II.18 To sum up, significant structural changes characterise the trends in savings and investment in the economy over the period since the structural reforms were undertaken in the economy since the 1990s. While the households continue to retain their status of being financially the surplus sector, in combination with the private corporate sector, the two sectors, namely the private sector, has strengthened its relative position in the sphere of savings and investment vis-à-vis the public sector.

Interpretational Significance of the Savings and Investment Estimates

II .19 In the light of the higher growth path of the economy in recent years, a critical review of the available estimates of domestic and national savings and investment in the economy would be useful with respect to their interpretational significance. Savings and investment estimates are attracting centre stage attention globally from the standpoint of their implications for contemporary issues such as persisting global imbalances. As mentioned earlier, savings can accrue to the economy from three sectors - namely, household, corporate and public sectors. More importantly, interpretational aspects and measurement issues have come to the fore, particularly in household savings, which is a dominant savings sector in India where a number of issues related to the estimation are still unsettled. Interpretational issues have remained endemic to the savings estimates, surfacing from time to time leading thereby to formation of Committees to address these concerns.

Savings from a Macro-Economic Perspective

From a macroeconomic perspective, three important measures of savings are private savings, Government savings and national savings.

(a) Private Savings = Sp = Private disposable income – Consumption

= (Y + NFP +TR – T + INT) – C ——————————————————(1)

(b) Government Savings = Sg = Net Government Income – Government purchase

= (T – TR – INT) – G ——————————————————————(2)

Where Y = Gross Domestic Product, NFP = Net Factor Payment from Abroad, TR = Transfers received from the Government, INT = Interest Payment on the Government’s Debt, T = Taxes (including income from entrepreneurship and property), C = Consumption and

G = Government purchases (purchase of goods and services and compensation of employees).

(c ) National Savings = S = Sp + Sg

= (Y + NFP +TR– T + INT) – C + (T – TR – INT) – G

= Y + NFP – C – G

= C + I + G + NX + NFP – C – G

= I + NX + NFP

= I + CA ———————————————————————————(3)

Where NX = Net Exports and CA = Current Account Deficit.

Sp + Sg = Ip + Ig + CA—————————————————————(4)

In the Indian context, the gap between the savings and investment (Gross Capital Formation) by different sectors and its distribution for the year 1999-2000 (the latest base year for the National Accounts Statistics) is given in Table 2.3.

II.20 One analytical use of the national savings identity is to bring out an important short-run, long-run dichotomy. In the short-run, international borrowing can go up or down depending on cyclical movements, exchange rates, and a host of other factors. Very few countries do without any international borrowing or lending in a particular year. But over a longer period of time, international borrowing kept close to zero stabilises a country’s ratio of international obligations to its gross domestic product (GDP). When this liability ratio is stable, a nation’s savings is implicitly financing most of its domestic investment.

Table 2.3: Savings and Gross Capital Formation (GCF) by Institutional Sectors, 1999-2000 |

(Rs. in crore) |

Particular |

Savings |

GCF |

Savings-GCF |

1 |

2 |

3 |

4 |

1. |

Total Economy |

302835 |

312578 |

-9743 |

| |

1.1 |

Household |

350994 |

144392 |

206602 |

| |

1.2 |

Private Corporate |

41036 |

97277 |

-56241 |

| |

1.3 |

Public Sector |

-89195 |

70909 |

-160104 |

2. |

Valuables |

|

15519 |

-15519 |

3. |

Current Account Deficit |

21988 |

|

21988 |

4. |

Errors and Omissions |

|

-3274 |

3274 |

5. |

Total |

324823 |

324823 |

0 |

II.21 Secondly, persistent borrowing, keeping investment above savings, may be possible, but it is not common, and in any case it automatically implies a build-up of international liabilities relative to its national output. If a nation wants to have its investment and not pay increasing shares of income in interest or dividends, it has to finance this investment by its own national savings. Alternatively, turning the equation around, high national savings will raise future living standards, whether it finances investment directly or reduces international borrowing.

II.22 Thirdly, the identity (4) ties savings to budget and current account deficits. Both deficits are subtraction items.

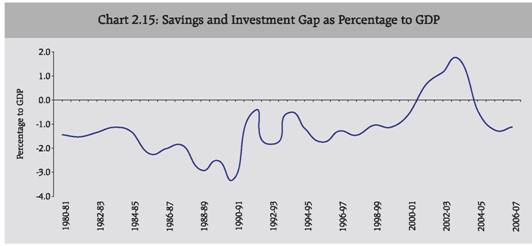

II.23 The savings-investment gap in India is relatively low reflective of modest reliance on foreign savings. Among the domestic sectors, contribution-wise, the private corporate sector savings, of late, has turned out to be a significant driver in domestic savings and together with household sector, is contributing to the generation of private savings. Although the public sector savings remained in a dis-savings mode for a long time, there is a turn-around recently. Significantly, these changes are occurring when the economy remained on a high growth trajectory in the last five years.

II.24 Cross-country differences in the evolution of gross corporate savings over the past half decade have tended to reflect to a large extent those of the gross operating surplus. Such differences across countries are likely to be due to countries’ exposure to global factors (accelerated globalisation and technological progress), presumably depending on institutional framework conditions (such as product and labour market regulations), as well as the sectoral composition of their economies.

II.25 As mentioned earlier, there is an across-the board rise in savings by all the constituent sectors in a period of high growth particularly in the post-reform period of the 1990s and 2000s. To the extent there are compositional shifts within the components of savings happening in conjunction with the structural transformation of the Indian economy, these trends have been recognised as structural in nature in the literature. Within the constituent sectors, the household financial savings, the non-departmental undertakings within the Government sector and the non-financial joint stock companies within the private corporate sector contribute predominantly to the generation of domestic savings in the era of reforms.

Interpretational Difficulties that have led to Frequent Questions on Estimation

II.26 Amongst the components of national accounts statistics (NAS), it is the savings and investment estimation on which the authorities have cast doubts at frequent intervals on the grounds of interpretational difficulties faced by them in explaining some aspect of macroeconomic development or the other. Working Groups/Expert Groups were appointed to enquire into the questions and they have all come out with recommendations for improvements in the methodology of savings and investment estimation.

II.27 It may be recalled that Raj and Chelliah Expert Groups were asked to look into some of the interpretational issues then existing. First, there was the K.N. Raj Working Group (1982), which was set up when it was found that,

II.28 “The rates of gross capital formation and of gross saving have gone up significantly since the early years of the 1970s, to about 24 per cent of the gross domestic product by 1978-79; even net capital formation and savings were touching rates of around 20 per cent of the national income. This has raised a number of questions, in regard to both the estimates themselves and their interpretation, particularly since there has been evidently no corresponding improvement in growth momentum within the economy and the problems of mobilisation of resources for development seem still as severe as ever before” (RBI, 1982).

II.29 Second, there was the Chelliah Expert Group appointed in the context of the contrary development when savings fell and growth improved. It was found that:

II.30 “An important reason for this lagged recovery in private savings is the decline in the absolute amount of household savings in 1992-93 as estimated by the CSO. Since this decline is observed for a year in which the GDP growth rates rises from 0.9 per cent to 4.3 per cent and GDP growth from agriculture shows a sharp turnaround from (-) 2.5 per cent to plus 5.3 per cent, there appear to be grounds for reviewing the methodology for estimating, saving and capital formation in the economy [Economic Survey 1994-95:3].

II.31 The Chelliah Expert Group itself argued that there were large discrepancies in the estimates of saving and investment, with saving being far in excess of investment – “the order of discrepancy being almost 2 per cent of GDP in 1994-95. Indeed, this has raised questions about the quality of the estimates, and the methodology adopted for collecting data” (Department of Statistics 1996:5).

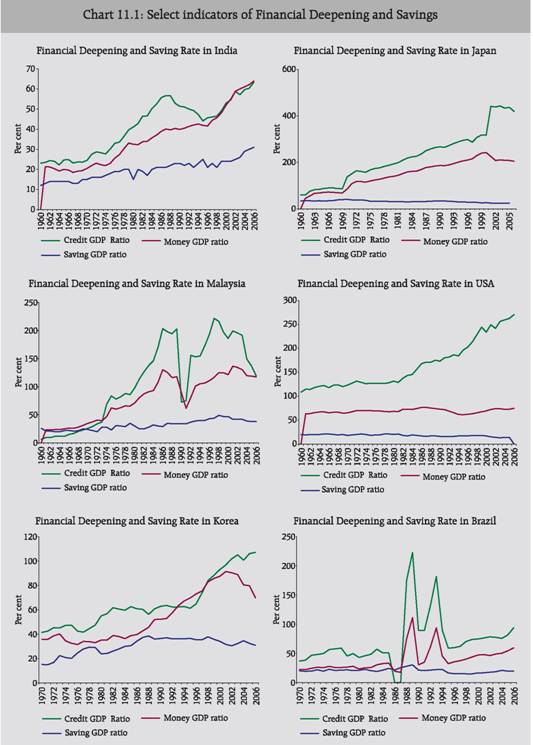

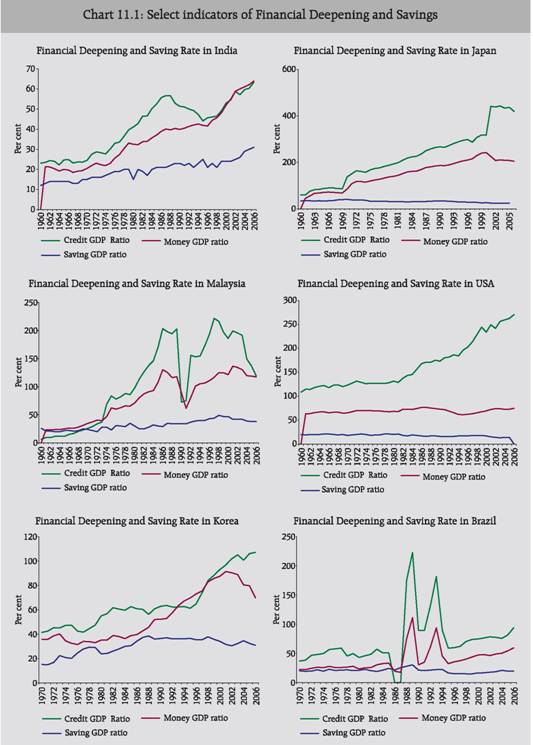

II.32 More recently, the Report of the Working Group on Savings for the Eleventh Five Year Plan, 2007-08 to 2011-12 (RBI, 2007) argued that “the procedures currently adopted for estimation of household savings and its projection needs a re-look as we move along”. This is because the estimates of household financial savings are showing a decline, despite signs of financial deepening - a puzzle for the Working Group, which has impliedly made out a case for fully measuring household income, expenditure and savings through integrated nation-wide field surveys so as to capture the complex interplay of a number of variables impacting on household savings.

II.33 The important observations that the above Committees have made on the interpretational issues of savings and investment estimates are given below.

II.34 First, the relatively small accretion to the savings rate during the ‘eighties’ underscored the need for undertaking measures to raise this rate or/and lower the incremental capital output ratio (ICOR) for effecting improvement in the overall growth rate. This position changed subsequently with rise in growth since the eighties.

II.35 Second, a sharp increase in the preference for financial assets as against physical assets in the 1990s implied that this preference is essentially a reflection of financial widening in the sense of availability of a larger menu of financial assets, and of a sharp reduction in financial controls. The growing flexibility that investors enjoyed in terms of choice of assets in the increasing financial portfolios and in terms of optimisation of rates of return with risk minimisation furthered by financial sector reforms. The Chelliah Committee (1996) noted that as the reforms are intensified, financial savings are bound to play a more crucial role in economic development than hitherto.

II.36 Third, apart from undertaking structural and institutional measures for influencing productivity, it is imperative that the investment rate in the economy is higher than the GDS rate essentially to ensure that savings of a relatively underdeveloped country such as ours is not exported. One of the aspects of the estimates of savings and investment in India is the discrepancy in the estimates of GDS and gross domestic capital formation (GDCF) in most of the years. The Chelliah Group believed that GDCF estimates are subject to errors in several respects, and methodologies need to be, therefore, improved. The savings in the form of physical assets of the household sector being a part of the estimate of capital formation of the economy would reflect the errors, which creep in the estimates of total capital formation in the economy. As physical assets of the household sector are common and critical to both the aggregates, the Chelliah Group thought it desirable to have this component independently estimated.

II.37 Fourth, the problem of obtaining the data on a regular basis is severe in the case of the household sector. This sector comprises not only farm households engaged in agricultural production, but also individual households and unincorporated enterprises engaged in industry, trade, transport, finance, private trusts, etc. The estimates for the household sector are worked out on the basis of the available data from various censuses, sample surveys, and research studies and assumed relationships. The estimates, therefore, would have errors.

II.38 Fifth, as is known, number of ratios and norms are used in the preparation of estimates of capital formation for the economy as a whole and in respect of the household sector. These ratios are based on data of somewhat remote past and their use may be unwarranted in the light of the structural changes taking place in the economy. If these ratios are updated, the estimation of capital formation would considerably improve in qualitative terms and the relative size of errors and omissions would probably come down.

II.39 Sixth, according to Mulheisen (1997), the interpretation of Indian savings trends is complicated by a number of weaknesses in the methodology for measuring both investment and savings. The most important shortcomings are:

-

The estimate for physical household savings is set equal to household investment, which itself is calculated only indirectly as a residual. Measured physical household savings has been highly volatile

-

There are errors and omissions in the estimates of both savings and investment, but adjustments are made only to investment. The underlying assumption is that the savings estimates are more reliable (based on the greater accuracy of public, financial, and corporate savings data) and, therefore, investment is adjusted to equal the sum of domestic and foreign savings. Reversing the present CSO practice, when domestic savings is adjusted to include errors and omissions, so that the sum of adjusted domestic savings and foreign savings equals the original investment estimates. This yields a much smoother, more plausible path for domestic savings (Mulheisen, 1997).

-

The estimates of corporate savings and investment are based on a small, unrepresentative sample, and rely largely on voluntary responses from enterprises.

II.40 Seventhly, as we move to the 1990s, what we see is that financial deepening has strengthened in India, judged by a host of indicators, which however has not been reflected in financial savings of the household sector contrary to the a priori expectation that financial development should spur economic growth and saving. Part of the reason could be methodological to the extent that household financial liabilities, which finance physical savings, are deducted from gross financial savings to arrive at the net financial savings.

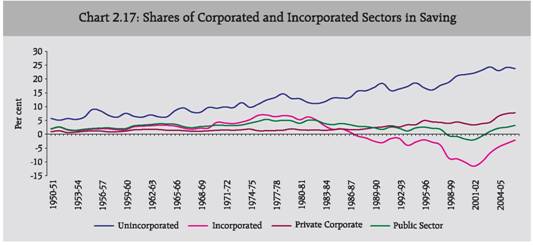

II.41 Another issue that has come into focus in the recent literature was that if the corporate sector’s saving is going up, the household sector’s savings would come down, to the extent that unincorporated entities, constituting a part of the household sector, get incorporated and such savings are reflected as corporate savings. In future, to the extent the savings from the incorporated sectors is getting strengthened, it may lead to a decline in the share of savings of unincorporated (household) sector.

Interpretation of India’s Savings and Investment Estimates

II.42 The HLC discussed the interpretational significance of the estimates of savings and investment. It recognised that earlier Committees like Raj Committee and Chelliah Committee as also reputed economists and statisticians have endorsed India’s present procedure of estimation as conceptually sound. Notwithstanding the conceptual strength of India’s practice, the present method is subject to weaknesses mainly emanating from data quality and related problems. For correct interpretation and a clear understanding of the available estimates of domestic savings and capital formation, it is essential to first keep in mind the various data sources used and the current methodology of estimation of

savings and the capital formation. In doing so, it would be possible to indicate the areas where errors in estimation could arise. The discussions of the HLC focused mainly on savings from a macro-economic perspective to bring out certain analytical underpinnings of the estimates, interpretational issues with regard to India’s savings estimates, indicating the possibility of under or over estimation of savings mainly in the context of problems with regard to measurement, data base, method of estimation and reliability, both at the overall and sectoral levels. Similarly, a brief analysis on the investment estimates was attempted by the HLC. Based on such detailed deliberations, the HLC has made some broad observations. A synthesis of the HLC’s deliberations and the views are provided below.

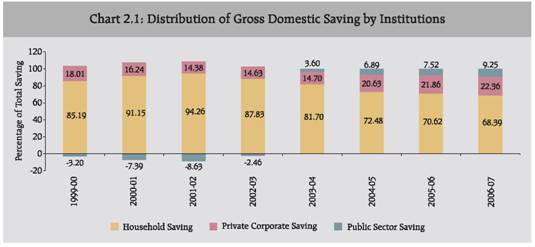

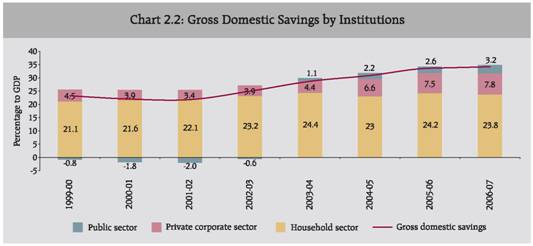

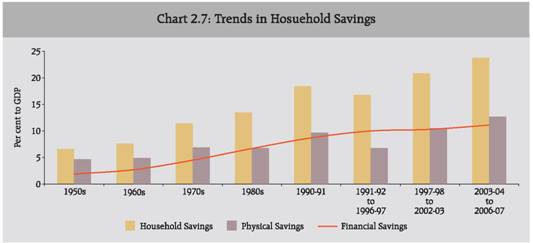

II.43 As mentioned earlier, an analysis of the recent trends in Gross Domestic Savings

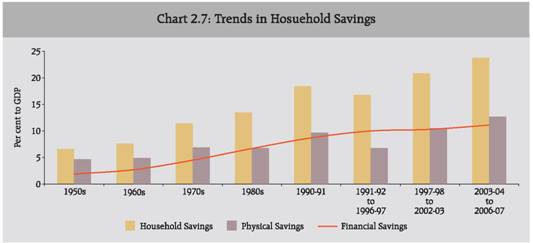

(GDS), overall and across sectors, suggests that at a disaggregated level, it is the household sector, which occupies a position of dominance over the other institutional sectors like private corporate sector and the public sector in terms of generating savings. Household savings composed of both financial and physical savings, as a percentage of GDP at current market prices, increased from around 6.6 per cent in the 1950s to 23.8 per cent in 2006-07. Savings by public sector and private corporate sector are improving in recent years.

Household Savings

II .44 With regard to the household sector, over the period 1999-00 to 2006-07, while personal disposable income has grown at an average rate of 10.3 per cent per annum, private final consumption expenditure has grown at the rate of 9.2 per cent per annum, leading to an increase in household savings, in turn, attributable to both household financial and physical savings. Within the former category, a clear preference pattern changes are seen in rise in the rate of contractual savings (mainly life insurance funds) and decline in the rate of net deposits. As per the related literature, the household savings rate responds to changes in economic environment as well as to structural changes (for example, financial liberalisation) and it is expected that the quantum of the household savings tracks a host of theoretically well-established determinants, the prime among them being the growth in per capita income, financial liberalisation, favourable demographics, low wealth effects on consumption, greater opportunities for diversification across financial assets and market related returns. As already stated earlier, a documentation of the theoretical and empirical literature on savings behavior in India can be found in EPWRF-NCAER study (2003). One of the supportive factors of contemporary relevance in emerging market economies and India in particular is the low dependency ratio (measured as share of population in the total population which falls outside the working population in the age group of 15-59 years) and a near one-for-one relationship between it and national savings (Mulheisen, 1997, Rodrik and Subramanian, 2004, Poddar and Yi, 2007, and Hiroko Oura, 2007). Some of the estimated

results of the above-mentioned studies are as follows:

- Poddar and Yi (2007) find that a 1 percentage point decrease in the dependency ratio adds 0.8 to the national savings ratio.

- Hiroko Oura (IMF 2007) finds that 10 per cent increase in the savings ratio between 2005 and 2025 is on account of fall in dependency ratio.

II .45 The household savings are also driven in recent years by the physical savings, especially since 2000-01 when the household sector has shown a preference for savings in the form of physical assets. This could be attributed partly to the soft interest regime in recent years. Increase in the rate of household savings in physical asset in recent yearsreflects booming construction activities mainly of housing and accelerated industrial activities requiring machinery and equipments.

II.46 While countries like the US and UK have established a mechanism to directly estimate the savings of their respective household sector through income-expenditure surveys, India follows a unique way of estimating the household savings indirectly by a method, which is a mix of flow-of-funds and commodity flow approaches, where household sector’s share is

extracted as residual.

II.47 The estimates of financial savings in respect of households including non-profit institutions and unincorporated private business are estimated by changes in the net financial assets held by them such as: currency, deposits with financial institutions, shares and debentures, claims on Government, net equity in the life funds, provident and pension funds net of changes in financial liabilities. The estimates in respect of various financial instruments are arrived at as a residual after duly accounting for such instruments held by public and private corporate sectors. In estimating the financial savings of the households, increments in their holdings of financial assets are calculated net of increments in their financial liabilities. These annual flows are compiled instrument-wise. As the household sector is an unorganised sector and its balance sheets are not available, its financial flows are either estimated on the basis of firm information obtained from the accounts of counterpart institutions engaged in transactions with the households or as a residual after deducting the accounted financial information for the other sectors from the financial totals or are based on the information collected on sectoral distribution either directly or on the basis of surveys. Select methodological problems are the following.

II.48 First, in absence of comprehensive income-expenditure surveys, instrument-wise savings estimates are prepared in an indirect manner through the residual treatment accorded to household sector in the flow-of-funds accounts. The difficulty here is the absence of cross-validation from a direct survey. Savings is estimated either from the income-expenditure account or from the flow-of-funds account, as earned net worth, being the difference between change in asset and liabilities, adjusted for capital gains and losses. Theoretically, these two measures of savings should yield identical results. In US and UK, both the estimates are available, which help in cross-validating the income-expenditure survey based direct estimates of savings. But in India, only flow-of-funds based estimation is available for household financial savings and commodity flow based estimation is available for household physical savings.

II.49 Second, in the absence of income-expenditure survey, there is no direct estimation of household savings and as a result there is no cross validation of the indirect (residual) estimates of savings.

II.50 Third, the estimates of domestic savings are presently prepared only at current prices. The estimates at constant prices have not been attempted so far as the suitable procedure of estimation is yet to be evolved.

Some Marked Features of Trends in the Savings in India

Predominance of Household Savings

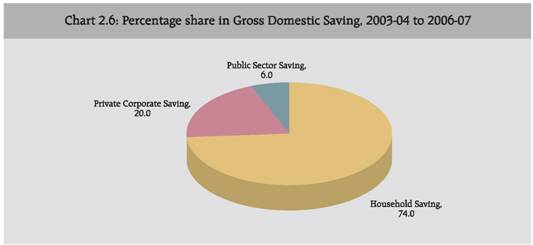

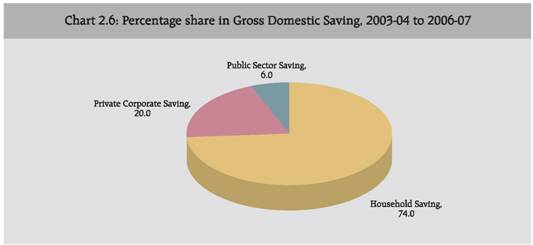

II.51 A remarkable feature of the Indian macro-economic story since independence has been the continuous rise in household savings over the decades. Since the 1950s, the household sector has remained the predominant source of the GDS, and it contributed, on an average, around 74.0 per cent to total domestic savings during the last five years ending 2006-07. Conversely, private corporate sector accounting for 20.0 per cent, occupies second place followed by the public sector (6.0 per cent) (Chart 2.6).

Structural Shift in the Household Savings

II.52 A salient feature of the 1990s was the rising trend in the household sector savings. Within the household sector savings, the rate of savings held in financial assets steadily increased during this period. Financial liberalisation has an important bearing on financial savings as it involves the creation of newer instruments and avenues of savings, and also reduces intermediation costs (McKinnon, 1973). In India, the phenomenon of improvement in financial savings could be attributed to more efficient financial intermediation, greater opportunities for diversification across financial assets and emergence of market related returns.

II.53 Over time, although both financial and physical savings have recorded an increase, the composition of household savings has seen a shift in favour of financial savings reflecting the spread of banking and financial services across the country. The share of household savings in physical assets in the total household savings declined from more than 70.0 per cent in the 1950s to around 53.5 per cent in last five years ending 2006-07. Concomitantly, the share of household financial savings in the total household savings increased from around 25.0 per cent in the 1950s to around 47.0 during the same period. The rate of financial savings increased from less than 2.0 per cent in the 1950s to over 11.0 per cent during 2003-04 to 2006-07 (Chart 2.7). The spread of the financial sector, in particular of bank branches, post office savings and the likes, seems to have helped in mobilising household financial savings.

II.54 However, since 2000-01, the household sector has shown some preference for savings in the form of physical assets, which could be attributed partly to the soft interest rate regime in recent years, substantial growth in self-employment giving rise to a large number of informal sector activities as well as the rising expectation arising from rapid appreciation of the value of investments in housing. The ongoing financial deepening is facilitating larger access of bank credit for the households. As a result, household financial savings have increased only marginally from an average of 10.3 per cent during 1997-2003 to 11.3 per cent of GDP during 2003-2007. On the other hand, with increased availability of housing finance, household sector’s investment rate (physical savings) increased from 10.5 to 12.7 per cent during the same period. Thus, the widening of Savings-Investment gaps of the public and private corporate sectors combined was partly financed from household financial savings and partly by foreign savings.

Changing Composition of Household Financial Savings

II.55 The rate of household savings increased from 18.4 per cent in 1990-91 to the peak level at 24.4 per cent in 2003-04 and subsequently it declined to 23.8 per cent in 2006-07. At the average level, the rate of household savings is rising from 17.3 per cent during the five year period (1990-95) to 18.1 per cent during 1996-2000 and further to 23.2 per cent during 2006-07.

II.56 ‘Bank deposits’ is an instrument of great significance in that it constitutes the largest proportion of household financial savings (Table 2.4). Its share which fell during the 1980s, has been recovering since the 1990s. Notwithstanding financial innovations, bank deposits continued to be the most important instrument of financial savings among the households during the period of reforms. The buoyancy in bank deposits over the recent years partly reflects some migration from small savings; as this signifies only a shift in the asset portfolio composition of households.

II.57 Another important feature of household savings during the reform period has been the increasing importance of savings held in insurance funds, and provident and pension funds (together described as contractual savings). Within financial assets, preference has shifted from savings in the form of shares and debentures and deposits to claims on Government and contractual savings. A major component of contractual savings, viz, savings in life insurance funds, amounted to around 14.6 per cent of total savings during 2003-04 to 2006-07 much higher compared to the earlier periods (Table 2.4). Demographic variables like life expectancy, literacy rate and dependency ratios have emerged as key determinants of savings in addition to traditional variables like real interest rate, growth, per capita income, spread of banking facilities and rate of inflation (Athukorala and Sen, 2001). Apart from ensuring assured rates of return with tax exemptions, contractual savings also provides old age security. As disposable income rises and life expectancy continues to increase, concerns regarding old age security can be expected to result in increasing share of financial savings held in contractual instruments. Going forward, improvement in financial savings would depend on the further deepening of the financial sector, particularly through the continuation of insurance through participation of private insurance companies and pension sector reforms.

II.58 ‘Shares and debentures’ is another instrument of financial savings that was expected to get a boost from the reforms. Measures undertaken for developing the capital market were expected to divert savings from the traditional financial instruments to the capital market instruments. Reflecting this, the proportion of household savings in ‘shares and debentures’ (inclusive of investment in mutual funds) rose steeply to over 8 per cent of total financial savings in the initial years of the 1990s from 4 per cent in the 1980s. This was due to a shift away from the relatively safer modes of savings, such as small savings instruments (included under ‘claims on Government’). Following the irregularities in stock market in 1992 and the associated price uncertainty that prevailed in the subsequent period, the proportion of household financial savings held in ‘shares and debentures’, however, witnessed a decline to reach a low of around 4.0 per cent in the subsequent period. The pattern of financial savings that emerges during the decade of reforms, thus, indicates a continued preference of households for relatively safer instruments with assured returns (RBI, 2001-02).

Table 2.4: Components of Household Financial Savings |

(Percentage Share in Gross Financial Savings) |

Item |

1970s |

1980s |

1990-91 |

1991-92 to 1996-97 |

1997-98 to 2002-03 |

2003-04 to 2006-07 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

Currency |

13.9 |

11.9 |

10.6 |

10.9 |

8.6 |

9.3 |

Bank deposits |

45.6 |

40.3 |

31.9 |

33.1 |

38.5 |

4.4 |

Non- banking deposits |

3.0 |

4.6 |

2.2 |

9.4 |

2.9 |

0.7 |

Life Insurance Fund |

9.0 |

7.5 |

9.5 |

9.5 |

13.1 |

14.6 |

Provident and Pension Fund |

19.6 |

17.5 |

18.9 |

17.6 |

19.0 |

11.4 |

Claims on Government |

4.2 |

11.1 |

13.4 |

7.1 |

14.9 |

16.9 |

Shares and Debentures |

1.5 |

3.9 |

8.4 |

8.3 |

3.7 |

3.9 |

Units of UTI |

0.5 |

2.2 |

5.8 |

5.0 |

0.1 |

-0.8 |

Trade Debt (Net) |

2.7 |

0.9 |

-0.8 |

-0.8 |

-0.7 |

0 |

Total Financial Savings (Gross) |

100 |

100 |

100 |

100 |

100 |

100 |

Source: Handbook of Statistics on the Indian Economy, RBI, 2006-07. |

II.59 In sum, the rise in household savings is attributed to both household financial andb physical savings. Furthermore, at the average level, there are clear changes in the preference pattern as seen in the rise in the rate of contractual savings (mainly life insurance funds) and decline in the rate of net deposits, while as per the related literature, the quantum of the household savings tracks a host of theoretically well-established determinants, the prime among them being the growth in per capita income, financial liberalisation, greater opportunities for diversification across financial assets and market related returns. A succinct discussion can be found in Athukorala and Sen (2001), EPWRF-NCAER study (2003) and Report of the Working Group on Savings for the Eleventh Five Year Plan (2007). Financial savings have gained increasing importance and to that extent, the existing methodology has captured these critical economic changes rather well as seen from the savings estimates.

Quality and Limitations of Data Base

II.60 It may be stated that there is the possibility of under/over estimation bias in the present estimates of household sector’s savings. Some of the contributing factors have been identified in the Sources and Method, CSO, 2007. According to CSO, the savings estimates suffer from a number of limitations, mainly from deficiency of data. These are:

-

Data on Co-operative societies are not available for all the years. There is a time lag of four to five years.

-

Estimates for the household sector are built up in two parts (i) savings in financial assets, and (ii) savings in physical assets.

-

In case of savings in financial assets, the estimates of household savings in currency are estimated as 93 per cent of total currency on the basis of past trends of currency holding.

-

The estimates of provident fund of non-departmental enterprises are obtained by doubling the employers’ contribution as available in the books of accounts. No adjustments are made for withdrawals, interest, etc., since the data on these items are not available.

-

The non-Government educational institutions are being covered under the Employees Provident Fund Act, 1952 since 1981-82. However, the coverage of private educational institutions has been incomplete as many of these institutions are not making any returns to the CPFC. Thus, the estimates of PF can be improved only when the coverage of private educational institutions improves and reliable data on withdrawals, interest, etc., in respect of non-departmental enterprises becomes available.

-

The results of the RBI survey on ‘Growth of Deposits with Non-banking Companies and Ownership of Capital of Joint Stock Companies’ are not available beyond 1995-96. Estimates in respect of most of the other financial assets are based on current data, though, they mainly refer to total savings under each of these categories and households’ contributions are obtained as residuals.

-

The households’ savings in physical assets is also estimated by using the residual approach. The residual approach adopted for deriving savings estimates for households is undoubtedly not very satisfactory in all cases and has enough scope for improvement. The only approach through which this can be achieved is by conducting independent household surveys to collect direct data on income and expenditures, as far as pure households are concerned and by conducting annual surveys on household enterprises.

Private Corporate Savings

II.61 Private corporate sector, primarily characterised for its capital-intensive nature, contributed substantially to the rise in the overall domestic savings rate. The share of private corporate sector in overall savings increased markedly over the years and it stood at 22.4 per cent in 2006-07 as against average 9.5 per cent in the 1980s and 17.1 per cent in 1990s. It is interesting to observe that the rate of savings of the private corporate has increased from around 1.0 per cent in the 1950s, 1.5 per cent in the 1960s and 1970s, 1.7 per cent in the 1980s and 3.8 per cent in the 1990s to 7.8 per cent in 2006-07.

II.62 Generally higher growth in revenues vis-a-vis a slower growth in expenditure resulted in marked improvement in financial performance of the business enterprises in last few years. The reform process has helped the corporate sector favourably for more efficient business activity. The corporate tax rate is steadily reduced from 45.0 per cent in 1992-93 to 30.0 per cent by 2005-06 and was kept stable thereafter. The peak custom duty on non-farm goods was reduced gradually from 150.0 per cent in 1991-92 to just 10.0 per cent in 2007-08. Effective monetary policy has contributed to the sustained moderation of inflation leading to a reduction in nominal interest rates and, therefore, the interest burden.

II.63 The strong growth in profits reflective of improved productivity, increased efficiency through increased application of technology and lower tax rates, enabled corporates to de-leverage their balance sheets resulting in the sharp decline in the debt-equity ratio. Financial restructuring of firms also led to the reduction in overall debt equity ratios. The substantial reduction in debt servicing costs thereby added to the corporate sector’s competitiveness and profitability. Notable feature of this improved performance of the corporate sector in the recent period has been the progressive increase in retained profits, which as a share of net profits (PAT) increased from 30.9 per cent in 2001-02 to 78.3 per cent in 2006-07. The private corporate sector has financed a large part of its investment in the on-going long capex cycle from such retained earnings. Strong financial performance translated into a more than doubling of the private corporate sector savings rate from 3.4 per cent in 2001-02 to 7.8 per cent in 2006-07.

Public Sector Savings

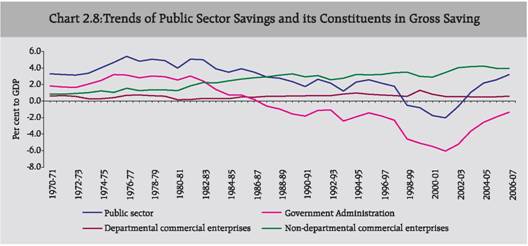

II .64 The trends in savings of the public sector in the country in terms of rates (of GDP at market prices), since 1950-51 are presented in the following Table 2.5. From this table, it can be seen that there has been a gradual increase in the savings of the Nom-Departmental Commercial Undertakings (NDCUs) over the years, since 1950-51. However, in the case of administrative departments, till 1980s, there has been positive savings, but since then the savings of these departments has been negative, although the dis-savings is reducing gradually following the FRBM Act. The savings of Departmental Commercial Undertakings (DCUs) has more or less stagnated at about 0.6 per cent over the years, although there were decreases and increases in between.

II .65 The estimates of savings from the public sector by its various entities, since 1999- 2000, year-wise, are presented in Table 2.6. There were some changes made in the procedure/ analysis of the economic transactions of the budget analysis in the current NAS series. One such major change is identification of capital expenditure incurred under object head“office expenses”. In consultation with the State Governments and central ministries, it has been given to understand that about 25 per cent of the total expenditure incurred under the head “office expenses” relates to purchase of machinery and equipment like photocopiers, ACs, furniture, Computers, etc. Due to this, the CSO included part of purchase of goods services into other capital outlay, machinery outlay and software outlay, which in turn, resulted in additional gross fixed capital formation from current expenditure of goods and services. The consequent changes are that there is decrease in the final consumption expenditure and increase in savings as well as GFCF of public sector.

II .66 The second major change made in analysis of budgets in the new series of national accounts (base year 1999-2000) is treatment of operating losses of the DCUs as imputed subsidies. The rationale behind is that the DCUs incur losses on account of administrative policies of the Government and the losses are met through the Governments’ current revenues. This treatment was only restricted to irrigation departments earlier, but in the new series it has been extended to all DCUs incurring losses.

Table 2.5: Rates of Savings (Percentage of GDP at market prices) |

Savings |

1950-51 |

1960-61 |

1970-71 |

1980-81 |

1990-91 |

1999-00 |

2006-07 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

Public Sector |

2.0 |

3.1 |

3.3 |

4.0 |

1.8 |

-0.8 |

3.2 |

Administrative Depts. |

1.9 |

2.7 |

1.8 |

2.6 |

-1.8 |

-5.1 |

-1.3 |

DCUs |

— |

— |

0.6 |

0.2 |

0.6 |

1.3 |

0.6 |

NDCUs |

0.1 |

0.4 |

0.9 |

1.3 |

2.9 |

3.0 |

4.0 |

Note: for 1950-51 and 1960-61, DCU part is included in Administrative Departments. |

Table 2.6: Estimates of Savings from Public Sector |

( Rs. in crore) |

Sl No. |

Item |

1999-00 |

2000-01 |

2001-02 |

2002-03 |

2003-04 |

2004-05 |

2005-06 |

2006-07 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

1 |

Gross Savings |

-15494 |

-36882 |

-46186 |

-15936 |

29521 |

68951 |

92263 |

133359 |

1.1 |

Admn. Depts. |

-102221 |

-118331 |

-141033 |

-132081 |

-103976 |

-85252 |

-73513 |

-61218 |

1.2 |

DCUs |

25540 |

17368 |

12732 |

13236 |

14414 |

16250 |

18732 |

24646 |

1.3 |

NDCUs |

58473 |

61148 |

78880 |

99337 |

115057 |

133511 |

142141 |

164524 |

1.4 |

Ouasi-Govt. |

2714 |

2933 |

3235 |

3572 |

4026 |

4442 |

4903 |

5407 |

2 |

C.F.C |

73701 |

77426 |

84367 |

89626 |

96758 |

108802 |

120101 |

130944 |

2.1 |

Admn. Depts |

17126 |

18106 |

19804 |

21321 |

22885 |

25896 |

28723 |

32361 |

2.2 |

DCUs |

16528 |

11845 |

12486 |

13072 |

14271 |

16395 |

17755 |

19005 |

2.3 |

NDCUs |

38113 |

45366 |

49749 |

52700 |

56812 |

63378 |

70110 |

75684 |

2.4 |

Ouasi-Govt. |

1934 |

2109 |

2328 |

2533 |

2790 |

3133 |

3513 |

3894 |

3 |

Net Savings |

-89195 |

-114308 |

-130553 |

-105562 |

-67237 |

-39851 |

-27838 |

2415 |

3.1 |

Admn. Depts |

-119347 |

-136437 |

-160837 |

-153402 |

-126861 |

-111148 |

-102236 |

-93579 |

3.2 |

DCUs |

9012 |

5523 |

246 |

164 |

143 |

-145 |

977 |

5641 |

3.3 |

NDCUs |

20360 |

15782 |

29131 |

46637 |

58245 |

70133 |

72031 |

88840 |

3.4 |

Ouasi-Govt. |

780 |

824 |

907 |

1039 |

1236 |

1309 |

1390 |

1513 |

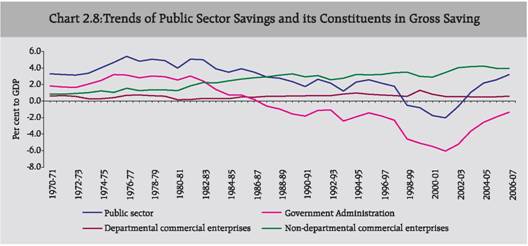

II.67 The role of public sector in propping up the domestic savings of the Indian economy, however, declined since the 1970s. The share of the public sector in gross savings of the country declined to 19.9 per cent in the 1980s, which further went down to 9.6 per cent in the mid-1990s. The public sector savings, however, turned negative for the first time in 1998-99. This declining trend continued for five years till 2002-03, after which the public sector savings become positive. Since 2003-04, the public sector savings have turned positive.

II.68 As per the sources of public sector savings, it is found that Government Administration accounted for a bulk of the savings in the 1970s – accounting for nearly 60 per cent of gross savings. However, the savings of Government Administration received a setback in the 1980s and since the 1990s, they have turned into huge dis-savings, which, in turn has led to declining savings in the public sector.

II.69 However, in the last two decades or so, a rise in the savings of the non-departmental enterprises has been instrumental in keeping the public sector savings positive except during 1998-99 to 2002-03, when huge dis-savings of Government Administration led to negative public sector savings. While the savings of the departmental enterprises have broadly remained lower.

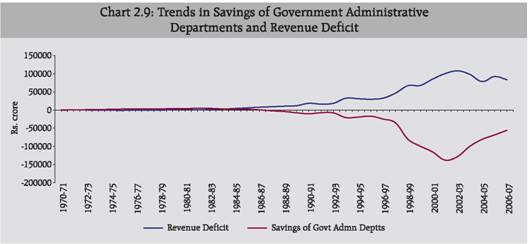

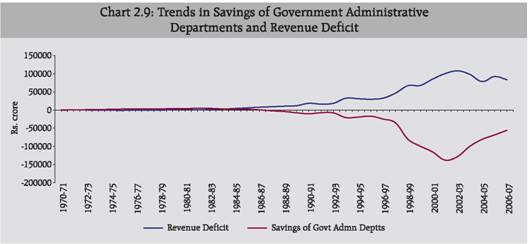

II.70 The savings of the Government Administration had been positive since the 1970s, but it turned negative since 1987-88. What led to this? Possibly, fiscal profligacy in the late 1980s was responsible for this. On examination of the trends in revenue deficit, it is observed that it also started worsening from the year 1987-88. Trends in revenue deficit and savings of the Government Departments reveal that the dis-savings of the Government Administration were reflected in the rising revenue deficit (Chart 2.8). A rise in revenue deficit led to the widening of the dis-savings of the Government Administration departments.

II.71 The dis-savings of the Government Administration further worsened since the mid-1990s till 2001-02. This could have also been on account of the implementation of the Fifth Pay Commission award during 1997-98, which revised up the salaries of Government employees, which enhanced the Government expenses by about Rs.17,000 crore (Chart 2.9).

II.72 In the recent years in India, however, efforts at fiscal consolidation has led to the buoyancy in the revenues following revenue augmenting strategy encompassing moderation in tax rates, broadening the tax base, removal of exemptions, and some improvement in tax administration. This has led to improvement on revenue deficit since 2003-04. The trend is also reflected in the dis-savings of the Government Administration, which has also declined.

II.73 Since the year 1983-84, the savings of non-departmental undertakings has become the major component of public sector savings.

II.74 Much before the public sector savings turned negative in 1998-99, the savings ratio of Government Administration turned negative much earlier in 1986-87. It is the non-departmental enterprises’ (NDEs) savings that has kept the public sector savings positive for over a decade.

II.75 The savings of the NDEs have seen a consistent improvement on account of improvement in the functioning of the public sector enterprises (PSEs). They have exhibited continued and steady improvement in their commercial functioning since the early 1990s. Consequently, since 2003-04 onwards, total public savings have turned positive again.

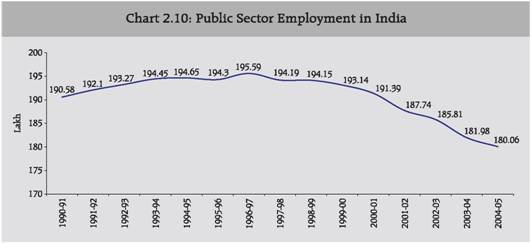

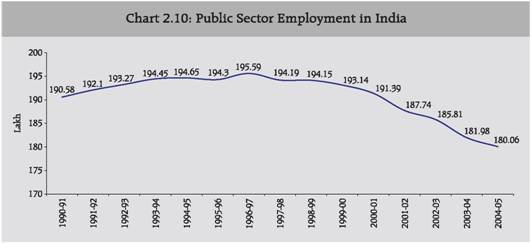

II.76 The improvement in the functioning of the PSEs is on account of the following two factors, which led to improvement in the savings of the NDEs. First, the public sector enterprises have benefitted from the autonomy given to them since the mid-1990s. In July 1997, the Government identified nine PSEs viz., BHEL, BPCL, HPCL, IOC, IPCL, NTPC, ONGC, SAIL and VSNL as Navratnas to turn these firms into global giants. This Navratna status granted of autonomy to the Boards of these PSEs. Second, there has been a decline in employment in the PSEs, which has led to improvement in the efficiency of operation of the PSEs. The employment in the public sector had been rising on a secular basis till the mid-1990s. Public sector employment reached a peak of 19.6 million in 1996-97 and since then, however, it has been declining (Chart 2.10). The public sector employment declined from 19.6 million in 1996-97 to 18.0 million in 2004-05, which represents a decline of about 8.2 per cent.

Public Sector Savings - Data Related Issues

II .77 The present savings estimates of the public sector broadly reflect the broad set of changes that occur in the economy. For instance, a rising revenue deficit leads to either lower/decline in public sector savings, which is clearly reflected in the available savings estimates. Besides, the declining public sector employment leading to reduction in wage cost, which has led to some improvement in savings estimates for Government Administration.

- The savings estimates for the public sector are arrived at using the budget documents/ reports and audited accounts of public enterprises and, therefore, the public sector savings estimates are reasonably accurate and consistent.

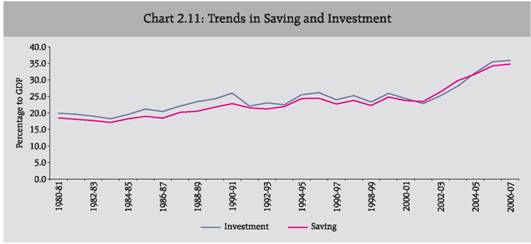

- Besides, since the public sector falls within the organised sector, there are very few adjustments made to arrive at public sector savings data and, thus, the estimates are reliable.

Nonetheless, there is a need to improve the quality of savings estimates of the public sector by taking on board the related data from the local authorities and quasi-Government bodies, which might further refine the savings estimates of the public sector.

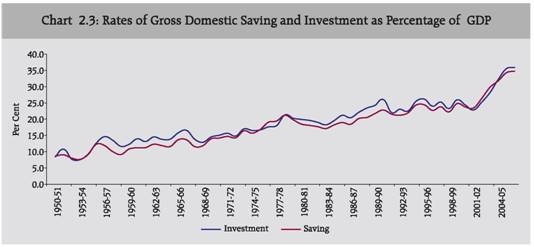

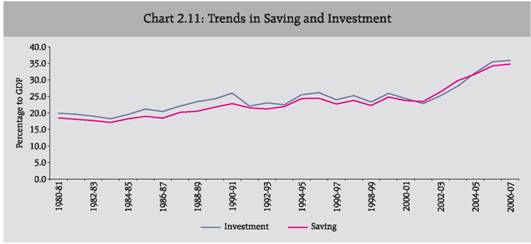

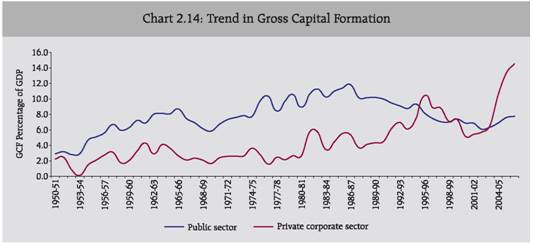

Investment

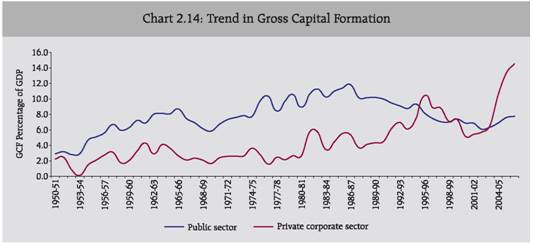

II .78 Indian economy being trapped in ‘low level equilibrium trap’ during the 1950s with subsistence level of economic activities and lack of industrialisation implied that the savings would be perpetually low for some years resulting in very small level of gross fixed capital formation (investment) in the country. Gross domestic savings have increased continuously from an average of 9.6 per cent of GDP during the 1950s to almost 35 per cent of GDP at present; over the same period, the domestic investment rate has also increased continuously from 11.2 per cent in the 1950s to close to 36 per cent by 2006-07 (Chart 2.11 and Table 2.2). A very significant feature of these trends in savings and investment rates is that Indian economic growth has been financed predominantly by domestic savings. The recourse to foreign savings – equivalently, current account deficit – has been rather modest in the Indian growth process.

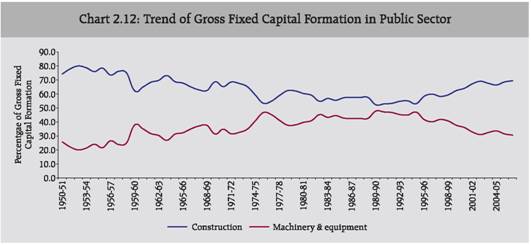

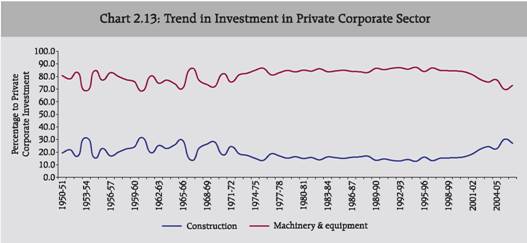

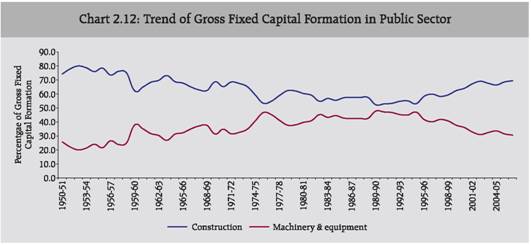

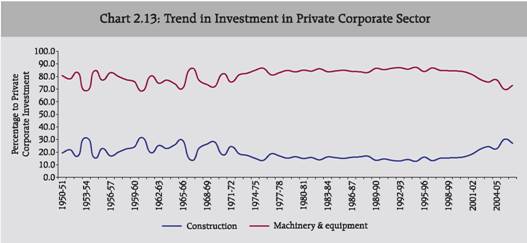

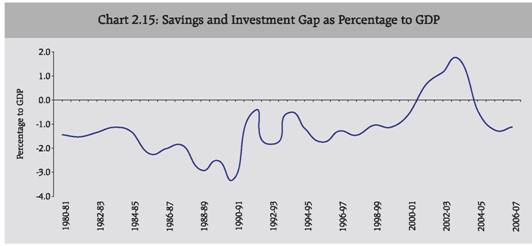

II.79 The dominant mode of investment for public and household sectors remained the construction activities with some variations over the years. The investment trends for public sector witnessed secular deterioration in the share of construction over years, while the share of machinery and equipment picked up over the same period (Chart 2.12). However, after reforms the trends have reversed with construction share rising and share of machinery and equipment falling. For private corporate sector dominant share for investment remained machinery & equipment over the years (Chart 2.13).

II.80 The increase in the rate of capital formation between the middle of the 1950s and in the middle of the 1960s was mainly in the public sector. This was on account of adoption of industrialisation in a big way by huge investments in Public sector undertakings since second plan onwards. The savings mobilised in the economy was invested by the Government in setting various projects. During this period (which coincided with the Second and Third Plans) inflows of foreign savings were considerable, ranging from 2 to 4 per cent of GDP. Since the early 1960s there has been some decline in the rate of capital formation in the private corporate sector, but this has been more than compensated for by increase in the household sector.

II.81 The adoption of mixed economy after independence implied that the dominant source of investment would be public sectors with private sector playing only supportive role. The reliance on public sector for rapid industrialisation was mainly on account of absence of mature private corporate sector. The investment remained predominantly in the sphere of public sector. However, economic reforms have reversed this trend with private corporate sector overtaking the public sector in realm of investment in the economy since 1994-95 (Chart 2.14).

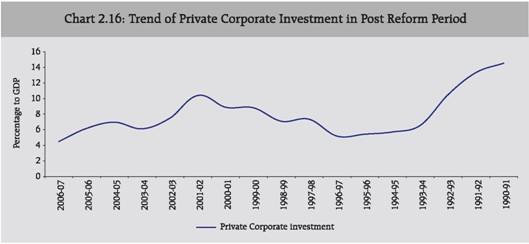

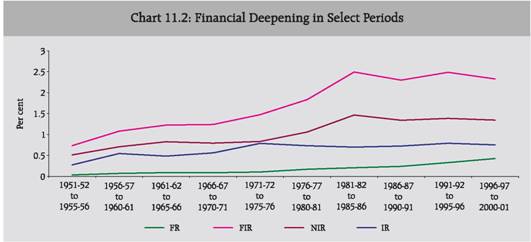

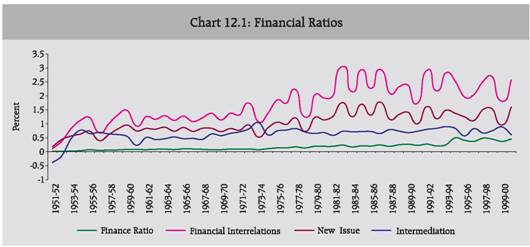

II.82 The long-term upward trends in savings and investment have been interspersed with phases of stagnation. In particular, during the 1980s, the inability of Government revenues to keep pace with the growing expenditure resulted in widening of the overall resource gap. Accordingly, the public sector savings investment gap, which averaged (-) 3.7 per cent of GDP during the period 1950-51 to 1979-80, widened sharply during the 1980s culminating in a high of (-) 8.2 per cent of GDP in 1990-91 (Chart 2.15). The resultant higher borrowing requirements of the public sector led the Government to tap financial surpluses of the household sector through enhanced statutory pre-emption from financial intermediaries at below market clearing interest rates. As fiscal deficits widened, periodic increases in the statutory liquidity ratio (SLR) were resorted to finance the rising fiscal gap, indicative of the financial repression regime in place.

II.83 The 1991 brought a break from planning era with economic reforms ushering structural changes in the economy. The investment trends since then have been impacted by the various changes brought in the economy. The success of structural adjustment programme (SAP) reform in bringing out a sustainable recovery in economic activity in the economy depended crucially on the behaviour of investment in the aftermath of the reform process. Since the expansion of public investment is usually constrained as a part of fiscal austerity measures embodied in SAP reform, the required recovery of investment came largely from the private sector. Investment by private corporate sector plays a significant role in sustaining the industrial growth of an economy. The economic reforms in the 1990s had a significant impact on the Indian economy. At a generic level, the reforms played a facilitative role and created a competitive environment for Indian’ companies. Industrial de-licensing provided flexibility to firms in investment decisions. This led to a surge in private investment.

II.84 Since the early 1990s, growth impulses appeared to have gathered further momentum in the aftermath of comprehensive reforms encompassing the various sectors of the economy. There was some loss of the growth momentum in the latter half of the 1990s, which coincided with the onset of the East Asian financial crisis, setbacks to the fiscal correction process, quality of fiscal adjustment, slowdown in agriculture growth affected by lower than normal monsoon years, and some slackening in the pace of structural reforms. The slowdown could also be attributed to the excessive enthusiasm and optimism in regard to investment plans in domestic industry following deregulation, which was followed by significant problems experienced in viability and competitiveness. The investment during this period remained more or less stagnant with income growth being also moderate. Thus, during the 1990s the average economic growth was moderate and the investment improved only marginally over the 1980s rates.

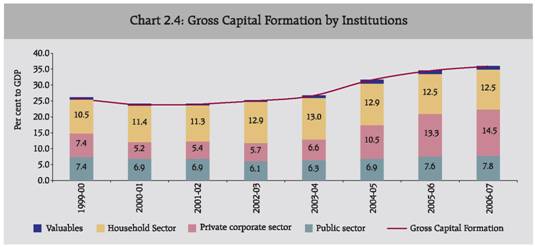

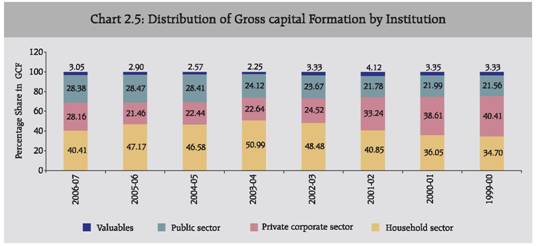

II.85 An important structural change in the investment behaviour of the economy in the recent past is the change in relative shares of public and private investment. Years of reforms has marked a significant break from previous trends in terms of increasing investment with major role being played by private corporate sector in last five years. The investment (gross capital formation) has increased sharply from 24.2 per cent of GDP in 2001-02 to 36.0 per cent during 2006-07 i.e., increase of 11.8 percentage point within five years (Table 2.7).

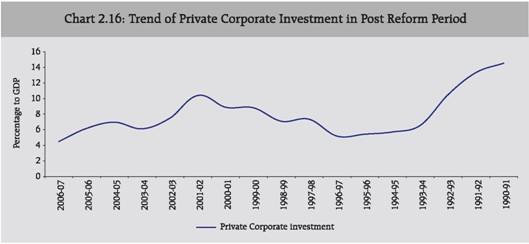

II.86 In the same period, the investment in private corporate sector trebled from 5.4 to 14.5 per cent of GDP, thus, accounting for the overall increase in investment in the economy (Chart 2.16). The rapid increase in private sector investment in the aggregate investment is in large part a reflection of the impact of the reforms initiated in the 1990s, which reduced restrictions on private investment and created a more favourable investment climate. It reflects the fact that the private sector has responded positively with an improvement in the investment climate. The reduced requirement by the centre for meeting budgetary mismatches, and for overall public sector financing has improved the availability of resources for the private sector considerably. Furthermore, the corporate sector has responded to increased global competition by improving its productivity and efficiency through increased application of technology. The economic reform process has helped greatly in making the policy environment more conducive for more efficient entrepreneurial activity.

Table 2.7: Trends in Investment in Post-Reform Era |

(As Percentage of GDP) |

| |

1990-91 1994-95 |

1995-96 1999-00 |

2000-01 |

2001-02 |

2002-03 |

2003-04 |

2004-05 |

2005-06 |

2006-07 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

Gross Capital Formation |

22.9 |

23.4 |

24.2 |

24.2 |

25.2 |

26.8 |

31.6 |

34.5 |

36.0 |

Public Sector |

9.3 |

9.0 |

6.9 |

6.9 |

6.1 |

6.3 |

6.9 |

7.6 |

7.8 |

Private Corporate Sector |

6.3 |

7.4 |

5.2 |

5.4 |

5.7 |

6.6 |

10.5 |

13.3 |

14.5 |

Household Sector |

7.3 |

7.0 |

11.4 |

11.3 |

12.9 |

13.0 |

12.9 |

12.5 |

12.5 |

Valuables |

0.0 |

0.0 |

0.7 |

0.6 |

0.6 |

0.9 |

1.3 |

1.2 |

1.2 |

Errors & Omissions |

0.9 |

0.7 |

0.2 |

-1.3 |

0.0 |

1.4 |

0.6 |

1.0 |

-0.1 |

II.87 From the long-term perspective, it is interesting to observe that the rate of savings of the private corporate sector has increased from around 1 per cent in the 1950s, 1.7 per cent in the 1980s and 3.8 per cent in the 1990s, to almost 8 per cent at present. Higher retained profits along with availability of resources from the banking sector facilitated by the lower financing requirement of the Government and the increased access to the domestic and international capital markets led to a sharp increase in the investment rate of the corporates.

Inadequacies in Investment Estimates

-

The turnaround in public sector savings in recent years has not reflected corresponding improvement in public sector investment levels (Table 2.8). The public sector investment estimates might be underestimated particularly with reference to defence capital expenditures, local bodies and autonomous Government institutions.

-

One of the aspects of the estimates of savings and investment in India is the discrepancy in the estimates of GDS and gross domestic capital formation (GDCF). While the Raj Committee categorically mentioned that no adjustments be made to the estimates of capital formation on account of the ‘errors and omissions’, the Chelliah Group believed that GDCF estimates are subject to errors in several respects, and methodologies need to be, therefore, improved. The savings in the form of physical assets of the household sector being a part of the estimate of capital formation of the economy, would reflect the errors which creep in the estimates of total capital formation in the economy.

-

Non availability of current and reliable data on output of capital goods in respect of unregistered manufacturing sector, which is essential in the estimation of capital formation for the entire economy through the commodity-flow approach.

-

Lack of annual enterprise surveys and reliable data from benchmark enterprise surveys in respect of expenditures made by various industries on acquiring capital goods, as also on inventories, which is essential for industry-wise and State-wise estimates of capital formation.

Table 2.8: Public Sector Savings and Investment |

(As Percentage of GDP) |

| |

Public sector savings |

Public sector investment |

1 |

2 |

3 |

2001-02 |

-2.0 |

6.9 |

2002-03 |

-0.6 |

6.1 |

2003-04 |

1.1 |

6.3 |

2004-05 |

2.2 |

6.9 |

2005-06 |

2.6 |

7.6 |

2006-07 |

3.2 |

7.8 |

-

While estimating the fixed capital formation by the ‘Commodity Flow Method’, a number of rates and ratios are being used in absence of direct data. Some of these rates and ratios are based on old surveys or studies, while some of them are updated using the data available from Input Output Tables at the time of revising the base year of national accounts series.

-

The estimates in respect of local authorities are not based on actual annual expenditure data. The estimates relating to Quasi-Government bodies are prepared using the workforce estimates and the estimated value added per worker obtained from the annual reports of the research and scientific institutions. There is a need, therefore, to improve the quality of estimates of public sector with regard to local authorities and quasi-Government bodies, as also the emerging PPPs and SPVs.

-

There is under-coverage of the private corporate sector in the analysis in respect of new companies under setting up, besides the large time-lag in the availability of detailed results from the NABARD on cooperative sector. The under-coverage of capital formation in the public and private corporate sectors gets reflected in the household sector, as they are derived as residual from the overall estimates of capital formation, which are compiled through the commodity flow approach.

-

A number of ratios and norms are used in the preparation of estimates of capital formation for the economy as a whole. Some of these ratios are based on very old norms and may not be appropriate in the current economic scenario.

-

The estimates of capital formation by type of assets suffer from limitation. The proportions used for estimating the production of capital goods out of partly capital goods and part of capital goods are based on data on household durable goods as obtained from NSS survey results.

-

Estimates of GFCF by industry of use are prepared mainly following expenditure approach. A critical evaluation of the estimates in the context of data base shows that for a large percentage share of the aggregate capital formation (about 70 per cent) originating in organised industry groups like registered manufacturing, electricity, gas, railways and public administration sector etc in public sector, the estimates are based on direct annual data. For the remaining sectors (namely, private corporate and household sectors) the estimates are based on either benchmark estimates or analysis of balance sheets of selected companies in the corporate sector which leads. The estimates for some of these industry activities where private share is dominant, therefore, need to be based on more satisfactory information and current data in order to improve their reliability.

A Summary of HLC’s Observations

II.a Despite the fact that the NAS provide a consistent and coherent set of macro-economic accounts, often interpretational issues arise while analysing these data. The following points can be made in regard to the interpretational significance of the savings and investment estimates:

II.b Contribution-wise, with regard to the generation of savings, the major drivers are household sector, corporate sector and public sector in that order and for investment; they are corporate sector, household sector and public sector. While households have traditionally remained major savings sector in Indian economy reinforced by demographic dividends in turn reflecting lower dependency, of late corporate savings have emerged as savings generator responding inter alia to robust sales and corporate profitability with the economy on a high growth trajectory recently. Cross-country differences in the evolution of gross corporate savings over the past half decade have tended to reflect to a large extent those of the gross operating surplus, which in turn are likely to be due to countries’ exposure to global factors (accelerated globalisation and technological progress), presumably depending on institutional framework conditions (such as product and labour market regulations), as well as the sectoral composition of their economies. With Indian economy being increasingly gloabalised, the interplay of domestic and external factors in enhancing corporate savings can be envisaged. Within the public sector, the sources of savings are characterised by certain differential performance with the Government Administration being on a consistent deficit mode since the 1990s and the non-Departmental enterprises and Departmental enterprises in that order compensating by way of positive savings reflective of their steady improvement in commercial functioning. Significantly, these changes are occurring when the economy remained on a high growth trajectory in the last five years.

II.c As highlighted in the aforementioned paras, there are limitations in the estimation of savings and investment at the level of each of the institutional sectors. This is understandable given the predominance of unorganised sector in India. Even for the organised sectors, analysts have pointed out the data gaps and quality issues for those data that are available. Interpretational issues have, thus, remained endemic to the savings and investment estimates, surfacing from time to time leading thereby to formation of Committees to address these concerns.

II.d A point mentioned in the past Committees regarding correct interpretation and a clear understanding of the available estimates of domestic savings and capital formation, it is essential to first keep in mind the various data sources used and the current methodology of estimation of savings and the capital formation. In doing so, it would be possible to indicate the areas where errors in estimation could arise.

II.e Interpretational issues with regard to estimates of savings and investment are important to be assessed from time to time, as is the practice so far in India. In this connection, it is desirable to develop alternative data bases for these estimates for the constituent sectors so that savings estimates could be cross-validated with the help of appropriate alternative data bases, methodologies and surveys.

II.f Notwithstanding the limitations, which are well accepted, the HLC observes that the existing methodology for estimation of savings has broadly captured the changes that are taking place in the economy in general and various sectors like the household, corporate and public sectors in particular. The estimates are reasonably reliable reflective of the trends in the economy. The estimates may be reasonably reliable on account of the following factors:

-

To the extent increase in GDS is spread across all constituent sectors, the improvement in the GDS rate in the recent decades is essentially a reflection of the fundamental transformation of the structure of the economy. The rise during 2000s simultaneous with the buoyant growth performance corroborates the positive cycle of growth, savings and investment, such that as growth enhances savings, which in turn further enhances growth. The rise in savings rates in India appears to be mainly structural and one can expect savings rates to increase further with rising income and declining dependency ratio.

-

A look at the time series of ‘errors and omissions’ relative to GDP indicates that the magnitude of this item is narrowing over time which is a welcome development.

-

Seen vis-à-vis the efficiency of capital use (ICOR) trends, there is a clear movement downwards, which has enabled the same dose of capital formation leading to higher GDP growth contributed to a larger extent by services sector which is less capital intensive in nature. It may be mentioned that at the economy level, the ICOR has decreased to 4.2 during the Tenth Five Year Plan period as compared to 4.5 during the Ninth Five Year Plan.

II.g The savings and investment estimates are crucial in the decision making and planning process. They are used to compile incremental capital-output ratios (ICORs). The ICOR is a summary measure of the productivity of investment in the economy or the output generating capacity of incremental capital (ICOR = (capital employed - previous year capital employed) / (value of output - previous year value of output)). That is, the ratio of incremental capital to incremental output or the amount of incremental capital that goes to generate one unit of incremental output. The recent increases in the savings and investment rates indicate to some extent the lowering of the ICORs. As in the case of aggregates which hide inherent deficiencies at the detailed industry levels, the data on industry-wise deployment of capital formation is crucial in further identifying the key sectors of the economy, data on which are currently provided through national accounts statistics.

II.h Increasing evidences of a rise in efficiency in the economy is seen by the declining share of inputs - final use of commodities and services in gross value added (GVA). The share of inputs in the gross value added has come down to 49.7 per cent in 2003-04 as compared to 60.3 per cent in 1968-69.

II.i Another issue that has come into focus in the recent literature was that if the corporate sector’s savings is going up, the household sector’s savings would come down, to the extent

Table 2.9: Shares of Unincorporated and Incorporated Sectors in Gross Domestic Savings |

(Per cent) |

| |

1950-51 to 1959-60 |

1960-61 to 1969-70 |

1970-71 to 1979-80 |

1980-81 to 1989-90 |

1990-91 to 1999-00 |

2000-01 |

2001-02 |

2002-03 |

2003-04 |

2004-05 |

2005-06 |

2006-07 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

12 |

13 |

Unincorporated (Households) |

68.2 |

61.7 |

66.5 |

71.0 |

77.0 |

91.1 |

94.3 |

87.8 |

81.7 |

72.5 |

70.6 |

68.4 |

Incorporated |

31.8 |

38.3 |

33.5 |

29.0 |

23.0 |

8.9 |

5.7 |

12.2 |

18.3 |

27.5 |

29.4 |

31.6 |

a) Public |

21.4 |

26.3 |

24.3 |

19.9 |

6.7 |

-7.4 |

-8.6 |

-2.5 |

3.6 |

6.9 |

7.5 |

9.3 |

b) Private Corporate |

10.4 |

12.0 |

9.1 |

9.2 |

16.3 |

16.2 |

14.4 |

14.6 |

14.7 |

20.6 |

21.9 |

22.4 |

Gross Domestic savings |

100 |

100 |

100 |

100 |

100 |

100 |

100 |

100 |

100 |

100 |

100 |

100 |

Source: Central Statistical Organisation. |

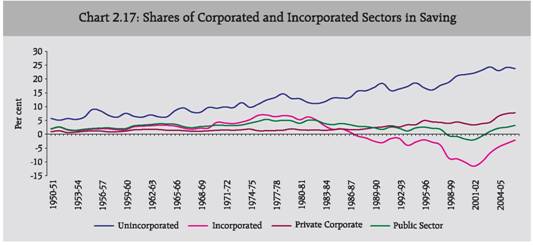

that unincorporated entities, constituting a part of the household sector, get incorporated and such savings are reflected as corporate savings. An examination of the data since the 1950s shows a declining trend in the share of unincorporated sector. If this trend continues, as to be expected, the share of household savings as a percentage of GDP may decline correspondingly with a rise in corporate sector savings (Table 2.9 and Chart 2.17).

II.j In sum, the interpretational issues with regard to estimates of savings and investment are important to be assessed from time to time, as is the practice so far in India. In this connection, it is desirable to develop alternative data bases for these estimates for the constituent sectors so that savings estimates could be cross-validated with the help of appropriate alternative data bases, methodologies and surveys. In the absence of income-expenditure survey of households and household enterprises, there is no direct estimation of household savings and as a result, there is no cross validation of the indirect (residual) estimates of savings at present which is expected to be taken up in due course enabling cross-validation of savings of the predominant household sector. With regard to private corporate sector and the public sector, the issues of inadequate data coverage and local bodies and autonomous Government institutions, respectively, are the weak areas that need to be resolved.

Chapter III : Broad Approach adopted by the Committee

III.1 The approach adopted by the HLC in addressing various ToRs is distinctly different than those of the earlier Committees appointed to review the estimation of savings and investment. Unlike the approach followed by the past two Committees, namely Raj and Chelliah Committees, keeping in view the relatively large number of ToRs assigned to it and the intricacies involved in the estimational issues of savings and investment, the HLC set up four Sub-Committees for examining the estimational issues pertaining to the savings of the household sector, private corporate sector, public sector and one Sub-Committee for investment. The approach followed by the HLC is briefly explained below.

III.2 At the outset, the HLC examined the existing methodology adopted to estimate the savings and investment and whether household savings estimates can be based on any other alternative methodology. Perhaps this is first such attempt by any formal committee. It was recognised that the present method needs to be strengthened though updation of various rates and ratios and development of alternative data base for constant cross-validation of the estimates. Accordingly, a ‘Worksheet Approach’ was followed, wherein each and every component of financial savings in the financial savings worksheet was examined with respect to data base, data quality and methodology. A comprehensive review of the rates and ratios used in the estimation procedure was undertaken.

III.3 Secondly, keeping in view the number of rates and ratios underlying the present estimation procedure, the HLC sought the involvement of apex financial bodies for the different financial instruments as well as sectors, which provide the required data for estimation of savings and investment. This is also a maiden effort, which is expected to enable development of alternative databases for robust estimation of savings estimates and also enable alignment of the present procedures to the procedures as laid down in the National Accounts - ‘Sources and Methods, 2007’ of the CSO.

III.4 Thirdly, an effort was made for the first time to involve and elicit the views of the NSSO on the possibility of introducing a comprehensive Survey of Income and Expenditure of the household sector. Although the reference to estimate savings by direct method through a comprehensive income-expenditure household survey was made in the earlier Committees’ Reports, there was no progress on that front. The NSSO has agreed in principle to undertake such a Survey for the households initially with a pilot survey on the basis of its interaction with the HLC. When undertaken and stabilised, such a survey is expected to provide an alternative database for direct estimation of household savings, which can be cross-validated with the present estimates.

III.5 In sum, the principal approach adopted by the HLC was to examine in detail the conceptual aspects of the estimates of savings and investment and refine the procedure by eliminating the data gaps and thereby improving the data quality. Efforts were directed at strengthening the databases presently used for estimation of savings and investment. It was felt useful to involve the apex financial bodies and NSSO for development of appropriate alternatives, which could achieve eventually the desired level of accuracy at disaggregated and sectoral level.

Brief Description of the Deliberations in the HLC Meetings

III.6 The first meeting of the HLC on Estimation of Savings and Investments was held on January 24, 2008 at RBI, New Delhi. The Chairman, Dr. C. Rangarajan, in his opening remarks explained that recently, a sharp increase has been observed in the savings and investment estimates and, therefore, they require a fresh look. At the present juncture, the issues related to methodology, nature and procedure of data collection and accuracy of collected data require critical examination. In the process of estimation, the blow-up factors or ‘Rates and Ratios’ currently used require to be examined afresh in the light of evolving developments. It was, thus, decided that the Committee has to examine three aspects of Savings and Investment estimates, viz., (a) methodology; (b) procedure of data collection and identification of data gaps; and (c) validation of the data. In order to accomplish the task assigned to the Committee, it was decided to set-up four Sub-Committees that would critically examine these aspects for each of the three sectors for savings estimates and the fourth that of capital formations. The Sub-Committees were advised to report to the HLC, after due deliberations. The SubCommittees constituted were namely, Sub-Committee on Household Sector Savings, SubCommittee on Private Corporate Sector Savings, Sub-Committee on Public Sector Savings and Sub-Committee on Investment.

III.7 In the second meeting of the HLC held on April 18, 2008 the Committee discussed the draft reports submitted by the Sub-Committee on Household Sector and Sub-Committee on Private Corporate Sector. In this context, HLC had broadly agreed with the major recommendations made by the two Sub-Committees and suggested improvements in certain areas. The HLC’s discussions focused on the “worksheet” approach adopted by the SubCommittee on Household Sector, wherein each and every constituent items for household sector’s financial savings compilation was examined with respect to (a) sources of data and the underlying conceptual issues (focusing mainly on Raj Committee, Chelliah Committee, National Statistical Commission Reports wherever applicable), (b) methodology adopted for each of the parameter along with the limitations and problems, (c) prescribed procedure for estimation, (d) procedure followed in practice, (e) deviations and constraints in practice, and (f) lacunae identified in data and methodology. In this meeting, it was felt essential to involve the Apex Financial Bodies for developing an alternative database and facilitating cross-validation of the present estimation. Accordingly, it was explained that the Sub-Committee on household sector had a separate meeting with the apex financial bodies namely, SEBI, IRDA, NABARD and NHB, which were invited for an interface with the Sub-Committee on Household Sector Savings for supply of authentic, appropriate and timely data on the household financial savings instruments that come under their regulatory purview. The representatives from the apex financial bodies agreed in-principle to provide regular information, henceforth, to the RBI as per the format to be provided by the RBI.