II. Fiscal Situation - RBI - Reserve Bank of India

II. Fiscal Situation

| Centre's Fiscal Position |

| Combined Government Finances |

| Public Debt |

| Outlook |

With the introduction of the Fiscal Responsibility and Budget Management (FRBM) Rules 2004, the year 2004-05 marked a new beginning in the Centre's fiscal consolidation process. The revenue deficit was budgeted at 2.5 per cent of GDP for 2004-05 as against 3.6 per cent of GDP in the revised estimates (RE) for 2003-04. The RE placed the revenue deficit for 2004-05 at 2.7 per cent of GDP. As against the stipulation of a yearly reduction of 0.5 percentage points in the revenue deficit to GDP ratio in the FRBM Rules, the actual reduction for 2004-05 turned out to be higher at 0.9 percentage points. The required reduction of 0.3 percentage points in the GFD to GDP ratio for 2004-05 under the FRBM Rules was also achieved [The GFD to GDP ratio for 2004-05 was 4.5 per cent in the RE as against 4.8 per cent in 2003-04 (RE)]. Notwithstanding these corrections, the revised estimates for 2004-05 exceeded the budgeted targets in respect of all the key deficit indicators (Table 6). The slippage in the revenue deficit was mainly on account of a shortfall of Rs. 8,102 crore in net tax revenue. The slippage in fiscal deficit, albeit of a lower order was on account of reduction in non-defence capital outlay by Rs.4,103 crore and lower net lending (loans and advances net of recovery of loans) to the extent of Rs.2,976 crore.

| Table 6 : Deficit Indicators of the Centre |

|||||

| (Amount |

in Rs. crore) |

||||

| Item |

2003-04 |

2004-05 (BE) |

2004-05 (RE) |

Variation |

(4 over 3) |

| Amount |

Per cent |

||||

| 1 |

2 |

3 |

4 |

5 |

6 |

| 1. Gross Fiscal Deficit |

1,23,272 |

1,37,407 |

1,39,231 |

1 , 8 2 4 |

1 . 3 |

| (4.5) |

(4.4) |

(4.5) |

|||

| 2. Revenue Deficit |

9 8 , 2 6 2 |

7 6 , 1 7 1 |

8 5 , 1 6 5 |

8 , 9 9 4 |

1 1 . 8 |

| (3.6) |

(2.5) |

(2.7) |

|||

| 3. Gross Primary Deficit |

-816 |

7 , 9 0 7 |

1 3 , 3 2 6 |

5 , 4 1 9 |

6 8 . 5 |

| (0.0) |

(0.3) |

(0.4) |

|||

| BE: Budget Estimates. |

|||||

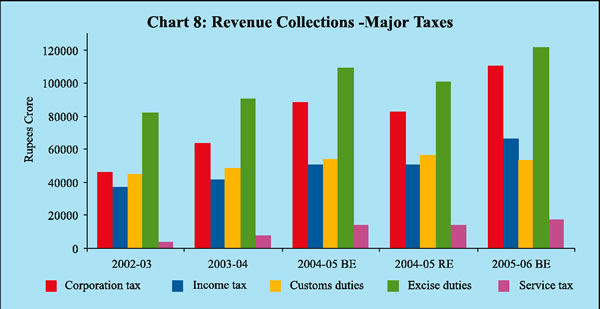

Revenue receipts of the Centre were lower by 2.7 per cent than their budgeted level for 2004-05 due to decline in both tax and non-tax revenues. The gross tax revenue was 3.7 per cent lower than the budget estimates (BE) mainly on account of lower corporation tax collections and union excise duties (Chart 8). The lower collections from excise duties reflected the post-budget reduction of duties in respect of certain petroleum products and non-alloy steel to contain inflationary pressures.

The shortfall in non-tax revenue was mainly due to lower interest receipts and external grants. Dividends and profits exceeded BE. Non-debt capital receipts (comprising disinvestment and recovery of loans) were significantly higher at 32.0 per cent of the total capital receipts than the budgeted 18.5 per cent (Table 7). This was largely on account of receipts under the Debt Swap Scheme (DSS) which enabled the States to swap their high cost debt owed to the Central Government with additional market borrowings and a part of current small savings transfers. Non-debt capital receipts, after netting the receipts under debt swap, however, constituted 12.0 per cent of the total capital receipts.

| Table 7 : Total Receipts of the Centre |

|||||

| (Amount |

in Rs. crore) |

||||

| Item |

2003-04 |

2004-05 (BE) |

2004-05 (RE) |

Variation |

(4 over 3) |

| Amount |

Per cent |

||||

| 1 |

2 |

3 |

4 |

5 |

6 |

| 1. Total Receipts (2+3) |

4,71,368 |

4,77,829 |

5,05,791 |

2 7 , 9 6 2 |

5 . 9 |

| (17.1) |

(15.3) |

(16.3) |

|||

| 2. Revenue Receipts (i+ii) |

2,63,878 |

3,09,322 |

3,00,904 |

-8,418 |

- 2 . 7 |

| (9.6) |

(9.9) |

(9.7) |

|||

| i. Tax Revenue |

1,86,982 |

2,33,906 |

2,25,804 |

-8,102 |

- 3 . 5 |

| (6.8) |

(7.5) |

(7.3) |

|||

| ii. Non-tax Revenue |

7 6 , 8 9 6 |

7 5 , 4 1 6 |

7 5 , 1 0 0 |

-316 |

- 0 . 4 |

| (2.8) |

(2.4) |

(2.4) |

|||

| 3. Capital Receipts |

2 0 7 , 4 9 0 |

1 6 8 , 5 0 7 |

2 0 4 , 8 8 7 |

3 6 , 3 8 0 |

2 1 . 6 |

| (7.5) |

(5.4) |

(6.6) |

|||

| of which: |

|||||

| Market Borrowings |

8 8 , 8 6 9 |

9 0 , 3 6 5 |

4 5 , 9 4 3 |

-44,422 |

- 4 9 . 2 |

| Recovery of Loans |

6 7 , 2 6 5 |

2 7 , 1 0 0 |

6 1 , 5 6 5 |

3 4 , 4 6 5 |

1 2 7 . 2 |

| Disinvestment proceeds |

1 6 , 9 5 3 |

4 , 0 0 0 |

4 , 0 9 1 |

9 1 |

2 . 3 |

| BE: Budget Estimates. |

|||||

Aggregate expenditure was higher than the budgeted level by 5.9 per cent for 2004-05, mainly on account of debt swap transactions. Aggregate expenditure net of debt swap transactions, was, however, lower than the budget estimates by one per cent (Table 8). The expenditure was compressed entirely in respect of the Plan component in the form of a reduction of Rs.2,170 crore in the revenue account and Rs.6,033 crore in the capital account.

| Table 8 : Aggregate Expenditure of the Centre |

|||||||

| (Amount |

in Rs. crore) |

||||||

| Item |

2003-04 |

2004-05 (BE) |

2004-05 (RE) |

Variation |

(4 over 3) |

||

| Amount |

Per cent |

||||||

| 1 |

2 |

3 |

4 |

5 |

6 |

||

| 1. |

Total Expenditure |

4,25,157* |

4,77,829 |

4,73,126* |

-4,703 |

- 1 . 0 |

|

| ( 2 + 3 = 4 + 5 ) |

(15.4) |

(15.3) |

(15.2) |

||||

| 2. |

Non-Plan Expenditure |

3,02,877* |

3,32,239 |

3,35,739* |

3 |

, 5 0 0 |

1 . 1 |

| (11.0) |

(10.6) |

(10.8) |

|||||

| of which: |

|||||||

| Interest Payments |

1,24,088 |

1,29,500 |

1,25,905 |

-3,595 |

- 2 . 8 |

||

| (4.5) |

(4.1) |

(4.1) |

|||||

| Defence |

6 0 , 0 6 6 |

7 7 , 0 0 0 |

7 7 , 0 0 0 |

0 |

0 . 0 |

||

| (2.2) |

(2.5) |

(2.5) |

|||||

| Subsidies |

4 4 , 2 5 6 |

4 3 , 5 1 6 |

4 6 , 5 1 4 |

2 |

, 9 9 8 |

6 . 9 |

|

| (1.6) |

(1.4) |

(1.5) |

|||||

| 3. |

Plan Expenditure |

1,22,280 |

1,45,590 |

1,37,387 |

-8,203 |

- 5 . 6 |

|

| (4.4) |

(4.7) |

(4.4) |

|||||

| 4. |

Revenue Expenditure |

3,62,140 |

3,85,493 |

3,86,069 |

5 7 6 |

0 . 1 |

|

| (13.1) |

(12.3) |

(12.4) |

|||||

| 5. |

Capital Expenditure |

6 3 , 0 1 7 * |

9 2 , 3 3 6 |

8 7 , 0 5 7 * |

-5,279 |

- 5 . 7 |

|

| (2.3) |

(3.0) |

(2.8) |

|||||

| *:Net of the repayments made to the NSSF. |

|||||||

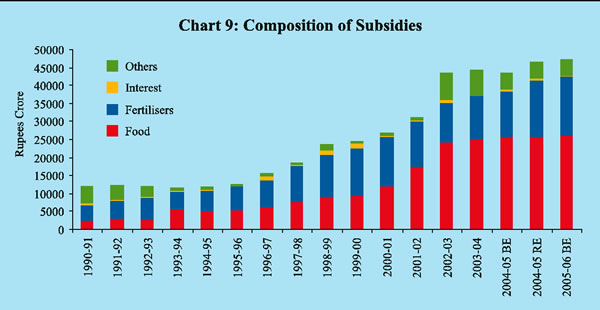

Non-Plan revenue expenditure was marginally higher than the BE, mainly on account of higher fertiliser subsidies due to increase in their input cost (Chart 9). Interest payments were, however, lower mainly due to less than anticipated recourse to market borrowings and substitution of high cost loans with low cost loans.

A notable feature of the Central Government finances during 2004-05 was the persistence of surplus cash balances held by the Government with the Reserve Bank. While this reflected, to a large extent, debt swap proceeds and advance tax payments, particularly in the third quarter of the year, it also represented compression in expenditure. Owing to the availability of surplus cash balances, the Central Government cancelled its auctions for market borrowings of the order of Rs.18,000 crore during October-December 2004. The Central Government had also ended the preceding financial years 2003-04 and 2002-03 with surplus cash positions.

Gross market borrowings of the Centre for 2004-05 were budgeted at Rs.1,50,817 crore and the net market borrowings at Rs.90,365 crore. The RE placed the net market borrowings at Rs.45,943 crore which were 49.2 per cent lower than the budget estimates. Although the DSS transactions are deficit neutral, they resulted in a compositional shift in the financing pattern of GFD. Market borrowings financed 33.0 per cent of GFD as compared with the budgeted level of 65.8 per cent, while the securities issued against small savings - which represent reinvestment by National Small Savings Fund (NSSF) out of the proceeds received on redemption of Special Central Government securities - financed around 24 per cent of the gross fiscal deficit as compared with one per cent in the BE.

The agreed limits on the Centre's Ways and Means Advances (WMA) from the Reserve Bank for the first and second halves of 2004-05 continued to be at Rs.10,000 crore (April-September) and Rs.6,000 crore (October-March), respectively. As alluded to earlier, the Central Government maintained surplus cash balances with the Reserve Bank for the greater part of 2004-05. As a result, the Centre abjured from WMA from September 10, 2004.

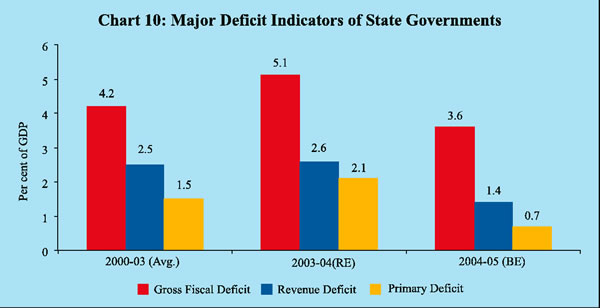

The finances of the State governments are expected to improve during 2004-05 with all the major deficit indicators budgeted to decline in 2004-05 from their respective levels in the revised estimates of the previous year (Chart 10).

The decomposition of the States’ GFD indicates that although the share of the revenue deficit would decline substantially in 2004-05, it would still be higher than the average for the first half of the 1990s. Small savings [securities issued to the National Small Savings Fund (NSSF)] would continue to be the main source of financing the GFD, followed by market borrowings (Table 9).

| Table 9: Decomposition and Financing of States’ Gross Fiscal Deficit |

|||||||

| (Per cent) |

|||||||

| Item |

1990-95 |

1995-2000 |

2000-02 |

2002-03 |

2003-04 |

2004-05 |

|

| (Avg.) |

(Avg.) |

(Avg.) |

(RE) |

(BE) |

|||

| 1 |

2 |

3 |

4 |

5 |

6 |

7 |

|

| Decomposition (1+2+3) |

1 0 0 |

1 0 0 |

1 0 0 |

1 0 0 |

1 0 0 |

1 0 0 |

|

| 1. |

Revenue Deficit |

2 4 . 7 |

4 4 . 7 |

6 0 . 7 |

5 4 . 0 |

5 1 . 1 |

3 9 . 1 |

| 2. |

Capital Outlay |

5 5 . 3 |

4 3 . 2 |

3 4 . 2 |

3 5 . 8 |

4 3 . 6 |

5 4 . 2 |

| 3. |

Net Lending |

2 0 . 0 |

1 2 . 1 |

5 . 1 |

1 0 . 2 |

5 . 3 |

6 . 7 |

| Financing (1+2+3+4+5) |

1 0 0 |

1 0 0 |

1 0 0 |

1 0 0 |

1 0 0 |

1 0 0 |

|

| 1. |

Small Savings |

– |

5 . 8 |

3 6 . 8 |

5 1 . 2 |

4 3 . 4 |

5 7 . 0 |

| 2. |

Market Borrowings |

1 6 . 0 |

1 6 . 1 |

1 6 . 0 |

2 7 . 9 |

3 2 . 0 |

2 4 . 6 |

| 3. |

State Provident Fund |

1 4 . 3 |

1 3 . 4 |

1 0 . 2 |

7 . 0 |

6 . 8 |

9 . 3 |

| 4. |

Loans from Centre |

4 9 . 0 |

4 0 . 6 |

1 3 . 5 |

-0.9 |

-15.2 |

-7.4 |

| 5. |

Others* |

2 0 . 7 |

2 4 . 0 |

2 3 . 6 |

1 4 . 8 |

3 3 . 0 |

1 6 . 5 |

| Avg. : Average. |

|||||||

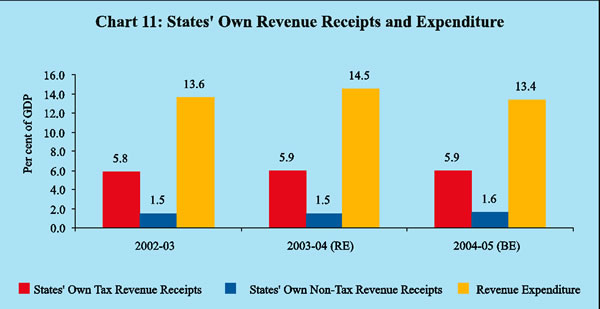

The budget estimates for 2004-05 reveal an endeavour of the State Governments to carry forward fiscal reforms. A number of States have underscored the need to increase the magnitude and efficiency of tax revenue mobilisation. The general approach is to rationalise and simplify the tax structure, broaden the tax base and have moderate rates of taxation. Most of the State Governments have reiterated the need to contain unproductive expenditures and reorient spending towards developmental purposes. Several State Governments have already enacted Fiscal Responsibility legislation (FRL) and formulated medium-term fiscal plans to bring about an orderly correction of their financial positions. Some of the remaining State Governments have also proposed to enact FRL. A number of State Governments have taken initiatives towards empowering the local bodies based on the recommendations of the respective State Finance Commissions. The recent implementation of the Value Added Tax (VAT) by a number of States, with effect from April 1, 2005, is an important milestone in the area of tax reforms.

Financing of the State Budgets

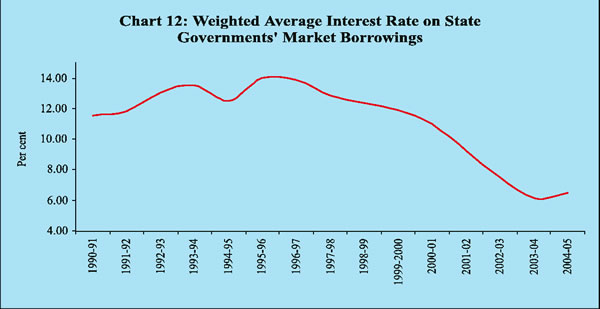

The net market borrowings allocated to the States for 2004-05 amounted to Rs.36,935 crore, including additional allocation of Rs.18,805 crore under the Debt Swap Scheme (DSS). Taking into account repayments of Rs.5,123 crore, the gross allocation amounted to Rs.42,058 crore. The gross market borrowings raised during 2004-05 by the State Governments amounted to Rs.39,101 crore (Rs.38,216 crore through tap sale and Rs.885 crore through auctions) including allocation under the DSS. An amount of Rs.16,943 crore was raised under the DSS. Interest rates on States' market borrowings were in the range of 5.60-7.36 per cent as compared with 5.78-6.40 per cent in 2003-04. The weighted average interest rate on market loans, which declined between the mid-1990s and 2003-04,firmed up somewhat during 2004-05 (Chart 12).

Weaknesses in the finances of some State Governments were manifested in the widening of spreads and under-subscription in respect of their market loans. The spread between the rate of interest on State market loans and Central market loans of ten-year maturity in the secondary market widened from 25 basis points in 2000-01 to 50 basis points in the recent period.

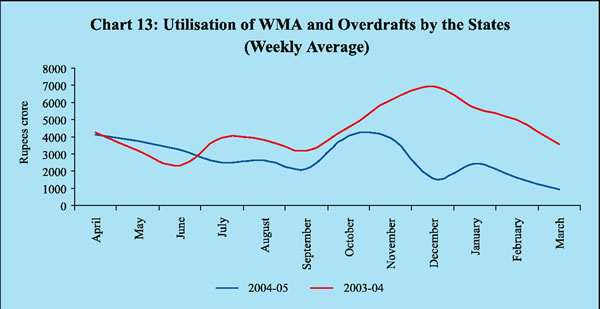

The State Governments' recourse to WMA and overdrafts was lower during 2004-05 than in the previous year (Chart 13).

The combined gross fiscal deficit of the Centre and the States for 2004-05 was budgeted at 7.9 per cent of GDP, lower than 9.4 per cent in the RE for 2003-04. Commensurate reductions were also budgeted for the gross primary deficit and the revenue deficit which were placed at 1.8 per cent and 3.8 per cent of GDP, respectively, as compared with RE of 2.9 per cent and 6.2 per cent, respectively, in 2003-04. Reduction in the various deficit indicators was envisaged to be achieved through higher revenue mobilisation and moderation in the growth of expenditure.

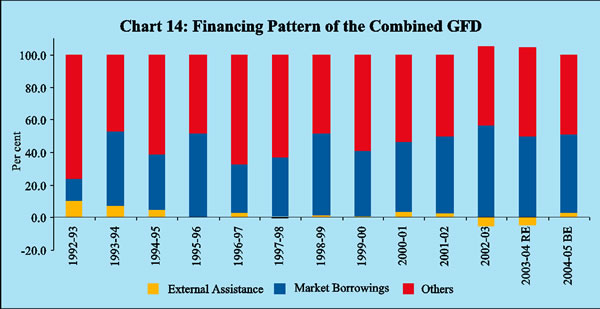

The combined fiscal deficit of the Centre and the States during 2004-05 is budgeted to be financed primarily from domestic sources. The share of 'other liabilities' (small savings, provident funds and deposits) in financing declined from 54.3 per cent in 2003-04 to 48.8 per cent in 2004-05. The share of financing through market borrowings also declined from 50.1 per cent to 47.9 per cent over the same period. External sources financed 3.3 per cent of the combined fiscal deficit during 2004-05, unlike in the preceding two years when there was a net outflow due to prepayment of external debt (Chart 14).

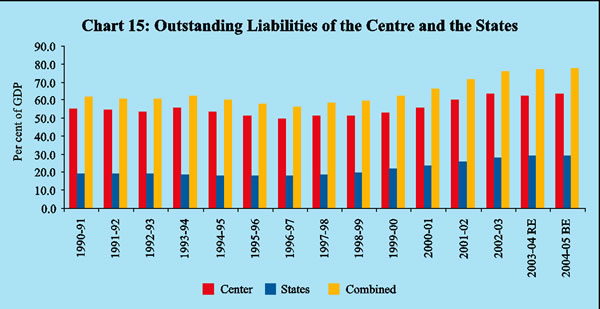

The combined debt-GDP ratio of the Centre and the States is estimated to have remained broadly stable at 77.6 per cent in 2004-05 as compared with 77.1 per cent in 2003-04 (Chart 15). The weighted average maturity of dated securities of the Central Government issued during the year increased from 7.70 years in 1998-99 to 14.94 years in 2003-04. The maturity profile of dated securities issued during 2004-05 reflected the prevailing liquidity conditions and the sentiment of market participants. Accordingly, the weighted average maturity of the dated securities of the Central Government issued during the current year at 14.13 years was lower than 14.94 years during 2003-04.

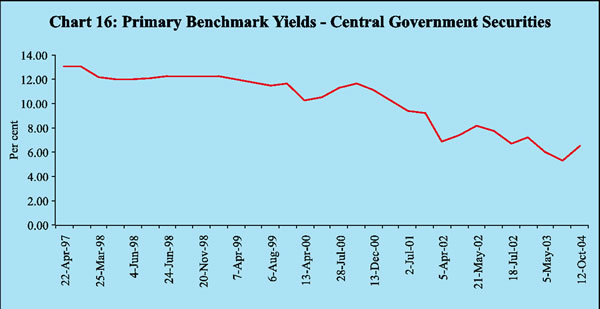

Interest rates on market borrowings firmed up somewhat during 2004-05, mainly on account of inflationary expectations. The weighted average yield of the dated securities issued during the year worked out to 6.11 per cent as compared with 5.71 per cent in 2003-04, reflecting the firming up of interest rate conditions. The yield on the benchmark security of 10-year maturity in the primary market hardened to 6.99 per cent as on October 12, 2004 from 5.32 per cent as on February 16, 2004 (Chart 16).

The Government has committed itself to pursuing fiscal policies designed to promote savings, to devise ways and means to channel these savings into productive investment and to fund necessary social expenditures through the Union Budget, 2005-06. The central theme that runs through the various schemes and programmes is creation of jobs, strengthening of social infrastructure and providing succour to the weaker sections of society. The Union Budget seeks to carry forward the process of fiscal consolidation in coordination with the States through the mechanism of cooperative fiscal federalism.

The Union Budget has set a 'pause' in the path outlined in the Fiscal Responsibility and Budget Management (FRBM) Act 2003 due to constraints emanating from implementation of the Twelfth Finance Commission's (TWFC) recommendations and the need to compensate the States for any revenue loss due to implementation of VAT. It is also significant to note that the disinvestment receipts have been taken out of the budgetary receipts so as to create a separate fund for the same. Revenue receipts of the Centre are expected to grow by 16.7 per cent and aggregate expenditure by 8.7 per cent (over the expenditure net of NSSF repayments in 2004-05). The revenue deficit is budgeted at 2.7 per cent of GDP - the same as in 2004-05 - while the fiscal deficit is budgeted to decline to 4.3 per cent from 4.5 per cent in the preceding year. The gross primary deficit to GDP ratio is placed at 0.5 per cent, marginally higher than 0.4 per cent in the previous year (Table 10).

Under revenue receipts, tax revenue is projected to increase by 21.1 per cent, the major portion of which is estimated to emanate from corporation tax. Collections from customs duties are budgeted to decline reflecting the rationalisation of these duties. Excise duties and income tax are budgeted to register significant increases during 2005-06. Consequently, the gross tax-GDP ratio of the Central Government is expected to rise to 10.5 per cent in 2005-06, the highest level after 1989-90. Non-tax revenue is budgeted to increase by 3.5 per cent mainly on account of higher receipts from 'dividends and profits'. On the expenditure side, revenue expenditure is budgeted to register a significantly higher increase of 15.7 per cent mainly due to higher grants to the States on account of the TWFC's recommendations and compensation to the States for revenue losses that may occur on implementation of VAT. Higher interest payments reflect the

| Table 10 : Union Budget 2005-06 at a Glance |

||||||

| (Amount in |

Rs. Crore) |

|||||

| Item |

2004-05 (RE) |

2005-06 (BE) |

Variation (per cent) |

|||

| (Col. 3 over |

Col. 2) |

|||||

| (Amount) |

(Per cent) |

|||||

| 1 |

2 |

3 |

4 |

5 |

||

| 1. |

Revenue Receipts (i+ii) |

3,00,904 |

3,51,200 |

50,296 |

1 6 . 7 |

|

| (9.7) |

(10.0) |

|||||

| i) |

Tax Revenue |

2,25,804 |

2,73,466 |

47,662 |

2 1 . 1 |

|

| (7.3) |

(7.8) |

|||||

| ii) |

Non-tax Revenue |

75,100 |

77,734 |

2,634 |

3 . 5 |

|

| (2.4) |

(2.2) |

|||||

| 2. |

Non-Plan Expenditure |

3,68,404 |

3,70,847 |

2,443 |

0 . 7 |

|

| (11.9) |

(10.6) |

|||||

| of which: |

||||||

| i ) |

Interest Payments |

1,25,905 |

1,33,945 |

8,040 |

6 . 4 |

|

| (4.1) |

(3.8) |

|||||

| ii) |

Defence |

77,000 |

83,000 |

6,000 |

7 . 8 |

|

| (2.5) |

(2.4) |

|||||

| iii) |

Subsidies |

46,514 |

47,432 |

918 |

2 . 0 |

|

| (1.5) |

(1.3) |

|||||

| 3. |

Plan Expenditure |

1,37,387 |

1,43,497 |

6,110 |

4 . 4 |

|

| (4.4) |

(4.1) |

|||||

| 4. |

Revenue Expenditure |

3,86,069 |

4,46,512 |

60,443 |

1 5 . 7 |

|

| (12.4) |

(12.7) |

|||||

| 5. |

Capital Expenditure |

1,19,722 |

67,832 |

-51,890 |

-43.3 |

|

| (3.9) |

(1.9) |

|||||

| 6. |

Revenue Deficit |

85,165 |

95,312 |

10,147 |

1 1 . 9 |

|

| (2.7) |

(2.7) |

|||||

| 7. |

Gross Fiscal Deficit |

1,39,231 |

1,51,144 |

11,913 |

8 . 6 |

|

| (4.5) |

(4.3) |

|||||

| 8. |

Gross Primary Deficit |

13,326 |

17,199 |

3,873 |

2 9 . 1 |

|

| (0.4) |

(0.5) |

|||||

| BE: Budget Estimates. |

||||||

continuing dependence on debt resources and the interest outgo on account of the Market Stabilisation Scheme. Capital expenditure is budgeted to decline by 43.3 per cent in 2005-06, reflecting mainly the absence of NSSF repayments and Plan loans to the States in pursuance of the recommendations of the TWFC. Adjusted for these components, capital expenditure is budgeted to show an increase of 9.2 per cent.

During 2005-06, net market borrowings are budgeted to be higher at Rs.1,03,791 crore as against Rs.45,943 crore in the RE for 2004-05 . Inclusive of repayments to the tune of Rs.61,676 crore, the gross market borrowings are placed at Rs.1,65,467 crore. Net market borrowings would finance 68.7 per cent of the GFD in 2005-06 as compared with 33.0 per cent in the revised estimates for 2004-05. The securities issued against small savings would finance 2.0 per cent of the GFD as against 24.4 per cent in 2004-05, reflecting the discontinuance of the DSS and associated NSSF repayments. The fiscal measures initiated in the Union Budget would augment revenue, promote efficient utilisation of expenditure and pave the way for sustained economic development.