IST,

IST,

Core Investment Companies

A. Definitions:

Ans: CICs (a) with an asset size of less than ₹100 crore, irrespective of whether accessing public funds or not and (b) with an asset size of ₹100 crore and above and not accessing public funds are not required to register with the Bank under Section 45IA of the RBI Act, 1934 in terms of para 6 of Master Direction DoR(NBFC).PD.003/03.10.119/2016-17, and are termed as ‘Unregistered CICs’. An Unregistered CIC as per the aforementioned criteria is not required to submit any application to continue as Unregistered CIC. Such Unregistered CICs are exempted from the regulation of Reserve Bank. However, if they wish to make overseas investments in the financial sector, they are required to hold a Certificate of Registration from the Reserve Bank and have a prior approval of the Bank as required in para 34 of the Master Direction.

FAQs on Priority Sector Lending (PSL)

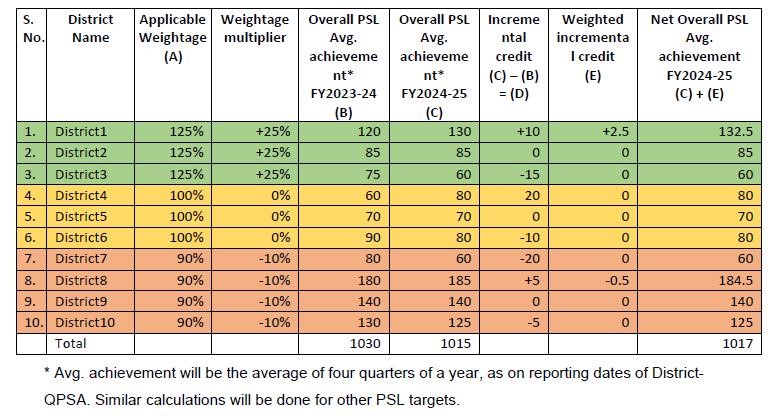

C. Adjustment for Weights in PSL Achievement

Clarification: If there is a decline in credit, the weighted incremental credit will be zero (0). The methodology as given below will be considered for all the districts for which data is reported in ADEPT and District-QPSA statement. Further, based on the methodology detailed below, banks are expected to monitor their own PSL achievement during the year taking into account the prescription of differential weights for credit in identified districts, for the purpose of trading in PSLCs.

Clarification: For mapping a credit facility to a particular district, the ‘place of utilization of credit’ shall be the qualifying criteria.

Clarification: While calculating district-wise incremental credit for assigning weights, the organic credit i.e. only the credit directly disbursed by banks and for which the actual borrower/beneficiary wise details are maintained in the books of the bank, will be considered. Credit disbursed through the following inorganic routes shall not be considered for incremental weights.

- Investments by banks in securitised assets

- Transfer of Assets through Direct Assignment/Outright purchase

- Inter Bank Participation Certificates (IBPCs)

- Priority Sector Lending Certificates (PSLCs)

- Bank loans to MFIs (NBFC-MFIs, Societies, Trusts, etc.) for on-lending

- Bank loans to NBFCs for on-lending

Bank loans to HFCs for on-lending

D. Agriculture

Clarification: The PSL guidelines are activity and beneficiary specific and are not based on type of collateral. Therefore, bank loans given to individuals/ businesses for undertaking agriculture activities do not automatically become ineligible for priority sector classification, only on account of the fact that underlying asset is gold jewellery/ornament etc. It may, however, be noted that as per FIDD Circular dated December 6, 2024, it has been advised that banks may waive collateral security and margin requirements for agricultural loans upto ₹2 lakh. Therefore, bank should have extended the loan based on scale of finance and assessment of credit requirement for undertaking the agriculture activity and not solely based on available collateral in the form of gold. Further, as applicable to all loans under PSL, banks should put in place proper internal controls and systems to ensure that the loans extended under PSL are for approved purposes and the end use is continuously monitored.

Housing Loans

Targeted Long Term Repo Operations (TLTROs)

Ans: There is no maturity restriction on the specified securities to be acquired under TLTRO scheme. However, the outstanding amount of specified securities in bank’s HTM portfolio should not fall below the level of amount availed under TLTRO scheme.

FAQs on Non-Banking Financial Companies

Registration

Framework for Compromise Settlements and Technical Write-offs

A. COMPROMISE SETTLEMENT IN WILFUL DEFAULT AND FRAUD CASES

No. The cooling period has been introduced as a general prescription for normal cases of compromise settlements, without prejudice to the penal measures applicable in respect of borrowers classified as fraud or wilful defaulter as per the Master Directions on Frauds dated July 1, 2016 and the Master Circular on Wilful Defaulters dated July 1, 2015, respectively, as mentioned at (2) above.