FAQ Page 1 - আরবিআই - Reserve Bank of India

All you wanted to know about NBFCs

B. Entities Regulated by RBI and applicable regulations

If companies that are required to be registered with the Reserve Bank as NBFCs, are found to be conducting non-banking financial activity, such as, lending, investment or deposit acceptance as their principal business, without obtaining Certificate of Registration from the Reserve Bank, the same would be treated as contravention of the provisions of the RBI Act, 1934 and would invite penal action viz., penalty or fine or even prosecution in a Court of Law. If members of public come across any entity which undertakes non-banking financial activity but does not figure in the list of authorized NBFCs on the Reserve Bank’s website, they should inform the nearest Regional Office of the Reserve Bank, for appropriate action to be taken for contravention of the provisions of the RBI Act, 1934.

Core Investment Companies

B. Registration and related matters:

Ans: The NBFC would have to apply to RBI with full details of the plan and exemptions could be considered on a selective basis on the merits of the case.

Government Securities Market in India – A Primer

14.1 The return on a security is a combination of two elements (i) coupon income – that is, interest earned on the security and (ii) the gain / loss on the security due to price changes and reinvestment gains or losses.

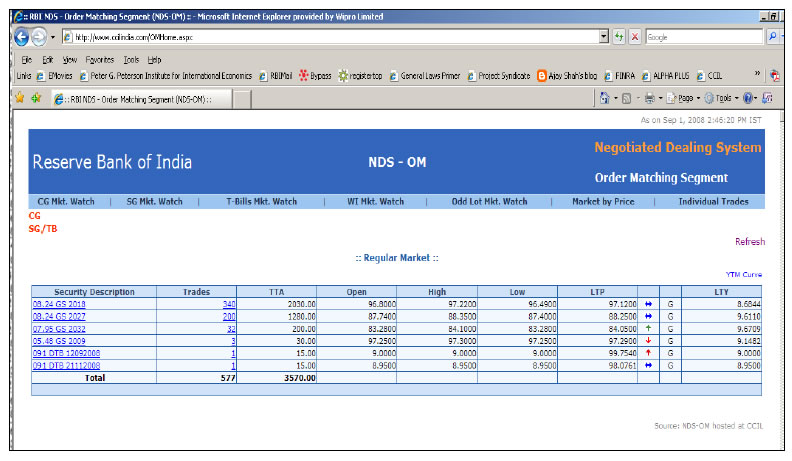

14.2 Price information is vital to any investor intending to either buy or sell G-Secs. Information on traded prices of securities is available on the RBI website http://www.rbi.org.in under the path Home → Financial Markets → Financial Markets Watch → Order Matching Segment of Negotiated Dealing System. This will show a screen containing the details of the latest trades undertaken in the market along with the prices. Additionally, trade information can also be seen on CCIL website http://www.ccilindia.com/OMHome.aspx. On this page, the list of securities and the summary of trades is displayed. The total traded amount (TTA) on that day is shown against each security. Typically, liquid securities are those with the largest amount of TTA. Pricing in these securities is efficient and hence UCBs can choose these securities for their transactions. Since the prices are available on the screen they can invest in these securities at the current prices through their custodians. Participants can thus get near real-time information on traded prices and take informed decisions while buying / selling G-Secs. The screenshots of the above webpage are given below:

NDS-OM Market

The website of the Financial Benchmarks India Private Limited (FBIL), (www.fbil.org.in) is also a right source of price information, especially on securities that are not traded frequently.

Domestic Deposits

I. Domestic Deposits

-

In the case of term deposit standing in the name/s of a deceased individual depositor, or two or more joint depositors, where one of the depositor has died, the criterion for payment of interest on matured deposits in the event of death of the depositor in the above cases has been left to the discretion of individual banks subject to their Board laying down a transparent policy in this regard.

-

In the case of balances lying in current account standing in the name of a deceased individual depositor/ sole proprietorship concern, interest should be paid only from May 1, 1983 or from the date of death of the depositor, whichever is later, till the date of repayment to the claimant/s at the rate of interest applicable to savings deposit as on the date of payment. However, in the case of NRE deposit, if the claimants are residents, the deposit on maturity is treated as domestic rupee and interest is paid for the subsequent period at a rate applicable to the domestic deposit of similar maturity.

Annual Return on Foreign Liabilities and Assets (FLA) under FEMA 1999

Eligible entities and requirements to submit the FLA return

Ans: If all non-resident shareholders of an entity have transferred their shares to the residents during the reporting period and the entity does not have any outstanding investment in respect of inward and outward FDI as on end-March of the latest FY, then the entity need not submit the FLA return.

External Commercial Borrowings (ECB) and Trade Credits

E. AVERAGE MATURITY PERIOD

Remittances (Money Transfer Service Scheme (MTSS) and Rupee Drawing Arrangement (RDA))

Money Transfer Service Scheme (MTSS)

FAQs on Non-Banking Financial Companies

Ceiling on deposits

A. As per the new Regulatory framework, there is no overall ceiling on the borrowings of NBFCs. However, limits have been prescribed for acceptance of Public Deposits as indicated here.

Level of credit rating |

Ceiling on public deposits |

|

EL/HP Cos. |

LC/ICs |

|

AAA |

4.0 |

2.0 |

AA |

2.5 |

1.0 |

A |

1.5 |

0.5 |

A - (CRISIL & ICRA) } |

||

BBB (CARE) } |

0.5 |

Nil |

BBB- (DCR India) } |

||

It is to be noted that there is an in-built ceiling on the total borrowings of the NBFCs accepting deposits from public, because they are required to maintain a capital adequacy ratio of 10 per cent of their risk weighted assets effective from 31.3.1998 and 12 per cent from 31.3.1999. Their capacity to create assets and raise corresponding borrowings will be restricted because of capital adequacy norms.