somewhat increased volatility, the standard deviation (percentage

change) of rupee-dollar exchange rate increased marginally from 0.27 during 2006-07

to 0.38 during 2007-08.

7.50 During 2008-09, the rupee continued the

depreciating trend till July 2008, reflecting FII outflows, bearish stock market

conditions, higher demand for dollars in the backdrop of rise in crude oil prices

and elevated inflation. Notwithstanding easing of international crude oil prices

from the peak of about US $ 147 per barrel in early July 2008 to around US $ 65

per barrel by third week of October 2008 and moderation in domestic WPI inflation

from a peak of 12.9 per cent on August 2, 2008 to 11.1 per cent by October 11,

2008, the rupee continued to depreciate. The exchange rate of the rupee fell from

Rs.39.99 per dollar at end-March 2008 to Rs.49.95 dollar on October 24, 2008.

7.51 As per the BIS Triennial Survey on the global foreign exchange and derivatives

market activity (2007), the foreign exchange market in India with a total daily

turnover of US $ 34 billion during 2006-07 was the 16th largest market in the

world. The daily average turnover in the OTC derivatives segment of the foreign

exchange market was US $ 24 billion, which was 17th largest among all countries.

Foreign exchange market exhibited a significant growth during the financial year

2007-08 as reflected in the turnover in both the inter-bank and merchant segments

highlighting enhanced liquidity and growing importance of foreign exchange as

an asset class. The high turnover was contributed by large cross-border trade

and capital flows. The average daily inter-bank turnover increased to US $ 34.0

billion during 2007-08 from US $ 18.7 billion during 2006-07 and the average daily

merchant turnover increased to US $ 13.9 billion from US $ 7.0 billion over the

same period. The total turnover in the foreign exchange market registered a growth

of 86.0 per cent during 2007-08. During 2007-08, the inter-bank to merchant turnover

ratio was in the range of 1.8-2.8 (Chart VII.10).

Government Securities Market

7.52 In order

to facilitate efficient price discovery, the Reserve Bank initiated a series of

measures from the early 1990s to develop the Government securities market. Consequently,

the Government securities market witnessed significant transformation in various

dimensions, viz., market-based price discovery, widening of investor

base, introduction of new instruments, establishment of primary dealers, and electronic

trading and settlement infrastructure. This, in turn, has enabled the Reserve

Bank to perform its functions in tandem with the evolving economic and financial

conditions.

7.53 The Government securities markets

reasonably remained stable during 2007-08 and April-October 2008 (Chart

VII.11). The movements in the yields tracked the monetary policy measures.

The other factors which influenced the modulations in the yield include the significant

increase in issuances of MSS securities between July 2007 and October 2007 to

sterilise the liquidity on account of intervention, increased demand for SLR securities

on the back of large deposit growth and demand from the insurance sector. Incidentally,

the Government securities market exhibits liquidity only in a few benchmark securities.

The Government securities market remains predominantly a domestic market. Although

the FIIs were allowed to increase exposure to Government securities market from

US $ 2.6 billion to US $ 3.2 billion in January 2008 and further to US $ 5 billion

in May 2008, the response has been moderate so far. To some extent, the system

of allocating the limits amongst the FIIs acts as a dampener. On the other hand,

unlike in case of equity market which has seen significant sell off by FIIs in

recent months, FII exposure to Government securities market has remained relatively

unaffected.

7.54 During 2008-09 so far (up to September 1, 2008), the 10-year yield moved

in the range of 7.79-9.51 per cent. The yields in the Government securities market

started the current financial year with a hardening bias in response to increase

in the inflation.The 10-year yield rose to 8.69 per cent by end-June 2008 and

further to 9.32 per cent by end-July 2008. The G-Sec yields eased during August

2008 and September 2008 tracking the consistent fall in global crude prices and

SLR related buying arising from increase in net demand and time liabilities. The

10-year yields declined from 8.45 per cent by end-September 2008 to 7.45 per cent

by end-October 2008 reacting also to the monetary policy action of reducing the

repo rate from 9.00 per cent to 7.50 per cent and the cash reserve ratio from

9.00 per cent to 5.50 per cent (Chart VII.12). The 10-year

yields continued to decline during the month of November 2008 on expectations

of further easing of inflation and policy rates and stood at 7.11 per cent by

November 25, 2008. Over the years, the turnover in the Government securities market

and yield have generally witnessed an inverse relationship.

7.55 The

spread between one and 10-year yields widened marginally to 45 basis points at

end-March 2008 from 42 basis points at end-March 2007. At the longer end, the

spread between 10 and 30-year yields increased to 47 basis points at end-March

2008 from 37 basis points at end-March 2007. The spread further increased to 61

basis points at end-October 2008. The yield spread of 5-year AAA-rated bonds over

5-year Government securities widened to 390 basis points at end-October 2008 from

156 basis points at end-March 2008 (Table VII.4).

Capital Markets

7.56

From a financial stability perspective, it is necessary to have an efficient and

diversified financial system wherein both the capital market and financial institutions

play an important role in facilitating raising of resources and allocation of

capital, with the ultimate objective of raising the productivity and growth of

the economy. Furthermore, the existence of a well-functioning capital market apart

from contributing to the financial deepening of the economy also imposes discipline

on firms to perform (Beck et al.,2000; Bandiera et al., 2000).

Equity and debt markets can also diffuse stress on the banking sector by diversifying

credit risk across the economy. In response to a series of reforms introduced

since the early 1990s, the capital market has become safe, modern and transparent.

7.57 The resources raised by the corporates through public issues in the

capital market rose sharply to touch a record high of Rs.83,707 crore, an increase

of 158.5 per cent over that in 2006-07. Most of the issues were equity issues,

which accounted for 98.4 per cent of total resource mobilisation through public

issues during 2007-08 as compared with 97.4 per cent in the previous year (Chart

VII.13). The resource mobilisation through public issues, however, declined

sharply to Rs.12,502.64 crore during April-October 2008 from Rs.32,116.78 crore

during the corresponding period of the previous year. During April-October 2008,

there were no public issues by scheduled commercial banks as against three issues

(by scheduled commercial banks) of Rs.11,379 crore during the corresponding period

of the previous year.

Table

VII.4: Yield Spreads | (Basis

points) | Year/Month | 10

Year- | 10

Year- | 20

Year- | 30

Year- | 5

Year |

| reverse | 1

Year | 10

Year | 10

Year | AAA

Bond- |

| repo

rate |

|

|

| 5

Year G-sec | 1 | 2 | 3 | 4 | 5 | 6 |

2006-07 | 189 | 77 | 32 | 43 | 106 |

2007-08 | 192 | 37 | 30 | 38 | 151 |

Jan 2007 | 176 | 36 | 32 | 35 | 130 |

Feb 2007 | 198 | 37 | 16 | 21 | 137 |

Mar 2007 | 197 | 42 | 26 | 37 | 177 |

Apr 2007 | 217 | 27 | 19 | 33 | 166 |

May 2007 | 212 | 41 | 25 | 36 | 190 |

Jun 2007 | 220 | 65 | 23 | 31 | 190 |

Jul 2007 | 190 | 77 | 30 | 47 | 152 |

Aug 2007 | 194 | 51 | 31 | 39 | 184 |

Sep 2007 | 193 | 52 | 40 | 49 | 163 |

Oct 2007 | 189 | 21 | 37 | 43 | 128 |

Nov 2007 | 196 | 20 | 31 | 39 | 132 |

Dec 2007 | 182 | 19 | 25 | 31 | 127 |

Jan 2008 | 157 | 11 | 24 | 28 | 144 |

Feb 2008 | 160 | 11 | 32 | 36 | 163 |

Mar 2008 | 193 | 45 | 38 | 47 | 156 |

Apr 2008 | 201 | 27 | 38 | 42 | 144 |

May 2008 | 217 | 29 | 24 | 29 | 144 |

Jun 2008 | 269 | -49 | 58 | 50 | 158 |

Jul 2008 | 332 | -4 | 50 | 53 | 124 |

Aug 2008 | 278 | -34 | 93 | 98 | 196 |

Sep 2008 | 263 | 11 | 67 | 74 | 224 |

Oct 2008 | 145 | 17 | 53 | 61 | 390 |

7.58 In recent years, large resources have been raised by way of debt from the

private placement market. During 2007-08, resources raised from the private placement

market increased sharply by 45.7 per cent to Rs.2,12,568 crore. However, during

the first half of the current financial year (April-September 2008), mobilisation

of resources through private placements declined by 15.7 per cent to Rs.79,594

crore.

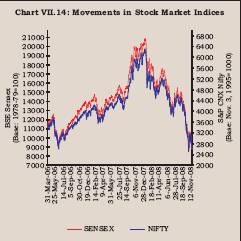

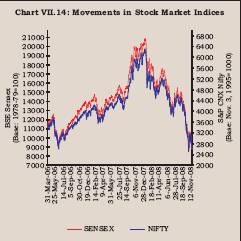

7.59 During the financial year 2007-08, the domestic stock markets

continued to surge from the beginning of the year till January 8, 2008 on the

back of robust macroeconomic fundamentals, healthy corporate earnings, strong

FII inflows, rise in global metal prices, cut in US Fed rate and easing of domestic

annual inflation rate. The upward trend, although punctuated by mild corrections

during mid-August 2007, mid-October 2007 and mid-December 2007 on account of worries

over sub-prime losses and credit crunch in US and Europe, concerns over slowdown

in US economy, it recovered again to attain new highs. The BSE Sensex closed at

an all-time high of 20873.33 on January 8, 2008, recording gains of 59.7 per cent

over end-March 2007.

7.60 Beginning, January 9, 2008, the domestic stock

markets have witnessed a generally downtrend due to heightened concerns over recession

in the US economy. Downward revision of GDP growth rate by CSO, hike in short-term

capital gains tax in the Union Budget 2008-09, rise in domestic annual inflation

rate, rise in global crude oil prices to record high levels, heavy net sales by

FIIs and liquidity squeeze from the secondary market in the wake of biggest IPO

by Reliance Power were other factors which dampened the market sentiment. As a

result of these developments, the BSE Sensex at 15644.44 at end-March 2008, declined

by 25.1 per cent from its all-time high level of 20873.33 on January 8, 2008.

S&P CNX Nifty closed at 4734.50 at end-March 2008, recording gains of 23.9

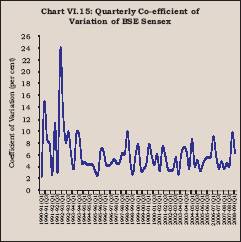

per cent over end-March 2007. The coefficient of variation, a measure of volatility,

of the BSE Sensex rose to 13.7 per cent during 2007-08, from 11.1 per cent during

2006-07.

7.61 The performance of domestic stock markets in 2008-09 (up

to December 8, 2008) has witnessed two distinct phases. The markets witnessed

an upward trend till May 21, 2008 on account of strong Q4 2007-08 results by some

IT and telecom companies, permission for short selling and securities lending

and borrowing by both institutional and retail investors with effect from April

21, 2008, increase in global metal prices and other sector and stock specific

news. On May 21, 2008, the BSE Sensex registered gains of 10.2 per cent over end-March

2008. A downward trend followed thereafter, mainly due to downswing in major international

equity markets due to concerns over recession in the US. The BSE Sensex on December

8, 2008 at 9162.62, was 41.4 per cent lower than end-March 2008, while S&P

CNX Nifty at 2784.00 was 41.2 per cent lower than end-March 2008 (Chart

VII.14).

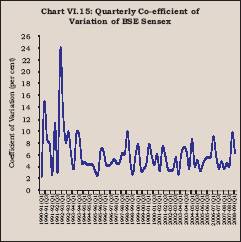

7.62 The volatility in the stock markets, as measured by the coefficient of variation

in the BSE Sensex and Nifty, increased beginning January 2008, reflecting episodes

of erratic movements (Chart VII.15). To contain volatility,

emphasis has been laid on risk management practices at the stock exchange level

and strengthening of the market design in recent times.

Payment

and Settlement System

7.63 The payment and settlement systems,

by providing a fast, efficient and secure basis for financial transactions, form

the bedrock of the financial system. Current payment systems operate based on

the technological development. The efficiency and velocity of the payment systems,

based on the technological developments of the last 20 years, may diffuse a crisis

arising in one country to the rest of the world, given the interconnection of

the systems and the fact that their regulation and legislation have not advanced

as fast as technological innovations (Box VII.3). Payment systems

assume special significance, given the uncertain consequences that a disequilibrium

in the payment systems could have on the implementation of monetary policy and

the repurcussions the propagation of a systemic crisis has for financial stability.

With a view to preventing systemic crises that could arise due to the failure

of one or more payment system participants, the Committee for Payment and Settlement

System (CPSS) at the BIS formulated the Core Principles for systemically important

payment systems. Moreover, remarkable advances on the creation of the Core Principles

for Securities Settlement Systems have been achieved. The principles are intended

to be accurate and precise, and at the same time universal, capable of being followed

and applied depending on the development, resources and necessities of each country.

7.64 A sound legal base for the payments system constitutes one of the core

principles for systemically important payment systems. The notification of the

Payment and Settlement Systems Act, 2007 along with its regulations, viz.,

Board for Regulation and Supervision of Payment and Settlement Systems Regulations,

2008 and Payment and Settlement Systems Regulations, 2008 on the same date (August

12, 2008), was a leap forward towards providing a well founded legal basis for

payment systems in India. Accordingly, the Reserve Bank has been vested with the

powers to regulate and oversee the payment and settlement systems in the country,

including those operated by entities not regulated by the Reserve Bank. The Bank

has framed the minimum standards for magnetic ink character recognition (MICR)

and non-MICR clearing houses. Similarly minimum standards for operations of ECS

and NEFT have also been prepared and circulated to clearing houses for adoption. Box

VII.3: Inter-dependencies of the Payment and Settlement Systems The

network of domestic and cross-border systems that comprise the global payment

and settlement infrastructure has evolved significantly in recent years. These

systems, like the financial markets and economies they support, are increasingly

connected through a wide array of complex inter-relationships. Through these relationships,

the smooth functioning of a single system often becomes contingent on the performance

of one or more other systems. It is because of the implications that disturbances

in payment systems may create for financial and economic stability that central

banks have, as a priority task, the purpose of facing the challenges stated by

the interdependence of payment systems.

This increasing inter-dependence

is driven by several interrelated factors, including technological innovations,

globalisation and financial sector consolidation. In addition, a number of initiatives

by the financial industry and by public authorities to reduce the costs and risks

of settlement have purposely promoted greater integration among the numerous components

of the global payment and settlement infrastructure. For instance, the 1989 G-30

recommendations for T+3 securities settlement, central bank policies encouraging

the development and reliance on systems with intra-day finality, and the CPSS

focus on reducing foreign exchange settlement risk have provided incentives for

more straight through processing (STP) and tighter relationships among individual

systems.

While these explicit initiatives explain one aspect of tightening

inter-dependencies, institutions' profit-seeking and cost management incentives

also foster interdependencies. Inter-dependencies have important implications

for the safety and efficiency of the global payment and settlement infrastructure.

Some forms of inter-dependencies have facilitated significant improvements in

the safety and efficiency of payment and settlement processes. On the positive

side, interdependencies improve the safety of the global payment and settlement

infrastructure by facilitating delivery versus payment (DvP)

and payment versus payment (PvP) processes, thereby eliminating

a key source of principal credit risk. In addition, inter-dependencies can reduce

credit and liquidity risk by facilitating the use of central bank money as a settlement

medium. Inter-dependencies can also help reduce operational risk through better

integration of the different steps across systems. At the same time, inter-dependencies

increase the potential for a given disruption to spread quickly to many different

systems. This potential was noted in the G-10 report on Financial sector consolidation

(the Ferguson Report, 2000), which suggested that inter-dependencies might accentuate

the role of payment and settlement systems in the transmission of disruptions

across the financial system. In some circumstances, disruptions may amplify as

they spread across systems. In other situations, inter-dependencies may help dampen

the effect of disruptions, in particular by allowing liquidity to flow more rapidly

across different elements of the global payment and settlement infrastructure.

Moreover, the actual path that a disruption would follow could be influenced by

many other factors, including the reactions of systems and institutions. In addition,

risks have become increasingly concentrated in a limited number of critical systems,

institutions and service providers. In some cases, such as that of CLS, this trade-off

has been anticipated and accepted, especially in the light of reduction of principal

credit risk.

While some risk management practices and standards consider

inter-dependencies to an extent, there is still a considerable room for improvement.

Additional exercises to test the compatibility of different entities' business

continuity plans, for instance, could improve the degree of co-ordination among

inter-dependent stakeholders, helping to prevent and manage potential disruptions.

Moreover, the increasing inter-dependence of the global payment and settlement

infrastructure is a dynamic phenomenon, and generally poses risks to be managed

rather than eliminated. To maintain their effectiveness, risk management policies

need to keep pace with the changing sources of risk arising from inter-dependencies.

Strengthening systems to prevent and contain systemic risks has been a long-standing

focus of the CPSS and its member central banks. As a result, many elements of

the CPSS Core Principles for systemically important payment systems (Core Principles),

CPSS/IOSCO recommendations for securities settlement systems (RSSS), and CPSS/

IOSCO recommendations for central counterparties (RCCP) address some of the challenges

posed by interdependencies, including the potential for disruptions to spread

across systems. The RSSS and RCCP standards, for example, contain explicit recommendations

on links between two central securities depositories (CSDs) and two central counterparties

(CCPs), respectively. Moreover, all three sets of standards address the management

of settlement risk, including settlement asset risk, and the related potential

for disruptions to affect other systems.

To address the problem of the potential

for a disruption to spread quickly to many systems, the system operators, financial

institutions, and service providers are required to take several actions in order

to adapt their existing risk management practices to the more complex, integrated

environment resulting from tighter inter-dependencies. Towards that end, the importance

of broad risk management perspectives, risk management controls commensurate with

the role played in the global payment and settlement infrastructure, and greater

coordination among inter-dependent stakeholders cannot be overlooked. Central

banks and other authorities also need to review, and where necessary, adjust their

policies in the light of the challenges posed by inter-dependencies.

References:

BIS. 2005. Central Bank Oversight of Payment

and Settlement Systems. CPSS Paper No.68. May.

BIS. 2008. The Interdependencies

of Payment and Settlement Systems. CPSS Paper No.84. June.

BIS. 2001. Core

Principles for Systemically Important Payment Systems. CPSS Paper No.43. January.

7.65 The Reserve Bank continued to exercise its oversight over payment and settlement

systems with a view to ensuring its security, efficiency and soundness. Significant

measures were taken by the Board for Regulation and Supervision of Payment and

Settlement Systems (BPSS) towards risk mitigation, improving customer service,

as well as modernising, and increasing technological intensity of the system.

Some of the important measures initiated included, inter alia, preparation

of a framework for payments through mobile phones; extension of jurisdiction of

the MICR clearing houses; computerisation of non-MICR clearing houses; expanding

national electronic funds transfer (NEFT) system to make all real time gross settlement

RTGS branches NEFT enabled; upgrading the NEFT system into a 24x7 type remittance

system; making mandatory use of electronic mode of payment for large value transactions

(initially Rs.1 crore and above, later Rs.10 lakh and above) between the Reserve

Bank regulated entities and markets. The Report on Oversight of Payment Systems

in India released on November 28, 2007 laid down the major international initiatives

towards oversight of the payment and settlement systems, and status of implementation

in the Indian case. 7.66 The major highlight of the Reserve Bank's initiatives

in the area of information technology (IT) during 2007-08 was setting up of new

data centres, and consolidation of systems for centralised data processing, business

continuity and disaster recovery. In order to delineate the broad approaches being

followed by the Reserve Bank so as to enable banks to plan their IT initiatives

suitably, the latest version of the Financial Sector Technology (FST) Vision document

for the period 2008-10 was also released.

7.67 The Reserve Bank continued

to play a major role in developing the payment and settlement systems in India.

This was reflected in an increase in the use of various electronic and paper based

transactions. Various indicators of the payment system point towards a sharp increase

in both volumes and values put through systemically important payment system (SIPS)

and retail payment system, especially through the electronic clearing instruments,

viz., RTGS, forex and Government securities clearing and retail electronic

fund transfer and card based payments within retail payment system. The systemically

important payment systems (SIPS) transactions and the settlement of financial

market clearing constituted 85.1 per cent of total transactions during 2007-08.

7.68 The ratio of annual turnover through various channels of the payment

and settlement systems to GDP increased to 12.7 in 2007-08 from 8.6 in 2005-06,

reflecting the robust increase in the value of annual turnover by 41.8 per cent

during 2007-08 over and above the increase of 37.5 per cent in the previous year.

The turnover of the various retail payment systems, including cheque clearing,

electronic clearing services and card payments, increased by 23.4 per cent during

2007-08 from 11.6 per cent in 2006-07 mainly on account of sharp growth in retail

electronic funds transfer. Cheques continued to be the predominant mode of retail

payment, though the share of retail electronic mode of payment increased during

2007-08. MICR cheque clearing constituted 83.7 per cent and 86.1 per cent of the

volume and value, respectively, of the paper based clearing during 2007-08. More

than 800 clearing houses have been computerised where the settlement is done electronically,

while the instruments still continue to be sorted manually.

7.69 The

electronic funds transfer increased by more than five times during 2007-08 over

the previous year, reflecting a significant increase across all modes of retail

electronic funds transfer systems, viz., electronic clearing services

(ECS), EFT and NEFT systems (Table VII.5). The sharp growth

in value of retail transactions vis-a-vis their volume reflected, inter

alia, the use of electronic mode, as mandated by the stock exchanges, for

refunding the oversubscription amount of IPOs floated by companies. Accordingly,

the share of retail electronic funds transfer, which remained fairly low in the

retail payment system (2.6 per cent during 2006-07), increased sharply to 10.9

per cent during 2007-08.

Table

VII.5: Paper-based versus Electronic Transactions |

(Volume

in thousand and Value in Rs. crore) | Year | Volume | Value |

| Paper | Electronic | Total | Share

of | Paper | Electronic | Total | Share

of |

| -based |

|

| Electronic | -based |

|

| Electronic |

|

|

|

| (%) |

|

|

| (%) |

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

2002-03 | 1,013,900 | 173,000 | 1,186,900 | 14.6 | 1,34,24,313 | 37,536 | 1,34,61,849 | 0.3 |

2003-04 | 1,022,800 | 167,551 | 1,190,351 | 14.1 | 1,15,95,960 | 49,67,813 | 1,65,63,773 | 30.0 |

2004-05 | 1,166,848 | 230,044 | 1,396,892 | 16.5 | 1,04,58,895 | 1,18,86,255 | 2,23,45,150 | 53.2 |

2005-06 | 1,286,758 | 287,489 | 1,574,247 | 18.3 | 1,13,29,134 | 2,24,39,286 | 3,37,68,420 | 66.5 |

2006-07 | 1,367,280 | 383,445 | 1,754,007 | 21.9 | 1,20,42,426 | 3,50,50,234 | 4,71,06,333 | 74.4 |

2007-08 | 1,460,564 | 541,150 | 2,001,714 | 27.0 | 1,33,96,066 | 2,83,60,321 | 4,17,56,387 | 67.9 |

7.70 To encourage the use of electronic mode of payments, the

Reserve Bank waived the processing charges for all electronic payment systems

operated by it for another year, i.e., till March 2009. The availability

ofECS at 70 centres as against 67 centres in the previous year and the proposed

National ECS (NECS) as announced in the Mid-Term review of the Annual Policy for

2007-08 would facilitate prompt services to the customers. The ECS as also NEFT

are being preferred for making refunds of subscription to IPOs. The EFT, which

was operationalised in 1995, is now permitted only for Government payments. All

other electronic retail funds transfer are encouraged through NEFT, which is a

much more secure payment system. These developments have contributed to the speed,

efficiency and safety of the payment system.

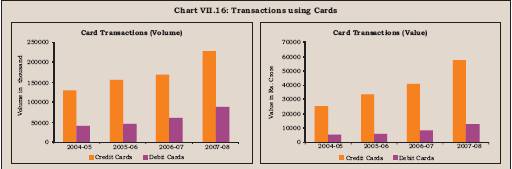

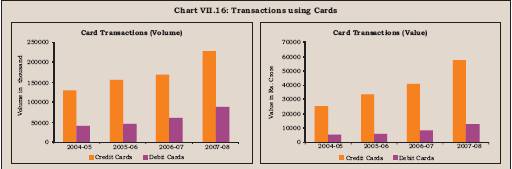

7.71 The use of cards for

making retail payments is also one of the preferred modes. The convenience and

the acceptability of this mode of payment are reflected in the increased volume

of transactions through cards - both debit as well as credit. Credit card transaction

volumes increased by 34.6 per cent in 2007-08 and 8.6 per cent in 2006-07, while

the increase in value was 40.2 per cent and 22.1 per cent, respectively, during

the same period. Debit card transaction volumes increased by 46.7 per cent in

2007-08 and 31.7 per cent in 2006-07, while the increase in value was 53.2 per

cent and 38.6 per cent, respectively, during the same period (Chart

VII.16). Banks had issued a total of 26.7 million credit cards and 122.0 million

debit cards, and the number of merchant establishments reached 428,479 at end-October

2008. The average value of transaction at point of sale (POS) using debit card

and credit card was Rs.161 and Rs.2,415, respectively. With the increased usage

of cards and to mitigate risk the Reserve Bank issued guidelines for credit card

operations (refer Chapter II, paras 2.179-2.180).

7.72 The use of automated teller machines (ATMs) has also increased in view of

the customer convenience. The number of ATMs increased to 36,314 at end-June 2008

from 28,704 at end-June 2007. The Reserve Bank examined the various issues through

the Approach Paper on 'ATMs of Banks: Fair Pricing and Enhanced Access,' and issued

regulatory guidelines on customer charges for use of ATMs for cash withdrawal

and balance enquiry (refer Chapter II, para 2.197).

7.73 The RTGS system,

which was operationalised in March 2004 for facilitating faster settlement of

high value transactions, has stabilised with increased branch network and wider

geographical coverage. The RTGS connectivity was extended to 47,608 branches at

end-June 2008 facilitating sharp increase in volumes settled through this system.

The volume and value of transactions through the RTGS system, both in the inter-bank

and customer segment, increased sharply, particularly during the last quarter

of 2007-08. The integration of the RTGS system with the Reserve Banks' internal

accounting system (IAS) has enabled straight through processing (STP). Also, with

the integration of the RTGS-IAS and the securities settlement system (SSS), automatic

intra-day liquidity (IDL) is available. The clearing and settlement operations

at NCC, Mumbai and CCIL operated systems are settled in the RTGS as multilateral

net settlement batch (MNSB) mode. These measures have contributed to financial

stability.

7.74 The Clearing Corporation of India Limited (CCIL) set

up by banks and financial institutions at the initiative of the Reserve Bank clears

and settles inter-bank trades in Government securities and foreign exchange as

well as a money market product, viz., the CBLO. The settlement of all

secondary market outright sales and repo transactions in Government securities

is carried out through CCIL. All OTC trades in this segment, which are reported

on the Reserve Bank's NDS platform, and trades which are contracted on the online

anonymous, trading platform NDS-OM, are accepted by CCIL for settlement. These

trades are settled on a delivery versus payment (DvP) III basis, i.e.,

the funds leg as well as the securities leg is settled on a net basis. CCIL also

provides guaranteed settlement facility for all US dollar - Indian rupee, inter-bank

cash, spot and forward transactions by becoming the central counter party to every

trade accepted for settlement, through the process of novation11. The rupee legs

of the transactions are settled through the member's current accounts with the

Reserve Bank and the US $ leg through CCIL's account with the settlement bank

at New York. CCIL also provides continuous linked settlement (CLS) services for

banks in India by availing of third party services of a settlement bank. Currently,

13 banks are availing this facility to settle cross currency trades. The total

volume and value transacted through the two systems - Government Securities Clearing

and Forex Clearing has witnessed a significant increase (Table

VII.6). These systems have significantly promoted safety and efficiency in

the settlement of inter-bank payments.

7.75 The centralised funds management

system (CFMS) enables banks holding current account with the Reserve Bank to view

their balances at all the Reserve Bank offices [through centralised funds enquiry

system (CFES)] and transfer funds between the Reserve Bank offices [through centralised

funds transfer system (CFTS)]. This facility is now available at all the Reserve

Bank centres. At present, 71 member banks are making use of this facility extensively.

7.76 It is thus evident that in the conduct of its oversight of the payment

and settlement system, the Reserve Bank's responses to the emerging challenges

were based on credible communication, adequate and timely availability of information

and a broad-based, participative and consultative approach in its developmental

and regulatory policies with involvement of all stakeholders. Any shortcoming

in this vital infrastructure could lead to broader financial and economic instability

as large-values are transacted by the SIPS and failures in the retail payments

segment could lead to the erosion of public confidence. In an event of financial

stress, market participants or central banks may wish to supply emergency liquidity

to certain participants in a payment and settlement system in an attempt to encourage

the orderly settlement of transactions in the interests of overall financial system.

Additionally, central bank's role in payment systems frequently calls for co-operation

and co-ordination of activities with other authorities such as banking supervisors

and securities regulators to ensure smooth discharge of legal or other responsibilities

essential for the payment system. Accordingly, the role of the central bank in

discharging its oversight function is to assess the risks involved and to seek

cooperation with relevant stakeholders to put in place risk mitigation measures,

and also ensure that the risks are not transmitted to other systems/participants.

Table

VII.6: Government Securities and Forex Clearing by CCIL |

(No.

of trades in 000's; value in Rs. crore) | Period | Government

Securities Settlement | Forex

Settlement |

| Outright | Repo |

|

|

| No.

of | Value | No.

of | Value | No.

of | Value |

| Trades |

| Trades |

| Trades |

|

1 | 2 | 3 | 4 | 5 | 6 | 7 |

2004-05 | 161 | 11,34,222 | 24 | 15,57,907 | 466 | 40,42,435 |

2005-06 | 125 | 8,64,751 | 25 | 16,94,509 | 490 | 52,39,674 |

2006-07 | 137 | 10,21,536 | 30 | 25,56,502 | 606 | 80,23,078 |

2007-08 | 189 | 16,53,851 | 27 | 39,48,751 | 757 | 127,26,832 |

3. Key Sources of Vulnerability to the Indian

Financial System

7.77 The multi-pronged approach followed for

strengthening and developing financial institutions, markets, payment systems

and infrastructure have had a positive impact on the Indian financial system.

The assessment of developments during 2007-08 and 2008-09 so far suggests that

financial institutions, especially scheduled commercial banks, are on a sound

footing. Domestic financial markets have been constantly developing, and functioning

normally, despite some indirect knock on effects of global developments. Financial

infrastructure now is much more robust than it was a few years ago. While the

financial system on the whole is quite robust, which augurs well for financial

stability, there is also a need to be aware of some downside risks in certain

areas that could have a bearing on the stability of the financial sector in the

near future.

7.78 In the backdrop of the financial market turmoil in

the developed economies, threats to financial stability remain at elevated levels

with possible feedback into the prospects for macroeconomic performance. Since

the collapse of the leading US investment banks in August-September 2008, there

has been a breakdown of trust in inter-bank and inter-institutional lending. Given

that this kind of extreme risk perception would be reversed only slowly, the full

resolution of the crisis would inevitably take time. While emerging markets had

initially remained fairly resilient to global financial market turmoil, they have

recently come under increasing pressure. Financing conditions have deteriorated

since beginning of 2008 and equity markets have declined sharply, albeit

from elevated levels. Capital outflows have intensified leading to tighter international

and, in some cases, domestic liquidity conditions. Borrowers and financial institutions

in emerging markets are likely to be confronted with a more trying macroeconomic

environment. The developments in these areas need to be watched carefully with

a view to putting in place corrective macroeconomic policy responses with the

ultimate objective of maintaining stability in different segments of the financial

system and to fortify the economy from the possible spillover effects.

Adverse International Developments

7.79 Developments

in the global financial system have heightened the uncertainty in the global economy.

The credit markets in the western world, especially in the US, have, in the recent

past, witnessed considerable turmoil and significant loss of market liquidity

leading to financial distress in a few institutions and considerable financial

damage to several others, prompting some of the major central banks to inject

liquidity into the markets. There was a collective failure to appreciate the extent

of leverage taken on by a wide range of institutions - banks, monoline insurers,

government-sponsored entities, hedge funds - and the associated risks of a disorderly

unwinding. Private sector risk management, disclosure, financial sector supervision,

and regulation all lagged behind the rapid innovation and shifts in business models,

leaving scope for excessive risk-taking, weak underwriting, maturity mismatches,

and asset price inflation. The transfer of risks off bank balance sheets was underestimated.

As risks have materialised, this has placed enormous pressures back on the balance

sheets of banks. Notwithstanding unprecedented intervention by major central banks,

financial markets remain under considerable strain, now compounded by a more worrisome

macroeconomic environment, weakly capitalised institutions, and broad-based deleveraging.

7.80 The exact extent of losses and exposures is not known as yet and perceptions

of a pronounced increase in default risk continues to prevail as was evident in

high credit default swap (CDS) spreads. Money markets remain dislocated and, despite

central bank liquidity injections alleviating pressures, uncertainty about future

liquidity supply and counterparty risk persists. Global equity markets have fallen

considerably in 2008 with an increase in volatility, decline in investors' risk

tolerance, the worsening of the macroeconomic outlook and renewed credit related

concerns. Bond yields, which stabilised since mid-March, 2008 have started to

recover in developed economies and a flight to safety is leading up to a shortage

of paper. Longer term real yields have declined sharply on recession fears. In

the foreign exchange market, the US dollar and the pound sterling depreciated

in effective terms whereas the euro, the yen and the Swiss franc appreciated along

with several Asian currencies. Concerns about a more widespread slowdown, and

perceptions of overvaluation have been weighing on emerging market asset classes

in 2008 with spreads on sovereign debt widening. The outlook is highly unclear

and the prospects of resolution of the multiple disequilibria embedded in global

developments are fraught with uncertainty.

7.81 The financial market

crisis with US at its epicentre has started to spread across markets, and across

nations. The US slowdown is spreading via the trade and financial channels.

The significant slowdown in the projected global growth from 5.0 per cent in 2007

to 3.7 per cent in 2008, and to just over 2.0 per cent in 2009, is likely to have

implications for every economy (WEO Update, November 2008). In view of strong

international linkages among economies, macroeconomic prospects for the EMEs,

which till very recently remained relatively insulated, face the downside risks

from lagged effects of the downturn. As the notion of 'decoupling' of emerging

market countries from mature markets has turned out to be incorrect, emerging

market policymakers would have to cope with a global growth slowdown, and reversal

of capital flows (Box VII.4). As per the WEO update of November

2008, growth in emerging economies would decelerate from 8.0 per cent in 2007

to 6.6 per cent in 2008 and further to 5.1 per cent in 2009. There is a risk that

the confluence of circumstances emerging out of the financial turmoil could accelerate

a downturn in the credit cycle in some emerging market economies.

7.82

The banking sector in India does not have any direct exposure to the US sub-prime

market. Some banks in India, however, have indirect exposure through their overseas

branches and subsidiaries to the US sub-prime markets in the form of structured

products, such as collateralised debt obligations (CDOs) and other investments.

However, such exposure is not very significant, and banks have made adequate provisions

to meet mark-to-market losses on such investments. Besides, banks also maintain

high level of capital adequacy ratio. Thus, the risks in the banking sector appear

limited and manageable.

7.83 There is, however, apprehension that current

market conditions, may lead to recession in the US having significant impact on

other economies. In this context, it may be noted that India is largely a domestic

demand driven economy and exports constitute a relatively smaller portion of India's

GDP, as compared to many other economies. In recent years, India's export basket

has also become more diversified, although the US continues to be one of the major

trading partners. While strong regional sources of growth within EMEs may be a

mitigating factor, weakening of economic activity in the US would impact India's

economy through the trade channel. There are indications that the current crisis

has implications in terms of higher funding costs and difficulties in raising

external finance, particularly, for lower rated firms. Box

VII.4: Economic Integration and Decoupling of the Emerging Economies In

recent years with rapid increase in trade and financial linkages across countries,

emerging market economies have emerged as major players in the global economy.

Decoupling holds that emerging European and Asian economies have broadened and

deepened to the point that they no longer depend on the US for growth This has

generated a debate about possible changes in the generally observed patterns of

international business cycle co-movement.

The major channels of coupling

include: (i) integration between economies and rise in internationally integrated

production; (ii) the international movement of workers leading to remittances;

(iii) growth in international linkages in financial services through increased

cross-listings of stocks and more cross-border ownership and control of exchanges,

banks, and securities settlement systems; (iv) spillover through commodity prices

and through financial variables such as short- and long-term interest rates and

equity prices.

Empirical research shows convergence of business cycles

among a larger group of industrial economies and among emerging market economies

over time, but there has also been a simultaneous decoupling of business cycles

between these two sets of countries (Kose, Ortok and Prasad, 2008). The authors

cautioned that although the results suggested emerging markets as a group are

becoming an independent driver of global growth, their decoupling potential would

still depend on the duration and severity of a US downturn. However, their analysis

includes linkages through real macroeconomic aggregates but does not account for

financial ones.

So long as the US slowdown was attributed to US specific developments

- primarily in housing and manufacturing, the spillover effects to other economies

was Considered modest. However, as the transmission began to involve asset price

spillovers or confidence channels, the impact became much larger. The influence

of the U.S. economy on other economies does not appear to have diminished. On

the contrary, indications are that the magnitude of spillovers has increased over

time, particularly in neighboring countries and regions, which is consistent with

the notion that greater trade and financial integration tends to magnify the cross-border

effects of disturbances (WEO, 2007).Stock prices in the emerging market economies

moved downward during acute periods of US financial stress over the past year.

The IMF in a recent study confirms that global factors are as important in explaining

the movement in emerging markets equity prices as their domestic fundamentals.

Using various measures of correlation, it is also found that the scope for spillovers

to emerging equity markets has risen, suggesting a growing transmission channel

for equity price movements. This could, in turn, affect consumption and investment

in emerging markets, although such macrofinancial linkages are found to be small

and they tend to play out gradually (GFSR, 2008).

In the context of effect

of financial crisis on developed countries, it is argued that financial innovations

like growth of non-bank intermediaries such as private equity firms and hedge

funds, deepening of resale markets for capital, and sophisticated products and

contracts, among others, might have made these economies less vulnerable to crises

by widening the access to liquidity and allowing assets to be traded more easily

during periods of stress (Gai et al., 2008). Though the developed economies

are able to tide over mild and less severe shocks, in case of extremely severe

shocks, a crisis is inevitable, regardless of the ex ante beliefs. In the crisis

situation, such financial innovations could impact more severely by way of relaxing

the financial constraints facing borrowers with the result that asset prices are

driven down to such an extent that all intermediaries and firms are forced to

liquidate all of their assets, intermediaries shut down, and the closure of firms

means that there are no investment opportunities in the more-productive sectors

of the economy. It is also argued that crises in emerging market economies are

more frequent but less severe than in developed countries [Caprio and Klingebiel

(1996), and Demirguc-Kunt and Detragiache (2005)].

References:

Bayoumi, Tamim and Andrew Swiston. 2007. "Foreign Entanglements: Estimating

the Source and Size of Spillovers Across Industrial Countries." IMF Working

Paper 07/182. Washington: International Monetary Fund. July. World Economic Outlook.

2007. "Decoupling the Train? Spillovers and Cycles in the Global Economy."

International Monetary Fund. April.

Kose. M. Ayhan, Christopher Otrok,

and Eswar Prasad. 2008. "Global Business Cycles: Convergence or Decoupling?"

IZA Discussion Paper No. 3442. April. Gai, Prasanna, Sujit Kapadia, Stephen Millard

and Ander Perez. 2008. "Financial Innovation, Macroeconomic Stability and

Systemic Crises." Bank of England Working Paper No. 340. February.

Kohn, Donald L. 2008. "Global Economic Integration and Decoupling" at

the International Research Forum on Monetary Policy. Frankfurt. Germany. June

26. 7.84 The main impact of the global financial turmoil in India has emanated

from the significant change experienced in the capital account in 2008-09 so far,

relative to the previous year. Total net capital flows declined from US $17.3

billion in April-June 2007 to US $13.2 billion in April-June 2008. Capital flows

are expected to be lower in the current fiscal year 2008-09 as compared with the

previous year. While foreign direct investment (FDI) inflows have continued to

exhibit accelerated growth (US $ 19.3 billion during April-September 2008 as compared

with US $ 9.2 billion in the corresponding period of 2007), portfolio investments

by foreign institutional investors (FIIs) witnessed a net outflow of about US

$ 11.9 billion in April-October 2008 as compared with a net inflow of US $ 22.3

billion in the corresponding period of the previous year.

7.85 The slowdown/reversal

of capital flows could affect an economy through several ways such as (i) decline

in equity markets and the resultant difficulty in raising capital from the market;

(ii) sharp realignment of exchange rates; (iii) tightening of liquidity conditions

and rise in interest rates; and (iv) hard lending of credit cycle. Capital flows

have also become an important determinant of exchange rate movements on a day-to-day

basis. Such exchange rate movements have implications for the financial and real

sectors of the economy. With the existence of a merchandise trade deficit of 7.7

per cent of GDP in 2007-08, and a current account deficit of 1.5 per cent, and

change in perceptions with respect to capital flows, there has been significant

pressure on the Indian exchange rate in recent months. The exchange rate has depreciated

from Rs.39.99 per dollar as at end-March 2008 to Rs.49.11 as on December 10, 2008.

In real effective terms whereas the 6-currency real exchange rate appreciated

from an index of 104.9 (base 1993-94=100) in September 2006 to 115.0 in September

2007, it has now depreciated to a level of 100.1 as on December 10, 2008.

7.86 The net sales by FIIs have adversely affected the equity market in India.

This combined with some other factors resulted in a decline in the BSE Sensex

by 56.1 per cent (as on December 8, 2008), since January 8, 2008. According to

the IMF's Global Financial Stability Report of October 2008, correlation of equity

markets in EMEs with those in the advanced economies has risen, suggesting a growing

transmission channel for equity price movements.

7.87 In India, inflation

based on year-on-year variations in the wholesale price index (WPI) increased

to 7.7 per cent in 2007-08 compared with 5.9 per cent in 2006-07. Consistent with

the stance of monetary policy, the evolving liquidity situations and on the basis

of incoming information on domestic and global macroeconomic and financial developments,

it was decided to increase the CRR by 25 basis points each on May 10, 2008 and

May 24, 2008 to 8.25 per cent. Furthermore, the repo rate under the LAF was increased

from 7.75 per cent to 8.00 per cent on June 12, 2008 and further to 8.50 per cent

with effect from June 25, 2008. The CRR was again increased by 50 basis points

to 8.75 per cent in two stages from July 5, 2008 and July 19, 2008 by 25 basis

points each.

7.88 Inflation, in terms of the WPI,

softened steadily from the level of 12.9 per cent on August 9, 2008 and has declined

to 8.4 per cent for the week-ended November 22, 2008, reflecting decline in prices

of freely priced petroleum products (in the range of 15-22 per cent) in line with

decline in international crude oil prices (by 45 per cent since July 2008) as

well as easing in other commodity prices such as oilseeds/edible oils/oil cakes,

raw cotton and cotton textiles following global trends. Globally, pressures from

commodity prices, including crude, appear to be abating. The international crude

prices which hardened from an average level of US $ 57 per barrel at end-2005

to an average level of US $ 73 per barrel by July 2006, and thereafter rose sharply

to reach a historic high of US $ 145.3 per barrel by early July 2008, eased significantly

to around US $ 44 per barrel by December 10, 2008 reflecting decline in demand

in OECD countries and improved near-term supply prospects in non-OPEC countries.

The moderation in key global commodity prices, if sustained, would further reduce

inflationary pressures.

7.89 The adverse global developments

have led to moderation of growth in the industrial and services sectors in the

first-half of 2008-09. In recent weeks, the impact on liquidity and credit has

also been felt. On the growth front, it is important to ensure that credit requirements

for productive purposes are adequately met so as to support the growth momentum

of the economy. The Reserve Bank has kept a close vigil on the entire financial

system to prevent pressures from building up in the financial markets. This includes

liquidity enhancing measures to ease liquidity pressures.

7.90 The global

financial situation, described as the worst since the Great Depression, continues

to be uncertain and unsettled. Currently, it is difficult to speculate about the

trajectory of global downturn, and its consequent fallout for the Indian economy.

This remains uncharted territory and experience suggests that there is at times

the need to go beyond standard or conventional solutions. The Reserve Bank has

endeavoured to be proactive, and has taken measures to manage the rapid developments

and ease pressures stemming from the global crisis. The stance of monetary policy

has been eased with the reduction in CRR by 350 basis points, repo rate by 250

basis points and reverse repo rate by 100 basis points between October and December

6, 2008 (refer Chapter II, Box II.2).

Asset Prices

7.91 The role of real estate exposure's (REE) in financial crises has been

recognised since long. In the late 1990s, the 'Asian crisis' amply demonstrated

the interlocking of credit booms and real estate bubbles in the economic upswing,

followed by the damaging impacts of prolonged real estate slumps on the solvency

of banks, the availability of credit and general economic growth.

7.92

The recent global financial turmoil caused by the crisis in the mortgage market

in the US has once again brought into focus the dangerous inter-dependence between

real estate cycles, bank crisis and the ultimate threat to financial stability.

The major portion of real estate exposure consists of mortgage related assets

which are long-term in nature having dynamic cash flow characteristics which render

them as risky ventures. It, therefore, becomes imperative on the part of the banks

to manage the balance sheet risks associated with real estate exposure, particularly

in the current scenario of slowdown in the economy with its expected ramifications

on real estate prices, given the historically positive correlation between economic

downturn and its adverse impact on real estate prices (Box VII.5).

7.93 Asset prices (real estate and equity prices) in India rose sharply beginning

2005. The BSE Sensex rose by 240.2 per cent between April 19, 2005 and January

8, 2008, when the market was at its peak. Real estate prices also rose sharply.

Although no firm information is available on the extent of the rise in real estate

prices, anecdotal evidence suggests that real estate price rose between two to

four times during the last three to four years in different parts of the country.

A pilot survey on Real Estate Prices and Rent in Greater Mumbai conducted

by the Reserve Bank also showed that the rent and sale/ resale prices of residential

properties in Mumbai increased significantly over the last four years.

7.94 The phenomenon of sharply rising asset prices is not confined to India alone

but has also occurred around the world. For instance, the US, Australia, Denmark,

France, Sweden, Spain, New Zealand, and the United Kingdom have all had rapid

appreciation of real estate prices in recent years.

Box

VII.5: Banks' Exposure to the Real Estate Sector - Various Risks Real

estate lending involves a variety of inherent and interrelated risks. There are

various channels through which risks may be transmitted to a bank's balance sheet

in respect of its REE:

(i) Credit Risk: A downturn in the economic cycle

could result in a depletion in the households' surplus which in turn would increase

the default risk and reduction in collateral values. Also the probability of adverse

selection during credit boom raises the delinquencies during economic downturn.

Further, rise in interest rates leads to increase in EMIs for floating rate exposure,

especially in retail housing loans, which borrowers may find difficult to pay.

(ii) Interest Rate Risk: As interest rate goes up, fixed rate real estate

advances could have a negative effect on banks' profitability due to increase

in funding costs. Management of assets and liabilities becomes essential with

enhanced efforts to garner long-term deposits as a risk mitigating measure.

(iii) Liquidity Risk: Real estate exposures are essentially illiquid and

are difficult to liquidate at short notice without incurring loss. Thus, banks

need to have a thorough understanding of variability of mortgage cash flows and

corresponding impact on balance sheet which is inversely related to the movements

in interest rates.

(iv) Prepayment Risk: This risk is related to interest

rate cycle. It increases in a falling interest rate scenario. There is also the

inherent asset-liability mismatch arising from very long maturity real estate

loans such as retail housing loans.

(v) Transfer of Risks from Subsidiaries:

The risk that difficulties faced by specialised non-bank subsidiaries or connected

entities involved in the real estate sector may get transferred to the parent

bank.

(vi) Operational Risk (frauds): The incidence of frauds in the

area of housing loans has witnessed a sharp increase in the recent years. Submission

of forged documents, laxity in conduct of due diligence of borrowers / builders,

non-observance of appraisal procedures and laxity in post-disbursement supervision

mainly contributed to frauds in this area.

Apart from these, there could

be 'second round' effects in that the risks related to adverse changes in the

macroeconomic and financial environment could get linked to a period of declining

real estate prices. Internationally, loan-to-value ratio (LTV) is regarded as

a dominant indicator of default probability of residential mortgage loans, loans

with high LTV (say, above 80 per cent) could be assigned higher risk weight. The

suggestion is based on empirical evidence from some countries. While acknowledging

the obvious shortcomings of LTV being positively correlated with probability of

default, it needs to be pointed out that in India there is no reliable real estate

price index as yet and any estimation of LTV is thus only a conjecture.

7.95 While equity prices have since corrected by 56.8 per

cent (as on November 26, 2008) from the peak level, real estate prices continue

at their elevated levels, although some reports do suggest some softening of prices

in some parts of the country in recent months.

7.96 Sharp rise in asset

prices raises some concerns for financial stability (Box VII.6).

Real estate prices, like other asset prices, have important effects on output

and inflation. There are primarily two ways through which real estate prices affect

the economy. First, in a rising prices scenario, the expectation of further appreciation

is factored into the prices. That expectation stimulates demand for homes, which,

in turn, stimulates new construction activity and aggregate demand. Second, higher

real estate prices increase household wealth, which stimulates consumer spending.

If real estate prices rise above the level than what is justified by the fundamentals,

too many houses will be built. At some point, the correction would set in and

asset prices then return to their fundamental values. When this happens, the sharp

downward revision of asset prices can lead to a sharp contraction in the economy,

both directly, through effects on investment, and indirectly, through the effects

of reduced household wealth on consumer spending. There is, thus, concern that

rapid rise in real estate prices at some stage might have adverse effects on the

economy.

7.97 Over the years, banks in India enlarged their exposure

to the real estate market. Such exposure at end-March 2008 constituted 19.3 per

cent of total bank credit as against 1.6 per cent at end-March 2004. The Reserve

Bank alerted banks about 'early signs of overheating of the Indian economy' during

2006-07 on the back of some evidence of firming up of demand pressures, in particular,

the combination of high growth and consumer inflation coupled with escalating

asset prices and tightening infrastructural bottlenecks. In this context, to supplement

monetary measures and to protect the banking system from a possible enduring asset

bubble without undermining growth impulses, prudential measures were also initiated

in the form of enhanced provisioning requirements and risk weights in specific

sectors in addition to select supervisory reviews. Box

VII.6: Real Estate Price and Financial Stability Asset prices such

as real estate prices and stock prices, are conceptually different from the prices

of current consumption goods and services. Real estate prices are somewhat special

in that they are forward looking and reflect the market expectations on valuations

of future stream of services associated with the asset. That is, they convey information

about future demand and supply conditions. In addition, changes in real estate

prices influence household wealth and, therefore, impact consumer spending and

aggregate demand. Accordingly, asset prices contain important information about

the current and future state of the economy and can play an important role in

monetary policy setting with the overall objectives of price stability and sustainable

output growth.

Standard economic principles suggest that prices are determined

by the fundamentals of supply and demand. So rising prices typically reflect growth

in demand relative to supply. In the case of real estate price movements, however,

many of these fundamental factors that shape the market's expectations of future

supply and demand are not directly observable. As a result, it is difficult to

ascertain whether rapid shifts in real estate prices are reflecting changes in

the underlying fundamentals or not. When the expectations turn out to be wrong

or get revised as new information becomes available, the real estate market may

witness dramatic adjustments in prices and raises concern that prices have lost

touch with the underlying fundamentals. In such a circumstance, there is the fear

that a 'bubble' may be developing that may eventually burst.

Price bubbles

in the real estate market have distinct features - a price bubble implies that

the market is sending misleading price signals and, therefore, distorting resource

allocations. For example, overinvestment in some assets and under-investment in

others is a likely outcome. The bubble may also be accompanied by excessive accumulation

of debt. Second, given the distortions and imbalances created during the run-up

in prices, the bursting of the bubble and associated rapid decline in prices can

wreak havoc with the balance sheets of individuals and financial institutions.

This can impart ripple effects through the rest of the economy. For example, rapid

declines in asset prices have at times been associated with sharp contractions

of economic activity and severe financial problems as the imbalances and distortions

are reversed. Finally, the biggest hurdle is to determine if there is a bubble

or not.

There is general agreement among policymakers that, regardless

of the cause of a rapid rise in housing or other asset prices, the rapid unwinding

of such price booms should be monitored carefully by policymakers. Otherwise,

the risk of misallocating resources and risk-bearing, as well as increased moral

hazard problems could ultimately make the financial system more fragile. Therefore,

a key ingredient for ensuring asset price bursts triggering widespread adverse

effects on the financial system is to develop a healthy banking system providing

real estate loans and monitor real estate price movement across regions on a regular

basis.

References :

Bernanke, B. and M. Gertler.

2001. "Should Central Banks Respond to Movements in Asset Prices?" American

Economic Review. 912. 253-257.

Hunter, W.C., G. G. Kaufman and M. Pomerleano.(eds).

2003. "Asset Price Bubbles: The Implications for Monetary, Regulatory and

International Policies." MIT Press.

Plosser, C.I. 2007. House Prices

and Monetary Policy. Speech by the President, Federal Reserve Bank of Philadelphia.

European Economics and Financial Centre. Distinguished Speakers Series.

7.98 In view of the risks posed by accelerated exposures to

the real estate sector, the Reserve Bank initiated several regulatory measures

including advising banks to frame Board approved policy, prescribing higher risk

weights, disclosure and reporting of the REE, and even revising the definition

of REE. In June 2005, the Reserve Bank advised banks to have a Board mandated

policy in respect of their real estate exposure, robust risk management framework

covering single/ group exposure limits, margins, collaterals/ security, repayment

schedule and availability of supplementary finance. In view of the rapid increase

in loans to the real estate sector raising concerns about asset quality and the

potential systemic risks posed by such exposure, the risk weight on banks' exposure

to commercial real estate was increased from 100 per cent to 125 per cent in July

2005 and further to 150 per cent in April 2006. However, as a counter cyclical

measure, it was decided on November 15, 2008 to reduce the risk weights on claims

secured by commercial real estate to 100 per cent and to reduce the provisioning

requirements for all types of standard assets to a uniform level of 0.40 per cent

except in the case of direct advances to the agricultural and SME sectors, which

would continue to attract a provisioning of 0.25 per cent, as hitherto.

7.99 The risk weights on housing loans extended by banks to individuals against

mortgage of housing properties and investments in mortgage backed securities (MBS)

of housing finance companies (HFCs), recognised and supervised by National Housing

Bank (NHB), were increased from 50 per cent to 75 per cent in December 2004. However,

on a review, banks were advised to reduce the risk weight in respect of exposures

arising out of housing loans up to Rs.30 lakh to individuals against the mortgage

of residential housing properties from 75 per cent to 50 per cent, in view of

the lower perception of risks in these exposures.

7.100 Banks are required

to disclose their gross exposure to the real estate sector in their published

balance sheets to act as market discipline. As part of the regular off-site reporting

mechanism, banks are required to report on a monthly basis their gross exposures

to various real estate sectors. Real estate exposures both at macro and micro

levels are closely monitored and any unusual spurt in exposures are taken up with

respective banks for further discussion.

7.101 Apart from the above-mentioned

regulatory measures, several measures were taken to prevent/contain the frauds

in the area of housing loans such as: (i) caution advices against borrowers/developers/

builders, etc., in all cases of frauds in housing loans in which amount

involved was Rs.5 lakh and above against each individual borrower; (ii) modus

operandi circulars/making the banks aware of the various practices being

adopted by fraudsters; (iii) dialogues with the State Governments impressing upon

them the need for rationalising stamp duty/registration fees in order to tackle

the problem of availing multiple finance by borrowers by mortgaging the same property

with different banks; and (iv) detailed instructions to banks in May 2006 highlighting

the need for adopting best risk management practices covering credit appraisal,

verification of documents, pre and post sanction appraisal, ensuring due diligence,

among others, in order to reduce the incidence of frauds in the residential mortgage

segment.

4. Mitigating Risks through Financial

Sector Policies

7.102 Owing to globalisation and integration,

any disruption in the financial system has a tendency to spill over to other segments

of the economy and also spread to other geographical regions, thereby causing

a contagion effect. The loss of confidence, if it happens, has the potential to

cause large scale damages, and ultimately adversely affect the real economy. In

view of the cross border contagion and disruptive herd behavior, any imbalance

or any anticipated risks in the economy, which starts materialising, needs to

be mitigated immediately. The strategy to mitigate the risk depends upon various

factors such as the nature of the risk, its extent of reach and the emerging macrofinancial

conditions. At the same time, policy trade-offs between inflation, growth, and

financial stability are becoming increasingly difficult.

7.103 The turbulence

in the global financial markets during most part of 2007-08 and 2008-09 so far,

has been characterised by an abrupt and widespread increase in the pricing of

credit risk alongwith a significant demand for liquidity in many asset markets,

most notably in the inter-bank market. Contingency consultations among central

banks about

11 Novation is the process by which Government securities transactions

are settled through CCIL. This means that CCIL will act as a buyer to the seller

of security and simultaneously will act as a seller to the buyer of the security.

This will in effect remove the credit risk faced by members vis-à-vis their

counterparties. Besides, CCIL provides the additional comfort of improved risk

management practices through daily marking to market of collateral, maintenance

of daily margins by members and through a Guarantee Fund. |

IST,

IST,