FAQ Page 1 - আরবিআই - Reserve Bank of India

Domestic Deposits

II. Deposits of Non-Residents Indians (NRIs)

Biennial survey on Foreign Collaboration in Indian Industry (FCS)

Some other important points to be noted

Ans.: Please read the definitions of foreign subsidiary, foreign associate, Pure Technical Collaboration and accordingly select the type of reporting company. Further, if you have chosen “Others” in identification of reporting company, please specify.

Core Investment Companies

Core Investment Companies (CICs)

Ans: CICs having asset size of below Rs 100 crore are exempted from registration and regulation from the Reserve Bank, except if they wish to make overseas investments in the financial sector.

Retail Direct Scheme

Know Your Customer (KYC) related queries

-

Upload a scanned copy of your PAN card.

-

Download the XML version of your Aadhaar from the UIDAI website and upload it. Use the 4-digit pin specified while downloading XML version.

-

Provide address details, scanned copy of your signature, bank account details and nominee details.

-

Complete the video KYC by choosing a time slot for later or immediately, depending on the availability at that point of time.

-

Authenticate the user agreement form by Aadhaar using the OTP sent on your mobile number linked to Aadhaar.

Targeted Long Term Repo Operations (TLTROs)

FAQs pertaining to On Tap TLTRO/ reversal of TLTRO/ TLTRO 2.0 transactions

Ans: Banks can use either of the alternatives. However, the request of the bank will be subject to availability of funds as on date of application i.e., funds cannot be guaranteed in case the total amount of ₹1,00,000 crore is already availed.

Housing Loans

- At the time of sourcing the loan, banks are required to provide information about the interest rate applicable, the fees / charges and any other matter which affects your interest and the same are usually furnished in the product brochure of the banks. Complete transparency is mandatory.

- The banks will supply you authenticated copies of all the loan documents executed by you at their cost along with a copy each of all enclosures quoted in the loan document on request.

A bank cannot reject your loan application without furnishing valid reason(s) for the same.

Indian Currency

B) Banknotes

With a view to enhancing operational efficiency and cost effectiveness in banknote printing, non-sequential numbering was introduced in 2011 consistent with international best practices. Packets of banknotes with non-sequential numbering contain 100 notes which are not sequentially numbered.

All you wanted to know about NBFCs

B. Entities Regulated by RBI and applicable regulations

Foreign Investment in India

FAQs on Non-Banking Financial Companies

Ceiling on deposits

Annual Return on Foreign Liabilities and Assets (FLA) under FEMA 1999

Eligible entities and requirements to submit the FLA return

Ans: No, balance sheet or profit and loss (P&L) accounts are not required to be submitted along with the FLA return.

External Commercial Borrowings (ECB) and Trade Credits

F. LEVERAGE CRITERIA AND BORROWING LIMIT

Government Securities Market in India – A Primer

Primary Market

16.1 Once the allotment process in the primary auction is finalized, the successful participants are advised of the consideration amounts that they need to pay to the Government on settlement day. The settlement cycle for auctions of all kind of G-Secs i.e. dated securities, T-Bills, CMBs or SDLs, is T+1, i.e. funds and securities are settled on next working day from the conclusion of the trade. On the settlement date, the fund accounts of the participants are debited by their respective consideration amounts and their securities accounts (SGL accounts) are credited with the amount of securities allotted to them.

Secondary Market

16.2 The transactions relating to G-Secs are settled through the member’s securities / current accounts maintained with the RBI. The securities and funds are settled on a net basis i.e. Delivery versus Payment System-III (DvP-III). CCIL guarantees settlement of trades on the settlement date by becoming a central counter-party (CCP) to every trade through the process of novation, i.e., it becomes seller to the buyer and buyer to the seller. 16.3 All outright secondary market transactions in G-Secs are settled on a T+1 basis. However, in case of repo transactions in G-Secs, the market participants have the choice of settling the first leg on either T+0 basis or T+1 basis as per their requirement. RBI vide FMRD.DIRD.05/14.03.007/2017-18 dated November 16, 2017 had permitted FPIs to settle OTC secondary market transactions in Government Securities either on T+1 or on T+2 basis and in such cases, It may be ensured that all trades are reported on the trade date itself.

Business restrictions imposed on Paytm Payments Bank Limited vide Press Releases dated January 31 and February 16, 2024

FASTag issued by Paytm Payments Bank

Coordinated Portfolio Investment Survey – India

Some important definitions and concepts

Ans: Equity consists of all instruments and records that acknowledge claims on the residual value of a corporation or quasi-corporation, after the claims of all creditors have been met. Equity may be split into listed shares, unlisted shares, and other equity. Both listed and unlisted shares are equity securities. Equity securities are commonly called shares or stocks. Other equity is equity that is not in the form of securities.

Annual Return on Foreign Liabilities and Assets (FLA) under FEMA 1999

Procedure for submission of the FLA return

Ans: Entities can submit the FLA return through the online web-based portal Foreign Liabilities and Assets Information Reporting (FLAIR) system, having address https://flair.rbi.org.in/fla/faces/pages/login.xhtml.

-

To access the URL https://flair.rbi.org.in/fla/faces/pages/login.xhtml, any of the browsers viz, Internet Explorer, Google chrome, Firefox etc. can be used, as all of these would support this application.

-

The entity has to register on the portal by clicking Registration for New Entity Users.

-

The entity has to fill the details in the FLA user registration form, upload the documents mentioned (Verification Letter and Authority Letter) and click submit to complete the registration.

-

After successful registration, user id and default password will be sent to the authorized person’s mail id. Using this user id and password, entities can login to the FLAIR portal and file the FLA Return.

- Please note: The excel-based format and email-based reporting system has been replaced by the web-based format for submission of annual FLA return from June 2019.

Biennial survey on Foreign Collaboration in Indian Industry (FCS)

Some other important points to be noted

Ans.: In the FCS form, industry codes are given as per the National Industrial Classification (NIC) (2 digit) codes. Please specify, if you have chosen “Other” industry codes, like Other manufacturing, Other services activities.

Retail Direct Scheme

Know Your Customer (KYC) related queries

Targeted Long Term Repo Operations (TLTROs)

FAQs pertaining to On Tap TLTRO/ reversal of TLTRO/ TLTRO 2.0 transactions

Ans: There is no restriction with respect to primary/ secondary market investments in specified securities under the on Tap TLTRO scheme.

Housing Loans

If you have a complaint against only scheduled bank on any of the above grounds, you can lodge a complaint with the bank concerned in writing in a specific complaint register provided at the branches as per the recommendation of the Goiporia Committee or on a sheet of paper. Ask for a receipt of your complaint. The details of the official receiving your complaint may be specifically sought. If the bank fails to respond within 30 days, you can lodge a complaint with the Banking Ombudsman. (Please note that complaints pending in any other judicial forum will not be entertained by the Banking Ombudsman). No fee is levied by the office of the Banking Ombudsman for resolving the customer’s complaint. A unique complaint identification number will be given to you for tracking purpose. (A list of the Banking Ombudsmen along with their contact details is provided on the RBI website).

Complaints are to be addressed to the Banking Ombudsman within whose jurisdiction the branch or office of the bank complained against is located. Complaints can be lodged simply by writing on a plain paper or online at www.bankingombudsman.rbi.org.in or by sending an email to the Banking Ombudsman. Complaint forms are available at all bank branches also.

Complaint can also be lodged by your authorised representative (other than a lawyer) or by a consumer association / forum acting on your behalf.

If you are not happy with the decision of the Banking Ombudsman, you can appeal to the Appellate Authority in the Reserve Bank of India.

Indian Currency

B) Banknotes

Fresh banknotes issued by Reserve Bank of India till August 2006 were serially numbered. Each of these banknote bears a distinctive serial number along with a prefix consisting of numerals and letter/s. The banknotes are issued in packets containing 100 pieces.

The Bank adopted the "STAR series" numbering system for replacement of defectively printed banknote in a packet of 100 pieces of serially numbered banknotes. The Star series banknotes are exactly similar to the other banknotes, but have an additional character viz., a *(star) in the number panel in the space between the prefix.

Core Investment Companies

Core Investment Companies (CICs)

Ans: CICs are prohibited from contributing capital to any partnership firm or to be partners in partnership firms including Limited Liability Partnerships (LLPs) or any association of person similar in nature to partnership firms.

All you wanted to know about NBFCs

B. Entities Regulated by RBI and applicable regulations

The Bank has issued detailed directions on prudential norms, vide Non-Banking Financial (Deposit Accepting or Holding) Companies Prudential Norms (Reserve Bank) Directions, 2007, Non-Systemically Important Non-Banking Financial (Non-Deposit Accepting or Holding) Companies Prudential Norms (Reserve Bank) Directions, 2015 and Systemically Important Non-Banking Financial (Non-Deposit Accepting or Holding) Companies Prudential Norms (Reserve Bank) Directions, 2015. Applicable regulations vary based on the deposit acceptance or systemic importance of the NBFC.

The directions inter alia, prescribe guidelines on income recognition, asset classification and provisioning requirements applicable to NBFCs, exposure norms, disclosures in the balance sheet, requirement of capital adequacy, restrictions on investments in land and building and unquoted shares, loan to value (LTV) ratio for NBFCs predominantly engaged in business of lending against gold jewellery, besides others. Deposit accepting NBFCs have also to comply with the statutory liquidity requirements. Details of the prudential regulations applicable to NBFCs holding deposits and those not holding deposits is available in the section ‘Regulation – Non-Banking – Notifications - Master Circulars’ in the RBI website.

Foreign Investment in India

FAQs on Non-Banking Financial Companies

Inter-corporate deposits (ICDs)

Domestic Deposits

II. Deposits of Non-Residents Indians (NRIs)

External Commercial Borrowings (ECB) and Trade Credits

F. LEVERAGE CRITERIA AND BORROWING LIMIT

Government Securities Market in India – A Primer

Coordinated Portfolio Investment Survey – India

Some important definitions and concepts

Ans: The following are included under equity securities:

-

Ordinary shares.

-

Stocks.

-

Participating preference shares.

-

Shares/units in mutual funds and investment trusts

-

Depository receipts (e.g., American Depository Receipts) denoting ownership of equity securities issued by non-residents.

-

Securities sold under repos or “lent” under securities lending arrangements.

-

Securities acquired under reverse repos or securities borrowing arrangements and subsequently sold to a third party should be reported as a negative holding.

Business restrictions imposed on Paytm Payments Bank Limited vide Press Releases dated January 31 and February 16, 2024

FASTag issued by Paytm Payments Bank

Biennial survey on Foreign Collaboration in Indian Industry (FCS)

Some other important points to be noted

Ans.: Yes, it is mandatory. Here the person authorised to fill the form owns the responsibility of information furnished and declares its accuracy including CIN number. It is a final check for all the details which are filled-up in the survey schedule of FCS survey.

Government Securities Market in India – A Primer

Delivery versus Payment (DvP) is the mode of settlement of securities wherein the transfer of securities and funds happen simultaneously. This ensures that unless the funds are paid, the securities are not delivered and vice versa. DvP settlement eliminates the settlement risk in transactions. There are three types of DvP settlements, viz., DvP I, II and III which are explained below:

Delivery versus Payment (DvP) is the mode of settlement of securities wherein the transfer of securities and funds happen simultaneously. This ensures that unless the funds are paid, the securities are not delivered and vice versa. DvP settlement eliminates the settlement risk in transactions. There are three types of DvP settlements, viz., DvP I, II and III which are explained below:

i. DvP I – The securities and funds legs of the transactions are settled on a gross basis, that is, the settlements occur transaction by transaction without netting the payables and receivables of the participant.

ii. DvP II – In this method, the securities are settled on gross basis whereas the funds are settled on a net basis, that is, the funds payable and receivable of all transactions of a party are netted to arrive at the final payable or receivable position which is settled.

iii. DvP III – In this method, both the securities and the funds legs are settled on a net basis and only the final net position of all transactions undertaken by a participant is settled.

Liquidity requirement in a gross mode is higher than that of a net mode since the payables and receivables are set off against each other in the net mode.

Retail Direct Scheme

Know Your Customer (KYC) related queries

Housing Loans

REVERSE MORTGAGE LOAN

The scheme of reverse mortgage has been introduced recently for the benefit of senior citizens owning a house but having inadequate income to meet their needs. Some important features of reverse mortgage are:

- A homeowner who is above 60 years of age is eligible for reverse mortgage loan. It allows him to turn the equity in his home into one lump sum or periodic payments mutually agreed by the borrower and the banker.

- The property should be clear from encumbrances and should have clear title of the borrower.

- NO REPAYMENT is required as long as the borrower lives, Borrower should pay all taxes relating to the house and maintain the property as his primary residence.

- The amount of loan is based on several factors: borrower’s age, value of the property, current interest rates and the specific plan chosen. Generally speaking, the higher the age, higher the value of the home, the more money is available.

- The valuation of the residential property is done at periodic intervals and it shall be clearly specified to the borrowers upfront. The banks shall have the option to revise the periodic / lump sum amount at such frequency or intervals based on revaluation of property.

- Married couples will be eligible as joint borrowers for financial assistance. In such a case, the age criteria for the couple would be at the discretion of the lending institution, subject to at least one of them being above 60 years of age.

- The loan shall become due and payable only when the last surviving borrower dies or would like to sell the home, or permanently moves out.

- On death of the home owner, the legal heirs have the choice of keeping or selling the house. If they decide to sell the house, the proceeds of the sale would be used to repay the mortgage, with the remainder going to the heirs.

- As per the scheme formulated by National Housing Bank (NHB), the maximum period of the loan period is 15 years. The residual life of the property should be at least 20 years. Where the borrower lives longer than 15 years, periodic payments will not be made by lender. However, the borrower can continue to occupy.

- From FY 2008-09, the lump sum amount or periodic payments received on reverse mortgage loan will not attract income tax or capital gains tax.

Note- Reverse mortgage is a fixed interest discounted product in reverse. It does not take into account the changes in interest rates as yet.

Important – This part is fine printed to help you practice reading the fine print. The loan agreement documentation runs into nearly 50 pages and its language is complex. If you thought everyone signs the same agreements with the bank, where is the need to read? You are not taking an informed decision. If you thought somebody would have pointed this to me if there was any problem, then maybe they did but you could not read or listen to it. Think again! Borrowers' and lenders' rights may not be expressed clearly in a transparent manner in all the loan agreements. The home loan agreement may not be provided to you in advance so that this could be read and understood before you sign the agreement. Every method may be used to delay handing over a copy to the borrower in sufficient time. Some areas you may focus are a) check the “reset clause” incorporated by some banks in their home loan agreements that allows them to change the interest rate in the future, even on fixed rate loans. Banks may set their reset clauses for 3 or 2 year intervals. They say a lender cannot have an agreement that a fixed rate is set for the entire tenure of 15 to 20 years as this will cause an asset-liability mismatch. Talk to your bank. b) Please seek clarifications on the term “exceptional circumstances” (if stated in the loan agreement) under which loan rates can be unilaterally changed by your bank. c) A common person thinks that default ideally means non-payment of one or more loan installments. In some loan documentation it can include divorce and death (in individual case) and even involvement in civil litigation or criminal offence. d) Does the loan agreement say that disbursement of the loan may be made directly to the builder or developer and in the case of a ready-built property to the vendor thereof and/or in such other manner as may be decided solely by bank? It is the borrower whose original property papers are retained with the bank, so why disburse to the builder. Possession of property has been delayed in some cases when the cheque was issued in the name of the builder and the builder refused to pay delay penalty to the borrower e) Does the agreement enable assignment of your loan to a third party? You take into account reputation and credibility of the bank before entering into a loan agreement with it. Are you comfortable with third party takes over or should you also be allowed to move your home loan from one bank to another in that case? Look for ambiguous clauses and discuss with the banker. Some agreements say changes in employment etc. have to be informed well in advance without quantifying the term “well in advance”. f) In one case the loan documentation says “issuance of pre-approval letter should not be construed as a commitment by the bank to grant the housing loan and processing fees is not re-fundable even if the home loan is not processed”. This is never ending it seems. The above are only indicative instances of what has been observed / reported/ indicated by various sources. However, our main objective was to get you into the habit of reading the fine print. If you have read this, you would have understood the importance of reading fine print in any document and we have achieved our objective. I only wish I could have made the print smaller as in the real cases.

Indian Currency

B) Banknotes

In terms of Section 25 of the RBI Act, the design, form and material of bank notes shall be such as may be approved by the Central Government after consideration of the recommendations made by Central Board.

Core Investment Companies

Core Investment Companies (CICs)

Ans: The term used in the CIC circulars is block sale and not block deal which has been defined by SEBI. In the context of the circular, a block sale would be a long term or strategic sale made for purposes of disinvestment or investment and not for short term trading. Unlike a block deal, there is no minimum number/value defined for the purpose.

All you wanted to know about NBFCs

B. Entities Regulated by RBI and applicable regulations

Foreign Investment in India

Answer: Please refer to regulation 11 of FEMA 20(R).

| Particulars | Listed Company | Un-Listed Company |

| Issue by an Indian company or transferred from a resident to non-resident - Price should not be less than | The price worked out in accordance with the relevant SEBI guidelines | The fair value worked out as per any internationally accepted pricing methodology for valuation on an arm’s length basis, duly certified by a Chartered Accountant or a SEBI registered Merchant Banker or a practicing Cost Accountant. |

| Transfer from a non-resident to resident - Price should not be more than | The price worked out in accordance with the relevant SEBI guidelines | The fair value as per any internationally accepted pricing methodology for valuation on an arm’s length basis, duly certified by a Chartered Accountant or a SEBI registered Merchant Banker. |

The pricing guidelines shall not be applicable for investment by a person resident outside India on non-repatriation basis.

FAQs on Non-Banking Financial Companies

Inter-corporate deposits (ICDs)

Domestic Deposits

II. Deposits of Non-Residents Indians (NRIs)

Annual Return on Foreign Liabilities and Assets (FLA) under FEMA 1999

Procedure for submission of the FLA return

Ans: You will receive the system-generated acknowledgement of FLA data submitted by you at the time of final submission itself. No separate mail will be sent in this regard.

External Commercial Borrowings (ECB) and Trade Credits

F. LEVERAGE CRITERIA AND BORROWING LIMIT

Coordinated Portfolio Investment Survey – India

Some important definitions and concepts

Ans: The following are not included under equity securities:

-

Equity securities issued by a nonresident enterprise that is related to the resident owner of those securities should be excluded from this survey.

-

Non-participating preference shares.

-

Securities acquired under reverse repos.

-

Securities acquired under borrowing arrangements.

Business restrictions imposed on Paytm Payments Bank Limited vide Press Releases dated January 31 and February 16, 2024

National Common Mobility Card (NCMC) issued by Paytm Payments Bank

External Commercial Borrowings (ECB) and Trade Credits

F. LEVERAGE CRITERIA AND BORROWING LIMIT

Retail Direct Scheme

Know Your Customer (KYC) related queries

Domestic Deposits

II. Deposits of Non-Residents Indians (NRIs)

Housing Loans

REVERSE MORTGAGE LOAN

EXAMPLE OF EMI CALCULATION (PURE FIXED LOAN)

|

|

Amount of Loan |

1,000,000.00 |

|

|

|

|

Annual Interest Rate |

15.00% |

|

|

|

|

Number of Payments |

120 |

|

|

|

|

Monthly Payment |

16,133.50 |

|

|

| Number |

Payment |

Interest |

Principal |

Balance |

| 0 |

|

|

|

1,000,000.00 |

| 1 |

16,133.50 |

12,500.00 |

3,633.50 |

996,366.50 |

| 2 |

16,133.50 |

12,454.58 |

3,678.91 |

992,687.59 |

| 3 |

16,133.50 |

12,408.59 |

3,724.90 |

988,962.69 |

| 4 |

16,133.50 |

12,362.03 |

3,771.46 |

985,191.23 |

| 5 |

16,133.50 |

12,314.89 |

3,818.61 |

981,372.62 |

| 6 |

16,133.50 |

12,267.16 |

3,866.34 |

977,506.28 |

| 7 |

16,133.50 |

12,218.83 |

3,914.67 |

973,591.62 |

| 8 |

16,133.50 |

12,169.90 |

3,963.60 |

969,628.02 |

| 9 |

16,133.50 |

12,120.35 |

4,013.15 |

965,614.87 |

| 10 |

16,133.50 |

12,070.19 |

4,063.31 |

961,551.56 |

| 11 |

16,133.50 |

12,019.39 |

4,114.10 |

957,437.46 |

| 12 |

16,133.50 |

11,967.97 |

4,165.53 |

953,271.93 |

| 13 |

16,133.50 |

11,915.90 |

4,217.60 |

949,054.34 |

| 14 |

16,133.50 |

11,863.18 |

4,270.32 |

944,784.02 |

| 15 |

16,133.50 |

11,809.80 |

4,323.70 |

940,460.32 |

| 16 |

16,133.50 |

11,755.75 |

4,377.74 |

936,082.58 |

| 17 |

16,133.50 |

11,701.03 |

4,432.46 |

931,650.12 |

| 18 |

16,133.50 |

11,645.63 |

4,487.87 |

927,162.25 |

| 19 |

16,133.50 |

11,589.53 |

4,543.97 |

922,618.28 |

| 20 |

16,133.50 |

11,532.73 |

4,600.77 |

918,017.51 |

| 21 |

16,133.50 |

11,475.22 |

4,658.28 |

913,359.24 |

| 22 |

16,133.50 |

11,416.99 |

4,716.51 |

908,642.73 |

| 23 |

16,133.50 |

11,358.03 |

4,775.46 |

903,867.27 |

| 24 |

16,133.50 |

11,298.34 |

4,835.15 |

899,032.12 |

| 25 |

16,133.50 |

11,237.90 |

4,895.59 |

894,136.52 |

| 26 |

16,133.50 |

11,176.71 |

4,956.79 |

889,179.73 |

| 27 |

16,133.50 |

11,114.75 |

5,018.75 |

884,160.98 |

| 28 |

16,133.50 |

11,052.01 |

5,081.48 |

879,079.50 |

| 29 |

16,133.50 |

10,988.49 |

5,145.00 |

873,934.50 |

| 30 |

16,133.50 |

10,924.18 |

5,209.31 |

868,725.18 |

| 31 |

16,133.50 |

10,859.06 |

5,274.43 |

863,450.75 |

| 32 |

16,133.50 |

10,793.13 |

5,340.36 |

858,110.39 |

| 33 |

16,133.50 |

10,726.38 |

5,407.12 |

852,703.28 |

| 34 |

16,133.50 |

10,658.79 |

5,474.70 |

847,228.57 |

| 35 |

16,133.50 |

10,590.36 |

5,543.14 |

841,685.43 |

| 36 |

16,133.50 |

10,521.07 |

5,612.43 |

836,073.00 |

| 37 |

16,133.50 |

10,450.91 |

5,682.58 |

830,390.42 |

| 38 |

16,133.50 |

10,379.88 |

5,753.62 |

824,636.81 |

| 39 |

16,133.50 |

10,307.96 |

5,825.54 |

818,811.27 |

| 40 |

16,133.50 |

10,235.14 |

5,898.35 |

812,912.92 |

| 41 |

16,133.50 |

10,161.41 |

5,972.08 |

806,940.83 |

| 42 |

16,133.50 |

10,086.76 |

6,046.74 |

800,894.10 |

| 43 |

16,133.50 |

10,011.18 |

6,122.32 |

794,771.78 |

| 44 |

16,133.50 |

9,934.65 |

6,198.85 |

788,572.93 |

| 45 |

16,133.50 |

9,857.16 |

6,276.33 |

782,296.59 |

| 46 |

16,133.50 |

9,778.71 |

6,354.79 |

775,941.81 |

| 47 |

16,133.50 |

9,699.27 |

6,434.22 |

769,507.58 |

| 48 |

16,133.50 |

9,618.84 |

6,514.65 |

762,992.93 |

| 49 |

16,133.50 |

9,537.41 |

6,596.08 |

756,396.85 |

| 50 |

16,133.50 |

9,454.96 |

6,678.54 |

749,718.31 |

| 51 |

16,133.50 |

9,371.48 |

6,762.02 |

742,956.30 |

| 52 |

16,133.50 |

9,286.95 |

6,846.54 |

736,109.75 |

| 53 |

16,133.50 |

9,201.37 |

6,932.12 |

729,177.63 |

| 54 |

16,133.50 |

9,114.72 |

7,018.78 |

722,158.85 |

| 55 |

16,133.50 |

9,026.99 |

7,106.51 |

715,052.34 |

| 56 |

16,133.50 |

8,938.15 |

7,195.34 |

707,857.00 |

| 57 |

16,133.50 |

8,848.21 |

7,285.28 |

700,571.72 |

| 58 |

16,133.50 |

8,757.15 |

7,376.35 |

693,195.37 |

| 59 |

16,133.50 |

8,664.94 |

7,468.55 |

685,726.82 |

| 60 |

16,133.50 |

8,571.59 |

7,561.91 |

678,164.91 |

| 61 |

16,133.50 |

8,477.06 |

7,656.43 |

670,508.47 |

| 62 |

16,133.50 |

8,381.36 |

7,752.14 |

662,756.33 |

| 63 |

16,133.50 |

8,284.45 |

7,849.04 |

654,907.29 |

| 64 |

16,133.50 |

8,186.34 |

7,947.15 |

646,960.14 |

| 65 |

16,133.50 |

8,087.00 |

8,046.49 |

638,913.64 |

| 66 |

16,133.50 |

7,986.42 |

8,147.08 |

630,766.57 |

| 67 |

16,133.50 |

7,884.58 |

8,248.91 |

622,517.65 |

| 68 |

16,133.50 |

7,781.47 |

8,352.03 |

614,165.63 |

| 69 |

16,133.50 |

7,677.07 |

8,456.43 |

605,709.20 |

| 70 |

16,133.50 |

7,571.37 |

8,562.13 |

597,147.07 |

| 71 |

16,133.50 |

7,464.34 |

8,669.16 |

588,477.91 |

| 72 |

16,133.50 |

7,355.97 |

8,777.52 |

579,700.39 |

| 73 |

16,133.50 |

7,246.25 |

8,887.24 |

570,813.15 |

| 74 |

16,133.50 |

7,135.16 |

8,998.33 |

561,814.82 |

| 75 |

16,133.50 |

7,022.69 |

9,110.81 |

552,704.01 |

| 76 |

16,133.50 |

6,908.80 |

9,224.70 |

543,479.31 |

| 77 |

16,133.50 |

6,793.49 |

9,340.00 |

534,139.31 |

| 78 |

16,133.50 |

6,676.74 |

9,456.75 |

524,682.56 |

| 79 |

16,133.50 |

6,558.53 |

9,574.96 |

515,107.59 |

| 80 |

16,133.50 |

6,438.84 |

9,694.65 |

505,412.94 |

| 81 |

16,133.50 |

6,317.66 |

9,815.83 |

495,597.11 |

| 82 |

16,133.50 |

6,194.96 |

9,938.53 |

485,658.58 |

| 83 |

16,133.50 |

6,070.73 |

10,062.76 |

475,595.81 |

| 84 |

16,133.50 |

5,944.95 |

10,188.55 |

465,407.26 |

| 85 |

16,133.50 |

5,817.59 |

10,315.90 |

455,091.36 |

| 86 |

16,133.50 |

5,688.64 |

10,444.85 |

444,646.51 |

| 87 |

16,133.50 |

5,558.08 |

10,575.41 |

434,071.09 |

| 88 |

16,133.50 |

5,425.89 |

10,707.61 |

423,363.48 |

| 89 |

16,133.50 |

5,292.04 |

10,841.45 |

412,522.03 |

| 90 |

16,133.50 |

5,156.53 |

10,976.97 |

401,545.06 |

| 91 |

16,133.50 |

5,019.31 |

11,114.18 |

390,430.88 |

| 92 |

16,133.50 |

4,880.39 |

11,253.11 |

379,177.77 |

| 93 |

16,133.50 |

4,739.72 |

11,393.77 |

367,784.00 |

| 94 |

16,133.50 |

4,597.30 |

11,536.20 |

356,247.80 |

| 95 |

16,133.50 |

4,453.10 |

11,680.40 |

344,567.40 |

| 96 |

16,133.50 |

4,307.09 |

11,826.40 |

332,741.00 |

| 97 |

16,133.50 |

4,159.26 |

11,974.23 |

320,766.77 |

| 98 |

16,133.50 |

4,009.58 |

12,123.91 |

308,642.85 |

| 99 |

16,133.50 |

3,858.04 |

12,275.46 |

296,367.39 |

| 100 |

16,133.50 |

3,704.59 |

12,428.90 |

283,938.49 |

| 101 |

16,133.50 |

3,549.23 |

12,584.26 |

271,354.23 |

| 102 |

16,133.50 |

3,391.93 |

12,741.57 |

258,612.66 |

| 103 |

16,133.50 |

3,232.66 |

12,900.84 |

245,711.82 |

| 104 |

16,133.50 |

3,071.40 |

13,062.10 |

232,649.72 |

| 105 |

16,133.50 |

2,908.12 |

13,225.37 |

219,424.35 |

| 106 |

16,133.50 |

2,742.80 |

13,390.69 |

206,033.66 |

| 107 |

16,133.50 |

2,575.42 |

13,558.07 |

192,475.58 |

| 108 |

16,133.50 |

2,405.94 |

13,727.55 |

178,748.03 |

| 109 |

16,133.50 |

2,234.35 |

13,899.15 |

164,848.89 |

| 110 |

16,133.50 |

2,060.61 |

14,072.88 |

150,776.00 |

| 111 |

16,133.50 |

1,884.70 |

14,248.80 |

136,527.21 |

| 112 |

16,133.50 |

1,706.59 |

14,426.91 |

122,100.30 |

| 113 |

16,133.50 |

1,526.25 |

14,607.24 |

107,493.06 |

| 114 |

16,133.50 |

1,343.66 |

14,789.83 |

92,703.23 |

| 115 |

16,133.50 |

1,158.79 |

14,974.71 |

77,728.52 |

| 116 |

16,133.50 |

971.61 |

15,161.89 |

62,566.63 |

| 117 |

16,133.50 |

782.08 |

15,351.41 |

47,215.22 |

| 118 |

16,133.50 |

590.19 |

15,543.31 |

31,671.91 |

| 119 |

16,133.50 |

395.90 |

15,737.60 |

15,934.32 |

| 120 |

16,133.50 |

199.18 |

15,934.32 |

0.00 |

Loan amount x rpm x (1+pm)

(1+pm)

- rpm= interest per month (rate of interest per year/12)

- n= number of installments

NB: If you have a fixed budget towards EMI you can arrive at loan amount by changing the other variables such as by reducing the rate of interest or by increasing the tenure of loan. This can also be arrived at through EMI calculator by a trial-and-error approach.

Indian Currency

B) Banknotes

The volume and value of banknotes to be printed in a year depends on various factors such as (i) the expected increase in Notes in Circulation (NIC) to meet the growing needs of the public and (ii) the need for replacing soiled/mutilated notes so as to ensure that only good quality notes are in circulation. The expected increase in NIC is estimated using statistical models which consider macro-economic factors such as expected growth in GDP, inflation, interest rates, growth in non-cash modes of payment etc. The replacement requirement depends on the volume of notes already in circulation and the average life of banknotes. The Reserve Bank estimates the volume and value of notes to be printed in a year based on the above factors as well as feedback received from its own Regional Offices and banks regarding expected demand for cash and finalises the same in consultation with the Government of India and the printing presses.

Core Investment Companies

Core Investment Companies (CICs)

Ans: No, CICs/ CICs-ND-SI cannot accept deposits. That is one of the eligibility criteria.

All you wanted to know about NBFCs

B. Entities Regulated by RBI and applicable regulations

-

NBS-1 Quarterly Returns on deposits in First Schedule.

-

NBS-2 Quarterly return on Prudential Norms is required to be submitted by NBFC accepting public deposits.

-

NBS-3 Quarterly return on Liquid Assets by deposit taking NBFC.

-

NBS-4 Annual return of critical parameters by a rejected company holding public deposits. (NBS-5 stands withdrawn as submission of NBS 1 has been made quarterly.)

-

NBS-6 Monthly return on exposure to capital market by deposit taking NBFC with total assets of ₹ 100 crore and above.

-

Half-yearly ALM return by NBFC holding public deposits of more than ₹ 20 crore or asset size of more than ₹ 100 crore

-

Audited Balance sheet and Auditor’s Report by NBFC accepting public deposits.

-

Branch Info Return.

B. Returns to be submitted by NBFCs-ND-SI

-

NBS-7 A Quarterly statement of capital funds, risk weighted assets, risk asset ratio etc., for NBFC-ND-SI.

-

Monthly Return on Important Financial Parameters of NBFCs-ND-SI.

-

ALM returns:

(i) Statement of short term dynamic liquidity in format ALM [NBS-ALM1] -Monthly,

(ii) Statement of structural liquidity in format ALM [NBS-ALM2] Half yearly,

(iii) Statement of Interest Rate Sensitivity in format ALM -[NBS-ALM3], Half yearly -

Branch Info return

C. Quarterly return on important financial parameters of non deposit taking NBFCs having assets of more than ₹ 50 crore and above but less than ₹ 100 crore

Basic information like name of the company, address, NOF, profit / loss during the last three years has to be submitted quarterly by non-deposit taking NBFCs with asset size between ₹ 50 crore and ₹ 100 crore.

There are other generic reports to be submitted by all NBFCs as elaborated in Master Circular on Returns to be submitted by NBFCs as available on www.rbi.org.in → Notifications → Master Circulars → Non-banking and Circular DNBS (IT) CC.No.02/24.01.191/2015-16 dated July 9, 2015 as available on www.rbi.org.in → Notifications.

Foreign Investment in India

FAQs on Non-Banking Financial Companies

Inter-corporate deposits (ICDs)

Annual Return on Foreign Liabilities and Assets (FLA) under FEMA 1999

Procedure for submission of the FLA return

Ans: An AIF needs to register on the FLAIR portal. Since there is no provision for online filing of FLA return for AIF in the prescribed format as of now, they need to send a mail requesting for the latest format for filing of FLA Return for AIF after completing registration process on the portal. Thereafter FLA Team will send the excel based format for filling FLA return by AIF via mail to them. They need to fill the excel format and send us the same on email. Email based acknowledgement form will be sent to them by FLA Team on receiving the filled-in FLA form.

Government Securities Market in India – A Primer

Biennial survey on Foreign Collaboration in Indian Industry (FCS)

Some other important points to be noted

Ans.: Please refer to the below table containing the error codes (Fatal error, non-Fatal error) with their descriptions. If you get an acknowledgment of the processed data with any Fatal error codes, then follow the below-mentioned fatal error message/description and revise your data and resubmit it on fcs@rbi.org.in. If you get an acknowledgment of the processed data with any Non-fatal error codes then give justification/clarification on the errors, by sending the same to fcsquery@rbi.org.in.

| Sr. No. | Revised- Rejection Criteria | Revised - Error Message/descriptions | Error Code |

| Fatal Error | |||

| 1 | When the year is left blank | The year cannot be left blank. Please specify the reference year and fill the return. | FCS_F_001 |

| 2 | When the survey year is incorrect | Survey year should be the subsequent survey after the latest closed survey year in the system. Please specify the correct Survey year | FCS_F_001 |

| 3 | When survey year is null | The survey year cannot be NULL. Please specify the survey year and fill the return. | FCS_F_001 |

| 4 | When survey year is incorrect | Please specify proper survey year, please fill the form for the survey year | FCS_F_001 |

| 5 | When survey year is invalid | The year for which the information is pertaining, is invalid survey year. Please mention the reference year for which the return is filled | FCS_F_001 |

| 6 | When survey year is closed | FCS survey for {year} is closed | FCS_F_001 |

| 5 | When name of company not provided | Name of company is not provided. Please provide the name of company. | FCS_F_002 |

| 6 | When CIN Number is not given | CIN number is not provided. Please provide CIN number of the company. | FCS_F_003 |

| 7 | When telephone number is not given | Please provide the telephone number of contact person. | FCS_F_004 |

| 8 | When email id is not given | Please provide the email id of the contact person. | FCS_F_005 |

| Non-Fatal Error | |||

| 1 | When type of organization is not given | Please provide the type of organization. | FCS_NF_001 |

| 2 | Identification of the Reporting company when it is not given | Please specify the Identification of the Reporting company. | FCS_NF_002 |

| 3 | When economic activity is not given | Please provide the economic activity. | FCS_NF_003 |

| 4 | Please provide details for country name / equity share. | Please provide details for country name / equity share. | FCS_NF_008 |

| 5 | When provide details for country name / loan details is not given | Please provide details for country name / loan details. | FCS_NF_009 |

| 6 | When provide details for country name / amount details is not given | Please provide details for country name / amount details. | FCS_NF_011 |

| 7 | When the total equity capital of organization is not given | Please provide the total equity capital of the organization. | FCS_NF_004 |

| 8 | When foreign participation in equity capital cannot be more than total equity capital. | The foreign participation in equity capital cannot be more than total equity capital. | FCS_NF_005_PY |

| 9 | When foreign participation in equity capital cannot be more than total equity capital. | The foreign participation in equity capital cannot be more than total equity capital. | FCS_NF_005_CY |

| 10 | When foreign participation in equity capital cannot be more than total equity capital. | The foreign participation in equity capital cannot be more than total equity capital. | FCS_NF_005 |

| 11 | When Field 2: (2a) cannot be blank for both the years as company is foreign subsidiary. | Field 2: (2a) cannot be blank for both the years as company is foreign subsidiary. | FCS_NF_006 |

| 12 | When Field 2 cannot be blank for both the years as company is foreign associate. | Field 2 cannot be blank for both the years as company is foreign associate. | FCS_NF_007 |

| 13 | In part II, block 7, Total value of imports (7.1) cannot be less than sum of imports from foreign parent/associate/collaborator (7.1.1) and imports under collaboration arrangement (7.1.2). | In part II, block 7, Total value of imports (7.1) cannot be less than sum of imports from foreign parent/associate/collaborator (7.1.1) and imports under collaboration arrangement (7.1.2). | FCS_NF_012_PY |

| 14 | In part II, block 7, Total value of imports (7.1) cannot be less than sum of imports from foreign parent/associate/collaborator (7.1.1) and imports under collaboration arrangement (7.1.2). | In part II, block 7, Total value of imports (7.1) cannot be less than sum of imports from foreign parent/associate/collaborator (7.1.1) and imports under collaboration arrangement (7.1.2). | FCS_NF_012_CY |

| 15 | In part II, block 7, Total value of imports (7.1) cannot be less than sum of imports from foreign parent/associate/collaborator (7.1.1) and imports under collaboration arrangement (7.1.2). | In part II, block 7, Total value of imports (7.1) cannot be less than sum of imports from foreign parent/associate/collaborator (7.1.1) and imports under collaboration arrangement (7.1.2). | FCS_NF_012 |

| 16 | In part II, block 7, Exports of goods (7.2.1) cannot be less than sum of export of goods produced under foreign collaboration agreements (7.2.1.1) and exports to/on behalf of/through foreign collaborator/associate (7.2.1.2). | In part II, block 7, Exports of goods (7.2.1) cannot be less than sum of export of goods produced under foreign collaboration agreements (7.2.1.1) and exports to/on behalf of/through foreign collaborator/associate (7.2.1.2). | FCS_NF_013_PY |

| 17 | In part II, block 7, Exports of goods (7.2.1) cannot be less than sum of export of goods produced under foreign collaboration agreements (7.2.1.1) and exports to/on behalf of/through foreign collaborator/associate (7.2.1.2). | In part II, block 7, Exports of goods (7.2.1) cannot be less than sum of export of goods produced under foreign collaboration agreements (7.2.1.1) and exports to/on behalf of/through foreign collaborator/associate (7.2.1.2). | FCS_NF_013_CY |

| 18 | In part II, block 7, Exports of goods (7.2.1) cannot be less than sum of export of goods produced under foreign collaboration agreements (7.2.1.1) and exports to/on behalf of/through foreign collaborator/associate (7.2.1.2). | In part II, block 7, Exports of goods (7.2.1) cannot be less than sum of export of goods produced under foreign collaboration agreements (7.2.1.1) and exports to/on behalf of/through foreign collaborator/associate (7.2.1.2). | FCS_NF_013 |

| 19 | In part II, block 7, Export of services and other foreign exchange earnings (7.2.2) cannot be less than exports to foreign collaborator/associate (7.2.2.1). | In part II, block 7, Export of services and other foreign exchange earnings (7.2.2) cannot be less than exports to foreign collaborator/associate (7.2.2.1). | FCS_NF_014_PY |

| 20 | In part II, block 7, Export of services and other foreign exchange earnings (7.2.2) cannot be less than exports to foreign collaborator/associate (7.2.2.1). | In part II, block 7, Export of services and other foreign exchange earnings (7.2.2) cannot be less than exports to foreign collaborator/associate (7.2.2.1). | FCS_NF_014_CY |

| 21 | In part II, block 7, Export of services and other foreign exchange earnings (7.2.2) cannot be less than exports to foreign collaborator/associate (7.2.2.1). | In part II, block 7, Export of services and other foreign exchange earnings (7.2.2) cannot be less than exports to foreign collaborator/associate (7.2.2.1). | FCS_NF_014 |

| 22 | In part II, block 7, Total value of export on f. o. b. basis (7.2) cannot be less than sum of export of goods (7.2.1) and export of services and other foreign exchange earnings (7.2.2). | In part II, block 7, Total value of export on f. o. b. basis (7.2) cannot be less than sum of export of goods (7.2.1) and export of services and other foreign exchange earnings (7.2.2). | FCS_NF_015_PY |

| 23 | In part II, block 7, Total value of export on f. o. b. basis (7.2) cannot be less than sum of export of goods (7.2.1) and export of services and other foreign exchange earnings (7.2.2). | In part II, block 7, Total value of export on f. o. b. basis (7.2) cannot be less than sum of export of goods (7.2.1) and export of services and other foreign exchange earnings (7.2.2). | FCS_NF_015_CY |

| 24 | In part II, block 7, Total value of export on f. o. b. basis (7.2) cannot be less than sum of export of goods (7.2.1) and export of services and other foreign exchange earnings (7.2.2). | In part II, block 7, Total value of export on f. o. b. basis (7.2) cannot be less than sum of export of goods (7.2.1) and export of services and other foreign exchange earnings (7.2.2). | FCS_NF_015 |

| 25 | when company has foreign technical collaboration agreements, please provide the number of agreements. | Since your company has foreign technical collaboration agreements, please provide the number of agreements. | FCS_NF_016 |

| 26 | agreement details by providing information on all fields need to be filled | Please provide the agreement details by providing information on all fields. | FCS_NF_017 |

| 27 | Incomplete information. Please provide the agreement details for all the foreign technical collaboration agreements mentioned in field 11(b). | Incomplete information. Please provide the agreement details for all the foreign technical collaboration agreements mentioned in field 11(b). | FCS_NF_018 |

Business restrictions imposed on Paytm Payments Bank Limited vide Press Releases dated January 31 and February 16, 2024

National Common Mobility Card (NCMC) issued by Paytm Payments Bank

Coordinated Portfolio Investment Survey – India

Some important definitions and concepts

Ans: Debt securities are negotiable instruments serving as evidence of a debt. They include bills, bonds, notes, negotiable certificates of deposit, commercial paper, debentures, asset-backed securities, money market instruments, and similar instruments normally traded in the financial markets.

Retail Direct Scheme

Know Your Customer (KYC) related queries

Domestic Deposits

II. Deposits of Non-Residents Indians (NRIs)

Indian Currency

B) Banknotes

All banknotes issued by RBI are backed by assets such as gold, Government Securities and Foreign Currency Assets, as defined in Section 33 of RBI Act, 1934.

Core Investment Companies

Core Investment Companies (CICs)

Ans: Public funds are not the same as public deposits. Public funds include public deposits, inter-corporate deposits, bank finance and all funds received whether directly or indirectly from outside sources such as funds raised by issue of Commercial Papers, debentures etc. However, even though public funds include public deposits in the general course, it may be noted that CICs/CICs-ND-SI cannot accept public deposits.

All you wanted to know about NBFCs

B. Entities Regulated by RBI and applicable regulations

Foreign Investment in India

FAQs on Non-Banking Financial Companies

Inter-corporate deposits (ICDs)

Annual Return on Foreign Liabilities and Assets (FLA) under FEMA 1999

Procedure for submission of the FLA return

Ans: Any query regarding filling of FLA return should be sent by email. We will revert back to you within one or two working days.

External Commercial Borrowings (ECB) and Trade Credits

F. LEVERAGE CRITERIA AND BORROWING LIMIT

Government Securities Market in India – A Primer

"When, as and if issued" (commonly known as ‘When Issued’) security refers to a security that has been authorized for issuance but not yet actually issued. When Issued trading takes place between the time a Government Security is announced for issuance and the time it is actually issued. All 'When Issued' transactions are on an 'if' basis, to be settled if and when the actual security is issued. RBI vide its notification FMRD.DIRD.03/14.03.007/2018-19 dated July 24, 2018 has issued When Issued Transactions (Reserve Bank) Directions, 2018 applicable to ‘When Issued’ transactions in Central Government securities.

Both new and reissued Government securities issued by the Central Government are eligible for ‘When Issued’ transactions. Eligibility of an issue for ‘When Issue’ trades would be indicated in the respective specific auction notification. Participants eligible to undertake both net long and short position in ‘When Issued’ market are (a) All entities which are eligible to participate in the primary auction of Central Government securities,(b) However, resident individuals, Hindu Undivided Families (HUF), Non-Resident Indians (NRI) and Overseas Citizens of India (OCI) are eligible to undertake only long position in ‘When Issued’ securities. (c) Entities other than scheduled commercial banks and Primary Dealers (PDs), shall close their short positions, if any, by the close of trading on the date of auction of the underlying Central Government security.

When Issued transactions would commence after the issue of a security is notified by the Central Government and it would cease at the close of trading on the date of auction. All ‘When Issued’ transactions for all trade dates shall be contracted for settlement on the date of issue. When Issued’ transactions shall be undertaken only on the Negotiated Dealing System-Order Matching (NDS-OM) platform. However, an existing position in a ‘When Issued’ security may be closed either on the NDS-OM platform or outside the NDS-OM platform, i.e., through Over-the-Counter (OTC) market. The open position limits are prescribed in the directions. All NDS-OM members participating in the ‘When Issued’ market are required to have in place a written policy on ‘When Issued’ trading which should be approved by the Board of Directors or equivalent body.

"Short sale" means sale of a security one does not own. RBI vide its notification FMRD.DIRD.05/14.03.007/2018-19 dated July 25, 2018 has issued Short Sale (Reserve Bank) Directions, 2018 applicable to ‘Short Sale’ transactions in Central Government dated securities. Banks may treat sale of a security held in the investment portfolio as a short sale and follow the process laid down in these directions. These transactions shall be referred to as ‘notional’ short sales. For the purpose of these guidelines, short sale would include 'notional' short sale.

Entities eligible to undertake short sales are (a) Scheduled commercial banks, (b) Primary Dealers, (c) Urban Cooperative Banks as permitted under circular UBD.BPD (PCB). Circular No.9/09.29.000/2013-14 dated September 4, 2013 and (d) Any other regulated entity which has the approval of the concerned regulator (SEBI, IRDA, PFRDA, NABARD, NHB). The maximum amount of a security (face value) that can be short sold is (a) for Liquid securities: 2% of the total outstanding stock of each security, or, ₹ 500 crore, whichever is higher; (b) for other securities: 1% of the total outstanding stock of each security, or, ₹ 250 crore, whichever is higher. The list of liquid securities shall be disseminated by FIMMDA/FBIL from time to time. Short sales shall be covered within a period of three months from the date of transaction (inclusive of the date). Banks undertaking ‘notional’ short sales shall ordinarily borrow securities from the repo market to meet delivery obligations, but in exceptional situations of market stress (e.g., short squeeze), it may deliver securities from its own investment portfolio. If securities are delivered out of its own portfolio, it must be accounted for appropriately and reflect the transactions as internal borrowing. It shall be ensured that the securities so borrowed are brought back to the same portfolio, without any change in book value.

Business restrictions imposed on Paytm Payments Bank Limited vide Press Releases dated January 31 and February 16, 2024

National Common Mobility Card (NCMC) issued by Paytm Payments Bank

Coordinated Portfolio Investment Survey – India

Some important definitions and concepts

Ans: Debt securities with original maturity of more than one year is classified as long-term debt securities. These include bonds, debentures, and notes that usually give the holder the unconditional right to a fixed cash flow or contractually determined variable money income.

Annual Return on Foreign Liabilities and Assets (FLA) under FEMA 1999

Procedure for submission of the FLA return

Ans: Please follow the below given step to revise the FLA return for a previous year:

Visit https://flair.rbi.org.in/fla/faces/pages/login.xhtml → Login to FLAIR → Click on MENU tab on the left-hand side of the homepage → ONLINE FLA FORM → FLA ONLINE FORM → “Please click here to get the approval to fill revised FLA form for current year after due date /previous year” → select "Year" and click on  → Click “Request”.

→ Click “Request”.

Your request status will be visible in the table below available on the screen. After sending request to RBI through FLA portal, entities need to wait for at least one working day for approval. Entities can check the status of their request in “Multiple Year Enable Screen” under menu on the left corner. Once approved by DSIM, RBI, the entity can revise FLA return for selected year.

External Commercial Borrowings (ECB) and Trade Credits

G. ALL-IN-COST

Government Securities Market in India – A Primer

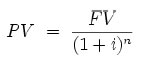

The time value of money functions related to calculation of Present Value (PV), Future Value (FV), etc. are important mathematical concepts related to bond market. An outline of the same with illustrations is provided in Box II below.

| Time Value of Money Money has time value as a Rupee today is more valuable and useful than a Rupee a year later. The concept of time value of money is based on the premise that an investor prefers to receive a payment of a fixed amount of money today, rather than an equal amount in the future, all else being equal. In particular, if one receives the payment today, one can then earn interest on the money until that specified future date. Further, in an inflationary environment, a Rupee today will have greater purchasing power than after a year. Present value of a future sum The present value formula is the core formula for the time value of money. The present value (PV) formula has four variables, each of which can be solved for: Present Value (PV) is the value at time=0

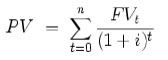

The cumulative present value of future cash flows can be calculated by adding the contributions of FVt, the value of cash flow at time=t

An illustration Taking the cash flows as;

Assuming that the interest rate is at 10% per annum; The discount factor for each year can be calculated as 1/(1+interest rate)^no. of years The present value can then be worked out as Amount x discount factor The PV of ₹100 accruing after 3 years:

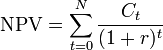

The cumulative present value = 90.91+82.64+75.13 = ₹ 248.69 Net Present Value (NPV) Net present value (NPV) or net present worth (NPW) is defined as the present value of net cash flows. It is a standard method for using the time value of money to appraise long-term projects. Used for capital budgeting, and widely throughout economics, it measures the excess or shortfall of cash flows, in present value (PV) terms, once financing charges are met. Formula Each cash inflow/outflow is discounted back to its present value (PV). Then they are summed. Therefore

Where In the illustration given above under the Present value, if the three cash flows accrues on a deposit of ₹ 240, the NPV of the investment is equal to 248.69-240 = ₹ 8.69 |

Core Investment Companies

Core Investment Companies (CICs)

Ans: Indirect receipt of public funds means funds received not directly but through associates and group entities which have access to public funds.

Retail Direct Scheme

Nomination related queries

Domestic Deposits

II. Deposits of Non-Residents Indians (NRIs)

Indian Currency

C. Different Types of Bank Notes and Security Features of banknotes

The details are as under:

i. Ashoka Pillar Banknotes:

The first banknote issued by independent India was the one rupee note issued in 1949. While retaining the same designs the new banknotes were issued with the symbol of Lion Capital of Ashoka Pillar at Sarnath in the watermark window in place of the portrait of King George.

The name of the issuer, the denomination and the guarantee clause were printed in Hindi on the new banknotes from the year 1951. The banknotes in the denomination of ₹1000, ₹5000 and ₹10000 were issued in the year 1954. Banknotes in Ashoka Pillar watermark Series, in ₹10 denomination were issued between 1967 and 1992, ₹20 denomination in 1972 and 1975, ₹50 in 1975 and 1981, and ₹100 between 1967-1979. The banknotes issued during the above period, contained the symbols representing science and technology, progress, orientation to Indian Art forms. In the year 1970, banknotes with the legend "Satyameva Jayate", i.e., truth alone shall prevail were introduced for the first time. In October 1987, ₹500, banknote was introduced with the portrait of Mahatma Gandhi and the Ashoka Pillar watermark.

ii. Mahatma Gandhi (MG) Series 1996

The details of banknotes issued in MG Series – 1996 is as under:

| Denomination | Month and year of introduction |

| ₹5 | November 2001 |

| ₹10 | June 1996 |

| ₹20 | August 2001 |

| ₹50 | March 1997 |

| ₹100 | June 1996 |

| ₹500 | October 1997 |

| ₹1000 | November 2000 |

All the banknotes of this series bear the portrait of Mahatma Gandhi on the obverse (front) side, in place of symbol of Lion Capital of Ashoka Pillar, which has also been retained and shifted to the left side next to the watermark window. This means that these banknotes contain Mahatma Gandhi watermark as well as Mahatma Gandhi's portrait.

iii. Mahatma Gandhi series – 2005 banknotes

MG series 2005 banknotes were issued in the denomination of ₹10, ₹20, ₹50, ₹100, ₹500 and ₹1000 and contain some additional/new security features as compared to the 1996 MG series. The year of introduction of these banknotes is as under:

| Denomination | Month and year of Introduction |

| ₹50 and ₹100 | August 2005 |

| ₹500 and ₹1000 | October 2005 |

| ₹10 | April 2006 |

| ₹20 | August 2006 |

The Legal tender of banknotes of ₹500 and ₹1000 of this series was subsequently withdrawn w.e.f. the midnight of November 8, 2016.

iv. Mahatma Gandhi (New) Series (MGNS) – Nov 2016

The Mahatma Gandhi (New) Series, introduced in the year 2016, highlights the cultural heritage and scientific achievements of the country. The banknotes in the series are more wallet friendly, being of reduced dimensions and hence expected to incur less wear and tear. For the first time, designs for banknotes has been indigenously developed on themes reflecting the diverse history, culture and ethos of the country as also its scientific achievements. The colour scheme is sharp and vivid to make the banknotes distinctive.

The first banknote from the new series was introduced on November 8, 2016 and is a new denomination, ₹2000-with the theme of Mangalyaan. Subsequently, banknotes in this series in denomination of ₹500, ₹200, ₹100, ₹50, ₹20 and ₹10 have also been introduced.

All you wanted to know about NBFCs

B. Entities Regulated by RBI and applicable regulations

Foreign Investment in India

Answer: There are no restrictions under FEMA for investment in Rights shares issued at a discount by an Indian company under the provisions of the Companies Act, 2013. The offer on rights basis to the persons resident outside India shall be:

-

in case of shares of a company listed on a recognized stock exchange in India, at a price, as determined by the company; and

-

in case of shares of a company not listed on a recognized stock exchange in India, at a price, which is not less than the price at which the offer on right basis is made to resident shareholders.

FAQs on Non-Banking Financial Companies

Mutual benefit financial companies (nidhis)

Coordinated Portfolio Investment Survey – India

Some important definitions and concepts

Ans: Debt securities with original maturity of one year or less is classified as short-term debt securities. Examples of short-term securities are treasury bills, negotiable certificates of deposit, bankers’ acceptances, promissory notes, and commercial paper.

Business restrictions imposed on Paytm Payments Bank Limited vide Press Releases dated January 31 and February 16, 2024

Merchants using Paytm Payments Bank to receive payments

Retail Direct Scheme

Nomination related queries

Domestic Deposits

II. Deposits of Non-Residents Indians (NRIs)

Indian Currency

C. Different Types of Bank Notes and Security Features of banknotes

₹500, ₹1000 and ₹10000 banknotes, which were then in circulation were demonetized in January 1946. The higher denomination banknotes in ₹1000, ₹5000 and ₹10000 were reintroduced in the year 1954, and these banknotes (₹1000, ₹5000 and ₹10000) were again demonetized in January 1978.

Recently, banknotes in the denomination of ₹500 and ₹1000 issued under the Mahatma Gandhi Series have been withdrawn from circulation with effect from the midnight of November 08, 2016 and are, therefore, no more legal tender.

As regards prohibition on holding, transferring or receiving specified bank notes, Section 5 of The Specified Banknotes (Cessation of Liabilities) Act, 2017 reads as under:

On and from the appointed day, no person shall, knowingly or voluntarily, hold, transfer or receive any specified bank note:

Provided that nothing contained in this section shall prohibit the holding of specified bank notes—

(a) by any person—

(i) up to the expiry of the grace period; or

(ii) after the expiry of the grace period,—

-

not more than ten notes in total, irrespective of the denomination; or

-

not more than twenty-five notes for the purposes of study, research or numismatics;

(b) by the Reserve Bank or its agencies, or any other person authorised by the Reserve Bank;

(c) by any person on the direction of a court in relation to any case pending in the court

Directions and Circulars issued by RBI from time to time in connection with SBNs are available on our website www.rbi.org.in under Function wise sites>>Issuer of Currency>>All You Wanted Know About SBNs. All You wanted to know from RBI about Withdrawal of Legal Tender Status of ₹ 500 and ₹ 1000 Notes

Core Investment Companies

Core Investment Companies (CICs)

Ans: Yes, CICs may be required to issue guarantees or take on other contingent liabilities on behalf of their group entities. Guarantees per se do not fall under the definition of public funds. However, it is possible that CICs which do not accept public funds take recourse to public funds if and when the guarantee devolves. Hence, before doing so, CICs must ensure that they can meet the obligation there under, as and when they arise. In particular, CICs which are exempt from registration requirement must be in a position to do so without recourse to public funds in the event the liability devolves. If unregistered CICs with asset size above Rs. 100 crore access public funds without obtaining a Certificate of Registration (CoR) from RBI, they will be seen as violating Core Investment Companies (Reserve Bank) Directions, 2011 dated January 05, 2011.

All you wanted to know about NBFCs

B. Entities Regulated by RBI and applicable regulations

Foreign Investment in India

Answer: No, renunciation of rights shares shall be done in accordance with the instructions contained in Para 6.11 of Master Direction - Foreign Investment in India dated January 4, 2018, read with Regulation 6 of FEMA 20(R).

FAQs on Non-Banking Financial Companies

Mutual benefit financial companies (nidhis)

Annual Return on Foreign Liabilities and Assets (FLA) under FEMA 1999

Some Useful Definitions

Ans: Direct investment is a category of international investment in which a resident entity in one economy [Direct Investor (DI)] acquires a lasting interest in an enterprise resident in another economy [Direct Investment Enterprise (DIE)]. It consists of two components, viz., Equity Capital and Other Capital.

External Commercial Borrowings (ECB) and Trade Credits

G. ALL-IN-COST

Government Securities Market in India – A Primer

The price of a bond is nothing but the sum of present value of all future cash flows of the bond. The interest rate used for discounting the cash flows is the Yield to Maturity (YTM) (explained in detail in question no. 24) of the bond. Price can be calculated using the excel function ‘Price’ (please refer to Annex 6).

Accrued interest is the interest calculated for the broken period from the last coupon day till a day prior to the settlement date of the trade. Since the seller of the security is holding the security for the period up to the day prior to the settlement date of the trade, he is entitled to receive the coupon for the period held. During settlement of the trade, the buyer of security will pay the accrued interest in addition to the agreed price and pays the ‘consideration amount’.

An illustration is given below;

For a trade of ₹ 5 crore (face value) of security 8.83% 2023 for settlement date Jan 30, 2014 at a price of ₹100.50, the consideration amount payable to the seller of the security is worked out below:

Here the price quoted is called ‘clean price’ as the ‘accrued interest’ component is not added to it.

Accrued interest:

The last coupon date being Nov 25, 2013, the number of days in broken period till Jan 29, 2014 (one day prior to settlement date i.e. on trade day) are 65.

| The accrued interest on ₹100 face value for 65 days | = 8.83 x (65/360) |

| = ₹1.5943 |

When we add the accrued interest component to the ‘clean price’, the resultant price is called the ‘dirty price’. In the instant case, it is 100.50+1.5943 = ₹102.0943

| The total consideration amount | = Face value of trade x dirty price |

| = 5,00,00,000 x (102.0943/100) | |

| = ₹ 5,10,47,150 |

Business restrictions imposed on Paytm Payments Bank Limited vide Press Releases dated January 31 and February 16, 2024

Merchants using Paytm Payments Bank to receive payments

Coordinated Portfolio Investment Survey – India

Some important definitions and concepts

Ans: Equity securities should be reported at market prices converted to domestic currency using the exchange rate prevailing at March 31/ September 30, [Year]. For enterprises listed on a stock exchange, the market value of your holding of the equity securities should be calculated using the market price on the main stock exchange prevailing at March 31/ September 30, [Year]. For unlisted enterprises, if a market value is not available at the close of business on March 31/ September 30, [Year], estimate of the market value of your holding of equity securities can be calculated by using one of the six alternatives methods given in Q23.

Debt securities should be recorded at market prices converted to domestic currency, using the exchange rate prevailing at the close of business on March 31/ September 30, [Year]. For listed debt securities, a quoted traded market price at the close of business on March 31/ September 30, [Year], should be used. When market prices are unavailable (e.g., in the case of unlisted debt securities), the following methods for estimating fair value (which is an approximation of the market value of such instruments) should be used:

-

discounting future cash flows to the present value using a market rate of interest and

-

using market prices of financial assets and liabilities that are similar.

Retail Direct Scheme

Nomination related queries

Domestic Deposits

II. Deposits of Non-Residents Indians (NRIs)

In respect of deposit accepted in the name of –

-

member or a retired member of the bank’s staff, either singly or jointly with any other member or members of his/ her family, or

-

the spouse of a deceased member or a deceased retired member of the bank’s staff,

the bank may, in its discretion, allow additional interest at a rate not exceeding one per cent per annum over and above the rate of interest stipulated, subject to the condition that overall ceiling prescribed for FCNR(B) deposits is not breached,

Provided that –

-

the depositor or all the depositors of a joint account is/ are non-resident/s of Indian nationality or origin, and

-

the bank shall obtain a declaration from the depositor concerned that the moneys so deposited or which may, from time to time, be deposited, shall be moneys belonging to the depositor as stated in clause (a) and (b) above.

Explanation: The word “family” shall mean and include the spouse of the member/ retired member of the bank’s staff, his/her children, parents, brothers and sisters who are dependent on such a member/ retired member but shall not include a legally separated spouse.

Indian Currency

C. Different Types of Bank Notes and Security Features of banknotes

Reserve Bank of India decided to withdraw from circulation all banknotes issued prior to 2005 as they have fewer security features as compared to banknotes printed after 2005. It is a standard international practice to withdraw old series notes. The RBI has already been withdrawing these banknotes in a routine manner through banks. It is estimated that the volume of such banknotes (pre-2005) in circulation is not significant enough to impact the general public in a big way. The exchange facility for pre-2005 banknotes is available only at the following offices of the Reserve Bank: Ahmedabad, Bengaluru, Belapur, Bhopal, Bhubaneswar, Chandigarh, Chennai, Guwahati, Hyderabad, Jaipur, Jammu, Kanpur, Kolkata, Lucknow, Mumbai, Nagpur, New Delhi, Patna, Thiruvananthapuram and Kochi. This, however, did not imply that banks cannot accept deposits of pre-2005 banknotes for crediting to the customers’ accounts. Please refer to our Press Release no. 2016-17/1565 dated December 19, 2016 in this regard which can be accessed at the following link /en/web/rbi/-/press-releases/banks-should-accept-pre-2005-banknotes-in-deposit-rbi-clarifies-38951

Core Investment Companies

Core Investment Companies (CICs)

Ans: For the purposes of determining whether a company is a CIC/CIC-ND-SI, ‘companies in the group’ have been exhaustively defined in para 3(1) b of Notification No. DNBS. (PD) 219/CGM(US)-2011 dated January 5, 2011 as “an arrangement involving two or more entities related to each other through any of the following relationships, viz.,Subsidiary – parent (defined in terms of AS 21), Joint venture (defined in terms of AS 27), Associate (defined in terms of AS 23), Promoter-promotee [as provided in the SEBI (Acquisition of Shares and Takeover) Regulations, 1997] for listed companies, a related party (defined in terms of AS 18) Common brand name, and investment in equity shares of 20% and above).”

All you wanted to know about NBFCs

B. Entities Regulated by RBI and applicable regulations

Foreign Investment in India

Answer: Yes, subject to conditions laid down in para 7.11 of the Master Direction on Foreign Investment in India.