IST,

IST,

II. Economic Review

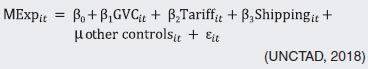

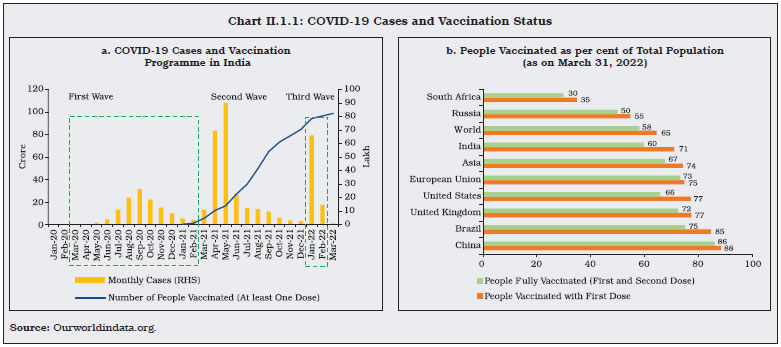

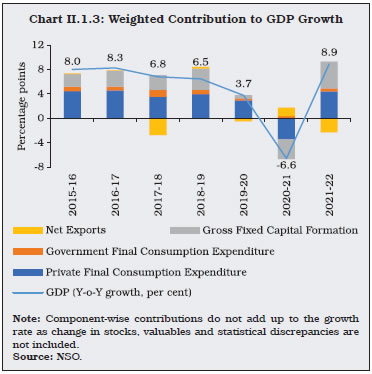

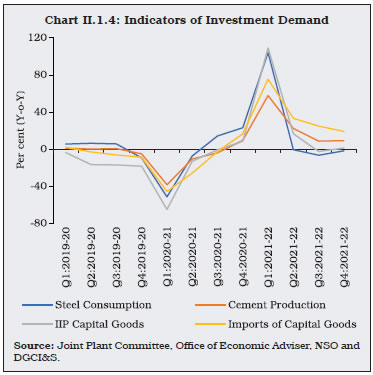

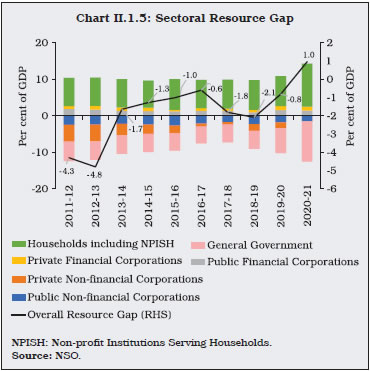

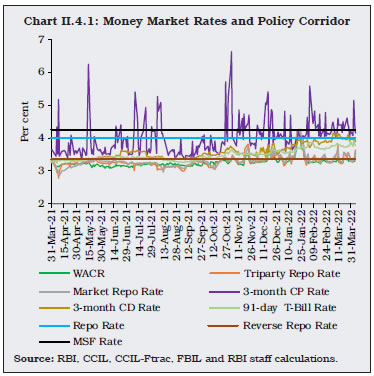

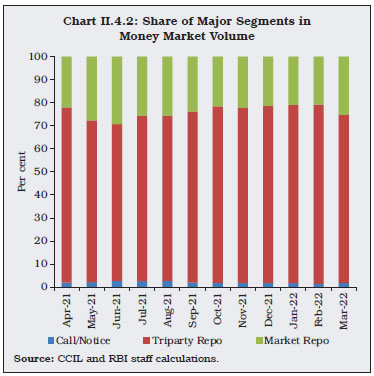

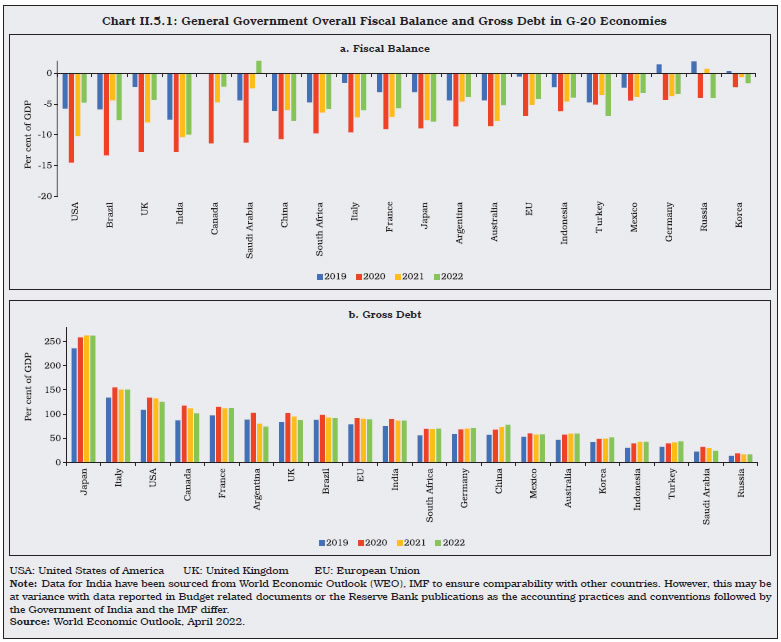

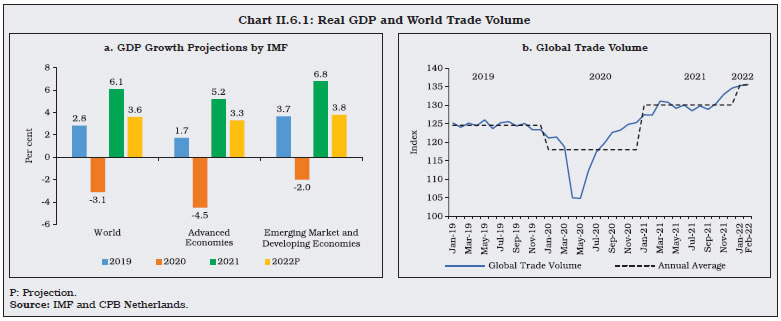

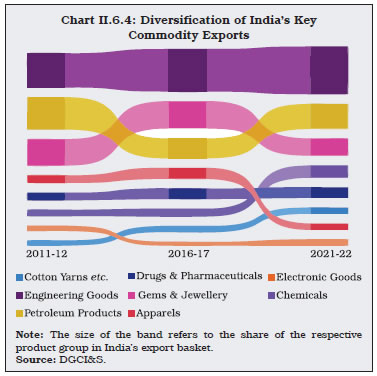

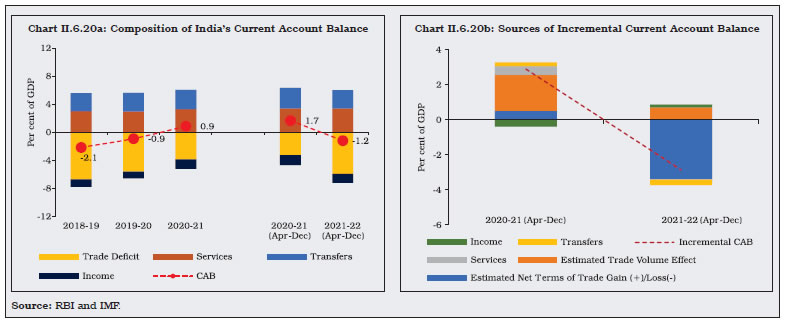

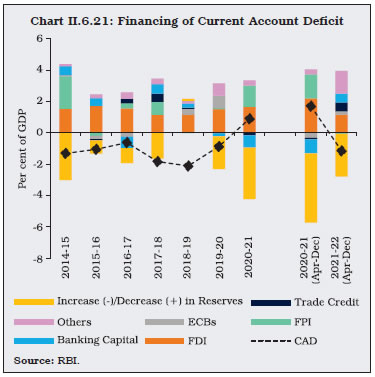

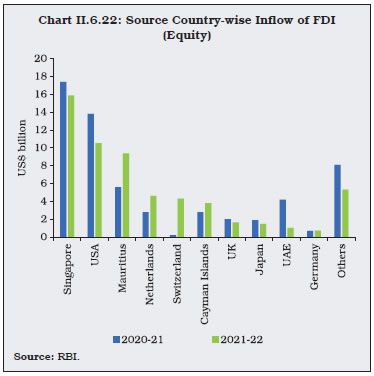

The Indian economy renewed its tryst with the recovery from the pandemic in 2021-22, albeit interrupted by a virulent second wave of infections and a relatively milder third wave. Headline inflation spiked on repetitive supply shocks during the year, though reversion to the target was also evident as shocks receded. Monetary and credit conditions evolved in sync with the accommodative monetary policy stance, although global spillovers towards the close of the year led to some tightening in financial conditions and heightened volatility in financial markets. The intensification and materialisation of geopolitical risks in early 2022 overcast the global outlook, with EMEs including India, being the most vulnerable to spillovers. A robust recovery in tax revenues helped contain the gross fiscal deficit close to budgetary targets. The sustained strength of exports and revival in inbound remittances underpinned the viability of the balance of payments, with net capital flows also contributing to the accretion to foreign exchange reserves. II.1 THE REAL ECONOMY Global Economy1 II.1.1 Omicron, rising food prices and sticky inflation, the US Fed’s much anticipated lift-off, and escalation of geopolitical tensions towards the end of the year flaring up into conflict in early 2022 defined the macroeconomic and financial landscape during this Annual Report’s period under review. Over the first half of 2021, an uneven and divergent recovery had lifted the global economy out of the deep contraction imposed by the pandemic in the preceding year. According to the International Monetary Fund (IMF) in its World Economic Outlook of April 2022, world GDP expanded by 6.1 per cent in 2021 as against a contraction of 3.1 per cent in the previous year. After a sharp setback due to the virulent Delta variant of the coronavirus in the early part of 2021, the global recovery had regained some traction even as paths of growth were widely differentiated across jurisdictions by the size and durability of monetary and fiscal stimuli, and access to vaccines. Global growth lost pace in the second half of the year, beset by the highly transmissible but milder variant of COVID-19 – Omicron. Despite these waves superimposed on global supply chain and logistics disruptions, global trade recovered in the second half of the year and grew by 10.1 per cent in 2021. Underpinning this upturn, global manufacturing accelerated to 9.4 per cent in2021 from 4.2 per cent in 2020.2 II.1.2 Even as the release of pent-up spending supported aggregate demand, persisting supply disruptions fuelled inflation which increased markedly in the US, the Euro area and a number of emerging market economies (EMEs). Commodity prices increased sharply in 2021 from their lows a year ago as the nascent recovery in demand collided with supply bottlenecks. While fiscal and monetary policies remained largely accommodative, inflation ruling above targets forced several EMEs to tighten monetary policy, with advanced economy (AE) central banks following in their train. Tapers of pandemic-induced liquidity overhangs but without tantrums tightened financial conditions. In the financial markets, risk-off sentiment drove equity markets into correction. Bearish government bond market experienced hardening of real yields across AEs. As shorter-term yields began to reflect the shift in the monetary policy stance, the consequent flattening of the yield curve pointed to global growth momentum losing steam towards the close of 2021 and in early 2022. As risk aversion set in with geopolitical conflict, there was considerable re-pricing of financial assets. Consequently, gold prices have surged, also buoyed by stagflation concerns and rate hike expectations. Investors face a very different dynamic as fiscal and monetary policy support fades in the face of elevated levels of public debt3 with higher and persisting inflationary pressures across AEs and EMEs alike. Domestic Economy II.1.3 In 2021-22, India renewed its tryst with the recovery that had commenced in the second half of 2020-21 with the abatement of the first wave. The second wave took a grievous toll, however, pushing the nation into arguably the worst health crisis the country had ever faced (Chart II.1.1). Supported by continuing fiscal measures and congenial financial conditions engendered by monetary, regulatory and liquidity initiatives undertaken by the Reserve Bank, including some unconventional ones, the real GDP bounced back in Q2:2021-22 and grew at 1.3 per cent over Q2:2019-20. The recovery was further entrenched in Q3:2021-22 with GDP exceeding the corresponding pre-pandemic quarter by 6.2 per cent. In Q4, however, the third wave of the pandemic driven by the Omicron variant and more recently, geopolitical conflict has caused a loss of pace in the recovery and darkened the outlook.  II.1.4 Unlike in the first wave, the economic impact of the second wave of the pandemic was contained due to the localised nature of lockdowns and better adaptability to pandemic protocols. Growth impulses, rejuvenated by the receding of the second wave from June 2021, were fortified bythe pace and scale of inoculation.4 II.1.5 Turning to financial conditions, money markets were flush with abundant liquidity, with short-term interest rates aligned to the floor of the Reserve Bank’s liquidity adjustment facility (LAF), although they did firm up in the second half of the year as a result of rebalancing of liquidity towards auctions and away from the fixed rate reverse repo, a cessation of large liquidity injections through secondary market asset purchases and the lapsing of some extraordinary measures on due dates. In the debt markets, yields hardened in the second half of the year and spreads widened as market sentiment turned bearish on large issuances by governments (centre and states) and the recurring incidence of global spillovers as monetary policy stances diverged across the world. The Indian rupee (INR) traded range-bound, displaying strong mean reversion after every bout of volatility from global developments. The INR was also buoyed by sustained capital inflows in the form of foreign direct investment and portfolio flows attracted by a spate of initial public offerings (IPOs). Domestic equity indices outperformed the peer country indices in 2021. After two years of large gains, however, valuations of Indian equities were stretched by most conventional yardsticks. II.1.6 The Omicron-led third wave hit India at the end of December 2021. It, however, turned out to be short-lived. The spike in infections with high transmissibility was followed by a steep fall - daily infections peaked on January 20, 2022 with 3.47 lakh new cases and total 20.1 lakh active cases but began to subside thereafter. The mortality rate remained much below that of the second wave. High frequency indicators of economic activity suggest that the impact of third wave on the economy will likely be muted in comparison with the first two waves. II.1.7 Against this backdrop, an analysis of aggregate demand in the following sub-section is followed by an assessment of aggregate supply conditions. Sub-section 4 presents a drill-down into employment and labour market developments. The concluding sub-section provides some policy perspectives. 2. Aggregate Demand II.1.8 The second advance estimates (SAE) that were released by the National Statistical Office (NSO) on February 28, 2022 indicated that aggregate demand, measured by real GDP, registered a growth of 8.9 per cent in 2021-22, up from a contraction of 6.6 per cent in the previous year (Table II.1.1 and Appendix Table 1). Consequently, the GDP level surpassed the pre-pandemic level of 2019-20 by 1.8 per cent. II.1.9 In the first half of 2021-22, real GDP registered double-digit growth which tapered in the second half due to the gradual waning of base effects. The underlying momentum remained strong, however, as evident in a sharp rebound in the seasonally adjusted annualised growth rate (SAAR) in Q2:2021-22 that appears to have been sustained in subsequent quarters (Chart II.1.2 and Appendix Table 2). II.1.10 Within this turnaround during the year, there was a compositional shift among constituents of aggregate demand (Chart II.1.3). Private final consumption expenditure (PFCE) remained weak by historical standards although it managed to surpass its pre-pandemic level by 1.2 per cent. With contact-intensive activity yet to normalise fully, discretionary consumption spending lacked traction. Government consumption expenditure accelerated in 2021-22, providing an upward thrust to aggregate demand. Gross fixed capital formation (GFCF) rebounded sharply, primarily backed by public investment as government prioritised capital expenditure. Exports recovered strongly in spite of hostile international environment and entered into positive growth territory from Q4 of 2020-21. Propelled by surging import demand and rising international commodity prices, especially of crude, the current account shifted from a surplus to modest deficits from Q2:2021-22.   Consumption II.1.11 Private consumption - the mainstay of aggregate demand in India - partially recuperated with the gradual relaxation of restrictions on mobility and the accelerated pace of vaccination, both enabling a restoration of consumer confidence. Spending on consumer durables improved on a y-o-y basis and discretionary expenditure mainly took the form of revenge spending. A combination of factors, viz., robust growth in agriculture and allied activities, support from the government in the form of cut in excise duty on petrol and diesel, and continuation of direct benefit transfer (DBT) schemes helped shore up confidence and boost consumption spending. II.1.12 With the second wave’s intensity, private consumption sank below its pre-pandemic level in Q1:2021-22 and consumer confidence plummeted to an all-time low. The wave peaked during the month of May 2021 and thereafter, conditions started to improve. In the subsequent rounds, the Reserve Bank’s consumer confidence survey exhibited gradual improvement in consumer perceptions pertaining to both the current situation and future expectations except a dip in the January 2022 round at the peak of Omicron variant impact of COVID-19. PFCE rebounded in Q2 and Q3 of 2021-22, with an uptick in y-o-y terms as well as on a sequential basis (in level terms). The release of pent-up demand coupled with an upbeat festival season sentiment was partially offset by supply-side disruptions in the form of shortages of supply of coal, electricity and, particularly, semiconductor chips. This was manifested in moderation in growth in sales of passenger vehicles, motorcycles, and two-wheelers during the second half of the year. On the other hand, an encouraging development was the gradual pick-up in bank credit, especially in the personal loans segment. Credit growth also accelerated in respect of agriculture, MSMEs and select services. II.1.13 Indicators of rural demand reveal a slackness, vis-a-vis urban demand despite resilience in agriculture and allied activities during the first half of the year. Furthermore, a bountiful monsoon, adequate soil moisture and replenished reservoir levels brightened its prospects for the rest of the year. However, the last quarter reflected signs of demand slowdown as firms increasingly passed on cost pressures to end use customers. Investment and Saving II.1.14 The rate of gross domestic investment in the Indian economy, measured by the ratio of gross capital formation (GCF) to GDP at current prices, nosedived to 27.3 per cent in 2020-21 from 30.7 per cent in the preceding year. Although data on GCF are not yet available for 2021-22, movements in its constituents suggest an uptick led by government spending on infrastructure. The ratio of real GFCF to GDP surged to 32.0 per cent in 2021-22 from 30.5 per cent in 2020-21, reflecting a revival of investment sentiments. GFCF registered an acceleration of 14.6 per cent in 2021-22, on the back of a favourable base effect. II.1.15 Among the components of GFCF, recovery in the construction sector was facilitated by the focus of the central government on infrastructure, in addition to an uptick in the housing segment on favourable interest rates and attractive offers by developers. This resurgence is evident in its proximate coincident indicator – cement production (Chart II.1.4). A similar recovery became evident in investment in machinery and equipment. Both its proximate coincident indicators - imports and production of capital goods - registered sharp expansion in 2021-22. II.1.16 As per the order books, inventories and capacity utilisation survey (OBICUS) of the Reserve Bank, capacity utilisation in manufacturing recovered to 68.3 per cent in Q2 and further to 72.4 per cent in Q3:2021-22 after a drop to 60.0 per cent in Q1:2021-22 in the wake of the second wave of the COVID-19. The inventory to sales ratio increased in Q1:2021-22, reflecting the containment measures under which the economy was operating. With the subsequent improvement in sales and stable levels of inventories maintained by manufacturing companies, the inventory to sales ratio declined sequentially in Q2 and Q3:2021-22. The respondents of the 97th round of the Industrial Outlook Survey (IOS) assessed that there was improvement in demand conditions in terms of production, order books and employment situation in Q4:2021-22, albeit at a slower pace than Q3:2021-22. Capacity utilisation and the overall financial situation are expected to improve further in Q1:2022-23 while business expectations remained high, though optimism has moderated from the previous quarter. Respondents expressed higher optimism for growth in selling prices, indicating more pricing power combined with input cost pressures in Q1:2022-23.  II.1.17 The rate of gross domestic saving had dropped to 27.8 per cent of gross national disposable income (GNDI) in 2020-21 from 29.4 per cent a year ago due to dissaving of the general government sector and a fall in saving of the non-financial corporations. The financial saving of the household sector – the most important source of funds – surged by 3.6 percentage points to 11.5 per cent of GNDI in 2020-21, the highest in over two decades (Table II.1.2 and Appendix Table 3). The reduction in discretionary spending amidst the pandemic and the associated forced saving as well as a surge in precautionary saving on concerns relating to income flows in the near-term boosted saving by households. II.1.18 In 2020-21, saving had exceeded investment for the first time since 2004-05. The surplus from the household sector amounted to 11.8 per cent of GDP in 2020-21. The resource gap of private non-financial corporations closed in 2020-21, due to a curtailment in investment amidst the pandemic. As alluded to earlier, the drawdown on saving by the general government sector increased due to increase in spending to ameliorate the impact of the pandemic (Chart II.1.5).   3. Aggregate Supply II.1.19 Aggregate supply, measured by gross value added (GVA) at basic prices, expanded by 8.3 per cent in 2021-22 after registering a contraction of 4.8 per cent in 2020-21. With the gradual unshackling of the economy from pandemic-related restrictions, the three-quarter moving average of seasonally adjusted annualised growth rate (MA-SAAR) exhibited an upturn in Q2:2021-22 and remained resilient in Q3:2021-22 (Chart II.1.6). II.1.20 The acceleration in GVA growth was facilitated by a sustained recovery in the industrial and the services sectors, albeit on a favourable base. The agricultural sector provided a cushion to the economy, staying resilient throughout the year (Table II.1.3). II.1.21 Globally, COVID-19 induced shutdowns caused output losses in the manufacturing sector and overall GDP. In the case of India, the sharp contraction in Q1:2020-21 during the stringent nationwide lockdown was followed by a rebound in profits of the corporate non-financial sector (Box II.1.1).

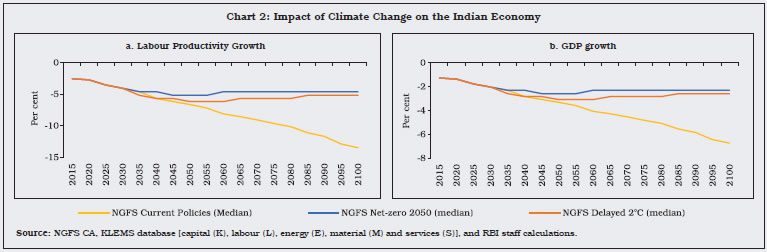

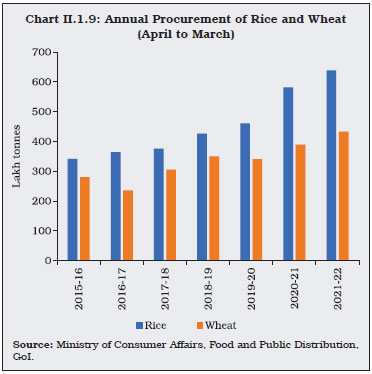

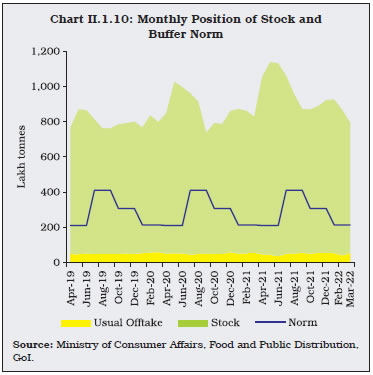

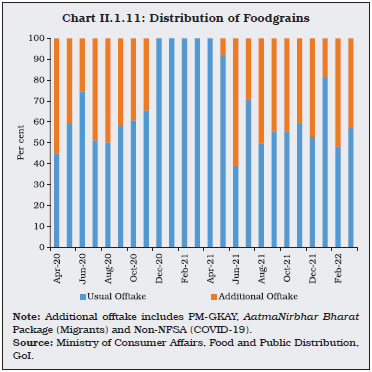

Agriculture and Allied Activities II.1.22 Agriculture and allied activities posted a robust performance in 2021-22, even though the second wave of the pandemic affected rural areas on a larger scale than during the first wave. The sector registered a growth of 3.3 per cent in 2021-22, with record production in foodgrains. The strong growth was aided by a sharp catch-up in south-west monsoon (SWM) and kharif sowing in the month of September 2021. Except for rice and wheat, the prospects for rabi production was good with robust sowing, coupled with adequate soil moisture and replenished reservoir levels. The buoyancy in the agriculture sector was mirrored in sales of tractors and fertilisers, which consistently outstripped pre-pandemic levels for the major part of 2021-22.  II.1.23 In 2021, the SWM made its onset on June 3, but lost momentum during end-June to mid-July and again in August, with uneven distribution of rainfall across states (Chart II.1.7a). Notwithstanding these two weak spells of rainfall during the critical sowing months of July and August, rainfall revived subsequently and ended on a positive note for the season, i.e., ‘normal’, with a deficit of 1 per cent from the long period average (LPA) as on September 30, 2021. Kharif sowing which stalled in July and August, subsequently, caught up and surpassed the previous year’s sowing levels by 0.2 per cent and 5-year average levels by 4.1 per cent as on September 30, 2021. II.1.24 Subsequently, the delayed withdrawal of the SWM and simultaneous start of the north-east monsoon (NEM) on October 25, 2021 created congenial soil moisture conditions and raised reservoir levels (Chart II.1.7b). As on January 27, 2022, the reservoir level stood at 66 per cent of full reservoir capacity as compared with the decadal average of 53 per cent (Chart II.1.8). II.1.25 The jump in rabi acreage this year was mainly driven by higher sowing of oilseeds, especially mustard and rapeseed, and gram and lentils, offsetting the lower sowing of wheat. Consequently, total foodgrain production in 2021-22 is placed at 3,145.1 lakh tonnes, in the third advance estimates (3rd AE), 1.2 per cent higher than 2020-21 final estimates (FE) [Table II.1.4]. The downward revision of foodgrain production estimate by 0.5 per cent (3rd AE over 2nd AE) is mainly on account of yield loss in wheat due to persistent heatwaves in 2022 (March and April). Horticulture crops logged a production at 3,332.5 lakh tonnes (1st AE) during 2021-22, 0.4 per cent lower than 2020-21 FE due to lower output of tomato, other vegetables, spices, flowers, aromatics and medicinal plants, while the output of total fruits and onion have registered an increase.  II.1.26 In line with the approach adopted in recent years, the minimum support prices (MSPs) announced in 2021-22 for both rabi and kharif crops ensured a minimum return of 50 per centover the cost of production.8 The prices were raised in the range of 1.1 - 8.6 per cent across crops. The procurement level at 503.42 lakh tonnes for rice as on March 31, 2022, during the kharif marketing season of 2021-22, was 8.2 per cent higher than the corresponding period of last year (Chart II.1.9). The stock of cereals remained comfortable at 7.2 and 1.4 times the quarterly buffer norms for rice and wheat, respectively, as on March 31, 2022 (Chart II.1.10).  II.1.27 Stock levels of cereals were maintained despite the additional free distribution of foodgrains over and above the normal National Food Security Act (NFSA) entitlements of 5 kilogram/person/month to all NFSA beneficiaries under the Pradhan Mantri Garib Kalyan Anna Yojana (PM-GKAY) to alleviate the impact of the pandemic (Chart II.1.11).   II.1.28 In recent years, the impact of climate change in terms of volatile rainfall intensity, increase in extreme events and rising temperature has implications for the outlook for agriculture and in turn, for overall economic performance. In this regard, central banks are being drawn into climate risk management because of the implications of extreme weather for business cycles, and monetary policy. Physical and transition risks for the financial sector have raised financial stability concerns among central banks (Box II.1.2).

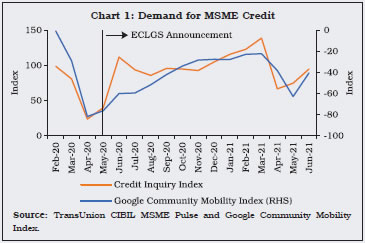

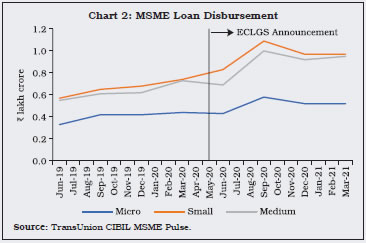

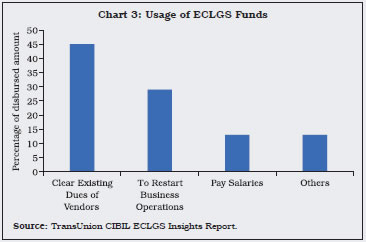

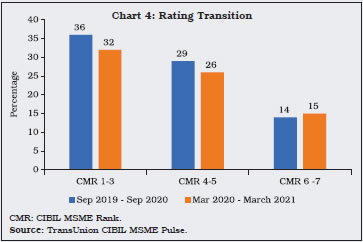

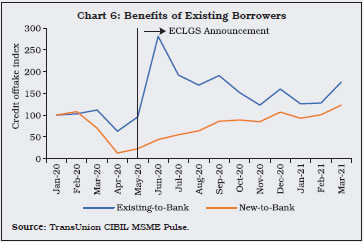

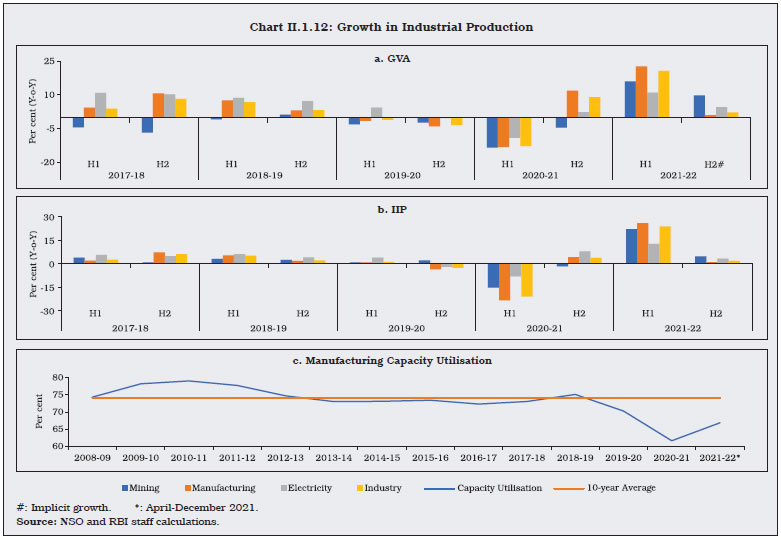

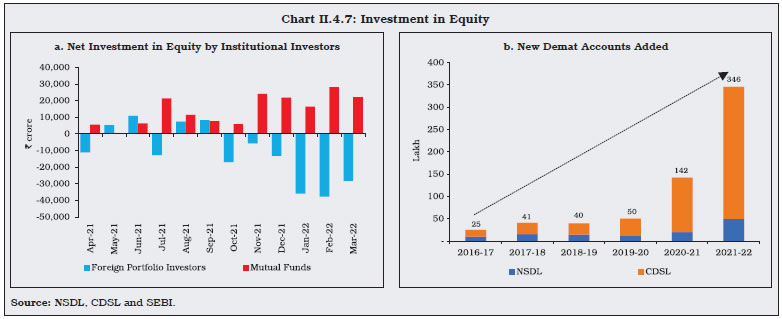

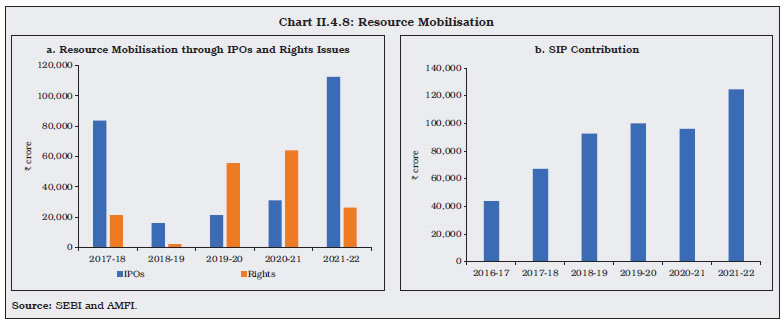

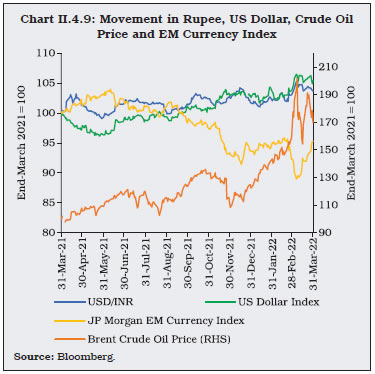

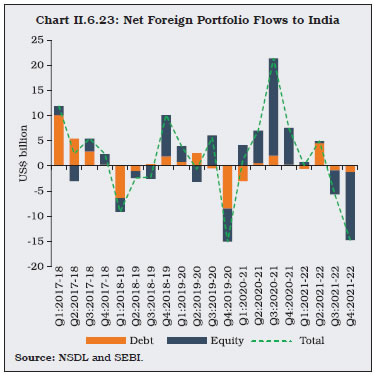

Industrial Sector II.1.29 The industrial sector, which was severely affected by the first wave of the pandemic, recovered with the easing of mobility restrictions in 2021-22. The second and third wave of the pandemic resulted in some moderation in the momentum of recovery. Industrial output measured by the index of industrial production (IIP) expanded by 11.4 per cent during 2021-22 as against a contraction of 8.4 per cent in the previous year (Charts II.1.12a and II.1.12b). However, manufacturing capacity utilisation continues to drag (Chart II.1.12c). II.1.30 Within the manufacturing sector, recovery picked up in the second half, as the impact of second wave of COVID-19 subsided. Cumulatively, in 2021-22, of the 23 industry groups, eight recorded expansion over 2019-20 levels. In terms of use-based classification, infrastructure goods registered robust growth as increased activity in the construction sector led recovery. Other categories of intermediate and primary goods also recovered even as investment scenario remained muted with consumer demand yet to fully recover, as reflected in contraction in capital goods and consumer durables goods segment, over pre-pandemic 2019-20 (Chart II.1.13).   II.1.31 In India, micro, small and medium enterprises (MSMEs), which contribute about a third of the total gross value added (GVA) and provide employment to around 11 crore people was badly hit by the pandemic (Box II.1.3).

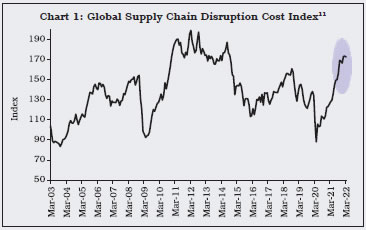

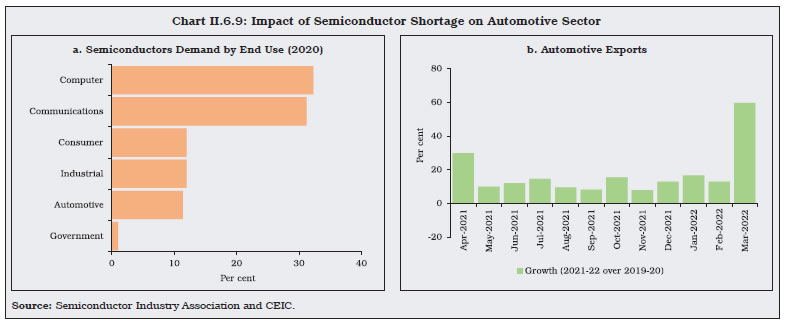

II.1.32 The mining sector recorded resilience in 2021-22, registering growth both year-on-year and over pre-pandemic 2019-20. Electricity generation also expanded in H1:2021-22 – led by a double digit expansion in thermal electricity generation over a year ago, even as hydro and nuclear electricity generation recorded a contraction. Renewable energy, which accounts for about 11 per cent of total generation, recorded a double-digit expansion over pre-pandemic levels during H1:2021-22. In H2:2021-22, electricity generation moderated on account of low thermal electricity generation in Q3, due to supply disruptions resulting from unseasonal rains and coal shortage. In H2:2021-22, renewables continued to register robust growth, while nuclear and hydro electricity generation recovered, posting double digit growth over the corresponding period a year ago. II.1.33 The Union Budget 2022-23 has made an additional allocation of ₹19,500 crore for production linked incentive (PLI) for manufacturing of high efficiency solar modules. Measures were also announced to increase domestic production of capital goods, electronics, chemicals and gems and jewellery. Other incentives for production included, extension of the concessional tax regime by one year and measures to ease doing business in special economic zones (SEZs) units. On the industry front, tax incentives to startups have been extended by one year. II.1.34 The COVID-19 pandemic caused supply chain disruptions globally. These disruptions were manifested in reduced access to low cost labour, clogged ports, shortages of semiconductor chips, containers and ships, and other commodities (Box II.1.4).

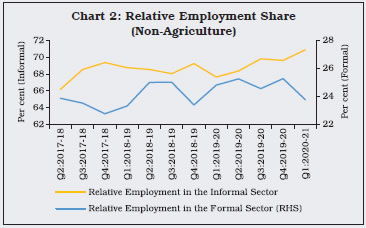

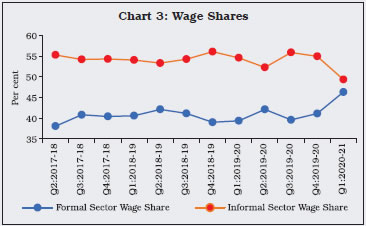

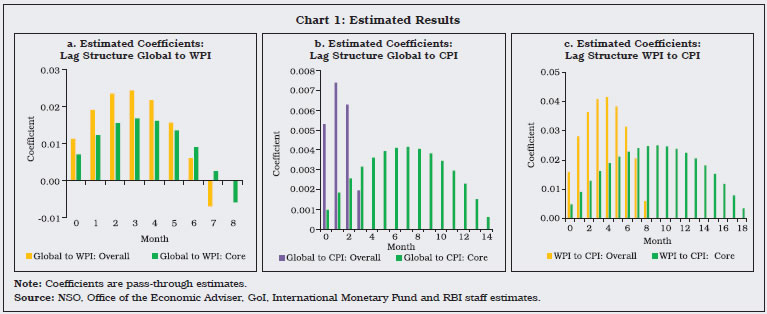

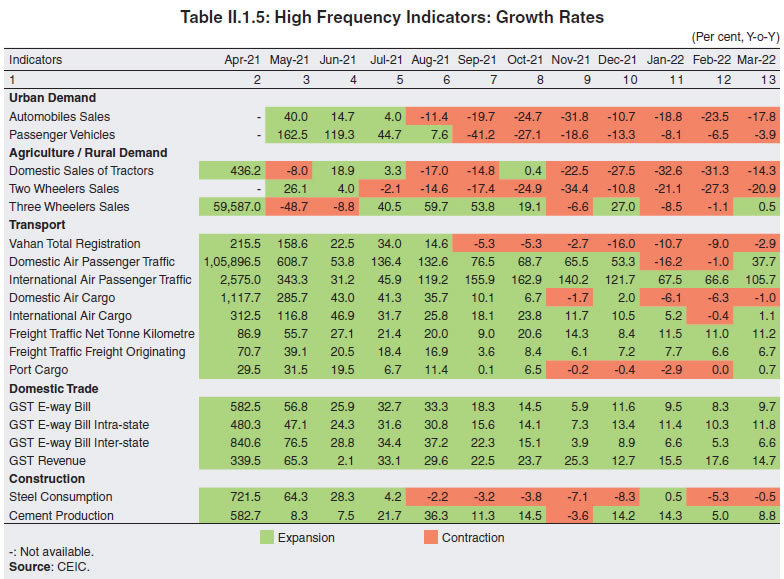

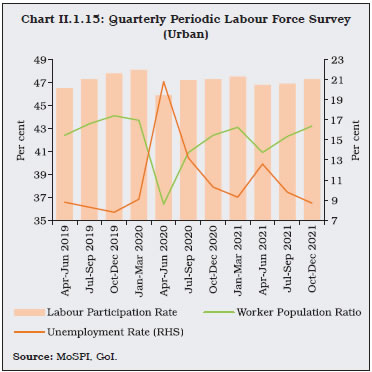

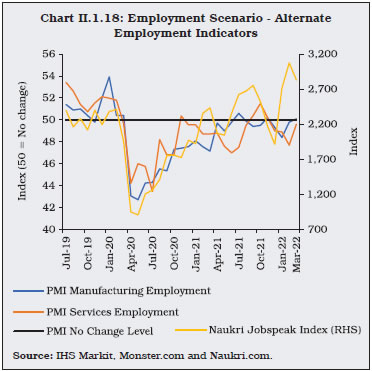

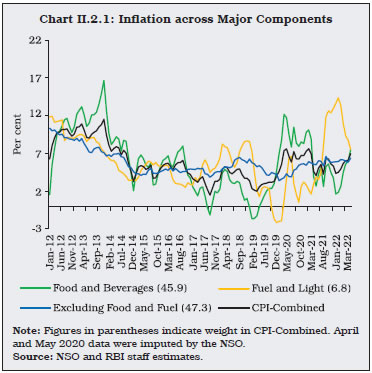

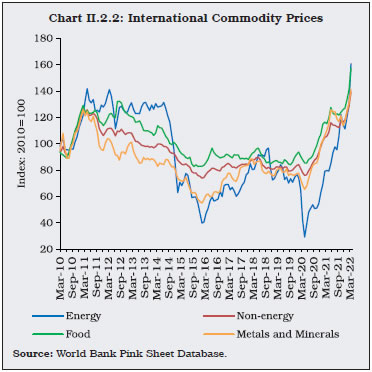

Services Sector II.1.35 The services sector, which had suffered an unprecedented contraction in 2020-21, regained some lost ground in 2021-22. Despite the virulent second wave during Q1:2021-22, the recovery of the services sector was broad-based as all the sub-segments except trade, hotels, transport, communication, and services related to broadcasting surpassed their pre-pandemic levels (of 2019-20). II.1.36 The residential housing sector registered recovery in Q4:2021-22, with sales and launches improving sequentially, and inventory overhang declining to the lowest in eight quarters. The optimism in the sector was reflected in the number of units launched, the highest in 15 quarters. The construction sector benefitted from the thrust by the government on infrastructure, coupled with activity in the housing segment. The Pradhan Mantri Awas Yojana, with an allocation of ₹48,000 crore, is expected to support growth in the construction sector along with generation of mass employment in the economy. Financial, real estate and professional services surpassed their pre-pandemic levels. The performance of information technology (IT) companies has been better than hospitality and aviation segments. In the financial sector, while bank credit to commercial sector improved, aggregate deposits moderated with the ebbing of precautionary savings. Public administration, defence and other services (PADO) witnessed an impressive turnaround to register a double-digit growth of 12.5 per cent on account of strong growth in both central and state governments’ expenditure. Rail and cargo freight also saw swift recovery. II.1.37 Global supply side disruptions in semiconductor chips spilled over to the automobile sector, where declining production and increased delivery timings impacted registrations adversely (Table II.1.5). Passenger car sales registered contraction. Two-wheeler sales also declined in H2, and tractor sales were impacted by exhaustion of pent-up demand. A low base pushed up growth in air passenger traffic, even though they remained muted vis-à-vis pre-pandemic levels. Port cargo segment, which displayed resilience during the pandemic, was impacted in the third quarter by global container shortages. Indicators that remain robust despite a high base include railway freight, GST E-way bills and GST revenue. II.1.38 The Reserve Bank’s services sectorcomposite index (SSCI),14 which tracks activity in construction, trade, transport and finance and is a coincident indicator of GVA growth in the services excluding PADO, remained almost at the same level in Q4:2021-22 as in Q3, after declining for previous two consecutive quarters (Chart II.1.14). 4. Employment II.1.39 Annual PLFS data are available up to 2019-20 and the quarterly PLFS data released by the Ministry of Statistics and Programme Implementation (MoSPI) for urban areas is available till December 2021. The impact of the second wave of COVID-19 infections was relatively muted as compared to the first wave (Chart II.1.15). During the first wave (April-June 2020), the labour force participation rate (LFPR) fell to 45.9 per cent, but during the second wave (April-June 2021), the LFPR declined to 46.8 per cent. Similarly, the worker population ratio (WPR) contracted less during the second wave as compared to the first. While the unemployment rate ballooned to 20.8 per cent during first wave, they rose relatively less to 9.8 per cent during the second wave. However, the labour market recovery was not complete by December 2021, and LFPR and WPR, both remain low as compared to the pre-pandemic quarter (January-March 2020).   II.1.40 Organised sector employment, measured by payroll data, presents a picture of strong recovery in job creation in 2021-22 so far. On a cumulative basis, net subscribers added to employees’ provident fund organisation (EPFO) per month increased to 10.1 lakh in April-February 2021-22 from 6.0 lakh for the same period in the previous year. On the other hand, the average number of members who paid their contribution to employees’ state insurance corporation (ESIC) improved from 1.0 lakh per month during April-February 2020-21 to 1.6 lakh per month during April-February 2021-22. New subscribers to the national pension scheme (NPS) also increased during the same period (Chart II.1.16).  II.1.41 An assessment of the employment and unemployment situation using CMIE household survey data indicates relatively resilient labour market conditions during the second and third wave. The localised nature of restrictions and intermittent relaxations for movement ensured that there were sufficient employment opportunities available. During 2021-22, the average monthly labour force participation rate stood above 40 per cent as compared to 39.9 per cent in 2020-21. Further, the peak unemployment rate between the two waves halved from 23.5 per cent in April 2020 to 11.8 per cent in May 2021. Across both rural and urban areas, unemployment rate followed the same pattern. In terms of gender gap in the labour market, the unemployment rate for women registered a sluggish recovery. The male unemployment rate declined substantially from 11.2 per cent in May 2021, at the peak of the second wave, to 6.7 per cent in March 2022, but the decline was lower for female unemployment rate from 16.8 per cent in May 2021 to 15.6 per cent in March 2022 (Chart II.1.17).  II.1.42 Other surveys covering information on employment like the employment sub-index of the overall purchasing managers’ index (PMI) registered marginal contraction in hiring in manufacturing and services sectors after the second wave of COVID-19. As compared to the first wave, the services sector during the second wave was severely affected in comparison to the manufacturing sector. During Q3:2021-22, however, the services sector employment expanded at a brisk pace. Similarly, Naukri Jobspeak index shows that private sector hiring picked up in Q4:2021-22 (Chart II.1.18).   5. Conclusion II.1.43 India’s economic recovery from the pandemic depths has been sustained in 2021-22 and the momentum is expected to broadly continue in 2022-23, though with risks to the downside from the geopolitical shock and its spillovers. Despite these risks, the recovery is getting entrenched and is broadening. The Union Budget 2022-23 envisioned the roadmap for ‘India at 100’, with a focus on demand side measures. The substantial increase in government capex outlay could crowd-in private investment and propel a virtuous cycle, thereby improving aggregate demand. Furthermore, the National Infrastructure Plan (NIP) amounting to ₹100 lakh crore and the National Monetisation Pipeline (NMP) involving ₹6 lakh crore - both targeted for completion by 2024-25, are also expected to give a major thrust to infrastructure spending. The focus on supplyside management15 through ‘process reforms’, facilitating the smoothening and simplification of processes in some sectors where government’s presence as a facilitator or regulator is necessary, would help improve the resilience of the Indian economy. Several sectors have benefitted from process reforms such as public procurement and telecommunications. Laying out a path for sustainable agricultural growth and enhanced farm income, the Union Budget 2022-23 announced several initiatives focusing on chemical free natural farming, increase in the domestic production of oilseeds and millets and promotion of agri-tech startups to enhance productivity. The Pradhan Mantri Gati Shakti Yojana laid the roadmap, driven by seven engines of roads, railways, airports, ports, mass transport, waterways, and logistics infrastructure. For the MSME sector, the ECLGS has been extended up to March 2023 with the guarantee cover expanded by ₹50,000 crore to a total cover of ₹5 lakh crore, the additional amount being earmarked exclusively for hospitality and related enterprises. II.1.44 Overall consumer and business confidence remains resilient in spite of the third wave on the back of the accelerated pace of vaccination and better prospects for economic activity. A full recovery in aggregate demand is, however, contingent on a turnaround in private investment. On the supply side, there is a resurgence in mining and manufacturing sectors. The services sector, which felt the brunt of the pandemic, is staging a broad-based recovery since Q2:2021-22. II.1.45 The future path of growth will be conditioned by addressing supply-side bottlenecks and by calibrating monetary and fiscal policy support to aggregate demand and structural reforms. Such reforms are also warranted in the labour market so as to adapt to the pandemic by reskilling workers. The pandemic also provides a unique opportunity to boost digitalisation and adopt new technologies for raising productivity growth. II.2 PRICE SITUATION II.2.1 Inflation rose sharply across advanced economies (AEs) and emerging market and developing economies (EMDEs) during 2021, reflecting pandemic related supply and logistics disruptions, a rebound in global commodity prices and a release of pent-up demand. The intensity of price pressures varied across countries, with AEs registering a sharper rise in inflation than EMDEs in spite of the latter also facing the pass-through of exchange rate depreciation into domestic inflation. II.2.2 During 2021, the World Bank energy price index was 81 per cent higher than 2020, while ‘metals and minerals’ and agriculture commodity price indices were up by 47.1 per cent and 24.2 per cent, respectively. Energy prices, which had undergone corrections during November-December 2021 as supply conditions improved, increased sharply in the first quarter of 2022 due to geopolitical conflict and subsequent economic sanctions. Brent crude prices rose by 55.6 per cent in March 2022 over December 2021 levels. Other major primary commodities have also recorded significant price increases – metals and minerals by 21 per cent and food by 23.6 per cent in March 2022 over December 2021. This broad-based increase in commodity prices has raised concerns about extreme inflation risks. The conflict has placed at risk the prospect of an early normalisation of global supply chain disruptions and has brought forward the danger of inflation expectations getting unhinged. II.2.3 In India, headline inflation16 breached the upper tolerance level of the inflation target during May-June 2021, driven by a sharp increase in inflation in all the three major groups - food, fuel and excluding food and fuel (core) - due to supply disruptions induced by the localised lockdowns (Chart II.2.1). Subsequently, while fuel inflation increased due to rising international prices, core inflation remained elevated, reflecting the pass-through of input cost pressures. By contrast, food inflation eased with the progress in kharif crop sowing until excess/unseasonal rains during October-November 2021 damaged standing crops (especially vegetables) and led to a build-up in price pressures. As a result, headline inflation which had eased close to the inflation target by September 2021 aided by favourable base effects, increased again in October 2021 and breached the upper tolerance level of 6 per cent during January-March 2022. This rise in Q4:2021-22 was led by elevated international commodity prices and supply bottlenecks on account of the Russia-Ukraine conflict along with lower winter easing in domestic food prices.  II.2.4 Average inflation, as well as volatility measured by the standard deviation of the consumer price index (CPI) inflation, was lower in 2021-22 than a year ago (Table II.2.1). The intra-year distribution of inflation was also more balanced, as reflected in a smaller negative skew. II.2.5 Against this backdrop, sub-section 2 assesses developments in global commodity prices. Sub-section 3 discusses movements in headline inflation in India including major turning points, followed by a detailed analysis of its primary constituents in sub-section 4. Other indicators of prices and costs are analysed in sub-section 5, followed by concluding observations. 2. Global Inflation Developments II.2.6 Elevation in global commodity prices was primarily led by energy prices (Chart II.2.2). Natural gas and coal prices reached record highs amid supply constraints and an increase in demand for electricity as global economic activity revived. Global crude oil prices remained volatile during the year and rose sharply in Q4:2021-22 due to the conflict in Ukraine. The decision by the organisation of petroleum exporting countries (OPEC) and their allies (OPEC+) in July 2021 to increase production only gradually by 0.4 million barrels per day on a monthly basis from August 2021 to make up for the large production cuts announced in April 2020, together with sluggish pick up in investment in new oil production, including US shale, supported prices. As a result, global crude oil prices picked up to US$ 112 per barrel in March 2022 from US$ 49 per barrel in December 2020. The demand for metals continued to increase even as production was disrupted by energy shortages and lockdowns. International food prices also remained elevated during the year and the food index (World Bank Pink Sheet) reached an all-time high (since January 1960) in March 2022, primarily driven by edible oils (palm oil; sunflower oil; rapeseed oil and soybean oil) and grain prices, due to tight supply conditions caused by adverse weather in several producing countries (South America and East Asia), Russia-Ukraine conflict and higher demand for animal feed (maize and soybean). Moreover, higher natural gas and coal prices affected fertiliser production, pushing up their prices and consequently the input costs for food crops. Reflecting these global commodity price developments, consumer price inflation rose in both AEs and EMDEs.

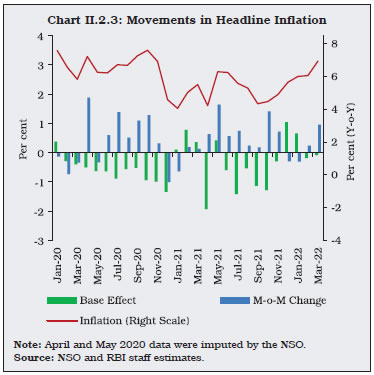

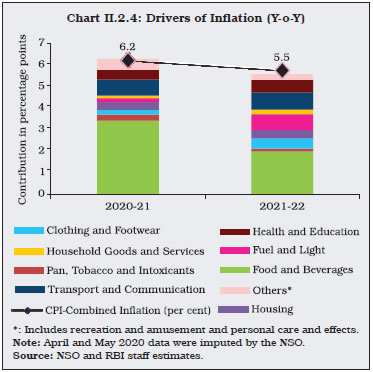

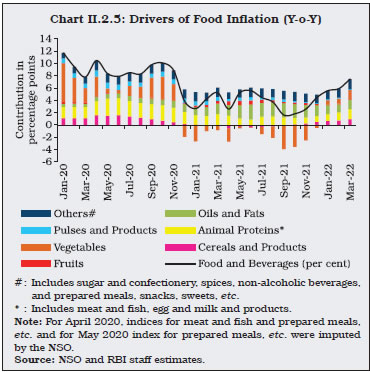

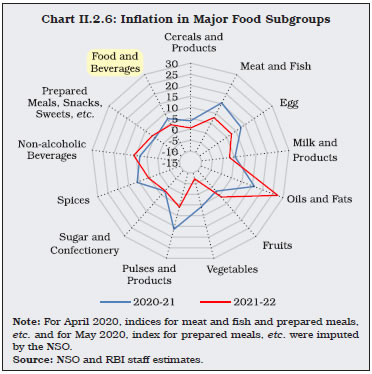

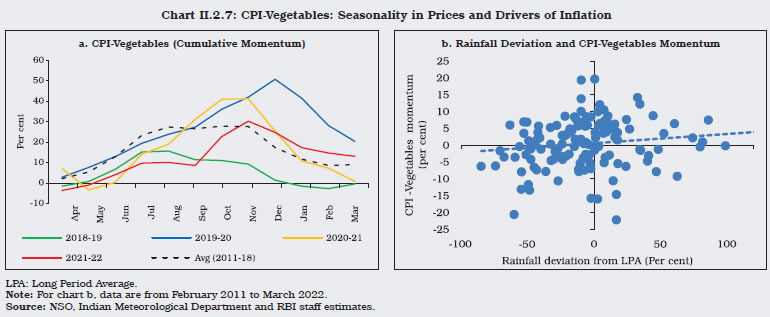

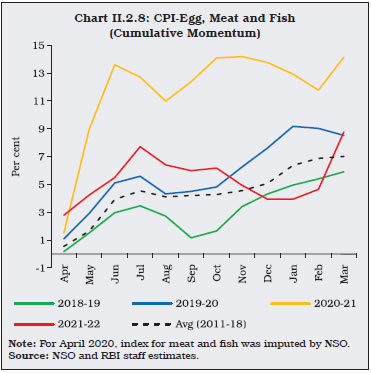

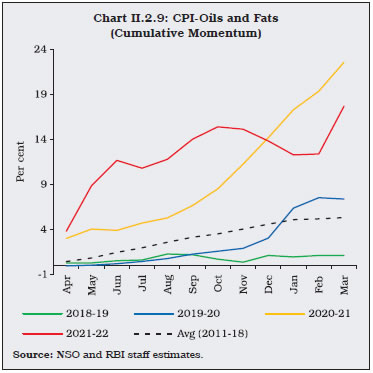

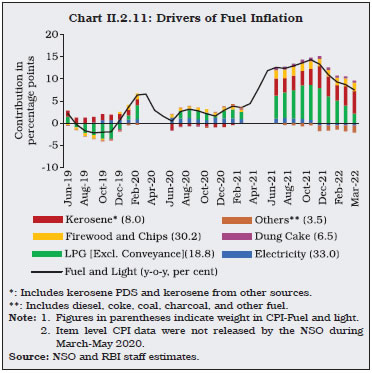

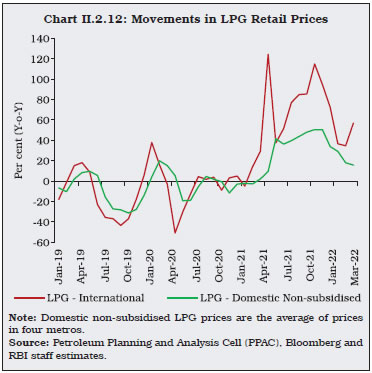

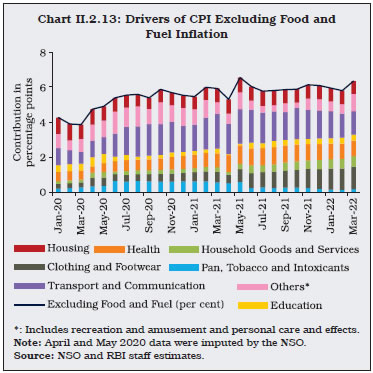

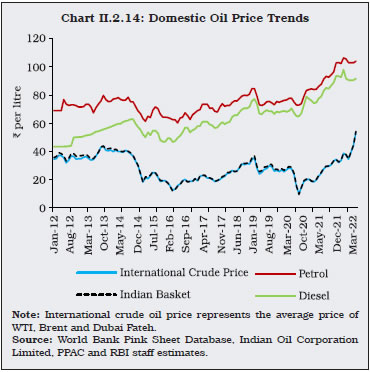

3. Inflation in India II.2.7 Circling back to CPI headline inflation in India, it had eased to 4.2 per cent in April 2021 (Chart II.2.3), before the second wave of COVID-19 led supply disruptions, localised lockdowns and pass-through of increase in global commodity prices (crude oil and metals) led to a sharp and broad-based pick up in headline inflation during May-June 2021. Inflation eased thereafter with moderation in food prices aided by the easing of curbs and favourable base effects. Inflation began picking up again from October 2021, breaching the upper tolerance level in Q4: 2021-22 as stated earlier. II.2.8 Inflation in food and beverages remained the primary mover of headline inflation although its contribution to headline inflation declined to 35.9 per cent in 2021-22 from 54.8 per cent a year ago. Nonetheless, supply-side measures implemented by the central government to relieve price pressures in edible oils and pulses aided in keeping food inflation under control.  II.2.9 Fuel prices, on the other hand, scaled new peaks and reached an all-time high of 14.3 per cent in the current inflation series in October 2021 due to a sharp pick up in prices of liquefied petroleum gas (LPG) and kerosene, in line with international prices. Subsequently, fuel inflation eased during November 2021 - March 2022 mainly due to the reduction in electricity prices announced by some states and favourable base effects. II.2.10 Inflation excluding food and fuel or core inflation remained elevated throughout the year reflecting input cost pressures amid global supply disruptions and some recovery in domestic demand. The main contributors were prices of transport and communication; health; household goods and services; and clothing and footwear. The excise duty cut in petrol and diesel prices in early November 2021 led to some easing of transport and communication inflation. II.2.11 For the year, inflation eased to an average of 5.5 per cent in 2021-22, 66 basis points (bps) lower than a year ago (Appendix Table 4). Notwithstanding the easing in headline inflation, households’ median inflation expectations hardened during 2021-22 by 59 bps three months ahead and by 62 bps a year ahead reflecting the uncertainty surrounding the path of the pandemic and sporadic supply shocks. 4. Constituents of CPI Inflation II.2.12 During 2021-22, the drivers of CPI headline inflation showed notable changes wherein food and beverages; fuel and light; transport and communication; health; and clothing and footwear remained the major drivers (Chart II.2.4).  Food II.2.13 Inflation in prices of food and beverages (weight: 45.9 per cent in CPI) moved within a wide range of 1.6 per cent to 7.5 per cent during 2021-22 largely reflecting the movements in vegetables and oils and fats inflation (Chart II.2.5).   II.2.14 Food inflation averaged 4.2 per cent in 2021-22, compared to 7.3 per cent in 2020-21. Eight out of the 12 sub-groups witnessed a moderation in inflation (Chart II.2.6). Vegetable prices (weight: 13.2 per cent in CPI-Food and beverages) remained in deflation during a major part of the year, recording an average deflation of (-) 7.2 per cent on favourable base effects and exerted downward pressure on overall food inflation during the year. II.2.15 Food inflation, excluding vegetables would have averaged 204 bps higher (Chart II.2.7a). While higher production generally led to lower price build-up, excess/unseasonal rains pushed up vegetable prices during October-November 2021, as also observed in the past (Chart II.2.7b). II.2.16 Onion prices increased during the months of June-July 2021 reflecting summer uptick and damage to stored rabi onions in Maharashtra and Gujarat due to cyclone Tauktae and again during October-November 2021 as heavy rains damaged kharif crops in major producing states. Government intervened by releasing stored onions from a total buffer stock of 2 lakh metric tonnes under the price stabilisation fund (PSF) scheme. Support came from fresh arrivals, which eased price pressures during December 2021- March 2022, barring a temporary rise in February 2022. In the case of tomatoes, price pick-up was observed during October-November 2021 owing to erratic rains in some major producing states in north India in September 2021 followed by heavy rains in major producing states in south India in October 2021, which resulted in supply disruption and crop damages. Potato prices were in deflation throughout 2021-22 (barring February-March 2022) on higher production [15.7 per cent in 2020-21 final estimates (FE) over 2019-20 FE] in response to attractive prices in the previous year. However, prices firmed up during October-November 2021 due to unseasonal rains and delays in the arrivals of fresh crops. Lower production in 2021-22 [estimated to be (-) 4.6 per cent in 2021-22 1st advanced estimates (AE) over 2020-21 FE] led to the re-emergence of price pressures in March 2022.  II.2.17 Prices of cereals and products (weight of 21 per cent in the CPI-Food and beverages) recorded deflation during the first half of the year, before registering some price pressures during October 2021-March 2022. Higher procurement, offtake under Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY), record production of rice (4.3 per cent as per 2021-22 3rd AE over 2020-21 FE) kept prices soft during the first half of the year. However, price pressures emerged in wheat during the second half due to higher exports (236 per cent year-on-year during 2021-22). II.2.18 In the case of protein-rich items such as eggs, meat and fish (weight of 8.8 per cent in CPI-Food and beverages), price pressures were seen during April-July 2021 reflecting supply disruptions and input cost pressures from an increase in feed and transportation costs (Chart II.2.8). Prices eased during August 2021-January 2022 in line with the gradual normalisation of supply chains and import of 12 lakh tonnes of genetically modified soya meal. However, price pressures re-emerged during February-March 2022 reflecting a further increase in feed costs. In the case of milk and products prices remained subdued, barring the increase seen in July 2021 and March 2022, due to upward revision in retail prices by ₹2 per litre by major milk co-operatives like Amul and Mother Dairy, followed by some state milk co-operatives.  