IST,

IST,

Some Thoughts on Credit Risk and Bank Capital Regulation

Shri N.S. Vishwanathan, Deputy Governor, Reserve Bank of India

delivered-on নভেম্বর 02, 2018

It is a privilege to be welcomed within the precincts of one of the premier management institutes of the country and, more importantly, to get an opportunity to engage with some of the promising young minds and aspiring future leaders. All of you are going to enter the job stream at a very interesting point in our country’s economic history. We are all meeting today in the wake of a number of landmark economic reforms, of which I would like to touch upon two in particular– the Insolvency and Bankruptcy Code (IBC), 2016 and the RBI circular dated February 12, 2018 on the Revised Framework for Resolution of Stressed Assets. I will attempt to give you a regulator’s perspective on the above reforms, and about banking industry in general while debunking a few fallacies. Using this background, I will also segue into another contentious issue of adequacy or otherwise of prudential capital for banks, particularly for credit risk. Let us start with the fundamentals. Banks bring together the liquidity surplus agents in an economy with the liquidity deficit agents by establishing an intermediation channel, thus aiding the flow of savings in an economy towards investments. The banking licence issued by the regulator allows these institutions to raise uncollateralised funds from the public in the form of demand deposits. It is primarily from these deposits that banks give out loans to the borrowers. Thus, it is not that banks have a huge coffer like that of Uncle Scrooge, holding their own money, from which they make loans, but it is the funds that they raise through deposits that are used for making loans. Do we need banks? The above description, though, does not immediately make it clear why we need banks to do this intermediation function – why the savers cannot directly lend to the borrowers, and why we need an intermediation infrastructure. The answer is that the information asymmetry inherent in such relationships makes direct monitoring by individual savers of borrowers both costly and inefficient. In most cases, the borrowers have more knowledge of their ability to pay than the lender. Through specialised skills in project appraisals and risk monitoring, banks are expected to contain default by a borrower and thus play the useful role of delegated monitors (Diamond, 1984) in an economy, at substantially lower cost than direct monitoring by agents. This role of delegated monitors is codified by banks through inclusion of suitable covenants in a loan contract. This formalisation has two dimensions – well drafted covenants that protect the rights of banks if the borrower fails to perform as expected, and proper enforcement of covenants in the event of a deviation in the performance of the borrower from the expectations. A well-drafted covenant is to be more of a deterrent in normal times, as it serves to remind the borrower about the consequences of not honouring the loan contract. Such a contract would be the result of strong appraisal and monitoring systems that are put in place by a lender. The appraisal would properly price the risk the lender is taking upon by extending a loan to a borrower. It would also involve proper understanding of the sector to which the loan is extended, including the vagaries and various risks that could potentially affect the projected cash flows of the venture that is being financed. A good loan contract would account for all this and more, so that it serves as a blueprint for the bank as to how to react in a given scenario during the lifetime of the loan. However, when the monitoring by banks or action taken by them on covenant breaches are inadequate, the deterrence effect is weakened leading to further covenant breaks. Banks need to be exacting in their role as monitors of loans. This in turn would force the other actors to perform their roles diligently. Say, for example, if banks go easy on a particular borrower because the borrower has been affected by delays in receipt of his claims from his client, the delays at the level of the client would never get addressed, and in fact, may get accepted as the norm. When banks perform their monitoring roles properly, the borrower would be forced to take up his case with his client for timely realisation of his claims. Banks are not supposed to be shock-absorbers of first resort of the difficulties faced by their borrowers as banks do not have the luxury of delaying payments to their depositors. Of course, a bank can renegotiate terms of a loan if circumstances warrant, but this must be for a good reason and the bank should recognise the consequent risks. This renegotiation of terms should be an exception rather than the rule, as resorting to it often would endanger the safety of deposits, dent a bank’s ability to lend further and imperil its existence as an intermediating entity. Thus, the next time we hear about a bank making efforts to recover loans from borrowers, we should all note to remember that it is essentially trying to get back the depositors’ money. In this context, the most important objective of the Revised Framework for Resolution of Stressed Assets is to alter the balance of power in favour of creditors. For long, the balance of power in our country was in favour of debtors, especially for large debtors. Debtor vs Creditor: The Change in Roles This changing debtor-creditor equation disturbs the status quo and it is only natural that it is facing resistance. The earlier debtor-friendly environment made it possible for the defaulting debtors to secure moratoriums and force write-downs on debt repayment, while retaining management control over the borrowing units or thwart banks efforts to realise their dues by indulging in serial litigations. The out-of-court restructuring mechanisms too suffered high failure rates resulting in the borrowing entities continuing to indulge in repeated defaults, being confident that the balance of power remained with them and the ability of banks to discipline errant borrowers was weak2. The debtor friendly environment had its effect on banks’ business preference, while also partly contributing to the ever-increasing stressed assets in the banking system. Banks’ ability and/or willingness to lend to persons or entities that needed credit were hampered. The Bankruptcy Law Reforms Committee (2015) has observed and I quote:

In India, before the enactment of IBC, the Reserve Bank as banking regulator had to design resolution mechanisms that tried to emulate the desirable features of a bankruptcy law as identified in the literature. However, in the absence of a bankruptcy law in the country, those schemes could not result in meaningful resolution of the stressed loans. This resulted in significant mismatches between the book values of loans carried by banks and the inherent economic value of those loans. In this context, the enactment of the IBC is a watershed event, which has completely changed the legal framework governing the insolvency regime in the country. The enactment of IBC also enabled the Reserve Bank to come out with a revised framework for resolution of stressed assets. These initiatives by the Government of India and the Reserve Bank are being challenged by the defaulting borrowers in various judicial fora. The Hon’ble Supreme Court of India in the matter of Innoventive Industries Ltd. vs ICICI Bank Ltd. (2017), observed that:

As observed by the Hon’ble Supreme Court of India, the judicial system of the country has internalized the paradigm shift in the law and defaulting debtors’ efforts to stymie the insolvency regime with frivolous litigation have not met with success so far. In this context, it needs to be recognised that when banks take recourse to legal remedies available to them when a borrower defaults on his debt servicing, including that of security enforcement, they are essentially trying to recover the depositors’ money from a defaulting borrower, whatever be the reasons for default. However, the defaulting borrowers portray such an action by banks as a case of a ‘ruthless big bank’ taking over the assets of a ‘hapless borrower’. This is the kind of portrayal used even by the large corporates. Here, one needs to distinguish between a private moneylender lending his own money for making a profit and a bank, which to a large extent uses depositors’ money (and tax payers’ money, in case of public sector banks). A correct portrayal of the situation would be: public interest (i.e., depositors + taxpayers) vs borrowers’ interest. Fallacy of ‘Genuine’ Defaulters One argument that we hear quite often is that there are different reasons for default, and the regulations should treat them differently based on the reasons which lead to the default. The proponents of this line of thought argue that where the borrowers are affected by external factors beyond their control, they should be treated as ‘genuine’ defaulters and some leniency in prudential norms is warranted. This is a fallacy, even though it is important to appreciate that some defaults are inevitable part of lending business. There are two issues here: recognition and resolution. The recognition of default or accounting for deterioration in the quality of asset should be independent of the reasons for such default or deterioration. Whereas, it is the resolution plan which should be a function of ability and willingness of the borrower to honour his obligations. Where a borrower has temporarily lost his ability to pay due to circumstances beyond his control, a quick and efficient restructuring of the debt either outside the courts or within the insolvency framework would be in order. In case of wilful or strategic defaulters, i.e., borrowers with the ability but no willingness to pay up their debt, change in ownership accompanied by punitive action against the defaulting management is the way to go. Finally, if the business is beyond revival, faster liquidation would help in reallocation of resources to productive use. This is what the Revised Framework for Resolution of Stressed Assets seeks to achieve. The following matrix illustrates this approach:

Another fallacy is the claim by the managements of defaulting borrowers that the restructuring plan proposed by them will result in ‘zero haircut’ for banks; whereas, if banks file insolvency application, new investor would be willing to take over the defaulting entities only with ‘huge haircuts’ on debt. What one needs to understand is that while the payments offered by the existing management are usually spread over a long period, the new investors mostly come up with upfront cash payments. The choice before banks is: ‘illusory future payments’ vs ‘upfront real cash’. Banks need to arrive at the present value of ‘illusory future payments’ by discounting it for time value of money and more importantly for the uncertainty in receiving the payments taking into account the existing management’s past records. A related issue is the liability of existing promoters. The share of creditors in a successful project is limited to the agreed upon cash flows as per the loan contract, as against the equity holders who enjoy unlimited upside in a successful project. Further, if a project fails, the equity holders are protected by their limited liability even if the creditors are set to lose the entire amount lent to the borrower in the absence of strong creditor rights, given the capital structure of most of the projects. At this juncture, it would be useful to clarify that limited liability, even though is enshrined in modern corporate law as a right, should rather be viewed as a privilege of the shareholders. While the argument for limited liability structure is that it promotes entrepreneurship and innovation, an investment in a project is always a case of a risky bet that is calculated. For the shareholders to enjoy limited liability in a venture that has potential negative externalities to the society in the form of defaults and its further ramifications, someone has to bear the costs when such externalities do materialise. In almost all such cases, the society ends up underwriting the limited liability enjoyed by the shareholders through bearing the cost of default through lost jobs, concessions granted by the state, and above all, the haircuts taken by banks, which are in fact potential losses of depositors’/taxpayers’ money. Societies allow companies in default to reorganise themselves and attempt a resolution by allowing to renegotiate and rewrite private contracts under a formal bankruptcy mechanism. This is another reason why the equity holders are mostly wiped out in the bankruptcy of a corporate borrower since they already enjoyed the benefits of limited liability. While limited liability concept is fundamental for encouraging entrepreneurship and innovation, piercing of corporate veil i.e., disregarding the limited liability and making shareholders personally liable, is not uncommon now-a-days considering the negative externalities created by defaulting firms. Macey and Mitts (2014) have constructed a rational framework for conceptualizing the circumstances in which it is appropriate and consistent with sound public policy to pierce the corporate veil. Their hypothesis is that the corporate veil will be pierced if, and only if, doing so is required for any one of the following three reasons: (1) to achieve consistency and compliance with the goals of a clear and specific extant regulatory or statutory scheme such as environmental law or unemployment law; (2) when there is evidence of fraud or misrepresentation by companies or individuals trying to obtain credit (and particularly where such misrepresentations lead a creditor erroneously to think that an individual shareholder of a company is guaranteeing what ostensibly is corporate indebtedness); (3) when respecting the corporate form facilitates or enables favouritism among claimants to the cash flows of a firm and thus is inconsistent with the well-established bankruptcy law value of achieving the resolution of a bankrupt’s estate that conforms both to contract law principles and to the priorities among claimants established by state law. The Hon’ble Supreme Court of India has also observed in its recent judgement in ArcelorMittal India Private Limited versus Satish Kumar Gupta & Others (2018), as under:

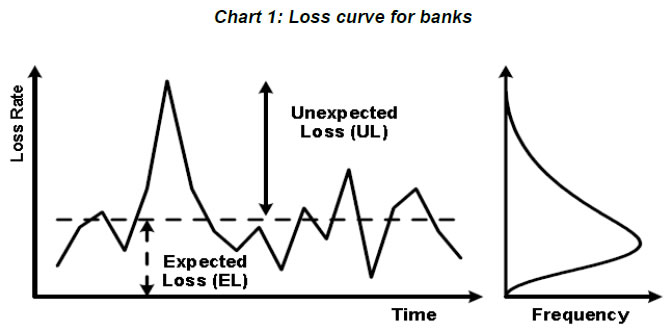

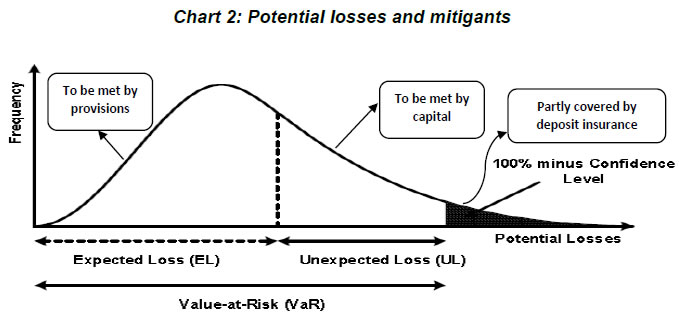

With this background I would like to move to the second but related subject of my talk, prudential bank capital regulations. As I will explain later, the credit recovery ecosystem has a bearing on prudential capital requirements, given that credit risk, in the Indian context, like in many other jurisdictions, is the major risk on the balance sheet of banks. Basel Capital Norms – The Prudential Imperative By nature, banks are susceptible to risks, viz., credit risk, market risk, liquidity risk etc. A “run” on the bank is an extreme case of liquidity risk. Banks try to mitigate the liquidity risk by holding liquid assets, which can easily be liquidated in times of need to honour the payment commitments to its creditors, majority of whom are depositors. Thus, the mitigants for liquidity risk are stable funding and holding liquid assets. While banks need liquid assets to mitigate liquidity risk, they need capital to avert solvency risk that the economic value of assets becomes lower than the promised debt obligations. If banks don’t have adequate capital, losses erode into deposits. Banks have to maintain adequate capital to ensure that the probability of deposits being eroded is close to zero. Banks are likely to face losses on their assets as it cannot be expected that all the loans will be repaid in full. There could be losses from other parts of the operations as well. The losses can be either expected or unexpected. Expected losses on account of credit risk can be reasonably estimated from historical data regarding a particular class of borrowers (e.g., rating category) or sector to which loans are made. However, the future can never be predicted perfectly – the actual losses incurred may be higher than the expected losses. This may be because of various reasons – for example, a systemic event where there are correlated defaults in a particular sector. This leads to unexpected losses. The following figure (Chart 1) explains the loss curve of a bank: The mitigants for expected losses are the provisions that are to be made from the current earnings, and for the unexpected losses (i.e., difference between peak loss for a given confidence level and average loss), it is the level of capital maintained by the bank (Chart 2). There are potential losses beyond unexpected loss, which are not covered by any buffer as it would be too costly to hold buffers to protect from such losses. While it can be argued that the quantum of capital to be held by banks for unexpected loss should be left to the market forces, any failure of the market forces has significant negative externalities, more particularly in the form of cost incurred through loss of deposits or by taxpayers for recapitalising, say a government owned bank. This calls for entry barriers as well as prudential regulation of activities of a bank. One of the important and widely adopted prudential regulations is capital adequacy norms. Internationally, prior to the introduction of Basel I norms in 1988, the most common approach was to lay down minimum capital requirements for banks in the respective banking legislations and determine the relative strength of capital position of a bank by ratios such as capital to deposit ratio, or its other variants for measuring the level of leverage. However, there were vast variations in the method and more importantly the risk sensitiveness of capital regulations across countries, rendering comparability difficult. Basel rules are an internationally accepted regulatory framework providing minimum standards to be met by banks. Since 1988, the Basel framework has evolved responding to various developments. While the concept of regulatory capital that is aligned to risks in the balance sheet of a bank was enunciated through the capital to risk weighted assets ratio (CRAR) under Basel I, the Basel II framework, introduced in 2004, brought about better determination of risks by introducing greater granulation of risks of various categories of assets of a bank. Basel II norms hinged on three pillars – capital adequacy, supervisory review, and market discipline. In particular, capital charges were to be made for credit risk, market risk and operational risk that banks faced. The main incentives for adoption of Basel II were (a) it was more risk sensitive; (b) it recognised developments in risk measurement and risk management techniques employed in the banking sector and accommodates them within the framework; and (c) it aligned regulatory capital closer to economic capital. These elements of Basel II took the regulatory framework closer to the business models employed in several large banks. In Basel II framework, banks’ capital requirements were more closely aligned with the underlying risks in the balance sheet. However, the weaknesses of Basel II standards were exposed during the Global Financial Crisis of 2007-09 which forced a rethink of the regulatory approach towards capital adequacy requirements. In September 2010, the Group of Governors and Heads of Supervision (GHOS) announced higher global minimum capital standards for commercial banks. This followed an agreement reached in July 2010 regarding the overall design of the capital and liquidity reform package, now referred to as "Basel III". The enhanced Basel framework revises and strengthens the three pillars established by Basel II and extends it in several areas. Most of the reforms are being phased in between 2013 and 2019. The important elements of the framework are the following:

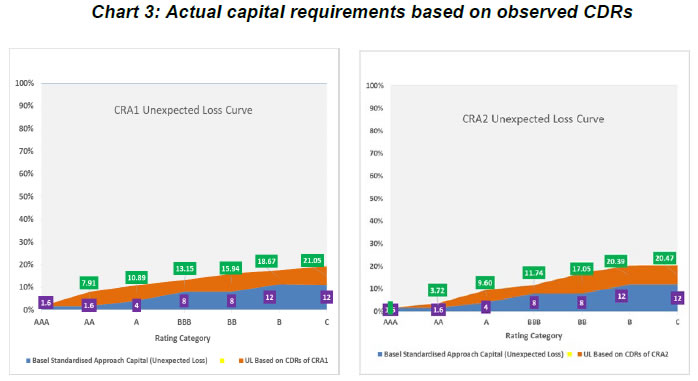

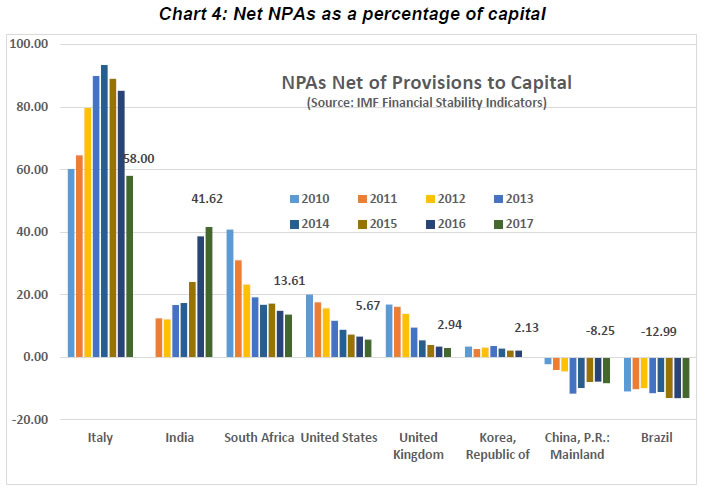

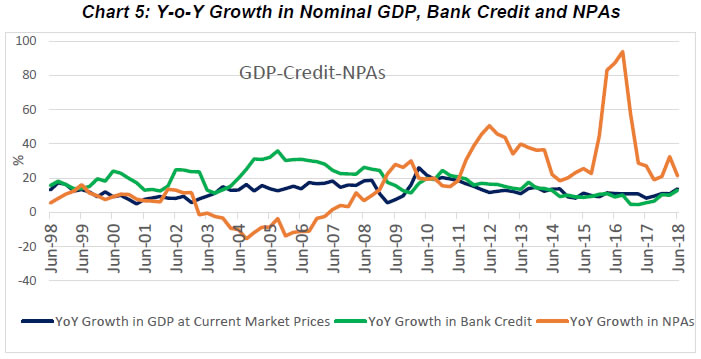

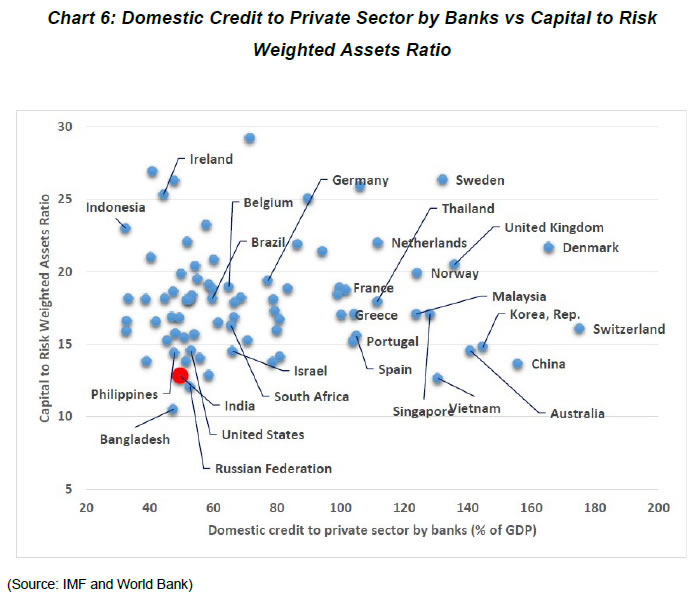

In India, Basel III capital regulation has been implemented from April 1, 2013 onwards in phases and it will be fully implemented by March 31, 2019. The latest round of reforms published by the Basel Committee in December 2017 have implementation timelines stretching up to 2022. Having understood the background for Basel regulations, let us go back to the issue of mitigating expected and unexpected losses in the credit portfolio, which, among other reasons, arise due to loans turning bad, leading to non-recovery or under-recovery of the loan. Once a loan is recognised as a non performing asset (NPA), the prudent action is to start recognising the expected losses from that loan upfront so that when the actual losses do materialise, the impact on the profit and loss statement of the bank is spread over a period of time. Since expected losses can be reasonably estimated based on past experience, the provisions to cover the losses are made from the current earnings of the bank. Provisions can be thought of as an expense from the income of a bank to mark a non-performing loan to its economic value in the books of banks. Sometimes, the actual realisation from a NPA could be higher than its marked down value, in which case banks write back the excess provision as profits in the accounting year in which the recovery takes place. Provisions can, as such, be also thought of as prudential devices that smoothen the impact of bad loans on profit and loss of banks, and not as a forced expense mandated by the regulator. The basic prudent behaviour always demands that banks should never be under provided. Ideally, banks should be able to test the loans in their books for expected losses and make provisions for such losses without any regulatory intervention. However, in the absence of robust models built by our banks that would serve this purpose, the Reserve Bank has prescribed minimum mandated levels of provisions that are linked to the age of a NPA. Since the provision methodology should be tailored to individual banks, and general regulations cannot do that, the regulatory expectation is that the minimum provisions mandated would serve as a guiding floor and the bank managements, using their insider knowledge about their assets, would make adequate provisions. However, unfortunately, banks in India remain one of the most under-provisioned ones, though there has been an improvement in this regard in the last few quarters. If the provisions required to be maintained by a bank exceed its earnings before provision, it is bound to affect the equity of the bank. This leads to one of the poorly understood aspects of banking regulation – capital norms for banks in general, and Basel norms in particular. One of the widely heard complaints in this regard is that the capital requirements for banks are unnecessarily high. In India, this relates to the CRAR prescribed by Reserve Bank being 9 percent as opposed to 8 percent required by Basel norms. To understand the response to this question, let us try to understand why capital is needed in the first place. Conceptually, the inherent unpredictable nature of unexpected losses calls for a buffer, and that is the function served by the capital maintained by the bank. Before we go any further, capital should be understood as the “own funds” used to create assets by banks, as against borrowed funds like deposits. The capital maintained by the bank merely shows the proportion of own funds brought in by the bank in the total funds deployed towards creating assets. There is a misconception that capital is a pile of money stacked away as some sort of “rainy-day fund”, and that the economy is deprived of that pile of money. The reality couldn’t be farther from the truth – the capital maintained by banks would have already been deployed on its balance sheet towards creating assets, including loans. Prudential capital regulations aim to enable banks to sustain unexpected losses without defaulting on its obligations, especially deposits, by maintaining adequate levels of bank capital. Higher capital levels in banks also have a stabilising effect on a country’s macro economy. Further, higher levels of capital increases the skin in the game for shareholders, thus potentially leading to better credit appraisal and screening. Raising capital does involve costs – there is no free lunch – but the costs to the economy are offset by the savings made in the form of potential losses avoided in averted banking crises. As the equity component in a bank goes up, the leverage goes down, potentially making the bank safer, thus leading the investors in the bank equity to demand lower returns on equity, and the depositors too may be willing to accept a lower return in view of greater safety of their funds. The holy-grail for banking regulators is to find the sweet spot for capital prescriptions for banks where the benefits are equal to or slightly outweigh the costs involved. Multiple recent studies (Cline, 2017) trying to derive the optimal Common Equity Tier 1 capital (CET 1) ratio for banks have arrived at figures on opposite ends of the spectrum – Dagher, Dell'Ariccia, Laeven, Ratnovski, and Tong (2016) estimate the optimal CET 1 ratio of 9-17% of the risk weighted assets, Admati and Hellwig (2013) estimates optimal CET1 ratio to be 36-53% of risk weighted assets. The median estimate arrived from these and other similar studies is about 13-14% of risk weighted assets of banks. In contrast to the above estimates, Basel III norms specify minimum CET 1 requirements of 4.5% of risk weighted assets. Thus, it can be seen that Basel III prescription is much lower than the median estimates by various researchers and should only be considered as a floor. In India, we have prescribed overall capital requirements of 9% of risk weighted assets, with the common equity tier 1 capital of 5.5 percent as against 8 percent and 4.5 percent, respectively, required under the Basel norms. As I said earlier, the regulatory capital is meant to serve as a buffer against unexpected loss. The cumulative unexpected loss in the assets of a bank will be an aggregation of the past loss behaviour of various sub-portfolios of the asset portfolio. The sub-portfolios can be built on the basis of riskiness of the assets. So, one can say government securities can form one sub-portfolio with a zero loss probability and build other sub-portfolios of different riskiness. The latter is normally classified on the basis of credit rating because an unexpected loss behaviour can be assigned to portfolios of similar rating. The risk-weights for each sub-portfolio are assigned based on the unexpected loss behaviour, normally based on their cumulative default rates. It thus goes without saying that the risk-weight assigned to a portfolio carrying a particular rating should be a function of the observed default behaviour of that portfolio in a jurisdiction. The higher CRAR of 9 percent prescribed by RBI basically reflects this difference. Under Basel III norms, unexpected losses are a function of the cumulative default rates (CDR) observed in the credit ratings provided by the credit rating agencies (CRAs). The CDR is nothing but the probability of a non-default rating assigned by a CRA turning into a default rating within a certain period of time. Based on internationally observed CDRs and recovery rates, Basel norms have prescribed risk weights for various credit exposures. However, the CDRs and the loss given default observed in India are much higher than that observed internationally, though there are signs of improvement in these parameters after the enactment of the IBC and RBI’s Revised Framework. The following graph (Chart 3) shows the Basel capital requirement for various rating categories vis-à-vis the unexpected loss computed using the observed CDRs of a portfolio of loans rated by Indian CRAs3. It would be evident that with this kind of default behaviour, applying the Basel specified risk weights would understate the true riskiness in the loan assets carried on the books of Indian banks. This could be overcome by two ways: (i) by keeping the minimum capital requirement at 8%, but recalibrating the Basel specified risk weights for each type of credit exposure in accordance with the observed CDRs in India; (ii) by using the Basel specified risk weights, but prescribing a higher minimum capital requirement. We adopted the second approach and prescribed minimum capital requirement of 9% while largely retaining the Basel specified risk weights. In view of the above explanation it is clear that the suggestion by some that our capital requirements are more onerous than international standards is not correct at all. As the need for repeated recapitalisation has proved, banks in India need to aspire to have higher capital levels. Moreover, the current levels of provisions maintained by banks may not be enough to cover the expected losses, and hence adequate buffers have to be built into the capital maintained to absorb the expected losses which have not been provided for, if and when they materialise. Chart 4 below demonstrates that the Indian banking system has a high proportion of un-provided NPAs vis-à-vis the capital levels. As I said, there are signs of improvement in the default rates and recovery rates after the IBC and RBI’s Revised Framework, which may result in lower unexpected losses for banks in the future. However, a recalibration of risk-weights or minimum capital requirements would need to wait till these trends are firmly entrenched in the economy. Frontloading of regulatory relaxations before the structural reforms fully set-in could be detrimental to the interests of the economy. One of the arguments for seeking a lower CRAR is that higher capital requirement leads to lower credit growth. While mathematically this may be correct, there are two important facts to underscore here. Firstly, such suggestions are being made when the credit growth in the economy is in line with the nominal GDP growth (see Chart 5 below). Bank credit has grown 14.4 percent YoY as at fortnight ended October 12, 2018. It may be mentioned as an aside that bank credit to NBFC sector, where there is perception of inadequate bank credit flow, recorded a growth of 17.1 percent from March 31, 2018 to September 30, 2018 and a YOY growth of 48.30 percent as on September 30, 2018 on the back of a strong base. Getting back to Chart, it may be noticed that in the past, high levels of credit growth due to ‘supply push’ have resulted in high corporate leverage and consequent NPAs in the banking system. Secondly, to make sure that the banking system is resilient enough to support higher credit growth going forward, it should have higher capital levels. Chart 6 below shows that countries which have high bank credit to GDP ratio also have higher levels of bank capital. Let me also clarify another oft repeated view that Public Sector Banks need not be subject to prudential capital regulations. The argument is that the sovereign ownership of these banks makes them de facto risk free and impervious to bank runs. In India, almost all commercial banks, except for the payment banks and small finance banks, are actively involved in providing credit facilities to enable international trade/investment of Indian corporates in the form of documentary credit, stand-by letters of credit, etc. Acceptance and confirmation by the foreign banks of such guarantees issued by the Indian banks is based on the soundness of Indian banks as perceived by the foreign banks. Conformity to an internationally accepted regulatory regime provides required credibility to the Indian banking system, which helps the Indian corporates to access international markets (both financial and real) on the strength of the support provided by Indian banks. Many Indian banks also access international markets for their own capital and funding requirements. The correspondent banking relationships of the Indian banks also depends upon their financial soundness. Any slackening of the prudential norms may result in a reset of their credibility/standing in the international markets. Such a reset could increase the cost and ease of doing business for their clientele and their clientele may need to migrate to other banks which are compliant with Basel standards. Moreover, differential prudential regulation for banks based on ownership structure, when they operate in the same market, would be anti-competitive and could create systemic imbalances, which obviously are not desirable outcomes. Let me conclude. A strong and stable banking system is essential for the development of the economy. This strength should be real and inherent. The real strength will come from recognising weaknesses in the balance sheet and making provisions for them rather than pretending to believe that the balance sheet is strong. Everything that the Government of India and the Reserve Bank of India have been doing in the recent past is to provide India with a clean banking system. This is a work in progress, which has started yielding results. As our insolvency and bankruptcy regime matures, many aspects of debt recovery and asset quality in the Indian financial system will match the global standards. Then our probability of default and loss given default will also come down to global levels. Hopefully, those days are nearer than we think. Till then, we must guard against any push for dilution of standards in the name of aligning them with international benchmarks because that will be cherry-picking and will result in our banks being strong in a make-believe sense and not in reality. It is by resisting such temptations, I believe, we will build a financial system that is lot stronger than today, with which you will be proud to be associated as future entrepreneurs, depositors, investors, managers and any other capacity that you would have an occasion to interact. With best wishes and Diwali Greetings. References: 1. Admati, Anat, and Martin Hellwig, The Bankers' New Clothes: What's Wrong with Banking and What to Do About It, Princeton University Press (2013) 2. Bankruptcy Law Reforms Committee, The Report of the Bankruptcy Law Reforms Committee, Volume I: Rationale and Design, (November 2015) 3. Basel Committee on Banking Supervision, “Regulatory treatment of accounting provisions”, BCBS Discussion Paper (October 2016) 4. Chang, Tom, and Antoinette Schoar, “The Effect of Judicial Bias in Chapter 11 Reorganisation”, mimeo (October 2016) 5. Cline, William R., The Right Balance for Banks: Theory and Evidence on Optimal Capital Requirement, Policy Analyses in International Economics 107 (June 2017), Peterson Institute for International Economics 6. Dagher, Jihad, Giovanni Dell'Ariccia, Luc Laeven, Lev Ratnovski, and Hui Tong, “Benefits and Costs of Bank Capital”, IMF Staff Discussion Note 16 (February 2016). 7. Diamond, Douglas W., “Financial Intermediation and Delegated Monitoring”, The Review of Economic Studies, Vol. 51, No. 3 (July 1984) 8. Farag, Marc, Damian Harland, and Dan Nixon, “Bank capital and liquidity, Bank of England Quarterly Bulletin, 2013 Q3 9. Macey, Jonathan, and Joshua Mitts, “Finding Order in the Morass: The Three Real Justifications for Piercing the Corporate Veil”, 100 Cornell L. Rev. 99 (2014) 10. McLeay, Michael, Amar Radia, and Ryland Thomas, “Money creation in the modern economy”, Bank of England Quarterly Bulletin, 2014 Q1 1 Address by Shri N.S. Vishwanathan, Deputy Governor of the Reserve Bank of India (RBI) at XLRI, Jamshedpur, October 29, 2018. 2 Academic studies (Chang, Tom, and Antoinette Schoar, 2016) show that pro-debtor bias in the bankruptcy process results in lower success rates in sustainable revival of distressed firms than pro-creditor bias. 3 Based on the CDRs published by the credit rating agencies and methodology adopted from the BCBS Discussion paper on ‘Regulatory treatment of accounting provisions’ (October 2016) |

পেজের শেষ আপডেট করা তারিখ: