IST,

IST,

Third Bi-monthly Monetary Policy Statement, 2016-17

By Monetary and Liquidity Measures On the basis of an assessment of the current and evolving macroeconomic situation, it has been decided to:

Consequently, the reverse repo rate under the LAF will remain unchanged at 6.0 per cent, and the marginal standing facility (MSF) rate and the Bank Rate at 7.0 per cent. Assessment 2. Since the second bi-monthly statement of June 2016, several developments have clouded the outlook for the global economy. Across advanced economies (AEs), growth in Q2 of 2016 has been slower than anticipated, and the outlook is still mixed. Headwinds in the United States from declining inventory investment were offset somewhat by strong payroll numbers. In the Euro area, the re-emergence of stress in some parts of the banking sector and the Brexit vote increased uncertainty. In Japan, downside risks have intensified in the form of a stronger yen, deflationary risks and contracting industrial production, triggering monetary and fiscal stimuli. 3. Among emerging market economies, activity remains varied. GDP growth stabilised in China in Q2, on the back of strong stimulus. Manufacturing activity was weak in July due to adverse weather and subdued export demand, although smaller firms recorded an uptick in new orders. Recessionary conditions are gradually diminishing in Brazil and Russia, but the near-term outlook is still fragile due to policy uncertainties and soft commodity prices. 4. World trade remains sluggish in the first half of 2016. International financial markets did not anticipate the Brexit vote and equities plunged worldwide, currency volatility increased and investors herded into safe havens. Since then, however, equity markets have regained lost ground. Currencies, barring the pound sterling, have stabilised, with the yen appreciating the most on risk-on demand as well as the announcement of fresh stimulus. Yields on government bonds have fallen further and the universe of negative yielding assets is expanding at a fast pace, reflecting high risk aversion and expectations of further monetary accommodation by systemic central banks. Crude prices, which had risen to an intra-year high in May on supply disruptions, remain volatile. Other commodity prices, barring those of precious metals, remain soft due to weak demand. 5. On the domestic front, several factors are helping to support the recovery. After a delayed onset, the south west monsoon picked up vigorously from the third week of June. By early August, the cumulative rainfall was 3 per cent higher than the long period average, with more than 80 per cent of the country receiving normal to excess precipitation. Kharif sowing strengthened after a lacklustre start, particularly with respect to pulses. Barring cotton, jute and mesta, sowing of all crops is currently above last year’s acreage. These developments engender greater confidence about the near-term outlook for value added in agriculture. The target for kharif production set by the Ministry of Agriculture appears within reach. 6. Industrial production picked up in May on the back of manufacturing and mining, following a contraction in the preceding month. The uneven performance of industrial output reflects the lumpy and order-driven contraction of insulated rubber cables, a component of capital goods. Excluding this item, industrial production rose at 3.0 per cent in the current financial year. In fact, capital goods production excluding insulated rubber cables expanded by 8.0 per cent. Nonetheless, the prolonged sluggishness in the capital goods sector is indicative of weak investment demand. The rate of contraction in consumer non-durables slowed, pointing to some revival in rural demand. On the other hand, the pace of growth of consumer durables has been stable and buoyed by urban consumption demand, although it eased in May on base effects. Barring the contraction in natural gas and crude oil on account of structural bottlenecks, the core sector has been resilient as of 2016-17 so far, and should support industrial activity going forward. There are some signs of green shoots in manufacturing too, with purchasing managers and the Reserve Bank’s industrial outlook survey indicating a pick-up in new orders, both domestic and external. Business confidence is also looking up in recent months, though the Reserve Bank’s survey for March 2016 suggests that capacity utilisation, seasonally adjusted, is still weak. 7. Service sector purchasing managers polled the thirteenth successive month of expansion in July on the basis of a sharp acceleration in new business. Business expectations remained optimistic on better economic conditions and planned increases in marketing budgets. High frequency indicators of service sector activity are still, however, emitting mixed signals, although a larger number of indicators are in acceleration mode in Q1 of 2016-17 than in the preceding quarter. Automobile sales across most segments, railway, port and international air freight traffic, foreign tourist arrivals, and domestic air passenger traffic are providing the underlying momentum for the upturn. The gradual improvement in the services sector is getting broad-based. 8. Retail inflation measured by the headline consumer price index (CPI) rose to a 22-month high in June, with a sharp pick-up in momentum overwhelming favourable base effects. The rise was mainly driven by food, with vegetable inflation higher than the usual seasonal rise at this time of the year. Sugar prices also firmed up due to a decline in domestic production after two successive years of drought. While pulses inflation started moderating, prices of pulses have been rising again since April after a short-lived correction in the previous quarter. Inflation pressures are also incipient in cereals. These developments fed through into households’ inflation expectations three months ahead, reversing the decline seen in the last two quarters. 9. Fuel inflation remained subdued, mainly due to sustained deflation in prices of liquefied petroleum gas. Excluding food and fuel, inflation eased across major sub-groups. Further excluding petrol and diesel from transport, inflation fell below 5 per cent for the first time since the introduction of the combined CPI. Softer inflation readings were recorded across services constituents in health, education, personal care and effects, and other categories of household consumption. Rural wage growth has been rising albeit moderately, driven up by wages of agricultural labourers. On the other hand, staff costs in the organised sector were relatively restrained. 10. Liquidity conditions eased significantly during June and July on the back of increased spending by the Government which more than offset the reduction in market liquidity because of higher-than-usual currency demand. The injection of durable liquidity through purchases under open market operations (OMOs), amounting to ₹ 805 billion so far, also helped in easing liquidity conditions, bringing the system-level ex ante liquidity deficit to close to neutrality (albeit without seasonal adjustment). Accordingly, the average daily liquidity operation switched from net injection of liquidity of ₹ 370 billion in June to net absorption of ₹ 141 billion in July and ₹ 405 billion in August (up to August 8). The Reserve Bank conducted variable rate repos and reverse repos of varying tenors in order to manage evolving liquidity conditions, with a more active use of reverse repos to manage the surplus liquidity. Reflecting the easy liquidity conditions, the weighted average call rate (WACR) and money market weighted average rate remained on average 15 basis points below the policy repo rate since June. Interest rates on other money market instruments such as certificates of deposit (CDs) and commercial paper (CPs) have also declined in both the primary and secondary markets. 11. In the external sector, merchandise export growth moved into positive territory in June after eighteen months. This upturn was reasonably widespread, covering chemicals, marine products, handicraft, plastic, rice, electronic and engineering goods. On the other hand, imports continued to decline, albeit at a slower pace than in recent months. While lower crude oil prices continued to compress the POL import bill, domestic demand for gold remained muted, with domestic gold prices trading at a discount vis-a-vis international prices. Non-oil non-gold imports continued to shrink, pulled down by coal, fertilisers, ores, iron and steel and machinery and transport equipment. Cumulatively, the trade deficit narrowed in Q1 of 2016-17 on a year-on-year basis. Net receipts on account of services remained flat in April-May 2016, with net outflow under communication services and sluggish software earnings. While the pace of foreign direct investment inflows slowed in the first two months of 2016-17, net portfolio flows were stronger after the Brexit vote, notwithstanding considerable volatility characterising these flows. The level of foreign exchange reserves rose to US$ 365.7 billion by August 5, 2016. Policy Stance and Rationale 12. The recent sharper-than-anticipated increase in food prices has pushed up the projected trajectory of inflation over the rest of the year. Moreover, prices of pulses and cereals are rising and services inflation remains somewhat sticky. There are early indications, however, that prices of vegetables are edging down. Going forward, the strong improvement in sowing on the back of the monsoon’s steady progress, along with supply management measures, augers well for the food inflation outlook. The prospects for inflation excluding food and fuel are more uncertain; if the current softness in crude prices proves to be transient and as the output gap continues to close, inflation excluding food and fuel may likely trend upwards and counterbalance the benefit of the expected easing of food inflation. In addition, the full implementation of the recommendations of the 7th central pay commission (CPC) on allowances will affect the magnitude of the direct effect of house rents on the CPI. On balance, inflation projections as given in the June bi-monthly statement, i.e. of a central trajectory towards 5 per cent by March 2017 with risks tilted to the upside, are retained (Chart 1). 13. Looking ahead, the momentum of growth is expected to be quickened by the normal monsoon raising agricultural growth and rural demand, as well as by the stimulus to consumption spending that can be expected from the disbursement of pay, pension and arrears following the implementation of the 7th CPC’s award. The passage of the Goods and Services Tax (GST) Bill augurs well for the growing political consensus for economic reforms. While timely implementation of GST will be challenging, there is no doubt that it should raise returns to investment across much of the economy, even while strengthening government finances over the medium-term. This should boost business sentiment and eventually investment. The current accommodative stance of monetary policy and comfortable liquidity conditions should also provide a congenial environment for the reinvigoration of aggregate demand conditions. However, successive downgrades of global growth projections by multilateral agencies and the continuing sluggishness in world trade points to further slackening of external demand going forward. Accordingly, the GVA growth projection for 2016-17 is retained at 7.6 per cent, with risks facing the economy at this juncture evenly balanced around it (Chart 2). 14. Risks to the inflation target of 5 per cent for March 2017 continue to be on the upside. Furthermore, while the direct statistical effect of house rent allowances under the 7th CPC’s award may be looked through, its impact on inflation expectations will have to be carefully monitored so as to pre-empt a generalisation of inflation pressures. In terms of immediate outcomes, much will depend on the benign effects of the monsoon on food prices. 15. In view of this configuration of risks, it is appropriate for the Reserve Bank to keep the policy repo rate unchanged at this juncture, while awaiting space for policy action. The stance of monetary policy remains accommodative and will continue to emphasise the adequate provision of liquidity. Easy liquidity conditions are already prompting banks to modestly transmit past policy rate cuts through their MCLRs and pro-active liquidity management should facilitate more pass-through. 16. It may be recalled that the refinements to the liquidity management framework effected in April 2016 were intended to smooth the supply of durable liquidity over the year using asset purchases and sales as needed, and progressively lower the average ex ante liquidity deficit in the system to a position closer to neutrality. The Reserve Bank intends to continue with this strategy, with the intention of closing the underlying liquidity deficit over time so that the system moves to a position of structural balance. As regards the management of the imminent FCNR(B) redemptions, the Reserve Bank has been frontloading liquidity provision through open market operations and spot interventions/deliveries of forward purchases. The Reserve Bank will continue with both domestic liquidity operations and foreign exchange interventions that should also enable management of the FCNR(B) redemptions without market disruptions. With a view to further front-loading the provision of liquidity, it has been decided to conduct an open market purchase auction on August 11, 2016. Details are being announced separately. 17. The fourth bi-monthly monetary policy statement will be announced on October 4, 2016. Alpana Killawala Press Release : 2016-2017/356 |

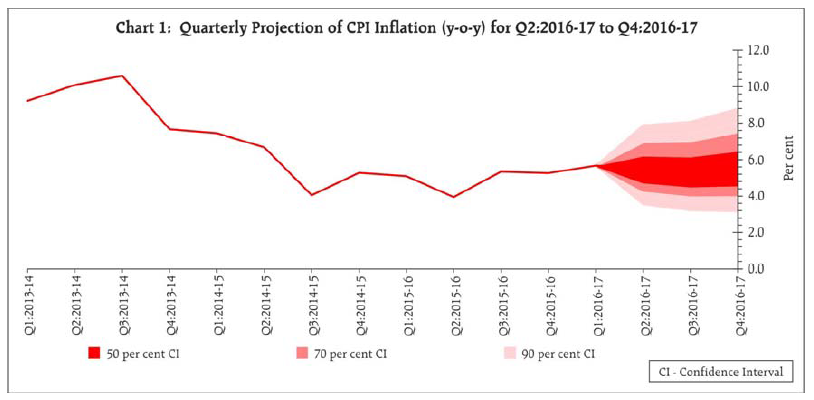

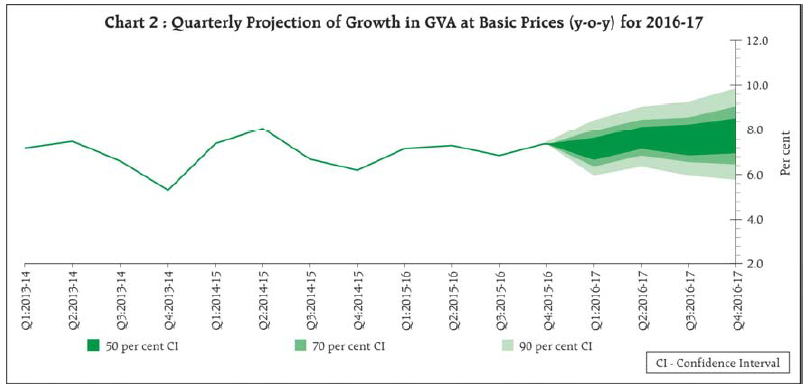

পেজের শেষ আপডেট করা তারিখ: