IST,

IST,

RBI WPS (DEPR): 02/2019: Cross-border Trade Credit: A Post- Crisis Empirical Analysis for India

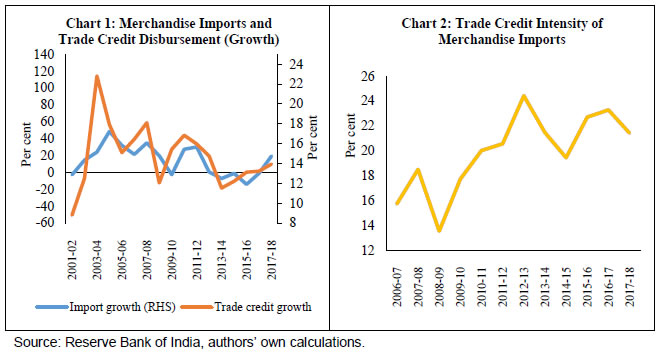

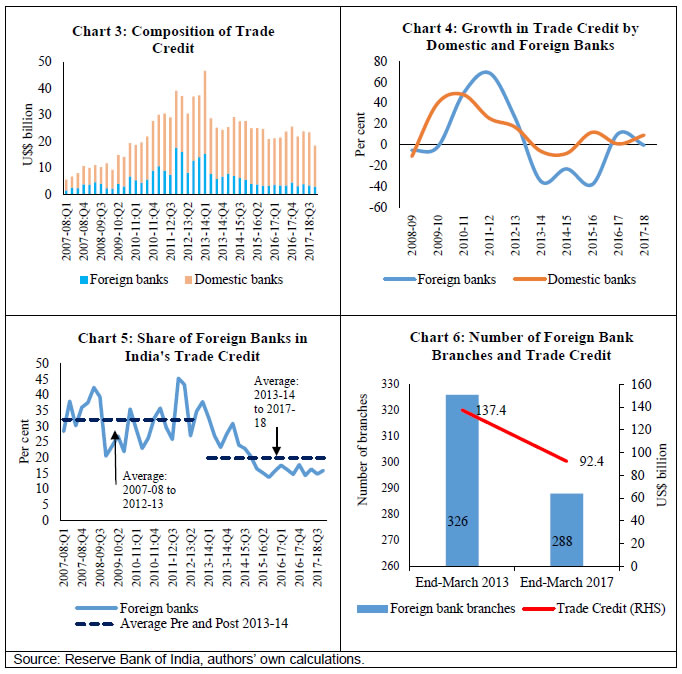

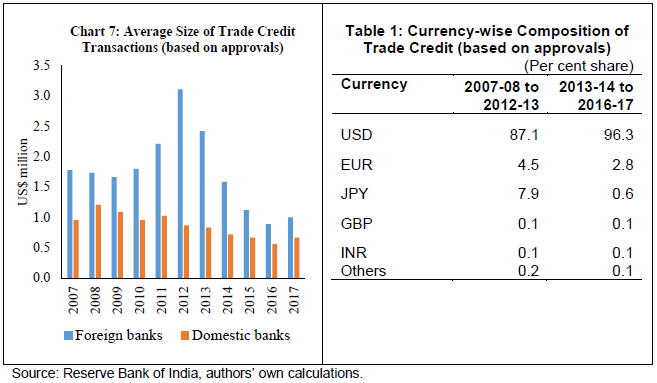

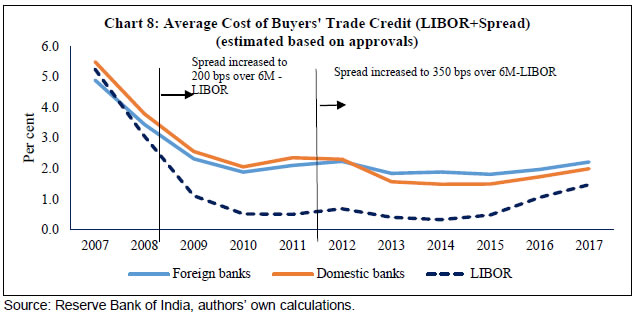

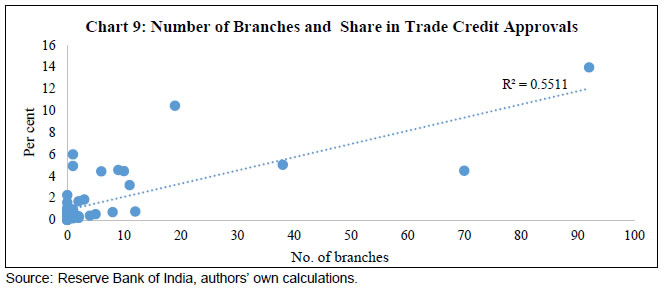

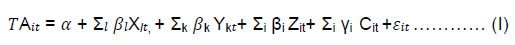

| RBI Working Paper Series No. 02 Cross-border Trade Credit: A Post-Crisis Empirical @Rajeev Jain, Dhirendra Gajbhiye and Soumasree Tewari Abstract *The paper profiles trade credit extended by domestic and foreign banks to Indian importers, focusing on its size, composition and cost pattern. Using a panel data of 55 banks for 2007-08:Q1 to 2016-17:Q4, the paper finds that both demand and supply-side factors influence the flow of trade credit. The paper suggests that higher imports – whether due to high prices or volumes – lead to an increase in trade credit. From the supply-side perspective, financial health of banks, cost of trade credit and size of their overseas network seem to influence their trade credit business. In light of the empirical findings, banks need to expand their global banking relationship and shift towards the use of globally accepted trade finance instruments instead of indigenous instruments (i.e., LoUs /LoCs) which, however, may push up the cost. JEL Classification: C5, C33, F34 Keywords: Trade finance, imports, panel data. Introduction Cross-border trade involves various risks as trade partners are unlikely to be familiar with one another. These risks mainly include payment risk, country risk and corporate risk which generally exacerbate during the period of global turbulence – whether caused by financial or political developments. To be more specific, the probability of global trade facing financial constraints is higher than domestic trade as the former involves higher risks, particularly due to exchange rate volatility, information asymmetries and possibility of credit default. Financial constraints are supposed to be more prominent for firms with global business presence/high import dependence due to their larger financing needs than other firms and larger time gap between production and final delivery. In the post-global financial crisis period, global trade finance activity has slowed down considerably. Slowdown in both global trade and cross-border trade finance during the post-crisis period evoked further interest among researchers. Taking cognisance of these factors, financial constraints have been accommodated into models of international trade in recent years to examine the role of trade finance channel. At the global level, up to 80 per cent of trade is supported by some form of credit, guarantee or insurance. As far as the role of bank-intermediated cross-border trade credit is concerned, it accounts for about one-third of the global merchandise trade (BIS, 2014). Various surveys conducted by multilateral agencies suggest a significant tightening in bank-intermediated trade finance markets during the 2008-09 financial crisis. A few of these surveys pointed out that disruptions in trade finance exacerbated trade slowdown during the crisis period. Even after the global financial crisis period, trade finance activity remained sluggish due to multiple factors. A study by Asian Development Bank (ADB, 2017) estimated a global trade finance gap of US$ 1.5 trillion in 2017 and 40 per cent of which originated in Asia and the Pacific regions. While there is no consensus as to what caused low trade finance activity at the global level in the post-crisis period, few studies based on cross-country surveys attribute it to both demand and supply-side factors. The importance of drawing clear linkages between trade finance and its determinants is critical especially when the trade protectionist sentiment has accentuated and banks continue to face capacity constraints since the peak of the global crisis. Further, availability of trade credit becomes important for countries where the import content of exports is high. In the case of India, the share of foreign value added in total value added of exports has nearly doubled from its level in the early 1990s (UNCTAD, 2018). Therefore, it is important that lack of trade credit does not become a binding constraint on the availability of inputs imported for domestic production. In other words, export performance may be indirectly contingent upon the availability of trade credit for imports. Furthermore, the discontinuation of trade credit instruments – viz., Letters of Undertaking (LoUs) and Letters of Comfort (LoCs) – in the case of India also underlines the need for analysis of demand and supply-side factors of trade credit. With this background, this paper analyses cross-border trade credit availed by Indian importers during the post-crisis period. The data suggest that flow of trade credit remained muted during 2013-14 to 2017-18 – the period coinciding with a slump in India’s merchandise imports coupled with regulatory tightening in the global banking system. Interestingly, despite a modest pickup in imports, trade credit intensity fell in 2017-18.1 It raises an interesting question, whether it was lower demand due to slump in imports or tightening of global funding conditions that caused slowdown in trade credit. Therefore, the objectives of this paper are (i) to study various facets of cross-border trade credit raised by domestic entities; and (ii) to examine the relative role of demand and supply-side factors in influencing the flow of trade credit in recent years. This study is first of its kind which exclusively focuses on trade credit availed by Indian importers. While the cross-border trade finance activity can support trade through various instruments, viz., loans (suppliers’ and buyers’ credit), letters of credit or guarantees, inter-firm credit and factoring; the paper restricts its scope to bank-intermediated buyers’ credit as it accounts for over 93 per cent of cross-border trade credit in the case of India. Lower recourse to suppliers’ credit may be reflective of India’s participation in global supply chain, perception of suppliers on the risk of default by importers and credit rating of domestic firms. The rest of the paper is organised into four sections. The second section provides a survey of literature focusing on factors that influence cross-border trade finance. The third section presents stylised facts on trade credit raised by importers. The fourth section discusses data sources and the methodology used for empirical analysis on demand and supply side determinants of trade credit. The fifth section discusses empirical findings, followed by sixth section which concludes the paper and draws policy implications. In the post-crisis period, global trade finance has received considerable attention of policymakers as well as academics. Tightening of global financial conditions and the ensuing trade collapse prompted them to look into trade finance as one of the constraints to global trade activity. In the midst of the crisis, due to liquidity problems across major economies, both inter-firm trade credit and bank-intermediated trade finance were inadequate leading to widening of the global trade finance gap. In order to provide trade financing to countries affected by the crisis, the G-20 – in its London Summit in April 2009 – adopted a broad package to provide at least US$ 250 billion to support trade finance over two years. Further, the International Finance Corporation (IFC) also enhanced its support to address the trade finance gap at the time of the global financial crisis. While the earlier episodes of regional financial crisis, e.g., 1997-98 East Asian crisis, had also illustrated the importance of trade finance for trade, policymakers largely blamed the opaque financial sector in the affected economies for the crisis (Chauffour and Malouche, 2011). In the literature, trade finance is also seen as substitute for domestic bank credit during periods of monetary tightening (Himmelberg et al., 1995; Choi and Kim, 2005; Love et al., 2007; Klapper et al., 2012). While at global level, bilateral trade credit between firms in a supply chain or different units of individual firm account for a major chunk of global trade credit, banks also play a central role not only by providing institutional finance but also through documentary letters of credit. Accordingly, most studies have focused on inter-firm trade credit and only few studies specifically dealt with the issue of bank-intermediated cross-border trade credit. In the absence of hard data on different instruments of trade credit, various proxies for trade credit have been used in literature (Engemann, 2011; Eck, 2011). The potential role of supply-side driven shortages of trade finance in global trade flows has been highlighted by several studies. A common finding is that tighter financial conditions impede trade flows, especially to sectors which are highly credit dependent (Auboin 2009; Lacovone and Zavacka, 2009; Coulibaly et al., 2011; Amiti and Weinstein, 2011). Niepmann and Schmidt-Eisenlohr (2013) find a causal effect of reductions in the supply of letters of credit by banks on U.S. exports. A study by the Committee on the Global Financial System (BIS, 2014) also provided some evidence that trade finance disruptions had a considerable effect on the trade slowdown following the 2008 Financial crisis, though there was less evidence of long-lasting effects. Highlighting the trade finance gaps at global level, the Global Survey on Trade Finance (International Chamber of Commerce, 2015) reported an increase in rejection rate of trade finance proposals/applications, especially impacting the small and medium sized enterprises (SME) sector. By contrast, there are studies which do not find trade finance as a major factor impacting global trade in the post-crisis period (Paravisini et al., 2011; Levchenko et al., 2011; Mora and Powers, 2011; Behrens et al., 2011). Few studies argued that cost rather than the supply of trade finance was a constraint during the crisis period (Hallaert, 2011). There is another set of studies that looks into factors that affected global trade finance in the post-crisis period. Even before the global financial crisis, studies based on earlier episodes of financial crises highlighted that the decline in trade credit across countries was often associated with weak domestic banking systems (IMF, 2003). In the post-crisis period, however, the issue that became pertinent was whether new regulatory requirements as part of banking sector reforms led to an overly conservative treatment of trade finance assets, thereby impacting the global trade finance activity. Most post-crisis studies were survey based except a few which used actual data for empirical analyses. A joint survey by IMF and the Bankers Association for Finance and Trade (IMF-BAFT) found evidence on majority of banks raising the cost of trade finance instruments after the global financial crisis period. Asmundson et al. (2011) argued that demand factors – especially commodity prices – played the most important role in the post-crisis period. Avdjiev et al. (2012) found that decline in cross-border bank lending to EMEs was linked to deterioration in the health of banks in advanced economies, especially in euro area. Analysing the role of both demand and supply side factors, Garralda and Vasishtha (2015) confirmed the role of both country-specific factors (trade flows and funding conditions of banks) as well as global trade and financial conditions in impairing bank-intermediated trade finance during the Global Financial crisis. The Global Survey on Trade Finance (ICC, 2016) revealed that de-risking and regulatory changes adversely impacted trade finance flows. Alexander et al. (2011), Starnes et al. (2016) and Erbenová et al. (2016) also pointed out that increased de-risking by banks is a risk for trade finance. Based on a survey of African countries, Malouche (2011) concluded that SMEs were affected more than large firms during crisis period due to their weaker capital base and bargaining power. Ichiue and Lambert (2016) argued that tighter home country capital regulations are negatively associated with the growth of both cross-border and domestic lending. Ivashina et al. (2015) finds that during the period of dollar shortages, synthetic dollar borrowing also becomes expensive which causes cuts in dollar lending by banks. As discussed earlier, trade finance helps to meet the trade cycle funding gaps of both exporters and importers. While the trade finance mitigates the payment risk for exporter by accelerating the receivables, it helps importer by mitigating the supply risk from the exporter by extending credit on their payments. Indian firms have access to various forms of trade credit. While there are schemes for pre- and post-shipment credit (both Indian Rupee and foreign currency) for exporters which are intended to provide short-term working capital finance, importers have access to foreign trade credit through channels such as buyers’ credit, suppliers’ credit and trade finance guarantees. Therefore, bank-intermediated trade finance provides not only working capital to support international trade transactions, but also means to reduce payment risk in the form of trade guarantees. Although numerous instruments are used for cross-border trade finance, the stylised facts presented in this section are confined to trade credit which mainly includes buyers’ credit, i.e., loans for payment of imports into India arranged by an importer (through its Authorised Dealer (AD) bank) from overseas bank or financial institution. III.1 Trade credit intensity of imports Importers in India meet their funding needs largely through buyers’ trade credit which in turn may be influenced by both demand (e.g., size of imports) and supply-side factors (e.g., ability and willingness of banks to extend credit). Even though trade credit broadly tracks the trend in imports, there are phases when trade credit has grown far more/less than proportionately to imports – implying the role of supply-side factors. For instance, flows of trade credit remained muted during 2013-14 to 2016-17 (an average decline of 6.7 per cent) broadly in line with the fall in merchandise import payments mainly due to lower commodity prices, especially of crude oil. The role of factors other than imports in influencing the level of trade credit can be gauged from the trend in trade credit intensity of merchandise imports – measured by trade credit disbursements as a ratio to imports. A steep increase in trade credit intensity during 2009-10 to 2012-13 seems to be reflective of ultra-accommodative global financial conditions as the average 6-month LIBOR declined to 0.6 per cent from an average of 3.7 per cent in 2007-08 and 2008-09. The trade credit intensity moderated during 2013-14 and 2014-15, albeit increased somewhat thereafter. It may partly be due to the growing reluctance of banks to extend trade finance in the aftermath of tightening of global banking regulations and other supply-side conditions in the global market. Furthermore, a sharp depreciation of the rupee may also have impacted the demand for trade credit during this period (Charts 1 and 2).  III.2 Trade credit: domestic versus foreign banks A sizeable amount of cross-border trade credit raised by importers is intermediated by domestic banks (Chart 3). In the immediate period after the global financial crisis (i.e., 2009-10 to 2011-12), trade credit intermediated by both domestic and foreign banks grew significantly. However, trade credit arranged by foreign banks grew at a faster pace possibly due to their advantageous position relative to domestic banks to benefit from accommodative global financial conditions. However, with greater focus on regulatory tightening in subsequent years, trade credit through foreign banks recorded either decline or a sharp deceleration during 2012-13 to 2015-16 which was more perceptible than in the case of domestic banks. In fact, the flow of trade credit raised through domestic banks was somewhat resilient in 2015-16 and 2016-17 (Chart 4). Consequently, the share of foreign banks in total cross-border trade credit declined from one-third during 2007-08 to 2012-13 to one-fifth during 2013-14 to 2016-17 (Chart 5). Incidentally, a number of foreign banks have closed their branches in India in recent years which inter alia may have also weighed on the volume of cross-border trade credit (Chart 6).  III.3 Size-wise and currency-wise composition of trade credit As regards the average size of trade credit transactions, foreign banks deal with high-value transactions relative to domestic banks (Chart 7). Foreign banks not only have more capacity to undertake high-value transactions due to their multinational presence, but also the dominance of large corporates in their customer base could be a major factor for the trade credit deals to be of higher size. In contrast, domestic banks generally cater to trade finance needs of importers from MSME sector. Currency-wise composition of trade credit shows that it is predominantly raised in US dollar terms, followed by euro (EUR) and Japanese yen (JPY). Both EUR and JPY seem to have become less preferred currencies for trade credit in recent years (Table 1). One of the reasons for decline in EUR and JPY denominated trade credit could be the fall in imports from Euro area and Japan during 2013-14 to 2016-17 compared to an earlier increase during 2007-08 to 2012-13. Lower volatility in rupee exchange rate vis-a-vis dollar relative to JPY/EUR may also have influenced the decision of importers to raise trade credit in dollar terms in the latter period.  III.4 Cost of trade credit: domestic versus foreign banks The all-in-cost for raising trade credit is prescribed by the Reserve Bank of India as spread over 6-month LIBOR for the respective currency of credit or applicable benchmark. Analysis shows that the average cost largely varies in line with the trend in 6-month LIBOR (Chart 8).2 Since 2015 the increase in cost was, however, less steep for both foreign and domestic banks relative to the LIBOR implying that trade credit was raised with lower spread – particularly in 2015 and 2016. This was despite the higher spread (over 6-month LIBOR) allowed by the Reserve Bank since November 2011. It may be due to the sluggish demand for trade credit as India’s imports remained muted in 2015 and 2016. Furthermore, the cost of raising trade credit by foreign banks is a tad higher than domestic banks particularly after 2012. It is consistent with the fact that foreign banks use Letters of Credit (LCs) as an instrument to raise credit which is generally more expensive than Letters of Comfort/ Letters of Undertaking (LoCs/LoUs).3 On top of that, various surveys conducted in the post-crisis period suggest that global banks have significantly reduced exposure to emerging markets since 2010 as part of their efforts to bolster capital ratios (IIF, 2017). Therefore, it is quite possible that financial regulatory reforms may have become more burdensome for foreign banks forcing them to arrange trade credit for importers at higher cost relative to domestic banks. Briault et al. (2018) also highlight that the cost of doing business for global banks in EMEs has increased and local banks face less competition from foreign banks.  III.5 Overseas presence of domestic banks and trade credit Even though domestic banks account for a significant portion of cross-border trade credit, its distribution is significantly skewed across banks. Domestic banks with large overseas presence in the form of bank branches, overseas subsidiaries and representative offices have higher share in total trade credit approvals (Chart 9). This is not surprising as overseas branches played a key role for domestic banks to arrange the trade credit through LoUs and LoCs before they were banned by the Reserve Bank in March 2018. Although not globally acceptable like other standard instruments such as LCs and bank guarantees (BGs), LoUs/LoCs were largely issued by domestic branches of Indian banks for importers to avail trade credit from foreign branches of their own or other domestic banks.  In this section, we estimate an empirical model to ascertain the determinants of cross-border trade credit arranged by banks in India. The existing literature on cross-border trade finance and trade finance structure of the Indian banking system suggests that both global and domestic factors including the size of banks’ overseas network may be the potential determinants of trade finance volumes raised by banks for their importer customers. To examine the impact of various factors that can potentially influence the trade finance activity of banks operating in India, an unbalanced panel dataset of 55 banks is used for the period 2007-08: Q1 to 2016-17: Q4. This dataset consists of both domestic banks and foreign bank branches/subsidiaries. Data are sourced from Bloomberg, Thomson Reuters, World Bank’s database on World Development Indicators (WDI), Global Financial Stability Report (GFSR) and the Reserve Bank of India. The panel estimation methodology follows the underlying equation:  Where the dependent variable is the log of short-term credit approved by the ith bank in the year t. Variation in the dependent variable is explained by four broad set of explanatory variables, where Xlt, denotes l global factors in year t, Ykt are k country-specific macroeconomic indicators in year t, Zit represents the health indicators of the ith bank in the year t. Since the Indian banks source their trade finance mostly from banks or branches abroad so the degree of interconnectedness of the banks with their counterparty banks is also likely to positively impact the supply of trade credit. Following this notion, we have used the size of counter-party network as a variable (Cit) to capture the interconnectedness of banks in India and finally ∈it represents the random error term (Annexure 1). The global factors having potential impact on the trade finance are proxied by two variables, viz., global volatility index (VIX) and foreign cross-currency basis swap rates. While VIX is the most widely used measure of global financial conditions in the literature showing the expected range of movement in the S&P 500 index over the next year, the foreign cross-currency basis swap indicates dollar funding pressure in the global forex market. Since more than 90 per cent of trade credit issued by banks is dollar denominated, dollar shortages and funding costs in global markets, measured by foreign cross-currency basis swap rates, may tend to restrict trade finance. Here, cross-currency basis swap is basically the spread between the dollar funding in the major foreign currency markets over 3-month dollar LIBOR. Wider the margin, higher will be the cost of acquiring dollar in the secured market. Cross-currency swaps are frequently used by financial institutions and multinational corporations for funding foreign currency investments, and can range in duration from one year to up to 30 years. We have taken an average cross-currency swap which is a simple average of cross currency swaps of major currencies, viz., the Canadian dollar, the euro, the pound, the Hong Kong dollar, the Singapore dollar, the Japanese yen, the Korean won and the Swiss franc vis-à-vis the US dollar. A rise in VIX implying greater volatility in the global financial market and widening of cross-currency basis swap indicating dollar funding pressure faced by banks are expected to adversely affect the supply of trade credit. Among the demand side factors, the size of merchandise imports is considered to be an important factor as most of the credit arranged by banks are buyer’s credit catering to the short-term financing needs of importers. Moreover, price effect in terms of interest cost to the borrower might also act as a deciding factor for demand for trade credit. Trade credit is likely to be positively correlated with higher imports and negatively with rising borrowing costs. Apart from the global and domestic factors, trade credit approvals by banks may also depend on the financial health of the issuing bank which may act as a constraint in providing further credits during the period of stress. Sound and profitable banks will have greater flexibility to issue more credit. As an indicator of profitability, the study uses the ratio of net operating profit to total assets which is expected to have a positive impact on the trade credit. Finally, the overseas network of banks operating in India is also important for their capacity to raise trade credit for their customers. As short-term trade credit involves third-party banks acting as source of funds for these banks, their own presence or their business relationship with other banks may be a critical factor for their trade credit business. Since the issuing banks source funds for importers from another overseas bank or its own overseas branch, the availability of wider network of counterparty banks is likely to augur well for supply of trade credit. Well-diversified portfolio of banks in terms of larger network will ensure more flexibility and liquidity for the bank and hence will ensure a steady issuance of trade credit. The counter-party aspect in the model is measured by the number of counterparties used by a particular bank during each period and its deviation from the average number of counterparty banks by all banks in that year. Banks with a wider network of counter-parties are expected to have larger trade credit portfolio as it enhances their capacity to arrange funds. In the benchmark specification, standard Fisher unit root tests for unbalanced panel confirm the stationarity of the variables (Annexure 2). The model selection was based on standard tests in panel data. Hausman test was run to test the null hypothesis, H0: random effect is preferred. The analysis rejected H0 in favour of the alternative indicating preference of the fixed effects model. Redundant fixed effects test results confirmed the applicability of fixed effects model over any other specifications. However, it is important to note that the Hausman specification test does not apply if disturbances are serially correlated or cross-sectional heteroscedastic. The over-identifying restrictions test, or Sargan-Hansen test, straightforwardly applies to the panel regression models with heteroscedastic disturbances and cluster-robust standard errors. Significance of the Sargan-Hansen test statistic also implies that the fixed effects model is more reasonable fit for the given data (Annexure 3). Subsequently, the regression model is estimated controlling for bank specific time-invariant characteristics and quarter specific shocks (the bank and time fixed effects). To allow for cross sectional heteroscedasticity in the coefficients generalised cross-section weights are used. Finally, to control for cross-section dependence arising from a number of factors, viz. sample selection, unobserved common shocks and policies adopted by the central bank, the model is estimated with Driscoll and Kraay (1998) robust standard errors (Annexure 4). Commodity-wise composition shows that 20 per cent of trade credit is raised for crude oil imports and is often routed through specified banks based on certain policy considerations. As trade credit issuance for oil imports might not be driven by the usual parameters, a separate model is estimated for trade credit issuance of non-oil sectors to check the robustness of the fit. Endogeneity might be present in a model in which an explanatory variable correlates with the error term due to measurement errors, omitted variables and presence of reverse causality. To check for potential endogeneity between the trade credit and imports, a pair-wise granger causality test was conducted which confirmed bi-directional granger causality and therefore, did not rule out the possible causation from trade credit to imports (Annexure 5). To address potential endogeneity in the model robustness check was done by running a 2SLS model with instrumental variables. In the alternative specification with 2SLS IV, imports variable was instrumented by lagged value of imports satisfying the condition of endogeneity. The results corroborate with the benchmark specification estimates. As some variables (interest costs, VIX and cross currency swap) were observed to have strong correlation with each other, we have used these explanatory variables in alternative specifications (Annexure 6). As observed from the data, Indian banks prefer to arrange funds from their own overseas branches. In contrast, foreign banks are more open, accessing funds from overseas banks adhering to international instruments of trade credit. As the nature of trade credit business seems to differ for domestic and foreign banks, separate panel regressions were estimated with the same specification to confirm whether relative importance of various determinants varies across bank categories. The results of the panel regression of the benchmark specifications and the alternative 2SLS-IV specification are discussed in this section. V.1 Benchmark specification: overall sample The regression results based on the benchmark specification (equation I) validate our hypotheses outlined in the previous section (Table 2). As expected a priori, the two demand side variables impact the volume of cross-border trade credit. The volume of trade credit varies positively with the size of India’s imports (LIMP). It implies that demand for trade credit tends to be high when imports are higher. Similarly, the trade credit activity varies negatively with increase in costs (LIBOR plus spread). Besides demand side variables, the supply side variables were also found to be statistically significant in explaining the trade credit activity of banks. Both specifications using alternative proxies for global financial conditions suggest that global volatility (VIX) as well as availability of US dollar funding (CSWAP) in the global interbank market play an important role in influencing the supply side conditions for trade credit. During the periods of the foreign currency scarcity, higher premiums in the inter-bank market may discourage banks to arrange dollar denominated trade credit. The financial health of banks, measured by operating profit performance (OPR), also positively influences the trade credit issuances by banks. The size of overseas network of banks (CP) turned out to be a significant factor in determining the size of their trade credit activity. As observed earlier, domestic banks mostly arrange funds through LoUs and LoCs which were accepted only by overseas branches/subsidiaries of their own or other Indian banks – acting as a counterparty. Thus, banks with larger size of overseas network were found to have higher trade credit issuances. Greater overseas network of counterparties may be ensuring easy accessibility to foreign funds for trade credit. V.2 Benchmark specification for non-oil sector The benchmark equation is re-estimated for the non-oil sector to check the robustness of fit as trade credit issuances for oil imports are generally administered rather than entirely driven by market forces and hence, might distort the results. The results corroborate the findings of the benchmark specification confirming the significant impact of the global, macroeconomic and financial health of concerned banks on trade credit activity (Table 3). V.3 Sub-sample estimation: domestic versus foreign banks The hypothesis that the demand and supply-side factors explaining the trade credit activity might vary for domestic and foreign banks was tested by separating the full sample into two sub-samples of domestic and foreign banks. The regression results of the sub-sample of bank groups mostly adhere to the overall sample results, explained significantly by the imports and global volatility. Further, the interconnectedness with overseas banks is equally important for both the bank groups (Table 4). There are, however, two points of difference emerging from the results. First, the elasticity of trade credit to interest cost is not significant for foreign banks unlike domestic banks. One reason could be that domestic banks cater mainly to MSME sector which may be more sensitive to the cost changes than large importers which form the majority customer base of foreign banks. Further, domestic banks are mostly operating through their own overseas branches with less formal internal system of documentation, thereby giving them the flexibility to vary the interest charged from their clients within the all-in-cost ceiling prescribed by the Reserve Bank. Foreign banks, on the other hand, generally operate with other foreign banks using internationally standardised instruments such as LCs with relatively more standardised cost structures. Another difference is with regard to the impact of banks’ health on trade credit. For domestic banks, the financial health parameter does not significantly influence their trade credit activity unlike in the case of foreign banks. As majority of Indian banks constitute public sector banks with implicit support of the government, health parameters of these banks may not matter much for their trade credit intermediation unlike foreign banks. V.4 Robustness check with 2SLS – IV estimation The benchmark model was re-estimated with a two-stage least square model with instrumental variables to address any potential endogeneity between imports and trade credit. The import variable was instrumented by lag of imports which has a strong correlation with the current imports but not with the dependant variable. The alternative specification, however, confirmed results of the benchmark model as the coefficient of LIMP was found to be statistically significant. However, the impact was much stronger than that estimated in the benchmark model (Table 5). VI. Conclusion The paper concludes that both demand and supply-side dynamics influence the flow of cross-border trade credit to India. The fall in trade finance intensity in recent years is clearly an indication of supply-side constraints. In particular, the financial health and size of overseas network of banks operating in India matter for trade credit. Empirical evidence suggesting positive impact of imports volume on trade credit flows makes short-term external debt as one of the critical variables to be monitored for external sector vulnerability. This is especially pertinent when imports payments are driven by higher international commodity prices. As tight global financial conditions are found to impede trade credit flows, policy efforts towards strengthening of banks’ overseas business network may make these flows more resilient. Domestic banks largely depend on their own branches or branches/subsidiaries of other domestic banks which hitherto have been accepting non-standardised trade instruments, viz., LoUs and LoCs for arranging the trade credit. The overdependence of domestic banks on their overseas branches through less standardised trade credit instruments limits the scope of their trade credit operations. Incidentally, the drying up of trade credit disbursed through domestic banks in the aftermath of prohibition of LoUs/LoCs by the Reserve Bank of India in March 2018 confirms that their narrow overseas network base is a binding constraint for their trade credit business. The empirical findings of the paper suggest that banks need to expand their global banking relationship and shift towards the use of globally accepted trade finance instruments instead of indigenous instruments (i.e., LoUs /LoCs) which, however, may push up the cost. @ Authors are Director, Assistant Adviser and Research Officer, respectively, in the Department of Economic and Policy Research (DEPR) of the Reserve Bank of India. * Authors are thankful to discussants Prof. C. Veeramani and Shri Rajeev Dwivedi for their valuable comments on an earlier version of this paper presented in the DEPR Study Circle. They are also grateful to Shri Rajan Goyal for his guidance. The views expressed in the article are those of the authors and do not represent the views of the Reserve Bank of India. 1 If the average trade credit intensity of 2015-16 and 2016-17 (i.e., 23 per cent of imports) is used to estimate trade credit disbursals in 2017-18, it would imply a gap of about US$ 7.5 billion during the year. 2 Cost of trade credit shown in Chart 8 is estimated on the basis of only those transactions (approvals) for which data were reported by banks. 3 LoUs/LoCs were largely issued by domestic branches of Indian banks for importers to avail trade credit from foreign branches of their own/other Indian banks. Globally, however, letters of credit (LCs) and bank guarantees are the accepted instruments of trade finance and are used when buyer and seller do not know each other. References: Asian Development Bank (2017). "2017 Trade Finance Gaps, Growth, and Jobs Survey", ADB Brief No. 83. Alexander, D. K., Tan, K. C., Adnan, G. and Lambert J.F (2011). “Private Bankers’ Response to the Crisis: Warnings about Changes to Basel Regulatory Treatment of Trade Finance” in Chauffour, J.P and Malouche, M. (eds.), Trade finance during the great trade collapse, pp 173-198, World Bank, Washington, D.C Amiti, M. and Weinstein, D. (2012). “How much do bank shocks affect investment? Evidence from matched bank-firm loan data”, Working Paper Series No. 310, Columbia Business School, December 2012. Asmundson, I., Dorsey, T., Khachatryan, A., Niculcea, I. and Saito, M. (2011). “Trade and trade finance in the 2008-09 financial crisis”, IMF Working Paper WP/11/16. Auboin, M. (2009). “Restoring trade finance during a period of financial crisis: stock-taking of recent initiatives”, Staff Working Paper ERSD-2009-16, World Trade Organization. Avdjiev, S., Zsolt, K., Előd, T. (2012). “The euro area crisis and cross-border bank lending to emerging markets”, BIS Quarterly Review, December. Bank for International Settlements (2014). “Trade finance: developments and issues” CGFS Papers No 50. Behrens, K., Gregory, C. and Giordano, M. (2011). "Trade Crisis? What Trade Crisis?”, CEPR Discussion Paper No. 7956, CEPR London. Briault, C., Erik, F., Mazo, I.G.D., Yee, B.K.C., Rademacher, J., and Skamnelos, I. (2018). “Cross-Border Spillover Effects of the G20 Financial Regulatory Reforms Results from a Pilot Survey”, World Bank Policy Research Working Paper No. 8300 (January). Calomiris, C., Himmelberg, C. and Wachtel, P. (1995). "Commercial Paper, Corporate Finance, and the Business Cycle: A Microeconomic Approach." Carnegie-Rochester Series on Public Policy 42: 203-250. Chauffour, J.P. and Malouche, M. (2011). “Trade finance during the great trade collapse”, World Bank, Washington, D.C. Choi, W. G. and Kim, Y. (2005). “Trade Credit and the Effect of Macro-Financial Shocks: Evidence from U.S. Panel Data”, Journal of Financial and Quantitative Analysis, Vol. 40, pp.897–925. Committee on the Global Financial System, “Trade Finance: developments and issues”, CGFS Papers No 50, January 2014, BIS. Coulibaly, B., Horacio, S. and Zlate, A. (2011). “Trade Credit and International Trade during the 2008-09 Global Financial Crisis”, International Finance Discussion Papers No.1020, Board of Governors of the Federal Reserve System. Driscoll, J. C. and Kraay, A. C. (1998). Consistent Covariance Matrix Estimation with Spatially Dependent Panel Data. Review of Economics and Statistics 80: 549–560. Eck, K. and Schnitzer, M. (2011). “How Trade Credits Foster International Trade”, University of Munich, mimeo. Engemann, M., Eck, K. and Schnitzer, M. (2011). “Trade Credits and Bank Credits in International Trade: Substitutes or Complements?”, BGPE Discussion Paper no. 108. Erbenová, M., Liu, Y., Kyriakos-Saad, N., Mejía, A. L., Gasha, G., Mathias, E., Norat, M., Fernando. F. and Almeida, Y. (2016). “The Withdrawal of Correspondent Banking Relationships: A Case for Policy Action”, IMF Staff Discussion Note, SDN/16/06, July. Garralda, J. M. S. and Vasishtha, G. (2015). “What drives bank-intermediated trade finance? Evidence from cross-country analysis”, Bank of Canada Working Paper No.2015-8. Hallaert, J. J. (2011). “Why Boosting the Availability of Trade Finance Became a Priority during the 2008–09 Crisis” in Chauffour, J.P. and Malouche, M. (eds.), Trade finance during the great trade collapse, pp 117-132, World Bank, Washington, D.C Hibiki, I. and Lambert, F. (2016). “Post-crisis International Banking: An Analysis with New Regulatory Survey Data”, IMF Working Paper No. 16/88. Iacovone, L. and Zavacka, V. (2009). “Banking Crisis and Exports-Lessons from the Past”, Policy Research Working Paper 5016, World Bank, August 2009. International Chamber of Commerce (2015). 2015: Rethinking Trade & Finance, ICC Global Survey on Trade Finance (September). International Chamber of Commerce (2016). 2016: Rethinking Trade & Finance, ICC Global Survey on Trade Finance (October). Institute of International Finance (2017). Basel Capital Reforms: Impact on Emerging Markets, January. International Monetary Fund (2003). “Trade Finance in Financial Crises: Assessment of Key Issues”, IMF Policy Paper (December). Ivashina, V., Scharfstein D. S. and Stein, J. C. (2015). “Dollar funding and the lending behavior of global banks”, Quarterly Journal of Economics, Vol. 130 (3), pp.1241-1281. Klapper, L. Laeven, L. and Rajan, R. (2012). "Trade Credit Contracts," Review of Financial Studies, Society for Financial Studies, Vol. 25(3), pp 838-867 Levchenko, A. A., Logan T. L. and Tesar, L. L. (2010). "The Collapse of International Trade during the 2008-2009 Crisis: In Search of the Smoking Gun", NBER Working Paper no. 16006. Love, I., Preve, L. A. and Sartia-Allende, V. (2007). “Trade Credit and Bank Credit: Evidence from Recent Financial Crises”, Journal of Financial Economics, Vol.83, pp.453–69. Malouche, M. (2011). “World Bank Firm and Bank Surveys in 14 Developing Countries, 2009 and 2010” in Chauffour, J.P. and Malouche, M. (eds.), Trade finance during the great trade collapse, pp 173-198, World Bank, Washington, D.C Mora, J. and Powers, W. (2011). Global Perspectives in the Decline of Trade Finance in Chauffour, J.P and Malouche, M. (eds.), Trade finance during the great trade collapse, pp 117-132, World Bank, Washington, D.C Niepmann, F. and Eisenlohr, T.S. (2013). “No Guarantees, No Trade: How Banks Affect Export Patterns,” Staff Report 659, Federal Reserve Bank of New York 2013. Paravisini, D., Rappoport, V., Schnabl, P. and Wolfenzon, D. (2011). "Dissecting the Effect of Credit Supply on Trade: Evidence from Matched Credit-Export Data", NBER Working Paper no. 16975. Starnes, S. K., Michael, K. and Alexander, A. J. (2016). “De-risking by banks in emerging markets – effects and responses for trade”, EMCompass Note 24, International Financial Corporation (World Bank Group). United Nations Conference on Trade and Development (2018). UNCTAD-Eora Global Value Chain Database, Geneva (Switzerland)

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

পৃষ্ঠাটো শেহতীয়া আপডেট কৰা তাৰিখ: