|

Today, the Reserve Bank released the results of 103rd round of its quarterly Industrial Outlook Survey (IOS). The survey encapsulates qualitative assessment of the business climate by Indian manufacturing companies for Q2:2023-24 and their expectations for Q3:2023-241 as well as outlook on select parameters for subsequent two quarters. In all, 1,223 companies responded in this round of the survey, which was conducted during Q2:2023-24.

Highlights:

A. Assessment for Q2:2023-24

-

Manufacturing companies reported higher optimism on demand conditions during Q2:2023-24, as reflected in their assessment on production, order books and capacity utilisation (Table A).

-

Respondents reported higher pressure from raw material cost; there was some easing of wage bill and finance cost burden.

-

Net sentiments on profit margin turned positive during Q2:2023-24 after four quarters of negative assessment.

-

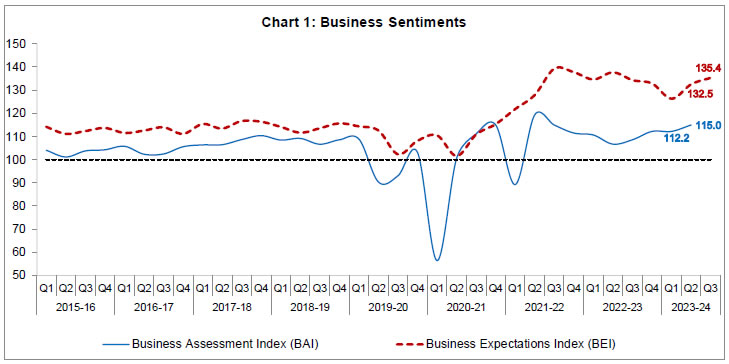

Overall business sentiments in the manufacturing sector improved further; the business assessment index (BAI)2 increased to 115.0 in Q2:2023-24 from 112.2 in the previous quarter (Chart 1).

B. Expectations for Q3:2023-24

-

Manufacturers expressed higher optimism for Q3:2023-24, as reflected in their improved expectations on production, order books, capacity utilisation and overall business situation (Table A).

-

Cost pressures from raw materials and financing are likely to persist.

-

Selling prices are expected to rise at a lower rate and profit margins are likely to remain steady.

- Reflecting the broad-based optimism, the business expectations index (BEI) for Q3:2023-24 improved to 135.4 from 132.5 in the previous quarter (Chart 1).

C. Expectations for Q4:2023-24 and Q1:2024-25

-

Manufacturers remain highly optimistic on production, order books, capacity utilisation and overall business situation till Q1:2024-25 (Table B).

-

Input cost pressures are likely to persist for manufacturers, but they also expect pricing power to pass on the rise in selling prices.

| Table A: Summary of Net responses3 on Survey Parameters |

| (per cent) |

| Parameters |

Assessment period |

Expectation period |

| Q1:2023-24 |

Q2:2023-24 |

Q2:2023-24 |

Q3:2023-24 |

| Production |

25.3 |

34.0 |

58.0 |

65.1 |

| Order Books |

21.9 |

30.7 |

58.1 |

62.3 |

| Pending Orders |

4.9 |

3.1 |

-1.7 |

-1.1 |

| Capacity Utilisation |

15.5 |

29.5 |

46.6 |

57.5 |

| Inventory of Raw Materials |

-6.3 |

-6.1 |

-29.0 |

-27.3 |

| Inventory of Finished Goods |

-7.2 |

-7.2 |

-28.8 |

-28.2 |

| Exports |

17.6 |

17.7 |

53.5 |

53.1 |

| Imports |

20.4 |

17.2 |

52.6 |

51.0 |

| Employment |

16.1 |

18.0 |

40.5 |

38.8 |

| Financial Situation (Overall) |

24.0 |

30.9 |

56.3 |

63.5 |

| Availability of Finance (from internal accruals) |

25.8 |

30.8 |

52.3 |

59.1 |

| Availability of Finance (from banks & other sources) |

20.4 |

29.1 |

49.0 |

55.8 |

| Availability of Finance (from overseas, if applicable) |

18.0 |

18.6 |

50.4 |

53.5 |

| Cost of Finance |

-32.4 |

-26.4 |

-54.2 |

-54.9 |

| Cost of Raw Material |

-41.1 |

-43.8 |

-58.3 |

-65.0 |

| Salary/ Other Remuneration |

-38.1 |

-28.8 |

-49.3 |

-45.6 |

| Selling Price |

12.8 |

11.7 |

41.4 |

40.1 |

| Profit Margin |

-1.2 |

4.5 |

35.7 |

35.8 |

| Overall Business Situation |

24.9 |

34.3 |

60.7 |

67.9 |

| Table B: Business Expectations on Select Parameters for extended period – Net response |

| (per cent) |

| Parameters |

Round 102 |

Round 103 |

| Q2:2023-24 |

Q3:2023-24 |

Q4:2023-24 |

Q1:2024:25 |

| Overall Business Situation |

60.7 |

67.9 |

67.5 |

69.9 |

| Production |

58.0 |

65.1 |

68.2 |

68.3 |

| Order Books |

58.1 |

62.3 |

66.0 |

67.3 |

| Capacity Utilisation |

46.6 |

57.5 |

65.3 |

65.0 |

| Employment |

40.5 |

38.8 |

47.2 |

45.5 |

| Cost of Raw Materials |

-58.3 |

-65.0 |

-63.0 |

-63.2 |

| Selling Prices |

41.4 |

40.1 |

48.6 |

46.6 |

Note: Please see the excel file for time series data.

| Table 1: Assessment and Expectations for Production |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Increase |

Decrease |

No change |

Net response |

Increase |

Decrease |

No change |

Net response |

| Q2:2022-23 |

1,234 |

34.3 |

16.3 |

49.4 |

18.1 |

72.4 |

5.0 |

22.6 |

67.4 |

| Q3:2022-23 |

1,356 |

40.5 |

15.4 |

44.1 |

25.1 |

60.8 |

4.6 |

34.5 |

56.2 |

| Q4:2022-23 |

1,066 |

46.3 |

13.3 |

40.4 |

33.0 |

61.2 |

3.8 |

34.9 |

57.4 |

| Q1:2023-24 |

1,247 |

39.6 |

14.3 |

46.0 |

25.3 |

60.6 |

5.8 |

33.6 |

54.8 |

| Q2:2023-24 |

1,223 |

45.2 |

11.2 |

43.6 |

34.0 |

63.0 |

5.0 |

31.9 |

58.0 |

| Q3:2023-24 |

|

|

|

|

|

70.9 |

5.7 |

23.4 |

65.1 |

‘Increase’ in production is optimistic.

Note: The sum of components may not add up to total due to rounding off (This is applicable for all tables). |

| Table 2: Assessment and Expectations for Order Books |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Increase |

Decrease |

No change |

Net response |

Increase |

Decrease |

No change |

Net response |

| Q2:2022-23 |

1,234 |

30.7 |

12.1 |

57.2 |

18.6 |

72.7 |

4.6 |

22.6 |

68.1 |

| Q3:2022-23 |

1,356 |

33.1 |

12.1 |

54.8 |

21.0 |

67.1 |

4.7 |

28.3 |

62.4 |

| Q4:2022-23 |

1,066 |

37.2 |

11.8 |

51.0 |

25.4 |

63.3 |

3.9 |

32.8 |

59.4 |

| Q1:2023-24 |

1,247 |

33.0 |

11.1 |

55.9 |

21.9 |

54.6 |

6.8 |

38.6 |

47.8 |

| Q2:2023-24 |

1,223 |

41.1 |

10.4 |

48.5 |

30.7 |

63.0 |

4.8 |

32.2 |

58.1 |

| Q3:2023-24 |

|

|

|

|

|

68.5 |

6.1 |

25.4 |

62.3 |

| ‘Increase’ in order books is optimistic. |

| Table 3: Assessment and Expectations for Pending Orders |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Above Normal |

Below Normal |

Normal |

Net response |

Above Normal |

Below Normal |

Normal |

Net response |

| Q2:2022-23 |

1,234 |

10.3 |

17.6 |

72.0 |

7.3 |

7.7 |

10.3 |

82.1 |

2.6 |

| Q3:2022-23 |

1,356 |

8.4 |

14.6 |

76.9 |

6.2 |

10.8 |

10.1 |

79.2 |

-0.7 |

| Q4:2022-23 |

1,066 |

4.2 |

13.1 |

82.7 |

8.9 |

8.9 |

10.1 |

81.0 |

1.2 |

| Q1:2023-24 |

1,247 |

9.2 |

14.1 |

76.6 |

4.9 |

4.5 |

8.0 |

87.5 |

3.4 |

| Q2:2023-24 |

1,223 |

8.6 |

11.6 |

79.8 |

3.1 |

10.9 |

9.2 |

79.9 |

-1.7 |

| Q3:2023-24 |

|

|

|

|

|

9.7 |

8.5 |

81.8 |

-1.1 |

| Pending orders ‘Below Normal’ is optimistic. |

| Table 4: Assessment and Expectations for Capacity Utilisation (Main Product) |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Increase |

Decrease |

No change |

Net response |

Increase |

Decrease |

No change |

Net response |

| Q2:2022-23 |

1,234 |

23.4 |

14.8 |

61.8 |

8.6 |

65.6 |

5.0 |

29.4 |

60.6 |

| Q3:2022-23 |

1,356 |

29.8 |

15.0 |

55.2 |

14.9 |

51.5 |

4.9 |

43.6 |

46.6 |

| Q4:2022-23 |

1,066 |

34.3 |

11.5 |

54.1 |

22.8 |

51.3 |

4.1 |

44.6 |

47.2 |

| Q1:2023-24 |

1,247 |

28.5 |

13.0 |

58.5 |

15.5 |

46.7 |

5.5 |

47.8 |

41.2 |

| Q2:2023-24 |

1,223 |

38.2 |

8.7 |

53.0 |

29.5 |

51.8 |

5.2 |

42.9 |

46.6 |

| Q3:2023-24 |

|

|

|

|

|

62.1 |

4.6 |

33.3 |

57.5 |

| ‘Increase’ in capacity utilisation is optimistic. |

| Table 5: Assessment and Expectations for Level of CU (compared to the average in last 4 quarters) |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Above Normal |

Below Normal |

Normal |

Net response |

Above Normal |

Below Normal |

Normal |

Net response |

| Q2:2022-23 |

1,234 |

20.5 |

12.8 |

66.7 |

7.8 |

50.2 |

6.3 |

43.5 |

43.9 |

| Q3:2022-23 |

1,356 |

28.7 |

13.2 |

58.1 |

15.5 |

37.0 |

6.1 |

56.9 |

30.9 |

| Q4:2022-23 |

1,066 |

19.8 |

10.5 |

69.7 |

9.3 |

34.7 |

8.1 |

57.2 |

26.7 |

| Q1:2023-24 |

1,247 |

31.4 |

10.4 |

58.2 |

21.0 |

23.7 |

6.2 |

70.2 |

17.5 |

| Q2:2023-24 |

1,223 |

30.5 |

9.0 |

60.6 |

21.5 |

39.0 |

6.0 |

55.1 |

33.0 |

| Q3:2023-24 |

|

|

|

|

|

36.1 |

6.1 |

57.8 |

30.1 |

| ‘Above Normal’ in Level of capacity utilisation is optimistic. |

| Table 6: Assessment and Expectations for Production Capacity (with regard to expected demand in next 6 months) |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| More than adequate |

Less than adequate |

Adequate |

Net response |

More than adequate |

Less than adequate |

Adequate |

Net response |

| Q2:2022-23 |

1,234 |

21.1 |

6.8 |

72.1 |

14.3 |

51.5 |

5.4 |

43.0 |

46.1 |

| Q3:2022-23 |

1,356 |

28.9 |

4.4 |

66.7 |

24.6 |

42.9 |

4.5 |

52.7 |

38.4 |

| Q4:2022-23 |

1,066 |

17.3 |

5.7 |

77.0 |

11.6 |

42.7 |

3.3 |

53.9 |

39.4 |

| Q1:2023-24 |

1,247 |

25.8 |

5.7 |

68.4 |

20.1 |

25.3 |

3.8 |

70.9 |

21.5 |

| Q2:2023-24 |

1,223 |

23.3 |

4.0 |

72.7 |

19.3 |

43.4 |

3.9 |

52.7 |

39.5 |

| Q3:2023-24 |

|

|

|

|

|

42.7 |

3.2 |

54.1 |

39.5 |

| ‘More than adequate’ in Assessment of Production Capacity is optimistic. |

| Table 7: Assessment and Expectations for Exports |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Increase |

Decrease |

No change |

Net response |

Increase |

Decrease |

No change |

Net response |

| Q2:2022-23 |

1,234 |

25.2 |

14.0 |

60.8 |

11.1 |

65.2 |

4.4 |

30.4 |

60.8 |

| Q3:2022-23 |

1,356 |

25.6 |

17.1 |

57.3 |

8.5 |

61.2 |

5.2 |

33.6 |

56.0 |

| Q4:2022-23 |

1,066 |

25.4 |

13.3 |

61.3 |

12.2 |

55.5 |

3.9 |

40.6 |

51.5 |

| Q1:2023-24 |

1,247 |

30.1 |

12.5 |

57.4 |

17.6 |

43.0 |

6.8 |

50.2 |

36.2 |

| Q2:2023-24 |

1,223 |

27.7 |

10.0 |

62.3 |

17.7 |

57.9 |

4.4 |

37.7 |

53.5 |

| Q3:2023-24 |

|

|

|

|

|

58.1 |

5.0 |

36.9 |

53.1 |

| ‘Increase’ in exports is optimistic. |

| Table 8: Assessment and Expectations for Imports |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Increase |

Decrease |

No change |

Net response |

Increase |

Decrease |

No change |

Net response |

| Q2:2022-23 |

1,234 |

23.5 |

10.1 |

66.4 |

13.4 |

64.5 |

3.2 |

32.3 |

61.3 |

| Q3:2022-23 |

1,356 |

23.8 |

12.2 |

64.0 |

11.6 |

60.8 |

3.2 |

36.0 |

57.6 |

| Q4:2022-23 |

1,066 |

22.6 |

7.3 |

70.1 |

15.3 |

54.3 |

2.8 |

42.9 |

51.5 |

| Q1:2023-24 |

1,247 |

28.9 |

8.6 |

62.5 |

20.4 |

37.4 |

4.2 |

58.4 |

33.2 |

| Q2:2023-24 |

1,223 |

25.5 |

8.2 |

66.3 |

17.2 |

55.8 |

3.2 |

41.0 |

52.6 |

| Q3:2023-24 |

|

|

|

|

|

54.8 |

3.9 |

41.3 |

51.0 |

| ‘Increase’ in imports is optimistic. |

| Table 9: Assessment and Expectations for level of Raw Materials Inventory |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Above average |

Below average |

Average |

Net response |

Above average |

Below average |

Average |

Net response |

| Q2:2022-23 |

1,234 |

15.0 |

10.5 |

74.5 |

-4.6 |

46.1 |

4.6 |

49.3 |

-41.5 |

| Q3:2022-23 |

1,356 |

18.1 |

7.3 |

74.6 |

-10.8 |

32.8 |

7.1 |

60.1 |

-25.7 |

| Q4:2022-23 |

1,066 |

13.1 |

4.7 |

82.2 |

-8.3 |

32.4 |

5.6 |

62.0 |

-26.8 |

| Q1:2023-24 |

1,247 |

13.4 |

7.1 |

79.5 |

-6.3 |

20.5 |

2.5 |

76.9 |

-18.0 |

| Q2:2023-24 |

1,223 |

11.5 |

5.3 |

83.2 |

-6.1 |

33.0 |

4.0 |

63.1 |

-29.0 |

| Q3:2023-24 |

|

|

|

|

|

30.9 |

3.6 |

65.6 |

-27.3 |

| ‘Below average’ Inventory of raw materials is optimistic. |

| Table 10: Assessment and Expectations for level of Finished Goods Inventory |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Above average |

Below average |

Average |

Net response |

Above average |

Below average |

Average |

Net response |

| Q2:2022-23 |

1,234 |

14.2 |

10.2 |

75.6 |

-4.0 |

45.6 |

4.3 |

50.1 |

-41.3 |

| Q3:2022-23 |

1,356 |

17.1 |

7.7 |

75.2 |

-9.5 |

33.4 |

6.9 |

59.7 |

-26.5 |

| Q4:2022-23 |

1,066 |

13.3 |

5.1 |

81.5 |

-8.2 |

31.9 |

5.8 |

62.3 |

-26.1 |

| Q1:2023-24 |

1,247 |

14.0 |

6.8 |

79.2 |

-7.2 |

19.9 |

2.8 |

77.3 |

-17.2 |

| Q2:2023-24 |

1,223 |

11.7 |

4.5 |

83.7 |

-7.2 |

33.2 |

4.4 |

62.4 |

-28.8 |

| Q3:2023-24 |

|

|

|

|

|

31.4 |

3.3 |

65.3 |

-28.2 |

| ‘Below average’ Inventory of finished goods is optimistic. |

| Table 11: Assessment and Expectations for Employment |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Increase |

Decrease |

No change |

Net response |

Increase |

Decrease |

No change |

Net response |

| Q2:2022-23 |

1,234 |

21.5 |

9.0 |

69.5 |

12.5 |

57.1 |

2.1 |

40.8 |

54.9 |

| Q3:2022-23 |

1,356 |

23.0 |

9.4 |

67.7 |

13.6 |

45.0 |

1.2 |

53.9 |

43.8 |

| Q4:2022-23 |

1,066 |

19.3 |

7.0 |

73.7 |

12.4 |

39.0 |

2.5 |

58.5 |

36.4 |

| Q1:2023-24 |

1,247 |

25.9 |

9.9 |

64.2 |

16.1 |

29.8 |

3.1 |

67.1 |

26.7 |

| Q2:2023-24 |

1,223 |

25.1 |

7.1 |

67.7 |

18.0 |

43.5 |

3.0 |

53.5 |

40.5 |

| Q3:2023-24 |

|

|

|

|

|

42.5 |

3.7 |

53.8 |

38.8 |

| ‘Increase’ in employment is optimistic. |

| Table 12: Assessment and Expectations for Overall Financial Situation |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Better |

Worsen |

No change |

Net response |

Better |

Worsen |

No change |

Net response |

| Q2:2022-23 |

1,234 |

28.7 |

14.8 |

56.4 |

13.9 |

70.4 |

3.4 |

26.2 |

67.1 |

| Q3:2022-23 |

1,356 |

35.6 |

15.5 |

49.0 |

20.1 |

61.4 |

3.8 |

34.8 |

57.7 |

| Q4:2022-23 |

1,066 |

40.2 |

9.6 |

50.2 |

30.6 |

63.9 |

3.3 |

32.8 |

60.6 |

| Q1:2023-24 |

1,247 |

36.6 |

12.6 |

50.7 |

24.0 |

56.3 |

3.4 |

40.3 |

52.9 |

| Q2:2023-24 |

1,223 |

41.6 |

10.7 |

47.7 |

30.9 |

60.2 |

3.9 |

35.9 |

56.3 |

| Q3:2023-24 |

|

|

|

|

|

68.7 |

5.1 |

26.2 |

63.5 |

| ‘Better’ overall financial situation is optimistic. |

| Table 13: Assessment and Expectations for Working Capital Finance Requirement |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Increase |

Decrease |

No change |

Net response |

Increase |

Decrease |

No change |

Net response |

| Q2:2022-23 |

1,234 |

29.6 |

6.8 |

63.5 |

22.8 |

65.0 |

2.6 |

32.5 |

62.4 |

| Q3:2022-23 |

1,356 |

35.2 |

7.3 |

57.5 |

27.9 |

51.2 |

1.6 |

47.3 |

49.6 |

| Q4:2022-23 |

1,066 |

36.4 |

4.3 |

59.3 |

32.1 |

52.3 |

1.1 |

46.5 |

51.2 |

| Q1:2023-24 |

1,247 |

34.8 |

5.8 |

59.4 |

29.1 |

48.0 |

1.9 |

50.0 |

46.1 |

| Q2:2023-24 |

1,223 |

38.4 |

5.1 |

56.6 |

33.3 |

53.3 |

2.2 |

44.4 |

51.1 |

| Q3:2023-24 |

|

|

|

|

|

60.2 |

2.6 |

37.3 |

57.6 |

| ‘Increase’ in working capital finance is optimistic. |

| Table 14: Assessment and Expectations for Availability of Finance (from Internal Accruals) |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Improve |

Worsen |

No change |

Net response |

Improve |

Worsen |

No change |

Net response |

| Q2:2022-23 |

1,234 |

24.0 |

8.0 |

68.0 |

15.9 |

64.2 |

2.4 |

33.4 |

61.9 |

| Q3:2022-23 |

1,356 |

31.1 |

9.1 |

59.8 |

21.9 |

51.3 |

2.0 |

46.7 |

49.3 |

| Q4:2022-23 |

1,066 |

33.3 |

4.5 |

62.2 |

28.8 |

55.2 |

1.7 |

43.1 |

53.5 |

| Q1:2023-24 |

1,247 |

33.2 |

7.4 |

59.4 |

25.8 |

48.7 |

2.0 |

49.3 |

46.6 |

| Q2:2023-24 |

1,223 |

37.1 |

6.3 |

56.6 |

30.8 |

54.4 |

2.1 |

43.5 |

52.3 |

| Q3:2023-24 |

|

|

|

|

|

61.6 |

2.5 |

35.9 |

59.1 |

| ‘Improvement’ in availability of finance is optimistic. |

| Table 15: Assessment and Expectations for Availability of Finance (from banks and other sources) |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Improve |

Worsen |

No change |

Net response |

Improve |

Worsen |

No change |

Net response |

| Q2:2022-23 |

1,234 |

21.9 |

6.5 |

71.6 |

15.4 |

62.2 |

1.8 |

36.1 |

60.4 |

| Q3:2022-23 |

1,356 |

26.0 |

9.1 |

64.9 |

17.0 |

56.7 |

1.7 |

41.6 |

55.1 |

| Q4:2022-23 |

1,066 |

27.8 |

4.5 |

67.7 |

23.3 |

50.5 |

1.3 |

48.2 |

49.2 |

| Q1:2023-24 |

1,247 |

26.5 |

6.1 |

67.4 |

20.4 |

42.2 |

2.1 |

55.7 |

40.1 |

| Q2:2023-24 |

1,223 |

34.9 |

5.7 |

59.4 |

29.1 |

50.5 |

1.5 |

47.9 |

49.0 |

| Q3:2023-24 |

|

|

|

|

|

58.2 |

2.5 |

39.3 |

55.8 |

| ‘Improvement’ in availability of finance is optimistic. |

| Table 16: Assessment and Expectations for Availability of Finance (from overseas, if applicable) |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Improve |

Worsen |

No change |

Net response |

Improve |

Worsen |

No change |

Net response |

| Q2:2022-23 |

1,234 |

17.4 |

6.8 |

75.8 |

10.6 |

65.8 |

1.2 |

33.0 |

64.6 |

| Q3:2022-23 |

1,356 |

20.4 |

9.7 |

69.9 |

10.7 |

59.6 |

0.8 |

39.6 |

58.9 |

| Q4:2022-23 |

1,066 |

11.1 |

3.6 |

85.3 |

7.6 |

51.3 |

1.3 |

47.4 |

50.1 |

| Q1:2023-24 |

1,247 |

23.8 |

5.8 |

70.4 |

18.0 |

34.3 |

1.8 |

64.0 |

32.5 |

| Q2:2023-24 |

1,223 |

24.3 |

5.7 |

69.9 |

18.6 |

52.4 |

2.0 |

45.7 |

50.4 |

| Q3:2023-24 |

|

|

|

|

|

56.4 |

2.9 |

40.7 |

53.5 |

| ‘Improvement’ in availability of finance is optimistic. |

| Table 17: Assessment and Expectations for Cost of Finance |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Increase |

Decrease |

No change |

Net response |

Increase |

Decrease |

No change |

Net response |

| Q2:2022-23 |

1,234 |

36.1 |

6.1 |

57.8 |

-30.1 |

65.6 |

1.6 |

32.8 |

-64.0 |

| Q3:2022-23 |

1,356 |

37.0 |

5.9 |

57.1 |

-31.1 |

53.5 |

1.6 |

44.9 |

-51.9 |

| Q4:2022-23 |

1,066 |

36.2 |

3.8 |

60.0 |

-32.4 |

51.6 |

1.1 |

47.3 |

-50.5 |

| Q1:2023-24 |

1,247 |

36.9 |

4.5 |

58.6 |

-32.4 |

47.5 |

1.7 |

50.8 |

-45.8 |

| Q2:2023-24 |

1,223 |

33.0 |

6.6 |

60.4 |

-26.4 |

56.4 |

2.2 |

41.5 |

-54.2 |

| Q3:2023-24 |

|

|

|

|

|

58.5 |

3.6 |

37.9 |

-54.9 |

| ‘Decrease’ in cost of finance is optimistic. |

| Table 18: Assessment and Expectations for Cost of Raw Materials |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Increase |

Decrease |

No change |

Net response |

Increase |

Decrease |

No change |

Net response |

| Q2:2022-23 |

1,234 |

77.0 |

4.6 |

18.4 |

-72.5 |

80.6 |

1.6 |

17.9 |

-79.0 |

| Q3:2022-23 |

1,356 |

73.0 |

8.1 |

18.9 |

-64.9 |

66.8 |

2.6 |

30.7 |

-64.2 |

| Q4:2022-23 |

1,066 |

64.5 |

5.4 |

30.2 |

-59.1 |

63.4 |

2.4 |

34.2 |

-60.9 |

| Q1:2023-24 |

1,247 |

49.1 |

8.0 |

42.8 |

-41.1 |

62.6 |

1.7 |

35.8 |

-60.9 |

| Q2:2023-24 |

1,223 |

49.3 |

5.5 |

45.3 |

-43.8 |

60.6 |

2.4 |

37.0 |

-58.3 |

| Q3:2023-24 |

|

|

|

|

|

67.8 |

2.8 |

29.3 |

-65.0 |

| ‘Decrease’ in cost of raw materials is optimistic. |

| Table 19: Assessment and Expectations for Salary/Other Remuneration |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Increase |

Decrease |

No change |

Net response |

Increase |

Decrease |

No change |

Net response |

| Q2:2022-23 |

1,234 |

30.8 |

4.4 |

64.7 |

-26.4 |

61.3 |

0.4 |

38.3 |

-60.8 |

| Q3:2022-23 |

1,356 |

30.1 |

3.1 |

66.8 |

-27.0 |

46.3 |

0.3 |

53.4 |

-46.0 |

| Q4:2022-23 |

1,066 |

23.1 |

1.9 |

75.0 |

-21.2 |

39.3 |

0.6 |

60.0 |

-38.7 |

| Q1:2023-24 |

1,247 |

41.1 |

3.0 |

56.0 |

-38.1 |

45.2 |

0.9 |

53.9 |

-44.3 |

| Q2:2023-24 |

1,223 |

32.3 |

3.5 |

64.2 |

-28.8 |

49.8 |

0.5 |

49.7 |

-49.3 |

| Q3:2023-24 |

|

|

|

|

|

47.3 |

1.7 |

51.0 |

-45.6 |

| ‘Decrease’ in Salary / other remuneration is optimistic. |

| Table 20: Assessment and Expectations for Selling Price |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Increase |

Decrease |

No change |

Net response |

Increase |

Decrease |

No change |

Net response |

| Q2:2022-23 |

1,234 |

25.1 |

10.7 |

64.2 |

14.4 |

63.4 |

3.2 |

33.4 |

60.3 |

| Q3:2022-23 |

1,356 |

23.3 |

12.9 |

63.8 |

10.4 |

48.8 |

3.7 |

47.5 |

45.1 |

| Q4:2022-23 |

1,066 |

21.6 |

11.8 |

66.6 |

9.7 |

43.2 |

3.6 |

53.1 |

39.6 |

| Q1:2023-24 |

1,247 |

26.1 |

13.3 |

60.6 |

12.8 |

34.0 |

5.6 |

60.4 |

28.4 |

| Q2:2023-24 |

1,223 |

22.3 |

10.6 |

67.1 |

11.7 |

46.9 |

5.4 |

47.7 |

41.4 |

| Q3:2023-24 |

|

|

|

|

|

45.2 |

5.2 |

49.6 |

40.1 |

| ‘Increase’ in selling price is optimistic. |

| Table 21: Assessment and Expectations for Profit Margin |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Increase |

Decrease |

No change |

Net response |

Increase |

Decrease |

No change |

Net response |

| Q2:2022-23 |

1,234 |

16.2 |

25.5 |

58.2 |

-9.3 |

57.6 |

10.1 |

32.3 |

47.4 |

| Q3:2022-23 |

1,356 |

17.6 |

26.1 |

56.3 |

-8.4 |

44.2 |

9.0 |

46.8 |

35.2 |

| Q4:2022-23 |

1,066 |

16.2 |

21.6 |

62.1 |

-5.4 |

41.0 |

8.1 |

50.9 |

32.9 |

| Q1:2023-24 |

1,247 |

20.6 |

21.8 |

57.5 |

-1.2 |

30.5 |

11.4 |

58.1 |

19.1 |

| Q2:2023-24 |

1,223 |

21.9 |

17.4 |

60.7 |

4.5 |

43.8 |

8.1 |

48.1 |

35.7 |

| Q3:2023-24 |

|

|

|

|

|

45.5 |

9.7 |

44.8 |

35.8 |

| ‘Increase’ in profit margin is optimistic. |

| Table 22: Assessment and Expectations for Overall Business Situation |

| (Percentage responses) |

| Quarter |

Total response |

Assessment |

Expectations |

| Better |

Worsen |

No change |

Net response |

Better |

Worsen |

No change |

Net response |

| Q2:2022-23 |

1,234 |

31.6 |

15.7 |

52.7 |

15.8 |

73.9 |

3.2 |

22.9 |

70.7 |

| Q3:2022-23 |

1,356 |

37.7 |

17.4 |

44.9 |

20.3 |

63.8 |

4.4 |

31.7 |

59.4 |

| Q4:2022-23 |

1,066 |

45.9 |

11.4 |

42.7 |

34.4 |

66.9 |

3.7 |

29.4 |

63.1 |

| Q1:2023-24 |

1,247 |

39.9 |

15.0 |

45.1 |

24.9 |

62.4 |

4.0 |

33.6 |

58.3 |

| Q2:2023-24 |

1,223 |

46.0 |

11.8 |

42.2 |

34.3 |

65.0 |

4.3 |

30.7 |

60.7 |

| Q3:2023-24 |

|

|

|

|

|

73.1 |

5.2 |

21.7 |

67.9 |

| ‘Better’ Overall Business Situation is optimistic. |

| Table 23: Business Sentiments |

| Quarter |

Business Assessment Index (BAI) |

Business Expectations Index (BEI) |

| Q2:2022-23 |

106.7 |

137.5 |

| Q3:2022-23 |

108.6 |

134.4 |

| Q4:2022-23 |

112.2 |

132.9 |

| Q1:2023-24 |

112.2 |

126.4 |

| Q2:2023-24 |

115.0 |

132.5 |

| Q3:2023-24 |

|

135.4 |

|

IST,

IST,