IST,

IST,

Union Budget 2023-24: An Assessment

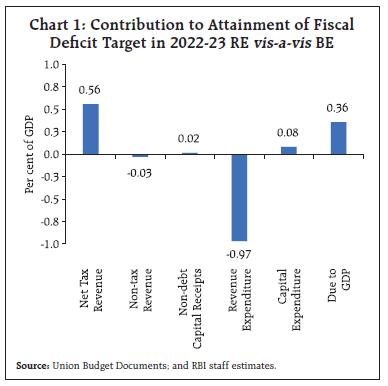

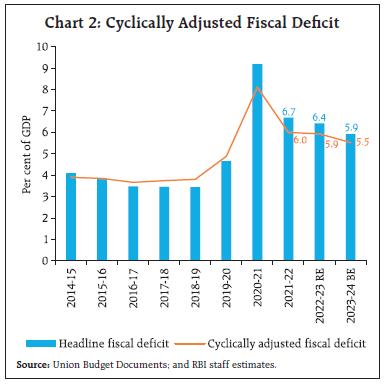

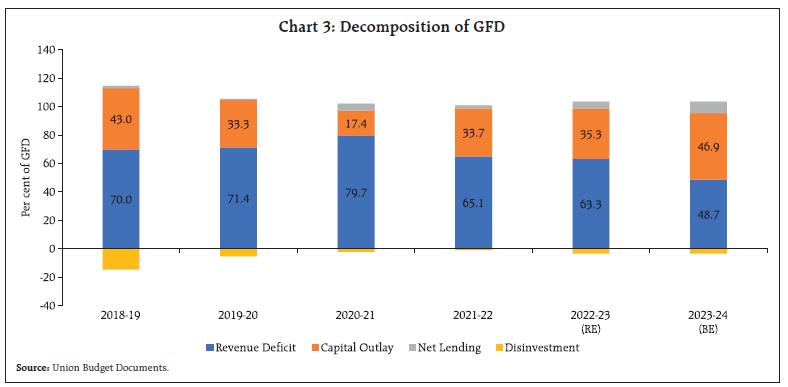

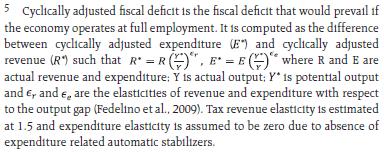

by Saksham Sood, Ipsita Padhi, Anoop K. Suresh, Bichitrananda Seth and Samir Ranjan Behera The Union Budget 2023-24 envisages capital expenditure as a key lever of growth and commits to credible fiscal consolidation for strengthening macro-stability. Public debt levels have moderated as the government resorted to prudent fiscal management notwithstanding the challenges induced by the pandemic. Budget proposals for infrastructure creation, digitisation, green transition and youth empowerment are expected to yield dividends beyond the near-term by lifting the economy’s growth potential. Introduction The Union Budget 2023-24 comes at a time when India is being viewed globally as a bright spot, in an otherwise uninspiring global economic landscape. It strikes the right chords through measures aimed at accelerating growth and job creation while promoting macroeconomic stability. The Budget adopts seven priorities that complement each other viz., inclusive development, infrastructure and investment, reaching the last mile, unleashing the potential, green growth, youth power and financial sector to guide its policy objectives. These initiatives would lift the economy’s potential, providing productivity benefits into the long-term. According due attention to fiscal prudence, the union government has managed to adhere to the budgeted fiscal deficit target of 6.4 per cent of GDP in 2022-23 (RE) despite the supply-side disruptions emanating largely from the war in Europe. In 2023-24, the gross fiscal deficit is budgeted to further consolidate to 5.9 per cent of GDP. The government has also reiterated its commitment to reduce the fiscal deficit to below 4.5 per cent of GDP by 2025-26, which was first announced in the Union Budget 2021-22. The Budget proposes measures to simplify the tax structure and widen the tax base through measures aimed at reducing the compliance burden of the taxpayers, formalisation of the supply chains and improvement in the ease of doing business. Redrawing of the personal income tax slabs will help boost consumption, especially at a time when global recessionary fears continue. On the expenditure front, revenue expenditure growth has been contained at 1.2 per cent, while capital expenditure is budgeted to increase to 3.3 per cent of GDP in 2023-24 (BE) as against an average of 1.7 per cent during 2010-20. Furthermore, to incentivise States to undertake capital expenditure, the scheme for providing financial assistance to the States for capital expenditure1 has been extended to 2023-24 (BE) with an enhanced allocation of ₹1.3 lakh crore.2 Against this backdrop, the rest of the article is divided into seven sections. Section II discusses the underlying dynamics of the fiscal deficit. Section III and IV make an assessment of the trends in receipts and expenditure of the union government. Section V delineates the outstanding liabilities of the union government. Section VI discusses the major sources of financing the fiscal deficit whereas Section VII dwells upon the transfer of resources to States. Section VIII sets out the concluding observations. II. Fiscal Deficit – The Underlying Dynamics The government adhered to the budgeted fiscal target of 6.4 per cent of GDP in 2022-23 (RE).3 In absolute terms, however, the gross fiscal deficit (GFD) surpassed budget estimates by ₹94,123 crore as the increase in revenue expenditure outweighed the higher receipts. Revenue expenditure surpassed the budget estimates by ₹2.6 lakh crore while capital expenditure fell short by ₹21,972 crore, resulting in a net increase in total expenditure by ₹2.4 lakh crore. On the receipts side, net tax revenue overshot the budgeted target by ₹1.5 lakh crore and non-debt capital receipts are estimated to exceed the budget estimates by ₹4,209 crore. This was partly offset by lower non-tax collections, which witnessed a shortfall of ₹7,900 crore (Chart 1). For 2023-24, the GFD is budgeted at 5.9 per cent of GDP4 - a consolidation of 51 basis points over 2022-23 (RE). Considering the underlying economic cycle, the cyclically-adjusted fiscal deficit for 2023-24 stands lower at 5.5 per cent (Chart 2).5 Further, the government remains committed to attain the medium-term target of achieving GFD of below 4.5 per cent by 2025-26. The consolidation in 2023-24 is sought to be achieved through containment of revenue expenditure to 11.6 per cent of GDP, even as capital expenditure is budgeted to rise to a high of 3.3 per cent of GDP (Table 1). Fiscal consolidation can free up productive resources for the private sector and contribute to lowering the cost of capital, thereby raising the growth rate of the economy in 2023-24.   Decomposition of GFD The revenue deficit, which pre-empted around 70 per cent of the GFD during 2018-19 to 2020-21, is estimated to decline to 63.3 per cent in 2022-23 (RE) and further to 48.7 per cent in 2023-24 (BE). On the other hand, the contribution of growth-inducing capital outlay is budgeted to rise to 46.9 per cent in 2023-24 from an average of 36.5 per cent of GFD during 2010-11 to 2019-20 (Chart 3).

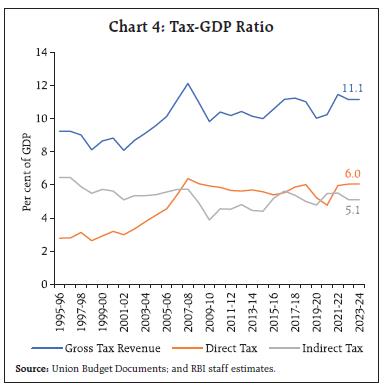

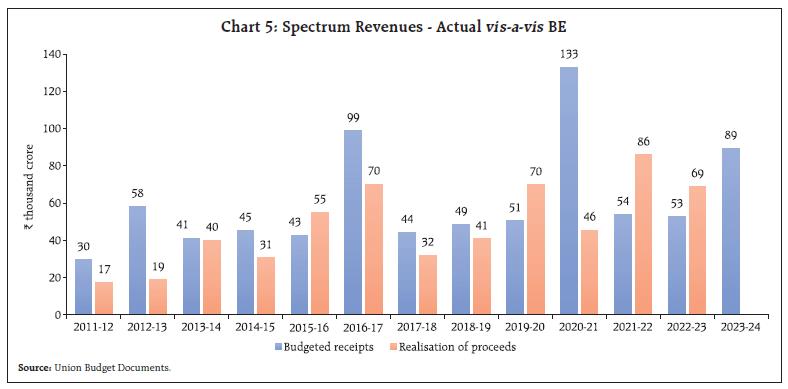

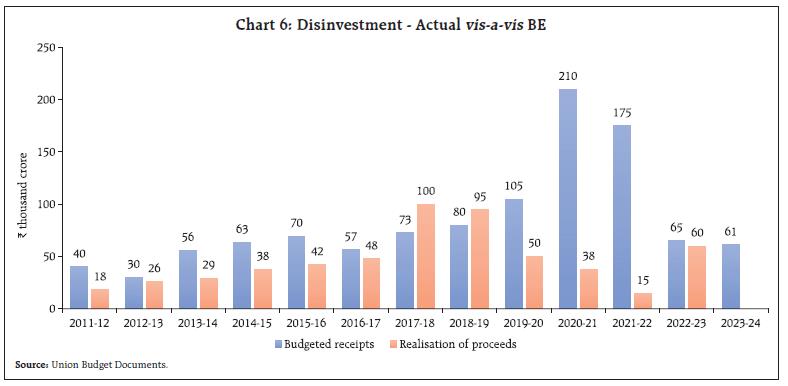

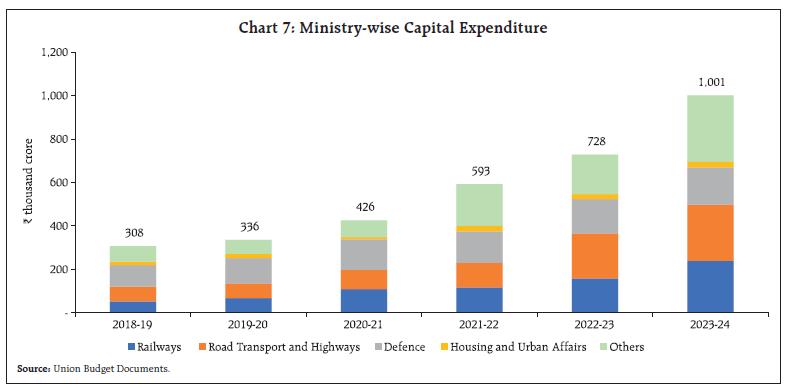

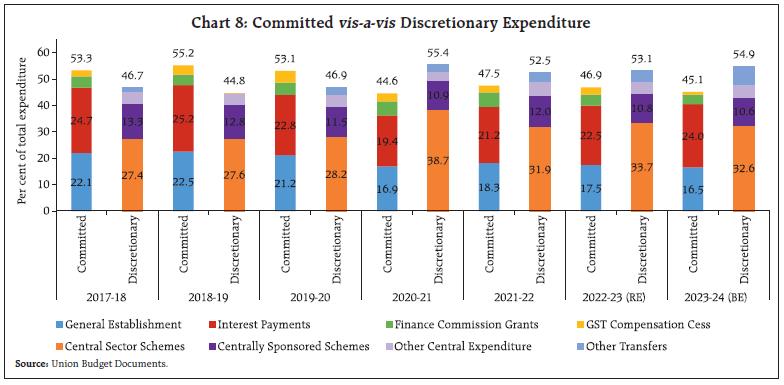

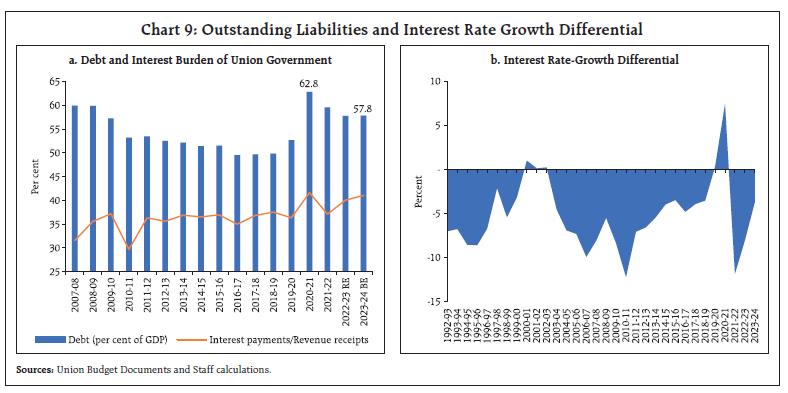

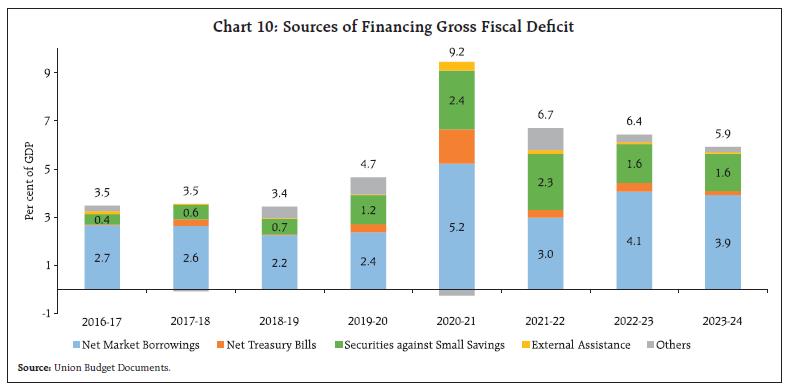

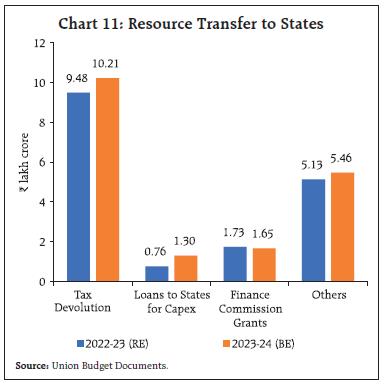

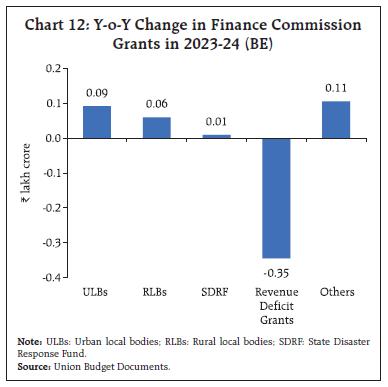

Total receipts comprising net tax revenues, non-tax revenues and non-debt capital receipts, stood at 8.91 per cent of GDP in 2022-23 (RE), marginally exceeding the budgeted level of 8.85 per cent as tax revenues surpassed budget estimates, outweighing the shortfall in non-tax receipts. For 2023-24, total receipts are budgeted to rise to 9.0 per cent of GDP. Tax Revenues Gross tax revenues exhibited robust performance in 2022-23 (RE), despite the macroeconomic consequences of the war in Ukraine. Gross tax revenue exceeded the budget estimates by ₹2.9 lakh crore, on account of higher than budgeted collections in corporation tax, income tax and GST. In 2023-24, gross tax revenue is budgeted to increase by 10.4 per cent, with a budgeted buoyancy of 0.99 that is close to the trend level (proxied by the average for 2010-11 to 2018-19) [Table 2].  Direct Taxes After registering a growth of 17.2 per cent in 2022-23 (RE), direct taxes are budgeted to grow by 10.5 per cent to reach 6.0 per cent of GDP in 2023-24 (Chart 4). Several direct tax changes have been proposed in the Budget to simplify and rationalise various provisions, to reduce the compliance burden and provide tax relief to citizens. Under personal income tax, the Budget proposes the following major changes to the new tax regime – (i) an increase in rebate limit to ₹7 lakh from ₹5 lakh, (ii) a reduction in the number of slabs to five from six and an increase in the tax exemption limit to ₹3 lakh from ₹2.5 lakh and (iii) extension of standard deduction benefit for salaried class and pensioners to the new tax regime. The highest surcharge rate was also brought down from 37 per cent to 25 per cent in the new tax regime, which would result in a reduction of the maximum tax rate to 39 per cent from the current rate at 42.74 per cent. Indirect Taxes Indirect tax collections in 2022-23 (RE) exceeded the BE by ₹55,247 crore, as GST collections exceeded budget estimates by ₹74,000 crore, offsetting the shortfall in customs (₹3,000 crore) and excise duty collections (₹15,000 crore). While the cut in excise duty on fuel in May 2022 contributed to lower excise duty collections in 2022-23 (RE), GST collections recorded a buoyancy of 1.45, reflecting the improvement in economic activity and the impact of efforts to increase the tax base and improve compliance. In 2023-24 (BE), indirect taxes are budgeted to grow by 10.4 per cent with GST, customs and excise budgeted to increase by 12.0 per cent, 11.0 per cent and 5.9 per cent, respectively.  The tax changes (direct and indirect) proposed in the Budget are expected to increase disposable income by ₹35,000 crore. This is estimated to increase the real GDP growth by 15 basis points in 2023-24 by boosting personal consumption.7 Non-Tax Revenues Receipts from non-tax sources fell short of budgeted targets in 2022-23 (RE) by ₹7,900 crore as the lower than budgeted surplus transfer by the Reserve Bank was partly offset by higher interest receipts, dividends from public sector enterprises and spectrum revenues (Chart 5). In 2023-24, non-tax revenues are budgeted to increase by 15.2 per cent to ₹3.0 lakh crore.  Non-debt Capital Receipts In 2022-23 (RE), disinvestment receipts8 are placed at ₹60,000 crore, as against the budgeted target of ₹65,000 crore of which only ₹38,671 crore has been garnered till end December 2022. In 2023-24 (BE), the disinvestment target has been pegged at ₹61,000 crore (Chart 6). Recoveries of loans and advances exceeded budget estimates in 2022-23 (RE) by ₹9,209 crore, outweighing the shortfall in disinvestment receipts. In 2023-24, recovery in loans is budgeted to decline by 2.1 per cent over 2022-23 (RE).  Total expenditure is budgeted to grow by 7.5 per cent in 2023-24, lower than the 10.4 per cent growth recorded in 2022-23 (RE). In 2023-24, revenue expenditure is budgeted to grow by only 1.2 per cent as expenditure on major subsidies is budgeted to contract by 28.2 per cent due to the rationalisation of food subsidy and softening of urea prices. Noteworthy from the point of view of reviving investment and growth is the continued thrust provided to capital expenditure in the post pandemic period as the capital expenditure is budgeted to increase to 3.3 per cent of GDP in 2023-24 from an average of 1.7 per cent during 2010-20 (Table 3). In 2023-24, capital expenditure is budgeted at ₹10 lakh crore, which is close to three times the amount spent in 2019-20. Ministry-wise allocation of capital expenditure indicates that the Ministry of Railways and Road Transport and Highways account for almost half of the budgeted capital expenditure for 2023-24 (Chart 7). The increase in effective capital expenditure (capital expenditure plus grants-in-aid for creation of capital assets), through its multiplier effect, will generate additional output of ₹10.3 lakh crore during 2023-27 of which railways and loan assistance to States will contribute 43 per cent, while investment in logistics will contribute 19 per cent.9 Next, we decompose the total expenditure of the union government into committed expenditure, which includes establishment expenditure10, interest payments, grants recommended by the Finance Commission and GST compensation to States; and discretionary expenditure which includes central sector schemes, centrally sponsored schemes and transfers to States (excluding Finance Commission grants and GST compensation). Prior to the pandemic, the share of committed expenditure was higher than discretionary expenditure. However, with the end of GST compensation regime and introduction of interest free loans to States for capital expenditure, the share of committed expenditure stands reduced to 45.1 per cent of total expenditure in 2023-24 (BE) (Chart 8).  After peaking at 62.8 per cent of GDP in 2020-21 due to the impact of the pandemic, the total outstanding debt of the Union government is budgeted to consolidate to 57.8 per cent of GDP in 2023-24 (BE). The ratio of interest payments to revenue receipts, however, is budgeted to increase to 41.0 per cent (Chart 9a). The interest rate growth differential (IRGD), an indicator of debt sustainability, continues to remain favourable, even though its magnitude has declined in the recent years (Chart 9b). However, as the union government debt still remains elevated vis-à-vis pre-pandemic trend, there is a need to stay on the path of fiscal consolidation.   VI. Gross Fiscal Deficit Financing As per the revised estimates (RE) for 2022-23, the budgeted fiscal deficit target of 6.4 per cent of the GDP is likely to be met. In 2023-24 (BE) gross fiscal deficit (GFD) is budgeted at 5.9 per cent of GDP. Market borrowings are the main source of financing GFD for the union government, followed by securities issued against small savings (Chart 10). In 2023-24, gross and net market borrowings are budgeted at ₹15.4 lakh crore and ₹11.8 lakh crore, up from ₹14.2 lakh crore and ₹11.1 lakh crore, respectively in 2022-23 (RE) (Table 4). The gradual downscaling in the market borrowing requirements (as per cent of GDP) of the union government towards pre-pandemic level will open up space for private investment.  VII. Resource Transfer from Centre to States The Centre has fixed States’ gross fiscal deficit at 3.5 per cent of the gross state domestic product (GSDP) for 2023-24, of which 0.5 per cent will be tied to power sector reforms. The gross transfer to the States is budgeted to increase in 2023-24 (BE), largely due to enhanced tax devolution and an increase in allocation for special assistance to States for capital expenditure (Chart 11, Annex 3). The Finance Commission Grants are expected to decline in 2023-24, primarily due to lower transfers under Post-Devolution Revenue Deficit Grants, while the transfers to the local bodies and health sector have seen a sharp rise (Chart 12). To spur States’ investment in infrastructure and incentivise them to undertake complementary policy actions, the Centre has decided to continue with the 50-year interest-free loan to States for one more year with an enhanced allocation of ₹1.3 lakh crore.11 The loan amount will have to be spent in 2023-24. While most of the loan will be at the discretion of the States, a part of it will be contingent on States increasing their actual capital expenditure. A part of the outlay will also be linked to, or allocated for, scrapping old government vehicles, urban planning reforms and actions, financing reforms in urban local bodies (to make them creditworthy for municipal bonds), housing for police personnel above or as part of police stations, constructing Unity Malls, children and adolescents’ libraries and digital infrastructure, and States’ share of capital expenditure of central schemes. The Union Budget also proposes to incentivise cities to improve their creditworthiness for municipal bonds through property tax governance reforms and ring-fencing user charges on urban infrastructure. Additionally, an Urban Infrastructure Development Fund (UIDF) is proposed to be established. It will be managed by the National Housing Bank and used by public agencies to create urban infrastructure in Tier 2 and Tier 3 cities.   The Union Budget 2023-24 aims to strengthen growth momentum (through higher capital expenditure) and promote macroeconomic stability by strengthening the economic foundations with commitment to fiscal consolidation. While higher capital expenditure would generate multiplier effects and crowd-in private investment, fiscal consolidation would free up productive resources for the private sector. Further, infrastructure development, supported by integrated and coordinated planning, measures to promote digitisation and green economy, and skilling initiatives to harness the demographic dividend are expected to yield dividends beyond the near-term and raise the economy’s growth potential in the medium-run, as expounded in the accompanying article on “State of the Economy”. Annex 2: Highlights of the Union Budget 2023-24 The economic agenda presented in the Budget focuses on three things: first, facilitating ample opportunities for citizens, especially the youth, to fulfil their aspirations; second, providing strong impetus to growth and job creation; and third, strengthening macro-economic stability. Following four opportunities can be transformative to service the above-mentioned focus areas. 1. Economic Empowerment of Women: Facilitation of the women self-help groups (SHGs), mobilised by DAY-NRLM (Aajivika – National Rural Livelihood Mission) to attain next level of economic empowerment through formation of large producer enterprises or collectives. 2. PM VIshwakarma KAushal Samman (PM VIKAS): Scheme to integrate traditional artisans and craftspeople with micro, small and medium-scale enterprises (MSMEs) value chains. 3. Tourism: Promotion of tourism on mission mode with active participation of States, convergence of government programmes and public-private partnerships. 4. Green Growth: Implementation of programmes for green fuel, green energy, green farming and green mobility for efficient use of energy across various economic sectors. The Budget has announced seven priorities. The major policy actions proposed by the Budget under each priority are listed below. Priority 1: Inclusive Development Agriculture and Cooperation

Health, Education and Skilling

Priority 2: Reaching the Last Mile

Priority 3: Infrastructure and Investment

Urban Development

Priority 4: Unleashing the Potential

Priority 5: Green Growth

Priority 6: Youth Power Skilling

Tourism

Priority 7: Financial Sector • Expanded corpus of ₹9,000 crore under a revamped credit guarantee scheme for MSMEs is proposed to enable additional collateral-free guarantee credit of ₹2 lakh crore. • A national financial information registry will be set up to serve as the central repository of financial and ancillary information. This will facilitate efficient flow of credit, promote financial inclusion, and foster financial stability. A new legislative framework will govern this credit public infrastructure, and it will be designed in consultation with the Reserve Bank. • To meet the needs of Amrit Kaal and to facilitate optimum regulation in the financial sector, public consultation, as necessary and feasible, will be brought to the process of regulation-making and issuing subsidiary directions. • To simplify, ease and reduce cost of compliance, financial sector regulators will be requested to carry out a comprehensive review of existing regulations. For this, they will consider suggestions from public and regulated entities. Time limits to decide the applications under various regulations will also be laid down. • Gujarat International Finance Tec-City (GIFT) International Financial Services Centre (IFSC): To enhance business activities in GIFT IFSC, the following measures will be taken:

• To improve bank governance and to enhance investors’ protection, certain amendments to the Banking Regulation Act, the Banking Companies Act and the Reserve Bank of India Act are proposed. • To build capacity of functionaries and professionals in the securities market, SEBI will be empowered to maintain standards for education in the National Institute of Securities Markets. • A Central Data Processing Centre will be setup for faster handling of administrative work under the Companies Act. • An integrated IT portal will be established for investors to reclaim unclaimed shares and unpaid dividends from the Investor Education and Protection Fund Authority. • Digital payments continue to find wide acceptance. In 2022, they recorded an increase of 76 per cent in transactions and 91 per cent in value. Fiscal support for this digital public infrastructure will be continued in 2023-24. • A one-time new small savings scheme, Mahila Samman Savings Certificate, will be made available for a two-year period up to March 2025. This will offer deposit facility up to ₹2 lakh in the name of women or girls for a tenor of 2 years at fixed interest rate of 7.5 per cent with partial withdrawal option. • The maximum deposit limit for Senior Citizen Savings Scheme will be enhanced from ₹15 lakh to ₹30 lakh. The maximum deposit limit for Monthly Income Account Scheme will be enhanced from ₹4.5 lakh to ₹9 lakh for single account and from ₹9 lakh to ₹15 lakh for joint account. Fiscal Management • Fifty-year interest free loan to States: The entire fifty-year loan to States has to be spent on capital expenditure within 2023-24. Most of this will be at the discretion of States, but a part will be conditional on States increasing their actual capital expenditure. Parts of the outlay will also be linked to, or allocated for, the following purposes:

• States will be allowed a fiscal deficit of 3.5 per cent of gross state domestic product (GSDP) of which 0.5 per cent will be tied to power sector reforms. Tax Proposals Indirect Tax Proposals

Sector Specific Indirect Tax Proposals

Direct Tax Proposals

Personal Income Tax

* The authors are from Department of Economic and Policy Research. The authors are thankful to Dr. Deba Prasad Rath and Dr. GV Nadhanael for their valuable inputs and to Supriya Abhinav Sutar for data support. The views expressed in this article are those of the authors and do not necessarily represent the views of the Reserve Bank of India. 1 Under the Scheme for Special Assistance to States for Capital Investment, the Centre provides 50-year interest free loans to States for spending on capital investment projects. 2 For detailed budget proposals please refer to Annex 2. 3 In 2016-17, the budgeted fiscal deficit target (3.5 per cent of GDP) was adhered to by the Union Government. However, from 2017-18 to 2020-21 the Union Government was unable to meet its budgeted fiscal deficit target. 4 Nominal GDP for 2023-2024 (BE) has been projected at ₹3,01,75,065 crore assuming 10.5 per cent growth over the preceding year (viz., ₹2,73,07,751 crore as per the first advance estimates for 2022-23 released by the Ministry of Statistics and Programme Implementation, Government of India on January 06, 2023).  6 For details please refer to Annex 1 7 For details, refer to the article on “State of the Economy” RBI Bulletin (February 2023). 8 Disinvestment receipts refers to miscellaneous capital receipts, which include disinvestment and other receipts. 9 For details, refer to the article “State of the Economy” RBI Bulletin (February 2023). 10 Establishment expenditure includes expenditure on salaries, wages, pensions and office expenses. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Page Last Updated on: