IST,

IST,

Annual Report on Banking Ombudsman Scheme, 2012-13

Vision and Goals of the Banking Ombudsman Offices Vision • To be a visible and credible system of dispute resolution mechanism for common persons utilizing banking services. Goals • To ensure redressal of grievances of users of banking services in an inexpensive, expeditious and fair manner that will provide impetus to improved customer services in the banking sector on a continuous basis. • To provide feedback/suggestions to Reserve Bank of India towards framing appropriate and timely guidelines to banks to improve the level of customer service and to strengthen their internal grievance redressal systems • To enhance the awareness of the Banking Ombudsman Scheme. • To facilitate quick and fair (non-discriminatory) redressal of grievances through use of IT systems, comprehensive and easily accessible database and enhanced capabilities of staff through training. 1. Customer Service Initiatives by the Reserve Bank of India 1.1 As competition has failed to deliver desired result to safeguard the interests of bank customers, the RBI has to intervene to ensure that the interests of bank customers are protected. Over the years, RBI has initiated several such measures. Some of the important customer service initiatives taken by RBI during the year 2012-13 are enumerated below. 1.2 Implementation of recommendations of the Damodaran Committee: Committee on customer service in banks (Damodaran Committee) had made 232 recommendations in its report. Of these, 155 recommendations stand implemented. Abolition of foreclosure charges on floating rate home loans, introduction of basic savings account, unique identification No. (UID) as KYC for opening ' no frills ' account, differential merchant discount/ fee for debit cards, multi-factor authentication for card transactions, blocking of card by SMS, uniformity in inter-sol charges are some of the important recommendations which have been implemented. Some of the recommendations which are yet to be implemented are minimum account balance - transparency, uniformity in charges for non-maintenance of minimum balance, charges for basic services, penalty for returned clearing cheques - presenting party (Payee) should be exempt from penalties, customers should be compensated for wrong returns by banks, home loans - no discrimination between existing and new borrowers with floating rates, internet banking - secure total protection policy, zero-liability against loss for any customer induced transaction, onus of proving customer negligence on bank, multi-lateral arrangements amongst banks to deal with on-line banking frauds, compensation. The issues involved in implementation of these are being deliberated upon with the stakeholders. 1.3 Inter-sol Charges As announced in the Monetary Policy Statement 2013-14, RBI advised banks to follow a uniform, fair and transparent pricing policy and not discriminate between their customers at home branch and non-home branches. Accordingly, banks have been advised that, if a particular service is provided free at home branch the same should be available free at non home branches also. There should be no discrimination as regards inter-sol charges between similar transactions done by customers at home branch and those done at non-home branches. 1.4 Levy of penal charges by banks for delay in re-presentation of cheques returned on technical grounds In view of complaints regarding cheque return charges levied by banks in cases where customers were not at fault and also of delaying the re-presentation of the cheques, which had been returned by the paying banks under technical reasons, banks were advised that the cheque return charges shall be levied only in cases where the customer is at fault and is responsible for such returns. The illustrative, but not exhaustive, list of returns, where the customers are not considered to be at fault has also been circulated to banks. Further, banks have also been advised that the cheques that need to be re-presented without any recourse to the payee, shall be made in the immediate next presentation clearing not later than 24 hours(excluding holidays) with due notification to the customers of such re-presentation through SMS alert, email etc. 1.5 Payment of pension to the Central Government pensioners - Continuation of either or survivor pension account after death of a pensioner With a view to reduce the delays in getting family pension after demise of the pensioner, banks were advised that in case the spouse (Family pensioner) opts for existing joint account for credit of family pension, banks should not insist on opening of a new account, when the spouse is the survivor and having a joint account with the pensioner and in whose favour an authorization for payment of family pension exists in the Pension Payment Order (PPO). 1.6 Loss of Pension Payment order in transit: Against the backdrop of a large number of complaints from pensioners regarding inordinate delay in payment of pension on account of loss of PPOs during transit from one bank-branch to another or from branch to CPPC and non-receipt of PPOs from the issuing authorities etc., RBI advised agency banks to issue instructions to their regional offices/branches authorised to disburse pension to strictly adhere to the procedure laid down in the pension schemes to be followed by pension disbursing bank-branches in the eventuality of loss of PPO in transit and non-receipt of PPO from the issuing authorities etc., to ensure that pensioners get their pension without any delay. 1.7 Bank Customers can ask for CCTV Recording of ATM Transactions National Payments Corporation of India (NPCI) has directed banks to facilitate providing CCTV recording of failed ATM transactions to bank customers when they ask for it. In its circular NPCI/2012-13/NFS/2737 dated March 26, 2013, NPCI advised its member banks to make a provision in the "Customer Complaint Form" for the complainant to raise a request for the CCTV/camera images if the customer so desires at the time of submitting the complaint form to the issuing bank. The issuing bank shall upload the request for CCTV image while raising the charge-back in the DMS module (Dispute Management System of NPCI). NPCI has clarified that only the request for CCTV / Images can be uploaded through DMS but the recording itself has to be exchanged among the banks in accordance with the existing practice. 1.8 Security in Card Payments The Reserve Bank has been seeking to enhance the safety and security of card payment transactions – both Card Present (CP) and Card Not Present (CNP) transactions. Besides mandating introduction of SMS alerts, use of additional factors of authentication in case of CNP transactions have also been mandated. In addition, the Reserve Bank has also issued necessary instructions for securing CP transactions based on the recommendations of a Working Group which submitted its report in May 2011. The Working Group inter-alia suggested evaluation of the usefulness of Aadhaar as additional factor of authentication (AFA) for card present transactions. Accordingly, based on the results of the Pilot conducted at New Delhi in December 2012-January 2013, a Working Group has been formed to study the feasibility of Aadhaar as an AFA for CP transactions and other related issues. The Reserve Bank has advised banks and other stakeholders to put in place certain security measures in a time bound manner to strengthen the security aspects of the eco-system. Some of these measures relate to introduction of AFA for online payments and implementation of digital signatures for customer-based large value payments in RTGS, securing PoS terminals to prevent data compromise as well as putting in place techniques for fraud prevention; placing restrictions on addition of beneficiaries in internet banking accounts and number of online transfers; issuance of international card only on demand by customers and limiting the usage threshold on magstripe cards for international transactions; issuance of EMV card to people who use cards internationally etc. 1.9 Master circulars: The Master Circular on Customer Service which incorporates RBI instructions/ guidelines issued to banks on various customer service related issues such as operations of deposit accounts, levy of service charges, disclosure of information, remittances, collection of instruments, dishonor of cheques, safe deposit lockers, nomination facility, dealing with complaints etc., was updated and placed on the website of RBI on July 1, 2013.

2. The Banking Ombudsman Scheme 2006 2.1 As an effective step towards ensuring best services by banks in India to their customers, The Banking Ombudsman Scheme (BOS) was introduced in the year 1995 by the RBI. The purpose behind introducing the BOS was to provide expeditious and inexpensive redress of customers’ grievances against deficiencies in banking services provided by Commercial Banks, Scheduled Primary Co-operative Banks and Regional Rural Banks. Due to changing levels of expectations of the customers of various banks and the range of new products offered by these banks, the BOS has undergone extensive changes in June 2002 (BOS 2002) and December 2005 (BOS 2006). BOS 2002 introduced “Review Authority” and “Arbitration and Conciliation Procedure” in the Scheme. While augmenting the scope of the Scheme, BOS 2006 removed the above two major provisions of BOS 2002. The BOS 2006 brought in the concept of “Appellate Authority” and made the administration of the Scheme, the responsibility of RBI. In May 2007, the BOS 2006 was amended further to enable appeal against Award or rejection of a complaint for reasons stipulated under the BOS, to the Appellate Authority. The BOS 2006 was amended last in February 2009 to include deficiencies arising out of internet banking. Under this amended BOS, a customer can complain to the Banking Ombudsman (BO) against the deficiencies in almost any banking service including credit cards, ATM and internet banking. In addition, a customer would also be able to lodge a complaint against the bank for its non-adherence to the provisions of the Fair Practices Code for lenders or the Code of Bank’s commitment to Customers issued by the Banking Codes and Standards Board of India (BCSBI). 2.2 Working group for revision and updation of the Banking Ombudsman Scheme 2006: Introduction of various new banking products coupled with advent of technology in banking warranted a fresh look at the BOS 2006. Further, the Committee on Customer Service in Banks (Damodaran Committee) and the Rajya Sabha Committee on Subordinate Legislation in their report on the BOS had made certain recommendations. In view of this, an internal Working group for revision and updation of the BOS 2006 was constituted by the RBI in July 2012. The Working Group submitted its report in January 2013. Some of the important recommendations of the Working Group pertain to extending the BOS to non-scheduled urban cooperative banks/district and state co-operative banks, modifying the definition of 'bank' in the BOS, pecuniary jurisdiction of BO, opening of new offices of Banking Ombudsman (OBOs), introduction of fresh grounds of complaint, appointment of additional Ombudsman in offices with high volume of complaints, and increasing public awareness about the BOS. The recommendations of the Working Group are being examined by the Customer Service Department of RBI for implementation. 3.1 Fifteen OBOs covering 29 States and 7 Union Territories, handle the complaints received from bank customers on deficiency in banking services under the various grounds of complaints specified in the BOS. During the year 2012-13, OBOs received 70541 complaints. Comparative position of complaints received during the last three years in given in Table 1.

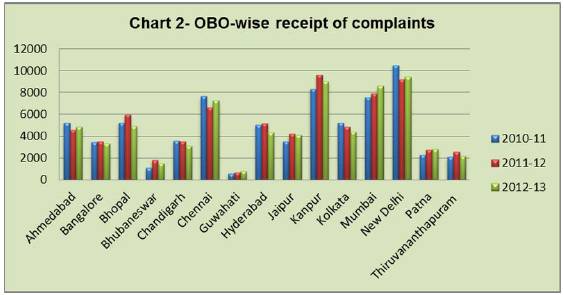

During the year 2011-12 there was an increase of 2% in the number of complaints received over the previous year, whereas in 2012-13 there was a decline of 3% in receipt of complaints compared to previous year. OBO-wise receipt of complaints 3.2 OBO-wise position of complaints received during the last three years is given the Table 2.

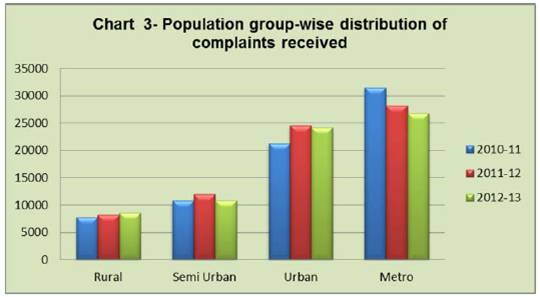

OBO New Delhi, Kanpur, Mumbai & Chennai were the four OBOs which received more than five thousand complaints against banks. These four OBOs accounted for almost 50% of the complaints received by all OBOs. OBO Ahmadabad, Chennai, Guwahati, Mumbai, New Delhi and Patna recorded increase in complaints received whereas OBO Bangalore, Bhopal, Bhubaneswar, Chandigarh, Hyderabad, Jaipur, Kanpur, Kolkata and Thiruvananthapuram recorded a decline in receipt of complaints over the previous year On an average, each OBO received 4702 complaints during the year. Population group-wise distribution of complaints received 3.3 Comparative position of last three years’ Population group-wise distribution of complaints is given in Table 3. It may be observed from the above table that there has been only marginal change in the population-group wise source of complaints received in the OBOs. The source of complaints remained heavily skewed towards customers from Metro / Urban areas. Complaints from urban and metro areas continued to account for about 72% of the total complaints received as compared to about 28% complaints received from rural and semi-urban areas during the year 2012-13. Some of the reasons that can be attributed to the greater share of complaints from urban and metro areas are, increased availability of banking services, financial literacy and expectation level of bank customers and greater awareness about the BOS among residents of such areas as compared to their counterparts in semi-urban and rural areas. With increasing penetration of banking services into rural hinterlands and ongoing drives aimed at universal financial inclusion and financial literacy, this mix is expected to undergo significant change in coming years. Marginal increase of 1% in complaints received from rural areas this year is indicative of this trend. Receipt of complaints Mode-wise 3.4 OBOs receive complaints through diverse modes such as online, e-mails, Fax, couriers, registered / ordinary posts, hand delivery. Comparative position of complaints received through different modes during the last three years is indicated in Table 4.

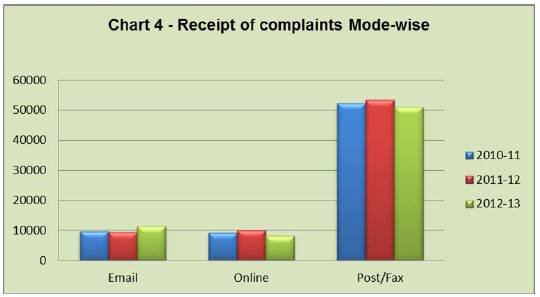

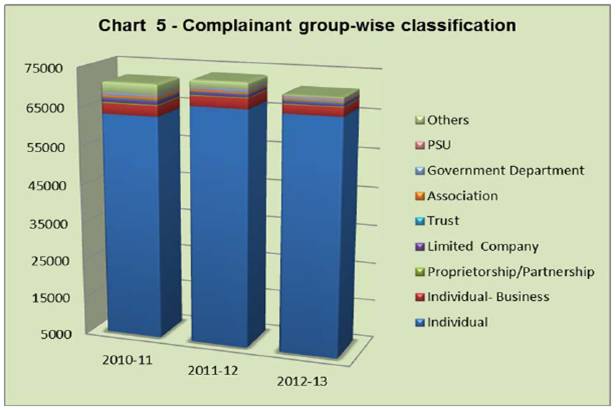

Post/Fax/Courier continued to remain a popular mode of lodging complaints with OBOs with 72% of total complaints received through this mode. Electronic mode was preferred by 28% of the complainants. As compared to last year, there was a marginal increase of 1% in complaints received through electronic mode. Complainant group-wise classification 3.5 Continuing with the past trend, majority of the complaints received during the year were from individuals. Break-up of complaints received from various segments of society is given in Table 5.

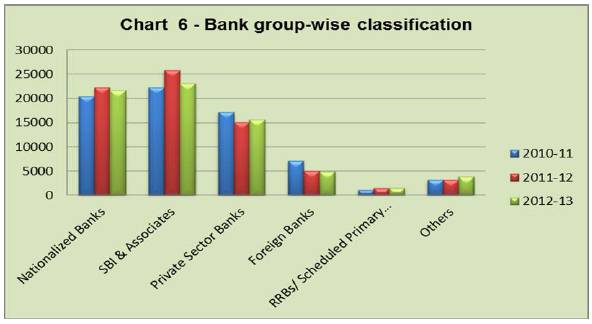

Bank group-wise classification Bank-group-wise classification of complaints received by OBOs is indicated in the Table - 6 and graphical presentation thereof is shown in Chart -6.

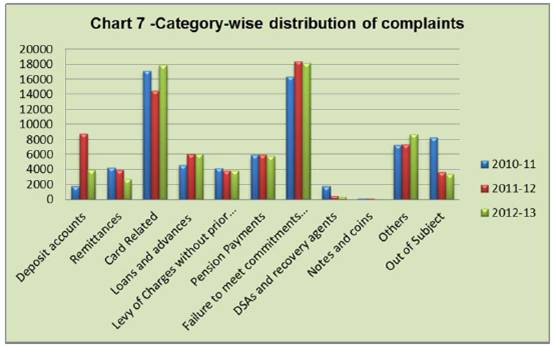

It may be seen that the highest number of complaints (33%) were received against SBI group followed by other nationalised banks (31%), Private Sector banks (22%) and foreign banks (7%). Compared to last years, there was a fall of 2% in complaints against SBI & Associates, whereas, complaints against Private Sector banks increased by 1%. The detailed bank-wise (Scheduled Commercial banks) and complaint category-wise break-up of complaints received in the year 2012 - 13 is given in Annex V. 4. Nature of Complaints Handled 4.1 There are 27 grounds of complaints against deficiency in banking services specified under Clause 8 of BOS 2006 for which complaints can be lodged with the OBO. Complaints received under these grounds are broadly categorized into major heads indicated in the Table 7 below.

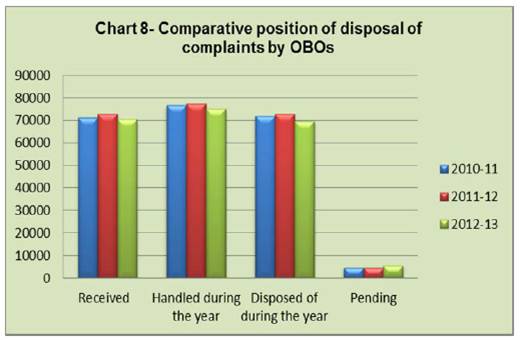

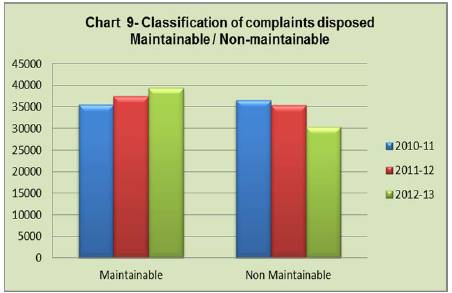

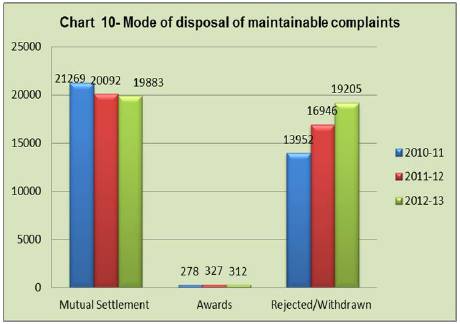

4.1 Complaints pertaining to failure to meet commitments / non observance of fair practices code / BCSBI Codes were a major ground of complaint with 18130 complaints constituting 26% of the complaints received. There was a decline of 1% in complaints received on this ground over the previous year. A large volume of complaints on this ground indicates lack of awareness about these Codes among bank staff as also the customers. Banks need to devote special attention to this aspect and provide ongoing training to their staff on the Codes. 4.2 With 25% of the total complaints received, Card related complaints was the second largest ground of complaint recording increase of 23% over these complaints received during the last year. Out of total 17867 card complaints 10123 complaints were pertaining to ATM/Debit Cards. Broadly, the reasons for these card-related complaints are; issue of unsolicited cards, sale of unsolicited insurance policies and recovery of premium, charging of annual fee in spite of being offered as 'free' card, authorization of loans over phone, wrong billing, settlement offers conveyed telephonically, non-settlement of insurance claims after the demise of the card holder, excessive charges, wrong debits to account, non-dispensation/short dispensation of cash from ATM, skimming of cards. 4.3 Loans and Advances, pension payments, deposit accounts, levy of charges without prior notice were other major source of complaints. In Loans and Advances, complaints were mainly related to non-sanction/delay in sanction of educational loans, charging of excessive rate of interest, non-return of Registration Certificate in case of vehicle loans, non-issuance of No-Due Certificate, non-return of title deeds of properties pledged, wrong reporting to CIBIL, etc. Complaints related to pension though remained static at 8% over last three years, still this is a major area of grievance. These complaints were mainly regarding delayed payments, errors in calculations, difficulties in switching over to family pension. Non-maintenance of minimum Average Quarterly Balance (AQB) in savings and current accounts, renewal charges, processing fees and pre-payment penalties in loan accounts, cheque collection charges were some of the reasons for complaints pertaining to levy of charges without prior notice. 5.1 Table 8 and Chart 8 below indicate a comparative position of disposal of complaints by OBOs. During the year 2012-13, OBOs handled 75183 complaints. This, comprised of 4642 complaints brought forward from the previous year and 70541 fresh complaints received during the year under review. Of these, 69704 complaints (93%) were disposed of during the year 2012-13. BO office wise position of complaints disposed during the year 2012-13 is indicated in Table 9 below: 5.2 Classification of complaints- Maintainable / Non Maintainable The complaints which do not pertain to grounds of complaint specified in the BOS and those complaints where procedure for filing the complaint laid down in the BOS is not followed are classified as non-maintainable. All other complaints are classified as maintainable and dealt with as per the provisions of the BOS 2006. Table 10 indicates classification of complaints disposed by all the OBOs during the last three years. Of the 69704 complaints disposed during the year 2012-13, 56% complaints were maintainable. Over last three years, percentage of maintainable complaints has increased gradually from 49% in 2010-11 to 56% in 2012-13. This indicates increasing awareness about the applicability of the BOS among bank customers. 5.3 Mode of disposal of maintainable complaints Thrust of the BOS is redress of grievance by reconciliation and mediation. Where both the parties do not come to settlement despite BO’s mediation, the BO resorts to passing an Award. Table 11 and Chart 10 below indicate the mode of disposal of Maintainable complaints.

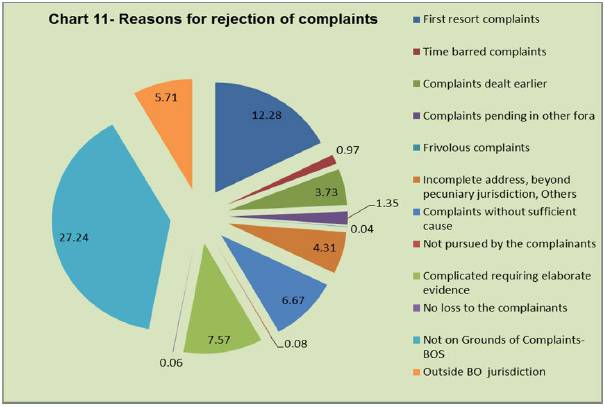

Of the total maintainable complaints, 50% complaints were resolved by mutual settlement. Awards were passed in 1% of the cases, whereas 49% of the complaints were rejected/withdrawn (118). Maintainable complaints are rejected on account of reasons such as out of pecuniary jurisdiction of the BO, requiring consideration of elaborate documentary and oral evidence and the proceedings before the Banking Ombudsman are not appropriate for adjudication of such complaint, without sufficient cause, no loss or damage or inconvenience caused to the complainant. Concerted efforts to increase awareness about these issues are being made by the OBOs to reduce the proportion of complaints getting rejected. 5.4 Awards Issued: During the year BOs issued 312 Awards. OBO-wise position of Awards issued during the year 2012-13 is indicated in Table 12 below: 5.5 Non-Maintainable complaints Non-maintainable complaints include first Resort complaints, subject matter of the complaint outside the scheme, complaints outside the BO jurisdiction, complaints against entities other than banks, time-barred, pending in Courts/other fora, frivolous complaints etc. In all such cases the complainant is advised about the reason for his complaint being not processed under the BOS. During the year 2012-13, 44% of the complaints received were non-maintainable. However, over the last three years, this percentage has come down from 51% to 44%. 5.6 Reasons for rejection of complaints Table 13 below indicates the number of complaints rejected for various reasons.

5.7 Complaints not on grounds of complaints under BOS The grounds on which complaints can be lodged with the BO are specified under Clause 8 of the BOS. Complaints which are not covered under these grounds are rejected. This was the major reason for rejection of complaints during the year 2012-13 constituting 27.24% of the complaints rejected. 5.8 First resort complaints BOS stipulates that before approaching BO, the complainant must approach his bank first for redress of his grievance. If no reply is received from the bank within one month or the complainant is not satisfied with bank's reply, he can approach the OBO. Such complaints received in OBOs are rejected and the complainant is advised accordingly. These complaints are forwarded to the bank concerned for suitable action. During the year 2012-13 12.28% of the complaints received were rejected as FRCs. As recommended by the Committee on Customer Service in banks (Damodaran Committee), the On-line complaint form placed on the RBI website for lodging of complaints with the OBOs was modified to divert the first resort complaint to the respective bank online since July 2012. During the year 2012-13, 5553 FRCs were diverted directly to concerned banks through this Module. OBOs also have option to send the FRCs received physically to concerned banks through this Module which provides for uploading of scanned documents. OBOs sent 3729 FRCs to concerned banks using this Module. 5.9 Complaints requiring elaborate evidence In terms of Clause 13 (c) of the BOS, BO can reject a complaint at any stage if it appears to him that the complaint made is requiring consideration of elaborate documentary and oral evidence and the proceedings before the BO are not appropriate for adjudication of such complaint. During the year OBOs rejected 7.57% of the complaints under this clause. 5.10 Complaints made without sufficient cause If BO is of the opinion that the complaint made is without any sufficient cause, such complaints can be rejected under Clause 13 (d) of the BOS. In such complaints, the bank concerned might have acted as per the covenants of the products and service contracts. During the year, 0.67% of the complaints were rejected under this clause. 5.11 Rejection of complaints due to other reasons Complaints outside the BO's territorial limits, complaints time-barred, dealt with earlier, complaints pending in other fora, frivolous complaints, beyond pecuniary jurisdiction of the BO, complaints pertaining to other institutions, not pursued by the complainants, complaints involving no loss to the complainants were other reasons for rejection of complaints. 5.12 Age -wise classification of pending complaints Table 14 and Chart 12 below indicate age-wise classification of pending complaints.

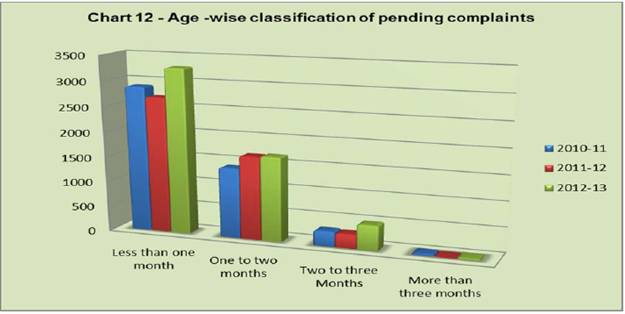

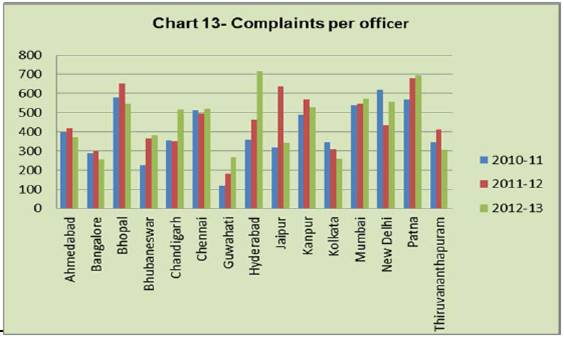

OBOs disposed 93% of the complaints handled during the year 2012-13. At the end of the year 5479 (7%) complaints were pending at all OBOs. Out of these, 4.36% of the complaints were pending for a period of less than one month, 2% complaints were pending for a period between one to two months, 0.6% complaints were pending for a period between two to three months and only 0.04% complaints were pending beyond three months. Generally OBOs try to dispose of complaints within the shortest possible time. Delays in resolution are on account of insufficient information/documents submitted, delays in getting information from parties. 5.13 Complaints per officer Table 15 and Chart 13 below indicate complaints 'per officer' in respective OBOs.

On an average each officer in the OBOs received 449 complaints this year. 6.1 Total expenditure incurred for running the BOS is fully borne by the RBI. The cost includes the revenue expenditure and capital expenditure incurred on administration of the BOS. The revenue expenditure includes establishment items like salary and allowances of the staff attached to OBOs and non-establishment items such as rent, taxes, insurance, law charges, postage and telegram charges, printing and stationery expenses, publicity expenses, depreciation and other miscellaneous items. The capital expenditure items include furniture, electrical installations, computers/related equipment, telecommunication equipment and motor vehicle.

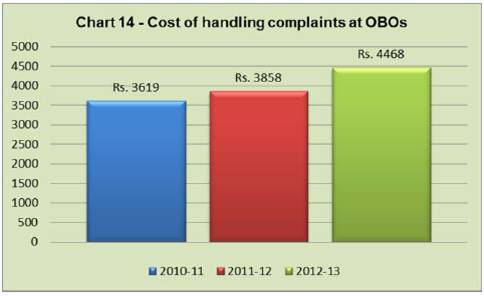

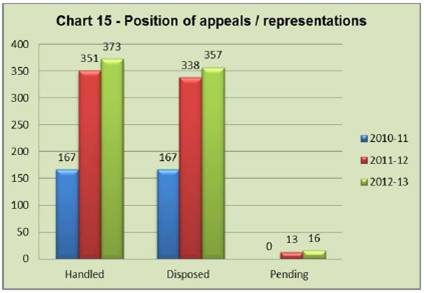

During the last three years the aggregate cost of running the BOS has increased from Rs. 261 millions in 2010-11 to Rs. 315 millions in 2012-13. Average cost of handling a complaint has increased from Rs. 3619 to Rs. 4468 per complaint during this period. BO Office wise 'Per-Complaint Cost’ for the year 2012-13 is given in Table 17: 7. Appeals against the Decisions of the BOs 7.1 The complainants as well as banks have the option of appeal against the decision of the BO for cases closed under certain clauses of the BOS 2006. All such appeals are classified as maintainable appeals as per the enabling provisions of clause 14 of the BOS 2006. The Deputy Governor in charge of the department of RBI administering the Scheme (Customer Service Department) is the Appellate Authority. The secretarial assistance to the Appellate Authority is provided by the Customer Service Department of the RBI. The department also receives representations against decisions of the BOs, that are not appealable as per the extant provisions of the BOS 2006. These representations are also processed in the department. Table 18 and Chart 15 below indicate the consolidated data of appeals/representations.

7.2 During the year 360 appeals/representations were received out of which, fifty two were maintainable as per the provisions of clause 14 of the BOS and 308 were representations pertaining to complaints closed under the non-appellable clauses of the Scheme. Position of disposal of maintainable appeals during the year 2012-13 is as under:

Out of thirty six appeals disposed during the year, in five cases BO's decision was set aside. All the 321 representations arising out of complaints closed under non-appealable clauses of the Scheme were disposed during the year. The OBO wise position of appeals/representations for the year 2012-13 is given in the Table 19 8. Complaints received through Centralised Public Grievance Redress and Monitoring System (CPGRAMS) CPGRAMS is a web based application developed by the Department of Administrative Reforms and Public Grievances of Government of India for receipt of complaints from public. Customer Service Department is the Nodal Office for RBI for this portal. 15 OBOs are sub-ordinate offices which receive complaints forwarded by the Government of India through this portal. 9. Applications received under Right to Information Act, 2005 The Banking Ombudsmen have been designated as the Central Public Information Officers under the Right to Information Act 2005 to receive applications and furnish information relating to complaints handled by the OBO. During the year OBOs received 895 requests under RTI Act. The OBO wise position is indicated in the Table 21 10. Other Important Developments 10.1 Annual BO Conference The Annual Conference of Banking Ombudsmen was held on January 4, 2013 at RBI Mumbai. The Conference was inaugurated by the Hon'ble Governor, Dr. D Subbarao. In his inaugural speech the Governor expressed satisfaction on the commendable job being performed by the Banking Ombudsmen and the banks, within their ambit, resultantly witnessing considerable improvement in the area of customer service and grievance redressal. While highlighting the importance of town-hall events being organised by the Banking Ombudsmen in co-ordination with banks as a valuable source of customer feedback, the Governor stressed that these events should not lose its objectivity and should be executed in its true spirit. Considering that the Banking Ombudsman Scheme remained largely an urban-literate phenomenon, the Governor desired that the senior officers of banks and RBI may make it a point to visit at least a few remote rural and semi urban branches every year to understand ground realities. He urged that requisite efforts be made to reach out to those segments and geographies that remain unserved or underserved. Governor, also urged to identify five best practices for the banks and obtain five commitments from the Banking Ombudsmen during the conference. Speaking on the occasion, Deputy Governor, Dr. K C Chakrabarty said that though the fact that the offices of the Banking Ombudsman receive more than 70000 complaints a year bears a testimony to the credibility of the Banking Ombudsman Scheme, it also reflects on the poor redress system of banks as it shows that the customers repose greater faith in the Banking Ombudsman. He emphasized banks to make efforts to strengthen their grievance redressal mechanism by proactively reviewing their processes, improving efficiency and delivering promised services in a fair, non-discriminatory and transparent manner. He stressed that the banks needed to address issues of safety and security in electronic banking to increase customer confidence and also to bring in uniformity in the service charges levied. The Conference was attended by the Top Management of RBI, Director DFS, Ministry of Finance, GoI, Chairman IBA, SBI, CMDs/CEOs of major commercial banks in Public and Private Sector, BCSBI, CAFRAL, IRDA, SEBI, CIBIL and NPCI. Box I: Annual BO Conference 2012 - Five commitments by Banking Ombudsmen 1. QUICK TURNAROUND TIME - Shorter time taken to deal with the complaints will instil confidence in the people in the grievance redress mechanism of the Banking Ombudsman Scheme. In this regard, Banking Ombudsmen should endeavour to dispose of complaints registered over the Complaint Tracking System (CTS) within a maximum of two months. 2. ACCESS TO THE COMPLAINT TRACKING SYSTEM Facility to be given to Banks: The banks and the offices of Banking Ombudsmen should fully utilise the CTS feature that supports uploading of documents/queries/clarifications, etc. by banks and the Banking Ombudsmen. Customer Service Department of RBI will create necessary access for the Principal Nodal Officers of the banks to enable them to monitor the position of bank-wide complaints at a single location. This will facilitate quicker action as well as less-paper handling of cases as a part of our ‘go green’ efforts. 3. INTER DISTRICT MOBILITY OF BO WITHIN THE STATE - Banking Ombudsmen should be mobile, make efforts to adjudicate cases by taking their office as close to the complainant as possible. This will not only increase awareness but also the faith of the common person in the Banking Ombudsman Scheme, who would feel empowered by the opportunity to present their case in person. The Banking Ombudsmen may hold sittings at districts of their region depending on larger incidence of complaints from a particular jurisdiction. 4. BLOG SITE - The Banking Ombudsmen may exchange information and post important decisions on a dedicated blog-site to encourage greater knowledge dissemination. 5. IBA-NPCI BRIDGE FOR RESOLUTION OF ATM DISPUTES - In order to speed up the dispute resolution mechanism in ATM transactions as also to ensure technically competent resolution in the disputes involving two banks, the IBA and NPCI would jointly evolve a platform for dealing with such cases. The offices of Banking Ombudsmen would admit these complaints only if these remain unresolved at the end of this process. In all ATM related disputes before the Banking Ombudsmen, the banks’ submissions should be from a senior IT official designated for the purpose. Box II. Annual BO Conference 2012 - The five best practices for banks: 1. ACKNOWLEDGEMENT OF ALL APPLICATIONS/REQUESTS Issuing an acknowledgement of customer level request is not a uniform practice. Consequently, several grievances and service requests as also potential business requests go unnoticed/unacknowledged and unaccounted for. Banks, therefore, must put in place a system of acknowledgment of receipt of all kinds of customer requests. This will ensure that the customers as well as non-customers have access to the banking system and its grievance redress machinery in case of need. 2. FEEDBACK ON QUALITY OF SERVICE EXPERIENCE - Banks need to evolve a quick and easy way to register feedback on service quality/complaints through such means as text messages viz. ‘SMS Happy/Unhappy’ using mobile telephony. In all such cases, the banks shall revert to the customer early, preferably within 48 hours. This will go a long way to improve the customers’ faith in the redress system and would be an effective feedback mechanism for the banks to assess and further improve their services. 3. NO DISCRIMINATION BETWEEN HOME/NON-HOME CUSTOMERS - The banks believe that customers should get basic banking services at all the branches, home or otherwise. Banks will decide the basic retail banking services that will be offered to non-home branch customers. These services and charges applicable at non-home branches will be standardised and charges transparently displayed / notified for information of the public and customers. Banks will simultaneously develop safety measures to ward off threats geared against fraudulent machinations. 4. SAFETY AND SECURITY OF e-TRANSACTIONS - For ensuring safety and security and thereby building customer confidence in electronic banking, banks shall endeavour to work out a policy on zero liability/compensation/insurance at appropriate cost including customer education and hand holding sensitization efforts. Banks shall do all that is required to make electronic banking safe for the customers. These measures inter-alia will include setting appropriate limits in regard to the amount, frequency, number of third party beneficiaries etc. 5. DEDICATED HELPLINE - Misinformation about banking products often gives rise to customer complaints. Banks should set up a dedicated Helpline manned by experienced personnel to impart correct and crucial information about the products to the customers. Frontline staff should also be in a position to explain the features of all Banks’ products to the customers. 10.2 26th Conference of State Finance Secretaries The 26th conference of the State Finance Secretaries was convened by IDMD, RBI in Mumbai on May 21st, 2013. While inaugurating the Conference, the Governor urged State Finance Secretaries to visit a few districts to get first-hand information on problems faced by pensioners and initiate corrective action. During the Conference, CGM, CSD highlighted certain issues related to pension, cyber-crimes, mis-selling of third-party products. It was decided that the State Governments would endeavour to ensure uniformity in pension regulations and alignment of the same with the central pension regulations, to the extent possible. They were requested to align their identification requirements to the KYC norms of RBI for banks and to partner with banks for prompt and correct payment of pension, wherever direct electronic payment has not been embraced. It was also decided that they would associate themselves with the BOs during the awareness programs and sensitize the police machinery for prompt lodging and investigation of cybercrimes. In order to curb mis-selling of third party products and pre-empting financial frauds, it was decided that the State Governments would coordinate with RBI and provide market intelligence and critical information for prompt regulatory intervention. 10.3 Open House event Dr K C Chakrabarty Deputy Governor participated in an Open House event organized in Mumbai on June 03, 2013 by one of the NGOs committed to protection of consumer rights. The major issues discussed/debated were competition not having intended consequences for consumers of banking services, de-regulation of interest rates/service charges had resulted in exploitation/cartelization, mis-selling of third party products by banks, misreporting by banks to CIBIL and the consequent harassment, RBI to decide on reasonableness of charges and not delegate to IBA/Board of banks, simplification of KYC norms, improving effectiveness of grievance redress mechanism and regulating the sale of gold coins by banks. 10.4 Regional Conferences of BOs The lead OBO of every zone has been entrusted with the responsibility of organising and conducting the Regional Conferences of Banking Ombudsmen in their zone. The main purpose of such Conferences is to ensure uniformity in decision making among the BOs and to exchange views on important systemic issues. During the year all nodal offices organized such conferences in their zone. On sidelines of these conferences, a meeting is also held with the Zonal Heads of major banks of the region to discuss customer service related issues of topical interest and sharing of regulatory concerns and expectations with banks,, besides discussing practical issues, problems & obstacles impeding prompt resolution of customer grievances. 10.5 Meetings with Nodal Officers/Controlling Heads of banks In order to ensure quantitative and qualitative resolution of complaints as also to get feedback from the banks, periodical meetings were held by OBOs with Nodal Officers of the banks. Such regular meetings with nodal officers help in ironing out problems in resolution of complaints. Wherever problems persist and adequate responses to complaints are not forthcoming, the matter is taken up with the respective controlling heads. 10.6 Offsite sittings of Banking Ombudsmen During Annual Banking Ombudsmen Conference held on January 4, 2013, the Governor, RBI had highlighted the need to broaden the reach of BOS by increasing mobility of the BOs within their jurisdiction by identifying districts of the region and putting in place system of conducting sittings at such places. Taking this forward, OBOs organized sittings at district headquarters to resolve complaints pertaining to the branches of that region. During these sittings attempts were made to resolve complaints on-the-spot. Considering the response and the added benefit of reaching out to complainants and making the scheme popular, the initiative has proved very effective. 10.7 Spreading Awareness about BOS 2006 - Efforts of OBOs 10.7.1 Town Hall Events As decided in the Annual Conference of Banking Ombudsmen 2011 Town-Hall Events were organized by all OBOs mainly in Tier II cities within their jurisdiction. The objective of organizing such events is to create awareness among the public on how to transact responsibly in their dealings with banks and in the case of a dispute or grievance, the avenues available to the customers under the individual banks’ internal grievance process as well as recourse to the Banking Ombudsman. These events are conducted in local language and Hindi. During the year OBOs conducted (36) Town Hall Events at places indicated below.

10.7.2 Awareness Campaigns and other initiatives Considering the fact that the OBOs are mainly located in State capitals only, the OBOs engage in activities to spread public awareness about the BOS in rural and semi-urban areas. During the year 15 OBOs situated across the country organized various awareness campaigns/outreach activities within the area of their jurisdiction. A large number of villagers, school, college students, bank customers, bank officials of public and private sector banks, representatives from Pensioners’ Association, Depositors’ Association are involved in these awareness programmes. Information about salient features of the BOS, latest guidelines issued by RBI, BCSBI Code, issues related to pension, education loans, precautions to be taken in using ATM cards, genuine vis-à-vis counterfeit currency notes etc. is given to participants and their queries on these issues are also replied. OBOs also participated in the outreach programmes, financial literacy camps organized by the Rural Planning Credit Department of RBI. Documentary films, publicity through local newspapers, All India Radio, Doordarshan, setting up stalls at various public festivals like Pushkar Mela, Kumbha Mela, Bikaner Camel Fair, Winter festival of Mount Abu etc, participating in trade fairs, book exhibitions, live interactive programmes on Doordarshan, AIR were some of the measures initiated to spread awareness about the BOS. 10.7.3 Sharing of information with Media The practice of sharing information on complaints handled by OBOs with local media started after conclusion of the Annual Conference of Banking Ombudsmen 2011, is well received by local press. During such Press Meets BOs share information regarding complaints received and resolved, including important cases and awards given. These Press Meets are extensively covered in several newspapers, including Hindi and vernacular languages. 10.7.4 In-cognito visits to bank-branches: During the year, random In-cognito visits of bank branches were undertaken by OBOs. BOs also visited some bank branches during outreach programmes to assess the quality of services extended by the branch to customers and members of public in general. During these visits compliance with the requirements under clause 15 of the BO scheme i.e. Display salient features of the scheme for common knowledge of public, was also ascertained. The findings of such in-cognito visits are discussed with the branch officials as well as Nodal Officers so as to improve upon existing system and procedures and to excel in service rendered to the bank customers. 10.7.5 Knowledge sharing - Capacity building: OBOs organized meetings with branch heads / staff of banks, arranged workshops for bank managers, participated in banker-customer meets arranged by banks, meetings of Committees constituted under the Lead Bank Scheme/DCC and SLBC and Customer Service Centres, delivered lectures to bank officials, college students, pensioners army jawans on various provisions of the BOS 2006, arranged Knowledge Sharing Programmes in co-ordination with banks, With a view to up-grading skills of Dealing Officers of OBOs and to help them better understand and appreciate the nuances of the underlying transactions, OBOs arranged in-house training programmes on subjects like net-banking, ATM operations, pension etc. OBOs also arranged sessions with other BOs for sharing of experience with staff of the OBO. Annex - 1

Annex - 2