| Annex 1: Annual Forecasts for 2019-20 |

| | Key Macroeconomic Indicators | Annual Forecasts for 2019-20 |

| Mean | Median | Max | Min | 1st quartile | 3rd quartile |

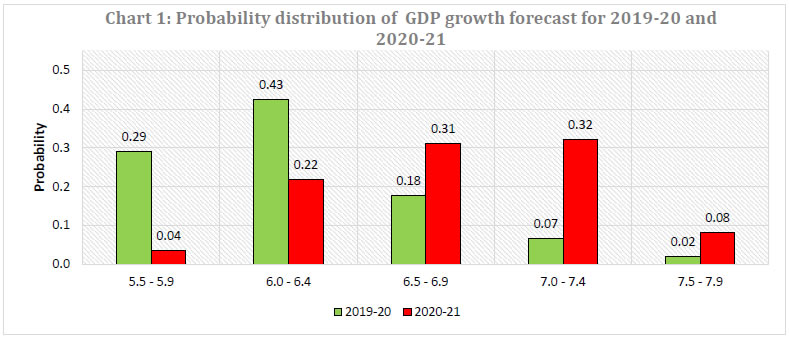

| 1 | GDP at constant (2011-12) prices: Annual Growth (per cent) | 6.2 | 6.2 | 7.0 | 5.6 | 6.0 | 6.3 |

| a | Private Final Consumption Expenditure (PFCE) at constant (2011-12) prices: Annual Growth (per cent) | 5.6 | 5.5 | 7.8 | 3.9 | 5.0 | 6.1 |

| b | Gross Fixed Capital Formation (GFCF) at constant (2011-12) prices: Annual Growth (per cent) | 6.2 | 6.0 | 10.2 | 4.0 | 5.1 | 7.1 |

| 2 | Private Final Consumption Expenditure (PFCE) at current prices: Annual Growth (per cent) | 8.8 | 9.1 | 11.9 | 6.3 | 8.0 | 9.3 |

| 3 | Gross Capital Formation (GCF) Rate (per cent of GDP at current market prices) | 30.8 | 31.0 | 32.1 | 29.0 | 30.2 | 31.6 |

| 4 | GVA at constant (2011-12) prices: Annual Growth (per cent) | 6.0 | 6.0 | 6.6 | 5.4 | 5.8 | 6.2 |

| a | Agriculture & Allied Activities at constant (2011-12) prices: Annual Growth (per cent) | 3.0 | 3.0 | 4.3 | 2.0 | 2.8 | 3.4 |

| b | Industry at constant (2011-12) prices: Annual Growth (per cent) | 4.5 | 4.4 | 7.0 | 0.4 | 3.9 | 5.1 |

| c | Services at constant (2011-12) prices: Annual Growth (per cent) | 7.2 | 7.4 | 8.3 | 1.7 | 7.3 | 7.7 |

| 5 | Gross Saving Rate (per cent of Gross National Disposable Income) - at current prices | 30.1 | 30.1 | 30.9 | 29.4 | 30.0 | 30.3 |

| 6 | Fiscal Deficit of Central Govt. (per cent of GDP at current market prices) | 3.4 | 3.3 | 3.8 | 3.1 | 3.3 | 3.4 |

| 7 | Combined Gross Fiscal Deficit (per cent to GDP at current market prices) | 6.2 | 6.1 | 6.9 | 5.8 | 6.0 | 6.4 |

| 8 | Bank Credit of Scheduled commercial banks: Annual Growth (per cent) | 12.0 | 12.0 | 15.0 | 10.0 | 11.6 | 12.4 |

| 9 | Yield on 10-Year G-Sec of Central Govt. (end-period) | 6.3 | 6.3 | 7.1 | 5.8 | 6.0 | 6.6 |

| 10 | Yield on 91-day T-Bill of Central Govt. (end-period) | 5.2 | 5.2 | 6.2 | 4.9 | 5.0 | 5.3 |

| 11 | Merchandise Exports (BoP basis in US$ terms): Annual Growth (per cent) | 1.8 | 1.5 | 10.0 | -5.0 | -0.7 | 3.2 |

| 12 | Merchandise Imports (BoP basis in US$ terms): Annual Growth (per cent) | 1.3 | 0.5 | 12.0 | -5.9 | -1.2 | 3.8 |

| 13 | Current Account Balance in US$ bn. | -56.3 | -55.5 | -40.1 | -70.0 | -58.7 | -54.2 |

| 14 | Current Account Balance (per cent to GDP at current market prices) | -2.0 | -1.9 | -1.3 | -2.8 | -2.1 | -1.8 |

| 15 | Overall BoP in US$ bn. | 16.5 | 15.1 | 44.0 | -18.4 | 6.7 | 25.2 |

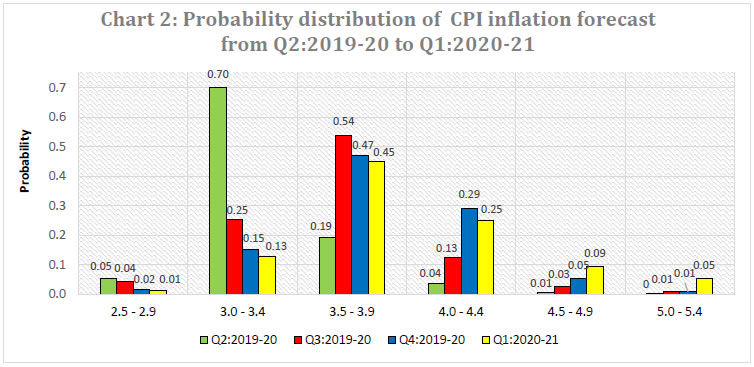

| 16 | Inflation based on CPI Combined: Headline | 3.6 | 3.5 | 4.0 | 3.2 | 3.5 | 3.7 |

| 17 | Inflation based on CPI Combined: excluding Food and Beverages, Pan, Tobacco and Intoxicants and Fuel and Light | 4.2 | 4.2 | 5.2 | 4.0 | 4.0 | 4.3 |

| 18 | Inflation based on WPI: All Commodities | 2.0 | 1.8 | 3.2 | 1.1 | 1.5 | 2.6 |

| 19 | Inflation based on WPI: Non-food Manufactured Products | 0.9 | 0.5 | 3.3 | 0.0 | 0.3 | 1.7 |

IST,

IST,