IST,

IST,

Monetary Policy Statement, 2021-22 Resolution of the Monetary Policy Committee (MPC) June 2-4, 2021

On the basis of an assessment of the current and evolving macroeconomic situation, the Monetary Policy Committee (MPC) at its meeting today (June 4, 2021) decided to:

Consequently, the reverse repo rate under the LAF remains unchanged at 3.35 per cent and the marginal standing facility (MSF) rate and the Bank Rate at 4.25 per cent.

These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth. The main considerations underlying the decision are set out in the statement below. Assessment Global Economy 2. Since the MPC’s meeting in April, the global economic recovery has been gaining momentum, driven mainly by major advanced economies (AEs) and powered by massive vaccination programmes and stimulus packages. Activity remains uneven in major emerging market economies (EMEs), with downside risks from renewed waves of infections due to contagious mutants of the virus and the relatively slow progress in vaccination. World merchandise trade continues to recover as external demand resumes, though elevated freight rates and container dislocations are emerging as constraints. CPI inflation is firming up in most AEs, driven by release of pent-up demand, elevated input prices and unfavourable base effects. Inflation in major EMEs has been generally close to or above official targets in recent months, pushed up by the sustained rise in global food and commodity prices. Global financial conditions remain benign. Domestic Economy 3. Turning to the domestic economy, provisional estimates of national income released by the National Statistical Office (NSO) on May 31, 2021 placed India’s real gross domestic product (GDP) contraction at 7.3 per cent for 2020-21, with GDP growth in Q4 at 1.6 per cent year-on-year (y-o-y). On June 1, the India Meteorological Department (IMD) has forecast a normal south-west monsoon, with rainfall at 101 per cent of the long period average (LPA). This augurs well for agriculture. With the rise in infections in rural areas, however, indicators of rural demand – tractor sales and two-wheeler sales – posted sequential declines during April. 4. Industrial production registered a broad-based improvement in March 2021. While mining and electricity output surpassed March 2019 (pre-pandemic) levels, manufacturing did not catch up. The output of core industries registered a double digit y-o-y growth in April 2021, propelled by a weak base. Although GST collections were at their highest during April 2021, there are indications of moderation in May as reflected in lower E-way bills generation. Other high-frequency indicators – electricity generation; railway freight traffic; port cargo; steel consumption; cement production; and toll collections – recorded sequential moderation during April-May 2021, reflecting the impact of restrictions and localised lockdowns imposed by states with exemptions for specific activities. The manufacturing purchasing managers’ index (PMI) remained in expansion in May although it moderated to 50.8 from 55.5 in April due to a slowdown in output and new orders. The services PMI, which was 54.0 in April, entered into contraction (46.4) in May, after seven months of sustained expansion. 5. Headline inflation registered a moderation to 4.3 per cent in April from 5.5 per cent in March, largely on favourable base effects. Food inflation fell to 2.7 per cent in April from 5.2 per cent in March, with prices of cereals, vegetables and sugar continuing to decline on a y-o-y basis. While fuel inflation surged, core (CPI excluding food and fuel) inflation moderated in April across most sub-groups barring housing and health, mainly due to base effects. Inflation in transport and communication remained in double digits. 