IST,

IST,

Minutes of the Monetary Policy Committee Meeting, April 3 to 5, 2024 [Under Section 45ZL of the Reserve Bank of India Act, 1934]

|

The forty eighth meeting of the Monetary Policy Committee (MPC), constituted under Section 45ZB of the Reserve Bank of India Act, 1934, was held during April 3 to 5, 2024. 2. The meeting was attended by all the members – Dr. Shashanka Bhide, Honorary Senior Advisor, National Council of Applied Economic Research, Delhi; Dr. Ashima Goyal, Emeritus Professor, Indira Gandhi Institute of Development Research, Mumbai; Prof. Jayanth R. Varma, Professor, Indian Institute of Management, Ahmedabad; Dr. Rajiv Ranjan, Executive Director (the officer of the Reserve Bank nominated by the Central Board under Section 45ZB(2)(c) of the Reserve Bank of India Act, 1934); Dr. Michael Debabrata Patra, Deputy Governor in charge of monetary policy – and was chaired by Shri Shaktikanta Das, Governor. 3. According to Section 45ZL of the Reserve Bank of India Act, 1934, the Reserve Bank shall publish, on the fourteenth day after every meeting of the Monetary Policy Committee, the minutes of the proceedings of the meeting which shall include the following, namely: (a) the resolution adopted at the meeting of the Monetary Policy Committee; (b) the vote of each member of the Monetary Policy Committee, ascribed to such member, on the resolution adopted in the said meeting; and (c) the statement of each member of the Monetary Policy Committee under sub-section (11) of section 45ZI on the resolution adopted in the said meeting. 4. The MPC reviewed the surveys conducted by the Reserve Bank to gauge consumer confidence, households’ inflation expectations, corporate sector performance, credit conditions, the outlook for the industrial, services and infrastructure sectors, and the projections of professional forecasters. The MPC also reviewed in detail the staff’s macroeconomic projections, and alternative scenarios around various risks to the outlook. Drawing on the above and after extensive discussions on the stance of monetary policy, the MPC adopted the resolution that is set out below. Resolution 5. On the basis of an assessment of the current and evolving macroeconomic situation, the Monetary Policy Committee (MPC) at its meeting today (April 5, 2024) decided to:

Consequently, the standing deposit facility (SDF) rate remains unchanged at 6.25 per cent and the marginal standing facility (MSF) rate and the Bank Rate at 6.75 per cent.

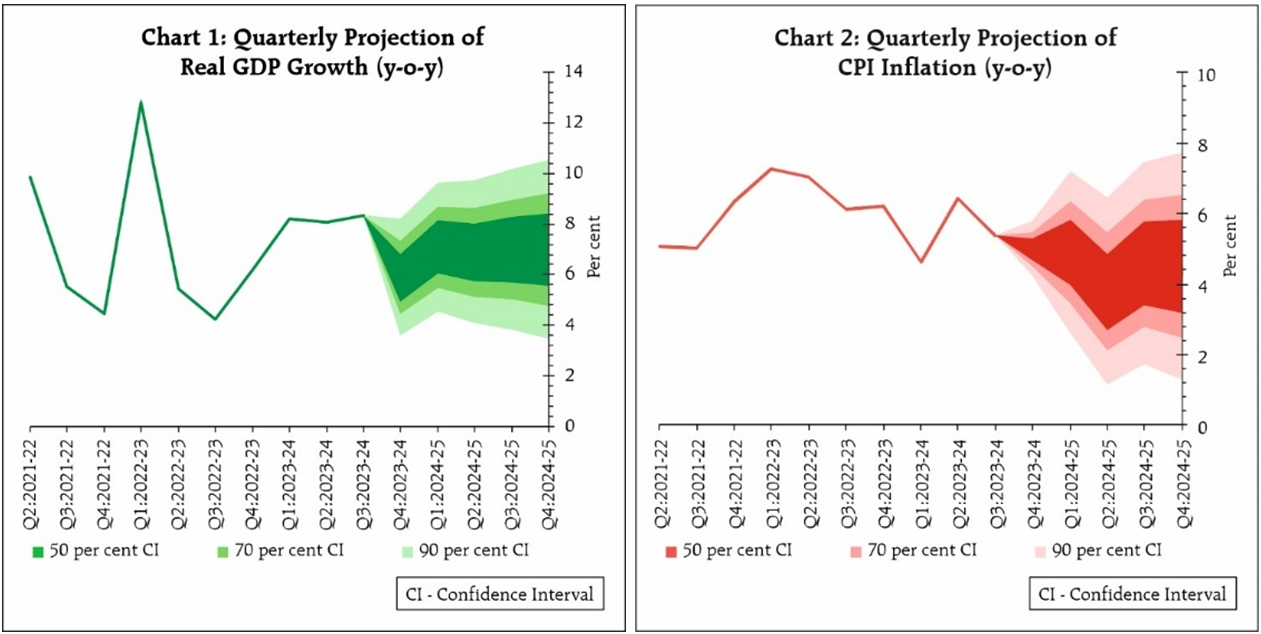

These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth. Assessment and Outlook 6. The global economy exhibits resilience and is likely to maintain its steady growth in 2024. Inflation is treading down, supported by favourable base effects though stubborn services prices are keeping it elevated relative to targets. As the central banks navigate the last mile of disinflation, financial markets are responding to changing perceptions on the timing and pace of monetary policy trajectories. Equity markets are rallying, while sovereign bond yields and the US dollar are exhibiting bidirectional movements. Gold prices have surged on safe haven demand. 7. The domestic economy is experiencing strong momentum. As per the second advance estimates (SAE), real gross domestic product (GDP) expanded at 7.6 per cent in 2023-24 on the back of buoyant domestic demand. Real GDP increased by 8.4 per cent in Q3, with strong investment activity and a lower drag from net external demand. On the supply side, gross value added recorded a growth of 6.9 per cent in 2023-24, driven by manufacturing and construction activity. 8. Looking ahead, an expected normal south-west monsoon should support agricultural activity. Manufacturing is expected to maintain its momentum on the back of sustained profitability. Services activity is likely to grow above the pre-pandemic trend. Private consumption should gain steam with further pick-up in rural activity and steady urban demand. A rise in discretionary spending expected by urban households, as per the Reserve Bank’s consumer survey, and improving income levels augur well for the strengthening of private consumption. The prospects of fixed investment remain bright with business optimism, healthy corporate and bank balance sheets, robust government capital expenditure and signs of upturn in the private capex cycle. Headwinds from geopolitical tensions, volatility in international financial markets, geoeconomic fragmentation, rising Red Sea disruptions, and extreme weather events, however, pose risks to the outlook. Taking all these factors into consideration, real GDP growth for 2024-25 is projected at 7.0 per cent with Q1 at 7.1 per cent; Q2 at 6.9 per cent; Q3 at 7.0 per cent; and Q4 at 7.0 per cent (Chart 1). The risks are evenly balanced. 9. Headline inflation softened to 5.1 per cent during January-February 2024, from 5.7 per cent in December. After correcting in January, food inflation edged up to 7.8 per cent in February primarily driven by vegetables, eggs, meat and fish. Fuel prices remained in deflation for the sixth consecutive month in February. CPI core (CPI excluding food and fuel) disinflation took it down to 3.4 per cent in February – this was one of the lowest in the current CPI series, with both goods and services components registering a fall in inflation. 10. Going ahead, food price uncertainties would continue to weigh on the inflation outlook. An expected record rabi wheat production in 2023-24, however, will help contain cereal prices. Early indications of a normal monsoon also augur well for the kharif season. On the other hand, the increasing incidence of climate shocks remains a key upside risk to food prices. Low reservoir levels, especially in the southern states and outlook of above normal temperatures during April-June, also pose concern. Tight demand supply conditions in certain pulses and the prices of key vegetables need close monitoring. Fuel price deflation is likely to deepen in the near term following the recent cut in LPG prices. After witnessing sustained moderation, cost push pressures faced by firms are showing upward bias. The recent firming up of international crude oil prices warrants close monitoring. Geo-political tensions and volatility in financial markets also pose risks to the inflation outlook. Taking into account these factors and assuming a normal monsoon, CPI inflation for 2024-25 is projected at 4.5 per cent with Q1 at 4.9 per cent; Q2 at 3.8 per cent; Q3 at 4.6 per cent; and Q4 at 4.5 per cent (Chart 2). The risks are evenly balanced. 11. The MPC noted that domestic economic activity remains resilient, backed by strong investment demand and upbeat business and consumer sentiments. Headline inflation has come off the December peak; however, food price pressures have been interrupting the ongoing disinflation process, posing challenges for the final descent of inflation to the target. Unpredictable supply side shocks from adverse climate events and their impact on agricultural production as also geo-political tensions and spillovers to trade and commodity markets add uncertainties to the outlook. As the path of disinflation needs to be sustained till inflation reaches the 4 per cent target on a durable basis, the MPC decided to keep the policy repo rate unchanged at 6.50 per cent in this meeting. Monetary policy must continue to be actively disinflationary to ensure anchoring of inflation expectations and fuller transmission. The MPC will remain resolute in its commitment to aligning inflation to the target. The MPC believes that durable price stability would set strong foundations for a period of high growth. The MPC also decided to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns to the target, while supporting growth. 12. Dr. Shashanka Bhide, Dr. Ashima Goyal, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra and Shri Shaktikanta Das voted to keep the policy repo rate unchanged at 6.50 per cent. Prof. Jayanth R. Varma voted to reduce the policy repo rate by 25 basis points. 13. Dr. Shashanka Bhide, Dr. Ashima Goyal, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra and Shri Shaktikanta Das voted to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns to the target, while supporting growth. Prof. Jayanth R. Varma voted for a change in stance to neutral. 14. The minutes of the MPC’s meeting will be published on April 19, 2024. 15. The next meeting of the MPC is scheduled during June 5 to 7, 2024. Voting on the Resolution to keep the policy repo rate unchanged

Statement by Dr. Shashanka Bhide 16. High growth and moderating inflation rates have marked the prevailing macroeconomic conditions. The recent assessment by the National Statistical Organisation in its Second Advance Estimates places the year on year growth of GDP in Q3: 2023-24 at 8.4 per cent, the third consecutive quarter this year with a growth rate of above 8 per cent. The annual growth of GDP for 2023-24 is now estimated at 7.6 per cent, higher than the growth of 7 per cent in the previous year, and also above the First Advance Estimates for the current year. The annual headline inflation rate for February was 5.1 per cent the same level as in the previous month and well below 5.7 per cent in December 2023. 17. Agriculture and allied activities is the only one among the main production sectors with a marginal growth of less than 1 per cent in GVA. Industry is estimated to grow at 8.3 per cent and services at 7.9 per cent in 2023-24. Growth in industry has followed negative growth (-0.6) per cent in 2022-23 and services sector has registered a high growth of 7.9 per cent over 9.9 per cent in the previous year. Year on year growth rate of GVA in mining and manufacturing in the industry and construction and the composite financial, real estate, and personal services in the services exceeded 8 per cent in 2023-24. The Index of Industrial Production shows, however, that there are sub-sectors in manufacturing such as chemicals, textiles, readymade garments and leather in which output growth during April-2023- January 2024 has been subdued. Weakness in the external demand conditions has posed constraints on some of export-oriented industries. 18. The expenditure side is marked by high growth in investment demand relative to consumption. The former expanded by 10.2 per cent over the previous year and the latter by 3 per cent. The quarterly assessments point to improvement in consumption expenditure as private final consumption expenditure rose by 3.5 per cent in Q3 compared to 2.4 per cent growth in Q2: 2023-24. 19. On the inflation front, the pattern remains the same, which prevailed at the time of MPC meeting of February: expectations of moderation in inflation rates of fuels and the ‘core’ items of consumption leading to softening of the headline inflation in Q4: 2023-24. The actual inflation rates for January and February have reflected the projected trends as the headline rate dropped to 5.1 per cent and food inflation was above 7.5 per cent. Although the projections for 2024-25 in the February MPC meeting were at 4.5 per cent, the headline inflation trajectory reflected rates above 4.5 per cent for three out of four quarters in 2024-25. 20. The favourable outlook for the short-term is, therefore, conditioned by the continuation of the present growth and inflation trends. The economic conditions in 2023-24 were also impacted by the slow recovery of overall global economic growth and moderation in inflation rates combined with a decline in commodity prices, particularly crude oil and vegetable oils. The supportive economic policies have sustained domestic growth and investment inflows. 21. The indicators of current economic activity reflect strong momentum of growth in a number of sectors. Indicators such as high levels of capacity utilisation in the manufacturing sector, government capital expenditure, FDI inflows have remained positive for investment spending. Although expansion of private consumption expenditure has lagged behind GFCF and exports, even with reference to the levels in 2019-20, there has been a steady improvement in the consumer confidence of urban households, particularly on the general economic conditions, employment, and household income, as reflected in the sample household surveys carried out by the RBI. The RBI’s enterprise surveys conducted during January to March 2024 indicate that the demand conditions in H1: 2024-25 for manufacturing and infrastructure firms are expected to remain stable; in the case of services, conditions are expected to improve significantly. The broader measures of economic activity such as decline in unemployment rate and steady bank credit growth point to the favourable conditions. A key exogenous factor impacting the outlook in 2024-25 is the nature of the monsoon this year. The present expectations are one of a normal monsoon, which would help bolster the output performance of agriculture, rural demand and moderate inflation pressures. 22. Taking these factors into account the GDP growth for 2024-25 is projected at 7 per cent, the same level as in the February meeting of the MPC. The quarterly projections are 7.1 per cent in Q1, 6.9 per cent in Q2 and 7 per cent each in Q3 and Q4. RBI’s Survey of Professional Forecasters carried out in March 2024 provides a median real GDP growth forecast of 6.7 per cent for 2024-25, with an upward revision from its previous assessment of 6.5 per cent. 23. On the inflation front, as noted, food inflation trends would remain crucial to sustaining the movement of the headline inflation closer to the policy target of 4 per cent on a durable basis. Global conditions affecting commodity prices are the other exogenous elements impacting the fuel prices and prices of other inputs. These conditions- the food inflation and the global supply, and price conditions remain subject to significant risks given the uncertain weather events and geoeconomic conflicts affecting supply chains. However, short term spikes may not affect the projected headline inflation trajectory, given the moderating trend in the recent period in the forward looking expectations of inflation by the households (RBI’s Inflation Expectations Survey of Households and Business Inflation Expectations Survey by the Misra Centre for Financial Markets and Economy, Indian Institute of Management Ahmedabad). But prolonged disturbances in the supply conditions would be a concern. 24. Based on an assessment of the developing situation and the assumption of a normal monsoon, the headline inflation for Q4: 2023-24 is projected at 5 percent, Q1: 2024-25 at 4.9, Q2 at 3.8, Q3 at 4.6 and Q4 at 4.5 per cent. The average inflation rate for 2024-25 is projected at 4.5 per cent, the same as in the February MPC meeting. The RBI’s Survey of Professional Forecasters conducted in March 2024 also places the forecast for 2024-25 at 4.5 per cent. 25. The prevailing macroeconomic conditions point to a continuation of the strong growth momentum into 2024-25, particularly as a normal monsoon brings relief to the outlook for agricultural sector. A favourable monsoon is also crucial in bringing down the present high levels of food inflation rates, which would also support consumption demand in the rural economy. Sustaining the growth momentum will require moderate levels of consumer inflation. Tight monetary policy and government interventions in managing the supply side shocks on the food and energy front have been important in moderating inflation. While the projected inflation trends point to further moderation in inflation rate in 2024-25, they also indicate an upturn well above the target rate of 4 per cent in the second half of the year. Given the strong momentum of growth at this juncture, it is necessary to maintain monetary policy focus on aligning the inflation trends with the target. 26. Accordingly, I vote: i. to keep the policy repo rate unchanged at 6.50 per cent, and ii. to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns with the target, while supporting growth. Statement by Dr. Ashima Goyal 27. Global trade seems to be recovering but growth is mixed and geopolitical risks continue. Inflation has come down substantially but further progress is slow. The consensus of current research for advanced economies (AEs) seems to be that those who thought inflation was largely driven by supply-side bottlenecks were right after all, because it has come down sharply without prolonged macroeconomic tightening. It persisted longer than supply chain unravelling because of labour market tightness1. Longer term inflation expectations remained anchored and central bank tightening helped ensure that. 28. India did not have a tight labour market but recurrent food price shocks created inflation persistence. A rapid rise in repo rates, as well as government supply-side action, helped anchor inflation expectations. Real rates near equilibrium kept demand in balance with supply. 29. Partly as a result, commodity shocks were transient in 2023. This transience suggests it is not necessary to keep rates high because of expected future shocks. Moreover, even reaching 4% is no warranty inflation will stay at 4% if there are large shocks such as the pre and post pandemic ones. 30. In term of current and expected core inflation, real interest rates are now higher than the natural or neutral interest rate (NIR) compatible with keeping inflation at target and output at potential. This is less of a worry at present, since corporate profits are also high and despite some issues, growth is strong; private investment is rising in sectors where there is innovation or capacity is reached; exports and rural consumption are recovering. Most important, credit growth continues to be robust. The slight slackening in momentum, especially in categories with sharp growth, is desirable since credit spikes create risk. India’s relatively low credit/GDP ratio has to rise, but it is best if this happens gradually so that it is sustainable. 31. But there has to be a limit to squeezing core inflation to compensate for periodic headline shocks. Core sustaining below 4% implies real policy rates are in the contraction zone. 32. Real policy rates kept near the neutral rate of around unity after the pandemic, along with supply-side action to neutralize shocks, supported growth while anchoring inflation expectations. But real rates rise as inflation falls and if they sustain above neutral rates lagged effects of monetary policy will start reducing growth after some months2. Flexible inflation targeting (FIT) is forward-looking and aims to ensure expected real rates do not rise above the NIR. Since the NIR is time varying and difficult to estimate precisely, judgement is important. 33. It is possible to assess relevant factors affecting the Indian NIR in the policy time horizon3. Higher growth and demand for credit raise the NIR, but reforms raising potential output and enabling non-inflationary rise in low per capita incomes; higher capital inflows, lower current account deficit, reduction in fiscal deficits, use of prudential risk weights and provisioning that lower risk premiums4; wage growth below productivity growth all tend to lower the NIR. Since these factors work in opposite directions they may cancel each other. 34. Expected medium-run variables are more important for current policy in emerging markets that are far from a steady-state. So inflation itself gives useful insights for determining feasible or potential growth. Inflation approaching the target suggests the absence of over-heating so growth is below potential and the NIR has not risen. If despite robust growth core inflation is less than 4%, yet continues to fall, there cannot be excess demand. The IIM Ahmedabad survey finds firms’ average inflation expectations remained well-anchored at 4.3% in the past year. Firms may have internalized the inflation target apart from restructuring and reducing costs. Non-inflationary high growth is feasible as part of a transitional catch-up process that would create productive jobs for India’s underemployed youth, 35. Core sustaining near target inflation and average headline below 5 implies a credible approach to target, since research for the FIT period suggests long-run causality continues to be from core to headline inflation despite the pandemic shocks5. Publishing forecasts of core inflation can help the convergence of headline to target inflation. Competitive forecasts are an important discipline in a FIT regime. Core is less volatile than headline but correct forecasts require an understanding of how new data acts in the Indian structure. 36. While there are risks, there are also reasons to expect moderation in future supply shocks and their impacts—such as improved governance 6and steady rise in investment reducing bottlenecks and logistics costs; resilience rising with development and diversity; El Nino changing to La Nina; the impact of substitution away from oil, of LPG and petrol-diesel price cuts and falling weights of volatile price items such as food in consumption baskets. 37. Even if the NIR is raised to 1.5% because of abundant caution since steady growth allows a focus on reaching the inflation target the real policy rate is above it at 2% even in terms of expected FY25 headline inflation (4.5%); and even higher in terms of expected core inflation. Despite a cut in repo rates policy will still be contractionary. In the current situation of many types of uncertainty, however, maintaining stability must have priority. Therefore, I continue to vote for a pause in the repo rate and for an unchanged stance. Giving indications of the future repo rate is not compatible with data-based guidance and can create unnecessary market turbulence as it has in the US. Policy continues to be forward-looking since it responds to how data affects published inflation and growth forecasts. Its reaction function should by now be well understood by markets, giving them adequate guidance. 38. The tightness in market liquidity has abated. Such tightness affects short rates more, which have little effect on aggregate demand and inflation. Under FIT, policy transmission occurs best through keeping the repo rate at an appropriate level, determined by domestic factors. Rates transmit through both banks and markets. For example, non-food credit of banks as a % of annual flow of resources available to the commercial sector has averaged 44.3% over 2007-23. Competition from other sources may mean less than full transmission of policy repo to loan rates, but points to growing diversity, maturity, fall in spreads and rising efficiency in the Indian financial sector. Market rates also rise with repo rates. Statement by Prof. Jayanth R. Varma 39. My views are largely the same as in the last meeting (February 2024) and so I will be brief. Despite an uptick in crude oil prices, the outlook for inflation continues to be benign, and I remain convinced that a real interest rate of 1-1.5% would be sufficient to glide inflation to the target of 4%. The current real policy rate of 2% (based on projected inflation for 2024-25) is therefore excessive. 40. This unwarrantedly high real rate imposes significant costs on the economy because of the short run Phillips curve. The fact that economic growth in 2024-25 is projected to slow by over half a percent relative to 2023-24 is a reminder that high interest rates entail a growth sacrifice. Monetary policy should try to reduce this sacrifice while ensuring that inflation (a) remains within the band and (b) glides towards the target. 41. I therefore vote to reduce the repo rate by 25 basis points, and to change the stance to neutral. Statement by Dr. Rajiv Ranjan 42. In my last statement of February 2024, I had explained clearly why no easing in stance or rate was desirable at that time. Now between last policy and this policy, what has changed. 43. Real GDP growth has turned out to be firmer with stronger momentum, better than all projections, as per the Second Advance Estimates (SAE) released after February policy. There seems to be minimal scarring of growth due to the pandemic or monetary tightening. 44. CPI headline inflation moderation remains on anticipated lines, though the diverging trajectory between food and core inflation continues. Food inflation remained a hostage to vegetable prices due to shallower winter season price correction, which could linger due to the likely above normal temperatures during the summer. Core inflation softened further since the last policy. This has been broad based across goods and services and almost universal, across all exclusion-based measures of core as well as statistical trimmed mean measures.7 Besides, it is driven by lower price momentum.8 While low core inflation would further the disinflation process, concerns remain on food inflation outlook. We need to remain watchful on upside risks to inflation outlook from adverse climatic factors, supply side shocks and geopolitical events. 45. Going ahead, while monetary policy seems to be on the right track, it is too early to ease guard against inflation. It is important that we gain more confidence on our macro numbers for 2024-25 and their nuances. We are just at the beginning of the financial year. The financial year 2022-23 is not far behind when all our assumptions and projections got altered within a month’s time because of unforeseen events. Few months into the year, we will have clarity on monsoon and its spatial distribution, impact of expected hot weather in the current quarter, rabi production and procurement and kharif sowing, all of which are critical to shape up the growth-inflation balance in 2024-25. Crude outlook is fast changing with the changing perceptions on demand supply in line with the geopolitics and developments in the middle east, which is on the edge. Besides, led by global developments, input prices are showing signs of an uptick, which needs to be watched. Return of inflation to the 4 per cent target is our objective and having come this far, it is not far from sight. We need to utilise the space provided by stronger growth to focus on inflation. Our own history, including that of many other emerging market economies (EMEs), shows that taking any risk on inflation front leads to huge price in terms of unhinging of inflation expectations that elongates the inflation episodes and makes the price stability task more daunting. 46. Globally, market expectation of an early and faster rate cut by advanced economies’ central banks are not aligning with the incoming data that is adding to some uncertainty on market perceptions of timing of policy easing cycle in major economies. In India, however, market expectations at present seem to be closely aligned to the MPC views and assessment. This is a win-win situation for India’s last mile of disinflation process when beliefs are consistent with the policy regime contributing towards anchoring of long-term expectations.9 Therefore, even if the current upside risks to price stability were to materialise, largely pertaining to the non-core components from uncertain food or international commodity prices, anchored inflation expectations may lower the pass through of such shocks 10 with benefits that go beyond monetary policy. 11 47. To conclude, in recent years the series of large and unfavourable supply shocks have induced monetary policy with difficult trade-offs 12 – to stabilise both prices and output, which were moving in adverse directions. The MPC has utilised the ‘flexibility’ of the flexible inflation targeting framework and we have reached a situation in which this trade off seems to have blurred with inflation on a declining path and growth on a firmer footing. During this transition phase, the three Cs – Caution, Consistency and Credibility – have been the hallmark. While ‘caution’ entails waiting for more data to confirm our conviction, ‘consistency’ eliminates backpedalling in policy decision and ‘credibility’ facilitates firm anchoring of inflation expectations. This approach has stood us in good stead despite challenges and we need to persevere with this for its merits. To recall, just before we embarked on the path of monetary tightening, it was our endeavour then not to give up the accommodative policy setting till growth takes root and becomes self-sustaining. The fall out is that today growth is on a sustainable path despite monetary tightening. On a similar footing, ensuring a durable downward trajectory of inflation towards the 4 per cent target backed by this approach is the best way to address the transition challenges. Instead of haste for policy action, patience is the need of the hour. Hence, I vote for status quo on rate and stance in this policy. Statement by Dr. Michael Debabrata Patra 48. Recent inflation prints and high frequency data on salient food prices indicate that food inflation risks remain elevated. A relatively shallow and short-lived winter trough is giving way to a build-up of price momentum as summer sets in, with forecasts of rising temperatures up to May 2024. Some global food prices are firming up in an environment of rising input costs and supply chain pressures. The headroom provided by the steady core disinflation and fuel price deflation does not assure a faster alignment of the headline with the target. Consequently, headline inflation can be expected to remain in the upper reaches of the tolerance band until favourable base effects come into play in the second quarter of 2024-25. Hence, conditions are not yet in place for any let-up in the restrictive stance of monetary policy. Downward pressure on inflation must be maintained until a better balance of risks becomes evident and the layers of uncertainty clouding the near-term clear away. In the interregnum, the commitment to enduringly aligning inflation with the target of 4 per cent needs to be emphasised. Stabilising inflation expectations is progressing, as reflected in forward-looking surveys; anchoring them is crucial for achieving the inflation target. 49. Domestic demand is expanding, and the output gap has closed. The investment outlook is improving; however, a stronger revival in private consumption and in corporate sales growth may await greater confidence that inflation is declining. The recent improvement in export performance, if sustained, will ease the drag on aggregate demand. 50. Supply responses are also improving, but they will be contingent on a normal monsoon; an upturn in the private investment cycle to boost manufacturing sales and ease capacity constraints; and on sustaining the trend growth of services. The external balance sheet is strong, with a modest current account deficit, ebullient capital flows and rising foreign exchange reserves. This should insulate domestic economic activity from global spillovers in response to regime shifts in monetary policy stances of systemic central banks that are either underway or imminent. Nevertheless, financial stability risks to macroeconomic outcomes in India have to be closely and continuously monitored, and pre-emptively headed off. Overall, price stability has to be restored in order to ensure that the rising growth trajectory that India is embarking upon is sustained. 51. Accordingly, I vote for status quo on the policy rate and for perseverance with the stance of withdrawal of accommodation. Statement by Shri Shaktikanta Das 52. The Indian economy is growing at a robust pace with an average annual growth of 8 per cent during the last three years. India continues to be the fastest growing major economy in the world, supported by an upturn in investment cycle and revival in manufacturing. Services sector continues to grow at a strong pace. 53. CPI headline inflation during January-February 2024 (5.1 per cent in each of the months) has moderated from the elevated level seen in December 2023 (5.7 per cent). The persistent and broad-based softening in CPI core inflation (CPI excluding food and fuel inflation) by 180 bps since June 2023 is driving the disinflation process, though volatile and elevated food inflation is disrupting its pace. 54. Looking ahead, the baseline projections show inflation moderating to 4.5 per cent in 2024-25 from 5.4 per cent in 2023-24 and 6.7 per cent in 2022-23. This success in the disinflation process should not distract us from the vulnerability of the inflation trajectory to the frequent incidences of supply side shocks, especially to food inflation due to adverse weather events and other factors. Overlapping food price shocks, apart from imparting volatility to headline inflation, may also result in spillovers to core inflation. Lingering geo-political tensions and their impact on commodity prices and supply chains are also adding to uncertainties in the inflation trajectory. These considerations call for monetary policy actions to tread the last mile of disinflation with extreme care. 55. The growth prospects of the Indian economy in 2024-25 look bright. Expectations of normal southwest monsoon in 2024 augur well for the agricultural sector and rural demand. Strengthening rural demand, along with rising consumer confidence and optimism on employment and income, are expected to boost private consumption. Prospects of the manufacturing and services sectors also remain bright. Upbeat business outlook of firms, healthy corporate and bank balance sheets, upturn in private capex cycle with capacity utilisation ruling above the long period average can be expected to give further boost to domestic investment activity. Improving global growth and international trade prospects may provide thrust to external demand. 56. Given these growth inflation dynamics, I believe that the extant monetary policy setting is well positioned. Market expectations are also closely aligned with that of the MPC. Monetary policy transmission is continuing and inflation expectations of households are also getting further anchored. At this stage, we should stay the course and remain vigilant. The gains in disinflation achieved over last two years have to be preserved and taken forward towards aligning the headline inflation to the 4 per cent target on a durable basis. The strong growth momentum, together with our GDP projections for 2024-25, give us the policy space to unwaveringly focus on price stability. Price stability is our mandated goal and it sets strong foundations for a period of high growth. Accordingly, I vote to keep the policy repo rate unchanged and continue with the focus on withdrawal of accommodation.

(Yogesh Dayal) Press Release: 2024-2025/138

1English, B., Forbes, K. & Ubide, A. 2024. 'Monetary Policy Responses to the Post-Pandemic Inflation.' CEPR Press. London, UK. Available at: https://cepr.org/publications/books-and-reports/monetary-policy-responses-post-pandemic-inflation 2Fear of this has made the US Fed’s ‘higher for longer’ to change from policy rates to inflation. There is more willingness to allow inflation to remain marginally above target for longer in order to reduce output sacrifice. 3IMF (April 2023) in Chapter 2 of the World Economic Outlook estimates the long-term Indian NIR will converge to AE levels that will go back to pre-pandemic lows. 4See Goyal et.al. (2021), for a cross-country estimation of the, factors including exchange rates, that affect EM risk premiums. Goyal (2024) analyses open economy factors affecting Indian interest rates. For example, one year forward exchange rate premium that was 5.19% over 2014-19 fell to 1.95% in 2023. Goyal, A., Verma, A., and Sengupta, R. 2021. ‘‘External shocks, cross-border flows and macroeconomic risks in emerging market economies’ Empirical Economics, 62, pp. 2111-2148. Available at: https://doi.org/10.1007/s00181-021-02099-z; Goyal, A. 2024. 'India's exchange rate regime under inflation targeting. ' Indian Economic Journal, Special Issue in honour of Dr. Rangarajan, 72(5), October, forthcoming. Previous version available at: http://www.igidr.ac.in/pdf/publication/WP-2023-015.pdf. 5While an IMF study in 2014 found causality from headline to core inflation, subsequent studies all find a reversal. The time taken for convergence depends on shocks, but the direction does not reverse. It can be faster despite shocks to the extant inflation expectations are more anchored, George, A.T., Bhatia, S., John, J., & Das, P. 2024. 'Headline and Core Inflation Dynamics: Have the Recent Shocks Changed the Core Inflation Properties for India? RBI Bulletin, February: 101-116 6Goyal, A. 2012. ‘Propagation Mechanisms in Inflation: Governance as Key.’ Chapter 3 in S. M. Dev (ed.), India Development Report 2012, pp. 32-46, New Delhi: IGIDR and Oxford University Press. 7Various exclusion-based measures declined in a range of 10-40 basis points between December 2023 and February 2024. Trimmed mean measures also declined in a range of 20-50 basis points between December 2023 and February 2024, with weighted median moderating from 4.1 per cent in December to 3.6 per cent in February. 8CPI core momentum (on a Seasonally Adjusted Annualised Rate -SAAR basis) moderated to 2.4 per cent in February 2024 from 3.1 per cent in January. 9Eusepi, S., and B. Preston (2010): “Central Bank Communication and Macroeconomic Stabilization,”, American Economic Journal: Macroeconomics, 2, 235–271. 10Gáti, L. (2023), "Monetary policy & anchored expectations – An endogenous gain learning model", Journal of Monetary Economics, Volume 140, Supplement, pp S37-S47. 11Anchoring inflation expectations increases FDI, helps stabilise output and employment. Helder Ferreira de Mendonça and Bruno Pires Tiberto analyse data from 75 emerging market and developing economies (EMDEs) from 1990 to 2019; https://www.bis.org/publ/bppdf/bispap143_j.pdf 12When economy is driven by only demand shocks, price stability and output stabilisation would warrant monetary policy to move in the same direction and there is no trade-off – ‘divine coincidence’ (A term coined by Blanchard, Olivier; Galí, Jordi (2007). "Real Wage Rigidities and the New Keynesian Model", Journal of Money, Credit and Banking. 39 (1): (35–65) |

পেজের শেষ আপডেট করা তারিখ: