IST,

IST,

Minutes of the Monetary Policy Committee Meeting December 3-5, 2018

[Under Section 45ZL of the Reserve Bank of India Act, 1934] The fourteenth meeting of the Monetary Policy Committee (MPC), constituted under section 45ZB of the Reserve Bank of India Act, 1934, was held from December 3-5, 2018 at the Reserve Bank of India, Mumbai. 2. The meeting was attended by all the members - Dr. Chetan Ghate, Professor, Indian Statistical Institute; Dr. Pami Dua, Director, Delhi School of Economics; Dr. Ravindra H. Dholakia, former Professor, Indian Institute of Management, Ahmedabad; Dr. Michael Debabrata Patra, Executive Director (the officer of the Reserve Bank nominated by the Central Board under Section 45ZB(2)(c) of the Reserve Bank of India Act, 1934); Dr. Viral V. Acharya, Deputy Governor in charge of monetary policy - and was chaired by Dr. Urjit R. Patel, Governor. 3. According to Section 45ZL of the Reserve Bank of India Act, 1934, the Reserve Bank shall publish, on the fourteenth day after every meeting of the Monetary Policy Committee, the minutes of the proceedings of the meeting which shall include the following, namely:

4. The MPC reviewed the surveys conducted by the Reserve Bank to gauge consumer confidence, households’ inflation expectations, corporate sector performance, credit conditions, the outlook for the industrial, services and infrastructure sectors, and the projections of professional forecasters. The MPC also reviewed in detail staff’s macroeconomic projections, and alternative scenarios around various risks to the outlook. Drawing on the above and after extensive discussions on the stance of monetary policy, the MPC adopted the resolution that is set out below. Resolution 5. On the basis of an assessment of the current and evolving macroeconomic situation at its meeting today, the Monetary Policy Committee (MPC) decided to:

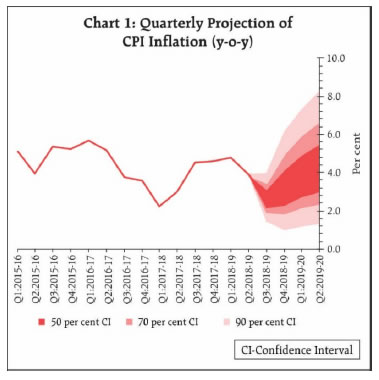

Consequently, the reverse repo rate under the LAF remains at 6.25 per cent, and the marginal standing facility (MSF) rate and the Bank Rate at 6.75 per cent. The decision of the MPC is consistent with the stance of calibrated tightening of monetary policy in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth. The main considerations underlying the decision are set out in the statement below. Assessment 6. Since the last MPC meeting in October 2018, global economic activity has shown increasing signs of weakness on rising trade tensions. Among advanced economies (AEs), economic activity appears to be slowing in the US in Q4:2018, after a buoyant Q3. The Euro area growth lost pace in Q3, impacted by weaker trade growth and new vehicle emission standards. The Japanese economy contracted in Q3 on subdued external and domestic demand. 7. Economic activity also decelerated in major emerging market economies (EMEs) in Q3. In China, growth slowed down on weak domestic demand. The ongoing trade tensions and the possible cooling of the housing market pose major risks to growth in China. The Russian economy lost some traction, pulled down largely by a weak agriculture harvest, though the growth was buttressed by strong performance of the energy sector. The Brazilian economy seems to be recovering gradually from the economic disruption in the first half of the year. The South African economy expanded in Q3, after contracting in the previous two quarters, driven by agriculture and manufacturing. 8. Crude oil prices have declined sharply, reflecting higher supplies and easing of geo-political tensions. Base metal prices have continued to decline on selling pressure following weak demand from major economies. Gold price has risen underpinned by safe haven demand triggered by political uncertainty in some geographies, though a strong dollar may stem the rise. The inflation scenario has remained broadly unchanged in the US and the Euro area. In many key EMEs, however, inflation has risen, though the recent retreat in energy prices, tightening of policy stances by central banks and stabilising of currencies may have a salutary impact, going forward. 9. Global financial markets have been driven mainly by rising policy rates in the US, volatile crude oil prices and expectations of a slowdown compared with earlier projections. Among AEs, equity markets in the US witnessed a selloff on the weakening outlook for corporate earnings caused by rising borrowing costs, while the European stock markets declined on political uncertainties. The Japanese stock market also shed gains on global cues and the gradual strengthening of the yen. EM stock markets have corrected on shrinking global liquidity, weak economic data in some key EMEs, and lingering trade tensions. The 10-year yield in the US, which surged on robust economic data at the beginning of October, softened subsequently on the unchanged Fed stance. Among other AEs, bond yields in the Euro area and Japan softened on weak economic sentiment and idiosyncratic factors. In most EMEs, bond yields have softened in recent weeks on falling crude oil prices and steadying currencies. In currency markets, the US dollar, which was strengthening on a widening growth differential with its peers, eased in the second half of November. The euro has weakened on Brexit and budget concerns in Italy, while the yen appreciated on safe haven buying in November. EME currencies have been trading with an appreciating bias, supported by a sharp decline in crude oil prices and conservative domestic monetary policy stances. 10. On the domestic front, gross domestic product (GDP) growth slowed down to 7.1 per cent year-on-year (y-o-y) in Q2:2018-19, after four consecutive quarters of acceleration, weighed down by moderation in private consumption and a large drag from net exports. Private consumption slowed down possibly on account of moderation in rural demand, subdued growth in kharif output, depressed prices of agricultural commodities and sluggish growth in rural wages. However, growth in government final consumption expenditure (GFCE) strengthened, buoyed by higher spending by the central government. Gross fixed capital formation (GFCF) expanded by double-digits for the third consecutive quarter, driven mainly by the public sector’s thrust on national highways and rural infrastructure, which was also reflected in robust growth in cement production and steel consumption. Growth of imports accelerated at a much faster pace than that of exports, resulting in net exports pulling down aggregate demand. 11. On the supply side, growth of gross value added (GVA) at basic prices decelerated to 6.9 per cent in Q2, reflecting moderation in agricultural and industrial activities. Slowdown in agricultural GVA was largely the outcome of tepid growth in kharif production. Within industry, growth in manufacturing decelerated due to lower profitability of manufacturing firms, pulled down largely by a rise in input costs, while that in mining and quarrying turned negative, caused by a contraction in output of crude oil and natural gas. Growth in electricity, gas, water supply and other utility services strengthened. Services sector growth remained unchanged at the previous quarter’s level. Of its constituents, growth in construction activity decelerated sequentially, but it was much higher on a y-o-y basis. Growth in public administration and defence services accelerated sharply. 12. Looking beyond Q2, rabi sowing so far (up to end-November) has been 8.3 per cent lower as compared with the same period last year due mainly to lower soil moisture levels resulting from a deficient monsoon and a delayed kharif harvest across states. Precipitation during the north-east monsoon as on November 28 was 49 per cent below the long period average. Storage in major reservoirs, the main source of irrigation during the rabi season, was at 61 per cent of the full reservoir level as on November 29. 13. Growth in the index of industrial production (IIP) slowed down to 4.5 per cent in September 2018. Capacity utilisation (CU), measured by the Reserve Bank’s Order Books, Inventories and Capacity Utilisation Survey (OBICUS), increased from 73.8 per cent in Q1 to 76.1 per cent in Q2, which was higher than the long-term average of 74.9 per cent; seasonally adjusted CU also increased to 76.4 per cent. Available high frequency indicators suggest that industrial activity has been improving in Q3. The growth in core industries recovered in October on the back of double-digit expansion in coal, cement and electricity. The purchasing managers’ index (PMI) for manufacturing touched an eleven-month high of 54.0 in November, supported by an expansion in output, and domestic and export orders. According to the assessment of the Reserve Bank’s Industrial Outlook Survey (IOS), the overall business sentiment in Q3 remained stable, with sustained optimism about production and exports. 14. High frequency indicators of service sector activity showed a mixed picture in September-October. Growth in tractors sales – an indicator of rural demand – turned negative in September. Growth in two-wheeler sales, another indicator of rural demand, rebounded in October, supported by a base effect. Growth in passenger vehicles sales – an indicator of urban demand – turned marginally positive in October, after three consecutive months of negative growth coincident with changes in mandatory long-term third-party insurance requirements and a sharp increase in fuel prices. Commercial vehicle sales growth remained robust in September-October, despite some deceleration. Railway freight traffic improved markedly in October to touch a five-year high growth. While domestic air passenger traffic sustained robust growth, international passenger traffic contracted. PMI for services registered a sharp uptick in November, driven by new business. The composite PMI output index touched a two-year high of 54.5 in November. 15. Retail inflation, measured by y-o-y change in CPI, declined from 3.7 per cent in September to 3.3 per cent in October. A large fall in food prices pushed food group into deflation and more than offset the increase in inflation in items excluding food and fuel. Adjusting for the estimated impact of an increase in house rent allowance (HRA) for central government employees, headline inflation was 3.1 per cent in October. 16. Within the food and beverages group, deflation in vegetables, pulses and sugar deepened in October. Among other items, there was a broad-based softening across food items, especially cereals, milk, fruits and prepared meals. Milk and milk products inflation softened caused by surplus supplies in the domestic market. Fruits inflation moderated, while prepared meals registered a price decline for the first time in the CPI series. Inflation, however, showed an uptick in meat and fish, and non-alcoholic beverages. 17. Inflation in the fuel and light group remained elevated, driven by liquefied petroleum gas prices in October, tracking international petroleum product prices. Kerosene prices also edged up, reflecting the calibrated increase in their administered price. However, electricity prices softened in October. Inflation in rural fuel items such as firewood and chips and dung cake also moderated. 18. CPI inflation excluding food and fuel accelerated to 6.1 per cent in October; adjusted for the estimated HRA impact, it was 5.9 per cent. Transport and communication registered a marked increase, pulled up by higher petroleum product prices, transportation fares and prices of automobiles. A broad-based increase was also observed in health, household goods and services, and personal care and effects. However, inflation moderated significantly in clothing and footwear, as also housing on waning of the HRA impact of central government employees. 19. Inflation expectations of households, measured by the November 2018 round of the Reserve Bank’s survey, softened by 40 basis points for the three-month ahead horizon over the last round reflecting decline in food and petroleum product prices, while they remained unchanged for the twelve-month ahead horizon. Producers’ assessment for input prices inflation eased marginally in Q3 as reported by manufacturing firms polled by the Reserve Bank’s IOS. Domestic farm and industrial input costs remained high. Rural wage growth remained muted in Q2, while staff cost growth in the manufacturing sector remained elevated. 20. The weighted average call rate (WACR) traded below the policy repo rate on 14 out of 21 days in October, on all 18 days in November and both days in December (December 3 and 4). The WACR traded below the repo rate on an average by 5 basis points in October, 9 basis points in November and 16 basis points in December. There was large currency expansion in October and especially during the festive season in November. Currency in circulation, however, contracted in each of the last three weeks in November. Liquidity needs arising from the growth in currency and the Reserve Bank’s forex operations were met through a mixture of tools based on an assessment of the evolving liquidity conditions. The Reserve Bank injected durable liquidity amounting to ₹360 billion in October and ₹500 billion in November through open market purchase operations, bringing total durable liquidity injection to ₹1.36 trillion for 2018-19. Liquidity injected under the LAF, on an average daily net basis, was ₹560 billion in October, ₹806 billion in November and ₹105 billion in December (up to December 4). 21. India’s merchandise exports rebounded in October 2018, after moderating in the previous month, driven mainly by petroleum products, engineering goods, chemicals, electronics, readymade garments, and gems and jewellery. Imports also grew at a faster pace in October relative to the previous month, contributed mainly by petroleum products and electronic goods. Consequently, the trade deficit widened in October 2018 sequentially as also in comparison with the level a year ago. Provisional data suggest a modest improvement in net exports of services in Q2:2018-19, which augurs well for the current account balance. On the financing side, net FDI flows moderated in April-September 2018. Portfolio flows turned positive in November on account of a sharp decline in oil prices, indications of a less hawkish stance by the US Fed and a softer US dollar. However, during the year, there were net portfolio outflows of US$ 14.8 billion (up to November 30). Non-resident deposits increased markedly in H1:2018-19 on a net basis over their level a year ago. India’s foreign exchange reserves were at US$ 393.7 billion on November 30, 2018. Outlook 22. In the fourth bi-monthly resolution of October 2018, CPI inflation was projected at 4.0 per cent in Q2:2018-19, 3.9-4.5 per cent in H2 and 4.8 per cent in Q1:2019-20, with risks somewhat to the upside. Excluding the HRA impact, CPI inflation was projected at 3.7 per cent in Q2:2018-19, 3.8-4.5 per cent in H2 and 4.8 per cent in Q1:2019-20. The actual inflation outcome in Q2 at 3.9 per cent was marginally lower than the projection of 4.0 per cent. However, the October inflation print at 3.3 per cent turned out to be unexpectedly low. 23. There have been several important developments since the October policy which will have a bearing on the inflation outlook. First, despite a significant scaling down of inflation projections in the October policy primarily due to moderation in food inflation, subsequent readings have continued to surprise on the downside with the food group slipping into deflation. At a disaggregated level, deflation in pulses, vegetables and sugar widened, while cereals inflation moderated sequentially. The broad-based weakening of food prices imparts downward bias to the headline inflation trajectory, going forward. Secondly, in contrast to the food group, there has been a broad-based increase in inflation in non-food groups. Thirdly, international crude oil prices have declined sharply since the last policy; the price of Indian crude basket collapsed to below US$ 60 a barrel by end-November after touching US$ 85 a barrel in early October. However, selling prices, as reported by firms polled in the Reserve Bank’s latest IOS, are expected to edge up further in Q4 on the back of increased demand. Fourthly, global financial markets have continued to be volatile with EME currencies showing a somewhat appreciating bias in the last one month. Finally, the effect of the 7th Central Pay Commission’s HRA increase has continued to wane along expected lines. Taking all these factors into consideration and assuming a normal monsoon in 2019, inflation is projected at 2.7-3.2 per cent in H2:2018-19 and 3.8-4.2 per cent in H1:2019-20, with risks tilted to the upside (Chart 1). The projected inflation path remains unchanged after adjusting for the HRA impact of central government employees as this impact dissipates completely from December 2018 onwards. Although recent food inflation prints have surprised on the downside and prices of petroleum products have softened considerably, it is important to monitor their evolution closely and allow heightened short-term uncertainties to be resolved by incoming data. 24. Turning to growth projections, although Q2 growth was lower than that projected in the October policy, GDP growth in H1 has been broadly along the line in the April policy when for the year as a whole GDP growth was projected at 7.4 per cent. Going forward, lower rabi sowing may adversely affect agriculture and hence rural demand. Financial market volatility, slowing global demand and rising trade tensions pose negative risk to exports. However, on the positive side, the decline in crude oil prices is expected to boost India’s growth prospects by improving corporate earnings and raising private consumption through higher disposable incomes. Increased capacity utilisation in the manufacturing sector also portends well for new capacity additions. There has been significant acceleration in investment activity and high frequency indicators suggest that it is likely to be sustained. Credit offtake from the banking sector has continued to strengthen even as global financial conditions have tightened. FDI flows could also increase with the improving prospects of the external sector. The demand outlook as reported by firms polled in the Reserve Bank’s IOS has improved in Q4. Based on an overall assessment, GDP growth for 2018-19 has been projected at 7.4 per cent (7.2-7.3 per cent in H2) as in the October policy, and for H1:2019-20 at 7.5 per cent, with risks somewhat to the downside (Chart 2). 25. Even as inflation projections have been revised downwards significantly and some of the risks pointed out in the last resolution have been mitigated, especially of crude oil prices, several uncertainties still cloud the inflation outlook. First, inflation projections incorporate benign food prices based on the realised outcomes of food inflation in recent months. The prices of several food items are at unusually low levels and there is a risk of sudden reversal, especially of volatile perishable items. Secondly, available data suggest that the effect of revision in minimum support prices (MSPs) announced in July on prices has been subdued so far. However, uncertainty continues about the exact impact of MSP on inflation, going forward. Thirdly, the medium-term outlook for crude oil prices is still uncertain due to global demand conditions, geo-political tensions and decision of OPEC which could impinge on supplies. Fourthly, global financial markets continue to be volatile. Fifthly, though households’ near-term inflation expectations have moderated in the latest round of the Reserve Bank’s survey, one-year ahead expectations remain elevated and unchanged. Sixthly, fiscal slippages, if any, at the centre/state levels, will influence the inflation outlook, heighten market volatility and crowd out private investment. Finally, the staggered impact of HRA revision by State Governments may push up headline inflation. While the MPC will look through the statistical impact of HRA revisions, it will be watchful of any second-round effects on inflation. 26. The MPC noted that the benign outlook for headline inflation is driven mainly by the unexpected softening of food inflation and collapse in oil prices in a relatively short period of time. Excluding food items, inflation has remained sticky and elevated, and the output gap remains virtually closed. The MPC also noted that even as escalating trade tensions, tightening of global financial conditions and slowing down of global demand pose some downside risks to the domestic economy, the decline in oil prices in recent weeks, if sustained, will provide tailwinds. The acceleration in investment activity also bodes well for the medium-term growth potential of the economy. The time is apposite to further strengthen domestic macroeconomic fundamentals. In this context, fiscal discipline is critical to create space for and crowd in private investment activity. 27. Against this backdrop, the MPC decided to keep the policy repo rate on hold and maintain the stance of calibrated tightening. While the decision on keeping the policy rate unchanged was unanimous, Dr. Ravindra H. Dholakia voted to change the stance to neutral. The MPC reiterates its commitment to achieving the medium-term target for headline inflation of 4 per cent on a durable basis. The minutes of the MPC’s meeting will be published by December 19, 2018. 28. The next meeting of the MPC is scheduled from February 5 to 7, 2019. Voting on the Resolution to keep the policy repo rate unchanged at 6.5 per cent

Statement by Dr. Chetan Ghate 29. In the October policy, I had highlighted the primacy of keeping inflationary expectations anchored – whether formed rationally or adaptively – durably at the 4% target. While the one-year ahead median inflationary expectations remained unchanged at 9.8% in the latest round, the three-month median inflationary expectations declined by 40 bps to 9%. The decline in the three-month inflationary expectations number, but unchanged one-year ahead expectations number probably indicates that households don’t expect the current decline in inflation to last. Notwithstanding this, these numbers bring some comfort. 30. In the October policy, I had also mentioned that two interlaced variables pose the potential of un-anchoring inflationary expectations, and thereby making it difficult to ensure price stability on an enduring basis: the nominal depreciation of the Rupee, and the increase in the price of oil. Since October, there was a substantial, though unanticipated, reversal in the price of oil, and by December, it was lower by over 29% compared to its October peak. There was also a strengthening of the Rupee by close to 4.6% (Dec 4 over Oct 5). Food inflation also fell to -0.1% in October. If oil and food prices stay lower for longer, this will help inflationary expectations taper. However, given the buoyancy in oil, and the risks of imported inflation from movements in the exchange rate, both variables need to be carefully watched. 31. The evolution of MSP-inflation dynamics also needs to be carefully watched, although this risk to inflation projections appears mitigated compared to a few months ago. 32. The elevated level of inflation excluding food and fuel (6.1%) at a 3-month high continues to be problematic. Most sub-groups of inflation excluding food and fuel, other than clothing and footwear, have registered upticks. The reversal in inflation excluding food and fuel needs to be carefully watched. 33. Since the last review, overall demand conditions in the manufacturing sector have continued to remain steady. Capacity utilization in Q2 crossed its long-term average (74.9%) and is expected to gather pace going forward. The sustained acceleration in investment activity is encouraging, and this will support rising capex and a higher investment/GDP ratio. There is an improvement in the overall business situation, as tracked by the BEI for manufacturing. Both leading and coincident economic indicators for Q3 growth look good at the current juncture. Organized sector nominal wage growth continues to be high suggesting input cost pressures. 34. Consumer confidence however worsened compared to the previous round suggesting pessimism about the present. Private final consumption expenditure growth momentum also fell in Q2. Merchandise export growth in Q2 however improved relative to Q1, although on the external front, the potential for escalation of tariffs or trade tensions may slow down global growth more than expected. 35. With both the inflation and growth numbers having developed “soft-spots”, the appropriate risk-management approach at the current juncture would be to “wait and watch.” This will allow the MPC to see how various risks to both inflation and growth evolve, and better assess the ability of flexible inflation targeting to absorb the impact of shocks that the economy is currently experiencing. 36. I therefore vote to keep the policy rate unchanged. I vote to keep the stance as calibrated tightening. Statement by Dr. Pami Dua 37. Headline inflation softened to 3.3 per cent in October from 3.7 per cent in September, primarily due to the drop in food inflation from 1 per cent in September to -0.1 per cent in October. Headline inflation adjusted for the estimated impact of an increase in house rent allowance (HRA) of central government employees (as per RBI’s estimates) also moderated from 3.5 per cent in September to 3.1 per cent in October, while CPI excluding food and fuel adjusted for the impact of an increase in HRA increased from 5.3 per cent in September to 5.9 per cent in October. At the same time, various surveys provide mixed signals regarding inflation expectations. Inflation expectations from the November round of the Reserve Bank’s Survey of Households softened by 40 basis points for three-month ahead expectations vis-à-vis the last round but did not change for one-year ahead expectations. The Reserve Bank’s Industrial Outlook Survey indicates moderation in input prices in the third quarter of 2018-19 as reported by manufacturing firms. 38. Looking forward, downside risks to the inflation outlook include continuing moderation in food inflation and a sharp fall in crude oil prices. At the same time, the slowdown in global growth may also lead to softening of crude oil prices. On the flip side, there is also the possibility of a rebound in crude oil prices due to supply factors. Additionally, fiscal slippages by the government may have adverse implications for market volatility and impact the outlook for inflation. Upside risks associated with an increase in minimum support prices (MSPs) still persist. Risks due to an increase in state level HRAs and input prices also prevail. Thus, there is considerable uncertainty with respect to the inflation outlook and movements in both food inflation and crude oil prices have to be watched closely. 39. On the output side, GDP growth in the second quarter of 2018-19 slowed to 7.1 per cent from 8.2 per cent in the previous quarter. Private consumption growth moderated possibly due to easing in rural demand that may have resulted from depressed farm prices and sluggish rural wage growth although investment growth was strong partly due to government spending in infrastructure projects. At the same time, the Purchasing Managers’ Index (PMI) for manufacturing rose to an eleven-month high in November reflecting an expansion in output, and orders (domestic and exports). PMI for services also rose due to new businesses. Forward looking indicators such as RBI’s Business Expectations Index for the manufacturing sector signal an improvement in the fourth quarter based on upbeat sentiments on production, order books, exports and capacity utilisation. Meanwhile, growth in the Indian Leading Index, a predictor of the direction of Indian economic growth maintained by the Economic Cycle Research Institute (ECRI), New York, has risen lately, indicating some improvement in economic growth prospects. 40. Downside risks to growth include lower sowing in the rabi season, financial volatility, global slowdown and trade war, while the drop in crude oil prices and rise in credit offtake augur well for growth prospects. As of now, net exports are a drag with growth in imports sharper relative to exports growth. However, growth in ECRI’s Indian Leading Export Index, a predictor of the direction of exports growth, has ticked up lately, indicating a slightly brighter Indian export growth outlook, despite languishing growth in ECRI’s 20-country composite Long Leading Index, which still points to a continued global growth slowdown. 41. In sum, while inflation has softened, upside risks to inflation remain. It is therefore best to pause and wait for incoming data while maintaining a vigil on inflation, especially with respect to food and crude oil. I therefore vote for keeping the policy repo rate unchanged. At the same time, given the uncertainty with respect to the inflation outlook, I also vote for maintaining the stance of calibrated tightening. Statement by Dr. Ravindra H. Dholakia 42. Drastic and sudden changes in external economic environment have taken place after the last meeting of MPC in October 2018. Should these changes evoke a response through an appropriate policy action? - yes, if they are not purely temporary and have reasonably long term impact on the economy. RBI’s own downward revision of the forecast of inflation 12 months ahead to a substantial extent in response to those developments, is a clear indication of their long-term impact on the economy. Thus, a policy response is called for. If there is no policy action in response to such a major favourable shock, MPC would run the risk of being considered neither current nor relevant! With inflation forecast coming down by around 120 basis points and quarterly growth forecasts marginally revised downward opening up output gap going forward, there is hardly any justification in retaining calibrated tightening stance. In my opinion, this would be the right time to cut the rate and bring the unduly high real interest rates in the country back to around 2 per cent. It was, however, unfortunate that in October 2018, MPC had changed its stance to calibrated tightening with 5:1 majority despite my unsuccessful persuasion to maintain neutral stance. As a result, any rate cut is off the table for now and any such action would not be advisable at this point. The best we can do under the circumstance is to hold the rate, but change the stance to neutral to take care of all possible uncertainties. We should not deny any possibility of either a rate cut or a rate hike in the near future depending on data coming in. 43. More specific reasons for my vote on the rate and the stance are:

44. Under such circumstances, retaining the stance of calibrated tightening seems totally inconsistent and unjustified. All these points require a change in the stance from calibrated tightening to neutral to take care of several uncertainties on both sides so that a rate decision can be appropriately data driven in future. Statement by Dr. Michael Debabrata Patra 45. I vote for status quo on the policy repo rate and for maintaining the stance of calibrated tightening. 46. In its October 2018 meeting, the MPC anticipated the softening of headline inflation in the months ahead, revising its forecast down by 90 basis points in Q3: 2018-19 and by 30 basis points in Q4, and this sentiment was also reflected in individual minutes. The actual outturns for September and October undershot even the revised projections substantially, with prices of food unexpectedly sinking into deflation. In my view, the Indian economy is experiencing the onset of positive supply shocks as reflected in the sizable easing of prices of food and petroleum products, which could reverse. Accordingly, they should be looked through, while remaining alert to spillovers to the rest of inflation which is already elevated and rising. Households have ignored this unusual softening of inflation prints and have kept their 12-months ahead expectations unchanged, while professional forecasters have projected inflation to rise to 4.5-4.6 per cent in the first half of 2019-20. Consumers remain pessimistic about the price situation, citing it as the main factor influencing their perceptions of worsening general economic conditions. Corporates assess that input cost pressures will remain firm. Based on current reckoning, the MPC projects inflation to rise above the target in the first half of 2019-20. Taking these factors into account, I reiterate that although softer inflation prints could likely lull inflation expectations, abundant precaution and decisiveness in quelling risks to the target are warranted if the hard-earned gains in terms of macroeconomic stability and credibility are to be preserved. 47. Turning to growth, the CSO’s GDP estimates for Q2:2018-19 show a sequential moderation, but this needs to be caveated by the base effect driven bump in the previous quarter; on a year-on-year basis, though, there has been a marked acceleration in aggregate demand in the first half of 2018-19 and two main engines – investment and exports – are firing. Lead/coincident indicators for Q3 – order books; capacity utilisation in manufacturing; non-food credit growth; capital goods imports; railway and port freight traffic; construction activity – all point to the momentum of growth being sustained. Annual real GDP growth will likely accelerate in 2018-19 from its level a year ago. On the production side, the momentum of activity would be underpinned by buoyancy in manufacturing and some improvement in services sector performance. 48. With average inflation gradually converging to target, these growth impulses can be maintained by ensuring that the expansion remains sustainable. It is in this context that my preference is for keeping the policy rate unchanged. With inflation projected to rise above 4 per cent over the 12-month ahead horizon, it is apposite to persevere with the stance of calibrated tightening to head off inflation pressures from potentially corroding the foundations of the growth path that is evolving over the medium-term. Statement by Dr. Viral V. Acharya 49. Since the October 2018 Monetary Policy Committee (MPC) meeting, there have been two downward surprises to realised inflation. 50. First, food inflation has had an unexpectedly large collapse, again in vegetables and fruits, but somewhat more broad-based than the inflation decline in preceding months; the collapse has been sharper in rural inflation than in urban inflation. 51. Secondly, international crude oil prices that had been simmering to levels above $85 per barrel also crashed dramatically – by close to 30%. It appears that the “stock out” supply risk that was priced at the short end of the oil futures curve has subsided as the curve has flattened now compared to its sharp backwardation shape in early October. The oil price crash, in turn, has improved external sector prospects for India and caused the currency to strengthen appreciably, reducing the magnitude of imported inflation. 52. Together, these factors have resulted in an extraordinary downward revision in the Reserve Bank’s 12-month ahead inflation outlook. However, the past two months have also been extraordinarily volatile, making it difficult to make a complete sense of recent data. Let me elaborate. 53. First, it is not easy to ascertain fully at this stage the nature of the collapse of food inflation seen in recent months, particularly in terms of its implications for the food inflation outlook over the medium term. A clearer assessment is particularly clouded by divergence in the direction of price movements in data in key food items provided by the Department of Consumer Affairs (DCA) and realised food inflation for October. Such divergence in the direction is rarely observed. Further examination of data is necessary to understand with greater clarity the drivers of food deflation. 54. Secondly, market indicators of uncertainty in international crude oil prices remain high, reflecting the unexpectedly large gyrations in their movement this year and upcoming geo-political risks such as OPEC supply decision and trade war uncertainty’s impact on global demand. The implied volatility in crude oil options markets was around 25% per annum (p.a.) in October, which rose to around 45% p.a following the oil price crash. This is a rather high level of uncertainty embedded in expectations of market participants. 55. Thirdly, inflation excluding food and fuel remains persistently high. It is over 6% at present, with only 20-30 basis points attributable to the statistical impact of Centre’s House Rent Allowances (HRA). 56. Fourthly, the Reserve Bank’s Industrial Outlook Survey suggests that input cost pressures are still high for firms and expected to remain elevated (consistent with both closing of the output gap and improvement in capacity utilisation beyond the long period average). This is expected to result in cost pass-through to consumers in the coming months. 57. Fifthly, median household inflation expectations have softened at 3-month horizon by 40 basis points but remain unchanged for 12-month horizon. Over a 12-month period during which the Reserve Bank has raised the policy rate by 50 basis points (bps), median household expectations of inflation for 3-month horizon have risen by 150 bps and for 12-month horizon by 120 bps. 58. Finally, the risk of a fiscal slippage at the center and/or state levels appears to be considered within the realm of reasonable possibility. As such, the sharp decline in oil prices has provided an opportunity for fiscal consolidation. 59. In summary, even though the projections have been revised downwards significantly, several upside risks remain. In my view, it is better to understand data somewhat better over the next two months. Counter-factual exercises suggest that with headline inflation at 12-month horizon above the target (at 4.2% in Q2 of 2019-20), a change in the stance at this stage, especially with heightened oil price volatility, would be premature. In other words, while the recent downward surprises to inflation have significantly reduced the extent of policy tightening required in future, they have not eliminated the requirement altogether. 60. Turning to growth, the outlook remains overall healthy, though there are some signs of emerging downside risks. On the positive front, investment has picked up and should be buoyed further by improving capacity utilisation. Composite PMI stands at its highest level in 24 months. Coincident and leading indicators, such as aggregate bank credit, are increasing above the nominal GDP growth rate. Oil price and external sector pressures have reduced which should ease financing conditions. On the negative front, there are some segments experiencing slowdown such as auto sales, but at least a part of this appears, in our research, to be linked to fuel price rise of past six months and regulatory revisions in mandatory third-party insurance requirements. The Q2 print for GDP growth was below the Reserve Bank’s expectation but the Q1 print was far above. Overall, due to change in macroeconomic conditions, the two-sided growth surprises have not led to revision in our growth forecast for next 12 months. 61. On balance, given the relatively short period of time over which inflation has softened, it is important to wait and watch, i.e., remain data-dependent as well as reliant on clear understanding of the drivers of recent data. I, therefore, vote for keeping the policy repo rate on hold and maintaining the stance of monetary policy as calibrated tightening. Statement by Dr. Urjit R. Patel 62. Headline inflation moderated significantly to 3.3 per cent in October from 3.7 per cent in August. Headline inflation adjusted for the estimated impact of HRA for central government employees also softened to 3.1 per cent in October from 3.4 per cent in August 2018. Food inflation continued to surprise on the downside; widening of deflation in pulses, vegetables, and sugar, along with broad-based moderation in other food items moved the food group into deflation. Inflation in fuel remained elevated, reflecting a rise in international prices of liquefied petroleum gas and calibrated increase in domestic administered prices of kerosene. Inflation in items other than food and fuel rose sharply (to more than 6 per cent) on account of transport and communication, health, household goods and services and personal care and effects. On the whole, actual CPI inflation prints, especially in October, turned out to be markedly lower than the projections set out in the October policy. 63. Going forward, inflation is projected at 2.7-3.2 per cent in H2:2018-19 and 3.8-4.2 per cent in H1:2019-20, with risks tilted to the upside. Adjusted for the HRA impact also, the above projections remain unchanged as the impact will fade away completely in December. Though inflation projections have been revised downwards, several uncertainties continue to cloud the outlook in the form of : (i) the risk of a sudden reversal of the unusually low food prices; (ii) continuing uncertainty about the exact impact of MSP on food inflation; (iii) uncertainty of the oil price trajectory; (iv) volatile financial markets; (v) elevated inflation expectations; (vi) the likely staggered impact of HRA revisions by state governments; the direct statistical impact of HRA will be looked through while being mindful of the second-round effects; and (vii) the risk of fiscal slippages at the centre and/or state levels. With the general government (centre plus states) fiscal deficit budgeted at about 6 per cent of GDP in 2018-19, the extant national fiscal stance continues to be more akin to a “shock amplifier” rather than a “shock absorber” for our macroeconomy. 64. Gross domestic product (GDP) growth decelerated to 7.1 per cent in Q2:2018-19, after four consecutive quarters of acceleration, driven mainly by a slowdown in private consumption. A sharper growth of imports relative to exports resulted in net exports pulling down aggregate demand. However, gross fixed capital formation expanded by double-digits for the third consecutive quarter. On the supply side, growth in manufacturing decelerated due to lower profitability of manufacturing firms. Low precipitation level during the north-east monsoon – 49 per cent below the long period average – may have negative impact on activity in the farm sector. However, on the positive side, the decline in crude oil prices could boost India’s growth prospects. Increased capacity utilisation in the manufacturing sector also augurs well for investment activity, especially because bank credit growth has continued to accelerate. Based on an overall assessment, GDP growth for 2018-19 has been projected at 7.4 per cent (7.2-7.3 per cent in H2) as in the October policy, and for H1:2019-20 at 7.5 per cent, with risks somewhat to the downside. All things considered, the time is apposite to further strengthen domestic macroeconomic fundamentals; fiscal discipline is critical to create space for and crowd in private investment activity. 65. Although the inflation trajectory has been revised downwards, several uncertainties persist, especially about the medium-term outlook of food inflation and oil prices. Incoming data should help clear the haziness and enable better assessment of the inflation outlook, especially regarding the permanence of the current softness in inflation prints. Hence, I vote for keeping the policy repo rate unchanged and retaining the stance of monetary policy as “calibrated tightening”. Should upside risks, as outlined above, not materialise on a durable basis in the coming months, there is possibility of space opening up for policy action in due course. Jose J. Kattoor Press Release: 2018-2019/1411 |

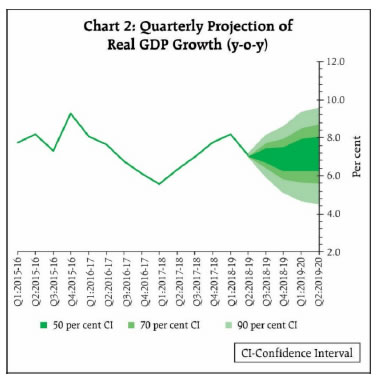

পেজের শেষ আপডেট করা তারিখ: