IST,

IST,

Union Budget 2024-25: An Assessment

|

by Aayushi Khandelwal, Harshita Yadav, Akash Raj, Saksham Sood, Ipsita Padhi, Bichitrananda Seth, Anoop K. Suresh, and Samir Ranjan Behera^ The Union Budget 2024-25 aims at providing a boost to growth and job creation while pursuing fiscal consolidation. The Budget has proposed simplification of direct and indirect tax regimes and continues its thrust towards increasing capital expenditure and strengthening the quality of government spending. The Budget chalks out an agenda for next-generation economic reforms intended to improve overall factor productivity and efficiency in the factor markets, which augur well for medium-term growth prospects. Introduction Amidst the global economy grappling with multiple uncertainties, India’s economic growth remains resilient. The Union Budget 2024-25 has laid down a medium-term roadmap for achieving ‘Viksit Bharat’ through nine priorities, viz., productivity and resilience in agriculture, employment and skilling, inclusive human resource development and social justice, manufacturing and services, urban development, energy security, infrastructure, innovation, research and development, and next generation reforms. The Budget has also proposed the formulation of an ‘Economic Policy Framework’ towards implementing next-generation reforms with a focus on improving overall productivity and facilitating sector and market efficiency. Emphasising the principles of competitive and cooperative federalism, the Budget proposes to incentivise States for faster implementation of reforms by earmarking a significant portion of the 50-year interest-free loan.1 The Budget has proposed to simplify both direct and indirect tax regimes. A comprehensive review of the customs duty rate structure is proposed to be undertaken over the next six months for facilitating ease of trade, addressing duty inversion and reducing disputes. It has also announced a comprehensive review of the Income-Tax Act, 1961, with an aim to reduce disputes and litigation, thereby providing certainty to taxpayers. On the personal income tax front, the rate structure for the new tax regime has been revised, along with increased standard deduction for salaried employees, to provide relief to taxpayers.2 On the expenditure front, acknowledging the strong multiplier effects of infrastructure development, the Budget 2024-25 has provisioned ₹11.1 lakh crore (3.4 per cent of GDP) for capital expenditure, higher than the 3.2 per cent of GDP allocated in 2023-24 (Provisional Accounts, PA). On the other hand, revenue expenditure is estimated to decline from 11.8 per cent of GDP in 2023-24 (PA) to 11. 4 per cent in 2024-25 (BE). The Union Budget 2024-25 reiterated the government’s commitment towards fiscal prudence by budgeting a reduction in the gross fiscal deficit (GFD) to 4.9 per cent of GDP in 2024-25, in line with the medium-term target of GFD below 4.5 per cent of GDP by 2025-26. From 2026-27 onwards, the Budget has announced the government’s intention to maintain the GFD at a level that ensures that the Union government debt as per cent of GDP will be on a declining path. Against this backdrop, the rest of the article is divided into seven sections. Section II presents the underlying dynamics of the fiscal deficit. Sections III and IV assess the trends in receipts and expenditure, respectively, of the Union government. Section V covers the outstanding debt position of the Union government. Section VI examines the major sources of financing of the fiscal deficit whereas Section VII dwells upon the transfer of resources to States. Section VIII puts forth the concluding observations. II. Fiscal Deficit – The Underlying Dynamics During 2023-24, the government continued the focus on prudent fiscal management. The GFD of the Union government stood at 5.9 per cent of the GDP in 2023-24 (RE) in line with BE. As per 2023-24 (PA), the GFD stood lower at 5.6 per cent of GDP, on account of higher non-tax receipts along with lower revenue and capital expenditure resulting in consolidation of 32 basis points over 2023-24 (BE) [Chart 1]. The primary deficit stood at 2.0 per cent of GDP in 2023-24 (PA) as against the 2.3 per of GDP in the BE (Table 1).

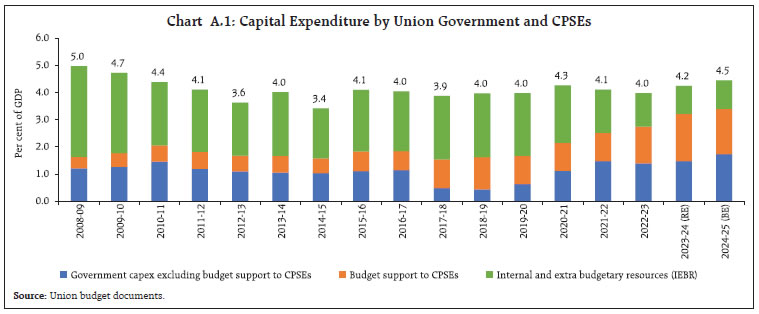

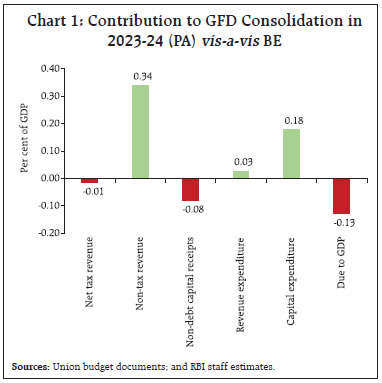

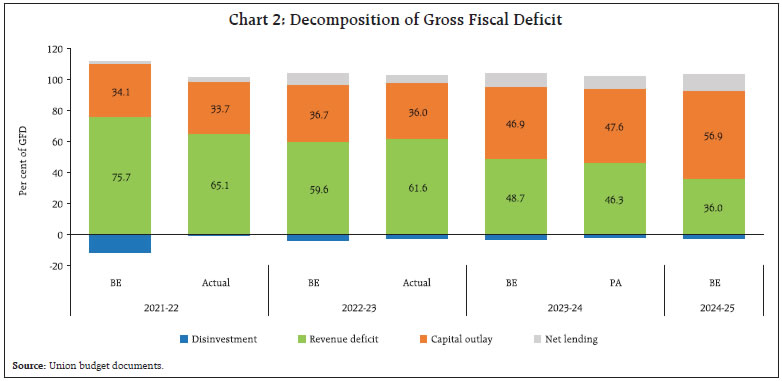

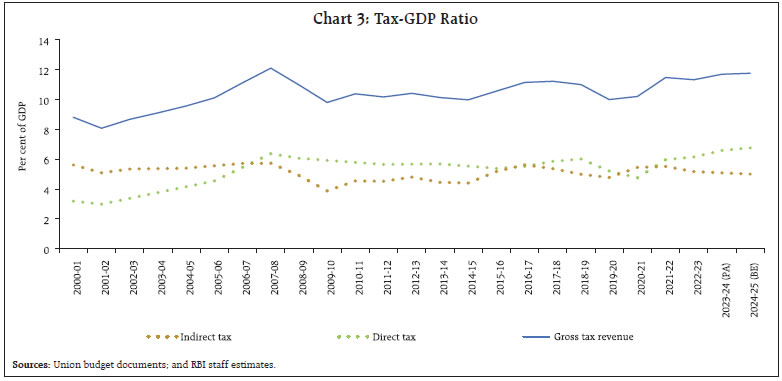

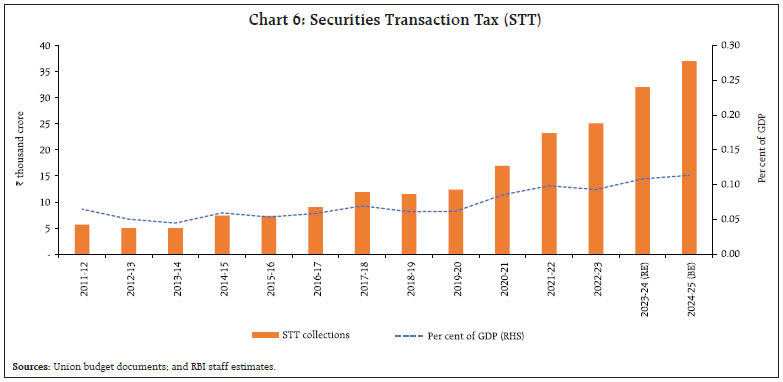

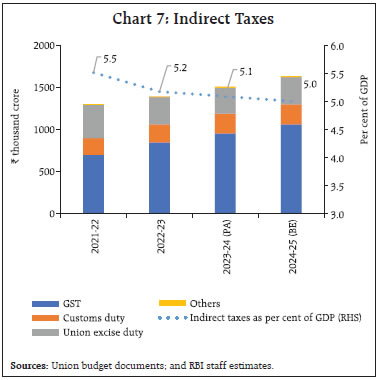

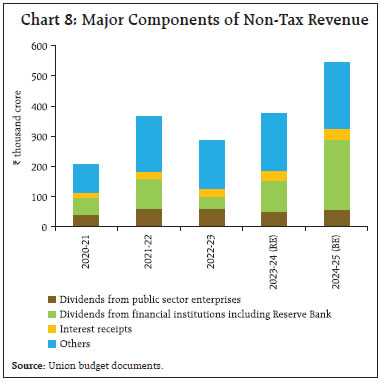

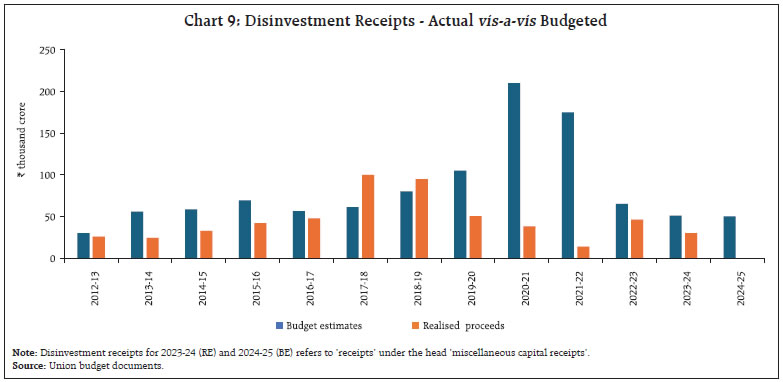

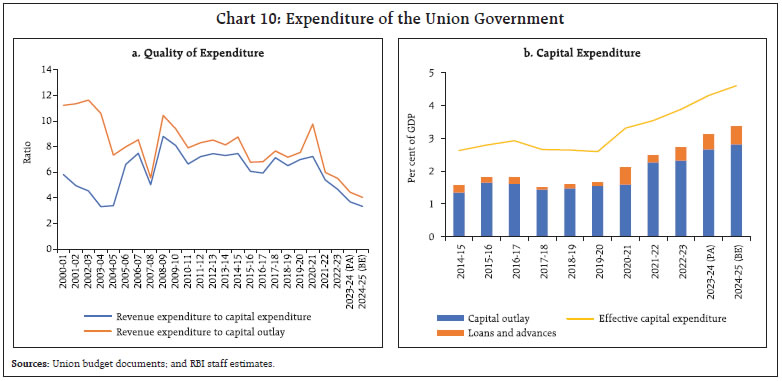

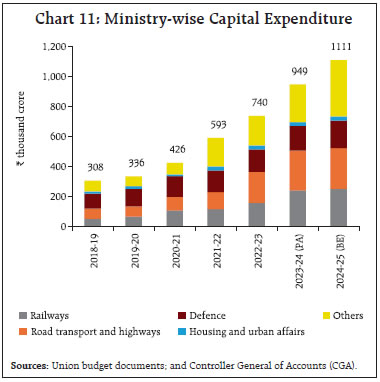

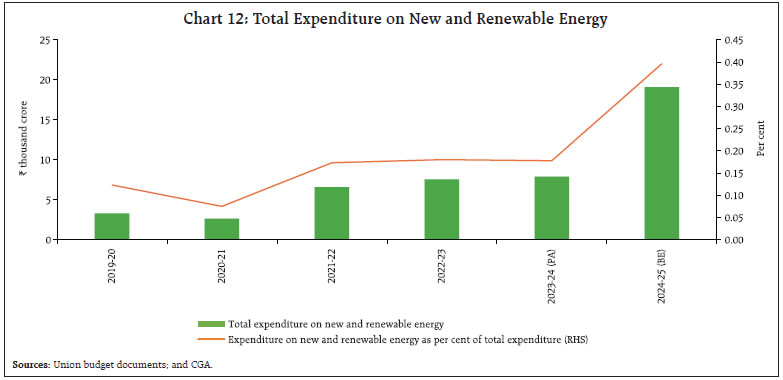

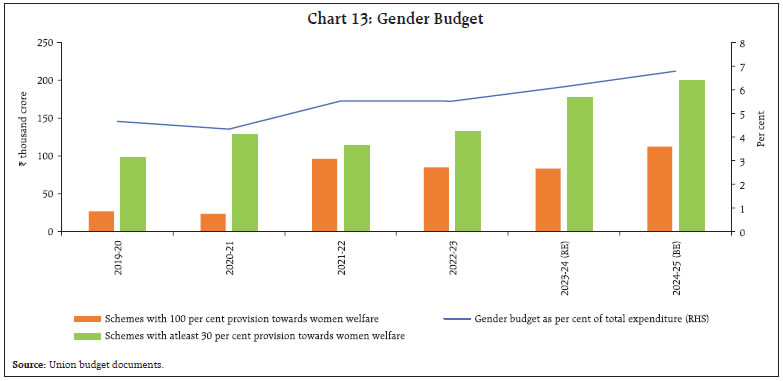

For 2024-25, the GFD is budgeted at 4.9 per cent of GDP, lower than 5.1 per cent of GDP in the Interim Budget 2024-254. The fiscal consolidation in 2024-25 (BE) over 2023-24 (PA) is sought to be achieved through containment in revenue expenditure to 11.4 per cent of GDP and robust growth in revenue receipts. The revenue deficit is budgeted to decline from 2.6 per cent of GDP in 2023-24 (PA) to 1.8 per cent in 2024-25 (BE), freeing up fiscal space to boost capital expenditure [Table 1]. Decomposition of GFD The proportion of GFD pre-empted by revenue deficit (RD) has come down from an average of 73.7 per cent of GFD during 2018-19 to 2020-21 to 46.3 per cent in 2023-24 (PA) and further to 36.0 per cent in 2024-25 (BE). Concomitantly, the share of growth-inducing capital outlay in GFD has risen to 47.6 per cent in 2023-24 (PA) and is expected to increase further to 56.9 per cent in 2024-25 (BE) from an average of 31.3 per cent of GFD during 2018-19 to 2020-21 (Chart 2). In 2023-24 (PA), the total non-debt receipts (comprising of net tax revenues, non-tax revenues and non-debt capital receipts) grew by 13.6 per cent over 2022-23, primarily on account of robust growth in tax revenues supported by buoyant income tax collections and increase in non-tax revenues on account of higher-than-budgeted surplus/dividend from the Reserve Bank/nationalised banks/financial institutions. The total non-debt receipts are expected to sustain their momentum in 2024-25 (BE) with a growth of 15.0 per cent and are budgeted to rise to 9.8 per cent of GDP from 9.4 per cent in 2023-24 (PA). Tax Revenues Gross tax revenues in 2023-24 (PA) exceeded the budget estimates by ₹1.04 lakh crore. Net tax revenues5 in 2023-24 (PA) were, however, marginally below the budgeted amount attributable to higher tax devolution to the States. For 2024-25, the gross tax revenues are budgeted to grow by 10.8 per cent over 2023-24 (PA). The tax-GDP ratio will increase to 11.8 per cent of GDP, the highest since 2007-08 (Chart 3).   For 2024-25 (BE), the buoyancy of the gross tax revenue at 1.1 will be in line with its average during 2010-11 to 2018-19. The buoyancy of direct taxes in 2024-25 (BE) is lower compared to 2023-24 (PA), but higher than the average trend. On the other hand, the buoyancy of indirect taxes in 2024-25 (BE) will be higher compared to 2023-24 (PA), although it remains lower than the average trend (Chart 4a and b). Direct Taxes Direct taxes recorded a robust growth in 2023-24 (PA) and exceeded their budget estimates by ₹1.3 lakh crore, boosted by a growth of 25.0 per cent in income tax collections. In 2024-25, direct taxes are budgeted to grow by 12.8 per cent, with income tax and corporation tax expected to grow by 13.8 per cent and 12.0 per cent, respectively (Chart 5).   The Budget has proposed a comprehensive review of the Income-Tax Act, 1961 to improve tax certainty and reduce tax litigations along with taking steps for simplification of tax regime for charities, structure of tax deducted at source (TDS), capital gains taxation and deepening of income tax base. The corporate tax rate on foreign companies is proposed to be reduced from 40 per cent to 35 per cent. On the personal income tax front, the standard deductions for salaried employees and family pensions for pensioners under the new tax regime have been enhanced to ₹75,000 and ₹25,000, respectively, along with revisions in the tax structure under the new tax regime; these changes are estimated to result in income tax savings up to ₹17,500 for the salaried employees. Further, the government has increased the securities transaction tax (STT) on futures and options to check the heightened activity in the market segment (Chart 6).  Indirect Taxes Indirect tax revenues posted a growth of 8.2 per cent in 2023-24 (PA) and fell below the budgeted amount, primarily on account of shortfall of ₹33,670 crore in Union government’s excise duty collections. In 2024-25 (BE), the growth in indirect taxes is budgeted at 8.3 per cent, led by GST collections (11.0 per cent), customs duties (2.0 per cent), and excise duty (6.1 per cent) [Chart 7]. To boost domestic production, deepen local value additions, and foster export competitiveness, the Budget proposed a reduction in customs duties on certain medical equipment, mobile phones, critical minerals, marine products, certain electronics, precious metals, certain inputs for leather and textile industry and expanded the list of the exempted capital goods for manufacturing of solar cells and panels. A comprehensive review of the customs rate structure is also proposed to be undertaken in the coming months to promote ease of trade, remove duty inversion, and reduce the incidence of disputes. Non-Tax Revenues Non-tax receipts posted a growth rate of 40.8 per cent in 2023-24 (PA), exceeding their BE by ₹1.0 lakh crore, primarily due to a higher than budgeted surplus/dividend transfer by the Reserve Bank/nationalised banks/financial institutions. In 2024-25 (BE), non-tax revenues are expected to maintain their momentum and increase by 35.8 per cent, on the back of an increase in dividend and profits led by the surplus transfer by the Reserve Bank (Chart 8).   Non-Debt Capital Receipts In 2023-24 (PA), non-debt capital receipts declined by 16.3 per cent on account of a contraction in proceeds from disinvestment. In 2024-25 (BE), the non-debt capital receipts are pegged to grow at 29.0 per cent, with the disinvestment target at ₹50,000 crore (Chart 9). Total expenditure is budgeted to grow by 8.5 per cent in 2024-25 (BE) over 2023-24 (PA), as against 5.9 per cent growth in 2023-24 (PA). Capital expenditure is budgeted at a two decade high of 3.4 per cent of GDP, with a provision of ₹11.1 lakh crore in 2024-25 (BE). Revenue expenditure is budgeted to grow by 6.2 per cent whereas capital expenditure growth is pegged at 17.1 per cent (Table 2). The revenue expenditure to capital outlay ratio is at an all-time low of 4.0 as per 2024-25 (BE), indicative of improvement in the quality of expenditure. The outlay for the ‘Scheme for Special Assistance to States for Capital Investments’ has been enhanced to ₹1.5 lakh crore in 2024-25 (BE) from ₹1.1 lakh crore in 2023-24 (RE) [Chart 10a and b].   Among the major schemes, PM Awas Yojana (Rural), PM Awas Yojana (Urban), National Health Mission6, road works and Samagra Shiksha have witnessed increased allocation in 2024-25 (BE) over 2023-24 (RE) [Table 2]. The combined capex of the Union government and the central public sector enterprises (CPSEs) has witnessed an increase from 2021-22 onwards, though there has been a reversal in the financing pattern of CPSEs, with the share of the budgetary support to finance capex of CPSEs rising and that of the internal resources and extra budgetary resources moderating (Box A). The Ministry of Railways and Road Transport and Highways account for almost half of the budgeted capital expenditure for 2024-25 (Chart 11). The total allocation towards new and renewable energy is budgeted to increase from 0.03 per cent of GDP in 2023-24 (PA) to 0.06 per cent in 2024-25 (BE), driven by solar power projects (grid) and PM Surya Ghar Muft Bijli Yojana11 (Chart 12). The Budget has emphasised on enhancing the role of women in the economy as one of the four pillars of inclusive growth, reflected in a growth of 18.9 per cent in the gender budget allocations for 2024-25 (BE). More than half of the total increment has been allocated towards schemes having 100 per cent allocation towards the welfare of the women (Chart 13).

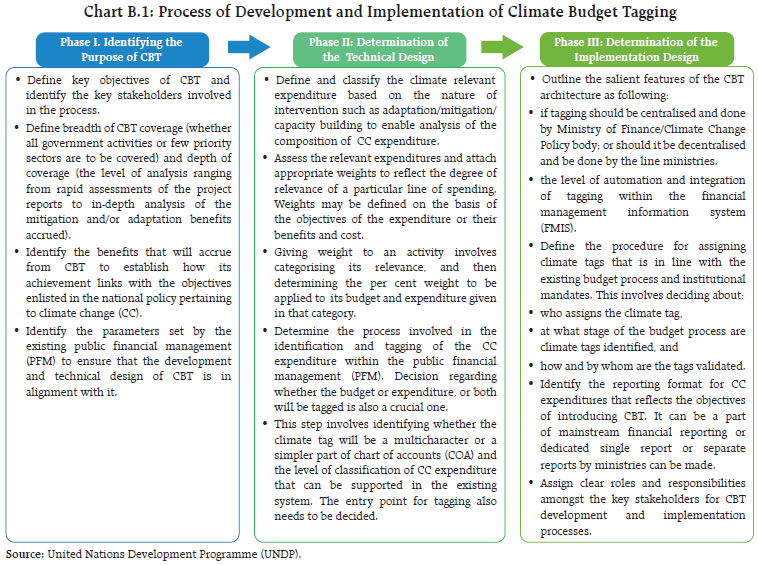

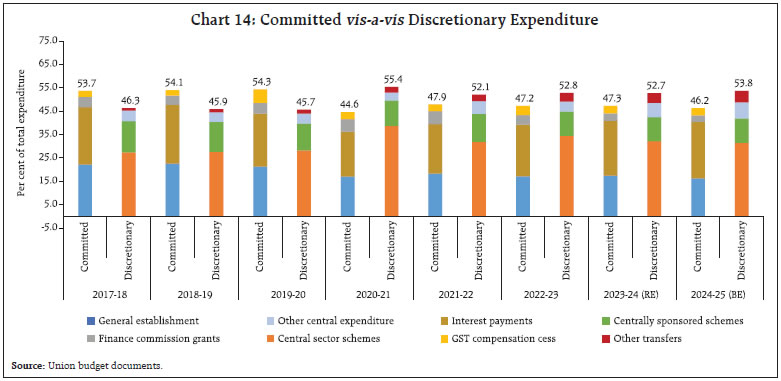

Next, we decompose the total expenditure of the Union government into committed expenditure (which includes establishment expenditure12, interest payments, grants recommended by the Finance Commission and GST compensation to States) and discretionary expenditure [which includes central sector schemes, centrally sponsored schemes and transfers to States (excluding Finance Commission grants and GST compensation)]. Prior to the pandemic, the share of committed expenditure was higher than discretionary expenditure. However, with the introduction of interest free loans to States for capital expenditure and reduction in the share of expenditure on general establishment, the share of committed expenditure stands reduced at 46.2 per cent of total expenditure in 2024-25 (BE) [Chart 14].   The Budget proposes to develop a taxonomy for climate financing to augment the capital available for projects pertaining to climate adaptation and mitigation. This will also serve to support India’s climate and green commitments. Recently, some countries have adopted the practice of climate budget tagging (CBT) to meet their climate commitments (Box B).

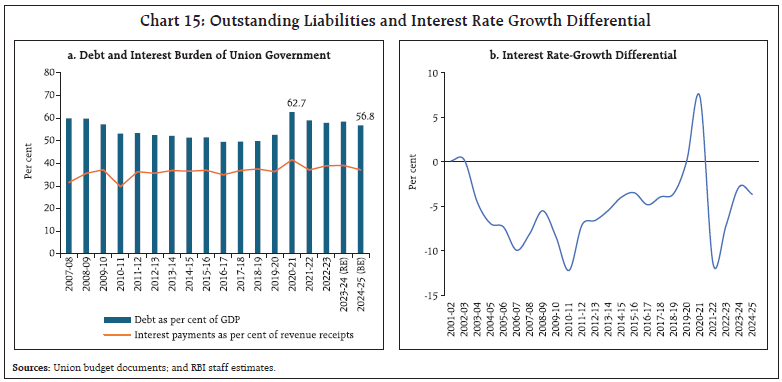

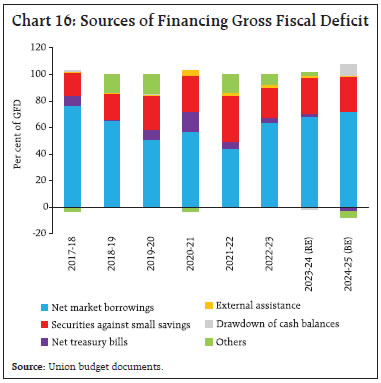

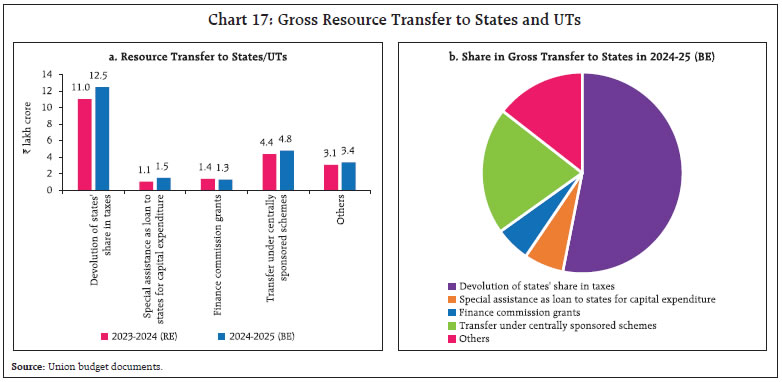

After peaking at 62.7 per cent of GDP in 2020-21 due to the impact of the COVID-19 pandemic, the total outstanding debt of the Union government is estimated to fall to 56.8 per cent of GDP in 2024-25 (BE). The interest payment - revenue receipts ratio is estimated to decline from 39.1 per cent in 2023-24 (RE) to 37.2 per cent in 2024-25 (BE). The interest rate growth differential (IRGD), an indicator of debt sustainability, remains favourable. Reiterating its commitment towards debt consolidation, from 2026-27, the government aims to keep the fiscal deficit each year such that the Union government debt as a per cent of GDP will be on a declining path (Chart 15a and b). VI. Gross Fiscal Deficit Financing In 2024-25 (BE), GFD is budgeted at 4.9 per cent of GDP, lower than 5.6 per cent of GDP in 2023-24 (PA). Tracking the fiscal deficit dynamics, net as well as gross market borrowings of the Union government in 2024-25 (BE) have been placed lower than 2023-24 (RE) as well as the amount announced in the Interim Union Budget 2024-25. Market borrowings are the main source of financing GFD for the Union government, followed by securities issued against small savings. Net market borrowings through dated securities (excluding T-Bills) are expected to finance 72.1 per cent of GFD in 2024-25 (BE) as against 68.0 per cent in 2023-24 (RE) while small savings (NSSF) (₹4.20 lakh crore) would finance 26.0 per cent of GFD in 2024-25 (BE) (₹4.71 lakh crore in 2023-24) [Chart 16].   The gradual downscaling in the market borrowing requirements (as per cent of GDP) of the Union government towards the pre-pandemic level will facilitate greater availability of resources for the private sector (Table 3). VII. Resource Transfer from Centre to States For the fiscal year 2024-25, gross transfers to States/UTs are budgeted to increase by 11.9 per cent as compared with 12.6 per cent growth in 2023-24 (RE), led by higher tax devolution, special assistance for capital expenditure, and transfers under centrally sponsored schemes (Chart 17a and b). Accordingly, the gross transfers to GDP ratio is expected to increase to 7.2 per cent in 2024-25 from 7.1 per cent in 2023-24.15 Finance Commission Grants are budgeted to decline by 5.7 per cent in 2024-25 (BE), mainly due to a reduction in post devolution revenue deficit grants16 (Table 4). In the Union Budget for 2024-25, the Union government has proposed to introduce the Purvodaya plan aimed at the all-round development of the eastern States - Bihar, Jharkhand, West Bengal, Odisha, and Andhra Pradesh. This initiative will focus on human resource development, infrastructure enhancement, and economic opportunity creation, with the goal of transforming the region into a significant driver of Viksit Bharat. For 2024-25, ₹1.5 lakh crore has been allocated for long-term, interest-free loans to support States17, an increase from ₹1.1 lakh crore in the previous year.  The Centre will work with States and the private sector to develop ‘plug and play’ industrial parks equipped with complete infrastructure in or near 100 cities, using town planning schemes. Both the Centre and States will collaborate on developing ‘cities as growth hubs’ through economic and transit planning, ensuring orderly development of peri-urban areas utilising town planning scheme. Additionally, the Centre, in collaboration with States, will implement a digital public infrastructure initiative in agriculture, aiming to register details of 6 crore farmers and their lands within three years. States with high stamp duties will be encouraged to reduce rates, particularly for properties purchased by women, since this reform would be a critical element for urban development schemes. States will be incentivised for advancing business reforms action plans and digitalisation efforts. A new centrally sponsored scheme for skilling, developed in partnership with State governments and industry, will be announced. The Union Budget 2024-25 aims at further strengthening the macroeconomic stability as well as harnessing the potential in different sectors of the economy. Special emphasis has been placed on skill development, aimed at improving employability and employment opportunities for the youth. The Budget continues its thrust towards capital expenditure with increased allocations and sustained support towards States’ capital expenditure. The Centre has reiterated its commitment towards its medium-term target of GFD below 4.5 per cent of the GDP by 2025-26. From 2026-27 onwards, the Budget has announced its intention to maintain the gross fiscal deficit at a level that ensures that the Union government debt will be on a declining path as per cent of GDP. Overall, the Union Budget 2024-25 strikes the right balance between fiscal prudence and macroeconomic stability which should strengthen the medium-term growth outlook. Annex III: Highlights of Union Budget 2024-25 The Budget lays down the roadmap for the pursuit of the goal of ‘Viksit Bharat’ by focusing on nine priorities. Few key proposals for these nine priorities as well as highlights of tax proposals announced in the Budget are enumerated below: Priority 1: Productivity and Resilience in Agriculture

Priority 2: Employment and Skilling

Priority 3: Inclusive Human Resource Development and Social Justice

Priority 4: Manufacturing and Services

Priority 5: Urban Development

Priority 6: Energy Security

Priority 7: Infrastructure

Priority 8: Innovation, Research and Development

Priority 9: Next Generation Reforms

Tax Proposals Direct Tax Proposals

Indirect Tax Proposals

^ This article is prepared under the overall guidance of Smt. Rekha Misra. The authors are thankful to Dr. Nadhanael for his valuable comments and suggestions. The authors are from the Department of Economic and Policy Research. The views expressed in this article are those of the authors and do not necessarily represent the views of the Reserve Bank of India. 1 The 50-year interest free loan refers to the long-term interest-free capex loan provided by Centre to States under the ‘Scheme for Special Assistance to States for Capital Investment’. In each financial year, a portion of the capex assistance to States under this scheme is earmarked for providing incentives to States for carrying out citizen centric reforms. For instance, in 2023-24, a part of the capex loan under this scheme was provided to States as an incentive amount for reform centric and sector specific areas, viz., scrapping old vehicles, urban planning reforms, financing reforms in urban local bodies to make them creditworthy for municipal bonds, housing for police personnel above or as part of police stations, unity malls, ‘children and adolescent’ library and digital infrastructure. 2 For detailed Budget proposals please refer to Annex III. 3 For details, please refer to Annex I. 4 Nominal GDP for final 2024-25 (BE) announced on July 23, 2024 been projected at ₹3,26,36,912 crore assuming 10.5 per cent growth over the Provisional Estimates (PE) of GDP of 2023-24 at ₹2,95,35,667 crore released by MoSPI on May 31, 2024. 5 Gross tax revenues less tax devolution to the States and transfer to NCCD (National Calamity Contingent Duty) funds. 6 National Health Mission includes allocation for the Flexible Pool for Reproductive and Child Health (RCH) and Health System Strengthening, National Health Programme and National Urban Health Mission. 7 CPSEs are companies incorporated under the Companies Act, 2013 or under any previous company law, or institutions formed in pursuance of an Act of Parliament, in which not less than fifty-one per cent of the share capital is held by the Union government or by any other CPSEs, or partly by the Union government and partly by one or more CPSEs (GoI, 2022). 8 As per the latest Public Enterprises Survey of 2022-23, there are 402 CPSEs out of which 254 are operating. 9 IEBR comprises of Internal Resources (comprising of retained profits-net of dividend to Government, depreciation provision and carry forward of reserves and surpluses) and Extra Budgetary Resources (consisting of receipts from issue of bonds, debentures, external commercial borrowing, suppliers’ credit, deposit receipts and term loans from financial institutions). Budgetary support and IEBR together finance the capital expenditure of CPSEs. 10 The Food Corporation of India is excluded from this analysis as majority of the expenditure incurred is for purchasing of food grains for the Public Distribution System. 11 PM Surya Ghar Muft Bijli Yojana is a central scheme that aims to provide free electricity to one crore households in India, who opt to install roof top solar electricity unit. The households will be able to get 300 units of electricity free every month. 12 Establishment expenditure includes expenditure on salaries, wages, pensions and office expenses. 13 For example, in Philippines, the implementation of CBT and related reforms have helped to mainstream climate change in the budget process and as a result the allocation of the national budget towards the climate change has increased at compound annual growth rate of 10.9 per cent during 2018 to 2024. 14 The act of misrepresentation of the environmental performance of an activity/programme to mislead the public/consumers regarding its environmental benefits to paint a more positive picture. 15 For details, please refer to Annex II. 16 The post devolution revenue deficit grants are provided to the States under Article 275 of the Constitution. The grants are released to the States as per the recommendations of the successive Finance Commissions to meet the gap in Revenue Accounts of the States post devolution. 17 A significant part of the 50-year interest-free loan will be earmarked to facilitate faster implementation of reforms related to land, labour, capital, entrepreneurship and technology. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Page Last Updated on: