INDIA’S FINANCIAL SECTOR

AN ASSESSMENT |

| |

Volume III |

| |

Contents |

| |

|

| |

|

| |

INDIA’S FINANCIAL SECTOR

AN ASSESSMENT |

| |

Volume III |

Advisory Panel on Financial Stability Assessment and Stress Testing |

| |

Committee on Financial Sector Assessment March 2009 |

| |

|

| |

This Report was completed in June 2008. However, looking at the global financial developments of late, an attempt has been made to update some relevant portions of the report, particularly Chapter I (Macroeconomic Environment) and Chapter IV (Aspects of Stability and Functioning of Financial Markets). |

| |

© Committee on Financial Sector Assessment, 2009

All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording and/or otherwise, without the prior written permission of the publisher. |

| |

Sale Price: Rs. 2,000

Volumes I-VI (including one CD) |

| |

| Exclusively distributed by: |

|

Foundation Books

An Imprint of Cambridge University Press India Pvt. Ltd,

Cambridge House, 4381/4, Ansari Road

Darya Ganj, New Delhi - 110 002

Tel: + 91 11 43543500, Fax: + 91 11 23288534

www.cambridgeindia.org |

| |

| Published by Dr. Mohua Roy, Director, Monetary Policy Department, Reserve Bank of India, Central Office, Mumbai - 400 001 and printed at Jayant Printery, 352/54, Girgaum Road, Murlidhar Temple Compound, Near Thakurdwar Post Office, Mumbai - 400 002. |

| |

Composition of the Advisory Panel on

Financial Stability Assessment and Stress Testing |

Shri M.B.N.Rao |

Chairman and Managing Director Canara Bank |

Chairman |

Dr. Rajiv B. Lall |

Managing Director and Chief Executive Officer Infrastructure Development Finance Company Ltd. |

Member |

Dr. T.T.Ram Mohan |

Professor Indian Institute of Management Ahmedabad |

Member |

Shri Ravi Mohan |

Managing Director and Region Head Standard & Poor's, South Asia |

Member |

Shri Ashok Soota |

Chairman and Managing Director Mind Tree Consulting Ltd. |

Member |

Shri Pavan Sukhdev |

Head of Global Markets Deutsche Bank AG. |

Member |

Special Invitees |

|

|

Shri G.C. Chaturvedi |

Joint Secretary (Banking & Insurance) Department of Financial Services Ministry of Finance Government of India |

|

Dr. K. P. Krishnan |

Joint Secretary (Capital Markets) Department of Economic Affairs Ministry of Finance Government of India |

|

Shri Amitabh Verma |

Joint Secretary (Banking Operations) Department of Financial Services Ministry of Finance Government of India |

|

Shri V.K.Sharma |

Executive Director Reserve Bank of India |

|

Dr. R. Kannan |

Member (Actuary) Insurance Regulatory and Development Authority |

|

Dr. Sanjeevan Kapshe |

Officer on Special Duty Securities and Exchange Board of India |

|

|

| |

List of Acronyms |

| |

ABS |

Asset Backed Securities |

ACRC |

Agricultural Credit Review Committee |

AD |

Authorised Dealer |

ADR |

American Depository Receipt |

AFC |

Asset Finance Company |

AFS |

Available for Sale |

AGL |

Aggregate Gap Limit |

AIDIS |

All India Debt and Investment Survey |

ALD |

Aggregate Liability to Depositors |

ALM |

Asset Liability Management |

AMBI |

Association of Merchant Bankers of India |

AMFI |

Association of Mutual Funds of India |

ANMI |

Association of National Exchange Members of India |

ANP |

Average of Net Premiums |

ATM |

Automated Teller Machine |

AU |

Asset Utilisation |

AUM |

Assets under Management |

BCBS |

Basel Committee on Banking Supervision |

BCI |

Business Confidence Index |

BCM |

Business Continuity Management |

BCP |

Business Continuity Plan |

BCP |

Basel Core Principles |

BCSBI |

Banking Codes and Standards Board of India |

BE |

Budget Estimates |

BFRS |

Board for Financial Regulation and Supervision |

BFS |

Board for Financial Supervision |

BHC |

Bank Holding Company |

BIS |

Bank for International Settlements |

BO |

Banking Ombudsman |

BPLR |

Benchmark Prime Lending Rate |

BPO |

Business Process Outsourcing |

BPSS |

Board for regulation and supervision of Payment and Settlement Systems |

BR Act |

Banking Regulation Act |

BSE |

Bombay Stock Exchange |

CA |

Current Account |

CAB |

Change Approval Board |

CAC |

Capital Account Convertibility |

CAGR |

Compound Average Growth Rate |

CAMELS |

Capital adequacy, Asset quality, Management, Earnings, Liquidity and Systems |

CASA |

Current And Savings Account |

CBLO |

Collateralised Borrowing and Lending Obligation |

CBS |

Core Banking Solution/s |

CCC |

Credit Card Companies |

CCF |

Contingent Credit Facility |

CCIL |

Clearing Corporation of India Ltd. |

CCP |

Central Counter Party |

CD |

Credit deposit/Certificates of Deposit |

CDBMS |

Centralised Data Base Management Systems |

CDO |

Collateralised Debt Obligation |

CDS |

Credit Default Swap |

CDSL |

Central Depository Services (India) Ltd. |

CEO |

Chief Executive Officer |

CFCAC |

Committee on Fuller Capital Account Convertibility |

CFMS |

Centralised Funds Management System |

CFS |

Consolidated Financial Statements |

CFSA |

Committee on Financial Sector Assessment |

CGF |

Credit Guarantee Fund |

CHF |

Swiss Franc |

CIB |

Credit Information Bureau |

CIBIL |

Credit Information Bureau (India) Ltd. |

CIP |

Central Integrated Platform |

CIR |

Cost Income Ratio |

CLO |

Collateralised Loan Obligation |

CLS |

Continuous Linked Settlement |

CMBS |

Commercial Mortgage-Backed Security |

CMD |

Chairman and Managing Director |

CoR |

Certificate of Registration |

CP |

Commercial Paper |

CPC |

Cheque Processing Centre |

CPI |

Consumer Price Index |

CPM |

Credit Portfolio Management |

CPPAPS |

Committee on Procedures and Performance Audit of Public Services |

CPR |

Consolidated Prudential Reports |

CPSS |

Committee on Payment and Settlement Systems |

CRAR |

Capital to Risk-weighted Assets Ratio |

CRISIL |

Credit Rating Information Services of India Ltd. |

CRR |

Cash Reserve Ratio |

CRT |

Credit Risk Transfer |

CSR |

Corporate Social Responsibility |

CUG |

Closed User Group |

CVC |

Central Vigilance Commission |

DCCB |

District Central Cooperative Bank |

DFI |

Development Financial Institution |

DI |

Deposit Insurance |

DICGC |

Deposit Insurance and Credit Guarantee Corporation |

DIF |

Deposit Insurance Fund |

DMA |

Direct Marketing Associates/ Agencies |

DMO |

Debt Management Office |

DNS |

Deferred Net Settlement |

DoE |

Duration of Equity |

DOS |

Denial of Service |

DR |

Disaster Recovery |

DRAT |

Debt Recovery Appellate Tribunal |

DRR |

Designated Reserve Ratio |

DRT |

Debt Recovery Tribunal |

DSA |

Direct Selling Association/ Agency |

DVP |

Delivery versus Payment |

EaR |

Earnings at Risk |

ECB |

European Central Bank/External Commercial Borrowing |

ECR |

Export Credit Refinance |

ECS |

Electronic Clearing Service |

EFT |

Electronic Funds Transfer |

EL |

Equipment Leasing |

EME |

Emerging Market Economy |

ESM |

Enterprise Security Management |

ESOP |

Employees Stock Option Plan |

EV |

Economic Value |

FAO |

Food and Agriculture Organisation |

FC |

Financial Conglomerate/Foreign Currency |

FCA |

Foreign Currency Asset |

FCAC |

Fuller Capital Account Convertibility |

FCCB |

Foreign Currency Convertible Bond |

FCNR |

Foreign Currency Non Resident |

FDI |

Foreign Direct Investment |

FDIC |

Federal Deposit Insurance Corporation |

FEDAI |

Foreign Exchange Dealers' Association of India |

FEMA |

Foreign Exchange Management Act |

FERA |

Foreign Exchange Regulations Act |

FFMC |

Full Fledged Money Changer |

FII |

Foreign Institutional Investor |

FIMMDA |

Fixed Income, Money Market and Derivatives Association of India |

FIU-IND |

Financial Intelligence Unit-India |

FMC |

Financial Markets Committee |

FPI |

Foreign Portfolio Investment |

FPSBI |

Financial Planning Standards Board of India |

FRBM Act |

Fiscal Responsibility and Budget Management Act |

FSI |

Financial Stability Institute |

FY |

Financial Year |

GBC |

Gross Bank Credit |

GCC |

General Credit Card |

GCF |

Gross Capital Formation |

GDP |

Gross Domestic Product |

GDR |

Global Depository Receipt |

GE |

General Electric |

GER |

Gross Enrolment Ratio |

GoI |

Government of India |

GP |

Gross Premium |

G-Secs |

Government Securities |

HFC |

Housing Finance Company |

HFT |

Held for Trading |

HIDS |

Host Intrusion Detection System |

HLCCFM |

High Level Coordination Committee on Financial Markets |

HP |

Hire Purchase |

HR |

Human Resource |

HTM |

Held to Maturity |

HUDCO |

Housing and Urban Development Corporation |

IAIS |

International Association of Insurance Supervisors |

IAS |

International Accounting Standards |

IBNR |

Incurred But Not Reported |

IC |

Investment Companies |

ICAAP |

Internal Capital Adequacy Assessment Process |

ICAI |

Institute of Chartered Accountants of India |

ICOR |

Incremental Capital Output Ratio |

IDFC |

Infrastructure Development Finance Company |

IDL |

Intra-Day Liquidity |

IDS |

Intrusion Detection System |

IEM |

Industrial Entrepreneurs Memoranda |

IFCI |

Industrial Finance Corporation of India |

IFRS |

International Financial Reporting Standards |

IIBI |

Industrial Investment Bank of India |

IIFC |

India Infrastructure Finance Company |

IMF |

International Monetary Fund |

IMSS |

Integrated Market Surveillance System |

INFINET |

Indian Financial Network |

INR |

Indian Rupee |

IOSCO |

International Organisation of Securities Commissions |

IPDI |

Innovative Perpetual Debt Instrument |

IPO |

Initial Public Offer |

IPS |

Intrusion Prevention System |

IRAC |

Income Recognition and Asset Classification |

IRDA |

Insurance Regulatory and Development Authority |

IRF |

Interest Rate Futures |

IRFC |

Indian Railway Finance Corporation |

IRS |

Interest Rate Swaps |

ISDA |

International Swaps and Derivatives Association |

IT |

Information Technology |

IT Act |

Information Technology Act |

ITC |

India Tobacco Company |

ITES |

Information Technology Enabled Services |

JPY |

Japanese Yen |

KCC |

Kisan Credit Card |

KYC |

Know Your Customer |

LAB |

Local Area Bank |

LAF |

Liquidity Adjustment Facility |

LC |

Loan Companies |

LCB |

Large and Complex Bank |

LCBG |

Large and Complex Banking Group |

LCDS |

Loan Credit Default Swaps |

LIB OR |

London Interbank Offered Rate |

LIC |

Life Insurance Corporation of India |

LLP |

Loan Loss Provision |

LLR |

Lender of Last Resort |

LoC |

Line of Credit |

LPG |

Liquefied Petroleum Gas |

LTV |

Loan to Value |

MBC |

Mutual Benefit Company |

MBFC |

Mutual Benefit Finance Company |

MCA |

Model Confidentiality Agreement |

MFI |

Micro Finance Institution |

MIBOR |

Mumbai Inter-Bank Offer Rate |

MICR |

Magnetic Ink Character Recognition |

MIFOR |

Mumbai Inter-Bank Forward Offer Rate |

MIS |

Management Information System |

MNBC |

Miscellaneous Non Banking Company |

MoU |

Memorandum of Understanding |

MR |

Mathematical Reserves |

MRTP Act |

Monopolies and Restrictive Trade Practices Act |

MSCI |

Morgan Stanley Capital International |

MSE |

Micro and Small Enterprises |

MSMED Act |

Micro, Small and Medium Enterprises Development Act |

MSS |

Market Stabilisation Scheme |

MTM |

Marked to Market |

NA |

Not Available |

NABARD |

National Bank for Agriculture and Rural Development |

NBFC |

Non-Banking Finance Company |

NBFC-ND-SI |

Non Deposit Taking Systemically Important Non-Banking Finance Company |

NBO |

National Building Organisation |

NCAER |

National Council of Applied Economic Research |

NCLT |

National Company Law Tribunal |

NDA |

Non-Disclosure Agreement |

NDF |

Non-Deliverable Forwards |

NDP |

Net Domestic Product |

NDS |

Negotiated Dealing System |

NDTL |

Net Demand and Time Liabilities |

NEAT |

National Exchange for Automated Trading |

NEFT |

National Electronic Funds Transfer |

NFS |

National Financial Switch |

NGO |

Non Governmental Organisation |

NHB |

National Housing Bank |

NII |

Net Interest Income |

NIM |

Net Interest Margin |

NL |

Non-Linked |

NLNBP |

Non-Linked New Business Premium |

NLNPNBP |

Non-Linked Non-Par New Business Premium |

NoF |

Net Owned Fund |

NP |

Net Premium |

NPA |

Non-Performing Assets |

NPL |

Non-Performing Loans |

NRE |

Non Resident External |

NRFIP |

National Rural Financial Inclusion Plan |

NSCCL |

National Securities Clearing Corporation Ltd. |

NSDL |

National Securities Depository Ltd. |

NSE |

National Stock Exchange |

OBS |

Off-Balance Sheet |

ODC |

Office Data Connection |

OECD |

Organisation for Economic Co-operation and Development |

OIS |

Overnight Indexed Swap |

OMO |

Open Market Operation |

OPB |

Old Private-sector Bank |

OTC |

Over The Counter |

P/E ratio |

Price Earnings Ratio |

PACS |

Primary Agricultural Credit Societies |

PCA |

Prompt Corrective Action |

PCARDB |

Primary Cooperative Agriculture and Rural Development Bank |

PD |

Primary Dealer |

PDAI |

Primary Dealers Association of India |

PDO |

Public Debt Office |

PFC |

Power Finance Corporation |

PFI |

Public Financial Institution |

PFRDA |

Pension Fund Regulatory and Development Authority |

PLR |

Prime Lending Rate |

PM |

Profit Margin |

PMLA |

Prevention of Money Laundering Act |

PN |

Participatory Note |

PoS |

Point of Sale |

PPP |

Public Private Partnership |

PSB |

Public Sector Bank |

PV |

Present Value |

PV01 |

Present Value Impact of 1 Basis Point Movement in Interest Rate |

QIB |

Qualified Institutional Buyers |

RaRoC |

Risk-adjusted Return on Capital |

RBI |

Reserve Bank of India |

RBS |

Risk Based Supervision |

RC |

Reconstruction Company |

RCS |

Registrar of Cooperative Societies |

RE |

Revised Estimate |

REC |

Rural Electrification Corporation |

RMBS |

Residential Mortgage Backed Securities |

RMDS |

Reuters Market Data System |

RNBC |

Residuary Non-Banking Companies |

RoA |

Return on Assets |

RoE |

Return on Equity |

RRB |

Regional Rural Bank |

Rs. |

Indian Rupees |

RTGS |

Real Time Gross Settlement |

RWA |

Risk Weighted Asset |

SA |

System Administrator |

SARFAESI |

Act Securitisation And Reconstruction of Financial Assets and Enforcement of Security Interest Act |

SBI |

State Bank of India |

SC |

Securitisation Company |

SCARDB |

State Cooperative Agriculture and Rural Development Bank |

SCB |

Scheduled Commercial Bank |

SCRA |

Securities Contracts (Regulation) Act |

SD |

Standard Deviation |

SDDS |

Special Data Dissemination Standards |

SEBI |

Securities and Exchange Board of India |

SFC |

State Financial Corporation |

SGL |

Subsidiary General Ledger |

SHG |

Self Help Group |

SIDBI |

Small Industries Development Bank of India |

SIDC |

State Industrial Development Corporation |

SIPS |

Systemically Important Payment Systems |

SIV |

Structured Investment Vehicles |

SLOC |

Source Lines of Code |

SLR |

Statutory Liquidity Ratio |

SME |

Small and Medium Enterprise |

SPV |

Special Purpose Vehicle |

SR |

Solvency Ratio |

SRI |

Socially Responsible Investment |

SRO |

Self Regulatory Organisation |

SSI |

Small-Scale Industry |

SSS |

Securities Settlement System |

StCB |

State Cooperative Bank |

STP |

Straight Through Processing |

SUCB |

Scheduled Urban Co-operative Bank |

TAFCUB |

Task Force for Urban Cooperative Banks |

TAG |

Technical Advisory Group |

TDS |

Tax Deduction at Source |

TFCI |

Tourism Finance Corporation of India |

TMR |

Total Mathematical Reserves |

TRAI |

Telecom Regulatory Authority of India |

UCB |

Urban Cooperative Bank |

UK |

United Kingdom |

US |

United States |

USD |

US Dollar |

VaR |

Value at Risk |

VC |

Vice Chairman |

VRS |

Voluntary Retirement Scheme |

WDM |

Wholesale Debt Market |

WI |

When Issued |

WMA |

Ways and Means Advance |

WOS |

Wholly Owned Subsidiaries |

WPI |

Wholesale Price Index |

|

| |

Terms of Reference and Scheme of Report |

| |

The Government of India, in consultation with the Reserve Bank of India constituted the Committee on Financial Sector Assessment (CFSA) in September 2006, with a mandate to undertake a comprehensive assessment of the Indian Financial Sector, focusing upon stability and development. The CFSA was chaired by Dr. Rakesh Mohan, Deputy Governor, Reserve Bank of India. The Co-Chairmen at different points in time were Shri Ashok Jha, Dr. D. Subbarao and Shri Ashok Chawla, Secretary, Economic Affairs, Government of India. The Committee also had other officials from the Government of India as its members.

To assist the Committee in the process of assessment, the CFSA constituted four Advisory Panels respectively for the assessment of Financial Stability Assessment and Stress Testing, Financial Regulation and Supervision, Institutions and Market Structure and Transparency Standards. These Panels were assisted by Technical Groups comprising mainly of officials from relevant organisations to provide technical inputs and data support, as appropriate, to the respective Advisory Panels.

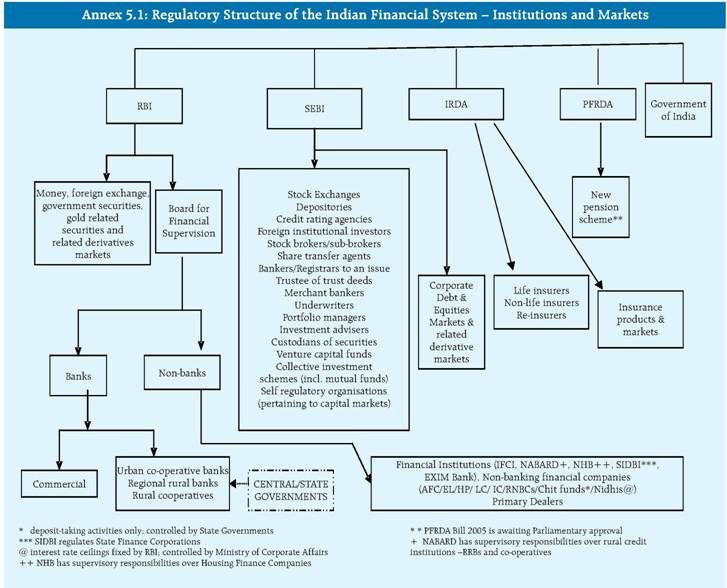

Taking into account the legal, regulatory and supervisory architecture in India, it was felt that there was a need for involving and closely associating the major regulatory institutions, viz., Reserve Bank of India (RBI),

Securities and Exchange Board of India (SEBI) and Insurance Regulatory and Development Authority (IRDA), in addition to representatives from the Government. Based on the discussion with the regulatory agencies, IRDA instituted its own groups for financial stability assessment and stress testing and financial regulation and supervision, whereas the Reserve Bank and SEBI nominated suitable officials for the Technical Groups. These institutions were also represented in Advisory Panels, constituted by the CFSA, as Special Invitees. In order to leverage the available expertise to the maximum permissible extent, it was also deemed fit to involve, besides the above regulatory authorities, other agencies as relevant to the work.

Advisory Panel on Financial Stability Assessment and Stress Testing

A key analytical component of financial sector assessment was a comprehensive assessment of financial stability and stress testing of the Indian financial sector. The Advisory Panel on Financial Stability Assessment and Stress Testing was constituted to conduct macro-prudential surveillance (including system level stress testing) to assess the soundness and stability of financial system and suggest measures for strengthening the

financial structure and system and its development in a medium-term perspective. The Advisory Panel chaired by Shri M.B.N. Rao comprised of non-official experts as members and officials representing Government and other agencies as special invitees – Annex A.

The terms of reference of the Advisory Panel were:

- to conduct an analysis of macro-prudential surveillance and financial stability (including business continuity and disaster recovery) and to assess the impact of potential macroeconomic and institutional factors (both domestic and external) on the soundness (risks and vulnerabilities) and stability of financial systems;

- to analyse relevant data and information and apply techniques and methodologies as relevant to banking, insurance, securities markets and non-banking financial sectors;

- to subject the assessment of stability to stress testing duly taking into account potential impact of macroeconomic and institutional factors and risks on the stability (including business continuity and disaster recovery) indicators, including natural and man-made disasters/catastrophe; and

- based on the assessment, suggest measures for strengthening the financial structure and system and its development in a medium-term perspective.

The Advisory Panel also had the option of co-opting as Special Invitees any other experts as they deemed fit.

Technical Group on Financial Stability Assessment and Stress Testing

A Technical Group comprising of officials drawn from the Government and other agencies who are directly associated with respective areas of work, assisted the Advisory Panel in preparing preliminary assessments and background material which served as inputs to the Advisory Panel's work (Please see Annex B for the composition of the Technical Group and terms of reference). Apart from the officials indicated in the Annex B the Panel also benefited from the inputs of the officials indicated in Annex C. IRDA formed its own Technical Group for assessment of aspects of Stability and Performance of the Insurance Sector - Annex D.

Approach and Methodology

Along with the Reserve Bank and SEBI officials, the Technical Group involved officials from CCIL, CRISIL, ICRA, DICGC, ICICI Bank, SBI, NABARD, NHB and IBA in their deliberations. To facilitate analysis of various areas which were covered in the report, the group formed three sub-groups. The first one was for deciding upon the methodology to be adopted for conduct of various system level stress tests and projections. Another sub-group went into identification of issues germane to financial stability. The third sub-group deliberated on the methodology to be adopted for assessment of level of Business Continuity Management in the Indian financial system. Focused discussions were held with some members of other Advisory Panels on HR issues and financial inclusion. The Group also held discussions with various resource persons

within the Reserve Bank in areas of their expertise. The preliminary report of the Technical Group also drew on initial write ups provided by various departments within RBI. Similarly, IRDA in its separate exercise drew resources from Life Insurance Council, Prudential Corporation, Asia, ICICI Prudential Life Insurance Company Ltd, IIM, Bangalore and Genpact. Based on the deliberations of the Technical Groups, the Secretariat to the Committee identified the preliminary set of issues and results which was taken up for discussion by the Advisory Panel.

The Advisory Panel also drew upon various reports published, both in India and elsewhere. A major input for the Report was the Handbook on Financial Sector Assessment, published by the Fund and the World Bank in September 2005. Drawing on the framework for assessment as elucidated in the Handbook, the draft Report has been tailored to suit country-specific realities, taking on board the state of development of the financial system and the maturity of financial institutions and markets. The report also benefited from the issues and recommendations flagged by other Advisory Panels on assessments of standards and codes. Extensive use has been made of off-site supervisory data in building up of various financial soundness indicators and stress testing. The Advisory Panel held a total of nine meetings.

Peer Review

At the request of the CFSA, two international experts (Annex E) peer reviewed the draft reports on respective assessments and recommendations. The Advisory Panel considered in depth the comments made by the peer reviewers and modified the report after appropriately incorporating their comments / suggestions. The Panel also had the option to differ with the peer reviewers comments. In the interest of transparency, the comments of the peer reviewers and the stance taken by the Panel thereon are appended to this report.

Scheme of the Report

The report is divided into seven chapters. Chapter I dwells on the macroeconomic environment in the backdrop of current global economic scenario. To the extent that the overall economic situation impinges upon the functioning of institutions, markets and infrastructure, the analysis in this Chapter focuses on potential areas of vulnerabilities which have a bearing on overall stability for sustained growth. It provides an overview of the institutional and financial market environment, bringing out the importance of various financial institutions in the overall financial system as also the relative importance of various financial market segments.

Chapter II assesses the soundness and performance of financial institutions and discusses the emerging issues confronting the financial institutions at the present juncture. It employs various ratios/trend analyses to gauge the performance of financial institutions and benchmarks them with available international best practices, as appropriate. In addition, drawing upon recent events in global financial markets, the analysis also devises a set of liquidity ratios and evaluates the trends. Institutional coverage includes banking sector (commercial banks/Regional Rural Banks/cooperative banks), broader financial sector (NBFCs, DFIs and HFCs) as also the relevant non-financial sectors (corporate and household). Central to the analyses of Chapter II has been the use of stress tests to ascertain the resilience of the concerned institutions. Taking into account the maturity of the financial system and the present financial health of the relevant institutions, stress tests were appropriately designed to focus on the major risk factors.

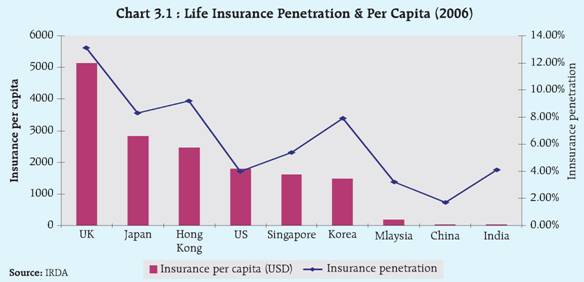

Chapter III examines the stability and performance of the insurance sector. Subsequent to its opening up to private participation, there has been a rapid growth in this sector. As a consequence, it was deemed desirable to undertake an initial assessment of the strength and resilience of this sector including a stress test.

Chapter IV examines the stability and functioning of financial markets, including the money market, government securities market, foreign exchange market, equity market and corporate bond market. In addition, it also addresses the stability and developmental issues as germane to the credit market.

Financial infrastructure issues are examined in Chapter V, covering the payment and settlement infrastructure, business continuity and disaster management, the regulatory and supervisory structure, the legal infrastructure, liquidity infrastructure and issues relating to the safety net such as deposit insurance.

Chapter VI focuses on some of the salient developmental issues in the Indian context having a bearing on the equity and efficiency aspects, such as financial inclusion.

The final Chapter VII provides a summary of observations and recommendations. |

| |

Annex A |

| |

RESERVE BANK OF INDIA

CENTRAL OFFICE,

SHAHID BHAGAT SINGH ROAD,

MUMBAI – 400 001, INDIA |

| |

MEMORANDUM |

| |

Constitution of Advisory Panel on Financial Stability Assessment and Stress Testing

A Committee on Financial Sector Assessment (CFSA) has been constituted by the Government of India (GOI) in consultation with the Reserve Bank with the objective of undertaking a self-assessment of financial sector stability and development. One of the analytical components of Financial Sector Assessment would encompass a comprehensive assessment of financial stability and stress testing of the Indian financial sector.

2. In this connection the CFSA has decided to constitute an Advisory Panel on Financial Stability Assessment and Stress Testing comprising the following: |

| |

Sr. No. |

Name |

Designation/Institution |

|

1. |

Shri M.B.N.Rao |

Chairman and Managing Director, Canara Bank |

Chairman |

2. |

Dr. Rajiv B. Lall |

Managing Director and Chief Executive Officer, Infrastructure Development Finance Company Ltd. |

Member |

3. |

Dr. T.T.Ram Mohan |

Professor, Indian Institute of Management, Ahmedabad |

Member |

4. |

Shri Ravi Mohan |

Managing Director and Region Head, Standard & Poor's, South Asia |

Member |

5. |

Shri Ashok Soota |

Chairman and Managing Director, Mind Tree Consulting Ltd. |

Member |

6. |

Shri Pavan Sukhdev |

Head of Global Markets, Deutsche Bank AG |

Member |

|

| |

| 3. In addition, the Advisory Panel can utilise the expertise of the following ex-officio Special Invitees: |

| |

Sr. No. |

Name |

Designation/Organisation |

1. |

Shri G. C. Chaturvedi |

Joint Secretary (Banking & Insurance), Government of India |

2. |

Dr. K.P.Krishnan |

Joint Secretary (Capital Markets), Government of India |

3. |

Shri Amitabh Verma |

Joint Secretary (Banking Operations), Government of India |

4. |

Shri V.KSharma |

Executive Director, Reserve Bank of India |

5. |

Dr. R. Kannan |

Member (Actuary), Insurance Regulatory and Development Authority |

6. |

Dr. Sanjeevan Kapshe |

Officer on Special Duty, Securities and Exchange Board of India |

|

| |

4. The Advisory Panel will have the following terms of reference:

- to conduct an analysis of macro-prudential surveillance and financial stability (including business continuity and disaster recovery) and to assess the impact of potential macroeconomic and institutional factors (both domestic and external) on the soundness (risks and vulnerabilities) and stability of financial systems;

- to analyse relevant data and information and apply techniques and methodologies as relevant to Banking, Insurance, Securities Markets and Non-banking financial sectors;

- to subject the assessment of stability to stress testing duly taking into account potential impact of macroeconomic and institutional factors and risks on the stability (including business continuity and disaster recovery) indicators, including natural and man-made disasters/catastrophe; and

- based on the assessment, suggest measures for strengthening the financial structure and system and its development in a medium-term perspective.

|

| |

- The Advisory Panel would have the option of co-opting as Special Invitees any other experts as they deem fit.

- The secretarial assistance to the Advisory Panel will be provided by the Reserve Bank of India. The Technical Groups on Financial Stability Assessment and Stress Testing constituted by the Reserve Bank and the Insurance Regulatory and Development Authority (IRDA) at the instance of the Committee have already progressed with the technical work with regard to above terms of reference. The technical notes and background material prepared by these groups would inter-alia form the basis for discussion by the Panel and in drafting of the Report.

- The Advisory Panel will prepare a detailed Report covering the above aspects and the Government of India/ Reserve Bank of India will have the discretion of making the Report public, after a peer review, as they may deem fit.

- The Advisory Panel is expected to submit its Report in about three months from the date of its first meeting.

|

| |

(Rakesh Mohan) |

| |

Deputy Governor and |

Chairman of the Committee on Financial Sector Assessment |

Mumbai

August 10, 2007 |

| |

Annex B |

| |

RESERVE BANK OF INDIA

CENTRAL OFFICE,

SHAHID BHAGAT SINGH ROAD,

MUMBAI – 400 001, INDIA |

| |

DEPUTY GOVERNOR |

MEMORANDUM |

| |

Constitution of Technical Group on Financial Stability Assessment and Stress Testing |

| |

The Committee on Financial Sector Assessment (CFSA) will undertake a self-assessment of financial sector stability and development. CFSA has decided to constitute a Technical Group on Financial Stability Assessment and Stress Testing comprising the following: |

| |

Sr. No. |

Name |

Designation/Organisation |

|

1. |

Shri C.S. Murthy |

Chief General Manager, RBI |

Member |

2. |

Shri P.Krishnamurthy |

Chief General Manager, RBI |

Member |

3. |

Shri Prashant Saran |

Chief General Manager, RBI |

Member |

4. |

Shri N.S. Vishwanathan |

Chief General Manager, RBI |

Member |

5. |

Shri Chandan Sinha |

Chief General Manager, RBI |

Member |

6. |

Shri S.Sen |

Chief General Manager, RBI |

Member |

7. |

S. Ramann |

Chief General Manager, SEBI |

Member |

8. |

Dr A.S Ramasastri |

Adviser, RBI |

Member |

9. |

Dr Charan Singh |

Director, RBI |

Member |

10. |

Shri K. Kanagasabapathy |

Secretary, CFSA |

Convener |

|

| |

| 2. The Group will have the following terms of reference: |

(i) to contribute to the work related to analysis of macroprudential surveillance and financial stability to monitor the impact of potential macroeconomic and institutional factors (both domestic and external) on the soundness (risks and vulnerabilities) and stability of financial systems based on the direction/guideline provided by the Advisory Panel; and

(ii) to compile relevant data and information and apply techniques and methodologies as relevant to Banking, Insurance, Securities Markets and Non-banking financial sectors; and

(iii) to subject the assessment of stability (including Business Continuity and Disaster recovery) to stress testing duly taking into account potential impact of macroeconomic and institutional factors and risks on the stability (including Business Continuity and Disaster recovery) indicators, including natural and man-made disasters/ catastrophe; and

(iv) based on the assessment, to suggest measures for strengthening the financial structure and system and its development in a medium-term perspective; and

(v) to provide such inputs for discussion to the Advisory Group on Financial Stability Assessment and Stress testing as needed and participate in their deliberations.

|

| |

3. The Group would function under the overall guidance of Shri V.K. Sharma, Executive Director, Reserve Bank of India. Shri Anand Sinha, Executive Director, Reserve Bank of India will be a permanent invitee.

4. The Group will also be directed by decisions taken in the Advisory Panel for Financial Stability Assessment and Stress Testing.

5. A list of Special Invitees who could act as resource persons to the Group and whose expertise can be called upon by the Group while preparing inputs for the Advisory Panels is provided in Annex C. The Group may co-opt as special invitees, one or more of the identified officials, or any other officials from RBI, Government or other agencies as they deem appropriate.

6 . The Group is expected to complete its task in the minimum possible time which, in any case, would not go beyond four months from the date of its constitution. |

| |

(Rakesh Mohan) |

Chairman |

Mumbai

March 1, 2007 |

| |

Annex C |

| |

List of Officials who Assisted the Advisory Panel

|

| |

| The Panel has also benefited considerably from the inputs provided by following officials from different agencies. |

| |

Sr. No. |

Name |

Areas |

1. |

Shri Mohandas Pai, Member of the Board and Director-Human Resources, Infosys |

HR issues in the Financial Sector |

2 |

Shri Anand Sinha, Executive Director, RBI |

Liquidity issues in commercial banks, Stress Testing methodology |

3. |

Shri S.K. Mitra, Executive Director, NABARD |

Stability issues in the rural financial sector |

4. |

Shri Nachiket Mor, President, ICICI Foundation for Inclusive Growth |

Financial Inclusion |

5. |

Shri H N Sinor, Ex Chief Executive, IBA |

Major issues facing commercial banks |

6. |

Shri Akhilesh Tuteja, ED, KPMG |

Business Continuity Management and Payment & Settlement Systems |

|

| |

| Further, the Panel also acknowledges the contributions made by the following officials in preparation of the draft reports. |

| |

Sr. No. |

Name |

Designation |

1. |

Shri G. Padmanabhan |

Chief General Manager, RBI |

2. |

Shri A. P. Hota |

Chief General Manager, RBI |

3. |

Shri A. K. Khound |

Chief General Manager, RBI |

4. |

Shri K.D. Zacharias |

Legal Adviser, RBI |

5. |

Dr Janak Raj |

Adviser, RBI |

6. |

Dr A. M. Pedgaonkar |

Chief General Manager, RBI |

7. |

Shri M.P. Kothari |

Chief General Manager, DICGC |

8. |

Shri R. Ravlchandran |

Chief General Manager, SEBI |

9. |

Shri B. B. Mohanty |

Chief General Manager, NABARD |

10. |

Shri R. Nagarajan |

Chief General Manager, SBI |

11. |

Ms. Ritu Anand |

Principal Adviser & Chief Economist, IDFC |

12. |

Shri R. Bhalla |

General Manager, NHB |

13. |

Shri P.R. Ravlmohan |

General Manager, RBI |

14. |

Shri E. T. Rajendran |

General Manager, RBI |

15. |

Shri Somnath Chatterjee |

Director, RBI |

16. |

Shri S. Ganesh Kumar |

General Manager, RBI |

17. |

Shri A. S. Meena |

General Manager, RBI |

18. |

Dr Ashok Hegde |

Vice President, Mind Tree Consulting Ltd |

19. |

Smt. Asha P. Kannan |

Director, RBI |

20. |

Shri R. K. Jain |

Director, RBI |

21. |

Shri Anujit Mltra |

General Manager, RBI |

22. |

Shri Rajan Goyal |

Director, RBI |

23. |

Smt. R. Kausallya |

Director, DICGC |

24. |

Shri Neeraj Gambhlr |

Former General Manager, ICICI Bank |

25. |

Shri B. P. Tikekar |

Senior Vice President, HDFC |

26. |

Shri S. Ray |

Senior Vice President, CCIL |

27. |

Shri Ashok Naraln |

Deputy General Manager, RBI |

28. |

Shri T. Rabi Shankar |

Deputy General Manager, RBI |

29. |

Shri K. Babuji |

Deputy General Manager, RBI |

30. |

Shri K.R. Krishna Kumar |

Deputy General Manager, RBI |

31. |

Shri Aloke Chatteriee |

Deputy General Manager, RBI |

32. |

Shri Haregour Nayak |

Deputy General Manager, RBI |

33. |

Shri Shayama Chakraborty |

Deputy Director, IRDA |

34. |

Shri R. Chaudhuri |

Deputy General Manager, ICICI Bank |

35. |

Shri V. Konda |

Deputy General Manager, ICICI Bank |

36. |

Shri Rakesh Bansal |

Deputy General Manager, ICICI Bank |

37. |

Shri Sanjay Purao |

Deputy General Manager, SEBI |

38. |

Shri B. Rajendran |

Deputy General Manager, SEBI |

39. |

Shri N. Muthuraman |

Former Director, CRISIL |

50. |

Shri Somasekhar Vemuri |

Senior Manager, CRISIL |

41. |

Shri G. Sankaranarayanan |

Former Senior Vice President, IBA |

42. |

Shri Puneet Pancholy |

Assistant General Manager, RBI |

43. |

Shri D. Sathish Kumar |

Assistant General Manager, RBI |

44. |

Shri Divyaman Srivastava |

Assistant General Manager, RBI |

45. |

Shri Y. Jayakumar |

Assistant General Manager, RBI |

46. |

Shri K. Vijay Kumar |

Assistant General Manager, RBI |

47. |

Shri Navin Nambiar |

Assistant General Manager, RBI |

48. |

Shri N. Suganandh |

Assistant General Manager, RBI |

49. |

Shri Ashok Kumar |

Assistant General Manager, RBI |

50. |

Shri Ashish Verma |

Assistant General Manager, RBI |

51. |

Shri Brij Raj |

Assistant General Manager, RBI |

52. |

Shri D.P. Singh |

Assistant Adviser, RBI |

53. |

Shri Indranil Bhattacharya |

Assistant Adviser, RBI |

54. |

Dr. Pradip Bhuyan |

Assistant Adviser, RBI |

55. |

Shri Unnikrishnan N. K. |

Assistant Adviser, RBI |

56. |

Smt. Anupam Prakash |

Assistant Adviser, RBI |

57. |

Shri Jai Chander |

Assistant Adviser, RBI |

58. |

Shri S. Madhusudhanan |

Assistant General Manager, SEBI |

59. |

Shri Vineet Gupta |

Former General Manager, ICRA |

60. |

Shri Ranjul Goswami |

Director, Deutsche Bank |

61. |

Shri Abhilash A. |

Legal Officer, RBI |

62. |

Shri M. Unnikrishnan |

Legal Officer, RBI |

63. |

Shri Piyush Gupta |

Manager, RBI |

64. |

Shri Aloke Kumar Ghosh |

Research Officer, RBI |

65. |

Ms. Sangita Misra |

Research Officer, RBI |

66. |

Ms. P. B. Rakhi |

Research Officer, RBI |

67. |

Shri Dipankar Mitra |

Research Officer, RBI |

68. |

Shri S. K. Chattopadhyay |

Research Officer, RBI |

69. |

Shri Samir Behera |

Research Officer, RBI |

|

| |

Annex D |

| |

Technical Group for Aspects of Stability and Performance of Insurance

Sector – List of Members |

| |

Sr. No. |

Name |

Designation |

1. |

Shri S.V. Mony |

Secretary General, Life Insurance Council |

2. |

Shri S. P. Subhedar |

Senior Advisor, Prudential Corporation, Asia |

3. |

Shri N. S. Kannan |

Executive Director, ICICI Prudential Life Insurance Company Ltd |

4. |

Prof R. Vaidyanathan |

Professor (Finance), IIM Bangalore |

5. |

Dr. K. Sriram |

Consulting Actuary, Genpact |

|

| |

Annex E |

| |

List of Peer Reviewers who Reviewed the Report |

| |

Sr. No. |

Names of the Peer Reviewers |

1. |

Mr. V. Sundararajan, |

| |

Director, and Head of Financial Practice, Centennial Group Holdings, Washington DC and former Deputy Director, Department of Monetary and Capital Markets, International Monetary Fund (IMF). |

2. |

Mr. Andrew Sheng, Adjunct Professor, University of Malaya and Tsinghua, Beijing and former Chairman of Securities and Futures Commission, Hong Kong. |

|

| |

NOTE |

| |

This report was completed in June 2008. However, looking at the global financial developments of late, an attempt has been made to update some relevant portions of the report, particularly Chapter I (The Macroeconomic Environment) and Chapter IV (Aspects of Stability and Functioning of Financial Markets). |

| |

Chapter I |

| |

The Macroeconomic Environment |

| |

1.1 Introduction

After a period of robust global growth and favourable economic conditions, global financial markets have entered a turbulent phase because of the subprime crisis which started in mid-2007. Non-performing housing loans, declining global equity prices and the rising cost of default protection on corporate bonds forced some major banks to face significant losses. Alongside, the tightening of banking credit standards in major industrial economies has reinforced worries of an impending credit crunch.

The impact has been compounded by the volatility in international food and oil prices. These effects are expected to impact global economic growth in the current year as well as next.

The adjustment process in the advanced economies is underway and its gradual unfolding has implications for global capital flows, exchange rates and the adjustment of domestic economies. With the growing integration of the Indian economy with global markets, the weight of global factors, along with domestic considerations, has also become important in the formulation of macroeconomic policies and outcomes. There are several positives pointing to sustainable higher growth rate. But, some of the recent global and domestic developments show heightened domestic risks to the short-term outlook of the Indian economy.

Against this background, Chapter I analyses the linkages between macroeconomic performance and financial stability and goes on to summarise the global economic developments. It then provides an overview of the Indian economic scenario including the institutional and financial market environment and identifies certain potential macroeconomic vulnerabilities in the Indian economy at the present juncture.

1.2 Linkages Between Macroeconomic Performance and Financial Stability

Macroeconomic developments and shocks can have an impact on the financial sector. The role of macro-prudential or financial stability analysis has therefore gained importance among central banks, regulatory authorities and international agencies. Various macroeconomic developments such as an increase in inflation due to a spurt in crude oil/commodity prices, a sudden inflow/ outflow of capital, a sharp increase in the fiscal deficit, sudden and sharp increases in interest rate/asset prices can adversely affect financial institutions’ balance sheets and the financial markets. This has implications for financial stability. Macro stress testing has, therefore, assumed significance in recent years.

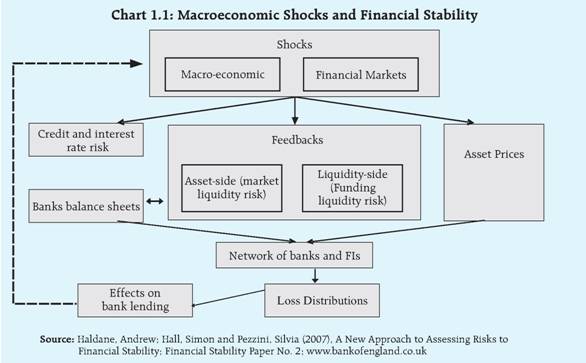

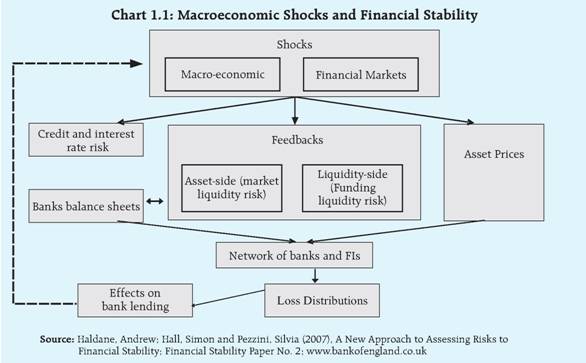

The linkages between macroeconomic performance and financial stability are schematically presented in Chart 1.1. These shocks can emanate from the real or the financial sector. Such shocks affect the banks’ balance sheets through the conventional channels of credit and market risk. They also affect balance sheets through the financial markets and asset prices. Both effects may amplify the first round balance sheet impact, in particular the liquidity and network effects. Taken together, all of these channels then translate into a final impact on balance sheets, as reflected in aggregate loss distribution. This loss distribution, in turn, can then be mapped back into the impact on the economy.

A stable and resilient financial system is therefore vital for achieving sustained growth with low inflation as it can withstand fluctuations resulting from dynamic changes in economic conditions, as well as sudden and substantial increases in uncertainty.

The resilience of the financial system can be tested by subjecting the system to stress scenarios. Since the early 1990’s, stress-tests at the level of individual institutions have been widely applied by internationally active banks. In addition to applying such stress tests to the portfolios of individual institutions at the micro level, stress-testing is assuming an increasingly important role in the macro-prudential analysis |

| |

|

| |

as well. The main objective of an aggregate stress test is to help public authorities identify those structural vulnerabilities and overall risk exposures that could lead to systemic problems.

For macro stress testing, a distinction is made between the “bottom-up” and “top-down” approaches. Under the former, the response to various shocks in a given scenario is estimated at the portfolio level using highly disaggregated data from individual financial institutions at a point in time. The results of the bottom-up approach can then be aggregated or compared to analyse the sensitivity of the entire sector or group of institutions. This approach has the advantage of making better use of individual portfolio data. However, if individual institutions provide their own estimates, the approach may introduce some inconsistencies about how each institution applies the scenario and produces its numerical estimates.

The top-down approach entails the calculation of the consequences based on a centralised model, normally using aggregated data, for the entire sector as a whole. The advantages of the top-down approach are that these stress tests are relatively easy to implement without burdening the individual institutions. The drawback is that the aggregated data only captures the effects for the sector as a whole, and not the different risk profiles and vulnerabilities of the individual institutions.

An important issue relating to stress testing is the determination of yardsticks to be used when setting the ranges of shock variables. In India, stress testing scenarios often tend to be hypothetical due to the lack of past data on benchmarks. To get a more realistic view, however, there is a need to construct scenarios which are combinations of shock variables. The correlations among such variables would need to be considered when constructing such scenarios.

As in many other countries, macro stress-testing in India is constrained by data availability and absence of a comprehensive macroeconomic model. But, in view of its importance for monetary and financial stability, there is, a need to put in place a macroeconomic stress-testing framework for assessment and surveillance on a regular basis.

The rapid pace of financial innovation of the last few years has brought about a proliferation of new and increasingly sophisticated financial products. It has also, in turn, led to significant institutional changes requiring and creating new and expanded roles in the system. Against this backdrop of increased complexity, financial stability depends on the ability to understand financial markets and to be able to identify, in a timely fashion, the potential consequences of new developments. This requires a great deal of reliance on expertise and judgment, market intelligence and a broad range of financial indicators. Many of these indicators are also measures of financial strength.

1.3 The Global Economy

After four years of continuous strong expansion, global activity has slowed down significantly during 2008. Many advanced economies are experiencing recessionary conditions while growth in emerging market economies is also weakening. The financial crisis that first erupted with the collapse of the US subprime mortgage (Box 1.1) has deepened further and entered a new turbulent phase in September 2008, which has severely affected confidence in global financial institutions and markets. According to the projections released by the International Monetary Fund (IMF) in January 2009 (Table 1.1), global economic activity is estimated to soften from 5.2 per cent in 2007 to 3.4 per cent in 2008 and to 0.5 per cent in 2009 with the downturn led by advanced economies. In advanced economies, output is |

| |

Box1.1: The Sub-Prime Crisis |

| |

The delinquency rate in the US sub-prime mortgage market began to rise in 2005, but market response to developments began only in mid 2007, when credit spreads suddenly began to widen. The trigger was the revelation of losses by a number of firms and the cascade of rating downgrades for sub-prime mortgage products and some other structured products. By August 2007, growing concerns about counterparty risk and liquidity risk, aided by difficulties in valuing structured products, led to a number of other advanced markets being adversely affected. In particular, there was an effective collapse in the market for Collateralised Debt Obligations (CDOs), which are structured products based, in part, on sub-prime mortgages and a withdrawal from asset-backed commercial paper market, and a sudden drying up of the inter-bank term money market. A high degree of inter-linkages across various markets resulted in swift transmission of the crisis from one segment to other segments.

Two explanations have been advanced for the underlying causes. The first highlights the influences particular to this period. Central to this hypothesis is that the ‘originate and distribute’ model altered incentives, so that it became less likely to produce ‘due diligence’ in making loans. Those at the beginning of the sub-prime chain received fees to originate mortgages and were secure in the knowledge that someone else would buy them. Banks at the centre of the securitisation process focused on the profits associated with these instruments, rather than possible threats to their financial soundness and capacity to sustain liquidity. As a result, the quality of mortgage credit declined in the sub-prime area, and much of this credit seems to have ended up being held in highly leveraged positions. Insofar as structured products are concerned, many were highly rated by the concerned rating agencies. In retrospect, it became clear that the ratings were highly sensitive to even minor changes in assumptions about the underlying fundamentals, as well as correlations among defaults and recovery rates. Many investors also did not take on board the fact that ratings were concerned with only credit risk, and high ratings provided no indication of possible major movements in market prices.

The second explanation focuses on the fact that these problems are a manifestation of the unwinding of credit excesses. A continuous worsening of credit standards over the years, in a period of benign interest rates and robust economic growth, eventually culminated in a moment of recognition and recoil.

In terms of possible policy responses, proponents of the first set of arguments contend that the logic of this position leads to the need for central bank liquidity infusions to get markets back on keel. Looking forward, a better understanding of complex financial products and how credit risk transfer techniques reshape downside risks and the greater role of transparency as a cornerstone of modern financial markets assumes importance. Those who focus on credit excesses would emphasise, in addition to the measures enunciated above, the desirability of easing monetary policy, in response to a significant threat to growth.

The current financial turmoil has several important lessons. First, the appropriate role of the monetary authorities and second, the appropriate structure of regulation and supervision. As regards the first, the evidence indicates that the focus of central banks has gradually been narrowing, relative to the more complex responsibilities they have traditionally shouldered. Secondly, there is an increasing trend towards separation of financial regulation and supervision from monetary policy. A view has emerged that problems of information asymmetry might become aggravated in case prudential regulation and supervision are separated from monetary policy, contributing to less than adequate surveillance.

The role of the central bank apart, the sub-prime crisis has thrown up fresh issues and challenges for regulation; the management of risks posed by securitisation; the role of credit rating agencies; the need for greater transparency in financial markets especially where highly leveraged institutions are concerned; better pricing of risk; the design of incentives in banking; better management and supervision of liquidity risk; and, perhaps, the need for the central bank to bring investment banks as well as non-bank financial entities and other market intermediaries that have the potential to affect the stability of financial system under the ambit of its policy framework and operations.

In the Indian case, the authorities have not favoured the adoption of inflation targeting, owing to several reasons. Secondly, the approach to regulation has been institution and market based, being located within the central bank and other regulators combined with a system of coordinated information sharing and monitoring among them. With joint responsibilities for monetary policy and supervision, this has enabled the authorities to use techniques that are precisely calibrated to emerging issues or problems.

forecast to contract on a full-year basis in 2009, the first such fall in the post-war period. Slowdown has been witnessed in both advanced as well as emerging market economies (EMEs) like Argentina, China, India and Thailand during 2008. All major advanced economies like the |

| |

Table 1.1: Output Growth, Inflation and Interest Rates in Select Economies |

(per cent) |

Region/ Country |

Real GDP* |

Consumer price Inflation |

Short-term interest rate |

2007 |

2008 |

2009 |

2010 |

2007 |

2008 |

Current |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

World |

5.2 |

3.4 |

0.5 |

3.0 |

- |

- |

|

Advanced economies |

2.7 |

1.0 |

(-2.0) |

1.1 |

2.1 |

3.5 |

|

Of which |

|

|

|

|

|

|

|

United States |

2.0 |

1.1 |

(-1.6) |

1.6 |

4.1 |

3.8 |

0.36 |

Euro Area |

2.6 |

1.0 |

(-2.0) |

0.2 |

3.2 |

3.1 |

2.05 |

Japan |

2.4 |

(-0.3) |

(-2.6) |

0.6 |

0.7 |

1.4 |

0.61 |

Emerging economies |

8.3 |

6.3 |

3.3 |

5.0 |

6.4 |

9.2 |

|

Developing Asia |

10.6 |

7.8 |

5.5 |

6.9 |

5.4 |

7.8 |

|

China |

13.0 |

9.0 |

6.7 |

8.0 |

6.5 |

5.9 |

1.34 |

India** |

9.3 |

7.3 |

5.1 |

6.5 |

5.5 |

8.2 |

4.78 |

South Korea |

5.0 |

4.1 |

(-2.8) |

- |

3.9 |

4.9 |

2.93 |

Singapore |

7.7 |

1.9 |

(-2.9) |

- |

4.4 |

6.6 |

0.56 |

Thailand |

4.8 |

3.4 |

(-1.0) |

- |

4.3 |

5.5 |

2.22 |

Argentina |

8.7 |

5.5 |

(-1.8) |

- |

8.5 |

8.6 |

15.13 |

Brazil |

5.7 |

5.8 |

1.8 |

3.5 |

4.5 |

5.7 |

12.66 |

Mexico |

3.2 |

1.8 |

(-0.3) |

2.1 |

3.8 |

5.1 |

7.16 |

Central and |

|

|

|

|

|

|

|

Eastern Europe |

5.4 |

3.2 |

(-0.4) |

2.5 |

- |

- |

|

Russia |

8.1 |

6.2 |

(-0.7) |

1.3 |

12.6 |

14.1 |

13.00 |

Turkey |

4.6 |

2.3 |

0.4 |

- |

8.2 |

10.5 |

14.02 |

Updated from World Economic Outlook – January 28, 2009 and ‘The Economist’ – February 7, 2009

* : Average annual change, in per cent;

** : for India, wholesale prices;

Note: Interest rate per cent per annum.

Source: IMF World Economic Outlook and the Economist. |

|

| |

Euro area, Japan, the UK and the US are projected to register decelerated growth rates (at times negative growth rates) in 2008 as compared to those during 2007.

The IMF has projected the US economy to grow by 1.1 per cent in 2008 (2.0 per cent in 2007) and contract by 1.6 per cent in 2009. The US economy has been severely impacted by the direct effects of the financial crisis that originated in its subprime mortgage market, though aggressive policy easing by the Federal Reserve, a timely fiscal stimulus package, and a strong export performance on the back of a weakening US dollar have helped to cushion the impact of the financial crisis till the second quarter of 2008. The US economy may contract during the final quarter of 2008 and the first half of 2009, as export momentum moderates and tight financial conditions lead to more problems. The IMF expects the US economy to stabilise by the end of 2009 and then recover gradually. The key factors that will determine short-term outlook include effectiveness of recent Government initiatives to stabilise financial market conditions, the behaviour of US households in the face of rising stress and the depth of housing cycle. The projections envisage a significant slowdown in growth in the Euro area to 1.0 per cent in 2008 from 2.6 per cent in 2007 mainly on account of tightening credit conditions, falling confidence, housing downturns in several economies and the US slowdown. The economy is expected to contract by 2.0 per cent in 2009. The momentum of recession in Japan is projected to accelerate to -2.6 per cent in 2009 (-0.3 per cent in 2008) on account of slowing exports, expected further weakening of domestic demand and slowing down of private investment.

The emerging and developing economies have not decoupled from this downturn. Growth projection for developing Asia by the IMF is placed at 7.8 per cent for 2008 as against 10.6 per cent in 2007 as domestic demand, particularly investment and net exports have moderated. Countries with strong trade links with the US and Europe are slowing down markedly. Also, countries relying on bank-related or portfolio flows to finance large current account deficits have been adversely affected by strong risk aversion, deleveraging and the consequent shrinkage in external financing. Nevertheless, growth in emerging Asia during 2008 was led by China and India. GDP in China eased to 9.0 per cent for 2008 (projected to grow at 6.7 per cent in 2009) from 13.0 per cent during

2007 partly due to slowing of exports. The IMF projects India's growth rate to moderate from 9.0 per cent in 2007 to 7.3 per cent in 2008.

Upon weakening of investment though private consumption and exports, India’s GDP is expected to decelerate further to 5.1 per cent

during 2009.

Going forward, financial conditions are likely to remain fragile, constraining global growth prospects. Financial markets are expected to remain under stress throughout

2008 and 2009 though some recovery is expected in 2010. Though the forceful and co ordinated policy responses in many countries

have contained the risks of a systemic financial meltdown, further strong and complementary policy efforts may be needed to rekindle activity.

At the same time fiscal stimulus packages should rely primarily on temporary measures and be formulated within medium-term fiscal frameworks that ensure that the envisaged build-up in fiscal deficits can be reversed as economies recover. There are many reasons to remain concerned about the potential impact on activity of the financial crisis. There are substantial downside risks to the global growth outlook, which relate to two concerns, viz., financial stress could remain very high and credit constraints from deleveraging could be deeper and more protracted than envisaged. This would increase risk of substantial capital flow reversals and disorderly exchange rate depreciation for many emerging market economies. Another downside risk relates to growing risk for deflationary conditions in advanced economies. Additionally, the US housing market deterioration could be deeper and more prolonged than forecast, and the European housing markets could weaken more broadly. Factors that would help in reviving the global economy in late 2009 include expected stabilisation in commodity prices, a turnaround in the US housing sector after finally reaching the bottom and support from continued robust demand in many EMEs despite some cooling of their momentum. Policy makers face the major challenge of stabilising global financial markets, while nursing their economies through a period of slower growth and keeping inflation under control.

Rising inflation, which was a concern for a major part of 2008, has however, eased since September 2008 and is now a declining concern on account of marked decline in food and fuel prices as well as augmentation of downward risks to growth from the intensification of the global financial crisis.

As per the IMF projections, inflation in the advanced economies will decline from 3.5 per cent in 2008 to 0.3 per cent in 2009, before edging up to 0.8 per cent in 2010. For the emerging market and developing economies, the IMF projects the CPI inflation to subside from 9.2 per cent in 2008 to 5.8 per cent 2009, and to 5.0 per cent in 2010.

Global financial markets witnessed generally uncertain conditions since 2008. The turbulence that had erupted in the US sub-prime mortgage market in mid 2007 and gradually deepened towards early 2008, resulted in the inter-bank money markets failing to recover as liquidity demand remained elevated. Spreads between LIBOR rates and overnight index swap rates increased in all three major markets, viz., the US, the UK and the euro area. Central banks continued to work together and also individually to improve liquidity conditions in financial markets. Financial markets deteriorated substantially during the third quarter of 2008 (July-September). Bankruptcy/sell-out/ restructuring became more widespread spreading from mortgage lending institutions to systemically important financial institutions and further to commercial banks. The failure of banks and financial institutions also broadened geographically from the US to many European countries. As a result, funding pressures in the inter-bank money market persisted, equity markets weakened further and counterparty credit risk increased. Central banks continued to take action to enhance the effectiveness of their liquidity facilities. EMEs, which had been relatively resilient in the initial phase of the financial turbulence, witnessed an environment of tightened external funding condition, rising risk and till recently, high inflation led by elevated food and energy prices.

During the last quarter of 2008, short-term interest rates in advanced economies eased considerably, moving broadly in tandem with the policy rates and liquidity conditions. In the US, short-term interest rates continued to decline between October 2008 and December 2008 as a result of reduction in its policy rates and liquidity injections. In the UK, short-term interest rates which increased till September 2008, declined from October 2008 as a consequence of the cuts in the policy rate. Short-term interest rates which increased in the Euro area during the quarter ended September 2008, declined in October 2008 on account of reductions in its refinance rate. In the EMEs, short-term interest rates generally softened in countries such as China, India, Singapore, South Korea, Brazil and Thailand but firmed up in economies like Argentina and Philippines from October 2008.

1.4 India

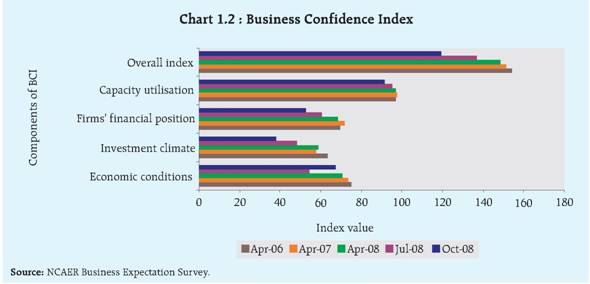

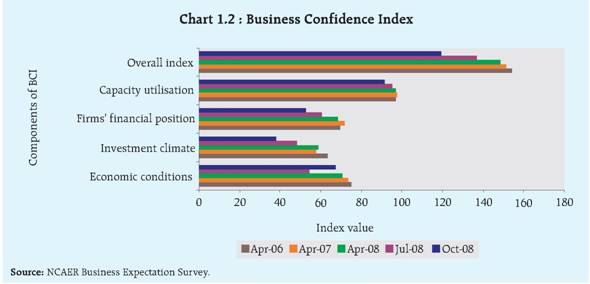

The impressive performance of the Indian economy in recent years bears testimony to the benefits of the economic reforms undertaken since the early 1990s (Table 1.2). Real GDP growth had averaged 5.2 per cent during 1997-98 to 2002-03. Since 2003-04, there has been a strengthening of the growth momentum. Real GDP growth averaged 8.8 per cent during the five year period ended 2007-08,making it one of the world’s fastest growing economies. This is because of a number of factors, including the restructuring measures taken by Indian industry, the overall reduction in domestic interest rates, improved corporate profitability, a benign investment climate, strong global demand and a commitment to a rule based fiscal policy. In the very recent period, growth in Indian economy has seen some moderation on the back of the global financial meltdown. The recent Business Confidence Index (NCAER, October 2008), has fallen to a five-year low of 119.9 reflecting a dent in optimism because of current financial market volatility (Chart 1.2)1. The index stood at 154 in January 2008 but has consistently deteriorated since then.

Unlike in East Asia, domestic demand has been the main driver of economic activity in India. The consumption to GDP ratio at nearly two-thirds is one of the highest in Asia. The |

| |

Table 1.2 : Key Macroeconomic Ratios (Per Cent to GDP) |

(at Factor cost) |

2000-01 |

2006-07 |

2007-08 |

1 |

2 |

3 |

4 |

Gross Domestic Product (Per cent growth) |

4.4 |

9.6 |

9.0 |

Consumption Expenditure |

76.3 |

66.1 |

65.5 |

Investment |

24.3 |

35.5 |

39.0 |

Savings |

23.7 |

34.3 |

37.7 |

Exports |

13.2 |

22.1 |

21.3 |

Imports |

14.2 |

25.1 |

24.4 |

Balance of Trade |

-1.0 |

-3.0 |

-3.1 |

Current Account Deficit |

-0.4 |

-0.9 |

-1.4 |

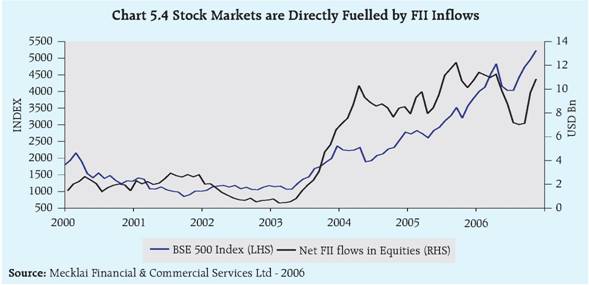

Net inflows by FIIs in the Indian stock market |

0.52 |

0.81 |

1.54 |

Source : RBI, CSO |

|

| |

1 The computation of BCI is based on two indicators each for overall economic environment and business performance. These include: (a) overall assessment of the economy over the next six months; (b) prevailing investment climate; (c) financial position of firms over the next six months; and (d) present rate of capacity utilisation. In essence, the index captures the prospective assessment of the business conditions and the economic environment by the business sector. |

| |

|

| |

corporate sector has responded to increased global competition by improving productivity between 2003-04 to 2006-07. This, in turn, has improved corporate profitability and led to a pick-up in investment rates, from 22.8 per cent of GDP in 2001-02 to 35.9 per cent in 2006-07. The Wholesale Price Index (WPI) inflation was contained, averaging 5.1 per cent over 2000-01 to 2007-08, partly reflecting a very limited pass through of higher oil prices, administrative steps to dampen food price pressures and stable inflation expectations in view of pre-emptive policy measures. Higher food prices, however, have contributed to Consumer Price Index (CPI) inflation, which has hovered around 6 per cent. Mid-2008 also saw a significant increase in WPI resulting in a high rate of inflation touching almost 13 per cent in August 2008 which however has maintained a downward trend since September 2008. The administered price of petroleum products, which were revised upwards in June 2008, was the major driver of the high inflation rate. Prices of freely priced petroleum products had also increased and added to the inflationary pressure. There has however, been a very significant reduction in oil prices in recent months. The administered price of petroleum products have been reduced in January 2009.

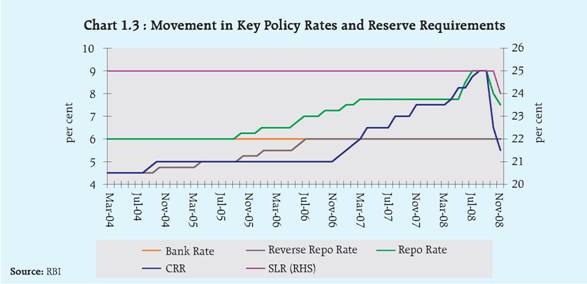

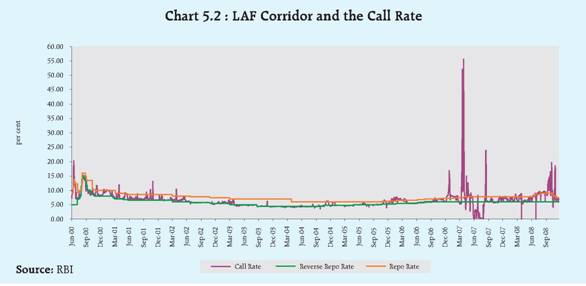

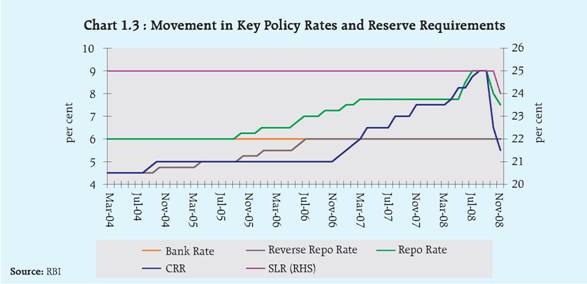

In response to global hardening of interest rates and increased inflationary pressure till August 2008, the Reserve Bank had gradually raised policy rates. The reverse repo (borrowing) rate had risen to 6 per cent (since July 2006), while the repo (lending) rate had risen to 9 per cent. The Cash Reserve Ratio (CRR) for the banking system also was raised from 5.25 per cent in December 2006 to 9 per cent effective from August 30, 2008. In response to higher credit growth, the Reserve Bank tightened prudential norms, including increasing provisioning requirements and raising risk-weights in select sectors. Indicators on financial soundness, including stress tests of credit and interest rate risks, suggest that banks’ balance sheets and income remain healthy and robust.

However, consequent to the reversal of capital flows which have led to a liquidity shortage in the economy the Reserve Bank has reduced key ratios from October 2008, to facilitate flow of funds in the market. By January 2009 the CRR was reduced to 5.0 per cent, repo rate to 5.5 per cent and reverse repo rate to 4.0 per cent. The banks were also allowed to reduce SLR to 24 per cent (Table 1.3 & Chart 1.3).

Merchandise exports has been growing and becoming increasingly broad-based in terms of destinations and composition, reflecting India’s growing integration into the global economy. A striking feature of export growth has been the rapid growth in services exports, amounting to USD 87.7 billion in 2007-08. Merchandise exports and imports for quarter ended June 2008 stood at USD 43.7 billion and USD 75.2 billion respectively. Export to GDP ratio has more than doubled to 13.5 per cent in 2007-08 compared to less than 6 per cent in 1990-91. The growth in imports has also been rapid, with the import/GDP ratio being 21.2 per cent in 2007-08. Despite the widening trade deficit, the current account deficit has remained modest, due largely to high levels of private transfers, aggregating USD 42.6 billion in 2007-08 averaging 3.2 per cent of GDP during the last four years. India is the leading remittance receiving country in the world with relative stability of such inflows. |

| |

Table 1.3: Benchmark Policy Rates |

(per cent per annum) |

| |

2000-01* |

2003-04* |

2006-07* |

2007-08* |

January 17, 2009 |

1 |

2 |

3 |

4 |

5 |

6 |

Repo rate$ |

6.50 |

6.00 |

7.75 |

7.75 |

5.50 |

Reverse repo rate$ |

8.50 |

4.75 |

6.00 |

6.00 |

4.00 |

CRR |

8.00 |

5.00 |

7.50 |

7.50 |

5.00 |

SLR |

25.00 |

25.00 |

25.00 |

25.00 |

24.00 |

* Position as on March 31.

$ w.e.f October 29, 2004 the nomenclature of repo and reverse repo has been changed as per international

usage in terms of which, repo rate represents the rate at which the central bank injects liquidity into the

system and the reverse repo rate represents the rate at which it absorbs liquidity.

CRR – Cash Reserve Ratio

SLR – Statutory Liquidity Ratio

Source: RBI |

|

| |

|

| |

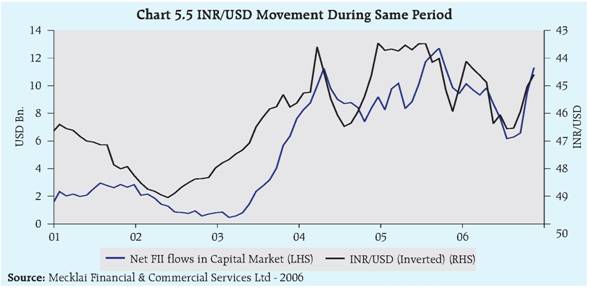

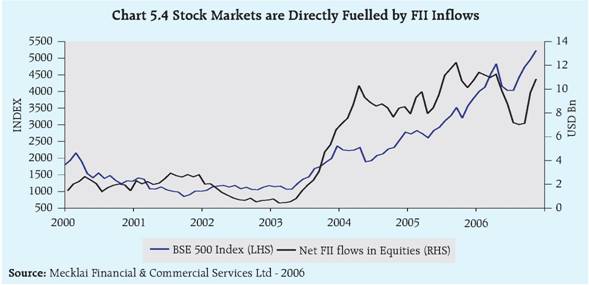

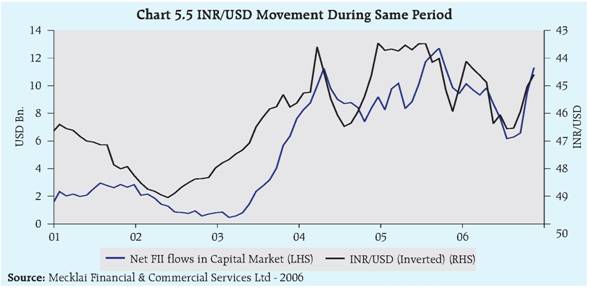

Strong capital inflows have been instrumental in financing the current account deficit. Capital flows (net) jumped from an average of around USD 9.4 billion (2 per cent of GDP) during 2000-03 to around USD 51.8 billion (5.3 per cent of GDP) during 2004-08. Capital flows (net) amounted to USD108.0 billion during 2007-08. In a reversal of a previously observed trend, foreign direct investment (FDI) has outpaced foreign portfolio investment (FPI), in 2008-09. FDI and FPI for the quarter ended June 2008 stood at USD 10 billion and USD (-)4 billion respectively. The positive investment climate, progressive liberalisation of the FDI policy regime, along with rising pace of mergers and acquisitions across diverse sectors, has boosted FDI flows. The reversal in trend in respect of portfolio capital inflows in 2008-09. however, has, impacted the capital market and the foreign exchange markets in India significantly.

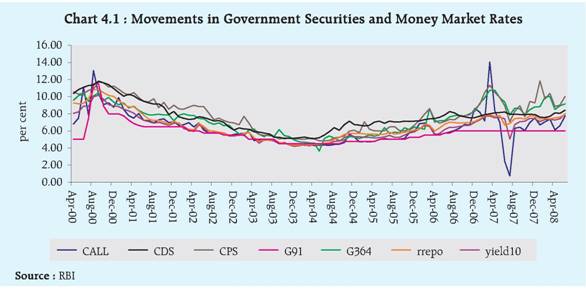

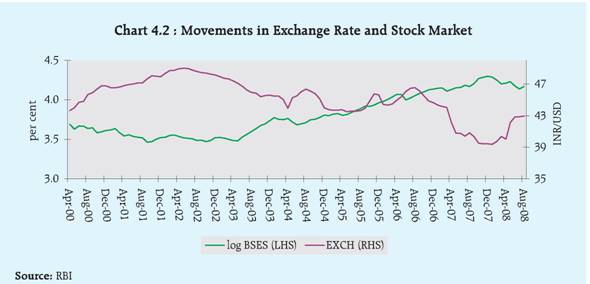

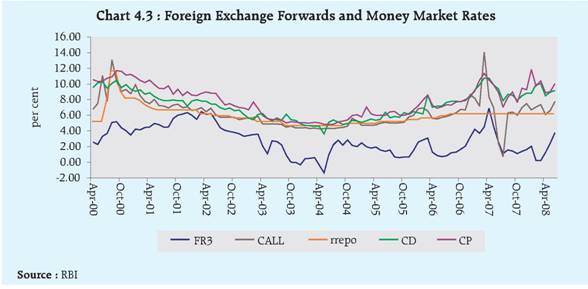

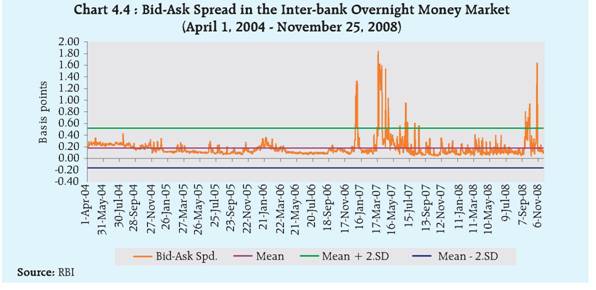

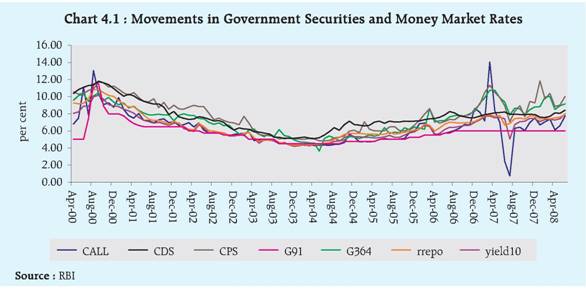

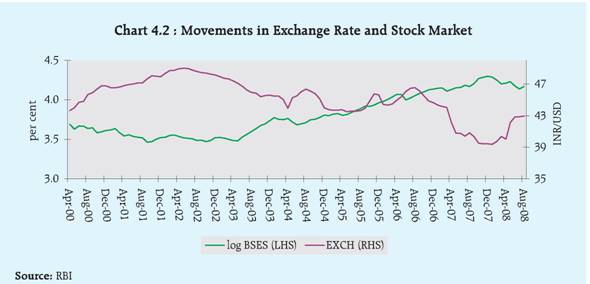

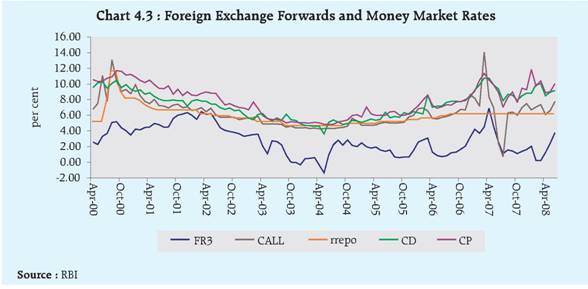

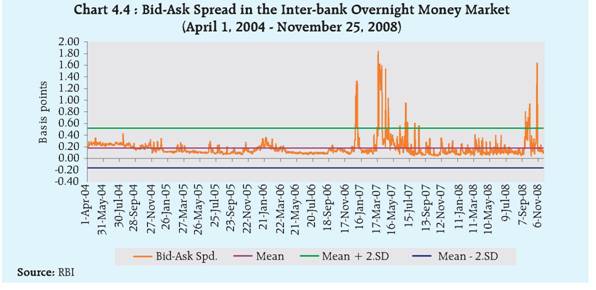

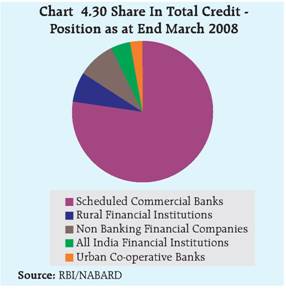

Foreign exchange reserves rose to USD 309.7 billion at end March 2008. The increase in reserves has mainly been on account of an increase in foreign currency assets from USD 191.9 billion during end March 2007 to USD 299.2 billion as at end March 2008. However, in the past few months, the foreign exchange reserves, have shown a declining trend, mainly reflecting valuation changes and stood at USD 248.6 billion as on January 30, 2009.