IST,

IST,

Monetary Policy Statement, 2021-22 Resolution of the Monetary Policy Committee (MPC) October 6-8, 2021

On the basis of an assessment of the current and evolving macroeconomic situation, the Monetary Policy Committee (MPC) at its meeting today (October 8, 2021) decided to:

The reverse repo rate under the LAF remains unchanged at 3.35 per cent and the marginal standing facility (MSF) rate and the Bank Rate at 4.25 per cent.

These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth. The main considerations underlying the decision are set out in the statement below. Assessment Global Economy 2. Since the MPC’s meeting during August 4-6, 2021, the momentum of the global recovery has ebbed across geographies with the rapid spread of the delta variant of COVID-19, including in some countries with relatively high vaccination rates. After sliding to a seven-month low in August, the global purchasing managers’ index (PMI) rose marginally in September. World merchandise trade volumes remained resilient in Q2:2021, but more recently there has been a loss of momentum with the persistence of supply and logistics bottlenecks. 3. Commodity prices remain elevated, and consequently, inflationary pressures have accentuated in most advanced economies (AEs) and emerging market economies (EMEs), prompting monetary tightening by a few central banks in the former group and several in the latter. Change in monetary policy stances, in conjunction with a likely tapering of bond purchases in major advanced economies later this year, is beginning to strain the international financial markets with a sharp rise in bond yields in major AEs and EMEs after remaining range-bound in August. The US dollar has strengthened sharply, while the EME currencies have weakened since early-September with capital outflows in recent weeks. Domestic Economy 4. On the domestic front, real gross domestic product (GDP) expanded by 20.1 per cent year-on-year (y-o-y) during Q1:2021-22 on a large favourable base; however, its momentum was dragged down by the second wave of the pandemic. The level of real GDP in Q1:2021-22 was 9.2 per cent below its pre-pandemic level two years ago. On the demand side, almost all the constituents of GDP posted robust y-o-y growth. On the supply side, real gross value added (GVA) increased by 18.8 per cent y-o-y during Q1:2021-22. 5. The rebound in economic activity gained traction in August-September, facilitated by the ebbing of infections, easing of restrictions and a sharp pick-up in the pace of vaccination. The south-west monsoon, after a lull in August, picked up in September, narrowing the deficit in the cumulative seasonal rainfall to 0.7 per cent below the long period average and kharif sowing exceeded the previous year’s level. Record kharif foodgrains production of 150.5 million tonnes as per the first advance estimates augurs well for the overall agricultural sector. By end-September, reservoir levels at 80 per cent of the full reservoir level were above the decadal average, which is expected to boost rabi production prospects. 6. After a prolonged slowdown, industrial production posted a high y-o-y growth for the fifth consecutive month in July. The manufacturing PMI at 53.7 in September remained in positive territory. Services activity gained ground with support from the pent-up demand for contact-intensive activities. The services PMI continued in expansion zone in September at 55.2, although some sub-components moderated. High-frequency indicators for August-September – railway freight traffic; cement production; electricity demand; port cargo; e-way bills; GST and toll collections – suggest progress in the normalisation of economic activity relative to pre-pandemic levels; however, indicators such as domestic air traffic, two-wheeler sales and steel consumption continue to lag. Non-oil export growth remained strong on buoyant external demand. 7. Headline CPI inflation at 5.3 per cent in August softened for the second consecutive month, declining by one percentage point from the recent peak in May-June 2021. This was primarily driven by an easing in food inflation. Fuel inflation edged up to a new high in August. Core inflation, i.e. inflation excluding food and fuel, remained elevated and sticky at 5.8 per cent in July-August 2021. 8. System liquidity remained in large surplus in August-September, with daily absorptions rising from an average of ₹7.7 lakh crore in July-August to ₹9.0 lakh crore during September and ₹9.5 lakh crore during October (up to October 6) through the fixed rate reverse repo, the 14-day variable rate reverse repo (VRRR) and fine-tuning operations under the liquidity adjustment facility (LAF). Auctions of ₹1.2 lakh crore under the secondary market government securities acquisition programme (G-SAP 2.0) during Q2:2021-22 provided liquidity across the term structure. As on October 1, 2021, reserve money (adjusted for the first-round impact of the change in the cash reserve ratio) expanded by 8.3 per cent (y-o-y); money supply (M3) and bank credit grew by 9.3 per cent and 6.7 per cent, respectively, as on September 24, 2021. India’s foreign exchange reserves increased by US$ 60.5 billion in 2021-22 (up to October 1) to US$ 637.5 billion, partly reflecting the allocation of special drawing rights (SDRs), and were close to 14 months of projected imports for 2021-22. Outlook 9. Going forward, the inflation trajectory is set to edge down during Q3:2021-22, drawing comfort from the recent catch-up in kharif sowing and likely record production. Along with adequate buffer stock of foodgrains, these factors should help to keep cereal prices range bound. Vegetable prices, a major source of inflation volatility, have remained contained in the year so far and are likely to remain soft, assuming no disruption due to unseasonal rains. Supply side interventions by the Government in the case of pulses and edible oils are helping to bridge the demand supply gap; the situation is expected to improve with kharif harvest arrivals. The resurgence of edible oils prices in the recent period, however, is a cause of concern. On the other hand, pressures persist from crude oil prices which remain volatile over uncertainties on the global supply and demand conditions. Domestic pump prices remain at very high levels. Rising metals and energy prices, acute shortage of key industrial components and high logistics costs are adding to input cost pressures. Weak demand conditions, however, are tempering the pass-through to output prices. The CPI headline momentum is moderating with the easing of food prices which, combined with favourable base effects, could bring about a substantial softening in inflation in the near-term. Taking into consideration all these factors, CPI inflation is projected at 5.3 per cent for 2021-22; 5.1 per cent in Q2, 4.5 per cent in Q3; 5.8 per cent in Q4 of 2021-22, with risks broadly balanced. CPI inflation for Q1:2022-23 is projected at 5.2 per cent (Chart 1). 10. Domestic economic activity is gaining traction with the ebbing of the second wave. Going forward, rural demand is likely to maintain its buoyancy, given the above normal kharif sowing while rabi prospects are bright. The substantial acceleration in the pace of vaccination, the sustained lowering of new infections and the coming festival season should support a rebound in the pent-up demand for contact intensive services, strengthen the demand for non-contact intensive services, and bolster urban demand. Monetary and financial conditions remain easy and supportive of growth. Capacity utilisation is improving, while the business outlook and consumer confidence are reviving. The broad-based reforms by the government focusing on infrastructure development, asset monetisation, taxation, telecom sector and banking sector should boost investor confidence, enhance capacity expansion and facilitate crowding in of private investment. The production-linked incentive (PLI) scheme augurs well for domestic manufacturing and exports. Global semiconductor shortages, elevated commodity prices and input costs, and potential global financial market volatility are key downside risks to domestic growth prospects, along with uncertainty around the future COVID-19 trajectory. Taking all these factors into consideration, projection for real GDP growth is retained at 9.5 per cent in 2021-22 consisting of 7.9 per cent in Q2; 6.8 per cent in Q3; and 6.1 per cent in Q4 of 2021-22. Real GDP growth for Q1:2022-23 is projected at 17.2 per cent (Chart 2).  11. Inflation prints in July-August were lower than anticipated. With core inflation persisting at an elevated level, measures to further ameliorate supply side and cost pressures, including through calibrated cuts in indirect taxes on petrol and diesel by both Centre and States, would contribute to a more durable reduction in inflation and anchoring of inflation expectations. The outlook for aggregate demand is progressively improving but the slack is large: output is still below pre-COVID level and the recovery is uneven and critically dependent upon policy support. Compared to pre-pandemic levels, contact intensive services, which contribute around two-fifth of economic activity in India, still lag considerably. Capacity utilisation in the manufacturing sector is below its pre-pandemic levels and an early recovery to its long-run average is critical for a sustained rebound in investment demand. Even as the domestic economy is showing signs of mending, the external environment is turning more uncertain and challenging, with headwinds from slowing growth in some major Asian and advanced economies, steep jump in natural gas prices in the recent weeks and concerns emanating from normalisation of monetary policy in some major advanced economies. Against this backdrop, the ongoing domestic recovery needs to be nurtured assiduously through all policy channels. The MPC will remain watchful given the uncertainties surrounding the outlook for growth and inflation. Accordingly, keeping in mind the evolving situation, the MPC decided to keep the policy repo rate unchanged at 4 per cent and continue with an accommodative stance as long as necessary to revive and sustain growth on a durable basis and continue to mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward. 12. All members of the MPC – Dr. Shashanka Bhide, Dr. Ashima Goyal, Prof. Jayanth R. Varma, Dr. Mridul K. Saggar, Dr. Michael Debabrata Patra and Shri Shaktikanta Das – unanimously voted to keep the policy repo rate unchanged at 4.0 per cent. 13. All members, namely, Dr. Shashanka Bhide, Dr. Ashima Goyal, Dr. Mridul K. Saggar, Dr. Michael Debabrata Patra and Shri Shaktikanta Das, except Prof. Jayanth R. Varma, voted to continue with the accommodative stance as long as necessary to revive and sustain growth on a durable basis and continue to mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward. Prof. Jayanth R. Varma expressed reservations on this part of the resolution. 14. The minutes of the MPC’s meeting will be published on October 22, 2021. 15. The next meeting of the MPC is scheduled during December 6 to 8, 2021. (Yogesh Dayal) Press Release: 2021-2022/1002 |

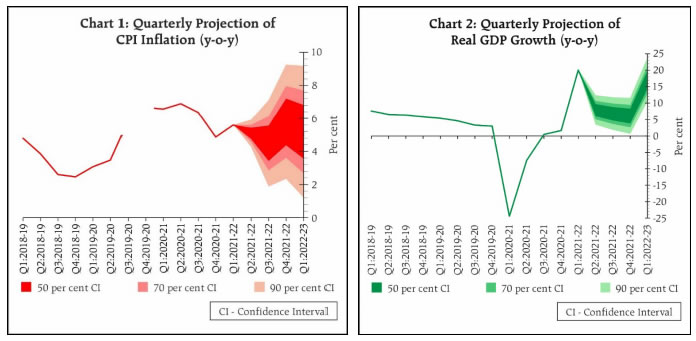

পেজের শেষ আপডেট করা তারিখ: