IST,

IST,

Annual Report of the Banking Ombudsman Scheme for the year 2017-18

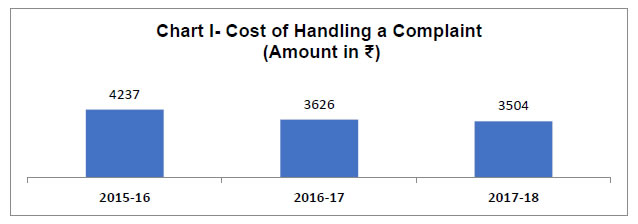

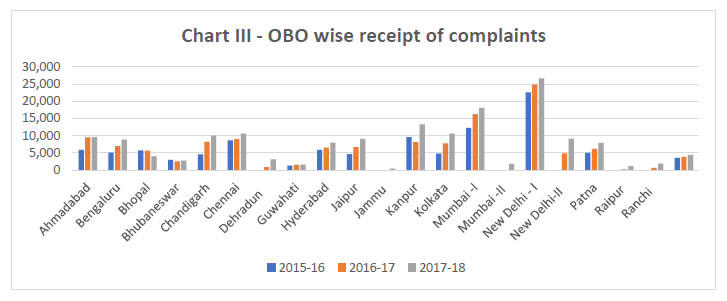

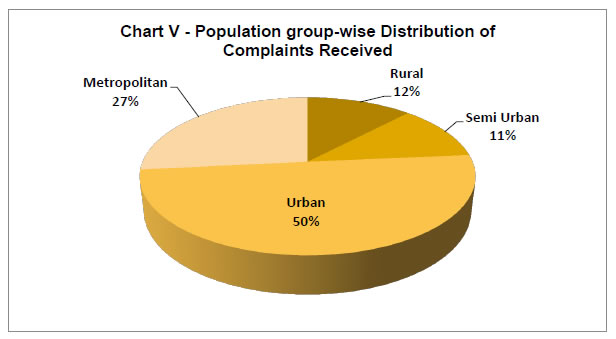

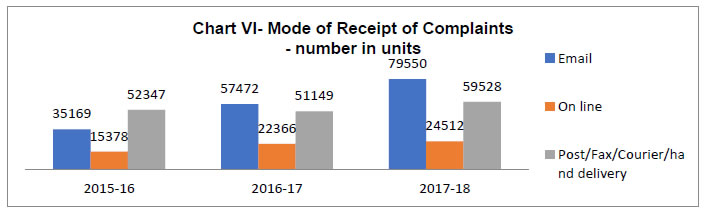

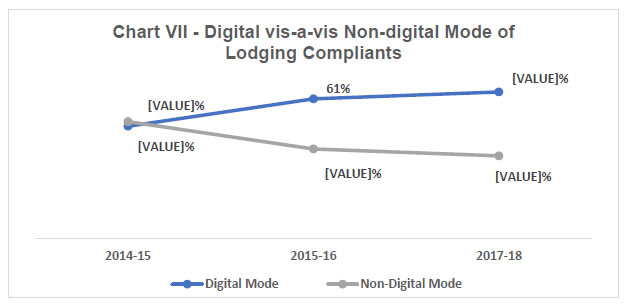

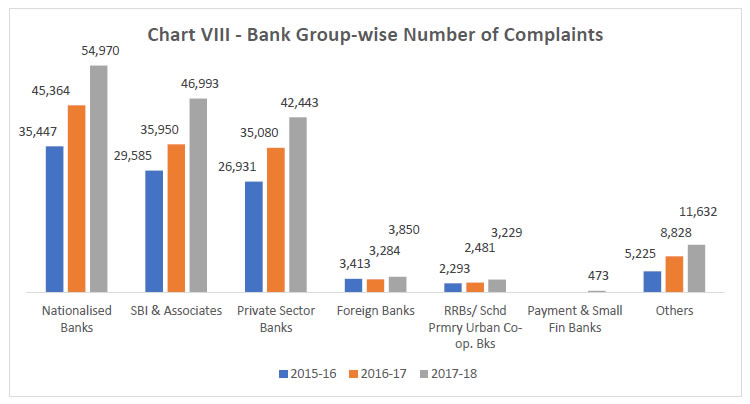

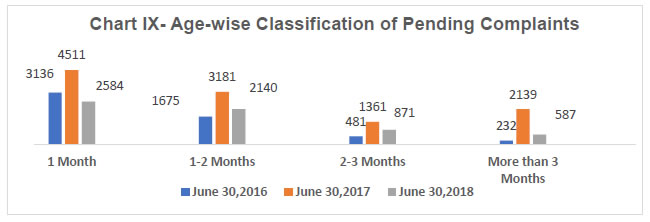

M K Jain The Banking Ombudsman Scheme (BO Scheme) was introduced in 1995 as a cost free and expeditious grievance redressal mechanism for customers of banks and has over the years, gained traction. This is reflected by consistently rising number of complaints being handled by the Offices of Banking Ombudsman (OBOs). During last three years, volume of complaints rose at an average annual rate of about 25%, recording a total of 163,590 complaints in 2017-18. I am happy to note that BOs could dispose over 96% of these complaints during the year. In its endeavor to ensure consumer protection, several measures were introduced by Reserve Bank in 2017-18. The BO Scheme was revised to enhance the powers of BOs by removing the pecuniary limit of ₹1 million on the Award that BOs can pass and doubling the amount of compensation for loss that can be granted to ₹2 million. The Scheme was updated to include grievances relating to mobile/electronic banking and mis-selling as grounds of complaint. Another significant measure taken in 2017-18 was the mass public awareness campaign launched by the Reserve Bank during the year through mobile, print and electronic media against fictitious offers of money and phishing/vishing calls made by miscreants who persuade innocent customers to share OTP and other confidential information for cheating them. A second Office of Ombudsman was set up at Mumbai to address the challenge of increasing volume of complaints. Towards this endeavor, a project for development of comprehensive web-based Complaint Management System for integrated processing of complaints received in RBI from all sources and channels was also set into motion during 2017-18. The success of the BO Scheme provided impetus for launching of an Ombudsman scheme on similar lines, for the customers of select categories of Non-Banking Financial Companies (NBFCs). This Scheme has been initially operationalized for deposit-taking NBFCs and based on experience gained, will be extended to other eligible NBFCs. Keeping in view the rising volume and pace of electronic financial transactions and the related emerging risks for consumers, Reserve Bank initiated steps to formulate a separate Ombudsman Scheme for digital transactions. With a view to further strengthen the internal grievance redressal mechanism in banks, RBI issued Internal Ombudsman Scheme, 2018 (IO Scheme) under Section 35 A of the Banking Regulation Act, 1949. It aims at ensuring greater autonomy for the IOs while strengthening the mechanism for monitoring the implementation of the Scheme through internal audit and enhanced supervisory oversight. The Annual Report, 2018 through its delineation of the functioning of the BO Scheme during 2017-18, reflects the changing landscape of the financial sector. The report also touches upon the Way Forward, particularly about formulating a separate Ombudsman Scheme for Digital transaction, developing a system for online resolution of disputes as well as capacity building of the OBOs to facilitate efficient and effective management of the rising volume of complaints. (M K Jain) Vision and Goals of the Vision • To act as a visible and credible dispute resolution agency for common persons utilising banking services Goals • To ensure grievance redressal of users of banking services in an inexpensive, expeditious and fair manner that provides impetus to improve customer services in the banking sector on a continuous basis • To provide policy feedback/suggestions to the Reserve Bank of India towards framing appropriate and timely guidelines for banks to improve the level of customer service and to strengthen their internal grievance redressal system • To enhance awareness of the Banking Ombudsman Scheme • To facilitate quick and fair (non-discriminatory) redressal of grievances through use of IT systems, comprehensive and easily accessible database and enhanced capabilities of staff through capacity building Background The Banking Ombudsman Scheme was notified by the Reserve Bank of India (RBI) in 1995 under Section 35 A of the Banking Regulation Act, 1949. As on date, Scheduled Commercial Banks, Scheduled Primary Urban Co-operative Banks and the Regional Rural Banks (RRBs), Small Finance Banks and Payment Banks are covered under the Scheme. It is administered by the RBI through 21 Offices of Banking Ombudsman (OBOs) covering all states and union territories. Complaints handled by Banking Ombudsman (BO) - Brief Analysis 2. A brief analysis of complaints handled by BOs during the year is as under:

Developments during the Year 3. The significant developments during 2017-18, are summarized below: i. Revision of Banking Ombudsman Scheme, 2006: Keeping in view the changing profile of complaints, the Scheme was revised to include mis-selling, as also electronic and mobile banking related grievances as valid grounds of complaints. The ceiling of ₹1 million on the pecuniary jurisdiction of BOs, i.e. on the maximum amount of loss on which the BOs pass the award was removed, thereby enabling the BOs to entertain complaints and give their decision regardless of the amount involved in the dispute. The amount of compensation that BOs can award, in addition to the disputed amount, was increased from ₹1 million to ₹2 million and compensation of ₹0.1 million, towards harassment and mental anguish (previously available only to credit card complaints), was extended to all complainants. The scope for a complainant to prefer an appeal was enhanced by making, the Clause “requiring consideration of elaborate documentary and oral evidence’’ used for closure of cases by BOs, as appealable. ii. Opening of New Office of Ombudsman: A second office of the Banking Ombudsman was operationalized at Mumbai with a view to reduce the turnaround time in disposal of the increasing number of complaints. With this, the total number of OBOs went up to 212. iii. Strengthening Internal Grievance Redressal in banks: As a step towards strengthening the internal grievance redressal system in banks, the functioning of Internal Ombudsman (IO) mechanism, mandated by the RBI in 2015, was revisited and a revised ‘Internal Ombudsman Scheme, 2018’ was issued under Section 35 A of Banking Regulation Act, 1949. The coverage of the IO Scheme was extended (from PSBs and eight select private and foreign banks) to all Scheduled Commercial Banks (other than Regional Rural Banks), having 10 or more banking outlets in India. iv. Awareness Programmes: During the year, the OBOs organised Town Hall Events (26), awareness programmes/outreach activities (129) and several advertisement campaigns, particularly in rural and semi-urban areas for spreading awareness about the Scheme. RBI’s SMS handle ‘RBISAY’ was extensively used for sending text messages on topics such as fictitious offers of money, secured use of electronic banking facilities, BO Scheme, etc. An Integrated Voice Recognition Service facility (by giving a missed call on 14440) was also made available to public by RBI for getting more information on the above. v. Leveraging Technology: To address the challenge of increasing volume of complaints and enable their faster resolution, RBI is developing an integrated web-based Complaint Management System for automating the process of handling complaints received in RBI from all sources and channels. A System Integrator for this project has been appointed and the project is expected to be rolled out during the year 2018-19. vi. Ombudsman Scheme for customers of NBFC: Taking forward the success of the BO Scheme, Ombudsman Scheme for the customers of deposit-taking NBFC was implemented. Way Forward 4. i) In order to handle the rising number of complaints with respect to financial transactions conducted through digital mode, Ombudsman Scheme for digital transactions is proposed to be formulated and implemented during 2018-19. ii) Keeping in view the increasing complexity, pace and volume of banking products/ transactions, measures will be taken for capacity building of the staff of OBOs, as also those handling customer complaints in banks, to enhance their understanding of the intricacies of various types of cases as well as to evolve greater uniformity in the processing of complaints. This will also be facilitated by the implementation of the proposed Complaint Management System which, inter alia, is envisaged to provide capability for end-to-end Online Resolution of Disputes (ORD). iii) The functioning of the NBFC Ombudsman Scheme which was implemented in February 2018 would be reviewed and scope of extending the Scheme to include NBFCs with asset size of over ₹1 billion and having public interface, would be considered. The Banking Ombudsman Scheme The Banking Ombudsman Scheme was notified by the Reserve Bank of India (RBI) in 1995 under Section 35 A of the Banking Regulation Act, 1949. Over the years, it has evolved and has undergone five revisions since its inception, the last being in July 2017. As on date, Scheduled Commercial Banks, Scheduled Primary Urban Co-operative Banks and the Regional Rural Banks (RRBs), Small Finance Banks and Payment Banks are covered under the Scheme. It is administered by the RBI through 21 Offices of Banking Ombudsman (OBOs) covering all states and union territories of India. The cost of running the Scheme, which includes revenue and capital expenditures3 on administration is borne by the RBI. 1.2 Over the years, the Scheme has gained wide acceptance and popularity as reflected by the year on year increase in the number of complaints received at the OBOs. 1.3 In tune with the changing landscape of banking, the Scheme was revised to include mis-selling and mobile / internet banking related grievances as new grounds of complaints. In the first year itself, complaints relating to internet / mobile banking accounted for 5.2% of total complaints received by BOs during the period. However, complaints related to mis-selling received during the year were few and their share stood at only 0.4% of total complaints. 1.4 As a part of the revision of the Scheme, BOs became authorized to handle complaints irrespective of the amount involved, by lifting the restriction (of ₹1 million) on the pecuniary jurisdiction of BOs. BOs were also empowered to award a higher compensation of ₹2 million for losses arising out of deficiency in service vis-à-vis ₹1 million earlier. A compensation of ₹0.1 million towards harassment and mental anguish, which was previously available only to credit card complaints was extended for all complainants. Further, by making the Clause ‘’requiring consideration of elaborate documentary and oral evidence’’ appealable, the scope for a complainant to prefer an appeal, against the decision of the BO was also increased as an additional measure of customer protection. The number of appeals received increased from 15 in 2016-17 to 125 during the year under review, reflecting the significance of this revision. 1.5 In order to bring down the turnaround time in the disposal of the increasing number of complaints, a second office of the Banking Ombudsman was set up at Mumbai. The territorial jurisdiction of this new office extends to Goa and Maharashtra excluding the districts of Mumbai, Mumbai Suburban and Thane. The total number of OBOs now stands at 21. 1.6 During the year, the average cost of handling a complaint came down from ₹3,626/- to ₹3,504/- due to increase in the number of complaints and economies of scale. The decline in the average cost of handling a compliant during the last three years is evident from Chart I below: A comparative position of cost of running the Scheme as well as the average cost per complaint during the last three years is given at Appendix I. The OBO-wise per complaint cost for the year 2017-18 is given at Appendix II. Considering the fixed costs involved, the offices having fewer complaints mostly show higher cost per complaint. 1.7 A record 174,805 complaints were handled by OBOs in 2017-18, of which 96.5% were disposed during the same period and 3.5% remained pending as on June 30, 2018. The position of customer complaints handled by OBOs is given at Appendix III. 1.8 In addition to handling the disposal of cases, the BOs also sought to spreading awareness about the Scheme by organising Town Hall events, awareness programmes / outreach activities particularly in rural and semi-urban areas. In this direction, advertisement campaigns were launched by BOs besides participating in trade fairs etc. Analysis of Complaints 2.1 A comparison of the number complaints received by OBOs during the last three years is given in Chart II. 2.2 In 2017-18, the number of complaints received by the BOs increased by 24.9% as compared to a rise of 27.3% in 2016-17(Appendix IV). The upward trend could, inter alia, be attributed to the increase in the number of bank customers and the impact of initiatives for spreading awareness taken by RBI, including through TV channels, FM Radio, SMS handle viz., “RBISay” as well as the efforts made by OBOs at the regional levels. Receipt of Complaints 2.3 During the year, the number of complaints received by the OBOs stood at 1,63,590. OBO-wise receipt of complaints is at Appendix V. OBO New Delhi received the maximum number of complaints (26,653), which accounted for 16.3% of the total complaints received. Last year too, the same OBO had received the highest number of complaints. Together with the recently opened OBO, New Delhi II, the total number of complaints handled by the two offices at New Delhi stood at 35,737 representing 21.8% of total complaints received during the year. 2.4 OBO Kanpur witnessed a sharp increase of 63% in the number of complaints received during 2017-18. A significant increase in the number of complaints was also observed in the four recently opened OBOs viz. Dehradun, New Delhi II, Raipur and Ranchi. A comparative position of complaints received by OBOs during the last three years is given in Chart III. Zone-wise Distribution of Complaints 2.5 The North zone received the maximum share of complaints (44%) while East Zone accounted for only 15% of total complaints received. The zone-wise distribution of complaints received is depicted in Chart IV below. Zone-wise receipt of complaints is given at Appendix VI. It may be observed therefrom that the maximum Y-o-Y growth in the number of complaints was also observed in the North zone (33.4%), followed by East zone (31.5%), South zone (21.1%) and West zone (9.7%) respectively. Population Group-wise Distribution of Complaints 2.6 During the year, 50% of the total number of complaints were lodged by bank customers residing in urban areas, while 12% were received from those in rural areas. The latter grew by 18% over last year which could be attributed, inter alia, to increased awareness about the Scheme. However, the number of complaints filed by customers of banks residing in semi urban and rural areas taken together accounted for only 23% of total complaints, highlighting the need for increasing the awareness levels of people residing in these areas. Population group-wise distribution of complaints during the last year is given in Chart V below and at Appendix VII. Modes of Receipt of Complaints 2.7 Complaints were received in the OBOs through various modes, including hand delivery, post, courier, fax, e-mails and online portal i.e. the department’s Complaint Tracking System (Appendix VIII). A comparison of the various modes through which complaints were received during the last three years is shown in Chart VI below: 2.8 The trend in the last three years indicates that complainants are increasingly moving towards using email and online portal from the previously predominant physical mode of lodging complaints. During the year, 64% of the complaints were filed using the digital mode of which 49% were through e-mails and 15% using the online portal. The trend during the last three years is given in Chart VII below. Complainants: Group-wise Classification 2.9 Out of the total number of complaints lodged, 92.1% were by individuals, of which, 1.3% were by senior citizens. Due to the persistent efforts by RBI, including the advertisement campaign along with the issuance of a circular advising banks to meet the specific needs of senior citizens, the number of complaints filed by this group has been increasing steadily over the past three years from 1,569 (in 2015-16), to 1,745 (2016-17) and 2,098 (2017-18) as detailed at Appendix IX. Bank Group-wise Classification 2.10 The bank-group wise classification of complaints received by OBOs during the last three years is indicated in Chart VIII. Of the total number of complaints received in OBOs, nationalised banks and SBI taken together accounted for 63% as detailed at Appendix X. There was an increase of 31% in complaints received against SBI during the year, one of the major reasons being the merger of associate banks with SBI. The share of Foreign banks stood at 2% while that of Private Sector banks was 26% of total complaints received. The RRBs and Scheduled Primary Urban Cooperative banks together accounted for 1.97% of total number of complaints. The complaints against the new entities viz., Payment and Small Finance banks stood at 0.03%. Almost 7% of the complaints were against entities that are not covered under the Scheme. Nature of Complaints Handled 2.11 As specified under Clause 8 of the Scheme, there are 30 grounds for lodging complaints with the BO. Table 1 below broadly indicates the proportion of complaints received under the various grounds of complaints listed in the Scheme. 2.12 The ground of complaint, ‘Non-observance of Fair Practice Code’ continued to account for the highest share (22.1%) of complaints received in OBOs. This, along with the other grounds i.e. ‘Failure to Meet Commitments’ and ‘Non-adherence to BCSBI Codes’, constituted 31.3% of the total complaints. Focused action by banks is necessary in this regard in order to ensure that the staff, especially at customer touch points are equipped with requisite skills and are adequately trained. 2.13 Complaints relating to ATM / Debit Cards comprised 15.1% of total complaints marking an increase of 50% over last year. Of the total number of ATM / Debit Cards complaints, a major sub-category was ‘Account debited but cash not dispensed by ATMs’ which accounted for almost 60% of the ATM related complaints (Table 2). 2.14 ‘Non-adherence to RBI instructions on Mobile / Electronic Banking’ was included as a ground of complaint in the revised Scheme in July 2017. During the first year of inclusion, 5.2% of the complaints were received on this ground. 2.15 Of the 7.7% of the credit card related complaints received during the year, 30% pertained to wrong billing / debits, 8% to wrong / delayed reporting / non-updating credit status with credit information to Credit Information Bureau and 5% to threatening calls / inappropriate approach of recovery agents. 2.16 The complaints relating to digital transactions (mobile, internet, ATM and credit cards) accounted for 28% of total complaints, registering a rise of 9% over the previous year. The increasing utilization of digital modes of transactions and consequent rise in such complaints coincides with the issue of RBI instructions on ‘Limiting Liability of Customers in Unauthorised Electronic Banking Transactions’ issued on July 6, 2017 and the intensive awareness campaign in this regard, launched through print and electronic media during the year under review. 2.17 ‘Non-adherence to Reserve Bank guidelines on para-banking activities like sale of insurance / mutual fund / other third-party investment products by banks’ was also included as a ground of complaint in the revised Scheme in July 2017. Only 0.4% of the complaints pertained to this ground. 2.18 During the year, 4.8% of the complaints related to ‘Pension Payments’. The number of complaints in this category has come down both in absolute and in percentage term, inter alia, due to the continued efforts of RBI, including the issuance of circulars (to all agency banks dealing with pension payments), to provide considerate and sympathetic customer service to pensioners and holding meetings for sensitising banks, advising them to give special attention to this class of customers etc. 2.19 Complaints on ‘Levy of Charges without prior notice’ constituted 5% of the total complaints but on a year-on-year basis it witnessed an increase of 13%. Levying charges for non-maintenance of minimum balance, processing fees, pre-payment penalties in the guise of loan takeovers by the other banks are some of the causes for complaints under this ground. Banks need to analyse the root cause and patterns of such complaints for taking corrective actions. 2.20 During the year, 4.1% of complaints pertained to ‘Deposit Accounts’ and were mainly on grounds of delay in credit, non-credit of proceeds to party’s account, non-payment of deposit or non-observance of the RBI directives, if any, applicable to rate of interest on deposits in savings, current or other accounts, etc. 2.21 Complaints relating to ‘Loans and Advances’ constituted 3.8% of the total complaints and generally pertained to delay in sanction, disbursement, non-observance of prescribed time schedule for disposal of loan applications, non-acceptance of application without valid reason, etc. 2.22 In 2017-18, 2% of the total complaints related to ‘Remittances’ such as non-payment/ inordinate delay in the payment or in the collections of cheques, drafts, bills etc. 2.23 OBOs also received complaints which were ‘Out of Purview’ of the Scheme and were closed as non-maintainable. During the year, 3.5% of the complaints were ‘Out of Purview’ of the Scheme, which were marginally less than those in the previous year (4.8%). 2.24 Nearly 16% complaints fell under ‘Others’ category and related to complaints on ‘Non-adherence to Prescribed Working Hours’, delay in providing banking facilities, etc. as detailed in Table 3. 2.25 During the current year, the OBOs handled an all-time high of 174,805 complaints (an increase of 28% from the last year) of which 96.5% were closed. Table 4 below indicates a comparative position of disposal of complaints by OBOs. The OBO-wise position of complaints disposed during the year 2017-18 is given at Appendix XI. 2.26 In 2017-18, 48.9% of total complaints were closed as Non-Maintainable4 as compared to 52.3% during the previous year. This decline can be attributed to increased awareness amongst common people as a result of the numerous initiatives taken by RBI. Consequently, the share of maintainable complaints rose by 3.4% during 2017-18. Bank and wise distribution of maintainable complaints is given at Appendix XII and the OBO wise distribution is given at Appendix XIII. Age–wise Classification of Pending Complaints 2.27 Although the Scheme specifies no time limit for resolution of complaints by OBOs, efforts are made to resolve the same within two months. However, due to reasons such as non-submission and / or delay in submission of complete information by complainants/banks, the time taken for resolution may get extended. Of the total complaints pending as on June 30, 2018, only 0.83% were over two months old. The age-wise classification of number of pending complaints is detailed at Appendix XIV. Chart IX below indicates age-wise classification of pending complaints. Mode of Disposal of Maintainable Complaints 2.28 The Scheme promotes settlement of complaints by agreement through conciliation or mediation by BOs. If the parties fail to arrive at an acceptable conclusion by agreement, the BO gives a decision or passes an Award. A noteworthy feature of 2017-18 is the marked increase in the number of complaints resolved by agreement. As detailed in Table 5 below 65.82% of the maintainable complaints were resolved through agreement as compared to 42.43% during the previous year. This shows that mediation is increasingly being used as an effective tool in complaint resolution. Grounds for Rejection of Maintainable complaints 2.29 The grounds for rejection of maintainable complaints and their proportion to total complaints received during the year are indicated in Table 6. The BO Scheme envisages summary disposal of complaints. As may be seen from the above table, the maximum number of rejections are on the ground that ‘elaborate documentary and oral evidence’ is required as provided for closure of such cases under Clause 13 (d) of the Scheme. Keeping in view the high number of such rejections, this ground was made appealable with effect from July 1, 2017. The total number of Appeals increased eight-fold from 15 in 2016-17 to 125 in 2017-18, of which, 98 Appeals pertained to closure under the said Clause. However, the 98 appeals account for only 4.2% of 2,337 complaints closed under Clause 13 (d) of the Scheme. 2.30 First Resort Complaints5: ‘First Resort Complaints’ (FRCs) are returned to the complainants advising them to follow the laid down procedure with a copy to the concerned bank for suitable redressal. During the year, 10% of the non-maintainable complaints were FRCs. Awards Issued 2.31 During the year, 148 Awards were issued by BOs. The OBO-wise position of Awards issued and implemented is indicated in Table 7. Appeals against the Decisions of the BOs 2.32 The Deputy Governor-in-Charge of the Consumer Education and Protection Department (CEPD) of the RBI is the designated as the Appellate Authority6 (AA) as per the provisions of the BO Scheme. CEPD provided the Secretariat to the AA. During the year, there was an eightfold increase in the number of appeals (125) as compared to the last year (15) owing to the revision in the Scheme as discussed at para 2.29 above. Of these, 115 appeals were received from complainants who were aggrieved by the decision of the respective BOs whereas 10 were filed by the banks. The AA handled 132 appeals during the year, including 7 appeals that were pending at the beginning of the year. Of these, 377 appeals were disposed as on June 30, 2018. 2.33 The position of appeals handled by the AA during the last three years and the OBO-wise position of appeals received during the year 2017-18 is given in Tables 8 and 9 respectively. Other Complaints / Applications Received in RBI Centralised Public Grievance Redress and Monitoring System 3.1 Centralised Public Grievance Redress and Monitoring System (CPGRAMS) is an initiative of Government of India which provides an alternate channel to public to lodge their complaints with regulators. The CPGRAMS portal has been developed by the Department of Administrative Reforms and Public Grievances of Government of India. Government Departments and banks are subordinate offices in this portal, to receive and redress complaints. CEPD is the Nodal Office for RBI and OBOs are subordinate offices. 3.2 A comparative position of these complaints received through this portal and handled by OBOs during the last three years is given at Appendix XV. During 2017-18, a declining trend has been observed in the complaints received through this portal. Applications Received under Right to Information Act, 2005 3.3 The Banking Ombudsmen are the Central Public Information Officers under the Right to Information Act, 2005 (RTI Act) to receive applications and furnish information relating to complaints handled by the OBOs. During the year, 1,039 RTI applications were received by all OBOs. The OBO-wise position of such applications received during the last three years is detailed at Appendix XVI. Important Developments and Way Forward Revision of the Banking Ombudsman Scheme 4.1 To keep pace with the rapid changes in the banking arena, the BO Scheme was revised, for the fifth time since its inception in 1995, with effect from July 1, 2017. The salient features of the revision are as follows:

Second Office of Banking Ombudsman at Mumbai 4.2 In an effort to provide speedier resolution for the increasing volume of complaints, a second office of Banking Ombudsman (designated ‘Office of the Banking Ombudsman – Mumbai - II’) was opened at Mumbai. The jurisdiction of the OBO-II, Mumbai - II extends over Maharashtra and Goa [except the districts of Mumbai, Mumbai (Suburban) and Thane]. Review of Internal Ombudsman Mechanism in Banks 4.3 The RBI had, in May 2015, advised all public-sector and select private and foreign banks to appoint Internal Ombudsman (IO) as an independent authority to review complaints that were partially or wholly rejected by the bank. RBI revisited this arrangement and in September 2018 issued revised directions under Section 35 A of the Banking Regulation Act, 1949 in the form of an ‘Internal Ombudsman Scheme, 2018’. The Scheme covers, inter-alia, appointment / tenure, roles and responsibilities, procedural guidelines and oversight mechanism for the IOs. All Scheduled Commercial Banks in India having more than ten banking outlets (excluding Regional Rural Banks), are required to appoint one or more IO. The IO shall examine all customer complaints, which are in the nature of deficiency in service on the part of the bank, (including those on the grounds of complaints listed in Clause 8 of the BO Scheme, 2006), which are partly or wholly rejected by the bank. As the banks shall internally escalate all complaints which are not fully redressed, to its IOs, before conveying the final decision to the complainant, the customers of banks need not approach the IO directly. The implementation of IO Scheme will be monitored through the bank’s internal audit mechanism apart from supervisory oversight by RBI. Ombudsman for Digital Transactions 4.4 In the backdrop of the increasing volume of complaints involving digital payments and the large number of Prepaid Payment Instruments issued by banks and non-bank issuers, RBI is in the process of formulating an Ombudsman Scheme for digital transactions. As an initial step in this direction, CEPD organised a seminar on “Consumer Protection in Digital Transactions” on August 30, 2018 to discuss the various aspects of regulatory and customer protection issues with the stakeholders of digital payment services. The seminar involved talks by Shri M Mohapatra, Deputy Managing Director (Strategy) & Chief Digital Officer, SBI, Shri Sunil Bajpai, Principal Advisor (IT), Telecom Regulatory Authority of India and Shri Shri G Padmanabhan, non-executive Chairman, Bank of India. A panel discussion chaired by Dr A S Ramasastri, Director, Institute of Development and Research in Banking Technology was also held which included Shri Rajiv Anand, Executive Director, Axis Bank, Shri Madivannan, CTO, ICICI Bank, Shri Dilip Asbe, MD & CEO, National Payments Corporation of India, Shri Sameer Nigam, Co-founder & CEO, Phone Pe as the panellists. The seminar was attended by Executive Directors of RBI, Shri. Deepak Singhal Smt. Surekha Marandi, Smt. Rosemary Sebastian, Smt. Parvathy V Sundaram, senior officers from regulatory and supervisory departments of RBI and banks, Banking Ombudsman of metro cities, PNOs and Internal Ombudsman of select banks / e-wallets and other industry representatives. Other Banking Ombudsman and in-charges of CEPCs of 31 offices also participated through video conference. The seminar threw light on a large number of consumer protection-related issues including necessity for clear identification of the transactions to be covered under the term “digital” and distinguishing them from “non-digital” transactions, trade-off between the requirements of the grievance redressal system and freedom for innovations and requirement for adequate talent with essential skill-sets. The feasibility of co-regulation was also discussed considering that certain service providers in the supply chain of digital transactions, like for mobile banking, are outside the regulatory purview of the RBI. Complaint Management System (CMS) 4.5 RBI has initiated the process of developing a CMS to meet the challenges in the area of grievance redressal. The System Integrator for this project has been selected through a tendering process. During the year, the CMS will be implemented as an online dispute resolution mechanism for customers of banks and eligible NBFCs and in due course would be extended to complaints related to digital transactions. Pilot Study on Service Charges Levied by Banks for Basic Banking Services 4.6 RBI commissioned a pilot study in the city of Mumbai on charges levied by banks for basic banking services to ascertain customer feedback and need for rationalisation of charges. The study revealed that 72% of the respondents were aware about availability of tariff schedule at the branches and that the front-line staff of the branch was the main source of information in this regard. More than 30% of the respondents indicated that information about service charges and fees was not shared by the banks at the time of opening of account and any subsequent changes were also not informed to them. More than 25% of the respondents expressed their discontent over charges such as penalty on non-maintenance of minimum balance, cash deposit charges at home and non-home branches, cheque return charges (deposited by the customers) and for signature verification. Conference of Principal Nodal Officers of Banks 4.7 The Conference of the Principal Nodal Officers (PNO) of Scheduled Commercial banks was convened on November 28, 2017 at RBI Academy, Mumbai. Smt. Surekha Marandi, Executive Director, RBI while inaugurating the Conference informed the participants that RBI was examining the possibility of providing access points for conducting meetings through video conferencing to enhance penetration of the grievance redressal mechanism in rural and semi-urban areas. The speakers included Chief General Manager, CEPD, CEO, BCSBI and Senior Advisor, IBA were important speakers in the conference. Besides the PNOs of banks, it was also attended by BOs and senior officers of supervisory/regulatory departments of the RBI. During the Conference, presentations were made by groups of PNOs on the following topics: i) Challenges and strategies for spreading consumer education / awareness – Role of banks ii) Cyber security risks in digital banking iii) Strengthening the internal grievance redressal mechanism in the banks and role of Internal Ombudsman - current status and way forward. The conference highlighted the need for banks to spread financial literacy and awareness, impart proper training to frontline staff on the extant regulations, such as determining the suitability of a financial product or service vis-a-vis the targeted class of customers. Working Group for Streamlining the Resolution Process for ATM-related Complaints 4.8 A group headed by the PNO of SBI along with representatives from NPCI, ICICI, HDFC and Corporation bank was set up to analyse the pattern of ATM-related complaints and identify issues that cause customer inconvenience and / or delay in redressal / settlement of ATM disputes, including the issuer and acquirer bank dynamics. The group has submitted its report which is being examined for implementation. Video Conference on Digital Banking and Cyber Security 4.9 To provide further clarity to BOs and in-charges of Consumer Education and Protection Cells on Digital Banking and Cyber Security, a video conference was organised on August 28, 2017 by CEPD. Shri S Ganesh Kumar, Executive Director in charge of Department of Payment and Settlement Systems provided guidance on issues such as erroneous transfer of funds through NEFT/RTGS, disputed ATM transactions, cloning of cards, preservation of CCTV footage, complaints relating to white label ATM, fictitious offers, risks in static password in Card Not Present and e-commerce transactions, extra charges levied by banks on usage of cards, etc. Awareness and Consumer Education 4.10 The OBOs adopted a multipronged outreach strategy to spread awareness about the Banking Ombudsman Scheme and consumer education during the year. This included conducting 129 outreach and awareness programmes and 26 Town Hall events throughout the country, especially in the rural and semi-urban areas, advertisement campaigns in print and electronic media, participation in exhibitions / trade fairs, display of banners, posters etc., and distribution of promotional material. 4.11 RBI also conducted a country-wide awareness campaign on fictitious offers, Basic Savings Bank Deposit account through print and electronic media. RBI’s SMS handle ‘RBISAY’ was extensively used for sending messages across India on topics such as fictitious offers of money, secured use of electronic banking facilities, Banking Ombudsman Scheme, etc. An Integrated Voice Recognition Service facility (by giving a missed call on 14440) was made available to public by RBI for getting more information on these topics. Way Forward 4.12 In order to handle the rising number of complaints relating to financial transactions conducted through digital mode, Ombudsman Scheme for digital transactions is proposed to be formulated and implemented during 2018-19. 4.13 Keeping in view the increasing complexity, pace and volume of banking products / transactions, measures will be taken for capacity building of the staff of OBOs, as also those handling customer complaints in banks, to enhance their understanding of the intricacies of various types of cases as well as to evolve greater uniformity in the processing of complaints. This will also be facilitated by the implementation of the proposed Complaint Management System which, inter alia, is envisaged to provide capability for end-to-end Online Resolution of Disputes (ORD). 4.14 The functioning of the NBFC Ombudsman Scheme which was implemented in February 2018 would be reviewed and scope of extending the Scheme to include NBFCs with asset size of over ₹1 billion and having public interface, would be considered. Important Notifications Relating to Customer Service issued by the RBI in 2017-18