|

Financial System Support for the Transport Sector |

| |

| |

It is widely recognized that in order to obtain all the benefits of greater reliance on voluntary market based decision making, an economy would need an efficient financial system. In the traditional model, the financial system played a marginal role in infrastructure development in the face of an overwhelming public sector presence. Even given this limited role of the financial system, governments especially in developing countries often paid inadequate attention to regulatory and prudential matters, to the detriment of their financial systems. Two questions can be raised at this point: |

| |

(a) Given the emerging liberalized economic framework what sort of an expanded role would financial systems be expected to play in promoting infrastructural development?

(b)

And given the expanded role of financial systems, what role should government play in creating and ensuring efficient systems? |

This section examines these issues in the light of experience in both developed and developing countries and attempts to identify an appropriate framework which will enable the Indian financial system to provide the requisite services to the transport sector, in particular, in the decades to come. We begin with the traditional model of financing.

The financial system plays a critical role in infrastructure financing by making available the savings of the households, corporates, government and the rest of the world for infrastructural activities. Since the financial saving of the government in the Indian context is rather limited (Table 4.1) and private sector savings is mostly redeployed in the industry where it originates from, the financial saving of the household sector is crucial for additional resource generation for transport financing. The financial saving by households is more than double the savings by private and public sectors and thus crucial from the viewpoint of generating additional saving |

|

|

Table 4.1- Gross Domestic Savings in India and its Components- 1996-97to 1999-2000). |

(percent) |

Sources |

1993-94

to

1996-97 |

1997-98

|

1998-99

|

1999-2000

|

1 |

2 |

3 |

4 |

5 |

Household Saving |

18.3 |

17.8 |

19.1 |

19.8 |

o/w Financial Saving |

10.5 |

9.9 |

10.9 |

10.5 |

| Private Corporate Sector |

4.1 |

4.2 |

3.7 |

3.7 |

Public Sector |

1.5 |

1.5 |

-0.8 |

-1.2 |

Source : CSO, National Accounts Statistics |

|

for the infrastructure sector. Thus, a closer look at the distribution of household financial saving becomes necessary from the point of view of resource generation potential for transport.( Table 4.2) |

|

|

Table 4.2 Distribution of Household financial saving in india-1970-71 to 1998-99. |

Years |

Currency |

Deposits |

Shares

and

Debentures |

Claims on Government |

Insurance Funds |

Provident

and

Pension

Funds |

Gross

Household

Financial

Savings |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

1970-71 |

17.9 |

38.1 |

3.4 |

5.3 |

10.5 |

24.8 |

100.0 |

1975-76 |

6.8 |

42.0 |

0.8 |

17.8 |

8.4 |

24.2 |

100.0 |

1980-81 |

13.4 |

52.0 |

3.7 |

5.9 |

7.6 |

17.5 |

100.0 |

1985-86 |

8.7 |

46.9 |

7.8 |

13.4 |

7.1 |

16.2 |

100.0 |

1990-91 |

10.6 |

33.3 |

14.3 |

13.5 |

9.5 |

18.9 |

100.0 |

1992-93 |

8.2 |

42.5 |

17.2 |

4.9 |

8.8 |

18.4 |

100.0 |

1995-96 |

13.4 |

42.1 |

7.4 |

7.8 |

11.3 |

18.1 |

100.0 |

1998-99 |

10.1 |

41.8 |

2.5 |

12.3 |

10.5 |

22.7 |

100.0 |

Source: Percentages calculated on the basis of CSO data |

|

The distribution pattern of financial saving of households (Table 4.2) reveals that the bulk of financial savings was in banking sector instruments, mainly in the form of deposits of various maturities. The banking sector is, thus, the major source of financial savings of the households in the country. However, with the deepening of financial markets, its share has fallen on an average from 45.6 percent in the 1970s to 40.3 percent in the 1980s and further to 40 percent in the 2004-05. The share of non- banking financing companies has grown from 3 percent in 1970s to nearly 8 percent in 1990s. This apart, long term contractual savings like insurance premium and pension funds which accounted for 35 percent of financial saving in 1970s stood at 26 per cent in 2004-05. The allocation of financial savings by the household sector has crucial significance for infrastructure financing. In India, as the households are ready to part with about 26 per cent of their saving, amounting to above Rs. 81,000 crore in 2004-05 alone towards long term contractual aggrements in provident and pension funds and insurance funds and another Rs.25,000 crores in small saving instruments, this provides a huge pool of long term funds which can potentially be utilized for infrastructure financing.

The pattern of funding by the financial sector is dependent on the policy environment in which the savings are made. In the subsequent sections, we analyse the ability of the banking and non banking sectors, the capital markets and the contractual saving institutions to divert funds towards the infrastructure sector. Such sectoral analysis will give us a better idea of financial resources that can flow into infrastructure financing. |

| |

Role of Commercial Banks in Transport Sector Financing in India

The commercial banking sectors involvement in financing the transport sector may be broadly classified into two groups:

a. Advances to transport operations including those under priority sector lending scheme.

b. Project financing. |

The traditional model reveals that the commercial banking sector’s involvement in transport sector financing has been almost exclusively limited to loans given to transport operators, i.e., under group (i) while that under (ii) is assuming increasing importance as a possible component of investment. We examine the group (i) scheme first. Table.4.3 gives the distribution of outstanding credit of Scheduled commercial banks by activity.

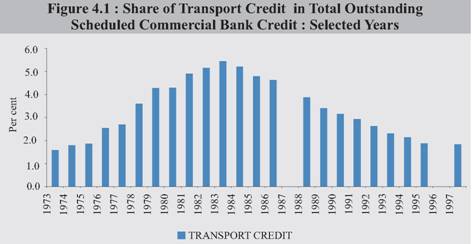

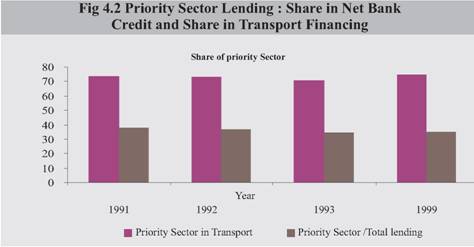

It is observed that share of transport in total credit rose sharply from 1.5% in 1973 to really 5.5% in the early eighties and has then gradually declined to about 1.2% in 2005. From Table 4.4 it is observed that much of credit was for land transport (90% or more). The major share of credit (70%) has been for heavy commercial vehicles (trucks and buses), with intermediate Public Transport modes (Taxis and Autorikshaw) receiving about 13-14% of credit, non-mechanised (land) and water transport modes receiving about 7-8% each.

Of the outstanding credit to the transport sector, a little more than 70% or so has been provided under the priority sector schemes under implementation at the instance of the Central Govt. The Committee on Transport Policy & Coordination (GOI, 1966) had emphatically pointed out that “a major source of weakness on the part of the road transport industry and of the position of vulnerability in which the vast majority of small operators are placed lies in the sphere of finance” (p.96). It was also pointed out that total volume of finance available was quite meagre and that was available on extortionate terms. More than a decade later, the National Transport Policy Committee (GOI,1980) held that following the recommendations of the Study Group on Road Transport Financing (GOI,1967) expansion of commercial bank credit had resulted in the flow |

|

|

Table 4.3 : Sectoral allocation of Total Outstanding Credit Advanced by Scheduled Commercial Banks |

|

Agriculture |

Industry |

Transport |

Personal & |

Trade |

FI |

MISC |

Other |

TOTAL |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

1975 |

8.9 |

59.1 |

1.9 |

1.7 |

17.5 |

2.2 |

5.2 |

3.6 |

100.0 |

1980 |

14.8 |

48.0 |

4.3 |

2.2 |

22.2 |

0.8 |

4.3 |

3.3 |

100.0 |

1985 |

17.6 |

41.3 |

4.8 |

3.1 |

23.4 |

1.2 |

5.3 |

3.3 |

100.0 |

1990 |

15.9 |

48.7 |

3.2 |

3.0 |

13.9 |

2.1 |

6.8 |

6.4 |

100.0 |

1995 |

11.8 |

45.6 |

1.9 |

2.3 |

17.1 |

3.8 |

8.5 |

9.0 |

100.0 |

1997 |

11.1 |

49.3 |

1.8 |

3.1 |

13.2 |

4.0 |

7.5 |

9.9 |

100.0 |

Source : BSR Returns |

|

| of funds to the road transport sector having improved considerably especially since the early seventies when the operators were made eligible to get credit under the priority lending scheme of commercial banks. While |

| |

|

| |

|

|

Table 4.4- Share of Transport and its Components in Total Bank Credit (%) |

|

1989 |

1990 |

1991 |

1992 |

1993 |

1995 |

1999 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

A. Transport Operators |

3.4 |

3.0 |

2.9 |

2.6 |

2.3 |

1.9 |

1.85 |

I. Land Transport |

2.4 |

2.8 |

2.7 |

2.4 |

2.1 |

1.7 |

Break up

Not

Available |

a. Cycle Rikshaws |

0.3 |

0.2 |

0.2 |

0.2 |

0.2 |

0.1 |

b. Taxi, Auto Rikshaw Scooter |

0.5 |

0.4 |

0.4 |

0.4 |

0.3 |

0.3 |

| c. Other Land Transport |

|

2.2 |

2.1 |

1.9 |

1.6 |

1.2 |

II. Water Transport |

0.2 |

0.2 |

0.2 |

0.2 |

0.1 |

0.3 |

III. Air Transport |

0.0 |

0.0 |

0.0 |

0.0 |

0.1 |

|

Source : Reserve Bank Of India BSR Returns, Various Years |

|

this was true till the early eighties, the trend has been reversed since then (Fig. 4.2).

An important factor contributing to reduced bank finance to the sector was the increasing number of default cases. “The rising proportion of non-performing loans has limited the volume of credit that banks can extend to new clients” (World Bank,1990,p.55). This problem was pointed out in |

|

the study undertaken by the Central Institute of Road Transport, Pune (CIRT,1993)and was also revealed to us in the course of our discussions with senior officials of some major nationalised banks. According to them, the main reasons for the poor recovery included: |

| |

a) inability of small operators to repay loans

b)

wilful default due to political influence

c)

Legal complications

d)

National system of permits which enable a truck operator to operate in number of states.

|

An underlying feature of the problem was the lack of clear operating guidelines/ framework for recoveries. As a result, a major nationalised bank like State Bank of India reported NPA’s to the extent of 42 per cent in the case of transport operators while Union Bank of India reported 18 per cent. Further, it was pointed out that the position in regard to poor recovery varied from state to state. While repayment was found to be satisfactory in States like Rajasthan, Tamilnadu etc., where there is an efficient back-up govt. machinery, in case of States like Bihar, U.P., the recovery performance was poor. In the absence of an efficient recovery mechanism, the flow of funds from the banks is unlikely to improve considerably.

From the point of view of the operator, it is felt that the commercial banking system did not demonstrate adequate flexibility in its approach to matter of financing which often resulted in complex procedures being adopted to process a loan application thereby resulting in considerable delays.

The financing of transport operators by the banks takes place directly and indirectly. In the direct method, finance is provided directly to the operators. But an emerging route where banks conceived less risks was by lending to Non-Banking financial companies.(NBFC’s) who, in turn, gave the finance to transport operators. In view of the legal problems involved, the large numbers of individual borrowers, management efficiency consideration suggest that credit worthy NBFC’s should act as intermediaries in the entire process. We attempt to understand how - a little later. We now turn to group (ii), namely, project financing by commercial banks. |

| |

Project Financing

Traditionally, project finance was limited largely by borrowing and to some extent to equity capital. This framework has continued to persist even in the case of infrastructure financing which has been increasingly oriented on a project finance basis as a result of greater attempts to attract the private sector into infrastructure development. But the similarity ends there. Conventionally, a project sponsor may finance new project using existing projects and hence his total assets- as collateral to secure the funding. Thus any outstanding financial claim against the new project is a claim on the sponsor’s total cash flows. With this structure, lenders look at the overall creditworthiness of the project sponsors and are less concerned with the profitability of any individual project. This way, creditors used to fund firms and firms used to fund projects.

But the essence of project financing (i.e., in its new form) in infrastructure lies in the recourse that financiers have to a project’s cash flows as primary security with secondary support from the projects assets which may not be of immediate use always unless the aspect is a relatively liquid one. (in the case of a road, the asset is most illiquid). (In the purest form, of project financing, creditors have no resource to the project’s assets but only to the cash of the project. This type is uncommon because lenders typically insist on some sort of sponsor- at least in the project development

phase- a completion guarantee from the project sponsor or their parent company). More formidable is the problem of the time taken to create an asset only after which the revenue/cash flow occurs. Further, the recovery period is long term so that tariffs/tolls to service the debt are not prohibitive. Herein lies the inability of banks to provide medium-term to long- term finance, which stems directly from the maturity structure of their liabilities. Most of the liabilities in commercial banks are in the nature of demand and short-term savings deposits. Naturally, making long-term commitments (either by way of loans or equity contributions) to infrastructure projects would create a serious maturity mismatch between the assets and liabilities of these institutions. This mismatch could be even more dangerous in the absence of efficient and liquid money markets that would otherwise provide banks with some tools to manage their liquidity and interest rate risks. A vibrant secondary market for Government securities and corporate debt is also an essential prerequisite of a greater flow of finance to the infrastructure sector.

Government policies and the banking sector’s limited experience in dealing with various risks involved in limited/ full resource financing and the lack of knowledge on mitigation methods are also responsible for their insignificant role. The weak base of knowledge stems from the time -honored practice of collateral based lending which guides the extension of credit in most developing countries. The requirement that a borrower post collateral or secure a guarantee from a third party generally means that the borrower’s credit worthiness is otherwise insufficient. As a result, with the exception of Malaysia and, to some extent, Thailand and Korea, commercial banks have played a very small role in project finance lending to infrastructure projects. The situation was even much worse in Latin America where high inflation, exchange rate risks and political uncertainty made long-term finance extremely scarce. In India, until financial reforms were initiated in 1991, 90 per cent of the commercial banking sector was owned by the state. Banks were required to invest 15 per cent of their funds to fulfil cash reserve requirement and 38 per cent in government and government approved securities, in addition, 40 per cent of bank credit were required to be provided as loans to priority sectors at somewhat commercial rates (Vitas and Cho,1995).

Financial sector reforms that revive or establish the role of commercial banks in long-term finance are essential for increasing the share of domestic sources in infrastructure finance. Commercial banks can play an important role in screening and monitoring the behaviour of projects. An effective and deep commercial banking sector is also a pre-requisite for the development of the securities and eventually derivatives market. Bonds, for example, are not easily absorbed by individual investors. Most bonds can be absorbed by financial institution such as banks. Banks can also play a major role in executing repository transaction where regulatory frameworks permit the offering and trading of such instruments.

In order to promote and strengthen infrastructure financing in India, the Reserve Bank of India has liberalised term loans by banks for this purpose. Earlier, there were prudential ceilings on the overall exposure that a bank could take on a single infrastructure project. Each bank is now free to sanction term loans to all projects within the overall ceiling of the prudential exposure norms prescribed by RBI, i.e., 25 per cent of the capital funds in the case of an individual borrower and 50 per cent in the case of a borrower group. The group exposure norm of 50 per cent is allowed to be exceeded upto 10 per cent provided the additional exposure is for the purpose of financing infrastructure projects. A concessional risk weight of 50 per cent applies to project financing in infrastructure, according to the February 2003 guidelines of the RBI. Further banks have been given freedom to decide the period of term loans keeping in view the maturity profile of their liabilities. |

| |

Forms of Infrastructure Financing by Commercial Banks

In April 1999 and subsequently in February 2003, the Reserve Bank of India has issued operational guidelines for financing of infrastructure projects. Banks have been permitted to sanction term loans to technically feasible, financially viable and bankable projects undertaken by both the public and the private sector undertakings. Six broad modes of financing has been identified for this purpose: |

1) financing through funds raised by subordinated debt,

2)

entering into take-out financing

3)

avail of liquidity support from IDFC

4)

direct financing through rupee term loans, deferred payment guarantees

5)

Inter-institutional Guarantees and

6)

investments in infrastructure bonds issued by project promoters and financial institutions.

|

Accordingly, banks have started to inject funds in the infrastructure sector in the form of project finance. The major banks have, in a bid to diversify their portfolio, have opened up project finance divisions to take care of infrastructure projects. Subordinated Debt

In the case of subordinated debt, the bank raises Tier II capital. In the event of default, subordinated debt will be treated as share capital, increasing the default risk. Consequently, a higher interest rate is charged on this type of debt. Given the higher risk and default probability in long term infrastructure project financing, the higher interest margin may induce banks to such financing. |

Take Out Financing

Financial innovations, like the Take out Financing deals provide opportunities to the commercial banks to create long term assets from

short term liabilities. The participation of a long term player is crucial in this deal. After a specified period of time, the long term asset is transferred to the books of this long term financial institution. Take out financing can be done through number of routes: |

a) where the risk is borne by the primary lender and the liquidity support is given by the long term financial institutions,

b)

where the risk is fully taken over by the term lending institutions and

c)

a blend of the both, whose structure has a number of possibilities.

|

The takeout structure is defined by a main document, the takeout financing agreement, which would be a tripartite agreement between the project company, bank and the term lending institutions.

In India, take out financing is in its nascent stage. In September 1998, The Infrastructure Development Finance Company Ltd. (IDFC) entered into a Rs. 400 crore take-out financing agreements with the State Bank of India. The IDFC provided liquidity support to SBI to the extent of Rs. 400 crore initially, which will go up to Rs. 5000 crores over the next five years. the structure will be applied to three projects- Bharati Telnet, Narmada bridge in Gujarat and Coimbatore bypass in Tamilnadu. In these projects, the debt fund was to be provided by SBI for 5 years, at the end of which SBI had the option to continue or call back the principal. At that point IDFC was take out SBI for the principal amount of the loan. the project companies, therefore would be able to get funds for a longer duration. Both IDFC and SBI would participate in the credit risk for the principal and the interest respectively. The takeout financing fee would be around 0.25 to 0.5 of the liquidity support given.

Liquidity support from IDFC

As an alternative to take-out financing structure, IDFC and SBI have

devised a product, providing liquidity support to banks. Under the scheme, IDFC would commit, at the point of sanction, to refinance the entire outstanding loan ( including principal and unrecovered interest) or part of the loan, to the bank after an agreed period, say, five years. The bank would repay the amount to IDFC with interest as per the terms agreed upon. Since IDFC would be taking a credit risk on the bank, the interest rate to be charged by it on the amount refinanced would depend on the IDFC’s risk perception of the bank. The refinance support from IDFC would particularly benefit the banks which have the requisite appraisal skills and the initial liquidity to fund the project.

Inter-institutional Guarantees

In terms of the extant RBI instructions, banks are not allowed to issue guarantees favouring other banks/lending institutions for the loans extended by the latter, as the primary lender is expected to assume the credit risk and not pass on the same by securing itself with a guarantee i.e. separation of credit risk and funding is not allowed. Keeping in view the special features of lending to infrastructure projects, banks are permitted to issue guarantees favouring other lending institutions in respect of infrastructure projects, provided the bank issuing the guarantee takes a funded share in the project at least to the extent of 5 per cent of the project cost and undertakes normal credit appraisal, monitoring and follow up of the project.

Financing promoter’s equity

The Reserve Bank has stipulated( Circular DBOD. Dir. BC. 90/ 13.07.05/ 98 dated 28 August 1998), that the promoter’s contribution towards the equity capital of a company should come from their own resources and the bank should not normally grant advances to take up shares of other companies. However, in view of the importance attached to infrastructure sector, it has been decided that, under certain circumstances, an exception may be made to this policy for financing the acquisition of promoter’s shares in an existing company which is engaged in implementing or operating an infrastructure project in India. The conditions, are as follows: |

i. The bank finance would be only for acquisition of shares of existing companies providing infrastructure facilities.

ii. The companies to which loans are extended should, inter alia, have a satisfactory net worth.

iii. The company financed and the promoters/ directors of such companies should not be defaulters to banks/ FIs.

iv. In order to ensure that the borrower has a substantial stake in the infrastructure company, bank finance should be restricted to 50% of the finance required for acquiring the promoter’s stake in the company being acquired.

v. Finance extended should be against the security of the assets of the borrowing company or the assets of the company acquired and not against the shares of that company or the company being acquired. The shares of borrower company / company being acquired may be accepted as additional security and not as primary security. The security charged to the banks should be marketable.

vi. Banks should ensure maintenance of stipulated margin at all times.

vii. The tenor of the bank loans may not be longer than seven years. However, the Boards of banks can make an exception in specific cases, where necessary, for financial viability of the project.

viii. The banks financing acquisition of equity shares by promoters should be within the regulatory ceiling of 5 per cent on capital market exposure in relation to its total outstanding advances (including commercial paper) as on March 31 of the previous year.

|

Transport Financing by Non- Banking Financial Companies (NBFCs)-A Case of Commercial Vehicle Financing

At present, major sources of finance for the trucking sector are the non-banking financial companies and the Scheduled commercial banks. According to a Sub-Committee Report (Sriraman, 1998), the share of different agencies in the truck financing for the Northern Region of India were as follows: |

| NBFC’s - 64 per cent |

| Banks - 23 per cent |

Self - 8 per cent |

Others - 5 per cent |

|

A similar profile emerges in the case of the Southern Region as revealed in another study (ITCOT,1996). Further, extensive discussions with a number of truck operators and agencies [ in the course of the work for the Sub-Committee (Sriraman,1998)] confirmed that the non-banking financial sector has emerged as the dominant source of finance for the trucking industry (recall that the share of transport sector credit of commercial bank has been falling since the mid-eighties. This has occurred despite high lending rates by NBFC’s. However as a consequence of certain policy measures/regulators undertaken since the mid-nineties, there has been a drastic reduction in the funds available with NBFC’s {including those from commercial banks}). Thus, availability of finance as well as the high cost of funds have been major emerging problems in regard to truck financing. When the cost of borrowing is high, borrowers/operators resort to practices of cutting corners to ensure a reasonable return. For example, truckers resort to extensive overloading which has its ill effects. When availability of finance is constrained, there is a tendency to borrow from high-cost private lenders.

Accordingly the Sub-Committee (Sriraman, 1998) adopted the view that the banking sector needs to strengthen its support of those NBFCs which have an (inherently)strong presence in the business of financing under the priority sector lending scheme of commercial banks. Quoting the Working Group on Financial companies (RBI, 1992) which had emphasised the need to encourage NBFCs which are, by nature, innovative, to evolve new types of financial services and products to meet the emerging needs of the society, the Sub-Committee recommended this new product which would be based on the strength of adequate funding available with the banking system and the inherent efficient credit delivery mechanism of NBFCs especially in regard to truck financing. We support this stand. In other words, banks could play the role of “Whole-sale financing/banking” while the NBFCs could play the role of “retail financing /banking”. The reasoning is many-sided. Some of the major players in the NBFC segment have, over the years, developed a special experience in evaluating credit worthiness potential borrowers (especially in the trucking sector) which is followed by an effective delivery system which is further backed up by an effective recovery management system which operates on the basis of vast retail network. This is because many of them have focussed exclusively on commercial vehicle operators. From the demand side, it does appear to be true to say that operators prefer these agencies to banks for a variety of reasons ranging from attention to banks for a variety of reasons ranging from attention to individual needs such as design of customer-oriented funding options to flexibility in recovery such as restructuring of payments in the case of genuine financial difficulties. (See Box 4.1)

Though the Reserve Bank of India issued a notification in late 1998 which enabled classifying bank credit to NBFCs for on-lending to small |

Box 4.1 Role of NBFC’S in Commercial Vehicle Financing |

The NBFC sector has been playing an important role in development of the Road Transport sector. The Banks have not been in a position to deploy more than 3 to 4 per cent of their funds to this sector. Therefore, disbursals to SRTOs (small road transport operators) have not been significant enough to support the Road Transport operators. Bank funding as a percentage of total funding in the commercial vehicle market has therefore not exceeded 25 to 30 per cent in the past. Recoveries have also not matched expectations.

Funding SRTOs requires specialised customer evaluation skills and infrastructure that is different from the requirements of typical bank borrowers. The operators are unable to provide necessary documentation and securities required fro processing of the disbursal. The purpose of special schemes for SRTOs has been defeated by this inability to conduct business in this segment. Further, recovery management in this also requires special skills and infrastructure.

The NBFC sector has grown to fill this void. It has developed necessary focus and the infrastructure to operate successfully in this sector. The high share of funding to this sector reflects this fact. The NBFC sector therefore is in an excellent position to develop this role in the Industry. |

1) Existence of recovery management systems and infrastructure to ensure high collection efficiency.

2)

Retail network geared to handle the funding requirements of commercial vehicle operators due to exclusive focus on this segment.

3)

Flexibility to design customized funding options to suit the needs of individual operators.

4)

NBFC’s jointly participate with manufacturers to provide higher levels of customer service. They are in a position to offer vehicle service packages in addition to funding. This is done jointly with manufactures and dealers.

5) Capability to induct new participants into commercial vehicle operating business by effective utilization of existing database infrastructure.

6)

Better capability to manage risk due to focussed infrastructure and activity.

|

The implications of bank support to NBFCs are as under :

- It will provide substantial relief to transport financiers (NBFCs) which have been facing a severe funds crunch following restrictions on mobilisation of public deposits and as a consequence of various policy measures undertaken by the RBI commercial banks in recent years. Shah (1997) provides another angle of reasoning to the reduced availability of funds. Banks (and not so much financial institutions) look upon NBFCs as their competitors in terms of both deposit mobilisation and credit expansion. This is one of the main reasons why almost every bank would like to do themselves what NBFCs have been doing. Further, it is for the same reason that there is a kind of bias against NBFCs in terms of availability of credit and cost of credit.

- The classification of such funds under the priority-lending scheme will enable banks to fulfill their targets under the scheme, which would also be based on a satisfactory recovery mechanism.

- Availability of bank finances at relatively reduced rates of interest would ultimately be reflected in reduced operating costs to the operators.

|

transport operators as priority sector lending( a step in the right direction), it is understood from banking circles(in the course of our discussions) that this scheme has not really taken off. Accordingly, immediate and effective implementation of this expanded funding scheme for truck operators is strongly recommended.

Another aspect that is related to trucking sector finance is the viability of small road transport operators (SRTOs) who dominate the sector in an overwhelming way. It is widely felt (among policies makers, banking circles and operators themselves) that it is essential that trucking operations should be made viable in order that the interests of not only the operators but also other stakeholders like the users, financing agencies are taken care of. Previous studies (NCAER,1979,CIRT,1993) and the work of several Committees have pointed out that due to intense competition, profitability is rather low in the case of single-owner operators. Absence of economies

of scale and of advantages arising from bulk purchase of spares lead to several inefficiencies. Even from the point of view of regulation, the presence of a large number of single-owner operators gives rise to several problems. Under such a situation, it is necessary that concept of consolidation of operators by way of formation of associations/cooperatives need to be positively encouraged. Such a trend is already visible in Punjab, U.P, Harayana and Tamilnadu. However, if integration of the industry in some form is considered important towards achieving greater efficiency, there ought to be a major shift in the small- scale approach of the financing agencies especially commercial banks. In other words the limit of minimum number of vehicles to qualify for the Small Roads Transport Operators (SRTOs) financing scheme which is currently at 10, needs to be revised and if necessary raised. Financing agencies should (over a period of time) insist on viability of operations either as a firm or as an association/ cooperative with a viable fleet and requisite infrastructure as a pre-requisite for lending.

The Role of the Capital Market

Capital markets provide debt and equity finance. By making long-term investment liquid, capital markets attempt to mediate successfully between the conflicting maturity preferences of lenders and borrowers. Since mobilisation of resources for infrastructure projects outside the framework of budgetary allocation is an emerging necessity (more so in developing countries), all infrastructure services are increasingly looking to the capital market (largely domestic & to some extent international). Given the long term profile of infrastructure projects, the objective is: to enhance mobilisation of long-term local currency debt which remains a major challenge for financing infrastructure. We begin with the successful experience of tapping the domestic market in other countries and then examine the situation in India.

Of the various instruments that have been used to finance infrastructure projects, long term fixed- rate bonds have been found to be most suitable. The nature of these projects are such that they tend to have stable earning profiles over extended periods of time, thereby providing a degree of predictability about future earnings. But such a profile does not follow sharp swings which may be required, for example, when there are sudden shifts in interest rates, since tariff levels are regulated. These features are compatible with the financing profile of fixed rate bonds.

Fixed- rate bond price is determined by interest rate movements in the currency of the bonds denomination. Thus, a stable macro economic environment is crucial to proper functioning of a long-term bond market. Inflation is a major worry since it erodes the purchasing power of the principal and also affects interest rates. Thus investments in long term fixed rate bonds such as those that can be used to finance infrastructure projects depend on the performance of a specific project as well as on a host of macro economic trends. Floating rate instruments protect investors against interest rate and inflationary movements. But these need to be supported with derivatives such as interest rate swaps in order to offer a predictable cost profile for borrowers. Long term swap markets are naturally as rare as long-term bond markets in developing countries.

Given these criteria, it is only natural to expect that domestic bond markets are either absent or at an enfant stage in Latin America. But given the economic stability that has been achieved since the nineties prospects for development of long-term bond markets have increased. This is partly due to the reformed pension and social security system that is emerging as a major source of demand for long-term debt instruments. (Vittas, 1995)

In East Asian economies, government bonds still dominate but the move towards privatisation of infrastructure services and new investment by the private sector has not only reduced the demand for budgetary outlays that might generate deficits, but has also facilitated and accelerated the pace of corporate issues and the development of bond markets. In Malaysia, the issue of debt securities increased since the early 1990s as a result of huge projects undertaken by the private sector. The North-South expressway which was financed entirely by local financing was able to raise $400 million by using convertible bonds. The purchase of $550 million of fixed rate bonds as part of a power project by the Employees Provident Fund was an example of a bond market satisfying the financing needs of huge infrastructural projects while at the same time providing an investment outlet for institutional investors looking for alternatives to issues of govt-securities (which were becoming much less frequent)

Till 1990, almost 90 per cent of the bonds outstanding in Thailand were govt. issues. This was the result of certain restrictions on corporations. But by 1992 a new law allowed all public & private companies to issue bonds. As a result, the size and competition of the Thai bond market changed with share of corporate bonds growing from 3 per cent to more than 25 per cent by 1995. This rapid growth enabled greater local financing of infrastructure privatisation and investments.

The tax regime has been a major constraint to the development of bond market in the Phillipines where a stamp tax made borrowing through bond more expensive than loans from commercial banks. The development of a secondary market for debt was inhibited because every sale of a debt instrument was subject to tax. With the replacement of this tax by a value added tax, the distortion has been removed.

According to Ferreira and Khatami (1996), public enterprises, especially in infrastructure and utilities, have been central to the development of bond markets. Given that state enterprises have been more efficient than their counterparts in other developing countries, these entities have participated in capital markets without requiring preferential treatment while at the same time, also helping to set benchmark for long term securities.

International Experience in Transport Financing through Capital Markets: Lessons for India

The international experience of successfully tapping the domestic capital markets to finance infrastructure projects provides certain interesting insights.

Firstly, the presence of Government to facilitate infrastructure financing in the financial market was crucial. In developed countries like the USA, UK or Canada, the bonds issues were backed by Government guarantees which enabled the companies to obtain a higher credit rating and investor acceptability. Thus, there is abundant evidence of the State in the mitigation of risk through the issue of general obligation guarantees or revenue guarantees. While the former guarantees repayment as well as debt servicing, in the latter, the repayment is tied to a given revenue stream. Such guarantees instilled greater confidence among investors and expanded the market. In India, interestingly, the guarantees route to fund infrastructure projects has been used extensively, which has often raised the issue of fiscal stability of the state governments. In order to meet the growing requirements of financing infrastructure and compensate for the decreasing capital expenditure arising on account of the inability to pierce borrowing ceilings imposed by the Centre, States have been resorting to issuing larger and larger amount of guarantees on behalf of pubic sector entities undertaking infrastructure investment and other developmental activities. No doubt these guarantees represent obligations that may or may not devolve on the government. occur and consequent to the invoking

of the guarantee. Nevertheless, in many cases, guarantees especially those issued after 1993-94 could represent direct liability on the State budget where there are assured payment arrangements and could represent a direct liability on the cash flow of the State. Hence the rising guarantees and assured payment arrangements at the State level, pose issues of sustainability of State finances.

Some countries like UK used treasury bond issues to develop earmarked/dedicated funds for infrastructure for onlending to agencies involved in infrastructure projects. Such earmarking of funds can be an important source of infrastructure financing.

This apart, the direct measures to strengthen the domestic securities market through a host of measures ( including, inter-alia, establishment of a legal framework for securities issues and trading, supervision of this process, introducing appropriate regulation for support facilities including underwriters, brokers, dealers and others, introducing adequate disclosure norms for shareholders, introducing regular benchmark issues, establishment of rating agencies, providing fiscal incentives and relaxation of investment regulations of investors, introducing sound payment systems for securities trading and by liberalising the interest rates to allow greater freedom to market participants and promotion of secondary market in debt securities ) were also crucial for the debt route of infrastructure finance. The creation of enabling environment has gone a long way in facilitating the growth of infrastructure finance.

Policy makers in Chile, for instance, encouraged the development of long-term investible resources through the pension fund system with the implementation of a revolutionary reform in the social security system in May 1981. Privatisation of pension funds in Chile was responsible for rapid accumulation of long-term funds and led to the emergence of a strong domestic market. Along side, there was also rapid growth in the holdings of life insurance and pension funds. In Malaysia, a high savings rate, coupled with the creation of Employees Provident Fund in 1991 led to growth in long-term investible resources. Liberalised investment restrictions of EPF (only 50 per cent to be invested in Government securities as against 75-85 per cent in its Indian counterparts), this provided enough resources for infrastructure.

Also, financial and macroeconomic stability is crucial for the development of domestic financial markets. Stable inflationary expectations, reduced volatility of interest rates and increased financial market efficiency helps the growth of debt markets, as the country experience suggests.. This apart, the state can provide incentives to projects by offering performance based grants or contingent lines of credit. In view of the uncertainties regarding return from investment projects, the government may mitigate the risks through contingent credit support which serves to tap private funding that would otherwise not be available.

State can also partially absorb the debt instruments of the projects. Public sector support vehicles exist in many emerging economies and the discussion paper deals with Pakistan Private Sector Energy Development Fund (PSEDF) and Jamaica Private Sector Energy Fund (JPSEF). The report also discusses the benefits of pooling and securitisation structures by the state through Infrastructural Development Fund (IDF). The IDF can raise the investor base, reduce the overall borrowing cost, open up new investor markets and provide stable access to capital. The IDF can identify a pool of projects for provision of finance.

Another innovative pooling method suggested is a Quasi-Blind Pool where government developers, contractors, local investors will pool their resources for a diversified corporate portfolio. Some examples of Quasi-Blind Pools are Morgan Stanley LIPTEC Fund and California Energy Company.

Chile, Malaysia, Argentina and Thailand all went for disinvestment of public utilities. The state found this a convenient way to generate financial resources needed to sustain the growth of the economy. The impact of such divestiture programme was enormous as the report tells us, the share of infrastructure stocks rose rapidly as a percentage of total stock market capitalisation.

Two features that stand out in regard to the development of debt market in recent years in developing countries referred to above and otherwise are: |

- Availability of contractual saving for infrastructure financing

- divestment of public enterprises and role of existing enterprises in raising long-term debt.

|

Pension funds have emerged as a class of financial intermediaries in many developing countries. They sell employees and self-employed people secondary securities in the form of contractual agreements that provide for benefit payments upon the participants retirement. Because their benefits are to be paid in the future, the secondary securities ( that is liability of pension funds) are effectively long term and the primary securities (their assets) are long-term. Pension funds are a part of the contractual saving sector. By contractual saving is meant any transaction in which agents enter into an arrangement with institutions, to trade current consumption for future income. Contractual savings institutions (life insurance company, occupational pension schemes, provident funds etc.) are often referred to as institutional investors because of their role as investors in capital market. In advanced countries, these institutions are major investors in the securities market especially in long term debt instruments. A report commissioned by the US Congress on financing future infrastructure investments in the U.S cited further mobilisation of resources of institutional investors as a priority (U.S. Congress, 1993). The report recognised institutional investors not only as potential sources of capital but also as players in infrastructure finance that can bring the discipline of investment risk and return evaluations to infrastructure decision- making. Moreover, the report pointed out that new instruments would be developed to cater to the needs of these institutions. According to the report, the development of securitisation and financial derivatives in the U.S. has been attributed, at least in part, due to the investment and risk management needs of institutional investors.

Emerging market economies have put in place policies to encourage contractual savings institutions. In 1994 domestic institutional investors in Asian countries, including mutual funds, held about $109 billion(World Bank, 1995). Malaysia and Singapore accounted for 70 per cent of this account, thereby suggesting the enormous potential for saving and investment through these institutions in other countries of the region.

In many developing countries, however, the preemptive use of these funds by Govts. (through requirements to invest in govt. securities) has been a major impediment to the development of contractual savings as a source of long-term corporate finance. Govt. borrowing from contractual savings institutions deprives markets of long-term funds, limiting equity investment, stock market growth and credit to private sector.

One factor contributing to the development of domestic capital markets for infrastructure has been the programme of disinvestment of publicly owned enterprises (more specifically, infrastructure companies). In Chile, disinvestment of the state electricity utilities occurred gradually through the eighties. By 1990, individuals and pension funds held around 60 per cent of the stake in the principal state power utility. In Malaysia, the govt., decided to allow private participation in infrastructure in the 1980s and launched a disinvestment programme. “Today infrastructure stock as a percentage of total share market capitalisation is approximately 30 per cent” (Kumar A.,et.al.,1997). The Korea Electric Power Corporation periodically issues bonds to raise revenue to expand power-generating facilities. Similarly highway construction bonds are issued traded like corporate bonds. In the case of Thailand, the supply of debt instruments has increased more notably in the state enterprise bonds. In Argentina the infrastructure disinvestment program during the early nineties, which affected the power, water, gas and rail sectors has relieved heavily in strategic investors, employee equity sales and international issues.

Thus in addition to the development of equity markets, privatisation of public enterprises can provide considerable contribution to the development of the equity market. These entities can rely on their stable and longer –term revenue profile in issuing debt securities, especially long-term debt instruments. Such debt instruments help set important benchmarks for the longer end of the debt market and provide attractive opportunities for contractual saving institutions. |

| |

Indian Perspective

From the above strategic perspective, let us now look at the Indian situation. In India, the investment stipulations for insurance and Pension/ Provident Funds have been progressively liberalized. In the Insurance sector, prior to 1950, life insurance companies were required to hold 55 per cent of their assets in government and other approved securities. Investment of the remaining 45 per cent was at the discretion of the user. In the Insurance act of 1950, life insurance companies were required to invest 25 per cent of their assets in government securities, 25 per cent in government or other approved securities and 35 per cent of ‘approved investments’ which included, apart from government and approved securities, shares and debentures of public limited companies satisfying certain criteria. Life insurers could invest not exceeding 15 per cent of their assets otherwise than in ‘approved investment’. In 1958, in exercise of powers under section 43(2) of the LIC Act of 1956, Section 27A of Insurance Act was made applicable to LIC with minor modification. In 1975, the application of Section 27A of LIC was further modified. Investment requirements for LIC each year : 75 per cent of the accretion to controlled fund to – |

A. Central Government Marketable Securities |

Not less than 20 per cent |

B. A + Loans to NHB |

Not less than 25 per cent |

C. State Government Securities + B |

Not less than 50 per cent |

D. Socially Oriented Sector including public Sector, cooperative sector, house building by Policy holders, OYH Schemes + C |

Not less than 75 per cent |

|

Rest 25 per cent may be invested in private corporate sector, loans to policy holders, construction and acquisition of immovable property.

The Malhotra Committee in 1994 recommended the following pattern of deployment of life funds |

A. Central Government Securities |

Not less than 20 per cent |

B. State Government Securities & Government Guaranteed Securities inclusive of (A) above |

Not less than 40 per cent |

C. In socially oriented sectors as may be Prescribed by government from time to time inclusive of (B) above |

Not less than 50 per cent |

|

| |

Similarly, the deployment of provident fund accruals as shown below are also based on Government stipulations. The investment pattern of these funds are based on the following rules and regulations : |

|

Pension/Provident Fund |

Rules of Investment |

1. |

EPF |

Contributions are invested according to the pattern prescribed by the central government. |

2. |

Coal Mines PF scheme |

As above |

3. |

PPF |

Not available |

4. |

Gratuity |

Investment of funds administered by a trust. Investment of trust money has to be in accordance with Rule 67 of Income Tax Rules, 1962. |

5. |

LIC Group |

Central Government Securities |

- 15 per cent |

|

Superannuation Fund |

State Government Securities |

- 15 per cent |

|

|

Special Deposits |

- 20 per cent |

|

|

PSU Bonds |

- 50 per cent |

6. |

Funds pertaining to |

PSU Bonds |

- 50 per cent |

|

Annuities i.e. after vesting of pension |

Private Sector Bonds |

- 50 per cent |

7. |

Malhotra Committee recommendation 1994 |

(a) Central Government Securities |

- not less than 20 per cent |

|

|

(b) State Government

Securities including (a) |

- not less than 35 per cent |

|

|

(c) Approved investment including (b) |

- not less than 75 per cent |

|

In India, the contractual savings form one third of financial saving of households. For long, these funds were invested mostly in approved government securities and thus were a source of finance for the Budget. In the second half of the 1990s, there has taken place a discernable shift in strategy, with the Government allowing greater investment of such contractual savings towards infrastructure activities. This is expected to promote infrastructure investment.

While liberalisation of investment norms represents the sources side from the flow of funds perspective, the demand for such funds were created in many countries through a well-planned programme of divestiture of public infrastructure utilities with a view to promote private participation in infrastructure, to reduce budgetary and management obligations and to promote competition. However, there has been very little disinvestment in the transport sector. Since the 1990s, majority of the Public Sector Enterprises disinvestments have taken place in the Power, Telecom, Oil, Steel, and other infrastructure sectors. |

| |

Development of Debt Market in India and Infrastructure Financing

The developed financial markets are characterized by the existence of a sound financial and legal infrastructure that is necessary for the |

|

|

Table 4.5: Comparative Position of the Indian Corporate Debt Market (2002) |

(US$ billion) |

|

India |

Malaysia |

Hong Kong |

Singapore |

USA |

Korea |

China |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

1. |

GDP |

510 |

95 |

164 |

91 |

10,445 |

462 |

1,238 |

2. |

Government Bonds |

143 |

47 |

11 |

31 |

6,685 |

225 |

201 |

3. |

Corporate Bonds |

19 |

36 |

34 |

27 |

9,588 |

156 |

212 |

4. |

Bank Loans to Corporates |

156 |

135 |

678 |

210 |

6,976 |

609 |

2,073 |

5. |

Equity |

170 |

123 |

463 |

102 |

11,010 |

216 |

463 |

6. |

% of Corporate Bonds to GDP |

4 |

38 |

21 |

30 |

92 |

34 |

17 |

7. |

% of Corporate Bonds to Total Bonds |

12 |

43 |

76 |

47 |

59 |

41 |

51 |

8. |

% of Corporate Bonds to Bank Loans |

12 |

27 |

5 |

13 |

137 |

26 |

10 |

9. |

% of Corporate Bonds to Equity |

11 |

29 |

7 |

26 |

87 |

72 |

46 |

Source: BIS, Deutsche Bank, World Bank, World Federation of Stock Markets. |

|

development of corporate bond market, supported by a well-functioning regulatory system. The USA is, by far, the most suitable example where the corporate bond market is deep, efficient and liquid. The bond markets in UK and Euro areas are also reasonably developed. The markets for debt securities in Western European countries and Japan are much smaller than that of the U.S., not only in absolute terms but also as a percentage of GDP. Unlike in the developed financial systems, the corporate bond market has a very short history of development in the emerging market economies. A comparative position of the corporate debt market in developing countries and United States is presented in Table 4.1.

Prior to the process of economic reforms, the debt market, particularly the Government securities market, was passive. Market participants were the captive investors investing in the Government securities market for their statutory requirements. Passive debt management policy along with automatic monetisation of the fiscal deficit of the central government prevented the growth of a vibrant debt market. With the phasing out of the ad-hoc treasury bills, the stage was set for the development of both government and non-government segments of the debt market.

A number of policy initiatives were taken during the 1990s to activate the corporate debt market in India. The interest rate ceiling on corporate debentures was abolished in 1991 paving the way for market-based pricing of corporate debt issues. In order to improve the quality of debt issues, rating was made mandatory for all publicly issued debt instruments, irrespective of their maturity. The role of trustees in case of bond and debenture issues was strengthened over the years. All privately placed debt issues are required to be listed on the stock exchanges and follow the disclosure requirements.

The corporate debt market in India has been in existence since independence. Public limited companies have been raising capital by issuing |

|

|

Table 4.6: Resource Mobilization by the Corporate Sector |

(Amount in Rs. crore) |

Year |

Public

Equity

Issue |

Debt Issues |

Total

Resource

Mobilization

(2+5) |

Share of

Private

Placements

in Debt Issues

(4/5*100) |

Share of Debt

in Total

Resource

Mobilization

(5/6*100) |

Public Issues |

Private Placements |

Total (3+4) |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

1995-96 |

14493 |

5970 |

13361 |

19331 |

33824 |

69.12 |

57.15 |

1996-97 |

7928 |

7483 |

15066 |

22549 |

30478 |

66.81 |

73.99 |

1997-98 |

1701 |

2957 |

30099 |

33056 |

34756 |

91.05 |

95.11 |

1998-99 |

2622 |

6743 |

49679 |

56422 |

59044 |

88.05 |

95.56 |

1999-00 |

3230 |

4475 |

61259 |

65734 |

68964 |

93.19 |

95.32 |

2000-01 |

3111 |

3251 |

67836 |

71087 |

74198 |

95.43 |

95.81 |

2001-02 |

1025 |

6087 |

64876 |

70963 |

71988 |

91.42 |

98.58 |

2002-03 |

1233 |

3634 |

66948 |

70582 |

71815 |

94.85 |

98.28 |

2003-04 |

3427 |

4424 |

63901 |

68325 |

71752 |

93.53 |

95.22 |

2004-05 |

18024 |

3868 |

85102 |

88970 |

106994 |

95.65 |

83.15 |

|

debt securities. From 1985-86, state owned public sector undertakings (PSUs) began issuing bonds. However, in the absence of a well-functioning secondary market, such debt instruments remained illiquid. In recent years, due to falling interest rates and adequate availability of funds, corporate debt issuance has shown a noticeable rise, especially through private placements (Table 4.2).

Corporates continue to prefer the private placement route for debt issues than floating public issues. The resource mobilization through private placement picked up from Rs.13,361 crore in 1995-96 to Rs.85,102 crore in 2004-05. The dominance of private placement has been attributed to several factors, viz., ease of issuance, cost efficiency, primarily institutional demand, etc. About 90 per cent of the corporate debt outstanding has been privately placed. In the private placement market, 57 per cent of the issuances are by financial institutions and banks, both in the public and private sector. Public sector companies account for 58 per cent of privately placed issues. About 26 per cent represents issues by public sector undertakings and central/state government guaranteed bonds.

The secondary market activity in the debt-segment, in general, remains subdued both at BSE and NSE, due to lack of sufficient number of securities and lack of interest by retail investors. In order to improve the secondary market activity in this segment, the Union Budget for 1999-2000 abolished stamp duty on transfer of dematerialized debt instruments. This enabled a pick up in the turnover in corporate debt at NSE from Rs.5,816 crore in 2002-03 to Rs.17,521 crore in 2004-05. The share of turnover in corporate debt securities in total turnover at WDM segment of NSE, however, remains small at around 2 per cent.

Policy initiatives to promote the Corporate debt market has crucial linkages with the financing of infrastructure sector.

First, a well developed debt market with a diversified investor base helps the commercial banks to manage their asset-liability mismatch for financing infrastructure through the use of derivative products. For instance, the limitations on exposure norms on commercial bank funding of infrastructure projects can be managed with the help of credit derivatives. Likewise, a number of products can exist in a well developed debt market.

Second, the development of the debt market will facilitate the process of asset securitisation in India. The Asset Securitisation Bill is on the anvil, which will encourage the banks and financial institutions to securities receivables and offer investors with liquidity at various stages of the infrastructure project.

Third, from the risk management perspective, a well developed debt market will facilitate the unbundling of credit risk from the liquidity and interest rate risk. As the secondary market in debt develops, debt instruments can be traded freely mitigating liquidity risks of infrastructure finance.

Fourth, the development of debt market leads to setting of benchmarks in the financial markets and helps in the price discovery process. This

ensures that finances are provided for infrastructure projects at market related rates.

At present, India is fairly well placed as far as pre-requisites for the development of the corporate bond market are concerned. There is a developed government securities market that provides a reasonably dependable yield curve. The major stock exchanges have trading platforms for the transactions in debt securities. Infrastructure for clearing and settlement also exists. The Clearing Corporation of India Limited (CCIL) has been successfully settling trades in government securities, foreign exchange and money market instruments. The existing depository system has been working well. The settlement system has improved significantly during the recent years. The settlement in government securities has moved over to delivery versus payment (DVP III)1 since March 29, 2004. The Real Time Gross Settlement (RTGS) is expanding its reach rapidly. RTGS has become operational for the commercial bank transactions in certain cities. The presence of multiple rating agencies provides an efficient rating mechanism in India.

With improvements in the legal and regulatory frameworks, and accounting and auditing standards for issuers, the Indian corporate debt market has the potential to become an important source of infrastructure financing in future.

A Sum Up

The commercial banking sector’s involvement in transport financing could be broadly classified into two groups: (a) Advances to transport operators including those under priority sector lending scheme, and (b) Project financing. Of the outstanding credit to the transport sector, a little

more than 70 per cent has been provided under the priority sector schemes. An important factor contributing to the reduction in bank finance to the sector was the increasing number of default cases. Main reasons for the poor recovery included: a) inability of small operators to repay loans; b) willful default due to political influence; c) legal complications; and d) National system of permits which enables a truck operator to operate in number of states. Further, poor recovery varied from State to State. While repayment was found to be satisfactory in States like Rajasthan and Tamil Nadu, where there is an efficient back-up government machinery, in the case of States like Bihar and U.P., the recovery performance was poor. The study observes that the flow of funds from the banks would improve considerably if the recovery mechanism could be made more effective.

Long-term commitments (either by way of loans or equity contributions) to infrastructure projects by Banks would create a serious maturity mismatch between the assets and liabilities. This mismatch could be even more precarious in the absence of efficient and liquid money markets that would otherwise provide banks with some tools to manage their liquidity and interest rate risks. In April 1999, banks were permitted to sanction term loans to technically feasible, financially viable and bankable projects through four broad modes of financing: (i) financing through funds raised by subordinated debt (Tier II); (ii) entering into takeout financing; (iii) direct financing through rupee term loans, deferred payment guarantees; and (iv) investments in infrastructure bonds issued by project promoters and financial institutions. Take-out Financing mechanism, though in its nascent stage in India, provides opportunities to the commercial banks to create long term assets from short term liabilities. The participation of a long-term player is crucial in this mechanism. After a specified period of time, the long-term asset is transferred to the books of the long-term financial institution.

The commercial banking system is very rigid its approach in respect of financing transport operators which often resulted in considerable delays in processing loan applications. The financing of transport operators through NBFCs is an emerging route. In view of the large numbers of individual borrowers, management efficiency considerations suggest that creditworthy NBFCs should act as intermediaries in the entire process. In other words, banks could play the role of “Wholesale financing/banking” while the NBFCs could play the role of “retail financing /banking”. Some of the major players in the NBFC segment have, over the years, developed a special expertise in evaluating credit worthiness of potential borrowers (especially in truck financing) which is supported by an effective delivery system, in turn, backed up by an effective recovery management system which operates on the basis of a large retail network. This has occurred because many of NBFCs have focussed exclusively on commercial vehicle operators. From the demand side, it appears that operators prefer NBFCs to banks for a variety of reasons ranging from the attention they get for individual needs such as design of customer-oriented funding options to flexibility in recovery such as restructuring of payments in the case of genuine financial difficulties.

At the same time, there is a need to increase bank support to NBFCs in the near future, mainly because: |

• It will provide substantial relief to transport financiers (NBFCs) which have been facing a severe resource crunch following restrictions on the mobilisation of public deposits. Banks look upon NBFCs as their competitors in terms of both deposit mobilisation and credit expansion.

• The classification of bank support to NBFCs under priority sector lending will enable banks to fulfill their targets under the scheme, which would also be based on a satisfactory recovery mechanism. |

All India financial institutions, including, IDBI, IFCI, ICICI, SIDBI and IIBI play a crucial role in providing infrastructure finance. They along with State Industrial Development Corporations provide long term finance to transport sector. Furthermore, the Infrastructure Development Finance Company (IDFC) was set up as a specialized intermediary to address the needs of the infrastructure sector and to facilitate the flow of private finance to commercially viable projects. The role of IDFC is crucial in transport financing in terms of (a) mitigating commercial and structural risk of transport projects and (b) designing innovative products. The Union Budget for 2002-03 entrusted additional responsibilities on the IDFC by creating an Infrastructure Equity Fund of Rs.1000 crore which would be structured and managed by IDFC and by requiring the company to play a coordinating role for debt financing by major financial institutions and banks for infrastructure projects larger than Rs.250 crore.

In East Asian economies, although government bonds continue to be the predominant mode for infrastructure financing, the move towards privatisation of infrastructure services and new investment by the private sector has not only reduced the need for government bond financing but has also facilitated and accelerated the pace of corporate issues and the development of corporate bond markets. Two features that stand out in regard to the development of the debt market in developing countries in recent years. (i) availability of contractual savings for infrastructure financing; and (ii) divestment of public enterprises and role of existing enterprises in mobilising long-term debt.

In India, since the Malhotra Committee recommendations, there has been progressive liberalization of investment norms of contractual savings instruments. This opens up supply of funds for transport sector, among other long term investment areas. The demand for such investible funds can come from (a) growth of private sector and (b) disinvestment of public

sector enterprises in the transport sector (through bond issues by such PSEs).

A well-developed debt market with a diversified investor base helps the commercial banks to manage their asset-liability mismatches. The development of bond markets facilitates the development of derivative products such as credit derivatives to hedge against credit risk. A deep liquid debt market ensures setting up benchmarks and helps the price discovery process. It also ensures the unbundling of credit risks, interest rate risk and liquidity risk. Major steps towards development of the debt market include: (i) developing a system of primary dealers in the government securities market; (ii) introduction of liquidity adjustment facility (LAF) to address temporary liquidity mismatches of financial institutions and also to provide interest rates segment to the market; and (iii) investment norms for contractual saving institutions were liberalized to promote a more proactive role of debt market towards infrastructure financing. |

| |

| |

1 Under DVP III mode of settlement, both securities leg and funds leg of transactions are settled on a net basis. |

IST,

IST,