4.1

Overview of Municipal Finances

This chapter presents an overview

of municipal finances in India. The first section analyses the pattern and trends

in municipal finances using all-India fiscal aggregates obtained from secondary

sources3 to provide a macro picture across the country . The second, third and

fourth sections provide indepth analysis of the structure of municipal finances

of select 35 Municipal Corporations (MCs). The analysis is based on data gathered

from the budget documents of these selected MCs, covering the period 1999-2000

to 2003-2004.

4.2 Size of the Municipal Sector

As per the Report of the Twelfth Finance Commission, India has 3,723 ULBs, of

which 109 are MCs, 1432 are municipalities and 2182 are Nagar Panchayats.

The total revenue of the municipalities grew from Rs.11,515 crore in 1998-99

to Rs.15,149 crore in 2001-02 at a compounded average growth rate (CAGR) of 9.6

per cent. The total expenditure increased from Rs 12,035 crore to Rs 15,914 crore

during the same period, registering a CAGR of 9.8 per cent. In spite of the growth

of the municipal sector in the country, it accounts for a very small proportion

of both Gross Domestic Product (GDP) (at current prices) as well as revenue and

expenditure of the upper tiers of Government.

Total revenue of the municipal

sector accounts for about 0.75 per cent of GDP of the country. In contrast, the

ratio is 4.5% for Poland, 5% for Brazil and 6% for South Africa [Buckley (2005)].

Similiarly, municipal revenue forms a little more than 2 per cent of

Table

13: Revenue Significance of Municipal Sector | Year | Municipal | Percentage | Relative

share of Municipal Revenue | | Revenue | of

GDP at | | (as

per cent of Total Revenue of) | | (Rs.

Crore) | Factor

Cost | State

Govt. | Central

Govt. | Combined

State &

Central Govt. | 1998-99 | 11,515 | 0.72 | 4.4 | 4.1 | 2.5 |

1999-00 | 13,173 | 0.75 | 4.2 | 4.4 | 2.5 |

2000-01 | 14,581 | 0.77 | 4.2 | 4.5 | 2.4 |

2001-02 | 15,149 | 0.73 | 4.1 | 4.2 | 2.3 |

Source : (i)

Reports of Eleventh and Twelfth Finance Commission, (ii) Economic Survey, GoI

2004-05. | combined revenue of

State and Central Governments. Total revenue of ULBs has been growing at a lower

rate (9.7 per cent during 1998-99 to 2001-02) than the growth of combined revenue

of Central and State Governments (10.8 per cent during 1998-99 to 2001-02). This

reflected in a marginal decline in the share of municipal revenue in total government

revenues from 2.5 per cent in 1998-99 to 2.3 per cent in 2001-02. Table 13 provides

an overview of the relative importance of municipal revenues in relation to revenues

of the States and the Centre.

In terms of total expenditure, the municipal

sector accounts for about 0.79 per cent of the GDP of the country. While, municipal

expenditure accounts for little over 2 per cent of the combined expenditure of

State and Central Governments, it declined further between 1999-2000 and 2001-2002.

Table 14 provides an overview

Table

14: Expenditure Significance of Municipal Sector | Year | Municipal | Percentage | Relative

share of Municipal Expenditure | | Expenditure | of

GDP at | (as

per cent of Total Expenditure of) | | (Rs.

Crore) | Factor

Cost | State

Govt. | Central

Govt. | Combined

State & Central Govt. | 1998-99 | 12035 | 0.75 | 4.52 | 4.31 | 2.21 |

1999-00 | 14452 | 0.82 | 4.60 | 4.85 | 2.36 |

2000-01 | 15743 | 0.83 | 4.53 | 4.84 | 2.34 |

2001-02 | 15914 | 0.76 | 4.22 | 4.39 | 2.15 |

Source: (i)

Reports of Eleventh and Twelfth Finance Commission (ii) Handbook of Statistics

on Indian Economy, RBI 2005-06 | of the relative

importance of municipal expenditure in relation to the expenditures of the States

and Centre.

4.3 Finances of Select Municipal Corporations

This and subsequent sections undertake indepth analysis of municiple finances

based on primary data obtained from the budget

Table

15: Study Sample - Cities with more than 1 million population in 2001 |

S. No.

| Name of the

City | Name

of the State | UA/City

Population | MC

Population | | | | (2001)

(million) | (2001) |

1 | Greater

Mumbai | Maharashtra | 16.37 | 11914398 |

2 | Kolkata | West

Bengal | 13.22 | 4580544 |

3 | Delhi

| Delhi | 12.79 | 9817439 |

4 | Chennai | Tamil

Nadu | 6.42 | 4216268 |

5 | Bangalore

| Karnataka | 5.69 | 4292223 |

6 | Hyderabad

| Andhra Pradesh | 5.53 | 3449878 |

7 | Ahmedabad | Gujarat

| 4.52 | 3515361 |

8 | Pune | Maharashtra

| 3.75 | 2540069 |

9 | Surat

| Gujarat | 2.81 | 2433787 |

10 | Kanpur

| Uttar Pradesh | 2.69 | 2532148 |

11 | Jaipur | Rajasthan | 2.32 | 2324319 |

12 | Lucknow

| Uttar Pradesh | 2.27 | 2207340 |

13 | Nagpur

| Maharashtra | 2.12 | 2051320 |

14 | Patna

| Bihar | 1.71 | 1376950 |

15 | Indore

| Madhya Pradesh | 1.64 | 1597441 |

16 | Vadodara | Gujarat

| 1.49 | 1306035 |

17 | Bhopal

| Madhya Pradesh | 1.45 | 1433875 |

18 | Coimbatore

| Tamil Nadu | 1.45 | 930882 |

19 | Ludhiana

| Punjab | 1.40 | 1395053 |

20 | Kochi

| Kerala | 1.35 | 596473 |

21 | Visakhapatnam

| Andhra Pradesh | 1.33 | 982940 |

22 | Agra

| Uttar Pradesh | 1.32 | 1259979 |

23 | Varanasi

| Uttar Pradesh | 1.21 | 1100748 |

24 | Madurai

| Tamil Nadu | 1.19 | 928869 |

25 | Meerut

| Uttar Pradesh | 1.17 | 1074229 |

26 | Nashik | Maharashtra

| 1.15 | 1076967 |

27 | Jabalpur

| Madhya Pradesh | 1.12 | 951469 |

28 | Jamshedpur

| Jharkhand | 1.10 | 570349 |

29 | Asansol | West

Bengal | 1.09 | 475439 |

30 | Dhanbad | Jharkhand | 1.06 | 198963 |

31 | Faridabad

| Haryana | 1.05 | 1054981 |

32 | Allahabad

| Uttar Pradesh | 1.05 | 975393 |

33 | Amritsar

| Punjab | 1.01 | 1011327 |

34 | Vijayawada

| Andhra Pradesh | 1.01 | 851282 |

35 | Rajkot

| Gujarat | 1.00 | 967476 |

Source :

(i) http://urbanindia.nic.in/mud-final-site/programs/urbandevelopment/nurm.htm

Website of MUD (accessed on November 15, 2005);

(ii) http://www.censusindia.net/results/millioncities.html

Census of India website (last accessed on March 24, 2006)

(iii) Secondary

sources, including budget documents of the MCs | documents

of 35 major MCs of the country whose population was 1 million and above as per

2001 Census. Table 15 shows the sample of MCs and the States to which they belong.

4.4 Municipal Revenues

4.4.1 Structure

of Municipal Revenues

The revenue base of MCs can be broadly

categorized into: (a) tax revenues, (b) non-tax revenues, (c) assigned (shared)

revenue, (c) grants-in-aid, (d) loans and (e) other receipts. Table16 lists out

revenue sources under each major revenue head. It may be mentioned that composition

as well as relative importance of revenue sources of MCs varies across the States.

Table 17 sets out the major components of tax revenue of selected MCs in India.

While, property tax is the major revenue source in most of the MCs, octroi is

the major source in the MCs of Maharashtra and Gujarat. Octroi has been abolished

in all other States excepting Maharashtra and Gujarat.

Table 18 illustrates

the major user charges and fees levied by the select MCs in India. There is considerable

heterogeneity in the levy of user charges by MCs across states.

Table

16: Revenue Sources of Municipal Corporations in India 1998-2002 |

Revenue

Head/Category | Sources

of revenue | Tax

revenue | Property Tax, Octroi,

Advertisement Tax, Tax on Animals, Vacant Land Tax, | | Taxes

on Carriages and Carts | Non-Tax

revenue | User Charges, Municipal

Fees, Sale & Hire Charges, Lease amounts | Other

receipts | Sundry receipts,

Law charges costs recovered, Lapsed deposits, Fees, Fines | | &

Forfeitures, Rent on Tools & Plants, Miscellaneous Sales etc. |

Assigned (Shared) revenue | Entertainment

Tax, Surcharge on Stamp duty, Profession Tax, Motor Vehicles Tax |

Grants-in-aid | (i)

Plan Grants made available through planned transfers from upper tier |

| of

Government under various projects, programmes and schemes | | (ii)

Non-Plan Grants made available to compensate against the loss of income |

| and

some specific transfers | Loans | Loans

borrowed by the local authorities for capital works etc. – HUDCO, |

| LIC,

State and Central Governments, Banks and Municipal Bonds | | |

Source:

Budgets of Municipal Corporations. |

Table

17: Sources of Major Tax Revenues of Selected Municipal Corporations |

| in

India 1998-2002 | |

Name of State | Name

of Municipal

Corporation | Major

Taxes | Andhra Pradesh | Hyderabad

| Property Tax, Profession Tax |

Bihar | Patna

| Property Tax, Profession Tax |

Delhi | Delhi

| Property Tax, Advertisement Tax |

Gujarat | Surat

| Property Tax, Octroi |

Karnataka | Bangalore

| Property Tax, Advertisement Tax |

Kerala | Kochi

| Property Tax, Profession Tax |

Madhya Pradesh | Indore

| Property Tax, Advertisement Tax |

Maharashtra | Mumbai | Octroi,

Property Tax | Punjab | Ludhiana

| Octroi, Property Tax |

Rajasthan | Jaipur | Octroi,

Property Tax | Tamil nadu | Chennai | Property

Tax, Profession Tax | Uttar

Pradesh | Varanasi | Property

Tax, Advertisement Tax | West

Bengal | Kolkota | Property

Tax, Advertisement Tax | | | |

Source: Budgets

of Municipal Corporations. | |

Shared tax revenue, which varies in terms of composition and

nature across states, also forms significant proportion of MC resources (Table

19). Entertainment tax is an important tax, not levied by the MCs, but collected

and assigned to the MCs by State Governments. In Andhra Pradesh and Tamil Nadu,

in addition to entertainment tax, profession tax and surcharge on stamp duty are

also assigned to local bodies.

Table

18: Sources of Major User Charges and Fees of Selected Municipal |

Corporations

in India 1998-2002 | Name

of State | Name of Municipal

Corporation | User Charges

and Fees | | | |

Maharashtra | Greater

Mumbai | Water Charges, Sewerage Charges,

Building | | | Licence

Fees | West Bengal | Kolkata | Planning

Fees, Car Parking Fees, Mutation | | | Fees |

Karnataka | Bangalore

| Betterment Charges, Building Licence

Fees, | | | Penalty

for Late Tax payment | Orissa | Bhubaneswar

| Building Licence Fees, Market Fees |

Gujarat | Surat

| Water Charges, Building-related Fees, |

| | Betterment

Charges | Tamil Nadu | Chennai | Building

Licence Fees, Market Fees, Other | | | Licence

Fees, Parking Fees | Andhra

Pradesh | Hyderabad | Dangerous

and Offensive Trade Licence | | | Fees,

Market Fees, Slaughter House Fees | Uttar

Pradesh | Kanpur | Building

Licence Fees, Market Fees | | | |

Source: Budgets

of Municipal Corporations. | |

Table

19: Sources of Shared Revenues of Selected Municipal Corporations in |

India

1998-2002 | Name

of State | Name

of Municipal

Corporation | Shared

Municipal

Taxes | Maharashtra

| Greater Mumbai | Non-agricultural

Assessment

Tax, | | | Entertainment

Tax | West Bengal | Kolkata | Motor

Vehicles Tax, Entertainment Tax | Karnataka | Bangalore

| Entertainment Tax, Surcharge on Stamp |

| | Duty |

Gujarat | Surat

| Entertainment Tax |

Tamil Nadu | Chennai | Surcharge

on Sales Tax, Duty on Transfer | | | of

Property, Entertainment Tax | Andhra

Pradesh | Hyderabad | Surcharge

on Stamp Duty, Profession | | | Tax,

Entertainment Tax | Source:

Budgets of Municipal Corporations. | |

Apart from their own revenue sources, i.e., tax

and non-tax revenue sources, the MCs depend upon grants from State Governments.

These grants are primarily intended to compensate for the mismatch of functions

and finance. Most of the MCs receive financial support in the form of revenue

grants from State Governments to meet current expenses. Similiarly, capital grants

are also provided for meeting project related expenditure. Table 20 shows the

composition of grants-in-aid in selected MCs.

In addition to own revenues,

shared revenues, user charges & fees and grants-in-aid, loans also constitute

an important source of municipal revenues in some ULBs.

4.4.2

Composition and Trends of Municipal Revenues

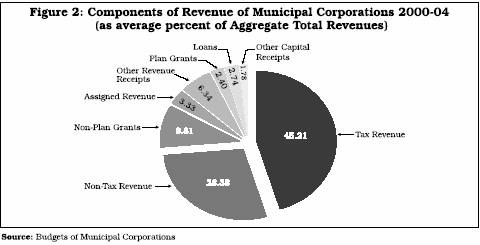

Relative contribution

of various components in the total revenue over the years has been presented in

Tables 21(a) and 21(b). Between 1999-00 to 2003-04, while the share of non-tax,

assigned revenue, non-plan and plan grants improved, the share of tax revenue

in total revenue receipts of MCs declined.

The average shares of major

revenue components (average of 2000-04) based on the data of 35 Municipal Corporations

are shown

Table

20: Major Sources of Grants-in-Aid of Selected Municipal Corporations |

in

India 1998-2002 | Name

of State | Name

of Municipal | Grants-in-Aid

provided to | | Corporation | Municipal

Corporations | Maharashtra

| Greater Mumbai | Primary

Education Grant and Secondary | | | Education

Grant | West Bengal

| Kolkata | Dearness

Allowance Grant, Grant to | | | Implement

Recommendations of Pay | | | Commission

and Water Supply, Sewerage | | | and

Drainage Grants | Karnataka | Bangalore

| Octroi Compensation, Motor-Vehicle

Tax | | | Compensation

and Family Planning | | | Scheme

Grants | Orissa | Bhubaneswar

| Salary and Dearness Allowance

Grants, | | | Road

Development Grant, Primary | | | Education

Grant and Secondary | | | Education

Grant | Gujarat

| Surat | Education

Grant, Family Planning Grant | | | and

Small Savings Grant | Tamil

Nadu | Chennai | Revenue

Grant, Contributions and | | | Compensation

for Toll | Andhra

Pradesh | Hyderabad | Property

Tax Compensation, Octroi | | | Compensation,

Per Capita Grant, Motor | | | Vehicle

Tax Compensation and Road Grant | Uttar

Pradesh | Kanpur | Octroi

Compensation, Salary Grant, | | | Education

Grant (Primary & Secondary | | | Education),

Medical Grant, Road Grant | Source:

Budgets of Municipal Corporations. | |

in the Figure 2. Among the various revenue sources, tax revenue

assumes greater importance in terms of both size and share. The

Table

21(a): Composition of Municipal Revenue and Trends |

(Rs.in

Lakh) | Sl. | Revenue

| 1999- | 2000- | 2001- | 2002- | 2003- | Average |

No. | component

| 2000 | 2001 | 2002 | 2003 | 2004 | Growth

Rate % | 1 | Tax

revenue | 458509 | 554597 | 461895 | 573952 | 599387 | 8.23 |

2 | Non-Tax

revenue | 238670 | 297890 | 296487 | 421422 | 434905 | 17.42 |

3 | Assigned

revenue | 87557 | 115909 | 110146 | 132588 | 131076 | 11.66 |

4 | Non-Plan

grants | 26667 | 34145 | 33341 | 54876 | 50161 | 20.42 |

5 | Other

revenue

receipts | 98600 | 86769 | 48024 | 64177 | 63271 | -6.11 |

| Revenue

Receipts | 910003 | 1089310 | 949893 | 1247015 | 1278800 | 10.18 |

6 | Plan

grants | 16753 | 15665 | 31712 | 30027 | 49898 | 39.20 |

7 | Loans | 19917 | 47245 | 31805 | 28520 | 32835 | 27.33 |

8 | Other

capital receipts | 11228 | 18101 | 18622 | 25785 | 33948 | 33.55 |

| Capital

Receipts | 47898 | 81011 | 82139 | 84332 | 116681 | 27.89 |

| Total

Receipts | 957901 | 1170321 | 1032032 | 1331347 | 1395481 | 11.04 |

Source:

Based on the Budgets of Municipal Corporations. |

Table

21(b): Composition of Municipal Revenue and Trends |

(Per cent to Total) |

Sl.No. | Revenue

component | 1999- | 2000- | 2001- | 2002- | 2003- | Average

% | | | 2000 | 2001 | 2002 | 2003 | 2004 | |

1 | Tax

revenue | 47.87 | 47.39 | 44.76 | 43.11 | 42.95 | 45.21 |

2 | Non-Tax

revenue | 24.92 | 25.45 | 28.73 | 31.65 | 31.17 | 28.38 |

3 | Assigned

revenue | 2.78 | 2.92 | 3.23 | 4.12 | 3.59 | 3.33 |

4 | Non-Plan

grants | 9.14 | 9.90 | 10.67 | 9.96 | 9.39 | 9.87 |

5 | Other

revenue receipts | 10.29 | 7.41 | 4.65 | 4.82 | 4.53 | 6.34 |

| Revenue

Receipts | 95.00 | 93.08 | 92.04 | 93.67 | 91.64 | 93.08 |

6 | Plan

grants | 1.75 | 1.34 | 3.07 | 2.26 | 3.58 | 2.40 |

7 | Loans | 2.08 | 4.04 | 3.08 | 2.14 | 2.35 | 2.74 |

8 | Other

capital receipts | 1.17 | 1.55 | 1.80 | 1.94 | 2.43 | 1.78 |

| Capital

Receipts | 5.00 | 6.92 | 7.96 | 6.33 | 8.36 | 8.36 |

| Total

Receipts | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 |

Source: Based

on the Budgets of Municipal Corporations. | aggregate

tax revenue of the 35 MCs constituted 45 per cent of average aggregate total revenue

(total receipts), which was followed by non-tax revenue constituting 28 per cent

of the average aggregate.

4.5 Municipal Expenditure

4.5.1 Structure of Municipal Expenditure The expenditure

incurred by the MCs can be broadly categorized into: (a) revenue expenditure and

(b) capital expenditure.

Table

22: Categorisation of Municipal Expenditures | Expenditure

Category | Expenditure

Items | Establishment

expenditure | Staff

salaries, Allowances, wages, Pensions & Retirement benefits etc. |

Administrative

expenditure | Rents,

rates & Taxes, Office maintenance, Communications, Books & |

| periodicals,

Printing & stationary, Travel expenditure, Law charges etc. |

Operations &

Maintenance | Power

& fuel, Bulk purchases, Stores, Hire charges, Repairs & expenditure Maintenance

and Interest payments made on loans | Capital

expenditure | Buildings,

Water supply & Sewerage, Energy/lighting, Solid waste management , Roads,

Bridges, Culverts, Causeways, Health & sanitation, Parks and recreation spaces,

Furniture & fittings, Tools & plant, Equipment etc., Principal

repayments of loans | Other

expenditure | Miscellaneous

expenses not accounted for in the above | Source:

Budgets of Municipal Corporations. | Further,

revenue expenditure broadly comprises (i) establishment expenditure, (ii) administrative

expenditure, (iii) operations and maintenance expenditure, and (iv) interest payments

on loans; the capital expenditure comprises (i) expenditure on capital formation

and (ii) principal repayment. The component of these major expenditure categories

are shown in table 22.

4.5.2 Composition and Trends of Municipal

Expenditure

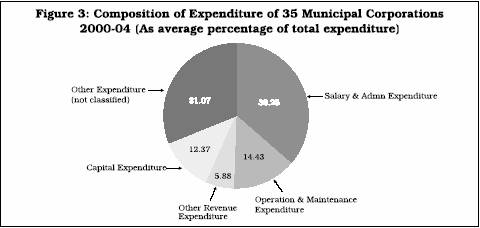

The composition of aggregate expenditure of the

MCs, in terms of the above categories, and trends are shown in Tables 23(a) and

23(b).

Table

23(a): Composition and Trends of Municipal Expenditure |

(Rs.in Lakh) |

Sl. No | Expenditure

component | 1999- | 2000- | 2001- | 2002- | 2003- | Average |

| | 2000 | 2001 | 2002 | 2003 | 2004

Rate

% | Growth |

1 | Establishment

and administration expenditure | 279216 | 330414 | 329592 | 411432 | 402550 | 10.19 |

2 | Operation

and maintenance expenditure | 107383 | 128165 | 142174 | 164406 | 154400 | 9.96 |

3 | Other

revenue expenditure | 51830 | 56120 | 55954 | 58190 | 56265 | 2.17 |

4 | Revenue

Expenditure | 438429 | 514699 | 527720 | 634028 | 613215 | 9.20 |

5 | Capital

Expenditure | 96933 | 105942 | 119463 | 124817 | 150424 | 11.76 |

6 | Other

Expenditure (not classified) | 209744 | 266611 | 210685 | 399205 | 470925 | 28.40 |

| Total

Expenditure | 745106 | 887252 | 857868 | 1158050 | 1234564 | 14.34 |

Source: Budgets

of Municipal Corporations. |

Table

23(b): Composition and Trends of Municipal Expenditure

| (Percent

to Total) | Sl.

No. | Expenditure

component | 1999- | 2000- | 2001- | 2002- | 2003- | Average% |

| | 2000 | 2001 | 2002 | 2003 | 2004 | |

1 | Establishment

and | 37.47 | 37.24 | 38.42 | 35.53 | 32.61 | 36.25 |

| administration

expenditure | | | | | | |

2 | Operation

and maintenance expenditure | 14.41 | 14.45 | 16.57 | 14.20 | 12.51 | 14.43 |

3 | Other

revenue expenditure | 6.96 | 6.33 | 6.52 | 5.02 | 4.56 | 5.88 |

4 | Revenue

Expenditure | 58.84 | 58.01 | 61.52 | 54.75 | 49.67 | 56.56 |

5 | Capital

Expenditure | 13.01 | 11.94 | 13.93 | 10.78 | 12.18 | 12.37 |

6 | Other

Expenditure (not classified) | 28.15 | 30.05 | 24.56 | 34.47 | 38.15 | 31.07 |

| Total

Expenditure | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 |

Source: Budgets

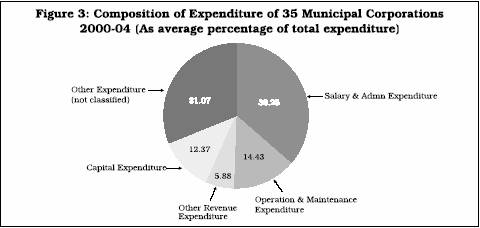

of Municipal Corporations. | The average shares

of different components in aggregate expenditure during the period of 2000-04

are shown in Figure 3.

Among all the components of municipal expenditure,

the expenditures on capital works, establishment & administration, and operations

& maintenance assume importance. The establishment & administrative expenditure

constituted 36.25 per cent of the aggregate total expenditure, during 2000-2004.

Capital expenditure, which is an important component, constituted less than 13

per cent of the total expenditure, during the same period.

The

above expenditure pattern indicates that the MCs’ spending on capital works

has been significantly low which is critical for building civic infrastructure

for planned urban development.

The under-investment in public works is

reflected in inadequate availability of civic amenities such as water supply,

sewerage, transportation networks and storm drainage system as discussed in the

next chapter.

4.5.3 Expenditure on Public Works

The expenditure on public works is an important component of the expenditure

incurred by the Municipal Corporations. It includes both the expenditure on capital

formation as well as the current expenditure incurred on public works by the MCs.

The current expenditure comprises expenditure on staff, administration and operations

& maintenance. The trends and compostion of expenditure on public works are

shown in Tables 24(a) and 24(b). The total expenditure on all public works of

the MCs accounted for 46.5 per cent of the total expenditure, on an average, during

2000-2004. Among the components, expenditures on health & sanitation and street

lighting have grown the fastest, followed by expenditures on roads, education

and sewerage. The growth in expenditures

Table

24(a): Composition of Expenditure on Public Works and its Trends |

(Rs.in Lakhs) |

Public Works | 1999- | 2000- | 2001- | 2002- | 2003- | Average |

| 2000 | 2001 | 2002 | 2003 | 2004 | Growth |

| | | | | | Rate

% | Health & Sanitation | 14593 | 33708 | 38339 | 47695 | 49443 | 43.20 |

Water supply | 28803 | 31742 | 34694 | 40792 | 40976 | 9.38 |

Roads | 58730 | 85658 | 83420 | 92270 | 97390 | 14.85 |

Parks & Playgrounds | 72658 | 77040 | 83298 | 88722 | 90533 | 5.68 |

Education | 48500 | 57782 | 60533 | 72218 | 74885 | 11.72 |

Sewerage | 20963 | 22742 | 27783 | 31013 | 32860 | 12.06 |

Solid waste management | 42440 | 50696 | 50886 | 57511 | 57614 | 8.26 |

Energy/lighting | 27436 | 43150 | 32092 | 81495 | 69277 | 42.65 |

All Major Works | 314123 | 402518 | 411046 | 511716 | 512977 | 13.75 |

Source: Budgets

of Municipal Corporations. |

Table

24(b): Composition of Expenditure on Public Services and its Trends |

(as Percentage

of Total) | Public

Works | 1999- | 2000- | 2001- | 2002- | 2003- | Average |

| 2000 | 2001 | 2002 | 2003 | 2004 | Growth |

Health & Sanitation | 4.65 | 8.37 | 9.33 | 9.32 | 9.64 | 8.26 |

Water supply | 9.17 | 7.89 | 8.44 | 7.97 | 7.99 | 8.29 |

Roads | 18.70 | 21.28 | 20.29 | 18.03 | 18.99 | 19.46 |

Parks & Playgrounds | 23.13 | 19.14 | 20.26 | 17.34 | 17.65 | 19.50 |

Education | 15.44 | 14.36 | 14.73 | 14.11 | 14.60 | 14.65 |

Sewerage | 6.67 | 5.65 | 6.76 | 6.06 | 6.41 | 6.31 |

Solid waste management | 13.51 | 12.59 | 12.38 | 11.24 | 11.23 | 12.19 |

Energy/lighting | 8.73 | 10.72 | 7.81 | 15.93 | 13.50 | 11.34 |

All Major Works | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 |

As share of Total Expenditure (%) | 42.16 | 45.37 | 47.91 | 44.19 | 41.55 | 44.24 |

Source: Budgets

of Municipal Corporations. | incurred on water

supply, parks and play grounds and solid waste management has been relatively

modest.

The MCs have been assigned some of the essential service delivery

functions as defined under the respective Municipal legislations. It was laid

down that they shall give primary attention to providing essential services like

water supply, sewerage, street lights, solid waste management and public (only

primary) health. A disproportionately high spending on non-discretionary items

like

secondary

education or secondary health care may not be desirable, unless an MC has already

attained satisfactory levels of services on essential services.

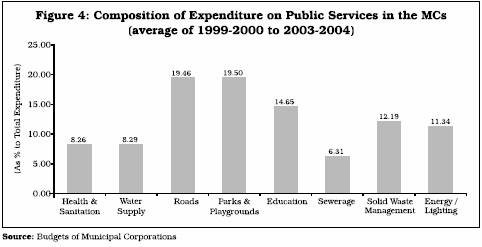

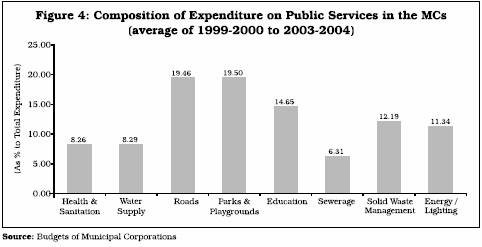

The composition

of expenditure on various public services in the MCs (shown in Figure 4) clearly

indicates that the expenditure incurred on essential municipal functions (obligatory/non-discretionary

items) like provision of water supply, drainage, sewerage, health & sanitation

and solid waste management has been comparatively lower than the expenditure incurred

on non-essential functions (discretionary items) like provision of education and

parks. This calls for rationalising the discretionary spending by MCs through

suitable guidelines; and to improve public accountability of expenditure through

citizen’s charters and social audits which will be discussed in Chapter

6.

Although water supply and sewerage functions are handled by separate

boards in some metropolitan cities like Delhi, Hyderabad, Bangalore and Chennai,

this fact does not affect the findings on municipal expenditures. In fact, the

pattern of expenditure on public works, after deducting the corresponding figures

for water supply and sewerage, of the above four metropolitan cities, more or

less remains the same.

4.6 Summary Observations

The municipal sector in India has remained small with its total revenue accounting

for about 0.75 per cent of GDP. In terms of both revenue and expenditure they

account for a little above 2 per cent of the combined revenues and expenditure

of Central Government, State Governments and ULBs. Analysis of the data for 35

major MCs indicated higher growth of expenditure (14.3 per cent) during 200-04

compared to the growth of total receipts (11.0 per cent). Component-wise, tax

revenue accounted for 45.2 per cent of total revenue, followed by non-tax revenue

(28.7 per cent) during 2000-04. Establishment and administration expenditure accounted

for about 36 per cent of total expenditure during 2000-04. Expenditure on public

works accounted for about 44 per cent of the total expenditure with expenditure

on roads and parks and playgrounds accounting for about 19.5 per cent of the total

expenditure. |

IST,

IST,