IST,

IST,

III. Monetary Policy Framework: An Analytical Overview (Part 2 of 2)

II. MONETARY POLICY FRAMEWORK IN INDIA

3.36 In India, the transition of economic policies in general, and financial sector policies in particular, from a control oriented regime to a liberalised but regulated regime has been reflected in changes in the nature of monetary management (Mohan, 2004a). While the basic objectives of monetary policy, namely price stability and ensuring credit flow to support growth, have remained unchanged, the underlying operating environment for monetary policy has undergone a significant transformation. An increasing concern is the maintenance of financial stability. The basic emphasis of monetary policy since the initiation of reforms has been to reduce segmentation through better linkages between various segments of the financial markets including money, Government securities and forex markets. The key development that has enabled a more independent monetary policy environment was the discontinuation of automatic monetisation of the

Government's fiscal deficit through an agreement between the Government and the Reserve Bank in 1997. The enactment of the Fiscal Responsibility and Budget Management (FRBM) Act, 2003 has strengthened this further. Development of the monetary policy framework has also involved a great deal of institutional initiatives to enable efficient functioning of the money market: development of appropriate trading, payments and settlement systems along with technological infrastructure.

3.37 Against this brief overview, this Section focuses on the key changes in the monetary policy framework that became necessary in the liberalised economic regime. As in Section I, the discussion is organised under three broad heads: objectives, intermediate targets and operating procedures.

Objectives

3.38 The preamble of the Reserve Bank of India Act, 1934 enjoins the central bank '…to regulate the issue of Bank Notes and keeping of reserves with a view to securing monetary stability in India and generally to operate the currency and credit system of the country to its advantage…'. Within this broad mandate, the Reserve Bank's monetary policy pursues the twin objectives of price stability and ensuring the availability of credit to the productive sectors in the Indian economy. The emphasis between the twin objectives of price stability and growth has,

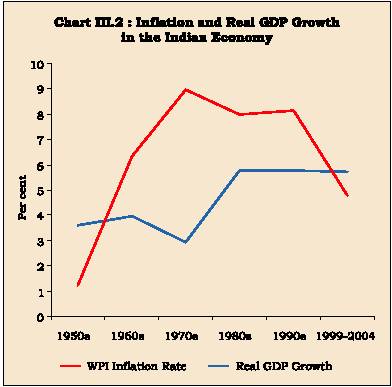

however, varied over time depending on the evolving price-output situation. Initially, this was guided by the concept of developmental central banking crystallised in the First Five Year Plan, which required the Reserve Bank to create an institutional framework for industrial as well as rural credit to support economic growth (GoI,1951)2. This reflected a widespread consensus that public investment could spur rapid growth. The concomitant deficit financing associated with public investment began to spill over into inflation and concerns began to be expressed over the inflationary consequences of the fiscal deficit during the 1960s (Iengar, 1959; Rama Rau, 1960; Narasimham, 1968). These concerns gathered momentum during the 1970s as inflation trended up to around nine per cent during the 1970s (Chart III.2). Against this backdrop of persistent high inflation, the Chakravar ty Committee recommended that price stability emerge as the 'dominant' objective of monetary policy with a concomitant commitment to fiscal discipline (RBI, 1985)3. Besides the conventional wisdom that fluctuations in prices affected business decisions, inflation was also seen as a social injustice, especially as the poor seldom had hedges against inflation (Rangarajan, 1988).

3.39 The case for price stability as the dominant -if not sole - objective of monetary policy gathered momentum in the early years of financial liberalisation. Although it had to stabilise the economy in the face of the balance of payments crisis of 1991, the Reserve Bank emphasised that its ultimate mission was to steer monetary policy with its sights set firmly on inflation control (RBI, 1992). Price stability was seen to be critical to sustain the process of reforms (RBI, 1993). This acquired a new urgency as strong capital flows, after the liberalisation of the external sector, began to push inflation into the double digits. The very fact that inflation could be reined in during the second half of the 1990s by tightening monetary conditions -in turn, enabled by improved monetary-fiscal interface, as discussed later - appeared to demonstrate the potency of monetary policy in ensuring price stability (RBI, 1997). In the latter half of the 1990s, as the economy slowed down, monetary policy pursued an accommodative stance with an explicit policy preference for a softer interest rate regime while continuing a constant vigil on the inflation front. The macroeconomic scenario began to change by the first half of 2004-05. In the face of sharp increases in international commodity prices and the persistence of a large liquidity overhang, the Reserve Bank reaffirmed that maintaining confidence in price stability was a continuing policy objective (RBI, 2004b). The inflation situation would be watched closely in order to respond in a timely and measured manner.

3.40 Thus, price stability has been an abiding objective of monetary policy since the early 1950s although the success with price stability has varied over time in response to the evolving monetary-fiscal interface. It is only since the second half of 1990s that both inflation and inflation expectations have moderated substantially (see Chapter V). There is very little disagreement about the fact that price stability should continue to be a key objective of monetary policy. The Advisory Group on Monetary and Financial

2 The First Five-Year Plan (1951) stated that: '...central banking in a planned economy can hardly be confined to the regulation of the overall supply of credit or to a somewhat negative regulation of the flow of bank credit. It would have to take on a direct and active role, firstly in creating or helping to create the machinery needed for financing developmental activities all over the country and secondly, ensuring that the finance available flows in the directions intended...'.

3 The Chakavarty Committee set out the following other tasks for the monetary system so that its functioning would be in consonance with the national development strategy as envisaged in the successive Five Year Plans: (a) mobilising the savings of the community and enlarging the financial savings pool; (b) promoting efficiency in the allocation of the savings of the community to relatively productive purposes in accordance with national economic goals; (c) enabling the resource needs of the major ‘entrepreneur’ in the country, viz., the government, to be met in adequate measure; and, (d) promoting an efficient payments system.

Policies (Chairman: Shri M. Narasimham) recommended that the Reserve Bank should be mandated a sole price stability objective (RBI, 2000a). There are, however, several constraints in pursuing a sole price stability objective (RBI, 2000).

- The recurrence of supply shocks limits the role of monetary policy in the inflation outcome.Structural factors and supply shocks from within and abroad make inflation in India depend on monetary as well as non-monetary factors

- The persistence of fiscal dominance implies that the debt management function gets inextricably linked with the monetary management function while steering liquidity conditions.

- The absence of fully integrated financial markets suggests that the interest rate transmission channel of policy is rather weak and yet to evolve fully. In particular, the lags in the pass-through from the policy rate to bank lending rates constrain the adoption of inflation targeting.

- The high frequency data requirements including those of a fully dependable inflation rate for targeting purposes are yet to be met.

3.41 With the opening up of the Indian economy and its growing integration, monetary policy had to contend not only with price stability but also to ensure orderly conditions in the financial markets (Box III.5). The growing integration of financial markets, while necessary for economic efficiency, posed challenges for monetary management in terms of heightened risks of contagion. Episodes of financial volatility, often sparked off by sudden switches in capital flows in response to various shocks - such as the East Asian financial crisis, sanctions after the nuclear explosions, downgrading of credit ratings, the meltdown of the information technology bubble and the September 11 US terrorist attacks - required a swift monetary policy response. The Reserve Bank, therefore, began to emphasise the need to ensure orderly conditions in financial markets as a prime concern of monetary management. Financial stability is now being recognised as a key consideration in the conduct of monetary policy, in terms of ensuring uninterrupted financial transactions; maintenance of a level of confidence in the financial system amongst all the participants and stakeholders; and absence of excess volatility that unduly and adversely affects real economic activity (Reddy, 2004a).

Box III. 5

Monetary Policy Matrix in India

The conduct of contemporary monetary policy in the Indian economy is based on a carefully crafted strategy. The strategy aims to balance the linkages between monetary policy, credit policy and the regulatory regime in a dynamic environment of structural transformation (Reddy, 2004).

Monetary policy now simultaneously pursues the objectives of price stability, provision of appropriate credit for growth and increasingly, financial stability. While there are complementarities between the objectives, especially in the long run, it cannot be denied that there are certain tradeoffs, particularly in the short run. The Reserve Bank has always had to address the monetary policy dilemma of providing adequate credit to the Government and the commercial sector, without fuelling inflationary pressures (Reddy, 1999a). With the deregulation of interest rates, an added dimension is to balance the interest cost of public debt with the price of commercial credit. Besides, with the opening up of the economy, there are times when it is necessary to tighten monetary conditions to ward off speculative pressures on the exchange rate, although the growth objective presages a softer interest rate regime. Finally, the imperatives of price stability have to be increasingly balanced with the impact of monetary policy actions on balance sheets of the banking system.

In order to achieve these objectives, the Reserve Bank has, at its disposal, three instruments - monetary policy, credit policy and regulatory policies. At the same time, it is, however, not possible to compartmentalise the policy actions, especially as the instruments are also used interchangeably to serve different objectives. Changes in the policy interest rates, for example, not only transmit a monetary policy signal but also change the price of credit and impact asset prices. This, in turn, requires some other complementary measures to manage the short-run trade-offs, especially in the context of the transitional problems and transactional costs of an economy in transition.

The process of monetary policy formulation is essentially based on the information content of a large host of macroeconomic indicators - quantum and rate - spanning the entire domestic macroeconomy as well as international macroeconomic developments. An internal Financial Markets Committee (FMC), instituted in 1997, monitors market developments and recommends tactical operations for meeting the evolving situation in the financial markets on a daily basis. For this purpose, the FMC makes an assessment of market liquidity based on the evaluation of inflows and outflows from the Reserve Bank balance sheet as a result of its operations with the banking sector, financial institutions and the Government (RBI, 2002). This is reinforced by inflation and growth forecasts produced by an Inter-Departmental Group. The Board for Financial Supervision (BFS), constituted as a Committee of the Central Board in November 1994 and headed by the Governor, is entrusted with the supervision of commercial and select co-operative banks, select financial institutions and non-banking financial companies. The Reserve Bank also draws policy inputs from the Technical Advisory Committee on Money and Government Securities Markets and the Standing Committee on Financial Regulation, which also includes external experts, as well as a number of working groups, again with external experts, appointed to look into specific issues.

Monetary-Fiscal Interface in India

3.42 A key message from the above discussion is that the surge in inflation during the 1970s and 1980s was a consequence of expansionary monetary policy. This, in turn, was the outcome of expansionary fiscal policies. Concomitantly, the 1990s received a renewed focus on improving monetary-fiscal interface in order to provide the monetary policy necessary flexibility in monetary management. This Section briefly touches upon the monetary-fiscal interface over the past decades and the recent efforts to strengthen the same through fiscal rules.

3.43 With the progressive widening of fiscal deficits from the 1960s onwards, the burden of financing was borne by the Reserve Bank and the banking system. The support of the banking system to the Government's borrowing programme took the form of a progressive increase in statutory liquidity ratio (SLR). Although interest rates - initially kept artificially low to contain the interest cost of public debt - on Government securities were steadily raised to enhance their attractiveness to the market, it got increasingly difficult to get voluntary subscriptions even at higher rates of return. The SLR, therefore, was raised to 38.5 per cent by the early 1990s4. The increase in the SLR was, however, unable to fully meet the fiscal requirements and the burden of financing the Government had also to be borne by the Reserve Bank. As Reserve Bank financing is inflationary beyond a limit, the increase in the Reserve Bank support to the Central Government was accompanied by an increase in cash reserve requirements (CRR). The CRR was increased from three per cent in the early 1970s to reach 15 per cent (in fact, 25 per cent if incremental reserve requirements are also taken into account) by the early 1990s. However, even this order of increase in the CRR to impound liquidity was insufficient and broad money growth continued to remain high during the 1970s and 1980s and spill over to inflation.

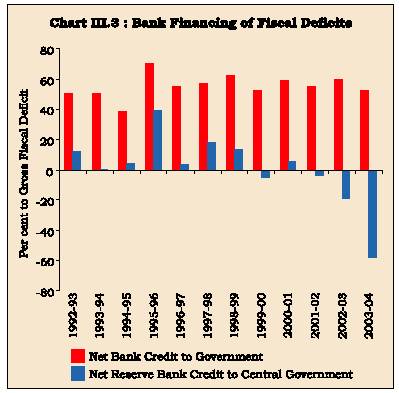

3.44 As discussed in Section I, there are limits to the effectiveness of monetary policy in containing inflation in the face of an expansionary fiscal policy. Accordingly, monetary-fiscal coordination is often emphasised in order to achieve price stability. In India too, following the balance of payments crisis of the early 1990s, structural reforms addressed the issue of imparting monetary policy greater flexibility. This was done through, inter alia, raising market borrowings at market-related yields and the phasing out of the automatic monetisation through ad hocs. These measures were able to reduce the reliance on the Reserve Bank significantly from mid-1990s onwards5 . It is now clear that the Reserve Bank is able to control the timing and form of its accommodation to the Government. The more critical issue is whether the Reserve Bank would be able to contain the volume of its support to the Government, once liquidity conditions change - either because domestic credit demand picks up or capital flows dry up. Not only is the Centre's fiscal deficit still substantial, but the share of net bank credit to the Government in financing the fiscal deficit remains high (Chart III.3). Monetary management, however adroit, and monetary-fiscal co-ordination, however seamless,

5 Other factors such as strong capital flows, weak credit demand and risk aversion by banks also lowered the recourse to monetisation. This, in turn, implies that commercial banks hold a large proportion of long-term Government paper although their deposit liabilities are usually short, creating an inherent maturity mismatch in commercial bank balance sheets. As their demand for longer-term assets is already met by investments in government paper, the ability of commercial banks to fund infrastructure financing is also thus limited (Mohan, 2004a) (see Chapter IV).

cannot thus be a substitute for fiscal discipline (Jadhav, 2003) (Box III.6). It is for these reasons that, as discussed in Section I, several countries have put in place fiscal responsibility legislation which, inter alia, place limits on fiscal deficits to guard against fiscal profligacy.

3.45 As in other economies, the fiscal-monetary coordination in India has been strengthened through the enactment of the FRBM Act, 2003. The FRBM Act, while placing limits on deficits, prohibits borrowings from the Reserve Bank from the fiscal year 2006-07 except by way of WMA or under exceptional circumstances. The

Box III.6

Monetary and Fiscal Co-ordination: The Indian Experience

The evolving relationship between the Reserve Bank and the Government over time can be analytically divided into four distinct phases (Reddy, 2001a). These span the periods of i) 1935-48, ii) 1948-69, iii) 1969-91 and iv) 1991 onwards. Interestingly, the proposal to set up a central bank, originally made by the Royal Commission on Indian Currency and Finance (Chairman: Sir Edward Hilton Young) in 1926, was itself long held up partly on account of the debates over the precise mechanism, which would ensure the independence of the central bank from the budgetary demands of the fisc (Deshmukh, 1948; RBI, 1970; Rangarajan, 1993)6.

During the first phase, the Reserve Bank, although set up as a privately owned and managed entity, was virtually subservient to the dictates of the British Indian Government, especially in view of the war effort. This was demonstrated by a Government threat to supersede the Reserve Bank board if it did not recommend monetary and exchange rate policies compatible with fiscal policy (RBI, 1970).

The second phase began with the nationalisation of the Reserve Bank in 1948. The pressure on public finances, emerging from the programme of large-scale industrialisation taken up in the Second Five Year Plan, led the Government to turn increasingly to the Reserve Bank for financing its deficit. It is during this phase that the process of automatic financing of the fiscal deficit through ad hoc Treasury Bills as and when the Government balances fell below a stipulated minimum took root (RBI, 1983). This led to persistent deficit financing with inflationary consequences.

Fiscal dominance increased further during the 1970s and 1980s. The entire financial system came to be geared to funding the budgetary requirements of the fisc. The continuous process of monetisation of the fiscal deficit, in particular, ended up effectively subjugating monetary policy to the imperatives of fiscal policy. It was in this context that the Chakravarty Committee (RBI, 1985) recommended a cap on the net Reserve Bank credit to the Government.

The fourth phase, co-incident with the programme of financial sector reforms, has been redrawing the institutional relationship between the Reserve Bank and the Central Government to ease the fiscal constraint on monetary policy (Rangarajan, 1993). An important initial step in this was the process of pricing Government debt at market-determined rates (Tarapore, 2002). This was supported by the development of a Government securities market. The emergence of a Government securities market enabled, and in turn was facilitated, by the reduction in SLR to the statutory minimum of 25.0 per cent of net demand and time liabilities. The investments in Government paper are now guided, to a large extent, by portfolio considerations, rather than administrative fiat (Reddy, 1999). Ad hoc Treasury Bills were phased out in April 1997 with a view to enabling the Reserve Bank to gain better control over money supply. During this period, the Reserve Bank adopted a strategy of combining private placements and devolvements in Government securities in order to moderate the impact of fluctuations in monetary conditions on the interest cost of public debt.

The Finance Minister, in the Union Budget Speech, 2000-01 announced that in the fast changing world of modern finance it had become necessary to accord greater operational flexibility to the Reserve Bank for the conduct of monetary policy and regulation of the financial system. A key step forward in this respect has been the enactment of the Fiscal Responsibility and Budget Management (FRBM) Act, 2003 which, inter alia, prohibits borrowings from the Reserve Bank from the fiscal year 2006-07 except by way of WMA or under exceptional circumstances. This is backed by limits on the fiscal deficit. The FRBM Act also seeks to eliminate the revenue deficit by March 2008.

6 The need for central bank independence was, in fact, prophetically stressed by the Government while piloting the Reserve Bank of India Act, 1934: '….It has generally been agreed in all the constitutional discussions, and the experience of all other countries bears this out, that when the direction of public finance is in the hands of a ministry responsible to a popularly elected Legislature, a ministry which would for that reason be liable to frequent change with the changing political situation, it is desirable that the control of currency and credit in the country should be in the hands of an independent authority which can act with continuity. Further, the experience of all countries is again united in leading to the conclusion that the best and indeed the only practical device for securing this independence and continuity is to set up a Central Bank, independent of political influence….(In) modern life, and modern economic organisations, there are two important functions: they are the functions of those who have to raise and use money and there are the functions of those who are responsible for producing the actual tokens of money, the money in circulation. The basis of the whole proposal for setting up an independent Central Bank is to keep these functions separate. The largest user of money in the country is the Government, and the whole principle of the proposal is that the Government, when it wants money to spend, should have to raise that money by fair and honest means in just the same way as every private individual has to raise money which he requires to spend for his own maintenance. If the Government is in control of the authority which is responsible for exercising the other function, then all sorts of abuses can intervene'.

Reserve Bank would, however, still be able to buy or sell Government securities in the secondary market consistent with the conduct of monetary policy. In exercise of the powers of the Act, the Central Government has framed the FRBM Rules, 2004. In the Fiscal Strategy Statement, the Government proposes to assist the Reserve Bank in restraining the growth in money supply without damaging the medium/long-term prospects of savings in the economy and without hurting the interests of the poor, senior citizens and other fixed-income earners.

3.46 To conclude, price stability has been an abiding objective of monetary policy in India although its achievement was circumscribed by the fiscal dominance of monetary policy till the mid-1990s. In the subsequent years, the reforms in the monetary-fiscal interface have been successful in providing the Reserve Bank greater flexibility in monetary management. A key development in this regard was the accord between the Government and the Reserve Bank in 1994 that eliminated the automatic monetisation of the Central Government's fiscal deficit by gradually phasing out ad hocs by 1997. The most noteworthy endeavour in this direction is the enactment of the FRBM Act. Adherence to FRBM targets is critical for the objective of maintaining price stability, and more importantly, to stabilise inflation expectations in the economy.

Intermediate Targets

3.47 As indicated earlier in Section I, central banks seek to achieve their final objectives through the control of intermediate targets. In India, these targets have evolved over time with changes in the overall operating environment of monetary policy and financial liberalisation of the Indian economy. This subsection presents a brief overview of the evolution of the intermediate targets - from broad money to a multiple indicator approach - in the conduct of the Reserve Bank's monetary policy.

3.48 The Reserve Bank did not have a formal intermediate target till the 1980s. Bank credit - aggregate as well as sectoral - came to serve as a proximate target of monetary policy after the adoption of credit planning from 1967-68 (Jalan, 2002). Credit targeting, in fact, wove well into the concept of development central banking. Since inflation was largely thought to be structural, selective credit controls were used, from 1956, to regulate bank advances to sensitive commodities to influence production outlays, on the one hand and to limit possibilities of speculation, on the other. A Credit Authorisation Scheme (CAS), introduced in November 1965, required commercial (and later, co- operative banks, since 1974) banks to seek the Reserve Bank's prior approval before sanctioning large working capital limits. This additional measure of credit regulation was expected to perform the multiple objectives of keeping inflationary pressures under check and ensuring that credit was directed to genuine purposes. The elaborate process of credit regulation, however well intentioned, was not only the cause of delays in credit disbursal but also impeded efficient resource allocation by segmenting credit markets [Marathe Committee (RBI, 1983); Chakravarty Committee (RBI, 1985)]. It was in this context that the requirement of prior authorisation in respect of credit limits exceeding a threshold level under the Credit Authorisation Scheme was replaced by a system of post-sanction scrutiny in 1988. Selective credit controls were also abolished in the 1990s.

3.49 During the early 1960s, even as the analytics of money supply continued to be governed by the expansion in credit, the Reserve Bank began to pay greater attention to the movements in monetary aggregates. This accent on monetary aggregates was supported by several empirical studies which provided evidence of a stable money demand function in the Indian economy (Vasudevan 1977; Jadhav 1994). By the early 1980s, there appeared to be a consensus that while fluctuations in agricultural prices and oil price shocks did affect prices, continuous inflation of the kind witnessed since the early 1960s could not occur unless it was sustained by the continuous excessive monetary expansion generated by the large-scale monetisation of the fiscal deficit.

3.50 Against this backdrop, the Chakravarty Committee recommended a monetary targeting framework to target an acceptable order of inflation in line with output growth (RBI, 1985). Changes in broad money were thought to provide reasonable predictions of average changes in prices over a medium-term horizon of 4-5 years, though not necessarily on a year-to-year basis. It was, in fact, argued that in the absence of a stable money demand function, the role of monetary policy in inflation management would itself be negligible. Thus, broad money emerged as an intermediate target of monetary policy and the Reserve Bank began to formally set monetary targets in order to rein in inflation. As the process of money creation is simultaneously a process of credit creation, it was also necessary to estimate the increase in credit required by the projected increase in output. The concept of monetary targeting adopted by the Reserve Bank was a flexible one allowing for various feedback effects.

3.51 The process of financial liberalisation, which gathered momentum in the 1990s, necessitated a re-look at the efficiency of broad money as an intermediate target of monetary policy. The Reserve Bank's Monetary and Credit Policy Statement of April 1998 noted that most studies in India show that money demand functions have so far been fairly stable. At the same time, it observed that financial innovations emerging in the economy provided some evidence that the dominant effect on the demand for money in the near future need not necessarily be real income, as in the past. Interest rates too seemed to exercise some influence on the decisions to hold money. In a similar vein, the Working Group on Money Supply: Analytics and Methodology of Compilation (Chairman: Dr. Y.V. Reddy) observed that monetary policy exclusively based on the demand function for money could lack precision (RBI, 1998a) (Box III.7).

3.52 The Reserve Bank, therefore, formally adopted a multiple indicator approach in April 1998. Besides broad money which remains an information variable, a host of macroeconomic indicators including interest rates or rates of return in different markets

Box III.7

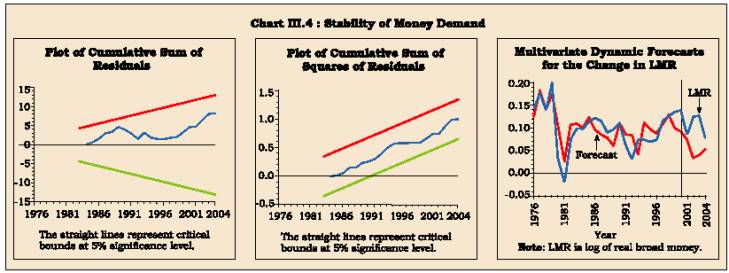

Stability of Money Demand

In India, broad money emerged as an intermediate target of monetary policy from the mid-1980s following the recommendations of the Chakravarty Committee (RBI, 1985). The monetary targeting framework was based on the premise of a stable relationship between money, output and prices. At the same time, in view of ongoing financial innovations, a view emerged that monetary policy exclusively based on the demand function for money could lack precision. This necessitated a switch to a multiple indicator approach in which broad money remains an important information variable in the conduct of monetary policy. Notwithstanding this shift, the Reserve Bank's monetary policy statements continue to provide an indicative trajectory of broad money growth. Amongst the recent studies, Joshi and Saggar (1995), Arif (1996), Mohanty and Mitra (1999) and Das and Mandal (2000) found evidence in favour of money demand stability while Bhoi (1995) and Pradhan and Subhramanian (2003) found that financial deregulation and liberalisation in the 1990s did affect the empirical stability of broad money demand.

Against this backdrop, an attempt is made to examine stability of money demand in India. Following the literature, real broad money is postulated to depend upon real GDP. In order to assess the role of interest rates, the interest rate on deposits of 1-3 years maturity is included. As these variables turn out to be non-stationary, cointegration analysis is undertaken in the Johansen-Jesuelius framework, using annual data from 1975-76 to 2003-04. Based on trace as well as maximum eigenvalue tests, the null hypothesis of a single cointegrating vector cannot be rejected. The coefficients of the cointegrating vector have the expected signs7 . Real money demand increases with real GDP and the estimated coefficient - although it cannot be interpreted as the elasticity - is close to the various estimates of income elasticity of money demand in India. As regards the interest rate, its coefficient is positive. This reflects the fact that time deposits are the predominant component of broad money and an increase in the interest rate on these deposits, therefore,

leads to a shift of financial assets towards bank deposits. This analysis, therefore, confirms that real money and output are cointegrated, i.e., there exists a long-run relationship between these variables.

Following this, the short-run dynamics are examined using an error correction model. Results indicate that real GDP and interest rates are weakly exogenous to the system. As regards real money, the error correction results show that the coefficient on the error correction term is negative and statistically significant (t-value is 4.0)8 . Stability properties of the short-run model are examined by employing CUSUM and CUSUM SQUARE tests. Both these tests indicate that the path of the parameters has been within the two standard error bands (Chart III.4). While this supports the stability of the parameters, the path of the parameters is not exactly horizontal. However, as noted by the Working Group on Money Supply (RBI, 1998), the predictive stability is equally important. Towards this purpose, the model is re-estimated up to 1999-2000 and multivariate dynamic forecasts for change in broad money are evaluated. As Chart III.4 indicates, the model under-predicts the demand for money. A number of factors may explain this behaviour. First, inflation has come down significantly since the second half of the 1990s and this could have increased the real demand for money. Second, monetary aggregates are inclusive of nonresident deposits and movements in these deposits have varied a lot from year-to-year, mainly in response to policy efforts to modulate these deposits. Third, the mergers in the banking industry have provided a jump to monetary aggregates. From these factors, it is evident that in the short-run, there can be deviations from the long-run equilibrium relationship. These results thus support the conclusions of RBI (1998) that monetary policy based solely on broad money could lack precision. At the same time, given the long-run relationship, there is a role for monetary aggregates to play. Accordingly, a multiple indicator approach in which broad money remains an important information seems to be appropriate.

7 LMR = -9.6 + 1.32 LGDPR + 0.02 DR

MR, GDPR and DR are real broad money, real GDP and nominal interest rate on

deposits of 1-3 years. The prefix L denotes that variables are in logs. The

VAR was estimated with three lags.

8 DLMR = 0.04 DLMR(-1) + 0.53 DLGDPR(-1) - 0.01 DDR(-1) + 0.08 DLMR(-2)

+ 0.05 DLGDPR(-2) + 0.003 DDR (-2) – 0.16 ECM(-1)–

R2 = 0.26 DW = 1.5

The variables are defined in the previous footnote. The prefix D denotes that

variables are in first-difference form while ECM is the error correction term.

3.53 This large panel of indicators is sometimes criticised as a 'check list' approach, which tends to water down the concept of a nominal anchor for monetary policy. It is certainly true that a single intermediate target is much more theoretically appealing and operationally easier. At the same time, it is very difficult to find a variable, which would be able to encapsulate the larger number of factors, which need to go into monetary policy making at this stage of transition from a relatively autarkic administered economy to a relatively open market-oriented economic system. As channels of monetary policy transmission shift course as a result of financial liberalisation, the central bank has to naturally operate through all the paths that transmit its policy impulses to the real economy. As discussed in Section I, given the environment of high uncertainty in which monetary authorities operate, a single model or a limited set of indicators is not a sufficient guide for the conduct of monetary policy. The multiple indicators approach provides the required 'encompassing and integrated set of data'.

Operating Procedures of Monetary Policy

3.54 With the shift away from the monetary targeting framework towards a multiple indicator approach, the operating procedures of monetary policy in India have undergone a significant shift. In particular, short-term interest rates have emerged as instruments to signal the stance of monetary policy. In order to stabilise short-term interest rates, the Reserve Bank now modulates market liquidity to steer monetary conditions to the desired trajectory. This is achieved by a mix of policy instruments including changes in reserve requirements and standing facilities and open market (including repo) operations which affect the quantum of marginal liquidity and changes in policy rates, such as the Bank Rate and reverse repo/repo rates, which impact the price of liquidity.

3.55 The Reserve Bank had originally conducted its monetary policy through a standard mix of open market operations and changes in the Bank Rate. The fiscal dominance during the 1970s and the 1980s changed the contours of the operating framework of monetary policy. A natural corollary was that the Reserve Bank's traditional instruments, the Bank Rate and open market operations, began to loose their efficacy. As a consequence, the Reserve Bank began to turn to changes in reserve requirements in order to modulate monetary conditions.

3.56 India, like most emerging market economies, saw a structural shift in the financing paradigm in the 1990s. The Ninth Five Year Plan recognised that the role of the financial system would have to be upgraded from mere channelisation to allocation of resources in order to reap the benefits of higher growth. In order to infuse a degree of efficiency in the allocation of resources by the financial system, the Reserve Bank initiated a multi-pronged strategy of institutional reforms to rekindle the process of price discovery in the financial markets (Reddy, 2002).

3.57 First, the Reserve Bank began to deregulate interest rates, beginning with the removal of restrictions on the inter-bank market as early as 1989. This was supported by the process of putting the market borrowing programme of the Government through the auction process in 1992-93. This was buttressed by a phased deregulation of lending rates in the credit markets. At present, banks are free to fix their lending rates on all classes of loans except small loans below Rs.2 lakh and expor t credit. The deregulation of deposit rates began later, especially as an incipient attempt in the late 1980s ended in a price war between banks. Banks are now free to offer interest rates on all classes of domestic deposits (except savings deposits), not only in terms of tenor but also in terms of size. Interest rates on non-resident deposits are linked to international interest rates and these are modulated from time to time, depending on the macroeconomic - including the balance of payments - scenario.

3.58 Second, the process of interest rate deregulation had to be supported by the development of market architecture, especially to address the problem of missing markets at the short end. Two key reasons explain as to why short-term instruments were not actively traded. First, the system of cash credit shifted the onus of cash management from the borrowers to the banks. Second, the availability of fixed rate 4.6 per cent Treasury Bills, with a discounting facility from the Reserve Bank, on tap, in turn, allowed banks to pass the fluctuations in liquidity onto the Reserve Bank balance sheet. To overcome these shortcomings, the Reserve Bank began to introduce a number of money market instruments, such as commercial paper, short-term Treasury Bills and cer tificates of deposits following the recommendations of the Working Group on the Money Market (Chairman: Shri N. N. Vaghul). The process of replacing cash credit with term loans, phasing out of fixed rate tap Treasury Bills and the development of a repo market outside the Reserve Bank is gradually generating a vibrant set of markets at the short end of the interest rate spectrum.

3.59 Third, the introduction of new instruments was buttressed by the parallel process of market development, beginning with the institution of the Discount and Finance House of India as a market maker with two-way quotes in the money markets. Although the call money market was initially widened by introducing non-bank participants, they are now being phased out in tandem with the parallel development of a repo market outside the Reserve Bank. The emergence of a vibrant Government securities market, in particular, has played a key role.

3.60 Fourth, with a view to deepening inter-linkages, the development of markets was supported by withdrawal of balance sheet restrictions which had tied financial intermediaries to their primary segments of the financial markets. Banks now operate across all the segments of the financial markets, including equity and foreign exchange markets, albeit with prudential limits on their exposures.

3.61 In brief, the liberalisation of the Indian economy required a comprehensive recast of the operating procedures of monetary policy. The Reserve Bank had to shift from direct to indirect instruments of monetary policy in consonance with the increasing market orientation of the economy (Reddy, 1999, 2001 and 2002; Kanagasabhapathy, 2001). This required development of an array of monetary policy instruments, which could effectively modulate monetary conditions in alignment with the rejuvenated process of price discovery. Besides, shifts in monetary policy transmission channels necessitated policy impulses which would travel through both quantum and rate channels. Finally, the episodes of volatility in the foreign exchange markets emphasised the need for swift policy reactions balancing the domestic and external sources of monetisation in order to maintain orderly conditions in the financial markets. Even within the set of indirect instruments, the preference is for relatively more market-based instruments such as open market operations. Accordingly, the cash reserve ratio (CRR) has been gradually lowered from 15 per cent in the early 1990s to five per cent by 2004, notwithstanding minor upward adjustments to deal with the evolving liquidity situation in the economy. As the Reserve Bank's Internal Working Group on Instruments for Sterilisation noted, the use of CRR as an instrument of sterilisation, under extreme conditions of excess liquidity and when other options are exhausted, should not be ruled out altogether by a prudent monetary authority ready to meet all eventualities (RBI, 2004a).

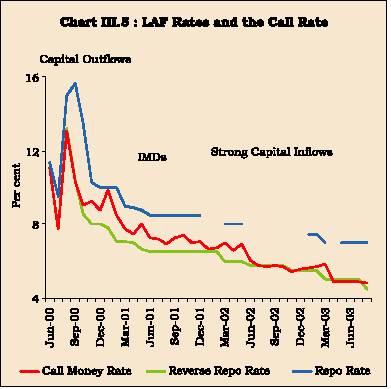

3.62 The Reserve Bank is now able to influence short-term interest rates by modulating the liquidity in the system through repo operations under the Liquidity Adjustment Facility, reinforced by interest rate signals (Box III.8) (RBI, 2000; Sen Gupta, Bhattacharyya, Sahoo and Sanyal, 2000; Dua, Raje and Sahoo, 2003). The Reserve Bank has been largely able to enforce the interest rate corridor defined by the reverse repo rate, the price at which it absorbs liquidity and the repo rate/Bank Rate, the price at which it injects liquidity9 (Chart III.5).

Box III.8

Facets of Liquidity Management

The Liquidity Adjustment Facility (LAF), introduced in June 2000, allows the Reserve Bank to manage market liquidity on a daily basis and also transmit interest rate signals to the market. The LAF, initially recommended by the Committee on Banking Sector Reforms (Chairman: Shri M. Narasimham), was introduced in stages in consonance with the level of market development and technological advances in payment and settlement systems. The first challenge was to combine the various sources of liquidity available from the Reserve Bank into a single comprehensive window, with a common price. An Interim Liquidity Adjustment Facility (ILAF), introduced in April 1999 as a mechanism for liquidity management through a combination of repo operations, export credit refinance facilities and collateralised lending facilities supported by open market operations at set rates of interest, was upgraded into a full-fledged LAF. Most of the alternate provisions of primary liquidity have been gradually phased out and even though export credit refinance is still available, it is linked to the repo rate since March 2004. Accordingly, the LAF has now emerged as the principal operating instrument of monetary policy.

Analytically, the LAF experience with market stabilisation can be partitioned into multiple sets of roles (Jadhav, 2003). First, the LAF stabilises regular liquidity cycles, by allowing banks to tune their liquidity requirements to the averaging requirements over the reporting fortnight and smoothening liquidity positions between beginning-of-the-month drawdown of salary accounts to fund household spending and end-of-the-month post-sales bulge in business current accounts.

Second, it irons out seasonal fluctuations. It injects liquidity during quarterly advance tax outflows or at end-March, when banks avoid lending on call, which adds to their Capital to Risk-Weighted-Assets Ratio (CRAR) requirements. It mops up liquidity in April to counter the typically large ways and means advances drawn by the Government prior to the inception of its borrowing programme. Third, it modulates sudden liquidity shocks, by injecting liquidity on account of say, temporary mismatches arising out of timing differences between outflows on account of Government auctions and inflows on account of redemptions. Fourth, the LAF has emerged as an effective instrument for maintaining orderly conditions in the financial markets in the face of sudden capital outflows to ward off the possibility of speculative attacks in the foreign exchange market. Fifth, by funding the Government through private placements and mopping up the liquidity by aggressive reverse repo operations at attractive rates, the LAF helps to minimise the impact of market volatility on the cost of public debt. Sixth, the LAF bore much of the burden of sterilisation in the face of sustained capital flows, especially since November 2000, by mopping up bank liquidity through reverse repos and at the same time, gradually reducing reverse repo rates to enable a softening of the interest rate structure. Finally, the Reserve Bank tailors monetary policy action through both quantum and rate channels of transmission. The LAF accords the Reserve Bank the operational flexibility to alter the liquidity in the system (by rejecting bids) as well as adjusting the structure of interest rates (through fixed rate operations) in response to evolving market circumstances.

3.63 Persistent capital inflows that India experienced since 2001-02 posed a challenge to the LAF operations. In view of large capital flows, the LAF emerged as the key instrument of managing capital flows through sterilisation. This was reflected in the outstanding reverse repo amount which increased from Rs.2,415 crore as at end-March 2003 to Rs. 62,995 crore by late March 2004 and further to Rs. 89,435 crore by mid-April 2004. Thus, instead of absorbing liquidity of a short-term and temporary nature, the LAF window was absorbing funds of a relatively more enduring nature. In order to address these issues, an Internal Group of the Reserve Bank reviewed the operations of the LAF in a cross-country perspective, keeping in view recent developments in the financial markets as well as in technology. The Group noted that it is difficult to distinguish

operationally between the sterilisation operations and liquidity management operations under the LAF. Nonetheless, it emphasised the need to conceptually distinguish surplus liquidity of 'temporary' nature arising from banks' cash management practices from surplus liquidity of a somewhat 'enduring' nature arising from sustained capital inflows. The Group also added that it would be desirable to de-emphasise the passive sterilisation attribute of the LAF-reverse repo facility so that it could emerge as the exclusive policy signalling rate. Accordingly, it felt a need for adequate instruments of sterilisation in addition to the liquidity management facilities and, recommended, inter alia, introduction of a standing deposit facility (Box III.9).

3.64 Pursuant to the recommendations of the Internal Working Group on LAF as well as the Internal Working Group on Instruments for Sterilisation (RBI, 2003b), a Market Stabilisation Scheme (MSS) was introduced in April 2004. Under this scheme, Government of India dated securities of a maturity of less than two years (so far) and Treasury Bills are being issued to absorb liquidity (see Chapter IV). As on December 10, 2004, the outstanding issuances under the MSS were Rs.51,334 crore, the pressure on the LAF window has gradually come down. The outstanding reverse repo amount, therefore, fell from Rs. 89,435 crore (mid-April 2004) to only Rs. 15,820 crore by December 10, 2004. The issuance of securities under the MSS enables the Reserve Bank to improve liquidity management in the system, to maintain stability in the foreign exchange market and to conduct monetary policy in accordance with the stated objectives.

3.65 The Indian experience underscores the need for constant innovation in terms of instruments and operating procedures for effective monetary management. Apart from introduction of innovative instruments such as the MSS, the policy framework has evolved in response to the changing environment. Illustratively, the interest rates in the LAF auctions were initially allowed to emerge from the bids, with the Reserve Bank holding occasional fixed rate auctions to transmit interest rate signals. As market players began to bid at the prices signalled by the Reserve Bank, the de jure market-determined LAF rates began to turn into de facto fixed rates. It is in this context that the Reserve Bank switched to a fixed auction format in March 2004. Second, while the reverse repo rate, acted as the floor, the practice of supplying liquidity at multiple rates, e.g., the Bank Rate and the repo rate, implied that there was no unique ceiling. It is in this context that the Reserve Bank has increasingly been resorting to pricing its liquidity at the repo rate, in recent years. Apart from WMA which are still at the Bank Rate, all other forms of liquidity support are at the repo rate.

Box III.9

Internal Group to Review the Liquidity Adjustment Facility: Recommendations

In the light of substantial technological developments, the objective of conducting LAF operation on real-time basis needs to be pursued further.

Introduction of a deposit facility to afford more flexibility to the Reserve Bank in using the reverse repo facility as a signalling device while not sacrificing the objective of the provision of a floor to the movement of short-term interest rates. As the Reserve Bank of India Act, 1934 in its present form does not permit the Reserve Bank to borrow on a clean basis from banks and pay interest thereon, this would necessitate a suitable amendment to the Reserve Bank Act.

Pending amendments to the Reserve Bank Act, the Reserve Bank should explore possibilities of modifying the current CRR provision to accommodate a standing deposit type facility - placement of deposits at the discretion of banks unlike CRR which is applicable to all banks irrespective of their liquidity position.

The remuneration of CRR, if any, could be delinked from the Bank Rate and placed at a rate lower than the reverse repo rate.

The minimum tenor of the repo/reverse repo operations under the LAF facility should be changed from overnight to 7 days to be conducted on daily basis to enable balanced development of various segments of money market.

The LAF auction could be a fixed rate auction enhancing its policy signalling rate, with the flexibility to revert to variable price auction format.

The Bank Rate under normal circumstances should be aligned to the repo rate and, therefore, the entire liquidity support including refinance should be made available at the repo rate/Bank Rate.

With intra-day liquidity (IDL) available under the RTGS system, the timing of LAF could be shifted to the middle of the day, say, 12 noon to ensure that marginal liquidity is kept in the system for a longer time. To take care of unforeseen contingencies, the Reserve Bank may consider discretionary announcement of timing of both repo auctions and reverse repo auctions at late hours.

As proposed by the Reserve Bank’s Working Group on Instruments of Sterilisation, Market Stabilisation Bills/ Bonds (MSBs) could be issued for mopping up enduring surplus liquidity from the system over and above the amount that could be absorbed under the day-to-day reverse repo operations of the LAF. The maturity, amount, and timing of issue of MSBs may be decided by the Reserve Bank in consultation with the Government depending, inter alia, on the expected duration and quantum of capital inflows, and the extent of sterilisation of such inflows.

3.66 The changes in the operating procedure of Reserve Bank's monetary policy in tune with financial sector reforms during the 1990s have impacted its balance sheet in terms of size and composition and sources of income and expenditure (Reddy, 1997). In consonance with the international experience, the programme of financial liberalisation was accompanied by several measures to further strengthen the health of the Reserve Bank balance sheet, especially as monetary policy emerged as the principal instrument of macroeconomic stabilisation (RBI, 2004b; Jadhav et al, forthcoming) (Box III.10 and Table 3.9).

Box III.10

The Reserve Bank's Balance Sheet during the 1990s

The process of financial liberalisation during the 1990s was accompanied by several measures to further strengthen the Reserve Bank's balance sheet and financial position. The pursuance of the already conservative accounting norms was accompanied by greater disclosures in the interest of transparency. Over the past few years, the Reserve Bank has recognised the need to proactively build up its internal reserves, i.e., Contingency Reserve (CR) and Asset Development Reserve (ADR), in order to ensure a sound balance sheet and undertake monetary and exchange operations without any overriding concerns on the impact of such operations on the balance sheet. The Reserve Bank, as per the current policy, aims at an indicative target of CR at 12 per cent of total assets by June 2005. This would provide cushion with respect to losses which cannot be absorbed by current earnings arising out of central bank operations/ interventions in the money, Government securities and foreign exchange markets and depreciation of domestic/foreign securities held by the Reserve Bank.

The size and composition of the Reserve Bank's balance sheet underwent significant shifts during the 1990s and thereafter. The asset size increased fivefold to Rs.6,09,738 crore as at end-June 2004 from Rs.1,23,836 crore as at end-June 1991. On the asset side, the share of foreign currency assets and gold in the total assets increased to 89.1 per cent as at end-June 2004 from 8.9 per cent as at end-June 1991, reflecting mainly the consistently overall balance of payments surplus throughout the intervening period.

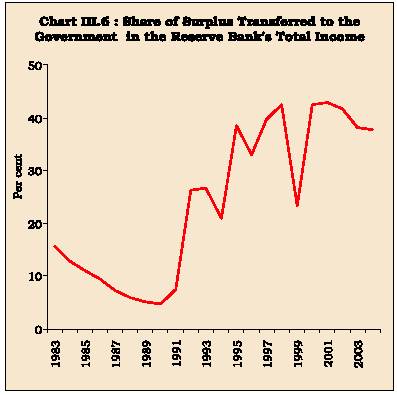

The structural changes in the composition of the Reserve Bank's assets were reflected in an increase in the share of income from foreign sources in total income. Besides, changes in the manner of conducting monetary operations have impacted the composition of income from domestic sources. Furthermore, financial market deregulation has enhanced the interest sensitivity of domestic income. The Reserve Bank's total income declined to 2.3 per cent of its assets as at end-June 2004 from 3.7 per cent during 1990-91, reflecting mainly the dominance of foreign currency assets, which carry relatively lower interest in comparison with domestic assets comprising largely Government securities (RBI, 2004b). Total expenditure declined to 1.3 per cent of assets as at end-June 2004 from 2.6 per cent as at end-June 1991, mainly as a result of decline in the interest outgo on the eligible CRR balances. The share of the surplus transferred to the Government in the total income has increased during the latter half of the 1990s but simultaneously with higher transfers to internal reserves (Chart III.6).

The increasing market orientation of monetary management was accompanied by greater balance sheet transparency in line with international best practices. The Reserve Bank follows conservative valuation and income recognition norms. Its holdings of both domestic and foreign securities are valued each month end at the market price or book value, whichever is lower. Foreign currency assets are revalued every week to take into account the impact of exchange rate changes. The resultant revaluation gain/loss is parked in a separate balance sheet head called the Currency and Gold Revaluation Account. Gold is similarly revalued at the end of the month at 90 per cent of the daily average price quoted at London for the month. Over the years, significant disclosures in respect of the Reserve Bank's accounts have been enhanced markedly in line with international best practice. These relate to i) details of interest income and interest expenditure in the Profit and Loss Account (since 1990); ii) statement of significant accounting policies and notes to accounts (since 1992); and iii) details of other assets and liabilities and contingency reserves (since 1993). The Advisory Group on Transparency in Monetary and Financial Policies (Chairman: M. Narasimham) observed that data dissemination by the Reserve Bank, including the balance sheet, bear up well in comparison with central banks in developed countries.

|

Table 3.9: Reserve Bank’s Capital Account |

|||||||

|

Per cent to total assets |

|||||||

|

End- |

Capital |

Contingency Reserves |

Currency and |

Exchange |

Total |

Memo Item: |

|

|

June |

Paid-up and |

(including Asset |

Gold Revaluation |

Equalisation |

National |

||

|

Reserves |

Development Reserve) |

Account |

Account |

Funds |

|||

|

1 |

2 |

3 |

4 |

5 |

6 = |

7 |

|

|

1+2+3+4+5 |

|||||||

|

1991 |

5.2 |

4.5 |

2.9 |

4.4 |

17.1 |

4.7 |

|

|

1996 |

2.8 |

3.3 |

5.1 |

1.2 |

12.3 |

2.5 |

|

|

2004 |

1.1 |

10.2$ |

10.2 |

0.0 |

21.5 |

0.1 |

|

|

$Includes previous balances under the National Industrial Credit (Long-Term

Operations) Fund. |

|||||||

III. CONCLUDING OBSERVATIONS

3.67 It is now widely agreed that monetary policy can contribute to sustainable economic growth by maintaining low and stable inflation. Within this overall objective of price stability, central banks attempt to stabilise output around its potential. In order to create enabling conditions for low and stable inflation as well as inflation expectations, there is an emerging consensus to secure the independence of monetary policy from the budgetary requirements of the fisc. A number of countries now limit Government access to central bank financing, reinforced by fiscal responsibility legislation.

3.68 With the growing globalisation and integration of economies, monetary authorities are now required to pay greater attention to external developments. Swings in trade flows and, especially capital flows are quite common and these impart a high degree of volatility to exchange rates. Even in an environment of price stability, the 1990s witnessed episodes of financial instability. The presumption that price stability ensures financial stability is thus not true, at least in the short-run. Ensuring orderly conditions in financial markets and maintenance of systemic financial stability has thus emerged as an important objective of monetary policy, even for central banks not involved with banking regulation and supervision.

3.69 Financial innovations have also impacted upon the conduct of monetary policy. In consonance with the preference for a degree of operational flexibility in a complex macroeconomic environment, most central banks are beginning to eschew setting unique intermediate targets or following some fixed rule of monetary policy. They, instead, prefer to monitor a range of macroeconomic indictors, which carry information about the ultimate objectives. Short-term interest rates have emerged as operative target/ instruments of monetary policy. Most central banks now prefer to manage liquidity to steer monetary conditions in consonance with the overall policy objectives of price stability and growth. Central banks usually forecast market liquidity and then conduct open market operations to impact the interest rate structure to affect the real economy. Along with these developments, central banks have strengthened their balance sheets in order to be able to meet unforeseen contingencies that may arise from their market operations.

3.70 In India, the opening up of the economy in the early 1990s had a significant impact upon the conduct of monetary policy. Price stability remains the key objective of monetary policy and there is virtually a national consensus that high inflation is not good. Inflation expectations and inflation tolerance have come down. Adherence to the Fiscal Responsibility and Budget Management Act should stabilise inflation expectations and hence contribute to the objective of price stability. While adequate availability of credit to meet investment demand continues to remain an important objective, the growing integration of the Indian economy with the global economy has led to financial stability emerging as a key consideration in the conduct of monetary policy. Although there are complementarities between the objectives in the long run, there are certain trade-offs in the short run.

3.71 In order to meet challenges thrown by financial liberalisation and the growing complexities of monetary management, the Reserve Bank switched from a monetary targeting framework to a multiple indicator approach. Short-term interest rates have emerged as indicators of the monetary policy stance. A significant shift is the move towards market-based instruments away from direct instruments of monetary management. In line with international trends, the Reserve Bank has now put in place a liquidity management framework in which market liquidity is now modulated through a mix of open market (including repo) operations and changes in reserve requirements and standing facilities, reinforced by changes in the policy rates, including the LAF rates and the Bank Rate. These arrangements have been quite effective in the recent years in managing liquidity in the system, especially in the context of persistent capital flows. The introduction of the Market Stabilisation Scheme has provided further flexibility to the Reserve Bank in its market operations.

3.72 As monetary policy emerges as the primary instrument of macroeconomic stabilisation, the Reserve Bank, like most other central banks, has initiated several measures to strengthen the health of its balance sheet. Over the past few years, the process of monetary policy formulation has become relatively more articulate, consultative and participative with external orientation, while the internal work processes have also been re-engineered. The stance of monetary policy and the rationale are communicated to the public in a variety of ways, the most important being the monetary policy statements. The communications strategy and provision of information have facilitated conduct of monetary policy in an increasingly market-oriented environment.

3.73 To conclude, while financial and external liberalisation present opportunities, they also throw challenges for policy authorities. Monetary authorities are increasingly required to take cognisance of not only domestic shocks but also external shocks. Given their objectives, central banks are required to monitor various segments of financial markets to ensure orderly conditions. Given the random nature of the shocks hitting the economy, central banks are increasingly acting as shock absorbers. In order to manage these shocks effectively, a steady stream of innovations is required by central banks in terms of instruments and operating procedures while strengthening their balance sheets.

Page Last Updated on: