IST,

IST,

A Handbook on RBI's Weekly Statistical Supplement

Weekly Statistical Supplement (WSS) is a premier publication of the Bank which is published on weekly basis as a supplement of RBI Monthly Bulletin since 1986. It contains high frequency current data and is released on every Friday at 5.00 PM on Reserve Bank website and also at the same time as a time series version on Database on Indian Economy (DBIE). This Handbook explains various data items and linkage among different tables which will be helpful in enhancing the understanding of the data. I trust users will find this Handbook useful. Deepak Mohanty June 16, 2014 1. Reserve Bank of India – Liabilities and Assets Introduction A central bank balance sheet is a reflection of its various functions, particularly its role as a monetary authority and as banker to the Government and banks. The structure of assets and liabilities of the Reserve Bank are, more or less, in line with the balance sheet followed by most central banks. The accounts of the Reserve Bank are, however, bifurcated into the Issue Department, reflecting the currency issue function and the Banking Department, accounting for all other central banking functions (such as banker to the Government and banks) in terms of Section 23(1) of the Reserve Bank of India Act, 1934, following the recommendations of the Hilton Young Commission (1926). However, the table provided in WSS is addition of assets and liabilities of both departments in such a way that it gives the clear picture to the market participants and other stake holders. It is one of the most important tables by which we can understand RBI’s interactions with the financial system on a weekly basis.

Item Descriptions Liabilities of Reserve Bank 1. Notes Issued: The currency notes issued by the Reserve Bank are the Reserve Bank’s liability and this constitutes the liabilities of the Issue Department. Total notes issued are the sum of Notes in circulation and Notes held in Banking Department of the Bank. 1.1 Notes in Circulation: The notes in circulation comprises the notes issued by Government of India up to 1935 and by the RBI since then, less notes held in the Banking Department, i.e. notes held outside Reserve Bank by the public, banks treasuries etc. The Government of India one rupee notes issued since July 1940 are treated as rupee coins and hence are not included under this head. 1.2 Notes held in the Banking Department: Notes held in the Banking Department represents the amount of notes held in the Banking Department of the Bank at different centre’s to meet the day to day requirements of that Department. Notes in circulation and Notes held in the Banking Department both items are liabilities of Issue Department. 2. Deposits: These represent the cash balances maintained with the Reserve Bank by the Central and State Governments, banks, all India financial institutions, such as, Export Import Bank (EXIM Bank) and NABARD, foreign central banks, international financial institutions, and the balance in different accounts relating to the Employees’ Provident Fund, Gratuity and Superannuation Funds. 2.1 Deposits of the Central Government: The Reserve Bank acts as banker to the Central Government in terms of sections 20 and 21 and as banker to the State Governments by mutual agreement in terms of section 21(A) of the RBI Act. Accordingly, the Central and the State Governments maintain deposits with the Reserve Bank. It has been agreed by the Central Government, to maintain a minimum balance of ` 10 crore daily and ` 100 crore as on Fridays. Whenever, the actual cash balance goes down below the minimum level, the replenishment is made by creation of WMA and overdraft. 2.2 Market Stabilisation Scheme: The Market Stabilisation Scheme (MSS) was introduced in April 2004 following the Memorandum of Understanding between the Government and the Reserve Bank, whereby, the Government issues securities specifically for the purpose of sterilisation operations. The issuances of Government paper under the MSS are undertaken to absorb rupee liquidity created by capital flows of an enduring nature. In order to neutralize the monetary and budgetary impact of this particular instrument, the proceeds under the MSS were parked in a separate deposit account maintained by the Government with the Reserve Bank which was used only for the purpose of redemption and/or buyback of paper issued under the MSS. 2.3 Deposits of State Governments: State Governments maintain accounts with the Reserve Bank to carry out business transactions. State Governments need to maintain minimum `40 crore balances on every Friday. The sum of these amounts is reflected as a liability of RBI under this head. Whenever the actual balance goes down below the minimum specified level, replenishment is made by creation of ways and means advances. 2.4 Deposits of Scheduled Commercial Banks: Scheduled Commercial Banks maintain balances with the Reserve Bank to meet the Cash Reserve Ratio (CRR) requirements and as working funds to meet payment and settlement obligations. These accounts are used to operate the remittance facility scheme, grant of financial accommodation, handling of government business, etc. Deposits in this account do not carry any interest. 2.5 Deposit of Scheduled State Co-operative Banks: Scheduled State Co-operative Banksmaintain certain balances with the RBI and sum of these balances is reflected in this head. 2.6 Deposits of Other Banks': Deposits of Other Banksinclude the outstanding balances in the deposit accounts of Regional Rural Banks (RRBs), Other Scheduled Co-operative Bank, Non-Scheduled Commercial Banks, Other Cooperative Banks and Other Banks (including Central Co-operative Banks and primary co-operative banks that have been permitted to open accounts with the Reserve Bank. 2.7 Other Deposits: Other deposits include deposits of foreign central banks, domestic and international financial institutions, deposits placed by mutual funds, accumulated retirement benefits and miscellaneous deposits viz., balances of Clearing Corporation of India Ltd, primary dealers, employee credit societies, etc. and sundry deposits. Deposits of the Reserve Bank of India Employees' Provident, Gratuity, Super-annotation and Guarantee Funds, are also part of other deposits. As per change in accounting practice with effect from July 11, 2014, transaction under Reverse repo is now treated as part of “Other Deposit.” 3. Other Liabilities: Other liabilities of the Reserve Bank’ include internal reserves and provisions of the Reserve Bank such as Currency and Gold Revaluation Account (CGRA), Exchange Equalisation Account (EEA), Contingency Reserve and Asset Development Reserve. Contingency Reserve represents the amount set aside on a year-to-year basis for meeting unexpected and unforeseen contingencies including depreciation in value of securities, exchange guarantees and risks arising out of monetary/exchange rate policy compulsions. These liabilities are also called non-monetary liabilities of the Reserve Bank. Currency and Gold Revaluation Account (CGRA): Currency and Gold Revaluation Account (CGRA) is one of the important accounts wherein unrealised gains/losses on valuation of Foreign Currency Assets (FCA) and gold due to movements in the exchange rates and/or price of gold are not taken to the Profit & Loss Account but instead booked under this head. As CGRA balances mirror the changes in prices of gold and in exchange rate, its balance varies with the size of asset base and volatility in the exchange rate and price of gold. In the recent past, even though FCA and gold have declined as a percentage of total assets, the CGRA has risen due to sharp depreciation of Indian Rupee against US Dollar. Investment Revaluation Account (IRA): The Reserve Bank values foreign dated securities at market prices prevailing on the last business day of each month and the appreciation/ depreciation arising there from is transferred to the IRA. The unrealised gains/losses arising from such periodic revaluation are adjusted against the balance in IRA. Paid-up Capital and Reserve Fund: The Capital of the Bank, of ` 0.05 billion, is held by the Government of India and reserve funds i.e. Credit (Long-term Operations) Fund, National Agricultural Credit (Stabilisation) Fund, National Industrial Credit (Long-term Operations) Fund of the Bank are part of other liability. Assets of Reserve Bank 1. Foreign Currency Assets: India's Foreign Exchange Reserves comprise Foreign Currency Assets, Gold, SDR's and Reserve Bank position with International Monetary Fund (IMF). Foreign currency assets include investments in US Treasury bonds, Bonds/Treasury Bills of other selected Governments, deposits with foreign central banks, foreign commercial banks etc. Foreign currency assets in WSS are sums the foreign currency assets of both Issue and Banking Departments. In Issue Department, these foreign assets back the issuance of notes along with rupee securities and gold. In Banking Department, it includes foreign currency assets and balances with foreign entities like Bank for International Settlements (BIS), foreign commercial banks etc. 2. Gold Coin Bullion: Gold coin bullion represents the gold coin bullion of Issue Department and Banking Department. The gold reserves of Issue Department and Banking Department are valued at value close to international market prices on monthly basis. The current total quantity of gold held is 557.75 tons. 3. Rupee Securities: Rupee securities (including treasury bills) includes the government securities held by Issue and Banking departments. In Issue Department rupee securities along with rupee securities include government securities of that 'foreign country maturing within ten years of Issue Department plus investment in government securities of Banking Department. 4. Loans and Advances: The Reserve Bank gives loans and advances to the Central & State Governments, commercial and co-operative banks and others in terms of Section 17 and 18 of the Reserve Bank of India Act, 1934. 4.1 Central Government: Reserve Bank provides loans and advances to the Central Government to meet the temporary gap between receipts and payments. These advances are termed as ways and means advances which are fixed from time to time in consultation with the Government. 4.2 State Governments: Loans and advances to the State Governments comprise ways and means advances granted under Section 17(5) of the Reserve Bank of India Act, 1934. The minimum balances to be maintained by the State Governments with the Bank and this is revised from time to time. 4.3 Loans and Advances to NABARD: The Reserve Bank can extend loans to NABARD under section 17 (4E) of the RBI Act. Currently no loans and advances are given to NABARD. 4.4 Loans and Advances to SCBs, State Co-operative Banks: Loans and advances to Scheduled Commercial Banks, State Co-operative Banks made by the Reserve Bank under Sections 17 & 18 of the Reserve Bank of India Act, 1934. The loans and advances to SCBs represent refinance facility made available to banks mainly on account of increase in export credit refinance. At present, ECR refinance limit is set at 50 per cent of eligible export credit outstanding. ECR is provided at the Repo rate. As per change in accounting practice with effect from July 11, 2014, transaction under Repo/Term Repo/MSF with banks is now treated as loans and advances to Banks. Earlier this amount was treated as investment in Government securities. 4.8 Loans and Advances to Others: Loans and advances to others include loans and advances made to various funds created under Section 46 of the Reserve Bank of India Act, 1934. This mainly includes the loans given under special refinance schemes to EXIM Bank and collateralised loans to primary dealers. 5. Bill Purchases and Discounted 5.1 Commercial: The Reserve Bank of India (RBI) Act permits holding internal bills of exchange and commercial papers eligible for purchase under various sub sections of Sections 17 and 18 as a cover for notes issued, they are not held in the books of the Reserve Bank, at present. 5.2 Treasury bills purchased and discounted of Government represent the Government of India Treasury Bills rediscounted by the Bank which is kept in the Banking Department. 6. Investment: This item mainly represents investment of RBI in Non-Government securities. The major items under this head are investment in DICGC share capital, Bharatiya Reserve Bank Note Mudran share capital, NABARD share capital, National Housing Bank share capital etc. 7. Others Assets: Other assets includes RBI’s fixed assets like various Premises, furniture, fittings, etc. at different centres, income accrued but not received, Rupee Coins which are claims on the Issue Department, small coin which are claims on the Government, Balances under various heads of expenditure such as charges account, agencies charges account etc. Introduction Forex Exchange Reserves (FER) comprises Foreign Currency Assets (FCA), Gold, Special Drawing Rights and Reserve Tranche Position. Reports on management of FER are published by RBI on half-yearly basis for bringing about more transparency and enhancing the level of disclosure. Table provides the picture of foreign exchange reserve on every Friday along with variations over week, end-March and year in the reserves.

Item descriptions 1.1 Foreign Currency Assets: Foreign Currency Assets (FCA) are maintained in major currencies like US dollar, Euro, Pound Sterling, Japanese Yen, etc. However, the Foreign Exchange Reserves are denominated and expressed in US dollar only. The movements in the FCA occur mainly on account of purchase and sale of foreign exchange by the RBI in the foreign exchange market in India, income arising out of the deployment of the foreign exchange reserves, external aid receipts of the Central Government and revaluation of the assets. The Foreign Currency Assets are invested in multi-currency, multi-asset portfolios. 1.2 Gold Reserves: Reserve Bank holds 557.8 tonnes of gold, which is revalued at the end of the month at 90% of the daily average price quoted by London Bullion market Association. 1.3 Special Drawing Right: Special Drawing Right (SDR) is an international reserve asset created by IMF and allocated to its members in proportion of the members’ quota at IMF. SDRs are held by Government of India/RBI and are shown as part of the Foreign Exchange Reserves. 1.4 Reserve Tranche Position: According to the IMF, Reserve Tranche equals the Fund’s holdings of a member’s currency (excluding holdings which reflect the member’s use of Fund credit) that are less than the member’s quota. The reserve tranche is reckoned as part of the member’s external reserves. 3. Cash Balances of Scheduled Commercial Banks Introduction This table gives average daily cash reserve required for the fortnight ending and actual daily cash balances with the Reserve Bank for the whole fortnight. Table contains the information on daily Cash Balances of Scheduled Commercial Banks (excluding Regional Rural Banks) with the Reserve Bank. The information is published in WSS with a lag of one week; however daily Press release on Money Market Operations publishes the same on next working day. Item Descriptions Average daily cash reserve requirement (CRR) for the fortnight ending contains ‘Average daily cash balances’ required to be maintained (CRR) for the fortnight ending with date and amount in ` Billion’. With a view to monitoring compliance of maintenance of statutory reserve requirement viz. CRR and SLR by the SCBs, the Reserve Bank of India has prescribed statutory return i.e. Form A Return (for CRR) under Section 42 (2) of the RBI Act, 1934. Actual Cash Balance with the RBI is sum of the current account balances maintained by scheduled commercial banks. Calculations CRR for the current fortnight= a fixed percentage (%) of the total demand and time liabilities reported by the banks in terms of Section 42 (1) of the Reserve Bank of India Act, 1934 with a lag of 1 fortnight i.e. CRR for the fortnight ended April 4, 2014 is a fixed percentage (%) of the total demand and time liabilities reported by the banks as on the reporting fortnight March 7, 2014. The Fixed percentage is based on the policy announcement or otherwise.

4. Scheduled Commercial Banks - Business in India Introduction In order to enable the Reserve Bank of India to monitor and ensure compliance of the statutory provisions regarding maintenance of minimum cash reserves(CRR) and Statutory Liquidity Ratio (SLR), every scheduled bank is required to furnish in the prescribed form called Form A return along with Annexure A and B to the Reserve Bank of India on a fortnightly basis on reporting Fridays and Last Fridays of the month statement showing its liabilities and assets in India as at the close of business on Friday in terms of Section 42(2) of the Reserve Bank of India Act, 1934. This return provides up-to-date information on deposits, advances and investments etc of banks.

Table presents balance sheet view of scheduled commercial banks business (including RRBs) on an aggregate basis. Assets and liabilities will not match as some items like capital; reserves etc. of banks have not been included. The variations of demand/time deposits, food/non-food credit, investment in Government securities are the major indicators for the banking System. Item Descriptions 1. Liabilities to the banking system: Liabilities to the banking system indicate total liabilities of all scheduled commercial banks to the banking system which means the amount banks owe to each other. Banks invest in demand and time deposits of other banks, certificates of deposit (CDs), borrow from other banks in call/money/notice market, market repo etc. These liabilities are divided under three heads viz., demand and time deposits, borrowings and other demand and time liabilities. Net liability of a scheduled bank towards the Banking System is treated as a liability for the purpose of maintenance of cash reserve. 1.1 Demand and Time Deposits from Banks: Demand and Time Deposits from Banks includes inter-bank deposits in current, savings and fixed deposits accounts. Deposits of co-operative banks with the scheduled co-operative banks are not included in this item. 1.2 Borrowing from banks: Borrowing from banks represents the inter-bank borrowings and includes inter-bank deposits at call or short notice not exceeding 14 days. 1.3 Other Demand and Time Liabilities: Other Demand and Time Liabilities represent the amount due to the banking system which is not in the nature of deposits or borrowings. Whenever it has not been possible to segregate the liabilities to the banking system from the total of 'Other demand and time liabilities' the entire 'Other demand and time liabilities' are treated as liability to 'Others'. 2. Liabilities to Others: Liabilities to Others are the most important and largest part of banks’ liabilities. It includes customer deposits, borrowings by the banks and other time and demand liabilities. 2.1 Aggregate Deposits: Aggregate Deposits is the total of demand and time deposits maintained in the bank. 2.1.1 Demand deposits: Demand deposits are liabilities which are payable on demand. They include current deposits, demand liabilities portion of savings bank deposits, margins held against letters of credit/ guarantees, balances in overdue fixed deposits, cash credit etc. 2.1.2 Time deposits: Time deposits are those which are payable otherwise than on demand and they include fixed deposits, cash certificates, cumulative and recurring deposits, time liabilities portion of savings bank deposits etc. 2.2 Borrowings: Borrowings represent the total borrowings from outside the banking system apart from domestic borrowings. It also includes loans/borrowings from abroad by banks in India. Borrowings from the Reserve Bank of India are excluded from this item. 2.3 Other Demand and Time Liabilities: Other Demand and Time Liabilities (ODTL) include interest accrued on deposits, bills payable, unpaid dividends, suspense account balances representing amounts due to other banks or public, net credit balances in branch adjustment account, any amounts due to the banking system which are not in the nature of deposits or borrowing. Such liabilities may arise due to items like (i) collection of bills on behalf of other banks, (ii) interest due to other banks and so on. If a bank cannot segregate the liabilities to the banking system, from the total of ODTL, the entire ODTL may be shown against this item. 3. Borrowing from Reserve Bank: Borrowing from Reserve Bankrepresents the total borrowings from the Reserve Bank of India. Borrowing under Repo account and other refinance facilities are included under this head. 4. Cash in Hand and Balances with Reserve Bank: Cash in hand and Balanceswith Reserve Bank represents the total of cash in hand with banks and their balances with the Reserve Bank of India. 4.1 Cash in hand: Cash in handrepresents notes and coins held by the banks as till money. Currencies of foreign countries are not included. 4.2 Balances with Reserve Bank: Balances with Reserve Bankrepresents the total of the actual outstanding balances maintained by the scheduled banks in their current accounts with the Reserve Bank of India and includes the minimum balances to be maintained with the Bank in terms of Section 42(1). The balances, if any, maintained by the banks incorporated outside India with the Reserve Bank of India in terms of Section 11(2) of the Banking Regulation Act, 1949 are also included in this item. 5. Assets with the Banking System of a bank include balances and advances of the bank with the banking system. It is the sum of 5.1, 5.2, 5.3 and 5.4. 5.1 Balances with Other Banks: Balances with Other Banks in current account represent the demand deposits held with other banks. Balances with other banks in other accounts are the amount held with other banks, in accounts other than the 'current account'. 5.2 Money at Call and Short Notice: Money at Call and Short Noticerepresents the amount made available to the 'banking system' by way of loans or deposits repayable at call or short notice of a fortnight or less. 5.3 Advances to Banks: Advances to Banksrepresent the loans other than money at call and short notice (5.2) made available to the banking system. Advances granted by scheduled state co-operative banks to co-operative banks are excluded from this item. 5.4 Other Assets: Other Assetsrepresent any amount due from the banking system which cannot be classified under the above sub-category. Amount, if any, held with other banks under the inter-bank remittance facilities scheme is included in this item. 6. Investments: Investments indicate the outstanding position of the total investment in Government and other approved securities by the banks. 6.1 Investments in Government Securities: Investments in Government Securities includes investments in the securities of the Central and State Governments including treasury bills, postal obligations such as national savings certificates etc. Government Securities deposited by foreign scheduled banks under Section 11(2) of the Banking Regulation Act, 1949 are also included here. 6.2 Other Approved Securities: Other Approved Securities include the investment in the securities of State associated bodies such as Electricity Board, Housing Board, and Corporation Bonds, debentures of Land Development Bank, shares of Regional Rural Banks etc. which are treated as approved securities under Section 5(a) of the Banking Regulation Act, 1949. 7. Bank Credit is arrived at by summing up food credits (7.1) and non-food credits (7.2) which are defined below. 7. a1 Food Credit relates to the advances made by the scheduled commercial banks to Food Corporation of India, State Governments and State Co-operative agencies for food procurement operations. 7. a2 Non-food Credit comprises: Loans are a one of the most important and largest advance made against with or without securities; a loan may be in the form of demand loan. Cash-credits are an arrangement by which a banker allows his customer to borrow money up to a certain limit. Cash credit arrangements are usually made against the security of commodities pledged with bank. Overdrafts represent all types of credit facilities (other than by way of bills purchased and discounted) such as demand loans, term loans, cash-credits, overdrafts, packing credit etc. granted to constituents other than banks. 7b.2 Inland Bills: Inland Bills represent the total bills drawn and payable in India, including the demand drafts and cheques, purchased and discounted by all the scheduled banks. This excludes bills rediscounted with the Reserve Bank of India and other financial institutions. 7b.4 Foreign Bills represent the foreign bills which cover all import and export bills including demand draft drawn in foreign currencies and payable in India, purchased and discounted by all the scheduled banks.

Calculations Column 2: Variations over Fortnight is calculated between current fortnight and the previous fortnight. Column 3: Variations over Previous Financial Year So far is calculated between corresponding fortnight in the last year and the last Reporting fortnight in the month of March of previous to previous financial year. Corresponding fortnight in the last year is the 26th fortnight counting back from the current fortnight (without including the current fortnight in the counting process). Column 4: Variations over Current Financial Year So far is calculated between current fortnight and the last fortnight in the month of March of previous financial year. Column 5: Variations over Year on Year - Previous Year is calculated between corresponding fortnight in the last year and the corresponding fortnight in the previous to previous year. Column 6: Variations over Year on Year is calculated between current fortnight and the corresponding fortnight in the previous year. * Non-reporting Friday data is not being published in WSS.

Definitions Scheduled Commercial Banks: Those banks which carry business of banking in India and which have paid-up capital and reserves of an aggregate, real or exchangeable value of not less than ` 5 lakh, and satisfy the Reserve Bank of India that their affairs are not being conducted in a manner detrimental to the interests of their depositors, are eligible for inclusion in the Second Schedule to the Reserve Bank of India Act, 1934 and when so included are known as 'Scheduled Banks.' All the Regional Rural Banks established under Section 3 of the Regional Rural Banks Act, 1976 are included in the Second Schedule of the Reserve Bank of India Act, 1934. As regards co-operative banks, only State co-operative banks are eligible for inclusion in the Second Schedule to the Act. Introduction This table presents rates and ratio for banking sector, money market, exchange rate movement prevailing during the period i.e. week ended Friday or fortnight.

Item Descriptions Cash Reserve Ratio: According to Section 42 of the Reserve Bank of India Act, 1934, each scheduled commercial bank has to maintain a minimum cash balance with the Reserve Bank as cash reserve ratio (CRR) which is prescribed by the Reserve Bank from time to time as certain percentage of its net demand and time liabilities (NDTL) relating to the second preceding fortnight. As of now, the CRR is 4 per cent of NDTL. Banks have to maintain minimum 95 per cent of the required CRR on a daily basis and 100 per cent on an average basis during the fortnight. Statutory Liquidity Ratio: In terms of Section 24 of the Banking Regulations Act, 1949, scheduled commercial banks have to invest in unencumbered government and approved securities certain minimum amount as statutory liquidity ratio (SLR) on a daily basis. At present, SLR is 23 per cent of the NDTL. In addition to investment in unencumbered government and other approved securities, gold, cash and excess CRR balance are also treated as liquid assets for the purpose of SLR. Cash Deposit ratios: Cash-deposit ratio of scheduled commercial banks is the ratio of cash in hands and balances with the RBI as percentage of aggregate deposits.

Balance with RBI is nothing but CRR balances with RBI. It indicates how much cash banks maintain for each rupee of deposit they accept. The ratio will always be higher than CRR as settlement balance is also included. The use of plastic money, Internet payments, electronic funds transfer, and so on, reduces this ratio near to CRR. Credit-Deposit Ratio: This is an important ratio as it conveys how much of each rupee of deposit is going towards credit markets. A higher growth in credit deposit ratio suggests credit growth is rising quickly which could lead to excessive risks and leveraging on the borrowers side. In case of banks, it could imply there will be a rise in NPAs when economic cycle reverses. This ratio serves as a useful measure to understand the systemic risks in the economy.

Investment-Deposit Ratio is calculated as Investments (Government Securities and Other Approved Securities)/ Aggregate Deposits. This helps one understand how much of the deposit is being invested in government securities. Since, banks need extra government security to meet their day to day liquidity therefore this ratio would be higher than SLR.

Policy Rate: Repo rate is the rate at which banks borrow funds from the Reserve Bank against eligible collaterals and the reverse repo rate is the rate at which banks place their surplus funds with the RBI under the liquidity adjustment facility (LAF) introduced in June 2000. The repo rate has emerged as the key policy rate for signaling the monetary policy stance since June 2000. Marginal Standing Facility Rate: To meet additional liquidity requirements, banks can borrow overnight funds from the Reserve Bank under the Marginal Standing Facility (MSF) at a higher rate of interest, normally 100 basis points above the policy repo rate. Banks can borrow against their excess SLR securities and are also permitted to dip down up to two percentage points below the prescribed SLR to avail funds under the MSF. Bank Rate: Under Section 49 of the Reserve Bank of India Act, 1934, the Bank Rate has been defined as “the standard rate at which the Reserve Bank is prepared to buy or re-discount bills of exchange or other commercial paper eligible for purchase under the Act. On introduction of LAF, discounting/rediscounting of bills of exchange by the Reserve Bank has been discontinued. As a result, the Bank Rate became dormant as an instrument of monetary management. It is now aligned to MSF rate and used for calculating penalty on default in the cash reserve ratio (CRR) and the statutory liquidity ratio (SLR). Base Rate: The Base Rate is the minimum interest rate of a bank below which it cannot lend, except in some cases allowed by the RBI. It was introduced in the Indian banking system effective July 1, 2010 after a directive by the Reserve Bank of India to replace the benchmark prime lending rate (BPLR) system, which was introduced in 2003. The reason for introducing Base Rate was to bring out the transparency in bank lending rates as well as to improve monetary policy transmission. Data relate to five major banks. Term Deposit rate: The Term Deposit Rates refers to the amount of money in interest paid on the maturity date for a specified amount of money placed in a Term Deposit. Term Deposits generally carry a fixed rate of interest. In WSS term deposit rate of five major banks maturity more than one are being presented. Saving deposit rate for five major banks are being presented in the table. Call money rate given in the table is weekly weighted average of call money market during the week. Week stands for Saturday to Friday. Cut-of-Yield of T-Bills is given in the table from primary market auction. 10-Year Government Securities Yield: 10-Year benchmark Government Securities Yield calculated by Fixed Income Money Market and Derivatives Association of India (FIMMDA) is being published in the table. Identification of benchmarks security is being done by FIMMDA. RBI Reference Rate: The Reserve Bank of India compiles on a daily basis and publishes reference rates for four major currencies i.e. USD, GBP, YEN and EUR. The rates are arrived at by averaging the mean of the bid/offer rates polled from a few select banks around 12 noon every week day (excluding Saturdays). The contributing banks are selected on the basis of their standing, market-share in the domestic foreign exchange market and representative character. The Reserve Bank periodically reviews the procedure for selecting the banks and the methodology of polling so as to ensure that the reference rate is a true reflection of the market activity. Forward Premia: An important aspect of functioning of the foreign exchange market relates to the behavior of forward premia in terms of its linkages with economic fundamentals such as interest rates and its ability to predict future spot rates. Forward premia reflects whether a currency is at a premium/discount with respect to other reserve currencies. Forward premia is particularly important for importers and exporters who need to hedge their risks to foreign currency. The forward market in India is active up to one year where two-way quotes are available.

6. Money Stock: Components and Sources Introduction Money supply (M3) in the WSS table 6 is derived on the basis of a balance sheet approach. It follows from the balance sheets of the Reserve Bank of India and the rest of the banking sector which includes commercial and co-operative banks. The components of the money supply are drawn from the liability side of the balance sheet of the banking sector (i.e., Reserve Bank + banks), and the various uses of the funds as obtained from the asset side are mapped to form the sources of M3 (Table 6).

1. Money Stock: Components 1.1 Currency with public: Currency with public comprises of notes in circulation, rupee and small coins (i.e. currency in circulation) less cash with banks. 1.2 Demand deposits with banks: Demand deposits with banks include all liabilities (excluding inter-bank) that are payable on demand. 1.3 Time deposits with banks: Time deposits with banks are those liabilities (excluding inter-bank) which are payable otherwise than on demand. 1.4 Other Deposits with the Reserve Bank: Other Deposits with the Reserve Bank for the purpose of monetary compilation include deposits from foreign central banks, multilateral institutions, financial institutions and sundry deposits net of IMF Account No.1. 2. Money Stock: Sources 2.1 Net Bank credit to government: Net Bank credit to government include the Reserve Bank’s net credit to both the central and state governments and commercial and co-operative banks’ investment in government securities. 2.2 Bank credit to commercial sector: Bank credit to commercial sector includes both the Reserve Bank’s and other banks’ credit to the commercial sector. The latter includes banks’ loans and advances to the commercial sector (including scheduled commercial banks’ food credit) and banks’ investments in “other approved” securities. 2.3 Net foreign exchange assets of the banking sector: Net foreign exchange assets of the banking sector comprise of the RBI’s net foreign exchange assets and other banks foreign assets. The latter comprises of authorised dealers’ balances. 2.4 Government currency liability to the public: Government currency liability to the public comprises of Rupee coin and small coins. 2.5 Net non-monetary liabilities (NNML) of the banking sector include that of both the RBI and the other banks. The NNML of other banks include items such as their capital, reserves, etc. 7. Reserve Money: Component and Sources Introduction Reserve money (M0), also called ‘base money’ or ‘high-powered money’, is the highly liquid component of money stock in the economy and plays a crucial role in the determination of other monetary aggregates. It broadly reflects the total monetary liabilities of the Reserve Bank. Monetary policy actions and market operations of the Reserve Bank that cause changes in the size of its balance sheet, whether on the asset or the liability side, could result in changes in the reserve money. In monetary statistics, changes in individual items on both the “components” and “sources” side could be seen to alter the stock of reserve money (Table 7).

1. Components of Reserve Money 1.1 Currency in Circulation: Currency in Circulation includes notes in circulation, rupee coins and small coins. Rupee coins and small coins in the balance sheet of the Reserve Bank of India include ten-rupee coins issued since October 1969, two rupee-coins issued since November 1982 and five rupee coins issued since November 1985. 1.2 Bankers’ Deposits with the RBI: Bankers’ Deposits with the RBI represent balances maintained by banks in the current account with the Reserve Bank mainly for maintaining Cash Reserve Ratio (CRR) and as working funds for clearing adjustments. 1.3 Other Deposits with the Reserve Bank: Other Deposits with the Reserve Bank for the purpose of monetary compilation includes deposits from foreign central banks, multilateral institutions, financial institutions and sundry deposits net of IMF Account No.1. 2. Sources of Reserve Money 2.1 Net Reserve Bank credit to Government: Net Reserve Bank Credit to Government includes the Reserve Bank’s credit to central as well as state governments. It includes ways and means advances (WMA) and overdrafts (OD) to the governments, the Reserve Bank’s holdings of government securities, and the Reserve Bank’s holdings of rupee coins less deposits of the concerned Government with the Reserve Bank. Since April 2004, centre’s deposits with the Reserve Bank also include amounts mobilised under the market stabilisation scheme (MSS) which are maintained with the Reserve Bank and are not available for the centre’s expenditure. The “net” impact gets reflected on the sources side. 2.2 RBI Credit to the Commercial Sector: RBI Credit to the Commercial Sector represents investments in bonds/shares of financial institutions, loans to them and holdings of internal bills purchased and discounted. 2.2.1 RBI Credit to Banks: RBI Credit to Banks includes the Reserve Bank’s claims on banks including loans to NABARD. 2.3 Net Foreign Exchange Assets of RBI: Net Foreign Exchange Assets of RBI are its holding of foreign currency assets and gold. The gross foreign assets are adjusted for any foreign liabilities. Since March 20, 2009, Net Foreign Exchange Assets of the RBI include investments in foreign currency denominated bonds issued by IIFC (UK). It is also inclusive of appreciation in the value of gold following its revaluation close to international market price effective October 17, 1990. Such appreciation has a corresponding effect on Reserve Bank’s net non-monetary liabilities. 2.4 Government Currency Liability to the Public comprises of Rupee coin and small coins. 2.5 Net non-monetary liabilities (NNML) of the Reserve Bank: NNML are liabilities which do not have any monetary impact. These comprise items such as the Reserve Bank’s paid-up capital and reserves, contribution to National Funds (NIC-LTO Fund and NHC-LTO Fund), RBI employees’ PF and superannuation funds, bills payable, compulsory deposits with the RBI, RBI’s profit held temporarily under other deposits, amount held in state Governments Loan Accounts under other deposits, IMF quota subscription and other payments and other liabilities of RBI less net other assets of the RBI. 8. Liquidity Operations by RBI Introduction Liquidity management refers to appropriate level of liquidity and overall monetary conditions. For a central bank, the concept of liquidity management typically refers to the framework and set of instruments that the central bank follows in steering the amount of bank reserves in order to anchor the money market interest rates around the policy rate. The importance of central bank liquidity management lies in its ability to exercise considerable influence and control over short-term interest rates and thereby affecting the entire interest rate term structure, which is important to monetary policy transmission. Central bank liquidity management has short-term effects on financial markets. However, the medium-term implications for the real sector and the inflation situation are particularly important.

The table contains information on daily injection/ absorption of liquidity by the RBI in the market through LAF (Repo, Term-Repo, Reverse Repo and MSF), and Standing Liquidity Facilities & Open market operations (OMO). OMO (overnight) excludes RBI’s agency operation. As per the standard practice only one week (daily) data needs to be published in this table. Liquidity Adjustment Facility: As part of the financial sector reforms in 1998 the Committee on Banking Sector Reforms (Narasimham Committee II), Liquidity Adjustment Facility (LAF) was introduced under which the Reserve Bank would conduct auctions periodically, if not necessarily daily. The Reserve Bank could reset its Repo and Reverse Repo rates which would in a sense provide a reasonable corridor for the call money market. At present, daily LAF operations are being conducted on overnight basis, in addition to term repo auctions. Repurchase Agreement (Repo): Repo is a money market instrument combining elements of two different types of transactions viz., lending-borrowing and sale-purchase. The Repo transaction has two legs, which can be explained as follows – in the first leg: Seller sells securities and receives cash while the purchaser buys securities and parts with cash. In the second leg: Securities are repurchased by the original holder. He pays to the counter party the amount originally received by him plus the return on the money for the number of days for which the money was used by him which is mutually agreed. Under Repo, the Reserve Bank of India injects funds to organisations (SCBs and Primary Dealers) which have both current account and SGL account with the Reserve Bank of India. Reverse Repo: This is exactly the opposite of the Repo transaction and is used for absorption of liquidity. The Reverse Repo Rate at present is at 100 basis points below the repo rate. Reverse Repo facility is available to Primary Dealers also. Marginal Standing Facility: The Reserve Bank, in 2011, introduced Marginal Standing Facility (MSF) for banks and primary dealers to reduce the volatility in the inter-bank call money market. The interest rate was fixed at 100 bps above the repo rate, which is the rate at which banks borrow from the RBI for the short term against the collateral of government securities. The rate may vary relative to the repo rate as warranted by economic conditions. Standing Liquidity Facilities: The Reserve Bank provides Standing Liquidity Facilities to the Scheduled commercial banks (excluding RRBs) under the Export Credit Refinance Facility (ECR) and to the stand-alone Primary Dealers. On the basis of banks’ eligible outstanding rupee export credit (pre-shipment and post-shipment), the Reserve Bank provides ECR facility to banks. All SCBs (excluding RRBs) who have extended export credit are eligible to avail the facility. Banks submit the ECR return to the Reserve Bank on fortnightly basis. The export credit refinance limit is computed for each bank, based on their outstanding export credit eligible for refinance as at the end of the second preceding fortnight. At present, ECR refinance limit is set at 50 per cent of eligible export credit outstanding. ECR is provided at the Repo rate. The ECR is repayable on demand or on the expiry of fixed periods not exceeding one hundred and eighty days. Term repos: Term repo is a new window for providing liquidity to the banking system. Through Term repo auctions of 7-day and 14-day tenors for a combined notified amount equivalent to 0.75 (at present) per cent of net demand and time liabilities (NDTL) of the banking system are conducted by the Reserve Bank through variable rate auctions on every Friday, since the beginning of October 11, 2013. Additional term repos of tenors ranging from 5-day to 28-day have also been auctioned on the basis of periodic assessment of liquidity conditions. The notified amount and tenor of the term repo auctions is being announced prior to the dates of the auctions. Introduction The movement of wholesale price index (WPI) and consumer price index (CPI) are important determinants for formulation of monetary and other economic policies. Besides WPI and CPI, price trend based on consumer price index for industrial workers (CPI-IW) is also presented in the table.

WPI data is regularly compiled and published every month by the Office of the Economic Adviser to the Government of India, Ministry of Commerce and Industry. All India CPI, including that for rural and urban, is compiled and published every month by Central Statistics Office (CSO), Ministry of Statistic and Programme Implementation (MoSPI), Government of India. Monthly CPI-IW data is compiled and published by the Labour Bureau, Government of India. WPI data corresponding to the latest two months are provisional. All India CPI data corresponding to the latest month is provisional. CPI-IW data is always final. The table contains index values of the latest two months of the current financial year followed by index values of the corresponding months of the last year. Frequency & Release Calendar:

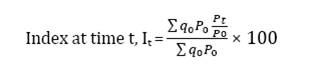

The index numbers are compiled on the basis of Laspeyres’ formula as weighted average of price relatives. The formula adopted for the purpose is:  Where It is the index for the particular month, qo po is the average expenditure per family on each of the items in the base period and Pt and Po, the current and the base prices for the specific goods and services included in the index scheme. Introduction Certificate of Deposit is a negotiable money market instrument introduced in June 1989, in order to widen the range of money market instruments and provide greater flexibility to investors for deploying their short-term surplus funds with banks and Financial Institutions. They are essentially securitised short term time deposits issued by banks and all-India financial institutions during periods of tight liquidity at relatively higher discount rates as compared to term deposits. At present minimum tenor of CDs should not be less than 7days and not to be exceeding 1 year. Certain portion of amount is being considered as proportion of average fortnightly outstanding aggregate deposits. Table below contains the information on outstanding amount of Certificates of Deposit, amount issued during the fortnights as well as the range of Rate of Interest.

Notes: 1. 1st column is for date (as per the standard practice latest two available fortnight data used to be publish in WSS) Definitions Scheduled commercial banks (excluding RRBs and Local Area Banks) and select All India Financial Institutions can issue CDs within the umbrella limit fixed by RBI i.e. issue of CD together with other instruments viz. term money, term deposits, commercial papers and inter-corporate deposits should not exceed 100 per cent of its net owned funds as per latest audited balance sheet. Denomination should be minimum ` 1 lakh and multiple of ` 1 lakh. Individuals, corporations, companies, trusts, funds, associations, etc can invest in CDs. NRIs can also subscribe on non-repatriation basis. CD is issued for minimum 7 days to one year. Financial Institutions can issue for a period not less than 1 year and not exceeding 3 years. CDs are issued only in dematerialised form and CRR and SLR are applicable on the amount of CDs outstanding. CDs are issued on discount basis and redeemed at face value. Introduction Commercial Paper (CP) is an unsecured money market instruments issued in the form of a promissory note. CP was introduced in India in January, 1990 with a view to enabling highly rates corporate borrowers to diversify their sources of short term borrowings and to provide an additional instrument to investors. Corporate, primary dealers and All India Financial Institutions are permitted to issue commercial paper to enable them to meet their short-term funding requirements for their operations. CP shall be issued at a discount to face value as may be determined by the user. CP is freely transferable; banks, financial institutions, insurance companies and others are able to invest their short-term surplus funds in a highly liquid instrument at attractive rates of return. The terms and conditions relating to issuing CPs such as eligibility, maturity periods and modes of issue have been gradually relaxed over the years by the Reserve Bank. The minimum tenor has been brought down to seven days (by October 2004) in stages and the minimum size of individual issue as well as individual investment has also been reduced to ` 5 lakh with a view to aligning it with other money market instruments.

Above table contains the information on face value of outstanding amount of Commercial Paper, face value of the amount Issued during the fortnight as well as the range of Rate of Interest. Rate of Interest is the typical effective discount rate range per annum on issues during the fortnight. Commercial paper is issued for 7 days to one year maturity in denomination of minimum ` 5 lakh and multiplies of ` 5 lakh at a discount and redeemed at face value. Individuals, Banking Companies, Other corporate bodies registered or incorporated in India, Unincorporated bodies, Non-Resident Indians and FIIs can invest in commercial paper. Mode of issue is either in the form of a promissory note or in demat form. 12. Average Daily Turnover in Select Money Markets Introduction The money market is a key component of the financial system. It is a market for short-term funds with maturity ranging from overnight to one year. The basic function of money market is to provide efficient liquidity position for commercial banks, financial institution, Mutual funds, insurance companies, corporate etc. The objective of monetary management by the Reserve Bank is to align money market rates with the key policy rate. Volatile money market creates confusion among the participants which is critical for monetary and financial stability. Thus, efficient functioning of the money market is important for the effectiveness of monetary policy. Statistically, short term interest rate is expected long-term interest rate and since, central banks have only limited control over long-term interest rates, thus Reserve Bank controls interest rates through money market inter-linkages. Call Money: In the call/notice money market, overnight money and money at short notice (up to a period of 14 days) are lent and borrowed without collateral. This market enables banks to bridge their short-term liquidity mismatches arising out of their day-to-day operations. In order to meet reserve requirements (CRR), banks borrow primarily from the inter-bank (call money) market. Hence, these transactions are reflective of the overall liquidity in the system. Notice Money: Notice money refers to those money where lender has to give certain number of days Notice which has been agreed on at the time of contract to borrower to repay the funds. In Indian call/notice money market, the tenors for Notice money range from overnight to maximum of fourteen days.

Term Money: The term money market is another segment of the uncollateralised money market. The maturity period in this segment ranges from 15 days to one year. For maintaining interbank liabilities, cash credit, volatility in the call money rates, inadequate asset liability management (ALM) among banks are main factors for development of the term money market. Collateralised Borrowing and Lending Obligation (CBLO): CBLO is a money market instrument which was introduced in 2003. This market was developed for the benefit of the entities who have either been phased out from inter-bank call money market or have been restricted to access to the call money market. CBLO is a discounted instrument available through the Clearing Corporation of India Limited (CCIL) from maturity period one day to upto one year. The collateralised market is now the predominant segment of the money market. This also provided an alternative avenue for banks to park their surplus funds beyond one day. Banks, Financial Institutions, Insurance companies, mutual funds, primary dealers, NBFCs corporate etc. are the participants of CBLO market. The members are required to open an account for depositing securities which are offered as collateral/margin for borrowing and lending. Eligible securities are central government securities including treasury bills. Market Repo: Repurchase agreements (repos) are recognized as a very useful money market instrument enabling smooth adjustment of short-term liquidity among varied categories of market participants such as banks, financial institutions, securities and investment firms. Compared with call/notice/term money transaction, which is non-collateralized, repo is fully collateralized by securities. Market repo has several advantages over other collateralized instruments also. One, while obtaining titles to securities in other collateralized lending instruments is a time-consuming and uncertain process, repo entails instantaneous legal transfer of ownership of the eligible securities. Two, it helps to promote greater integration between the money and the government securities markets, thereby creating a more continuous yield curve. We can say repo as a very powerful and flexible money market instrument for modulating market liquidity. Since it is a market-based instrument, it serves the purpose of an indirect instrument of monetary policy at the short-end of the yield curve. Since forward trading in securities was generally prohibited in India, repos were permitted under regulated conditions in terms of participants and instruments. Reforms in this market have encompassed both institutions and instruments. Both banks and non-banks were allowed in the market. All government securities and PSU bonds were eligible for repos till April 1988. Between April 1988 and mid- June 1992, only inter-bank repos were allowed in all government securities. Double ready forward transactions were part of the repos market throughout this period. Subsequent to the irregularities in securities transactions that surfaced in April 1992, repos were banned in all securities, except Treasury Bills, while double ready forward transactions were prohibited altogether. Repos were permitted only among banks and PDs. Repo in Corporate bonds: Money Market Mutual Funds (MMMF) were introduced in India in April 1991 to provide an additional short-term avenue to investors and to bring money market instruments within the reach of individuals. A detailed scheme of MMMFs was announced by the Reserve Bank in April 1992. The portfolio of MMMFs consists of short-term money market instruments. Investments in such funds provide an opportunity to investors to obtain a yield close to short-term money market rates coupled with adequate liquidity. The Reserve Bank has made several modifications in the scheme to make it more flexible and attractive to banks and financial institutions. In October 1997, MMMFs were permitted to invest in rated corporate bonds and debentures with a residual maturity of up to one year, within the ceiling existing for CPs. The minimum lock-in period was also reduced gradually to 15 days, making the scheme more attractive to investors. Data Sources/ Update Schedule/ Update Methods Table contains the information on average daily turnover in Call, Notice/ Term, CBLO, Market Repo & Corporate Bond market. Data is automated from CCIL system to Data Warehouse. Calculations

13. Govt. of India: Treasury Bills Outstanding Introduction Treasury Bills are the money market instruments issued by Government of India and play a vital role in its cash management. Currently 91-day, 182-day and 364-day treasury bills are issued on a regular basis. 91-day T-bills issues on weekly basis and 182-day and 364-day treasury bills issued on every alternate week. Characteristics like high liquidity and no risk have made Treasury Bills attractive instrument for short-term investment by banks, primary dealers, other financial institutions and corporates. The Treasury Bills are issued at discount wherein non-competitive biddings are also considered. Table contains the information on Government of India Treasury Bills outstanding as on close of the business on Friday. The information is published in WSS with a lag of one week. Table structure contains the entire treasury bills outstanding amount held under major categories (banks, primary dealers and state Governments). While 91-day, 182-day, 364-day and CMBs are issued through auction process by RBI, 14-day T-bills are the intermediate Treasury bills, used primarily for parking temporarily cash surplus of the States.

Cash Management Bills CMB is a new short-term instrument issued by Central Government to meet the temporary cash flow mismatches of the Government. CMBs are non-standard, discounted instruments issued for maturities less than 91 days. CMBs have the generic character of Treasury Bills. CMB is the most flexible instrument for a government, because it can be issued when needed. The tenure, notified amount and date of issue of the proposed Cash Management Bills depend upon the temporary cash requirement of the Government. The Bills are issued at discount to the face value through auctions, as in the case of the Treasury Bills. The announcement of the auction of the Bills is be made by the Reserve Bank of India through separate Press Release issued one day prior to the date of auction. The Non-Competitive Bidding Scheme for Treasury Bills is not extended to CMBs. Data Sources/ Update Schedule/ Update Methods All the primary data series are automated to Data Warehouse electronically with E-Kuber system (CBS of the Bank). The Information received from the CBS is classified under different heads. They have been clubbed together to arrive at the major holders for publication in the WSS. Primary Dealers (PDs) include banks undertaking PD business. Other publication reports are now made available in real-time basis to public at Database on Indian Economy. 14. Market Borrowings by the Government of India and State Governments Introduction The Reserve Bank of India generates and compiles the data on government securities. The data on market borrowings of Centre Government and State Governments are released to the public through press releases on RBI Website, following a transparent policy on data dissemination. The auction results in detail are also disseminated on the day of the auction itself through press release on RBI website. All the primary auction related reports are now being updated on real-time basis. Gross borrowings and net market borrowings: Net market borrowings refer to the amount of dated securities mobilized by Government of India and State Governments during a particular financial year. The amount to be raised is announced by the Centre in their budget every year. However, the borrowing amount may undergo change during the financial year. Gross market borrowing refer to net market borrowings plus the repayment amount (securities maturing) during the year. The table having 6 columns contains Government of India and State Governments’ Gross and Net Amount raised during the current year so far, vis-a-vis corresponding period of the previous year. The gross and net amounts raised during the previous year are also shown under column number 3 & 6 respectively.

------Reserve Bank of India. 2007 “Manual on Financial and Banking Statistics” ------Reserve Bank of India Monthly Bulletins various issues. ------Report of Currency and Finance various Issues. -----Handbook of Market Practices, FIMMDA. -----Reserve Bank of India (1958): Functions and Working -----Money Supply: Analytics and Methodology of compilation-Y V Reddy Committee ----International Monetary Fund (2008): Monetary and Financial Statistics – Compilation Guide ---RBI (1999), Repurchase Agreements (Repos): Report of the Sub-group of the Technical advisory ----Committee on Government Securities Market, April, 1999, Mumbai: Reserve Bank of India. ----RBI (2003), Report of the Internal Group on Liquidity Adjustment Facility, December 2003. -----RBI (2003), Report of the Working Group on Instruments of Sterilization, Mumbai. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

পেজের শেষ আপডেট করা তারিখ: