IST,

IST,

Exchange Rate Policy and Modelling in India

We are deeply indebted to Dr. Rakesh Mohan, former Deputy Governor, for giving us the opportunity to undertake this project. We are also very grateful to Dr. R.K. Pattnaik, former Adviser, Department of Economic Analysis and Policy (DEAP), for insightful discussions and support throughout the project. We are thankful to DRG for the excellent support rendered to us during the course of the study. The authors also gratefully acknowledge insightful inputs and suggestions from Sangita Misra, Harendra Behera, Binod B. Bhoi, Vijay Raina and Meena Ravichandran from the Reserve Bank of India. Special thanks are also due to Ganesh Manjhi, Chhanda Mandal and Reetika Garg for competent research assistance. We also gratefully acknowledge constructive comments and suggestions from two anonymous referees. The external expert also acknowledges a research grant from the Research and Development Programme of the University of Delhi awarded in the preliminary stages of this research. A large part of the research was conducted when the external expert was Visiting Professor at the Dayalbagh Educational Institute (Deemed University), Agra. The external expert gratefully acknowledges support from the Institute during the course of this study. Finally, we acknowledge that we are solely responsible for errors, if any. Pami Dua and Rajiv Ranjan

The exchange rate is a key financial variable that affects decisions made by foreign exchange investors, exporters, importers, bankers, businesses, financial institutions, policymakers and tourists in the developed as well as developing world. Exchange rate fluctuations affect the value of international investment portfolios, competitiveness of exports and imports, value of international reserves, currency value of debt payments, and the cost to tourists in terms of the value of their currency. Movements in exchange rates thus have important implications for the economy’s business cycle, trade and capital flows and are therefore crucial for understanding financial developments and changes in economic policy. The study covers two main topics: first, various aspects of economic policy with respect to the exchange rate, and second, modeling and forecasting the exchange rate. Accordingly, the study analyses India’s exchange rate story and discusses the structure of the foreign exchange market in India in terms of participants, instruments and trading platform as also turnover in the Indian foreign exchange market and forward premia. The Indian foreign exchange market has evolved over time as a deep, liquid and efficient market as against a highly regulated market prior to the 1990s. The market participants have become sophisticated, the range of instruments available for trading has increased, the turnover has also increased, while the bid–ask spreads have declined. This study also covers the exchange rate policy of India in the background of large capital flows, The study then attempts to develop a model for the rupee-dollar exchange rate taking into account variables from monetary and micro structure models as well as other variables including intervention by the central bank. The focus is on the exchange rate of the Indian rupee vis-àvis the US dollar, i.e., the Re/$ rate. To model the exchange rate, the monetary model is expanded to include variables that may have been important in determining exchange rate movements in India such as forward premia, capital flows, order flows and central bank intervention. Exchange Rates and Exchange Rate Policy in India: A Review India’s exchange rate policy has evolved over time in line with the gradual opening up of the economy as part of the broader strategy of macroeconomic reforms and liberalization since the early 1990s. In the post independence period, India’s exchange rate policy has seen a shift from a par value system to a basket-peg and further to a managed float exchange rate system. With the breakdown of the Bretton Woods System in 1971, the rupee was linked with pound sterling. In order to overcome the weaknesses associated with a single currency peg and to ensure stability of the exchange rate, the rupee, with effect from September 1975, was pegged to a basket of currencies till the early 1990s. The initiation of economic reforms saw, among other measures, a two step downward exchange rate adjustment by 9 per cent and 11 per cent between July 1 and 3, 1991 to counter the massive draw down in the foreign exchange reserves, to install confidence in the investors and to improve domestic competitiveness. The Liberalised Exchange Rate Management System (LERMS) was put in place in March 1992 involving the dual exchange rate system in the interim period. The dual exchange rate system was replaced by a unified exchange rate system in March 1993. The experience with a market determined exchange rate system in India since 1993 is generally described as ‘satisfactory’ as orderliness prevailed in the Indian market during most of the period. Episodes of volatility were effectively managed through timely monetary and administrative measures. An important aspect of the policy response in India to the various episodes of volatility has been market intervention combined with monetary and administrative measures to meet the threats to financial stability while complementary or parallel recourse has been taken to communications through speeches and press releases. In line with the exchange rate policy, it has also been observed that the Indian rupee is moving along with the economic fundamentals in the post-reform period. Moving forward, as India progresses towards full capital account convertibility and gets more and more integrated with the rest of the world, managing periods of volatility is bound to pose greater challenges in view of the impossible trinity of independent monetary policy, open capital account and exchange rate management. Preserving stability in the market would require more flexibility, adaptability and innovations with regard to the strategy for liquidity management as well as exchange rate management. With the likely turnover in the foreign exchange market rising in future, further development of the foreign exchange market will be crucial to manage the associated risks. Structure of the Indian Foreign Exchange Market and Turnover Prior to the 1990s, the Indian foreign exchange market (with a pegged exchange rate regime) was highly regulated with restrictions on transactions, participants and use of instruments. The period since the early 1990s has witnessed a wide range of regulatory and institutional reforms resulting in substantial development of the rupee exchange market as it is observed today. Market participants have become sophisticated and have acquired reasonable expertise in using various instruments and managing risks. The foreign exchange market in India today is equipped with several derivative instruments. Various informal forms of derivatives contracts have existed since time immemorial though the formal introduction of a variety of instruments in the foreign exchange derivatives market started only in the post reform period, especially since the mid-1990s. These derivative instruments have been cautiously introduced as part of the reforms in a phased manner, both for product diversity and more importantly as a risk management tool. Recognising the relatively nascent stage of the foreign exchange market then with the lack of capabilities to handle massive speculation, the ‘underlying exposure’ criteria had been imposed as a prerequisite. Trading volumes in the Indian foreign exchange market has grown significantly over the last few years. The daily average turnover has seen almost a ten-fold rise during the 10 year period from 1997-98 to 2007-08 from US $ 5 billion to US $ 48 billion. The pickup has been particularly sharp from 2003-04 onwards since when there was a massive surge in capital inflows. It is noteworthy that the increase in foreign exchange market turnover in India between April 2004 and April 2007 was the highest amongst the 54 countries covered in the latest Triennial Central Bank Survey of Foreign Exchange and Derivatives Market Activity conducted by the Bank for International Settlements (BIS). According to the survey, daily average turnover in India jumped almost 5-fold from US $ 7 billion in April 2004 to US $ 34 billion in April 2007; global turnover over the same period rose by only 66 per cent from US $ 2.4 trillion to US $ 4.0 trillion. Reflecting these trends, the share of India in global foreign exchange market turnover trebled from 0.3 per cent in April 2004 to 0.9 per cent in April 2007. With the increasing integration of the Indian economy with the rest of the world, the efficiency in the foreign exchange market has improved as evident from low bid-ask spreads. It is found that the spread is almost flat and very low. In India, the normal spot market quote has a spread of 0.25 paisa to 1 paise while swap quotes are available at 1 to 2 paise spread. Thus, the foreign exchange market has evolved over time as a deep, liquid and efficient market as against a highly regulated market prior to the 1990s. Capital Flows and Exchange Rates: The Indian Experience In the recent period, external sector developments in India have been marked by strong capital flows, which had led to an appreciating tendency in the exchange rate of the Indian rupee up to January 2008. The movement of the Indian rupee is largely influenced by the capital flow movements rather than traditional determinants like trade flows. Though capital flows are generally seen to be beneficial to an economy, a large surge in flows over a short span of time in excess of the domestic absorptive capacity can, however, be a source of stress to the economy giving rise to upward pressures on the exchange rate, overheating of the economy, and possible asset price bubbles. In India, the liquidity impact of large capital inflows was traditionally managed mainly through the repo and reverse repo auctions under the day-to-day Liquidity Adjustment Facility (LAF). The LAF operations were supplemented by outright open market operations (OMO), i.e. outright sales of the government securities, to absorb liquidity on an enduring basis. In addition to LAF and OMO, excess liquidity from the financial system was also absorbed through the building up of surplus balances of the Government with the Reserve Bank, particularly by raising the notified amount of 91-day Treasury Bill auctions, and forex swaps. In view of the large capital flows during the past few years, relaxations were effected in regard to outflows, both under the current and capital accounts. In addition, changes in policies are made from time to time to modulate the debt-creating capital flows depending on the financing needs of the corporate sector and vulnerability of the domestic economy to external shocks. In the face of large capital flows coupled with declining stock of government securities, the Reserve Bank of India introduced a new instrument of sterilisation, viz., the Market Stabilisation Scheme (MSS) to sustain market operations. Since its introduction in April 2004, the MSS has served as a very useful instrument for medium term monetary and liquidity management. The cost of sterilisation in India is shared by the Central Government (the cost of MSS), Reserve Bank (sterilization under LAF) and the banking system (in case of increase in the reserve requirements). With the surge in capital flows to EMEs, issues relating to management of those flows have assumed importance as they have bearings on the exchange rates. Large capital inflows create important challenges for policymakers because of their potential to generate overheating, loss of competitiveness, and increased vulnerability to crisis. Reflecting these concerns, policies in EMEs have responded to capital inflows in a variety of ways. While some countries have allowed the exchange rate to appreciate, in many cases monetary authorities have intervened heavily in forex markets to resist currency appreciation. EMEs have sought to neutralize the monetary impact of intervention through sterilization. Cross-country experiences reveal that in the recent period most of the EMEs have adopted a more flexible exchange rate regime. In view of the importance of capital flows, foreign exchange intervention and turnover in determination of exchange rates, these variables are included in the modeling exercise undertaken to analyze the behaviour of the exchange rate. Modelling and Forecasting the Re/$ Exchange Rate: Economic Theory and Review of Literature In the international finance literature, various theoretical models are available to analyze exchange rate determination and behaviour. Most of the studies on exchange rate models prior to the 1970s were based on the fixed price assumption1. With the advent of the floating exchange rate regime amongst major industrialized countries in the early 1970s, an important advance was made with the development of the monetary approach to exchange rate determination. The dominant model was the flexible-price monetary model that has been analyzed in many early studies like Frenkel (1976), Mussa (1976, 1979), Frenkel and Johnson (1978), and more recently by Vitek (2005), Nwafor (2006), Molodtsova and Papell, (2007). Following this, the sticky price or overshooting model by Dornbusch (1976, 1980) evolved, which has been tested, amongst others, by Alquist and Chinn (2008) and Zita and Gupta (2007). The portfolio balance model also developed alongside2 , which allowed for imperfect substitutability between domestic and foreign assets, and considered wealth effects of current account imbalances. With liberalization and development of foreign exchange and assets markets, variables such as capital flows, volatility in capital flows and forward premium have also became important in determining exchange rates. Furthermore, with the growing development of foreign exchange markets and a rise in the trading volume in these markets, the micro level dynamics in foreign exchange markets increasingly became important in determining exchange rates. Agents in the foreign exchange market have access to private information about fundamentals or liquidity, which is reflected in the buying/selling transactions they undertake, that are termed as order flows (Medeiros, 2005; Bjonnes and Rime, 2003). Microstructure theory evolved in order to capture the micro level dynamics in the foreign exchange market (Evans and Lyons, 2001, 2005, 2007). Another variable that is important in determining exchange rates is central bank intervention in the foreign exchange market. Non-linear models have also been considered in the literature. Sarno (2003), Altaville and Grauwe (2006) are some of the recent studies that have used non-linear models of the exchange rate. Overall, forecasting the exchange rates has remained a challenge for both academicians as well as market participants. In fact, Meese and Rogoff’s seminal study (1983) on the forecasting performance of the monetary models demonstrated that these failed to beat the random walk model. This has triggered a plethora of studies that test the superiority of theoretical and empirical models of exchange rate determination vis-a-vis a random walk. In sum, several exchange rate models available in the literature have been tested during the last two and a half decades. No particular model seems to work best at all times/horizons. Monetary models based on the idea of fundamentals’ driven exchange rate behaviour work best in the long-run, but lose their predictability in the short-run to naïve random walk forecasts. The volatility of exchange rates also substantially exceeds that of the volatility of macroeconomic fundamentals, thus providing further evidence of weakening fundamental-exchange rate link. A combination of the different monetary models, however, at times gives better results than the random walk. Order flows also play an important role in influencing the exchange rate. Keeping in view all the above results of the literature, this study attempts to develop a model for the rupee-dollar exchange rate taking into account all the different monetary models along with the microstructure models incorporating order flow, as well as capital flows, forward premium and central bank intervention. Modelling and Forecasting the Exchange Rate: Econometric Methodology, Estimation, Evaluation and Findings This study attempts to gauge the forecasting ability of economic models with respect to exchange rates with the difference that this is done in the context of a developing country that follows a managed floating (as opposed to flexible) exchange rate regime. Starting from the naïve model, this study examines the forecasting performance of the monetary model and various extensions of it in the vector autoregressive (VAR) and Bayesian vector autoregressive (BVAR) framework. Extensions of the monetary model considered in this study include the forward premium, capital inflows, volatility of capital flows, order flows and central bank intervention. The study therefore examines, first, whether the monetary model can beat a random walk. Second, it investigates if the forecasting performance of the monetary model can be improved by extending it. Third, the study evaluates the forecasting performance of a VAR model vs a BVAR model. Lastly, it considers if information on intervention by the central bank can improve forecast accuracy. The main findings are as follows : (i) The monetary model generally outperforms the naïve model. This negates the findings of the seminal study by Meese and Rogoff (1983) that finds that models which are based on economic fundamentals cannot outperform a naive random walk model. (ii) The result that it is possible to beat the naïve model may be due to the fact that the intervention by the central bank may help to curb volatility arising due to demand-supply mismatch and stabilize the exchange rate. The exchange rate policy of the RBI is guided by the need to reduce excess volatility. The Reserve Bank has been prepared to make sales and purchases of foreign currency in order to even out lumpy demand and supply in the relatively thin foreign exchange market and to smoothen jerky movements. (iii) Forecast accuracy can be improved by extending the monetary model to include forward premium, volatility of capital inflows and order flow. (iv) Information on intervention by the central bank helps to improve forecasts at the longer end. (v) Bayesian vector autoregressive models generally outperform their corresponding VAR variants. (vi) Turning points are difficult to predict as illustrated using Model 4 with predictions made in February 2008. Thus, availability of information on certain key variables at regular intervals that affect the exchange rate can lead to a more informed view about the behavior of the future exchange rates by the market participants, which may allow them to plan their foreign exchange exposure better by hedging them appropriately. Such key variables could include past data on exchange rates, forward premia, capital flows, turnover, and intervention by central banks etc. As regards availability of data on key variables relating to the Indian foreign exchange market, most of the data are available in public domain and can easily be accessed by market participants, academicians and professional researchers. Using these variables skillfully will help them to gain sound insight into future exchange rate movements. In this context, it is important to recognize that the Indian approach in recent years has been guided by the broad principles of careful monitoring and management of exchange rates with flexibility, without a fixed target or a pre-announced target or a band, coupled with the ability to intervene if and when necessary, while allowing the underlying demand and supply conditions to determine the exchange rate movements over a period in an orderly way. Subject to this predominant objective, the exchange rate policy is guided by the need to reduce excess volatility, prevent the emergence of establishing speculative activities, help maintain adequate level of reserves, and develop an orderly foreign exchange market. 1 See e.g. Marshall (1923), Lerner (1936), Nurkse (1944), Harberger (1950), Mundell (1961, 1962, 1963)

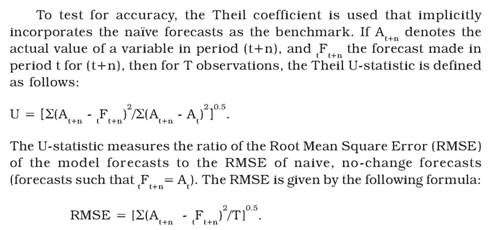

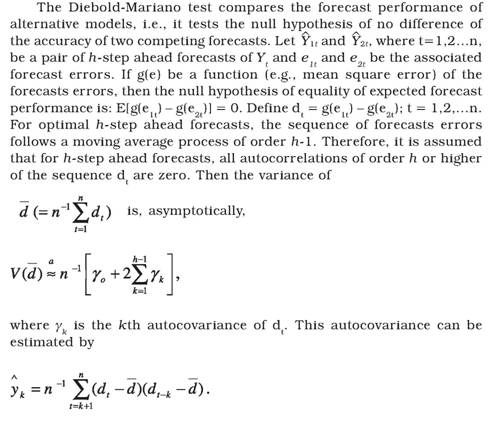

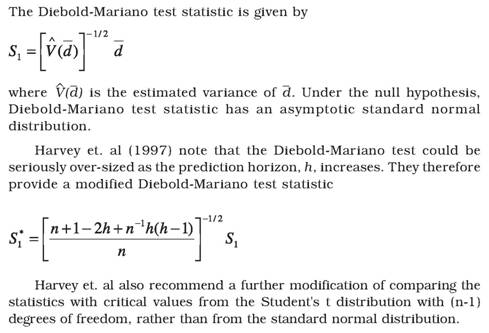

and Fleming (1962). EXCHANGE RATE POLICY AND MODELLING IN INDIA Pami Dua, Rajiv Ranjan* SECTION I The exchange rate is a key financial variable that affects decisions made by foreign exchange investors, exporters, importers, bankers, businesses, financial institutions, policymakers and tourists in the developed as well as developing world. Exchange rate fluctuations affect the value of international investment portfolios, competitiveness of exports and imports, value of international reserves, currency value of debt payments, and the cost to tourists in terms of the value of their currency. Movements in exchange rates thus have important implications for the economy’s business cycle, trade and capital flows and are therefore crucial for understanding financial developments and changes in economic policy. Timely forecasts of exchange rates can therefore provide valuable information to decision makers and participants in the spheres of international finance, trade and policy making. Nevertheless, the empirical literature is skeptical about the possibility of accurately predicting exchange rates. In the international finance literature, various theoretical models are available to analyze exchange rate behaviour. While exchange rate models existed prior to 1970s (Nurkse, 1944; Mundell, 1961, 1962, 1963), most of them were based on the fixed price assumption. With the advent of the floating exchange rate regime amongst major industrialized countries in the early 1970s, a major advance was made with the development of the monetary approach to the exchange rate determination. The dominant model was the flexible price monetary model that gave way to the sticky price and portfolio balance model. While considerable amount of empirical work was devoted to testing these monetary models, most of them focused on in-sample tests that do not really give the true predictive accuracy of the models. Following this, the sticky price or overshooting model by Dornbusch (1976, 1980) evolved, which has been tested, amongst others, by Alquist and Chinn (2008) and Zita and Gupta (2007). The portfolio balance model also developed alongside , which allowed for imperfect substitutability between domestic and foreign assets, and considered wealth effects of current account imbalances. With liberalization and development of foreign exchange and assets markets, variables such as capital flows, volatility in capital flows and forward premium have also became important in determining exchange rates. Furthermore, with the growing development of foreign exchange markets and a rise in the trading volume in these markets, the micro level dynamics in foreign exchange markets have increasingly became important in determining exchange rates. Agents in the foreign exchange market have access to private information about fundamentals or liquidity, which is reflected in the buying/selling transactions they undertake, that are termed as order flows (Medeiros, 2005; Bjonnes and Rime 2003). Thus microstructure theory evolved in order to capture the micro level dynamics in the foreign exchange market (Evans and Lyons, 2001, 2005, 2007). Another variable that is important in determining exchange rates is central bank intervention in the foreign exchange market. Non-linear models have also been considered in the literature. Sarno (2003), Altaville and Grauwe (2006) are some of the recent studies that have used non-linear models of the exchange rate. This study attempts to develop a model for the rupee-dollar exchange rate taking into account the different monetary models along with the micro structure models incorporating order flow as well as other variables including intervention by the central bank. The focus is on the exchange rate of the Indian rupee vis-à-vis the US dollar, i.e., the Re/$ rate. India has been operating on a managed floating exchange rate regime from March 1993, marking the start of an era of a market determined exchange rate regime of the rupee with provision for timely intervention by the central bank1 . India’s exchange rate policy has evolved overtime in line with the global situation and as a consequence to domestic developments. 1991-92 represents a major break in policy when India harped on reform measures following the balance of payments crisis and shifted to a market determined exchange rate system. As has been the experience with the exchange rate regimes the world over, the Reserve Bank as the central bank of the country has been actively participating in the market dynamics with a view to signaling its stance and maintaining orderly conditions in the foreign exchange market. The broad principles that have guided India’s exchange rate management have been periodically articulated in the various Monetary Policy Statements. These include careful monitoring and management of exchange rates with flexibility, no fixed target or a preannounced target or a band and ability to intervene, if and when necessary. Based on the preparedness of the foreign exchange market and India’s position on the external front (in terms of reserves, debt, current account deficit etc), reform measures have been progressively undertaken to have a liberalized exchange and payments system for current and capital account transactions and further to develop the foreign exchange market. This study covers two main topics: first, various aspects of economic policy with respect to the exchange rate, second, modelling and forecasting the exchang rate. Accordingly, this study analyses India’s exchange rate story, with particular focus on the policy responses during difficult times and the reforms undertaken to develop the rupee exchange market during relatively stable times. This study also discusses the structure of the foreign exchange market in India in terms of participants, instruments and trading platform as also turnover in the Indian foreign exchange market and forward premia. The Indian foreign exchange market has evolved over time as a deep, liquid and efficient market as against a highly regulated market prior to the 1990s. The market participants have become sophisticated, the range of instruments available for trading has increased, the turnover has also increased, while the bid–ask spreads have declined. This study also covers the exchange rate policy of India in the background of large capital flows, in terms of their magnitude, composition and management. In the recent period, up to 2007-08, external sector developments in India have been marked by strong capital inflows. Capital flows to India, which were earlier mainly confined to small official concessional finance, gained momentum from the 1990s after the initiation of economic reforms. After studying the analytics of foreign exchange market and the factors affecting the exchange rate in the first part of the study (Sections II, III and IV), this study then in the second part attempts to gauge the forecasting ability of economic models with respect to exchange rates in the context of a developing country that follows a managed floating (as opposed to flexible) exchange rate regime. Starting from the naïve model, this study examines the forecasting performance of the monetary model and various extensions of it in the vector autoregressive (VAR) and Bayesian vector autoregressive (BVAR) framework. Extensions of the monetary model considered in this study include the forward premium, capital inflows, volatility of capital flows, order flows and central bank intervention. The study therefore examines, first, whether the monetary model can beat a random walk. Second, it investigates if the forecasting performance of the monetary model can be improved by extending it. Third, the study evaluates the forecasting performance of a VAR model versus a BVAR model. Lastly, it considers if information on intervention by the central bank can improve forecast accuracy. This study concentrates on the post March 1993 period and provides insights into forecasting exchange rates for developing countries where the central bank intervenes periodically in the foreign exchange market. The alternative forecasting models are estimated using monthly data from July 1996 2 to December 2006 while out-of-sample forecasting performance is evaluated from January 2007 to June 2008. This study negates the finding of the seminal Study by Meese and Rogoff (1983) that models which are based on economic fundamentals cannot outperform a naive random walk model. Against this backdrop, Section II of this study presents a review of exchange rates and exchange rate policy in India during different phases. In Section III, the structure of the foreign exchange market in India, turnover and forward premia are discussed in detail. This is followed by a discussion on capital flows and the foreign exchange market in Section IV. The economic theory and review of literature are covered in Section V, while the econometric methodology is discussed in Section VI. The estimation and evaluation of forecasting models is done in Section VII. The last Section VIII presents some concluding observations. SECTION II India’s exchange rate policy has evolved over time in line with the gradual opening up of the economy as part of the broader strategy of macroeconomic reforms and liberalization since the early 1990s. This change was also warranted by the consensus response of all major countries to excessive exchange rate fluctuations that accompanied the abolishment of fixed exchange rate system. The major changes in the exchange rate policy started with the implementation of the recommendations of the High Level Committee on Balance of Payments (Chairman: Dr. C. Rangarajan, 1993) to make the exchange rate marketdetermined. The Expert Group on Foreign Exchange Markets in India (popularly known as Sodhani Committee, 1995) made several recommendations with respect to participants, trading, risk management as well as selective market intervention by the Reserve Bank to promote greater market development in an orderly fashion. Consequently, the period starting from January 1996 saw wide-ranging reforms in the Indian foreign exchange market. In essence, the exchange rate developments changed in side-by-side with the reform in the external sector of India. With the external sector reform, India stands considerably integrated with the rest of the world today in terms of increasing openness of the economy. As a result of calibrated and gradual capital account openness, the financial markets, particularly forex market, in India have also become increasingly integrated with the global network since 2003-04. This is reflected in the extent and magnitude of capital that has flown to India in recent years. Exchange rates exhibited considerable volatility and increased capital mobility has posed several challenges before the monetary authorities in managing exchange rates. Against this backdrop, the following section analyses in retrospect India’s exchange rate story, with particular focus on the policy responses during difficult times and the reforms undertaken to develop the rupee exchange market during relatively stable times. 1. Chronology of Reform Measures In the post independence period, India’s exchange rate policy has seen a shift from a par value system to a basket-peg and further to a managed float exchange rate system. During the period 1947 till 1971, India followed the par value system of the exchange rate whereby the rupee’s external par value was fixed at 4.15 grains of fine gold. The RBI maintained the par value of the rupee within the permitted margin of ±1% using pound sterling as the intervention currency. The devaluation of the rupee in September 1949 and June 1966 in terms of gold resulted in the reduction of the par value of rupee in terms of gold to 2.88 and 1.83 grains of fine gold, respectively. Since 1966, the exchange rate of the rupee remained constant till 1971 (Chart 2.1).

With the breakdown of the Bretton Woods System, in December 1971, the rupee was linked with pound sterling. Sterling being fixed in terms of US dollar under the Smithsonian Agreement of 1971, the rupee also remained stable against dollar. In order to overcome the weaknesses associated with a single currency peg and to ensure stability of the exchange rate, the rupee, with effect from September 1975, was pegged to a basket of currencies (Table 2.1). The currencies included in the basket as well as their relative weights were kept confidential by the Reserve Bank to discourage speculation. By the late ‘eighties and the early ‘nineties, it was recognised that both macroeconomic policy and structural factors had contributed to balance of payment difficulties. The current account deficit widened to 3.0 per cent of GDP in 1990-91 and the foreign currency assets depleted to less than a billion dollar by July 1991. It was against this backdrop that India embarked on stabilisation and structural reforms to generate impulses for growth.

The Report of the High Level Committee on Balance of Payments (Chairman Dr. C. Rangarajan) laid the framework for a credible macroeconomic, structural and stabilisation programme encompassing trade, industry, foreign investment, exchange rate and the foreign exchange reserves. With regard to the exchange rate policy, the committee recommended that consideration be given to (i) a realistic exchange rate, (ii) avoiding use of exchange mechanisms for subsidization, (iii) maintaining adequate level reserves to take care of short-term fluctuations, (iv) continuing the process of liberalization on current account, and (v) reinforcing effective control over capital transactions. The key to the maintenance of a realistic and a stable exchange rate is containing inflation through macro-economic policies and ensuring net capital receipts of the scale not beyond the expectation. The Committee further recommended that a decision be taken to unify the exchange rate, as an important step towards full convertibility. The initiation of economic reforms saw, among other measures, a two step downward exchange rate adjustment by 9 per cent and 11 per cent between July 1 and 3, 1991 to counter the massive draw down in the foreign exchange reserves, to install confidence in the investors and to improve domestic competitiveness. The two-step adjustment of July 1991 effectively brought to a close the period of pegged exchange rate. Following the recommendations of Rangarajan Committee to move towards the marketdetermined exchange rate, the Liberalised Exchange Rate Management System (LERMS) was put in place in March 1992 involving dual exchange rate system in the interim period. The dual exchange rate system was replaced by unified exchange rate system in March 1993. 2. Foreign Exchange Intervention In the post-Asian crisis period, particularly after 2002-03, capital flows into India surged creating space for speculation on Indian rupee. The Reserve Bank intervened actively in the forex market to reduce the volatility in the market. During this period, the Reserve Bank made direct interventions in the market through purchases and sales of the US Dollars in the forex market and sterilised its impact on monetary base. The Reserve Bank has been intervening to curb volatility arising due to demand-supply mismatch in the domestic foreign exchange market (Table 2.2). Sales in the foreign exchange market are generally guided by excess demand conditions that may arise due to several factors. Similarly, the Reserve Bank purchases dollars from the market when there is an excess supply pressure in market due to capital inflows. Demand-supply mismatch proxied by the difference between the purchase and sale transactions in the merchant segment of the spot market reveals a strong co-movement between demand-supply gap and intervention by the Reserve Bank (Chart 2.2) 3 .Thus, the Reserve Bank has been prepared to make sales and purchases of foreign currency in order to even out lumpy demand and supply in the relatively thin foreign exchange market and to smoothen jerky movements. However, such intervention is generally not governed by any predetermined target or band around the exchange rate (Jalan, 1999).

The volatility of Indian rupee remained low against the US dollar than against other major currencies as the Reserve Bank intervened mostly through purchases/sales of the US dollar. Empirical evidence in the Indian case has generally suggested that in the present day managed float regime of India, intervention has served as a potent instrument in containing the magnitude of exchange rate volatility of the rupee and the intervention operations do not influence as much the level of rupee (Pattanaik and Sahoo, 2001; Kohli, 2000; RBI, RCF 2002-03, 2005-06). The intervention of the Reserve Bank in order to neutralise the impact of excess foreign exchange inflows enhanced the RBI’s Foreign Currency Assets (FCA) continuously. In order to offset the effect of increase in FCA on monetary base, the Reserve Bank had mopped up the excess liquidity from the system through open market operation (Chart 2.3). It is, however, pertinent to note that Reserve Bank’s intervention in the foreign exchange market has been relatively small in terms of volume (less than 1 per cent during last few years), except during 2008-09. The Reserve Bank’s gross market intervention as a per cent of turnover in the foreign exchange market was the highest in 2003-04 though in absolute terms the highest intervention was US$ 84 billion in 2008-09 (Table 2.3). During October 2008 alone, when the contagion of the global financial crisis started affecting India, the RBI sold US$ 20.6 billion in the foreign exchange market. This was the highest intervention till date during any particular month.

3. Trends in Exchange Rate A look at the entire period since 1993 when we moved towards market determined exchange rates reveals that the Indian Rupee has generally depreciated against the dollar during the last 15 years except during the period 2003 to 2005 and during 2007-08 when the rupee had appreciated on account of dollar’s global weakness and large capital inflows (Table 2.4). For the period as a whole, 1993-94 to 2007-08, the Indian Rupee has depreciated against the dollar. The rupee has also depreciated against other major international currencies. Another important feature has been the reduction in the volatility of the Indian exchange rate during last few years. Among all currencies worldwide, which are not on a nominal peg, and certainly among all emerging market economies, the volatility of the rupee-dollar rate has remained low. Moreover, the rupee in real terms generally witnessed stability over the years despite volatility in capital flows and trade flows (Table 2.5).

The various episodes of volatility of exchange rate of the rupee have been managed in a flexible and pragmatic manner. In line with the exchange rate policy, it has also been observed that the Indian rupee is moving along with the economic fundamentals in the post-reform period. Thus, as can be observed maintaining orderly market conditions have been the central theme of RBI’s exchange rate policy. Despite several unexpected external and domestic developments, India’s exchange rate performance is considered to be satisfactory. The Reserve Bank has generally reacted promptly and swiftly to exchange market pressures through a combination of monetary, regulatory measures along with direct and indirect interventions and has preferred to withdraw from the market as soon as orderly conditions are restored. Moving forward, as India progresses towards full capital account convertibility and gets more and more integrated with the rest of the world, managing periods of volatility is bound to pose greater challenges in view of the impossible trinity of independent monetary policy, open capital account and exchange rate management. Preserving stability in the market would require more flexibility, adaptability and innovations with regard to the strategy for liquidity management as well as exchange rate management. Also, with the likely turnover in the foreign exchange market rising in future, further development of the foreign exchange market will be crucial to manage the associated risks. SECTION III Prior to the 1990s, the Indian foreign exchange market (with a pegged exchange rate regime) was highly regulated with restrictions on transactions, participants and use of instruments. The period since the early 1990s has witnessed a wide range of regulatory and institutional reforms resulting in substantial development of the rupee exchange market as it is observed today. Market participants have become sophisticated and have acquired reasonable expertise in using various instruments and managing risks. The range of instruments available for trading has also increased. Against this background, this Section discusses the structure of the foreign exchange market in India. The first sub-section of the Section gives an overview of the structure of the foreign exchange market in terms of participants, instruments and trading platform followed by discussions on turnover and forward premia in subsequent sections. 1. Current Rupee Market Structure While analysing the exchange rate behavior, it is also important to have a look at the market micro structure where the Indian rupee is traded. As in case of any other market, trading in Indian foreign exchange market involves some participants, a trading platform and a range of instruments for trading. Against this backdrop, the current market set up is given below. Market Segments and Players The Indian foreign exchange market is a decentralised multiple dealership market comprising two segments – the spot and the derivatives market. In a spot transaction, currencies are traded at the prevailing rates and the settlement or value date is two business days ahead. The two-day period gives adequate time for the parties to send instructions to debit and credit the appropriate bank accounts at home and abroad. The derivatives market encompasses forwards, swaps, and options. As in case of other Emerging Market Economies (EMEs), the spot market remains an important segment of the Indian foreign exchange market. With the Indian economy getting exposed to risks arising out of changes in exchange rates, the derivative segment of the foreign exchange market has also strengthened and the activity in this segment is gradually rising. Players in the Indian market include (a) Authorised Dealers (ADs), mostly banks who are authorised to deal in foreign exchange4 , (b) foreign exchange brokers who act as intermediaries between counterparties, matching buying and selling orders and (c) customers – individuals, corporates, who need foreign exchange for trade and investment purposes. Though customers are a major player in the foreign exchange market, for all practical purposes they depend upon ADs and brokers. In the spot foreign exchange market, foreign exchange transactions were earlier dominated by brokers, but the situation has changed with evolving market conditions as now the transactions are dominated by ADs. The brokers continue to dominate the derivatives market. The Reserve Bank like other central banks is a market participant who uses foreign exchange to manage reserves and intervenes to ensure orderly market conditions. The customer segment of the spot market in India essentially reflects the transactions reported in the balance of payments – both current and capital account. During the decade of the 1980s and 1990s, current account transactions such as exports, imports, invisible receipts and payments were the major sources of supply and demand in the foreign exchange market. Over the last five years, however, the daily supply and demand in the foreign exchange market is being increasingly determined by transactions in the capital account such as foreign direct investment (FDI) to India and by India, inflows and outflows of portfolio investment, external commercial borrowings (ECB) and its amortisations, non-resident deposit inflows and redemptions. It needs to be observed that in India, with the government having no foreign currency account, the external aid received by the Government comes directly to the reserves and the RBI releases the required rupee funds. Hence, this particular source of supply of foreign exchange e.g. external aid does not go into the market and to that extent does not reflect itself in the true determination of the value of the rupee. The foreign exchange market in India today is equipped with several derivative instruments. Various informal forms of derivatives contracts have existed since time immemorial though the formal introduction of a variety of instruments in the foreign exchange derivatives market started only in the post reform period, especially since the mid-1990s. These derivative instruments have been cautiously introduced as part of the reforms in a phased manner, both for product diversity and more importantly as a risk management tool. Recognising the relatively nascent stage of the foreign exchange market then with the lack of capabilities to handle massive speculation, the ‘underlying exposure’ criteria had been imposed as a prerequisite. 2. Foreign Exchange Market Turnover The depth and size of foreign exchange market is gauged generally

through the turnover in the market. Foreign exchange turnover considers

all the transactions related to foreign currency, i.e. purchases, sales,

booking and cancelation of foreign currency or related products. Forex

turnover or trading volume, which is also an indicator of liquidity in the

market, helps in price discovery. In the literature, it is held that the

foreign exchange market turnover may convey important private

information about market clearing prices, thus, it could act as a key

variable while making informed judgment about the future exchange rates.

Trading volumes in the Indian foreign exchange market has grown

significantly over the last few years. The daily average turnover has seen

almost a ten-fold rise during the 10 year period from 1997-98 to 2007-

08 from US $ 5 billion to US $ 48 billion (Table 3.1). The pickup has

It is noteworthy that the increase in foreign exchange market turnover in India between April 2004 and April 2007 was the highest amongst the 54 countries covered in the latest Triennial Central Bank Survey of Foreign Exchange and Derivatives Market Activity conducted by the Bank for International Settlements (BIS). According to the survey, daily average turnover in India jumped almost 5-fold from US $ 7 billion in April 2004 to US $ 34 billion in April 2007; global turnover over the same period rose by only 66 per cent from US $ 2.4 trillion to US $ 4.0 trillion. Reflecting these trends, the share of India in global foreign exchange market turnover trebled from 0.3 per cent in April 2004 to 0.9 per cent in April 2007. Looking at some of the comparable indicators, the turnover in the foreign exchange market has been an average of 7.6 times higher than the size of India’s balance of payments during last five years (Table 3.2). With the deepening of foreign exchange market and increased turnover, income of commercial banks through treasury operations has increased considerably.

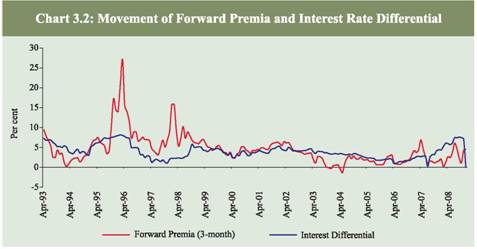

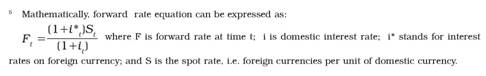

A look at the segments in the Indian foreign exchange market reveals that the spot market remains the most important foreign exchange market segment accounting for about 50 per cent of the total turnover (Table 3.3). However, its share has seen a marginal decline in the recent past mainly due to a pick up in turnover in derivative segment. The merchant segment of the spot market is generally dominated by the Government of India, select public sector units, such as Indian Oil Corporation (IOC), and the FIIs. As the foreign exchange demand on account of public sector units and FIIs tends to be lumpy and uneven, resultant demand-supply mismatches entail occasional pressures on the foreign exchange market, warranting market interventions by the Reserve Bank to even out lumpy demand and supply. However, as noted earlier, such intervention is not governed by a predetermined target or band around the exchange rate. Further, the inter-bank to merchant turnover ratio has almost halved from 5.2 during 1997-98 to 2.8 during 2008-09 reflecting the growing participation in the merchant segment of the foreign exchange market associated with growing trade activity, better corporate performance and increased liberalisation. Mumbai alone accounts for almost 80 per cent of the foreign exchange turnover. Behaviour of Forward Premia Next to the spot exchange market, the transactions on forwards and swaps are large in Indian context. Onshore deliverable forward contracts are generally available for maturities ranging from one month to ten years; however, the most common and liquid contracts have maturities of one year or less, and these have a bid/offer spread of Rs.0.01. The forward exchange rate5 is an important indicator of the future behavior of exchange rates as it is determined in the foreign exchange market based on expectations on the future exchange rates, which is expected to get influenced by a set of variables. Given its very nature, the forward premia is sensitive to any news having financial bearing. Thus, the information content of forward premia is important in any forecasting exercise. A swap transaction in the foreign exchange market is a combination of a spot and a forward in the opposite direction. Foreign exchange swaps account for the largest share of the total derivatives turnover in India, followed by forwards and options. In the Indian context, the forward price of the rupee is not essentially determined by the interest rate differentials, but it is also significantly influenced by: (a) supply and demand of forward US dollars; (b) interest differentials and expectations of future interest rates; and (c) expectations of future US dollar-rupee exchange rate (Chart 3.1). Empirical studies in the Indian context reveal that forward premia on US dollar is driven to a large extent by the interest rate differential in the interbank market of the two economies combined with FII flows, current account balance as well as changes in exchange rates of US dollar vis-à-vis Indian rupee (Sharma and Mitra, 2006). Further empirical analysis for the period January 1995-December 2006 have shown that the ability of forward rates in correctly predicting the future spot rates has improved overtime and there is co-integration relationship between the forward rate and the future spot rate (RCF, 2005-06).

With the opening up of the capital account, the forward premia is

getting aligned with the interest rate differential reflecting market Market Efficiency With the exchange rate primarily getting determined in the market, the issue of foreign exchange6 market efficiency has assumed importance for India in recent years. The bid-ask spread of Rupee/US$ market has almost converged with that of other major currencies in the international market. On some occasions, in fact, the bid-ask spread of Rupee/US$ market was lower than that of some major currencies.

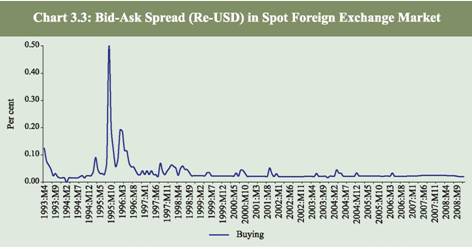

Besides maintaining orderly conditions, markets are perceived as efficient when market prices reflect all available information, so that it is not possible for any trader to earn excess profits in a systematic manner. The efficiency/ liquidity of the foreign exchange market is often gauged in terms of bid-ask spreads. The bid-ask spread refers to the transaction costs and operating costs involved with the transaction of the currency. These costs include phone bills, cable charges, book-keeping expenses, trader salaries, etc. in the spot segment, it may also include the risks involved with holding the foreign exchange. These costs/bid-ask spread may reduce with the increase in the volume of transaction of the currency. In the Indian context, it is found that the spread is almost flat and very low. In India, the normal spot market quote has a spread of 0.25 paisa to 1 paise while swap quotes are available at 1 to 2 paise spread. A closer look at the bid-ask spread in the rupee-US dollar spot market reveals that during the initial phase of market development (i.e., till the mid 1990s), the spread was high and volatile due to thin market with unidirectional behavior of market participants (Chart 3.3). In the later period, with relatively deep and liquid markets, bid-ask spread has sharply declined and has remained low and stable, reflecting efficiency gains.

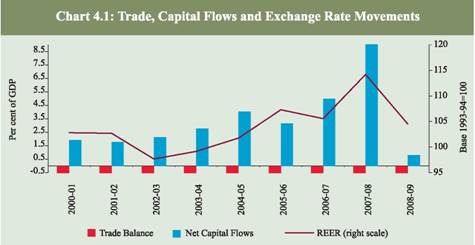

Thus, the foreign exchange market has evolved over time as a deep, liquid and efficient market as against highly regulated market prior to the 1990s. The market participants have become sophisticated, the range of instruments available for trading has increased, the turnover has also increased, while the bid-ask spreads have declined. The next Section discusses the dynamics of capital flows, which are also key variables in the modelling exercise. SECTION IV The capital inflows and outflows have implications for the conduct of domestic monetary policy and exchange rate management. The emerging market economies including India had seen a very sharp rise in capital flows in the past few years. The surge in the capital flows till 2007-08 had coincided mostly with a faster pace of financial liberalization, particularly a move towards regulation free open economies. Moreover, high interest rates prevailing in the emerging market economies had led to a wider interest rate differential in favour of the domestic markets, which stimulated a further surge of capital flows. In emerging markets, capital flows are often relatively more volatile and sentiment driven, not necessarily being related to the fundamentals in these markets. Such volatility imposes substantial risks on the market agents, which they may not be able to sustain or manage (Committee on the Global Financial System, BIS, 2009). In the literature, several instruments have been prescribed for sterilization purposes. Such tools include open market operations, tightening the access of banks at the discount window, adjusting reserve requirements or the placement of government deposits, using a foreign exchange swap facility, easing restrictions on capital outflows, pre-payment of external debt and promoting investment through absorption of capital flows for growth purposes. 1. Capital Flows: Indian Context In the recent period, external sector developments in India have been marked by strong capital flows, which had led to an appreciating tendency in the exchange rate of the Indian rupee up to January 2008. The movement of the Indian rupee is largely influenced by the capital flow movements rather than traditional determinants like trade flows (Chart 4.1). Capital flows to India, which were earlier mainly confined to small official concessional finance, gained momentum from the 1990s after the initiation of economic reforms. Apart from an increase in size, capital flows to India have undergone a compositional shift from predominantly official and private debt flows to non-debt creating flows in the post reform period. Private debt flows have begun to increase again in the more recent period. Though capital flows are generally seen to be beneficial to an economy, a large surge in flows over a short span of time in excess of the domestic absorptive capacity can, however, be a source of stress to the economy giving rise to upward pressures on the exchange rate, overheating of the economy, and possible asset price bubbles. The far reaching economic reforms in India in the 1990s, witnessed a sharp increase in capital inflows as a result of capital account liberalisation in India and a gradual decrease in home bias in asset allocation in advanced economies. During 1990-91, it was clear that the country was heading for a balance of payment crisis due to deficit financed fiscal expansion of the 1980s and the trigger of oil price spike caused by the Gulf War. The balance of payments crisis of 1991 led to the initiation of reform process. The broad approach to reform in the external sector was based on the recommendations made in the Report of the High Level Committee on Balance of Payments (Chairman: Shri. C. Rangarajan), 1991. The objectives of reform in the external sector were conditioned by the need to correct the deficiencies that led to payment imbalances in 1991. Recognizing that an inappropriate exchange rate regime, unsustainable current account deficit and a rise in short term debt in relation to the official reserves were amongst the key contributing factors to the crisis, a series of reform measures were put in place. The measures included a swift transition to a market determined exchange rate regime, dismantling of trade restrictions, moving towards current account convertibility and gradual opening up of the capital account. While liberalizing the private capital inflows, the Committee recommended, inter alia, a compositional shift in capital flows away from debt to nondebt creating flows; strict regulation of external commercial borrowings, especially short term debt; discouraging volatile element of flows from non-resident Indians; and gradual liberalization of outflows. Among the components, since the 1990s, the broad approach towards permitting foreign direct investment has been through a dual route, i.e., automatic and approval, with the ambit of automatic route progressively enlarged to almost all the sectors, coupled with higher sectoral caps stipulated for such investments. Portfolio investments are restricted to institutional investors. The approach to external commercial borrowings has been one of prudence, with self imposed ceilings on approvals and a careful monitoring of the cost of raising funds as well as their end use. In respect of NRI deposits, some modulation of inflows is exercised through specification of interest rate ceilings and maturity requirements. In respect of capital outflows, the approach has been to facilitate direct overseas investment through joint ventures and wholly owned subsidiaries and provision of financial support to exports, especially project exports from India. Ceilings on such outflows have been substantially liberalized over time. The limits on remittances by domestic individuals have also been eased. With progressive opening up of its capital account since the early 1990s, the state of capital account in India today can be considered as the most liberalized it has ever been in its history since the late 1950s. All these developments have ramifications on exchange rate management (Mohan 2008b). 2. Management of Capital Flows and Exchange Rates The recent episode of capital flows, which has occurred in the backdrop of current account surplus in most of the emerging Asian economies, highlights the importance of absorption of capital flows. The absorption of capital flows is limited by the extant magnitude of the current account deficit, which has traditionally been low in India, and seldom above 2 per cent of GDP. In India, with a view to neutralising the impact of excess forex flows on account of a large capital account surplus, the central bank has intervened in the foreign exchange market at regular intervals. But unsterilised forex market intervention can result in inflation, loss of competitiveness and attenuation of monetary control. The loss of monetary control could be steep if such flows are large. Therefore, it is essential that the monetary authorities take measures to offset the impact of such foreign exchange market intervention, partly or wholly, so as to retain the intent of monetary policy through such intervention. In India, the liquidity impact of large capital inflows was traditionally managed mainly through the repo and reverse repo auctions under the day-to-day Liquidity Adjustment Facility (LAF). The LAF operations were supplemented by outright open market operations (OMO), i.e. outright sales of the government securities, to absorb liquidity on an enduring basis. In addition to LAF and OMO, excess liquidity from the financial system was also absorbed through the building up of surplus balances of the Government with the Reserve Bank, particularly by raising the notified amount of 91-day Treasury Bill auctions, forex swaps and prepayment of external loans, The market-based operations led to a progressive reduction in the quantum of securities with the Reserve Bank. This apart, as per those operations, the usage of the entire stock of securities for outright open market sales was constrained by the allocation of a part of the securities for day-to-day LAF operations as well as for investments of surplus balances of the Central Government, besides investments by the State Governments in respect of earmarked funds (CSF/GRF) while some of the government securities were also in non-marketable lots. In the face of large capital flows coupled with declining stock of government securities, the Reserve Bank of India introduced a new instrument of sterilisation, viz., the Market Stabilisation Scheme (MSS) to sustain market operations. Since its introduction in April 2004, the MSS has served as a very useful instrument for medium term monetary and liquidity management. In the choice of instruments for sterilisation, it is important to recognise the benefits from and the costs of sterilisation in general and the relative costs/benefits in the usage of a particular instrument. The various instruments have differential impact on the balance sheets of the central bank, government and the financial sector. The cost of sterilisation in India is shared by the Central Government (the cost of MSS), Reserve Bank (sterilization under LAF) and the banking system (in case of increase in the reserve requirements). Since surpluses of the Reserve Bank are transferred to the Central Government, on a combined balance sheet basis, the relative burdens of cost between the Government and Reserve Bank are not of great relevance. However, the direct cost borne by the Government is transparently shown in its budget accounts. Owing to the difference between international and Indian interest rates, there is a positive cost of sterilisation but the cost has to be traded-off with the benefits associated with market stability, export competitiveness and possible crisis avoidance in the external sector. Sterilized interventions and interest rate policy are generally consistent with overall monetary policy stance that is primarily framed on the basis of the domestic macro-economic outlook. With surge in capital flows to EMEs, issues relating to management of those flows have assumed importance as they have bearings on the exchange rates. Large capital inflows create important challenges for policymakers because of their potential to generate overheating, loss of competitiveness, and increased vulnerability to crisis. Reflecting these concerns, policies in EMEs have responded to capital inflows in a variety of ways. While some countries have allowed exchange rate to appreciate, in many cases monetary authorities have intervened heavily in forex markets to resist currency appreciation. EMEs have sought to neutralize the monetary impact of intervention through sterilization. Cross-country experiences reveal that in the recent period most of the EMEs have adopted a more flexible exchange rate regime. In view of the importance of capital flows and foreign exchange intervention in determination of exchange rates, these variables are included in the modelling exercise undertaken in this study to analyze the behaviour of the exchange rate. SECTION V In the international finance literature, various theoretical models are available to analyze exchange rate determination and behaviour. Most of the studies on exchange rate models prior to the 1970s were based on the fixed price assumption7. With the advent of the floating exchange rate regime amongst major industrialized countries in the early 1970s, an important advance was made with the development of the monetary approach to exchange rate determination. The dominant model was the flexible-price monetary model that has been analyzed in many early studies like Frenkel (1976), Mussa (1976, 1979), Frenkel and Johnson (1978), and more recently by Vitek (2005), Nwafor (2006), Molodtsova and Papell, (2007). Following this, the sticky price or overshooting model by Dornbusch (1976, 1980) evolved, which has been tested, amongst others, by Alquist and Chinn (2008) and Zita and Gupta (2007). The portfolio balance model also developed alongside8 , which allowed for imperfect substitutability between domestic and foreign assets and considered wealth effects of current account imbalances. With liberalization and development of foreign exchange and assets markets, variables such as capital flows, volatility in capital flows and forward premium have also became important in determining exchange rates. Furthermore, with the growing development of foreign exchange markets and a rise in the trading volume in these markets, the micro level dynamics in foreign exchange markets increasingly became important in determining exchange rates. Agents in the foreign exchange market have access to private information about fundamentals or liquidity, which is reflected in the buying/selling transactions they undertake, that are termed as order flows (Medeiros, 2005; Bjonnes and Rime, 2003). Microstructure theory evolved in order to capture the micro level dynamics in the foreign exchange market (Evans and Lyons, 2001, 2005, 2007). Another variable that is important in determining exchange rates is central bank intervention in the foreign exchange market. Non-linear models have also been considered in the literature. Sarno (2003), Altaville and Grauwe (2006) are some of the recent studies that have used non-linear models of the exchange rate. Overall, forecasting the exchange rates has remained a challenge for both academicians as well as market participants. In fact, Meese and Rogoff's seminal study (1983) on the forecasting performance of the monetary models demonstrated that these failed to beat the random walk model. This has triggered a plethora of studies that test the superiority of theoretical and empirical models of exchange rate determination visà- vis a random walk. Against this backdrop, various models of exchange rate determination are examined to derive the relevant macroeconomic fundamentals affecting exchange rates. The empirical literature on exchange rate determination is analyzed next. 1. Exchange Rate Models: Theoretical Considerations (i) Theory: Purchasing Power Parity, Monetary and Portfolio Balance Models The earliest and simplest model of exchange rate determination, known as the Purchasing Power Parity (PPP) theory, represented the application of ''the law of one price''. This states that arbitrage forces will lead to the equalization of goods prices internationally once the prices are measured in the same currency. PPP theory provided a point of reference for the long-run exchange rate in many of the modern exchange rate theories. It was observed initially that there were deviations from the PPP in short-run, but in the long-run, PPP holds in equilibrium. However, many of the recent studies like Jacobson, Lyhagen, Larsson and Nessen (2002) find deviations from PPP even in the long-run. The reasons for the failure of the PPP have been attributed to heterogeneity in the baskets of goods considered for construction of price indices in various countries, the presence of transportation cost, the imperfect competition in the goods market, and the increase in the volume of global capital flows during the last few decades which led to sharp deviation from PPP. The Harrod Balassa Samuelson Model, rationalized the long run deviations from PPP. According to this model, productivity differentials are important in explaining exchange rates. They relax PPP assumption and allow real exchange rates to depend on relative price of non-tradables which are a function of productivity differentials. Chinn (1999) and Clostermann and Schnatz (2000) find that a model with productivity differentials, better explains and forecasts exchange rate behaviour. The failure of PPP models gave way to Monetary Models which took into account the possibility of capital/bond market arbitrage apart from goods market arbitrage assumed in the PPP theory. In the monetary models, it is the money supply in relation to money demand in both home and foreign country, which determine the exchange rate. The prominent monetary models include the flexible and sticky-price monetary models of exchange rates as well as the real interest differential model and Hooper-Morton's extension of the sticky-price model. In this class of asset market models, domestic and foreign bonds are assumed to be perfect substitutes. The Flexible-Price Monetary Model (Frenkel, 1976) assumes that prices are perfectly flexible. Consequently, changes in the nominal interest rate reflect changes in the expected inflation rate. A relative increase in the domestic interest rate compared to the foreign interest rate implies that the domestic currency is expected to depreciate through the effect of inflation which causes the demand for the domestic currency to fall relative to the foreign currency. In addition to flexible prices, the model also assumes uncovered interest parity, continuous purchasing power parity and the existence of stable money demand functions for the domestic and foreign economies. The model further implies that an increase in the domestic money supply relative to the foreign money supply would lead to a rise in domestic prices and depreciation of the domestic currency to maintain PPP. Further, an increase in domestic output would lead to an appreciation of the domestic currency since an increase in real income creates an excess demand for domestic money supply. This, in turn, causes a reduction in aggregate demand as agents try to increase their real money balances leading to a fall in prices until money market equilibrium is restored. In the Sticky-Price Monetary Model (due originally to Dornbusch, 1976), changes in the nominal interest rate reflect changes in the tightness of monetary policy. When the domestic interest rate rises relative to the foreign rate, it is because there has been a contraction in the domestic money supply relative to the domestic money demand without a matching fall in prices. The higher interest rate at home attracts a capital inflow, which causes the domestic currency to appreciate. This model retains the assumption of stability of the money demand function and uncovered interest parity but replaces instantaneous purchasing power parity with a long-run version. Since the PPP holds only in the long-run, an increase in the money supply does not depreciate the exchange rate proportionately in the shortrun. In the short-run, because of sticky prices, a monetary expansion leads to a fall in interest rates resulting in a capital outflow. This causes the exchange rate to depreciate instantaneously and overshoot its equilibrium level to give rise to an anticipation of appreciation in order to satisfy the uncovered interest parity condition. The above analysis assumes full employment so that real output is fixed. If instead, output responds to aggregate demand, the exchange rate and interest rate changes will be dampened. Frankel (1979) argued that a drawback of the Dornbusch (1976) formulation of the sticky-price monetary model was that it did not allow a role for differences in secular rates of inflation. He develops a model that emphasizes the role of expectation and rapid adjustment in capital markets. The innovation is that it combines the assumption of sticky prices with that of flexible prices with the assumption that there are secular rates of inflation. This yields the real interest differential model. Hooper and Morton (1982) extend the sticky price formulation by incorporating changes in the long-run real exchange rate. The change in the long-run exchange rate is assumed to be correlated with unanticipated shocks to the trade balance. They therefore introduce the trade balance in the exchange rate determination equation. A domestic (foreign) trade balance surplus (deficit) indicates an appreciation (depreciation) of the exchange rate. The four models discussed above can be derived from the following equation specified in logs with starred variables denoting foreign counterparts:

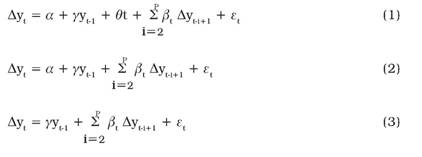

These models can be further extended to incorporate portfolio choice between domestic and foreign assets. The portfolio balance model assumes imperfect substitutability between domestic and foreign assets. It is a dynamic model of exchange rate determination that allows for the interaction between the exchange rate, current account and the level of wealth. For instance, an increase in the money supply is expected to lead to a rise in domestic prices. The change in prices, in turn, can affect net exports and thus imply changes in the current account of the balance of payments. This, in turn, affects the level of wealth (via changes in the capital account) and consequently, asset market and exchange rate behaviour. Under freely floating exchange rates, a current account deficit (surplus) is compensated by accommodating transactions in the capital account i.e. capital account surplus (deficit). This has implications for the demand and supply of currency in the foreign exchange market, which can lead to appreciation (depreciation) of the exchange rate. Thus the coefficient of the current account differential in the exchange rate model is hypothesized to have a positive sign. The portfolio approach thus introduces current account in the exchange rate equation. The theoretical model can be expressed as a hybrid model as follows: