IST,

IST,

II. Fiscal Position of the State Governments

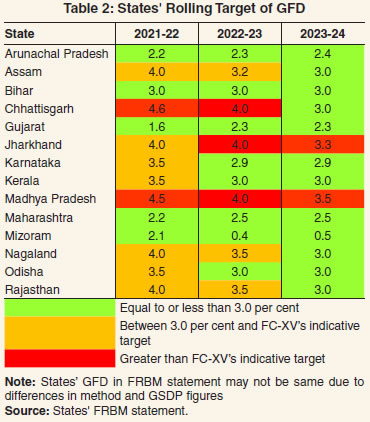

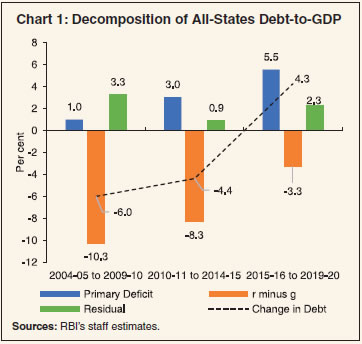

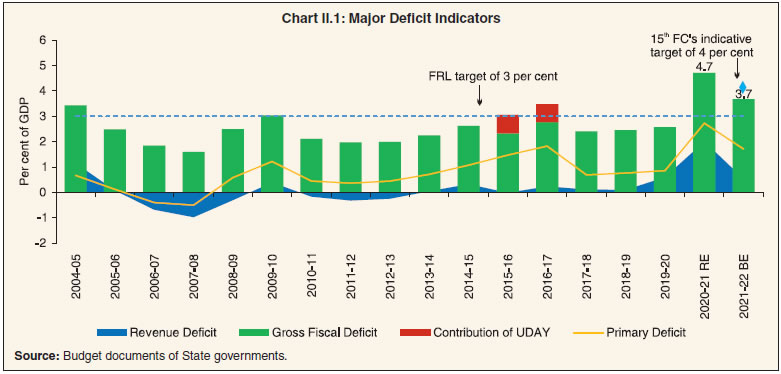

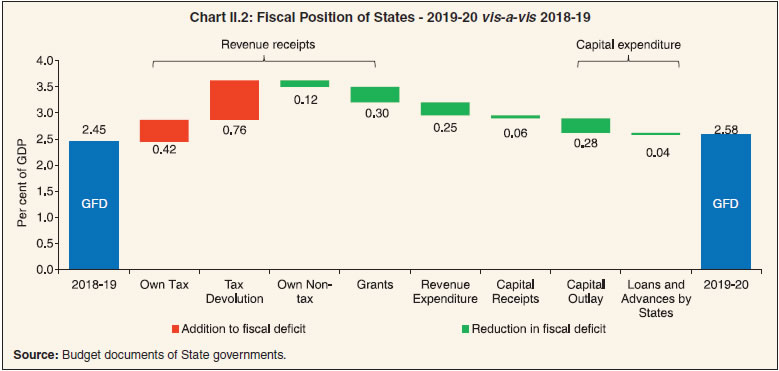

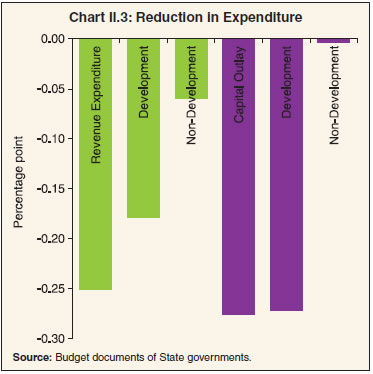

1. Introduction 2.1 This chapter reviews the fiscal performance of States in 2019-20 and 2020-21 as a backdrop to an evaluation of their budget estimates for 2021-22. As most of the States had released their budgets for 2020-21 before the outbreak of the first wave of COVID-19, there were large deviations between budget estimates (BE) for the year and the revised estimates (RE) as well as provisional accounts (PA). In 2021-22 too, most States have presented their budgets before the spread of the second wave; however, deviations from BE are expected to be smaller than in 2020-21 because of less stringent and State-specific restrictions than the nationwide lockdown imposed a year ago. 2.2 The rest of this chapter is divided into nine sections. Section 2 highlights some of the key fiscal indicators of the State governments. Sections 3, 4 and 5 analyse actual budgetary outcomes for 2019-20, RE for 2020-21 and BE for 2021-22, respectively. The expenditure plans of the States, as envisaged in their budget documents, are analysed in Section 6. The evolving role of central transfers in shaping State government finances is discussed in Section 7 against the backdrop of the 15th Finance Commission’s recommendations. While Section 8 describes financing patterns, Section 9 provides an estimate of outstanding liabilities, including contingent liabilities of the States. Section 10 sets out some concluding observations. 2.3 States had maintained their combined gross fiscal deficit (GFD) below the FRL1 threshold of 3 per cent of gross domestic product (GDP) since 2005-06, except for the years 2009-10, 2015-16 and 2016-17. The overshooting of GFD-GDP ratio in 2009-10 was due to the response to the global financial crisis, whereas the implementation of Ujwal DISCOM Assurance Yojana (UDAY) was responsible for higher GFD-GDP ratios in 2015-16 and 2016-17 (Chart II.1). In 2020-21, the GFD breached 3 per cent of GDP again under the impact of the pandemic, with spillovers expected in 2021-22 as well. Notably, the revenue deficit (RD) of the States, which was contained at 0.1 per cent of GDP in 2018-19, reached 2.0 per cent of GDP in 2020-21. Commensurately, the primary deficit (PD) of States also deteriorated during the last two years. While both RD and PD are budgeted to decline in 2021-22, the actual outcome will depend on the future course of the pandemic. 3. Fiscal Performance in 2019-20 (Accounts) 2.4 The consolidated GFD of the State governments deteriorated marginally in 2019-20 from its level a year ago (Table II.1). This was caused by a decline in revenue receipts due to a slowdown in economic activity, though its effects were partially offset by rationalisation of expenditure. 2.5 The consolidated RD of the States widened sizably in 2019-20, mainly because of a decline in revenue receipts from 13.9 per cent of GDP in 2018-19 to 13.1 per cent in 2019-20. Underlying the decline in revenue receipts was a sharp fall in the States’ own tax revenue due to lower mobilisation under sales tax and State goods and services tax (SGST) as well as a decline in tax devolution from the Centre (Chart II.2).  2.6 States’ non-tax revenue continued to increase for the second consecutive year in 2019-20, led by general services, which primarily include unclaimed deposits, sale of land and property, guarantee fees and the like. Grants from the Centre also increased during the year due to higher statutory grants (Finance Commission grants) and the GST compensation cess. Under capital receipts, recovery of loans and advances posted a rise (Table II.2). 2.7 In the face of dwindling revenue receipts, States took recourse to expenditure compression to adhere to the FRL target (Chart II.3). As a consequence, developmental expenditure on crop husbandry, water supply and sanitation, social security and welfare, housing and rural development was squeezed while capex was cut in key social and economic services like water supply and sanitation, medical and public health, irrigation and flood control, transport and rural development. This experience underscores the importance of raising additional resources at the sub-national levels.   4. Developments in 2020-21 (Revised Estimates and Provisional Accounts) 2.8 State governments budgeted a higher GFD2 for 2020-21 in view of the onset of COVID-19 in India at the time of presentation of their budgets (Table II.3). The impact of the pandemic on the State finances, however, turned out to be more severe than anticipated. Revenue collections were hit hard by the nationwide lockdown introduced in March 2020. 2.9 With the easing of lockdown restrictions towards the second half of the year, the focus shifted to fiscal consolidation with a recovery in revenue collection, certainty on GST compensation cess and rationalisation of expenditure. For the year as a whole, the consolidated GFD of the States surged to a historical high3, with revenue receipts falling short of the budgeted amounts by more than 2.7 per cent of GDP. The provisional data on 26 States from the Comptroller and Auditor General of India (CAG) and budget estimates of the remaining five States and UTs indicate that the GFD-GDP ratio was closer to the RE than to the BE (Table II.3).

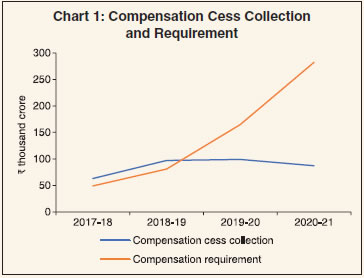

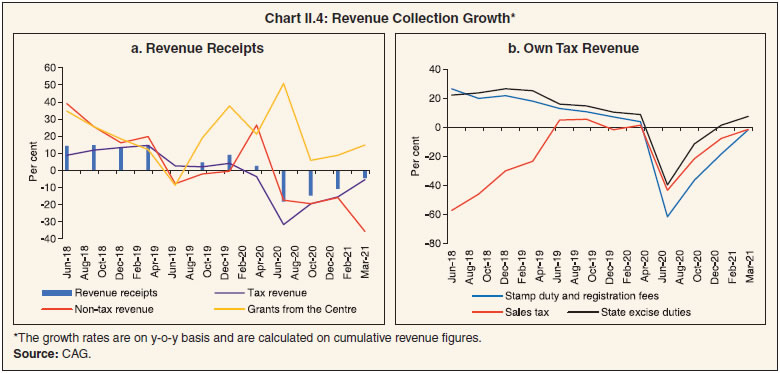

2.10 All categories of taxes started recovering from the second half of the year as economic activity resumed. Consequently, contractions in own tax revenue and other revenue receipts started becoming smaller, with the former returning to positive terrain in Q4:2020-21. Own non-tax revenues, with a small share in total revenue receipts relative to own tax revenue, continued to lag behind (Chart II.4). Additionally, 22 States/ UTs hiked their duties on petrol and diesel and 25 States/UTs hiked duties on alcohol to offset some of the revenue loss. Thus, the total compensation funds which flowed to States amounted to ₹2.01 lakh crore (₹1.10 lakh crore back-to-back loans and ₹0.91 lakh crore compensation cess) (Box II.1).

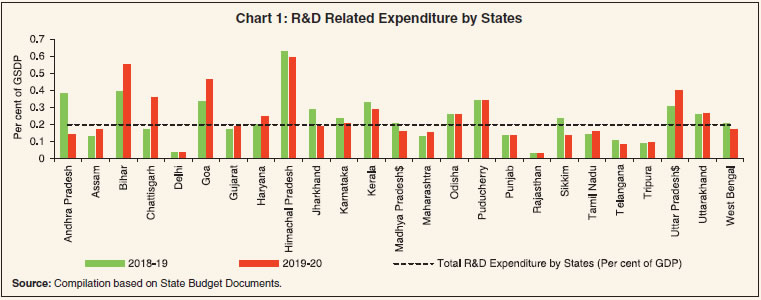

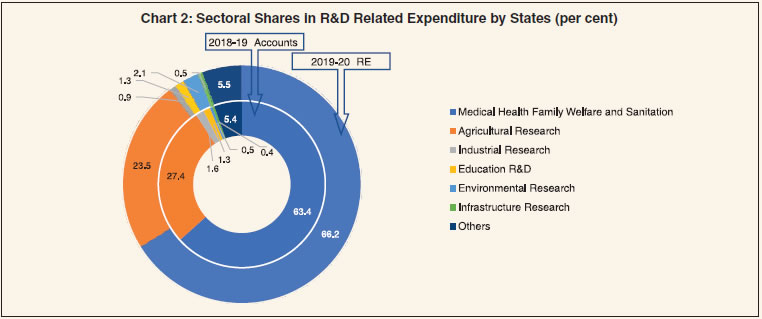

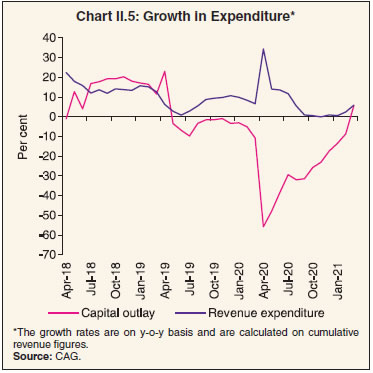

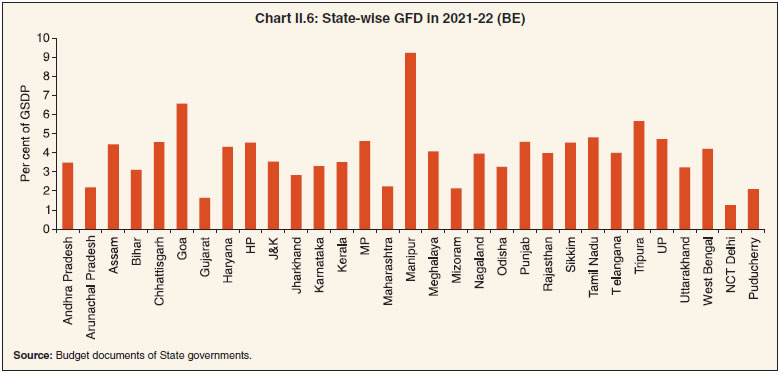

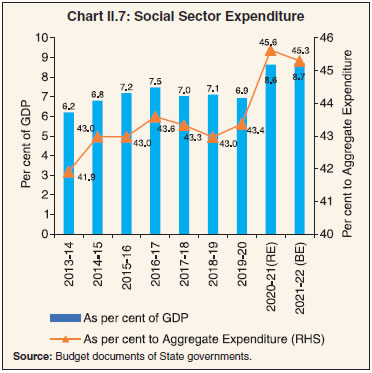

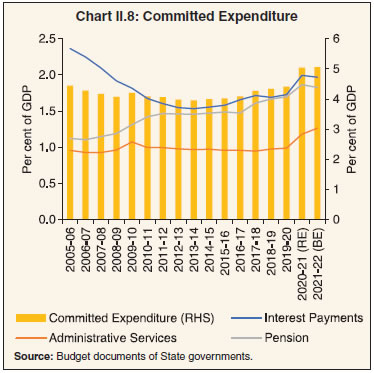

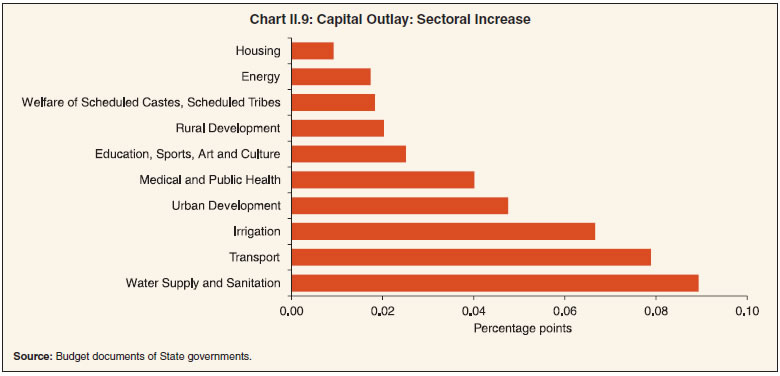

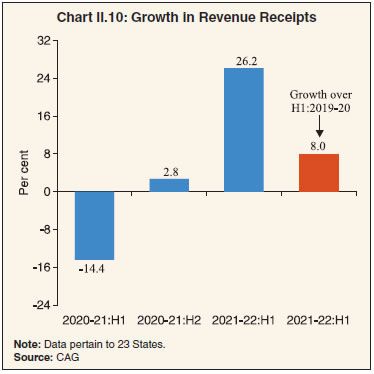

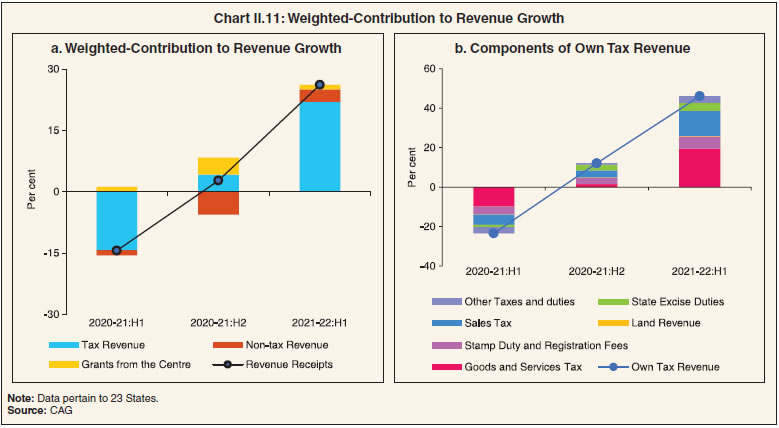

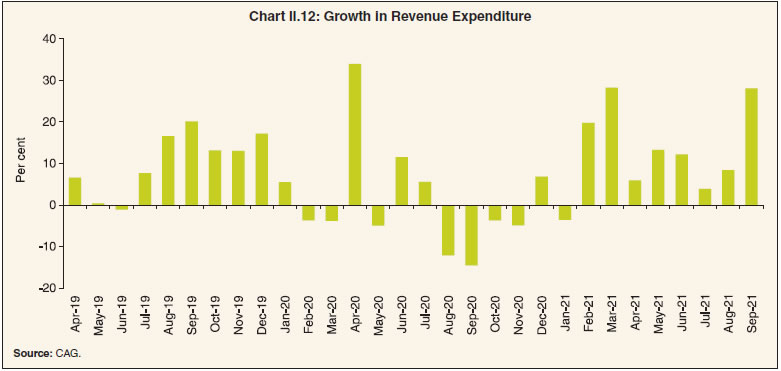

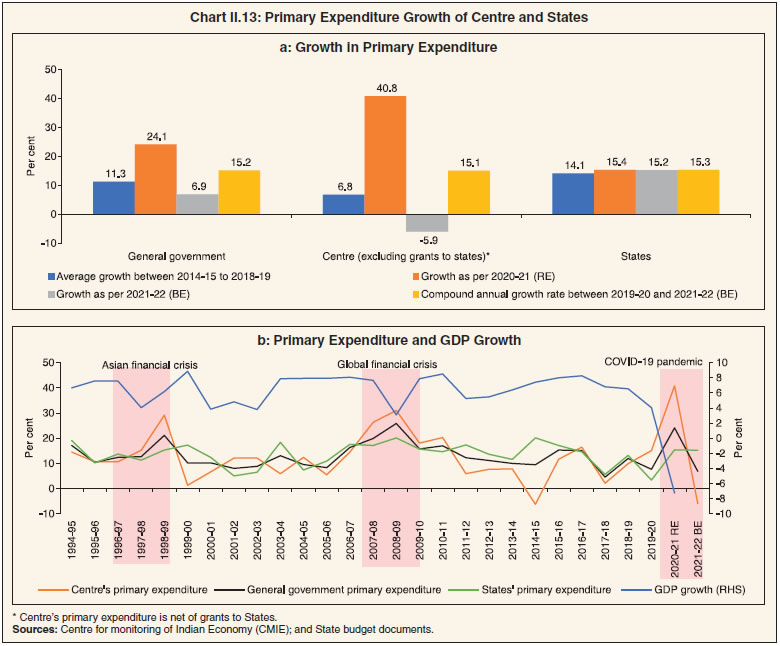

2.11 States’ revenue expenditure increased sharply during April 2020, reflecting the measures taken by them to support life and livelihood, viz., insurance cover for doctors and nurses; purchase of medical equipment and tools; hospital arrangements with sufficient number of beds for COVID-19 patients; providing food free of cost; cash transfer to those who did not avail of any government schemes; cash transfer to registered construction workers; remitting a fixed sum for those residents trapped in other States; and advance salary and pension payments (Chart II.5 and Table II.4). Some States also adopted revenue expenditure rationalisation measures like dearness allowance freeze, deferment of part or full salaries and wages, and deduction from salaries to create fiscal space for accommodating higher expenditure on medical and social services. 2.12 After a dip in April 2020, capex growth recovered swiftly in the second half of the year, which augers well for the economy in the medium-term. To boost capital expenditure by the States, the Centre announced the scheme of “Special Assistance to States for Capital Expenditure” on October 12, 2020 as part of the Aatma Nirbhar Bharat package. Capital expenditure proposals of ₹11,912 crore for 27 States were approved under this scheme by the Centre to fund projects in sectors like health, rural development, water supply, irrigation, power, transport, education and urban development.  5. Budget Estimates for 2021-22 2.13 For 2021-22, States have budgeted the GFD-GDP ratio at 3.7 per cent, with most of them breaching the 3.0 per cent threshold (Table II.5 and Chart II.6). The improvement over 2020-21 is expected to be achieved through higher revenue receipts. States have also budgeted a revenue deficit, departing from the recent practice of budgeting a revenue surplus. Most of the States have presented their budget before the onset of the second wave of COVID-19.  Receipts 2.14 States expect higher revenue receipts in 2021-22, primarily driven by their own tax revenue from SGST, States’ excise duty and sales tax collections (Table II.2). Tax devolution from the Centre is also budgeted to increase on the expectation of higher revenue collection by the Centre from different heads. In addition, ₹1.59 lakh crore has already been given to the States by the Centre for GST compensation in the form of back-to-back loans and ₹0.60 lakh crore from GST compensation fund, as explained in Box II.1. Expenditure 2.15 States’ total expenditure is budgeted to increase moderately in 2021-22. This expenditure growth is expected to be driven by capex, while revenue spending (as a per cent of GDP) will be compressed (Table II.4). Expenditure on social services, which recorded a sharp increase during 2020-21(RE) due to higher spending on medical and health services, is budgeted to increase further in 2021-22 (Chart II.7). Within social services, the share of water supply and sanitation, housing, urban development, and social security is expected to get a boost (Table II.6). States have budgeted a marginal increase in committed expenditure in 2021-22, led primarily by administrative expenditure (Chart II.8).  2.16 They have also budgeted a higher capital outlay in 2021-22 (BE) vis-à-vis 2020-21(RE), mainly in social services. As a result of the need to upscale heath infrastructure in the face of the multi-year nature of pandemic, higher spending is budgeted in medical and public health. Capex outlays have also been increased for urban development, water supply and sanitation, irrigation and transport (Chart II.9). Actual Outcome in 2021-22 So Far 2.17 Monthly data from the CAG indicate that States’ revenue receipts increased sharply on a y-o-y basis in H1:2021-22. States’ revenue receipts are running higher than in H1:2019-20 (pre-COVID year) as well, despite the adverse impact of localised restrictions imposed in the wake of the second wave (Chart II.10).   2.18 At a disaggregated level, revenue receipts were largely driven by own tax revenue and non-tax revenue in H1:2021-22 (Chart II.11a). Among own tax revenue sources, States’ GST and sales tax collections performed relatively better during this period (Chart II.11b). Following the Centre’s move to reduce excise duty on petrol and diesel by ₹5 and ₹10 per litre, respectively, on November 3, 2021, 21 States and UTs (with legislature) have also reduced their value added tax (VAT) in the range of ₹1.8 to ₹10.0 per litre for petrol and ₹2.0 to ₹7.0 per litre for diesel. The revenue loss to States due to reduction in VAT is estimated at 0.08 per cent of GDP. This, however, is expected to generate counter-cyclical policy response and translate into a positive impact on GDP, especially, if States abstain from spending cuts to compensate their revenue loss.  2.19 The second wave forced States to provide financial support to different sections of society during the first few months of the year. For instance, three States, viz., Odisha, Kerala and Karnataka, have explicitly announced relief packages amounting to around ₹22,000 crore (0.1 per cent of GDP). Other States have also made additional COVID related spending. The government of Tamil Nadu incurred additional expenditure of ₹17,618.8 crore on COVID related relief, including cash support and additional food subsidies. Consequently, the revenue expenditure of the State governments increased sharply in May 2021 before subsiding by July (Chart II.12). In September, revenue spending increased sharply in line with robust revenue receipt growth. Chhattisgarh, Kerala, Madhya Pradesh, Meghalaya, Punjab, Rajasthan and Telangana received permission to borrow an additional amount of ₹16,691 crore as an incentive on achieving the capital expenditure target set by the Ministry of Finance for H1:2021-22.   6. Expenditure Plans by States in 2021-22 2.20 The twin impact of a contraction in economic activity and increase in the fiscal deficit to accommodate the fiscal stimulus has resulted in a worsening of debt to GDP ratios of States. Even as the sharp expenditure cutback by the Centre is expected to bring about a deceleration in the growth of primary expenditure of the general government in 2021-22 (BE), the budget estimates of the States reveal a continuation of robust expenditure growth (Chart II.13a and b). 2.21 In terms of the composition of States’ spending, enhancing social protection, improving human capital (healthcare and education) and building physical infrastructure have assumed critical importance during the pandemic. It is also necessary to improve expenditure on research and development to optimise benefits from the above three expenditure categories (Box II.2).

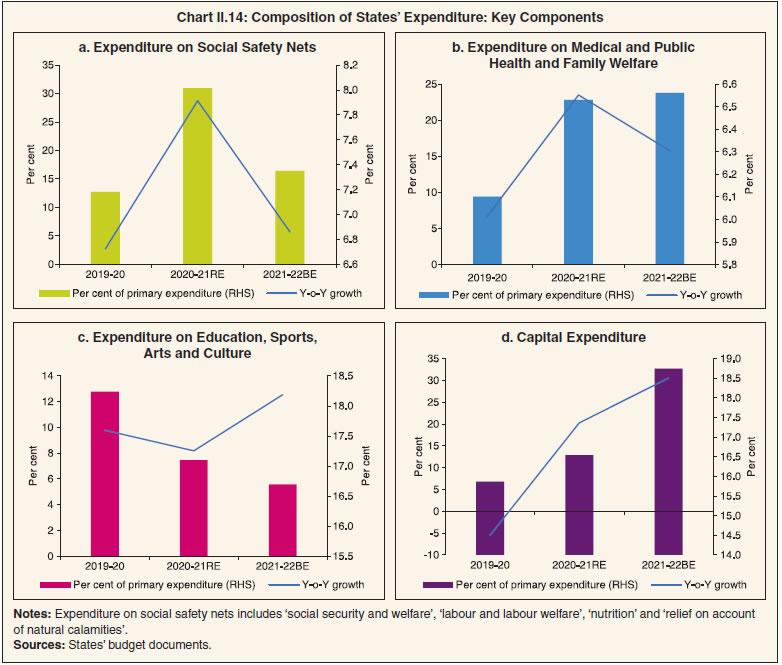

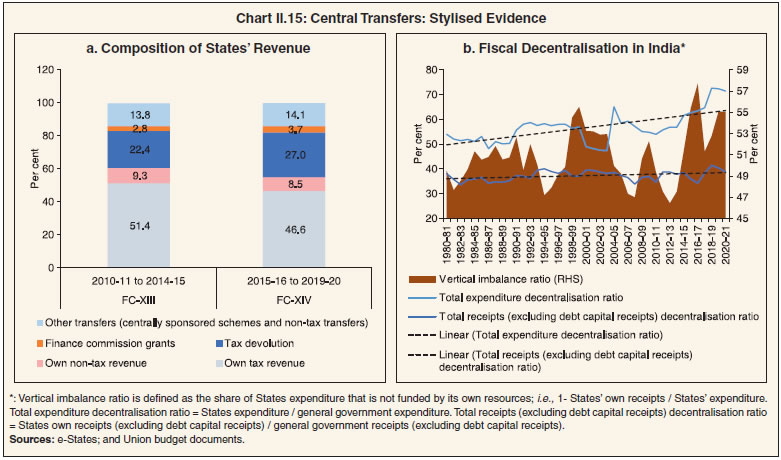

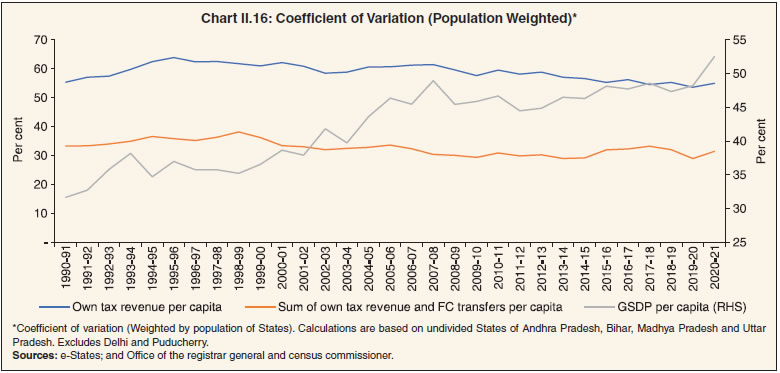

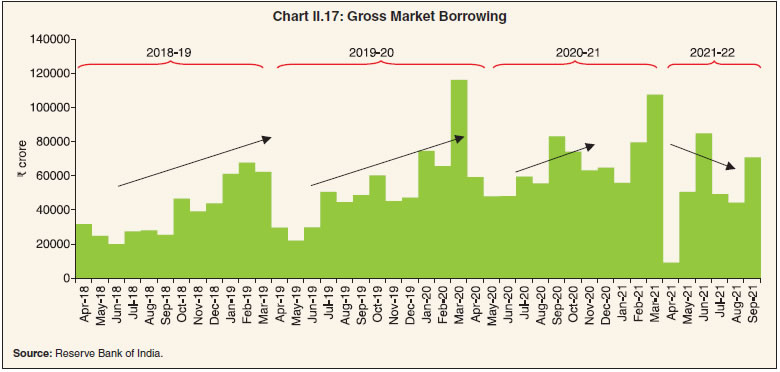

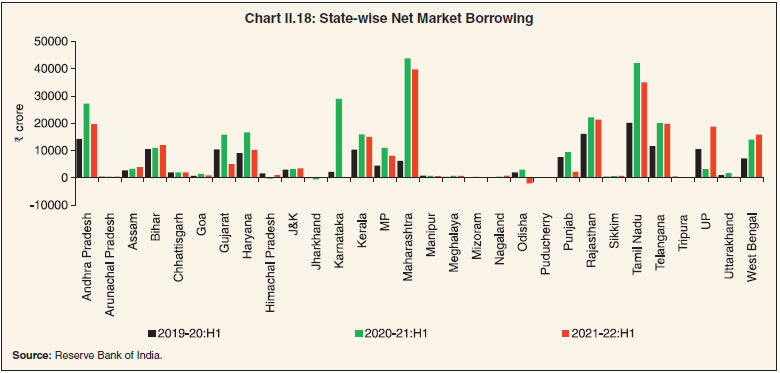

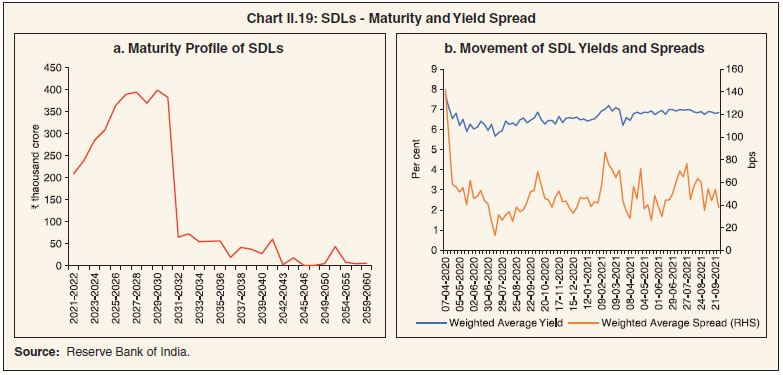

2.22 The expenditure of States on social safety nets7 saw a sharp upturn in 2020-21(RE) across all sub-categories. In 2021-22 (BE), deceleration in expenditure on nutrition programme and contraction in expenditure on natural calamities is budgeted (Chart II.14a). Despite a sharp increase compared to pre-COVID years, expenditure on healthcare at 6.6 per cent of primary expenditure in 2021-22 is significantly lower than the 8 per cent target set by the National Health Policy 2017 (Chart II.14b). Expenditure on education moderated in 2020-21 (RE) but is budgeted to recover in 2021-22 (Chart II.14c). States have budgeted significantly higher capital expenditure in 2021-22 than in preceding years (Chart II.14d). 2.23 The fifteenth Finance Commission (FC-XV) has recommended sector-specific grants from the Union Government to protect vulnerable communities. It has also recommended relaxed borrowing limit for State governments to create fiscal space for accommodating priority expenditure.  7. Role of Finance Commission Transfers 2.24 The Finance Commission (FC), appointed by the President of India under Article 280 of the constitution is the most important institution governing the transfer of resources from the Union Government to States. It recommends the share of taxes collected by the Centre to be devolved to States and its inter-se distribution among different States (Article 270). In addition, FCs recommend revenue grants to States for various purposes (Article 275). Although the composition of these grants has varied over time, grants for bridging the post-devolution revenue deficit of States have been the mainstay, and grants to local bodies have accounted for an increasing share (RBI, 2021b). 2.25 In the period between 2015-16 to 2019-20, corresponding to the tenure of the Fourteenth Finance Commission (FC-XIV), FC transfers averaged 30.9 per cent of States’ revenues. The overall reliance of States on central transfers increased in this period compared to the five years prior (corresponding to the tenure of the Thirteenth Finance Commission) (Chart II.15a). The increase in transfers has helped offset the increase in asymmetry (vertical imbalance) between the decentralisation of receipts and expenditure (Chart II.15b).  2.26 Regarding the share of individual States in tax devolution and grants, FCs have traditionally been guided by considerations of need, equity and efficiency. The distribution of Finance Commission transfers (tax devolution and grants) has a progressive element, aimed at mitigating the inherent fiscal disabilities of poorer States and enabling them to provide basic services and incur development expenditure. On a standardised measure of variability – the coefficient of variation (CoV) – Finance Commission transfers are found to reduce this inherent variability in States’ own tax revenue, thus ensuring fiscal convergence (Chart II.16). 2.27 Under the FC-XV’s recommendation presented to the Parliament on February 1, 2021 relating to resource transfers to States during 2020-21 to 2025-26, status quo (after adjusting for the share of Jammu and Kashmir) is proposed on the tax devolution ratio at 41 per cent but changes are envisaged in the ratio of allocation to individual States. 2.28 On revenue grants, the FC-XV has made a departure vis-à-vis earlier commissions. In addition to grants for bridging the revenue deficit, funding local governments and augmenting disaster relief funds, FC-XV has given a thrust to social sector grants with a particular focus on health and education. In addition, the commission has recommended sectoral grants for agriculture, rural roads, aspirational districts, judiciary and statistics. The Union Government has, however, not accepted the commission’s recommendations except for health sector grants. As regards grants for local government, the commission has attached entry-level conditions for access.  2.29 Considering the extraordinary fiscal stress from the pandemic on State finances and the potential need for stimulus for recovery in the years ahead, FC-XV has proposed relaxations in the borrowing limits for States. The normal limit of net borrowing has been fixed at 4 per cent of GSDP for 2021-22, 3.5 per cent for 2022-23 and 3 per cent for 2023-24 to 2025-26. An additional conditional borrowing of 0.5 per cent of GSDP has been proposed for the years 2021-22 to 2024-25, predicated on reforms in the power distribution sector. 8. Financing of GFD and Market Borrowings by State Governments Financing of GFD 2.30 The dependence of States on market borrowings for the financing of GFD has been secularly increasing from less than 15 per cent in 1994-95 to 94.8 per cent in 2019-20. Following the recommendation of the FC-XIV to exclude States (barring Delhi, Madhya Pradesh, Kerala and Arunachal Pradesh) from the National Small Savings Fund (NSSF) financing facility, the share of market borrowing in financing the GFD of States jumped to an all-time high in 2019-20. While the share of market borrowing declined in 2020-21 (RE), it is budgeted to increase in 2021-22 (BE) (Table II.7). Market Borrowing 2.31 The gross market borrowing of States/ UTs picked up to ₹7.99 lakh crore in 2020-21 – a growth of 25.9 per cent – from ₹6.35 lakh crore a year ago. The higher borrowings reflect pandemic-related uncertainty around revenue collections and higher government expenditure (Chart II.17). During H1:2021-22, the gross market borrowing was 12.6 per cent lower than the corresponding period of last year. 2.32 Net market borrowing grew by 33.7 per cent to ₹6.52 lakh crore in 2020-21 and contracted by 21.2 per cent during H1:2021-22 relative to the corresponding period a year ago. The increase in net market borrowing was concentrated in a few States like Assam, Bihar, Himachal Pradesh, Jammu and Kashmir, Jharkhand, Nagaland, Sikkim, Uttar Pradesh and West Bengal (Chart II.18). As per the recently released indicative calendar, States are expected to avail ₹2.02 lakh crore of market borrowing during October-December 2021.   2.33 During 2020-21, the States undertook 742 issuances (of which 56 were re-issuances) as against 636 issuances in 2019-20 (of which 114 were re-issuances). Following the policy of passive consolidation, States such as Madhya Pradesh, Maharashtra, Punjab and Tamil Nadu undertook re-issuances in 2020-21. Passive consolidation of States continued during H1:2021-22 as out of 262 issuances undertaken by States, 21 were re-issuances (Table II.8). 2.34 The standard plain vanilla issuances amounted to 36.3 per cent of the total amount of issuances in 2020-21. The rest (64.7 per cent) was spread across non-standard maturities. Twenty-six States and the UT of Puducherry issued securities of non-standard maturities, ranging between 1.5 and 35 years. Reflecting these debt consolidation efforts, 64.2 per cent of the outstanding State development loans (SDLs) was in the residual maturity bucket of five years and above as on March 2021 (Table II.9). SDL redemptions are likely to be more than double from 2021-22 to 2026-27 and beyond (Chart II.19a). 2.35 At the beginning of Q1:2020-21, the SDL yields traded with a softening bias (Chart II.19b). From end-June 2020, various developments, viz., a downgrade of India’s sovereign credit rating outlook by Fitch Ratings coupled with higher supply kept SDL yields firm till September. Thereafter, yields softened as the Reserve Bank increased the limit of SLR securities kept under the held to maturity (HTM) category by 2.5 per cent of NDTL – from 19.5 per cent to 22 per cent. During February 2021, SDL yields were additionally impacted by international factors, viz., rise in US yields and crude oil prices. Overall, the weighted average (cut-off) yield (WAY) of SDLs issued during 2020-21 stood at 6.55 per cent, compared with 7.24 per cent a year ago. The weighted average spread of SDL issuances over corresponding tenor of Union Government G-Sec stood at 52.72 basis points (bps) in 2020-21 as compared with 55.02 bps in the previous year. The average inter-State spread during 2020-21 stood at 10 bps as against 6 bps a year ago; by mid-July 2021, it declined to around 5 bps. During 2021-22 so far (up to September 30, 2021), the WAY of SDLs stood at 6.88 per cent, while the weighted average spread of SDL issuances over corresponding tenor of Union Government G-Sec stood at 47.74 bps. The average inter-State spread on securities of 10-year tenor (fresh issuances) was 4 bps in H1:2021-22 as compared with 9 bps in H1:2020-21. Status of Additional Market Borrowing 2.36 Given the additional expenditure requirements in order to cope with the pandemic, the Centre allowed States additional borrowing of up to 2 per cent of GSDP for the year 2020-21 on May 17, 2020. Within this additional borrowing limit, 0.5 per cent was kept unconditional; 1 per cent was linked to four citizen-centric areas of reforms: (i) implementation of One Nation One Ration Card System, (ii) ease of doing business reform, (iii) urban local body/ utility reforms and (iv) power sector reforms; and the remaining 0.5 per cent was linked to the completion of at least 3 reforms mentioned above.  2.37 One Nation One Ration Card system ensures the availability of rations to beneficiaries under the National Food Security Act (NFSA) and other welfare schemes, especially migrant workers and their families at any electronic point of sale (e-PoS) enabled Fair Price Shop (FPSs) of their choice anywhere in the country. It also enables States to target beneficiaries better and eliminate bogus/duplicate/ineligible card-holders. An additional borrowing limit of 0.25 per cent of GSDP is allowed to States only on completion of both of the following actions: (i) Aadhar Seeding of all the ration cards and beneficiaries in the State; and (ii) Automation of all the FPSs in the State. During 2020-21, 17 States could comply with this reform and received permission to raise ₹37,600 crore from the Centre. 2.38 For ease of doing business, the recommended reforms include: (i) completion of the first assessment of ‘District Level Business Reform Action Plan’8; (ii) elimination of the requirements of renewal of registration certificates/approvals/ licences obtained by businesses under various Acts; and (iii) implementation of a computerised central random inspection system. During 2020-21, 20 States could complete the reform and accordingly, the Centre granted permission to raise additional financial resources of ₹39,521 crore through market borrowings. 2.39 Urban utility reforms aim to financially strengthen urban local bodies (ULBs) and enable them to provide better public health and sanitation services to citizens. The set of reforms stipulated by the Centre to achieve these objectives are: (i) the State will notify: (a) floor rates of property tax in ULBs which are in consonance with the prevailing circle rates (i.e. guideline rates for property transactions), and (b) floor rates of user charges in respect of the provision of water supply, drainage and sewerage which reflect current costs/past inflation; (ii) the State will put in place a system of periodic increase in floor rates of property tax/ user charges in line with price increases. Eleven States successfully undertook this reform and were granted additional open market borrowing permission of ₹15,957 crore in 2020-21. 2.40 Under power sector reform, States can get an additional borrowing of 0.25 per cent of GSDP if they can: (i) meet the target set for the reduction in aggregate technical and commercial (AT&C) losses (0.05 per cent of GSDP); (ii) achieve the targeted reduction in the gap between average cost of supply and average revenue realisation (ACS-ARR) (0.05 per cent of GSDP); and (iii) implement direct benefit transfer (DBT) of electricity subsidy to farmers (0.15 per cent of GSDP). As many as 13 States successfully met the target of either (i) or (ii), while six States undertook the third reform in the power sector. These States were granted additional borrowing permission of ₹13,201 crore. 2.41 The final instalment of 0.5 per cent was linked to carrying out at least three out of four reforms stipulated by the Government of India. However, the conditionality was waived later, and all the States were granted permission for this additional borrowing. The relaxation of borrowing limits and deviations from the FRL target during the pandemic calls for a revised fiscal roadmap aimed towards fiscal consolidation in the medium term (Box II.3). Financial Accommodation to States 2.42 The Report of the Advisory Committee on Ways and Means Advances to State Governments (Chairman: Shri Sumit Bose) that was constituted in 2015 reviewed the Ways and Means Advances (WMA) limits of the States and retained the limit at ₹32,225 crores for all States/UTs together. The WMA limit of States/ UTs was increased by 60 per cent on April 17, 2020 (to ₹51,560 crore) over the level of ₹32,225 crore prevailing on March 31, 2020. In order to provide greater flexibility to State governments to tide over their cash-flow mismatches, the overdraft (OD) scheme for State governments was relaxed on April 7, 2020, whereby the number of days a State can continue to be in OD was increased from 14 to 21 consecutive working days and from 36 to 50 working days in a quarter. These interim measures were initially valid until September 30, 2020 and were later extended till March 31, 2021. Subsequently, the Advisory Committee on Ways and Means Advances to State Governments (Chairman: Shri Sudhir Shrivastava) reviewed the WMA limits (Box II.4). Considering the uncertainties related to the ongoing pandemic, the Reserve Bank decided to continue with the enhanced WMA limits up to March 31, 2022. During 2020-21, 18 States/UTs have availed the special drawing facility (SDF), 15 States/UTs resorted to WMA, and 8 States/ UTs availed OD. During 2021-22:H1, 14 States/ UTs have availed SDF, 14 States/UTs resorted to WMA and 6 States/UTs availed OD.

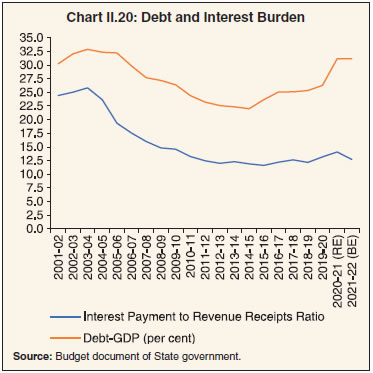

Cash Management of State Governments 2.43 In recent years, States/UTs have been accumulating sizeable cash surpluses in intermediate treasury bills (ITBs) and auction treasury bills (ATBs). Although positive cash balances indicate low intra-year fiscal pressure, they involve a negative carry on interest rates, warranting improvement in cash management practices. The outstanding investments of States in ITBs as at end-March 2021 stood at ₹2,05,230 crore as against ₹1,54,757 crore in the previous year, while outstanding investments of States in ATBs stood at ₹41,293 crore at end-March 2021 as against ₹33,504 crore at end-March 2020 (Table II.10). During 2021-22 so far (as on September 30, 2021) outstanding investments of States in ITBs stood at ₹1,20,777 crore, while outstanding investments of States/UTs in ATBs stood at ₹96,510 crore. States’ Reserve Funds 2.44 Given the increasing borrowing requirements of States and mounting contingent liabilities, it is desirable to keep adequate buffers to minimise the fiscal stress arising from redemption pressures and unforeseen liabilities. State governments maintain the Consolidated Sinking Fund (CSF) and the Guarantee Redemption Fund (GRF) with the Reserve Bank as a buffer for repayment of their future liabilities. States can also avail a special drawing facility (SDF) at a discounted rate from the Reserve Bank against incremental funds invested in CSF and GRF. Currently, 24 States and one Union Territory are members of the CSF scheme, while 17 States are members of the GRF scheme (Table II.11). Outstanding investment by States in the CSF and GRF stood at ₹1,27,208 crores and ₹8,405 crore, respectively, as at end-March 2021, as against ₹1,30,431 crore and ₹7,486 crore, respectively, as at end-March 2020. 2.45 In recent years, States’ outstanding debt has showed a gradual upward movement due to inter alia implementation of UDAY, farm loan waivers, and the growth slowdown in 2019-20. Pandemic-related revenue losses and additional expenditure increased the debt-GDP ratio in 2020-21 (RE) (Table II.12). The debt-GSDP ratio is expected to increase for 18 States and UTs during 2021-22 (Statement 20). 2.46 The ratio of interest payment to revenue receipts has been increasing in recent years at a steady pace, indicating erosion of debt sustainability (Chart II.20).

Composition of Debt 2.47 Market borrowing, the largest component of outstanding debt, is expected to reach 63 per cent at end-March 2022 (Table II.13). On the other hand, the shares of NSSF, loans from banks and financial institutions and public accounts in total outstanding liabilities of the States have declined over the years. The declining trend in borrowings from the Centre reversed in 2020-21 with GST compensation in the form of back-to-back loans from the Centre.

Contingent Liabilities of States 2.48 After the implementation of UDAY, States could reduce their outstanding guarantees to 2 per cent of GDP in 2016-17 (Table II.14). In recent years, however, the guarantees have been rising again, reaching 2.9 per cent of GDP at end-March 2020, with implications for debt sustainability (Box II.5).

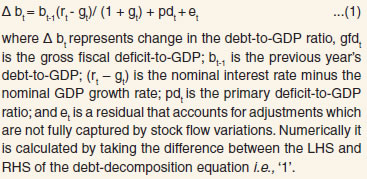

2.49 In 2020-21, the first wave of the pandemic posed States the critical challenge of declining revenue and the need for higher spending. To partially offset the revenue shortfall, the States hiked their duties on petrol, diesel and alcohol and focused on rationalising non-priority expenditures to make room for higher expenditure on healthcare and social services. While the GFD of the States overshot the 2020-21(BE) by a wide margin, this needs to be seen in the context of the concerted efforts taken by the Centre, States and the RBI to mitigate the impact of the pandemic on human life and the economy. These measures also helped in reducing fiscal stress on States. 2.50 The year 2021-22 started on a similar note, with the outbreak of the second wave. However, the impact of the second wave on State finances is likely to be less severe than the first wave due to less stringent and localised restrictions imposed this time as opposed to the nationwide lockdown during the first wave of COVID-19. States’ fiscal situation is buoyed by robust tax collection, expected higher tax devolution due to healthy tax collection by the Centre, ₹2.19 lakh crore GST compensation (both back to back loans and compensation cess), lower pressure from revenue spending and relatively lower yields on SDLs. Furthermore, the increased pace of vaccination, waning of the second wave and removal of restrictions are expected to put the economic recovery on a robust and sustainable path, setting the stage for States to map out a credible glide path for fiscal consolidation over the medium term. 1 Fiscal Responsibility Legislation. 2 State governments that presented their budgets after the COVID-19 lockdowns budgeted for GFD at 4.6 per cent of their combined GSDP in 2020-21. 3 In last year’s Report titled ‘State Finances: A Study of Budgets 2020-21’, the GFD-GDP ratio was projected at 4 per cent with a bias tilted to the upside. 4 GST (Compensation to States) Act, 2017 and GST (Compensation to States) Amendment Act, 2018. 5 Based on a survey of more than 6800 Science and Technology Institutions spread across varied sectors like central government, State governments, higher education, public sector industry, and private sector industry in the country. According to the Ministry of Science and Technology response rate of more than 90 per cent was achieved in the survey. 7 include expenditure on social security and welfare, labour and labour welfare, nutrition and relief on account of natural calamities. 8 A comprehensive 218-point District Reform Plan has been prepared and shared with the State Governments with a request to implement the same in the districts. The Action Plan is spread across 8 areas: Starting a Business for Construction, Urban Local Body Services, Paying Taxes, Land Reform Enabler, Land Administration and Property Registration Enablers, Obtaining Approval, Miscellaneous and Grievance Redressal/ Paperless Courts and Law & Order. 9 The cyclically adjusted (HP filter) gross fiscal deficit for States amounted to 3.4 per cent of GDP in 2020-21. 10 It may be noted that only actual data till 2019-20 prior to the pandemic has been used to undertake this analysis. Nominal effective interest rates are computed for States by taking the ratio of interest payment in current year to liabilities outstanding (or debt) at previous year. 11 Residual is numerically calculated by taking the difference between the LHS and RHS of the debt-decomposition equation 1. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

পেজের শেষ আপডেট করা তারিখ: