IST,

IST,

Is India’s Trade Balance Sensitive to Real Exchange Rates? A Bilateral Trade Data Analysis

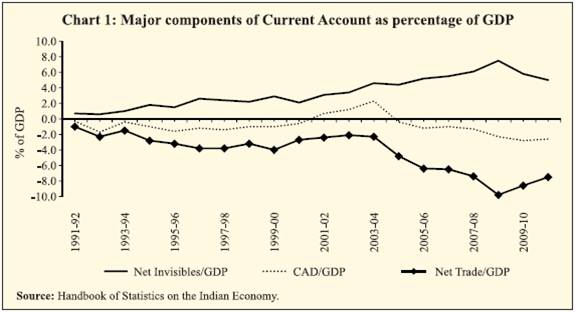

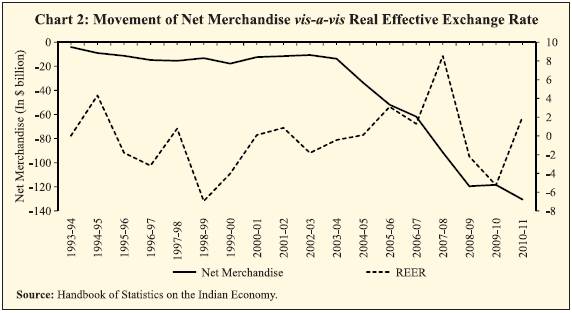

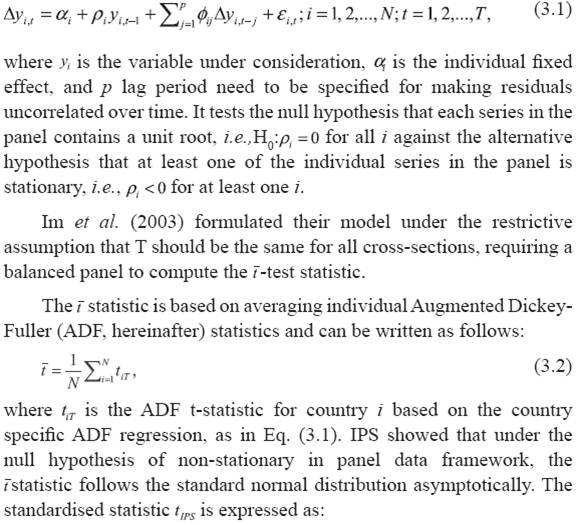

Vivek Kumar and Vishal Maurya* India’s considerable current account is characterised by large merchandise trade deficit even though invisibles account has been in surplus. In this context, this study analysed the effect of real exchange rate on India’s bilateral trade balance with her trading partner countries. This is the first attempt to examine the long-run effects of bilateral real exchange rate on bilateral trade balance of India with her 89 trading partner countries. The study uses Fully Modified Ordinary Least Square (FMOLS) method, a non-parametric heterogeneous panel cointegration technique, for removing the endogeneity problem among regressors. The result shows an existence of a long-run relationship between India’s trade balance and real exchange rate. India’s trade balance would improve with the real depreciation of exchange rate in the long run but deteriorate with the rise of India’s real income. JEL Classification : F31, F41, C33 Introduction: India has been experiencing the current account deficit (CAD) with intermittent changes. In 1991, it reached a high of 3 percent of GDP and forex reserves were almost depleted to the level that the import bill could not be financed even for three weeks leading to major balance of payments (BoP) crisis. To overcome this problem, government took several policy initiatives to improve the BoP crisis including acceptance of the chapter VIII of the International Monetary Fund (IMF) thereby making the current account transactions convertible. Accordingly, under the exchange rate management system, the unified exchange rate was accepted and initiatives were taken for promoting the export, attracting non-resident deposits, etc. Due to these initiatives, the CAD moderated in the range of 1 to 2 percent of GDP till the period 2007-08 including brief surplus period during 2001-02 to 2003-04. In the recent period, large CAD posed a serious concern for the policy makers as it reached to 2.6 percent of GDP in 2010-11 and has remained higher than that level in the subsequent period. Large trade deficit has been the main driver for the CAD even though the invisibles account has remained in a surplus for a long time (Chart 1). The reason for the merchandise trade deficit in recent years is continuous higher growth in imports as compared to exports. There are two approaches namely internal approach and external approach, which help to reduce trade deficit through increasing country’s competitiveness. The internal approach depends on the supply-side policies like curbing inflation, improving labour market conditions, increasing labour productivity, etc., whereas external approach depends on depreciating the local currency. On the presumption that a simple relationship exists among the exchange rate, the price of imports and exports and the subsequent demand for imports and exports. However, the outcome depends on the price elasticity of demand for both imports and exports. When the exchange rate appreciates or depreciates, the relative prices of imports and exports change. As per the Marshall-Lerner conditions, devaluation/ depreciation of currencies will be effective to correct the adverse trade balance if the sum of elasticity of import and exports is more than unity. Empirical studies show that Marshall-Lerner condition holds in the industrialised countries in the long run even though trade balance would deteriorate in the short run in the event of currency depreciation. For export and import contract made before the depreciation of currency, post-devaluation would increase the import bill which would deteriorate the trade balance in the short run. However, in the long run, imports begin to decline and exports pick up with depreciation of currency. Consequently, deterioration in the trade balance is halted and trade balance condition starts to improve. Such phenomenon is also known as J-curve effect. The movement of India’s trade balance vis-a-vis the percentage change in real effective exchange rate based on 36-currency bilateral trade is shown below in Chart 2. It may be observed that depreciation of real exchange rate has impact on improving the bilateral trade for the period 1993-94 to 2003-04 and 2008-09 to 2009-10. The remainder of the paper is organised as follows: Section II presents a brief overview of studies undertaken on the impact of exchange rate on the trade balance. Section III describes the econometric methodology. Section IV presents the theoretical model used here. Data sources and definitions are provided in the section V along with the empirical results. Section VI, the final section, provides the summary and conclusions. Section II A number of empirical studies investigate the effects of real exchange rate on India’s trade balance. Most of them employ an aggregate approach (see Bahmani-Oskooee (1991), Bahmani-Oskooee and Alse (1994), Buluswar et al. (1996), Tarlok Singh (2002) for more details). While these traditional studies use aggregate trade data to investigate export and import demand elasticities in order to establish whether the so-called Marshall-Lerner condition holds, they suffer from an aggregation bias. They overlook significant elasticities with some trading partners, it can be more than offset by insignificant elasticities with other trading partners in the process of aggregation. If the responses to changes in exchange rates differ across trading partners, the aggregate trade flow approach could provide misleading results. Junz and Rhomberg (1973), Magee (1973), Miles (1979), Levin (1983), Meade (1988), Noland (1989), Rose (1990), Bahmani-Oskooee and Malixi (1992), Boyd et al. (2001), Lee and Chinn (2002), Lal and Lowinger (2002), Hacker and Hatemi-J (2003), and others have a major contribution in the study for aggregate trade data for countries other than India. A number of studies also had been carried out based on bilateral trade to avoid the aggregation base errors. A pioneer work relating to bilateral trade includes Rose and Yellen (1989), Marquez (1990),Bahmani-Oskooee and Brooks (1999), Gupta-Kapoor and Ramakrishnan (1999), Wilson (2001), Bahmani-Oskooee and Kanitpong (2001), Hacker and Hatemi-J (2003, 2004), Bahmani-Oskooee and Goswami (2003), Onafowora (2003), Bahmani-Oskooee and Ratha (2004, 2007). For detailed review of previous studies on bilateral trade, we refer Bahmani-Oskooee and Ratha (2004a). In their study, Bahmani- Oskooee and Ratha (2004a) found that real depreciation of currency has different impact on trade balance in the short run while in the long run the real depreciation of the currency improves the trade balance. In the context of India, no study on the effect of exchange rate on the bilateral trade has been done except the study by Arora et al. (2003) and Dhasmana (2012). Arora et al. (2003) have investigated the short-run and the long-run effects of real depreciation of the rupee on India’s’ trade balance with her seven largest trade partners for quarterly data of the period 1977-1998. They used the ARDL (Pesaran and Shin 1995, Pesaran et al. 1996) technique to investigate the impact of currency depreciation on improving trade balance against seven largest merchandise trade partners. They found a positive impact of real depreciation of currency on India’s trade balance with Australia, Germany, Italy and Japan in the long run. Recently, Dhasmana (2012) has supported the finding of Arora et al. (2003) and found that real exchange rate volatility depreciation is associated with an improvement in India’s trade balance in the long run. In addition to the limitations of aggregated data, the results of above cited studies suffered from the problem of endogeneity among each variable. Rose and Yellen (1989), Summary (1989) and Bahmani- Oskooee and Wang (2006) showed in their respective studies that trade balance, income, and real exchange rate are endogenous. To avoid this problem of endogeneity, Chiu et al. (2010) utilises the fully modified ordinary least squares (FMOLS) approach proposed by Phillips and Hansen (1990) and extended by Pedroni (2000) to investigate the effect of real exchange rate changes on the U.S. trade balance. They found that geographical structure and income per capita of the partner countries may also affect the bilateral trade balance. In this paper, we follow the Chiu et al. (2010) study to examine the effects of bilateral real exchange rates on bilateral trade balance for India vis-a-vis eighty nine of her trading partners (see Appendix 2 for the list of countries) for the period 1991-2010. We have considered the data since 1991 due to change in the exchange rate policy from fixed exchange rate regime to floating exchange rate regime. Trade with partner countries can be influenced by many factors like the geographical location of the partner countries, income level of the partner countries, international treaty with the partner country and member of international organisation. Thus, this study classifies the sample data into ten sub-samples to explore whether the locations, international treaty and levels of the real income of the India’s trading partners exhibit different impacts on the relationship between currency depreciation and the India’s bilateral trade balance. In addition to the ten sub-sample groups, we have also considered one more group of ten major partner countries which constituted around 55 per cent of India’s total trade. Section III III.1. Panel unit root tests In this study, we have used the panel unit root tests given by Maddala and Wu (1999, hereafter MW) and Im et al. (2003, hereafter IPS) for testing the level of integration of all the variables. The ability of these tests to allow for heterogeneity in the autoregressive coefficient makes them more powerful than the tests developed by Levin and Lin (1993) and Levin et al. (2002). The IPS tests solved the serial correlation problem of Levin and Lin’s tests by assuming the heterogeneity between units in a dynamic panel framework. In IPS test, a separate ADF regression has been specified for each cross section as:

Breitung (2000) found that the IPS test is more sensitive to the specification of deterministic trends as compared to the MW test. Moreover, the advantage of MW test over IPS test is that the former is robust to the different lag lengths in the individual ADF regressions. III.2. Panel cointegration tests Once it is confirmed that all the variables are stationary at first difference, the next step is to test for the cointegration among these variables. For this, we used the panel cointegration tests proposed by Pedroni (1999). Like IPS and MW unit root tests, Pedroni’s cointegration methodology (see Pedroni (1999, 2004) for details) also takes into account the heterogeneity by allowing specific parameters to vary across individual members of the sample. The advantage of taking into account of such heterogeneity is that it helps us in relaxing the unrealistic assumption of identical vectors of cointegration among individuals in the panel. The implementation of Pedroni’s cointegration test requires estimating first the following long-run relationship:  The finite sample distribution for the seven statistics has been tabulated by Pedroni through Monte Carlo simulations. The calculated test statistic must be smaller than the tabulated critical value to reject the null hypothesis. III.3. Panel Cointegration estimations Although Pedroni’s methodology allows us to test the presence of cointegration, it cannot provide an estimate of the long-run relationship. For panel frameworks, several estimators are proposed in the presence of cointegration: Ordinary Least Square (OLS), Fully Modified OLS (FMOLS) and Dynamic OLS (DOLS). Chen et al. (1999) analysed the properties of the OLS estimator and found that the bias-corrected OLS estimator generally does not improve over the OLS estimator. These results suggest that alternatives such as the FMOLS estimator or the DOLS estimator may be more promising in cointegrated panel regressions. In this paper, we have considered FMOLS to examine the effect of exchange rate on India’s trade balance. The FMOLS is popular in conventional time series econometrics, for it is believed to eliminate endogeneity in the regressors and serial correlation in the errors. Pedroni (2000, 2001) proposes two methods to apply the fully modified method to panel cointegration regression: the pooled (or within group) panel FMOLS estimator and the group-mean (between-group) FMOLS estimator. We use the between-group FMOLS estimator as it permits greater flexibility in the presence of the heterogeneity of cointegrating vectors. The group-mean panel FMOLS estimator can be written as:

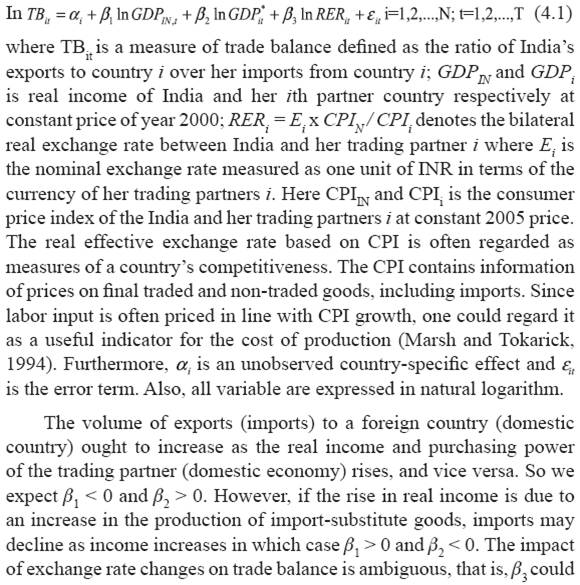

Section IV The international trade between the countries depends on the relative competitiveness in producing the goods and the national income of the country. In this model, the real exchange rate as proxy of competitiveness of producing goods and real GDP as the proxy for the national income are considered as influencing factors affecting the bilateral trade balance. Therefore, the model is specified as follows:  be positive or negative. If there is a real depreciation or devaluation of the domestic currency, that is RER decreases, then the increased competitiveness in prices for the domestic country should result in it exporting more and importing less (the “volume effect”). However, the lower RER also increases the value of each unit of import (the “import value effect”), which would tend to diminish the trade balance. Krugman and Obstfeld (2001) argued that in the short run import value effects prevail, whereas the volume effects dominate in the longer run. Section V V.1 Data The annual data used in this study cover the period from 1991 to 2010. To explore the possible impact of international treaty, locations and the income levels of the India trading partners on the relationship between trade balance and real exchange rate, we classify the 89 trading partners into 11 groups (3 International treaty group, 4 regional group, 3 Income group and a group of Major trade partner countries, see Annex 2 for further details). The first three groups are International treaty group which includes Oil exporting countries, SAARC countries and ASEAN countries. The four regional groups include Africa, America, Europe and Asia and Oceania, and the three income groups based on 2008 gross national income (GNI) per capita (the World Bank Atlas method) are low income (US$975-3,855), middle income (US$3856–$11,905), and high income (US$11,906 or more). The data of exports and imports are taken from the Direction of Trade statistics published by the International Monetary Fund. The domestic and foreign real gross domestic product (GDP), CPI, and nominal exchange rate come from World Development Indicators. In the wake of the European Union and the new currency ‘Euro’, the nominal exchange rates are defined as one unit of INR in terms of Euros. We convert their nominal exchange rates into one unit of INR in terms of Austrian schilling, Belgian franc, Cypriot pound, Dutch guilder, Estonian kroon, Finnish markka, French franc, German Mark, Greek drachma, Irish pound, Italian lira, Luxembourgish franc, Maltese lira, Monegasque franc, Portuguese escudo, Sammarinese lira, Slovak koruna, Slovenian tolar, Spanish peseta, Vatican lira by multiplying the fixed converted ratios: 13.7603, 40.3399, 0.585274, 2.20371, 15.6466, 5.94573, 6.55957, 1.95583, 340.75, 0.787564, 1936.27, 40.3399, 0.4293, 6.55957, 200.482, 1936.27, 30.126, 239.64, 166.386, 1936.27 respectively. Limitation of the data: As per guidelines of International Monetary Fund (IMF) or World trade organization (WTO), the data on merchandise trade has been compiled based on the physical movement of goods crossings the boundary of compiling economy. Those goods which do not cross the boundary of the compiling economy will not be recorded in the merchandise trade statistics. As per the guidelines of IMF, the goods exported/imported by the subsidiaries of the Indian companies should be counted in the statistics of those countries where the subsidiaries are incorporated. We have used the Consumer Price Index (CPI) to convert the nominal GDP and nominal exchange rate to real one. As in the case of India, Wholesale Price Index (WPI) is considered as a better price index, but making the data comparable with other countries, we have used CPI. V.2 The unit root tests The outcome of the two panel unit roots test: IPS and MW are given below. It may be seen that both the tests fails to reject the null hypothesis of unit root for all the groups (Table 1), i.e., the panel data series for the entire four variables at level are non-stationary. Hence, we test for stationary of the variables at first difference and both the IPS and MU test results indicate that variables at first difference are stationary (Table 2). This implies that all the variables under consideration follows an I (1) process. V.3 Panel Co-integration tests Since all the variables are stationary at first difference, we employ panel cointegration test (Pedroni, 1999) to test the existence of cointegration among the variables. The results of the tests are given in Table 3. We use four within-group tests and three between-group tests to check whether the panel data are cointegrated. All the tests reject the null hypothesis of no cointegration between the variable at 1 per cent level of significance for the group of all the countries, Africa, America, Europe, Asia & Oceania, HL, ML, and LI whereas for other groups, the null hypothesis is rejected at 5 per cent or 10 per cent level of significance. It suggests that there is a long run relationship between the trade balance, exchange rate, GDP of India and GDP of partner country.

V.4. FMOLS Results The estimation based on the FMOLS for the Groups of countries has been provided in the Table 4. The FMOLS estimates are obtained using the RATS code provided by Peter Pedroni. The coefficient of India’s real Income (lnGDPIN) and real exchange rate (lnRERi) is negative and statistically significant at 1 per cent level and 5 per cent level respectively for the group of all the countries which indicates that the trade balance will deteriorate with the increase of India’s income and the depreciation of the Indian rupees will improve the trade balance in the long run, respectively. Also, the coefficient of partner country’s real income (lnGDPi) is positive and statistically significant at 1 per cent level of significance and is greater than the coefficient of lnGDPIN indicating that the increase in the partner country’s real income in comparison to India’s real income will improve India’s trade balance more effectively. The empirical results for the three different international treaty groups reveal that the India’s bilateral trade balances with her trading partners in SAARC countries become worse if India’s real income rises. When the real income rises in SAARC countries, the demand for India’s goods and services increases and the India’s trade balance improves. The depreciation of the exchange rate has no impact on improving the India’s trade balances with the SAARC countries. In case of the SAARC countries, the income level of the partner countries have the major role in fostering the trade between these countries rather than the exchange rate because of the probable advantage of the proximities of countries in mitigating the transport costs. However, the coefficient of real exchange rate (lnRERi) of ASEAN group is found to be negative and statistically significant which implies that the depreciation of the Indian rupees can improve the bilateral trade balance with ASEAN countries. The real income of India and her trading partners in ASEAN countries has also significant effect on India’s trade balance. In case of the Oil exporting countries, the coefficient of real exchange rate is found to be negative and statistically significant indicating that the depreciation of the real exchange rate would improve the trade balance with the oil countries which is counter-intuitive given the high dependency of India on oil imports. However, on further examination, it was found that the Indonesia has very little share of around 2 per cent of oil export in its total export to India. We therefore, re-estimated the coefficient of the variables for the oil exporting countries excluding Indonesia and not surprisingly found that the real exchange rate is the insignificant factor for improving the trade balance in case of the oil exporting countries. Like SAARC and ASEAN groups, the real income of India and her partner countries belonging to four regional groups, i.e., Africa, America, Europe and Asia & Oceania, are found to be significant factors affecting the bilateral trade balance of India. The results reveal that the rise in the real income of these countries will improve the trade balance of India. On the other hand, the increase in the India’s real income will deteriorate the bilateral trade balance of India with these countries. The coefficient of real exchange rate is statistically significant and carries correct negative signs in case of Asia & Oceania. It implies that the depreciation of the Indian rupee can improve the bilateral trade balance with this group of countries. Turning to the empirical results for the three income groups, the estimated coefficient of the real exchange rate is found to be negative and statistically significant only in the case of middle income group countries revealing that depreciation of Indian rupee can improve the bilateral trade balance of India with these countries. The rise in the real income of High income and Middle income group countries can improve the trade balance of India with these countries. In case of Low income group countries, neither the real income nor the real exchange rate has any impact on the India’s trade balance with this group. Depreciation of real exchange rate has no impact on improving the trade balance with the major countries whereas the real income of the major countries have a significant effect on improving its trade balance with major partner countries. In case of ASEAN and Asia & Oceania countries, the coefficient of the exchange rate is less than -1 and statistically significant which fulfi ls the Marshall-Learner condition of the J-curve. In the long run, therefore, there is a positive impact of the exchange rate depreciation in improving the trade balance with the countries of these groups. The estimation based on the FMOLS for the 89 individual partner countries is given in the Annex 1. The empirical results reveal that real exchange rate is statistically significant at 5 per cent level in 36 countries, out of which, 22 partners countries have the negative sign indicating that real depreciation of Indian rupee can improve the bilateral trade balance of India with these countries. The coefficient of India’s real income are statistically significant for 39 partner countries with negative sign at 5 per cent level of significance, indicating that rise in India’s real income will deteriorate the bilateral trade balance of India with these countries due to an increase in the imports from these countries. The coefficient of the foreign real income is statistically significant with positive sign in 36 cases whereas 13 cases are found to be statistically significant with a negative sign. The countries with positive sign of coefficient of foreign real income indicate that the rise in the income of these countries will improve the India’s trade balance due to increase in the demand for goods and services of India in these countries. In case of individual trade partner countries, it is observed that there is no impact of real exchange rate depreciation in improving the trade balance with the USA which is in agreement with the study due to Arora et al. (2003). However, the effect of exchange rate with Australia, Italy and Japan is found to be insignificant whereas it is significant in case of UK for improving the trade balance of India contradicting the findings of Arora et al. (2003). Also, our empirical findings for India and China are consistent with Arunachalaramanan and Golait (2011) whereby the trade deficit with China can be improved by a depreciation of the real exchange rate. In case of the USA and Australia the national income of the partner countries has a positive impact on India’s trade balance as the income of these partner countries increase there will be more demand of the Indian goods. In case of United Kingdom and China, the co-efficient of their real income is negative and significant at 10 per cent level which shows that the rise of their national income would not create the demand for the Indian goods, one of the reasons might be the producing of the same at their home. In case of some of major partner countries such as with Canada, Norway, Denmark, France, Germany and Sweden, the real exchange rate is positively significant indicating the value effects of real exchange rate with these countries. With the depreciation of the real bilateral exchange rate with these countries, India’s trade balance will deteriorate. In the long run, real depreciation of rupee has a negative relation with India’s trade deficit i.e., real depreciation of currency is effective in correcting the adverse trade balance through increased competitiveness. In case of trade with the Asia & Oceania and ASEAN countries, the elasticity of import and exports is less than -1 and validates the Marshall-Lerner condition. In the long-run, the real depreciation of INR will improve the trade balance with these groups of the countries. In case of Africa, SAARC, High-income and low income group countries, depreciation of real exchange rate would not improve the trade balance, and more structural measures may be necessary to improve trade balance. India’s trade with the oil exporting countries is relatively inelastic due to large oil imports and the effect of real exchange rate on trade deficit is found to be statistically insignificant in these countries excluding Indonesia. In the case of the groups of all countries, the Marshall- Lerner condition (J-curve effect) does not hold due to the aggregation bias. However, the J-curve effect has been observed in the 17 trading partner countries of India where the major countries are Belgium, Indonesia, Malaysia and UAE. References Arora, S., Bahmani-Oskooee, M. and Goswami, G. G. (2003). “Bilateral J-curve between India and her trading partners”, Applied Economics, Vol. 35, pp.1037–41. Bahmani-Oskooee, M. and Pourheydarian, M. (1991). “The Australian J-curve: a re-examination”, International Economic Journal, Vol. 5, pp.49–58. Bahmani-Oskooee, M. and Malixi, M. (1992). “More evidence on the J-curve from LDCs”, Journal of Policy Modeling, Vol. 14, pp.641–53. Bahmani-Oskooee, M. and Alse, J. (1994). “Short-Run versus Long-Run Effects of devaluation: Error-Correction Modeling and Cointegration”, Eastern Economic Journal, Vol. 20, pp. 453–464. Bahmani-Oskooee, M. and Brooks, T. J. (1999). “Bilateral J-curve between US and her trading partners”, WeltwirtschaftlichesArchiv, Vol. 135, pp.156–65. Bahmani-Oskooee, M. and Goswami, G. G. (2003). “A disaggregated approach to test the J-curve phenomenon: Japan vs. her major trading partners”, Journal of Economics and Finance, Vol. 27, pp.102–13 Bahmani-Oskooee, M., Kanitpong, T., (2001). “Bilateral J-curve between Thailand and her trading partners”, Journal of Economics Development, Vol. 26, pp.107–117. Bahmani-Oskooee, M., and A. Ratha (2004a), “J-Curve – A Literature Survey,” Applied Economics, Vol. 36, Issue 13, pp.1377-98 Bahmani-Oskooee, M., Wang, Y., (2006). “The J curve: China versus her trading partners”, Bulletin of Economic Research Vol. 58, No.4, pp.323–343. Bahmnai-Oskooee, M., and A. Ratha (2007). “The Bilateral J-Curve: Sweden versus Her17 Major Trading Partners,” International Journal of Applied Economics, Vol. 4, No.1, pp.1-13. Boyd, Derick, Guglielmo Maria Caporale and Ron Smith, (2001), “Real Exchange RateEffects on the Balance of Trade: Cointegration and the Marshall-Lerner Condition,”International Journal of Finance and Economics, Vol. 6, pp.187-200. Breitung, J., 2000. The Local Power of Some Unit Root Tests for Panel Data. In B. Baltagi (ed.), Nonstationary Panels, Panel Cointegration, and Dynamic Panels, Advances in Econometrics, 15, JAI, Amsterdam, pp.161-178. Buluswar, M.D., Thompson, H. and Upadhyaya, K.P. (1996) “Devaluation and the trade balance in India: stationarity and cointegration”. Applied Economics, Vol. 28, pp.429-432. Chen, B., McCoskey, S. and Kao, C. (1999). “Estimation and Inference of a Cointegrated Regression in Panel Data: A Monte Carlo Study”, American Journal of Mathematical and Management Sciences, Vol.19, pp.75-114. Chiu, Y.-B., C.-C.Lee and C.-H. Sun. (2010). “The U.S. trade imbalance and real exchange rate: An application of the heterogeneous panel cointegration method”, Economic Modellings, Vol. 27, pp.705–716 Dhasmana, Anubha (2012). “India’s Real Exchange Rate and Trade Balance: Fresh Empirical Evidence”, IIM Bangalore Research Paper, 373. Dickey, D. and W. Fuller (1979), “Distribution of the Estimators for Autoregressive Time serieswith a Unit Root”, Journal of the American Statistical Association, Vol. 74, pp. 427-431. Fisher, R. A. (1932). Statistical Methods for Research Workers, Oliver & Boyd,Edinburgh, 4th Edition. Gupta-Kapoor, A. and Ramakrishnan, U. (1999). “Is there a J-curve? A new estimation for Japan”, International Economic Journal, Vol. 13, pp.71–9. Hacker, R. S. and Abdulnasser, H.-J. (2003). “Is the J-curve effect observable for small North European economies?”, Open Economies Review, Vol. 14, pp.119–34. Hacker, R.S., Hatemi-J, A., 2004. The effect of exchange rate changes on trade balances in the short and long run: evidence fromGerman trade with transitional Central European economies”, Economics of Transition, Vol. 12, pp.777–799. Im, K.S, M.H Pesaran& Shin, Y. C (2003). “Testing for units roots in heterogeneous panels”, Journal of Econometrics, Vol. 115, pp.53-74. Junz, H. B. and Rhomberg, R. R. (1973). “Price-competitiveness in export trade among industrial countries”, American Economic Review, Vol. 63, No.2, pp.412–18. Kao, C., & Chiang, M.H (2000). “On the estimation and inference of a cointegrated regression in panel data”, Advances in Econometrics, Vol. 15, pp.179-222. Krugman, P. and Obstfeld, M. (2001), International Economics: Theory and Policy, 5th ed., Addison-Wesley, New York. Lal, A. K. and Lowinger, T. C. (2002). “The J-curve: evidence from East Asia”, Journal of Economic Integration, Vol. 17, pp.397–415. Lee, J. and Chinn, M. D. (2002). “Current account and real exchange rate dynamics in the G-7 countries”, IMF Working Paper, (#WP/02/130). Levin, J. H. (1983). “The J-curve, rational expectations, and the stability of the flexible exchange rate system”, Journal of International Economics, Vol. 15, pp.239–51. Levin, A., & Lin, C. F. (1993). “Unit Root Tests in Panel Data: New Results”, Discussion paper, Department of Economics, UC-San Diego. Levin, A., Lin, C., & Chu, C. (2002). “Unit root test in panel data: asymptotic and finite sample properties”, Journal of Econometrics, Vol. 108, No.1, pp.1-24. Maddala, G.S., & Wu, S. (1999). “A comparative study of unit root tests with panel data and new simple test”, Oxford Bulletin of Economics and Statistics, Vol. 61, pp.631-652. Magee, S. P. (1973). “Currency contracts, pass through and devaluation”, Brooking Papers on Economic Activity, Vol. 1, pp.303–25. Marquez, J. (1990) “Bilateral Trade Elasticities”, The Review of Economics and Statistics, Vol. 72, No.1, pp.70-77. Marsh, Ian W., and Stephen P., Tokarick (1994). “Competitiveness Indicators: A Theoreticaland Empirical Assessment”, IMF Working Paper, WP/94/29 Meade, E. E. (1988). “Exchange rates, adjustment, and the J-curve”, Federal Reserve Bulletin, October, pp.633–44. Miles, M. A. (1979). “The effects of devaluation on the trade balance and the balance of payments: some new results”, Journal of Political Economy, Vol. 87, No.3, pp.600–20 Noland, M. (1989). “Japanese trade elasticities and the J-curve”, Review of Economics and Statistics, Vol. 71, pp.175–9. Onafowora, O., (2003). “Exchange rate and trade balance in East Asia: is there a J−Curve?”, Economics Bulletin, Vol. 5, Issue 18, pp.1−13. Pedroni, P.,( 2000). “Fully modified OLS for heterogeneous cointegrated panels”, Advances in Econometrics, Vol. 15, pp.93–130. Pesaran, M. H. and Shin, Y. (1995). An autoregressive distributed lag modelling approach to cointegration analysis. In Centennial Volume of Rangar Frisch, (ed.) S. Strom, A. Holly, and P. Diamond, Cambridge University Press, Cambridge. Pesaran, M. H., Shin, Y. and Smith, R. J. (1996). “Testing for the existence of a long-run relationship”, DAE Working Paper No. 9622, Department of Applied Economics, University of Cambridge. Phillips, P. and P. Perron (1988), “Testing for Unit Root in Time Series Regression”, Biometrica,Vol. 75, pp. 335-346. Phillips, P.C.B., Hansen, B.E., (1990). “Statistical inference in instrumental variables regression with I (1) processes”, Review of Economic Studies, Vol. 57, No.1, pp.99–125. Rose, A. K. (1990). “Exchange rates and the trade balance: someevidence from developing countries”, Economics Letters, Vol. 34, pp.271–5. Rose, A.K. and Yellen, J.L. (1989). “Is There a J-curve?” Journal of Monetary Economics, Vol. 24, pp.53–68. Arunachalaramanan S. and Ramesh Golait (2011). “The Implication of renminbi revolution on India’s trade –A study”, RBI working paper series 2/2011 Singh, T.,(2002). “India’s trade balance: the role of income and exchange rates”, Journal of Policy Modeling, Vol. 24, No.5, pp.437–452. Summary, R.M. (1989). “A political–economic model of U.S. bilateral trade”, Review of Economics and Statistics, Vol. 71, No.1, pp.179–182. Wilson, P. (2001). “Exchange rates and the trade balance for dynamic Asian economies: does the J-curve exist for Singapore, Malaysia and Korea?”, Open Economies Review, Vol. 12, pp.389–413.

* Vivek Kumar is Assistant Adviser and Vishal Maurya is Research Officer in the Department of Statistics and Information Management (DSIM) of Reserve Bank of India (RBI), Mumbai. The views expressed in the paper are those of the authors and not of the institution to which they belong. The authors are grateful to Dr. O.P. Mall, Adviser, DSIM for his valuable suggestions which improved this article. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Page Last Updated on: September 12, 2023