IST,

IST,

Introduction

Chapter I |

|||||||||||||||||||||||||||

Introduction |

|||||||||||||||||||||||||||

The importance of infrastructure financing towards economic growth can hardly be overemphasized. It has remained a principal area of State intervention in India, given the sector’s fundamental contribution to economic growth and social welfare. The extent of State intervention was justified by market failure hypotheses, high risk perception emanating from long gestation periods, irregular revenue flows, higher average debt-equity ratio, and economies of scale as well as substantial sunk costs reflected in the high costs of entry and exit. While the Government entered many spheres of the infrastructure sector, public sector ownership, management and financing of infrastructure in India started showing several forms of inefficiencies which has impeded the generation of adequate internal surpluses leading to excessive dependence on budgetary support. In most countries, the predominant source of financing of transport infrastructure and services has traditionally been the State, with the private sector playing a secondary role. In recent years, a major issue in providing adequate transport is the insufficiency in the flows of funds from conventional sources (mostly public agencies) to meet the requirements of new investment and maintenance of transport systems, due to inefficient public sector management of its transport assets, and pricing of services which have been kept at a lower level to fulfill the social objectives. The need for more efficient alternatives has stemmed from a changing perspective regarding the role of governments in the provision of transport services over the last two decades, which has been further strengthened by success of the private sector in the creation of wealth and incentive effects in various segments of the transport sector. Accordingly, intense interest in the private provision of transport infrastructure and services and the necessity of forging effective public-private alliances have emerged. |

|||||||||||||||||||||||||||

The Developing Country Perspective |

|||||||||||||||||||||||||||

The provision of infrastructure services through traditional institutional arrangements - public sector financing and operation - has generally been fraught with inefficiencies. Low productivity of labour and capital, weak incentive structures, neglect of timely maintenance, lack of sufficient links between demand and supply, soft budget constraints, the absence of financial risk management and the entwining of financial management of public enterprises providing infrastructure services with macroeconomic management are only a few sources of inefficiencies that have characterized the provision of infrastructure services especially in developing countries. The World Development Report (World Bank, 1994) has provided some information on the annual costs to developing countries of inefficiencies in the traditional structure of provision of infrastructure services (Table 1.1) and considerable gains that can be achieved through appropriate reform (Table 1.2). Transport Financing in India : Problems and Challenges |

|||||||||||||||||||||||||||

Emerging Requirements for the Transport Sector |

|||||||||||||||||||||||||||

Available demand based and need based estimates of the financing gap in the transport sector indicate the investment requirements of a very |

|||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||

high magnitude. The most comprehensive effort at estimating the investment requirement for the transport sector was done by the India Infrastructure Report. The Report projected gross domestic investment in infrastructure in India to grow from the current level of 5.5 per cent of GDP in mid nineties to about 7 per cent in 2000-01 and 8 per cent in 2005-06. Thus, it would continue to comprise 22 to 25 per cent of gross domestic investment. While arriving at the overall macro estimation, the report took into consideration the Indian experience over the past 15 years, observing broad generalities of infrastructure investment across the world and examining in particular the East and South East Asian experience over the past two decades. Sectoral additional requirement of funds were also estimated by the report. For the road sector, investment requirement was about Rs.100 billion in 2000-01 and Rs.150 billion in 2005-06. The requirements for ports estimated by the Report was about Rs.24 billion in 2000-01 and Rs.40 billion in 2005-06. |

|||||||||||||||||||||||||||

The India Infrastructure Report observed that the projected share of the private sector in infrastructure investment would increase from the current 25 per cent to 40 per cent in 2000-01 and to about 45 per cent by 2005-06. This would mean an increase in private sector infrastructure investment from 1.0 - 1.3 per cent of GDP to 2.8 – 3.0 per cent of GDP by 2000-01 and to 3.5 per cent by 2005-06. In absolute numbers, it implies an increase from the current Rs.160 billion to about Rs.430 billion in 2000-01 and about Rs.800 billion by 2005-06. |

|||||||||||||||||||||||||||

Other estimates of investment requirement include the estimates by the Expert group on Commercialisation of Infrastrcture projects, which estimated that to meet projected growth of infrastructure, India would have to invest $ 115-130 billion and $ 215 billion for the five years after that. This effectively means an additional 20,000 crore per year in Ninth Plan, which will be further enhanced to Rs.30,000-35,000 crores a year in the Tenth plan. |

|||||||||||||||||||||||||||

Traditional Form of Financing the Transport Sector |

|||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||

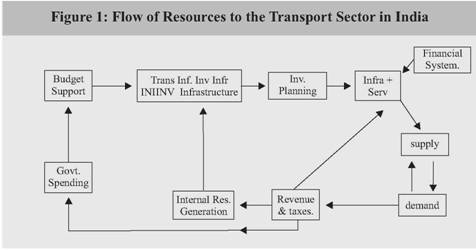

| Government Budgetary Support to infrastructure and internal resource generation are the main sources of transport financing in India, supported to some extent by the financial system. An important component of the new economic policy framework introduced in India in the early nineties is the resolve to correct the fiscal deficit by emphasizing internal resource generation with a view to reduce budgetary support to public sector organizations in general including the transport sector. This envisages encouraging the public sector to generate maximum internal resources to finance future expansion programmes without having to depend on government support by motivating them to operate on business- like principle without relying on public funds to close the resource gap. For a developing country like India which has built up substantial transport infrastructure capacity, strategies for further development must necessarily take into account the issue of whether the dependence on budgetary resources is one of resource availability or efficient management of service delivery or both. |

|||||||||||||||||||||||||||

Scope of the Study |

|||||||||||||||||||||||||||

| a) possible improvements in the overall efficiency of state- controlled enterprises ; b) the continuing role of the state in financing of transportation infrastructure and services; c) opening up of transport activities for private sector participation and the appropriate course of action for the process of unbundling of activities to the private sector and d) the emerging role of the increasingly competitive and liberalized financial system in financing transport infrastructure and services. |

|||||||||||||||||||||||||||

| The present study addresses the above issues relating to the financing of transport infrastructure and services. Reviewing the existing literature in the national and international context, the study tries to develop a pragmatic policy framework in India. The introductory chapter discusses the problems with transport financing. We discuss the existing estimates of resource gap in transport sector in India and the problems that constrain the transport sector. Chapter 2 deals with the inefficiency of public sector in transport. Two segments of transport sector are discussed in this chapter-viz., the Railways and the road transport undertakings. Both sectors are affected by inefficiencies and social pricing of services. Discussing the two sectors, the study tries to evolve a strategy towards improved resource generation. Chapter 3 deals with the role of the State in financing transport infrastructure and services. Given the central role of the State in the provision of roads, due to its strong public goods traits, the Chapter highlights that state presence is critical in the sector in the coming future. However, the study stresses the need for a significant transformation in the modes of state intervention. A critical aspect of State intervention in India would be to facilitate greater public-private cooperation in the sector. The scope of public-private sector cooperation is discussed in the Chapter with respect to the road sector, the railways and the seaports in India. Discussing the international experience, the chapter tries to evaluate the lessons learnt from the Indian experience and tries to chalk out the road ahead towards effective public-private partnerships in the road sector. Chapter 4 evaluates the emerging role of the financial sector in India in financing transport infrastructure and services. The financial sector in India has undergone a radical transformation over the last decade in India resulting in the availability of a wide range of financial instruments and the development of financial markets. The changing face of the financial sector paves the way for a more active role of the financial sector in ransport financing. The Chapter discusses the prospects of the financial sector in mobilizing resources towards the transport sector. Chapter 5 presents the concluding remarks and the policy suggestions of the study. | |||||||||||||||||||||||||||

| The study is not designed to be a thorough review of the transport sector. Rather, it tries to address specific issues relating to transport financing in India. While discussing the issues, appropriate sector specific examples have been highlighted. | |||||||||||||||||||||||||||

Page Last Updated on: September 12, 2023