IST,

IST,

Policy Environment

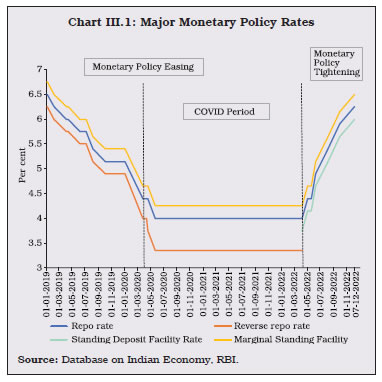

The Reserve Bank’s policies in 2021-22 aimed at assuaging the impact of the pandemic and nurturing economic recovery. During 2022-23 so far, the policy focus has shifted to securing price stability characterised by policy rate action and gradual withdrawal of accommodation. The regulatory and supervisory policy measures of the Reserve Bank were undertaken to ensure level playing field across regulated entities, enhance consumers’ convenience and expand the reach and quality of financial services. 1. Introduction III.1 During 2021-22, the Reserve Bank sustained its policy focus on mitigating the adverse impact of the pandemic on the economy while supporting the nascent economic recovery. In the second half of the year, there was a gradual shift towards a calibrated withdrawal of liquidity by allowing pandemic-related measures to lapse on due dates and cessation of unconventional measures with a view to safeguarding financial stability and ensuring that inflation remains within the target going forward. During 2022-23 so far, the policy focus has shifted to securing price stability in view of the inflationary pressures. Accordingly, policy rate hikes and the gradual withdrawal of accommodation have commenced. Simultaneously, the Reserve Bank has also ushered in major regulatory and supervisory reforms, with a focus on containing potential vulnerabilities, ensuring orderly functioning of financial markets, strengthening consumer protection, expanding the reach and quality of financial services, improving the payments ecosystem and enhancing the adoption of digital banking. III.2 Against this backdrop, this chapter begins with an account of monetary and liquidity measures in Section 2. This is followed by an overview of the regulatory policy developments relating to scheduled commercial banks (SCBs), non-banking finance companies (NBFCs) and credit co-operatives in Section 3. Supervisory strategies for banks and NBFCs are discussed in Section 4, while policies pertaining to technological innovations are covered in Section 5. Policies relating to financial markets and foreign exchange, and credit delivery and financial inclusion are covered in Sections 6 and 7, respectively. Section 8 reviews initiatives related to consumer protection and retail participation, while the Reserve Bank’s initiatives for enhancing the scope and reach of the payments ecosystem are set out in Section 9. The chapter concludes with an overall assessment in Section 10. 2. Monetary Policy and Liquidity Management III.3 The monetary policy committee (MPC) kept the policy repo rate under the liquidity adjustment facility (LAF) unchanged at 4 per cent during 2021-22 with a view to supporting a tenuous recovery that was taking hold after the severe impact of the second wave of COVID-19. Inflationary pressures, which had built up in Q4:2021-22 due to rising international crude oil and other commodity prices, were expected to moderate in H1:2022-23. Accordingly, the MPC decided to continue with an accommodative monetary policy stance during 2021-22. III.4 Within a fortnight from the sixth and final meeting of MPC for the year 2021-22, the conflict in Ukraine broke out amidst escalated geopolitical tensions and the global and domestic outlook was drastically altered. Surging prices of international crude oil and other commodities and food and energy shortages imposed upside risks to domestic inflation and downside risks to the growth outlook. In its April 2022 resolution, the MPC decided to keep the policy rate on hold. The Reserve Bank, however, started the process of withdrawal of accommodation by restoration of the liquidity management framework. The institution of a standing deposit facility (SDF), replacing the fixed rate reverse repo (FRRR) as the floor of the LAF at a rate 40 basis points (bps) above the latter, effectively tightened monetary conditions as money market rates rose from their pandemic lows and the liquidity overhang was pulled in through variable reverse repo (VRR) auctions of varying maturities. With the shock of the war causing commodity prices to scale new highs and upside risks to the inflation outlook, the MPC raised the policy repo rate by 40 bps in an off-cycle meeting in May 2022, followed by increases of 50 bps each in June 2022, August 2022 and September 2022, and 35 bps in December 2022. Since May 2022, the Reserve Bank has thus cumulatively raised the policy repo rate by 225 bps to anchor inflation expectations and contain second-round effects of repetitive shocks. Empirical estimates for India indicate that high and volatile inflation is detrimental to the functioning of the credit market (Box III.1). Liquidity Management during 2021-22 III.5 The Reserve Bank announced a secondary market government securities acquisition programme (G-SAP) 1.0 in April 2021 to assuage market sentiments in view of the large market borrowing programme of the central government, followed by G-SAP 2.0 in June 2021, with a commitment to cumulatively purchase ₹2.2 lakh crore of government securities (G-secs) in H1:2021-22. Under the G-SAP, the Reserve Bank purchased both on the run (liquid) and off the run (illiquid) securities across the maturity spectrum, with more than 68 per cent of the purchases concentrated in the 5 to 10-year maturity segment, thus imparting liquidity to maturities across the mid-segment of the term structure. G-SAP also facilitated monetary transmission by containing volatility in G-sec yields that serve as the benchmark for the pricing of other financial market instruments. In October 2021, given the overhang of surplus liquidity, the Reserve Bank discontinued G-SAP. III.6 Apart from G-SAP, the Reserve Bank provided special refinance facilities of ₹66,000 crore to all-India financial institutions (AIFIs); a term liquidity facility of ₹50,000 crore to ramp up COVID-related healthcare infrastructure and services in the country; special long-term repo operations (SLTRO) for small finance banks (SFBs) of which ₹10,000 crore had to be deployed in fresh lending of up to ₹10 lakh per borrower; and an on-tap liquidity window of ₹15,000 crore in order to mitigate the adverse impact of the second wave of the pandemic on certain contact-intensive sectors. The deadlines of key targeted liquidity facilities were also extended, given the needs of the stressed sectors: the SLTRO facility for SFBs was made available till December 31, 2021, while also making it available on tap; the liquidity facility of ₹50,000 crore to ease access to emergency health services and ₹15,000 crore for contact-intensive sectors were extended up to June 30, 2022. III.7 Recognising that the large liquidity overhang from the pandemic-induced measures could engender mispricing of risks and pose financial stability challenges, the Reserve Bank started normalisation of liquidity conditions during 2021-22 to align them with the evolving macroeconomic developments. As a part of this process, the cash reserve ratio (CRR) was restored to its pre-pandemic level of 4.0 per cent of net demand and time liabilities (NDTL) in two phases with an increase of 0.5 percentage point each, effective from the fortnights beginning March 27, 2021 and May 22, 2021.

III.8 In order to re-establish the 14-day variable rate reverse repo (VRRR) as the main liquidity management tool as part of the restoration of the revised liquidity management framework, an upscaling of the size of VRRR auctions was undertaken through a pre-announced schedule from ₹2.0 lakh crore during April-July 2021 to ₹7.5 lakh crore by end-December 2021. As a result, surplus liquidity absorption was seamlessly rebalanced from the overnight FRRR window to longer tenor 14-day VRRR auctions. These operations were complemented by the 28-day VRRRs and fine-tuning operations of 3-8 days maturities. Reflecting these developments, the amount absorbed under the FRRR reduced significantly, averaging ₹2.0 lakh crore during H2:2021-22 from ₹4.6 lakh crore during H1:2021-22. III.9 As an additional step towards absorbing the liquidity surplus, banks were provided one more option in December 2021 to prepay the outstanding amount of funds availed under the targeted long-term repo operations (TLTRO 1.0 and 2.0) conducted during March-April 2020. Accordingly, banks returned ₹2,434 crore in December 2021 over and above ₹37,348 crore paid earlier in November 2020. III.10 Given the limited recourse to the marginal standing facility (MSF) by banks due to surplus liquidity conditions in the post-pandemic period, the normal dispensation of allowing banks to dip up to 2 per cent (instead of 3 per cent during the pandemic) of their NDTL was reinstated effective January 1, 2022. III.11 With the progressive return of normalcy, the Reserve Bank announced on February 10, 2022 that (i) the VRR operations of varying tenors would be conducted as and when warranted as fine-tuning operations to tide over any unanticipated liquidity changes during the reserve maintenance period, while auctions of longer maturity will also be conducted, if required; and (ii) the windows for FRRR and the MSF operations would be available during 17.30-23.59 hours on all days effective March 1, 2022 (as against 09.00-23.59 hours since March 30, 2020). Market participants were advised to shift their balances out of the FRRR into VRRR auctions and avail the automated sweep-in and sweep-out (ASISO) facility in the e-Kuber portal for operational convenience4. Liquidity Management during 2022-23 III.12 Against the backdrop of the economic recovery gaining traction and the persistence of inflation above the upper tolerance band of the target, the focus of liquidity management during 2022-23 moved to withdrawal of accommodation in a non-disruptive manner. III.13 In April 2022, as alluded to earlier, SDF at 3.75 per cent was introduced as the floor of the LAF corridor, replacing the FRRR. Thus, the SDF rate was placed 25 bps below the then prevailing policy rate (4.00 per cent) and was applicable on overnight deposits; however, the SDF window retained the flexibility to absorb liquidity of longer tenors, if necessary, with appropriate pricing. The MSF rate was retained at 4.25 per cent – 25 bps above the policy repo rate. Thus, the width of the LAF corridor was restored to its pre-pandemic configuration of +/- 25 bps symmetrically around the policy repo rate (Chart III.1). With the institution of the SDF, the FRRR rate was retained at 3.35 per cent and was delinked from the policy repo rate. It remains a part of the toolkit and will be used at the Reserve Bank’s discretion for purposes specified from time to time. Akin to the MSF, access to the SDF is at the discretion of banks, unlike repo/reverse repo, open market operation (OMO) and CRR which are at the discretion of the Reserve Bank. By removing the binding collateral constraint on the central bank, the SDF strengthens the operating framework of monetary policy. Moreover, it is a financial stability tool in addition to its role in liquidity management.  III.14 Along with the policy repo rate hike in an off-cycle meeting on May 4, 2022, the Reserve Bank increased the CRR by 50 bps to 4.50 per cent (effective fortnight beginning May 21, 2022), withdrawing primary liquidity to the tune of ₹87,000 crore from the banking system. In sync with the stance of withdrawal of accommodation, surplus liquidity as indicated by the daily average absorption under the LAF moderated from ₹7.5 lakh crore during March 2022 to ₹2.6 lakh crore in December 2022 (up to December 11). Cumulatively, these actions gradually lifted overnight money market rates closer to the policy repo rate. To assuage the temporary liquidity tightness from transient liquidity frictions due to tax outflows, the Reserve Bank conducted two VRR auctions on July 26 and September 21, 2022 of 3 days and 1 day maturity, respectively. Going forward, the Reserve Bank would be nimble and flexible in its liquidity management operations to meet the requirements of the productive sectors of the economy. III.15 The Reserve Bank complemented the post-COVID monetary and liquidity measures with regulatory policy changes to assuage the impact of the pandemic while containing associated risks to financial stability. During the second half of 2021-22 and 2022-23 so far, the focus of the Reserve Bank has been on gradual and non-disruptive withdrawal of post-COVID policy support and regulations, keeping in mind the needs of regulated entities (REs) and their customers. 3.1 Scheduled Commercial Banks Regulatory Framework for Microfinance Loans III.16 The regulatory framework for NBFC - Micro Finance Institutions (NBFC-MFIs) was reviewed. With effect from April 1, 2022 a uniform regulatory framework for microfinance lending by all REs was introduced. Apart from introducing a common definition of a microfinance loan and withdrawal of exemption for ‘not for profit’ companies engaged in these activities, the guidelines also required REs to put in place Board-approved policies on assessment of household income and indebtedness, pricing of microfinance loans, conduct of employees and flexibility in repayment periodicity of microfinance loans as per borrowers’ requirements. Besides introducing activity-based regulation in the microfinance sector, this framework is intended to deleverage microfinance borrowers, strengthen customer protection measures, enable competitive forces to bring down interest rates, and provide flexibility to the REs to meet credit needs of the microfinance borrowers in a comprehensive manner. Foreign Currency (Non-resident) Accounts (Banks) [FCNR(B)] Scheme – Revised Benchmark Rate III.17 In view of the discontinuance of London interbank offered rate (LIBOR) as a benchmark rate, it was decided in November 2021 to permit banks to offer interest rates on FCNR(B) deposits using the widely accepted overnight alternative reference rate (O-ARR) for the respective currency. Accordingly, the interest rate ceiling for FCNR(B) deposits with a maturity period of 1 year to less than 3 years was revised as O-ARR or swap plus 250 bps. For deposits of 3 years and above up to and including 5 years, it was revised to O-ARR or swap plus 350 bps. On July 6, 2022, the ceiling was temporarily withdrawn for incremental FCNR (B) deposits mobilized by banks for the period until October 31, 2022 as a measure for attracting capital inflows in the face of heightened volatility in financial markets globally and ensuing spillovers. Provisioning Requirement for Investment in Security Receipts (SRs) III.18 REs are permitted to sell their stressed assets, irrespective of their ageing criteria, to asset reconstruction companies (ARCs) against inter alia the SRs issued by the latter. In cases where stressed assets are sold against SRs, the risks of the underlying exposures do not effectively get separated from the sellers’ books. With a view to mitigating this concern and ensuring ‘true sale’ of such assets, in 2016, the Reserve Bank had prescribed higher provisioning with a floor when investments in such SRs constituted more than 50 per cent (later reduced to 10 per cent) of the total SRs issued under that specific securitization. These instructions were made applicable to all lenders on September 24, 2021. In order to ensure smooth implementation, REs other than SCBs were advised on June 28, 2022, that the additional provisions could be spread over a five-year period starting with the financial year ending March 31, 2022, i.e., from 2021-22 till 2025-26. Moreover, additional provisions made in every financial year should not be less than one fifth of the total required provisions. Large Exposure Framework (LEF) III.19 In the absence of a formal cross-border resolution regime, a large exposure framework (LEF) was made applicable to foreign banks’ (FBs’) exposures on their head office (HO) to ring-fence the operations of their branches in India. Considering that this will place additional capital burdens on such banks, a new credit risk mitigation (CRM) mechanism was issued on September 9, 2021. The CRM can comprise cash/unencumbered approved securities, the sources of which should be interest-free funds from HO, or remittable surplus retained in the Indian books (reserves). The gross exposure of foreign bank branches to HO (including overseas branches) was allowed to be offset with the CRM while reckoning LEF limits, subject to certain conditions. Foreign bank branches were permitted to exclude all derivative contracts executed prior to April 1, 2019 (grandfathering), while computing derivative exposure on the HO. Limit on Loans to Directors III.20 The threshold of loans to directors of other banks and relatives of directors (of own banks as also other banks) requiring sanction of the Board or Management Committee of banks was fixed at ₹25 lakh in 1996. The limit needed an upward revision to reflect the increase in general prices, to encourage expert professionals to join the Boards and reduce the number of cases requiring approval of the Board or Management Committee. Accordingly, on July 23, 2021, the Reserve Bank revised the threshold to ₹5 crore for sanction of personal loans to directors of other banks and all loans to relatives of directors (of own banks as also other banks) and associated entities. Fair Valuation of Banks’ Investment in Re-capitalisation Bonds III.21 On March 31, 2022, the Reserve Bank clarified that banks’ investment in special securities received from the Government towards banks’ recapitalisation from 2021-22 onwards shall be recognised at their fair value or market value on initial recognition in the held to maturity (HTM) category. Any difference between the acquisition cost and fair value based on the criteria specified shall be immediately recognised in the profit and loss account. Implementation of Net Stable Funding Ratio III.22 The final guidelines regarding the Basel III net stable funding ratio (NSFR) were issued on May 17, 2018 and were scheduled to come into effect from April 1, 2020. Due to the uncertainty on account of COVID-19, the implementation of these guidelines was deferred progressively till September 30, 2021 and came into effect from October 1, 2021. Review of Definition of Small Business Customers for LCR and NSFR III.23 For maintenance of liquidity coverage ratio (LCR) and NSFR, the extant guidelines consider deposits and other extensions of funds made by non-financial small business customers as having similar liquidity risk characteristics as retail accounts. To be eligible, a threshold of ₹5 crore (on a consolidated basis where applicable) was prescribed on the aggregated funding from each customer. To better align the Reserve Bank’s guidelines with the Basel Committee on Banking Supervision (BCBS) standards and enable banks to manage liquidity risk more effectively, the threshold was increased to ₹7.5 crore with effect from January 06, 2022. Periodic Updation of KYC III.24 In order to avoid inconvenience to customers during the pandemic, REs were advised on May 5, 2021 that in cases where know-your-customer (KYC) updation was due and pending, no restrictions on operations of their accounts may be placed till December 31, 2021. This relaxation was extended till March 31, 2022. III.25 REs are required to periodically update the KYC (re-KYC) at least once in 2 years, 8 years and 10 years for high-risk, medium-risk and low-risk customers, respectively. On May 10, 2021, the Reserve Bank simplified this process. In case of no change in KYC details, a self-declaration can be furnished by the customer using various channels, including digital. This provision was also introduced in respect of legal entities (LEs). In case of a change only in the address of the individual customer, a self-declaration of the new address has been allowed, subject to verification by REs through a ‘positive confirmation’ within two months. These simplified measures are expected to provide convenience to customers and enable REs to update KYC records on time. Regulatory Response to Climate Risks III.26 The Reserve Bank joined the Network for Greening the Financial System (NGFS) as a Member on April 23, 2021 and published its ‘Statement of Commitment to Support Greening India’s Financial System’ on November 3, 2021. In view of the increasing significance of climate-related financial risks, the Reserve Bank set up a Sustainable Finance Group (SFG) in May 2021 to lead the regulatory initiatives in the area of climate risk and sustainable finance, including appropriate climate-related disclosures for banks and other REs, propagate sustainable practices and mitigate climate-related risks in the Indian context. The Reserve Bank conducted a survey on climate risk and sustainable finance in January 2022 (Box III.2). 3.2 Non-Banking Finance Companies III.27 The contribution of NBFCs towards supporting real economic activity and acting as an additional channel of credit intermediation supplementing the banks is well recognised. In recent years, this sector has grown in size, complexity and interconnectedness, making some of the entities systemically significant. This necessitated adoption of a scale-based regulatory (SBR) approach, effective October 1, 2022. The framework divides NBFCs into a base layer (NBFC-BL), middle layer (NBFC-ML), upper layer (NBFC-UL) and top layer, with a progressive increase in the intensity of regulation. Glide paths were provided to ensure that the implementation of SBR is smooth and gradual. In particular, the glide paths for NPA classification norms and minimum net owned funds requirement norms extend up to March 31, 2026 and March 31, 2027, respectively. Large Exposure Framework for NBFC-UL III.28 The upper layer of NBFCs as per the SBR comprises those that are specifically identified by the Reserve Bank as warranting enhanced regulatory attention, based on a set of parameters. Detailed guidelines on regulatory restrictions on lending and large exposures framework (LEF) for NBFC-UL were issued on April 19, 2022 (Table III.1). Capital Requirements for NBFC-UL III.29 In order to enhance the quality of regulatory capital, NBFCs-UL are required to maintain common equity tier (CET)-1 capital of at least 9 per cent of risk weighted assets. On April 19, 2022, the Reserve Bank issued guidelines providing detailed instructions on components as well as regulatory adjustments and deductions from CET-1 capital, applicable to all NBFCs identified as NBFC-UL, except Core Investment Companies (CICs)5. Provisioning for Standard Assets for NBFC-UL III.30 With a view to harmonising the provisioning norms for outstanding funded assets of NBFCs-UL with those of the commercial banks, standard asset provisioning norms for the former were issued on June 6, 2022. The guidelines became effective from October 1, 2022 and the provisioning rates range from 0.25 per cent for individual housing loans and loans to small and micro enterprises (SMEs) to 2.00 per cent for teaser housing loans (Table III.2). Registration of Factors III.31 Subsequent to the amendment to the Factoring Regulation Act, 2011, on January 14, 2022 the Reserve Bank specified criteria for granting certificates of registration to NBFCs which propose to undertake factoring business. In addition to NBFC-Factors, all non-deposit taking NBFC-investment and credit companies (NBFC-ICCs) with asset size of ₹1,000 crore and above were permitted to undertake factoring business, subject to meeting specified conditions. Any other NBFC-ICC intending to undertake factoring business has to approach the Reserve Bank for conversion to NBFC-Factor. Housing Finance Companies (HFCs) as Financial Institutions (FIs) under SARFAESI Act III.32 Earlier, HFCs had to satisfy certain prescribed norms6 to be notified as an FI under the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 (SARFAESI Act) for the purpose of enforcement of security interest in secured debts and were required to apply on an individual entity basis. In order to simplify the process and improve the enforceability of the objectives of the SARFAESI Act, the Government of India notified on June 17, 2021 that HFCs registered under Section 29A of National Housing Bank Act, 1987, which have assets worth ₹100 crore and above, may be treated as ‘FI’ under Section 2(1)(m)(iv) of the SARFAESI Act, 2002. Accordingly, the previously prescribed criteria for notification of HFCs were withdrawn by the Reserve Bank on August 25, 2021. Review of Minimum Investment Grade Credit Ratings (MIGR) for Deposits of HFCs and NBFCs III.33 Extant guidelines relating to acceptance of public deposits by NBFCs and HFCs lay down a list of approved credit rating agencies (CRAs) and their corresponding MIGR. On May 02, 2022 the approved rating was uniformly standardized to ‘BBB-’ for any of the SEBI-registered CRAs, resulting in better comparability with other long-term debt instruments and across CRAs. Aadhaar e-KYC Authentication for Non-Bank Entities III.34 In terms of Section 11A of the prevention of money laundering (PML) Act, 2002, entities other than banking companies may be permitted through a notification of the central government to carry out authentication of clients’ Aadhaar number using e-KYC facility provided by the Unique Identification Authority of India (UIDAI). Such notification is to be issued only after consultation with UIDAI and the appropriate regulator. Accordingly, on September 13, 2021, the Reserve Bank enabled all NBFCs, payment system providers and payment system participants desirous of obtaining Aadhaar Authentication Licence—KYC User Agency (KUA) Licence or sub-KUA Licence (to perform authentication through a KUA)—to submit their applications to the Reserve Bank for examination and recommending to UIDAI after necessary due diligence. Guidelines on Compensation of Key Managerial Personnel (KMP) and Senior Management in NBFCs III.35 On April 29, 2022, the Reserve Bank issued a set of principles for fixing compensation of key managerial personnel (KMP) and senior management of NBFCs. As per the guidelines, NBFCs are required to constitute a Nomination and Remuneration Committee (NRC), which will be responsible for framing, reviewing and implementing the compensation policy. The NRC is also required to ensure ‘fit and proper’ status of the proposed as well as existing directors and that there is no conflict of interest in appointment of directors on Board of the company, KMPs and senior management. The guidelines inter alia prescribe that the compensation package comprising fixed and variable pay may be adjusted for all types of risks. A certain portion of variable pay may have a deferral arrangement and the deferral pay may be subjected to malus/ clawback arrangement. Diversification of Activities by Standalone Primary Dealers (SPDs) III.36 On October 11, 2022, the Reserve Bank allowed SPDs to offer all foreign exchange market-making facilities to users as a part of their non-core activities, as currently permitted to Authorized Dealers Category-I (AD-1), to strengthen their role as market makers at par with banks operating primary dealer business. Effective January 01, 2023, all financial transactions involving the Rupee undertaken globally by related entities of the SPD are required to be reported to Clearing Corporation of India’s trade repository before 12 noon of the business day following the date of transaction. Revised Regulatory Framework for Asset Reconstruction Companies III.37 In April 2021, the Reserve Bank had set up a Committee to undertake a comprehensive review of the working of ARCs and recommend suitable measures to enable them to fully utilise their potential for resolving stressed assets and function in a more transparent and efficient manner. Accordingly, the extant regulatory framework for ARCs was amended on the basis of recommendations of the Committee and feedback from the stakeholders (Box III.3). 3.3 Co-operative Banks Appointment of Chief Risk Officer in Primary (Urban) Co-operative Banks III.38 On June 25, 2021, the Reserve Bank advised all UCBs having asset size of ₹5,000 crore or above to appoint a Chief Risk Officer (CRO) in view of the increasing size and scope of their business. The Board of the UCB is required to clearly define the CRO’s role and responsibilities and ensure that they function independently. Revised Regulatory Framework for UCBs III.39 On July 19, 2022, the Reserve Bank issued a revised regulatory framework for UCBs under which a simple four-tiered approach was adopted with differentiated regulatory prescriptions aimed at strengthening their financial soundness7. It stipulated a minimum net worth of ₹2 crore for Tier 1 UCBs operating in single district and ₹5 crore for all other UCBs (of all tiers) to strengthen their resilience and ability to fund their growth. Recent guidelines on the matter stipulate that UCBs which do not meet the requirement are provided a glide path till March 31, 2028 with an intermediate target to achieve at least 50 per cent of the applicable minimum net worth on or before March 31, 2026 to facilitate smooth transition. III.40 The minimum CRAR requirement for Tier 1 banks was retained at 9 per cent, while that for Tier 2, Tier 3 and Tier 4 UCBs was revised to 12 per cent to strengthen their capital structure. Banks that did not meet the revised CRAR were provided a glide path of three years with a target of achieving CRAR of 10 per cent by March 31, 2024, 11 per cent by March 31, 2025 and 12 per cent by March 31, 2026. Automatic Route for Branch Expansion III.41 Under the revised regulatory framework, the Reserve Bank decided to introduce an automatic route for branch expansion of UCBs that meet the revised financially sound and well managed (FSWM) criteria8, permitting them to open new branches up to 10 per cent of the number of branches as at end of the previous financial year subject to a minimum of one branch and a maximum of five branches. While the branch expansion proposals under the prior approval route will continue to be examined as hitherto, the process of granting approval will be simplified. III.42 In line with international best practices, the Reserve Bank has evolved its supervision to be more risk focused and forward looking. Ongoing activities and proposed projects are expected to further augment the scope and capacity of off-site as well as on-site supervision, monitoring and surveillance. To ensure that the supervisory intensity and effectiveness remain contemporaneous with the fast-changing financial system, efforts are channelised towards making the surveillance systems sharper, more comprehensive and in tune with the international best practices. Chief Compliance Officer (CCO) in NBFCs III.43 To strengthen the compliance function in NBFCs, the Reserve Bank prescribed certain principles, standards, and procedures on April 11, 2022. The guidelines, made applicable to NBFCs in the upper and middle layer, envisage putting in place a board approved policy and a compliance function, including the appointment of a Chief Compliance Officer (CCO), latest by April 1, 2023 and October 1, 2023, respectively. The instructions inter alia specify the responsibilities of the Board and senior management, conditions for appointment and tenure of CCO, and minimum expectations from, independence of and dual hatting of compliance function. Core Financial Services Solution for NBFCs III.44 NBFCs in the middle and upper layer with ten and more fixed point service delivery units as on October 1, 2022 are mandated to implement core financial services solution (CFSS) by September 30, 2025 in a phased manner akin to the core banking solution (CBS) adopted by banks. NBFCs in the base layer and those in middle and upper layers with less than ten fixed point service delivery units were advised to consider implementation of a CFSS for their own benefit. Establishment of Digital Banking Units III.45 A Committee on establishment of digital banking units (DBUs) was set up by the Reserve Bank, which gave its recommendations on a digital banking unit model, facilities to be offered in DBUs, monitoring of functioning of DBUs, cyber security and other IT related aspects, and the role of DBUs in spreading digital banking awareness. Based on the recommendations of the Committee, the guidelines on establishment of DBUs were issued on April 7, 2022. III.46 The guidelines provided clarity on definitions of digital banking and DBUs, the infrastructure and resources required by DBUs, products and services to be offered, reporting requirements, role of Board of Directors and customer grievance redressal mechanism. As per the guidelines, DBUs are required to create awareness among their customers by offering hands-on customer education on safe digital banking practices. They will facilitate customers in embarking on the digital journey through digital modes in a paperless, efficient, safe and secured environment. This is expected to enhance financial inclusion and make available the full array of financial products to the public in a seamless and efficient manner. In the process, digital banking has also been recognised as a distinct business segment under retail banking. III.47 On October 16, 2022 75 DBUs were set up in 75 districts of the country to commemorate 75 years of India’s independence. The financial services to be provided by the DBUs include savings, credit, investment and insurance. On the credit delivery front, to start with, the DBUs will provide end-to-end digital processing of small ticket retail and MSME loans, starting from online applications to disbursals. The DBUs will also provide services related to certain identified government sponsored schemes. The products and services in these units will be provided in two modes, namely, self-service and assisted modes, with self-service mode being available on 24*7*365 basis. Digital Lending III.48 In the recent period, technological innovations have led to marked improvements in efficiency, productivity, quality, inclusion and competitiveness in extension of financial services, especially in the area of digital lending. Against the backdrop of business conduct and customer protection concerns arising out of the spurt in digital lending activities, the Reserve Bank had set up a Working Group on ‘Digital Lending including Lending through Online Platforms and Mobile Applications’ (WGDL), which placed its report in the public domain on November 18, 2021. On August 10, 2022, the Reserve Bank released a regulatory framework for its REs, lending service providers (LSPs) engaged by them and their respective digital lending applications (DLAs) to support orderly growth of credit delivery through digital lending methods based on the inputs received from various stakeholders. III.49 The recommendations of WGDL accepted for immediate implementation on September 2, 2022 focus on enhancing customer protection and making the digital lending ecosystem safe and sound while encouraging innovation. These include: (i) all loan disbursals and repayments to be executed only between the bank accounts of borrower and the RE without any pass-through/ pool account of the LSP or any third party; (ii) any fees or charges payable to LSPs in the credit intermediation process to be paid directly by the RE and not by the borrower; (iii) a standardized key fact statement (KFS), including annual percentage rate (APR), to be provided to the borrower before executing the loan contract; (iv) a cooling-off period during which the borrowers can exit digital loans by paying the principal and the proportionate APR without any penalty to be provided as part of the loan contract; (v) REs to ensure that they and the LSPs engaged by them have a suitable nodal grievance redressal officer to deal with FinTech/ digital lending related complaints; (vi) data collected by DLAs to be need based, have clear audit trails and only collected with prior explicit consent of the borrower, wherein the borrower may accept or deny consent for use of specific data; and (vii) any lending sourced through DLAs and all new digital lending products extended by REs over merchant platforms involving short term credit or deferred payments are required to be reported to credit information companies (CICs) by REs. The guidelines were made applicable to new customers getting onboarded as well as to the existing customers availing fresh loans effective September 2, 2022, while the existing digital loans had to comply with the guidelines by November 30, 2022. 6. Financial Markets and Foreign Exchange III.50 The Reserve Bank introduced market reforms and regulatory policy changes in coordination with the Government and other stakeholders with a view to developing safe and stable financial markets which facilitate efficient price discovery. The policy aim is to increase the depth and width of financial markets and provide appropriate products for trading and risk management. As a part of this approach, it also aims at easing access, enhancing participation, facilitating innovation, protecting users and promoting fair conduct of businesses. Foreign Currency Lending by Authorised Dealer Category I (AD-I) Banks III.51 With a view to facilitating foreign currency borrowings by a larger set of borrowers who may find it difficult to directly access overseas markets, the Reserve Bank permitted AD-I banks on July 07, 2022 to utilise overseas foreign currency borrowings (OFCBs) for lending in foreign currency to constituents in India for a wider set of end-use purposes. This is, however, subject to the negative list set out for external commercial borrowings (ECBs). The dispensation for raising such borrowings was available till October 31, 2022. Permitting Banks and SPDs to Deal in Off-shore Foreign Currency Settled Rupee Derivatives Market III.52 To provide a fillip to the interest rate derivatives market, remove the segmentation between on-shore and off-shore markets and improve the efficiency of price discovery, the Reserve Bank on February 10, 2022 and August 8, 2022 allowed AD-I banks and SPDs authorized under section 10(1) of FEMA, 1999, respectively, to undertake transactions in the off-shore foreign currency settled overnight indexed swap (FCS-OIS) market based on the overnight Mumbai interbank offered rate (MIBOR) benchmark with non-residents and other market-makers. AD-1 banks can undertake these transactions through their branches in India, foreign branches or International Financial Services Centre (IFSC) banking units. International Trade Settlement in Indian Rupees (INR) III.53 In order to boost export growth and to support the increasing interest of the global trading community in the Indian rupee, on July 11, 2022 the Reserve Bank put in place an additional arrangement for invoicing, payment and settlement of exports and imports in INR. Accordingly, AD banks in India were allowed to open special rupee vostro accounts of correspondent banks of the partner trading country for settlement of trade transactions with the prior approval of Reserve Bank. Liberalisation of External Commercial Borrowing (ECB) Policy III.54 On August 1, 2022, the Reserve Bank, in consultation with the Central Government, increased the automatic route limit for ECBs from USD 750 million or equivalent to USD 1.5 billion or equivalent and the all-in-cost ceiling for ECBs by 100 bps for eligible borrowers with an investment grade rating from Indian CRAs. The above dispensations will be available up to December 31, 2022. Operationalisation of New Overseas Investment Regime III.55 On August 22, 2022, the Reserve Bank issued directions operationalising a new overseas investment regime. The new regime, simplifying the existing framework for such investment by persons resident in India, covered a wider range of economic activities and significantly reduced the need for seeking specific approvals. The directions, brought through the Overseas Investment Rules and Regulations, 2022, are expected to promote ease of doing business and reduce compliance burden and associated compliance costs. The directions include, inter alia, the introduction of the concept of ‘strategic sector’, flexibility in pricing guidelines for investment/ disinvestment, and investment in financial service sector by non-financial sector (except insurance and banking) entities under the automatic route subject to certain conditions. Additionally, a mechanism of a ‘late submission fee (LSF)’ was introduced for taking on record delayed reporting. 7. Credit Delivery and Financial Inclusion III.56 The Reserve Bank has put in place several policies to improve access to an array of basic formal financial services and products and to scale up financial awareness. The National Strategy for Financial Inclusion (NSFI) 2019-24 sets forth the vision and key objectives of financial inclusion policies in India, with an emphasis on enhancing digital financial inclusion, promoting financial literacy and strengthening the grievance redressal mechanism in the country. Initiatives in Priority Sector Lending (PSL) III.57 To ensure continuation of the synergies that have been developed between banks and NBFCs in delivering credit to the specified priority sectors, the facility of PSL classification for loans to NBFCs by commercial banks and loans to NBFC-MFIs by SFBs for the purpose of on-lending to certain priority sectors has been allowed on an on-going basis. The PSL limit for loans against negotiable warehouse receipts (NWRs) or electronic NWRs (eNWRs)9 was increased from ₹50 lakh to ₹75 lakh per borrower to encourage their use and to ensure greater flow of credit to the farmers against pledge or hypothecation of agricultural produce. Enhancement of Collateral Free Loans to Self Help Groups (SHGs) under Deendayal Antyodaya Yojana III.58 Following amendments in the Credit Guarantee Fund for Micro Units (CGFMU) scheme carried out by the Government in July 2021, the amount of collateral free loan to SHGs under the Deendayal Antyodaya Yojana- National Rural Livelihood Mission (DAY-NRLM) has been enhanced from ₹10 lakh to ₹20 lakh. The guidelines of the Reserve Bank have been revised to stipulate that for loans to SHGs above ₹10 lakh and up to ₹20 lakh, no collateral should be charged and no lien should be marked against their savings bank account. The entire loan (irrespective of the loan outstanding, even if it subsequently goes below ₹10 lakh) would be eligible for coverage under CGFMU. This is expected to enable women SHGs to access higher quantum of loans. 8. Consumer Protection and Retail Participation III.59 Consumer education and protection have been the prime focus of the Reserve Bank. It continued to take initiatives at various levels— covering REs, customers and the Reserve Bank ombudsmen—to improve customer satisfaction. During 2021-22, the Reserve Bank also initiated steps to increase retail participation in G-secs. Reserve Bank - Integrated Ombudsman Scheme (RB-IOS), 2021 III.60 To make the Ombudsman mechanism simpler, efficient and more responsive, the Reserve Bank rolled out the RB-IOS on November 12, 2021 by integrating the three erstwhile ombudsman schemes, namely the Banking Ombudsman Scheme (BOS), 2006; the Ombudsman Scheme for Non-Banking Financial Companies (OSNBFC), 2018 and the Ombudsman Scheme for Digital Transactions (OSDT), 2019. The scheme defines ‘deficiency in service’ as the ground for filing a complaint with a specified list of exclusions. This implies that no complaints will be rejected on account of not being covered under the grounds listed in the scheme. The system is designed on the ‘One Nation, One Ombudsman’ principle and has done away with the jurisdictions assigned to each of the 22 ombudsman offices. To address credit information related issues, cr edit information companies (CICs) were also brought under the ambit of RB-IOS with effect from September 01, 2022. Internal Ombudsman (IO) Scheme for NBFCs and CICs III.61 The objective of the IO scheme is to enable satisfactory resolution of complaints at the REs’ level itself so as to minimise the need for escalation of complaints at other fora. Accordingly, deposit-taking NBFCs (NBFCs-D) with 10 or more branches and non-deposit taking NBFCs (NBFCs-ND) with an asset size of ₹5,000 crore and above having a public customer interface were directed on November 15, 2021 to appoint an IO at the apex of their internal grievance redressal mechanisms. On October 6, 2022, the directions were extended to CICs and will come into effect from April 1, 2023. The directions cover inter alia the appointment and tenure, roles and responsibilities, procedural guidelines, and oversight mechanism for the IO. All complaints that are wholly or partially rejected by the internal grievance mechanism of the RE, except on aspects related to frauds, and complaints involving commercial decisions, internal administration, pay and emoluments of staff and sub-judice matters, are required to be reviewed by the IO before a final decision is conveyed to the complainant. Introduction of the Reserve Bank Retail Direct Scheme III.62 The Reserve Bank as the debt manager of the Government of India has been proactively engaged in the development of the G-secs market, including broadening of the investor base. As a part of the continuing efforts to increase retail participation in G-secs, the ‘RBI Retail Direct Scheme’ was announced on July 12, 2021. The online portal, which was launched on November 12, 2021 makes it convenient for the retail investors to invest in central government securities, state government securities and sovereign gold bonds (SGBs) by opening a retail direct gilt (RDG) account with the Reserve Bank and to participate in both primary issuances of these securities as well as their secondary markets in a safe, simple, secured and direct manner. III.63 Further, the Reserve Bank on January 04, 2022 also notified Retail Direct Market Making Scheme mandating primary dealers to be present on the Negotiated Dealing System-Order Matching (NDS-OM) platform (odd lots and request for quotes segments) throughout market hours and respond to buy/sell requests from RDG account holders. 9. Payments and Settlement Systems III.64 The accelerated development of the payments ecosystem in India, facilitated by increased adoption of technology and innovation, has established the country as a force to reckon with in the global payments arena not only in terms of growth in digital payments but also through the availability of a bouquet of safe, secure, innovative and efficient payment systems. The recent initiatives taken by the Reserve Bank have focused on technology-based solutions for the improvement of the payments ecosystem and are built upon the five pillars of integrity, inclusion, innovation, institutionalisation and internationalisation, as envisaged in the Payments Vision 2025. Enhancements to Unified Payments Interface (UPI) III.65 UPI123Pay was launched in March 2022 to enable feature phone users to make UPI payments. It can be accessed through four options viz., (i) app-based functionality, (ii) missed call, (iii) interactive voice response (IVR), and (iv) proximity sound-based payments. It has facilitated access to UPI for more than 40 crore feature phone subscribers in the country. In September 2022, UPI Lite was introduced to facilitate low value transactions in offline mode through an on-device wallet feature. The Reserve Bank also allowed linking of credit cards to the UPI network in June 2022, with the initial facilitation planned for RuPay credit cards. This arrangement is expected to enhance convenience by providing more avenues to customers for making payments through the UPI platform. Interoperable Card-less Cash Withdrawal (ICCW) at ATMs III.66 To encourage a card-less cash withdrawal facility across all banks and ATM networks in an interoperable manner, the Reserve bank permitted customer authorisation using UPI with settlement of transactions through the ATM network in May 2022. The facility of card-less cash withdrawal will help contain frauds like skimming, card cloning and device tampering. Offline Payments III.67 Absence of or erratic internet connectivity, especially in remote areas, is a major impediment for adoption of digital payments. A pilot to test innovative technologies that enable offline digital payments was undertaken in different parts of the country from September 2020 to July 2021. The experience of pilot programmes and the feedback received indicated a scope for introduction of such offline payment solutions, particularly in semi-urban and rural areas. Accordingly, the Reserve Bank released a framework for facilitating small value digital payments in offline mode on January 03, 2022. Under this framework, offline transactions do not require an additional factor of authentication (AFA) and are subject to a limit of ₹200 per transaction with an overall limit of ₹2,000 for all transactions until the balance in the account is replenished. Replenishment of used limit is permitted only in online mode with AFA. e-Mandates for Recurring Payments – Limit Enhancement III.68 Keeping in view the dynamic payment requirements and the need to balance safety and security of card transactions with customer convenience, the Reserve Bank had permitted processing of e-mandates on all types of cards for recurring transactions on August 21, 2019. The instructions were subsequently extended on January 10, 2020 to cover UPI transactions. Based on requests received from stakeholders and keeping in mind the sufficient protection available to customers, the limit for such transactions was increased from ₹2,000 to ₹15,000 per transaction on June 16, 2022. Availability of National Automated Clearing House (NACH) on All Days of the Week III.69 The NACH system is a web-based solution operated by National Payments Corporation of India to facilitate inter-bank, high volume, electronic transactions which are repetitive and periodic in nature. In 2021-22, the NACH processed 421 crore transactions that included 313 crore credit transactions, of which 247 crore involved direct benefit transfers (DBT). III.70 To cater to the demand from Government and billers and the rising need to ensure availability of all channels facilitating electronic payments throughout the year, the Reserve Bank made NACH operational on all days of the week, including weekends and other holidays, with effect from August 1, 2021. Thereafter, more settlement cycles have been introduced in NACH to further enhance efficiency of the ecosystem. This initiative provided many advantages including inter alia faster credit and utilisation of DBT, allowing corporates and other stakeholders to pay dividend and interest on all days, and enabling recovery of recurring amounts like loan instalments, insurance premiums and SIPs on due dates. Enhancements to Indo-Nepal Remittance Facility Scheme III.71 The ceiling per transaction under the Indo-Nepal Remittance Facility Scheme was enhanced from ₹50,000 to ₹2 lakh with effect from October 1, 2021 and the cap on the number of remittances in a year was removed to boost trade payments between India and Nepal and facilitate person-to-person remittances electronically to Nepal. The enhancements are expected to facilitate payments including inter alia retirement and pension to ex-servicemen who have settled in or relocated to Nepal. III.72 The Reserve Bank’s policy responses in 2021-22 and 2022-23 so far have been conditioned by the fast changing macro-financial environment hit by multiple shocks as also the overriding goal of promoting a robust, resilient and efficient financial system. Even as storm clouds gather over the global economy, the strength and resilience of the Indian financial system has been a key factor in supporting its comparatively superior overall macro outlook. Banks and non-banking financial institutions will have to remain prepared to face new challenges and reap emerging opportunities in this dynamic environment, keeping their focus on appropriate business models, adoption of new technologies, sustainability, stability, consumer protection and financial inclusion. The Reserve Bank’s forthcoming initiatives are expected to guide the progress of regulated entities in this direction, secure and preserve financial stability and enhance efficient functioning of markets. 1 Since the variables under consideration are of different orders of integration, Engle Granger and Johansen tests of cointegration cannot be applied. To circumvent this problem, the ARDL method was chosen. 2 Inflation volatility was calculated using an exponential generalised auto regressive conditional heteroskedastic (EGARCH (1,1)) model as it does not impose non-negativity constraints on parameters and is able to capture asymmetry in the responsiveness of inflation volatility to shocks to inflation (Katusiime, 2018). 3 Business expectations index (BEI) combines nine parameters- (1) overall business situation, (2) production, (3) order books, (4) inventory of raw material, (5) inventory of finished goods, (6) profit margin, (7) employment, (8) exports and (9) capacity utilisation. A value above 100 indicates an expansion of the overall business activity and a value below 100 indicates contraction. 4 ASISO was introduced in August 2020 to provide greater flexibility to banks in managing their day-end CRR balances under which banks pre-set a specific (or range of) amount that they wish to maintain at the end of the day. Any shortfall or excess balances maintained automatically trigger MSF or reverse repo bids, as the case may be, under the ASISO facility. 5 CICs will continue to maintain, on an on-going basis, adjusted net worth in terms of their extant directions. 6 such as compliance with minimum supervisory rating and no adverse report from other authorities. 7 Tier 1 - All unit UCBs and salary earners’ UCBs (irrespective of deposit size), and all other UCBs having deposits up to ₹100 crore; Tier 2 - UCBs with deposits more than ₹100 crore and up to ₹1,000 crore; Tier 3 - UCBs with deposits more than ₹1,000 crore and up to ₹10,000 crore; Tier 4 - UCBs with deposits more than ₹10,000 crore. 8 The revised criteria for determining the FSWM status include: CRAR to be at least 1 percentage point above the minimum CRAR applicable; net NPA of not more than 3 per cent; net profit for at least three out of preceding four years and no net loss in the immediate preceding year; no default in the maintenance of CRR / SLR during the preceding financial year; sound internal control system with at least two professional directors on the Board; core banking solution (CBS) fully implemented; and no monetary penalty imposed on the bank on account of violation of the Reserve Bank directives/ guidelines during the last two financial years. 9 NWRs and eNWRs are issued by warehouses registered and regulated by Warehouse Development and Regulatory Authority. |

Page Last Updated on: