IST,

IST,

Retail Direct Scheme

Investment and Account holdings related queries

Domestic Deposits

IV. Advances against shares and debentures

Foreign Investment in India

IV. Reporting Delays

Answer: The reporting requirements are laid down in the Master Direction on Reporting under Foreign Exchange Management Act, 1999.

Indian Currency

E) Counterfeits/Forgeries

The Reserve Bank of India has been organizing training sessions on the authentication of banknotes security features for people handling significant amounts of cash like banks/consumer forums/merchant associations/educational institutions/police professionals. Apart from the training sessions, information on security features of banknotes is also available on the Bank’s website at https://rbi.org.in/web/rbi/rbi-kehta-hai/know-your-banknotes.

All you wanted to know about NBFCs

D. Definition of deposits, Eligible / Ineligible Institutions to accept deposits and Related Matters

FAQs on Non-Banking Financial Companies

Repayment of matured deposits

Retail Direct Scheme

Investment and Account holdings related queries

Yes, securities can be gifted/transferred to a relative/friend/anybody who fulfills the eligibility criteria. The bonds shall be transferred in accordance with the provisions of the Government Securities Act, 2006 and Government Securities Regulations, 2007.

Domestic Deposits

IV. Advances against shares and debentures

Indian Currency

F) COINS

Coins in India are presently being issued in denominations of 50 paise, one rupee, two rupees, five rupees, ten rupees and twenty rupees. Coins up to 50 paise are called 'small coins' and coins of Rupee one and above are called 'Rupee Coins'. Coins can be issued up to the denomination of ₹1000 under The Coinage Act, 2011.

Foreign Investment in India

IV. Reporting Delays

All you wanted to know about NBFCs

D. Definition of deposits, Eligible / Ineligible Institutions to accept deposits and Related Matters

NBFCs are prohibited by the Reserve Bank from associating with any unincorporated bodies. If NBFCs associate themselves with unincorporated entities which are accepting deposits in contravention of RBI Act, they are also liable for penal action under the Act, or action under the Protection of Interest of Depositors (in Financial Establishments) Act, or the Banning of Unregulated Deposit Schemes Act, 2019, as applicable.

FAQs on Non-Banking Financial Companies

Prudential Norms

Retail Direct Scheme

Investment and Account holdings related queries

Domestic Deposits

IV. Advances against shares and debentures

Indian Currency

F) COINS

Twenty-five (25) paise coins have been withdrawn from circulation with effect from June 30, 2011, vide gazette notification No. 2529 dated December 20, 2010, and are, therefore, no more legal tender. Coins of denominations below 25 paise were withdrawn from circulation much earlier. All other denominations of coins of various size, theme and design minted by Government of India under The Coinage Act, 2011 and issued by RBI for circulation from time to time, continue to remain legal tender.

All you wanted to know about NBFCs

D. Definition of deposits, Eligible / Ineligible Institutions to accept deposits and Related Matters

Deposits are defined under the RBI Act 1934 as acceptance of money other than that raised by way of share capital, money received from banks and other financial institutions, money received as security deposit, earnest money and advance against goods or services and subscriptions to chits. All other amounts received in any form are treated as deposits. Chit Funds activity involves contributions by members in instalments by way of subscription to the Chit and by rotation each member of the Chit receives the chit amount. The subscriptions are specifically excluded from the definition of deposits and cannot be termed as deposits. While Chit funds may collect subscriptions as above, they are prohibited by the Reserve Bank from accepting deposits from public (except from shareholders) with effect from August 2009.

FAQs on Non-Banking Financial Companies

Prudential Norms

- Each category of quoted investments is to be valued scrip-wise. Category of investment means the different types of securities under each head viz. equity shares, preference shares, debentures, bonds and Government securities. Only quoted investments can be classified as long term or current investments. The long term investments are allowed to be valued as per AS-13 of the ICAI but the current investments are required to be valued at their market price. However, the NBFCs have been permitted under Prudential Norm Directions, the facility of block valuation method for accounting for the investments. The net of depreciation and the appreciation in the value of the current quoted investments, is only required to be charged to the Profit and Loss Account of the current year. The appreciation in the value of current investments in any category cannot be booked as profit. The concept of block valuation is explained below :

Example No. 1

Name of the scrip | Market value | Book value | Difference (+)/(-) | |

A | 200 | 150 | (+) 50 | |

B | 210 | 180 | (+) 30 | |

C | 180 | 240 | (-) 60 | |

D | 240 | 300 | (-) 60 |

Total appreciation Rs. 80/-

Total depreciation Rs. 120/-

Net depreciation Rs. 40/- to be charged to Profit and Loss | |

Account as per provisions for | |

Example No. 2

Name of the scrip | Market value | Book value | Difference (+)/(-) | |

A | 150 | 200 | (-) 50 | |

B | 180 | 210 | (-) 30 | |

C | 240 | 180 | (+) 60 | |

D | 300 | 240 | (+) 60 |

Total appreciation Rs. 120/-

Total depreciation Rs. 80/-

Net appreciation Rs. 40/- to be ignored.

This appreciation in the value of equity shares cannot be adjusted against the depreciation in the value of any other category of securities.

Retail Direct Scheme

Investment and Account holdings related queries

Domestic Deposits

V. Donations

Indian Currency

F) COINS

RBI has not prescribed any limit for coin deposits by customers with banks. Banks are free to accept any amount of coins from their customers.

All you wanted to know about NBFCs

E. Depositor Protection Issues

Some of the important regulations relating to acceptance of deposits by NBFCs are as under:

-

The NBFCs are allowed to accept/renew public deposits for a minimum period of 12 months and maximum period of 60 months. They cannot accept deposits repayable on demand.

-

NBFCs cannot offer interest rates higher than the ceiling rate prescribed by RBI from time to time. The present ceiling is 12.5 per cent per annum. The interest may be paid or compounded at rests not shorter than monthly rests.

-

NBFCs cannot offer gifts/incentives or any other additional benefit to the depositors.

-

NBFCs should have minimum investment grade credit rating.

-

The deposits with NBFCs are not insured.

-

The repayment of deposits by NBFCs is not guaranteed by RBI.

-

Certain mandatory disclosures are to be made about the company in the Application Form issued by the company soliciting deposits.

FAQs on Non-Banking Financial Companies

Prudential Norms

A. Earning Value : | Average Profit after tax (net of | ||

dividend on preference shares | |||

and extra ordinary items ) for | |||

the last three years | Capitalisation | ||

X | factor | ||

Number of equity shares |

Hypothetically, the profit after tax for the last three | } | Rs. 100.00 lakhs, |

financial years net of dividend on preference shares } | Rs. 120.00 lakhs | |

and net of extra ordinary items | } & | Rs. 140.00 lakhs |

No. of equity shares of the company | 10,00,000 shares | |

The investee company is a predominantly manufacturing | ||

company and the capitalisation factor would be | : 8 per cent | |

The earning value will be worked out as under : | ||

(100.00+120.00+140.00) | 100 | ||

X | --- | = Rs.150/- | |

3 X 10,00,000 | 8 |

Retail Direct Scheme

Contact us

You can reach us in three ways:

-

Toll free phone number: 1800 267 7955 (between 9 am to 7 pm on any working day).

-

E-mail id: support@rbiretaildirect.org.in

-

Raise a request on the Retail Direct portal.

For additional details on using the Retail Direct portal, you may refer to the User Manual in the Help section of the Retail Direct Portal.

Domestic Deposits

V. Donations

Indian Currency

F) COINS

The One Rupee notes issued under the Coinage Act, 2011 are legal tender and included in the expression Rupee coin for all the purposes of the Reserve Bank of India Act, 1934. Since the rupee coins issued by Government constitute the liabilities of the Government, one rupee Note is also liability of the Government of India.

All you wanted to know about NBFCs

E. Depositor Protection Issues

A depositor wanting to place deposit with an NBFC must take the following precautions before placing deposits:

i. That the NBFC is registered with the Reserve Bank and specifically authorized by the Reserve Bank to accept deposits. The list of deposit taking NBFCs entitled to accept deposits is available on the web site of the Reserve Bank of India (www.rbi.org.in) under ‘Regulation → Non-Banking’. The depositor should check the above list to know about NBFCs permitted to accept public deposits therein.

ii. NBFCs have to prominently display the Certificate of Registration (CoR) issued by the Reserve Bank at place of business. This CoR should also reflect that the NBFC has been specifically authorized by the Reserve Bank to accept deposits. Depositors must scrutinize the CoR to ensure that the NBFC is authorized to accept deposits.

iii. The maximum interest rate that an NBFC can pay to a depositor should not exceed 12.5% currently. The Reserve Bank keeps altering the interest rates depending on the macro-economic environment and publishes the change in the interest rates on its website (www.rbi.org.in) under ‘notifications’.

iv. The depositor must insist on a proper receipt for every amount of deposit placed with the NBFC. The receipt should be duly signed by an officer authorized by the NBFC and should state the date of the deposit, the name of the depositor, the amount in words and figures, rate of interest payable, maturity date and amount.

v. In the case of brokers/agents, etc., collecting public deposits on behalf of NBFCs, the depositors should satisfy themselves that the brokers/agents are duly authorized by the NBFC.

vi. The depositor must bear in mind that public deposits are unsecured and Deposit Insurance facility is not available to depositors of NBFCs.

vii. The Reserve Bank of India does not accept any responsibility or guarantee about the present position as to the financial soundness of the company or for the correctness of any of the statements or representations made or opinions expressed by the company and for repayment of deposits/discharge of the liabilities by the NBFC.

FAQs on Non-Banking Financial Companies

Prudential Norms

- The Prudential Norms have prescribed that the unquoted shares should be valued at break up value. However, an NBFC can also value these shares at fair value, if it so desires.

Break up value and fair value are to be calculated as per the formula given in the Directions. The formula is illustrated as under :

If the paid equity capital of the company is = Rs. 1,00,00,000

The free reserves net of intangible assets

and deferred revenue expenditure = Rs. 3,20,00,000

Number of equity shares = 10,00,000 shares

The break up value will be : | 1,00,00,000 + 3,20,00,000 | = Rs. 42/- |

10,00,000 |

If we take the earning value worked out in the previous question, and since we know that the fair value is the mean of the break up value and the earning value, the fair value will be | 150+42 | = Rs.96/- |

2 |

In the given case, the company may value its shares at fair value viz, Rs.96/- which is higher than the break up value at Rs.42/- or cost, whichever is lower.

Domestic Deposits

V. Donations

Indian Currency

F) COINS

Yes. Different designs of ₹10 coins are currently in circulation. All coins of ₹10 denomination minted from time to time by the Government of India (with/without the Rupee symbol) are legal tender. For more details kindly see our Press Release issued in this regard which is available at the following link www.rbi.org.in>>Issuer of currency>>Press Release>>January 17, 2018. https://rbi.org.in/en/web/rbi/-/press-releases/rbi-reiterates-legal-tender-status-of-%E2%82%B9-10-coins-of-different-designs-42887.

All you wanted to know about NBFCs

E. Depositor Protection Issues

No. The Reserve Bank does not guarantee repayment of deposits by NBFCs even though they may be authorized to collect deposits. As such, depositors should take informed decisions while placing deposits with an NBFC.

FAQs on Non-Banking Financial Companies

Prudential Norms

Domestic Deposits

VI. Premises Loan

-

The Board of Directors of the banks should lay down the policy and formulate operational guidelines separately in respect of metropolitan, urban, semi-urban and rural areas covering all areas in respect of acquiring premises on lease/ rental basis for the banks’ use. These guidelines should include also delegation of powers at various levels. The decision in regard to surrendering or shifting of premises other than at rural centers should be taken at the central office level by a committee of senior executives.

-

The Board of Directors of the bank should lay down separate policy for granting of loans to landlords who provide them premises on lease/ rental basis. The rate of interest to be charged on such loans should be fixed as per the lending rate directives issued by RBI with BPLR as the minimum lending rate for the loans above Rs.2 lakhs. The rate of interest may be simple or compound, in accordance with the usual practice of the bank, as applicable to other term loans.

-

Banks should provide a suitable mechanism for redressing the genuine grievances of the landlord expeditiously.

-

The details of negotiated contracts in respect of advances to landlords and rental (including taxes etc. and deposits of Rs.25 lakhs and above) on premises taken on lease/ rental by the public sector banks, should be reported to the Central Bureau of Investigation (CBI) as per the extant Government instructions. This requirement will not be applicable to banks in the private sector.

Indian Currency

F) COINS

The Government of India is responsible for the designing and minting of coins in various denominations.

All you wanted to know about NBFCs

E. Depositor Protection Issues

If an NBFC defaults in repayment of deposit, the depositor can approach the Company Law Board (now National Company Law Tribunal) or Consumer Forum or file a civil suit in a Court of Law to recover the deposits. Further, at the level of the State Government, the State Legislations on Protection of Interest of Depositors (in Financial Establishments) empowers the State Governments to take action even before the default takes place or complaints are received from depositors. If there is perpetration of an offence and if the intention is to defraud, the State Government can even attach properties. NBFCs are also advised to lay down an appropriate grievance redressal mechanism as indicated in reply to question 57 below.

FAQs on Non-Banking Financial Companies

Prudential Norms

Domestic Deposits

VII. Service charges

Indian Currency

F) COINS

The Government of India decides on the quantity of coins to be minted on the basis of indent received from the Reserve Bank on yearly basis.

All you wanted to know about NBFCs

E. Depositor Protection Issues

When an NBFC fails to repay any deposit or part thereof in accordance with the terms and conditions of such deposit, the CLB/NCLT either on its own motion or on an application from the depositor, direct by order, the NBFC to make repayment of such deposit or part thereof forthwith or within such time and subject to such conditions as may be specified in the order. After making the payment, the company will need to file the compliance with the local office of the Reserve Bank of India.

As explained above, the depositor can approach CLB/NCLT by mailing an application in prescribed form to the appropriate bench of the CLB/NCLT according to its territorial jurisdiction.

FAQs on Non-Banking Financial Companies

Depositor Awareness

Indian Currency

F) COINS

Coins of denominations 50 paise, one rupee, two rupees, five rupees, ten rupees and twenty rupees continue to be legal tender.

Reserve Bank of India has been issuing press releases from time to time advising the members of public to accept coins as legal tender in all their transactions without any hesitation. These press releases are available on our website www.rbi.org.in under Currency Management > Press release at the following links:

Further, RBI has been conducting awareness campaigns in Print, SMS and social media and also disseminates awareness on coins through “RBI says’’ and “RBI Kehta Hai’’ from time to time.

Besides, the Reserve Bank has instructed the banks to accept coins for transactions and exchange at all their branches.

All you wanted to know about NBFCs

E. Depositor Protection Issues

The details of addresses and territorial jurisdiction of the bench officers of CLB/NCLT are available on the website https://nclt.gov.in/about-nclt.

FAQs on Non-Banking Financial Companies

Depositor Awareness

Indian Currency

F) COINS

For commemorative coins, you may refer to the website of SPMCIL at http://www.spmcil.com or contact SPMCIL.

All you wanted to know about NBFCs

E. Depositor Protection Issues

An Official Liquidator is appointed by the court after giving the company reasonable opportunity of being heard in a winding up petition. The liquidator performs the duties of winding up of the company and such duties in reference thereto as the court may impose. Where the court has appointed an official liquidator or provisional liquidator, he becomes custodian of the property of the company and runs day-to-day affairs of the company. He has to draw up a statement of affairs of the company in prescribed form containing particulars of assets of the company, its debts and liabilities, names/residences/occupations of its creditors, the debts due to the company and such other information as may be prescribed. The scheme is drawn up by the liquidator and same is put up to the court for approval. The liquidator realizes the assets of the company and arranges to repay the creditors according to the scheme approved by the court. The liquidator generally inserts advertisement in the newspaper inviting claims from depositors/investors in compliance with court orders. Therefore, the depositors should file the claims within due time as per such notices of the liquidator.

With the enactment of the Insolvency and Bankruptcy Code, 2016, the corporate insolvency resolution process can be initiated by the Reserve Bank subject to the provisions of the Code, provided, the asset size of the NBFC is ₹500 crore or more. Thereafter, the resolution process would be undertaken as per the process prescribed under IBC.

FAQs on Non-Banking Financial Companies

Depositor Awareness

All you wanted to know about NBFCs

E. Depositor Protection Issues

The depositor is entitled to approach the relevant authorities as permissible under Law.

Indian Currency

F) COINS

Customers aggrieved with the services provided by the banks and a related grievance not resolved to the satisfaction of the customers, or not replied to within a period of 30 days by the bank may approach the RBI Ombudsman under ‘The Reserve Bank - Integrated Ombudsman Scheme, 2021’. Complaints can be filed online on https://cms.rbi.org.in and also through the dedicated e-mail or sent in physical mode to the ‘Centralised Receipt and Processing Centre’ set up at Reserve Bank of India, 4th Floor, Sector 17, Chandigarh - 160017 with the bank/ postal receipts as proof for necessary action.

FAQs on Non-Banking Financial Companies

Depositor Awareness

All you wanted to know about NBFCs

E. Depositor Protection Issues

It is prescribed that the Board of Directors of NBFCs shall lay down the appropriate grievance redressal mechanism within the organisation and such mechanism shall ensure that all disputes arising out of the decisions of the lending institution’s functionaries are heard and disposed of at least at the next higher level.

Further, NBFCs (excluding Housing Finance Companies) which are authorised to accept deposits; or have customer interface and an asset size of ₹100 crore & above as on the date of the last audited balance sheet, are covered under Reserve Bank - Integrated Ombudsman Scheme, 2021 (as amended from time to time). In case of grievances against NBFCs, which are covered under RBI Ombudsman Scheme, are not redressed within a period of one month, the customer may approach the Ombudsman through its CMS portal accessible on the link https://cms.rbi.org.in/cms/indexpage.html#eng.

FAQs on Non-Banking Financial Companies

Depositor Awareness

All you wanted to know about NBFCs

E. Depositor Protection Issues

Companies registered with MCA but not required to be registered with the Reserve Bank as NBFCs are not under the regulatory domain of the Reserve Bank. Whenever Reserve Bank receives any such complaints about the companies registered with MCA but not registered with the Reserve Bank as NBFCs, it forwards the complaints to the Registrar of Companies (RoC) of the respective state for any action. The complainants are advised that the complaints relating to irregularities of such companies should be promptly lodged with RoC concerned for initiating corrective action. However, in case it comes to the knowledge of the Reserve Bank that those companies were required to be registered with the Reserve Bank but have not done so and have accepted deposits as defined under RBI Act, such action, as is deemed necessary under the provisions of the RBI Act, will be taken.

FAQs on Non-Banking Financial Companies

Depositor Awareness

All you wanted to know about NBFCs

E. Depositor Protection Issues

As per Reserve Bank’s Directions, overdue interest is payable to the depositors in case the NBFC has delayed the repayment of matured deposits, and such interest is payable from the date of receipt of such claim by the NBFC or the date of maturity of the deposit whichever is later, till the date of actual payment. If the depositor has lodged his claim after the date of maturity, the NBFC would be liable to pay interest for the period from the date of claim till the date of repayment. For the period between the date of maturity and the date of claim it is the discretion of the company to pay interest.

In cases where NBFCs are required to freeze the term deposits of customer based on the orders of the Government authorities or the deposit receipts are seized by the Government authorities, they shall follow the procedure as given below:

i. A request letter may be obtained from the depositor on maturity. While obtaining the request letter from the depositor for renewal, NBFCs should also advise him to indicate the term for which the deposit is to be renewed. In case the depositor does not exercise his option of choosing the term for renewal, NBFCs may renew the same for a term equal to the original term.

ii. No new receipt is required to be issued. However, suitable note may be made regarding renewal in the deposit ledger.

iii. Renewal of deposit may be advised by registered letter / speed post / courier service to the concerned Government department under advice to the depositor. In the advice to the depositor, the rate of interest at which the deposit is renewed should also be mentioned.

iv. If overdue period does not exceed 14 days on the date of receipt of the request letter, renewal may be done from the date of maturity. If it exceeds 14 days, NBFCs may pay interest for the overdue period as per the policy adopted by them, and keep it in a separate interest free sub-account which should be released when the original fixed deposit is released.

However, the final repayment of the principal and the interest so accrued should be done only after the clearance regarding the same is obtained by the NBFCs from the respective Government agencies.

FAQs on Non-Banking Financial Companies

RNBCs

All you wanted to know about NBFCs

E. Depositor Protection Issues

An NBFC accepts deposits under a mutual contract with its depositors. In case a depositor requests for pre-mature payment, the Reserve Bank has prescribed regulations for such an eventuality in the Master Direction - Non-Banking Financial Companies Acceptance of Public Deposits (Reserve Bank) Directions, 2016 (as amended from time to time) wherein it is specified that NBFCs cannot grant any loan against a public deposit or make premature repayment of a public deposit within a period of three months (lock-in period) from the date of its acceptance. However, in the event of death of a depositor, the NBFC may, even within the lock-in period, repay the deposit at the request of the joint holders with survivor clause, or to the nominee / legal heir only against submission of relevant proof, to the satisfaction of the NBFC. Further, in order to enable a depositor to meet the expenses of an emergent nature, the NBFC may subject to satisfaction of the NBFC about the circumstances, prematurely repay tiny deposits (i.e., up to ₹10,000/-) and also other deposits, as per the provisions laid down by the Reserve Bank.

An NBFC, which is not a problem company, subject to above provisions, may permit premature repayment of a public deposit after the lock–in period, at its sole discretion, at the rate of interest prescribed by the Reserve Bank.

A problem NBFC is prohibited from making premature repayment of any deposits or granting any loan against public deposits, as the case may be. The prohibition shall not, however, apply in the case of death of depositor or repayment of tiny deposits (i.e. up to ₹ 10,000/-) in order to enable a depositor to meet expenses of an emergent nature, subject to lock in period of 3 months in the latter case.

FAQs on Non-Banking Financial Companies

Nomination facility

All you wanted to know about NBFCs

E. Depositor Protection Issues

In terms of Section 45-IB of the RBI Act, 1934, the minimum level of liquid assets to be maintained by deposit taking NBFCs is 15% of public deposits outstanding as on the last working day of the second preceding quarter. Of the 15%, NBFCs are required to invest not less than 10% in approved securities and the remaining 5% can be in unencumbered term deposits with any Scheduled Commercial Bank (SCB)/ SIDBI/ NABARD; or bonds issued by SIDBI or NABARD. Thus, the liquid assets may consist of Government securities, Government guaranteed bonds and term deposits/ bonds, as specified.

The investment in Government Securities should be in dematerialised form which can be maintained in Subsidiary General Ledger (SGL) Account with the Reserve Bank or a Gilt Account with Constituents’ Subsidiary General Ledger (CSGL) Account or a dematerialized account with a depository through a depository participant registered with SEBI. In case of Government guaranteed bonds, the same may be kept in dematerialised form with SCB/ Stock Holding Corporation of India Limited (SHCIL) or in a dematerialised account with a depository through a depository participant registered with SEBI. However, in case Government bonds are in physical form, the same may be kept in safe custody of SCB/SHCIL along with term deposits of SCB/ SIDBI/ NABARD.

NBFCs have been directed to maintain the mandated liquid asset securities at a place where the registered office of the company is situated. However, if an NBFC intends to entrust the securities at a place other than the place at which its registered office is located, it may do so after obtaining the permission of the Reserve Bank in writing. The liquid assets maintained as above are to be utilised for payment of claims of depositors. However, deposits being unsecured in nature, the depositors do not have direct claim on liquid assets.

The Reserve Bank has issued detailed regulations on deposit acceptance, including the quantum of deposits that can be collected, mandatory credit rating, mandatory maintenance of liquid assets for repayment to depositors, manner of maintenance of its deposit books, prudential regulations including maintenance of adequate capital, limitations on exposures, and inspection of the NBFCs, besides others, to ensure that the NBFCs function on sound lines. If the Reserve Bank observes through its inspection or audit of any NBFC or through complaints or through market intelligence, that a certain NBFC is not complying with the Reserve Bank’s directions, it may prohibit the NBFC from accepting further deposits and prohibit it from selling its assets. In addition, if the depositor has complained to the Company Law Board (CLB) [now National Company Law Tribunal (NCLT)] which has ordered repayment and the NBFC has not complied with the CLB/NCLT order, the Reserve Bank can initiate prosecution of the NBFC, including criminal action and winding up of the NBFC.

More importantly, the Reserve Bank initiates prompt action, including imposing penalties and taking legal action against companies which are found to be violating its instructions/norms on the basis of Market Intelligence reports, complaints, exception reports from statutory auditors of the companies, information received through SLCC meetings, etc. The Reserve Bank immediately shares such information with all the financial sector regulators and enforcement agencies in the State Level Coordination Committee Meetings.

As part of its public policy measure, the Reserve Bank has been in the forefront in taking several initiatives to create awareness among the general public on the need to be careful while investing their hard earned money. The initiatives include issue of cautionary notices in print media and distribution of informative and educative brochures/pamphlets and close interaction with the public during awareness/outreach programs, Townhall events, participation in State Government sponsored trade fairs and exhibitions. At times, it even requests newspapers with large circulation (English and vernacular) to desist from accepting advertisements from unincorporated entities seeking deposits. The Reserve Bank has also launched its public awareness initiative with the tag line ‘RBI Kehta Hai’ which may be accessed at https://rbikehtahai.rbi.org.in/.

NBFCs shall obtain credit rating from any of the SEBI-registered credit rating agencies.

The minimum investment grade credit rating issued by any of the SEBI-registered credit rating agencies for deposit taking NBFCs shall be ‘BBB–‘.

In the event of downgrading of credit rating below the minimum specified investment grade rating, the deposit taking NBFC shall stop accepting public deposits and also stop renewing existing deposits with immediate effect, however the existing deposits would be allowed to run off to maturity. The NBFCs shall also report the position within fifteen working days to the Reserve Bank.

The purpose of enacting this law is to protect the interests of the depositors. The provisions of RBI Act are directed towards enabling RBI to issue prudential regulations that make the financial entities function on sound lines. RBI is a civil body and the RBI Act is a civil Act. Both do not have specific provisions to effect recovery by attachment and sale of assets of the defaulting companies, entities or their officials. It is the State government machinery which can effectively do this. The Protection of Interest of Depositors in Financial Establishments Acts, confers adequate powers on the State Governments to attach and sell assets of the defaulting companies, entities and their officials.

Yes, to a large extent. The Act makes offences, such as, unauthorized acceptance of deposits by any entity, firm or company a cognizable offence, that is entities that are indulging in unauthorized deposit acceptance or unlawful financial activities can be immediately imprisoned and prosecuted. Under the Act, the State Governments have been given vast powers to attach the property of such entities, dispose them off under the orders of special courts and distribute the proceeds to the depositors. The widespread State Government / State Police machinery is best positioned to take quick action against the culprits.

Further, Government of India has recently enacted the Banning of Unregulated Deposit Schemes Act, 2019, a Central Legislation, which provides a comprehensive mechanism to ban the unregulated deposit schemes, other than deposits taken in ordinary course of business, and to protect the interest of depositors. This Act has specific provisions for restitution of depositors through various means viz., attachment and sale of property, etc. This Act also provides for enhanced legislative mechanism for handling unregulated deposit schemes viz., constitution of Designated Courts to deal with matters under the Act, powers for investigation (including by Central Bureau of Investigation in case deposits, deposit-takers and properties are located in more than one State or Union Territory, or outside India), search & seizure, penal provisions, etc.

The Reserve Bank is strengthening its market intelligence function and is constantly examining the financials of companies, references for which are received through market intelligence or complaints to the Reserve Bank. As part of initiative of State Level Consultation Committee comprising of Regulators and Government, the Sachet portal (https://sachet.rbi.org.in/) has been launched and members of public are requested to share any relevant information pertaining to unauthorised collection of deposits. In this, context, members of public can contribute a great deal by being vigilant and lodging a complaint immediately if they come across any financial entity that contravenes the RBI Act. For example, if they are accepting deposits unauthorisedly and/conducting NBFC activities without obtaining due permission from the Reserve Bank. More importantly, these entities will not be able to function if members of public start investing wisely. Members of the public must know that high returns on investments will also have high risks. And there can be no assured return for speculative activities. Before investing, the public must ensure that the entity they are investing in is a regulated entity with one of the financial sector regulators.

F. Collective Investment Schemes (CIS) and Chit Funds

No. CIS are schemes where money is exchanged for units, be it profits, income, produce, property etc. Collective Investment Schemes (CIS) do not fall under the regulatory purview of the Reserve Bank and falls under the regulatory purview of SEBI.

Chit Fund companies are regulated under the Chit Fund Act, 1982, which is a Central Act, and is implemented by the State Governments. In order to avoid duality of regulation, companies, doing the business of chit, as defined under Section 2(b) of the Chit Funds Act, 1982 are exempted from the provisions of Section 45-IA, 45-IB and 45-IC of the RBI Act, 1934. Thus, chit fund companies are not required to be registered with the Reserve Bank and would be registered and regulated by the State Government under Chit Funds Act, 1982. However, chit fund companies are subject to other provisions under Chapter IIIB of the RBI Act, 1934 and the Reserve Bank has prohibited chit fund companies from accepting deposits from the public in 2009. In case any Chit Fund is accepting public deposits, the Reserve Bank can prosecute such chit funds

G. Money Circulation/Multi-Level Marketing (MLM)/ Ponzi Schemes/ Unincorporated Bodies (UIBs)

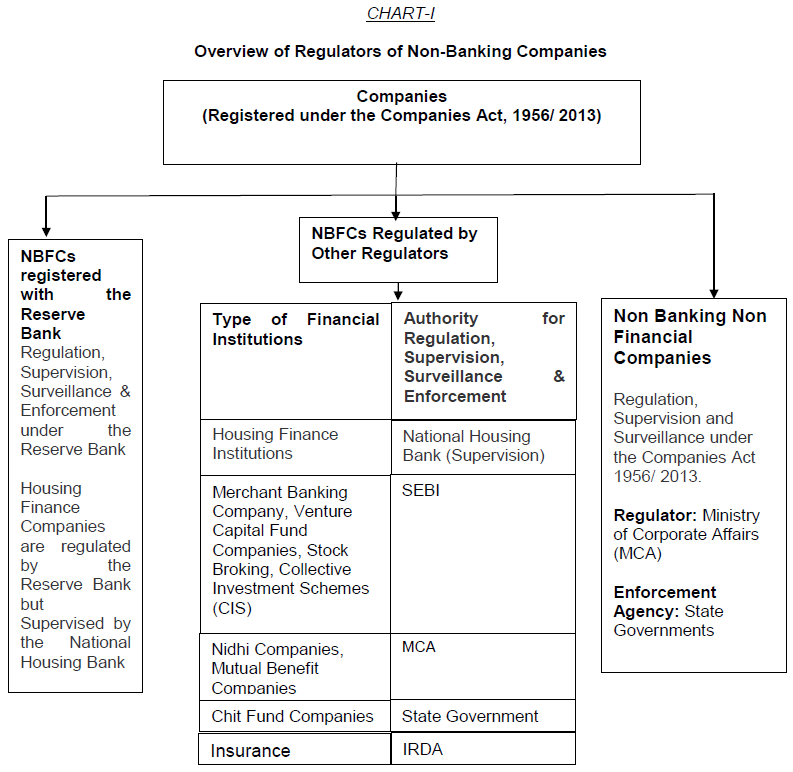

No, Multi-Level Marketing companies, Direct Selling Companies, Online Selling Companies do not fall under the purview of the Reserve Bank. Activities of these companies fall under the regulatory/administrative domain of respective state government. The provisions of the Consumer Protection Act, 2019 and the Consumer Protection (Direct Selling) Rules, 2021 may be referred. The list of regulators and the entities regulated by them are provided in Annex I.

While some of these terms are not formally defined, generally, the money circulation, multi-level marketing / chain marketing or Ponzi schemes are schemes promising easy or quick money upon enrollment of members. Income under multi-level marketing or pyramid structured schemes do not come from the sale of products they offer as much as from enrolling more and more members from whom hefty subscription fees are taken. It is incumbent upon all members to enroll more members, as a portion of the subscription amounts so collected is distributed among the members at the top of the pyramid. Any break in the chain leads to the collapse of the pyramid, and the members lower in the pyramid are the ones that are affected the most. Ponzi schemes are those schemes that collect money from the public on promises of high returns. As there is no asset creation, money collected from one depositor is paid as returns to the other. Since there is no other activity generating returns, the scheme becomes unviable and impossible for the people running the scheme to meet the promised return or even return the principal amounts collected. The scheme inevitably fails, and the perpetrators disappear with the money.

No. Acceptance of money under Money Circulation Schemes, by whatever name called, is not allowed as acceptance of money under those schemes is a cognizable offence under the Prize Chit and Money Circulation (Banning) Act, 1978, and are banned. The Reserve Bank has no role in implementation of this Act, except advising and assisting the Central Government in framing the Rules under this Act.

Money Circulation schemes, by whatever name called, are an offence under the Prize Chits and Money Circulation Schemes (Banning) Act, 1978. The Act prohibits any person or individual to promote or conduct any money circulation scheme or enrol as member to its schemes or anyone to participate in it by either receiving or remitting any money in pursuance of such chit or scheme. Contravention of the provisions of this Act, is monitored and dealt with by the State Governments.

Any information/grievance relating to such schemes should be given to the police / Economic Offence Wing (EOW) of the concerned State Government or the Ministry of Corporate Affairs. If brought to the notice of the Reserve Bank, the same shall be informed to the concerned State Government authorities.

UIBs include an individual, a firm or an unincorporated association of individuals. In terms of provisions of section 45S of RBI Act, these entities are prohibited from accepting any deposit. The Act makes acceptance of deposits by such UIBs punishable with imprisonment or fine or both. The State government has to play a proactive role in arresting the illegal activities of such entities to protect the interests of depositors.

UIBs do not come under the regulatory domain of the Reserve Bank. Whenever the Reserve Bank receives any complaints against UIBs, it immediately forwards the same to the Economic Offences Wing (EOW) of the State Government police agencies. The complainants are also advised to lodge the complaints directly with the State government police authorities (EOW) so that appropriate action against the culprits is taken immediately and the process is hastened.

As per Section 45T of the RBI Act, both the Reserve Bank and the State Governments can apply for search warrant before appropriate Court, and on issue of such warrant, the same shall be executed as per procedure laid down in Law by the enforcement authorities. Nonetheless, in order to take immediate action against the offenders, the information should immediately be passed on to the State Police or the Economic Offences Wing of the concerned State, who can take prompt and appropriate action. Since the State Government machinery is widespread and the State Government is also empowered to take action under the provisions of the RBI Act, 1934, any information on such entities accepting deposits may be provided immediately to the respective State Government’s Police Department/EOW.

Many of the State Governments have enacted the State Protection of Interests of Depositors in Financial Establishments Act, which empowers the State Government to take appropriate and timely action.

The Reserve Bank on its part has taken various steps to curb activities of UIBs which includes spreading awareness through advertisements in leading newspapers to sensitise public, organize various depositor awareness programmes, and keeps close liaison with the law enforcing agencies (Economic Offences Wing).

Before investing in schemes that promise high rates of return, the depositors/ investors must ensure that the entity offering such returns is registered with one of the Financial Sector Regulators and is authorized to accept funds, whether in the form of deposits or otherwise. Depositors/ investors must generally be circumspect if the interest rates or rates of return on deposits/ investments offered are high. Unless the entity accepting funds is able to earn more than what it promises, the entity will not be able to repay the depositor/ investor as promised. For earning higher returns, the entity will have to take higher risks on the investments it makes. Higher the risk, the more speculative would be its investments on which there can be no assured return. As such, members of public should forewarn themselves that the likelihood of losing money in schemes that offer high rates of interest are more.

The two Charts given at Annex I and Annex II depict the activities and the regulators overseeing the same. Further, The First Schedule of the ‘The Banning of Unregulated Deposit Schemes Act, 2019’ may be referred for the list of regulated deposit schemes.

Complaints may hence be addressed to the concerned regulator. If the activity is a banned activity, the aggrieved person can approach the State Police/Economic Offences Wing of the State Police and lodge a suitable complaint.

H. Other/ miscellaneous aspects

Commercial Real Estate (CRE) would consist of loans to builders/ developers/ others for creation/ acquisition of commercial real estate (such as office building, retail space, multi-purpose commercial premises, multi-tenanted commercial premises, industrial or warehouse space, hotels, land acquisition, development and construction etc.) where the prospects for repayment, or recovery in case of default, would depend primarily on the cash flows generated by the asset by way of lease/rental payments, sale etc. Further, loans for third dwelling unit onwards to an individual will be treated as CRE exposure. Exposure shall also include non-fund based limits.

Commercial Real Estate – Residential Housing (CRE–RH) is a sub-category of CRE that consist of loans to builders/ developers for residential housing projects (except for captive consumption). Such projects should ordinarily not include non-residential commercial real estate. However integrated housing project comprising of some commercial spaces (e.g., shopping complex, school etc.) can also be specified under CRE-RH, provided that the commercial area in the residential housing project does not exceed 10 percent of the total Floor Space Index (FSI) of the project. In case the FSI of the commercial area in the predominantly residential housing complex exceed the ceiling of 10 percent, the entire loan should be classified as CRE and not CRE-RH.

No, the group requires to consolidate total assets of only those NBFCs which have been granted Certificate of Registration by the Bank. However, in case unregistered CICs in the group with asset size below ₹100 crore have accessed public funds, the asset size of such CICs shall be consolidated for the above purpose, but it would not change the status of unregistered CICs.

Loans against units of mutual funds (except units of exclusively debt oriented mutual funds) would attract LTV requirements as applicable to loans against shares. Further, the LTV requirement for loans/ advances against units of exclusively debt-oriented mutual funds may be decided by individual NBFCs in accordance with their loan policy.

In this case prior written approval of the Reserve Bank is to be obtained by the NBFC ‘A’. In case NBFC ‘A’ would cease to exist after the merger, the Certificate of Registration shall be surrendered for cancellation. Where ‘B’ is an NBFC, as a result of merger if there is change in control in ‘B’, or change in shareholding pattern of paid-up equity capital of ‘B’ by 26% or more, or change in management in ‘B’ which would result in change in more than 30% of the directors (excluding independent directors), prior written approval of the Reserve Bank is required. If ‘B’ is not an NBFC but is likely to meet Principal Business Criteria (i.e., 50-50 criteria) post-merger, it would also need to approach the Reserve Bank for prior written approval as well as registration as an NBFC.

Where a non-NBFC mergers with an NBFC, prior written approval of the Reserve Bank would be required if such a merger satisfies any one or all of the conditions viz., (i) any change in control in the NBFC due to merger, (ii) any change in the shareholding of the NBFC consequent to the merger which would result in change in shareholding of 26% or more of the paid up equity capital of the NBFC, (iii) any change in the management of the NBFC which would result in change in more than 30% of the directors, excluding independent directors. It may be noted that the NBFC shall continue to fulfil the Principal Business Criteria (i.e., 50-50 criteria) after merger to be eligible to hold the Certificate of Registration as an NBFC.

The NBFCs being amalgamated will require to obtain prior written approval of the Reserve Bank. Depending upon the nature of amalgamation/merger proposal, requisite approvals as per regulations needs to be sought.

Yes, prior approval of the Reserve Bank would have to be obtained before approaching any Court or Tribunal seeking orders for merger/ amalgamation in all such cases which would ordinarily fall under the scenarios explained in FAQs 84, 85 or 86.

Disclaimer: These FAQs are issued by the Reserve Bank for information and general guidance purposes only. The Reserve Bank will not be held responsible for actions taken and/or decisions made on the basis of the same. For clarifications or interpretations, if any, one may be guided by the relevant circulars and notifications issued from time to time.

| Related Press Release | |

| May 31, 2013 | Check before Depositing Money with Financial Entities: RBI Advisory |

পেজের শেষ আপডেট করা তারিখ: