IST,

IST,

Credit Scoring

Dr. (Smt.) Deepali Pant Joshi, Executive Director, Reserve Bank of India

delivered-on মে 13, 2014

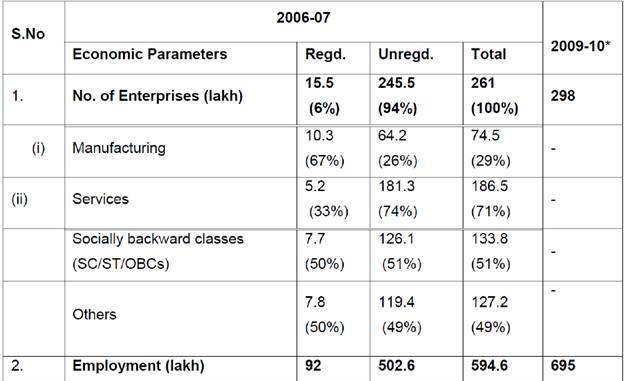

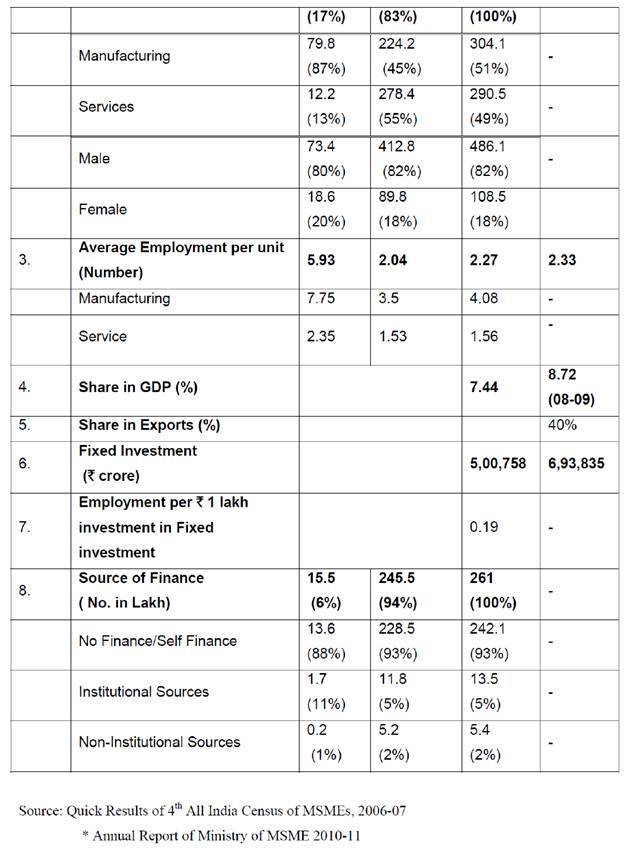

Shri R.K. Dubey, Chairman and Managing Director, Canara Bank of India, other distinguished guests, ladies and gentlemen. I am happy to be here for the launch of Canara Bank’s credit scoring model for MSMEs. We had recently on November 29, 2013 held a workshop on credit scoring models with experts from IFC, which was fundamentally aimed at capacity building in the banking sector by imparting practical knowhow to Bankers who are expected to use it in their day-to-day operations. I am happy to note that Canara Bank has taken the initiative to launch the credit scoring model for loan evaluation of MSME loan proposals. I compliment Shri R.K. Dubey, Chairman and Managing Director, Canara Bank, for his enlightened leadership and taking this initiative to further the growth of the MSME sector. A. Importance of the MSME sector 1. Micro, Small and Medium Enterprises (MSME) sector has emerged as a highly vibrant and dynamic sector of the Indian economy. The sector contributes about 8 per cent of India’s GDP, 45 per cent of the manufacturing output and 40 per cent of the exports. The growth in the manufacturing sector had dropped by 8.6 points from 7.4% in April-June 2011 to minus 1.2% in April-June 2013. After agriculture, MSME sector employs the largest number of persons. The employment picture is disturbing. According to the Planning Commission, between fiscal years 2004-05 and 2009-10, employment growth slowed, increasing by merely 2.7 million people. The largest absolute decline was in agriculture, followed by manufacturing, down by 7.2 million people or 13% of those employed in 2004-05. The decline is worrisome; more disconcerting is the sharp fall in the percentage change in employment for each percentage change in value added a metric known as employment elasticity. Simply stated, increase in value added led to increase in employment in the first period and to virtually none in the second. Manufacturing elasticity of demand has fallen from 0.76 in the first period to 0.31 in the second. So a sector with high employment elasticity has reduced its growth and potential for creating more jobs. MSMEs are widely dispersed throughout the country and produce a diverse range of products catering to various segments of the market. The geographic spread, diverse product range and potential for innovation and employment generation make them extremely important in the context of economic growth. They also help in industrialisation of rural and backward areas, thereby, reducing regional imbalances, assuring more equitable distribution of national income and wealth. MSMEs are complementary to large industries as ancillary units and this sector contributes enormously to the socioeconomic development of the country. The MSME sector in general and more particularly the Micro and Small Enterprises (MSE) sector, assumes even greater importance now as the country needs to move towards faster and a more inclusive growth agenda. The deceleration in the sector has been marked and is a cause of great concern. The entire SME sector needs to be nurtured. B. Features of MSME Sector 2. Office of the Development Commissioner, Ministry of Micro, Small & Medium Enterprises, has conducted 4th Census on MSMEs with reference period 2006-07. Some of the socio-economic features of MSME sector in India are given in Table 1 below.   C. MSMEs and the Manufacturing sector 3. The National Manufacturing Policy (NMP) envisages increasing the sectoral share of manufacturing in GDP to 25 % over the next decade from 16% at present and generating additional 100 million jobs in manufacturing sector through an annual average growth rate of 12-14 % in manufacturing sector. MSME sector being the major base of manufacturing sector in India, with its contribution of over 45% in the overall industrial output, the achievement of the NMP targeted growth of the manufacturing sector would necessitate substantial enhancement of the growth rate of MSME sector. 4. In the coming years, India is expected to witness significant demographic growth and a disproportionate expansion in the working age population. To absorb much of this labour force, the manufacturing sector would need to play an important role. Currently, the sector accounts for 12% of the total employment in the country and also provides a transitional opportunity to the labour force in agriculture. In addition, the sector has a multiplier effect for job creation in the services sector. According to the National Manufacturing Policy, every job created in the manufacturing sector creates two-three additional jobs in related activities. 5. Although the present fragile economic recovery in US and European countries and subdued business sentiments restrict the growth of the manufacturing sector, the country needs to be prepared for the times when an upswing in world demand would require an impetus to domestic manufacturing. Meanwhile, the huge domestic market, encompassing the rising aspirations not only of the urban middle class, but also of the rural economy, need to be addressed through innovative domestic products and business models. D. Financing of MSMEs 6. The MSME sector in general and more specifically the small and micro enterprises rely heavily on the banks for finance and as such banks have to recognise the vast potential that exists in responsible lending to the MSE segment. The Scheduled Commercial Banks need to understand the problem of the sector and devise strategies to gear their credit mechanism structure so as to achieve the prescribed target of lending to the sector as recommended by the PM’s Task Force. Sensitivity on the issue needs to be developed at various hierarchical levels. 7. Over the years, there has been a significant increase in credit extended to this sector by the banks as may be seen from Table-2 below. As at the end of March 2013, the total outstanding credit provided by all Scheduled Commercial Banks (SCBs) to the MSE sector stood at Rs.6,84,796 crore as against Rs.5,27,684 crore in March 2012, registering an increase of 29.77%.

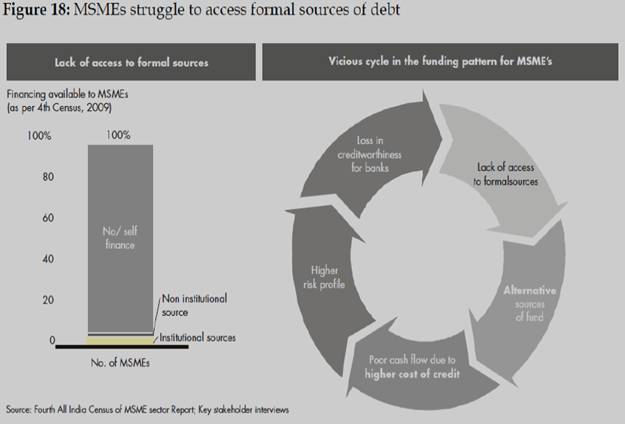

8. Nonetheless, despite the increase in financing to the sector there is still a considerable credit gap which needs to be bridged. The extent of financial exclusion and the vicious cycle of credit issues as graphically shown in the Report of the Inter-Ministerial Committee for Accelerating Manufacturing in the MSME Sector (Chairman: Shri Madhav Lal, Secretary Ministry of MSME) shows that the cycle starts from lack of access to formal sources of finance which leads to tapping alternate sources of funds that are costly- higher cost of credit results into poor net cash inflow- which increases the risk profile of the small unit-and reduces their credit worthiness- which in turn further aggravates lack of access to formal sources of finance.  9. Thus access to timely and adequate credit from banks is critical for the sector. The ability of MSMEs (especially those involving innovations and new technologies) to access alternate sources of capital like equity finance, angel funds/risk capital is extremely limited. At present, there is almost negligible flow of equity capital into this sector, which poses serious challenge to development of knowledge-based industries, particularly those that are promoted by first-generation entrepreneurs with the requisite expertise and knowledge. In the absence of alternate sources of finance, the SMEs’ reliance on debt finance is very high. The high reliance on debt, combined with high cost of credit adversely impacts the financial viability of start-ups, particularly in the initial years, thereby threatening their long-term survival and sustainability. 10. Credit is a crucial input for promoting growth of MSME sector, particularly the MSE sector, in view of its limited access to alternative sources of finance. Various estimates on the credit availability to the MSME sector, however, indicate a serious credit gap. Though the heterogeneous and unorganised nature of the sector poses inherent challenges for a credible estimate, the fact remains that there is considerable credit gap, which is a matter of serious concern and needs to be bridged if the sector has to foray into the next level of growth trajectory. 11. Information opacity arising from MSEs’ lack of accounting records, inadequate financial statements or business plans also makes it difficult for potential creditors to assess the creditworthiness of MSE applicants. Besides, high administrative/ transaction cost of lending small amounts also queers the pitch for banks insofar as MSE financing is concerned. Further, the existing system of banks’ credit appraisal and related processes also need to be geared to appraise the financial requirements of MSE sector. 12. Alongside extending the reach of their banking services, banks need to improve and customize the products offered, fine tune the pricing aspects and enhance the quality and efficiency of services. For this, banks need to have a proper business plan and delivery model that would harness the benefits of technology. This would help in planning product delivery and building lasting customer relationships which will translate into higher revenues. The costs of banking transactions need to be dramatically reduced just as in so many other fields such as telecom, after the advent of technology. It needs to be appreciated that the credit process in case of micro and small entrepreneurs cannot be identical to that of large corporations, where the borrower is able to provide detailed information about business plans and the firm’s financial statements and the lender carefully reviews the data using analytics that are time-consuming and expensive. In view of the relatively small size of the loan, banks do not find it worthwhile to conduct an elaborate appraisal of SME credit proposals both in terms of value and profit. Therefore, in order that the banks can quickly conduct appraisal of SME loan proposals without expending too much resources, it would be imperative to ensure the efficiency of the appraisal process. 13. Credit scoring offers an alternative method of evaluating loans for small businesses. The credit scoring approach, which is based on use of computer technology and mass production methods, was originally designed to handle consumer loans, but are now being used effectively for lending to small businesses by predicting their potential loan delinquency. I am happy to note that Canara Bank has taken the initiative to launch the credit scoring model for loan evaluation of MSME loan proposals. 14. Credit scoring, is a model applied by banks in their assessment and approval or decline of the loan requests by SMEs. As there is a strong link between the payment behaviour of the business owner and that of the business, SME credit scores usually include financial characteristics from both the business and the business owner. Credit scoring is based upon information like how the repayment of the previous loans has gone, what is the current income level of the enterprise, what are the outstanding debts, if any? It focuses on the credit history of the enterprise. As part of the process, the lenders see whether the enterprise/business owner has the reliability and honesty to repay the loan. It also examines how the enterprise has used credit before, its record for repayment of bills, including utility bills, how long the enterprise has been in existence, assets possessed by the enterprise and sustainability and viability of the activities that the unit is engaged in. Credit scoring model draws inputs from historical information on the performance of loans with similar characteristics. E. Benefits of Credit Scoring 15. When used appropriately, credit scoring can benefit multiple stakeholders, including lenders, borrowers, and the overall economy. For the lender, scoring leads to process automation which facilitates process improvements leading to many by-products such as improved management information, control and consistency. It also increases the profitability of SME lending by reducing the time and cost required to approve loans and increasing revenues by expanding lending opportunities as lenders can safely approve marginal applicants that an individual underwriter might reject. International evidence has shown that credit scoring can assist in overcoming the inherent benefit/cost trade-off that banks face when deciding whether or not to invest in obtaining information regarding a potential borrower. A study that was meant to test the credit scoring situation in US estimated that the cost of evaluating micro loan applications in the US using credit scoring was reduced to around $100 compared to a range of $500-$1800 prior to the introduction of credit scoring. The time saving involved meant that banks could focus more time on marginal applications, existing loans that are showing signs of distress and processing more loan applications. Use of credit scoring has also meant that the marginal benefits of taking and maintaining collateral are not justified for small loans. 16. The Bank of England has also acknowledged that there is some evidence of banks being more willing to lend on an unsecured basis when using credit scoring, which potentially improves the access to bank finance for very small and start-up Small and Medium Enterprises. For the borrower, the benefits from credit scoring include increased access to credit and, in some cases, lower borrowing costs. In its study of SME credit scoring’s impact on access to credit, the Federal Reserve Bank (FRB) of Atlanta found that, in general, the use of credit scoring increased the amount of credit banks extended to the Small and Medium Enterprises. It found that banks using scoring were more likely to lend to the Small and Medium Enterprises that lacked sufficient financial information for approval through traditional underwriting methods. Presumably, this is due to the inclusion of the business owner’s personal information in the scoring process. The study also found that banks using scoring were more likely to lend in low-income areas, a fact it attributed to greater objectivity in the underwriting process. 17. While credit scoring would definitely improve the speed and efficiency in SME lending, banks need to ensure effective follow up and monitoring of the MSME accounts. We should be careful to ensure that credit standards do not become lax so that lenders are willing to provide credit to more distant borrowers without conducting the appropriate due diligence or monitoring. Ultimately while models do help there is no substitute for the commercial judgement of the seasoned hardnosed banker which also must be applied! F. Way forward in bridging the gap in MSME Financing 18. Access to finance needs to be enlarged through alternative sources of capital such as private equity, venture capital and angel funds. This is crucial for facilitating the growth of knowledge based enterprises which have high potential in Indian context. They would require such alternative sources of finance since traditional channels may not meet their needs. Apart from fiscal incentives for promoting such alternative sources of capital (such as tax concessions), there has to be aggressive market intervention, such as promoting companies for market making and ensuring scaling up of operation of SME exchange by providing appropriate incentives. 19. Delayed payments or delayed realisation of receivables has all along been a growth constraint of MSME sector by impinging on their liquidity. Timely payments from customers will help SMEs in reducing their working capital requirements leading to lower interest costs, improved profitability and a positive impact on the long-term health and sustainability of India's SME sector. Delays in settlement of dues adversely affect the recycling of funds and business operations of the SME units. A study of 5,000 SMEs by CRISIL shows that high quantum of receivables is an endemic problem across industry sectors and geographies in the SME space. Smaller SMEs, perhaps due to their lower bargaining power, are in a more disadvantageous position with weaker receivable positions. The CRISIL study estimates that SMEs can enhance profits by at least 15% if they receive payments on time from their large corporate customers. 20. It is, therefore, critical to ensure that the small entities are able to raise liquidity against their receivables. This problem can be institutionally tackled by factoring, which provides liquidity to SMEs against their receivables and can be an alternative source of working capital. World over, factoring is a preferred route of accessing working capital for SMEs and even larger organisations. Some banks and financial institutions in India have already launched factoring services and I would urge more banks to offer such services, particularly for the MSMEs. To provide a legislative framework for factoring services, the Parliament has passed the Factoring Regulation Act that would address delays in payment and liquidity problems of micro and small enterprises. The Reserve Bank has also recently put up a Concept Paper on Financing of MSMEs -Trade Receivables and Credit Exchange on its website. The purpose is to create an institutional infrastructure for creating necessary liquidity for trade receivables through the mechanism of efficient and cost effective factoring/reverse factoring process. The Governor in his statement on September 4, 2013 had clearly stated the intention to facilitate Electronic Bill Exchanges, whereby MSME bills against large companies can be accepted electronically and auctioned so that MSMEs are paid promptly. G. Conclusion 21. Before, I conclude let me re-emphasise that given the extent of exclusion in the SME sector and the criticality of the sector for the economy, banks urgently need to step up lending to the sector. For evaluating loan proposals and for facilitating SME financing, banks would need to employ low cost and quick decision making alternatives. The use of credit scoring models can go a long way in facilitating lending decisions by reducing costs and increasing service levels, which can deliver great benefits for both the lenders and MSE borrowers. By launching the credit scoring model, Canara Bank has shown willingness and determination to expand credit coverage to this sector. I once again compliment the bank for this initiative and wish them all success in their endeavour. Thank You! References: 1. Report of the Working Group on Micro, Small and Medium(MSMEs) Enterprises Growth for the 12th Five Year Plan (102-2017), Ministry of MSME, New Delhi, January13, 2012 2. Recommendation of the Inter-Ministerial Committee for Accelerating Manufacturing in MSME sector (Chairman: Shri Madhav Lal, Secretary Ministry of MSME, New Delhi), September 2013. 3. Does Distance Still Matter? The Information Revolution in Small Business Lending - Mitchell A Peterson and Raghuram G. Rajan, March 2001. 4. Annual Reports of the Ministry of MSME Speech delivered by Dr. Deepali Pant Joshi, Executive Director, Reserve Bank of India at the launch of credit scoring model by Canara Bank on May 8, 2014 at Mumbai. Assistance rendered by Smt. Lily Vadera, General Manager is gratefully acknowledged. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

পেজের শেষ আপডেট করা তারিখ: