IST,

IST,

Market Financing Conditions for NBFCs: Issues and Policy Options

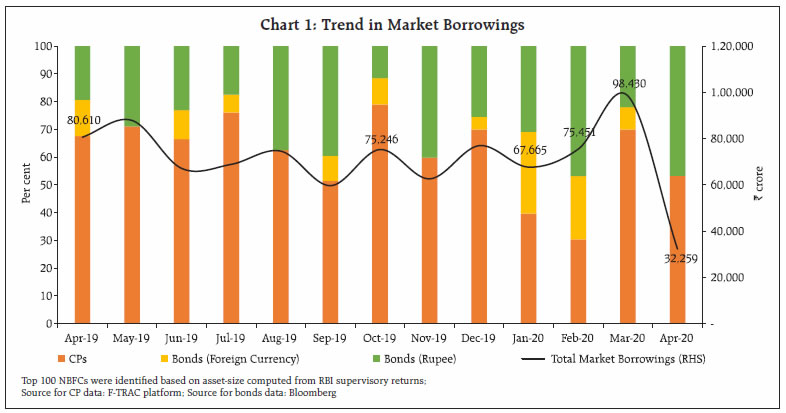

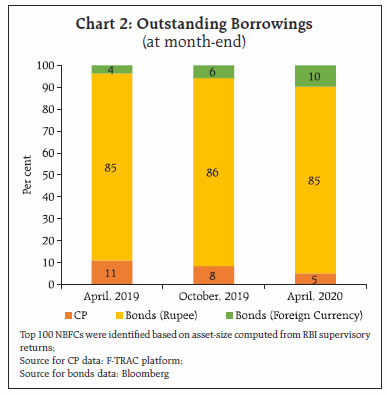

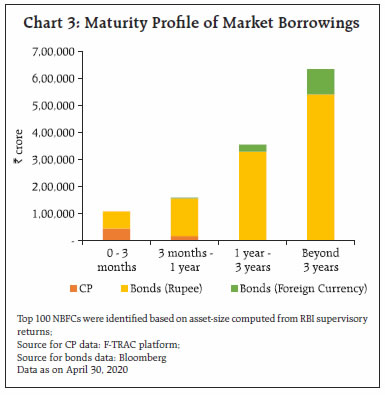

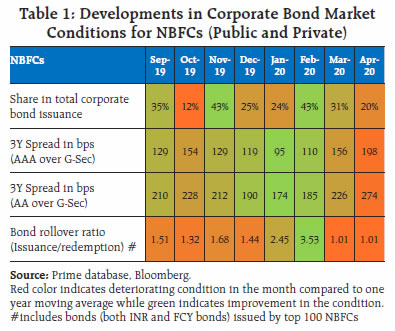

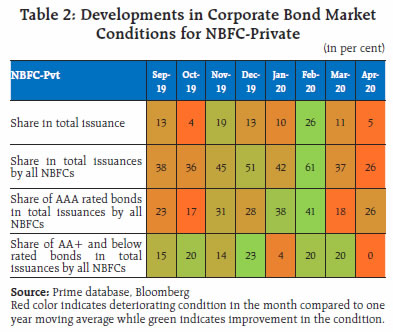

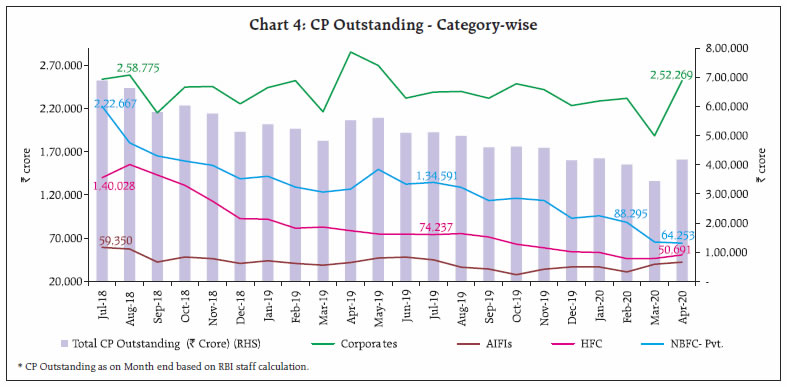

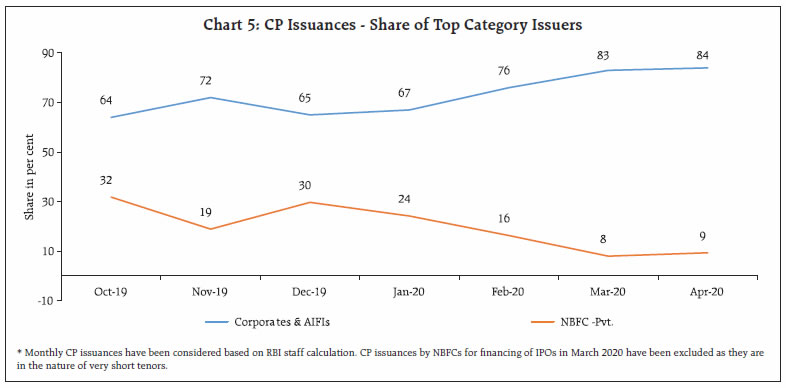

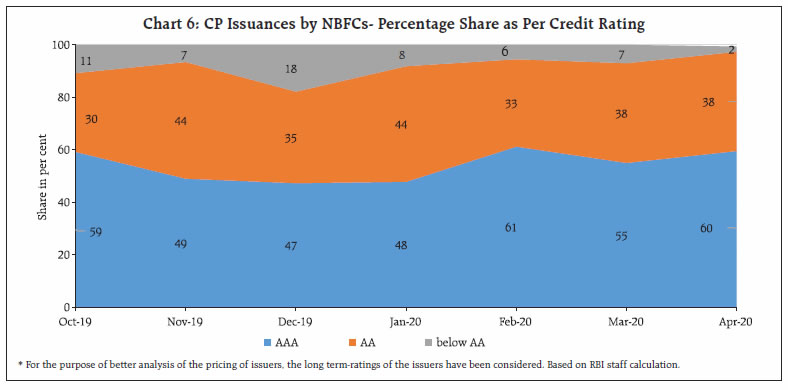

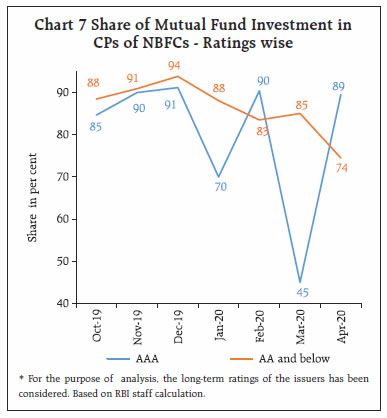

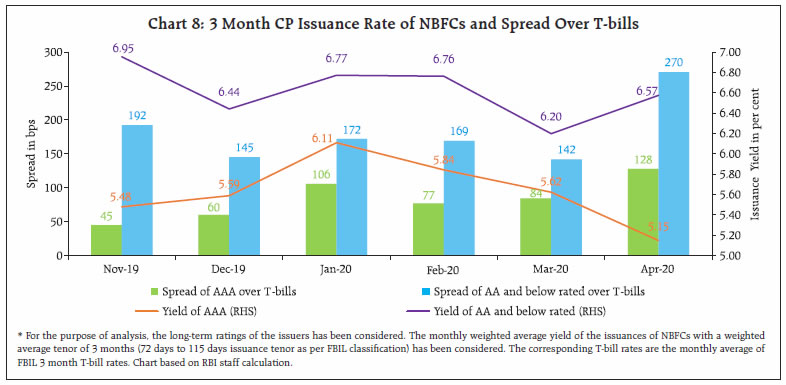

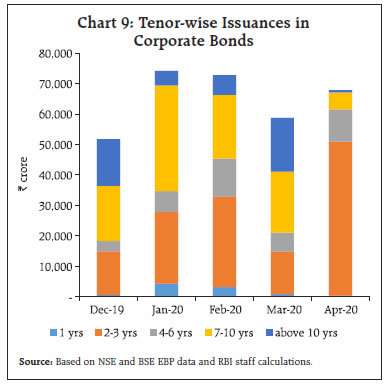

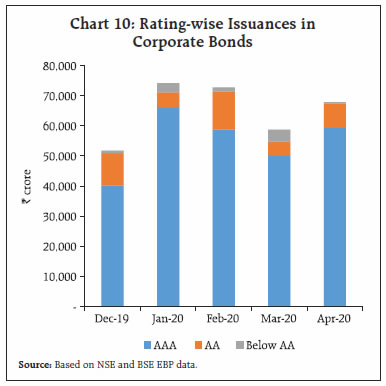

Market financing conditions for non-banking financial companies (NBFCs), have become more challenging in recent times, due to COVID-19 related disruptions, and developments in the mutual fund sector, in an environment of heightened risk aversion and differentiation between entities, based on their perceived risk profile. Further policy interventions may be needed to ensure flow of funds to credit-worthy NBFCs, especially small and medium-sized ones and to minimise systemic risks. Introduction Non-banking financial companies play an important role in promoting inclusive growth in the country, by catering to the diverse financial needs of customers not having access to bank finance. NBFCs in India appear to be substituting for direct lending by banks in the non-urban parts of the Indian economy (Acharya et al., 2013). In recent years, NBFCs have also been a significant source of credit to the micro, small and medium enterprises (MSMEs) sector, which accounts for about 29 per cent of India’s GDP1. Further, specialised NBFCs have also played an important role in infrastructure development by providing long term financing to this sector. The significance of NBFCs in the Indian financial landscape has increased during the past years, with their combined assets expanding from ₹14.5 lakh crore as at end March-2014 to above ₹32 lakh crore by end September-20192, though there has been some moderation post Infrastructure Leasing & Financial Services (IL&FS) event. Over time, NBFCs have also become deeply intertwined with other categories of financial institutions. Banks are a key source of credit for NBFCs. The Reserve Bank of India’s (RBI) regulations making credit to NBFCs for on-lending to certain specific sectors, eligible for classification as priority sector lending have also incentivised the flow of credit from banks to NBFCs. The reliance of NBFCs on market-based instruments, like corporate bonds and commercial paper (CPs), to meet their financing needs has also grown and stands at about 31 per cent of their total liabilities at end-December 20193. Mutual funds, especially debt funds, are one of the major investors in market instruments issued by NBFCs: mutual funds account for 61 per cent of total outstanding commercial papers issued by NBFCs as at end-March, 20204. Post IL&FS, however, market financing conditions for NBFCs became challenging. Action in terms of rating downgrades, intensive investor scrutiny and enhanced regulatory oversight were instrumental in bringing about greater market discipline, with the better rated and better performing companies continuing to have relatively easy access to market financing, while those with asset-liability mismatch (ALM) issues and/or asset quality concerns were subjected to higher borrowing costs (Financial Stability Report, RBI, June 2019). This period also saw an increase in offshore borrowing due to difficulties in raising funds domestically. These financing conditions got further affected in the wake of the collapse of a large housing finance company during 2019. In more recent times, the disruptions caused by COVID-19 outbreak have led to apprehensions that credit profiles of NBFCs could deteriorate, given the moratorium extended by NBFCs on their assets, as well as the overall environment of heightened risk aversion. Recent developments in the mutual fund industry, which is one of the major source of funding for NBFCs, have also led to apprehensions that NBFCs may face rollover risks.  In this milieu, this article examines the impact of recent events on the financing conditions of NBFCs. It attempts to assess their impact on the ability of NBFCs to continue to raise funds from the markets to meet their repayment obligations and other funding needs. The analysis is restricted to NBFCs’ market liabilities and does not factor in the impact (amelioratory or otherwise) of their bank borrowings, given that bank credit to NBFCs increased by a robust 29 per cent during 2018-19 and by 26 per cent during 2019-205. Section II discusses developments in market-based borrowing by the top 100 NBFCs in terms of asset size. Sections III and IV examine the changes in financing conditions in the corporate bond and CP markets, respectively. The impact of recent measures by the RBI to channel liquidity to this sector is set out in Section V. Section VI concludes the study. II. Developments in Market Borrowing by Top 100 NBFCs As on April 30, 2020, outstanding market borrowings for top 100 NBFCs, through CPs and bonds (both onshore and offshore), stood at around ₹12.6 lakh crore, marginally higher than ₹12.5 lakh crore a year before. Monthly market borrowings, during the past one year, remained in the range of ₹60,000 crore to ₹1,00,000 crore. In April 2020, however, such borrowings fell to less than ₹33,000 crore (Chart 1). There were increased offshore borrowing too, especially in the last quarter of FY 2019-20. Consequently, over the last one year, the share of foreign currency bonds issued by NBFCs in their total outstanding market liabilities has increased even as the share of CPs has reduced (Chart 2). The share of outstanding corporate bonds remained largely unchanged.  An analysis of the maturity pattern of outstanding market liabilities of NBFCs shows that, on April 30, 2020, ₹1.08 lakh crore (or close to 9 per cent of total outstanding market borrowings) is expected to mature within the next three months, while another ₹1.6 lakh crore (or 13.4 per cent of total outstanding market borrowings) will become due for repayment in the following nine months (Chart 3). Some NBFCs could face challenges in rolling over / financing the redemption requirements at competitive rates, given the current financing conditions for the sector as set out in Section III and IV, and the overall economic environment. To a certain extent, regulatory/ liquidity measures by the Reserve Bank, increased financing by banks and recent decisions by some banks to extend moratorium to borrowings by NBFCs may alleviate these challenges. Corporate bonds and non-convertible debentures (NCDs) account for 29 percent6 of the total liabilities of NBFCs indicating the crucial role of this market in providing funding to the sector. The financing conditions for NBFCs through the bond market have been analysed through various metrics, viz., share of the sector in overall issuances; spread over Government securities (G-Secs) for AAA and lower rated NBFCs; and bond rollover ratio (Table 1 and 2).    The financing conditions in the corporate bond market, which have remained under stress since the IL&FS event, gradually stabilised in the period December 2019 to February 2020 aided by lower interest rates, higher banking system liquidity and liquidity support measures such as Long Term Repo Operations (LTRO) by the Reserve Bank. This is illustrated by the green cells for the month of February 2020. Rationalisation of External Commercial Borrowing (ECB) directions by the RBI in January 2019 also facilitated overseas capital access for NBFCs and helped in diversifying their funding avenues. However, post the outbreak of COVID-19, market conditions for NBFCs have shown signs of deterioration, with a relatively greater impact on financing conditions for NBFC-Pvt - their share in overall corporate bond issuances fell sharply to 5 per cent in April 2020 from 26 per cent in February 2020. Post the developments related to IL&FS, total outstanding CPs, which stood at ₹6.88 lakh crore as on July 31, 2018, declined by 39 per cent to ₹4.17 lakh crore as on April 30, 2020 primarily in the case of NBFC-Pvt. and Housing Finance Companies (HFCs). Issuances by corporates and All India Financial Institutions (AIFIs) remained largely unchanged. Outstanding CPs of NBFC-Pvt. in particular, fell by 71 per cent (from ₹2.22 lakh crore as on July 31, 2018 to ₹64,253 crore as on April 30, 2020) (Chart 4).   IV.1 CP Issuance of NBFCs CP issuances of corporates and AIFIs category of issuers, as a percentage of the total issuance, has been increasing steadily (Chart 5). However, the share of NBFC-Pvt. issuances in total issuances has fallen sharply, especially during February and March 2020. IV.2 Lower Rated NBFCs Even as the overall issuances of CPs by NBFCs have declined in recent months, there has been a sharper reduction in issuances by lower rated NBFCs, possibly a manifestation of the increasingly challenging financial conditions faced by them (Chart 6).  Mutual funds, which are the largest investors in the CP market, except during the month of January and March 2020 when banks were major subscribers, have brought down their share in AA and below rated NBFCs from 94 per cent in December 2019 to 74 per cent in April 2020 (Chart 7).  IV.3 Pricing of CP Issuances In the recent period, the issuance rates for AAA rated NBFCs have moderated in line with the softening of policy rates. Yields for lower rated NBFCs have also softened but not commensurately. Between January and April 2020, yields on CP issuances by AAA rated corporates eased, on an average, by 96 basis points while yields for lower rated issuances softened by only 20 basis points over the same period. This was accompanied by a sharp increase in the spread of AA and below rated papers over the corresponding tenor Treasuy-Bills in the month of April 2020 (Chart 8). Beginning March 2020, the Reserve Bank undertook Targeted Long Term Repo Operations (TLTROs) of three years tenor for a total amount of up to ₹1 lakh crore at a floating rate linked to the policy repo rate, with a view to easing liquidity constraints and de-stressing markets for corporate bonds and CPs. Liquidity availed under the scheme by banks had to be deployed in investment grade corporate bonds, CPs and NCDs. Investments under this facility are also eligible to be classified as held to maturity (HTM) even in excess of 25 per cent of total investment permitted to be included in the HTM portfolio. Furthermore, their exposures under this facility would not be reckoned under the large exposure framework.  TLTROs had a salutary impact on the market. In response to these auctions, there was a significant uptick in the corporate bond market and a moderation in the liquidity pressures faced by various entities including NBFCs. The weighted average rate of issuances in the 2-3 years bucket was also lower by around 150 basis points in April 2020 (Table 3). In respect of issuances by NBFCs, the weighted average rate of issuances in the bucket softened by around 85 bps. Around 74 per cent of the total issuance in April 2020 was in 2-3 years bucket as compared to around 41 per cent and 24 per cent of issuance being in the 2-3 years bucket during February and March 2020, respectively (Chart 9).  Corporates (including banks) were the major category of issuers, followed by NBFCs and HFCs during March and April 2020. However, like in previous months, most issuances in March-April 2020 were by AAA rated entities and public sector undertakings (Chart 10), indicating that the bulk of the benefit of TLTROs accrued to higher rated entities. In the CP market, issuances were lower across all categories in April as issuers appeared to prefer raising longer tenor bonds and lock-in the lower rates for a longer time to avoid roll-over risks. In order to ensure flow of liquidity to small and mid-sized corporates, including NBFCs and micro finance institutions (MFIs), the Reserve Bank decided to conduct TLTRO 2.0 for an aggregate amount of ₹50,000 crore. The funds availed by banks under TLTRO 2.0 should be invested in investment grade bonds, CPs, and NCDs of NBFCs, with at least 50 per cent of the total amount availed going to small and mid-sized NBFCs and MFIs. However, the response to these auctions has been less than encouraging, with the bid to cover ratio for the first tranche of TLTRO 2.0 for a notified amount of ₹25,000 crore at 0.5.  Going forward, there are significant near-term redemptions arising out of scheduled repayments on market borrowings through CPs and corporate bonds by NBFCs. The moratorium extended by NBFCs/HFCs on their assets, coupled with the overall environment of risk aversion, could impact the cashflows for the sector. The possibility of liquidity pressures remaining elevated for some of these NBFCs, especially those with high dependencies on market borrowing, cannot be ruled out. To a certain extent, this gap could be bridged through increased bank borrowing and/or group support by some NBFCs. However, one of the major lenders to NBFCs – the mutual fund industry – is also facing challenges due to the uncertain economic outlook and the impact of closure of a few debt funds. In this context, the possibility of the NBFC sector, at least some of the NBFCs, facing headwinds in meeting their funding requirements through market borrowing cannot be ruled out. Measures undertaken by the Reserve Bank have considerably eased the stress in market conditions; however, stress is still visible in certain areas of the market. This appears to suggest that the problem is not just of liquidity but, possibly, of expectations of deterioration in credit quality on account of COVID-19 related disruptions. The emerging developments indicate a need for policy interventions, which go beyond liquidity related measures to credit related ones. There is a need for ensuring flow of credit/liquidity to NBFCs with concrete credit backstop measures to address the risk aversion in the system, bridge the trust deficit and restore confidence. At the time of this article going to press, Government of India, as part of an economic stimulus package, has announced full and partial guarantees on investments in debt securities issued by NBFCs under two different schemes. The first scheme is a ₹ 30,000 crore special liquidity facility for NBFCs and HFCs, under which a Special Purpose Vehicle (SPV) would acquire investment grade debt of short duration (residual maturity of upto 3 months) of eligible NBFCs / HFCs. Through another scheme, which is an extension of already existing Partial Credit Guarantee Scheme (PCGS), Government would guarantee up to 20 percent of first loss for purchase by public sector banks of bonds or CPs with a rating of AA and below (including unrated paper with original/ initial maturity of up to one year) issued, among others, by NBFCs. These measures may lead to softening in yields of CPs and bonds of NBFCs, supplement the measures already announced by the Reserve Bank, and may alleviate the challenges in raising/rolling-over market debt for NBFCs. The improvements in market financing conditions and robust bank credit to the NBFC sector are expected to ease the liquidity conditions for this sector. In the medium term, there is a need to deepen the corporate bond markets. Standardisation of valuation of the corporate bonds will also result in transparent pricing for the investors, which will help them in taking more informed decision on their risk appetite. Diversification of investor base and increased participation from long term investors will also be needed. All these measures need to be supported by a credit risk transfer mechanism in the corporate bond market through an active credit default swap (CDS) market. Introduction of the legislation on bilateral netting could provide a fillip to the CDS market. References Shri P Vijaya Bhaskar (2014), “Non-Banking Finance Companies: Game Changers”, Speech delivered at ASSOCHAM, Delhi V. Acharya, H. Khandwala, T.S. Öncü (2013), “The growth of a shadow banking system in emerging markets: Evidence from India”, Journal of International Money and Finance, 39 (2013), pp. 207-230 RBI (2019), Financial Stability Report, July, Reserve Bank of India, Mumbai. * This article is prepared by Rituraj, M Jagadeesh, Abhishek Kumar and Amit Meena of Financial Markets Regulation Department, Reserve Bank of India. The authors are grateful to Saswat Mahapatra for valuable guidance. The views expressed in this article are those of the authors and do not represent the views of the Reserve Bank of India. The analysis is based on data upto end April 2020. 1 Annual Report of Ministry of MSMEs, 2018-19. 2 Various issues of Report on Trend and Progress of Banking in India. 3 RBI staff calculation for top 100 NBFCs from RBI supervisory returns. Data as on December 2019. 4 SEBI data and RBI staff calculation. 5 As per data on sectoral deployment of banks credit released by RBI. 6 RBI supervisory (provisional) returns data for top 100 NBFCs based on asset-size. Data as on December 31, 2019. |

Page Last Updated on: