Interactive Voice Response System |

| IWG |

Internal Working Group |

| KYC |

Know Your Customer |

| MITC |

Most Important Terms and Conditions |

| NACH |

National Automated Clearing House |

| NBFC |

Non-Banking Financial Company |

| NBFCO |

NBFC Ombudsman |

| NBPSP |

Non Bank Payment System Participant |

| NEFT |

National Electronic Funds Transfer |

| NETC |

National Electronic Toll Collection |

| NHB |

National Housing Bank |

| NPCI |

National Payments Corporation of India |

| OBO |

Office of Banking Ombudsman |

| ODR |

Online Dispute Resolution |

| ODT |

Ombudsman for Digital Transactions |

| ONBFCO |

Office of the NBFC Ombudsman |

| OODT |

Office of Ombudsman for Digital Transactions |

| ORBIO |

Office of Reserve Bank of India Ombudsman |

| OSDT |

Ombudsman Scheme for Digital Transactions |

| OSNBFC |

Ombudsman Scheme for NBFCs |

| PB |

Payment Bank |

| PD |

Primary Dealer |

| PIN |

Personal Identification Number |

| PMAY |

Pradhan Mantri Awas Yojana |

| PML |

Prevention of Money Laundering |

| PPI |

Prepaid Payment Instrument |

| PSO |

Payment System Operator |

| Pvt.SB |

Private Sector Bank |

| QR |

Quick Response |

| RBI |

Reserve Bank of India |

| RBIO |

Reserve Bank of India Ombudsman |

| RB-IOS |

Reserve Bank – Integrated Ombudsman Scheme |

| RCA |

Root Cause Analysis |

| RE |

Regulated Entity |

| RRB |

Regional Rural Bank |

| RTGS |

Real Time Gross Settlement |

| RTI |

Right to Information |

| SBI |

State Bank of India |

| SCB |

Scheduled Commercial Bank |

| SEBI |

Securities and Exchange Board of India |

| SFB |

Small Finance Bank |

| SMS |

Short Message Service |

| S-UCB |

Scheduled Urban Cooperative Bank |

| TAT |

Turn Around Time |

| TRAI |

Telecom Regulatory Authority of India |

| UCB |

Urban Cooperative Bank |

| UPI |

Unified Payments Interface |

| Y-o-Y |

Year-on-Year |

Foreword

Anil Kumar Sharma

Executive Director & Appellate Authority

The Annual Report of Ombudsman Schemes, 2021-22 marks an important juncture in the history of the Alternate Grievance Redress (AGR) framework of RBI. The year witnessed launch of Reserve Bank - Integrated Ombudsman Scheme (RB-IOS), 2021 which integrated the erstwhile three Ombudsman Schemes of RBI and brought the Non-Scheduled Urban Cooperative Banks with deposit size above ₹50 crore under its ambit. As an outcome of Centralization in the form of a CRPC, Automation of some processes in the form of initial processing by the CMS and Simplification in the form of removal of limited grounds of complaints and adoption of “deficiency in service” as a single broadbased ground for lodgement of complaints, the RB-IOS made the AGR efficient and faster. Setting up a Contact Centre for providing support in lodging complaints and providing information on the AGR has further added to the ease of lodging complaints.

It is satisfying to note that the Ombudsman mechanism achieved a disposal rate of 97.97%, despite this being a transition year and despite an increase in the receipt of complaints over the previous year. The year also witnessed scaling up of the awareness generation drive with “Ombudsman Speak” on the eve of World Consumer Rights Day in March 2022 and in September 2022. This was supplemented by a “Talkathon” with the media in August and “All India Intensive Awareness Campaign” run during the month of November 2022 in collaboration with the Regulated Entities.

This Annual Report is the first under the RB-IOS and thus, sets a new benchmark and creates a new legacy and I hope all stakeholders will find it useful.

Sd/-

(Anil Kumar Sharma)

EXECUTIVE SUMMARY

The year 2021-22 marked a major milestone for the Ombudsman mechanism of RBI as it witnessed the integration of the three erstwhile Ombudsman Schemes viz., Banking Ombudsman Scheme (BOS) 2006, Ombudsman Scheme for Non-Banking Financial Companies (OSNBFC) 2018, and Ombudsman Scheme for Digital Transactions (OSDT) 2019 into the Reserve Bank - Integrated Ombudsman Scheme (RB-IOS), 2021, that was launched by the Hon’ble Prime Minister on November 12, 2021. Along with its launch, the Centralised Receipt and Processing Center (CRPC) was also established at RBI, Chandigarh to receive complaints through email/physical mode from across the country and handle the initial scrutiny and processing of these complaints before assigning the maintainable ones to Offices of RBI Ombudsman (ORBIOs) for further redressal. The CRPC also hosts a Contact Center to assist complainants in lodging their complaints, providing them information regarding redressal mechanism at RBI and awareness messages related to safe banking practices in ten regional languages (Assamese, Bengali, Gujarati, Kannada, Oriya, Punjabi, Malayalam, Marathi, Tamil and Telugu) apart from Hindi and English.

A brief analysis of complaints handled under the three erstwhile Ombudsman Schemes (BOS, OSNBFC and OSDT) between April 1 and November 11, 2021 is as under:

a) BOS: The total number of complaints received by the 22 Offices of the Banking Ombudsman (OBOs) between April 1 and November 11, 2021 was 2,09,196. Around 90% of the total complaints were received through digital modes, including on the online Complaint Management System (CMS) portal, email, and Centralised Public Grievance Redress and Monitoring System (CPGRAMS). The North Zone, with eight of the 22 OBOs, received the highest volume (42.70%) of complaints, followed by the West and the South Zones. Share of complaints related to ATM/ Debit Cards, at 14.65% of the total, were the highest followed by complaints related to Mobile/ Electronic Banking at 13.64%. Majority (66.11%) of the maintainable complaints were resolved through mutual settlement/ conciliation/ mediation and a total of 17 Awards were issued under BOS. During the year 51 Appeals were received against the decisions of the Banking Ombudsmen (BOs) under BOS.

b) OSNBFC: The number of complaints received at the four Offices of NBFC Ombudsman (ONBFCO) between April 1 and November 11, 2021 was 20,439. Complaints relating to ‘Non-adherence of Fair Practices Code (FPC)’ were the highest, constituting 61.89% of the total, followed by complaints regarding ‘Non-observance of RBI directions’ and ‘Levy of Charges without prior notice’. Majority (70.08%) of the maintainable complaints were resolved through mutual settlement/ conciliation/ mediation and 12 Awards were issued under OSNBFC. During the year 10 Appeals were filed with Appellate Authority against the decisions of the NBFC Ombudsmen (NBFCOs).

c) OSDT: The number of complaints received by the 22 Offices of Ombudsman for Digital Transactions (OODTs) between April 1 and November 11, 2021 was 2,281. Complaints relating to fund transfers/ UPI/ BBPS/ Bharat QR Code constituted the largest share of complaints i.e., 44.76%. Majority (59.65%) of maintainable complaints were resolved through mutual agreement/ conciliation /mediation process. No Appeal was received under OSDT between April 1 and November 11, 2021. The rate of disposal under the three erstwhile Ombudsman Schemes stood at 100%, as all complaints brought forward and received between April 1 and November 11, 2021 were disposed by March 31, 2022.

d) RB-IOS, 2021: Under the RB-IOS, 2021, following the ‘One Nation, One Ombudsman’ principle, the territorial jurisdictions for the ORBIOs have been abrogated, and complaints are assigned to all the ORBIOs by the CMS. Grounds of complaint covered under the RB-IOS have also been expanded to cover all complaints involving “deficiency of service”, which has been defined under the scheme. The CMS was upgraded to align with the requirements under RB-IOS, 2021 to improve its overall efficiency. The coverage of RB-IOS was extended to include the non-scheduled Urban Cooperative Banks (UCBs) with a deposit size of ₹50 crore or above as at the end of previous Financial Year. Credit Information Companies (CICs) were brought under RBI-IOS with effect from September 1, 2022.

Between November 12 and March 31, 2022, a total of 1,86,268 complaints were received under the RB-IOS. The CRPC handled the preliminary scrutiny of the complaints received through email/ physical mode (i.e. 1,49,419 complaints) and closed 1,07,821 complaints as non-complaints/ non-maintainable complaints during the period. A total of 72,580 complaints were assigned to the ORBIOs from the CMS portal directly or through CRPC for redress during this period. A total of 31 Appeals were received against the decisions of ORBIOs and all such Appeals were filed by the complainants. Four Awards were issued by the ORBIOs during the period.

Under the erstwhile three Schemes and the RB-IOS, during the period April 1, 2021 to March 31, 2022, total number of complaints received at the ORBIOs and the CRPC, stood at 4,18,184, showing an increase of 9.39% over last year. Of these, 3,04,496 complaints were handled by the 22 ORBIOs. The overall disposal rate for the year at the ORBIOs stood at 97.97%. A total of 33 Awards were issued by the ORBIOs and 92 Appeals were received against the decisions of the RBI Ombudsmen (RBIOs) during the year.

Other Developments during the year

Apart from the launch of the RB-IOS, 2021 along with the setting up of the CRPC and Contact Center, several steps were undertaken to strengthen grievance redress system:

-

A Nationwide Customer Satisfaction Survey to assess the satisfaction level of the complainants who had approached the RBIOs for redress of their grievances was undertaken through a third-party agency, which indicated the overall satisfaction level of the complainants at 59.55%.

-

The annual Root Cause Analysis for the year 2022 was conducted and necessary action initiated based on the causes identified.

-

All medium-term strategic milestones (11) identified for CEPD in terms of Utkarsh 2022 were completed.

-

The ambit of RB-IOS, 2021 was extended to Credit Information Companies (CICs) with effect from September 1, 2022.

-

The RBIOs conducted 29 town-hall events and 175 awareness programmes during the year. These events were focused on avenues of grievance redress and consumer protection issues.

-

Nationwide Awareness Campaign was launched on the World Consumer Rights Day on March 15, 2022, to strengthen the on-going financial awareness and education by the department and Ombudsman Offices. Two phases of the programme have been completed so far.

Way forward

During the period April 1, 2022 to March 31, 2023, CEPD will work towards the following action plans:

-

Review of the guidelines on under “Strengthening of grievance redress framework for banks” issued in January 2021.

-

Extension of the RB-IOS, 2021 to more REs that are not covered presently under the Scheme.

-

Extension of Internal Ombudsman (IO) Scheme for Credit Information Companies (CICs) and Housing Finance Companies (HFCs).

-

Further initiatives under the nationwide awareness campaign to reach the remote and untouched regions and hitherto excluded segments of population.

-

Further enhance the efficiency & ease of usage of CMS.

-

Upgrade the Contact Centre and cater for Business Continuity and Disaster Recovery requirements.

Appropriate regulatory initiatives regarding financial consumer protection will be further enhanced to identify issues to address and improve the grievance redress mechanism of REs as well as the RBI, and measures for implementation of the framework for financial education shall be enhanced.

Chapter 1:

The Ombudsman Schemes of RBI: Activities during April 1, 2021 to March 31, 2022

|

The three erstwhile Ombudsman Schemes of RBI for banks, Non-Banking Financial Companies (NBFCs) and Non-Bank Payment System Participants (NBPSPs) were integrated into the ‘Reserve Bank – Integrated Ombudsman Scheme (RB-IOS), 2021 with effect from November 12, 2021. This Chapter presents the activities under the erstwhile Schemes as well as RB-IOS, 2021 in an integrated form for the year 2021-22. The launch of RB-IOS, 2021 was accompanied by setting-up of the Centralized Receipt and Processing Center (CRPC) along with a Contact Centre, at the Chandigarh Regional Office of RBI. The CRPC handles preliminary scrutiny and processing of all email and physical complaints received under RBI’s Alternate Grievance Redress (AGR) mechanism and converts them into complaints in the Complaint Management System (CMS) portal. The CRPC also weeds out certain non-maintainable complaints and assigns through CMS the maintainable complaints to the 22 Offices of RBI Ombudsman (ORBIOs) for redressal/adjudication under RB-IOS, 2021. The Contact Center, hosted at CRPC, assists/ guides the customers of the Regulated Entities (REs) to lodge their complaints with the RBI Ombudsman, check the status of already lodged complaints and provides them information related to the AGR mechanism of RBI, safe banking practices etc. Consumer Education and Protection Cells (CEPCs) functioning from 30 Regional Offices (ROs) of RBI handle those complaints against REs that are yet to be covered under RB-IOS, 2021.

The total number of complaints received by RB-IOS and CEPCs during April 1, 2021 to March 31, 2022 stood at 4,18,184 as against 3,82,292 complaints during the same period in 2020-21, marking an annual growth of 9.39%. Of these, 3,04,496 complaints were handled by the 22 Offices of RBI Ombudsman (ORBIOs), including the complaints received under the three erstwhile Ombudsman Schemes till November 11, 2021. During the period, 1,07,821 complaints were disposed of the 1,13,688 complaints received at the CRPC since its creation, viz., November 12, 2021.

Complaints relating to the digital modes of payment and transactions were the highest in number, constituting 42.12% of the total complaints received during the year. The rate of disposal of complaints by RBIOs improved to 97.97% in 2021-22 from 96.59% in 2020-21. Majority (63.63%) of the maintainable complaints were resolved through mutual settlement /conciliation /mediation. Thirty-three (33) Awards were issued against REs by the RBI Ombudsmen (RBIOs) during the year. Ninety-two (92) Appeals were received against the decisions of the RBIOs in 2021-22, of which 31 were received under the RB-IOS, 2021.

|

1.1 The Banking Ombudsman Scheme (BOS) was launched as an AGR mechanism with a view, inter-alia, to promote expeditious, cost free and efficient redressal of customer complaints that had not been satisfactorily redressed by the banks. The Scheme was last amended in 2017 to align it with the changes in the banking landscape. Due to the growing significance of NBFCs in the financial system and rising share of NBPSPs, the Ombudsman Scheme for the NBFCs (OSNBFCs) was launched in 2018 and the Ombudsman Scheme for Digital Transactions (OSDT) was launched in 2019.

1.2 The three erstwhile schemes had limited, specified and varying grounds of complaints which acted as a limiting factor and led to uneven redress across the customers of different REs. Hence, based on the recommendations of an internal Working Group, the three Ombudsman Schemes were integrated into RB-IOS, 2021. Based on the principle of ‘One nation, One Ombudsman’, the jurisdictions of the Ombudsmen offices were done away to ensure equal distribution of complaints across all 22 offices. The grounds of complaints were broad based to include all complaints involving “deficiency in service”. The Scheme was launched by the Hon’ble Prime Minister on November 12, 2021. With a view to provide one address and one email ID for lodging physical and email complaints from anywhere in the country, a CRPC was established at RBI, Chandigarh, along with a Contact Center available at a toll-free number (14448) to provide guidance on lodging complaints and information on complaints and AGR mechanism to the complainants in Hindi, English and 10 regional languages1 available during 9:30 AM to 5:15 PM on weekdays (except banking holidays) and through Interactive Voice Response System (IVRS) on 24x7 basis.

Receipt of complaints

1.3 The details relating to the total number of complaints received under the erstwhile Ombudsman Schemes (BOS, OSNBFC and OSDT) during the past three years and the RB-IOS, 2021 are provided in Table 1.1.

| Table 1.1: Total receipt of complaints under the Ombudsman Schemes during past three years |

| Scheme |

2019-20

(Jul-Jun) |

2020-21

(Apr-Mar) |

2021-22

(Apr-Mar) |

| |

Number |

Share (%) |

Number |

Share (%) |

Number |

Share(%) |

| BOS |

3,08,630 |

93.37 |

3,41,747 |

89.39 |

2,09,196 |

50.02 |

| OSNBFC |

19,432 |

5.88 |

36,951 |

9.67 |

20,439 |

4.89 |

| ODT |

2,481 |

0.75 |

3,594 |

0.94 |

2,281 |

0.54 |

| RB-IOS2 |

- |

|

- |

|

72,580 |

17.35 |

| Sub Total |

3,30,543 |

100.00 |

3,82,292 |

100.00 |

3,04,496 |

72.81 |

| CRPC3 |

- |

- |

- |

- |

1,13,6884 |

27.19 |

| Total |

3,30,543 |

100.00 |

3,82,292 |

100.00 |

4,18,184 |

100.00 |

| % Change |

64.97 |

|

15.7 |

|

9.39 |

|

ORBIO-wise receipt (prior to November 12, 2021) and allocation (November 12, 2021 onwards) of complaints

1.4 ORBIO wise receipt/ allocation of complaints under the Ombudsman Schemes during the past three years is given in Table 1.2:

| Table 1.2: Office wise receipt of complaints under Ombudsman Schemes for past three years |

| ORBIO |

2019-20

(Jul – Jun) |

2020-21

(Apr – Mar) |

2021-22

(Apr – Mar) |

BOS |

OSDT |

OSNBFC |

RB-IOS |

| Volume |

Share |

2021-22 |

| Ahmedabad |

16,082 |

21,078 |

16,426 |

5.39% |

12,634 |

94 |

|

3,698 |

| Bengaluru |

18,697 |

17,407 |

13,996 |

4.60% |

10,356 |

189 |

|

3,451 |

| Bhopal |

14,677 |

15,787 |

12,841 |

4.22% |

9,562 |

138 |

|

3,141 |

| Bhubaneswar |

5,386 |

6,920 |

7,806 |

2.56% |

4,585 |

94 |

|

3,127 |

| Chandigarh |

31,702 |

36,619 |

20,270 |

6.66% |

17,038 |

73 |

|

3,159 |

| Chennai |

21,157 |

27,446 |

21,396 |

7.03% |

13,137 |

116 |

4,415 |

3,728 |

| Dehradun |

7,913 |

7,970 |

8,342 |

2.74% |

5,470 |

28 |

|

2,844 |

| Guwahati |

3,661 |

3,543 |

5,444 |

1.79% |

2,425 |

27 |

|

2,992 |

| Hyderabad |

20,143 |

22,161 |

15,212 |

5.00% |

11,404 |

204 |

|

3,604 |

| Jaipur |

18,285 |

22,094 |

18,145 |

5.96% |

14,794 |

129 |

|

3,222 |

| Jammu |

1,538 |

1,767 |

4,300 |

1.41% |

1,331 |

25 |

|

2,944 |

| Kanpur |

24,026 |

26,499 |

24,214 |

7.95% |

20,872 |

115 |

|

3,227 |

| Kolkata |

13,146 |

17,160 |

14,766 |

4.85% |

9,192 |

201 |

1,870 |

3,503 |

| Mumbai I |

19,649 |

22,479 |

18,806 |

6.18% |

15,035 |

186 |

|

3,585 |

| Mumbai II |

26,155 |

30,999 |

20,672 |

6.79% |

11,261 |

182 |

5,526 |

3,703 |

| New Delhi I |

18,289 |

23,238 |

15,310 |

5.03% |

11,836 |

137 |

|

3,337 |

| New Delhi II |

27,829 |

34,673 |

24,259 |

7.97% |

12,377 |

106 |

8,628 |

3,148 |

| New Delhi III |

9,644 |

11,091 |

8,883 |

2.92% |

5,606 |

42 |

|

3,235 |

| Patna |

17,514 |

17,456 |

13,606 |

4.47% |

10,369 |

130 |

|

3,107 |

| Raipur |

3,705 |

4,018 |

5,362 |

1.76% |

2,217 |

26 |

|

3,119 |

| Ranchi |

4,622 |

4,765 |

6,307 |

2.07% |

3,189 |

29 |

|

3,089 |

| Thiruvananthapuram |

6,723 |

7,122 |

8,133 |

2.67% |

4,506 |

10 |

|

3,617 |

| Total |

3,30,543 |

3,82,292 |

3,04,496 |

100.00% |

2,09,196 |

2,281 |

20,439 |

72,580 |

1.6 As mentioned in para 1.2 above, the structural changes in the Ombudsman framework under RB-IOS 2021, particularly the setting up of CRPC for handling email and physical complaints and initial assessment on maintainability of complaints in CMS. have brought down the number of complaints handled by ORBIOs during 2021-22. During this period, the highest volume of complaints under the erstwhile Schemes were handled by ORBIO - New Delhi II at 7.97% of the total, followed by Kanpur and Chennai, while ORBIOs - Jammu, Raipur and Guwahati received the lowest volumes of complaints.

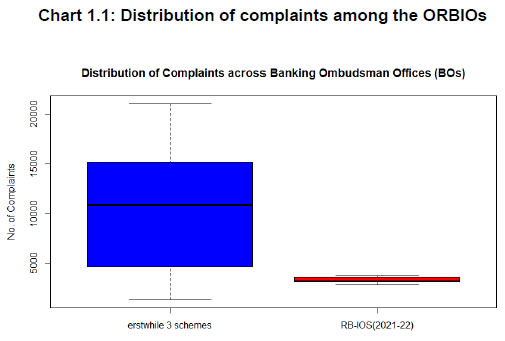

1.7 Post launch of RB-IOS, 2021, based on the ‘One Nation, One Ombudsman’ approach, the divergence in the number of complaints handled at different ORBIOs has been minimized and are primarily on account of physical complaints in regional languages and variation in the size of the office, as complaints are since assigned to ORBIOs according to a pre-defined algorithm embedded in CMS. The same can be observed in the Table 1.2 above and the Chart 1.15 given below:

Geographic dispersion of complaints across the states

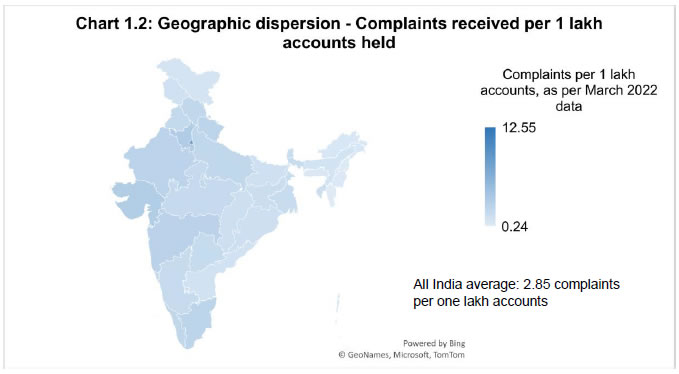

1.8 An analysis on the geographic dispersion of complaints received under the Ombudsman Schemes/ RB-IOS during the year across the states in the country, in proportion to the total number of accounts held (deposit and credit) by Scheduled Commercial Banks in the respective states is depicted in the map (Chart 1.2) given subsequently. The figure presented is based on complaints received per 1 lakh accounts held in the respective States/ Union Territories (UTs), as on March 31, 2022.

1.9 Major observations on geographical distribution of complaints are as follows:

-

NCT of Delhi, Chandigarh, Haryana, Gujarat, and Maharashtra were the top five states/UTs to contribute to Ombudsman complaints, while Arunachal Pradesh, Meghalaya, Manipur, Nagaland, and Mizoram were the lowest contributors.

-

The trends representing top five state/UTs could be attributed to higher awareness levels, better availability and higher usage of financial services, physical and broadband connectivity, etc. as compared to the other regions.

-

Awareness about avenues of redress tends to be higher in metro/urban areas as per the Satisfaction Survey conducted in 2021.

Modes of receipt of complaints

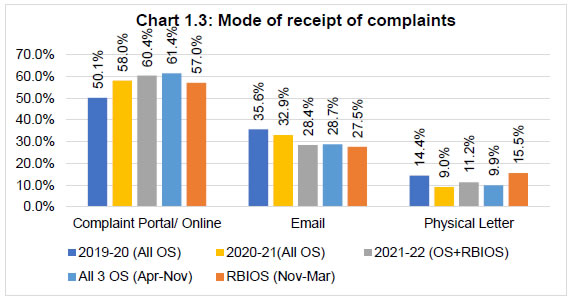

1.10 Complaints can be received online (through CMS portal/ CPGRAMS), through email or as physical complaints, with the CMS portal mode being the most efficient mode of complaint registration. The break-up on complaints received through the different modes of receipt in the past three years is given below (Chart 1.3).

1.11 It is observed that the CMS portal retains the highest share of complaints received/ assigned to ORBIOs. However, physical complaints have witnessed an uptick in the current year compared to the previous year, especially post launch of the RB-IOS, 2021. This could be ascribed to the convenience arising from a single address to send the physical complaints from anywhere in the country under the “One Nation One Ombudsman” approach adopted under RB-IOS. This data excludes email and physical complaints closed at CRPC which is detailed in para 1.6 of this report.

Category-wise receipt of complaints

1.12 Complaints against banks formed the largest portion, accounting for 88.04% of complaints received by the ORBIOs. The top 5 categories of complaints against each entity type are represented in Table 1.3 below. The complete list of ground wise receipt of complaints is given in the Appendix 1.1.

| Table 1.3: Entity type wise top five category of complaint receipt at ORBIOs |

| Nature of Complaints |

2019-20

(Jul-Jun) |

2020-21

(Apr-Mar) |

2021-22

(Apr-Mar) |

| Complaints against banks |

| ATM / Debit Cards |

67,800 |

60,203 |

41,375 |

| |

21.97% |

17.62% |

15.43% |

| Mobile / electronic banking |

41,310 |

44,385 |

39,388 |

| |

13.38% |

12.99% |

14.69% |

| Credit Cards |

28,713 |

40,721 |

32,162 |

| |

9.30% |

11.92% |

12.00% |

| Loans and advances |

16,437 |

20,218 |

24,507 |

| |

5.33% |

5.92% |

9.14% |

| Non-observance of Fair Practices Code (FPC) |

36,215 |

33,898 |

24,446 |

| |

11.73% |

9.92% |

9.12% |

| Others |

118,155 |

142,322 |

106,207 |

| |

38.28% |

41.65% |

39.62% |

| Total (Banks) |

3,08,630 |

3,41,747 |

2,68,085 |

| % Banks to Total complaints |

93.37% |

89.39% |

88.04% |

| Complaints against NBFCs |

| Loans & Advances related / Non-adherence to FPC |

7,052 |

17,915 |

18,729 |

| |

36.29% |

48.48% |

56.22% |

| Non-observance of RBI directions |

3,607 |

6,114 |

1,881 |

| |

18.56% |

16.55% |

5.65% |

| Levy of charges without prior notice |

1,628 |

3,189 |

1,751 |

| |

8.38% |

8.63% |

5.26% |

| Non-transparency in contract/ loan |

1,704 |

1,833 |

512 |

| |

8.77% |

4.96% |

1.54% |

| Delay in repayment of deposits |

395 |

536 |

319 |

| |

2.03% |

1.45% |

0.96% |

| Others |

5,046 |

7,364 |

10,122 |

| |

25.97% |

19.93% |

30.38% |

| Total (NBFCs) |

19,432 |

36,951 |

33,314 |

| % NBFCs to Total complaints |

5.88% |

9.67% |

10.94% |

| Complaints against NBPSPs |

| Mobile/Electronic Fund Transfers / Mobile/Electronic Banking |

598 |

824 |

1,209 |

| |

24.10% |

22.93% |

39.04% |

| Fund Transfers/ UPI/ BBPS/ Bharat QR Code |

1,089 |

1,775 |

951 |

| |

43.89% |

49.39% |

30.71% |

| Prepaid Payment Instruments (PPI) |

198 |

253 |

218 |

| |

7.98% |

7.04% |

7.04% |

| Non-reversal of Funds due to Wrong Beneficiary Transfer by System Participant |

218 |

291 |

186 |

| |

8.79% |

8.10% |

6.01% |

| Violation of RBI Directives in relation to Fees/Charges |

58 |

100 |

61 |

| |

2.34% |

2.78% |

1.97% |

| Others |

320 |

351 |

472 |

| |

12.90% |

9.77% |

15.24% |

| Total (NBPSPs) |

2,481 |

3,594 |

3,097 |

| % NBPSPs to Total complaints |

0.75% |

0.94% |

1.02% |

| |

|

|

|

| Grand Total |

3,30,543 |

3,82,292 |

3,04,496* |

| * Apart from the figures given in the above table, 1,13,688 complaints were closed at CRPC during 2021-22 under RB-IOS. |

1.13 Major observations are as under:

-

Complaints relating to ATM/ Debit Cards have witnessed a decline over the past three years; Share of complaints related to mobile banking/ electronic banking has seen a slight increase.

-

Share of complaints in respect of Loans and Advances has increased, mainly due to complaints against FPC being classified under ‘Loans and Advances’ since the launch of RB-IOS, 2021. This justifies the decline in FPC complaints.

-

Post dissolution of Banking Codes and Standards Board of India (BCSBI) and the launch of RB-IOS, complaints against BCSBI codes have also been diverted to other categories, including ‘Loans and Advances’.

-

Loans and Advances contribute to majority of complaints against NBFCs, followed by non-adherence to FPC, which is also indirectly related to Loans and Advances.

1.14 In addition to the above, marginal movement in a few categories is due to recategorization of ’Grounds’ of complaints in CMS post the launch of RB-IOS. Increase in share of complaints under “Loans and Advances” is contributed by diversion of certain complaints from the ‘BCSBI codes’.

Population group-wise distribution of complaints

1.15 The population group wise receipt of complaints under the Ombudsman Schemes for the past three years is given in the Chart 1.4. Majority of complaints are received from metropolitan regions, followed by Urban and Semi-urban. After launch of RB-IOS with effect from November 12, 2021 there is a decline in complaints received from rural, semi-urban and metropolitan areas, while a substantive spurt in the complaints received from urban areas.

Complainant-type wise receipt of complaints

1.16 The complainant type wise receipt of complaint under the Ombudsman Schemes during the past three years is given in the Table 1.4 below:

| Table 1.4: Complainant type wise receipt of complaints under the Ombudsman Schemes |

| Complainant Type |

2019-20

(Jul-Jun) |

2020-21

(Apr-Mar) |

2021-22

(Apr-Mar) |

| Individual |

2,73,432 |

3,05,093 |

2,43,244 |

| 82.72% |

79.81% |

79.88% |

| Individual – Business |

10,831 |

13,614 |

10,400 |

| 3.28% |

3.56% |

3.42% |

| Proprietorship/ Partnership |

5,583 |

7,505 |

6,712 |

| 1.69% |

1.96% |

2.20% |

| Limited Company |

6,917 |

8,381 |

7,427 |

| 2.09% |

2.19% |

2.44% |

| Trust |

559 |

665 |

613 |

| 0.17% |

0.17% |

0.20% |

| Association |

446 |

372 |

427 |

| 0.13% |

0.10% |

0.14% |

| Government Department |

5,180 |

6,447 |

4,993 |

| 1.57% |

1.69% |

1.64% |

| PSU |

1,297 |

1,475 |

1,799 |

| 0.39% |

0.39% |

0.59% |

| Senior Citizen |

8,237 |

10,061 |

9,244 |

| 2.49% |

2.63% |

3.04% |

| Others |

18,061 |

28,679 |

19,637 |

| 5.46% |

7.50% |

6.45% |

| Total |

3,30,543 |

3,82,292 |

3,04,496* |

| * Apart from the figures given in the above table, 1,13,688 complaints were closed at CRPC during 2021-22 under RB-IOS. |

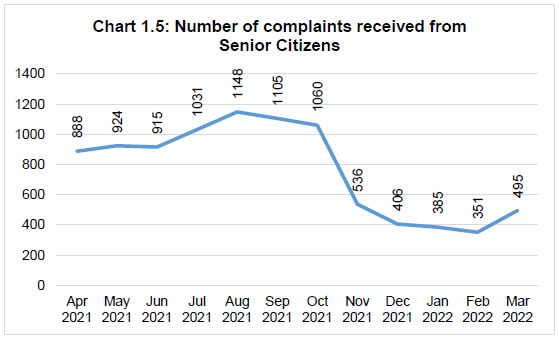

1.17 It is seen that individuals constitute close to 80% of complainants. However, complaints from Senior Citizens have risen in percentage terms, even though number of these complaints has come down during 2021-22. It is also observed, as depicted in Chart 1.5, that the complaints received from senior citizens went up during the first six months of the Financial Year and declined appreciably in the later months.

Entity-type wise receipt of complaints

1.18 Entity-type wise receipt of complaints for the past three years under the Ombudsman Schemes is presented in Table 1.5.

| Table 1.5: Entity-type wise receipt of complaints at the ORBIOs |

| |

Overall |

All 3 OS |

RBIOS |

Percentage Change |

| Entity Group |

2019-20 |

2020-21

(Apr-Mar) |

2021-22

(Apr-Mar) |

2021-22 |

2021-22 |

(Y-o-Y) |

| (Jul-Jun) |

| Public Sector Banks |

1,84,087 |

1,74,974 |

1,54,725# |

1,19,143 |

35,582 |

-11.57% |

| 55.69% |

45.77% |

50.81% |

51.37% |

49.02% |

| Private Sector Banks |

98,623 |

1,26,303 |

94,275 |

72,703 |

21,572 |

-25.36% |

| 29.84% |

33.04% |

30.96% |

31.35% |

29.72% |

| Payments and Small Finance Banks |

5,227 |

6,918 |

8,076 |

6,100 |

1,976 |

16.74% |

| 1.58% |

1.81% |

2.65% |

2.63% |

2.72% |

| Foreign Banks |

5,935 |

6,157 |

4,464 |

3,188 |

1,276 |

-27.50% |

| 1.80% |

1.61% |

1.47% |

1.37% |

1.76% |

| RRBs/ Urban Co-op. Banks |

6,060 |

6,382 |

6,508 |

4,292 |

2,216 |

1.97% |

| 1.83% |

1.67% |

2.14% |

1.85% |

3.05% |

| NBFC |

15,285 |

31,158 |

22,317 |

18,084 |

4,233 |

-28.37% |

| 4.62% |

8.15% |

7.33% |

7.80% |

5.83% |

| PPI/BBPOU |

2,172 |

3,168 |

3,040 |

2,064 |

976 |

-4.04% |

| 0.66% |

0.83% |

1.00% |

0.89% |

1.34% |

| Others |

13,154 |

27,232 |

11,091 |

6,342 |

4,749 |

-59.27% |

| 3.98% |

7.12% |

3.64% |

2.73% |

6.54% |

| Total |

3,30,543 |

3,82,292 |

3,04,496* |

2,31,916 |

72,580 |

-20.35% |

#Includes complaints received against SBI Cards which was included under BOS until the launch of RB-IOS.

* Apart from the figures given in the above table, 1,13,688 complaints were closed at CRPC during 2021-22 under RB-IOS. |

1.19 After the launch of RB-IOS, only maintainable complaints are assigned to ORBIOs post initial screening of non-maintainable/ non-complaints at the CRPC. Hence, the complaints closed at the CRPC do not get accounted for as complaints under ORBIOs as per the RB-IOS, 2021. However, the erstwhile Schemes account for all complaints/ references received at the ORBIOs. Hence, the data for 2021-22 is not comparable with previous years.

Disposal of complaints

1.20 The data on disposal of complaints under the Ombudsman Schemes during the past three years, along with their age wise pendency position at the end of the year is given in Table 1.6.

| Table 1.6: Disposal and pendency position at the ORBIOs during the past three years |

| Number of Complaints |

2019-20

(Jul - Jun) |

2020-21

(Jul - Mar) |

2021-22

(Apr - Mar) |

| Received during the year (All OS + RBIOS) |

3,30,543 |

3,03,107 |

3,04,496* |

| Brought forward from previous year |

12,158 |

25,636 |

11,429 |

| Complaints received by email before the start of the year but registered on or after start of the year; including complaints transferred from Consumer Education and Protection Cells on or after the start of the year |

- |

6,302 |

1,589 |

| Handled during the year |

3,42,701 |

3,35,045 |

3,17,514 |

| Disposed during the year |

3,17,065 |

3,23,616 |

3,11,067 |

| Rate of Disposal (%) |

92.52% |

96.59% |

97.97% |

| Carried forward to the next year |

25,636 |

11,429 |

6,447 |

| Complaints pending for less than one month (30 days) |

6,497 |

7,220 |

5,622 |

| 1.90% |

2.15% |

1.77% |

| Complaints pending for one to two months |

3,430 |

2,232 |

582 |

| 1.00% |

0.67% |

0.18% |

| Complaints pending for two to three months |

1,916 |

948 |

86 |

| 0.56% |

0.28% |

0.03% |

| Complaints pending for more than three months |

13,793 |

1,029 |

157 |

| 4.02% |

0.31% |

0.05% |

| * Apart from the figures given in the above table, 1,13,688 complaints were closed at CRPC during 2021-22 under RB-IOS. |

1.21 Observations from the table are that

-

Disposal rate has improved Y-o-Y over the past three years.

-

Pendency of 6,447 complaints with 157 outstanding for more than 3 months was lowest in last three years.

All complaints pertaining to the years 2019-20, 2020-21 and 2021-22 stand disposed.

Mode of disposal of Maintainable complaints

1.22 Under the Ombudsman Schemes, the majority of complaints are settled through conciliation and mediation efforts by the RBIOs. The mode of disposal of maintainable complaints during the past three years under the Ombudsman Schemes is given in Table 1.7.

| Table 1.7: Mode of disposal of maintainable complaints under the Ombudsman Schemes |

| Disposal of maintainable complaints |

2019-20

(Jul – Jun) |

2020-21

(Jul – Mar) |

2021-22

(Apr – Mar) |

| By Mutual Settlement/ Agreement |

1,30,413 |

1,34,504 |

1,11,820 |

| |

72.21% |

72.67% |

63.63% |

| Disposal by Award |

68 |

65 |

33 |

| |

0.04% |

0.04% |

0.02% |

| Maintainable Complaints Rejected |

49,930 |

50,326 |

62,936 |

| |

27.65% |

27.19% |

35.81% |

| Maintainable Complaints Withdrawn |

182 |

197 |

952 |

| |

0.10% |

0.11% |

0.54% |

| Total |

1,80,593 |

1,85,092 |

1,75,741 |

Reasons for closure of complaints under non-maintainable clauses

1.23 A total of 1,35,326 (42.62%) of the total handled complaints at ORBIOs were closed as non-maintainable during the year, due to reasons as mentioned in the Ombudsman Scheme. The Chart 1.6 below provides the major reasons for rejection of complaints as non-maintainable.

Receipt of Appeals

1.24 Any complainant/ RE aggrieved by the decision of RBI Ombudsman can appeal before the Appellate Authority (AA) under the scheme/(s), if the complaint is closed under any of the appealable clauses as per the Scheme/(s). While the appellate mechanism under RB-IOS, 2021 remains largely unchanged, cases involving awards passed by the Ombudsmen on REs due to non-submission of requisite information/ documents by the RE, has been made non-appealable by the REs under the RB-IOS, 2021 to ensure more discipline on part of the REs. Further, the Executive Director (ED) in-charge of CEPD has been designated as the Appellate Authority under RB-IOS, 2021 for the complaints receive under RB-IOS. The receipt of appeals under the Ombudsman Schemes during the past three years is given in the Table 1.8.

| Table 1.8: Receipt and disposal of Appeals under the Ombudsman Schemes for past three years |

| Particulars |

2019-20

(Jul-Jun) |

2020-21

(Jul-Mar) |

2021-22

(Apr-Mar) |

Break up of 2021-22 |

| |

OVERALL |

BOS |

NBFC |

ODT |

RB-IOS |

| Appeals pending at the beginning of the year |

73 |

48 |

45 |

44 |

1 |

0 |

0 |

| Appeals received during the year from complainants |

35 |

14 |

80 |

45 |

4 |

0 |

31 |

| Appeals received during the year from REs |

29 |

10 |

12 |

6 |

6 |

0 |

0 |

| Total appeals handled during the year |

137 |

72 |

137 |

95 |

11 |

0 |

31 |

| Appeal disposed during the year |

89 |

27 |

75 |

70 |

3 |

0 |

2 |

| Pending at the end of the year |

48 |

45 |

62 |

25* |

8* |

0 |

29* |

| Mode of Disposal |

| Appeals remanded to the RBIO |

4 |

2 |

1 |

1 |

0 |

0 |

0 |

| Appeals withdrawn / settled / infructuous |

14 |

5 |

14 |

11 |

1 |

0 |

2 |

| Appeals rejected |

44 |

10 |

33 |

32 |

1 |

0 |

0 |

| Appeals allowed |

27 |

10 |

27 |

26 |

1 |

0 |

0 |

| Appeals Disposed |

| i. In favour of complainant appellant |

30 |

11 |

20 |

19 |

1 |

0 |

0 |

| ii. In favour of REs |

21 |

5 |

22 |

21 |

1 |

0 |

0 |

| iii. Neither in favour of complainant appellant nor in favour of REs (Remanded back to BO / infructuous) |

38 |

11 |

33 |

30 |

1 |

0 |

2 |

| * All 25 BOS and 8 OSNBFC appeals pending as on March 31, 2022, have since been disposed. Of the 29 RB-IOS appeals pending up to March 31, 2022, 20 have since been disposed. |

1.25 The office wise receipt of Appeals under the erstwhile Ombudsman Schemes and RB-IOS during 2021-22 is given in the Appendix 1.2.

Cost of handling a complaint

1.26 During the year 2021-22, the average cost of handling a complaint at the ORBIOs stood at ₹2,895 per complaint, as compared to ₹1,599 per complaint in 2020-21. The increase in cost is primarily due to increase in staff due to the launch of the RB-IOS, setting up of CRPC revamp of CMS and due to the wage revision of RBI employees during the year. The office-wise cost of handling complaints has been provided at Appendix 1.3.

Turn Around Time (TAT) for disposal of complaints

1.27 One of the major factors impacting the level of satisfaction among the complainants is the time taken for redressal of their grievance. Based on the recommendations of the ‘Internal Working Group to review the Ombudsman Schemes’, to improve the TAT of complaints to 30 days in a phased manner, focussed efforts continue to be made in this direction.

1.28 It can be observed from the Chart 1.7 that TAT of complaint redress at ORBIOs has been improving continuously for the past three years. The TAT is expected to improve further with better systems in place streamlining of CRPC and the Contact Centre.

1.29 Further, the dispersion of TAT across complaints has also reduced significantly in the RB-IOS, 2021 as compared to the erstwhile Schemes. Under the old schemes, a total of 2.45 lakh complaints were disposed during 2021-22 with TAT of 46 Days, whereas under RB-IOS, around 66 thousand complaints were disposed with TAT of 38 Days. Granular data is shown using boxplot to reflect the dispersion in TAT in the Chart 1.86 below, indicating lesser dispersion under the new Scheme.

Bank-group wise complaint conversion rate

1.30 Several measures have been taken by RBI to propel the REs to redress complaints effectively and efficiently under their internal grievance redress system and to minimise the need for escalation thereof to the alternate redressal forums, including the RB-IOS. The steps include establishment of IO mechanism in banks to review the partly/ wholly rejected complaints, the issuance of guidelines on Strengthening of grievance redress mechanism in RBI in January 2021, which put in place a system for recovery of the cost of handling complaints under RB-IOS from the outlier banks, and the setting up of the CRPC along with the auto filtering of non-maintainable complaints in the upgraded CMS portal of RBI.

1.31 The complaint conversion rate represents the proportion of complaints received against the concerned bank group at the ORBIOs during the years ended 2021 and 2022, as compared to total volume of complaints received at the banks’ end from their customers. As seen from the Chart 1.9 given below, all bank groups have significantly improved on the conversion rates except Small Finance Banks.

Chapter 2:

Banking Ombudsman Scheme (BOS) 2006, as amended upto July 01, 2017: Activities during April 1, 2021 to November 11, 2021

|

Since BOS 2006 was integrated into the RB-IOS, 2021 with effect from November 12, 2021, this chapter presents the activities pertaining to BOS during the period April 1, 2021 to November 11, 2021. The number of complaints received by the 22 Offices of the Banking Ombudsman (OBOs) during April 1, 2021, to November 11, 2021 was 2,09,196. The rate of disposal of complaints stood at 100% during this period, as all complaints pertaining to the erstwhile Ombudsman Schemes were disposed as on March 31, 2022. Complaints pertaining to ATM/ Debit Cards constituted the largest share at 14.65%. Around 66.11% of maintainable complaints were resolved through mutual agreement/ conciliation /mediation. The share of complaints received under BOS lodged through digital modes, including the 24x7 online CMS portal, emails and CPGRAMS stood at 89.65%. During the year, 17 Awards were passed under the BOS. 51 Appeals were received against the decisions of the Banking Ombudsmen.

|

Receipt of complaints

2.1 The BOS, 2006 was administered through 22 Offices of the Banking Ombudsman (OBOs) spread across the country and covering their respective territorial jurisdictions. During April 1, 2021 to November 11, 2021, a total of 2,09,196 complaints were received at the OBOs after which the BOS was integrated into the RB-IOS, 2021 with effect from November 12, 2021. The year-wise number of complaints received at OBOs in last three years is given in Table 2.1

| Table 2.1 – Number of complaints received by OBOs |

| |

2019-20

(Jul-Jun) |

2020-21

(Apr-Mar) |

2021-22

(Apr 1, 2021 - Nov 11, 2021)* |

| Complaints received during the year |

3,08,630 |

3,41,747 |

2,09,196 |

| *BOS 2006 was integrated into the RB-IOS 2021, with effect from November 12, 2021. |

2.2 The position of customer complaints handled by OBOs during the year till the launch of RB-IOS, 2021 in November 2021 is tabulated in Table 2.2, along with age-wise pendency position.

| Table 2.2 - Position of customer complaints handled by OBOs |

| Particulars |

2019-20

(Jul – Jun) |

2020-21

(Jul - Mar) |

2021-22

(Apr 1, 2021 - Nov 11, 2021) |

| Brought forward from previous year |

12,069 |

24,498 |

10,082 |

| Complaints received by Email before June 30, 2020 but registered on or after July 01, 2020; including complaints transferred from Consumer Education and Protection Cells on or later than July 01, 2020 |

- |

4,789 |

1,255 |

| Received during the year |

3,08,630 |

2,73,204 |

2,09,196 |

| Handled during the year |

3,20,699 |

3,02,491 |

2,20,533 |

| Disposed during the year |

2,96,201 |

2,92,409 |

2,20,533 |

| Rate of Disposal (%) |

92.4% |

96.7% |

100.0% |

| Carried forward to the next year |

24,498 |

10,082 |

- |

| Complaints pending for less than one month (30 days) |

6,086 |

6543 |

0 |

| 2.05% |

2.24% |

0% |

| Complaints pending for one to two months |

3,223 |

1864 |

0 |

| 1.09% |

0.64% |

0% |

| Complaints pending for two to three months |

1,833 |

848 |

0 |

| 0.62% |

0.29% |

0% |

| Complaints pending for more than three months |

13,356 |

827 |

0 |

| 4.51% |

0.28% |

0% |

2.3 Of the total complaints received by the OBOs, OBO, Kanpur received the maximum number of complaints, followed by Chandigarh and Mumbai. The office wise receipt of complaints under the BOS, 2006 during the period April 1, 2021 to November 11, 2021 is given in Table 1.2 in Chapter 1.

Mode of receipt of complaints

2.4 During April 1, 2021 to November 11, 2021, 89.65% of the total complaints were received through digital modes, including, the 24x7 online CMS portal/ email/ CPGRAMS. A comparative position of the various modes through which the complaints were received is provided in Chart 2.1, with details provided at Appendix 2.1.

Zone-wise distribution of complaints

2.5 The zone wise receipt of complaints received under the BOS 2006 during the period April 1, 2021 – November 11, 2021, is given below in Chart 2.2. The North zone received the highest volume, followed by the West and the South zones. The details of office wise, zone-wise receipt is detailed in Appendix 2.2.

Complainant group-wise classification

2.6 Individual customers constituted close to 80% of the complainants. Senior citizens accounted for 3.43% of the total complaints. The complainant group-wise classification of complaints is given at Appendix 1.4.

Entity type-wise classification

2.7 The entity type-wise classification of complaints received by the OBOs during April 1, 2021 to November 11, 2021 is indicated in Table 2.3.

| Table 2.3: Entity-type wise receipt of complaints under BOS during April 1, 2021 - November 11, 2021 |

| Bank Group |

2019-20 |

2020-21 |

2021-22 |

| (Jul - Jun) |

(Apr - Mar) |

(Apr 1, 2021 - Nov 11, 2021) |

| Public Sector Banks* |

1,84,087 |

1,74,974 |

1,19,143 |

| |

59.65% |

51.20% |

56.95% |

| Private Sector Banks |

98,623 |

1,26,303 |

72,703 |

| |

32.00% |

37.00% |

34.80% |

| Payments and Small Finance Banks |

5,227 |

6,918 |

6,100 |

| |

1.70% |

2.00% |

2.90% |

| Foreign Banks |

5,935 |

6,157 |

3,188 |

| |

1.90% |

1.80% |

1.50% |

| RRBs/ Scheduled Primary Urban Co-op. Banks |

6,060 |

6,382 |

4,292 |

| |

2.00% |

1.90% |

2.10% |

| Others |

8,698 |

21,013 |

3,770 |

| |

2.80% |

6.10% |

1.80% |

| Total |

3,08,630 |

3,41,747 |

2,09,196 |

*Includes complaints against SBI Cards which were accounted along with SBI until the launch of RB-IOS, 2021

Note: Figures in percentages indicate share to total complaints |

Category wise receipt of complaints

2.8 The category wise description of complaints received during April 1, 2021 to November 11, 2021 is given in the Table 2.4 below.

| Table 2.4: Category wise receipt of complaints under the BOS |

| Category |

Complaints received during |

| |

2019-20

(Jul-Jun) |

2020-21

(Apr-Mar) |

2021-22

(Apr 1, 2021 - Nov 11, 2021) |

| ATM / Debit Cards |

67,800 |

60,203 |

30,652 |

| |

21.97% |

17.62% |

14.65% |

| Mobile / electronic banking |

41,310 |

44,385 |

28,533 |

| |

13.38% |

12.99% |

13.64% |

| Non-observance of FPC |

36,215 |

33,898 |

25,033 |

| |

11.73% |

9.92% |

11.97% |

| Credit Cards |

28,713 |

40,721 |

24,769 |

| |

9.30% |

11.92% |

11.84% |

| Failure to meet commitments |

25,036 |

35,999 |

22,293 |

| |

8.11% |

10.53% |

10.66% |

| Levy of charges without prior notice |

18,558 |

20,949 |

12,806 |

| |

6.01% |

6.13% |

6.12% |

| Loans and advances |

16,437 |

20,218 |

11,401 |

| |

5.33% |

5.92% |

5.45% |

| Deposit Accounts related |

8,778 |

8,580 |

6,196 |

| |

2.84% |

2.51% |

2.96% |

| Non-adherence to BCSBI Codes |

14,194 |

14,490 |

5,044 |

| |

4.60% |

4.24% |

2.41% |

| Pension payments |

6,307 |

4,966 |

4,321 |

| |

2.04% |

1.45% |

2.07% |

| Remittances |

4,045 |

3,394 |

2,164 |

| |

1.31% |

0.99% |

1.03% |

| DSAs and recovery agents |

1,406 |

2,440 |

1,632 |

| |

0.46% |

0.71% |

0.78% |

| Para banking |

1,117 |

1,236 |

778 |

| |

0.36% |

0.36% |

0.37% |

| Notes and Coins |

514 |

332 |

194 |

| |

0.17% |

0.10% |

0.09% |

| Others |

29,204 |

39,686 |

26,933 |

| |

9.46% |

11.61% |

12.87% |

| Out of purview of BOS |

8,996 |

10,250 |

6,447 |

| |

2.91% |

3.00% |

3.08% |

| Total |

3,08,630 |

3,41,747 |

2,09,196 |

Mode of disposal of complaints

2.9 All complaints received during April 1, 2021 to November 11, 2021 were disposed as at the end of the year. The details of complaints disposed is given at Appendix 2.3.

2.10 Of the total complaints handled during the period, 53.09% were ‘Maintainable’ complaints and all the complaints received under BOS, 2006 during the period were disposed as at the end of the year. Majority of the maintainable complaints, viz., 66.11% were resolved through mutual settlement/ agreement, conciliation and mediation efforts of the Ombudsmen.

|

Table 2.5: Mode of disposal of maintainable complaints under BOS

|

| Disposal of maintainable complaints |

2019-20

(Jul - Jun) |

2020-21

(Jul - Mar) |

2021-22

(Apr 1, 2021 - Nov 11, 2021) |

| By Mutual Settlement/ Agreement |

1,25,836 |

1,24,900 |

77,411 |

| |

72.34% |

72.73% |

66.11% |

| Disposal by Award |

68 |

59 |

17 |

| |

0.04% |

0.03% |

0.01% |

| Maintainable Complaints Rejected |

47,873 |

46,566 |

39,504 |

| |

27.52% |

27.12% |

33.74% |

| Maintainable Complaints Withdrawn |

181 |

197 |

160 |

| |

0.10% |

0.11% |

0.14% |

| Total |

1,73,958 |

1,71,722 |

1,17,092 |

Grounds for rejection of maintainable complaints

2.11 The grounds for rejection of maintainable complaints and their proportion to total complaints disposed under the BOS during the period April 1, 2021 – November 11, 2021 is given in the Table 2.6 below.

| Table 2.6: Grounds/reasons for rejection of maintainable complaints under BOS |

| Ground for rejection |

No. of complaints rejected |

| |

2019-20

(Jul-Jun) |

2020-21

(Jul - Mar) |

2021-22

(Apr 1, 2021 - Nov 11, 2021) |

| Not on grounds of complaint (Clause 8) - Clause 13(a) |

46,237 |

44,994 |

37,624 |

| |

96.58% |

96.62% |

95.24% |

| Not in accordance with provisions of Clause 9 (3) - Clause 13(b) |

983 |

946 |

1,248 |

| |

2.05% |

2.03% |

3.16% |

| Beyond pecuniary jurisdiction of BO - Clause 12 (5) & (6) - Clause 13(c) |

147 |

142 |

94 |

| |

0.31% |

0.30% |

0.24% |

| Requiring elaborate documentary and oral evidence - Clause 13 (d) |

28 |

50 |

94 |

| |

0.06% |

0.11% |

0.24% |

| Complaints without sufficient cause - Clause 13(e) |

195 |

23 |

3 |

| |

0.41% |

0.05% |

0.01% |

| Not pursued by the complainants - Clause 13(f) |

27 |

81 |

72 |

| |

0.06% |

0.17% |

0.18% |

| No loss/ damage/ inconvenience to the complainant - Clause 13 (g) |

44 |

11 |

4 |

| |

0.09% |

0.02% |

0.01% |

| The complaint pertains to the same cause of action, for which any proceedings before any court, tribunal or arbitrator or any other forum is pending 13(2) |

212 |

319 |

365 |

| |

0.44% |

0.69% |

0.92% |

| Total maintainable complaints rejected |

47,873 |

46,566 |

39,504 |

| Note: Figures in percentages indicate share to total. |

2.12 About 47% of the total complaints were closed as non-maintainable during the period April 1, 2021 – November 11, 2021. The reasons for rejection of complaints as non-maintainable are given in the Chart 2.3.

Appeals against the decisions of the BOs

2.13 A total of 51 Appeals were received under the BOS during the year 2021-22. The details of receipt, disposal and pendency of Appeals as at the end of the year is given in Table 2.7. The Appellate Authority (AA) under the BOS, 2006 as amended upto July 01, 2017 was the DG-in-charge of CEPD. Subsequently, the RB-IOS, 2021, launched in November 2021, has vested the powers of the AA with the ED-in-Charge of CEPD. However, the Appeals that were received against the decisions of the Ombudsmen in terms of the erstwhile BOS, 2006 have been disposed by AA-DG, in accordance with the provisions of BOS 2006.

| Table 2.7: Receipt and disposal of Appeals under the BOS |

| Particulars |

2019-20

(Jul-Jun) |

2020-21

(Jul-Mar) |

2021-22

(Apr 1, 2021 - Nov 11, 2021) |

| Appeals pending at the beginning |

72 |

47 |

44 |

| Appeals received during the year from complainants |

34 |

13 |

45 |

| Appeals received during the year from banks |

29 |

10 |

6 |

| Total appeals handled during the year |

135 |

70 |

95 |

| Appeal disposed during the year |

88 |

26 |

70 |

| Pending at the end of the year |

47 |

44 |

25 |

| Mode of Disposal |

|

| Appeals remanded to the BO |

4 |

2 |

1 |

| Appeals withdrawn / settled / infructuous |

14 |

5 |

11 |

| Appeals rejected |

43 |

9 |

32 |

| Appeals allowed |

27 |

10 |

26 |

| Appeals Disposed |

|

| i. In favour of complainant appellant |

29 |

10 |

19 |

| ii. In favour of banks |

21 |

5 |

21 |

| iii. Neither in favour of complainant appellant nor in favour of banks (Remanded back to BO / infructuous) |

38 |

11 |

30 |

| *All 25 appeals pending as on March 31, 2022, were disposed as on October 18, 2022. |

Chapter 3:

The Ombudsman Scheme for Non-Banking Financial Companies (OSNBFC), 2018: Activities during April 1, 2021 – November 11, 2021

|

The total number of complaints received at the four Offices of NBFC Ombudsman (ONBFCOs) during April 1, 2021 – November 11, 2021 was 20,439. Since the OSNBFC was integrated into the RB-IOS, 2021 from November 12, 2021 the data presented pertains to April 1, 2021 to November 11, 2021. The rate of disposal of complaints stood at 100% as at the end of the year i.e., March 31, 2022. Complaints relating to non-adherence to Fair Practices Code (FPC) were the highest, constituting 61.89% of the total complaints received during April 1, 2021 – November 11, 2021. Majority (70.08%) of the maintainable complaints were resolved through mutual settlement/conciliation/ mediation. During April 1, 2021 – November 11, 2021, 12 Awards were issued against NBFCs by the NBFC Ombudsmen (NBFCOs). Ten Appeals were received against the decisions of NBFCOs during April 1, 2021 – November 11, 2021.

|

3.1 The OSNBFC, 2018 was administered through four ONBFCOs located at Chennai, Kolkata, Mumbai, and New Delhi, which handled complaints of South, East, West and North zones respectively covering the entire country. It has since been repealed with effect from November 12, 2021, the date on which RB-IOS, 2021 came into force.

Receipt of complaints

3.2 During April 1, 2021 – November 11, 2021, 20,439 complaints were received at the ONBFCOs. ONBFCOs handled 22,077 complaints during the reference period, all of which were disposed at the end of the year. The position of customer complaints handled by ONBFCOs is tabulated in Table 3.1 below:

| Table 3.1: Position of customer complaints handled by ONBFCOs |

| Particulars |

2019-20

(Jul-Jun) |

2020-21

(Jul-Mar) |

2021-22

(Apr 1, 2021 - Nov 11, 2021) |

| Complaints brought forward from the previous year |

36 |

908 |

1,319 |

| Complaints received |

19,432 |

26,957 |

20,439 |

| Draft complaints received during previous year and transferred during current year, CEPC transferred |

- |

1,486 |

319 |

| Total number of complaints handled |

19,468 |

29,351 |

22,077 |

| Complaints disposed during the year |

18,560 |

28,032 |

22,077 |

| Rate of Disposal (%) |

95.34% |

95.51% |

100% |

| Complaints pending at the end of the year |

908 |

1,319 |

0 |

| Complaints pending for less than one month |

380 |

659 |

0 |

| Complaints pending for one to two months |

187 |

365 |

0 |

| Complaints pending for two to three months |

60 |

98 |

0 |

| Complaints pending for more than three months |

281 |

197 |

0 |

3.3 Of the 20,439 complaints received by the ONBFCOs, ONBFCO, New Delhi received the maximum number of complaints (8,628), which accounted for 42.21% of the total complaints received by the ONBFCOs. Office-wise receipt of complaints at ONBFCOs is given at Table 1.2 in Chapter 1.

Mode of receipt of complaints