IST,

IST,

Draft Guidelines on Transmission of Monetary Policy Rates to Banks’ Lending Rates – Base Rate Guidelines

Background 1. Under Base Rate system which came into effect from July 1, 2010, all categories of domestic rupee loans should be priced only with reference to the Base Rate, subject to the conditions mentioned in our circulars DBOD.No.Dir.BC.88/13.03.00/2009-10 dated April 9, 2010 and DBR. Dir.BC.No.63/13.03.00/2014-15 dated January 19, 2015. For monetary transmission to occur, lending rates have to be sensitive to the policy rate. At present, banks follow different methodologies for computing their Base Rate. While some use the average cost of funds method, some have adopted the marginal cost of funds while others use the blended cost of funds (liabilities) method. It was observed that Base Rates based on marginal cost of funds are more sensitive to changes in the policy rates 2. In this connection, attention is invited to the first Bi-monthly Monetary Policy Statement 2015-16 announced on April 7, 2015 wherein it was stated that in order to improve the efficiency of monetary policy transmission, the Reserve Bank will encourage banks to move in a time-bound manner to marginal-cost-of-funds-based determination of their Base Rate’. Revised Methodology 3. On the basis of supervisory findings and discussions with banks, the extant guidelines on computation of Base Rate as well as the methodology for determining lending rates have been reviewed. The banks will now be required to compute their Base Rate as under: (a) Components of Base Rate The components of Base Rate will include Cost of Funds, Negative Carry on CRR/SLR, Un-allocable overhead costs and Average return on Networth which will be calculated as under: (i) Cost of Funds The marginal cost of funds should be used for computing the cost of funds. The marginal cost should be arrived at by taking into consideration all sources of fund other than equity. Cost of deposits should be calculated using the latest interest rate/card rate payable on current and savings deposits and the term deposits of various maturities. Cost of borrowings should be arrived at using the average rates at which funds were raised in the last one month preceding the date of review. Each of these rates should be weighted by the proportionate balance outstanding on the date of review. Illustratively, marginal cost will be arrived at as under:

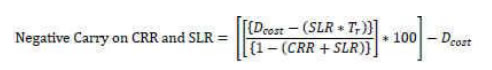

(ii) Negative carry on CRR and SLR Negative carry on the mandatory CRR arises because the return on CRR balances is nil. Negative carry on SLR balances may arise if the actual return thereon is less than the cost of funds. Negative carry on the mandatory levels of CRR and SLR balances should be calculated using the following formula:  where Dcost = marginal cost of funds calculated at 3(a)(i) above. SLR : mandatory level of Statutory Liquidity Ratio Tr : 364 T-Bill Rate CRR : mandatory level of Cash Reserve Ratio (iii) Un-allocable overhead cost The unallocable overhead costs should comprise solely of costs incurred for the bank as a whole and, hence, not allocable to any particular business activity/unit. These components would be fixed for 3 years, subject to review thereafter. (iv) Average Return on networth Average return on net worth is the hurdle rate of return on equity determined by the Board or management of the bank. It is expected that the component representing ‘return on networth’ will remain fairly constant and any change would be made only in case of a major shift in the business strategy of the bank. Spread (b) As advised in our circular DBR.Dir.BC.No.63/13.03.00/2014-15 dated January 19, 2015, banks should delineate the components of spread with the approval of their Boards. For the sake of uniformity in these components, broad components of spread finalised by IBA should be adopted by all banks. Interest Rates on Loans (c) The actual lending rates on the loans will be determined by adding the components of spread to the Base Rate in all cases. (d) All other stipulations mentioned in the circulars DBOD.No.Dir.BC.88/13.03.00/2009-10 dated April 9, 2010 and DBR. Dir.BC.No.63/13.03.00/2014-15 dated January 19, 2015 will continue. Time frame for implementation (e) In order to give sufficient time to all the banks to adopt the above as well as the spread guidelines contained in our circular dated January 19, 2015, the proposed effective date of these guidelines is April 1, 2016. (f) Banks should submit a road map clearly indicating the time frame for adopting the above to our Department of Banking Supervision, Central Office within a period of two months from the date of the final circular. Medium Term goal 4. It is expected that the above steps would also be helpful in the medium term goal of banks pricing their floating rate loans linked to an external benchmark. Once Financial Benchmarks India Pvt Ltd (FBIL) starts publishing various indices of market interest rates, banks will be encouraged to price their deposits as well as advances with reference to the external benchmarks publishedy the FBIL. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Page Last Updated on: