IST,

IST,

Is the Government Deficit in India Still Relevant for Stabilisation?

Jeevan K. Khundrakpam and Rajan Goyal* This paper employing bounds test to cointegration analysis (Pesaran et al, 2001) revisited the linkages between real output, price and money and studied the impact of government deficit on money in India for the period 1951-52 to 2006-07. It finds that money and real output cause price both in the short as well as in the long run while money is neutral to output. Further, evidence shows that government deficit leads to incremental reserve money creation even though the Reserve Bank financing of Government deficit almost ceased to exist during most part of the current decade. It argues that Government deficit by influencing the level of sterilisation impacts the accretion of net foreign assets to RBI balance sheet and, therefore, continues to be a key factor causing incremental reserve money creation and overall expansion in money supply. Given the finding that money leads to inflation, government deficit, therefore, remains relevant for stabilisation.

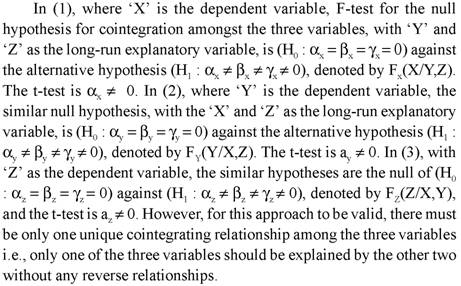

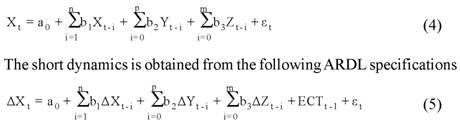

JEL Classification : E41, E52 Introduction Impact of Government deficit on money supply and the effect of the latter on real output and prices has been extensively investigated in India (for a survey of literature see Jadhav, 1994). There have been a number of reasons for this subject being revisited several times. First, until very recently, there was automatic monetisation of government deficit through the creation of ad hoc treasury bills, which led to expansion of reserve money and the overall money supply via the multiplier effect. Secondly, given the competing but contradictory theoretical postulates on the interaction between money, real output and prices, the precise nature of the relationship among these variables has been an empirical issue. Thirdly, the relationships might have undergone changes with the developments in the economy, particularly in the financial sector. Finally,there has been development in the estimation techniques and methodology to have more robust estimates and better insights into the relationships among these variables. We revisited the relationship between deficit, money, price and real output for the following reasons. First, growing globalisation of Indian economy and developments in the financial market has altered the financing pattern of government deficit leading to a change in the asset profile of Reserve Bank balance sheet in the recent years. In view of these changes in the recent times, Ashra et al (2004) revisited the issues and observed that the relationship between fiscal deficit and net RBI credit to government and the latter with broad money supply (M3) do not exist and, therefore, concluded that fiscal deficit is no longer relevant for stabilisation. Secondly, despite the plethora of empirical works in this area, including the recent ones, a number of methodological issues, however, still need to be addressed. In particular, many of the earlier works have either neglected the stationary properties of the series or proper adjustments were not made to correct for non-stationarity.1 Though studies in the later period have applied cointegration techniques on non-stationary series, the unit root tests employed in these studies have suffered from low explanatory powers, as they have not taken into account of structural breaks in the true data generating process (Zivot and Andrews, 1992).2 Third, most of the existing studies have not attempted a distinction between the short-run and long-run causality.3 Fourth, most of the studies in the Indian context have employed bivariate models which could give rise to omitted variables problem. The contribution of the paper is the following. First, we consider the deficit of the entire government sector derived from the national accounting framework and analyse its impact on money supply through the reserve money expansion. This approach is different from the earlier works where the impact of deficit on money supply is analysed through the creation of net RBI credit to the government. Second, we cover an extended time period from 1951-52 to 2006-07. Third, and importantly, we employ autoregressive distributed lag (ARDL) approach to cointegration analysis developed by Pesaran and Pesaran (1997), Pesaran and Shin (1999) and Pesaran, Shin and Smith (2001). This approach allows test for the presence of cointegrating relationship among variables characterised by different order of integration, and therefore, obviates the need to ascertain the unit root property of variables. Given the inconclusive unit root properties of relevant variables in India as shown in Appendix 1, this method appears to be more appropriate than other approaches. Fourth, for the cointegrated variables, an error correction framework is used for the causality tests in order to differentiate between short-run and long-run causality. Fifth, the relationships between money, real output and prices are analysed in a trivariate framework. The rest of the article is presented in four sections. Section I provides a brief review of the select literature on India. In section II, the analytical and the empirical framework are discussed. The data and empirical results are analysed in section III. Section IV concludes. A Brief Review of Select Literature on India A summary of the time period, procedure and technique adopted along with the reported causality in some of the select earlier studies on India is presented in table 1. Among these, the earliest contribution was by Ramachandra (1983, 1986) for the period 1951-1971 and 1951-1980 who concluded that money causes both real income and price, price causes real income and nominal income causes money. Gupta (1984) for the period 1954-55 to 1982-83 also concludes that both nominal and real income have unidirectional cause on money supply. On the other hand, Nachane and Nadkarni (1985) using the quarterly data over the period 1960-61 to 1981-82 find that money supply has a unidirectional causality to price and is a major determinant of nominal income, but the relationship between money and real output is inconclusive. Both Singh (1989), based on quarterly averages of monthly data for the period 1970-71 to 1986-87, and Biswas and Saunders (1990), on quarterly data for two sub-periods of 1962-1980 and 1957-1986, find bi-directional causality between money and prices. Jadhav (1994) for the period 1955-56 to 1987-88 finds that money causes both prices and output. Thus, the conclusions derived by these earlier studies have been quite divergent. More recently, Moosa (1997) using a seasonal cointegration framework shows long-run neutrality of money on output in India. On other hand, RBI (1998) for the period 1970-71 to 1996-97 finds that money is non-neutral to output. In nominal terms, there is bi-directional causality between money and output, while in real terms the causality is unidirectional running from money to output. Ashra et al., (2004) during the period 1950-51 to 2000-01 also find that narrow money (M1), but not broad money (M3), is non-neutral to output. They also find that broad money (M3) and prices have a bi-directional causality. However, RBI (1998) and Ashra et al., (2004), unlike Moosa (1997), do not make distinctions between short-run and long-run neutrality of money on output. There are also fairly a large number of studies in India on the nexus between government deficit, money supply and inflation. Sarma (1982), replicating Aghevli-Khan (1978), finds a self-perpetuating process of deficit-induced inflation and inflation-induced deficits in India. Jadhav (1994) in a macro-econometric framework for the period 1970-71 to 1986-87 also finds a self-perpetuating process of government deficit and inflation. Extending to later period of the 1990s, Rangarajan and Mohanty (1998) support the hypothesis that government deficits have been an important cause for inflation in India. In contrast, Ashra et al., (2004) find no long-run relationship between fiscal deficit and net RBI credit to government, and the latter with M3. Therefore, they question the rationale for targeting fiscal deficit as a tool for stabilisation. Section II Analytical Framework Money, Real Output and Prices In the literature, there are different theoretical postulates on the interrelationship between money, prices and real output. Classical economists argue that money in the long-run leads to only a corresponding rise in price leaving the real output unaltered. Monetarists, however, acknowledged that under adaptive expectations, money supply can impact real output in the short-run. Rational expectation theory denies any impact of money on output even in the short-run. On other hand, Keynesians argue that money supply by influencing interest rates can affect investment and in turn real output i.e., advocates non-neutrality of money on real output.4 Structural economists, on their part, argue that in less developed countries, in addition to money, structural factors such as supply and demand conditions also play an equally important role in determining price in the economy. Financing public investment through money expansion increases productive capacity and real output, while real output, at the same time, would increase the demand for money. Further, the concern of the Government to maintain a desired level of real public expenditure leads to increase in nominal expenditure of the Government leading to rise in prices. These competing theoretical constructs suggest that relationships between money, real output and prices could exist through different channels. Further, country specific conditions could have an impact on the relationship. Thus, the relationship between money, real output and price in India is considered to be an empirical issue. Fiscal Deficit, Reserve Money and Money Supply in India Though the growth of reserve money would normally be induced by the demand emanating from movements in output and price levels, in India, government deficit supplements these factors in determining the rate of reserve money expansion. Sources of reserve money have been observed to be intimately linked with the process of financing fiscal deficit. Till the early 1990s, a sizeable portion of government deficit which could not be financed through market subscription to Government securities issued at sub-market rates was automatically monetised with the creation of ad hoc treasury bills with the Reserve Bank. From 1992, coupon on Government securities was made market related (introduction of auction system) and beginning from 1994 the system of ad hoc treasury bills creation was phased out by 1996-97. However, monetisation of government deficit persisted to the extent that Reserve Bank continued to subscribe to these securities either due to inability of the market to absorb the entire floatation or its unwillingness to subscribe at the prevailing interest rates.5 This has been the fallout of the Reserve Bank being the debt manager of the government and the large and persistent government deficit. It has also been found that fiscal deficit by enhancing Government debt offerings tend to raise the real interest rates unless contained by the injection of reserve money by the central bank (Goyal, 2004). Thus, government deficit had led to reserve money creation through increased holding of Government securities by the Reserve Bank. In the recent years, increasing globalisation causing large capital inflows has added a new dimension in the dynamics of reserve money expansion and has also altered the channel of monetisation by varying the asset profile/composition of RBI balance sheet. With a view to maintaining stability of the system, RBI has been acquiring surplus capital inflows and subsequently sterilising6 them through selling of Government securities from its portfolio7 to contain corresponding reserve money expansion. Therefore, the Reserve Bank could guide the rate of reserve money expansion by sterilising only a required proportion of the liquidity created earlier through its acquisition of foreign assets. Moreover, being a debt manager, the Reserve Bank could be expected to take up sterilisation in a manner that the subscription to Government securities does not get affected due to liquidity constraints. Therefore, the level of fiscal deficit and consequent government borrowings could be a key factor in determining the accretion of net foreign assets net of sterilisation to RBI balance sheet or the reserve money expansion. Theoretically, money supply grows by a multiple of reserve money expansion. Almost all the studies conducted till date in the Indian context have observed that there is a significant relationship between money supply (both broad as well as narrow money) and reserve money and that the value of money multiplier has generally been stable. Although, progressive development of the financial sector with introduction of new instruments and financial innovations might have impacted the stability of money multiplier, the growth in money supply continues to be driven primarily by the movements in the reserve money stock. Thus, to analyse the macroeconomic impact of fiscal deficit, we investigate whether fiscal deficit leads to increase in reserve money with consequent increase in the money supply and how the latter interacts with price and real output. The Empirical Framework As unit properties presented in appendices are inconclusive for Indian data, the bounds test (ARDL) approach to cointegration analysis, which allows tests for cointegrating relationships among variables characterised by different order of integration, was adopted. This approach not only checks for the presence of long-run relationships but also determines the precise direction of that relationships i.e., which variable is the dependent variable and which are the explanatory variables. It involves estimating an unrestricted error-correction model (UECM), which for tri-variate models adopted here takes the following form  Here Δ is the first difference operator, and ‘X’, ‘Y’ and ‘Z’ are the three variables. The bounds test for the presence of long-run relationship involves using two separate statistics. The first is the F-test on the joint null hypothesis that the coefficients of the lag levels of the variables are jointly equal to zero, against the alternative that they are jointly different from zero. The second is a t-test on the lag level of the dependent variable that it is individually different from zero. When a long-run relationship exists between the variables, both F-test and t-test indicate which variables should be normalised.  Both the F-test and t-test have a non-standard distribution which depends upon: i) whether variables included in the ARDL model are I(1) or I(0); ii) whether the ARDL model contains an intercept and/or a trend. There are critical bound values of both the statistics set by the properties of the regressors into purely I(1) or I(0), which are provided in Pesaran, Shin and Smith (2001) for large sample size. The critical bound values for F-test in the case of small sample size are estimated in Narayan (2005). If the absolute value of the estimated F-statistics and t-statistics: i) lie in between the critical bounds set by I(1) and I(0), cointegration between the variables is inconclusive; ii) in absolute value is lower than set by I(0), cointegration is rejected; and iii) in absolute value is higher than set by I(1), cointegration is accepted. For the equation which shows cointegrating relationship, the conditional long-run relationship is estimated by the reduced form solution of the following ARDL equations. If ‘X’ is the explained variable the specification takes the form  The ECT term in (5) is the error obtaining from the long-run relationship in (4). Using (5) we perform the Granger-causality tests, as Engle and Granger (1987) had cautioned that if the series are cointegrated, VAR estimation only in first differences will be misleading. By including the lag ECT terms we determine not only the direction of causality but also differentiate between the short-run and long-run causality. For specifications where long-run relationships are rejected by the cointegration tests, the causality tests are only in difference form with the ECT term omitted. For the short-run, the causality tests are conducted through Wald test for significance of the joint coefficients of the individual lag independent variables in the ARDL specifications. Long-run causality is confirmed by the sign and the statistical significance of the lag ECT terms in the ARDL. Section III Data The relevant variables are culled from various publications for the period 1951-52 to 2006-07. Real output (Y) measured by GDP at factor cost at (1999-2000 prices), money supply (M3) and reserve money (RM) are obtained from Handbook of Statistics on Indian Economy 2007-08, RBI.8 Price measured by wholesale price index (P)9 are obtained from Monetary Statistics and various issues of Report on Currency and Finance, RBI. We use a broader concept of government deficit (GD), defined as the difference between investment and savings of the Government in the National Account Statistics from Economic Survey 2007-08. All the variables are considered in logarithm form. Empirical Results Cointegration Table 2 presents cointegration tests results.10 We accepted the presence of cointegration between the variables if F-test rejects the null at least at 95% critical bound values. Where both F-test and t-test can not reject the null at this critical value it is taken as a clear cut evidence of no long-run relationship. Based on the above criteria, the existence of the following long-run relationships can be accepted. a) Money, real output and prices: Between money, prices and real output there is only one cointegrating relationship. When price (LP) is the dependent variable, the estimated F and t-statistics are found to be higher than the upper critical bound values (table 2: row 3). For the reverse cointegrating relationships, both the F and t-statistics are lower than 95% upper critical bound values (rows 1 and 2 in table 2). However, the evidence on money supply being influenced by output and prices is inconclusive by F-test, as it is significant at 10% level. In such inconclusive situation the error correction term is a useful way of establishing cointegration (Kremers et al., 1992 and Banerjee et al., 1998).11 b) Government Deficit and Reserve Money: Both the F and t-statistics are higher than the upper critical bound value when change in reserve money is explained by the government deficit, while both the statistics are lower than the lower critical bound values for the reverse relationship. In other words, there is only one long-run relationship between change in reserve money and government deficit, with the former explained by the latter (table 2: row 4 and 5). c) Reserve Money and Money Supply: The bounds tests between reserve money and measure of money supply reveal that the F-statistics are higher than the upper critical bound values only when reserve money is the explaining variable (table 2: row 6 and 7). Thus, money supply share a long-run relationship with reserve money, with the latter as the explanatory variable. Long-run Coefficients The estimated long-run relationships based on ARDL in (4) for those variables found to be cointegrated by the bounds test are presented in table-3. These estimates, which bring out the precise nature of the long-run relationship, reveal the following:

a) Price on Money and Real Output In the price equation, the coefficient of money supply (LM3) has statistically significant positive sign, while that of real output (LY) is negative. In other words, while money leads to long-run inflation, real output lowers it. The negative impact of real output on long-run inflation in India is tenable, as supply factors is understood to play an important role in the determination of prices. Thus, improvement in supply position reflected in higher real output leads to fall in inflation, while increase in money supply causes inflation (table 3: column 2). b) Change in Reserve Money and Government Deficit It is seen from column 3 in table 3 that the coefficient of government deficit (LGD) on change in reserve money (LΔRM) is slightly above unity and statistically significant. In other words, one percent change in government deficit leads to about 1.06 percent expansion in the reserve money. c) Reserve Money and Money Supply The coefficient of reserve money (LRM) on money supply (LM3) is positive and statistically significant (table 3: column 4).

From the above results, it can be inferred that government deficit leads to additional reserve money creation, which leads to expansion in money supply that generates pressure on prices. d) Money on Price and Real Output Even though evidence on money supply being explained by price and real output was inconclusive from the bounds test, the long-run relationship was estimated in order obtain the error correction term. It is seen that both the real output (LY) and price (LP) have statistically significant positive coefficients on money supply (table 3: column 5). Thus, there is some evidence of money being caused by output and price, which would be confirmed later by the significance of the ECT term in the ECM framework a la Kremers et al., (1992) and Banerjee et al., (1998). Short-Run Dynamics and Causality The dynamics of the cointegrated variables were estimated using the specification given in (5). Short-run causality was performed using Wald test on the joint significance of the lagged variables. Long-run causality was confirmed by the sign and the statistical significance of the lagged ECT terms. Where long-run relationships were rejected by the bounds tests, the error correction term was excluded in the ARDL specification and a similar Wald test was conducted for short-run causality. Being annual data, the maximum lag length was set at two and the appropriate lag lengths were determined based on SBC criterion. a) Price is caused by Real Output and Money: The ECT terms in the price equations are negative and statistically significant, confirming the results obtained under bounds test, that price is caused by real output and money supply in the long-run (table 4: column 2). The one period speed of adjustment of price to its equilibrium relationship with real output and money following a shock is about 44 percent. In the short-run also, price is caused by both real output and money. Like in the long-run, real output has a negative impact on price, while money leads to increase in price. There is evidence of some inflation inertia in the short-run reflected in statistically significant positive coefficient (0.21) of lagged inflation (table 4: column 2). b) Money is caused by Real Output and Price: Though the evidence of cointegration of M3 with real output and prices by bounds test was inconclusive, the lagged error-correction terms (ECT) in column 3 (table 4) is negative and statistically significant. This indicates that there appears to be a long-run relationship between M3 on real output and prices. However, the coefficient is very small (-0.09), indicating very slow speed of adjustment to its equilibrium level following a shock. This low speed of adjustment could be a reflection of fiscal dominance, limiting the ability of the monetary authority to control money supply. In the short-run also, both real output and price positive cause money, but the coefficient is again very small in magnitude. The higher speed of adjustment to its equilibrium level in inflation than in money supply may suggest that averseness to inflation in India is much more than that to off-target money supply. Further, the ability to adjust price faster to its equilibrium level even when money supply adjustment is slower may also indicate the importance of supply management in inflationary control in India.12 c) Real Output is caused by Money and Price: As bounds test revealed no cointegrating relationship for real output on money and price, money and price are neutral to real output in the long-run, a result also obtained by Moosa (1997). In the short-run also, money has no effect on real output. Price, however, is non-neutral to real output in the short-run and has a negative impact (table 4: column 6). d) Government deficit causes Reserve Money: There is strong evidence of government deficit leading to incremental reserve money creation, both in the long-run and short-run (table 4: column 5). The ECT term of -0.66, which is statistically significant, indicate that the long-run relationship is strong and stable with about 2/ 3rd of the deviation from the long-run equilibrium following a shock being corrected in a single period. In the short-run, one percent increase in government deficit leads to 0.7 percent increase in incremental reserve money.

e) Reserve Money causes Money Supply: As the ECT term in column 4 in table 4 is negative and statistically significant, the long-run causality running from reserve money to bound money indicated by bounds test is confirmed. The speed of adjustment to equilibrium following a shock, however, is quite slow with coefficient of the ECT term of -0.07. In the short-run also increase in reserve money leads to expansion in money supply. It has been asserted that with the liberalisation of the Indian economy and cessation of automatic monetisation of government deficit, there is no linkage between government deficit and money supply and that government deficit is no more relevant for the purpose of price stabilisation (Ashra et al, 2004). This paper revisits causal relationships between government deficit and money, and the latter with real output and prices in India for an extended period 1951-52 to 2006-07 employing the ARDL approach to cointegration analysis. This approach to cointegration analysis, unlike in earlier studies, addressed the issues such as cognisance of inconclusive stationarity properties, variables with varying degree of integration and small sample size. Reflecting upon the higher degree of openness in the Indian economy, the paper argued that government deficit may now cause reserve money expansion through the incomplete sterilisation of Net Foreign Assets (NFA) accumulation intended to enable adequate market subscription to Government borrowings, replacing the erstwhile channel of ‘net RBI credit to the Government’. It found a strong evidence of government deficit leading to reserve money creation with consequent increase in money supply. Further, there is no evidence of money causing changes in real output both in the long-run and short-run. However, money causes inflation both in the long-run and short-run, while real output dampens inflation. There is also some evidence of output and price leading to money creation i.e., bi-directional causality between money and prices rendering money targeting a complicated exercise. Thus, it is concluded that targeting fiscal deficit as tool for stabilization continues to remain valid. Dicky-Fuller and Phillips-Perron Tests Augmented Dickey-Fuller and Phillips-Perron tests reported in table A1 show the following. Both the tests show that reserve money (LRM) is integrated of order one I(1), while government deficit (LGD) and change in reserve money (LΔRM) are stationary I(0). With regard to broad money (LM3), real output (LY) and price (LP), the two tests provide contradictory results.

Zivot-Andrews Test As both ADF and PP tests have low powers when the true data generating process is stationary about a broken linear trend, Zivot-Andrews (1992) tests were carried out. The tests are conducted on three models: Model A (structural break in the intercept of the trend function); Model B (structural break in the slope of the trend function); and model C (structural break in the intercept and slope of the trend function), which are reported in table A2. It reveals that only LM3 LRM and LΔRM are stationary with a structural break, while the rest of the series are non-stationary. * The authors are Directors in the Department of Economic Analysis and Policy, Reserve Bank of India. These are personal views of the authors and not of the institution they belong. Notes 1 Studies such as Ramachandra (1983, 1986) and Gupta (1984) have no considered the stationarity properties of the variables at all, while most of the later studies reported in table 1 have only considered first difference of the variables without formal test of the stationarity properties of the series. 2 As shown in appendix 1, unit root property of a series is highly sensitive to the presence of structural breaks. In fact, many of the series show opposite unit root properties between tests conducted with and without structural breaks, rendering use of standard cointegration analysis inappropriate. 3 As appendix 2 shows, the presence of cointegration is also sensitive to presence of structural break. 4 The debate on this issue has settled down significantly and there is a broad agreement between the present day monetarists and neo-Keynesians that money can have substantial short-run effect on output and prices. However, they still differ on its use for the purpose of stabilization known as the controversy on ‘rules versus discretion’. Monetarists are non-interventionist and believe in rules while Keynesians are interventionist and believe in discretion. 5 This liquidity constraint could arise on account of excess demand (including Government). RBI, as the debt manager ensures that government borrowing is successful and when the market is unwilling to absorb the entire floatation it subscribes to ease the liquidity constraints and pressure on interest rates. 6 Sterilisation, however, involves cost to the RBI not only in terms of interest earning differentials between acquired foreign assets and the corresponding Governments securities sold, but also from the lower price these securities are being sold at. 7 In 2004, Market Stabilisation Scheme was introduced wherein special bonds called Market Stabilisation Bonds are issued by the Government and are used by RBI to absorb excess liquidity in the system. The special feature of these bonds is that proceeds of the bonds are retained by the RBI and Government uses it only to redeem these bonds. 8 M3 and RM pertain to the fortnightly average in a year and not the March- end figures of the year. 9 We consider WPI, as it is the headline measure of inflation in India. 10 Being annual data, the maximum lag was fixed at two. 11 These studies hold the view that a highly significant error correction term is further proof of the existence of a stable long-run relationship. 12 In the wake of recent upsurge in oil prices, beside demand management measures by Reserve Bank, government also responded by cutting taxes on petroleum products to restrain price rise. Similarly, Government has resorted to imports of agricultural commodities in event of shortages. References: Aghevli, B.B., and Khan, M. (1978), “Government Deficits and the Inflationary Process in Developing Countries”, IMF Staff Papers, 25, 383-416. Ashra, S., Chattopadhyay, S., and Chaudhuri, K. (2004), “Deficit, Money and Price – the Indian Experience”, Journal of policy Modeling, 26, 289-99. Bajpai, N., and Jeffrey, D.S (1999), Fiscal Policy in India’s Economic reforms, In D.S. Jeffrey, A. Varshney, and N. Bajpai (Eds.), India in the Era of Economic Reforms, New Delhi: Oxford University Press. Banerjee, A., Dolado, J. J. and R. Mestre (1998), “Error-correction Mechanism Tests for Cointegration in Single Equation Framework”, Journal of Time Series Analysis, 19, 267-283. Biswas, B., and Saunders, P.J. (1990), “Money and Price Level in India: An Empirical Analysis,” Indian Economic Journal, 35, 103-113. Engle, R.F., and Granger, C.W.J. (1987), “Cointegration and Error Correction: Representation, Estimation and Testing”, Econometrica, 55, 251-276. Gregory, A.W., and Hansen, B.E. (1996), “Residual-based Tests for Cointegration in Models with Regime Shifts”, Journal of Econometrics, 70, 99-126. Goyal, Rajan (2004). “Does Higher Fiscal Deficit Lead to Rise in Interest Rates? An Empirical Investigation.” Economic and Political Weekly, Vol. XXXIX, No 21, May 22, 2128-33. Gupta, G.S. (1984), “Monetary Target Setting [Mimeo]”, Ahmedabad: Indian Institute of Management. Jadhav, N. (1994), Monetary Economics for India, Delhi: Macmillan India Limited. Kremers, J.J.M., N.R. Ericsson and J. J. Dolado (1992), “The Power of Cointegration Tests”, Oxford Bulletin of Economics and Statistics, 54, 325-343. Moosa, I. A. (1997), “Testing the Long-run Neutrality of Money in a Developing Economy: The Case of India”, Journal of Development Economics, 53, 139-155. Nachane, D.M., and Nadkarni, R.M. (1985), “Empirical Tests of Certain Monetarist Propositions via Causality Theory”, Indian Economic Journal, 33, 139-155. Narayan, P.K. (2005), “The Saving and Investment Nexus for China: Evidence from Co-integrating Tests”, Applied Economics, 35, 1979-1990. Pesaran, M. H., and Pesaran, B. (1997), Working with Microfit 4.0: Interactive Econometric Analysis, Oxford: Oxford University Press. Pesaran, M. H., and Shin, Y. (1999), “An Autoregressive Distributed Lag Modeling Approach to Cointegration Analysis” in Storm, S. (ed) Econometrics and Economic Theory in the 20th Century-the Ragnar Frisch Centennial Symposium, Cambridge: Cambridge University Press. Pesaran, M. H., Shin, Y. and Smith, R.J. (2001), “Bound Testing Approaches to the Analysis of level Relationships”, Journal of Applied Econometrics, 16, 289-326. Ramachandra, V.S. (1983), “Direction of Causality Between Monetary and Real Variables in India – An Empirical Result”, Indian Economic Journal, 31, 65-76. Ramachandra, V.S. (1986), “Direction of Causality Between Monetary and Real Variables in India – An Extended Result”, Indian Economic Journal, 34, 98-102. Rangarajan, C., and Mohanty M.S. (1998), “Fiscal Deficit, External Balance and Monetary Growth”, Reserve Bank of India Occasional Papers, 18, 635-653. Reserve Bank of India (1998), Money Supply Analytics and Methodology of Compilation, Report of the Working Group, Mumbai. Reserve Bank of India (2006), Handbook of Monetary Statistics of India. Reserve Bank of India (2005), Handbook of Statistics of the Indian Economy, 2006-07. Reserve Bank of India, Report on Currency and Finance, Various Issues. Sarma , Y.S.R. (1982), “Government Deficits, Money Supply and Inflation in India”, Reserve Bank of India Occasional Papers. Mumbai, India. Singh, B. (1989), “Money Supply-Prices Causality Revisited”, Economic and Political Weekly, 24. Zivot, E., and Andrews, D. (1992), “Further Evidence of the Great Crash, the Oil-price Shock and the Unit-root Hypothesis”, Journal of Business and Economic Statistics, 10, 251-70. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Page Last Updated on: September 12, 2023