II.2.19 Oils and fats (weight of 7.8 per cent in CPI-Food and beverages) recorded historically high inflation of 34.8 per cent in June 2021 on the back of rising international prices, especially of palm oil (Chart II.2.9). In order to contain price pressures, a number of measures were undertaken by the government - imposing stock limits on edible oils and oilseeds for a period up to September 31, 2022 and successive reduction in import duties on palm oil (bringing down the duty on refined and crude palm oil to 12.5 per cent and 5 per cent, respectively, by February 2022 from 37.5 per cent and 32.5 per cent, respectively, in June 2021), soybean oil and sunflower oil. Responding to these measures and following sharp increase in rabi oilseeds sowing, edible oil prices recorded a correction during November 2021-January 2022. However, the conflict in Ukraine (which is a major global supplier of sunflower oil) led to the return of price pressures during February-March 2022.  II.2.20 Inflation in prices of pulses (weight of 5.2 per cent in CPI-Food and beverages) followed a declining path after the May-June 2021 rise on account of a host of supply side measures undertaken by the government (Chart II.2.10). The supply measures include moving imports of tur, urad and moong from restricted to ‘free category’ from May 15, 2021 till October 31, 2021; imposing stock limit on all pulses except moong until October 31, 2021; completely abolishing import duty on masur and reducing Agriculture Infrastructure and Development Cess (AIDC) to 10 per cent from July 27, 2021; releasing masur from buffer stocks at discounted prices; and extending free import policy of urad and tur to March 31, 2023. These measures led to cooling down of inflation to 2.6 per cent by March 2022 from an intra-year peak of 10 per cent in June 2021.  II.2.21 Inflation in fruits (weight of 6.3 per cent in CPI-Food and beverages) picked up to a 3-year high of 11.8 per cent in May/June 2021. Subsequently, however, price pressures ebbed owing to higher production of apples and grapes. Fuel II.2.22 The contribution of the fuel group (weight of 6.8 per cent in CPI) to headline inflation increased to 13.1 per cent in 2021-22 from 2.9 per cent in the previous year. Fuel inflation picked up sharply to 14.3 per cent in October 2021, largely due to the hardening of domestic LPG and kerosene prices which tracked international price movements (Chart II.2.11 and Chart II.2.12). Subsequently, inflation witnessed some moderation and reached 7.5 per cent in March 2022 mainly due to the easing of electricity prices and favourable base effects. Inflation Excluding Food and Fuel II.2.23 Inflation excluding the volatile food and fuel items, i.e., core inflation, picked up to an average of 6.0 per cent in 2021-22, with an intra-year peak of 6.6 per cent at the height of the second wave of COVID-19 in May 2021 (Chart II.2.13) [Appendix Table 4]. Subsequently, inflation eased somewhat in line with the gradual removal of lockdown restrictions before crossing 6 per cent again during November 2021-March 2022 (barring February 2022) despite the cut in excise duty on petrol and diesel (₹5 per litre and ₹10 per litre, respectively) in early November 2021, followed by a reduction in value added tax (VAT) by most of the state governments.    II.2.24 Among the major constituents, double-digit inflation in transport and communication reflected an increase in domestic prices of petrol and diesel in line with international prices (Chart II.2.14). Inflation in the health sub-group rose on account of the increase in medicine prices and hospital and nursing charges due to higher raw material costs, supply bottlenecks and pandemic-induced demand. Within transport and communication, prices of personal transport vehicles also increased reflecting a gradual pass-through of higher input costs (especially metals and microchips) by major automobile manufacturers. Private telecom operators increased mobile tariff charges for various plans in July 2021 (around 40 per cent for base categories) and November 2021 (20-25 per cent). As a result of pass-through of input costs to retail prices, a larger number of items within core goods registered greater than 4 per cent inflation rates during 2021-22 (Chart II.2.15).  II.2.25 Housing inflation remained moderate at 3.7 per cent in 2021-22 (3.3 per cent in 2020-21), reflecting subdued rental demand on account of hybrid work culture amid the multiple waves of COVID-19. Net of housing, inflation excluding food and fuel averaged 6.6 per cent in 2021-22, up from 6.2 per cent a year ago. II.2.26 Inflation in clothing and footwear picked up significantly and remained a major pressure point, averaging 7.2 per cent in 2021-22. It increased consistently from 3.5 per cent in April 2021 to 9.4 per cent in March 2022, largely reflecting input cost pressures emanating from rising international prices of cotton (as measured by the Cotton A Index) due to lower global and domestic production as well as improved global demand.  5. Other Indicators of Inflation II.2.27 From a sectoral perspective, inflation based on the CPI for industrial workers (CPI-IW) remained slightly elevated at 5.1 per cent during 2021-22, although it eased to 4.4 per cent in September 2021 before picking up to 5.8 per cent in January 2022, largely due to the increase in food prices. On the other hand, inflation based on the CPI for agricultural labourers (CPI-AL) and rural labourers (CPI-RL) eased to 4.0 per cent and 4.2 per cent, respectively, in 2021-22 from 5.5 per cent in the previous year due to favourable base effects and subdued food inflation, although both crossed 6 per cent level in March 2022. II.2.28 Inflation measured by the wholesale price index (WPI) rose sharply from 1.3 per cent in 2020-21 to 13.0 per cent in 2021-22, with an intra-year peak of 14.9 per cent in November 2021 (the highest level in the current series). WPI Inflation picked up from February 2021 and remained in double-digits during the year, reflecting a sharp pick up in prices across all major groups. Within primary articles, inflation in non-food articles (21.2 per cent), minerals (19.4 per cent) and crude petroleum and natural gas (56.5 per cent) remained in double-digits, reflecting higher international commodity prices amid rising domestic demand. Inflation in fuel and power also jumped to an average of 32.8 per cent, driven mainly by a sharp increase in mineral oil prices. With the broad-based increase in input costs, manufactured product inflation also reached double-digits since May 2021 (Box II.2.1). Reflecting the sharp rise in WPI inflation and elevated CPI inflation, the gross domestic product (GDP) deflator inflation also hardened to 9.6 per cent in 2021-22 as per 2nd AE 2021-22 from 5.6 per cent in 2020-21.

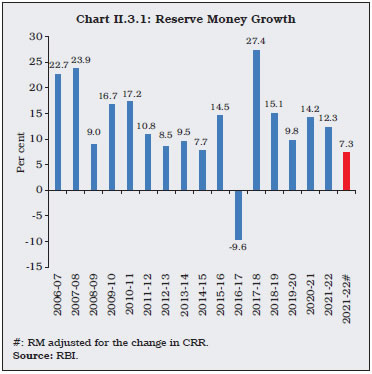

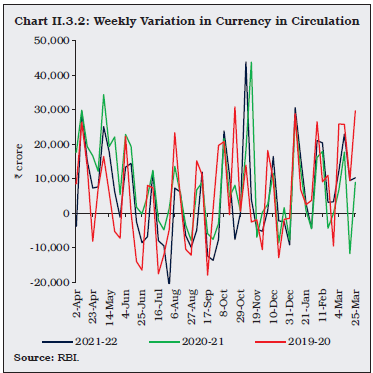

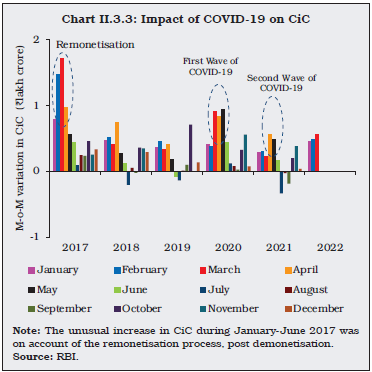

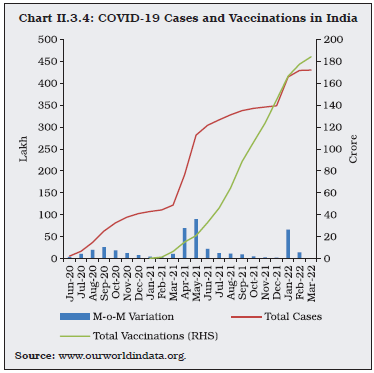

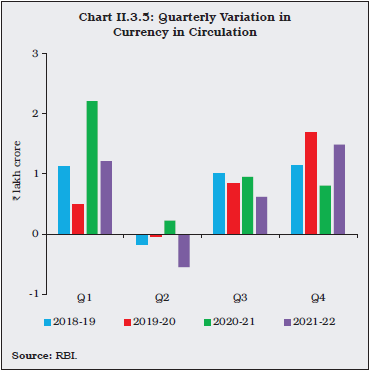

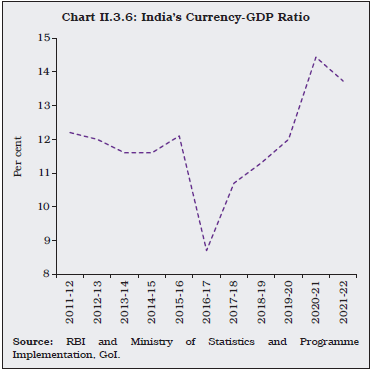

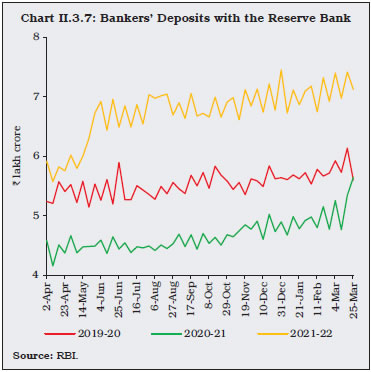

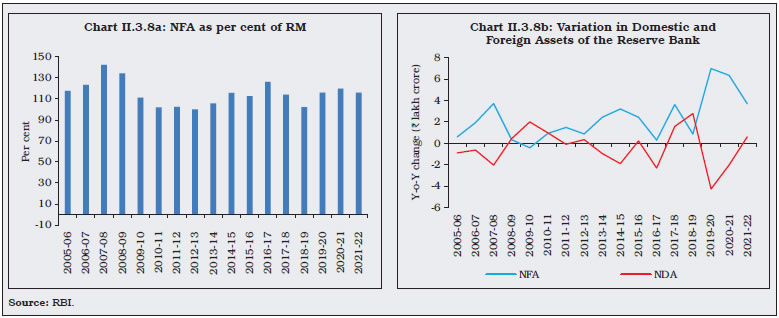

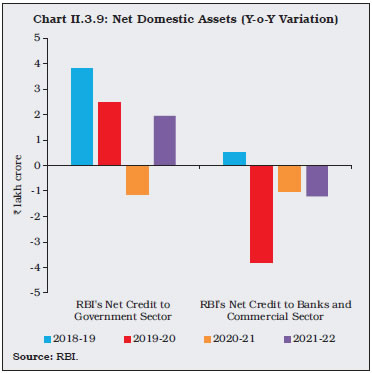

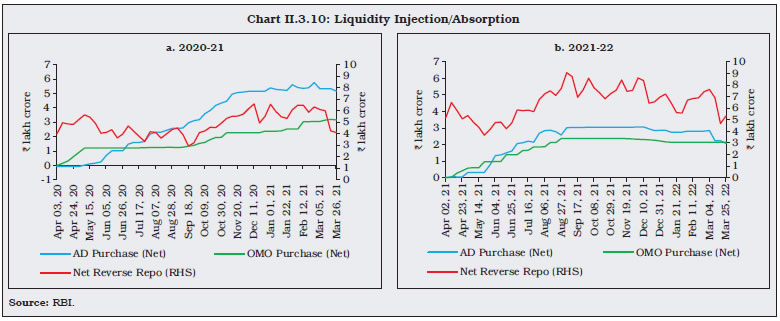

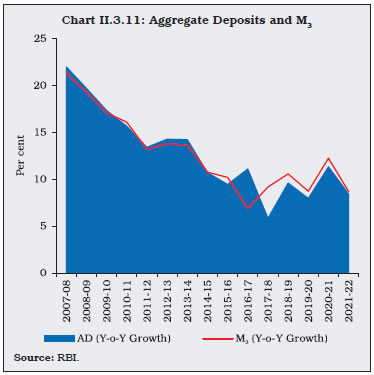

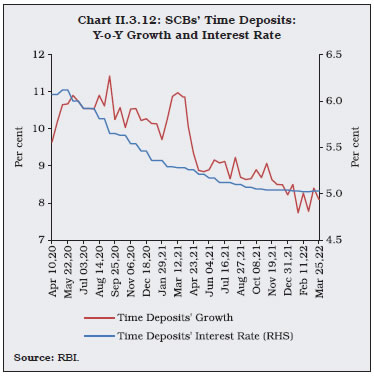

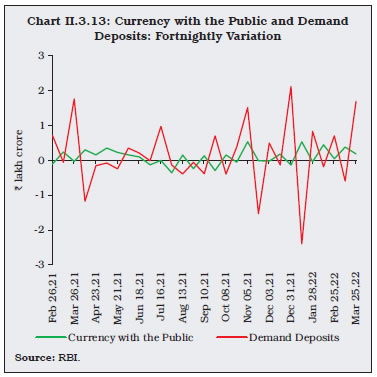

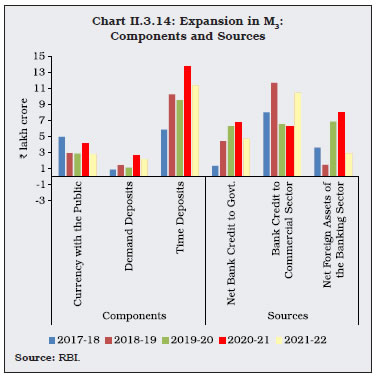

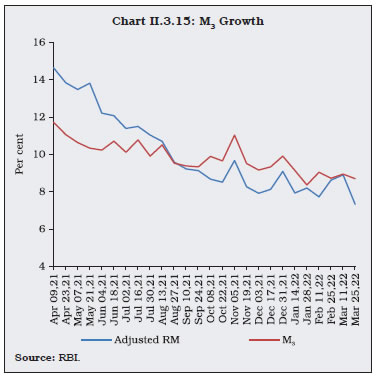

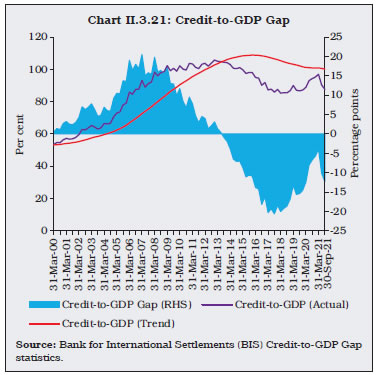

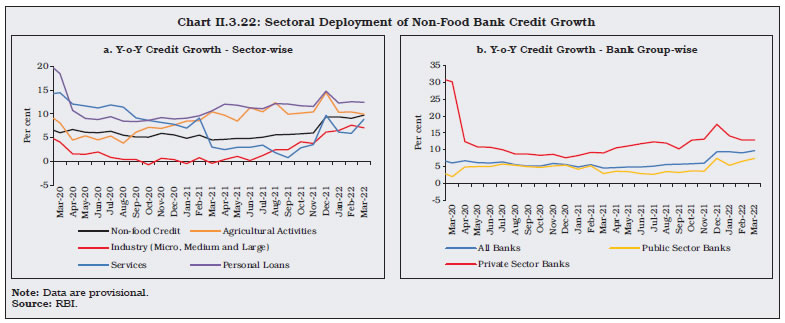

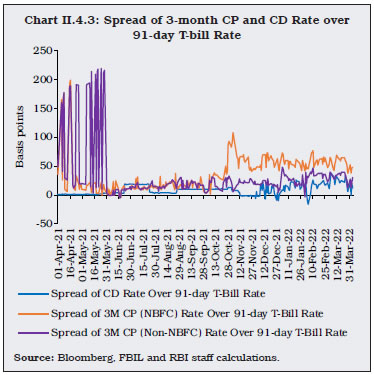

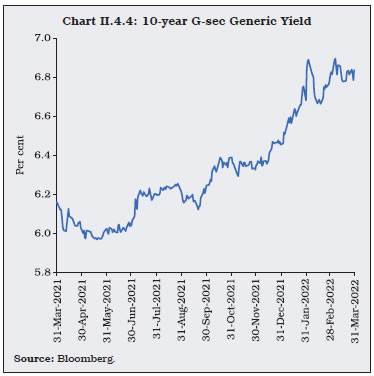

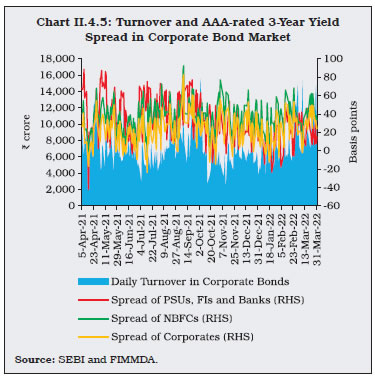

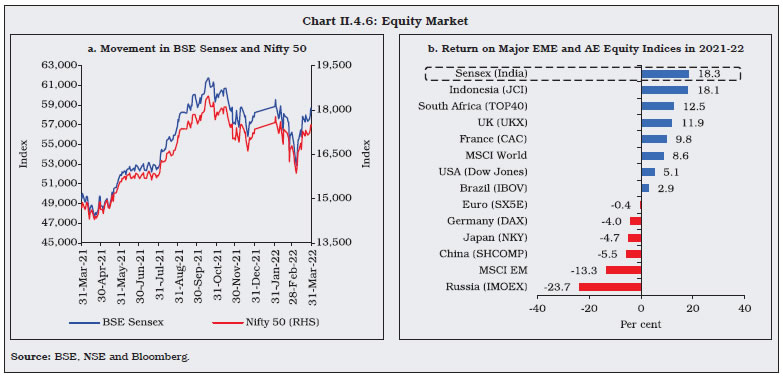

II.2.29 There was a moderate hike in minimum support prices (MSPs) for kharif and rabi crops in 2021-22. The extent of MSP increases varied across crops, ranging from 1.1 per cent in the case of moong and maize to 8.6 per cent for rapeseed/mustard. MSPs for rice and wheat were increased by 3.9 per cent and 2.0 per cent, respectively. II.2.30 Wage growth for agricultural and non-agricultural labourers remained muted during the year, averaging 4.4 per cent and 3.6 per cent, respectively, during May 2021-February 2022, on account of subdued demand conditions coexisting with lower rural inflation. However, agricultural wage growth picked up to 6.0 per cent in February 2022 from a low of 1.1 per cent in June 2021, while non-agricultural wage growth increased to 6.1 per cent in February 2022 from 0.2 per cent in May 2021, partly reflecting unfavourable base effects. 6. Conclusion II.2.31 In sum, headline inflation remains above the target of 4 per cent, having tested the upper tolerance level during the second wave in May-June 2021 and the third wave along with the Russia-Ukraine conflict in January-March 2022. The flare-up in vegetable prices due to heavy rains in October and November 2021 started to reverse with winter crop arrivals in December 2021 but the extent of winter easing was shallower than normal. The supply side interventions by the government continue to restrain the pass-through of elevated international edible oil prices to domestic retail inflation. Cost-push pressures from high industrial raw material prices, transportation costs, and global logistics and supply chain bottlenecks continue to impinge on core inflation. The substantial wedge between wholesale and retail price inflation amidst a sharp rise in manufactured products’ inflation poses risk of a possible pass-through of input cost pressures to retail inflation with a lag, although slack in the economy is muting the pass-through. The conflict over Ukraine and the consequent spike in commodity prices has overcast the outlook for inflation in India as in the rest of the world. II.3 MONEY AND CREDIT II.3.1 Monetary and credit conditions during the year evolved in sync with the Reserve Bank’s accommodative policy stance. Overall financial conditions remained benign although there has been some tightening in the recent period largely due to global spillovers. Reserve money (RM), adjusted for the first-round effects of the increasein the cash reserve ratio (CRR)18, moderated. Precautionary demand for currency, which had surged in 2020-21 due to the COVID-19-induced uncertainties, softened during the year. Concomitantly, there was a marginal uptick in the velocity of money, possibly reflecting improvement in consumer demand conditions in the economy. Money supply (M3) growth decelerated during the year, mirroring the behaviour of its largest component - aggregate deposits. On the other hand, bank credit growth picked up, especially since August 2021, and it was broad-based. II.3.2 Against this backdrop, sub-section 2 delves into the dynamics underlying movements in RM and, thereby, the shifts in the Reserve Bank’s balance sheet. Sub-section 3 examines developments in money supply in terms of its components and sources, throwing light on the movements in assets and liabilities of the banking sector. The underpinnings of bank credit are covered in sub-section 4, followed by concluding observations. 2. Reserve Money19 II.3.3 Reserve money - which is essentially an analytical and stylised depiction of the Reserve Bank’s balance sheet that focuses on its monetary liabilities, comprising currency in circulation, bankers’ deposits, and other deposits with the Reserve Bank - increased by 12.3 per cent in 2021-22, lower than 14.2 per cent a year ago but higher than its decennial average of 10.6 per cent (2012-21) [Chart II.3.1; Appendix Table 4]. Adjusted for the increase in CRR in phases by 100 basis points (bps) since March 27, 2021, RM grew by 7.3 per cent in 2021-22, as against 18.0 per cent a year ago.  II.3.4 Among its components, currency in circulation (CiC) constituted around 80 per cent of RM in 2021-22. Although the contribution of currency in determining the overall expansion inRM peaked in June 202120, CiC accounted for 88 per cent of the overall expansion in RM during the year (89 per cent a year ago), which is below the decennial average of 108 per cent (2012-21). II.3.5 The demand for CiC normally follows a predictable intra-month pattern - expansion during the first fortnight due to transactions by households, followed by a contraction in the second fortnight due to flow back of currency from households to the banking system (Chart II.3.2).   II.3.6 There was an unusual rise in month-over-month (M-o-M) CiC variation in April-May 2021 due to the second wave of COVID-19, albeit to a lesser extent as compared with the first wave in April-June 2020, but higher than the corresponding period of pre-pandemic years (Chart II.3.3). With the epidemiological curve bending downwards from June 2021, the variations in CiC were mostly determined by seasonal factors (Chart II.3.4). II.3.7 Barring the sharp surge during April-May 2021 due to the second wave of the pandemic, currency demand reverted to its usual seasonal pattern in 2021-22. The typical seasonal spurt in Q1:2021-22, associated with rabi procurement and kharif sowing, was significantly lower than Q1:2020-21, and was comparable with pre-pandemic years. In the following quarter, CiC contracted due to the seasonal slack in economic activity in cash-intensive sectors such as construction and agriculture. In Q3:2021-22, CiC expanded, reflecting increase in demand for currency for festivals and kharif harvest. Further expansion in CiC was evident in Q4:2021-22 due to the harvest of rabi crops, various festivals, and run up to the legislative assembly elections in five states (Chart II.3.5). Lower CiC growth at 9.7 per cent in 2021-22 (17.2 per cent a year ago) resulted in a decline in the currency-GDP ratio to 13.7 per cent (14.4 per cent in 2020-21) as cash-intensity in the economy started normalising with reduction in the intensity of the pandemic (Chart II.3.6).    II.3.8 Bankers’ deposits with the Reserve Bank increased by 25.3 per cent in 2021-22 as against a marginal expansion of 0.8 per cent in the previous year, primarily due to increase in CRR in phases by 100 bps to 4.0 per cent (Chart II.3.7). II.3.9 Amongst the sources of RM, during 2021-22, the main driver for RM growth was net foreign assets (NFA), even though net purchases from authorised dealers at ₹2.07 lakh crore were lower than ₹5.16 lakh crore of the previous year (Chart II.3.8a and II.3.8b). Consistent with the accommodative stance of monetary policy, liquidity management operations boosted net domestic assets (NDA) of the Reserve Bank.  II.3.10 In particular, net open market purchases (including auctions of special OMOs involving simultaneous purchase and sale of securities for liquidity distribution across the yield curve and OMOs in state development loans) of ₹2.14 lakh crore reflected in an increase in the net Reserve Bank credit to the government by ₹1.95 lakh crore in 2021-22. On the other hand, contraction in the Reserve Bank’s net credit to banks and the commercial sector (mainly PDs), primarily reflected in net liquidity adjustment facility (LAF) absorption (Chart II.3.9).   II.3.11 The net LAF position remained in reverse repo mode throughout 2021-22, averaging ₹6.7 lakh crore, indicating ample system level liquidity (Chart II.3.10). 3. Money Supply21 II.3.12 Stabilising from a prolonged decline till 2016-17, M3 comprising currency with the public (CwP), aggregate deposits (AD) and other deposits with the Reserve Bank, recorded a growth of 8.7 per cent in 2021-22 (12.3 per cent a year ago) driven by time deposits (Chart II.3.11). II.3.13 On the components side, M3 expansion was driven by AD, its largest constituent (85 per cent share). In fact, AD accounted for 82 per cent of the increase in M3 during the year, with time deposits growing at 8.1 per cent (10.9 per cent a year ago) in spite of considerable moderation in interest rates (Chart II.3.12). As usual, demand deposits remained volatile, largely mirroring the variations in currency with the public which grew by 10.2 per cent in 2021-22 vis-à-vis 17.7 per cent in the previous year (Chart II.3.13).    II.3.14 On the sources side, bank credit to the commercial sector, followed by net bank credit to the government and net foreign exchange assets of the banking sector led the expansion in M3 in 2021-22 (Chart II.3.14). Amongst these sources, bank credit to the commercial sector - the largest constituent of M3 from the sources side - grew at a rate higher than a year ago.

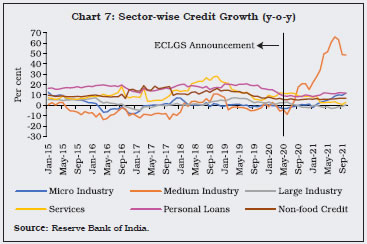

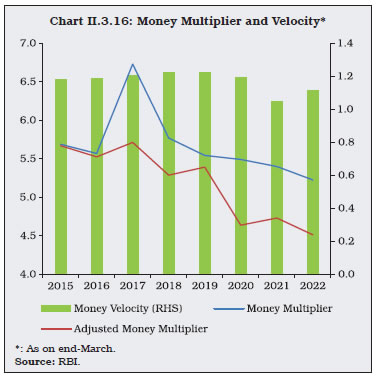

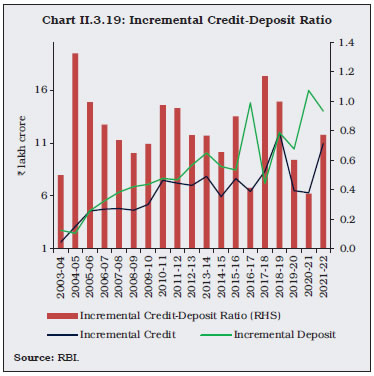

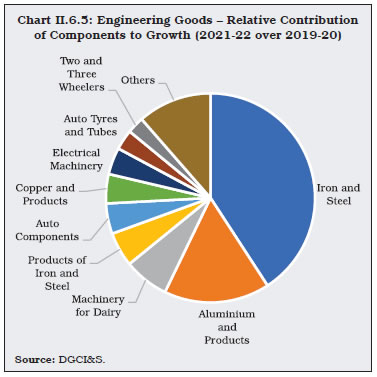

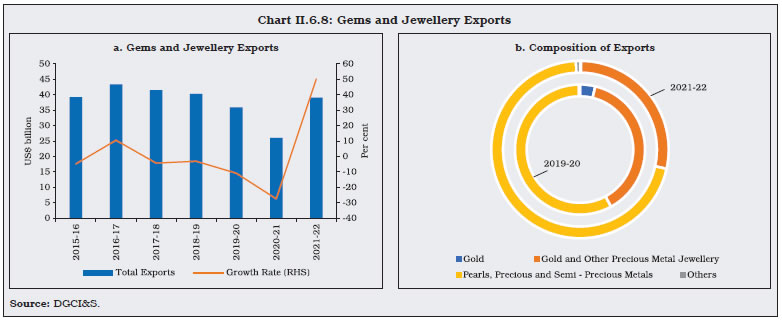

II.3.15 On the other hand, net bank credit to government decelerated to 8.2 per cent in 2021-22 as compared with 13.2 per cent a year ago, reflecting active usage of funds for credit creation, unlike a year ago when banks augmented their SLR portfolios in search of safe haven amidst COVID-19 induced uncertainties (Table II.3.1). Key Monetary Ratios II.3.16 The money multiplier stood at 5.2 in 2021-22, below its decennial average of 5.7 (2012-21). Adjusted for reverse repo - analytically more meaningful and akin to banks’ deposits with the central bank - the money multiplier turned out to be lower at 4.5. A weak money multiplier along with the deceleration in RM growth (adjusted for the first-round effects of CRR increase) explain the slower growth in M3 in 2021-22 vis-à-vis last year (Chart II.3.15 and Chart II.3.16). II.3.17 The currency-deposit ratio stood at 17.5 per cent in 2021-22, above its decennial average (2012-21) of 15.3 per cent. It is at a similar level vis-à-vis end-March 2021, indicating that the public’s preference towards cash, the most liquid asset, in response to the uncertainties relating to the pandemic, did not increase significantly during the year. The reserve-deposit ratio at 4.2 per cent (3.6 per cent a year ago), reflected the impact of CRR increase during 2021-22 (Chart II.3.17).   4. Credit II.3.18 With the current policy prescription of 4.5 per cent and 18 per cent for CRR and SLR, respectively, around 78 per cent of the deposits are available with the banking system for extending credit. In 2021-22, scheduled commercial banks’ (SCBs) credit-deposit ratio stood at 72.2 per cent, a level comparable with end-March 2021 (72.4 per cent), as credit expansion broadly maintained pace with deposit mobilisation after lagging behind during 2019-20 and 2020-21 (Chart II.3.18 and Chart II.3.19).     II.3.19 In 2021-22, the y-o-y growth in SCBs’ credit recouped lost pace. As per the Section 42 returns data submitted by banks under the Reserve Bank of India Act, the momentum in SCBs’ credit offtake has been mostly positive since end-August 2021 and its growth stood at 9.6 per cent on a year-on-year basis for 2021-22 as compared with 5.6 per cent a year ago (Chart II.3.20). The credit-to-GDP gap, however, continues to be large, reflecting the persisting slack in credit demand in the economy (Chart II.3.21). II.3.20 After remaining subdued in the beginning of the financial year 2021-22, a turnaround in credit growth was recorded across major sectors in Q4:2021-22. The Reserve Bank’s continuous efforts to maintain adequate liquidity in the banking system, coupled with the government’s efforts to boost credit demand conditions in the economy was reflected in the pickup in credit offtake by various sectors. According to data on the sectoral deployment of bank credit22, credit to agriculture and allied activities grew by 9.9 per cent in March 2022 vis-à-vis 10.5 per cent in March 2021. Bank credit growth remained robust for the resilient agriculture sector even during the COVID-19 pandemic period, with continued support of the government’s interest subvention scheme. Industrial credit growth improved steadily after Q1:2021-22 and accelerated to 7.1 per cent in March 2022. Medium industries, in particular, registered a growth of 71.4 per cent in March 2022, as compared with 34.5 per cent a year ago. Credit to micro and small industries also posted a faster growth of 21.5 per cent in March 2022 from 3.9 per cent a year ago. The growth recorded in the MSME sector’s credit demand is largely attributable to the government’s impetus and the Reserve Bank’s policies to revive the sector. Credit growth to large industry, which was mainly in contraction zone till December 2021, turned positive in January 2022 and stood at 0.9 per cent in March 2022 (Chart II.3.22a and Table II.3.2).   II.3.21 Among the industry sub sectors, credit to engineering, beverage and tobacco, chemicals and chemical products, construction, food processing, infrastructure, leather and leather products, mining and quarrying, petroleum, coal products and nuclear fuels, textiles, rubber plastic and their products, and vehicles, vehicle parts and transport equipment recorded accelerated growth in March 2022 on a year-on-year basis. However, credit growth to gems and jewellery, paper and paper products and wood and wood products decelerated. Bank credit to basic metal and metal products, cement and cement products, and glass and glassware recorded contraction during the same period.