FAQ Page 1 - আরবিআই - Reserve Bank of India

Coordinated Portfolio Investment Survey – India

Some important definitions and concepts

Ans: Debt securities with original maturity of more than one year is classified as long-term debt securities. These include bonds, debentures, and notes that usually give the holder the unconditional right to a fixed cash flow or contractually determined variable money income.

All you wanted to know about NBFCs

B. Entities Regulated by RBI and applicable regulations

NBFCs shall comply with the regulations contained in para 36 of the Master Direction – Reserve Bank of India (Non-Banking Financial Company – Scale Based Regulation) 2023 (as amended from time to time) while granting loans against security of shares. The regulations include, inter alia, maintaining a Loan to Value (LTV) ratio of 50% at all times, accept only Group 1 securities as collateral for loans of value more than ₹5 lakh where lending is done for investment in capital markets, undertake necessary reporting to stock exchanges on shares pledged in their favour, etc.

In addition to the above, there are other related regulations on NBFCs viz., there shall be ceiling of ₹1 crore per borrower for financing subscription to Initial Public Offer (IPO) and NBFCs can fix more conservative limits. Further, NBFCs are prohibited from lending against security of their own shares and debentures.

Core Investment Companies

B. Registration and related matters:

Ans: Yes, CICs presently registered with the Bank but fulfilling the criteria for ‘Unregistered CICs’ as defined under para 6 of the Master Direction DoR(NBFC).PD.003/03.10.119/2016-17 date August 25, 2016 can seek voluntary deregistration. Both audited balance sheet and auditor’s certificate are required to be submitted for the purpose.

Foreign Investment in India

Answer: There are no restrictions under FEMA for investment in Rights shares issued at a discount by an Indian company under the provisions of the Companies Act, 2013. The offer on rights basis to the persons resident outside India shall be:

-

in case of shares of a company listed on a recognized stock exchange in India, at a price, as determined by the company; and

-

in case of shares of a company not listed on a recognized stock exchange in India, at a price, which is not less than the price at which the offer on right basis is made to resident shareholders.

FAQs on Non-Banking Financial Companies

Mutual benefit financial companies (nidhis)

Business restrictions imposed on Paytm Payments Bank Limited vide Press Releases dated January 31 and February 16, 2024

Merchants using Paytm Payments Bank to receive payments

Annual Return on Foreign Liabilities and Assets (FLA) under FEMA 1999

Procedure for submission of the FLA return

Ans: Please follow the below given step to revise the FLA return for a previous year:

Visit https://flair.rbi.org.in/fla/faces/pages/login.xhtml → Login to FLAIR → Click on MENU tab on the left-hand side of the homepage → ONLINE FLA FORM → FLA ONLINE FORM → “Please click here to get the approval to fill revised FLA form for current year after due date /previous year” → select "Year" and click on  → Click “Request”.

→ Click “Request”.

Your request status will be visible in the table below available on the screen. After sending request to RBI through FLA portal, entities need to wait for at least one working day for approval. Entities can check the status of their request in “Multiple Year Enable Screen” under menu on the left corner. Once approved by DSIM, RBI, the entity can revise FLA return for selected year.

External Commercial Borrowings (ECB) and Trade Credits

G. ALL-IN-COST

Government Securities Market in India – A Primer

The time value of money functions related to calculation of Present Value (PV), Future Value (FV), etc. are important mathematical concepts related to bond market. An outline of the same with illustrations is provided in Box II below.

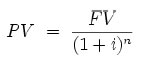

| Time Value of Money Money has time value as a Rupee today is more valuable and useful than a Rupee a year later. The concept of time value of money is based on the premise that an investor prefers to receive a payment of a fixed amount of money today, rather than an equal amount in the future, all else being equal. In particular, if one receives the payment today, one can then earn interest on the money until that specified future date. Further, in an inflationary environment, a Rupee today will have greater purchasing power than after a year. Present value of a future sum The present value formula is the core formula for the time value of money. The present value (PV) formula has four variables, each of which can be solved for: Present Value (PV) is the value at time=0

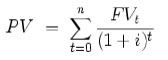

The cumulative present value of future cash flows can be calculated by adding the contributions of FVt, the value of cash flow at time=t

An illustration Taking the cash flows as;

Assuming that the interest rate is at 10% per annum; The discount factor for each year can be calculated as 1/(1+interest rate)^no. of years The present value can then be worked out as Amount x discount factor The PV of ₹100 accruing after 3 years:

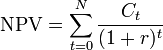

The cumulative present value = 90.91+82.64+75.13 = ₹ 248.69 Net Present Value (NPV) Net present value (NPV) or net present worth (NPW) is defined as the present value of net cash flows. It is a standard method for using the time value of money to appraise long-term projects. Used for capital budgeting, and widely throughout economics, it measures the excess or shortfall of cash flows, in present value (PV) terms, once financing charges are met. Formula Each cash inflow/outflow is discounted back to its present value (PV). Then they are summed. Therefore

Where In the illustration given above under the Present value, if the three cash flows accrues on a deposit of ₹ 240, the NPV of the investment is equal to 248.69-240 = ₹ 8.69 |