IST,

IST,

Onshoring the Offshore

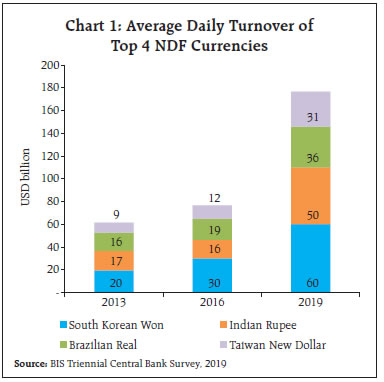

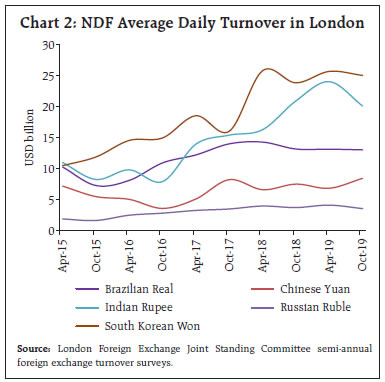

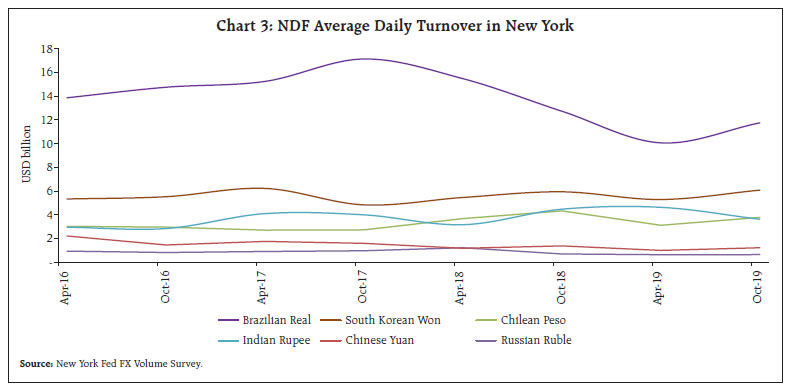

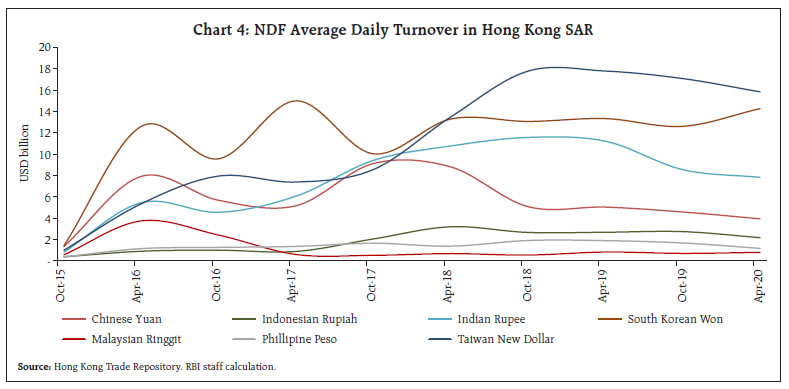

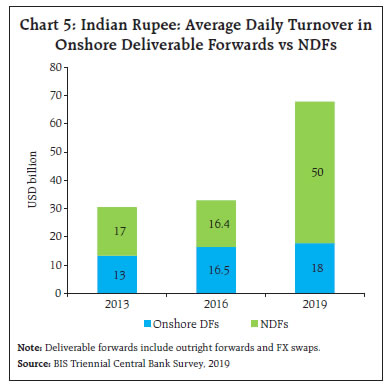

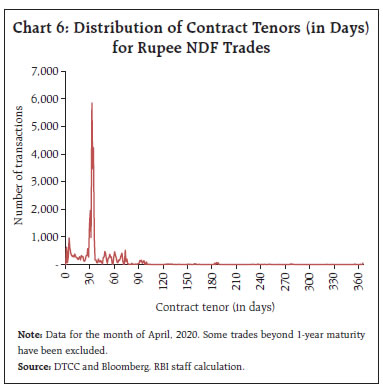

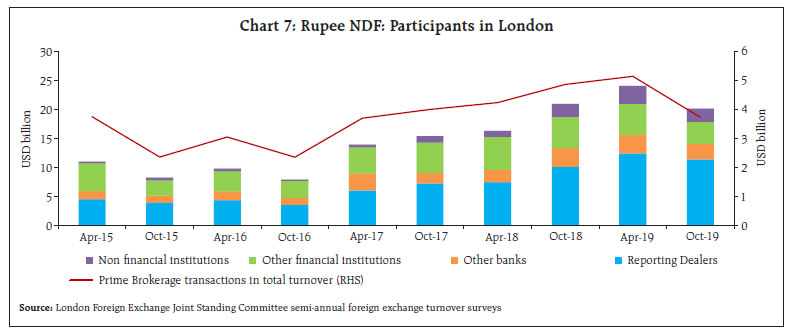

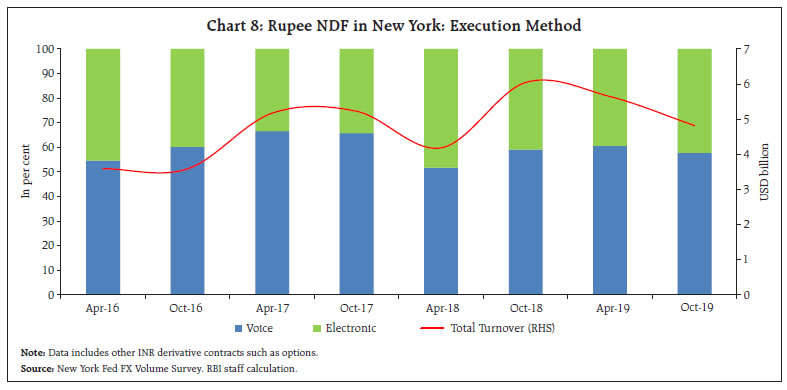

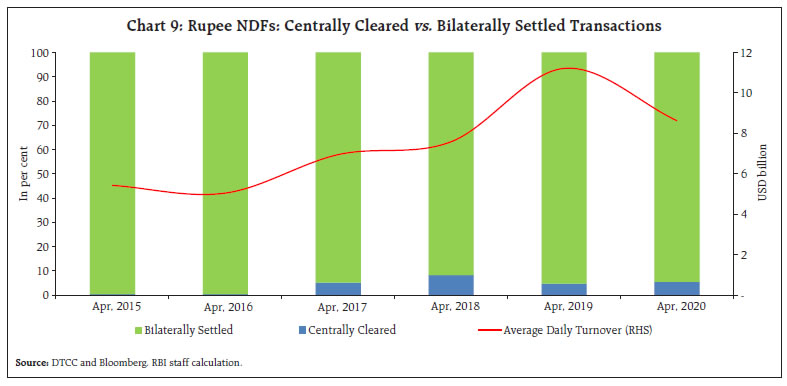

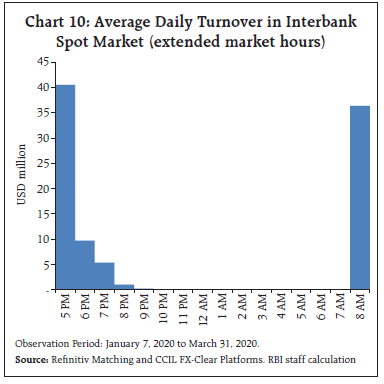

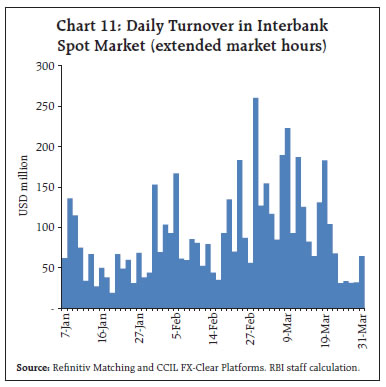

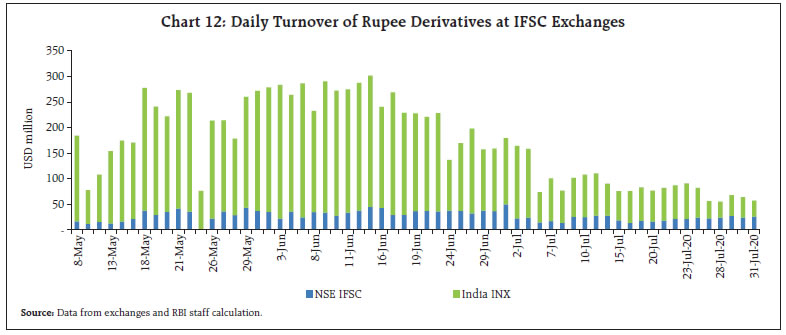

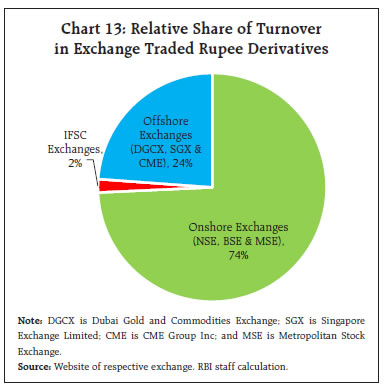

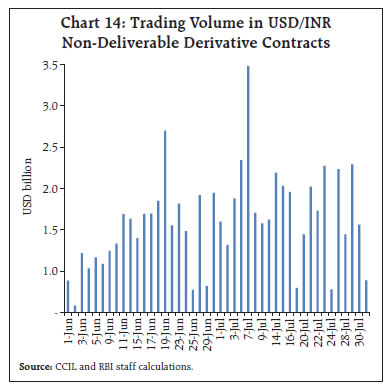

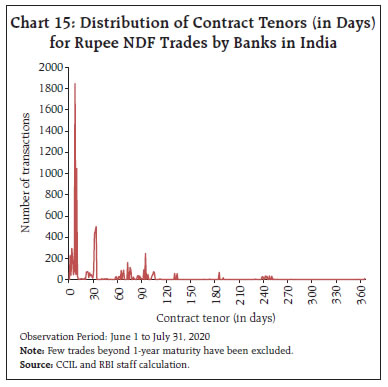

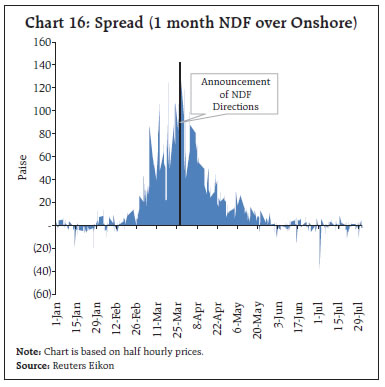

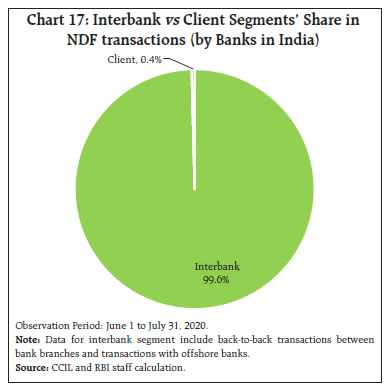

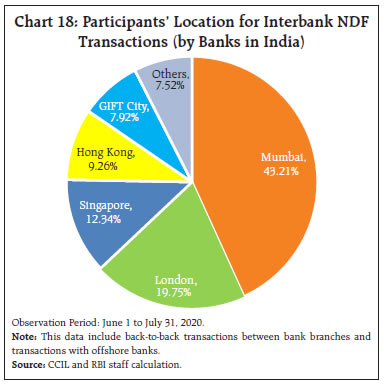

Currency internationalisation seems to have evolved as a natural corollary of globalisation. Several currencies, particularly those of emerging market economies (EMEs), have emerged as candidates for internationalisation. In 2019, the Reserve Bank set up a Task Force on Offshore Rupee Markets, which has spurred a number of measures on its recommendations. The regulatory framework adopted will facilitate the shift to domestic markets for hedging Indian Rupee (INR) exposures. Measures aimed at liberalising and further developing the domestic foreign exchange market will provide a conducive environment for a fuller internationalisation of the INR in consonance with India’s rising profile in the global economy. Introduction Currency internationalisation – the phenomenon of a national currency trading beyond its borders and actively used in the invoicing of trade and financial transactions, commodities, and foreign exchange reserves – seems to have evolved as a natural corollary of globalisation. A large body of work in the literature has shown that the internationalisation of a currency confers an exorbitant privilege (Eichengreen, 2011), it imposes, responsibilities as well - deep and liquid financial markets; strong macroeconomic fundamentals; absence of restrictions on international transactions; reserve currency status (Kenen, 2011). Over the last 100 years, currency internationalisation has been unipolar – the dominance of the pound sterling being supplanted by the US Dollar. The currencies of other advanced economies have failed to gain traction in spite of becoming convertible currencies satisfying the responsibilities referred to earlier. In recent years, however, a silent revolution has been underway. Several currencies, particularly those of emerging market economies, have emerged as candidates for internationalisation in spite of being ‘non-convertible’. These developments have challenged the orthodoxy and have shown that convertibility may be a necessary but not a sufficient condition for internationalisation. The circuit breaker has been the non-deliverable forward (NDF) market. Over the last three years, global turnover in foreign exchange markets rose by 33 per cent, but, EME currencies’ turnover expanded by close to 60 per cent boosting their global share to 23 per cent from 15 per cent in 2013. Among its drivers is the Indian Rupee (INR) in which trading has almost doubled, in sharp contrast to the Mexican Peso (MXN), the South African Rand (ZAR), the Malaysian Ringgit (MYR) and even the Singapore Dollar (SGD). The INR NDF market is the second largest globally in terms of average daily turnover and is larger than the onshore forward market (BIS, 2019). Volumes in the offshore NDF markets have also grown on account of various factors, viz., ease of access, market-making by global banks, availability of large participants like hedge funds, intermediation services like prime brokerage1, favorable tax treatment, convenience of time zones and electronification (Patel and Xia, 2019). An NDF is a foreign exchange derivative contract, which allows investors to trade in non-convertible currencies, with contract settlement in a convertible currency (mostly US Dollars). NDFs trade principally beyond the borders of the currency’s home jurisdiction (‘offshore’), enabling investors to transact outside the regulatory framework of the home market (‘onshore’) (McCauley et al, 2014). Recognising the existence of bidirectional price linkages between onshore and offshore rates (RBI, 2019), the possibility of volatility spillovers from offshore markets, segmentation between onshore and offshore markets impairing the efficiency of price discovery, and undermining the regulatory framework, the Reserve Bank has engaged in developing a deep and liquid onshore foreign exchange market. Its efforts have largely focused on improving access to the onshore markets by residents and non-residents and product innovations, including the introduction of exchange traded currency futures and options in 2008 and 2010, respectively. In 2019, the Reserve Bank set up a Task Force on Offshore Rupee Markets, which has also spurred a number of measures on its recommendations. Against this backdrop this article reflects on the recent efforts made in onshoring the offshore. Section II provides a comparative overview of NDF markets globally, and hones its focus to some insights into the microstructure of the Rupee NDF market in Section III. Section IV discusses cross country approaches to the NDF market and the efforts undertaken by the Reserve Bank in the context of the INR NDF markets. Section V concludes, with perspectives on what lies ahead. Historically, NDF markets evolved for nonconvertible currencies, beginning with Mexico and Brazil and moved on to emerging Asian economies, including India. The most recent development is the possibility of an offshore Turkish Lira (TRY) market in the wake of recent regulatory measures limiting speculation on TRY2. The average daily turnover in the global NDF market stood at about USD 259 billion in April, 20193, with NDFs for South Korean Won (KRW), INR, Brazilian Real (BRL) and Taiwan New Dollar (TWD) accounting for 70 per cent of the total NDF turnover. These four currencies saw a marked increase in turnover between April 2016 and April 2019 (Chart 1).  Globally, NDFs are traded only in a handful of locations with the maximum turnover in London followed by New York, Singapore and Hong Kong SAR (Patel and Xia, 2019). KRW and INR are the most widely traded NDFs in London (Chart 2).   In New York, the NDFs of BRL have the highest turnover followed by KRW, Chilean Peso (CLP) and INR (Chart 3). In Hong Kong SAR, TWD, KRW and INR are the most traded NDFs (Chart 4). INR NDFs are amongst the most traded contracts4 in all major centres. The average daily INR NDF turnover in these centres has, however, been declining after peaking in April 2019.  The Rupee NDF market was comparable in size to the onshore deliverable forward market, according to the BIS Triennial Surveys for April 2013 and April 2016. The 2019 Survey, however, suggests that the size of the market has increased to become almost thrice as large as the onshore market (Chart 5). Contracts with one-month or less maturity are the most liquid in the INR NDF market5 accounting for close to 70 per cent of total contracts, presumably reflecting short term speculative positions (Chart 6).   Participants’ data for London indicate that transactions among reporting dealers (relatively larger banks) may have contributed the most to the increase in INR NDF turnover (Chart 7). Prime brokerage transactions accounted for close to a quarter of this turnover. In New York, the only centre which disseminates data on execution method, roughly half the trades have been contracted by using electronic methods (Chart 8).   INR NDF trades, like most NDF trades, are over the counter (OTC) and bilaterally settled. In recent years, however, global legal and regulatory reforms for derivatives markets are transforming NDF market microstructure from a decentralised, bilateral market to one characterised by centralised trading, disclosure and clearing (McCauley and Shu, 2016). INR NDF transactions have started being centrally cleared through a derivatives clearing organisation (DCO). However, bilaterally settled transactions still account for 94 per cent of trades in gross notional terms (Chart 9).  Concerns about growing NDF volumes have led authorities in different jurisdictions deploying distinct strategies. Korea permitted participation of local banks in the NDF market as a result of which KRW NDF got closely integrated with the onshore markets. The Korean authorities also liberalised the onshore KRW market with measures, which abolished approval requirements for some capital account transactions. With the liberalisation of the onshore FX market and the development of a deliverable offshore market (CNH), volumes in the Chinese Yuan (CNY) NDF market have tapered off considerably. Although, Taiwanese authorities undertook measures to restrict trading in NDF markets, the central bank allowed overseas branches of domestic banks to transact in New Taiwan Dollar (TWD) NDF in 2014. Bank Negara Malaysia banned trading of Ringgit offshore and asked international banks operating within its jurisdiction to avoid the NDF market. Bank Indonesia, established the domestic non-deliverable forward (DNDF) market for Indonesian Rupiah (IDR), in 2018, to serve as a parallel market to NDF, settling in the onshore market and providing an alternative to foreign investors to hedge their IDR exposure without exchange of principal while at the same time enhancing the central bank’s oversight and access to the NDF market. In the Indian context, a number of measures have been taken by the Reserve Bank in recent months to improve ease of access to the onshore markets especially for non-residents. From January 2020, AD Category-I banks have been permitted to offer foreign exchange prices to users at all times out of their Indian books, either by a domestic sales team or through their overseas branches, in order to obviate time zone hinderances to trading. This also provided opportunities for domestic banks to access a larger international clientele, including by leveraging on their overseas branch networks. Transaction data indicate that liquidity was starting to build up in specific time buckets in the onshore market, especially before opening and post market closure, before COVID-19 struck (Charts 10 and 11).    In January 2020, the Reserve Bank permitted exchanges in the GIFT City International Financial Services Centre (IFSC) to offer INR derivative contracts with settlement in foreign currency. On May 8, 2020 the two IFSC Exchanges, India International Exchange Limited (India INX)6 and NSE IFSC Limited (NSE IFSC)7, launched INR derivative contracts. Since then, the average daily turnover in Rupee derivatives at IFSC exchanges has been USD 172 million with trading volume touching a high of USD 300 million on June 15. India INX has, on an average, accounted for about 80 per cent of the turnover in INR derivatives at IFSC (Chart 12). The share of INR derivatives at IFSC exchanges in total exchange traded INR derivatives turnover, globally, remains small at 2 per cent (Chart 13).  Banks in India which operate IFSC Banking Units (IBUs) were permitted to participate in the NDF market with effect from June 1, 2020. Several banks have started participating in the INR NDF markets since then. The average daily turnover by banks in India8 in the non-deliverable derivative contracts (forwards and options) currently stands at USD 1.1 billion9, with the highest volume of USD 2.97 billion recorded on July 7, 2020 (Chart 14). While Indian banks transact in both non-deliverable forward and option contracts, forward contracts so far dominate with a share of 97 per cent in total turnover, most contracts being short tenure contracts of maturity of about a week (Chart 15). This is a reflection of the market microstructure - greater liquidity in shorter tenors - as also the fact that Indian banks are still finding their way around unchartered territory, setting up counterparty lines and putting in place internal risk management systems.   The participation of Indian banks in the NDF market appears to have positively impacted the price differential between offshore and onshore rates (Chart 16). Spreads have gradually normalised both on reduced volatility and on announcement effects of the NDF Directions dated March 27, 2020. From more than 100 paise in March 2020, spreads have come down to zero / near zero (negative on a few occasions), since June 1, with banks arbitraging away the pricing differentials between onshore and offshore markets.  Almost all trades have so far taken place in the USD/INR currency pair. The volumes have been almost entirely concentrated in the interbank segment, although there are indications that interest from global funds and corporates is slowly growing (Chart 17). More than half of the turnover has been transacted by Indian bank branches in Mumbai or IBUs (Chart 18). Offshore participants were primarily located in London, Singapore and Hong Kong.   Importantly, an onshore interbank NDF market has emerged wherein local banks transact with each other. The participation of Indian banks in the NDF market has increased avenues for interbank risk management and, going forward, could help bring down hedging cost for customers. The regulatory framework for hedging of foreign exchange risk has evolved in line with this growing internationalisation. A revised regulatory framework for hedging of foreign exchange risks was introduced on April 7. The guidelines will come into effect from September 1. Their main features are:

With onshore foreign exchange market being permitted to function round-the-clock, liquidity in INR is now developing beyond normal market hours, albeit, in a limited manner, but setting the stage for wider access for non-residents to domestic markets. Indian banks are now well placed to reach out to offshore clients which have, hitherto, preferred the NDF market. Initial volumes in the NDF markets have been almost entirely in the interbank segment and with restricted counterparties. This was not unexpected as banks in India have counterparty limits in place with only a few overseas entities. Client inertia in moving from offshore to onshore markets is gradually waning and some interest from global corporates and funds is already visible. As a larger number of Indian banks start participating actively in the NDF market, they may also provide an impetus for INR trades to move out of offshore centres both to the onshore market as well as to the IFSC. The regulatory framework adopted will facilitate the shift to domestic markets for hedging INR exposures. Other initiatives, including revisions in interest rate derivative guidelines to enable easier access to non-residents, the Voluntary Retention Route (VRR), introduced to attract portfolio investors with longer investment horizons and the recent Fully Accessible Route (FAR) permitting non-residents to increase their exposure to the sovereign debt securities will increase INR exposures and hedging needs. Concomitantly, recent measures aimed at liberalising and further developing the domestic foreign exchange market will provide a conducive environment for a fuller internationalisation of the INR in consonance with India’s rising profile in the global economy. References Robert McCauley, Chang Shu and Guonan Ma (2014), ’Non-deliverable forwards: 2013 and beyond’, BIS Quarterly Review, March 2014 Nikhil Patel and Dora Xia (2019), ’Offshore markets drive trading of emerging market currencies’, BIS Quarterly Review, December 2019 RBI (2019), ’Report of the Task Force on Offshore Rupee Markets’, Reserve Bank of India Robert McCauley and Chang Shu (2016). ’Non-deliverable forwards: Impact of currency internationalisation and derivatives reform’, BIS Quarterly Review, December 2016 Barry Eichengreen (2011), ’Exorbitant Privilege: The Rise and Fall of the Dollar and the Future of the International Monetary System’, Oxford University Press Peter B. Kenen, 2011, ’Beyond the dollar’, Journal of Policy Modeling, Elsevier, vol. 33(5), pages 750-758, September. Harald Hau, Peter Hoffmann, Sam Langfield and Yannick Timmer (2019), ‘Discriminatory Pricing of Over-the-Counter Derivatives’. IMF Working papers. * This article is prepared by Abhishek Kumar and Rituraj of Financial Markets Regulation Department, Reserve Bank of India. The views expressed in this article are those of the authors and do not represent the views of the Reserve Bank of India. 1 Foreign exchange prime brokerage allows clients to access liquidity from multiple dealers while maintaining a relationship for funding, clearing and settlement with a single entity, usually a large bank or an investment company, referred to as the prime broker. 2 https://www.risk.net/derivatives/7551741/turkey-turmoil-opens-door-to-offshore-ndf-market. 3 BIS Triennial Central Bank Survey, 2019. 4 While currency wise NDF turnover data was not available for Singapore, the BIS Triennial Surveys and discussion with market participants indicate high INR NDF trading in Singapore. 5 Standard tenors (1 month, 2 months etc.) are generally more liquid than non-standard tenors. Liquidity generally declines as tenor increases (Hau et al, 2019). 6 Subsidiary of Bombay Stock Exchange (BSE). 7 Subsidiary of National Stock Exchange (NSE). 8 Banks can undertake such transactions through their branches in India, through their IBUs or through their foreign branches (in case of foreign banks operating in India, through any branch of the parent bank). 9 Including back-to-back transactions between bank branches. |

পৃষ্ঠাটো শেহতীয়া আপডেট কৰা তাৰিখ: