IST,

IST,

Regaining the Growth Momentum: Issues and Imperatives

Dr. K.C. Chakrabarty, Deputy Governor, Reserve Bank of India

delivered-on অক্টো 10, 2013

Shri Pratip Chaudhuri, Former Chairman, State Bank of India; Dr. Rajan Saxena, Vice-Chancellor, Narsee Monjee Institute of Management Studies (NMIMS); Dr. Debashis Sanyal, Dean; Dr. Vrinda Kamat, Chairperson (MBA Banking); Mr. C. B. Ramamurthy, my former boss at Bank of Baroda; faculty and students of the School of Business Management, NMIMS University; distinguished invitees, members of the print and electronic media, ladies and gentlemen! At the outset let me congratulate the Institute for being adjudged as the Fourth Best B-School by Business World and for also receiving an A*** rating from CRISIL. I would like to commend the University for the excellent service that it is providing to the students and, consequently, to the nation. 2. It is, indeed, a pleasure for me to be amidst you this morning to deliver the opening address at the sixth Annual Banking Conference “Bank on it, 2013” organized by the NMIMS University. It is heartening to be among the budding management professionals who would be the corporate leaders of tomorrow. The Conference has hosted some illustrious speakers in the past and deliberated upon various pertinent issues impacting the banking system. I am glad that the Institute has chosen ‘Sustaining Growth Amidst Adversity’ as the theme for this year’s Conference, a theme which could not be more apt considering the widespread concerns about the decline in growth momentum in the economy. Having an insider’s view of India’s financial system, first as a commercial banker and now as a central banker, I intend to use this platform today to share my perspectives on India’s growth, enterprise, governance, etc. and what needs to be done to return to the high growth trajectory and to sustain it. It is all the more inspiring to talk to students on this theme as they are the ones who are going to be ‘generators’ of growth and the torch bearers for the Indian economy in the days ahead. 3. We are all discussing the different projections of growth likely to be achieved by India in the current year. The range of projections for the growth in real GDP at factor cost by various agencies (being quoted in the media) is quite wide, between 4.25 per cent and 5.5 per cent. One must realize that the growth projections made by RBI and, for that matter, by any other institution are indicative and contingent upon certain assumptions. We can’t expect people to sit idle at their homes and the projected growth rate to be achieved. There is a general misconception that all the ills of the economy can be cured by RBI or by the financial system. We must understand that the financial system, on its own, cannot accelerate the growth process; it can only facilitate the economic growth by providing finance to the real sector. The basic impetus for sustainable growth has to necessarily emanate from the real sector. All of us are now well aware that the origins of the Global Financial Crisis lay in too much of financial innovation and the financial sector running too far ahead of the real sector. So, a total dependence on the financial sector to solve the problems of the real sector and accelerate the growth process is unrealistic. Introduction 4. Coming to the topic of discussion today, i.e. ‘Sustaining Growth Amidst Adversity’, I think it would have perhaps been more apt to call it ‘Improving Growth Amidst Adversity’. Mind you, the crisis has affected all the economies globally. In order for us to extricate ourselves from the deep morass, the first thing to be done is to start thinking positively and to stop the blame game. Blaming the central bank, banks, the policy makers, the government, etc. for the crisis is not going to help. Our starting point has to be an analysis of why the crisis happened in the first place or, more generally, why adversities strike? There are, of course, many reasons put forth, some economic in nature, some social and some political. I would discuss these in due course. But one common reason that could perhaps be attributed to all crises is an all round decline in virtue or discipline. Let me invoke Lord Shri Krishna here. In Chapter 4 of The Bhagavad Gita, he says: “यदा यदा हि धर्मस्य ग्लानिर्भवति भारत । अभ्युत्थानमधर्मस्य तदात्मानं सृजाम्यहम् ॥ This verse means that "Whenever and wherever there is a decline in virtue and a predominant rise of irreligion, at that time I descend myself to deliver the pious and to annihilate the miscreants, as well as to re-establish the principles of religion. I myself appear millennium after millennium." 5. If we extend this logic to the generation of crisis situation in the financial sector, we may conclude that financial crisis happens in order to weed out corrupt, inefficient and fraudulent elements from the system which generally are kept under check in normal times through good regulations, good policies and good corporate governance practices. The silver lining, however, is that crises of such magnitude normally happen only once in a life time. To emerge out of the crisis and move on to a high growth path, we need to develop good virtues and eliminate wrong practices- indiscipline being one of them. We need to be more disciplined in our personal and professional roles, more transparent in our work-life, must reduce wastages, work harder, enhance our productivity and efficiency and upgrade our skills. What is our potential growth? 6. Let me now turn to the economic aspect of the theme subject. The first part of the topic, “Sustaining Growth”, raises the question ‘what growth do we need to achieve and sustain’? This leads us to the issue of ‘potential growth’. ‘What is the potential growth rate of the Indian Economy?’ This question has been a subject of active debate in the academic and policy research circles. There are several methodological issues surrounding the estimation of potential output. Broadly speaking, there are two approaches, the growth accounting approach and the statistical filtering techniques. The use of different estimation methods yield different results leading to considerable uncertainty. Further, in the Indian context, the non-availability of relevant data aggravates the problem of estimation. Reserve Bank of India estimates that the trend/potential growth rate of the Indian economy, which averaged around 8.5 per cent during 2005-06 to 2007-08, dipped gradually thereafter and presently stands at about 7.0 per cent. The draft Twelfth Five Year Plan (2012-2017) document indicates that our full growth potential remains around 9 per cent. To get a perspective on these numbers, let me now recount India’s growth experience since 1951-52. India’s growth journey – a recap 7. India’s economic growth story since independence makes an interesting reading. We can identify about five major phases of growth in India in the sixty-three years since 1950 (Table 1 and Chart 1). As you all know, the first phase coincides with the ‘low growth’ period.2 During the first phase, 1951-52 to 1979-80, the average annual real GDP grew at 3.5 per cent and per capita income grew at 1.3 per cent, the so-called “Hindu Rate of Growth”3. Growth was primarily driven by domestic consumption. Investment rate was low and mostly financed by domestic savings and thus the Current Account Deficit (CAD) was less than 1 per cent of GDP. Growth during this phase was led by the industrial sector followed by the services sector (Table 2). 8. Growth accelerated during the second phase (1980-81 to 1993-94). The acceleration in growth during the 1980s was due to a number of factors, including the early efforts at industrial and trade liberalization and tax reform during the 1980s, a step-up in public investment, better performance of all three sectors, and an increasingly expansionist fiscal policy (Centre’s revenue deficit and capital expenditure both increased as a ratio to GDP in the 1980s). With investment growth outpacing the domestic savings, CAD increased. With growth picking up, WPI inflation also increased. 9. The growth process of the 1980s, however, turned increasingly unsustainable as manifest in the growing macroeconomic imbalances over the decade in the form of high fiscal deficit, high levels of CAD, and increasing levels of external debt, besides a repressive and weakening financial system. These imbalances culminated in the unprecedented external payments crisis in 1991, which was managed with the introduction of stabilization and structural reforms. 10. The economy stabilized around 1993-94 and growth picked up again. The third phase (1994-95 to 2002-03) witnessed relatively higher growth which ended, however, in 2002-03 with the economy being hit by a severe drought. Investment and savings rate picked up and the CAD moderated. Inflation also declined. The economy rebounded in the next five years (the fourth phase: 2003-04 to 2007-08) to post an average growth of nearly 9 per cent with pick-up in investment. With domestic saving growth outpacing investment, CAD declined further. Inflation was also benign. With the enactment of the Fiscal Responsibility and Budget Management Acts by the Central Government and various State Governments, the fiscal deficit was also brought under control. This period was, perhaps, the ‘golden period’ in India’s growth history and, consequently, sparked off the debate about whether the Indian economy had transformed from an ‘elephant into a tiger’.4 11. The Indian economy grew at 9.5 per cent during the three-year period from 2005-06 to 2007-08 enabled by moderate inflation, fiscal consolidation and acceleration in savings and investment. This was the highest average growth rate achieved during any three year period in the history of independent India and it was second only to China among the major countries during that period. 12. India’s high growth story was cut-short, perhaps prematurely, beginning with the global financial crisis of 2008-09 (real GDP growth dropped to 6.7 per cent). The focus of macroeconomic policy then was to arrest the contagion of the global crisis. In 2009-10, the focus of macroeconomic policy shifted from containing the contagion to management of recovery. The economy rebounded strongly in 2009-10 (8.6 per cent) and 2010-11 (9.3 per cent). Coordinated fiscal and monetary policies played a significant role in the recovery of the economy and in the maintenance of financial market stability. The growth momentum has been losing steam since then, with growth rates of 6.2 per cent in 2011-12, 5.0 per cent in 2012-13 and projected to be around 5.5 per cent in the current year 2013-14. The services sector, which had been the main driver of India’s high growth, also decelerated. The drop in growth was a result of a combination of domestic and global factors. Global macroeconomic and financial uncertainty, weak external demand, elevated price levels, widening twin deficits and falling investment combined to adversely impact growth. 13. One should also remember that due to the high growth achieved in the previous years, the aspiration of the people in general has gone up and nobody is happy with a 5.5 per cent growth rate. But the problem is that although everybody aspires to grow by more than 9 per cent, nobody wants to perspire (work hard) for achieving it. For our society to prosper we have to consistently achieve a growth rate of above 9% for the forseeable future and for this, the real sector would have to grow consistently. This can only be achieved by increasing productivity and efficiency and ensuring optimum utilization of resources. Let me add that it is also for the budding management professionals like you to go to the field and put in place systems that will encourage the people to aspire and perspire to achieve the potential growth. How have we fared vis-à-vis the rest of the World? 14. We have been one of the fastest growing economies in the World. This is evidenced in the growing share of India in the World’s GDP in Purchasing Power Parity (PPP) terms since 1980 (Chart 2). As I mentioned earlier also, the challenges that currently confront our economy are not unique to India. Several countries across the globe are grappling with the problem of tardy growth rates. One of the unwelcome consequences of Indian economy’s growing integration with the rest of the world is that we are no longer decoupled from the global economic growth trends. The current low rate of economic growth globally, has also hampered our mission of regaining higher growth rates. What have been our strengths over the years? Vibrant Democracy has made India resilient 15. That India has been a vibrant democracy since the adoption of the Indian Constitution has been our greatest strength. In the more than six and a half decades since independence, the nation has faced many adversities, external aggression and famines in the early years, some drought years, the oil crisis of the 70s, the BoP Crisis in the early 90s followed by the South-east Asian crisis in the late 90s, the global financial crisis that began with the US sub-prime crisis and currently, the eurozone crisis. A vibrant democracy and our resilience have helped us surpass all the adversities so far. I am sure we will wade through the current crisis as well. India has the capability to grow at 9 per cent and above 16. Looking at our growth history and our performance vis-à-vis the rest of the World, we can definitely say that the Indian economy has the potential to grow at 9 per cent and above. Therefore, we are currently growing below our potential and closing this negative output gap (i.e., actual growth minus potential growth) should be our highest priority. The next priority would be to raise the potential growth path itself. 17. However, there are some fundamental problems facing our economy which require urgent corrective measures. There is a common perception in the society that RBI is killing growth by keeping the interest rates high. Here, I want clarify that it is not because of RBI but because of inflation that the interest rates in the system are high. And for the inflation to moderate, the productivity and efficiency of all sectors in the economy has to improve. If we have to achieve growth rate of 9 per cent and above, the inflation has to be below 5 per cent. The higher inflation also puts pressure on our exchange rate and further aggravates the problem of Current Account Deficit. Added to that is the problem of import of gold. India being a poor country and in need for foreign exchange, the import of gold of more than $56 billion will not help in controlling the CAD and bringing down the inflation. While there has been some moderation in gold imports, primarily due to the recent measures introduced by the Government and the Reserve Bank, there is an urgent need to create awareness among the people about the problems faced by the country due to the high import of gold. This calls for a cultural change and I place my hope on this young brigade of management students to bring that orientation in the society. Let me re-emphasize that currency stability can only be achieved by bringing down inflation and CAD within manageable limits. 18. So far, growth has primarily been driven by domestic consumption followed by investment which was funded mostly through domestic savings. But in a persistently high inflation economy the propensity of the people to save has gradually declined, which is hampering our investments. Therefore, we have to increasingly rely on foreign inflows for achieving the potential growth. In this context, there is a need to have a relook at the current policies governing FDI in sectors like Retail, Banking, Insurance, etc. Actually we have a situation where we are asking more questions when the money comes in rather than when money is going out. We have to create policies which are conducive for the funds to flow into our economy for helping the economic growth. Concomitantly, we also have to create an enabling environment for rekindling the savings habit among ordinary citizens. Reaping the demographic dividend 19. India is a young nation and our population is also young. This ‘demographic dividend’, which has helped us in the past, would definitely help us in the future as well. However, in this age of technology and innovation, we need highly skilled human capital to give us an edge over other nations. For this, India needs to considerably step up its public spending on education and health. The quality of education also needs to undergo a significant change towards promoting innovation and entrepreneurship. More funds need to be invested for setting up institutions in the areas of Research and Development with special emphasis on improving productivity and efficiency in labour intensive sectors like agriculture, medium and small industries, etc. It is important to recognize that unless we are able to properly harness the demographic dividend, it could turn into a demographic curse. 20. One more advantage which we have is that our overall levels of productivity and efficiency are so low that the only way for it is to go up. You are a blessed lot who would have the skill sets to do well when you go out in the job market. Believe me, there is and always will be a demand for skilled professionals in not only a growing economy like India, but also worldwide. Issues that remain and how do we resolve them, going forward? 21. Various reasons are attributed to the growth slowdown in recent times, some global and some domestic. The global factors, of course, are well-known, which include the global financial and economic crisis followed by the Eurozone crisis and in recent times, the uncertainty over the US Fed’s move on tapering off the quantitative easing. My focus here is more on the domestic issues as these are under our control. Governance and Policy Issues 22. India is still below average on key governance parameters as indicated by the World Bank’s worldwide governance indicators compiled from 1996 to 2012. There have not been significant improvements in our governance (Chart 3). Clearly, there is a lot of scope for improvement on these parameters. Both our overall governance and corporate governance needs improvement. In fact, we need better governance at every level – from hospital and educational institutions to polity, firms, non-profit institutions, banking and finance, regulation, land records and even in our daily lives. Optimising the use of natural resources 23. We need to devise suitable policies that optimize the use of natural resources, like wind, water, energy and mineral resources. Enhancing infrastructure investments 24. Every developed economy has world class infrastructure and we are fortunate that we do not have any dearth of skilled engineers who can build these infrastructure for our country. But our problem is that while there is a demand for world class infrastructure, people are generally not inclined to pay for utilising these facilities. This attitude in our society has to change and people have to realize that unless these infrastructure facilities become self-sustaining, further investments in setting up such infrastructure may not be forthcoming. In this context, it is certain that we would have to make some sacrifices of our natural resources but it is equally important to ensure that people who are displaced are compensated in a just and equitable manner. Increasing investments in infrastructure and implementing the projects within a reasonable time frame, would provide a much needed fillip to the economy and galvanize it for all round progress and development. Innovation and Entrepreneurship 25. India has been lagging behind in innovation and entrepreneurship. We are ranked 89th out of the 118 nations in the Global Entrepreneurship and Development Index, 2013 (GEDI), published by GEDI, a specialized non-profit research and consulting firm. The ‘Doing Business 2013 report’, a study conducted by the International Finance Corporation of the World Bank Group ranks India at 173rd among the 185 countries surveyed on the criteria of ‘starting a business’. As I mentioned earlier, our education system needs to restructure itself significantly to promote innovation and entrepreneurship. As students of one of the premier institutions for management education in the country, I do expect that many of you would unleash your entrepreneurial energies to set up successful start-up business ventures instead of merely building up careers in already established firms. Funding of Entrepreneurship 26. Funding is one of the key concerns for any start-up venture. In this regard, it may be mentioned that SEBI data shows that investment by Venture Capital Funds (VCFs) and Foreign Venture Capital Investors (FVCIs), which had peaked at about 3.1 per cent of GDP at current market prices in Q3 of 2010(Jul-Sept), has started declining since then (Chart 4). There is a need to reverse this trend. 27. India is emerging as an attractive destination for risk capital. There is, however, a need to further improve the entrepreneurial ecosystem by enhancing availability of risk capital to entrepreneurs at start-up and early stage. It was in this context that the Planning Commission constituted, in October 2011, a Committee on Angel Investment and Early Stage Venture Capital chaired by Shri Sunil Mitra.5 28. The Sunil Mitra Committee believes India’s entrepreneurial growth can be accelerated by creating more conducive conditions – a catalytic government and regulatory environment, adequate capital flows (both debt and equity), support from businesses and society, and availability of appropriate talent and mentoring. Keeping in view the significant impact of taking forward these recommendations in the strategic area of employment and wealth creation in the country within the coming decade, the Committee had proposed the entrustment of the critical task of coordination to a National Entrepreneurship Mission. The recommendations of the Committee need to be examined in detail and appropriate action initiated on a priority basis so that bottlenecks in flow of funds to new ventures are overcome. Ease of doing business 29. India still needs to go a long way in creating an enabling and conducive business environment. We are ranked 132nd of the 185 countries in the ‘ease of doing business’ as per the ‘Doing Business 2013’ report. We need to create an effective institutional framework to support the genuine needs of businesses and to ensure that the entrepreneurial spirit of our people is not curbed by avoidable procedural complications. I am sure the Government and policy makers are fully seized of the issue and steps are being taken to remediate the situation. Enhancing Productivity 30. Low productivity has been a constraint over the years, more so in the case of agriculture and industry, perhaps less so in the case of the services sector. For instance, India is the second largest producer of Rice, Wheat, Sugarcane and Groundnut in the World (in 2010). However, the yields of these crops are much lower than that in the leading countries. There is an urgent need to enhance productivity in all the sectors as it is one of the critical drivers of growth. 31. I strongly believe that productivity and efficiency in banking services would be the bulwark for all round economic development in India.6 There have been definitive improvements in the productivity and efficiency parameters in the banking sector in India. However, the sector has only witnessed enhancements in operational efficiency and the allocational efficiency has suffered, whereby all segments of the society have not really benefitted. 32. Considering the challenges currently confronting the economy, there is little doubt that now is the time for the next big productivity push in Indian banking. There is a need for the entire paradigm of banking productivity and efficiency to be reoriented to be in alignment with our national priorities. Measures initiated by the Government and RBI so far 33. Let me recount some of the recent measures initiated by the Government and the Reserve Bank so far. Since the second week of September 2012, the Government of India announced a number of policy measures with the objective of strengthening the investment climate in the economy, which include, inter alia, the setting up of the Cabinet Committee on Investments (CCI) chaired by the Prime Minister, the liberalisation of FDI in multi-brand retail, aviation and broadcasting, and fast tracking of large investment projects in the areas of power, petroleum and gas, roads, coal, etc. The Government has also set up the Project Monitoring Group in the Cabinet Secretariat for monitoring the implementation of these high-value projects. 34. A High Level Committee on Manufacturing, headed by the PM, has been created for monitoring the implementation of the national manufacturing policy. The Government also proposes to set up an independent regulatory authority for the coal sector and has proposed changes in the natural gas pricing policy. The Government has also liberalised FDI norms in some more sectors including petroleum and natural gas refining, single brand retail trading, basic and cellular services, asset reconstruction companies, etc. 35. Towards creating economic space, the Finance Minister, in Union Budget 2013-14, sought to reduce the fiscal deficit to 4.8 per cent of GDP in 2013-14 from 5.2 per cent in the previous year. The Budget also proposed to carry forward the initiatives to boost infrastructure investment, including encouraging Infrastructure Debt Funds, credit enhancement via IIFCL-ADB to infrastructure companies that may access the bond market, increase in the aggregate ceiling of issuance of tax-free bonds to Rs.50,000 crore in 2013-14, setting up a regulatory authority for the road sector to address issues such as financial stress, enhanced construction risk and contract management. Furthermore, in order to attract new investment and to quicken the implementation of projects, an investment allowance for new high value investments was introduced. This is expected to provide enormous spill-over benefits to small and medium enterprises. 36. To reduce the CAD to sustainable levels, the Reserve Bank and Government of India have taken various policy measures including, inter alia, (i) an increase in the customs duty on gold, (ii) instructions to all nominated banks/nominated agencies to ensure that at least one fifth of every lot of import of gold (in any form/purity including import of gold coins/dore) is exclusively made available for the purpose of export and (iii) issuance of inflation linked bonds to wean away investors from gold to other savings instruments. 37. The Prime Minister’s Office has been monitoring the CAPEX and investment plans of selected Central Public Sector Enterprises (CPSEs) since FY 12-13 with a view to enhance investment in the economy and use CPSEs to drive economic growth. Developments in the Banking Sector 38. Coming specifically to the banking sector, I would like to emphasize that this sector plays a very important role in the economic growth of the country, by providing finance to the different sectors of the economy. Though our banking system continues to remain vibrant in terms of capital and profitability, despite the economic downturn, we cannot afford to relax. While the asset quality of the banking system is under stress, the situation is still manageable. Let me, however, highlight that as per our analysis, the higher NPAs in the banking system are, in a large measure, also attributable to some laxity in lending standards in the benign environment that preceded the Global Financial Crisis. We are witnessing another disconcerting trend in our economy and that is the corporate sector and Government have become highly leveraged. The banks have to be more discreet in lending to the highly leveraged corporates. The bank credit is primarily meant to be utilized for productive purposes and hence, people cannot be allowed to eat credit. 39. Specifically, there is lot of scope for improvement in our public sector banks in terms of governance, risk management capabilities and human capital. One of the primary reasons for the Financial Crisis was the greed and unethical practices of the market participants. History bears testimony to the fact that an inefficient system breeds indiscipline, which in turn leads to wastage of resources, complacency, frauds, low growth, etc. Our banking system has to ensure that it remains efficient and supports the activities of the real sector. Message for Students 40. I am wary of giving advice to the students as people of your generation are not too receptive to advices. So, I would just give you some suggestions. I would like to give three messages, which I always do whenever I get an opportunity to interact with the students. My first message is that you must strive to achieve ‘third generation literacy’. While the first generation of literacy pertains to acquiring knowledge by reading books; the second generation literacy pertains to knowledge about computers and information technology. I am sure all of you have attained the first and second generation of literacy. However, the third generation of literacy that I am talking about is being ‘information literate’. What I mean is that you should always be aware of the things happening around you. You should be hungry to learn more and constantly update yourself by keeping your curiosity to seek and assimilate knowledge, alive. My second message to you is never be complacent in life. Think positive and avoid complacency. It is all the more important if you enter the financial sector, because few moments of complacency can lead to disastrous results. In fact, when I am asked, whether I am concerned, I say “Yes, I am”. For that matter even RBI governor is always concerned because people in the financial sector and those dealing with money cannot afford to be complacent even for a single moment. My third and final message is that, life is not a bed of roses and in your career you are bound to face some bad times. Also when the bad times come, they arrive from all directions. During this period you should lie low, do not get desperate and pray to God, for good times are bound to come back again. You will always be successful in your life and professional career, if you follow the above three commandments. The knowledge you have acquired at this institute will open the doors of success for you in whichever field you choose. Conclusion 41. Let me conclude by saying that not only our problems are much simpler than most nations; we are also well aware of them. We have a growing population and, hence, we would continue to have a base level of growth whatever be the situation. The issue, therefore, is not to just ‘sustain’ growth but to grow at our higher ‘potential’ growth rate. To my mind, productivity and efficiency enhancements are central to achieving this higher growth rate. We must not get bogged down by the fact that others are not really doing their part, nor should we wait for everything else to be in place before setting our house in order. Charity begins at home and hence, we should do what is within our capability irrespective of the constraints surrounding us. The society has to collectively demand probity, accountability and transparency in public life and develop strict intolerance towards indiscipline. 42. I would once again like to thank Narsee Monjee Institute of Management Studies University and the faculty and students of the School of Business Management for inviting me to this Conference for sharing my thoughts on a topical subject. I am sure the bright young minds of the NMIMS would reflect on the issues that I have raised today and further deliberate and ideate on how India can regain its growth momentum in the coming days. As future business managers and potential captains of the industry, you carry a burden of expectations of an entire nation. I believe with hard work, we would be able to overcome the adversities and return to higher growth trajectory sooner than others. I would like to end with a quote from an American Novelist, Nora Roberts which says “if you don’t go after what you want, you’ll never have it. If you don’t ask, the answer is always no. If you don’t step forward, you’re always in the same place”. 43. I wish you a successful Conference today as well as success in all your future endeavors. Thank You. Annex A: Tables

Annex B: Charts 1 Chief Guest Address by Dr. K. C. Chakrabarty, Deputy Governor, Reserve Bank of India at the Sixth Annual Banking Conference “Bank on it, 2013” organised by the Narsee Monjee Institute of Management Studies in Mumbai on Oct 5, 2013. Assistance provided by Shri Arun Vishnu Kumar is gratefully acknowledged. 2 The ending date of the first phase is still debated. Many economists now argue that the economy moved to a higher growth path around 1980-81, a decade prior to the initiation of comprehensive structural reforms in the early 1990s. 3 “Professor Raj Krishna was one of the first to draw pointed attention to the inadequacy of our growth performance, when in the mid-seventies, he coined the much quoted phrase ''the Hindu rate of growth'' to describe India's disappointing trend growth” Montek Singh Ahluwalia (1995), “Economic Reforms for the Nineties”, lecture delivered as the First Raj Krishna Memorial Lecture in April 1995 at the University of Rajasthan accessed from the Planning Commission website http://planningcommission.gov.in/aboutus/speech/spemsa/msa033.pdf . However, “there is nothing in the literature that suggests that this period of the “Hindu Rate of Growth” had anything to do with Hinduism per se… that had a lot to do with the Indian version of Socialism.” (Virmani, (2004) “India’s Economic Growth: From Socialist Rate of Growth to Bharatiya Rate of Growth”, Working Paper No. 122, ICRIER, February 2004.). 4 Chakrabarty K,C, (2013),”Transit Path for Indian Economy: Six Steps for Transforming the Elephant into a Tiger gives a lucid exposition of this debate.” /en/web/rbi/-/publications/rbi-bulletin/transit-path-for-indian-economy-six-steps-for-transforming-the-elephant-into-a-tiger-by-k.-c.-chakrabarty-13912 5 The report of the Committee is available at planningcommission.nic.in/reports/genrep/rep_eco2708.pdf 6 Chakrabarty, K.C. (2013), “Productivity Trends in Indian Banking in the Post Reform Period – Experience, Issues and Future Challenges”, September available at /en/web/rbi/-/publications/rbi-bulletin/productivity-trends-in-indian-banking-in-the-post-reform-period-experience-issues-and-future-challenges-k.-c.-chakrabarty-14410 |

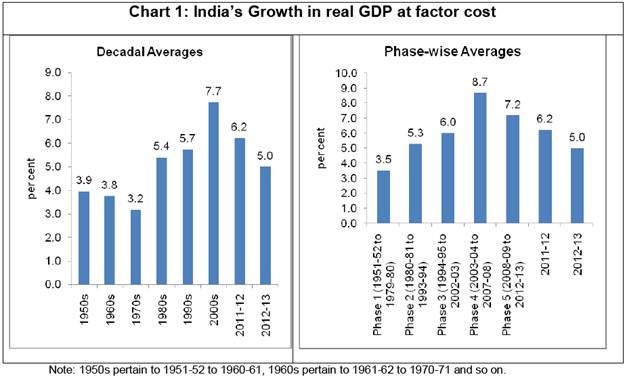

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

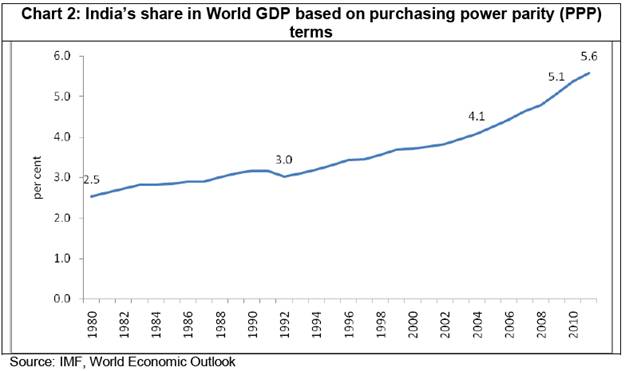

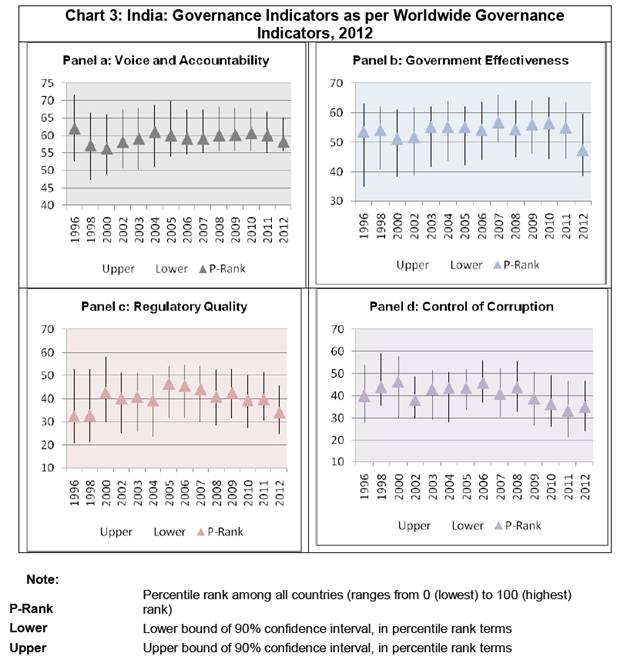

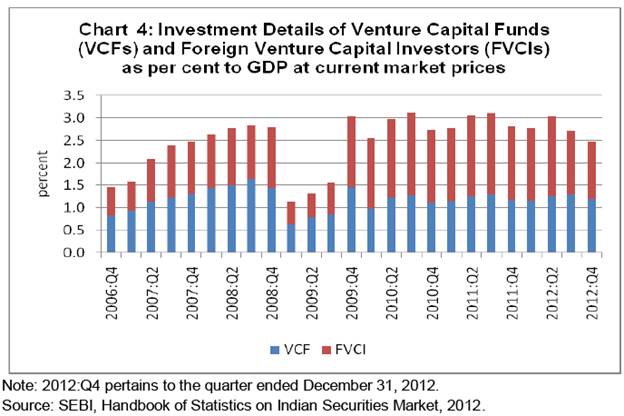

পৃষ্ঠাটো শেহতীয়া আপডেট কৰা তাৰিখ: