IST,

IST,

Chapter I: India's Digital Revolution: Opportunities and Challenges

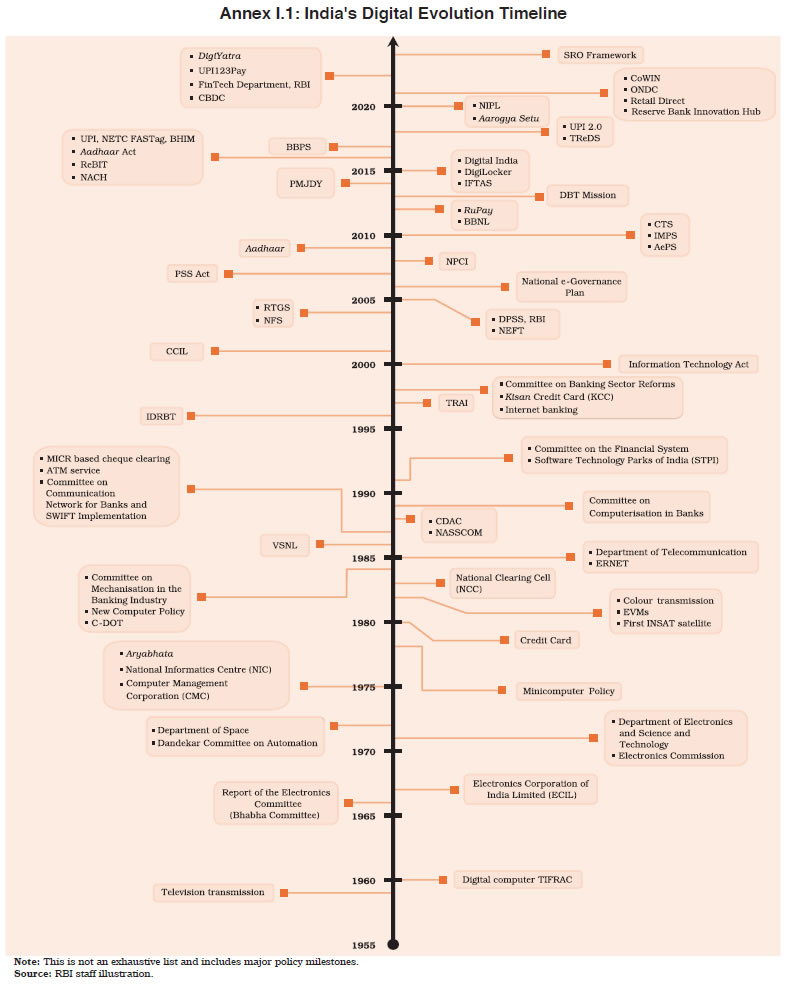

|

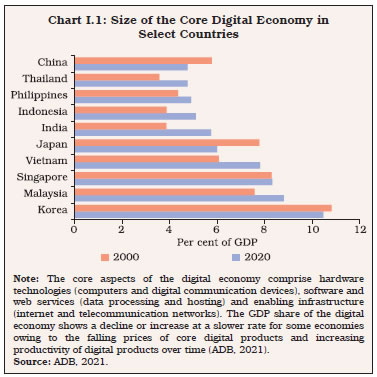

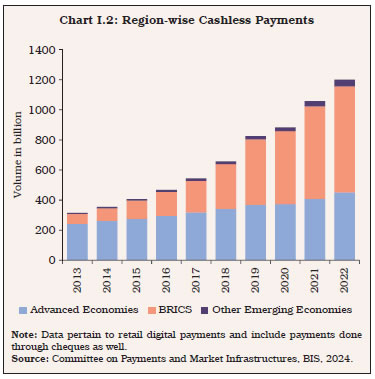

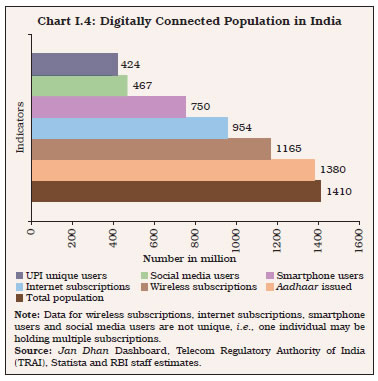

Digitalisation has fundamentally transformed the global economy, reshaping economic growth, employment, consumer welfare and living standards. In the adoption of digital technologies, the internationally recognised India Stack, a growing FinTech ecosystem and a burgeoning digitally-inclined population, combined with expanding internet and mobile connectivity, are driving India to become the fastest-growing digital economy. While digital technologies offer various opportunities for India, such as faster growth, financial inclusion and seamless fiscal transfers and cross-border payments, they also present challenges related to cybersecurity, data privacy and concentration risks. Balancing financial stability, customer protection and fair competition in this dynamic landscape, the Reserve Bank is actively involved in developing a safe, efficient and robust digital ecosystem. 1. Introduction I.1 Over the past three decades, a silent revolution has been transforming the world, its tides sweeping across advanced and developing economies alike, with countries like India riding its crest. The speed and scale of the digital revolution, as it is ubiquitously known, has eclipsed all past revolutions. Over the past decade itself, the global digital economy has grown 2.5 times faster than the physical world economy to account for more than 15 per cent of global GDP (UN, 2023). As the political commentator and author Thomas Friedman points out, the world’s gone from flat to fast, to smart, to deep (Friedman, 2019)! I.2 Digital technologies are reshaping our lives through their impact on economic growth, employment, consumer welfare and living standards. Process innovations are rapidly being generated, markedly in information collection, storage and exchange. Digital technologies are democratising innovation and entrepreneurship, being less costly than conventional technologies to scale up and are seen as transfiguring innovators into entrepreneurs (Panagariya, 2022). Perhaps the most dramatic effects of digitalisation are evident in the metamorphosis of the financial infrastructure, including through network externalities. Financial transactions are conducted more speedily and efficiently in real time; the ambit of financial inclusion expands over time and space; and fiscal transfers occur seamlessly and with precision. I.3 India is at the forefront of the digital revolution. As the next section portrays, it embraces not just financial technology (FinTech) speeding up digital payments but also the celebrated India Stack comprising biometric identification, the unified payments interface (UPI), mobile connectivity, digital lockers and consent-based data sharing. The digital revolution is galvanising banking infrastructure and public finance management systems covering both direct benefit transfers and tax collections. Vibrant e-markets are springing up and expanding their reach. It is estimated that the digital economy currently accounts for a tenth of India’s GDP; going by growth rates observed over the past decade, it is poised to constitute a fifth of GDP by 2026 (Chandrasekhar, 2023). I.4 Several enabling forces have come together to energise this revolution. Although internet penetration in India was at 55 per cent in 2023, the internet user base has grown by 199 million in the recent three years (IAMAI-Kantar, 2024). India’s cost per gigabyte (GB) of data consumed is the lowest globally at an average of ₹13.32 (US$ 0.16) per GB (Cable.co.uk, 2024). India also has one of the highest mobile data consumption in the world, with an average per-user per-month consumption of 24.1 GB in 2023 (GSMA, 2024; Nokia, 2024). There are about 750 million smartphone users, which is expected to reach about one billion by 2026. India is expected to be the second largest smartphone manufacturer in the next five years (Deloitte, 2022). India has the world’s third largest startup ecosystem with over 1.4 lakh startups and over 100 unicorns (DPIIT, 2024; Tracxn, 2024a). The heavily tech-based startup ecosystem includes various sectors like FinTech platforms, viz., insurance and payments, gaming, software as a service (SaaS)-based tools, logistics, healthcare services, education technology, e-commerce and online markets. India has also leveraged on public-private collaboration in the digitalisation of its economy, with the government working on telecom infrastructure projects with multinational investors. Since 2015, the “Digital India” initiative has been expanding digital infrastructure across the country and further reforms are either operational such as the Open Network for Digital Commerce (ONDC) or on the anvil such as the BharatNet project, investments in developing 5G and 6G infrastructure, the internationalisation of digital public infrastructure, the digital rupee and the development of data centres. I.5 With India on course to reap late mover advantages to become the fastest growing digital economy in the world with a digital ecosystem set to cross US$ 1 trillion by 2025 (MeitY, 2019), the theme of this year’s report, India’s Digital Revolution, virtually selects itself. In this chapter, we peer into the future at the fundamental ways in which it will impact our developmental aspirations and strategies after briefly reviewing the state of play in Section 2. Section 3 takes on a forward-looking perspective, evaluating the exciting opportunities that digitalisation is likely to throw up in this transformation, including through artificial intelligence (AI). Section 4 assesses the trade-offs involved in the challenges of digitalisation, sometimes considered as a disruptive technology at least in respect of traditional technologies, the labour market and the like. Digital transformation is also resource-intensive in demanding substantial investment in technology, learning, infrastructure and above all, adaptability of employees and management to new digital tools and processes. Digitalising operations can expose entities to potential cyber threats and data breaches, necessitating robust cybersecurity measures. The adoption of AI also brings challenges, including ethical concerns, data privacy and potential malicious use. Recent policy initiatives by Reserve Bank of India (RBI) are discussed in Section 5. The chapter concludes with Section 6, which lays out the structure of the rest of the report, the theme of each succeeding chapter and key findings. I.6 The term “digital economy” is believed to have been coined in 1996 (Tapscott, 1996; ADB, 2021). In a formal sense, it has been defined as the contribution of any economic transaction involving both digital products and digital industries to GDP - digital products being goods and services with the main function of generating, processing and/or storing digitised data (ADB, 2021). Digitalisation has varied across geographies, reflecting differing levels of infrastructure, regulatory frameworks and technological readiness. For countries like India, Malaysia and Thailand that have been fast adopters, the service-oriented structure of their economies has fostered deeper forward linkages with core digital activities than others (Chart I.1).  I.7 In the financial sector, payment systems serve as the first point of entry for digital technologies (Bech et al., 2018), with digital payment platforms, contactless cards and mobile wallets becoming all-pervasive. Globally, BRICS nations1 are contributing a larger share to total cashless payments than advanced nations (BIS, 2024) [Chart I.2]. India is leading the world with a share of 48.5 per cent in global real-time payments volume (ACI Worldwide, 2024). Global remittances that are increasingly being effected through mobile money and digital platforms are estimated to have increased to US$ 857.3 billion in 2023, led by India (US$ 115.3 billion), Mexico (US$ 66.2 billion), China (US$ 49.5 billion) and the Philippines (US$ 39.1 billion) [World Bank, 2024; RBI, 2024a].  I.8 Digitalisation has diversified the range of players in the financial services industry, with a significant increase in the number of FinTechs across nations (Chart I.3a). FinTechs are attracting funds from a range of investors, resulting in the total value of FinTech investments standing at US$ 61 billion globally in 2023 (Chart I.3b). India is one of the top recipients of FinTech funding in recent years, with US$ 2.6 billion of flows in 2023 (Tracxn, 2024b).2 Along with FinTechs, large technology companies (hereafter BigTechs) have also entered the financial industry. I.9 Advancements in digital payment systems, along with the increasing presence of FinTechs and BigTechs in the financial sector, is structurally shifting the global credit markets. Lending from FinTechs and BigTechs has steadily increased from US$ 132 billion and US$ 22 billion, respectively, in 2015 to US$ 223 billion and US$ 572 billion in 2019, with BigTech credit projected to reach US$ one trillion by 2023, indicating heightened competition between traditional lenders and new players (Cornelli et al., 2020; Asian Banker, 2022).  2.1 The Indian Experience I.10 India’s digital revolution is a blend of government-led initiatives and enabling regulatory frameworks of financial market regulators (the Reserve Bank and the Securities and Exchange Board of India (SEBI)) [Annex I.1]. This journey traverses four phases since independence (Box I.1).

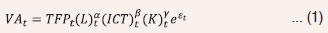

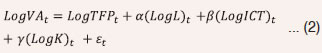

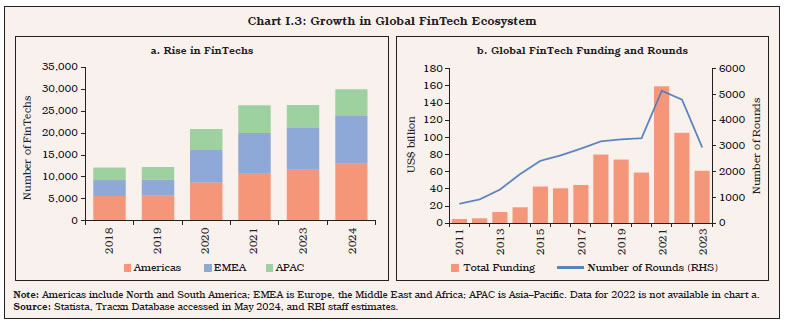

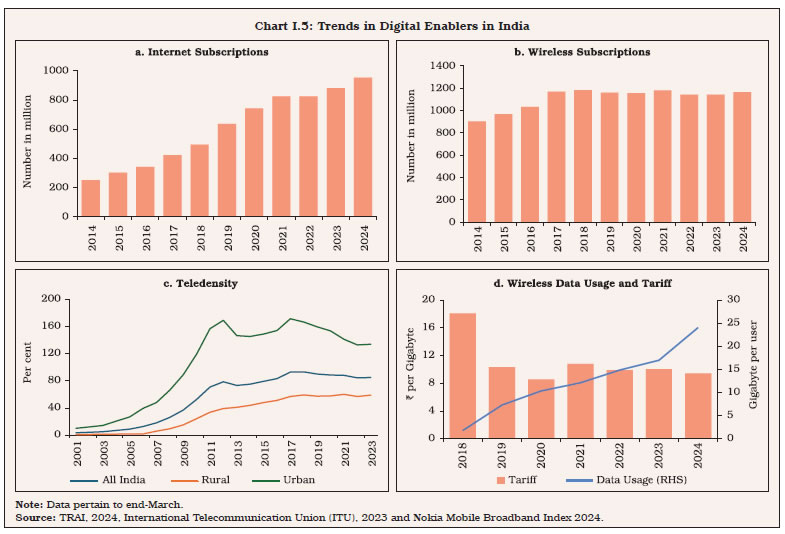

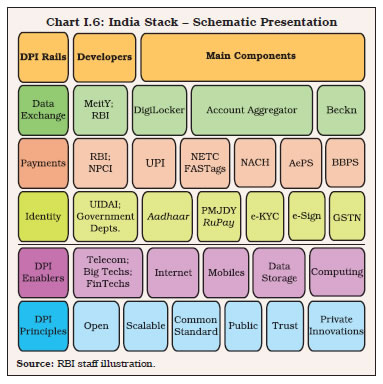

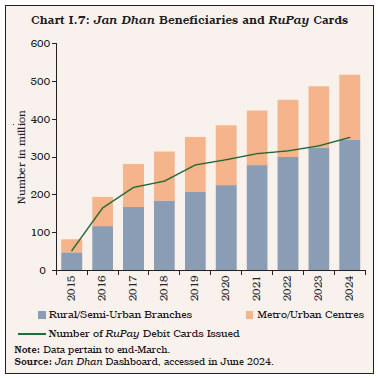

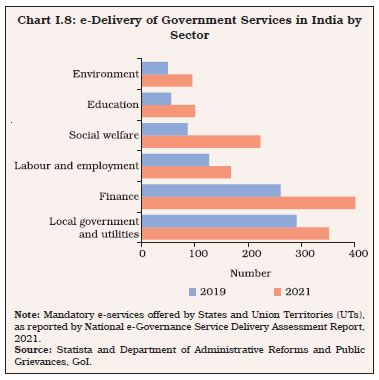

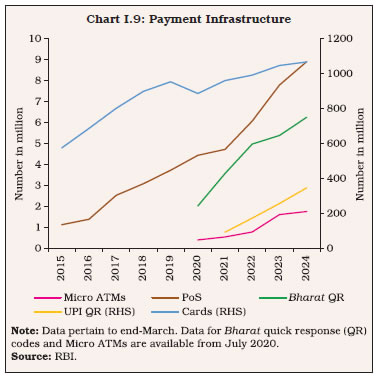

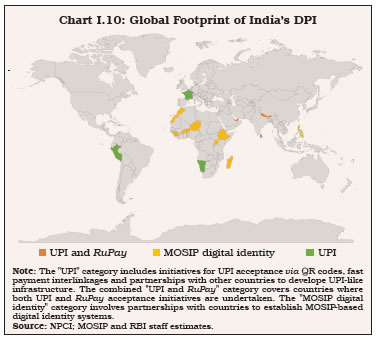

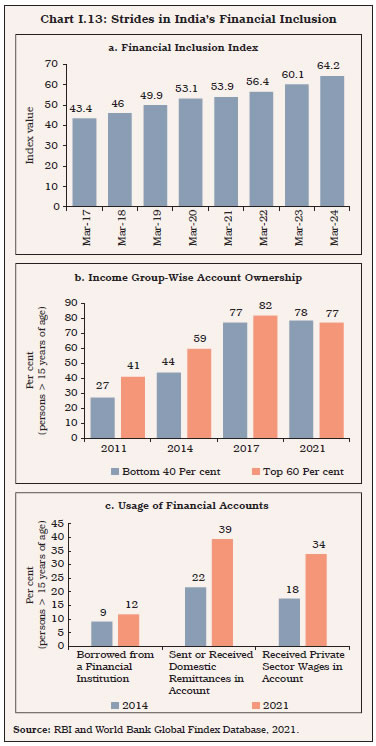

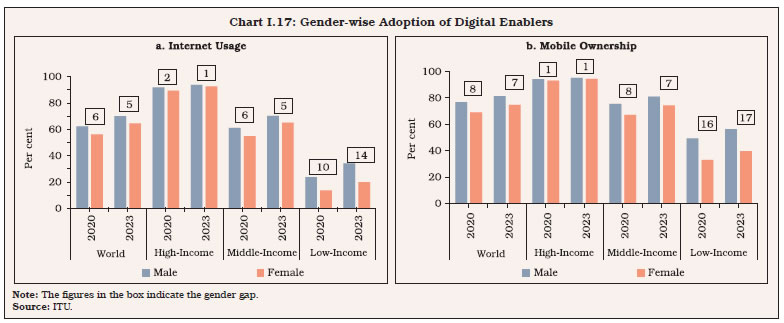

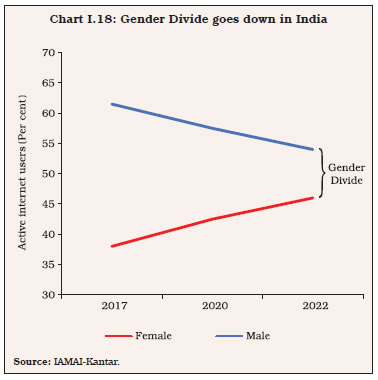

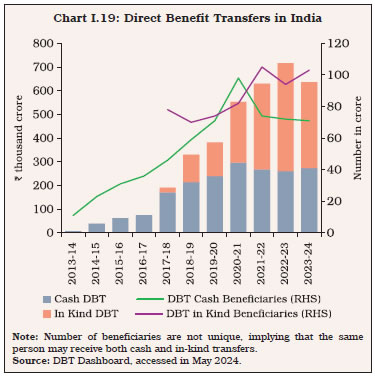

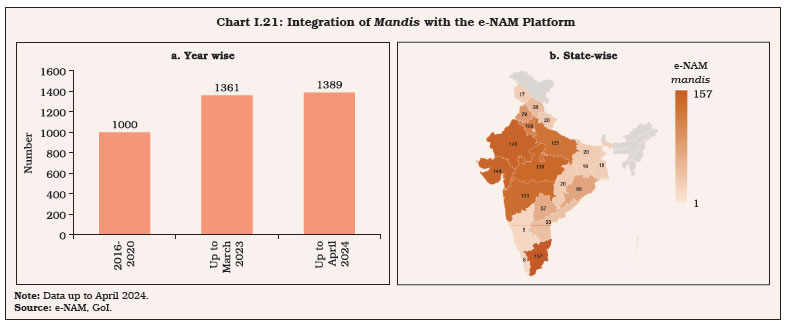

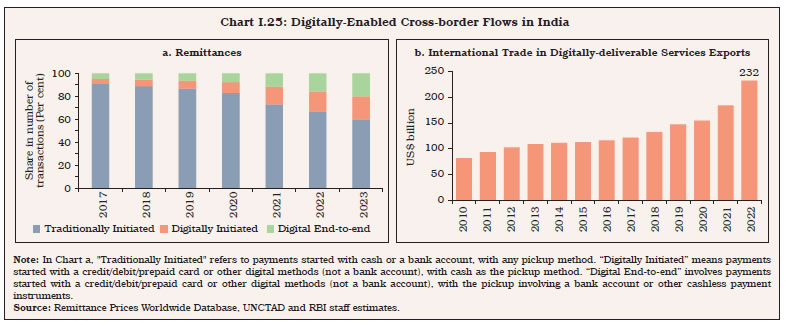

I.11 India has one of the largest digitally connected population worldwide (Chart I.4). The two fundamental drivers of this wave of digitalisation are: (a) ubiquitous connectivity through mobile, internet-connected devices and communication networks; and (b) low-cost computing and data storage. I.12 India is home to the second largest telecom subscriber base (TRAI, 2023) and internet user base globally (ICRIER, 2024). The growth in digital enablers has been powered by competitive offerings by telecom operators, advent of global tech giants and among the cheapest data prices in the world (Chart I.5). I.13 The average time Indian users spent online i.e., 6.45 hours per day, is close to the global average (6.4 hours) [Statista, 2024a]. In 2023, Indian internet users logged the second highest application downloads at 26 billion (data. ai, 2024). The median mobile download speed has also increased, climbing from 1.3 Megabits per second (Mbps) in 2014 to 107.03 Mbps in June 2024, partly driven by the rollout of 5G (Vaishnaw, 2023; Ookla, 2024).  2.2 Digital Public Infrastructure I.14 India’s foundational Digital Public Infrastructure (DPI) – the India Stack – has use cases across a spectrum of economic activities that allow private and public players to innovate and build customer-centric solutions (Chart I.6). Built on the pillars of providing DPI as a public good, encouraging private innovation by providing open access, creating a level-playing field through regulatory framework and empowering individuals through a consent-driven data-sharing framework, India Stack has facilitated population-scale delivery of services in a cost-effective manner, particularly benefitting marginalised segments (D’ Silva et al., 2019; Alonso et al., 2023). I.15 The identity layer of India’s DPI enables secure and unique identification of individuals on demand without the need for physical presence and facilitates seamless authentication, verification and integration of identity information. Since its inception in 2009, the 12-digit Aadhaar has become the world’s largest biometric-based identification system, with 1.38 billion ID holders covering 98 per cent of the population (UIDAI, 2024; MeitY, 2024). The subsequent launch of the Pradhan Mantri Jan Dhan Yojana (PMJDY) propelled Aadhaar-linked bank accounts for 52.5 crore citizens, increasing threefold since 2017. More than 50 per cent of the account holders are women and 67 per cent of the total accounts are in rural and semi-urban areas of the country (Chart I.7) [PMJDY, 2024]. Account ownership in India has more than doubled in 10 years from 35 per cent in 2011 to 78 per cent in 2021 (World Bank, 2021).  I.16 Since 2014, there have been over 116 billion Aadhaar-based authentications and 20 billion electronic-know your customer (e-KYC) authentications.8 This has helped to formalise the economy, with the Goods and Services Tax Network (GSTN) onboarding 1.4 crore taxpayers and issuing over 400 crore e-way bills (NASSCOM, 2024; GST, 2024). Direct Benefit Transfers (DBTs) have streamlined subsidies and reduced leakages, with ₹6.9 lakh crore transferred directly for 315 schemes reaching 176 crore beneficiaries (non-unique) in 2023-24. The DBTs have resulted in an estimated ₹3.4 lakh crore in cost savings over the years till March 2023 (DBT, 2024). The e-delivery of government services has expanded across sectors, particularly in finance, local government utilities and social welfare schemes (Chart I.8).  I.17 Under the payments layer, the development of a real-time, round-the-clock, scalable and interoperable retail payment option is enabled by the UPI. It powers multiple bank accounts into a single mobile application, merging several banking features, seamless fund routing and merchant payments. The payment platform has facilitated secure, convenient and low-cost transactions between individuals, businesses and governments on demand, with settlement in fiat money inside the formal financial system.  I.18 Digital payments have recorded a compound annual growth rate (CAGR) of 50 per cent and 10 per cent in volume and value terms, respectively, in the last seven years9 involving 164 billion transactions worth ₹2,428 lakh crore in 2023-24. Payment infrastructure has also received a boost from the Payment Infrastructure Development Fund (PIDF) [Chart I.9].10 I.19 The UPI has seen a tenfold increase in volume over the past four years, increasing from 12.5 billion transactions in 2019-20 to 131 billion transactions in 2023-24 - 80 per cent of all digital payment volumes. Currently, the UPI is recording nearly 14 billion transactions a month, buoyed by 424 million unique users in June 2024. The surpassing of UPI transactions volume for peer-to-merchant (P2M) transactions over the peer-to-peer (P2P) segment and high volume for small-value transaction categories indicate its high usage.  I.20 The data exchange layer provides a standardised, consent-driven and interoperable platform on which individuals, businesses and government agencies can securely share and access data for various purposes. Under the Account Aggregator (AA) framework, entities are governed by the guidelines issued in 2016 by the Reserve Bank. AAs are built on the Data Empowerment and Protection Architecture (DEPA), which serves as consent managers, empowering citizens to seamlessly access their financial data and exchange it with third-party institutions. Since the framework was first launched in August 2021, nearly 80 million individuals and companies have benefited from easier access to financial services through AAs. Adoption is increasing rapidly, with around 40 million new accounts being linked in 2024 alone so far (Sahamati, 2024). DigiLocker, the online cloud-based document depository, has issued more than six billion documents, catering to 300 million users in 2024 (DigiLocker, 2024). India has also enacted a Digital Personal Data Protection Act (DPDP Act) in 2023 to navigate the trade-off between ensuring effective regulation and maintaining individual privacy (Annex I.2). 2.3 Internationalisation of Digital Public Infrastructure I.21 India’s DPI is going global by a) collaborating with other nations to develop digital identity solutions under the Modular Open Source Identity Platform (MOSIP) programme; b) interlinkage of the UPI with fast payment systems of other nations like Singapore’s PayNow, the United Arab Emirates’ (UAE) Instant Pay Platform (IPP) and Nepal’s National Payments Interface (NPI) for cost-effective and fast remittances; c) partnering with other central banks and foreign payment service providers to broaden UPI and RuPay acceptance beyond geographical borders, such as in countries like Bhutan, Mauritius, Singapore and the UAE; and d) sharing the Beckn protocol11 with nations to provide their public and private services through open, lightweight and decentralised specifications (Chart I.10). 3. Expanding the Opportunities Frontier I.22 Digitalisation is unlocking opportunities across various sectors of the economy. In this section, the focus is on areas where digitalisation has permeated and has the potential to make further advances: (i) enhancing financial inclusion; (ii) addressing gender, economic and social inequalities; (iii) channelling formal finance to agriculture; (iv) enabling seamless cross-border transactions; and (v) supporting climate finance and sustainability. In the process, economic value generated by DPIs is expected to rise to 2.9 - 4.2 per cent of GDP by 2030 (NASSCOM, 2024), lifting India’s growth while improving total factor productivity (Box I.2).

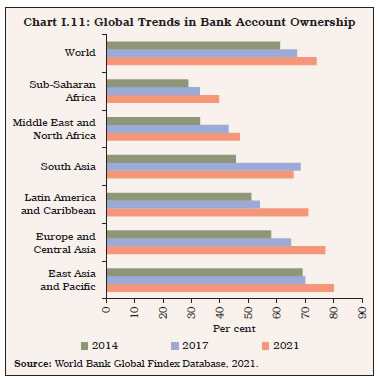

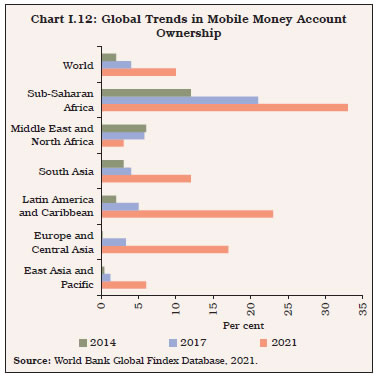

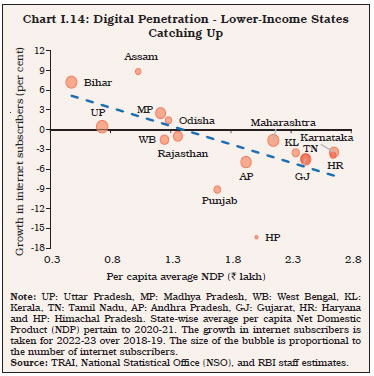

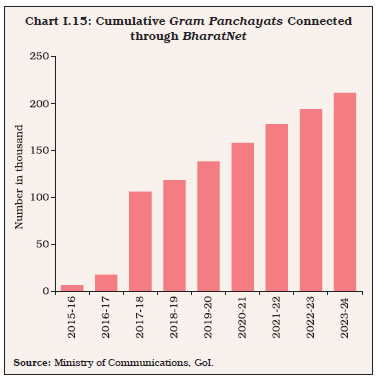

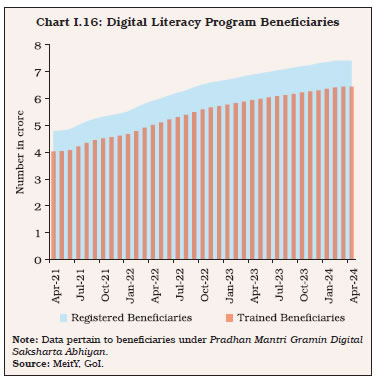

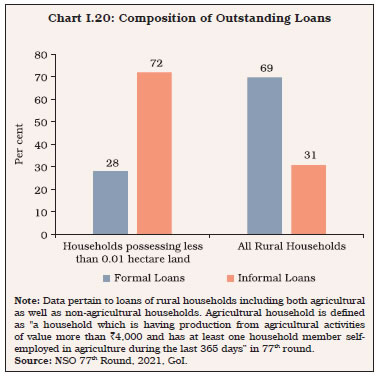

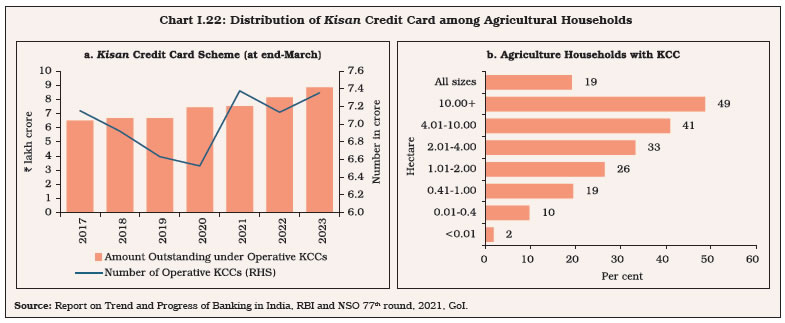

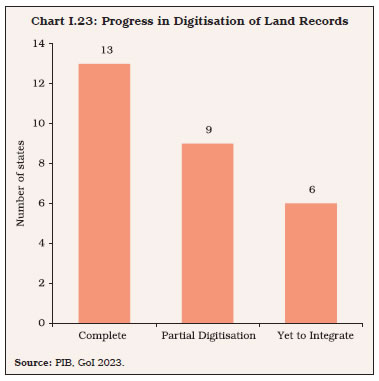

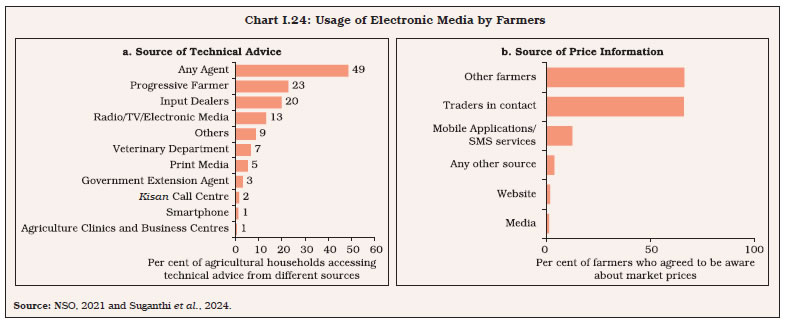

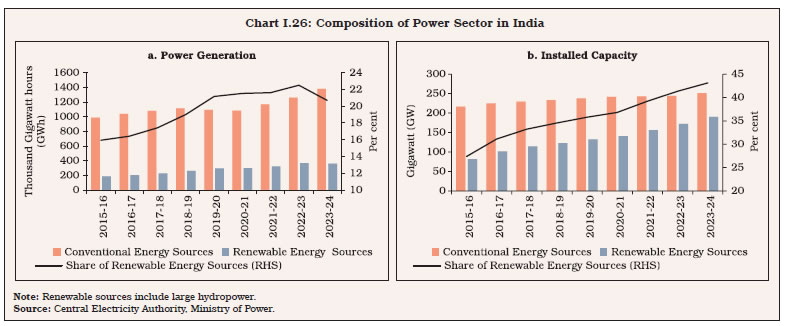

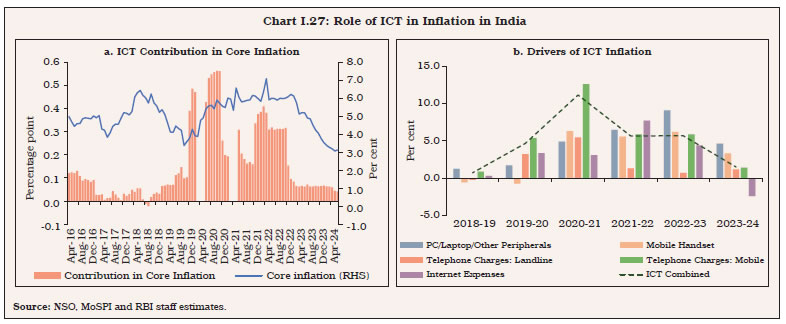

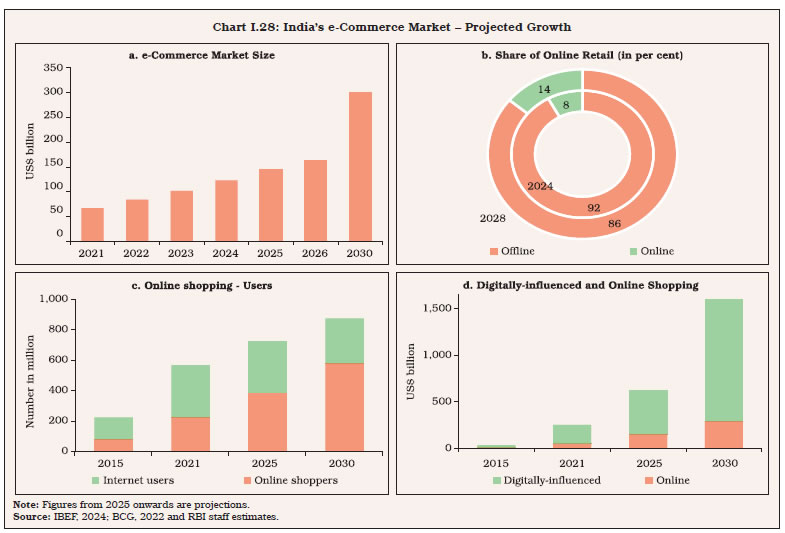

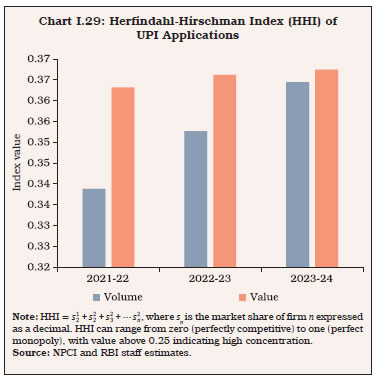

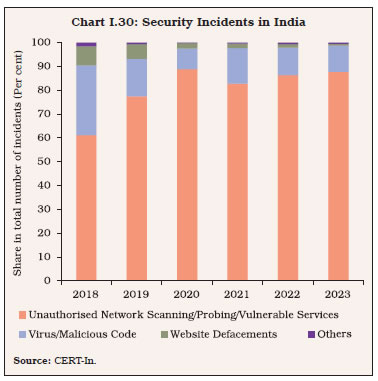

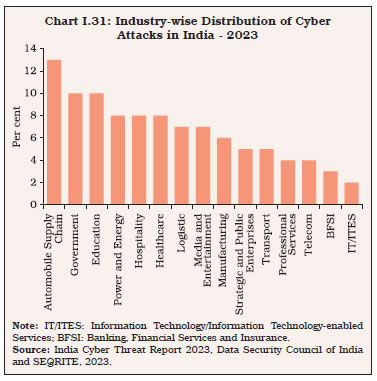

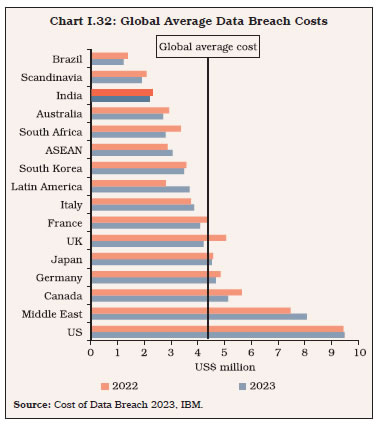

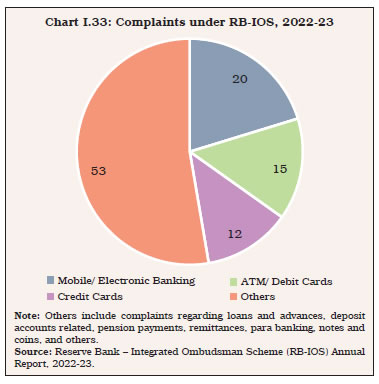

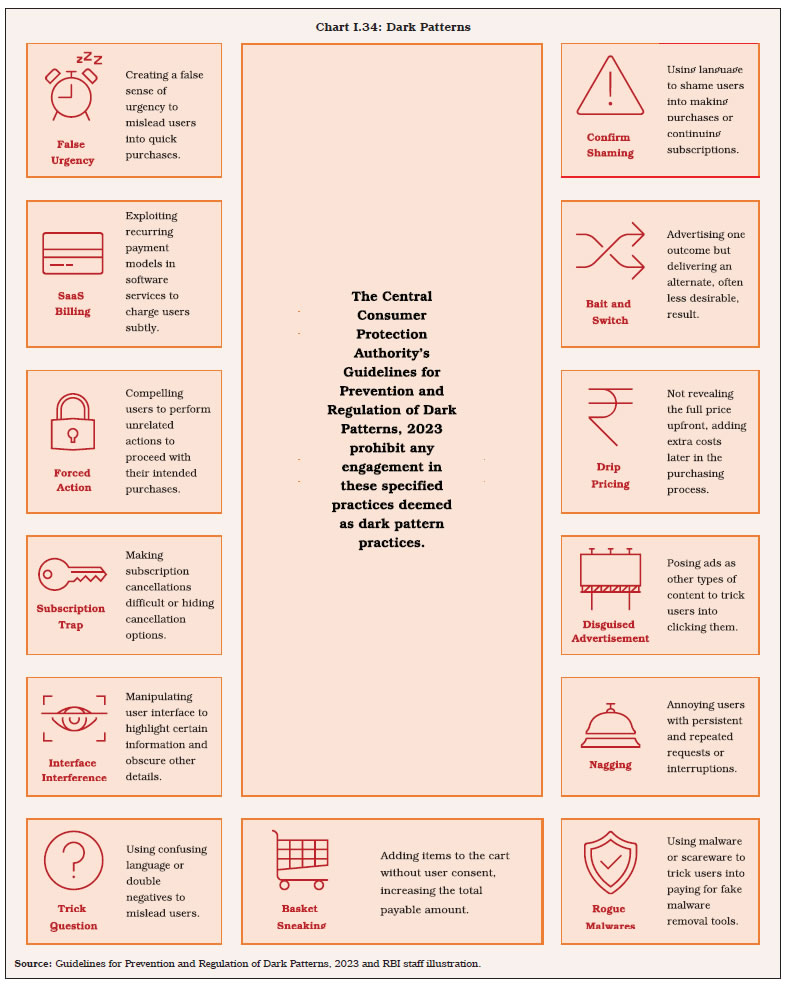

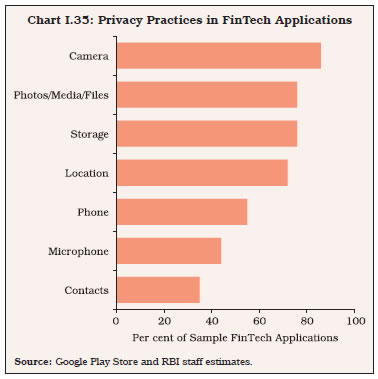

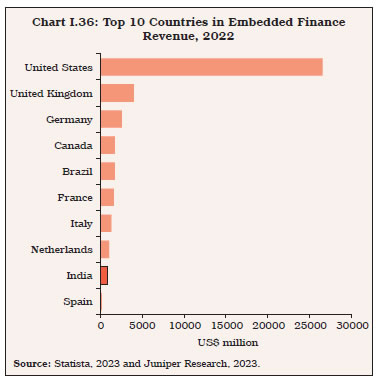

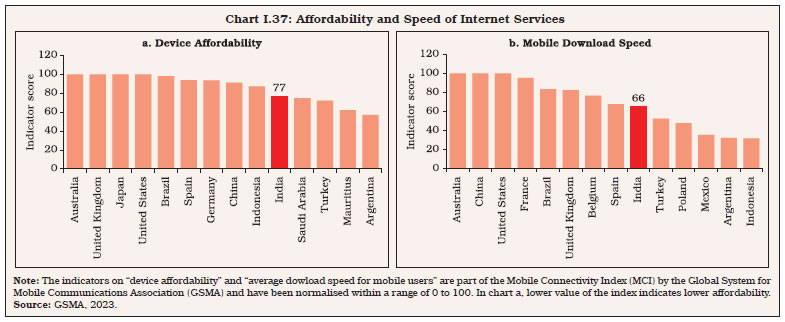

3.1 Financial Inclusion I.23 Digitalisation offers a unique and dynamic opportunity to expand the reach of financial services to the entire population, especially disadvantaged and voiceless sections, thereby formalising the economy. Globally, there has been an increase in bank account ownership from 61 per cent of the adult population in 2014 to 74 per cent in 2021 (Chart I.11).  I.24 The evolution and adoption of technological advancements have led to massive improvement in deepening of digital financial services (Das, 2021). Globally, there has been a notable increase in the use of mobile money accounts, bridging the gap between retail accounts and payments in emerging market and developing economies (EMDEs) [Chart I.12].  I.25 The potential for expanding financial inclusion in India by application of digital technologies is high in view of existing conditions. First, the progress of financial inclusion in India is evident in the Reserve Bank’s Financial Inclusion Index and narrowing account access gap between income groups. In addition, usage has increased in borrowings, remittances and the receipt of private sector wages (Chart I.13).   I.26 Second, in rural India, 46 per cent of the population consists of wireless phone subscribers (TRAI, 2024) and 54 per cent are active internet users (IAMAI-Kantar, 2024). Internet accessibility in low-income states has recorded a higher average growth than in relatively higher-income states (Chart I.14). I.27 Third, given that more than half of FinTech consumers are from semi-urban and rural India and more than a third of digital payment users are from rural areas (TransUnion CIBIL, 2023), there is potential for furthering digital penetration and closing the rural-urban gap. Over two lakh gram panchayats have been connected through BharatNet in the last decade, enabling provision of services like e-health, e-education and e-governance in rural areas (Chart I.15). Various initiatives have also been taken to promote digital literacy in rural India (Chart I.16). The adoption of a community-led participatory approach through the establishment of Centres for Financial Literacy (CFL) and the National Centre for Financial Education (NCFE), along with broadcasting regional language financial education messages and utilising community radio, reflects the public policy strategy for enhancing digital literacy (World Bank and IFAD, 2021).  3.2 Bridging Gender, Economic and Social Inequalities I.28 Digitalisation can play a vital role in increasing the contribution of women to economic activity and effectively targeting delivery of the public schemes for intended beneficiaries. Globally, men outnumbered women internet users by five percentage points in 2023 (Chart I.17a). For low-income countries, the gap increased to 14 percentage points in 2023, with the mobile ownership gap between genders at 17 percentage points vis-à-vis one percentage point for high-income countries and seven percentage points overall (Chart I.17b). In terms of the adoption and usage of FinTech products, a significant gap between gender persists globally14 (Chen et al., 2023).   I.29 Despite gender disparities in internet accessibility in India, the gender gap in internet adoption has narrowed significantly between 2017 and 2022 (Chart I.18). The digital gender gap has implications for expanding the female labour force participation rate (LFPR), which was 41 per cent relative to male LFPR of 78 per cent in 2023 (MoSPI, 2024). Digitalisation, thus, offers a unique opportunity to reap the demographic dividend. Digital tools can contribute to gender-neutral labour markets by offering flexible schedules, virtual workplaces and coworking spaces, aiding women in overcoming mobility barriers and promoting work-life balance. Technologies like virtual reality (VR), augmented reality (AR) and blockchain present exciting opportunities for women (Patra, 2024a). Sectors such as banking, financial services and insurance (BFSI), telecom and e-commerce are increasingly prioritised by women, with half of the female job seekers preferring work-from-home options (Press Trust of India, 2023).  I.30 Digitalisation is empowering India to bridge economic inequalities through a paradigm shift in social welfare schemes via DBTs. Over the last decade and especially since the pandemic, funds disbursed directly to beneficiary accounts through DBT have been ramped up, along with an increase in the number of beneficiaries (Chart I.19). By harnessing DPIs in conjunction with social welfare schemes and structural reforms, India has lifted 415 million people from poverty within a span of 15 years between 2005 and 2021 (UNDP, 2023)15. Multidimensional poverty has dropped from 29.1 per cent of the total population in 2013-14 to 11.2 per cent in 2022-23, surpassing the sustainable development goal well ahead of the deadline (NITI Aayog, 2024)16.  3.3 Addressing Finance for Agriculture I.31 A significant number of lower-income households and businesses in the informal sector remain excluded from credit registries as they often lack the necessary information that financial institutions need to evaluate creditworthiness. This exclusion decreases their chances of obtaining finance and increases the cost of loans when they do receive them (Carriere-Swallow et al., 2021). Consequently, informal finance is still thriving in rural India, despite the penetration of the formal financial sector. Among the total outstanding loans of rural households, 31 per cent is sourced from informal lenders. Penetration of informal loans is particularly high among the lowest economic strata of households (Chart I.20). Consumption smoothing, social ceremonies and medical emergencies together account for nearly 30 per cent of total loans availed by rural households in 2018-19 (NSO, 2021). This indicates that a significant portion of loans by rural households are driven by immediate and essential needs rather than long-term investment, reflecting vulnerability in their financial position and access to services.  I.32 Digitalisation can significantly transform the agriculture sector. Reforms such as the decoupling of income support for all farmers through direct disbursement of PM-KISAN instalments into bank accounts, the e-national agricultural market (e-NAM) for integrating mandis online for transactions and development of Kisan Suvidha mobile app to facilitate dissemination of information to farmers are playing a pivotal role. So far, 1,389 wholesale mandis located in 23 states and four UTs have been integrated on the e-NAM platform (Chart I.21). I.33 At end-March 2023, the number of operative Kisan Credit Cards (KCCs) stood at 7.4 crore (Chart I.22a).17 KCC penetration is less than 20 per cent among marginal farmers having less than one hectare of land (Chart 1.22b). The reasons for the low penetration of KCCs are the unavailability of online land and revenue records as well as a lack of awareness about the scheme, among others (Mani, 2016). Amount outstanding under operative KCCs has grown consistently, although there is a wide variation across states (RBI, 2023a). Digitalisation of agricultural finance through digital KCC products under the PTPFC will deepen inclusion through hassle-free disbursement of loans.  I.34 Central government funding is being provided to state governments through the National e-Governance Plan in Agriculture (NeGP-A) for initiatives involving AI and Machine Learning (ML), robotics, data analytics and blockchain. This is enabling IT-based solutions for crop planning and health, farm credit and insurance, crop estimation and market intelligence. The architecture of three core registries – farmer registry; village map registry; and crop sown registry – has been finalised (PIB, 2023a). The Digital India Land Records Modernisation Programme (DILRMP) is aiding digitisation of land records, minimising discrepancies, enhancing accessibility and facilitating seamless land transactions (Chart I.23). The programme is reducing the time taken to disburse crop loans and will accelerate the formalisation of land leasing within the farm sector, seamless land acquisition and forest clearance for infrastructure planning.   I.35 Digitalisation is also resulting in better price discovery for agricultural households. Around 16 per cent of them accessed technical advice from digital sources, including radio/TV/electronic media (13.2 per cent), kisan call centres (1.5 per cent), smartphone-based applications (1.2 per cent) and agricultural clinics and agricultural business (0.5 per cent) in 2018-19 (NSO, 2021) [Chart I.24]. 3.4 Enabling Seamless Cross-Border Payments I.36 Digitalisation is transforming payments for internationally traded goods and services. Technologies like real-time payment systems and blockchain enable instant transfers, reduce delays and improve tracking of funds. Automated processes cut costs, offer better exchange rates and ensure regulatory compliance through data analytics. User-friendly digital platforms also democratise access for small and medium-sized enterprises, making international trade more accessible. Powered by digitalisation, there has been a surge in cross-border payments worldwide in recent decades. India is a pioneer in digitally-enabled remittances and international trade in digitally deliverable services (Chart I.25). It usually takes one to three business days to disburse funds, costing five per cent for sending US$ 200 on average.18 I.37 The future of cross-border payments will be characterised by the setting up of dedicated payment rails for instantaneous transfers and greater harmonisation of payment regulations across borders (Patra, 2023). The Association of Southeast Asian Nations’ (ASEAN) Regional Payment Connectivity (RPC) initiative, akin to India’s UPI, is already adopted by countries like Singapore, Malaysia and Thailand and plays a substantial role in facilitating cross-border flows for trade, investment and remittances. Currently, seven countries19 accept UPI payments (NPCI, 2024). The Reserve Bank’s Payments Vision 2025 envisions that integrating with fast payment systems of foreign jurisdictions and increasing participation in global standard-setting bodies will facilitate trade and commerce, reducing remittance costs and time. Increased digital payment adoption will lower cash usage expenses, boost the share of digital payments in GDP and improve transaction transparency. The Reserve Bank plans to migrate all RBI-operated payment messaging systems to ISO 20022 standard to ensure interoperability with systems of other jurisdictions.   3.5 Greening of Infrastructure I.38 Digital technologies in finance can facilitate environmental sustainability and a circular economy by creating data-driven digital economy that support a transition towards a net-zero emission economy, protect natural resources and minimise waste (UNEP, 2022). India has committed to (i) achieve 50 per cent cumulative electric power installed capacity from non-fossil energy resources by 2030; (ii) reduce emission intensity of GDP by 45 per cent by 2030 from 2005 level; (iii) create an additional carbon sink of 2.5 to 3 billion tonnes through additional forest and tree cover (UNFCCC, 2022); (iv) achieve ‘Net Zero’ emissions by 2070; and, (v) reduce projected carbon emissions by one billion tonnes by 2030 (PIB, 2021). The share of renewable energy in India’s power generation mix has improved from 15.9 per cent in 2015-16 to 20.7 per cent in 2023-24 (Chart I.26a). India aims to achieve 500 Gigawatt (GW) of renewable energy capacity by 2030 (PIB, 2023b), up from 190 GW as on March 31, 2024 (Chart I.26b). I.39 The escalating demand for digital services increases data storage needs, raises energy consumption and widespread electronic product adoption generates significant e-waste. As per the United Nations’ Global e-Waste Monitor 2024, India ranks as the world’s third largest generator of e-waste in 2022, following China and the US (UNITAR, 2024). Thus, the responsible development and use of technology, coupled with adoption of renewable energy and formal e-waste management, are vital in leveraging digital technologies to combat climate challenges.  I.40 The growing imprint of digitalisation in all these areas is transforming production and consumption patterns of economic agents. Digitalisation influences price levels through direct and indirect channels (Csonto et al., 2019). Under the direct channel, digitalisation can feed into lower inflation rates through a decline in the prices of ICT-related goods, as observed in the post-pandemic period across both hardware and software charges in India20 (Chart I.27).  I.41 Digital technologies can also influence inflation indirectly through changes in firms’ price-setting behaviour and market dynamics, with new players enhancing competition enabled by e-commerce. Dynamic pricing of goods and services becomes possible with digital technologies, making prices more responsive to economic changes by reducing menu costs, improving access to information and enhancing price update flexibility (Glocker and Piribauer, 2021). Illustratively, price changes for vegetables and food items occur once in two and three days, respectively, on online platforms in India, which is much frequent than corresponding offline price changes (two to three weeks) [Nadhanael, 2022]. As internet penetration expands, there will be a corresponding increase in digitally-influenced retail purchases and number of digitally-influenced consumers and online shoppers (Chart I.28). I.42 This rise in digital engagement, coupled with increasing price and information transparency, can also put downward pressure on prices by lowering search, replication, transportation, tracking and verification costs (Goldfarb and Tucker, 2019). These developments can potentially make the Phillips curve steeper, enhancing the efficacy of monetary policy in securing price stability (Ari et al., 2023; Friedrich and Selcuk, 2022). Furthermore, digitalisation can improve access to financial services and enhanced financial inclusion is found to improve the transmission of interest rate-based monetary policy impulses (Patra, 2021).  4. Future Shocks: Digitalisation’s Challenges I.43 While digitalisation opens several opportunities across sectors, it also brings in new challenges while accentuating existing ones. In financial markets, this is stark. Digitalisation is leading to the introduction of a variety of complex financial products and services, with implications for market structure and financial stability. The emergence of digital players with unreliable funding models accentuates vulnerability in the system and poses challenges for financial stability. I.44 The hyper-diversification of financial services may lead to a “barbell”–like financial structure, with a small set of dominant multi-product players leveraging network effects and economies of scale, alongside a large set of niche service providers benefitting from efficiency gains and lower barriers to entry (Feyen et al., 2021). I.45 In India’s digital payment ecosystem, various UPI applications have emerged21, expanding customer choices and propelling turnover. The major share of transactions is, however, cornered by a few applications, as evident from the Herfindahl-Hirschman Index (HHI) being in the range of 0.35-0.37 for both volume and value of transactions on the platform (Chart I.29). In this context, the NPCI has capped the market share of a single third-party application provider in volume terms to 30 per cent by December 2024 in order to address concentration risks (NPCI, 2022). 4.1 Cyber Security I.46 Cyber security is an important challenge owing to the diverse nature of cyber threats targeting the digital financial infrastructure.22 In India, security incidents handled by the Indian Computer Emergency Response Team (CERT-In) have increased from 53,117 in 2017 to 13,20,106 during the period January-October 2023 (CERT-In, 2017; RBI, 2023a). Unauthorised network scanning/probing/vulnerable services account for more than 80 per cent of all security incidents in India (Chart I.30).  I.47 Industry-wise distribution of cyber attacks in India shows that the automotive industry is the most vulnerable, with smart mobility application programming interfaces (APIs) and electric vehicle (EV) charging infrastructure emerging as major attack vectors. The BFSI sector, governed by well-defined regulations, is relatively protected from such attacks (Chart I.31).  I.48 Globally, cybercrime costs are expected to reach US$ 13.82 trillion by 2028, up from US$ 8.15 trillion in 2023 (Statista, 2023). The average cost of a data breach has also risen to US$ 4.45 million in 2023, a 15 per cent increase over three years (IBM, 2023). Recognising the significant costs involved, most central banks have increased their cyber security investment budgets by five per cent since 2020 (Doerr et al., 2022). In India, the average cost of data breaches stands at US$ 2.18 million in 2023, a 28 per cent increase since 2020 albeit less than the global average cost of data breach (Chart I.32). The most common attacks in India are phishing (22 per cent), followed by stolen or compromised credentials (16 per cent) [IBM, 2023]. 4.2 Consumer Protection I.49 Customers are the epicentre of the digital economy. The success of any enterprise is intricately tied to the satisfaction and trust of its customers, and thus, adopting a customer-centric approach to innovation is vital for sustainable growth (Das, 2023a). While digitalisation offers enhanced convenience and accessibility, the growing complexity of financial products also introduces new challenges in ensuring customer protection. With the increasing adoption of digital payments, the share of complaints related to mobile/electronic banking, ATM/debit cards and credit cards received in the offices of the RBI ombudsman accounted for 47 per cent of total complaints in 2022-23 (RBI, 2024b) [Chart I.33].    I.50 Digital financial innovations present a trade-off between competition (thereby, enhancing customer convenience) and customer protection. Illustratively, while the digital lending platforms and buy-now-pay-later (BNPL) services bolster consumer convenience, they also entail various costs, including exorbitant charges, coercive recovery practices and hidden fees. In India, BNPL constitutes around three per cent of total e-commerce finance by value (Statista, 2024b). While BNPL is projected to grow every year by 74 per cent, making it a US$ 56 billion market by 2026, the model has a high dependence on late fees to ensure profitability which could become predatory for customers (HDFC securities, 2022). These risks are exacerbated by the seamless nature of digital technologies, facilitating impulsive spending and debt accumulation (Pradhan et al., 2018). I.51 Digitalisation is also giving rise to certain ‘invisible risks’ or ‘dark patterns’, whereby consumers are tricked into making decisions detrimental to their interests (Rao, 2023a) [Chart I.34]. I.52 The use of extensive customer data by companies raises concerns about data protection and privacy, potentially compromising customer trust and security (IMF, 2021). In India, three-fourths of the business-to-consumer (B2C) funded FinTech applications23 request permission to access camera, photo/media/files, location and storage for using applications (Chart I.35). I.53 India is one of the top ten countries in terms of embedded finance24 revenue (Chart I.36) and it is expected to expand at a CAGR of 30.4 per cent over 2022-29 to reach US$ 21.1 billion in 2029 (PwC, 2023). While cross-selling25 and embedded finance models enhance customer convenience, they may raise anti-competition concerns due to bundled services.   I.54 The declining costs of internet-enabled devices and mobile data have enhanced access; however, affordability remains a barrier to achieving universal internet usage (ICRIER, 2023). India also has immense potential to enhance the quality of digital services (Chart I.37). 4.3 Reshaping of Labour Markets I.55 Digital technologies are impacting workforce composition, job quality, skill requirements, and labour and regulatory policies. Implementation of AI in financial services is shifting roles to higher-skilled tasks, automating routine functions and aiding decision-making. Digitalisation is decentralising financial labour through outsourcing and telework (ILO, 2022). Automation replacing labour can potentially widen the gap between capital and labour returns, creating a fragmented labour market with low-skill/low-pay and high-skill/high-pay jobs, while middle-tier jobs are displaced by technology (Schwab, 2016).

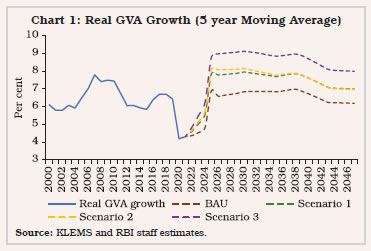

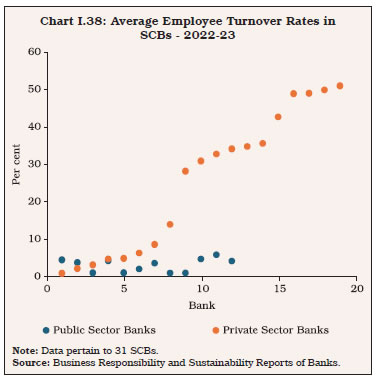

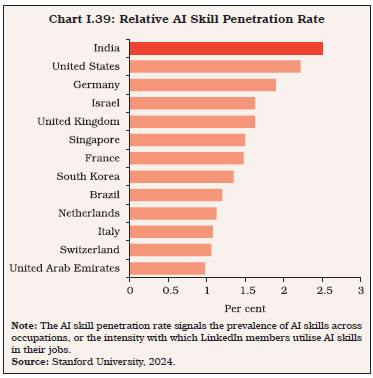

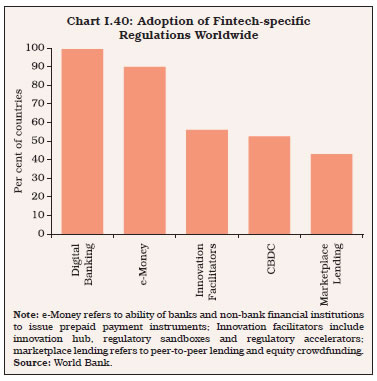

I.56 Between 2013 and 2019, employees in support roles in the financial sector decreased in many countries, while the number of professionals and technicians rose (ILO, 2022). This is evident in the Indian banking sector as well (Table I.1). I.57 In digital recruitment platforms, a major issue is the high average turnover rate of financial institutions, with some private sector banks in India reporting turnover rates of above 30 per cent in 2022-23 (Chart I.38). This raises significant risks for the financial sector, including loss of institutional knowledge, disruption in services and higher recruitment costs (Jain, 2023). I.58 Upskilling and reskilling the labour force pose significant challenges, given the growing shift towards digital-intensive roles. The rising importance of AI-related skills in the labour market in India is reflected in the growth in AI talent recruitment relative to overall recruitment26 in 2023 (16.8 per cent y-o-y) and the highest relative AI skill penetration rate (Chart I.39) [Stanford University, 2024]. Pre-existing traditional methods of learning and development, however, are inadequate for this transformation, necessitating significant investments to build the required skills at scale, leverage AI in learning and keep pace with the swiftly evolving demands of digital skills.   4.4 Emerging Regulatory Challenges I.59 Digitalisation generates regulatory challenges, necessitating that regulators stay ahead of the financial innovation curve while balancing the complex trade-offs related to financial stability, competition and customer protection. This will require enhancing the capacity of regulated entities and oversight authorities, updating legal and regulatory frameworks, engaging stakeholders to identify risks and expanding consumer education (Patra, 2024b). I.60 Regulations need to set boundaries to contain the irrational exuberance of participants and ensure a sound and robust set of institutions, thereby promoting financial stability (Rao, 2023b). In the context of peer-to-peer lending applications in India, regulations have been found to have a positive impact in building trust, thereby enabling adoption of financial innovations (Box I.3). I.61 Challenges facing regulatory and supervisory mandates stem from loosening entry barriers, potentially risking FinTech lending being promoted on weak business models with inadequate cyber infrastructure. Furthermore, unregulated non-bank payment services could disadvantage traditional banks, leading to regulatory arbitrage and deposit disintermediation (Sankar, 2023). Globally, countries have accordingly enacted regulations to strengthen enforcement in FinTech-related activities (Chart I.40). I.62 BigTechs, that can quickly become ‘too big to fail’ and dominate markets, may pose significant challenges in assessing risk profiles due to their unique characteristics, extensive group entities, interconnected activities and transnational presence. Partnerships with incumbent firms can encourage excessive risk-taking, especially when BigTechs handle the customer-facing aspect of the value chain without assuming underwritten risks (Crisanto and Ehrentraud, 2021). Collection of extensive data by BigTechs can be utilised to favour their own products, obtaining higher margins by making financial institutions’ access to prospective clients via their platforms, engaging in product bundling and cross-subsidising activities. This can give rise to adverse economic and welfare outcomes.

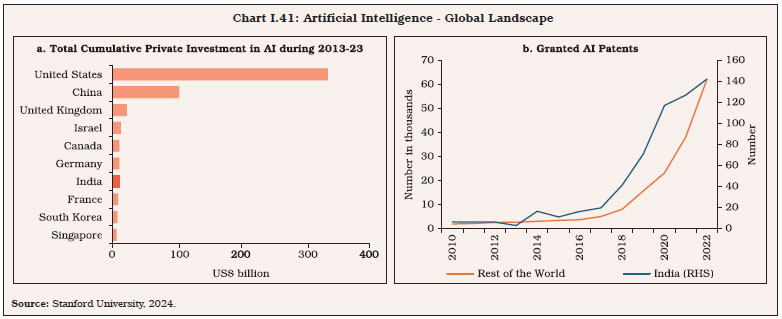

I.63 Digitalisation generates vast amount of data that can facilitate the use of advanced models like AI and Generative AI (GenAI) in the financial sector. The cumulative private investment in AI in India, however, is low relative to the rest of the world (Chart I.41a). The share of India in granted AI patents in the world is also low (Stanford University, 2024) [Chart I.41b].  I.64 On the regulatory front, the challenge is to balance financial security through data analytics with the need to protect individual privacy and customer rights.29 The increased use of AI algorithms - particularly deep learning models - by financial institutions presents additional challenges, such as lack of explainability, potential discriminatory biases, false signals and substantial investment requirements to integrate with legacy systems. Central bankers must also closely monitor quantum computing developments due to growing concerns about the vulnerability of current cryptographic methods in securing financial transactions (Patra, 2024b). I.65 It is crucial to ensure that model-based lending in banking and non-banking financial companies (NBFCs) employs robust, regularly tested algorithms to mitigate undue risk accumulation and uphold underwriting standards amidst evolving financial landscapes (Das, 2023b). Designing responsible and ethical AI solutions for financial services would necessitate consideration of ten principles - fairness; transparency; accuracy; consistency; data privacy; explainability; accountability; robustness; monitoring and updating; and human oversight (Rao, 2023c).  I.66 The online nature and cross-border reach of digital payments and trade across multiple jurisdictions with diverse regulatory frameworks necessitate effective regulation through international collaboration, harmonisation and promotion of common protocols, standardised APIs and secure communication channels. Globally, efforts are underway to harmonise cybersecurity regulations and anti-money laundering/countering the financing of terrorism (AML/CFT) frameworks. The Group of Seven (G7), the Basel Committee on Banking Supervision (BCBS), the Financial Stability Board (FSB) and the Committee on Payments and Market Infrastructure and International Organisation of Securities Commissions (CPMI-IOSCO) have issued high-level principles on cybersecurity to foster convergence in cyber resilience strategies. 5. Digitalisation and the Reserve Bank of India I.67 The Reserve Bank, as a full-service central bank and enabler of the market economy, has taken several policy initiatives to address various aspects of financial sector digitalisation, built on the principles of trust, stability and innovation (Das, 2024a). Trust is fostered through market reforms ensuring fair conduct, price transparency and enhanced disclosures. Stability is upheld by orderly market functioning and infrastructure. Innovation is promoted through principle-based regulation, new products/platforms and market access. The regulatory perimeter has also expanded as the Indian financial system has ventured into newer business models, product lines and geographical territories, ushering in a consultative, collaborative and forward-looking approach to regulation with customers at the centre of innovations (Rao, 2023b). 5.1 Financial and Digital Inclusion I.68 India has established digital banking units (DBUs), improved UPI with offline payments and conversational payments in local languages, extended payment system access to non-bank entities and extended operational hours of various digital modes to foster financial inclusion. Digitalisation of agricultural finance under the PTPFC, as noted earlier, will deepen inclusion. The PIDF has been launched to broad-base payment infrastructure. 5.2 Customer Protection I.69 In response to regulatory and customer protection challenges in the digital lending ecosystem, the Reserve Bank issued the Guidelines on Digital Lending, based on recommendations of the Working Group on Digital Lending (Chairperson: Shri Jayant Dash). These guidelines include provisions for loan servicing, comprehensive disclosures such as the key fact statement (KFS), grievance redressal mechanisms, credit assessment standards and borrower data privacy (RBI, 2023b). The implementation of the Reserve Bank-Integrated Ombudsman Scheme (RB-IOS) has resulted in structural improvements in grievance redress mechanism (Das, 2024b).30 Additionally, the Bank has initiated public awareness campaigns like the ‘RBI Kehta Hai’ and electronic Banking Awareness and Training (e-BAAT) programme across the country to educate the public about digital payment products, fraud prevention and risk mitigation (Das, 2024c). 5.3 Data Protection I.70 To tackle issues relating to misuse of data, the Reserve Bank has implemented data localisation for payments data and issued guidelines preventing digital lending applications from accessing private information without the explicit consent of users. In order to make digital payments more secure, safe and sound, the Reserve Bank has enabled card-on-file tokenisation (CoFT) through card-issuing banks and institutions. This will avoid any breach or leak of data since instead of card details, a specially created token is saved with the merchant. 5.4 Cyber Security I.71 The measures implemented in India to promote security of digital transactions include two-factor authentication for digital payments, increased customer control over card usage, faster turnaround time for transaction failures, augmented supervisory oversight with simulated phishing exercises. The Reserve Bank also issued comprehensive guidelines and frameworks for IT and Cyber Risk management, encompassing regulations on Digital Payment Security Controls and IT Services Outsourcing.31 5.5 FinTech Regulation I.72 To encourage FinTech innovations, the Reserve Bank has launched the Regulatory Sandbox scheme, the Reserve Bank Innovation Hub and FinTech Hackathons. To foster FinTech regulation through a consultative approach, the Reserve Bank has brought forth a framework for Self-Regulatory Organisations (SROs) in the FinTech sector, laying down the characteristics of FinTech SROs (SRO-FT) and their functions, governance standards, eligibility criteria and the like (RBI, 2024c). The SRO-FT would guide the conduct of its members, ensure adherence to industry standards, compliance with relevant laws and regulations and maintenance of high ethical standards, encourage responsible experimentation, address grievances, conflicts of interest, or disputes and foster a fair, equitable and competitive FinTech environment in India. 5.6 Digital Technologies in Regulation and Supervision I.73 Digital tools like regulatory technology (RegTech) and supervisory technology (SupTech) are leveraged to broaden the supervisory and monitoring frameworks and reassess the regulatory perimeter. The Reserve Bank has set up an Advanced Supervisory Analytics Group (ASAG) to leverage ML models for social media analytics, KYC compliances and for gauging governance effectiveness. The establishment of an advanced off-site supervisory monitoring system - DAKSH - is helping to digitalise supervisory processes. An Integrated Compliance Management and Tracking System (ICMTS) and a Centralised Information Management System (CIMS) are other two major SupTech initiatives being implemented for seamless reporting by supervised entities for enhancing data management and data analytics capabilities, respectively (Patra, 2024b). I.74 Digital technology infrastructure will be India’s growth engine of tomorrow. The focus is on next-generation communication technologies like 6G and satellite networks, alongside expanding the 5G network to rural and hitherto uncovered urban areas. Graduating to advanced technologies will unleash opportunities in the last mile. Attaining self-sufficiency in chip manufacturing is another key step in ensuring the realisation of the full potential of the digital revolution. As the semiconductor and chip manufacturing ecosystem matures in India, it will create strong backward and forward linkages in the digital world through a rise in cloud services and data storage including data centres. Converting to renewable energy sources will be critical while embracing these changes, as they involve energy consumption owing to voluminous data generation and data storage requirements. Demographic shifts impacting the demand and operations of financial services will also need to be taken care of while making policies. I.75 Against the backdrop of the contours of the digitalisation landscape and the opportunities and challenges it presents as it expands, the rest of the report is organised into four chapters. Chapter 2 presents the current uptake of financial innovations by financial institutions (FIs) and customers and discusses economic factors that facilitate the adoption of financial innovations in India. The chapter also highlights major aspects of FIs’ collaborations with FinTechs and BigTechs for embracing financial innovations. Digital lending is picking up momentum in India, especially in the retail segment. The digital lending landscape is also getting boosted by several policy innovations. The adoption of digital technologies has improved the efficiency of banks in India, along with increasing competition in the banking sector. Overall digitalisation in the financial sector enables banks to reduce various risks and improves integration across various financial markets, thus, boosting liquidity in these markets. The regulatory concerns raised by financial innovations, especially by the new collaborations in the financial sector are also discussed in the chapter along with major policy initiatives. I.76 Chapter 3 explores the implications of digitalisation on payment systems architecture, weighing benefits against emerging risks. Against the backdrop of the evolution of payment systems in India, the chapter undertakes a comparison of different modes of digitalisation of payments across countries and lays out the advantages of open-loop payment systems like the UPI where banks and other third-party application providers use the existing platform to process and settle payments. Empirical analysis in a cross-country setting shows that demography, which favours the younger population; penetration of internet; and size of the formal economy are factors that condition the adoption of digital payments. An All-India survey indicates that 42 per cent of the respondents had used at least one form of digital payments in their lifetime (as of end-2022) and the numbers are set to rise as more than three-fourths are aware of the facilities. The usage was found to be higher among metro and urban areas and among younger respondents. I.77 Chapter 4 provides an assessment of the opportunities for India in an open-economy setting. Digitalisation matters for trade, especially for India’s services trade, given India’s relative comparative advantage. Digitalisation in international payment systems has the potential to reduce the cost of sending remittances and to achieve the Sustainable Development Goal (SDG) target by 2030. Cross-border digital trade policies and digitalisation, along with measures aimed at internationalising the Indian Rupee (INR) and the CBDC project, would play a crucial role in harnessing new opportunities, supporting seamless international transactions, reducing foreign exchange risks and managing global liquidity. The availability of e-payment services, policy support for digital businesses, development of local digital skills and data security would help attract digital foreign direct investment (FDI). Going forward, given the significant surge in digital transactions, improving the measurement of digitalisation and digital trade in key macroeconomic statistics such as the System of National Accounts (SNA) and balance of payments (BoP) gains significance for better policy formulation, monitoring and governance of the digital economy. I.78 Chapter 5 explores the risks and challenges of digitalisation in India from a futuristic perspective. This chapter presents the major findings of a special survey of banks and NBFCs on the opportunities and challenges of digitalisation in India. Enhancing customer experiences, increasing operational efficiency and competitive considerations are seen as prime drivers of digitalisation whereas cybersecurity, data privacy and vendor and third-party risks are highlighted as key emerging challenges. Implications of digitalisation on consumer behaviour, monetary policy and financial stability are also examined. Results from a calibrated New Keynesian model reveal that monetary policy can be more effective in reducing inflation under digitalisation. This emanates from digitalisation-induced reduction in cost and steepening of the slope of the Phillips curve due to lower elasticity of demand. The chapter also discusses new risks and challenges that digitalisation can bring for customer protection and financial stability and the Reserve Bank’s proactive approach to mitigate risks while fostering financial innovations. References ACI Worldwide. (2024). Prime Time for Real-Time Global Payments Report. Alonso, C., Bhojwani, T., Hanedar, E., Prihardini, D., Uña, G., and Zhabska, K. (2023). Stacking Up the Benefits: Lessons from India’s Digital Journey. IMF Working Paper No. 2023/078. Ari, M. A., Garcia-Macia, M. D., and Mishra, S. (2023). Has the Phillips Curve Become Steeper?. IMF Working Paper No. 2023/100. Asian Banker. (2022). BigTech Credit Expected to Reach $1 Trillion by 2023. Asian Development Bank. (2021). Capturing the Digital Economy, a Proposed Measurement Framework and its Applications: A Special Supplement to Key Indicators for Asia and the Pacific 2021. Asian Development Bank Report. Bank for International Settlements. (2024). Red Book Statistics 2022. Committee on Payments and Market Infrastructures (CPMI). Retrieved from: https://www.bis.org/statistics/payment_stats.htm Bech, M. L., Faruqui, U., Ougaard, F., and Picillo, C. (2018). Payments are A-Changin’ but Cash Still Rules. BIS Quarterly Review, March 2018. Boston Consulting Group (BCG). (2022). Ten Things You Should Know About E-Commerce in India. June, 2022. Retrieved from: https://www.web-assets.bcg.com Cable.co.uk (2024). Worldwide Mobile Data Pricing. 2024. Retrieved from: https://www.cable.co.uk/mobiles/worldwide-data-pricing. Carriere-Swallow, M. Y., Haksar, M. V., and Patnam, M. (2021). India’s Approach to Open Banking: Some Implications for Financial Inclusion. IMF Working Paper No. 2021/052. CERT-In. (2017). CERT-In Annual Report 2017. Retrieved from: https://www.cert-in.otg.in/s2cMainServlet?pageid=PUBANULREPRT Chandrasekhar, R. (2023). Address by Minister of State for Electronics and Information Technology; and Skill Development and Entrepreneurship. GPI Global Summit in Pune, June 12. Chen, S., Doerr, S., Frost, J., Gambacorta, L., and Shin, H. S. (2023). The Fintech Gender Gap. Journal of Financial Intermediation, 54, 101026. Cornelli, G., Frost, J., Gambacorta, L., Rau, P. R., Wardrop, R., and Ziegler, T. (2020). Fintech and Big Tech Credit: a New Database. BIS Working Paper No. 887. Crisanto, J. C., and Ehrentraud, J. (2021). The Big Tech Risk in Finance. International Monetary Fund. Finance and Development. Retrieved from: https://www.imf.org/external/pubs/ft/fandd/2021/05/big-tech-fintech-and-financial-regulation-crisanto-ehrentraud.htm Csonto, M. B., Huang, Y., and Mora, M. C. E. T. (2019). Is Digitalization Driving Domestic Inflation?. IMF Working Paper No. 2019/271. D’Silva, D., Filková, Z., Packer, F., and Tiwari, S. (2019). The Design of Digital Financial Infrastructure: Lessons from India. BIS Paper No. 106. Das, S. (2021). Financial Inclusion – Past, Present and Future. Speech Delivered at the Economic Times Financial Inclusion Summit, July 15. Das, S. (2023a). FinTech and the Changing Financial Landscape. Speech at the Global Fintech Festival, Mumbai, September 6. Das, S. (2023b). Winning in Uncertain Times: The Indian Experience. Speech at the FIBAC 2023 Conference Organised jointly by FICCI and IBA, Mumbai. November 22. Das, S. (2024a). Evolution of Financial Markets in India: Charting the Future. Keynote Address at the FIMMDA-PDAI Annual Conference, Barcelona, April 8. Das, S. (2024b). Inaugural Address at the Annual Conference of RBI Ombudsman. Mumbai, March 15. Das, S. (2024c). Address at the Digital Payments Awareness Week Celebrations. Mumbai. March 4. Data.ai. (2024). Number of Mobile Application Downloads. Retrieved from: https://www.data.ai/en/insights/market-data/state-of-mobile-2024/ Data Security Council of India (DSCI) and SEQRITE. (2023). India Cyber Threat Report. Deloitte. (2022). TMT Predictions 2022. Big Bets on Smartphones, Semiconductors, and Streaming Service. Retrieved from: https://www2.deloitte.com/content/dam/Deloitte/in/Documents/technology-media-telecommunications/in-TMT-predictions-2022-noexp.pdf. Department for Promotion of Industry and Internal Trade. (2024). Startups. Startup India, May, 2024. Retrieved from: https://www.startupindia.gov.in. DigiLocker. (2024). Statistics. Retrieved from: https://www.digilocker.gov.in/statistics. Direct Benefit Transfer (DBT). (2024). DBT Dashboard. Retrieved from: https://dbtbharat.gov.in. Doerr, S., Gambacorta, L., Leach., T., Legros, B., and Whyte, D. (2022). Cyber Risk in Central Banking. BIS Working Papers No. 1039. Feyen, E., Frost, J., Gambacorta, L., Natarajan, H., and Saal, M. (2021). Fintech and the Digital Transformation of Financial Services: Implications for Market Structure and Public Policy. BIS Paper No. 117. Friedman, T.L. (2019). The World’s Gone from Flat, to Fast, to Deep. McKinsey and Company. Retrieved from: https://www.mckinsey.com/featured-insights-of-work/thomas-l-friedman-technology-moved-in-steps. Friedrich, C., and Selcuk, P. (2022). The Impact of Globalization and Digitalization on the Phillips Curve. Bank of Canada Staff Working Paper No. 2022-7. Glocker, C., and Piribauer, P. (2021). Digitalization, Retail Trade and Monetary Policy. Journal of International Money and Finance, 112, 102340. Goldfarb, A., and Tucker, C. (2019). Digital Economics. Journal of Economic Literature, 57(1), 3-43. Goods and Service Tax (GST). (2024). E-way Bill System. Retrieved from: https://ewaybillgst.gov.in GSMA. (2024). The Mobile Economy 2024. Retrieved from: https://www.gsma.com/solutions-and-impact/connectivity-for-good/mobile-economy/wp-content/uploads/2024/02/260224-The-Mobile-Economy-2024.pdf HDFC Securities (2022). Buy Now, Pay Later. Fintech Playbook Report. January 8, 2022. Internet and Mobile Association of India (IAMAI) and Kantar. (2024). Internet in India 2023. IBM (2023). Cost of a Data Breach Report. Retrieved from https://www.ibm.com/reports/data-breach India Brand Equity Foundation (IBEF). (2024). E-Commerce Industry Report. May, 2024. Indian Council for Research on International Economic Relations (ICRIER). (2023). State of India’s Digital Economy. Centre for Internet and Digital Economy. February 2023. Indian Council for Research on International Economic Relations. (2024). State of India’s Digital Economy (SIDE) Report, 2024. Centre for Internet and Digital Economy. February 2024. International Labour Organisation. (2022). Digitalization and the Future of Work in the Financial Services Sector. International Monetary Fund (IMF). (2021). Needed—A Global Approach to Data in the Digital Age. IMF Blog, October 26. Jain, M.K. (2023). Governance in Banks: Driving Sustainable Growth and Stability. Speech at the Conference of Directors of Banks organised by the Reserve Bank of India for Public Sector Banks and Private Sector Banks, Mumbai. May 22 and May 29. Mani, G. (2016). Study on Implementation of Kisan Credit Card Scheme. Occasional Paper. NABARD. Ministry of Electronics and Information Technology (MeitY). (2019). India's Trillion-Dollar Digital Opportunity. Ministry of Electronics and Information Technology (MeitY). (2024). MeitY Dashboard. Retrieved from: https://meity.dashboardnic.in/DashboardF.aspx. Ministry of Finance (MoF). (2024). Economic Survey 2023-24. Ministry of Statistics and Program Implementation (MoSPI). (2024). Key Employment Unemployment Indicators for January 2023 - December 2024. Periodic Labour Force Survey. Nadhanael, G.V. (2022). Essays on Inflation and Macroeconomic Dynamics in India. Doctoral Dissertation, University of British Columbia. National Association of Software and Service Companies (NASSCOM). (2024). India’s Digital Public Infrastructure – Accelerating India’s Digital Inclusion Report. National Payments Corporation of India. (2022). Guidelines on Volume Cap for Third Party App Providers (TPAPs) in UPI. NPCI Circular. National Payments Corporation of India. (2024). List of Countries that accept UPI. Retrieved from: https://www.npci.org.in/who-we-are/group-companies/npci-international/list-of-countries. National Statistical Office (NSO). (2021). 77th Round. Situation Assessment of Agricultural Household and Land and Livestock Holdings of Households in Rural India, 2019. NSS Report No. 587. NITI Aayog (2024). Multidimensional Poverty in India since 2005-06 – Discussion Paper. Nokia. (2024). MBiT Index. Retrieved from: https://www.nokia.com/about-us/company/worldwide-presence/india/mbit-index-2024/ Ookla (2024). Mobile Internet Download Speed, 2024. Retrieved from: https://www.speedtest.net/global-index/india Panagariya, A. (2022). Digital Revolution, Financial Infrastructure and Entrepreneurship: The Case of India. Asia and the Global Economy, 2(2), 100027. Patra, M.D. (2021). Financial Inclusion Empowers Monetary Policy. Address Delivered in the Project on Financial Inclusion, a Joint Initiative by the IIMA, IRMA and CIIE organised by the IIM, Ahmedabad, December 24. Patra, M.D. (2023). The Dawn of India’s Age. Address Delivered at the Indira Gandhi Institute of Development Research (IGIDR) Alumni Conference in Mumbai, May 10. Patra, M.D. (2024a). The Indian Economy: Opportunities and Challenges. Keynote Address Delivered at the Nomura’s 40th Central Bankers Seminar at Kyoto, Japan, March 25. Patra, M.D. (2024b). Harnessing Digital Technologies in Central Banks: Opportunities and Challenges. Speech at the SAARCFINANCE Seminar on Emerging Digital Technologies in Central Banking and Finance, Goa. January 17. Pradhan, D., Israel, D., and Jena, A. K. (2018). Materialism and Compulsive Buying Behaviour: The Role of Consumer Credit Card Use and Impulse Buying. Asia Pacific Journal of Marketing and Logistics, 30(5), 1239-1258. Pradhan Mantri Jan Dhan Yojana (PMJDY). (2024). Progress Report. Retrieved from: https://pmjdy.gov.in/account. Press Information Bureau (PIB). (2021). National Statement by Prime Minister Shri Narendra Modi at COP26 Summit in Glasgow. November 1. Press Information Bureau. (2023a). Information Technology in Agriculture Sector. Press Information Bureau. (2023b). Government Declares Plan to Add 50 GW of Renewable Energy Capacity Annually for next 5 years to achieve the Target of 500 GW by 2030. Retrieved from: https://pib.gov.in/PressReleaselframePage.aspx?PRID=1913789. Press Trust of India. (2023). BFSI Among Most Sought-after Sectors by Women, 50% of Job Applicants seek WFH Opportunities: Report. PricewaterhouseCoopers (PwC). (2023). Embedded Finance: A Strategic Outlook. Report. Rao, M. R (2023a). Changing Paradigms in the Financial Landscape. Speech at the FIBAC 2023 Conference organised jointly by FICCI and IBA, Mumbai, November 23. Rao, M.R. (2023b). Reflections: Challenges in Regulations. Speech at the Gatekeepers of Governance Summit organised by ‘Excellence Enablers’, Mumbai, November 2. Rao, M.R. (2023c). Innovations in Banking - the Emerging Role for Technology and AI. Speech at the 106th Annual Conference of Indian Economic Association, Delhi, December 22. Reserve Bank of India. (2023a). Report on Trend and Progress of Banking in India. Reserve Bank of India. (2023b). Guidelines on Digital Lending. February 14. Reserve Bank of India. (2024a). Developments in India's Balance of Payments during the Fourth Quarter (January-March) of 2023-24. June 24, 2024. Reserve Bank of India (2024b). Annual Report of Ombudsman Scheme, 2022-23. Reserve Bank of India. (2024c). Framework for Self-Regulatory Organisation(s) in the FinTech Sector. May 30. Sahamati (2024). Account Aggregator Ecosystem Dashboard. July, 2024. Retrieved from: https://sahamati.org.in/aa-dashboard/. Sankar, T.R. (2023). RBI and Fintech: The Road Ahead. Speech at the Moneycontrol India Startup Conclave, Bengaluru. July 11. Schwab, K. (2016). The Fourth Industrial Revolution: What it Means, How to Respond. World Economic Forum. Statista. (2023). Global Cybercrime Costs. May, 2024. Statista. (2024a). Hours Spent Online. Accessed in May 2024. Statista. (2024b). BNPL Component in E-commerce. Accessed in May 2024. Stanford University. (2024). AI Index Report. Retrieved from https://aiindex.stanford.edu/report/. Suganthi, D., Kumar, R., and Sethi, M. (2024). Agriculture Supply Chain Dynamics: Evidence from Pan-India Survey. RBI January Bulletin. Tapscott, D. (1996). The Digital Economy: Promise and Peril in the Age of Networked Intelligence. New York: McGraw-Hill. Telecom Regulatory Authority of India (TRAI). (2023). Consultation Paper on Digital Inclusion in the Era of Emerging Technologies. Government of India 2023. Telecom Regulatory Authority of India (2024). The Indian Telecom Services Performance Indicators October–December, 2023. Retrieved from: https://www.trai.gov.in/release-publication/reports/performance-indicators-reports. Tracxn. (2024a). Number of Unicorns in India. May 2024. Retrieved from: https://tracxn.com/d/unicorns/unicorns-in-india/__ujYf3QI9FSnpS3x-zJCSwnay2nENQhm1kAN-U8-6Kfg. Tracxn. (2024b). FinTech Funding in India. Report, April 2024. TransUnion CIBIL (2023). The Rise and Evolution of India’s Digital Finance. Retrieved from: https://www.transunioncibil.com/content/dam/transunion-cibil/business/collateral/report/Gff-report-2023.pdf. United Nations. (2023). Opening Session of Global Development Initiative Digital Cooperation Forum. United Nation Institute for Training and Research (UNITAR). (2024). Global E-Waste Monitor Report. United Nations Development Programme (2023) Unstacking Global Poverty: Data for High-Impact Action. Multidimensional Poverty Index Report. United Nations Framework Convention on Climate Change (UNFCCC). (2022). India’s Updated First Nationally Determined Contribution Under Paris Agreement (2021-2030). United Nations Environment Programme (UNEP). (2022). Accelerating Sustainability through Digital Transformation Use Cases and Innovations. Unique Identification Authority of India (UIDAI). (2024). Website. Government of India. Retrieved from: https://uidai.gov.in/en/my-aadhaar/about-your-aadhaar.html Vaishnaw, A. (2023). Government of India. Ministry of Communications. Retrieved from: https://www.indiaenvironmentportal.org.in/files/file/winter_session_2023/Loksabha-internet%20accessibility.pdf. World Bank and International Fund for Agricultural Development (WBIFADB). (2021). Resilience in the Market for International Remittances During COVID-19 Crisis. G20 Global Partnership for Financial Inclusion. World Bank. (2021). Global Findex Database. Retrieved from: https://www.worldbank.org/en/publication/globalfindex. World Bank. (2024). Remittances Slowed in 2023, Expected to Grow Faster in 2024. Migration and Development Brief 40, June 2024.  Annex I.2: The Digital Personal Data Protection Act, 2023 The Government of India has introduced key regulations to ensure safe e-commerce usage, including the Consumer Protection (e-Commerce) Rules, 2020, to prevent unfair trade practices, the Information Technology (Intermediary Guidelines and Digital Media Ethics Code) Rules, 2021, for digital platform accountability and the Digital Personal Data Protection (DPDP) Act, 2023, for comprehensive data protection (MoF, 2024). The DPDP Act of 202332 is a landmark legislation designed to fortify the protection of personal data in the rapidly evolving digital landscape. At its core, the Act establishes the Data Protection Board of India, a governing body appointed by the Central Government. This board is composed of individuals with specialised qualifications in data governance, administration, law, and technology, entrusted with the crucial task of overseeing and enforcing the provisions of the Act. Empowered with substantial authority, the Board can direct remedial measures in response to personal data breaches, impose penalties, and conduct inquiries into potential violations. The Act introduces the concept of “Data Fiduciary” for entities handling sensitive personal data, imposing additional responsibilities like appointing Data Protection Officers and conducting mandatory audits, emphasising secure data handling. It also establishes Consent Managers for individuals to manage their data consent centrally, ensuring accountability. Disputes are resolved through an Appellate Tribunal. Overall, the DPDP Act of 2023 aims to balance technological innovation with privacy protection. The General Data Protection Regulation (GDPR), enacted by the European Union (EU) in 2018, marked a global shift in data protection laws. India’s DPDP Act shares similarities, focusing on consent, data rights, and accountability. It extends jurisdiction broadly and introduces “Data Fiduciary” roles. Unlike GDPR, it offers more flexibility for legitimate data processing and detailed cross-border transfer rules (Table 1). Tailored to India’s needs, the DPDP Act presents a forward-thinking framework with potential advantages over GDPR. * This chapter has been prepared by a team comprising Michael Debabrata Patra, Sarat Dhal, Rakhe Balachandran, Sakshi Awasthy, Kunal Priyadarshi, Soumasree Tewari, Ranjeeta Mishra, Rachit Solanki, Satyarth Singh, Abhinandan Borad, Rajnish Chandra and D. Suganthi. 1 Brazil, Russia, India, China and South Africa. 2 Other countries being the US, UK and China. 3 The Reserve Bank recognised the pressing need to harness information technology for intra-bank and inter-bank communications in the 1980s and set up BANKNET as the communication network for the banking sector. 4 Report of the Committee on the Financial System (1991) and the Committee on Banking Sector Reforms (1998). 5 The Reserve Bank established the Institute for Development and Research in Banking Technology (IDRBT) in 1996 and constituted the Committee on Technology issues relating to Payments System, Cheque Clearing and Securities Settlement in the Banking Industry (Chairman: Shri W.S. Saraf) in 1994. 6 NPCI, as the umbrella organisation, created a strong payment and settlement infrastructure in India comprising the National Financial Switch (NFS) in 2004, the Immediate Payment Service (IMPS) in 2010, Aadhaar enabled Payment Systems (AePS) in 2010, the RuPay network in 2012, National Automated Clearing House (NACH) in 2016, National Electronic Toll Collection (NETC) in 2016 and the Bharat Bill Payment System (BBPS) in 2017, among others. 7 The High-Level Committee on Deepening of Digital Payments (Chairman: Shri Nandan Nilekani), 2019, advocated a secure, inclusive, and scalable digital payment ecosystem, promoting feature phone payments and simplified regulatory measures. 8 Other initiatives include the Co-Win app, Government e-Marketplace (GeM), Jeevan Praman and the Unified Mobile Application for New-age Governance (UMANG) app. 9 Between 2017-18 and 2023-24. 10 The PIDF scheme provides financial support to banks and NBFCs for expanding payment acceptance infrastructure in designated areas, including tier-3 to tier-6 cities and north-eastern India. 11 Beckn protocol is a set of technology-agnostic specifications that allows the applications on Beckn to exchange information in a standardised manner irrespective of the technology form or medium of exchange. 12 Includes IT equipment, communications equipment, and software. 13 The KLEMS – Capital (K); Labour (L); Energy (E); Materials (M); and Services (S) – Database is part of a research project supported by the Reserve Bank to analyse productivity performance in the Indian economy at a disaggregated industry level. 14 From a sample of 28 countries, including high-income and middle-income countries. 15 Global Multidimensional Poverty Index (MPI). 16 Headcount ratios (the proportion of population which is multidimensionally poor) based on NITI Aayog’s National MPI. The National MPI retains all ten indicators from the global MPI and incorporates two additional indicators - maternal health and bank accounts, aligning with India’s national priorities (NITI Aayog, 2024). 17 This includes KCCs issued by scheduled commercial banks, regional rural banks, and cooperative banks. 18 Average cost of remittance to India in the first quarter of 2024 as per the Remittance Price Worldwide Quarterly Report of World Bank (Issue 49, March 2024). 19 Singapore, Nepal, UAE, Bhutan, France (e-commerce), Mauritius, and Sri Lanka. 20 ICT price index is derived as a weighted average of PC/Laptop/other peripherals, including software, mobile handset, landline charges, mobile charges and internet expenses. 21 Currently, over 70 applications are operational. 22 The Colonial Pipeline ransomware attack in 2021, while not directly impacting financial institutions, demonstrated the interdependence of critical infrastructure systems and the potential for widespread effects across sectors, including banking, by triggering a run-on gas station, showcasing the ripple effects of a cyberattack. 23 Information is collected from 181 FinTech mobile applications on Google Play Store identified from the Tracxn database with practice area tags, viz., payments, alternative lending, banking tech, forex tech, direct remittance tech. 24 Embedded finance refers to the integration of banking and various financial services into non-financial applications and services. 25 Cross-selling involves suggesting related or complementary products to existing customers and leveraging established relationships to offer additional items or services aligned with their needs or previous purchases. 26 The overall hiring rate is computed as the percentage of LinkedIn members who added a new employer in the same period the job began, divided by the total number of LinkedIn members in the corresponding location. For each month, LinkedIn calculates the AI hiring rate in the geographic area, divides the AI hiring rate by overall hiring rate in that geographic area, calculates the year-over-year change of this ratio, and then takes the 12-month moving average using the last 12 months. 27 As per the Augmented Dickey-Fuller (ADF) Test, all variables are stationary at levels I(0) or first difference I(1) levels. 28 Sentiment polarity is computed as a ratio of the sum of the number of reviews with rating 5 and 1 over the total number of reviews (Schoenmueller et al., 2020). 29 Transaction data for monitoring suspicious activities can risk customer privacy and exposure to cyber-attacks. To address this trade-off, open banking regulations are being developed to securely share data with consumer consent. 30 With a complaint disposal rate of about 98 per cent and an average turnaround time of 33 days. 31 The Master Direction on Information Technology Governance, Risk, Controls and Assurance Practices (effective from April 1, 2024) requires REs to put in place a robust IT governance framework and adequate oversight mechanisms to ensure accountability and mitigation of business risks. 32 The Digital Personal Data Protection Act, 2023 (No. 22 OF 2023). The Gazette of India, August 11, 2023. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

পেজের শেষ আপডেট করা তারিখ: