Annual Report on Banking Ombudsman Scheme, 2008-09 - RBI - Reserve Bank of India

Annual Report on Banking Ombudsman Scheme, 2008-09

Dr. K.C.Chakrabarty The issue of ‘Treating the bank customers fairly’ is gaining currency with the awakening of consumers on the issues of investor/consumer protection. Banking being a service industry it is all the more important that there is a well defined and functional mechanism to ensure fairness to the customer. That is all what the Banking Ombudsman Scheme (BO Scheme) is about and that is what RBI does- without significantly backtracking on the freedom given to banks' boards to fx their rates and fees. In view of the fact that the Courts are restrained through an amendment to Section 21 A of Banking Regulation Act, 1949 from intervening in the matter of interest rates- usurious or otherwise - fxed by the banks to their debtors, it is ordained on RBI to ensure that the rates and service charges are reasonable, not usurious in all spheres of lending. The RBI, over the years, has undertaken a large number of initiatives on ensuring fair treatment to customers. This has taken the form of both regulatory fats ( like reining in of recovery agents, introduction of comprehensive display board, banking facilities for the visually challenged, rationalization of service charges on collection of outstation cheques, free use of ATMs etc ) as also moral suasion and class action. A minimum standard of banking practices for banks to follow when dealing with individual customers was established on introduction of the Code of Bank's Commitment to Customers in July 2006. However, a number of challenges still need to be addressed to make customer services responsive to the 'small customer'. The actions taken by the RBI so far do not in any way dwarf the challenges that confronts us in regard to fair treatment of customers. There is a sharp asymmetry in information and expertise between the manufacturers and distributors of products and retail investors and the latter typically exhibit a relatively low level of financial sophistication. The act of 'packaging' investments / sale of products can increase this asymmetry, for instance, by adding complexity that makes key investments / service characteristics less transparent and introducing additional layers of cost which may not be readily apparent. The Banking Ombudsman Scheme introduced by RBI in 1995 attempts to bridge this information and expertise asymmetry between the banks and the end user of their products and services. Having given freedom to the bank boards to decide on many issues, RBI should not be compelled by omissions and commissions by commercial banks to issue directives to them. However, there are a few ground rules which every commercial bank should be compelled to follow: a. Minimum courtesy and behavioral standards - Extending minimum courtesy and proper behavior towards customers is one of the guiding principles and banks should follow a 'zero-tolerance' policy towards misbehavior. The Customer Service Committees at all levels need to adopt aggressive stance in this regard. b. Transparency - A minimum standard needs to be adopted towards fostering transparency by making MITC (Most Important Terms and Conditions) mandatory for all retail products. A sign off should be obtained from the customer on understanding of the MITC. While MITC for credit card products has already been introduced, RBI is in active dialogue with the Indian Banks Association regarding MITC for all lending and deposit products. Also, these MITCs should be in regional languages as far as possible. Secondly, there should be transparency in pricing products and services. Banks should come out with transparent pricing based on cost of deposits plus risk premia plus spread and the same should be conveyed to the customer at the point of sale. If there is a change in pricing during the tenure of the product, the same should only be on reaching mutually agreeable milestones. c. Non-discriminatory policy - Banks should establish a basic standard of non-discriminatory pricing. This is based on the premise that 'new' customers cannot get preferential treatment over the 'old' customers if in the same risk category. Non-discriminatory policy should be observed in pricing as well as establishing standards of services and implementation of services. d. Deliver what is promised - There will always be customer service related problems, but when problems are brought to a bank's notice, priority should be given to solving the problems. There is a need to set up internal benchmarks and escalation policies with regard to customer complaints. e. Allowing seamless 'switching'

- The consumer should be able to

change products or switch products

without incurring excessive penalty.

Similarly, banks should not make it

unnecessarily difficult for consumers

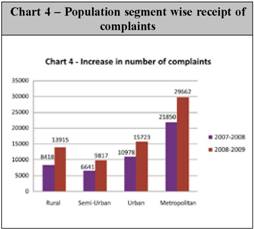

to make claims or to complain when f. Appropriateness of 'sell' - Products and services need to be designed with the targeted customer segment in mind. The customers should be targeted appropriately, to minimise the risk that marketing might prompt customers who are unsuitable to buy such products. g. Unreasonable customer demand - When banks find that a customer is unreasonable, they should take a firm but polite stand that what he/she wanted could not be accepted for some particular reasons. The above seven tenets should form the guiding principles towards resolution of customer grievances. The ultimate aim of regulation is to move towards an outcome based approach where customer outcomes can be quantitatively measured and regulatory response formulated accordingly. While introducing a more cumbersome regulatory regime is not our objective, it may be needed to tie-up customer experience outcomes to regulatory capital. Looking forward, a customer service rating based approach with quantitative parameters ultimately linked to its capital can serve such a purpose. The Offices of the Banking Ombudsmen have been rendering excellent service over the years in redressing customer grievances in an impartial and efficient manner. During the year 2008-09 the Banking Ombudsmen received 69117 complaints as against 47887 complaints received in the previous year (an increase of 44% ) and disposed off 87% of the total complaints (89% in the previous year ). 10% of the pending complaints were more than 2 months old as on June 30, 2009, as against 15% during the previous year end. The offices of the Banking Ombudsmen received increasing number of complaints from rural and semi-urban areas during the year 2008-09. This is a testimony to the success of the awareness efforts undertaken by the Banking Ombudsmen as well as the RBI through personal/ village visits, media campaign etc. While the number of complaints from rural areas increased by 65%, complaints from the semi-urban areas increased by 48%,which can be well compared against the aggregate increase of 44% in the number of complaints during the year 2008-09. As Appellate Authority, I notice that there is a discerning trend in appeals made by the customer- he understands the issues and he makes a pointed appeal to rectify the service deficiency and it is a welcome trend. The BO Scheme revised on May 24, 2007, made a provision for appeals by either party. The increased number of appeals indicates that the customer understands the BO Scheme fairly. I am sure the office of the Banking Ombudsmen will continue to play a stellar role in mitigating the challenges - existing and anticipated. (Dr.K.C.Chakrabarty) November 16, 2009 Vision and Goals of the Banking Ombudsman Offices Vision Statement

Goals

Customer Service Initiatives by the Reserve Bank of India over the years The deregulation of interest rates and product pricing by banks in India was followed up by the RBI with certain institutional, regulatory and infrastructural changes. A summary of the important initiatives taken by the RBI for improvement in customer service rendered by banks is detailed below:-

PROFILE OF CUSTOMER COMPLAINTS RECEIVED AT BO OFFICES

The Banking Ombudsman Scheme 2006 1. The word ‘Ombudsman’ (‘ahm’ ‘bedz’ ‘man’) in general means a public official who is appointed to investigate the citizen’s complaints against the administration. He is to intervene for the ordinary citizen in his dealings with the complex machinery of the establishment. In India, any person whose grievance against a bank is not resolved to his satisfaction by that bank within a period of one month can approach the Banking Ombudsman (BO) if his complaint pertains to any of the matters specified in the Scheme. Banking Ombudsmen have been authorized to look into complaints concerning (a) deficiency in banking service (b) sanction of loans and advances in so far as they relate to non-observance of the RBI directives on interest rates, delay in sanction or non-observance of prescribed time schedule for disposal of loan applications or non-observance of any other directions or instructions of RBI as may be specified for this purpose from time to time, and (c) such other matters as may be specified by RBI. The Scheme envisages expeditious and satisfactory disposal of customer complaints in a time bound manner. The BOs on receipt of any complaint endeavors to promote, if necessary, a settlement of the complaint by agreement between the complainant and the bank named in the complaint through conciliation or mediation. For the purpose of promoting a settlement of the complaint, the Banking Ombudsman has been allowed to follow such procedures as he may consider appropriate and he is not bound by any legal rule of evidence. If a complaint is not settled by agreement within a period of one month from the date of receipt of the complaint or such further period as the Banking Ombudsman may consider necessary, he may pass an Award after affording the parties reasonable opportunity to present their case. He shall be guided by the evidence placed before him by the parties, the principles of banking law and practice, directions, instructions and guidelines issued by the RBI from time to time and such other factors, which in his opinion are necessary in the interest of justice. The Amendment vide notification dated February 3, 2009 As per the Notification dated February 3, 2009, the scope of the Banking Ombudsman Scheme 2006 was widened to include deficiencies arising out of internet banking. Under the amended Scheme, a customer would also be able to lodge a complaint against the bank for its non-adherence to the provisions of the Fair Practices Code for lenders or the Code of Bank's Commitment to Customers issued by the Banking Codes and Standards Board of India (BCSBI). Further, non-observance of the RBI guidelines on engagement of recovery agents by banks has also been brought specifically under the purview of the Scheme. The amended Scheme, however, does not include certain banking transactions, such as, failure to honour bank guarantee or letter of credit, etc. since complaints on these areas of banking services are insignificant in number. The extant provisions allow the Banking Ombudsman to award compensation for the actual loss suffered by the complainant as a direct consequence of the act of omission or commission of the bank or Rupees ten lakh whichever is lower. As per the amended Scheme, the Banking Ombudsman can also award compensation not exceeding Rupees one lakh to the complainant in the case of complaints arising out of credit card operations, taking into account the loss of the complainant's time, expenses incurred by him as also harassment and mental anguish suffered. Any customer who has a grievance against a bank can complain to the Banking Ombudsman in whose jurisdiction the branch of the bank complained against is located. Some banks have centralised certain transactions, like housing loans, credit cards, etc. If there are complaints regarding such transactions, complaints would have to be made to the Banking Ombudsman in the State in which the bank customer receives the bill/ monthly statement. In addition, the RBI has simplified the format for lodging complaint to the Banking Ombudsman. Though the complainant need not lodge his complaint in a specific format, the Scheme now provides for an easy-to-fill format for lodging complaints, in case complainants prefer to use it. The jurisdictions of the Banking Ombudsman at Kanpur, New Delhi, Chandigarh, Chennai and Thiruvananthapuram have been rationalized to include/exclude certain areas taking into account the geographical proximity of those areas to the Office of the Banking Ombudsman. For wider dissemination, the RBI has asked all banks to place a copy of the Banking Ombudsman Scheme on their website. Causes of Complaints Any person, whose grievance against a bank is not resolved to his/her satisfaction by that bank within a period of one month, can approach the Banking Ombudsman if his complaint pertains to any of the matters alleging deficiency in banking including internet banking as specified in the Scheme. The matters include (a) non-payment or inordinate delay in the payment or collection of cheques, drafts, bills etc.;(b) non-acceptance, without sufficient cause, of small denomination notes tendered for any purpose, and for charging of commission in respect thereof; (c) non-acceptance, without sufficient cause, of coins tendered and for charging of commission in respect thereof; (d) non-payment or delay in payment of inward remittances ; (e) failure to issue or delay in issue of drafts, pay orders or bankers’ cheques; (f) non-adherence to prescribed working hours; (g) failure to provide or delay in providing a banking facility (other than loans and advances) promised in writing by a bank or its direct selling agents; (h) delays, non-credit of proceeds to parties' accounts, non-payment of deposit or non-observance of the RBI directives, if any, applicable to rate of interest on deposits in any savings, current or other account maintained with a bank ; (i) complaints from Non-Resident Indians having accounts in India in relation to their remittances from abroad, deposits and other bank-related matters; (j) refusal to open deposit accounts without any valid reason for refusal; (k) levying of charges without adequate prior notice to the customer; (l) non-adherence by the bank or its subsidiaries to the instructions of RBI on ATM/Debit card operations or credit card operations; (m) non-disbursement or delay in disbursement of pension (to the extent the grievance can be attributed to the action on the part of the bank concerned, but not with regard to its employees); (n) refusal to accept or delay in accepting payment towards taxes, as required by Reserve Bank/Government; (o) refusal to issue or delay in issuing, or failure to service or delay in servicing or redemption of Government securities; (p) forced closure of deposit accounts without due notice or without sufficient reason; (q) refusal to close or delay in closing the accounts; (r) non-adherence to the fair practices code as adopted by the bank and (s) non-adherence to the provisions of the Code of Bank's Commitment to Customers issued by Banking Codes and Standard Board of India and as adopted by the bank (t) non-observance of RBI guidelines on engagement of recovery agents by banks; and (u) any other matter relating to the violation of the directives issued by the RBI in relation to banking or other services. In respect of loans and advances, complaints relating to (a) non-observance of RBI Directives on interest rates; (b) delays in sanction, disbursement or non-observance of prescribed time schedule for disposal of loan applications; (c) non-acceptance of application for loans without furnishing valid reasons to the applicant; (d) non-adherence to the provisions of fair practices code for lenders as adopted by the bank or Code of Bank's Commitment to Customers, as the case may be (e) non-observance of RBI guidelines on engagement of recovery agents by banks; and (f) non-observance of any other direction or instruction of the RBI as may be specified by the RBI for this purpose from time to time.

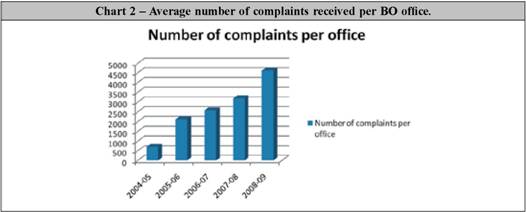

3.1 The Banking Ombudsman Offices receive complaints pertaining to deficiency in service provided by banks. The number of complaints received has increased substantially over the years and this trend is maintained during the year 2008-09 also by recording an increase of 44% over the previous year. The number of complaints received has recorded substantial increase since 2006 as new grounds of complaints such as credit card issues, failure in providing the promised facilities, non-adherence to fair practices code and levying of excessive charges without prior notice, etc were included in the Scheme. Further, internet banking related complaints were added as a new ground for complaint as per amendment of the Scheme dated February 3, 2009. Increased awareness among the public about the BOS and online accessibility to BO office through internet also contributed to the increase in receipt of complaints.

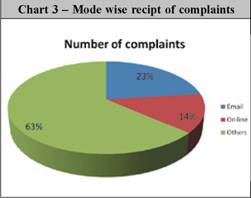

Mode-wise receipt of complaints 3.2 Complainants can log on to the RBI web site at “www.rbi.org.in” and complain about deficiency in bank’s services by using the online complaint form. The email ids of the Banking Ombudsmen are also available in the public domain and complainants can send emails to them. For those who have no access to internet, complaints can be sent by post. Complaints received are acknowledged and tracked till they are closed in the books of the Office of the Banking Ombudsman. During the year 2007-08 and 2008-09, the complaints received by different modes are as under: Though 63% of complaints received during 2008-09 are through letters, post-cards etc, the receipt in the electronic mode has been slowly picking up. Email complaints increased from 15% to 23% of the total complaints between 2007-08 and 2008-09. The Complaint Tracking Software in place in the Banking Ombudsman Office gives acknowledgement automatically and complaint number is given as soon as it is taken into the book of the Banking Ombudsman. The Complaint Tracking Software is updated from time to time to meet the changing requirements related to complaints. Population-segment wise Receipt 3.3 The offices of the Banking Ombudsmen received increasing number of complaints from rural and semi-urban areas during the year 2008-09. This is a testimony to the success of the awareness efforts undertaken by the Banking Ombudsmen as well as the RBI through personal/village visits, media campaign etc. While the number of complaints from rural areas increased by 65% during the year 2008-09, complaints from the semi-urban areas increased by 48%. These figures can be well compared against the total increase in the number of complaints by 44%. The region wise position of complaints is given below: Complainant group-wise Receipt 3.4 The majority of complaints are from individuals as seen from the break up given below. There is no substantial change regarding the source of complaints as compared to previous years. Since the Scheme is primarily meant for common individual customers, the focus continues to remain on the non-institutional category. Banking Ombudsman-wise receipt 3.5 The 15 Offices of the Banking Ombudsman receive and consider complaints from customers relating to the deficiencies in banking services in respect to their territorial jurisdiction. The revised territorial jurisdiction is given in Annex-1. During 2008-09, higher number of complaints were received by the BO Offices in New Delhi(15%), Chennai (15%), Mumbai (14%)and Kanpur (11%) followed by Hyderabad(6%) and Ahmedabad (6%). Percentage wise, Chennai office witnessed the highest increase in the number of complaints (128%).

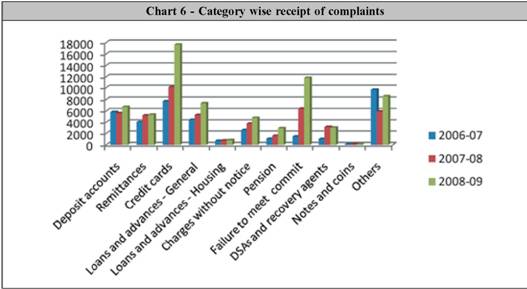

Enhancing Internal Grievance Redressal machinery of banks Bankers are required to place a complaint form in their home page on their website. With a view to enhance the effectiveness of the internal grievance redressal mechanism, banks were advised to place a review of complaints before their Boards / Customer Service Committees along with an analysis of the complaints received with effect from February 2007. The analysis should (i) Identify customer service areas in which the complaints are frequently received, (ii) Identify frequent sources of complaint, (iii) Identify systemic deficiencies and (iv) Make recommendations for initiating appropriate action to make the grievance redressal mechanism more effective. Details of complaints received and disposed off, awards passed and unimplemented awards of the Banking Ombudsman are required to be disclosed along with financial results. Banks were also advised in May 2008 to (i) Ensure that the complaint registers are kept at prominent place in their branches which would make it possible for the customers to enter their complaints, (ii) Have a system of acknowledging the complaints, where the complaints are received through letters / forms, (iii) Fix a time frame for resolving the complaints received at different levels, (iv) Ensure that redressal of complaints emanating from rural areas and those relating to financial assistance to Priority Sector and Government's Poverty Alleviation Programmes also form part of the above process, (v) Prominently display at the branches, the names of the officials who can be contacted for redressal of complaints, together with their direct telephone number, fax number, complete address (other than Post Box No.) and e-mail address etc. for proper and timely contact by the customers and for enhancing the effectiveness of the redressal machinery. 3.6 Bank Group wise receipt of complaints The complaints received by BO Offices against different bank groups are indicated below: Complaints vis-a vis business size 3.6 Instead of considering complaints in isolation, the number of complaints is seen with reference to the bank’s business size and the number of accounts and is analyzed as such. It is seen that the private sector banks and the foreign banks continue to have a larger share in the number of complaints vis a vis the total number of deposits and loan accounts. This may be due to the fact that these banks cater to customers who are more aware of their rights. The break-up of bank wise (scheduled commercial banks) complaints received in the year 2008-09 is given in Annex 4. 4.1 The grounds of complaints have been enumerated in Clause 8 of the Banking Ombudsman Scheme 2006. The following Table gives the broad category wise complaints received during the last three years:- 4.2 Complaints relating to credit cards (comprising 26% of the total complaints in 2008-09) continue to show an uptrend. The number of complaints pertaining to credit cards increased by 74% during 2008-09. While the user base of credit cards has definitely increased during 2008-09 (from 137.17 million to 170.03 million, i.e. by 24%), it does obviate the need for better service and transparency at the point of sales by banks. The types of complaints pertaining to credit cards continue to be those related to issuance of unsolicited credit cards and unsolicited insurance policies and recovery of premium charges, charging of annual fee in spite of being offered as 'free' cards and issuance of loans over phone, disputes over wrong billing, settlement offers conveyed telephonically, non-settlement of insurance claims after the demise of the card holder, abusive calls, excessive charges etc. A general source of these complaints continues to be difficulty in accessing the credit card issuers and the poor response from the call centers. This, in sum, is the issue of non-transparency and mis-selling. 4.3 Complaints relating to failure on commitments made (non-adherence to fair practices code as adopted by the bank, failure to provide or delay in providing banking facilities other than loans and advances etc) ranked second among the complaints received at the offices of the Banking Ombudsman (17% of the total complaints - an increase of 85% over the previous year). This points to the lack of sensitivity, transparency and need for improved MITC at the point of sales. As these complaints mostly relate to basic banking facilities, banks need to address these issues on priority basis without any demur. 4.4 ‘Other' complaints comprised 12% of the total complaints and increased by 45% during the year. These include mainly non-adherence to prescribed working hours, refusal to accept or delay in accepting payments towards taxes as required by RBI/ Government of India, refusal to accept/delay in issuing or failure to service or delay in servicing or redemption of Government securities, refusal to close or delay in closing of accounts. 5.1 A brief profile of the complaints disposed of by BO Offices during the year is given below:

5.2 Banking Ombudsman Offices disposed of 87% (65576) of the 75009 complaints received during the year 2008-09, as against disposal of 89% of the complaints received during previous year. Broadly, around 35% (22461) of the complaints dealt with (65576) have been closed by mutual settlement or by issue of awards while 65% (43115) of the complaints have been disposed of citing reasons like : First resort complaints(27.73%), Complaints Pending in other forum(1%), Subject matter outside the BO Scheme(16.50%), Complicated complaint requiring elaborate evidence(1%), Complaint without sufficient cause(7.30%), Bank branches outside the BO jurisdiction (4.20%), etc as shown in Table 11. Non maintainable complaints were rejected at the initial scrutiny stage itself while other complaints were rejected only after due processing. In both the cases, however, copy of the complaint is endorsed to the bank concerned for redressal. Banks were generally prompt in redressing the cases forwarded to them. In several cases, banks have kept BO informed of the action taken thereon, by endorsing a copy of their resolution letter issued to the complainant. 5.3 Mode of disposal of complaints Mode of disposal of complaints (other than rejected complaints) during the years 2004 - 05 to 2008-09 is as under:- As many as 22,388 complaints were settled by mutual agreement during the year as compared to mutual settlement of 29,295 complaints during the previous year. BO offices issued 73 awards during the year. Lesser number of awards issued by the BOs may be attributed to the bank’s attempt to resolve the complaints before issue of awards, since receipt of awards is considered as un-desirable. 5.4 Conciliation meetings Conciliation meetings which enable two parties to meet “face to face” has played an important role in the process of resolution of complaints. Although, Banking Ombudsman does not force parties to come to settlement, such meetings facilitate them to come to their own solution rather than have a solution imposed on them by way of an award. During the year, as many as 22,388 complaints were settled by the BO offices after holding conciliation meetings and other persuasive efforts. Thus, the objective of the BO Scheme (expeditious and inexpensive resolution of customer complaints without having to examine elaborate documentary evidences) could be satisfactorily achieved to a large extent by promoting settlement by mutual consent. 5.5 Rejected complaints

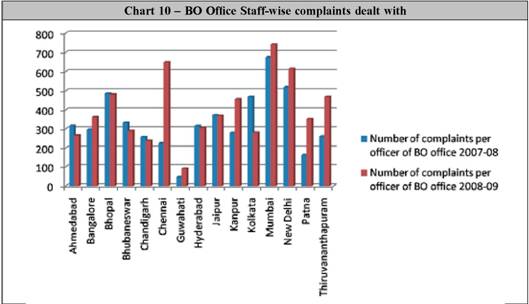

Although as much as 43,115 complaints were shown as rejected during the year, it may be mentioned that, as stated in paragraph 5.2, in most of these cases, the Scheme could provide relief to the complainant to a large extent by way of reversal of bank charges, overdue interest, over limit charges, partial settlement/ write off of overdue, etc during the process of resolution. 5.6 First resort complaints (42%) First resort complaints accounted for the highest percentage of complaints rejected (42% in 2008-09 as against 40% in 2007-08). High percentage of first resort complaints indicates greater faith of the complainants in the institution of the BO Scheme rather than in their banks or the inept handling of customer’s complaints by front line staff in the banks. While this highlights the marked increase in the customer awareness about the BO Scheme, it also points to the requirement of educating the public to lodge their complaints first with the bank concerned, and to approach the BO later, if they are not satisfied with the response from the bank. While rejecting such complaints, one copy of the complaint is endorsed to the bank concerned. The banks were generally prompt in redressing such complaints forwarded to them. Thus, although no data is available as to the exact number of such complaints redressed, it is our experience that very few first resort complaints rejected by BOs were received back. It could be that the reference to BO has helped the complainants to get their grievances redressed from the banks concerned. 5.7 Complaints outside the BO Scheme (25%) The second-highest cause of rejection, viz. complaints outside the Scheme comprising 25% of rejected complaints, indicates that the customer awareness campaigns need to be more fine-tuned and focused. These complaints were also rejected after initial scrutiny. However, copies of these complaints, as in the case of first resort complaints, were endorsed to the banks concerned .In several cases, banks have kept BO informed of the redressal measures taken on these complaints. Some of these complaints were sent to other RBI departments like Department of Banking Supervision, Department of Banking Operations and Development, Department of Non Banking Supervision, Rural Planning and Credit Department, etc or other organizations like Securities and Exchange Board of India, Insurance Regulatory and Development Authority for redressal. 5.8 Complaints made without sufficient cause (11%) Complaints made without sufficient cause represent those complaints where the banks concerned may have acted as per the covenants of the products and service contracts. Here also the complaints will be processed as usual and a decision taken to reject the complaint as it was made without sufficient cause. 5.9 Rejection due to other reasons Rejection of such complaints will be done only after giving proper opportunities to both the parties and due examination of bank’s submissions. Meetings will be arranged, wherever necessary, and if the complaint cannot be resolved fully under the BO Scheme provisions, it will be rejected giving reasons like complicated complaint requiring elaborate evidence, no loss to the complainant, beyond the pecuniary jurisdiction of BO Scheme, etc. 5.10 Pending complaints at BO Offices As regards pendency, 13% of the complaints were carried forward to the next year as against 11% in the previous year. During the year 2008-09, 10% of the pending complaints were pending for more than 2 months and 7% of them were pending for more than 3 months (15% and 15% respectively in the previous year). This indicates a slight improvement in position. The complaints not accompanied by documentary evidence, unusually long time given to the concerned banks to respond to queries etc mostly contributed to the delay in disposing of the complaints. Disposal of Complaints staff wise 6. During the year under review, most of the SLBC staff have been repatriated back to their banks in a phased manner. To handle the increased number of complaints and as replacement for the SLBC staff, the Offices of Banking Ombudsman were given additional staff. The staff wise position of complaints handled is given in the following table :

7. The total expenditure in operationalizing the Banking Ombudsman Scheme was shared by the banks, in the proportion of their working funds, up to December 2005. From January 1, 2006, the expenditure is fully borne by RBI in terms of the revised Banking Ombudsman Scheme, 2006. The cost of the Scheme includes the revenue expenditure and capital expenditure incurred in running the Banking Ombudsman offices. The revenue expenditure includes the establishment items like salary and allowances of the staff attached to Banking Ombudsman offices and non-establishment items such as rent, taxes, insurance, law charges, postage and telegram charges, printing and stationery expenses, publicity expenses, depreciation and other miscellaneous items. The capital expenditure items include the furniture, electrical installations, computers/ related equipments, telecommunication equipments and motor vehicle. While the aggregate cost of running the fifteen Banking Ombudsman Offices has increased by 22% during the year under review, with the increase in the number of complaints dealt with, the cost per complaint dealt has declined by 15%. The details are given as below. Appeal against the decisions of the Banking Ombudsmen 8.1 The Banking Ombudsman Scheme 2006 permits banks and complainants to appeal against the decisions of the Banking Ombudsman. The Appellate Authority is the Deputy Governor in charge of the Banking Ombudsman Scheme and secretariat is provided by the Customer Service Department. The number of Appeals preferred by banks and complainants during the year 2007-08 and 2008-09 are as under: 8.2. The number of appeals received at Central office level by the Appellate authority (AA) is increasing steadily since the appealing facility was widened to cover all decisions of BO and that appeals can be submitted by both the complainant and banks since May 2007. AA has handled 301 appeals during the year as against 191 during the previous year, recording an increase of 57%. 251 out of 301 appeals were received from public and 18 appeals were received from banks. The AA has disposed 180 complaints during the current year as compared to 159 appeals disposed during the previous year.

Some Important Developments during the year 2008-09 9.1 Meeting of the Committee on Subordinate Legislation, Rajya Sabha on functioning of the Banking Ombudsman Scheme in the private sector banks and foreign banks Deputy Governor represented the Bank during the deliberations of the Committee on Subordinate Legislation on functioning of the Banking Ombudsman Scheme in the private sector banks and foreign banks. The Committee was headed by Dr Najma Heptulla, MP and the banks called for discussion were HDFC, Citibank, Standard Chartered Bank, Deutsche Bank and HSBC Ltd. 9.2 Standing Committee on Finance The Standing Committee on Finance under the Chairmanship of Shri Ananth Kumar, Member of Parliament convened a meeting at Pune on July 26, 2008 to discuss the matters regarding Customer Service in public sector banks. Bank of Baroda and Central Bank of India were invited for the discussions. 9.3 Up gradation of Complaint Tracking Software (CTS) The upgraded version of CTS package went live from July 1, 2009. The upgraded CTS package has provision to enter the complaints, acknowledge the complaints, edit the complaints to update it, upload/ down load supporting files in respect of a complaint by the banks, view complaint details, view status of complaints, etc. It is capable of generating reports like complaint received reports, complaint disposed reports, award issued reports, complaint pending reports, bank wise/ subject wise reports, non-maintainable complaints report, monthly /quarterly statements, etc. 9.4 Advertisement under series 'Jago Grahak Jago" An advertisement campaign on the Banking Ombudsman Scheme has been released by the Bank in collaboration with Ministry of Consumer Affairs, Food & Public Distribution, Government of India as a joint campaign under the 'Jago Grahak Jago' series. A massive advertising & visual publicity campaign on the Banking Ombudsman scheme had been carried out in both print and electronic media. This publicity will help in elevating awareness about the BO Scheme among the common people. In addition, banks were instructed to display details of the BO Scheme in all bank branches for the benefit of their customers. 9.5 PGRC portal Department of Administrative Reforms and Public Grievances (DARPG), Government of India, with technical support from National Informatics Center (NIC) has developed a Public Portal viz. Centralized Public Grievances Redressal and Monitoring System (CPGRAMS) for prompt and effective redressal of grievances of citizens. The System is to record and receive the grievances online and redress them indicating action at different levels. The Government of India is monitoring the System. All the Public Sector banks, Offices of the Banking Ombudsman, RBI, SIDBI, IDBI Bank, NABARD etc., have been listed by Government of India as subordinate Offices and given username and password to access the DARPG portal to enable them to dispose of the grievances against banks online. The Government of India intends to discontinue with the disposal of grievances in paper form in a phased manner. 9.6 Committee on Financial Education and Investor Protection headed by Chairman of PFRDA (Pension Fund Regulatory & Development Authority) A Committee has been constituted by GOI under the chairmanship of Shri D. Swarup, Chairman, PFRDA for deliberation on the issues of financial education and investor protection in the Indian financial market. RBI was represented by Shri G. Gopalakrishna, Executive Director as a member of the Committee. The first meeting was held on March 30, 2009 and subsequent meetings were held at periodic intervals. The Committee has submitted the report to GOI. 9.7 International Network of Financial Services Deputy Governor, Dr. K C Chakrabarty, has been nominated as a member of International Network of Financial Education and also member of International Network of Financial Services. All BOs have been registered with the network of Financial Services Ombudsman Schemes and receive regular bulletins where latest news is incorporated and important decisions are conveyed. This forms an important aspect of knowledge sharing and helps the Banking Ombudsmen in disposal of cases.  9.8 Class Action Certain omissions and commissions by banks in their dealing with the customers in matters of lending, other services including liabilities tend to be detrimental to the interests of the customers at times. When such instances are noticed by/ brought to the notice of the Regulator, corrective action in the form of general directions to all banks is taken so that the customers in general including the complainants are protected against such omissions and commissions. This is a proactive measure as against a reactive one in that the redressal is afforded not just to the complainant but to all those similarly placed without waiting for further formal complaints. RBI has initiated class action against a foreign bank regarding mode of calculation of interest rates on deposit accounts. A PSU bank was advised to recalculate interest rate on all the housing loans as per terms of the agreements entered into with all the borrowers without their application for relief. Yet another PSU bank was asked to recredit insurance premium which was debited to SB account holders without their concurrence under group insurance scheme. The Customer Service Department of the Bank, on the basis of news items appearing in newspapers or any other media takes proactive action by taking up the matter with concerned bank for corrective action even if no specific complaints are received. 9.9 Outreach activities carried out by BOs for creating awareness of BOS 2006 The growing popularity of the Banking Ombudsman Scheme, 2006 stems from its hassle- free accessibility as well as the credibility of its processes and outcomes. Nevertheless, there are vast chunks of bank customer base, which are not aware of the Banking Ombudsman Scheme or how to access its redressal mechanism. Therefore, awareness and sensitization of banks and their customers necessarily remain at the core of any meaningful initiative to empower the bank customer. Towards this end, a number of focused initiatives were pursued during the year across the entire country.