6. System liquidity remained in large surplus in April and May 2021, with average daily net absorption under the liquidity adjustment facility (LAF) amounting to ₹5.2 lakh crore. Reserve money (adjusted for the first-round impact of the change in the cash reserve ratio) expanded by 12.4 per cent (y-o-y) on May 28, 2021, driven by currency demand. Money supply (M3) and bank credit grew by 9.9 per cent and 6.0 per cent, respectively, as on May 21, 2021 as compared with growth of 11.7 per cent and 6.2 per cent, respectively, a year ago. India’s foreign exchange reserves increased by US$ 21.2 billion in 2021-22 (up to May 28) to US$ 598.2 billion. Outlook 7. Going forward, the inflation trajectory is likely to be shaped by uncertainties impinging on the upside and the downside. The rising trajectory of international commodity prices, especially of crude, together with logistics costs, pose upside risks to the inflation outlook. Excise duties, cess and taxes imposed by the Centre and States need to be adjusted in a coordinated manner to contain input cost pressures emanating from petrol and diesel prices. A normal south-west monsoon along with comfortable buffer stocks should help to keep cereal price pressures in check. Recent supply side interventions are expected to ameliorate the tightness in the pulses market. Further supply side measures are needed to soften pressures on pulses and edible oil prices. With declining infections, restrictions and localised lockdowns across states could ease gradually and mitigate disruptions to supply chains, reducing cost pressures. Weak demand conditions may also temper the pass-through to core inflation. Taking into consideration all these factors, CPI inflation is projected at 5.1 per cent during 2021-22: 5.2 per cent in Q1; 5.4 per cent in Q2; 4.7 per cent in Q3; and 5.3 per cent in Q4:2021-22; with risks broadly balanced (Chart 1). 8. Turning to the growth outlook, rural demand remains strong and the expected normal monsoon bodes well for sustaining its buoyancy, going forward. The increased spread of COVID-19 infections in rural areas, however, poses downside risks. Urban demand has been dented by the second wave, but adoption of new COVID-compatible occupational models by businesses for an appropriate working environment may cushion the hit to economic activity, especially in manufacturing and services sectors that are not contact intensive. On the other hand, the strengthening global recovery should support the export sector. Domestic monetary and financial conditions remain highly accommodative and supportive of economic activity. Moreover, the vaccination process is expected to gather steam in the coming months and should help to normalise economic activity quickly. Taking these factors into consideration, real GDP growth is now projected at 9.5 per cent in 2021-22, consisting of 18.5 per cent in Q1; 7.9 per cent in Q2; 7.2 per cent in Q3; and 6.6 per cent in Q4:2021-22 (Chart 2).   9. The MPC notes that the second wave of COVID-19 has altered the near-term outlook, necessitating urgent policy interventions, active monitoring and further timely measures to prevent emergence of supply chain bottlenecks and build-up of retail margins. A hastened pace of the vaccination drive and quick ramping up of healthcare infrastructure across both urban and rural areas are critical to preserve lives and livelihoods and prevent a resurgence in new waves of infections. At this juncture, policy support from all sides – fiscal, monetary and sectoral – is required to nurture recovery and expedite return to normalcy. Accordingly, the MPC decided to retain the prevailing repo rate at 4 per cent and continue with the accommodative stance as long as necessary to revive and sustain growth on a durable basis and continue to mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward. 10. All members of the MPC – Dr. Shashanka Bhide, Dr. Ashima Goyal, Prof. Jayanth R. Varma, Dr. Mridul K. Saggar, Dr. Michael Debabrata Patra and Shri Shaktikanta Das – unanimously voted to keep the policy repo rate unchanged at 4.0 per cent. Furthermore, all members of the MPC unanimously voted to continue with the accommodative stance as long as necessary to revive and sustain growth on a durable basis and continue to mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward. 11. The minutes of the MPC’s meeting will be published on June 18, 2021. 12. The next meeting of the MPC is scheduled during August 4 to 6, 2021. (Yogesh Dayal) Press Release: 2021-2022/318 |

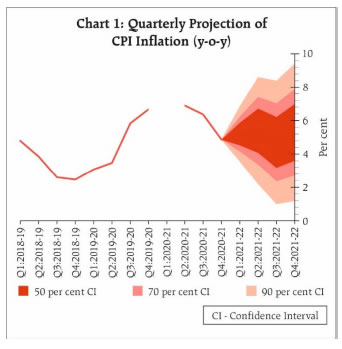

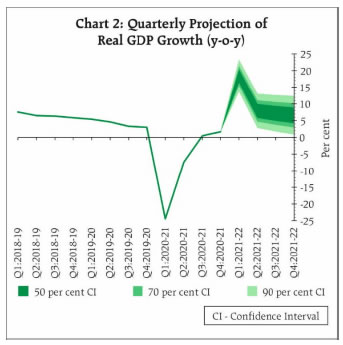

Page Last Updated on: