IST,

IST,

Bank Lending Survey for Q3:2021-22

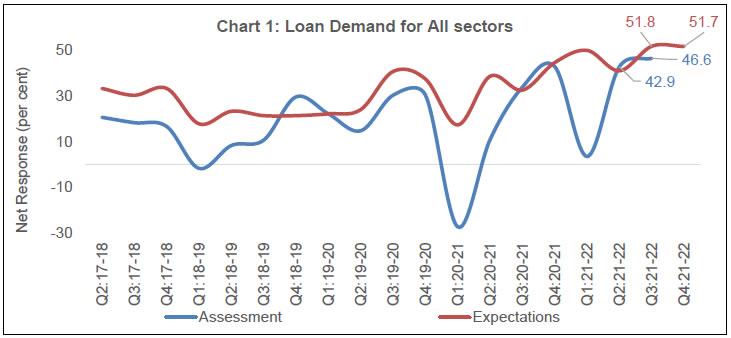

Today, the Reserve Bank released the results of 18th round of its quarterly bank lending survey (BLS)1, which captures qualitative assessment and expectations of major scheduled commercial banks (SCBs) on credit parameters (viz., loan demand, terms and conditions of loans) for major economic sectors2. The latest round of the survey collected senior loan officers’ assessment of credit parameters for Q3:2021-22 and expectations for Q4:2021-22. Owing to uncertainty driven by the COVID-19 pandemic, an additional block was included in this survey round for assessing outlook for two quarters ahead as well as three quarters ahead. Highlights: A. Assessment for Q3:2021-22

B. Expectations for Q4:2021-22

C. Expectations for Q1:2022-23 and Q2:2022-23

Note: Please see the excel file for time series data. 1 The results of 17th round of the BLS with reference period as July-September 2021 were released on the RBI website on October 8, 2021. The survey results reflect the views of the respondents, which are not necessarily shared by the Reserve Bank. 2 The survey questionnaire is canvassed among major 30 SCBs, which together account for over 90 per cent of credit by SCBs in India. 3 Net Response (NR) is computed as the difference of percentage of banks reporting increase/optimism and those reporting decrease/pessimism in respective parameter. The weights of +1.0, 0.5, 0, -0.5 and -1.0 are assigned for computing NR from aggregate per cent responses on 5-point scale i.e. substantial increase/ considerable easing, moderate increase/ somewhat easing, no change, moderate decrease/ somewhat tightening, substantial decrease/ considerable tightening for loan demand/loan terms and conditions parameters respectively. NR ranges between -100 to 100. Any value greater than zero indicates expansion/optimism and any value less than zero indicates contraction/pessimism. Increase in loan demand is considered optimism (Tables 1), while for loan terms and conditions, a positive value of net response indicates easy terms and conditions (Table 2). | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

Page Last Updated on: