IST,

IST,

I Conduct of Macroeconomic (Part 1 of 2)

3.1 Increasing integration of countries through growing volumes of trade and capital flows has been a characteristic feature of the world economy in recent times. Greater openness to trade and capital flows entailing greater interdependence among economies has long moved on from the realms of theoretical debate to that of inevitability. Indeed, the decades of the 1980s and 1990s have witnessed a generalised shift in policy stance towards openness among a number of emerging market economies - either spontaneously, so as to reap the benefits of greater volumes of trade and external investment or under the compulsions arising out of unsustainable domestic imbalances. These two decades, however, have also seen a series of financial crises in several open economies engendered by volatile capital flows -prompting a re-look into the conventional wisdom regarding the gains from cross-border trade and investment. This has brought to the fore a number of open-ended issues relating to the manner and sequencing of such opening up, the challenges posed by free capital flows and increased cross-border market integration, and the role of monetary and fiscal polices.

3.2 All these developments have profound implications for macroeconomic policies. After all, the process of opening up exposes the economy to global shocks on the one hand, and extends the closed economy domestic resource constraint on the other. Illustratively, in an open economy framework the inter-temporal budget constraint of the domestic government gets a new dimension; furthermore, domestic business cycles get synchronised with the peaks and troughs of the international business cycles. While there is no unanimity about the precise nature of these exposures and extensions, there is little doubt that the process of opening up makes the task of the policymakers far more complex than has been the case earlier.

3.3 In the Indian context, progressive dismantling of trade restrictions, current account convertibility, shift to market determined exchange rates and gradual liberalisation of capital account have all contributed to the emergence of a more open economy structure and higher degree of integration with the global markets since the early 1990s. Among

the more visible effects of these changes is the possibility of Indian business cycles synchronising with the global business cycles and increasing influence of trade cycles on the economy. Fur thermore, the increased integration with international markets as also the greater volumes of capital flows into the economy have entailed changes in the strategy for fiscal policy and monetary policy framework comprising their goals, instruments and target variables. While opening up of the external sector necessitated changes in the macroeconomic framework of the economy, liberalisation of the external sector itself was contingent on a broader set of reforms comprising the real sector, particularly industry, and the financial sector. Accordingly, the management of external sector liberalisation in India would have to be viewed in the context of a coordinated macro-level overhaul of the policy regime.

3.4 Against this backdrop, this Chapter looks into the changed context and paradigm of policymaking since the economy opened up in the early 1990s and moved progressively towards greater degree of openness. The changing contours of the policy framework under the process of opening up of the economy have been analysed at an aggregative level embracing the three major arms of public policy, viz., monetary, fiscal and financial policies. The Chapter is organised as follows. As a prologue to the process of opening up, Section I provides a quick run-down of the external sector policies, which are covered comprehensively in the ensuing chapters. A brief review of the paradigm shift in macroeconomic policy, covering some emerging policy challenges, is also included in this section. In Section II the emerging issues in fiscal policy making in a more globalised world, with special reference to India, are discussed against the backdrop of theoretical developments in the area. Section III discusses the theoretical and empirical literature on challenges to monetary policymaking in the evolving world scenario. Policymaking in India is discussed in the light of this analysis with special reference to the high order of capital flows in recent years. Section IV covers macro issues relating to the financial sector. Section V discusses the synchronicity of business cycles across economies under greater openness. The Chapter ends with concluding observations.

CONDUCT OF MACROECONOMIC POLICY IN

AN OPEN ECONOMY

I. OPENING UP OF THE ECONOMY

Liberalisation of the External Sector

3.5 The unprecedented external payment crisis of 1991 brought critical focus to bear on the management of the external sector characterised by the persistent build-up of current account deficits in the 1980s. The external sector reforms in India during the 1990s included a market based exchange rate system, introduction of convertibility of rupee for external transactions on the current account and compositional shift in cross-border capital inflows from debt creating to non-debt creating flows. Moreover, a cautious approach was followed in respect of debt creating external capital inflows especially those with short-term maturity, besides reduction of the volatile component of non-resident Indian (NRI) deposits and the flow of external assistance. In the 1990s, for the first time, a strategic external debt management policy was put in place, emphasising compositional aspects, cost, maturity, end-use, transparency and risk management. The overall approach of prudence was integrated into the process of growing openness and financial liberalisation which were basic elements of the package of structural reforms instituted in the wake of the balance of payments crisis of 1991. In order to strengthen the external sector reforms and to benefit from these measures, complementary reforms were introduced in other segments of the economy as well (see Chapter VI and VII).

3.6 The policy of ensuring a well diversified capital account with rising share of non-debt liabilities and low percentage of short-term debt in total debt liabilities is reflected in India’s policies relating to foreign direct investment (FDI), portfolio investment and external commercial borrowings (ECB). Quantitative annual ceilings on ECB along with maturity and end-use restrictions broadly shaped the ECB policy. FDI is encouraged through a very liberal but dual route: a progressively expanding automatic route and a case-by-case route. Portfolio investments are restricted to select players, particularly approved institutional investors and NRIs. Indian companies are also permitted to access international markets through Global Depository Receipts/American Depository Receipts (GDRs/ADRs) under an automatic route, subject to specified guidelines. Foreign investment in the form of Indian joint ventures abroad is also permitted. Restrictions on outflows involving Indian corporates, banks and those who earn foreign exchange (like exporters) have also been liberalised over time, subject to certain prudential guidelines (see Chapter VI).

3.7 As a result of pursuing the above approach, India has attracted considerable private flows, primarily in the form of FDI, portfolio investment, ECB and NRI deposits. Indeed, managing the surplus also became a challenge in the management of the capital account. The policy for reserve management is built upon a host of identifiable factors and other contingencies. Taking these factors into account, India’s foreign exchange reserves are at present comfortable and consistent with the rate of growth, the share of the external sector in the economy and the size of risk-adjusted capital flows (see Chapter VI).

Macroeconomic Policy Responses

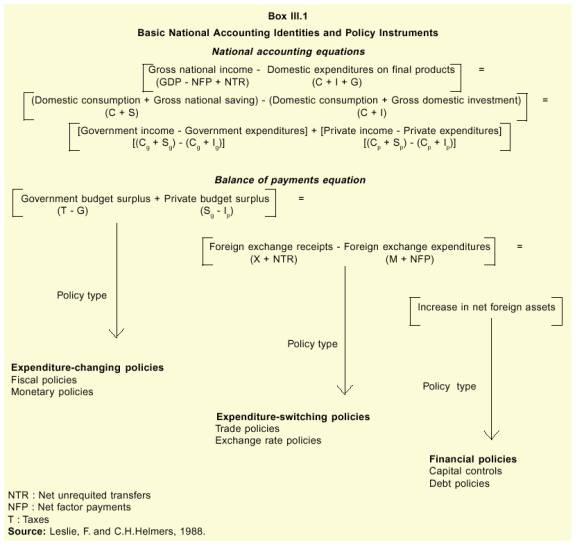

3.8 The starting point for policymaking in an open economy may be viewed in terms of the national income identity viz., Y = C + I + G + X - M, where C stands for consumption, I for investment, G for government expenditure, X for exports and M for imports. The national income identity in its gross national income variant, states that the difference between the gross national disposable income1 and the gross domestic expenditure must equal the current account balance. Differentiating private consumption and savings from those of the government, the identity could be reorganised to state that the sum of the government and private budget surpluses must equal the increase in the net foreign assets which, in turn, equals the difference between foreign receipts and payments (Box III.1). The identity holds for any country irrespective of the degree of its openness.

3.9 The crucial factor that may change with greater liberalisation of the external sector is the direction of causation along the identity. In a relatively closed economy, changes in the domestic budget surplus (government or private) would be expected to drive changes in the net foreign assets of any economy, whereas in a relatively open economy, capital flows may lead to changes in private or government budget surpluses. As such, the policy reaction function must take into account the source of imbalance. An imbalance originating in the domestic budget surpluses must be addressed by expenditure changing polices - i.e., traditional fiscal or monetary policies. Expenditure switching policies, in contrast, are seen as appropriate in addressing imbalances arising from the foreign exchange receipts and payments. Financial policies are deemed to be effective in addressing imbalances arising out of capital flows into or out of the economy.

1 Gross domestic income less net factor payments abroad plus net unrequited transfers from abroad.

REPORT ON CURRENCY AND FINANCE

3.10 There is a growing recognition that openness matters and globalisation is an irreversible process entailing both opportunities as well as challenges. The opening up of the economy has given rise to a number of macroeconomic policy challenges in recent times. These challenges, however, are in sharp contrast to the challenges witnessed during the pre-1990s representing a closed economic structure. For instance, policy challenges emanating from the growing degree of synchronicity between domestic and international business cycles coupled with the global slowdown witnessed in recent times have been highlighted in this Chapter. Similarly, consecutive surpluses in the current account have raised concerns about the options to attain the target of deficit in the current account (Chapter V).

CONDUCT OF MACROECONOMIC POLICY IN

AN OPEN ECONOMY

3.11 Moreover, with opening up of economies, capital movements have rendered exchange rates significantly more volatile than before (Mohan, 2003). For the majority of developing countries which continue to depend on export performance as a key to the health of the balance of payments, exchange rate volatility has had significant real effects in terms of fluctuations in employment and output and the distribution of activity between tradables and non- tradables (Chapter VII). In the face of continued capital inflows, the limits to sterilisation could pose further challenges to the conduct of macroeconomic policy (Chapter VI). At the same time, a key issue is enhancement of the absorptive capacity of the economy to better utilise these capital inflows for productive purposes. Issues relating to volatility in capital flows and capital account liberalisation are also important (Chapter VIII). Moreover, the concerns relating to international financial architecture, which have assumed importance in the wake of a series of crises in the 1990s cannot be ignored (Chapter IX).

3.12 From this perspective, the chronicle of Indian reforms towards increasing openness could be analytically reviewed in terms of the elements of the above identity. Thus, the impact of the reform policies could be seen in terms of fiscal, monetary and financial policies. Instead of a detailed narration of the Indian reform policies, as a backdrop, the following sections provide a synoptic rundown of the policies towards opening up of the Indian economy in terms of these crucial elements.

II. CHANGING DIMENSION OF FISCAL POLICY

3.13 Fiscal policy is expected to play a key role in ensuring macroeconomic stability while facilitating sustained economic growth within the framework of a market economy. Increasing openness of the economy complicates the task of fiscal policy formulation because of the uncertainties about the magnitude, speed and direction of the trade and capital flows. In this context, the efficiency and flexibility of fiscal policy as an instrument of macroeconomic policy response acquires significance. In an economy that is opening up, the design of fiscal policy would depend, inter alia, upon the nature of its monetary and exchange rate policies; the degree of openness of the capital market; the prevailing macroeconomic conditions; the position of the economy in the business cycle; on whether there is inflation or deflation, whether or not the external position is sustainable (Heller 2002).

3.14 For fiscal policy to play its stabilising role, however, the structural fiscal deficit should be modest. With the progressive opening up of the Indian economy in the 1990s, macroeconomic stabilisation assumed importance. This necessitated fiscal reforms geared towards attainment of fiscal balance, restructuring of the public sector through a process of disinvestments, and improvement in fiscal-monetary coordination. The strategy for restoring fiscal balance comprised a mix of tax and non-tax reforms, expenditure management and institutional reforms, while public sector restructuring mainly involved a preference for divestment of government ownership. The process of fiscal-monetary coordination encompassed deregulation of the financial system, elimination of automatic monetisation, and reduction in pre-emption of institutional resources by the Government (RBI, 2003).

3.15 Despite structural reforms, the fiscal deficit has, however, remained persistently high during the 1990s. Although there is a widespread recognition that all is not well on the fiscal front, the gravity of the situation has not received adequate appreciation (Mohan, 2000). Against this backdrop, this section provides theoretical discussion on the role of fiscal policy in an open economy followed by the Indian experience.

Fiscal Policy and Capital Mobility

3.16 The Mundell-Flemming model provides the theoretical paradigm for the effectiveness of fiscal policy in the face of capital mobility. The policy options under this model are broadly two fold: the first option is to change monetary and fiscal policies appropriately - for given levels of financial integration and the exchange rate regime. The second option is to control the degree of financial openness and choose an exchange rate regime that could enhance the effectiveness of both monetary and fiscal policies. Mundell’s work on monetary dynamics encompassing short-run effects of monetary and fiscal policy in an open economy demonstrated the far-reaching importance of the exchange rate regime; for instance, under a floating exchange rate regime monetary policy becomes powerful and fiscal policy powerless, whereas the opposite is true under a fixed exchange rate (Mundell, 1963). Moreover, with free capital mobility, monetary and fiscal policy can be oriented towards either an external objective such as exchange rate or an internal objective such as the price level, but not both at the same time. This insight is shared by a majority of policy makers and academicians.

3.17 Fiscal tightening is often advocated for countries opening their capital regimes, irrespective of whether the capital flows are inward or outward. Fiscal tightening is expected to reduce absorption, thereby easing the pressure on unsustainable current account deficits and limiting the credit squeeze on private investment on the one hand, and strengthening market assessment of the medium-term viability of a country’s fiscal stance, on the other (Heller, 1997). Fiscal tightening is also advocated in the context of significant capital inflows as an

REPORT ON CURRENCY AND FINANCE

Box III.2

Fiscal Policy and Exchange Rate

Fiscal expansion may be expected to effect a depreciation if capital is relatively immobile and an appreciation if there is greater capital mobility. The empirical evidence in this respect is inconclusive. Feldstein (1986), Throop (1989), Melvin et al. (1989), and Beck (1993) found a positive and significant relationship between fiscal expansion and the exchange rate in the context of movements of the US dollar during the1980s. But Evans (1986) and McMillin, Douglas and Koray (1990), among others, do not find a statistically significant relationship. The empirical evidence on the role of fiscal policy in explaining movements of ERM currencies in the early 1990s, summarised in IMF (1995), is also ambiguous.

Exchange rate appreciation (depreciation) also feeds into fiscal deficit. Depreciation would lead to an increase in the

fiscal deficit if foreign currency based expenditures outweigh foreign currency based revenues. Seade (1990) noted that in the presence of tariffs, a devaluation would (i) increase tax revenues if the (weighted aggregate) price elasticity of imports is less than unity; and (ii) tend to yield a lower revenue gain, if not a revenue loss, if the structure of revenues depends heavily on wage taxes.

While the stance of fiscal policy continues to derive from theoretical models popularised in the 1960s, at the operational level, recent years have seen countries undertake a number of reform measures relating to fiscal policy in part in its role as a public policy instrument and in part to enhance its efficacy and efficiency in its traditional role. These reform measures relate both to tax and expenditure policies.

instrument of sterilisation. In this context, it is noteworthy that large capital inflows to India in the recent period have been managed almost entirely through monetary policy measures since fiscal policy has limited leverage given the preponderance of committed expenditures of the Government as well as a low tax-GDP ratio.

3.18 The approach of tightening fiscal policy during periods of capital inflows could, however, prove costly if the content and composition of expenditure and revenue get altered under conditions of unpredictable and volatile capital flows (Tanzi, 1990). An alternative approach is to undertake pre-emptive tightening in the underlying fiscal stance as a country moves from a closed system to a more open capital economy as this would avoid frequent changes in fiscal variables. This approach is motivated by three principal factors viz., the desire to contain adverse effects of adjusting the fiscal structure in response to unpredictable capital flows; limiting the prospect of facing excessive risk premia; and, the need to instill greater international confidence in the durability of fiscal position. The magnitude of fiscal tightening needs to be large enough to lead to a lower trajectory in the ratio of public debt to GDP over time so as to be visible in international markets. The short-run macroeconomic impact of such fiscal consolidation, however, needs to be considered, as it could prove contractionary in the absence of crowding-in from the private sector (Heller, 1997). If the underlying fiscal position has been adequately tightened prior to the capital inflows, the appropriate fiscal response would depend on the factors governing such flows: whether they are exogenous, endogenous or an interplay of both. If the flows were exogenous and mostly speculative in nature, then the need for a strong reserve position in order to counter any future reversal of flows would necessitate an active sterilisation policy requiring further tightening of the fiscal position (Gavin, Hausmann and Leiderman, 1995).

3.19 It is also argued that increase in financial market integration reduces the effectiveness of fiscal policy, while an increase in goods market integration increases fiscal policy impulses through expenditure switching effects. Senay (1998) supports this in his analysis of the effectiveness of fiscal policy in the face of increasing financial market integration. In the presence of capital mobility, fiscal initiatives may be expected to affect the exchange rate, although the specific effects would depend on the underlying economic situation and the degree of capital mobility (Hemming, Kell and Mahfouz, 2002) (Box III.2).

Fiscal Policy Multipliers

3.20 In an open economy, as the government increases spending or reduces taxes, there is also an effect on the trade balance apart from the multiplier effect on output. Some results derived from the standard Keynesian framework are noteworthy here: (i) the more open the economy, the smaller is the effect on output and the larger is the effect on trade balance; (ii) multipliers of fiscal policy instruments are smaller in an open economy as compared with their closed economy counterpar ts; (iii) the government expenditure multiplier is larger than the tax multiplier in an open economy; (iv) in a large country, the effect of an increase in government expenditure on output is large while the effect on the trade balance is small;

CONDUCT OF MACROECONOMIC POLICY IN

AN OPEN ECONOMY

the opposite would hold for a small economy; and (v) in an imperfectly competitive small open economy, fiscal multipliers are found to be increasing with the degree of imperfection (Coto-Martinez and Dixon, 2001). It may be noted that result (iv) above ignores movements in the real exchange rate. The benefits an expansionary fiscal policy to bring about an increase in output are, in general, more difficult in small open economy.

3.21 An econometric exercise for the Indian economy (1970-71 to 1999-00), showed that the multiplier effect of an increase in government spending on income was 2.5, i.e., a one per cent increase Government spending would raise income by 2.5 per cent (RBI, 2001). However, rather than the static multiplier, the impact of fiscal policy intervention better explained by a super-multiplier framework, which, inter alia, takes into account the dynamics income-expenditure propagation. The role of fiscal policy could be assessed in line with the sustainability of the growth path which sets a limit for the deployment of counter-cyclical policy. The multiplier and accelerator interaction in the Indian economy generates stable and converging cycles, thereby making room for counter-cyclical policies (RBI, 2001)

Tax Policy

3.22 With financial liberalisation and the concomitant increase in capital mobility, a new dimension got incorporated in the process of tax reforms. On the one hand, governments came under increasing pressure to reduce the statutory tax rates on capital income in order to attract foreign direct investment and portfolio capital. On the other hand, they tried to compensate for the revenue loss by widening the tax base and increasing the statutory tax on less mobile factors of production, especially labour (Ganghof, 2001). In this context, rising tax interdependencies between countries and regions become obvious, raising two issues of concern, which could have different outcomes depending on the way they are tackled (Benassy et al, 2000). First, countries could undertake action on tax levels: this may lead tax harmonisation or tax competition depending on whether this action is co-operative or not. Second, countries would have to reconsider fiscal schemes, since the growing interdependence of countries tends to blur the notion of residence and source of revenue, which raises an incentive for tax evasion.

3.23 In recent years, tax reforms in most countries are aimed at reduction in income and payroll tax rates

and elimination of exemptions so as to provide a more enabling tax environment to the productive sectors of the economy. The manner and speed of tax reforms, however, has differed across nations. The emphasis in many countries, particularly in Europe, has been on a shift from direct taxes on labour and capital income towards indirect taxes. In Indonesia, a comprehensive reform of the tax structure and tax administration was initiated in 1981 and carried out within a fairly short period of 30 months. In South Korea, however, tax reform has been a gradual and continuous process. Malaysia too adopted a step-by-step approach to tax reforms. In Pakistan and Sri Lanka, tax reforms were necessitated by structural adjustment programmes. Unlike most countries which reformed their tax structures in order to improve their fiscal position, Thailand undertook tax reforms when the fiscal position was strong. The objectives of the reforms were to improve competitiveness and the investment climate and to enhance productive efficiency through elimination of tax induced distortions. In countries such as South Korea, Taiwan and China, increasing attention was given to property and land taxes. Korea’s tax system aimed at raising sufficient revenues to balance the budget and achieve its growth and industrial policy objectives (Asher, 1992). In the aftermath of the Asian crisis, the need for a more flexible fiscal policy, even at the cost of budget deficits, was emphasised (Horne, 1999).

3.24 India’s fiscal consolidation measures entailed a reduction in government expenditure and an increase in its revenue. Since tax rates were already high and the tax structure, particularly indirect taxes, was distortionary, it was neither possible nor desirable to raise the rates of indirect taxes. Substantial restructuring of the tax system based on the recommendations of the Tax Reform Committee (Chairman: Raja J. Chelliah) has been under way since 1991-92. In the area of direct taxes, reforms focused on stability of tax rates, rationalisation and simplification of tax laws and effective tax compliance. The marginal income tax rates were reduced substantially. On the indirect tax front, approach has been to overhaul and rationalise the rate structure and simplify the procedures to reduce compliance cost. During the 1990s, the number of customs tariff rates was reduced significantly and the structure was rationalised; input tariff rates were made significantly lower than output tariff rates in order to bring the tariff structure in alignment with that of the other developing countries in the region. Tax rationalisation measures announced in January 2004 are expected to strengthen the ongoing fiscal reform process in India.

REPORT ON CURRENCY AND FINANCE

3.25 The results of this rationalisation process have been mixed. The total tax buoyancy declined from 1.07 per cent in 1981-93 to 0.96 per cent in 1981-2001 implying that buoyancy could be less than unity during the post-reform period, 1994-2001 (RBI, 2003a). Although the decline in the rates of both customs and excise duties was inevitable in the context of the opening up of the economy and the need to provide a level playing field to domestic producers, the continuance of exemptions and concessions for both these taxes substantially reduced revenue collection. While there was an increase in both personal and corporate income tax revenue due to an increase in the number of assessees and better compliance following the reduction in the average and marginal tax rates, this was not sufficient to offset the fall in indirect tax revenue. The progressive reductions in direct and indirect tax rates did not produce the expected Laffer curve effect and there was a secular decline in the tax/GDP ratio on the revenue side (Mohan, 2002). A cross-country comparison in terms of tax-GDP ratio places India towards the lower end of the spectrum (Table 3.1). The table also highlights an atypical reliance on trade taxes in emerging economies like Argentina, India and Philippines.

Tax Policy and Trade Liberalisation

3.26 Trade liberalisation often results in loss of revenue for the government as tariffs are lowered to international levels. The quantum of such losses depends on the price and income elasticities of the demand for imports, the elasticity of substitution between imports, the market structure of import trade, 'announcement effects' and the degree of exchange rate flexibility in addition to the change in the tariff rate (Blejer and Cheasty, 1990). A strategy has been suggested for avoiding short-term revenue losses by effecting compensatory measures - a reduction in the scope of tariff exemptions in the existing system, a commensurate increase in their excise rates and adjustment in the rate of the general consumption tax (such as value added tax) to meet remaining revenue needs (Tanzi and Zee, 2001).

3.27 In India, the reduction in custom duties has led the secular decline in tax revenue (as a proportion of the GDP) in the post reforms period. Along with the fall in customs revenue, there has also been a sharp fall in Central excise and countervailing excise duties, which are related to the tariff reductions on imports. High proportion of revenue coming from trade taxes in India constrains the ability of the Government to progress towards rapid trade liberalisation. To the extent that there are constraints on compensating the loss of revenue on account of lower trade tariff, there exists resistance to trade reforms which is from the fiscal angle rather than of a protectionist origin (Rajaraman, 2003).

3.28 Moreover, in an open economy with more flexible exchange rates, the level of protection provided to the industry keeps on changing even if the tariff rates are kept unchanged. A combination of inflation differential, nominal exchange rate and the tariff rate could yield the same level of protection in an open economy with flexible exchange rate (Table 3.2).

|

Table 3.1: Tax Revenue of General Government |

|||||||||

|

(Per cent to GDP) |

|||||||||

|

Year |

Total Tax |

Income, Gains |

Sales Taxes |

Excise Duties |

International |

Property Taxes |

Social Security |

Others |

|

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

|

U. S. |

1999 |

28.9 |

14.2 |

2.2 |

1.7 |

0.2 |

3.1 |

6.9 |

0.6 |

|

Japan |

2000 |

42.3 |

14.2 |

6.6 |

3.8 |

0.1 |

1.8 |

12.0 |

3.8 |

|

Germany |

2000 |

37.8 |

11.4 |

6.9 |

3.3 |

0.2 |

0.9 |

14.8 |

0.4 |

|

U.K. |

2000 |

37.7 |

14.5 |

7.0 |

4.7 |

0.2 |

4.4 |

6.3 |

0.6 |

|

Argentina |

2001 |

20.9 |

4.9 |

3.3 |

1.7 |

5.2 |

2.4 |

3.1 |

0.3 |

|

Brazil |

1998 |

21.8 |

5.0 |

2.0 |

1.8 |

0.7 |

0.6 |

9.7 |

1.9 |

|

China |

1999 |

15.0 |

1.9 |

4.3 |

1.1 |

0.7 |

0.3 |

.. |

6.7 |

|

India |

1999 |

14.2 |

3.0 |

.. |

3.2 |

3.0 |

.. |

.. |

5.0 |

|

Indonesia |

2001 |

13.2 |

6.3 |

3.7 |

1.2 |

0.6 |

0.5 |

0.4 |

0.3 |

|

Mexico |

2000 |

17.0 |

5.0 |

3.5 |

1.6 |

0.8 |

0.2 |

1.5 |

4.3 |

|

Philippines |

2001 |

13.5 |

6.1 |

1.6 |

1.6 |

2.7 |

.. |

.. |

1.5 |

|

Thailand |

2001 |

16.0 |

4.9 |

3.1 |

3.6 |

1.8 |

0.2 |

0.5 |

1.9 |

|

Turkey |

2000 |

32.8 |

9.5 |

10.9 |

1.5 |

0.4 |

1.1 |

5.1 |

4.3 |

|

Source: Lorie, 2003. |

VAT : Value Added Tax. |

||||||||

CONDUCT OF MACROECONOMIC POLICY IN AN OPEN ECONOMY

|

Table 3.2: Combination of Exchange Rate and Tariffs Giving Equal Protection: An Illustration |

||

|

Average Exchange rate (Rs. per US dollar) |

Weighted Average Tariff |

Cost of imports including tariff (Rs. per US dollar |

|

1 |

2 |

3 |

|

43.67 |

40.0 |

61.14 |

|

45.29 |

35.0 |

61.14 |

|

47.69 |

28.2 |

61.14 |

|

48.91 |

25.0 |

61.14 |

|

50.95 |

20.0 |

61.14 |

Expenditure Policy

3.29 Expenditure reforms in the context of external sector liberalisation have two aspects, viz., consolidation so as to reduce the quantum of expenditure and restructuring with a view to changing the composition of government expenditure. A recent study indicates that expenditure reforms placed emphasis on a shift towards growth-inducing expenditure on infrastructure and human resource development and reduction in unwarranted subsidies (Lorie, 2003). In addition, during the initial years of transition, almost all the countries resorted to cuts in their public expenditures - though the severity of cuts varied across nations depending upon their ability to mobilise resources. While the average expenditure of Organisation for Economic Co-operation and Development (OECD) countries was around 43 per cent of GDP, for emerging economies it was much lower, at around 28 per cent (Table 3.3). Some of the common expenditure reform priorities include civil service reform, pension reform and reduction/ elimination of subsidies.

3.30 The composition of spending cuts are found to have a bearing on the effectiveness of the reforms. Broad-based spending cuts, which do not spare the most politically sensitive parts of the budget, viz., transfers, social security and government wages and employment, were found to be more successful than large cuts on capital expenditures (Alesina and Perotti, 1996). Also, fiscal adjustments relying primarily on tax increases and cuts in public investment tend to be short-lived and contractionary. Furthermore, careful and effective implementation of public spending programmes is important to assure the necessary results.

|

Table 3.3: General Government Expenditure |

||

|

(Per cent to GDP) |

||

|

Country |

Year |

Total Expenditure |

|

1 |

2 |

3 |

|

US |

2001 |

32.7 |

|

Germany |

1998 |

48.3 |

|

U.K. |

1999 |

39.2 |

|

Argentina |

2001 |

29.6 |

|

Brazil |

1998 |

39.8 |

|

China |

1999 |

20.4 |

|

India |

2001 |

26.5 |

|

Indonesia |

1999 |

21.2 |

|

Mexico |

2000 |

20.7 |

|

Thailand |

2001 |

22.1 |

|

Turkey |

2001 |

42.3 |

|

Source: Lorie, 2003. |

||

3.31 In India, on the expenditure side, a number of measures have been contemplated

to rein in the builtin growth bias in the fiscal deficit and restructure the

composition of government expenditure. The measures in this respect included

subjecting all ongoing schemes to zero-based budgeting, assessment of manpower

requirements of government departments, review of all subsidies, introducing

cost based user charges wherever possible, review of budgetary support to autonomous

institutions and greater commercialisation of the operations of public sector

enterprises.

3.32 Apart from these reforms aimed at fiscal consolidation, a number of institutional measures were taken during the 1990s. Public sector restructuring and disinvestments were undertaken with a view to increase the efficiency of the Public Sector Undertakings (PSUs) as also to provide additional resources to the Government. The Ahluwalia Committee Report on Fiscal Transparency (2001) underscored the need for improvements in budgetary practices, which prepared the ground for passing of the Fiscal Responsibility and Budget Management (FRBM) Act by the Government to usher in an era of fiscal consolidation based on fiscal policy rules.

3.33 The financing of fiscal deficit is another area, which underwent significant changes in the post reform period. With the discontinuation of ad hoc 91-day Treasury Bills in April 1997, automatic monetisation of deficits was eliminated. Greater reliance on borrowing at market related interest rates since 1992 led to a substantial lowering of statutory pre-emption of institutional resources by the Government. This has also facilitated development of the market for Government securities, which has witnessed remarkable changes since the latter half of the 1990s.

REPORT ON CURRENCY AND FINANCE

3.34 The current strategy towards accelerated growth and employment involves exploiting the opportunities offered by more rapid globalisation. The main impediment constraining India’s growth in future is the continuing fall in public investment in infrastructure which has been caused by deteriorating fiscal environment at both Central and State Governments levels. Apart from ensuring higher buoyancy in tax revenues, the key solutions to India’s fiscal predicament are bold programmes for imposing user charges, and implementation of a programme for disinvestment and privatisation (Mohan, 2000).

3.35 In sum, the growing liberalisation and integration of economies have led to fiscal reforms in several countries across the world. The general trend is to bring the level of taxes and expenditures in line with the international norms. The focus has shifted from fiscal stance to the composition of the fiscal package that takes into account the differential growth impact of tax and public expenditure instruments in a global framework. Within the ‘new consensus’, the use of discretionary fiscal policy and of long term budget deficit is seen as an exception rather than a rule. The norm for the fiscal policy should be to let automatic stabilisers operate in an environment of budgets balanced over the business cycle (Taylor, 2000; Arestis and Sawyer, 2003). Discretionary fiscal policies should focus on long run issues such as, tax reforms and social security reforms rather than on demand management (Aurbach, 2002). In an open economy framework, the issues in fiscal policy making relate to increasing the market friendliness of taxation and implementing efficiency-improving reforms of the expenditure system. There is greater emphasis on improving the budget and cash management and tightening both internal and external audit of the budget. Many countries have adopted medium-term budget frameworks as an important tool to introduce more strategic thinking in budget formulation, and have committed themselves to fiscal discipline by means of a binding fiscal rule. The strength and credibility of fiscal policy should attract the support of a well-informed public, result in a more favourable access to domestic and international capital markets, and play a role in reducing the incidence and severity of crises.

III. CONDUCT OF MONETARY POLICY IN AN OPEN ECONOMY

3.36 In a globalised world, monetary policy formulation has become more complex and interdependent. A key concern that seemingly guides the conduct of monetary policy is how to reap the benefits of market integration while minimising the risks of market instability. An integral component of central bank work is the development of financial markets that can increasingly shift the burden of risk mitigation and costs from the authorities to the markets. The adverse implications of excess volatility leading to financial crises are more severe for low-income countries. They can ill-afford the downside risks inherent in a financial sector collapse. It is increasingly being recognised that central banks need to take account of developments in the global economic situation, the international inflationary situation, interest rate situation, exchange rate movements and capital movements while formulating monetary policy (Mohan, 2003).

3.37 Although the basic objectives of monetary policy continue to remain unchanged, globalisation has implications for the conduct and instruments of monetary policy as global economic integration results in more economic convergence and more uncertainty (Solans, 2000). With increasing trade linkages, business cycles are quite synchronised; average cross-country correlation of GDP growth in the G-7 was 0.44 during 1984-2002 (Stock and Watson, 2003).

3.38 Globalised financial markets play an increasingly important role in the international transmission channel for several reasons. First, cross-border ownership of securities immediately transmits the effect of changes in market values of equities in one region to another. Second, the correlation between equity markets worldwide has increased in recent years. Third, large country-specific shocks and common shocks (for instance, oil shocks, the recent rise and fall in the information technology and related sectors) add to international linkages (Issing, 2002). Growing global macroeconomic imbalances create further uncertainty for market agents and policymakers. Growing openness of the economy and the increasing use of electronic money also create uncer tainty in regard to monetar y transmission. Thus, even though monetary policy is conducted exclusively for domestic goals, the international linkages have to be taken into account in policy formulation.

CONDUCT OF MACROECONOMIC POLICY IN AN OPEN ECONOMY

3.39 In an environment of such a heightened uncertainty, it is suggested that monetary policy strategies should have the following three features (ECB, 2001). First, following ‘Brainard’s conservatism principle’,2 monetary policy should be more cautious than activist. Accordingly, monetary policy should eschew attempts to fine-tune the economy in the short-run and should have a medium-term focus. This approach is reflected in the interest rate smoothing approach followed by modern central bankers. Second, monetary policy should be based on a diversified approach to the analysis of information which is robust to different views about the functioning of the economy. Hence, central banks should not rely exclusively on any particular indicator or model in isolation. Rather, a multiple indicators approach could be useful. Finally, central banks should not themselves become a source of additional uncertainty. This requires greater transparency and better communication of the key objective(s) of monetary policy.

3.40 In this context, inflation targeting (IT) has emerged as an important monetary policy approach. Full-fledged IT is based on five pillars (an institutional commitment to price stability, absence of other nominal anchors, absence of fiscal dominance, policy instrument independence, and policy transparency and credibility), although some countries adopted IT without satisfying all of them (Mishkin and Schmidt-Hebbel, 2001). The advantages of IT, with its focus on low and stable inflation, vis-à-vis the monetary aggregate or exchange rate anchored frameworks, are deemed to be the following: suppor t to macroeconomic stability and growth; an enhancement in the transparency and accountability of the monetary as well as fiscal policies; a scope for the central bank to undertake short-run stabilisation; and an impetus for institutional and structural reforms in the economy. Empirical evidence, however, does not show a definitive superiority of the IT regimes. Besides the IT-central banks, non-IT central banks were also successful in reducing inflation during the 1990s.

3.41 As regards emerging market economies (EMEs), inflation targeting is considered relatively more difficult on account of their greater openness, liability dollarisation and weak credibility (Eichengreen, 2002). There are a number of additional constraints in pursuing the sole objective of price stability. First, structural factors and recurrent supply shocks limit the role of monetary policy in the inflation outcomes. Second, the persistence of fiscal dominance implies that the debt management function gets inextricably linked with the monetary management function while steering liquidity conditions. Third, the absence of fully integrated financial markets suggests that the interest rate transmission channel of policy is generally weak and yet to evolve fully. In particular, the lags in the pass-through from the policy rate to bank lending rates constrain the adoption of inflation targeting. Fourth, the high frequency data requirements including those on a fully dependable inflation rate for targeting purposes are not adequately met. Finally, in view of large fluctuations in headline inflation rate, inflation targeting countries typically focus on a core measure of inflation which excludes volatile components. In developing countries, a measure of core inflation excluding food items - which can account for more than half of the weight in the index - may not be very meaningful. As such, the loss of information content in the construction of core inflation and the relatively greater public acceptability of the headline inflation make the core measures useful only as indicators of the underlying inflationary process rather than as policy targets (RBI, 2003).

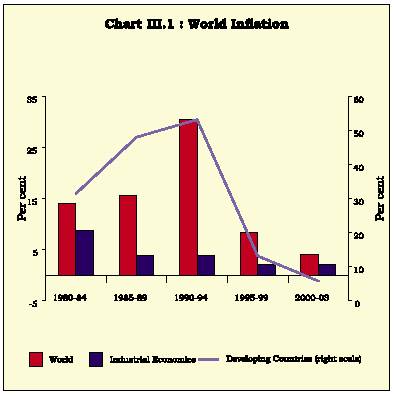

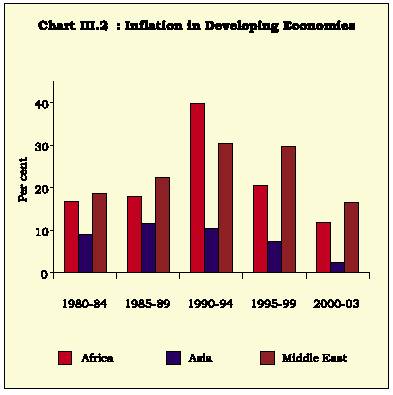

3.42 On the positive side, the forces of globalisation bring about deregulation and greater competition which have a stabilising influence on inflationary expectations. Competition reduces unwarranted price mark-ups; this, however, leads only to a one-time reduction in price levels. A more sustained reduction in inflation is enabled by competition among countries to attract and retain mobile production factors which forces governments to reduce inefficiencies. This requires greater fiscal discipline as well as macroeconomic stability. The focus on macroeconomic stability is one of the factors that has led to greater central bank independence and, in turn, lower inflation (Wagner, 2001; Jadhav, 2003). Greater competition in the economy makes prices more flexible which reduces the impact of unanticipated inflation on output. This lowers the incentive of the monetary authority to systematically raise output above the potential (Rogoff, 2003). Indeed, inflation has declined globally during the 1990s and this is seen both in advanced and developing economies (Charts III.1 and III.2). The significant fall in inflation worldwide may be attributed as much to the mutually reinforcing mix of Uncertainty about key parameters describing the transmission of monetary policy provides a rationale for an 'attenuated' approach to monetary policy-making in the sense of reacting less vigorously to incoming information than would be optimal if such uncertainty did not exist (Issing, 2002).

REPORT ON CURRENCY AND FINANCE

deregulation and globalisation and the consequent significant reduction in monopoly pricing power as to improved central bank design (Rogoff, 2003).

3.43 Apart from reduction in inflation, in recent years economic activity too has become less volatile, at least in the G-7 economies (Table 3.4). While moderation of inflation is primarily attributed to more effective monetary policy, the role of monetary policy in reduction of output volatility is a matter of debate. Relatively stable GDP growth in recent decades is attributed to a number of factors including the

|

Table 3.4: Volatility of Output Growth in G-7 Countries |

|||||

|

Standard Deviation, 1960-1983 |

Standard Deviation, 1984-2002 |

Standard Deviation, 1984-2002/Standard Deviation, 1960-1983. |

Variance,1984-2002/Variance, 1960-1983 |

||

|

1 |

2 |

3 |

4 |

5 |

|

|

Canada |

2.3 |

2.2 |

0.96 |

0.91 |

|

|

France |

1.8 |

1.4 |

0.71 |

0.51 |

|

|

Germany |

2.5 |

1.5 |

0.60 |

0.36 |

|

|

Italy |

3.0 |

1.3 |

0.43 |

0.19 |

|

|

Japan |

3.7 |

2.2 |

0.59 |

0.35 |

|

|

UK |

2.4 |

1.7 |

0.71 |

0.50 |

|

|

US |

2.7 |

1.7 |

0.63 |

0.40 |

|

|

Note: Standard deviations are computed from four-quarter growth in real GDP per capital. |

|||||

|

Source |

: Stock and Watson (2003). |

||||

increasing share of services in GDP, better inventory management, and improved consumption-smoothing on account of financial innovations and deregulation. Stock and Watson (2003) have recently argued that lower output volatility is primarily due to the absence of major supply disruptions and other such macroeconomic shocks in the recent decades.

3.44 A valuable lesson for an economy in the process of opening up is that increased globalisation and competition has contributed predominantly towards containment of inflation. With continued deregulation and globalisation, it is unlikely that there will be a reversal of the current trends in inflation. However, this is not to suggest that globalisation is a panacea. Any widespread relapses in the relatively favourable trends in globalisation and deregulation, or relatively benign fiscal policies could reverse the achievement of recent years. An important consideration for reining inflationary expectations relates to the need to have clarity on price stability, effective communication, consistency in conduct of policy and transparency in explaining actions. Central banks should speak clearly to markets and listen to markets more carefully to ensure the intended objectives of policy (Mohan, 2003).

Capital Flows and Monetary Management

3.45 As noted earlier, private capital flows have been substantial during the 1990s. More recently, the EMEs have recorded large current account surpluses. Recovery in capital flows coupled with growing current account surpluses has led to sharp reserve accretion in a number of EMEs. The reserve accretion, especially in the aftermath of the Asian crisis, reflected attempts by EMEs to build up reserves to be able to meet unpredictable and temporary imbalances in international payments and thereby, provide confidence to financial markets. Nonetheless, the persistent external flows have begun to pose problems in the conduct of discretionary monetary policy since such flows can threaten domestic macroeconomic stability.

Page Last Updated on: